ABSTRACT

The research expands the earnings management (EM) literature for Italian unlisted firms by investigating the drivers of both accrual-based (AEM) and real activity-based (REM) earnings management. According to prior literature, the reliability of financial statements of these firms concerns mainly lenders in assessing borrower creditworthiness, and Tax Offices in calculating corporate tax. We analyse unlisted firms as they represent 99.9% of Italian firms, consistent with most European countries. We estimate models using factors drawn from the literature which potentially influences both AEM and REM, along with some robustness tests. For AEM, ownership concentration is a positive driver, consistent with the entrenchment hypothesis, and firm leverage is a positive driver, suggesting the use of debt covenant violation avoidance strategies. Quality auditor engagement tends to constrain AEM, while size has a negative impact. However, tax drives AEM and profitability has a positive impact. For REM, ownership concentration has no impact, and leverage has a positive impact. The engagement of Big 4 constrains REM. Our expectations are confirmed when the total earnings management variable is used as the dependent.

Key words: Earnings management, accrual-based earnings management, real activity-based earnings management, determinants, unlisted firms, Italy.

Leuz et al. (2003) find for a sample of listed firms from 31 countries that Italy ranks highly (fifth) in terms of engagement in earnings management activity. Analysing a sample of Italian unlisted firms, Poli (2013a, b; 2015), including the earnings distribution, finds that such firms smooth their earnings for the purposes of loan covenants and tax reduction. The findings are consistent with the wider existing literature (Ball and Shivakumar, 2005; Burgstahler et al., 2006). Studying the factors that drive earnings management (EM) initiatives may be helpful in understanding the complex phenomenon of earnings manipulation, and should aid the enforcement of domestic accounting standards and rules. Italy presents an interesting case as it is a civil law country where accounting and tax rules are strongly aligned (Lamb et al., 1998). Consistent with the extant literature (Ball and Shivakumar, 2005), Italian firms may have an incentive to engage in earnings manipulation to both avoid debt covenant violations and to minimize tax payments.

Roychowdhury (2006) notes that earnings management may be undertaken using two main techniques, accrual-based earnings management (AEM) or real activity-based earnings management (REM). Fields et al. (2001) point out that an earnings management environment may only be fully comprehended by evaluating the use of both AEM and REM since managers aiming to manipulate earnings may use both EM techniques concurrently. Since unlisted firms are not under the scrutiny of stakeholders (Ball and Shivakumar, 2005), they may have an incentive to use the two earnings management techniques simultaneously, reducing the reliability of their financial information. However, to our best knowledge, prior literature analysing unlisted firms (Ball and Shivakumar, 2005; Coppens and Peek, 2005; Poli, 2013a, b, 2015; Bisogno and De Luca, 2016), focuses on the use of AEM alone. Therefore, to address this shortcoming, the aim of this research is to analyze EM in unlisted firms by investigating which corporate governance or/and financial characteristics are incentives when using AEM, REM of both. The study investigates the drivers of both AEM and REM techniques in Italian unlisted firms, which represent about 99.9% of firms in Italy. By analyzing both AEM and REM earnings management techniques, this research extends the prior literature which focuses mainly on AEM alone (Coppens and Peek, 2005; Bisogno, 2012; Hope et al., 2012; Poli, 2013a, b, 2015; Bisogno and De Luca, 2016), while, to our best knowledge, it does not provide evidence for REM in these firms.

The study makes at least three key contributions to the EM literature. Firstly, it examines the determinants of AEM and REM initiatives in Italian unlisted firms, an area of the EM literature which is currently underdeveloped, since it analyzes the simultaneous use of both earnings management techniques. Secondly, given that the Italian economy is characterized by highly concentrated firms, which are both family and non-family orientated (Giacomelli and Trento, 2005; Cascino et al., 2010; Cesaroni and Ciambotti, 2011), we examine how ownership concentration influences EM behaviour and the propensity to use one or both earnings management techniques. Thirdly, this study relates the use of the two earnings management techniques to corporate governance and firm characteristics that may, according to the literature, drive earnings management initiatives. Finally, we also add some control variables drawn from the literature which may have an impact on EM initiatives.

We estimate OLS regression models for a sample of 9,414 Italian unlisted firms over the period 2011 to 2018 giving a total of 75,312 firm-year observations. To address the issue of heteroscedasticity, the variable coefficients are estimated using robust standard errors. In addition, these errors are clustered by firms and years (Petersen, 2009). Our findings indicate that leverage and financial distress drive both EM techniques, suggesting that leveraged firms rely on both earnings management techniques to meet lenders’ expectations. Taxation and ownership concentration drive AEM alone. Finally, firm size and the engagement of Big 4 audit companies negatively drive both AEM and REM. The next section reviews the existing literature and presents our hypothesis development. The research methodology section discusses the research methods employed and the study data. The main findings of our empirical analysis are discussed in the results section, followed by a robustness test section. Finally, our conclusions and limitations of the study are discussed, and directions for future research are outlined.

Literature and hypothesis development

With foundations in agency theory (Jensen and Meckling, 1976), the extant literature identifies a range of factors that influence firms’ engagement in EM initiatives, and these factors vary across both firms and countries (Leuz et al., 2003). With regard to unlisted firms, the literature (Burgstahler et al., 2006; Poli, 2013a; 2013b; 2015) finds that firms engage in EM initiatives mainly for the purposes of meeting debt covenants or for tax reduction. These findings are confirmed by Poli (2015) who investigates the impact of concentrated, institutional and managerial ownership on EM initiatives in Italian unlisted firms over the years 2012-2013. Ball and Shivakumar (2005) find that earnings quality (manipulation of earnings) is higher (lower) in listed than in unlisted firms as the former are penalised with higher litigation costs when revealing low earnings quality. Further, Van Tendeloo and Vanstraelen (2008) argue that the financial statements of unlisted firms are not under such acute pressure from auditors and financial markets and therefore these firms may have a greater incentive to manage earnings in order to deal with influential stakeholders such as lenders and tax authorities better (Valentincic et al., 2017). Healy and Wahlen (1999) argue that the EM literature traditionally concentrated on accrual-based EM and the estimation of discretionary accruals. Drawing upon the advances of Schipper (1989), Fields et al. (2001) argue that EM is a complex phenomenon that is only partly investigated by examining accrual-based earnings management. Indeed, earnings may also be managed by adjusting the real operations of the firm, that is, real activity-based earnings management. Further, EM is difficult to detect as accrual-based and real activity-based EM may be employed as substitutes rather than complements (Zang, 2012).

The literature analysing the use of REM initiatives is focused largely on firms undergoing an IPO as such firms may have an incentive to boost their performance to make them more attractive to investors. Analysing UK IPOs over the period 1998-2008, Alhadab et al. (2016) provide empirical evidence that firms engage in both EM techniques in advance of the IPO, confirming their use as complements. Al-Amri et al. (2017) study unlisted firms from Gulf Cooperation Council countries and find that they engage more in REM than listed firms. Drawing on the extant literature, we next investigate the factors driving both AEM and REM strategies in unlisted firms.

