ABSTRACT

In recent years, job satisfaction has been seriously taken as one of the top priority concerns in developing countries, since the living standards of the people have been improving. The overarching aim of this study is to identify the top most determinants of job satisfaction among employees of Abay bank using a sample of 150 employees working in Addis Ababa. A combination of principal component analysis (PCA) and OLR models were used. Out of the 13 variables initially identified, 5 principal factors were drawn using PCA. Based on the earlier findings of PCA, OLR analysis was conducted on the five prime factors. The findings demonstrate that 4 factors are statistically significant with evidence that remuneration and fringe benefits and effective leadership are positively linked with job satisfaction wherein unmet job expectation and workload are negatively correlated with job satisfaction. However, evaluation and promotion appeared statistically insignificant. The findings highlight the need for establishing conducive working environment and recommend the bank to stay attuned in weighting workers economic status.

Key words: Bank employees, factors, determinants, job satisfaction, principal component analysis, principal component analysis (PCA), ordered logistic regression, OLR, Abay Bank, Ethiopia.

Before the economic liberalization in Ethiopia and for a couple of years ahead further, the growth of banking in Ethiopia was nascent. Nevertheless, for the preceding decade the banking sector exhibited a remarkable spurting among sectors of our economy. Most recently, the sector is getting a healthy booming and set out a major transformation in its operating environments. In a number of regions of the country, the formations and expansions of banking have been spectacular. In this transformation, the roles simultaneously played by both public and private commercial banks have remained indispensable and paramount. However, as the sector is getting more complex and is underway in a most volatile environment, there is a need for technological change and efficient use of economic resources so as to get the competitive edge. Being as one of the key economic resources in the bank, skilled workers are the bedrock and the most reliable source of competitiveness (Rana, 2015). Employees are the backbone of any bank that demands serious attention because of their ability in deploying all the elements of a bank to attain the desired goals (Shanmugapriya, 2016). Loyal and committed workers are the vital asset and source of success in the banking industry (Rana, 2015). Most recently, the banking sector in Ethiopia is experiencing a growing competition due to the creation of an outrageously demanding society and the complete absence of deterrents on new entrants. In order to stay in the competitive market, the banks have to focus on the provision of improved quality banking services to their loyal customers. This essentially requires the retention of well trained and skilled workforce (Rana, 2015). The only arbitrator, according to Shanmugapriya (2016), that decides the success and ability of the banks to compete with their competitors are the efficient utilization of human capitals. This is because all banks virtually have similar 80% accesses to information, resource and technology. However, the 20% difference that comes out of workers cannot done equally well by all banks (Shanmugapriya, 2016).

This makes employees the precious and most pivot of the banking services. Failure to enlarge employees’ latent potential and neglect to motivate the efforts that they are exerting at workplaces can severely jeopardize the productivity, competitiveness, growth potential, and technology upgrading capacity of the banks (Millan et al., 2011; Mai et al, 2015; Shanmugapriya, 2016). Therefore, for bank management, employees’ job satisfaction is not basically a moral compulsion but a business necessity (Shanmugapriya, 2016). Satisfaction of employees with their job is merely considered one of the key pillars for the success of banks (Rana, 2015) and plays vital role for the retention and attraction of competent human capital in the banks (Bista, 2016). Satisfied workers tend to contribute more for the benefit of the bank and would like to stay in the bank. In contrast, dissatisfied workers have negative attitudes and fail to release even the minimum effort that they could and often look towards outdoor opportunities to leave the bank (Adhikari, 2009; Sowmya and Panchanatham, 2011; Bista, 2016; Hossain and Wadud, 2017). If these are the cases, the question is what determines employees’ job satisfaction?

According to Millan et al. (2011), job satisfaction is a heterogeneous phenomenon and encompasses varieties of facets (Bista, 2016; Hossain and Wadud, 2017). In this regard, many empirical studies have identified (Locke, 1976; Ahmed and Uddin, 2012; Islam and Zaman, 2013; Kisto, 2016; Shanmugapriya, 2016; Hossain and Wadud, 2017) the rank of some top facets of job satisfaction correspondent to the objectives these studies dealt with. However, such top listed host of factors may not be entirely perceived by all employees of banks in Ethiopia.

Thus, the issue is what are the most important perceived factors that influence employees’ job satisfaction in the banking industry of Ethiopia with a particular reference to Abay bank?

While there is a vast growing body of empirical literature on job satisfaction in banking industry, to our knowledge, little work has been done on Abay bank. Bethelhem (2015) assessed the compensation and benefit practice and its implication on employee’s performance. Solomon (2015) assessed employees’ performance appraisal practice of the bank. However, determinants of employees’ job satisfaction to the context we are working with had not yet been empirically explored using estimation models. The underlying study therefore intends to uncover this gap with an overarching objective of examining factors that determine employees’ job satisfaction in Abay bank.

