ABSTRACT

China, the second-largest economy in the world, has been an eye-catching destination for several foreigners who wish to live and study there. As they are beneficiaries of the Chinese advanced digital payment system, subjective security in using the mobile payment system and the subsequent change in their consumption intention has been a behavioral concern that perplexes scholars. Using SEM, we integrated the technology acceptance model (TAM) with two Subjective security Constructs (perceived confidentiality and perceived trustworthiness) to determine their impact on the system's adoption intention. At the same time, we evaluated the change in consumption intention using one factor (post-adoption consumption intention). A self-administered questionnaire based on prior literature was developed, and a total of samples of 260 foreigners who are extensive users of mobile payment were engaged. The study revealed that once again, TAM's model constructs (perceived usefulness and perceived ease of use) are dominant factors of adoption intention. While one of the subjective security constructs (perceived trustworthiness) was found to be a significant decisive determinant factor, the other one (perceive confidentiality) was found to be a negative but insignificant factor in mobile payment adoption intention among the expatriates. Moreover, this study provides insight into the digital payment system and its impact on influencing consumption intention beyond adoption.

Key words: Technology acceptance model (TAM), subjective security, consumption behavior, expatriates.

The trajectory economic and technological advancement of China in the last few decades is considered as the result of the successful implementation of reform and open-up policy of the late 1980s (Dong et al., 2017). In line with this economic explosion, the digital payment system of China was always at the center. It has been attracting many practitioners, researchers, and scholars. Chinese techno experts and their partners work around the clock to improve this technology to make it more convenient, inclusive, and secure. Scholars critically dissected this extraordinary advancement and added to the pool of knowledge. With the ever increase in information symmetry, continuously plunged fixed costs, and availability of various financial products and services, the digital finance system becomes an inseparable part of Chines’ financial system.

Barnes and Mattsson (2017) describe mobile commerce (m-commerce) as any economic transaction involving direct or indirect monetary value, executed via wireless technology using smartphones. According to m-commerce estimates, there had been 1.8 billion worldwide digital customers in 2018, leading 21.55 percent of the world's population to be online buyers. The number is set to increase by more than 2.14 billion in 2021 (UNESCO, 2018). China's slice of the worldwide online retail pie is already more than half and will rise even more in the coming years (Statista, 2019).

With the overall strong economic shield and technological advancement integrated with the increase in globalization and international economic ties and coactions, China becomes the center of attraction. It gravitates international students, immigrant employees, traders, and foreign tourists from every corner of the world. For instance, in 2016, China stood third globally for the biggest recipient of international students, with 442,773 new students step their foot in the nation (UNESCO, 2018). By 2018 this number grew to 492,185 (10.49 percent growth over 2017) (China Ministry of Education, 2019). At the same time, according to China daily, in 2019, the number of permanent registered numbers of foreign workers in China was about 900,000. On the other hand, there were around 25 million visitors in mainland China in the year 2016 (Dong et al., 2017). Those opportunities come along with pressure and expand advanced financial services to the very people to improve their quality of time in China by making them feel comfortable and secure when they deal with the mobile payment system (Tampuri, Kong and Asare, 2019).

The People's Republic of China as the world's largest digital retailing market deserves special attention to understand its dynamics in the commercial landscape and its financial inclusion mechanism. Adequate managing online store that hasten consumers' satisfaction through mobile payment technology is a crucial factor not only for the diversified source of income but also for the sustainable growth of the economy. The proliferation of online shopping has stimulated widespread research to attract and retain consumers from either a consumer or a technology-oriented view (Delafrooz et al., 2009). Customer's satisfaction of online payment stores is directing to a positive outcome like trust, satisfaction (Fassnacht and Köse, 2007), customer referral, retention, e-shopping stickiness, online conversion (Ranaweera et al., 2008), and online loyalty (Anderson and Srinivasan, 2003; Fassnacht and Köse, 2007; Chiou and Chang, 2009). Although the number of foreigners in China is not significant considering the size of the nations' population, they are an important link and technology transfer between China and their respective countries. Thus, they need to have access and usages of advanced digital financial services, including mobile payment, without security concerns. They must undertake their day-to-day activities, make and receive payments, and stay connected and productive (Tampuri et al., 2019). The objective of this study is to investigate if foreigners living in China have security concerns when they are dealing with the mobile payment system and if there is a significant change in their consumption trend post-adoption of the m-payment system. Despite the wide varieties of studies directing mobile payment adoption intentions, there are limited (if any) studies connecting those dual objectives. This study’s’ outcome is not mainly to understand the security perceptions and concerns of foreigners residing in China but also to contribute useful insights into how money representation might affect consumption behavior.

