ABSTRACT

The article analyzes the management of the motorway system in Italy. It underlines the positive and critical aspects of the concession system, through the analysis of the financial statements of the main concessionary companies. From the analysis of the economic and non-financial performance, it is concluded that the current model is preferable to a totally public model, which would require significant investments. The current model, if managed economically, guarantees well-being to the community in the medium and long term.

Key words: Economy, efficiency, environmental, social and governance (ESG).

The Italian motorway system is managed through concessions to private companies. This solution was achieved after a long period of totally public management. This solution was adopted in the 1990s and today we are discussing again whether this model is effective or whether we should return to a totally public management model (Dei Conti, 2019).

The aim of the work is to verify the sustainability of the concession model, by analyzing the financial statements of the main concessionary companies. Thus, this research is based on the analysis of the economic results of the two main concessionary companies; in Italy, in fact, concessions are very concentrated and to assess the sustainability of the model it is essential to understand whether the concessionary companies are managed according to economic criteria (Winston, 2010). The research aimed to fill the literature gap by introducing the sustainability concept of the concession model and also enriching corporate social responsibility.

The previous analyses on the sustainability of the model are based on macroeconomic and legal studies and not on specific analyses on the results of company management.

The analysis of the model's sustainability also introduces the criterion of corporate social responsibility, as a fundamental element for identifying sustainability (World Economic Forum, 2019).

In Italy, in fact, the concession model has been undermined by recent events such as that of the Morandi Bridge. On this occasion, the concessionaire was attributed with little attention to maintenance and great attention to profits. The evaluation of the concession model is strictly connected to the evaluation of the ability of the concessionary companies to produce profits in compliance with social responsibility (Rusconi and Contrafatto, 2013).

The concessions model: Strength and weakness

The concession model adopted in Italy since the 90s of the last century is a model that has its proponents, but also its informers.

In particular, those who believe that a model entirely in the hands of the state is more appropriate, argues that the nationalized motorway service allows a lower increase in tariffs on users of the service and, at the same time, greater investments in infrastructure that a private individual does not require and the possibility of realizing (Ragazzi, 2008). Understanding, then, to distinguish everything within this approach due to distinct lines of argument: on one hand, there are those who argue that, given the peculiar characteristics of the motorway infrastructures, they must necessarily remain owned and publicly managed. Others, however, while admitting in principle the potential benefits of privatization, connected in discussion the Italian model, its original sins and its historical evolution (Biancardi, 2009).

The advocates of privatizations (Pisani, 2017) emphasize that the model adopted from the 1990s onwards arose to encourage the growth of competition in the motorway sector, which, however, can never be separated from compliance with the obligations entered into with dealers: this is a duty also for a future evolution of the infrastructure itself, which always needs to be constantly maintained, improved and developed. The increasing care of the existing network by the concessionary companies has allowed the end of the 90s to offer users a service that year after year reaches new quality standards, allowing our country to be able to count on infrastructure in step with the times and technology: this is demonstrated by the main data of the sector, which shows that traffic on motorways, although increasing over the years, is significantly more fluid and at the same time safer than in the past (accident rates and mortality in recent years). It is clear, however, that it is not possible to stop this infrastructure development process, under penalty of making future generations weigh on what could already be done, especially in terms of new works. Today's structure will inevitably tend to change in the coming years, with an ever greater standardization of the content of the concessions, so as to achieve a market that is as open and competitive as possible, without prejudice to the limits set by physical infrastructures that are difficult to duplicate. However, we must not forget the path that led to today's results, placing the highways as one of the few examples where privatizations, combined with the concurrent control of the concessionaires' work by the public grantor, have resulted in a substantial benefit (Macchia, 2016; Società Italiana di Politica dei Trasporti, 2020).

In a nutshell, there is a trend towards the preference of the concession system that passes through the tender procedure tool in the award of concessions can allow to maximize the revenues in favor of the grantor and, at the same time, to select the most efficient operator, capable of guaranteeing the best management in terms of service quality and safety. The design of an incentive tariff system, entrusted to an independent regulatory authority, has the aim of guaranteeing production and allocation efficiency, so that the benefits in terms of lower costs can translate into lower tariffs (Balassone, 2020).

