ABSTRACT

This study aims at examining the determinants of the financial performance of private commercial banks in Ethiopia. The study uses secondary data for eight private banks which are in the industry for more than ten years. These banks are chosen from sixteen private commercial banks which are currently functional in Ethiopia banking industry. The data for this study is obtained from annual reports of the banks, minutes and the national bank report. Correlation and multiple linear regressions of panel data for the eight banks for the years 2007 to 2016 is analyzed using random effect model. E-Views 9 software was used for analyzing the data. Return on Asset and Return on Equity are the selected dependent variables while non-performing loan, capital adequacy ratio, bank size, leverage ratio, credit interest income ratio, loan loss provision ratio and operation cost efficiency were the independent variables. Results show that Capital Adequacy Ratio (CAR), Credit Interest Income (CIR) and Size of the bank (SIZE) have positive and statistically significant effect on financial performance. Non-performing Loans (NPLs), Loan Loss Provision (LLP), Leverage Ratio (LR) and Operational Cost Efficiency (OCE) have negative and statistically significant effect on banks’ financial performance. The study suggests that Ethiopian commercial banks are advised to manage their loan loss, be cost efficient, and fix their leverage ratio at maximum level to enhance their profitability. Key words: Ethiopia, commercial banks, determinants, financial performance.

Financial institutions play significant role for economic development of nations in general and of developing countries like Ethiopia in particular, where the financial system as a whole is bank dependent due to poor development or even absence of the stock market. Banks are one of the deposit taking financial institutions that play pivotal role for financial stability and are also engines for economic development of a given nation (Al-Karim and Alam, 2013). One of the principal objectives of the financial institutions, particularity the banking sector is mobilizing resources from those who have excess supply especially in the form of saving deposits and channeling these funds to those who are with financial constraints, at the same time with productive investment opportunities. According to Sufian (2009), financial institutions paly key role in economic growth as they are mobilizing savings for productive investments through facilitating role in capital flows towards various sectors of the economy.

It is also worth noting that commercial banks in most of the world economies are dominant type of financial institution that provide installment, facilitate the internal and external trade and move money and capital when compared to any other financial institution (Greuning and Bratanovic, 2003). The overall operation of the economy of developing countries is dependent on well-functioning of their commercial banks. If not, the entire economy will be illiquid, saving and investment will be divorced which could result in further economic stagnation. According to Zawadi (2013), a healthy financial system of banks is the guarantee not only for depositors but also for all stakeholders who directly or indirectly are affected with banks’ operation such as: shareholders, employees, investors, depositors, government and the whole economy at large. As a means to boost the confidence of these stakeholders, efforts have been exerted to assess the determinants of financial performance of financial institutions in general and the banking sector in particular by various researchers.

But, in order for the banks to successfully provide such intermediation function and contribute their best to financial stability and economic growth as well, their financial performance has profound role. Private banking in Ethiopia is an infant practice as it exists only after two decades that private investors were allowed to invest in the industry. To this end, countless factors could set limit on their performance. Hence, these factors must be clearly identified so as to make the concerned governing body take corrective action. This particular article therefore, is devoted to identify the determinants of the bank industry in Ethiopia by providing special emphasis on private commercial banks.

Statement of the problem

The economic development of any country depends on the existence of well-organized financial system. The aforementioned is possible because it is the financial system that could provide inputs for the production of goods and provision of service that in turn will affect the standard of living of nations. The financial system is a complex system that consists of financial institutions, financial markets and instruments. Financial institutions are intermediaries that transfer funds from the surplus unit to deficit unit. Banks as financial institutions particularly provide unique function in an economy by bridging saving and investment activities. In the course of the desire to operate profitably, the banking sector acts as an engine in enhancing modern trade and commerce for business firms and individual traders (Melaku, 2016). But such function is not being provided smoothly without hindrances. Countless factors bottlenecked the operation of the financial system in general and the bank industry of developing countries like Ethiopia in particular. These factors are classified as internal and external factors. The internal factors are termed as micro or bank-specific factors like bank lending, bank size, efficiency of the management, deposit volume, bank liquidity, bank capitalization level and bank growth.