As a base theory, the current study applies Davis's technology acceptance model (TAM) (Davis 1989). This theory is reputable for its expressive power in explaining Information System (I.S.) adoption behavior in the previous studies. But several empirical works have found that TAM only explains a specific portion of the variance related to usage intention and action (Venkatesh and Davis, 2000). Therefore, the present research extends TAM's model by including two central determinants of security-related constructs and one post-adoption construct. The aim is to emphasize how those constructs could affect the decision to adopt and how those determinants change users' spending behavior over time.

LITERATURE REVIEW AND HYPOTHESIS FORMATION

Foreigners and Financial inclusion in China

According to the United Nations, financial inclusion is a financial system that efficaciously and comprehensively serves all social groups and classes (Runnemark et al., 2015). Fungacova and Weill (2014)define financial inclusion as the dissemination of conventional financial services to a vast population and the access to and use of financial products and services. Proxies of measuring the degree of financial inclusion could be more and sophisticated. But it could be defined as simple as the accessibility and usable of financial services by customers. When specific categories of society are excluded from this standard financial service and product, it could be referred to as financial exclusion (Hannig and Jansen, 2010). Mobile payment system technology, like any other cluster of financial products, needs to be inclusive. For example, in a report issued by a study from the Institute of Digital Finance of Peking University in 2019, the digital inclusive finance index increased from 46.9 in 2011 to 226.6 in 2018; increase of 383.2 percent since 2011.

This surge in Digital finance has created better economic progress and improved the living standards for most local people. Suppose we are devoted to understanding international communities’ perceptions towards a mobile payment system in China, the first thing needed to know is that if they do even have access to that technology. In the previous studies, it can be observed that the degree of financial inclusion and its access for foreigners in China is better (Dong et al., 2017; Tampuri et al., 2019). The foreign community in China can be considered as beneficiaries of financial inclusion. They have access to basic banking services, and in general, they claimed they are satisfied with the service (Tampuri et al., 2019). This immediate access is crucial for the experts, as it is the root of the various digital financial products and directly linked to the mobile payment system.

Technology adoption

Mobile payment is an electronic process in which a smartphone device and cellular phone communication techniques are utilized to initiate, authorize, or make payments (Pousttchi and Wiedemann, 2007). The procedure is, in essence, an information technology (Becker and Pousttchi, 2012). However, it is worth addressing that nearly 25 percent of the world's population is only active users of online shopping. It indicates that the majority of the world population does not have access to it. More specifically, most of the foreigners coming to China are new to the technology. Understanding their perceptions and security concerns toward accepting this technology, thus, become imperative. When new information technology is diffused to the public, an individual's perception regarding the utilization of technology becomes crucial since it is one of the ultimate reasons behind an individual's acceptance (Rogers, 1985; Moore and Benbasat, 1991).

A wide variety of theories are proposed to determine what attributes of innovation consistently influence adoption by individuals (Moore and Benbasat, 1991). Researchers employed acceptable and widely established behavioral models such as Theory of Planned Behavior (TPB) (Ajzen, 1991), Decomposed Theory of Planned Behavior (DTPB) (Taylor and Todd, 1995); Theory of Reasoned Action (TRA) (Fishbein and Ajzen, 1975)and models concerned with technology acceptance including Technology Acceptance Model (TAM) (Davis, 1989), TAM2 (Venkatesh and Davis, 2000)and Unified Theory of Acceptance and Use of Technology (UTAUT) (Venkatesh et al., 2003)mainly to curve the perception of individuals in adoption innovation. In this study, we focus on Davis's Technology Adoption Model (TAM) as it has been extensively used in previous information technology system-related researches to explicate users' adoption intention (Dahlberg et al., 2003).