The debate is open and this study aims to analyze whether, from the business economic point of view, the current system is actually a sustainable system. The studies cited analyze the issue from a general economic and legal point of view; this study proposes to analyze the issue from a corporate economic perspective.

The issue has been extensively analyzed in macroeconomic and legal studies, but not in business economics. This paper proposes the business economic analysis of the motorway concessions model.

Even in the international literature, the authors have analyzed the issue from a macroeconomic point of view, but they have not evaluated it in corporate economic terms (Ochoa, 2002; Contreras and Angulo, 2018; Soliño et al., 2017; Pons-Rigat et al., 2017; Ramalho, 2014). In particular, the analysis was conducted on the effects of the system on public accounts (Valdés Fernández De Alarcón and González, 2014). In Spain, for example, doctrine believes that this business model is very dynamic and serves as a sharp break with the past, tending towards unregulated business (urban highways with a variety of alternatives) or non-transfer of demand-related risk. Concessions have become large-scale business in themselves.

The motorway system in Italy: Analysis of the main concession companies

The structural features of the motorway concessions sector were defined at the end of the privatization process carried out in the 1990s and have undergone few changes over time (Banca d'Italia, 2011). The market structure is rather concentrated: of the twenty-five concessionaires managed by the Ministry of Infrastructure and Transport, nineteen refer to the two main groups operating in the sector, Atlantia and ASTM, to which more than half and more than a fifth of the highway network. Existing concessions have long residual durations: for about 60% of the network, the concession will expire in more than ten years. Between 2009 and 2018, toll revenues grew by 28% in nominal terms and by 13% in real terms, mainly as a consequence of the constant increase in unit tariffs, against a trend in traffic volumes that basically followed the economic cycle and which at the end of the period considered was at levels similar to the initial ones. The increase in tariffs in real terms is mainly attributable to the component linked to the return on investments (Ragazzi, 2006). In the same period, the annual investment expenditure has almost halved, reaching the minimum in 2017. The expenditure was mainly destined for the strengthening of the existing network. During the period there were significant differences between the investments planned in the dealers' economic and financial plans and those made (on average equal to one third); this gap, which has eased in recent years, is largely attributable to delays in the execution of some works, also due to the slowdowns that arose in the phases of project approval and issue of authorizations. The institutional structure that has long governed the sector was characterized by a limited application of the competitive principles. This was reflected in the reduced recourse to public evidence procedures and in the long durations of the assignments, also due to widespread extensions (Società Italiana di Politica dei Trasporti, 2020).

Until recently, the market was not subject to the regulation of an independent authority and there was limited transparency on the contents of the concessions and on the conditions under which they were modified. In recent years, the regulatory environment has improved, in particular due to the changes made by the Code of public contracts in 2016 and by Legislative Decree 109/2018 (Gilardi and Maggetti, 2011). The rules of the code should favor, especially when awarding new concessions, greater openness to competition and a clear attribution of operational risk to dealers (Pratt and Grabowski, 2010). The new provisions will immediately apply to managements covering 18% of the network under concession (Gaboardi, 2003); this percentage will rise to 40 in ten years; will be equal to 96 in 2040. The new powers attributed by the Legislative Decree 109/2018 to the Transport Regulatory Authority may allow for an appropriate homogenization of the tariff regimes, with the application of a single price cap model. In exercising these powers, the authority is entrusted with the task of ensuring that the dynamics of the tariffs is fully justified by the investments made and the quality standards achieved, while ensuring adequate remuneration for the concessionaire (Saltari and Tonetti, 2019). The authority has already adopted the resolutions approving the toll tariff system for unexpired concessions; however, the effective adjustment of the tariffs was deferred until the economic-financial plans were updated which, according to current legislation, should be completed by 30 July 2020.

The studies conducted on the Italian motorway system were based on econometric evaluations of the system and not on the analysis of the economic trend of the individual concessionary companies. This paper analyzes the financial statements of the concessionary companies to evaluate the overall evaluation of the system in a corporate economic approach.