Ownership concentration

The literature suggests that there are two mechanisms by which ownership concentration can affect earnings management: the alignment effect and the entrenchment effect. The alignment effect, which draws on the efficient monitoring hypothesis, suggests that as they share only a small proportion of the benefit of ownership, small shareholders do not have an incentive to monitor firm managers (Shleifer and Vishny, 1997; Swai and Mbogela, 2016). In contrast, large and controlling shareholders have a strong incentive to monitor firm management to preserve their significant investment in the firm, an effect supported by empirical evidence (Chen et al., 2010). Analysing a sample of East African listed firms, Swai and Mbogela (2016) provide empirical evidence of no relationship between ownership concentration and AEM, while they find ownership concentration impacts negatively on REM. Grimaldi and Muserra (2017) analyze Italian listed firms for the years 2010-2013, and find a negative relationship between AEM and ownership concentration, suggesting an alignment effect in concentrated ownership companies. The alignment effect may be explained in an Italian setting as firm ownership tends to be very stable, with owners changing little over time. Such owners have less incentive to manage earnings given their longer-term interest in the firm, particularly as they are often involved in its management (Poli, 2013a).

In contrast, the entrenchment effect suggests that controlling or majority owners have an incentive to use their position to damage the interests of non-controlling shareholders. Thus, following this line of argument we might expect ownership concentration and the extent of earnings management to be positively related (Shleifer and Vishny, 1997; Jaggi and Tsui, 2007) as the majority and controlling shareholders attempt to mask firm performance while destroying firm value for minority shareholders. Alternatively, Ding et al. (2007) find a U-shape relationship between EM initiatives and ownership concentration in Chinese listed firms, suggesting that the relationship is both nonlinear and may vary across countries.

Poli (2013a, b) finds empirical evidence that Italian unlisted firms tend to have highly concentrated ownership structures compared to listed firms, resulting in a high degree of managerial ownership and weak agency problems (Ball and Shivakumar, 2005). This dynamic may reduce the imperative for high-quality financial reporting for monitoring purposes (Fama and Jensen, 1983), while increasing it for debt covenant and tax reduction purposes. However, Poli (2015) provides empirical evidence that there is not a relationship between ownership concentration and earnings smoothing for Italian unlisted firms over the period 2012-2013. Taking into account the ownership characteristics and agency issues of Italian unlisted firms, we argue that they may have an incentive to mask their real performance through EM. Thus, we state the following hypothesis:

H1a: Ownership concentration is positively related to accruals-based earnings management in Italian unlisted firms.

There is a scarce literature investigating the relationship between ownership concentration and REM in relation to unlisted firms, perhaps due to the absence of available data. Swai and Mbogela (2016), analysing a sample of East African listed firms over the period 2010-2013, provide empirical evidence of a negative relationship between the two variables, consistent with an alignment effect. Francis et al. (2016) investigate the relationship between insider and outsider ownership concentration and real activity-based earnings management in a large international study of listed firms with different legal systems. They find that insider ownership is negatively related to REM, and that the relationship depends on the strength of a country’s legal system and its ability to tackle the earnings management initiatives of firms. Moreover, the authors argue that insider (concentrated) owners that own a large proportion of the firm’s capital are less likely to engage in REM as they destroy future firm value.

In Italian unlisted firms, ownership is considered stable (Poli, 2013a) as the owners are often involved in the management of the company (Ball and Shivakumar, 2005). Taking into account the corporate governance characteristics of Italian unlisted firms and the agency conflicts to which they are subject, and consistent with the prior literature suggesting that REM may cause a transfer of wealth from shareholders to other stakeholders (Garrod et al., 2007), we state the following hypothesis:

H1b: Ownership concentration is negatively related to REM in Italian unlisted firms.

Firms’ leverage

Agency theory suggests that leverage may impact on earnings management in order for firms to avoid debt covenant violations (Watts and Zimmerman, 1986). Prior literature (DeFond and Jiambalvo, 1994; Dichev and Skinner, 2002; Beatty and Weber, 2003; Lazzem and Jilani, 2018) finds that leverage impacts positively AEM, suggesting that contracting motives, such as debt covenants, may be an incentive for managing earnings.

However, few studies investigate the impact of leverage on EM in unlisted firms. Moreira (2006), analysing a sample of Portuguese unlisted firms, finds that higher leverage firms have a greater probability of engaging in AEM to avoid debt covenant violations, consistent with the entrenchment effect. Poli (2015) provides empirical evidence of a positive relationship between AEM and bank loans in Italian unlisted firms. However, some studies find a negative relationship between leverage and EM as indebted firms are under greater scrutiny from lenders (Yang et al., 2008), and suggesting that leverage mitigates EM initiatives (Jensen, 1986). As bank loans are the main source of capital in unlisted firms (Ball and Shivakumar, 2005; Mafrolla and D’Amico, 2017) and lenders are likely to assess the borrower’s creditworthiness by also analysing their financial information, leveraged firms are likely to improve firms’ financial performances by engaging in earnings management initiatives. As a consequence, we propose the following hypothesis:

H2a: Leverage is positively related to AEM in Italian unlisted firms.

Graham et al. (2005) argue that listed firms prefer to manage earnings through REM rather than through AEM, as the former are less easily detected than the latter by auditors, financial markets and regulators. Hoang and Phung (2019) find a positive relationship between REM and leverage in a sample of Vietnamese listed firms. They explain that REM is harder to detect than AEM and therefore managers of indebted firms, under the scrutiny of lenders, receive net benefits when also engaging in REM. Based on the theory and arguments stated above, we state the following hypothesis:

H2b: Leverage is positively related to REM in Italian unlisted firms.

Auditor quality

The literature provides empirical evidence that Big N audited firms are likely to exhibit a lower level of discretionary accruals than firms audited by non-Big N auditors (DeAngelo, 1981; Krishnan, 2003; Zhou and Elder, 2004; Francis et al., 2013; Alzoubi, 2016). The literature concerning the relationship between auditor choice and EM in unlisted firms suggests that larger auditors are of higher quality compared to other auditors due to their professional skills and competence, as well as their desire to maintain a good reputation (Mariani et al., 2010). Vander and Willekens (2004), analysing a sample firm of Belgian unlisted firms for the years 1994-1996, find that Big N audited firms are likely to exhibit a lower level of earnings management than smaller audited firms. Tendeloo and Vanstraelen (2008) investigate unlisted firms from Europe, and find that Big 4 auditors can limit earnings management practices more than other auditors due to their specialisation and skills. Mariani et al. (2010) examine Italian unlisted firms over the years 2004-2005, and include statutory auditors in the category of smaller auditors, that is, the typical independent audit body within the traditional corporate governance model of listed and unlisted firms. They find that large auditors are of higher quality compared to the statutory committee engaged as financial auditor.

In contrast, Bisogno (2012) studies Italian unlisted manufacturing firms, and finds no difference in the quality of audit performed across different auditor types. However, his results suffer from limitations as the research focuses only on industrial firms. We argue that larger auditors have an incentive to provide the same level of audit quality for unlisted firms as they do for listed firms, otherwise they may suffer some reputation loss. Within the traditional model of corporate governance, the Board of Statutory Auditors (the committee of statutory auditors) is an independent and professional body which has an important administrative auditing role. As a result, firm internal control systems are continuously checked by this committee whose role, work and responsibilities are regulated by Italian law (Mariani et al., 2010). Therefore, it is argued that financial information should be of high quality as the statutory committee checks for errors in preparing the financial statements and confirms their findings in a judgment report which must be approved at the shareholders meeting. Based on the extant literature and the discussion above, we posit the following hypothesis:

H3a: The engagement of a Big 4 auditor has the effect of reducing AEM in Italian unlisted firms.