Although TAM was initially applied to study work- related I.S. activity, the theory is still very relevant for other IS-related studies. It has been successfully implemented in various non-organizational contexts, including several mobile commerce scopes (Pousttchi and Wiedemann, 2007). While individual innovation adoption is believed to be necessary, the smartphone owner's intention to utilize the mobile payment system is of vital interest to researchers and practitioners. Based on previous literature works, we construct the conceptual framework of attributes that consistently influence mobile phone owners' decisions to adopt mobile payment systems. We are using the following characteristics as factors that always influence mobile phone owners' decision to adopt the online shopping system.

Perceived usefulness and perceived ease of use

Technology Acceptance Model (TAM) by Davis (1989)is among the well-known behavioral models often used to examine the intention of adopting technology by individuals. TAM model hypothesizes that perhaps the behavioral intentions of a person to embrace technology are defined by two conceptions, perceived usefulness and perceived ease of use. The former is related to the degree to which an individual believes that adopting the system will boost their activity performance (Becker and Pousttchi, 2012). While perceived ease of use is defined as the extent to which a person believes that to adopt the system will be effortless (Venkatesh and Davis, 2000). Since its establishment, TAM has become a deep-seated, resilient, influential, and pioneering model for user acceptance predictions (Venkatesh and Davis, 2000). In line with that, we are using the two essential TAM attributes as part of the reason to adopt the mobile payment system.

Moreover, we hold TAM's preposition of perceived ease of use to be a positive factor determining intention to use a technology (Davis, 1989). As all else being constant, the less troublesome a system is to operate, the higher tendency to use it. Considerable empirical evidence summed over the last decades proves that perceived ease of use significantly affects adoption intention (Davis, 1989; Venkatesh and Davis, 2000). Therefore, we hypothesize:

H1: Perceived usefulness is directly associated with the adoption intention of using mobile payment systems among foreigners living in China.

H2: Perceived ease of use is directly associated with the adoption intention of using mobile payment systems among expatriates living in China.

H3: There exists a positive effect of Perceived ease of use on perceived usefulness of m-payment among foreigners living in China.

Perceived security and privacy

Several empirical works have found that TAM's dual central belief attributes of perceived usefulness and perceived easiness explain only a certain portion of the variance related to usage intention and behavior (Venkatesh and Davis, 2000; Moon and Kim, 2001). Thus, numerous researchers are trying to include other attributes. Factors like, "Perceived playfulness" (Teo et al., 1999;Moon and Kim 2001), "Product involvement and perceived enjoyment" (Koufaris, 2002), "Computer self-efficacy" (Igbaria and Iivari, 1995; Chau, 2001; Hong et al., 2002), "Personal innovativeness" (Agarwal and Karahanna, 2000), "Social factors" (Hsu and Lu, 2004)and "Perceived information quality" (Shih, 2004). Several studies have also explained "Trust" as an additional variable to the Internet shopping (Gefen et al., 2003) and e-Government contexts (Teo et al., 2008) that can determine an individual's technology acceptance intention. Yet, it is noteworthy to understand that not all of the criteria matter equally to all users.

Notably, since one of our main objectives is to investigate if foreigners living in China have security concerns when they are dealing with mobile payment, we narrowed our focus only on the two ascendants of securities. A substantial component of m-payment adoption is the perception of subjective security (Becker and Pousttchi, 2012). The 'Perceived Privacy of information' and the 'Perceived trustworthiness are the most iterative applied explanatory factors when the subjective security in the literature has been studied in the case of m-commerce (Dong et al., 2017). In our model, we will integrate the work of Dong et al. (2017)to tackle foreigners' perception of the security concern of mobile payment. Kreyer et al. (2003) classified the security concern into two dimensions, objective and personal security. Due to the technical characteristics of objective security and average consumers are unable to evaluate it (Becker and Pousttchi, 2012), in this study, we will focus on subjective security as it is a measure of consumers' perception. Becker and Pousttchi (2012)define subjective security as "The degree to which a person believes that using a particular mobile payment procedure would be secure." Security issues, whether they are objective or subjective, are primary barriers to mobile payment acceptance. Gefen et al. (2003)analyze mobile payment adoption barriers and conclude concerns of subjective or immanent security are the most frequent causes of denial. Moreover, Pousttchi (2003)postulates that a violation of subjective security would block users from utilizing a specific procedure. Previous literature had contributed to craft attributes that explain subjective security characteristics (Linck et al., 2006).