The external factors are macroeconomic variables that are not related to bank management but reflect the monetary, economic and legal environment that affect the operation and performance of financial institutions (Gaiotti and Secchi, 2006). Bank performance could also be affected by external factors as social, economic, political and technological environments. It would be difficult to manage banks and enjoy their benefits to the economy without understanding and managing such determinants of bank financial performance. Numbers of researches were conducted to analyze the determinants of financial performance of banks in different parts of the world. But researchers devoted to analyzing the performance of banks in general and of private ones in particular are scarce. Researches like Addisu (2015), Berhanu (2016), Melaku (2016) and Rani and Lemma (2017), were, devoted to analyzing the determinants of bank performance using only return on asset as their only measure of financial performance.

However, the current study uses key variables which were not included in some of the previously mentioned researches such as interest income, leverage ratio and operational cost efficiency. Hence, this study mainly concentrated on determining key variables that could affect the financial performance of private commercial banks in Ethiopia by providing due emphasis to the bank specific variables as it could be difficult to bank managers to control the external factors. Therefore, this study will fill the aforementioned gap by focusing on only bank specific factors by including new determinant variables such as credit interest income, leverage ratio and operational cost efficiency. This study also uses more recent data (2007 to 2016) and could pinpoint the critical factors that affect the financial performance of private commercial banks in Ethiopia.

Objectives of the study

The main objective this study is to investigate the determinants of financial performance of private commercial banks in Ethiopia. More specifically the study is expected to achieve the following objectives.

1) To examine the effect of Non-performing Loans (NPLs) on financial performance of private commercial banks in Ethiopia.

2) To examine the effect of Loan Loss Provision (LLP) on financial performance of private commercial banks in Ethiopia.

3) To examine the effect of Capital Adequacy Ratio (CAR) on financial performance of private commercial banks in Ethiopia.

4) To examine the effect of Leverage Ratio (LR) on financial performance of private commercial banks in Ethiopia.

5) To examine the effect of Credit Interest Income (CIR) on financial performance of private commercial banks in Ethiopia.

6) To examine the effect of Bank size (SIZE) on financial performance of private commercial banks in Ethiopia.

7) To examine the effect of Operational Cost Efficiency (OCE) on financial performance of private commercial banks in Ethiopia.

Significance of the study

This study is useful in a number of ways. It will assist the banks to identify the specific determinants of bank performance and direct their operation accordingly. The study will also assist government to frame national policy by taking such determinants into account. The study will also bridge the literature gap as it will be used by upcoming researchers.

Poudel (2012) studies the impact of credit risk management on financial performance of commercial banks in Nepal for the period of 2001 to 2011. The result revealed that there is significant relationship between return on assets and all independent variables specifically, default rate, cost per loan assets and capital adequacy ratio. Funso et al. (2012) carried out an empirical investigation on the effect of credit risk on performance of five commercial banks in Nigeria of the years 2000 to 2010 and found that non-performing loans and loan loss provision have statistically significant negative impact on return on assets while loans and advances has statistically positive impact on performance. Habtamu (2012) further reached on the determinants of profitability of Ethiopian private commercial banks for the years 2002 to 2011. Return on assets, return on equity and net interest margin was used as measurement of performance. The fixed effect regression output revealed that Gross Domestic Product has positive effect on the three measurements of profitability. Management efficiency and bank size have positive effect on both return on assets and return on equity but have no significant effect on net interest margin.