Previous literature (Graham et al., 2005; Cohen and Zarowin, 2010) argues that because of their complexity, REM initiatives are more difficult for auditors and other stakeholders to detect. As REM strategies may be difficult to differentiate from the ordinary business operations of a firm, earnings management may be concealed. Indeed, there is empirical evidence that auditors are likely to detect AEM than REM (Cohen and Zarowin, 2010). Cohen and Zarowin study a sample of US-listed firms for the period 1987-2006 and find that larger auditors, while mitigating AEM, do not mitigate REM. The scholars explain this by assuming that REM “typically falls outside of the auditor’s responsibility” (Cohen and Zarowin, 2010: 13).

With regard to Italian firms, the statutory committee is less likely to discover a manipulation of real activities, as this body does not question the management of the firm as such, except in the case of firm value destruction. In addition, Chi et al. (2011) provide evidence that Big 4 auditors do not constrain REM in listed firms. Loy (2013) finds empirical evidence that Big 4 auditors do not constrain REM in unlisted firms. These findings suggest that auditors (including Big 4 audit companies) do not constrain real activity-based management since they are concerned more with controls and financial statements rather than with day-by-day operations. Consistent with the prior literature, we expect a positive relationship between the engagement of a large (Big 4) auditor and REM, and propose our hypothesis as follows:

H3b: The engagement of a Big 4 auditor does not constrain REM in Italian unlisted firms.

Firms’ size

According to the size hypothesis (Watt and Zimmermann, 1986), managers of larger firms are more likely to underestimate their earnings through their accounting choices (Amertha et al., 2014), thereby engaging in AEM techniques. This finding indicates that larger firms face higher political costs. Analysing a sample of listed firms over the period 1983-2000, Kim et al. (2003) find that small firms manage their earnings to a lesser extent than large firms. Further, Swastika (2013) finds a negative relationship between AEM and firm size in a sample of Indonesian listed firms for the years 2005-2007. These findings may be explained by the well-structured and organized internal control systems of large firms reducing AEM. Based on the extant literature, we posit the following hypothesis for AEM:

H4a: Firms’ size negatively affects AEM in Italian unlisted firms.

Swai and Mbogela (2016) find that firms’ size influences neither AEM nor REM initiatives in East African firms in the years 2004-2013. However, Vakilifard and Mortazavi (2016) provide empirical evidence that firm size impacts positively on REM in Japanese listed firms over the period 2004-2013, indicating that larger firms are likely to engage in REM. Thus, the literature on the relation between firm size and real activity-based earnings management is somewhat mixed. However, taking into account the fact that REM is more complex to arrange than AEM (Cohen and Zarowin, 2010), unlisted firms may find it simpler to engage in AEM than REM. We therefore develop the following hypothesis for the REM technique:

H4b: Firms’ size negatively affects REM in Italian unlisted firms.

Taxation

Taxation is one of the determinants of EM initiatives in unlisted firms. Ball and Shivakumar (2005) and Van Tendeloo and Vanstraelen (2008) argue that engagement in earnings management initiatives for tax purposes depends on the relationship between financial and tax rules. Financial information is used mainly for contractual incentives and less for tax purposes in countries where financial and tax accounting are either not aligned or the relationship is weak (Desai and Dharmapala, 2009). However, in countries such as Italy, accounting and tax rules are strongly aligned, and thus tax income is estimated starting from the pre-tax income shown in the income statement (Poli, 2013a).

Coppens and Peek (2005) provide empirical evidence that unlisted firms often select accounting policies that decrease their reported earnings to minimize their tax payments, suggesting that unlisted firms are likely to reduce tax burdens by manipulating accruals. Burgstahler et al. (2006) analyse a sample of European listed and unlisted firms for the years 1999-2003, and provide empirical evidence that taxation impacts positively on EM in countries with a strong relationship between financial and tax accounting, that is, where financial and tax rules are related. Marques et al. (2011) find that Portuguese unlisted firms have a strong incentive to minimize their income tax burden by manipulating earnings around zero, while Poli (2013b) finds that Italian unlisted firms engage in AEM to reduce their tax payments. However, Karjalainen (2015) finds no evidence of earnings management for tax purposes in Finnish unlisted firms. Based on findings in the previous literature, we posit the following hypothesis:

H5a: The tax burden is positively related to AEM in Italian unlisted firms.

Thedecision of a firm to use one of the two earnings management techniques depends on their relative costs (Zang, 2012). Zang argues that REM influences tax payments as a consequence of the manipulation of real operations, an example being overproduction in a given year that increases inventories in that year. Garrod et al. (2007) find that concentrated unlisted firms are less likely to engage in REM for tax purposes since REM transfers wealth from owners/managers to stakeholders (the tax authorities). We then posit the following hypothesis:

H5b: The tax burden is negatively related to REM in Italian unlisted firms.

Control variables

Consistent with previous literature on EM, we introduce some control variables in our empirical models. Firstly, we control for firms’ profitability. The literature (Van Tendeloo and Vanstraelen, 2008; Van and Chatterjee, 2015) provides empirical evidence that firms’ profitability negatively drives AEM. Based on the evidence above, a negative relationship between ROA and AEM is expected.

The literature also suggests a relationship between REM and firms’ profitability. REM alters the behaviour of firms and not just their accounting records and therefore it may have an impact on the future profitability of the firm, potentially destroying future firms’ value (Roychowdhury, 2006; Zang, 2012). Thus, a negative relationship between ROA and REM is expected. We also add some other control variables impacting on the earnings management behaviour. We control for firms’ age, because firms with a long history are expected to be exposed to more reputational risk (Ahmad et al., 2014) in which case earnings management initiatives could be detected by stakeholders. Gul et al. (2009) find a negative empirical association between firms’ age and the use of earnings management techniques (both AEM and REM). Therefore, a negative relationship between the control variable firms’ age and both earnings management techniques (AEM and REM) is expected. We also control for financial difficulties, proxied by the Altman Z-Score (Altman and Hotchkiss, 2006) for unlisted firms. A categorical indicator assuming three values was used: the value 0 for firms in health zone, the value 1 for firms in the grey zone, and the value 2 for distressed firms. Firms showing a high value of the Z-Score (that is a Z-score equals 2) have a lower probability to fail than firms showing a low value of the score. While financial difficulties may attract the scrutiny of lenders, Mafrolla and D’Amico (2017) note that they are the main sources of finance in unlisted firms. Therefore, firms with financial problems are more likely to engage in EM than other firms in order to improve their creditworthiness. Therefore, according to the debt hypothesis (Watts and Zimmerman, 1986), a positive association between the dependent variables AEM and REM and the control variable Z-Score indicator is expected. Agrawal and Chatterjee (2015) analyze a sample of Indian firms for the years 2009-2014 and find that financial problems (proxied by the Z-Score) impact positively EM. Finally, we control for the fixed assets ratio (Chen et al., 2018) since it may be an incentive to engage in earnings management initiatives. According to Chen et al. (2010), a positive relationship between the fixed assets ratio and AEM is expected, while a negative relationship between the fixed assets ratio and REM is expected because the amortization and depreciation only impacts accruals at the end of the year when the financial statements are prepared.