Perceived confidentiality (P.C.)

Koufaris (2002)defines privacy as the characteristics of an information technology system that assures restrict access to the intended authorized persons only. It can be made by using unique encrypted codes for each information. Confidentiality of information is by far proved to be the most crucial adoption attribute for mobile payments (Pousttchi, 2003)as consumers' biggest concern could be the invasion of their privacies and financial data. Therefore, it is natural for foreigners to be skeptical about their data confidentiality, particularly when they do not understand the whole mobile payment system laws and regulations in a host county. Thus, they need to be confident about their payment details safety if they have to accept the m-payment system. Therefore, we hypothesize:

H4: Perceived confidentiality will positively impact the intention to use m-payment system among foreigners living in China.

Perceived trustworthiness (P.T.)

Trust is a multi-factorial belief and user expectations when they consider privacy, security, acceptable norms, social influence, and efficaciousness (Grandison and Sloman, 2000). Trust as the explanatory variable is observed frequently with the numerous technology adoption models (Dong et al., 2017). Consumers' trust in the m-payment service provider is an essential determinant of his attitude towards the company, which eventually will lead to the notion of faith in the company. Dong et al. (2017)stated that "perceived privacy of information and the security is most iteratively used independent variables when the security in the literature has been studied in the case of m-commerce" (Dong et al., 2017 p.190). Concerning the perception of trust in the service provider, several different characteristics that trigger consumers' trust can be identified. The company's integrity, benefaction, competence, and reputation are among them (Mayer et al., 1995, Chandra et al., 2010). To contextualize the concept of trust, the perceived mobile payment service provider's trustworthiness represents the perception of the consumer's confidence in the system. It is expected that a belief in the distinct traits of the service provider will affect consumers' intention to use the mobile payment service. Therefore, we hypothesize:

H5: Perceived Trustworthiness will positively affect the intention to adopt the m-payment system among foreigners living in China.

Furthermore, perceived confidentiality and perceived trustworthiness are expected to influence each other (Hampton-Sosa and Koufaris, 2005). If consumers assume that a particular service provider is equipped with the essential technology to save their transaction and other private data from unauthorized access, they can feel secure. This feeling of security may enhance their trust in the service provider. Say it differently; any consumer will use a mobile payment that he/she perceived as secure and provided by a trustworthy company. Therefore, it can be hypothesized as:

H6: There exists a positive relationship between perceived confidentiality and perceived trustworthiness concerning the m-payment system.

Post adoption consumption perception

Unlike the classical economic thoughts, where consumers' valuation of goods and services are independent of the payment form or money representation, scholars find out the payment method itself does affect spending (Runnemark et al., 2015). Moreover, researches based on natural circumstances also provide similar patterns relating to spending behavior associated with different payment scenarios. Although there is no theoretical account of such temporal shifts, researchers also found that accepting mobile payment systems is related to increased shopping motives (Xu et al., 2019). In this paper, therefore, in minimal scope, we took a glance into foreigners' perceptions about their spending behavior after they adopt the m-payment. Consequently, we hypothesize:

H7: Mobile payment system adoption is negatively affecting the spending behavior of foreigners living in China.

We attempt to examine our theoretical model, and the hypotheses discussed above through self-administrated online surveys. This research's conception was a correlation design conducted on foreigners living in China. The entire instruments employed in this research are developed by discovering appropriate proxies from an extensive literature review. We adopt proxies of Perceived Usefulness and Perceived Ease of Use from Davis (1989), Perceived Confidentiality from Rammile and Nel (2012), Perceived Trustworthiness from Jarvenpaa et al. (2000), and Schneider et al. (1998), Intention Adopted from Davis (1989), Venkatesh and Davis (2000), and Post-Adoption Consumption Perception from Kelly et al. (2010). All of the adopted measurements are contextualized and modified to fit this study. Using scale measurements from prior studies has the advantage of well validating measurement scales, which then can only be assessed in terms of validity and reliability. We employed the PLS– structural equation model using statistical tools SmartPLS3 software package to test our hypothesis and model comprehensively.