Capital adequacy has negative relation with both return on assets and net interest margin but has no significant effect of return on equity. Assets quality has negative relation with net interest margin but have no effect on the remaining two proxies of performance. Ogboi and Unuafe (2013) examines the impact of credit risk management and capital adequacy on banks financial performance in Nigeria using a time series and cross sectional data from 2004 to 2009. Loan Loss Provisions (LLP), Loans and Advances (LA), Non-performing Loans (NPL), and Capital Adequacy (CA) were the proxies of the independent variable whereas; Return on Asset (ROA) was the measure of financial performance. The researcher found that the higher the loan and advances, the worst the performance of banks in Nigeria. The result further indicated that sound credit risk management and capital adequacy enhance performance of the banks under the study. Moreover, Tesfaye (2014) investigated the determinants of Ethiopian Commercial Banks Profitability taking into account bank specific and external variables for the 1990 to 2012 periods.

Accounting measures mainly Return on Assets (ROA) was used to measure the banks’ performance. The result indicated that management efficiency, expressed by non-interest expense to total expense has negative and significant relation with profitability. Result also showed that capital adequacy serves for providing assurance for liquidity position of banks than enhancing profitability and that liquid asset to total deposit have no significant effect on profitability. From the external determinants of profitability identified by the researcher, the inflation has been observed to have significant effect on profitability. Bank size and real GDP have got no significant effect on profitability. Kenenisa and Chawla (2015) who analyzed the effect of bank size and ownership on financial performance also for the years 2000 to 2013 revealed that bank size, measured by logarithm of total assets got significant effect on the three measurements of performance; mainly return on assets, return on equity and net interest margin. But the bank ownership has effect on performance measured by return on assets revealing that private banks outperform in generating profit on their assets especially those state-owned ones.

Million et al. (2015) investigated the impact of credit risk management on profitability of commercial banks in Ethiopia using return on assets and return on equity and found that non-performing loan ratio, has negative and significant impact on return on assets and return on equity. Loan loss provision ratio has statistically significant positive impact of both proxies of performance. Capital adequacy ratio has negative impact on return on equity but found to have no impact on return on assets. Tilahun and Chawla (2016) also assessed the determinants of commercial banks’ profitability in Ethiopia for the years 20001 to 2013. The researchers used Net Interest Margin (NIM) as proxy of profitability whereas; number of branches, loan amount, ownership structure, and deposit amount and bank size were used as independent variables for their study. The Ordinary Least Square (OLS) regression indicated that loan to deposit ratio, branch size, and ownership have significant effect on NIM; while bank size has no significant effect. Melaku (2016) also investigated the determinants of profitability of private commercial banks in Ethiopia using data of 2004 to 2011.

Return on assets was the measure of performance, whereas capital, assets size, loan to total assets, liquidity, labor productivity, overhead, credit risk, interest income, GDP growth rate, interest rate and market share were the dependent variables. The regression output revealed that provision for loan loss, overhead, have significant negative effect, while earning, net interest income, bank size, and productivity have positive effect on profitability measured by return on assets. Gemechu (2016) also researched on determinants of profitability of bank industry in Ethiopia for the years 2002 to 2012 using return on assets and net interest margin as measure of performance. The finding revealed that loan to advances, efficiency and productivity, have positive effect on both return on assets and net interest margin. Liquidity risk and exchange rate have positive effect on return on assets but have no effect on net interest margin.

At the same time, regulation, market concentration, economic growth, interest rate has positive effect on net interest margin but have insignificant effect on return on assets. But expense mismanagement has negative effect on both measure of performance but capital adequacy has no effect on performance. Lemma and Rani (2017) analyzed the determinants of financial performance of commercial banks in Ethiopia data from two public and seven private banks for the years that were considered for the study. Return on assets was used as proxies of financial performance while the internal and external factors were considered to analyze the factors. Descriptive, correlation and regression analysis were used to analyze the data and the findings revealed that liquidity and earnings ratio have positive relation with return on assets. The findings further revealed that CAR, the ratio of non-performing loan to total loans, and industry growth has negative relation with profitability.

Theoretical model

The following theoretical model was developed from the prevailing literature (Figure 1).