LITERATURE REVIEW AND DEVELOPMENT OF HYPOTHESES

Definition and facets of job satisfaction

Job satisfaction is a multifaceted and time variant concept that varies from individual to individual. The multifaceted nature of the concept produces a complexity to get a comprehensive and most single definition for it. Some of the frequently cited definitions of job satisfaction are described as follows. The early definition by Smith (1955) states that job satisfaction is the judgment of employees about how well their jobs are and the corresponding satisfaction that comes through fulfilling their various needs. Spector (1997) on his part defined job satisfaction in terms of the feeling that employees hold about their jobs and the different aspects they look after their jobs.

Robbins and Judge (2013) on their part defined job satisfaction as a positive feelings that employees have concerning a job that results from evaluating its inherent characteristics. Another definition by Robbins and Judge (2013) described job satisfaction as the difference between the amounts of rewards employees receive and the amount they believe they should be received. The most comprehensive and popular definition of job satisfaction especially in organizational study is that of Locke. The author defined job satisfaction as a state of pleasure or positive emotion appeared from the appraisal of one’s job or job experiences (Locke, 1976).

Many researchers recognize that job satisfaction is comprised of a host of various facets. Smith (1969) in their study considered pay, promotions, coworkers, supervision, and the work itself as the five most vital facets of job satisfaction in their categorization. Working conditions, recognition, management behavior are some of the other few facets added by Locke (1976). Misener et al. (1996) report a typical categorization that encompasses factors related to pay, benefits, promotion, work conditions, supervision, organizational practices and relationships with coworkers.

Neog and Barua (2014) listed salary, working environment, work-life balance, career opportunities, promotion, and proper training and development opportunities as the most essential facets of job satisfaction. The most crucial job satisfaction facets identified by Tanjeen (2013) are pay, working condition, relationship with coworkers, supervision and opportunities for promotions. According to Hackman (1980) and Dawson (1987) compensation and benefits, leadership behavior, promotion policies, and work itself are found to be among the significant facets of job satisfaction.

Empirical foundations

Many previous studies have developed empirical foundations for determinants of job satisfaction. In this section, some of the most decisive and highly related to this particular study have been reviewed.

Awan and Asghar (2014) investigate the factors that determine employees’ job satisfaction in the banking sector of Pakistan. These authors find that salary, job security and reward system have a positive and significant impact on job satisfaction. Chowdhary (2013) critically examine the determinants of bank employees’ job satisfaction in India and the findings imply that salary, employees’ performance, and promotional strategies have a significant consequence on job satisfaction. Islam and Saha (2001) empirically investigate factors that affect job satisfaction of bank officers in Bangladesh. These authors finding entail that salary, efficiency in work, benefits, leadership style, coworker relations, supervision, loyalty to bank, and work ability are highly significant with job satisfaction.

Rahman et al. (2009) analyze factors that influence employees’ job satisfaction in the banking industry of Bangladesh with a different setting than Islam and Saha (2001) and find that remuneration, reward, job security, and pride in work are significant on employees’ job satisfaction. Another study in Bangladesh by Ahmed and Uddin (2012) also finds a positive effect of salary, promotion, supervision, benefits and reward on job satisfaction. The findings in Nepalese commercial banks by Bista (2016) suggest that pay, job security, promotion potentials, relationship with coworkers and supervisors are top most influencing factors to job satisfaction. Weerasinghe et al. (2017) empirically investigate determinants of job satisfaction of banking employees in Sri Lanka and the finding imply that employees salary has a greatest significant impact on employees job satisfaction among other variables. The finding quantifiably states that when changing the employee salary by one percent it will lead to change employee job satisfaction by 0.695. These authors finding is also supported by Siebern-Thomas (2005) who finds wage as a statistically significant factor that influences job satisfaction. Using a pooled cross-section of five national longitudinal surveys of youth waves, Artz, (2010) estimates eight different fringe benefits, and find that fringe benefits are significant positive determinants of job satisfaction. Bethelhem (2015) findings at Abay bank imply that most employees of the bank are dissatisfied with the existing compensation and benefit packages of the bank.