Sustainability and criticality of the Italian model

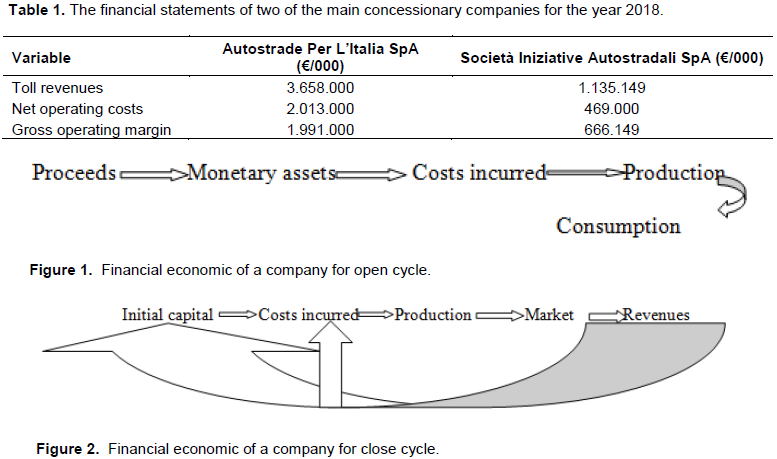

The Italian model, as mentioned, is based on the principle of granting the motorway service to a number of concessionary companies. The latter, today, are all joint stock companies, however many listed, which have among their main revenues the tolls paid by users. These revenues serve to cover the costs for the management and maintenance of the network. The financial statements of two of the main concessionary companies for the year 2018 are shown in Table 1.

Autostrade per l'Italia S.p.A. has toll revenues amounted to € 3,658 million and showed an overall increase of € 68 million (+ 2%) compared to 2017 (€ 3,590 million). It should be noted that the initiative relating to the exemption of the toll on the Genoese area has generated lower toll revenues estimated at around 7 million euros. "Net operating costs" amounted to 2,013 million euros and increased by 520 million euros compared to 2017 (1,493 million euros).

The "Gross operating margin" (EBITDA), therefore equals to 1,991 million euros, decreased by 461 million euro (-19%) compared to 2017 (2,452 million euros); on a homogeneous basis, EBITDA increased by 27 million euros (+ 1%) compared to 2017.

Società Iniziative Autostradali e Servizi S.p.A. has toll revenues amounting to 1,135,149. The increase in "net toll revenues" equals 86 million euros (+ 8.46%) The "operating costs", equals to a total of 469 million euros, show an increase of approximately 36.1 million euros. With regard to the aforementioned, the "gross operating margin" shows an increase of 43.8 million euro.

These values ​​show, mutatis mutandis, that the companies operating under concession have a positive margin; this means that for the private company, the flow from the toll is able to guarantee coverage of maintenance costs and a positive flow for the company (Bastia, 1989; Quagli, 2017).

The model used in Italy generates, from the corporate point of view, a hybrid, albeit widely used as mentioned, quite peculiar. In fact, the public economic entity decides to implement the motorway transport service, therefore a typical public consumer activity, through the concession system, then through the "purchase" of the service from private companies for profit (Costa and Guzzo, 2011).

The theme is not indifferent, in fact, a service such as the motorway could be provided directly by the state, through a public consumer company that could ask for a mere contribution from the user. In this case, the typical financial economic cycle of the company that produces for internal consumption would be configured (Bianchi, 2011).

The use of the concession model means that the service is provided by a company that produces for the market, whose financial and economic cycle is profoundly different from the previous one.

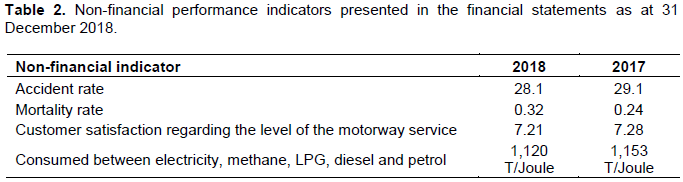

The economic and financial cycles of the two types of activities cannot be superimposed. The first, that of consumer companies, is an open cycle that finds its continuity in the proceeds assigned by the associates, in the case of the state, taxes, fees, and contributions (Figure 1). The second, that of the companies that produce for the market, is a closed cycle in which the volume of revenues coming from the market must cover the costs of production and assign remuneration to capital (Figure 2).