Sampling and data collection

The data were gathered via an online survey. It was arranged according to our specifications. Each item was measured on a five-point Likert scale from strongly disagrees to strongly agree. Pilot testing was conducted with 23 international Ph.D. students who are extensive users of mobile payment. Based on their responses, few questions were rephrased to make them explicit. The pilot test verified the proxies used to measure each construct and are valid to have an internal consistency with Cronbach's alpha of greater than 0.70. Our sample population includes all foreigners living in the People's Republic of China and who are users of the mobile payment system. Following the pilot testing, we distribute the self-administrated online-based structured questionnaire survey to different international community WeChat groups living in China. Even though we managed to collect 236 responses, we consider 227 responses for final analysis due to replies' completeness and integrity.

Empirical analysis

Descriptive statistics of the demographic analysis

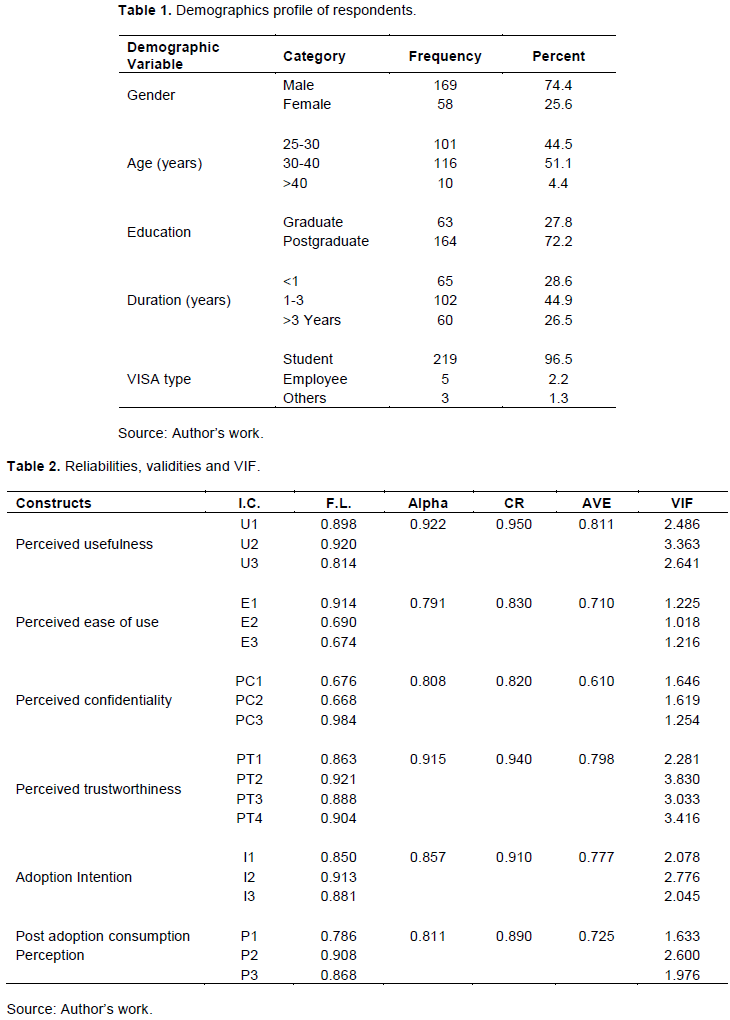

In the demographic aspect of the collected sample (Table 1), it is observed that most of the foreigners in P.R. China are youths within the age range of 25-40. The collected sample is dominated by male respondents (74.5%), and all of the respondents are highly involved in the mobile payment system. Simultaneously, almost all of the respondents are students (96.5%), with most postgraduate (72.2%). Concerning time duration, nearly half of them (45%) stay between one and three years and with almost equal percentage for those who stay for less than one year and those who stay for more than three years. It indicates that respondents have significant experiences with mobile payment systems, and their response could be reasonably convincing (all considered respondents are actively using mobile payment).