Nimalathasan and Brabete (2010); Saharuddin and Sulaiman (2016) and Abreham (2017) investigate the association between promotion and job satisfaction and these authors’ results indicate that promotion has a significant and positive influence on job satisfaction. Furthermore, Naveed et al. (2011) estimates impact of promotion on job satisfaction and find that promotion has a modest and positive effect on job satisfaction. The regression finding of Rana (2015) reveals that employees in the banking industry of Bangladesh weigh more value to leadership behavior than autonomy in improving their job satisfaction. Bista (2016) finding shows that there exists a strong positive relationship between job satisfaction and employees supervisor support. Hossain and Wadud (2017) and Rana (2015) results indicate that supervisor support and leadership behavior positively linked with overall job satisfaction.

As far as the influences unmet expectation could have on employees job satisfaction concerned, the findings of Nelson and Sutton (1991); Major, Kozlowski, Chao and Gardner (1995); Turnley and Feldman (2000) imply that employees unmet expectations often leads to a negative work results and ultimately lowers the workers level of job satisfaction. Similarly, the findings of Porter and Steers (1973); Hackman (1980); and Kim (2002) indicate that unmet expectations have strong negative influences on job satisfaction. The meta-analysis finding of Wanous, Poland, Premack, and Davis (1992) further attests that unmet expectations are indeed strongly correlated with a decrease job satisfaction.

The empirical results of Pearson (2008) and Bozkurt et al. (2012) regarding workload imply that work overload is negatively correlated with job satisfaction. Mansoor et al. (2011) and Ali and Farooqi (2014) also find that work overload and stressor workload have significant negative impacts on job satisfaction.

In line with the empirical literature described above, this study draws the following research hypotheses:

Research Hypothesis 1: There exists a positive relationship between remuneration and fringe benefits and employees’ job satisfaction in Abay bank.

Research Hypothesis 2: There exists a positive relationship between evaluation and promotion and employees’ job satisfaction in Abay bank.

Research Hypothesis 3: There exists a positive relationship between effective leadership and employees’ job satisfaction in Abay bank.

Research Hypothesis 4: There exists a negative relationship between unmet job expectation and employees’ job satisfaction in Abay bank.

Research Hypothesis 5: There exists a negative relationship between workload and employees’ job satisfaction in Abay bank.

DATA AND RESEARCH METHODOLOGY

Brief description of Abay Bank

During the last two decades, the banking sector in Ethiopia has experienced rapid transformation. Abay Bank Share Company is one of the private commercial banks that emerged recently in the banking industry of Ethiopia with a modern technological breakthrough. The bank has officially started a full-fledged banking operation in 2010 and nowadays the bank has been described as the emerging brand of Ethiopia. Within few years of its establishment, the total number of Abay bank branches throughout the country has reached 152. About 26 percent of the bank branches are located in Addis Ababa and the rest 74% are in regions (NBE, 2017). The bank has created an employment opportunity to 2,534 people of which 1,249 are permanent employees. Around 38 percent of them are working in Addis Ababa. In line with the expansion of the bank, the number of shareholders have risen to 3,929 and the total number of customers on books has reached 337,120 (Abay Bank, 2017). In addition to commendable performance that the bank has been exhibiting, it is the first and only bank in Ethiopia that launched evening banking service to further enlarge its service portfolio and to completely augment customer touch-points.

Method of data collection, sampling and analysis

The population of the study was all Abay bank employees who are working in Addis Ababa and out of them, 150 employees were randomly chosen from 10 sampled branches situated in Addis Ababa. The data were collected using a structured questionnaire and all the questionnaires were handily distributed to the respondents at their work places. A 5 point Likert scale was used where 1 is used to denote “strongly disagree” and 5 for “strongly agree”. To ensure the reliability of variables and the research instrument, we used Cronbach’s Alpha statistics and obtained 0.640 reliability coefficient. According to Nunnally (1970) the acceptable value is 0.5 and 0.6 is the value supported by Moss et al. (1998).

To identify the determinants of job satisfaction among employees of Abay bank, a combination of principal component analysis (PCA) and ordered logistic regression analysis was implemented. This study initially identified 13 factors that influence employees’ job satisfaction fetched from literature review. To highlight the similarities and differences of these independent variables and to compress the size of the problem, an initial factor analysis was executed on the 13 multiple inter-correlated quantitative factors and obtained 5 principal components using Stata version 13. It was done mainly to replace a group of correlated factors with a set of new independent variable and to statistically reduce the dimensions of the original independent variables. In the second stage, ordered logistic regression analysis was conducted on the 5 principal components generated from PCA. At this regression, overall job satisfaction was treated as an ordered dependent variable and the 5 principal components were treated as continuous independent variables. The dependent variable has five ordered categories where 5 is the highest degree of satisfaction and 1 is least degree of satisfaction.

The descriptive statistics stated that about 60.67% of the respondents were male. The age analysis indicated that about 73.33% of the respondents were belonging to age category of 20 to 30, whereas 26.67% of the respondents were in between 31-40 categories. Only about 51.33% of the respondents have a monthly income more than Birr 6000. About 84.67% of the respondents had bachelor’s degrees or higher degrees and the rest were diploma holders.