Sample selection

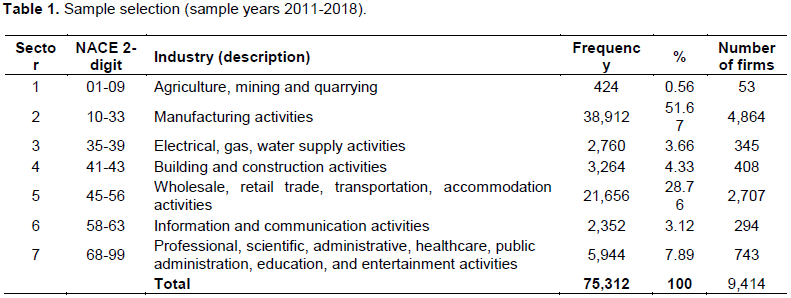

Data were collected from the Bureau van Dijk AIDA Database for the years 2011 to 2018. The data sample consists of Italian unlisted firms. These firms are not obliged to prepare consolidated financial statements, have equity capital exceeding the audit requirement threshold of €120,000. Finance firms were excluded given the non-standard format of their financial statements and regulatory status. Further, we remove firms with missing data in one or more years, and any firms that failed during the period of the analysis. Finally, we remove data outliers and missing values, arriving at a balanced panel of 9,414 firms, giving a total of 75,312 firm-year observations. A description of our balanced sample firms is given in Table 1.

Measurement of the AEM dependent variable

According to previous literature, signed discretionary accruals are used as we are interested in measuring the direction of the accruals, that is, whether earnings are over- or under estimated. The literature proposes several models for decomposing total accruals into both discretionary and non-discretionary accruals components (Jones, 1991); the Dechow et al. (1995) model (also named the modified Jones model), the Kasznik (1999) model, and the Kothari et al. (2005) model. In this paper, we used Mariani et al. (2010) and Bisogno (2012) models:

Measurement of the REM dependent variable

Roychowdhury (2006) estimates REM by using three metrics, as follows: (i) the expected value of the operating cash flows; (ii) expected production costs; and (iii) expected discretionary expenditures. In this paper, we estimate REM in relation to abnormal cash flows from operations and abnormal production costs. Since neither the net income statement format provided by the Italian civil code nor the notes to the accounts disclose the discretionary expenses such as R&D, we do not estimate discretionary expenses.

Abnormal cash flows from operations (CFO) are estimated by deducting actual cash flows from operations from the normal level of CFO, as in Subramanyam (1996). Equation 5 estimates the abnormal CFO.

Descriptive statistics

Descriptive statistics for both the dependent variables and for the continuous independent variables are presented in Table 3. Our sample firms show that the signed value of AEM has a mean of -0.002, while the signed value of REM has a mean of -0.017 and a maximum of 5.370. Mean financial leverage is 0.210 with a standard deviation of 0.177. The mean tax burden, measured as the ratio of total taxes to earnings before taxes, has a value of 0.241 with a standard deviation of 15.712. The recognition of both payable and deferred taxes across the years can have a negative or a positive balance according to the resorption of the temporary differences (for deferred taxes). The average profitability (ROA) of the sample firms is 2.6%, while the firm size is, on average, 10.115 (proxied by the natural logarithm of total assets).

Table 4 exhibits descriptive statistics for the dichotomous dummy independent variables. We observe that 53.8% of the sample firms have an ownership concentration greater than 25%, and thus Italian unlisted firms are in general highly concentrated (Cascino et al., 2010). With regard to the auditing of financial statements, 21.3% of our sample firms engage a Big 4 audit company, while 78.7% of them engage a non-Big 4 audit company or a Board of Statutory Auditors. Untabulated results show that for firms audited by smaller auditors, 52.25% are audited by a BSA, whereby it is engaged as both administrative and financial auditor. Finally, Table 4 exhibits that the 95.8% of the sample firms (72,147 firm-year observations) are in the distress zone (the Z-score takes the value of 2), the 3.60% in the grey zone (the Z-Score takes the value 1), while the 0.60% of the sample firms (the Z-Score takes the value of 0) is the healthy zone.

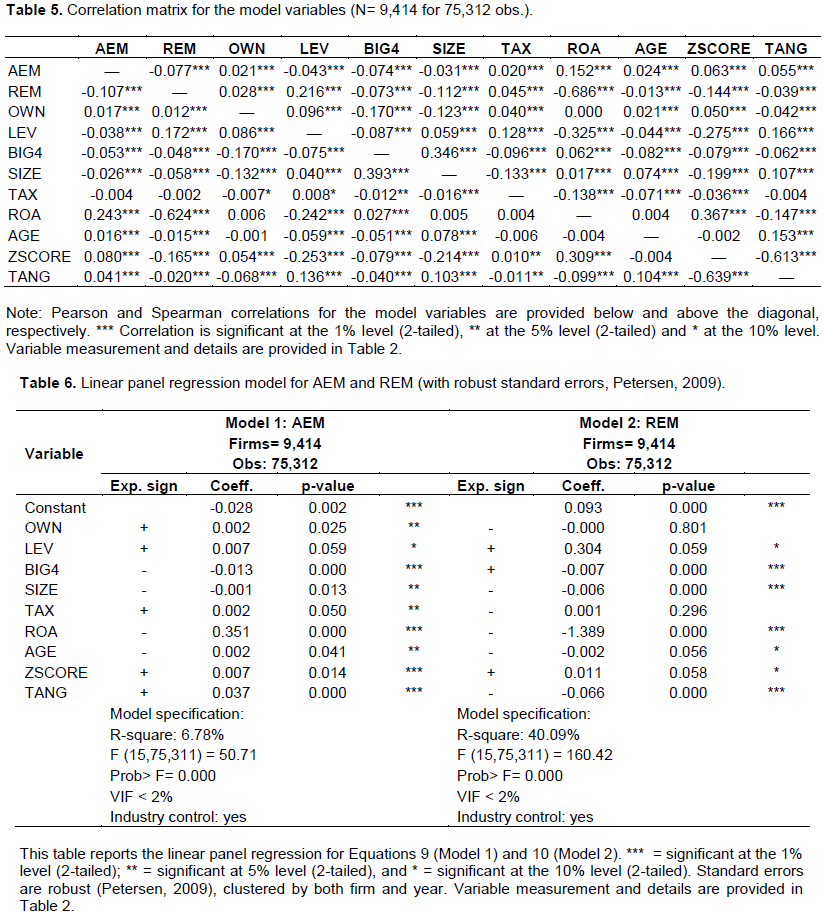

Correlation matrix

Table 5 gives the Pearson/Spearman correlation matrix for our model variables. Since the correlation coefï¬cients are fairly small in magnitude, we argue that multicollinearity is not a significant problem in our sample firms. Further, the VIFs for our model variables are lower than 2. The correlation between the dependent variables, AEM and REM, is negative (Pearson and Spearman coefficient) and significant at the 1% level (-0.107), demonstrating that these variables do not move in the same direction and that there is substitution between the two earnings management strategies.

It is observed that AEM exhibits a positive relationship with OWN, while it exhibits a negative relationship with LEV, BIG4, SIZE. Therefore, AEM technique is greater in firms with greater ownership concentration, and lower in firms with greater leverage, size and in firms engaging Big 4 auditors. In common with AEM, REM exhibits a positive relationship with OWN and LEV, while it exhibits a negative relationship with BIG4, SIZE. Thus, REM is higher in firms with greater ownership concentration and greater leverage, and lower in firms with greater size and in firms engaging Big 4 auditors. The variable TAX exhibits an insignificant correlation with the dependent variables, probably because the tax is determined by variables exogenous to our model. ROA exhibits a positive and significant relationship with AEM, while it exhibits a negative correlation with REM. These results imply that the lower ï¬rm performance may increase the likelihood of engaging in REM activities to signal future ï¬rm value.