Research design

Explanatory design with quantitative approach was used to accomplish the purpose of the study. All private commercial banks in Ethiopia were used as population of the research from which samples were selected. Purposive sampling was used to deliberately select sample banks based on the selection criteria set by the researchers. Accordingly, out of sixteen private commercial banks, ten banks were purposively selected as a sample based on the availability of data during the years 2007 to 2016. The only state owned bank, commercial bank of Ethiopia was excluded as it is an old aged bank and is also being favored by government policy and comparing it with other private banks could prejudice the findings. Accordingly, Awash International Bank S.C (AIB), Bank of Abyssinia S.C (BoA), Dashen Bank S.C (DB), Nib International Bank S.C (NIB), United Bank S.C (UB) and Wogagen Bank S.C (WB), Lion International Bank (LIB), and Cooperative Bank of Oromia (CBO) were selected as the sample for this particular study. Secondary data mainly collected from the audited financial statements of each banks obtained from website of the National Bank of Ethiopia (NBE) was mainly used to see the effect of the independent on dependent variable. The collected data were analyzed using descriptive statistics, correlations and multiple linear regression analysis of panel data for the years 2007 to 2016. Based on Hausman specification test conducted, random effect regression was conducted using E-views 9 econometric software package, to test the casual relationship between the independent variables and the financial performance.

Study variables

Return on assets expressed as the ratio of net profit after tax to average total assets and return on equity measured by the ratio of net profit after tax to shareholders’ equity are the dependent variables of this research. Whereas, non-performing loan which is the ratio of non-performing loans to total loans and advances, loan loss provision, measured by the provision to loan loss to that of total loan outstanding, capital adequacy ratio-measured by paid up capital to total assets, leverage ratio-the proportion of total debt to total equity, credit interest income ratio-the proportion of interest income to credit facilities granted, bank size-which is the logarithm of total assets and operating cost efficiency- the ratio of expenses to revenue are the explanatory variables for the study.

Model specification

The following model was developed based on the variables of the study

ROAit=α+β1NPLit+β2LLPit+β3CARit+β4CIRit+β5LRit+β6SIZEit+ β7OCEit (1)

ROEit= α +β1NPLit+ β2LLPit + β3CARit + β4CIRit + β5LRit +β6SIZEit + β7OCEit (2)

Where,

ROAit: is the Return on Asset of ith bank at year t

ROEit: is the Return on Equity of ith bank at year t

NPLit: is the Non-performing Loan ratio of the ithbank at year t

LLPit: is the Loan loss Provision ratio of the ithbank at year t

CARit: is the Capital Adequacy ratio of the ithbank at year t

CIRit: is the Credit Interest Income ratio of the ithbank at year t

LRit: is the Leverage ratio of the ithbank at year t

SIZEit: is the SIZE of the ith bank at year t

OCEit: is the Operational Cost Efficiency of the ithbank at year.

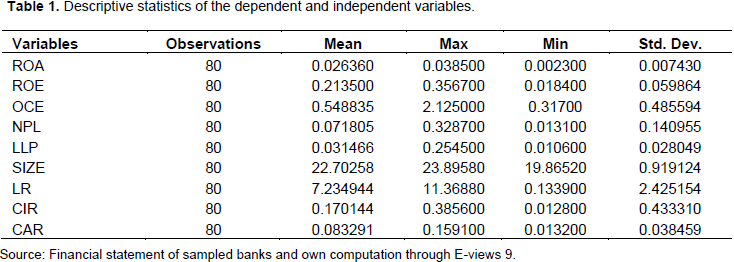

Descriptive statistics

Table 1 provides a summary of the descriptive statistics of the dependent and independent variables for eight private Commercial Banks from the year 2007 to 2016 with a total of 80 observations. Table 1 show that the mean value of dependent variable that is return on asset was 2.6% with a minimum of 0.2% and a maximum of 3.8%. That means during the period under consideration sampled banks earned an average of 2.6 cents of profit before tax for a single birr invested in their assets. The standard deviation for ROA was 0.007 which indicates that the profitability variation between the selected banks was very small. The mean value of the second dependent variable, that is, ROE was 21% with the maximum and minimum value of 35 and 1.8%, respectively. This revealed that private commercial banks in Ethiopia were able to generate an average positive return of 21% on their equity for the last 10 years.