Measurement model

PLS-SEM consists of two steps to complete the analysis, first measurement model testing, and then structural model analysis. Hence, before the structural model analysis, we evaluate the proxies of the constructs for reliability. It is not uncommon to find the measures to have adequate internal consistency as they are already tested and adopted from works of literature. Thus, all the items showed a Cronbach's alpha levels above 0.8. Part of the measurement model analysis is the test for content validity and convergent validity. Following the recommendation of Anderson and Gerbing (1988)and Hair et al. (1998), we address the measurement model's convergent and divergent validity through confirmatory factor analysis. Our sampling number was satisfactory as the adequacy measure (Kaiser-Meyer-Olkin) is 0.846, an excellent confirmatory value to perform factor analysis. The items employed in this study showed a loading of more than 0.5 or higher, as shown in Table 2.

The significantly higher loading value of the items within each factor variable implies a strong direct association with the latent construct (Anderson and Gerbing, 1988). Thus, the principal components analysis results in a strong construct validity with a Composite value (C.R.) above 0.70. (Fornell and Larcker, 1981)recommended AVE with a score of 0.5 as a threshold measurement for convergent validity. As seen in Table 2, the AVE points spread from 0.61 to 0.81, which are adequately above the threshold values.

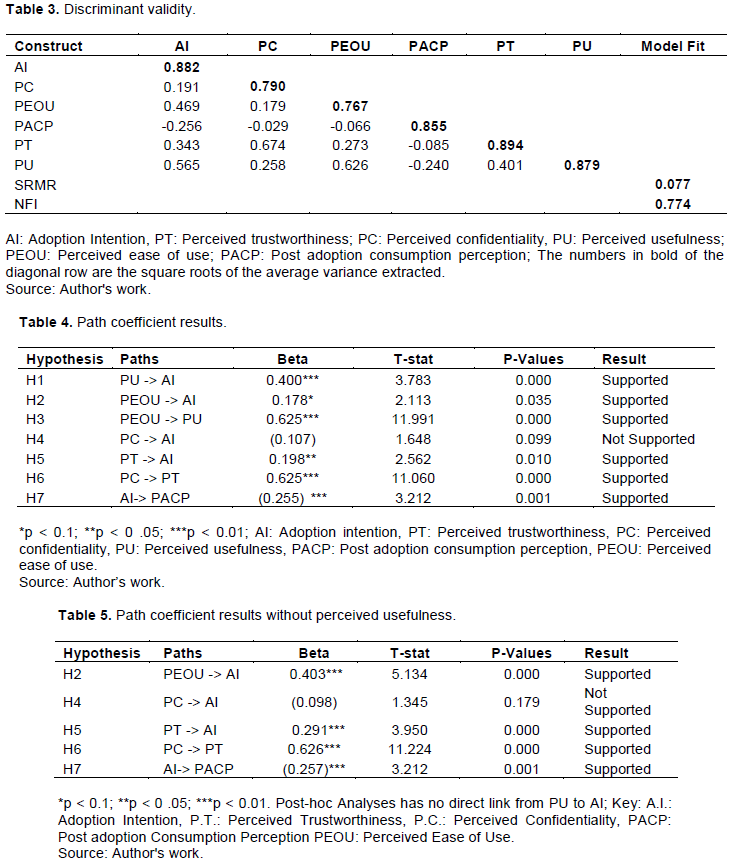

Computing the AVE's square root is used as a verification method for the discriminant validity of the constructs (Fornell and Larcker, 1981). When the computed values are higher in each of the inter-construct correlation as compared to the variance divided with the other variables in the model, they indicate a higher degree of variance and confirm discriminant validity. The result, shown in Table 3, affirms the discriminant validity of the variables. This trend of high validity and reliability is coherent with many former studies (Davis, 1989; Taylor and Todd, 1995; Venkatesh and Davis, 2000).

Structural model

Being successfully validating and verification of the constructs of the model, we check the variance inflation factors (VIF) to make sure that the constructs are free from multicollinearity. A VIF value for each variable turns out to be less than 5, a good indicator of multicollinearity free variables (Table 2). Following the proxy models' confirmation, the intended structural model was examined using the partial least squares (PLS) method. PLS has several advantages relative to the other structural equation model techniques. It requires a minimum sample size demand, measurement proxies, and residual distribution (Teo et al., 2008). Table 3 shows the measures of overall goodness-of-fit for the research model. Based on the rules of thumb set by Hair et al. (2019) for a model fit index, it can be considered that the hypothesized model fits acceptably with the observed data.