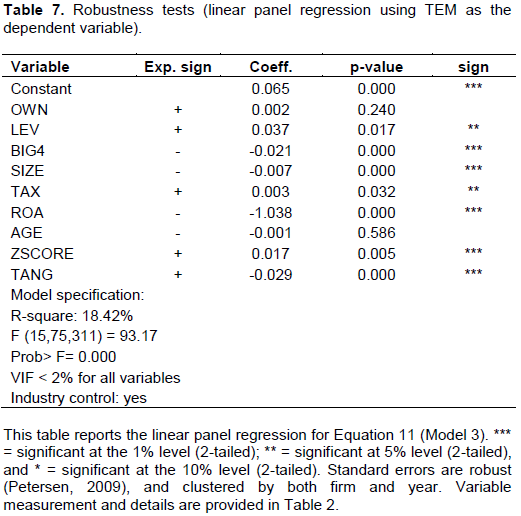

Table 6 exhibits the results of the OLS regression models of the potential drivers of the two earnings management techniques (AEM and REM). Model 1 employs the signed AEM as the dependent variable, while Model 2 employs the signed REM as the dependent. The coefficients in Models 1 and 2 are estimated according to Petersen (2009), by using robust standard errors clustered by firm and year to check for data endogeneity. VIF values are lower than 2 for all variables in Models 1 and 2, and both models also control for industry sector. Model 1, testing Equation 9, exhibits an R-square of 6.78%, while the F test is significant at the 1% level.

The coefficient of the independent variable OWN exhibits a positive sign, as expected, and is significant at the 5% level, indicating that more concentrated ownership in unlisted firms leads to greater AEM. This is consistent with Shleifer and Vishny (1997) and Jaggi and Tsui (2007). The positive relationship, consistent with the entrenchment effect, suggests that dominant shareholders (with greater than 25.01% of the firm’s equity) have greater incentives to damage the interests of the minority shareholders, masking firm performance by manipulating earnings. This finding is consistent with the entrenchment hypothesis. Therefore, H1a is supported.

The coefficient of the independent variable LEV exhibits a positive sign, as expected, which is significant at the 10% level. This finding indicates that unlisted firms, according to prior literature (Mafrolla and D’Amico, 2017), are more likely to engage in AEM as their financial leverage increases in order to avoid potential violation of debt covenants, or to mask their weak financial performance to lenders. This finding also suggests that managers of highly levered firms are likely to improve firms’ credit worthiness, according to the debt covenant hypothesis (Watts and Zimmermann, 1986). Our finding is inconsistent with prior literature (Yang et al., 2008). Therefore, our hypothesis H2a is supported.

The coefficient of the independent variable BIG4 exhibits a negative sign, as expected, and is significant at the 1% level. This finding indicates that the engagement of a large and high-quality auditor (a Big 4 audit company) tends to reduce AEM. This finding may indicate that Big 4 auditors have a reputation to protect (DeAngelo, 1981; Francis and Wang, 2008). In addition, to provide a high-quality audit service, auditors must follow rigorous audit processes and quality-control procedures that only large audit firms may ensure because of their investment in partner education and their worldwide industrial experience. In addition, engaging a Big 4 auditor may be used by firms to signal high financial reporting quality. Our finding is consistent with Van Tendeloo and Vanstraelen (2008) for unlisted firms and with Alzoubi (2016) and Krishnan (2003) for listed firms. Therefore, hypothesis H3a is supported.

The coefficient of the independent variable SIZE exhibits a negative sign and is significant at the 5% level and thus larger unlisted firms are less likely to engage in AEM than smaller firms. This finding suggests that large firms have better organized internal control systems than smaller firms. In the case of Italian (both listed and unlisted) firms the administrative audit is carried out by an independent and professional mandatory audit committee, the Board of Statutory Auditors, which maintains significant responsibility in controlling operations and accounting practices to protect minority shareholders and external stakeholders (Mariani et al., 2010). These findings are consistent with Swastika (2013) and Amertha et al. (2014). Therefore, hypothesis H4a is supported.

The coefficient of the independent TAX exhibits a positive sign, as expected, and is significant at 5% level. This finding indicates that corporate tax expense drives AEM in countries, such as Italy (Poli, 2013a), where financial and tax accounting are aligned. Therefore therefore unlisted firms are likely to manage accrual earnings for tax purposes (Van Tendeloo and Vanstraelen, 2008). Our finding is consistent with the extant literature, including studies such as Coppens and Peek (2005). Therefore, hypothesis H5a is supported.

The coefficient of the control variable ROA exhibits a positive sign, contrary to expectations, and is significant at the 1% level. This finding suggests that profitable firms are more likely than other firms to engage in AEM to match stakeholders’ expectations. This finding also indicates that growing firms are likely to manage accruals to signal future firm performance (Wu and Robin, 2012). Our finding is not consistent with Van Tendeloo and Vanstraelen (2008).

The control variable AGE has a positive sign, contrary to expectations, and is significant at the 5% level. This finding, inconsistent with prior literature concerning listed firms (Gul et al., 2009; Ahmad et al., 2014), suggests that unlisted firms are not exposed to increased reputational risk compared to other firms.

The coefficient of control variable ZSCORE exhibits a positive sign, as expected, and is significant at the 5% level. This finding, consistent with the debt hypothesis, indicates that firms in the distress zone are more likely than other firms to engage in AEM. Our finding is consistent with the prior literature (Agrawal and Chatterjee, 2015). Finally, the coefficient of the control variable TANG, gauged using the fixed assets ratio, has a positive sign, as expected, and is significant at the 1% level. This finding, consistent with Chen et al. (2010), indicates that firms investing in high fixed assets are more likely to adjust earnings through AEM technique. The results for Model 2, which employs REM as dependent, are shown in the second column of Table 6. The model exhibits an R-square of 40.09%, while the F test is significant at the 1% level. The variance inflation factor value is below 2 for all model variables.

The coefficient of the independent variable OWN exhibits a negative sign which is not significant, and therefore inconsistent with the prior literature concerning listed firms (Swai and Mbogela, 2016), while there is no existing empirical evidence for unlisted firms. This finding provides evidence that concentrated ownership does not impact on REM as it may cause a transfer of wealth to stakeholders, thereby damaging the shareholders (Garrod et al., 2007). Therefore, H1b is not supported.

The coefficient of the independent variable LEV exhibits a positive sign, as expected, and is significant at the 10% level, and thus highly leveraged firms are more likely to engage in REM (Zang, 2012). According to the debt hypothesis (Watts and Zimmerman, 1986), higher levered unlisted firms are more likely to manage earnings than firms that are not leveraged by using an EM technique that is hard to detect by lenders (Graham et al., 2005). Our finding is consistent with Hoang and Phung (2019). Therefore, hypothesis H2b is supported. The coefficient of the independent variable BIG4 exhibits a negative sign, contrary to expectations, which is significant at the 1% level. This finding suggests that Big 4 audited firms are less likely to engage in REM than other firms. Our finding is not consistent with the prior literature (Cohen and Zarowin, 2010; Chi et al., 2011). This suggests that in unlisted firms, big audit companies have the effect to constrain real activity-based earnings management since such firms are simpler to audit than listed firms. Therefore, H3b is not supported. The coefficient of the independent variable SIZE exhibits a consistent with the extant literature concerning listed firms (Swai and Mbogela, 2016; Vakilifard and Mortazavi, 2016).