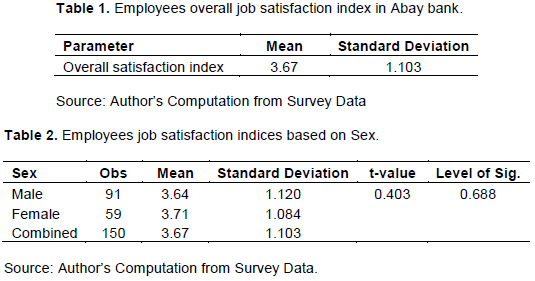

Table 1 presents the result of descriptive statistics concerning overall job satisfaction. It is noted that the higher the mean score of the factors, the higher will be the job satisfaction of the workers. Cognizant of this, we have estimated the mean score of the overall job satisfaction as 3.67 which indicates that employees are moderately satisfied in their work with Abay bank. This score further implies that Abay bank is perceived to be fairly attractive to the incumbent workers.

Table 2 presents the two mean comparison test (t-test) results to compare equality of means between sexes. Although the statistical decision for t-test statistics is not statistically significant (0.688 is greater than 5% level of significance), the t-value of 0.403 indicates that the equality of mean about job satisfaction between the sexes is slightly different between male and female employees of Abay bank.

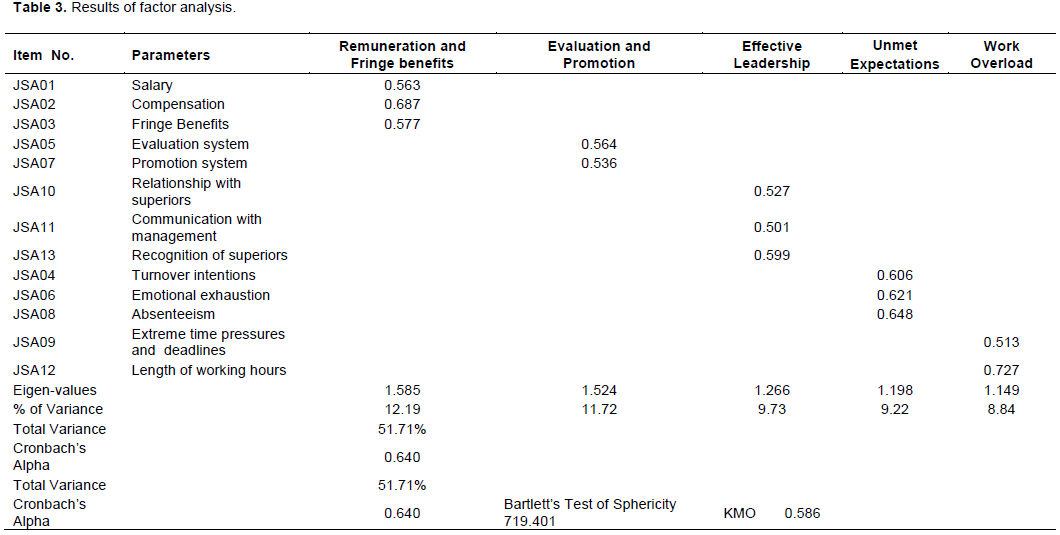

In order to assess the suitability of the data for PCA, the most vital assumptions underpinning factor analysis were examined. To check the factorability of the correlation matrix, we have performed Bartlett’s Test of Sphericity and found a result that meets the standard to proceed for factor analysis (the approximate Chi-square value is 719.401 and p-value is 0.000). Similarly, Kaiser-Meyer-Olkin (KMO) was 0.586, which exceeds the recommended minimum value of 0.50 (Kaiser, 1974). This implies the sufficiency of the sample to support PCA and the variables have much in common to warrant factor analysis.

The analysis of PCA resulted in the extraction of five principal components with eigenvalues of more than 1 by leaving out some factors which have lowest order of significance. The five principal components which constitute an eigenvalue above 1 collectively explained 51.71% of the total variance based on our data set and indicate the adequacy of the estimated total variance. In this regard, Odia and Agbonifoh (2017) asserted that more than 50% of total variance explained is adequate for an exploratory study. The values of the factor loadings in the five extracted components after Varimax rotation range between the highest loadings of 0.727 for JSA12 to the lowest loading of 0.501 for JSA11. Following Hair, Anderson, Tathan and Black (2005), a value of 0.50 is an acceptable value of factor loading because it represents a good correlation between the components and the original variables.