As far as independent variables are concerned, the mean value of OCE was 54.8% with maximum value 212% and minimum value 31.7%, which shows that there was a higher variation on the operational cost efficiency over the sample period for this study. The mean of NPLs was 7.18% with a minimum of 1.3% and a maximum of 32.8%. This indicates that, from the total loans that private commercial banks (PCBs) disbursed, an average of 7.18% were being default or uncollected over the sample period. The standard deviation of 14% of NPLs from its mean value shows the existence of variation among PCBs in terms of their loan recovering capacity. The mean value of capital adequacy was 8.32% with a maximum of 15.9%. The average capital adequacy ratio surpassed the minimum ratio of 8% set by NBE on Directives â„– SBB/50/2011. This can indicate existence of sound financial condition in Ethiopian commercial banks.

The standard deviation statistics for capital strength was 3.84% which shows the existence of variation of equity to asset ratio between the private commercial banks in Ethiopia. The standard deviation (2.4251), in leverage ratio indicates the existence of high variation among PCBs in terms of their leverage ratio and the same is true for bank size (0.9191). The credit interest income ratio of banks was between 38 and 1.28% with the standard deviation of 0.433 also indicating relatively high disparity among PCBs interest credit interest income to total asset. Among the independent variables, the smallest standard deviation was reported in loan loss provision ratio which was 0.028. This indicates the existence of less variation among the banks in terms of setting their loan loss provision amount.

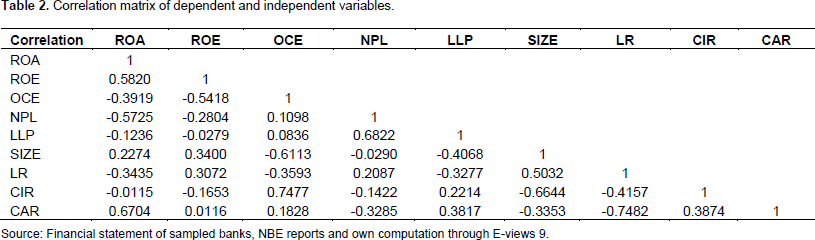

Correlation analysis

Correlation is a way to index the degree to which two or more variables are associated with or related to each other Brooks (2008). The most widely used bi-variant correlation statistics is the Pearson product-movement coefficient, commonly called the Pearson correlation which was used in this study. Table 2 shows the correlation between the variables used for this particular research. Table 2 shows that capital adequacy ratio and size of the banks had positive relation with ROA. The capital adequacy ratio positively affect their performance shows the banks tendency to boost up their paid up capital to gain strength and leading role in the industry. Results also show that bigger banks or banks with higher total asset amount are more profitable than smaller banks indicating that bigger banks could have high economies of scale. Further the operational cost inefficiency and leverage ratio have negative relation with return on asset, which indicate that the more costly and in debt the banks are, the lower will be their profit. As far as return on equity is concerned, operational cost inefficiency, non-performing loans and loan loss provision and credit interest income ratio have negative relation with return on equity. Whereas, size and leverage ratio have positive relation with return on equity.