Contrary to expectations, the variable TAX exhibits a positive sign, even though it is not significant. This result is inconsistent with the prior literature (Marques et al., 2011), and therefore, H5b is not supported. As REM is more complex to implement than AEM (Graham et al., 2005; Cohen and Zarowin, 2010), unlisted firms may find it simpler to engage in the latter. Therefore, taxation is evidently not associated with REM initiatives as suggested by Garrod et al. (2007). As expected, the control variable ROA exhibits a negative sign which is significant at the 1% level. Thus, profitable firms are less likely than other firms to manipulate earnings. This finding indicates that profitable firms do not engage in REM since it destroys cash flows and firms’ value, causing a transfer of firms’ wealth from shareholders to stakeholders. In addition, since abnormal cash flows and abnormal production costs are absorbed across the years (in contrast to accruals), the engagement in REM may impact negatively on the future performance of firms. The coefficient of the control variable AGE exhibits a negative sign, as expected, which is significant at the 10% level. This finding indicates that old firms are less likely to engage in real activity-based EM since they are exposed to reputational risks more than other firms (Ahmad et al., 2014). Our finding is consistent with the prior literature (Gui et al., 2009). The sign of the control variable ZSCORE exhibits a positive sign, as expected, and is significant at the 10% level. According to the prior literature (e.g. Altman, 2000), firms with financial difficulties, are more likely to engage in REM, consistent with the debt hypothesis. Finally, the coefficient of the control variable TANG exhibits a negative sign, as expected, and is significant at the 1% level. This finding suggests that the investment in tangible fixed assets does not impact on REM.

Robustness tests

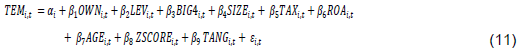

Finally, consistent with Fields et al. (2001), we regressed the extent of total earnings management (TEM), against the independent variables in Equations 9 and 10. Here, TEM is the total sum of AEM and REM. In this way, we examine the determinants of overall EM behavior in unlisted firms. Thus, Model 3 in Equation 11 uses TEM (total earnings management) as the dependent variable. The model results are shown in Table 7.

Model 3 has an R-square value of 18.42%, indicating that the firm characteristics explain 18.42% of the variability of the dependent variable TEM. This R-square is higher than that in Model 1 and lower than that in Model 2, both given in Table 6. Model 3 indicates that the dependent variable TEM is positively related to the variables LEV, TAX, and ZSCORE at the 5%, 5% and 1% levels, respectively, while the variables OWN and AGE are insignificant. The variable TEM is significantly negatively related to the variables BIG4, SIZE, ROA and TANG at the 1% level. These findings indicate that both higher leverage and greater financial difficulties lead to greater overall earnings management (that is, the sum of AEM and REM). These findings, consistent with Mafrolla and D’Amico (2017), suggest that high-indebted firms are more likely to manage earnings. Big 4 audited firms are less likely to engage in earnings management initiatives as such auditors constrain earnings management (DeAngelo, 1981). More profitable firms engage less in EM since these firms have less incentive to do so. Corporate tax drives positively TEM. This finding provides evidence that unlisted firms manage earnings for tax purposes (Ball and Shivakumar, 2005). Consistent with prior literature (Swastika, 2013; Amertha et al., 2014), larger firms engage less in EM initiatives than other firms because of their better internal control systems than smaller firms, consistent with Swastika (2013) and Amertha et al. (2014). Finally, the control variable TANG negatively affects the overall measure of earnings management (TEM).

In this paper, we set out to study the firm level determinants of accrual-based and real activity-based EM for a large sample of Italian unlisted firms over the years 2011-2018 in order to analyze which are incentives to management to engage in AEM and/or REM earnings management techniques. To capture accrual-based EM, we employ the Dechow et al. (1995)’s model, while we capture REM using abnormal cash flows and abnormal production costs. Garrod et al. (2007) find that concentrated unlisted firms are likely to manage AEM while such firms do not manage REM since it causes a wealth transfer from shareholders to stakeholders, even though REM is harder to detect than AEM (Zang, 2012).

We estimate two models to examine the determinants of earnings management: an accrual-based EM model and a real activity-based EM model. Further, following Fields et al. (2011), a robustness test analyzes the drivers of total earnings management. Our hypothesis development is based on key potential drivers identified in the EM literature, including ownership concentration, firm leverage, auditor type, firm size, tax burden, and firm profitability, the latter employed as a control variable.

Our key findings are summarised as follows. In terms of AEM, ownership concentration in unlisted firms is a positive driver, according to the entrenchment hypothesis. As firm equity is typically owned by only a few investors, then the quality of published financial information becomes less important to them. As expected, firm leverage is a positive driver, suggesting that firms manage earnings to avoid violations of debt covenants. Larger auditors (Big 4 audit companies) are more likely to constrain AEM than other auditors given their expertise and desire to maintain their reputations. Firm size is a negative driver, suggesting that larger firms have a well-organized and well-structured internal control system, reducing incentives for managing accruals. Consistent with prior literature (Burgstahler et al., 2006) taxation is a positive driver of AEM. Finally, for the control variables, firm profitability positively drives AEM which confirms the greater need of firms to manipulate earnings as their profitability increases. Firm age, financial difficulties, and the tangible fixed assets ratio are all positive drivers of AEM, consistent with the previous literature.

For our REM model, ownership concentration does not drive REM since it transfers wealth from shareholders to stakeholders. Big 4 audited firms are likely to constrain REM because they control for abnormal cash flows, one of the proxies of REM. Firm leverage is a positive driver of REM, suggesting that higher levered firms have more incentives to improve their credit worthiness. Firm size and firm age negatively drive REM. Financial difficulties, consistent with the debt hypothesis, is a positive driver of REM. Taxation does not impact REM, consistent with Garrod et al. (2007). Overall, when we compare the two models, we can confirm our general hypothesis that Italian unlisted firms engage in both AEM and REM techniques, especially for lending purposes, since leverage and financial distress indicators drive positively both AEM and REM.

For robustness, according to Fields et al. (2001), we introduce total earnings management (TEM) as a dependent variable to capture the overall measure of earnings management. The findings confirm the analysis of the main Models 1 and 2, suggesting that leverage and financial difficulties are drivers of overall earnings management behaviour, while taxation only impacts AEM, confirming that a firm’s tax payment is a political cost transferring wealth from owners to stakeholders (e.g. the tax authorities).

Firm size is a negative driver of overall earnings management since large firms are more likely to have well-organized internal control systems. Further, the engagement of a Big 4 audit company is likely to constrain earnings management. Firm profitability is a negative driver of TEM as in Model 2, indicating that profitable firms are less likely to manage earnings opportunistically. Finally, as expected, the tangible fixed assets ratio is a negative driver of TEM.

Our paper has implications for both academic researchers and practitioners. Our results suggest that Italian unlisted firms engage in both AEM and REM. We provide evidence on the firm characteristics such as ownership concentration, leverage, auditor type, firm size, and tax position which influence earnings management practice. In particular, our findings suggest that both academics and standard setters should focus on both AEM and REM incentives in preparing accounting standards and enforcing the role and the skills required of the board of statutory auditors. Understanding the ways in which firms manage their earnings may help in the prevention of such practices in the future, and facilitate the strengthening of domestic accounting standards to also detect REM initiatives. There are two main limitations to our study. The first is that we are not able to use all three metrics of REM suggested in the seminal literature (Roychowdhury, 2006) due to limitations in the format of the financial statements for Italian unlisted firms and the non-mandatory disclosure of R&D expenses. The second limitation is that our research does not analyze the trade-off between both earnings management techniques (AEM and REM) that may indicate the non-simultaneous use of earnings management techniques.