The standardized path coefficients for six of the proposed research models are shown in Tables 4 and 5. In general, six out of the seven proposed hypotheses in this study were statistically supported. As the percentages of variance explained by the model (32.1%) are greater than 10%, this is a satisfactory and significant model (Hair et al., 1998). Coherent with many previous pieces of researches and particularly with TAM theory, in this study, perceived usefulness is found to be a strong determinant of adoption intention with a beta of 0.39, R2 of 32.7% at P<0.01, and perceived ease of use with beta 0.184, R2 of 15.8%, at P<0.05 is a significant secondary determinant. The result validated the strong direct relationship between perceived usefulness and perceived ease of use with a beta of 0.626 at p < 0.01. Thus, the first three hypotheses, H1, H2, and H3, are supported. We run a separate mediation analysis without the construct perceived usefulness, to check if it mediates perceived ease of use (Figure 1).

Based on the result of this analysis (see Appendix A), we found that PU partially mediates PEOU as the path coefficient becomes strongly significant. This result is consistent with Davis (1989)’ argument that perceived ease of use might indirectly influence intentions to adopt a specific technology through usefulness. Assessing the dual subjective security, building blocks in adopting mobile payment technology, we find that perceived trustworthiness is a significant determinant factor of m-payment adoption intention with beta 0.175 at p <0.05 and hence supported the prediction of H5. This is in sync with the results of Dahlberg et al. (2003) surprisingly enough; however, unlike the products of Pousttchi (2003) and Pousttchi and Dehnert (2018), Perceived Confidentiality has shown to have a negative beta but statistically insignificant factor on the adoption of mobile payment system among foreigners in China. Thus, the result rejects H4. Nevertheless, in line with our prediction of a positive relationship between perceived confidentiality and perceived trust, the study reveals a strong positive correlation between those two antecedents of security with β=0.625 and p<0.01; hence H6 is supported.

The final set of analyses analyzes the important negative impact of the adoption of the mobile payment system on users' consumption behavior. Based on the assessment result, adoption intention and actual usage have a negative and significant determinant on foreigners' post-adoption consumption perception with beta -0.255 and p<0.05. Even though the variance explained by AI toward PACB is very low (6.6%), H7 is still supported (Figure 2).

The trend of e-commerce in China is increasing exponentially. In 2019, for example, online retail sales were expected to swell to $1.5 trillion, representing a quarter of Chana's total retail sales volume and more than the retail sales of the ten next largest markets in the world (Bu et al., 2019). The increasing number of experts living in China also marks that foreigners will also actively engage in the nation's m-payment system. Almost all respondents are active users of the m-payment system. To this effect, the need to secure financial inclusion and subsequent subjective security of the system becomes imperative.

This empirical study is orbiting around the whim of mobile payment system technology related to foreigners living in China. While one side of the study investigates the impact of subjective security concerns in adopting m-payment system, the other is allotted to taking an insight into the aftermath of adopting the technology in influencing their consumption perception. TAM has been considered as a desirable user adoption model to assess' Mobile payment. Nevertheless, many scholars agreed that it needs to expand and be customized to adhere to specific characteristics. Based on this relic, we formulate the study's structure based on the constructs from the TAM model (Davis, 1989) with two subjective security proxies constructs of trust and confidentiality (Gefen et al., 2003; Pousttchi, 2003). On the other hand, we employed perceived alternation in consumption behavior constructs to get insight into mobile payment users' perception of their spending behavior.

Consistent with previous major studies of technology acceptance, Perceived Usefulness and Perceived ease of use have a significant positive impact on intentions to adopt mobile payment technology among foreigners living in China. Moreover, this study added additional carapace to the literature pool towards the strong correlation between perceived usefulness and perceived ease of use. Not only that, but it also reveals that perceived usefulness partially moderates perceived ease of use towards mobile payment adoption intention. The above section's empirical outcome shows that one of the two antecedents of subjective security, perceived trustworthiness, is a robust significant determinant factor in mobile payment adoption. The Chinese Government's strict rules and regulations in controlling the system might deliver them the confidence to trust the system. The more they trust the system, the more foreigners likely will adopt it. The outcome is harmonious with many studies in the context of the mobile payment system. This implies that foreigners as potential users consider the service providers' trustfulness who intended to use the system. This trust can be achieved by checking the system providers' reputation and brand name as they are essential building blocks of faith.