Regression analysis

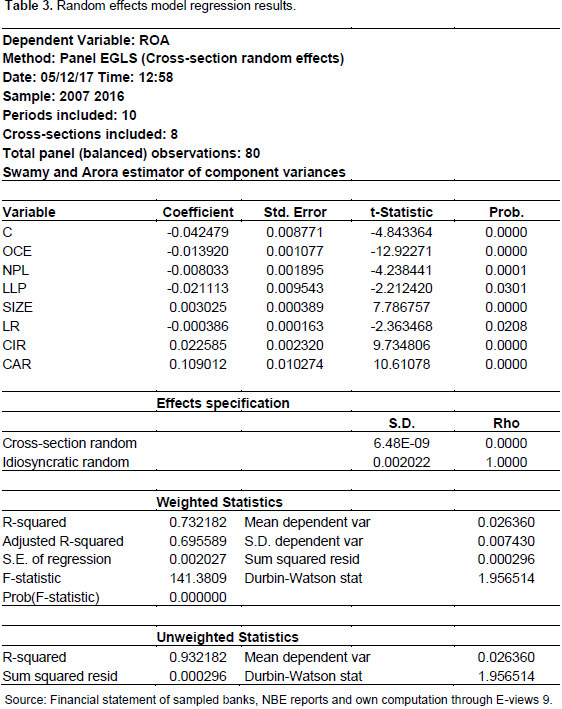

Return on assets model

Table 3 clearly shows the random analyzed effect of the independent variable indicated in the Return on Assets model. Table 3 depicts the estimation results of regression model of Return on Asset as dependent variable and bank specific explanatory variables for the sample of eight private commercial banks in Ethiopia. The R-squared and adjusted R-squared 73 and 70% respectively and the F-Statistics of (0.000000) indicates the fitness of the model. Table 3 shows that loan loss provision has statistically significant negative effect on return on assets of the private commercial banks in Ethiopia. That is, when Loan Loss Provision ratio (LLP) increased by one percent, Return on Asset (ROA) of sampled private commercial banks would decrease by 2%. Table 3 further shows that NPL has statistically significant negative effect on ROA. This indicates that holding other independent variables constant at their average value, an increase in NPLs by one percent, decreased Return on Asset (ROA) by 0.8033%. This negative association between nonperforming loans and return on asset could be attributed to the fact that, when the amount of non-performing loan increases the interest income that the banks get from these loans will decrease, which in turn, decrease the return on asset. This would in turn affect the banks’ ability to extend more loans to other customers that can generate more income.

Table 3 also reveals that banks size has positive relationship with profitability which is statistically significant at 1% significance level. This implies that every 1% increase in the banks size keeping other variables constant increase profit by 0.3025%. This would be because the bigger the bank, the more economies of scale and hence more profitable it will be. The result ratio of debt to asset has negative effect on ROA, which is statistically significant at 5% significance level. This result also shows that debt financing have a negative impact on profitability measured by ROA. The negative association between leverage ratio and return on asset of private commercial Banks in Ethiopia could be attributed to the fact that, when the amount of debt of the banks increases their commitment will rise which indirectly affect their liquidity and as a result their capacity to provide loans to their customers will decrease, which further decreases their ROA.

As indicated in Table 3 the coefficient of capital adequacy measured by the ratio of paid-up capital to total asset is 0.109012 and its p-value is 0.0000. This indicates that holding other independent variables constant at their average value, when capital adequacy ratio increased by one percent, return on asset (ROA) of sampled private commercial banks would be increased by 11% and statistically significant at 1% level of significance. Therefore, the researcher failed to reject the null hypothesis that capital adequacy ratio has a positive impact on return on asset. The result shows that there exists statistically significant negative relation between operational cost inefficiency and return on asset of private commercial banks in Ethiopia. The result of this study indicates that the financial performance of private commercial banks in Ethiopia decrease when the amount of their expense increase.