Autostrade per l'Italia S.p.A. financial statements as of December 31, 2018; Iniziative Autostradali e Servizi S.p.A. financial statements as of December 31, 2018.

Toll Revenue are only the revenue by the toll.

The first type of company records the following report: Revenue/costs R f(C,M)

Therefore, the condition of the company's economic equilibrium for the exchange is guaranteed by the ability to produce a surplus that allows coverage of costs and fair return on capital.

The Income Costs report, typical of the company for consumption, is as follows: C f(P)

This means that the condition of economic equilibrium is guaranteed by the balance between income and costs. Given a certain volume of proceeds, an equal volume of costs can be incurred.

The concession model that is used for the motorway service is the result of a precise choice, modified over time but also widely used, which is the one in which the public economic entity decides to produce the motorway service through a company for the exchange, therefore, of done, buy the service from this.

This choice implies that the concessionaire company must perform the service while maintaining a level of costs that still allows the achievement of an adequate margin for the remuneration of the shareholders.

The theme, from a business point of view, is to understand whether this choice can be sustainable and meet economic criteria.

The analysis must be conducted by remembering that the sustainability of a business model depends on its ability to be managed according to cost-effectiveness. The latter condition occurs when you are able to produce, achieving the objective of the economic entity, at minimum costs, without waste and with attention to future prospects (Bianchi, 2011). So it is necessary to be able to understand if the model that has been created is actually meeting economic criteria.

The data obtained from the financial statements of the main concessionaires, as seen, show a large margin deriving from the motorway service. This means that the companies in question are able to cover costs and guarantee margins through the flows derived from tolling.

As have been seen, the concession provides that the concessionaire can build, maintain, expand, then invest, and can recover the costs for such investments through the collection of traffic tolls. In other words, the dealers anticipate the costs for the investment against flows coming from the tolls. Moreover, the assets under concession are freely transferable assets at the end of the concession.

It is clear that when choosing this model, the state believed that investments in the construction of the highway belt would be made more efficiently by the private operator than by the public operator. The construction of almost 7,000 km of highways confirms that the constructive investment has been efficient and has contributed to GDP growth.

The issue is whether these investments, even today, with a rather complex concession system, are continuing to be effective.

Today the investment, the tragedy of the Morandi Bridge proves it; it is not only on the construction and expansion, but also and above all on maintenance. Yet the half-yearly financial report of Autostrade per l'Italia, which takes into account the failure to toll in the Genoese area as well as the costs for starting the demolition of the bridge, shows an EBIDTA of € / MLN 1,162 slightly lower than that of the same period of 2018. This shows that the economic and financial structure of the company built according to economic criteria is able to absorb extraordinary negative events.

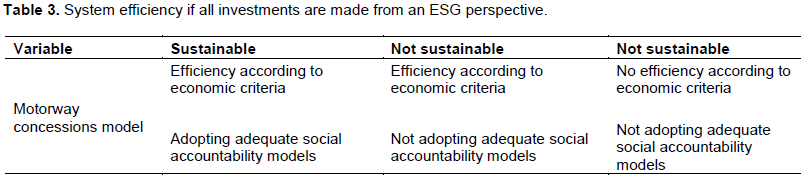

The model appears, overall, in economy. To have a further indication of this result, it may be interesting to analyze some non-financial performance indicators presented in the financial statements as at 31 December 2018 (Table 2).

R = revenue; C = costs; M = Market. Therefore revenues are a function of costs and of the market. In other words, there will be revenues if and only if the production structure has created goods and services to be sold and the market will purchase them.

C = costs; P = Proceeds. The costs are a function of the proceeds, that is, costs can be incurred within the limits of the disposable proceeds.