As illustrated in Table 3, 13 independent determinants were grouped into five factors. Based on the results obtained after the Varimax rotation, the first factor contains the three most important components, viz. salary, compensation and fringe benefits are related to remuneration and fringe benefits. The second factor which includes staff evaluation and promotion systems is named evaluation and promotion. The third factor comprises relationship with superiors, communication with management and recognition of superiors is related to effective leadership. The fourth factor which encompasses turnover intentions, emotional exhaustion and absenteeism is labeled unmet job expectations. Lastly, the fifth factor involves extreme time pressures and deadlines and length of working hours is named work load.

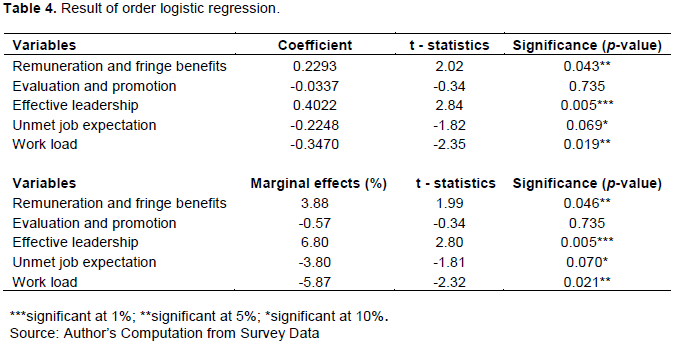

Contingent with this, the core results of our estimations emanated from ordered logistic model are presented as follows. The statistical estimates of the general ordered logistic model and the coefficients of marginal effects are presented in Table 4. At the top-half of the table, the general ordered logistic estimates are presented for the sake of interpreting the sign as we cannot interpret the magnitude of the coefficients. Below these estimated coefficients, only the effects of the independent variables on the probability that workers are highly satisfied with their job (job satisfaction equals 5) are presented in terms of marginal effects. Further to these, t-statistics and level of significance associated with both general ordered logistic estimates and marginal effects are reported in columns.

Looking at the results given in Table 4, four explanatory variables are found to be statistically significant. With respect to evaluation and promotion, it appears to be negative and statistically insignificant and implies that evaluation and promotion does not have any significant effects on workers level of job satisfaction in case of Abay bank. In accordance with hypothesis 1, we observed that remuneration and fringe benefits and job satisfaction are statistically associated at 5% level of significance and with a coefficient of 0.2293. The positive sign of the estimate describes that the higher the remuneration and fringe benefits that the workers of Abay bank are getting, the higher they are likely to be in the higher category of job satisfaction. These literary means workers are more satisfied as they are receiving more payments. This also observed in the marginal effects estimate that 1 unit increases in remuneration and fringe benefits of the workers, the predicted probability of being highly satisfied with their current job increases by 3.88%. The marginal estimate also implies that those workers who have higher payment are 3.88 percent more likely to have job satisfaction than those who have less payment

In terms of effective leadership, the empirical findings of earlier authors of the topic indicate that the workers relationship with superiors, recognition they have got from superiors and communication they have with their managers significantly influence job satisfaction (Bista, 2016; Hossain and Wadud, 2017). Moving into effective leadership estimate, it displays that effective leadership found to be statistically significant at 1% level with a coefficient of 0.4022. This supports the idea that leadership and job satisfaction are the two sides of the same coin. The sign of the statistical estimate implies that those workers who received recognition and have a good relationship and communication with their supervisors are more likely to be in the higher category of job satisfaction.

This result also attested in the marginal effects estimate that the workers predicted probability of being highly satisfied with their current jobs increases by 6.80% as the bank’s superiors are getting more effective leaders. As effective leadership is the strongest estimator of job satisfaction in our case, this study concludes that the existence of effective leaders in the bank would ultimately produce managerially satisfied workers. This result is vehemently consistent with hypothesis 3.

Regarding unmet job expectation and it consequences, the result of our estimation reported that unmet job expectation is negatively associated with job satisfaction.

As clearly displayed in Table 4, unmet job expectation appears to be statistically significant at 10% level with a negative coefficient of 0.2248. Consistent with the prior results of Turnley and Feldman (2000) and Kim (2002), the negative sign of the coefficient of this study tells that the higher level of unmet job expectations from workers lead to more negative outcomes on job satisfaction. This terminologically means that workers who have an exceeded and bunch of expectations from their works are less likely to be in the higher category of job satisfaction. In other words, workers who belief they are emotional exhausted and willing to leave their job are less likely to be in the higher position of job satisfaction. The marginal effects estimate also implies the fact that those workers who perceived they are working with unmet expectations the predicted probability of being highly satisfied with their current jobs decreases by 3.80%. The result of the marginal effect further indicates that those workers who have unmet job expectation are 3.80 percent less likely to have job satisfaction than those who have met their expectation. This finding is in accordance with hypothesis 4.