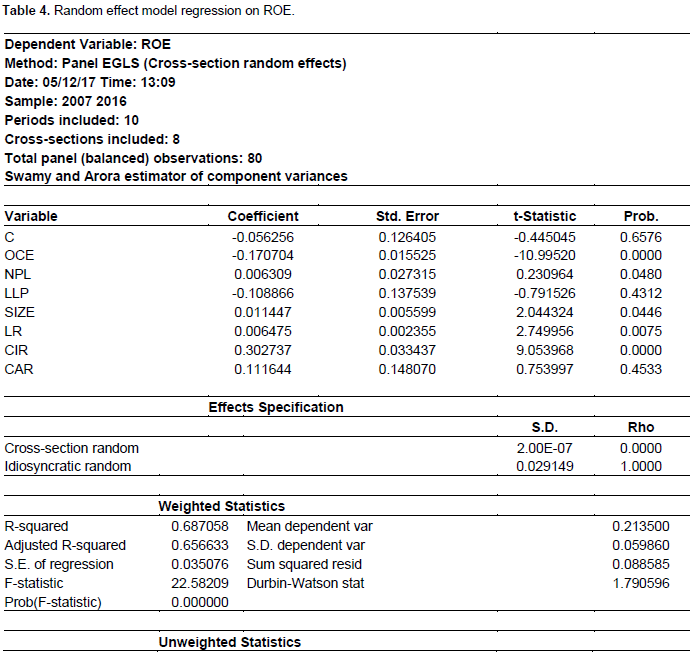

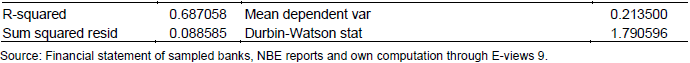

Return on equity model

The operational panel regression model is used to analyze the determinants of financial performance of private commercial banks in Ethiopia measured by return on equity. Table 4 shows that R-squared and adjusted R-squared are 69 and 66%, respectively. It indicates that the model is a good fit. This means, more than 66% of variations in return on equity of private commercial banks in Ethiopia were explained by independent variables included in the model. The F-statistics (0.0000) also assures that the overall model is highly fit to see the effect of independent variables on the dependent variables.

As indicated in Table 4, Bank size (SIZE) and Leverage Ratio (LR) And Credit Interest Income Ratio (CIR) have positive and statistically significant impact on the financial performance of private commercial banks in Ethiopia measured by return on equity. Table 4 also shows that there is a positive and statistically significant impact of Bank Size on return on equity. The result shows a positive coefficient of 0.011447. This indicates that the bank size is significant factor for bank performance even at 5% significance level. This implies that for one unit change in bank size, keeping the other things constant had resulted to 1% unit change on the level of ROE in the same direction. This is due to the fact that bigger banks extend more loans and advances to their customer and earns more income, which in turn boosts their return on equity. Non-performing loans had positive and significant effect on the return on equity of private commercial banks in Ethiopia with a coefficient sign that was opposite to the case of return on asset.

The research analyzed determinants of the financial performance of private commercial banks in Ethiopia. From the regression output, it can be concluded that size of banks is the determining factor that boosts the financial performance because, it can help them achieve economies of scale. Loan loss provision and non-performing loans are the factors that negatively affect the performance of private commercial banks in Ethiopia. It can also be concluded that the larger the leverage position of the bank, the higher their ability of lend and their performance will be enhanced. It can also be concluded that capitalized banks could extend more loans and advances to their customers and could generate more income than poorly capitalized banks. The finding also enables us to conclude that operational cost inefficiency reduces return on assets and hence banks are expected to work on minimizing their avoidable costs.

1) Private commercial banks in Ethiopia are advised to work towards improving their assets especially the liquid ones and level of capitalization so as to increase their lending ability and to ensure their profitability.

2) Non-performing loans, operational cost efficiency and leverage ratio were factors that negatively and significantly affect the return on asset of private commercial banks in Ethiopia. Thus, private banks in Ethiopia are recommended to revise their credit procedures and policies to reduce the nonperforming loans.

3) Banks should give due attention to their operational cost efficiency and leverage ratio, because excess expenses in relation with their revenue and engaging in debts beyond their capacity will have significant negative effect on their performance.