The authors have not declared any conflict of interests.

REFERENCES

|

Agrawal K, Chatterjee C (2015). Earnings management and financial distress: Evidence from India. Global Business Review 16(5suppl):140S-154S.

Crossref

|

|

|

|

Al-Amri K, Al Shidi S, Al Busaidi M, Akguc S (2017). Real earnings management in public vs private firms in the GCC countries: a risk perspective. Journal of Applied Accounting Research 18(2):242-260.

Crossref

|

|

|

|

|

Ahmad M, Anjum T, Azeem M (2014). Investigating the impact of corporate governance on earning management in the presence of firm size; evidence from Pakistan. International Interdisciplinary Research Journal 3(2):84-90.

|

|

|

|

|

Alhadab M, Clacher I, Keasey K (2016). Real and accrual earnings management and IPO failure risk. Accounting and Business Research 45(1):55-92.

Crossref

|

|

|

|

|

Altman EI, Hotchkiss E (2006). Corporate financial distress and bankruptcy. New Jersey. Wiley.

Crossref

|

|

|

|

|

Altman E (2000). Predicting financial distress of companies: revisiting the Z-score and ZETA. Handbook of Research Methods and Applications in Empirical Finance.

|

|

|

|

|

Alzoubi E (2016). Ownership Structure and Earnings Management: Evidence from Jordan. International Journal of Accounting and Information Management 24(2):135-161.

Crossref

|

|

|

|

|

Amertha ISP, Ulupui IGKA, Ulupui IGAMAD (2014). Analysis of firm size, leverage, corporate governance on earnings management practices (Indonesian evidence). Journal of Economics, Business and Accountancy 17(2):259-268.

Crossref

|

|

|

|

|

Ball R, Shivakumar L (2005). Earnings Quality in U.K. Private Firms: Corporative Loss Recognition. Journal of Accounting and Economics 38:83-128.

Crossref

|

|

|

|

|

Beatty A, Weber J (2003). The effects of debt contracting on voluntary accounting method changes. Accounting Review 78(1):119-142.

Crossref

|

|

|

|

|

Bisogno M (2012). Audit quality of Italian industrial non-listed firms: an empirical analysis. International Journal of Business Research and Development 1(1):32-47.

Crossref

|

|

|

|

|

Bisogno M, De Luca R (2016). Voluntary Joint Audit and Earnings Quality: Evidence from Italian SMEs, International Journal of Business Research 5(1):1-22.

Crossref

|

|

|

|

|

Burgstahler DC, Hail L, Leuz C (2006). The Importance of Reporting Incentives: Earnings Management in European Private and Public Firms. The Accounting Review 81(5):983-1016.

Crossref

|

|

|

|

|

Cascino S, Pugliese A, Mussolino D, Sansone C (2010). The Influence of Family Ownership on the Quality of Accounting Information. Family Business Review 23(3):246-265.

Crossref

|

|

|

|

|

Cesaroni FM, Ciambotti M (2011). La successione nelle imprese familiari. Profili aziendalistici, societari e fiscali. Milan: Franco Angeli.

|

|

|

|

|

Chen X, Cheng Q, Wang X (2010). Does increased board independence reduce earnings management? Evidence from recent regulatory reforms (Mimeo). University of Wisconsin-Madison and Chinese University of Hong Kong. Available at:

View

|

|

|

|

|

Chen WEI, Hribar P, Melessa S (2018). Incorrect inferences when using residuals as dependent variables. Journal of Accounting Research 56(3):751-796.

Crossref

|

|

|

|

|

Chi W, Lisic LL, Pevzner M (2011). Is enhanced audit quality associated with greater real earnings management?. Accounting Horizons 25(2):315-335.

Crossref

|

|

|

|

|

Cohen DA, Zarowin P (2010). Accrual-based and real earnings management activities around seasoned equity offerings. Journal of Accounting and Economics 50(1):2-19.

Crossref

|

|

|

|

|

Coppens L, Peek E (2005). An Analysis of Earnings Management by European Private Firms. Journal of International Accounting, Auditing and Taxation 14:1-17.

Crossref

|

|

|

|

|

DeAngelo LE (1981). Auditor size and audit quality. Journal of Accounting and Economics 3:183-199.

Crossref

|

|

|

|

|

Dechow P, Sloan RG, Sweeney AP (1995). Detecting earnings management. Accounting Review 70(2):193-225.

|

|

|

|

|

DeFond ML, Jiambalvo J (1994). Debt covenant violation and manipulation of accruals. Journal of Accounting and Economics 17(1/2):145-176.

Crossref

|

|

|

|

|

Desai MA, Dharmapala D (2009). Earnings Management, Corporate Tax Shelters, and Book-Tax Alignment. National Tax Journal LXII(1):169-186.

Crossref

|

|

|

|

|

Dichev ID, Skinner DJ (2002). Large-Sample Evidence on the Debt Covenant Hypothesis. Journal of Accounting Research 40(4):1091-1123.

Crossref

|

|

|

|

|

Ding Y, Zhang H, Zhang J (2007). Private vs. state ownership and earnings management: Evidence from Chinese listed companies. Corporate Governance: An International Review 15(2):223-238.

Crossref

|

|

|

|

|

Elkalla T (2017). An Empirical Investigation of Earnings Management in the MENA Region, (Unpublished doctoral thesis). Retrieved from:

View

|

|

|

|

|

Fama E, Jensen M (1983). Separation of ownership and control. Journal of Law and Economics 26:301-325.

Crossref

|

|

|

|

|

Fields TD, Lys TZ, Vincent L (2001). Empirical research on accounting choice. Journal of Accounting and Economics 31(1):255-307.

Crossref

|

|

|

|

|

Francis B, Hasan I, Li L (2016). A cross-country study of legal-system strength and real earnings management. Journal of Accounting and Public Policy 35(5):477-512.

Crossref

|

|

|

|

|

Francis J, Michas P, Seavey S (2013). Does Audit Market Concentration Harm the Quality of Audited Earnings? Evidence from Audit Markets in 42 Countries. Contemporary Accounting Research 30(1):325-355.

Crossref

|

|

|

|

|

Francis JR, Wang D (2008). The joint effect of investor protection and Big 4 audits on earnings quality around the world. Contemporary accounting research 25(1):157-191.

Crossref

|

|

|

|

|

Garrod N, Ratej PS, Valentincic A (2007). Political cost (dis) incentives for earnings management in private firms: 1-39.

Crossref

|

|

|

|

|

Giacomelli S, Trento S (2005). Proprietà, controllo e trasferimenti nelle imprese italiane. Cosa è cambiato nel decennio 1993-2003? (Ownership, control and acquisition of Italian firms. What is happened in the period 1993-2003?). Banca d'Italia (Bank of Italy), Temi di discussione n. 50.

|

|

|

|

|

Graham JR, Harvey CR, Rajgopal S (2005). The economic implications of corporate financial reporting. Journal of Accounting and Economics 40(1):3-73.

Crossref

|

|

|

|

|

Grimaldi F, Muserra AL (2017). The Effect of the Ownership Concentration on Earnings Management. Empirical Evidence from the Italian Context. Corporate Ownership & Control 14(3-1):236-248.