See Autostrade per l'Italia S.p.A half-yearly financial report at 30 June 2019: "Operating external costs" amounted to 436 million euros and increased by 202 million euro compared to the first half of 2018 (234 million euro). It should be noted that the change is essentially influenced by the costs associated with the preparatory interventions for the reconstruction of the Polcevera viaduct (€ 155 million), the impact of which on EBITDA is essentially zero due to the use of the recovery and replacement provision recorded in the item "Change operational fund management ". Excluding the aforementioned charges associated with the event of 14 August 2018, the external management costs increased by 47 million euros in particular due to the greater maintenance interventions on the Autostrade per l'Italia network in relation also to the new and more complex tender (started already in 2017) which affected the activities of the previous year.

Report on the management of the Autostrade per l'Italia financial statements as at 31 December 2018.

Reading these indicators reveals a company's focus on safety and the environment. This leads to an assessment of the effectiveness of the corporate action which is capable of producing positive economic, but also non-financial, positive results.

Returning, in fact, to the definition of cost-effectiveness, it should be stressed that this condition occurs when the company reaches its objectives at minimum costs, but with attention to future prospects. This leads to the assertion that a company is inexpensive if it is able to build the conditions for future development for itself and for the community in which it lives. Therefore, attention to future prospects (Bianchi, 2010) is not only the ability to create profits in the future (Capaldo, 2013) but also to make the company action heralding benefits for the environment, the safety of its workers, the local community, also through innovation activities (Malena and Foster, 2004).

The analysis of the complex of these data, not dissimilar to the other dealers, leads to the conclusion that the hypothesized model works because it achieves the sought-after cost-effectiveness of the system.

Clearly, the public operator will have to oversee some elements (Ackerman, 2005). In particular, it must always be borne in mind that the costs of the concessionaires must be incurred for the expenses and investments necessary for the correct maintenance of the network, there may be the temptation to minimize the costs not for an effect of efficiency, but of failure to comply with the needs of the network.

In particular, the monitoring of investments in maintenance and modernizations must be carefully evaluated. Just as it is clear that the concessionaire companies will have to carry on the Italian network the investments necessary to fulfill their obligations in terms of safety, environmental protection, maintenance and modernization and, then, if flows also coming from other activities will remain, they may decide to invest in other businesses or abroad, but the primary objective remains that of the obligations deriving from the concession. All in compliance with the stakeholders of the concessionary companies which, as companies that produce for the market, are called to achieve the objectives of their investors.

In Italy, there is a great debate on the topic of highway network management. There are pushes to return to the totally public model, while others would like to maintain the current situation (Ragazzi, 2004; Cassetta et al., 2013; Bonfratello et al., 2007). The analyses in favor of the public or private model are devalued with respect to macroeconomic analysis criteria, while an economic analysis of the company, such as the current one, allows the evaluation of the economy of the current system (Belardinelli and Stagnaro, 2020; Ochoa, 2002; Contreras and Angulo, 2018; Soliño et al., 2017; Pons-Rigat et al., 2017; Ramalho, 2014; Valdés Fernández De Alarcón and González, 2014). The objection of the proponents of the public model is that the private individual aims to maximize profits and forget investments in maintenance and security. The hypothesis of returning to the totally public model has been officially denied by the current government team (Barbera, 2019; Buzzi, 2019), but continues to exert some charm. The aforementioned analyses demonstrate the concessionaires must achieve the objectives in terms of profit, but also of future prospects and this second objective is achieved only through a management that does not aim only at short-term profit, but to achieve conditions of well-being in the medium/long term for the company and for the community. In other words, the concessionary companies must operate according to criteria of economy that allow to achieve results in terms of greater safety for the users of the network, through investments in maintenance and in the control over the network. The limitations of this study are the few academic works, from a corporate economic perspective, about this issue and the specific characteristic of the motorway market in Italy. The previous works did not analyze the financial and non-financial performance of the concessionary companies. They made an overall assessment of the concession system. The present work, on the other hand, has shown that the business economic analysis conducted on the main concessionary companies allows us to establish that the system is efficient if all investments are made from an ESG perspective (Table 3).