4) Currently, Ethiopian commercial banks that were sampled in this study were considering collateral as prime factor for assessing loan application in all conditions and hence, providing appropriate focus for factors such as repayment capacity of the client, the feasibility of the project and the experience of the management of the company in credit approval process could improve the quality of their loan portfolios.

5) Banks are also advised to leverage on technology to cut costs and enhance their profitability.

The authors have not declared any conflict of interests.

REFERENCES

|

Addisu A (2015). Non-performing asset and their impact on financial performance of commercial banks in Ethiopia. (MBA research paper), Addis Ababa University.

|

|

|

|

Al-Karim R, Alam T (2013). An evaluation of financial performance of private commercial banks in Bangladesh: Ratio analysis. J. Bus. Stud. Q. 5(2):65-77.

|

|

|

|

|

Berhanu A (2016). Determinants of Lending Decision and their Impact on Financial Performance: Empirical Study on Private Commercial Banks in Ethiopia. Unpublished Master's Thesis, at Addis Ababa University, College of Business and Economics, Department of Accounting and Finance.

|

|

|

|

|

Funso K, Kolade A, Ojo O (2012). Credit risk and Commercial Banks' Performance in Nigeria: A panel Model Approach. Australian J. Bus. Manage. Res. 2(02):31-38.

|

|

|

|

|

Gaiotti E, Secchi A (2006). Is there the Cost of Channel of Monetary Policy Transmission? An Investigation into the Pricing Behaviour of 2,000 firms. J. Money Credit Bank. 38(8):2013-2037.

Crossref

|

|

|

|

|

Gemechu AS (2016). Determinants of banks' profitability: Evidence from banking industry in Ethiopia. Int. J. Econ. Commerce Manage. IV(2):442-463.

|

|

|

|

|

Habtamu N (2012). Determinants of Bank Profitability. An Empirical Study on Ethiopian Private Commercial Banks. A Masters' Thesis at Addis Ababa University.

|

|

|

|

|

Kenenisa L, Chawla AS (2015). The effect of bank size and ownership on financial performance of commercial banks in Ethiopia EXCEL. Int. J. Multidisciplinary Manage. Stud. 5(8):57-68.

|

|

|

|

|

Lemma N. and Rani S. (2017) Determinants of financial performance of commercial banks: Panel data evidence from Ethiopia. Int. J. Res. Financ. Market. 7(1):39-50.

|

|

|

|

|

Melaku A (2016). Determinants of bank profitability in Ethiopia: A case study of private commercial banks. Res. J. Financ. Account. 7(7):28-43.

|

|

|

|

|

Million G, Matewos K, Sujatha S (2015). The impact of credit risk on profitability performance of commercial banks in Ethiopia. Afr. J. Bus. Manage. 9(2):59-66.

Crossref

|

|

|

|

|

Ogboi C, Unuafe OK (2013). Impact of credit risk management and capital adequacy on the financial performance of commercial banks in Nigeria. J. Emerging Issues Econ. Financ. Bank. 2(3):703-717.

|

|

|

|

|

Poudel RV (2012). The impact of credit risk management on financial performance of commercial banks in Nepal. Int. J. Arts Commerce 1(5):9-15.

|

|

|

|

|

Sufian F (2009). Bank specific and macro economic determinants of bank profitability: Empirical evidence from china banking sector. Frontier Econ. China. 4(2):274-291.

Crossref

|

|

|

|

|

Tesfaye B (2014). The determinants of ethiopian commercial banks performance. Eur. J. Bus. Manage. 6(14):52-62.

|

|

|

|

|

Tilahun M, Chawla AS (2016). Determinants of commercial banks profitability. Empirical evidence from Ethiopia. Zenith Int. J. Multidisciplinary Res. 6(1):79-89.

|

|

|

|

|

Zawadi A (2013). Comparative analysis of financial performance of commercial banks in Tanzania. Res. J. Financ. Account. 4(19):133-145.

|

|