Crossref

|

|

|

|

|

Gul FA, Fung SYK, Jaggi B (2009). Earnings quality: Some evidence on the role of auditor tenure and auditors' industry expertise. Journal of accounting and Economics 47(3):265-287.

Crossref

|

|

|

|

|

Healy PM, Wahlen JM (1999). A Review of the Earnings Management Literature and Its Implications for Standard Setting. Accounting Horizons 13(4):365-383.

Crossref

|

|

|

|

|

Hoang K, Phung T (2019). The effect of financial leverage on real and accrual-based earnings management in Vietnamese firms. Economics and Sociology 12:299-312.

Crossref

|

|

|

|

|

Hope OK, Langli J, Thomas W (2012). Agency conflicts and auditing in private firms, Accounting, Organizations and Society 37(7):500-517.

Crossref

|

|

|

|

|

Jaggi B, Tsui J (2007). Insider trading earnings management and corporate governance: Empirical evidence based on Hong Kong Firms. Journal of International Financial Management and Accounting 18(3):192-222.

Crossref

|

|

|

|

|

Jensen MC, Meckling WH (1976). Theory of the Firm: Managerial Behavior, Agency and Ownership Structure. Journal of Financial Economics 3(4):305-360.

Crossref

|

|

|

|

|

Jensen MC (1986). Agency Costs of Free Cash Flow, Corporate Finance, and Takeovers. American Economic Review 76(2):323-329.

|

|

|

|

|

Jones J (1991). Earnings management during import relief investigations. Journal of Accounting Research 29:193-228.

Crossref

|

|

|

|

|

Karjalainen J (2015). Essays on Earnings Management in Private Firms, University of Eastern Finland. Available at

View

|

|

|

|

|

Kasznik R (1999). On the association between voluntary disclosure and earnings management. Journal of Accounting Research 37:57-81.

Crossref

|

|

|

|

|

Kim Y, Liu C, Rhee, SG (2003). The effect of firm size on earnings management. Working paper, University of Hawaii. Available at

View

|

|

|

|

|

Kothari SP, Leone AJ, Wasley C (2005). Performance matched discretionary accrual measures. Journal of Accounting and Economics 39(1):163-197.

Crossref

|

|

|

|

|

Krishnan GV (2003). Does big 6 auditor industry expertise constrain earnings management?. Accounting Horizons 17:1-16.

Crossref

|

|

|

|

|

Lamb M, Nobes C, Roberts A (1998). International variations in the connections between tax and financial reporting. Accounting and Business Research 28:173-188.

Crossref

|

|

|

|

|

Lazzem S, Jilani F (2018). The impact of leverage on accrual-based earnings management: The case of listed French firms, Research in International Business and Finance 44:350-358.

Crossref

|

|

|

|

|

Leuz C, Nanda D, Wysocki P (2003). Earnings Management and Investor Protection: An International Comparison. Journal of Financial Economics 69(3):505-527.

Crossref

|

|

|

|

|

Mafrolla E, D'Amico E (2017). Borrowing capacity and earnings management: An analysis of private loans in private firms. Journal of Accounting and Public Policy 36(4):284-301.

Crossref

|

|

|

|

|

Mariani L, Tettamanzi P, Corno F (2010). External Auditing vs Statutory Committee Auditing: the Italian Evidence. International Journal of Auditing 14:25-40.

Crossref

|

|

|

|

|

Marques M, Rodrigues L, Craig R (2011). Earnings management induced by tax planning: The case of Portuguese private firms. Journal of International Accounting, Auditing and Taxation 20(2):83-96.

Crossref

|

|

|

|

|

Moreira JAC (2006). Are financing needs a constraint to earnings management? Evidence from private Portuguese firms. CETE discussion papers 0610, Faculdade de Economia, Universidade do Porto, unpublished results.

|

|

|

|

|

Omid AM (2015). Qualified audit opinion, accounting earnings management and real earnings management: Evidence from Iran. Asian Economic and Financial Review 5(1):46-57.

Crossref

|

|

|

|

|

Petersen MA (2009). Estimating standard errors in finance panel data sets: comparing approaches. The Review of Financial Studies 22(1):435-480.

Crossref

|

|

|

|

|

Poli S (2013a). Small-sized companies' earnings management: Evidence from Italy. International Journal of Accounting and Financial Reporting 3(2):93-109.

Crossref

|

|

|

|

|

Poli S (2013b). The Italian unlisted companies' earnings management practices: The impacts of fiscal and financial incentives. Research Journal of Finance and Accounting 4(11):48-60.

|

|

|

|

|

Poli S (2015). The links between accounting and tax reporting: The case of the bad debt expense in the Italian context. International Business Research 8(5):93-100.

Crossref

|

|

|

|

|

Roychowdhury S (2006). Earnings management through real activities manipulation. Journal of Accounting and Economics 42(3):335-370.

Crossref

|

|

|

|

|

Schipper K (1989). Commentary on Earnings Management. Accounting Horizons 3(4):91-102.

|

|

|

|

|

Shleifer A, Vishny RW (1997). A survey of Corporate Governance. Journal of Finance 52:737-783.

Crossref

|

|

|

|

|

Subramanyam KR (1996). The pricing of discretionary accruals. Journal of Accounting and Economics 22(1-3):249-281.

Crossref

|

|

|

|

|

Swai JP, Mbogela CS (2016). Accrual-based versus real earnings management, the effect of ownership structure: evidence from East Africa. ACRN Oxford Journal of Finance and Risk Perspectives 5(2):121-140.

|

|

|

|

|

Swastika DLT (2013). Corporate governance, firm size, and earning management: Evidence in Indonesia stock exchange. IOSR Journal of Business and Management 10(4):77-82.

Crossref

|

|

|

|

|

Vakilifard H, Mortazavi MS (2016). The Impact of Financial Leverage on Accrual-Based and Real Earnings Management. International Journal of Academic Research in Accounting, Finance and Management Sciences 6(2):53-60.

Crossref

|

|

|

|

|

Valentincic A, Novak A, Kosi U (2017). Accounting quality in private firms during the transition towards international standards. Accounting in Europe 14(3):358-387.

Crossref

|

|

|

|

|

Van Tendeloo B, Vanstraelen A (2008). Earnings management and audit quality in Europe: Evidence from the private client segment market. European Accounting Review 17(3):447-469.

Crossref

|

|

|

|

|

Vander BH, Willekens M (2004). Evidence on audit-quality differentiation in the private client segment of the Belgian audit market. European Accounting Review 13:501-522.

Crossref

|

|

|

|

|

Watts R, Zimmerman J (1986). Positive accounting theory. Englewood Cliffs, New Jersey: Prentice-Hall.

|

|

|

|

|

Wu Q, Robin A (2012). Firm growth and the pricing of discretionary accruals. Review of Quantitative Finance and Accounting, Forthcoming.

Crossref

|

|

|

|

|

Yang CY, Lai HN, Tan BL (2008). Managerial Ownership Structure and Earnings Management. Journal of Financial Reporting and Accounting 6(1):35-53.

Crossref

|

|

|

|

|

Zang A (2012). Evidence on the trade-off between real activities manipulation and accrual-based earnings management. Accounting Review 87(2):675-803.

Crossref

|

|

|

|

|

Zhou J, Elder RJ (2004). Audit quality and earnings management by seasoned equity offering firms. Asia-Pacific. Journal of Accounting and Economics 11(2):95-120.

Crossref

|

|