It being understood that whatever business model is chosen, the same works if it is managed according to economic criteria (Bianchi, 2011), however, the dismantling of the current system would entail significant costs and would require the state, a new economic entity, to continue investing.

The system of concessions, on the other hand, has its own stability. The dealers will have to demonstrate adequate social accountability models (Bianchi, 2010). In fact, it should be remembered that today, more and more, companies are evaluated for their socially responsible conduct and, therefore, the overall level of efficiency is not only read in terms of productivity, but of the effectiveness of the company action (Giangualano and Solimene, 2019).

In fact, from many sides he complained that the current system does not allow for proper disclosure of the dealers' economic and financial plan. This aspect must certainly be improved because the public economic entity must have absolute transparency on the investment plan of the concessionaire companies and also on investments in favor of the environment, safety, etc.

At a time when there is great concern about the issue of investment choices according to Environmental, Social, and Governance (ESG) criteria, it cannot be said that investments in a sector such as public transport must be made according to clear criteria of sustainability and responsibility social; criteria which, as recalled, are perfectly compatible with cost-effectiveness.

The author has not declared any conflict of interests.

REFERENCES

|

Ackerman JM (2005). Social Accountability in the Public Sector: A Conceptual Discussion. World Bank, Social and Development Papers, Participation and Civic Engagement P 82.

|

|

|

|

Banca d'Italia B (2011). Le infrastrutture in Italia: dotazione, programmazione, realizzazione (Seminari e convegni, No. 7).

|

|

|

|

|

Balassone F (2020). Indagine conoscitiva sulle concessioni autostradali, Testimonianza del Capo del Servizio di Struttura Economica di Banca d'Italia alla Commissione Ottava del Senato della Repubblica, luglio 2020.

|

|

|

|

|

Barbera A (2019). De Micheli: Ora basta con i no politici sui cantieri. La Stampa, 6 settembre. 2019.

|

|

|

|

|

Bastia P (1989). Il bilancio d'impresa. Formazione e interpretazione. Il Mulino, Bologna, 1989.

|

|

|

|

|

Biancardi A (2009). (acura di), L'eccezione e la regola. Tariffe, contratti e infrastrutture. Il Mulino, Bologna 2009.

|

|

|

|

|

Belardinelli P, Stagnaro CC (2020). Il sistema autostradale italiano: efficacia ed efficienza, in Federalismi, n.1 2020.

|

|

|

|

|

Bianchi C (2011). Il Modello Aziendale Come Modello di Economicità, Roma, 2011.

|

|

|

|

|

Bianchi C (2010). Strutture Aziendali nel Mercato Globalizzato, Bologna, 2010.

|

|

|

|

|

Bianchi MT (2017). Discovering the role of innovation in contemporary business systems: an assessment technique from the literature analysis. International Journal of Digital Culture and Electronic Tourism 2(1):1-15.

Crossref

|

|

|

|

|

Bonfratello L, Iozzi A, Valbonesi P (2007). La riforma del settore autostradale in Italia: un cantiere aperto. Pammolli F, Cambini C, Giannaccari A (a cura di), Politiche di liberalizzazione e concorrenza in Italia, il Mulino, Bologna.

|

|

|

|

|

Buzzi M (2018). Conte: Non siamo una banda di scriteriati, niente nazionalizzazioni. Corriere della sera. Available at:

View

|

|

|

|

|

Capaldo P (2013). L'Azienda. Centro di Produzione, Milano, Italy.

|

|

|

|

|

Contreras C, Angulo J (2018). Government cost of extending concession term rights. Journal of Infrastructure Systems 24(3):04018011.