Moving into workload, the finding of this study justifies the prior results by Mansoor et al. (2011) and Ali and Farooqi (2014) who found that workload and job satisfaction have negative and significant associations. In line with this, the finding of this study declares that workload and jobs satisfaction appears to be statistically associated at 5% level of significance with a negative coefficient of 0.3470. Looking into the sign of the coefficient apparently indicates that workload is perceived to be negatively associated with job satisfaction among employees of Abay bank. This implies that workers at Abay bank tend to be less satisfied with their jobs as they are working in the environment where extreme time pressures and deadlines are prevailing. Looking further into the marginal effects estimate, the finding reveals that 1 unit increases in the workload of the workers, the predicted probability of being highly satisfied with their job decreases by 5.87%. The marginal effect further implies that those workers who have workload are 5.87 percent less likely to have job satisfaction than those who have not workload. This finding is consistent with hypothesis 5.

CONCLUSION AND RECOMMENDATIONS

In this paper, we have investigated the determinants of job satisfaction for Abay bank workers in Addis Ababa using 150 respondents by applying factor analysis and ordered logistic model. Since no research has been conducted on Abay bank regarding the aforementioned issue, this study represents an initial step towards gaining thorough understanding of how job satisfaction affects workers of Abay bank. The level of job satisfaction of Abay bank employees depends on a host of factors. Out of the thirteen selected variables put in for factor analysis, five factors are found to gain the highest variance and represents 51.71% of the variability in all factors. These are remuneration and fringe benefits, evaluation and promotion, effective leadership, unmet job expectation and workload. Based on the prediction results of the factor analysis, ordered logistic regression analysis was conducted on five variables.

Four variables are found to be significantly connected with employees' level of job satisfaction whereas evaluation and promotion does not have such association. Remuneration and fringe benefits and effectiveness of leaders are found to be positively related with the employees' level of job satisfaction but variables such as unmet job expectation and workload are negatively correlated. Further to this, the study found that effective leadership and workload have stood as the two most significant variables of influencing job satisfaction in the context of Abay bank. The results of our investigation also verify the truth of the four directional research hypotheses, RH1, RH3, RH4 and RH5 wherein RH2 is the rejected hypothesis.

As the study finds that leaders’ effectiveness and workload are the two greatest explanatory variables to enhance employees’ job satisfaction in Abay bank, it is very appropriate that the bank management should critically concentrate on improving the leadership behavior to their employees and should establish conducive and stress free working environment. This would enhance the level of job satisfaction by reducing the imminent of absenteeism and turnover intentions. Furthermore, the study finds that employees weigh more to remuneration and fringe benefits. Thus, it is highly recommended that the bank should improve the economic status of the employees to gain their increased level of satisfaction on their jobs. This would in turn help the bank management to retain highly skilled and experienced employees of the bank.

Suggestions for future researches

In concluding we state the limitations of this study and propose some directions for future studies. One of the most obvious caveats is that the sample used in the present study was drawn only from 10 branches of the bank located in Addis Ababa. Hence, the findings cannot firmly be generalized to 152 branches of the bank located in different regions of the country. To address these issue further comprehensive studies on the topic with much larger sample size and broader coverage of branches throughout Ethiopia is required. Then we can confidently ensure the generalizability of the research findings of the study. Another caveat of this study is that job satisfaction is multi-dimensional and contingent upon various set of variables. While the present study examined the pertinent variables of job satisfaction, yet there are certain extra variables that were excluded from our regression because of measurement issues. Therefore, future studies could possibly examine a wider host of factors so as to culminate the lacuna and to improve the generalizability of the results.

The author has not declared any conflict of interests.

REFERENCES

|

Abay Bank (2017). Abay Bank S.C annual report of 2016/17. AB, Addis Ababa, Ethiopia. Available at:

View

|

|

|

|

Abreham T (2017). The effect of employee promotion practice on job satisfaction: The case of Dashen Bank S.C. A Thesis Submitted to Addis Ababa University Department of Business Administration and Information System in Partial Fulfillment of the Requirement for the Degree of Master of Arts in Human Resources Management, Addis Ababa, Ethiopia. Available at:

View

|

|

|

|

|

Adhikari R (2009). Job Requirement and Environmental Factors: The Fundamentals in designing shop floor Human Resource Management Policies, Nepal. Available at:

View

|

|

|

|

|

Ahmed S, Uddin N (2012). Job Satisfaction of Bankers and its Impact in Banking: A Case Study of Janata Bank. ASA University Review 6(2):95-102.