Crossref

|

|

|

|

|

Cassetta E, Pozzi C, Serra A (2013). Infrastrutture di trasporto e crescita: una relazione da costruire. Infrastrutture di Trasporto e Crescita 2013:1-242.

|

|

|

|

|

dei Conti C (2019). (2005). Sezione centrale di controllo sulla gestione delle Amministrazioni dello Stato. Ufficio di controllo sui Ministeri delle attività produttive, Investimenti nei settori dello sviluppo e della ricerca sull'agricoltura biologica ed econcompatibile.

|

|

|

|

|

Costa M, Guzzo G (2011). L'impresa pubblica in Italia: una "storia" economico-aziendale e dottrinale, in XI Convegno Nazionale della Società Italiana di Storia della Ragioneria - Finalismo e ruolo delle aziende nel processo di costruzione dello Stato unitario - Modelli aziendali e sistemi di produzione in Italia dal XIX al XX Secolo. Roma: Rirea.

|

|

|

|

|

Gaboardi F (2003). Aspetti tecnici e giuridici del sistema autostradale italiano, in Quaderni Amministrativi, III trimestre, 2003.

|

|

|

|

|

Giangualano P, Solimene L (2019). Sostenibilità in cerca di imprese. La rendicontazione non finanziaria come strumento di governance dei rischi e delle opportunità. Milano, Italy. Available at:

View

|

|

|

|

|

Gilardi F, Maggetti M (2011). 14 The independence of regulatory authorities. Handbook on the Politics of Regulation. Edward Elgar Publishing, Cheltenham, UK.

Crossref

|

|

|

|

|

Macchia M (2016). Le concessioni autostradali nella riforma del Codice dei contratti pubblici. Rivista Giuridica del Mezzogiorno 30(3):829-840.

|

|

|

|

|

Malena C, Forster R (2004). Social Accountability An introduction to the concept and emerging practice. Available at:

View

|

|

|

|

|

Ochoa JB (2002). Private promoters and the public works concession system. Revista de Obras Publicas 149(3425):151-153.

|

|

|

|

|

Pisani G (2017). Le concessioni autostradali: evoluzione normativa e regolamentare. Dagli albori alla delibera ART 119/2017. Universitalia, Roma. Available at:

View

|

|

|

|

|

Pratt SP, Grabowski RJ (2010). Cost of capital in litigation: applications and examples (Vol. 647). John Wiley & Sons.

|

|

|

|

|

Pons-Rigat A, Saurí S, Turró M (2017). Matching funding, mobility, and spatial equity objectives in a networkwide road pricing model: case of Catalonia, Spain. Transportation Research Record 2606(1):1-8.

Crossref

|

|

|

|

|

Saltari L, Alessandro T (2019). Concessioni autostradali. Available at:

View

|

|

|

|

|

Società Italiana di Politica dei Trasporti (2020). Le concessioni di infrastrutture nel settore dei trasporti, Maggioli, Milano 2020.

|

|

|

|

|

Soliño AS, Lara Galera AL, Colín FC (2017). Measuring uncertainty of traffic volume on motorway concessions: A time-series analysis. Transportation Research Procedia 27:3-10.

Crossref

|

|

|

|

|

Ragazzi G (2004). Politiche per la regolamentazione del settore autostradale e il finanziamento delle infrastrutture. Economia Pubblica 4:39.

|

|

|

|

|

Ragazzi G (2006). Autostrade: meglio pubblico o privato?. L'industria 27(3):505-522.

|

|

|

|

|

Ragazzi G (2008). I signori delle autostrade. Il Mulino, Bologna, Italy.

|

|

|

|

|

Ramalho AP (2014). The Portuguese road system: A search for sustainability. Carreteras 4(197):45-53.

|

|

|

|

|

Rusconi G, Contrafatto M (2013). Corporate Social Accounting And Accounts: a duty of accountability. Impresa Progetto 2(2):1-17.

|

|

|

|

|

Quagli A (2017). Bilancio di esercizio e principi contabili (Vol. 5). G Giappichelli Editore.

|

|

|

|

|

Valdés FS, González O (2014). Crisis of the tolled motorway companies in Spain: Causes and solutions. Carreteras 4(195):50-58.

|

|

|

|

|

Winston C (2010). Last exit: Privatization and deregulation of the US transportation system. Brookings Institution Press.

|

|

|

|

|

World Economic Forum (2019). Global Competitiveness Report 2019. Available at:

View

|

|