|

|

|

|

|

Ali S, Farooqi A (2014). Effect of Work Overload on Job Satisfaction, Effect of Job Satisfaction on Employee Performance and Employee Engagement (A Case of Public Sector University of Gujranwala Division). International Journal of Multidisciplinary Sciences and Engineering 5(8):23-30.

|

|

|

|

|

Artz B (2010). Fringe Benefits and Job Satisfaction, Working Paper 08-03, University of Wisconsin-Whitewater.

|

|

|

|

|

Awan A, Asghar I (2014). Impact of Employee Job Satisfaction on their Performance: A Case Study of Banking Sector in Muzaffargarh District, Pakistan. Global Journal of Human Resource Management 2(4):71-94.

|

|

|

|

|

Bethelhem R (2015). Compensation and Benefits Practice of Abay Bank Share Company and Its Implication for Employees Performance. A Thesis Submitted to St. Marys Unversity School of Graduate Studies In Partial Fulfillment of The Requirements for the Degree of Master of Business Administration. Available at:

View

|

|

|

|

|

Bista P (2016). Job Satisfaction among Employees of Commercial Banks in Nepal. Proceedings of the Australia-Middle East Conference on Business and Social Sciences 2016, Dubai and Journal of Developing Areas. pp. 163-177. Available at:

View

|

|

|

|

|

Bozkurt V, Aytaç S, Bondy J, Emirgil F (2012). Job satisfaction, role overload and gender in Turkey. Sosyoloji Konferansları 44:49-68.

|

|

|

|

|

Chowdhary B (2013). Job satisfaction among bank employees: An analysis of the contributing variables towards job satisfaction. International Journal of Scientific and Technology Research 2(8):11-20.

|

|

|

|

|

Dawson P (1987). Computer technology and the job of the Firstâ€Line Supervisor. New technology, Work and Employment 2(1):47-60.

Crossref

|

|

|

|

|

Hackman JR (1980). Work redesign and motivation. Professional Psychology 11(3):445.

Crossref

|

|

|

|

|

Hair J, Anderson R, Tatham R, Black C (2005). Multivariate Data Analysis, 6th ed., Low Price Edition, Pearson Education. Available at:

View

|

|

|

|

|

Hossain FF, Wadud A (2017). Determinants of Job Satisfaction of Bank Employees: A Comparison of State-owned and Private Commercial Banks in Bangladesh. A paper presented at the 2017 Biennial conference organized by Bangladesh Economic Association. Available at:

View

|

|

|

|

|

Islam A, Zaman M (2013). Job Satisfaction and Bankers Turnover: A Case Study on Bangladesh Commerce Bank Limited. International Journal of Business and Management Review 1(4):1-14.

|

|

|

|

|

Islam N, Saha G (2016). Job Satisfaction of Bank Officers in Bangladesh. Available at:

View

Crossref

|

|

|

|

|

Kaiser H (1974). An index of factor simplicity. Psychometrika 39(1):31-36.

Crossref

|

|

|

|

|

Kim S (2002). Participative management and job satisfaction: Lessons for management leadership. Public Administration Review 62(2):231-241.

Crossref

|

|

|

|

|

Locke E (1976). The Nature and Causes of Job Satisfaction. In Handbook of industrial and organizational psychology. pp. 1297-1349.

|

|

|

|

|

Mai NT, Anh NT, Trang NT, Minh NN, Hung DQ, Tien DN (2015). Modeling the Determinants of Job Satisfaction in Vietnam. Available at:

View

|

|

|

|

|

Major DA, Kozlowski SW, Chao GT, Gardner PD (1995). A longitudinal investigation of newcomer expectations, early socialization outcomes, and the moderating effects of role development factors. Journal of Applied Psychology 80(3):418-431.

Crossref

|

|

|

|

|

Mansoor M, Fida S, Nasir S, Ahmad Z (2011). The impact of job stress on employee job satisfaction a study on telecommunication sector of Pakistan. Journal of Business Studies Quarterly 2(3):50.

|

|

|

|

|

Millan JM, Hessels J, Thurik R, Aguado R (2011). Determinants of job satisfaction: a European comparison of self-employed and paid employees. Small business Economics 40(3):651-670.

Crossref

|

|

|

|

|

Misener TR, Haddock KS, Gleaton JU, Ajamieh AR (1996). Toward an international measure of job satisfaction. Nursing Research 45(2):87-91.

Crossref

|

|

|

|

|

National Bank of Ethiopia (NBE) (2017). National Bank of Ethiopia annual report of 2016/17. NBE, Addis Ababa, Ethiopia.

|

|

|

|

|

Naveed A, Ahmad U, Bushra F (2011). Promotion: A predictor of job satisfaction a study of glass industry of Lahore (Pakistan). International Journal of Business and Social Science, 2(16):301-305.

|

|

|

|

|

Nelson DL, Sutton CD (1991). The relationship between newcomer expectations of job stressors and adjustment to the new job. Work and Stress 5(3):241-251.

Crossref

|

|

|

|

|

Neog BB, Barua M (2014). Factors influencing employee's job satisfaction: An empirical study among employees of automobile service workshops in Assam. The SIJ Transactions on Industrial, Financial and Business Management (IFBM) 2(7):305-316.

|

|

|

|

|

Nimalathasan B, Brabete V (2010). Job satisfaction and employees' work performance: A case study of people's bank in Jaffna Peninsula, Sri Lanka. University of Craiova, Faculty of Economics and Business Administration Management and Marketing Journal 8(1):43-47.

|

|

|

|

|

Odia O, Agbonifoh A (2017). Determinants of the perceived image of Nigerian tourism industry. Oradea Journal of Business and Economics 2(2):16-26.

|

|

|

|

|

Pearson M (2008). Role overload, job satisfaction, leisure satisfaction, and psychological health among employed women. Journal of Counseling and Development 86(1):57-63.

Crossref

|

|

|

|

|

Porter L, Steers R (1973). Organizational, work, and personal factors in employee turnover and absenteeism. Psychological Bulletin 80:151-176

Crossref

|

|

|

|

|

Rahman M, Gurung B, Saha S (2009). Job Satisfaction of Bank Employees in Bangladesh: An Analysis of Satisfaction Factors. Daffodil International University Journal of Business and Economic 4(12):1-15.

|

|

|

|

|

Rana S (2015). Job Satisfaction Effecting Factors of Employees in Bangladesh Banking Sector. International Journal of Economics, Finance and Management Sciences 3(4):352-357.

|

|

|

|

|

Robbins P, Judge A (2013). Organizatioanal Behaviour. PHI learning private Limited, New Delhi, India.

|

|

|

|

|

Saharuddin, Sulaiman (2016). The Effect of Promotion and Compensation toward Working Productivity through Job Satisfaction and Working Motivation of Employees in the Department of Water and Mineral Resources Energy North Aceh District. International Journal of Business and Management Invention 5(10):33-40. Available at: View

|

|

|

|

|

Shanmugapriya S (2016). Determinants of Job Satisfaction of Public Sector Bank Employees. International Journal of Scientific Research and Modern Education 1(2):44-49.

|

|

|

|

|

Siebern-Thomas F (2005). Job quality in European labour markets. In Job quality and employer behaviour. Palgrave Macmillan, London. pp. 31-66.

Crossref

|

|

|

|

|

Smith P (1955). The prediction of individual differences in susceptibility to industrial monotony. Journal of Applied Psychology 39(5):322-329.

Crossref

|

|

|

|

|

Smith PC (1969). Measurement of satisfaction in work and retirement. Chicago: Rand-McNally. Available at:

View

|

|

|

|

|

Solomon M (2016). Assessment of Employee's performance Appraisal Practice: The Case of Abay Bank S.C. A Research Thesis Submitted to Addis Ababa University School of Commerce for the Partial Fulfillment of the Requirement for Masters of Art Degree in Human Resource Management.

|

|

|

|

|

Sowmya R, Panchanatham N (2011). Factors Influencing Job Satisfaction of Banking Sector Employees in Chennai, India. Journal of Law and Conflict Resolution 3(5):76-79.

|

|

|

|

|

Spector E (1997). Job satisfaction: Application, assessment, causes and consequences, Thousand Oaks, CA,Sage Publications, Inc.

|

|

|

|

|

Tanjeen E (2013). A study on factors affecting job satisfaction of telecommunication industries in Bangladesh. IOSR Journal of Business and Management 8(6):80-86.

Crossref

|

|

|

|

|

Turnley W, Feldman D (2000). Reâ€examining the effects of psychological contract violations: unmet expectations and job dissatisfaction as mediators. Journal of Organizational Behavior 21(1):25-42.

Crossref

|

|

|

|

|

Wanous J, Poland T, Premack S, Davis K (1992). The effects of met expectations on newcomer attitudes and behaviors: a review and meta-analysis. Journal of Applied Psychology 77:288-297.

Crossref

|

|

|

|

|

Weerasinghe S, Senawirathna J, Dedunu H (2017). Factors Affecting to Job Satisfaction of Banking Employees in Sri Lanka: Special Reference Public and Private Banks in Anuradhapura District. Business and Management Horizons 5(1):62-73.

Crossref

|

|