On the other hand, this empirical study indicates that Perceived confidentiality is not a significant subjective security component factor in the context of mobile payment system adoption for foreigners living in China. This result is strange and plausible, as many previous studies confirm it as a significant factor. Despite our trial by running a separate post hoc analysis to investigate if perceived confidentiality might fully be mediated by perceived trustworthiness to adopt intention, the result is not significant. It can be arguable that the majority of the respondents are international students with limited data risk exposure and financial transactions. This might lead them to the notion of "nothing to lose" sentiment. Thus, for them, confidentiality is not as strong as the other factor when dealing with mobile payment.

An important and fascinating finding that emerged was the negative effect of mobile payment system adoption on users' consumption behavior. Several studies confirm that keep other factors constant, payment methods, or how the money represents affect consumers' consumption intentions (Chae and Kim, 2004; Ghose et al., 2013; Xu, 2017; Xu et al., 2019). This paper supports the notion of the impact of money representation in consumption intention. In line with this conclusion, from our respondents' viewpoint, their consumption trends are negatively affected by their cognitive choice to use mobile payment technology. They claimed that technology has a part to play in increasing their impulse of spending. This trend is a favorable condition for online retailers and producers. They can utilize such information to discover and address users' requisites (in this case, foreigners) and mold their service accordingly. The mobile payment system has been operating in China for many years now. Studies like this can help to improve the system and become comprehensive. The collected result can be used to understand further foreigners' preferences and potential chokepoints in utilizing the system, including severe language constraints. Furthermore, it enables us to gain insight with the slightest scope to understand the impact of different money descriptions in reshaping spending behavior. As the number of expatriates living in China getting sour every year, analysis of outcome in each side of the theory might help discover a specific niche for improvement.

Limitations and further research

As the present study offers some interesting contributions on both sides of the mobile payment system, it is not free from limitations. Despite the narrowed measuring criteria employed in this study; Trust, confidentiality, and post-adoption indexes are broad terms. As such, we might fail to include some important security-related constructs for predicting foreigners' intentions. Unlike in this study with only two constructs of subjective security constructs and only one construct of post-adoption behavioral changes, several Scholars (Venkatesh and Davis, 2000; Gefen et al., 2003; Pousttchi, 2003; Venkatesh et al., 2003) have been trying to describe trust, confidentiality, subjective norms as well as the post-adoption behavior antecedents with several comprehensive constructs. On this basis, our paper might suffer from the fact that other possible factors might influence the variance.

Furthermore, the entire population of the study is foreigners with different backgrounds of cultural and technological experience. Ignoring these cross-cultural demographic effects might have a certain biased impact on the result of this study. Therefore, a replication of this study with comprehensive constructs might be necessary to investigate the issue. In conclusion, this result can further extend by making a meaningful comparison toward micro and macro payments to get a full picture, especially on the debate of money representation form and its impact on consumption intention.

Finally, it is noteworthy to point the gender demography in this study. As can be seen from Table 1, male participants are dominant in the sample population. Despite our attempt to be inclusive, most foreigners who come to China for numerous reasons are males. Such dominance was also seen in other previous papers that focused on foreigners in China (Dong et al., 2017; Yama et al., 2019). Using a gender dummy would have been easy to track if there is a significant difference in security perception among male and female users. Hence, a further study that considers gender differences could give a better picture.

The authors have not declared any conflict of interests.

The authors are indebted to Mr. Muhammad Zahid Nawaz and Mr. Mussie Tewelde for their valuable contribution and assistance.

REFERENCES

|

Agarwal R, Karahanna E (2000). Time flies when you're having fun: Cognitive absorption and beliefs about information technology usage. MIS Quarterly 24(4):665-694.

Crossref

|

|

|

|

Ajzen I (1991). The theory of planned behavior. Organizational Behavior and Human Decision Processes 50(2):179-211.

Crossref

|

|

|

|

|

Anderson JC, Gerbing DW (1988). Structural equation modeling in practice: A review and recommended two-step approach. Psychological Bulletin 103(3):411.

Crossref

|

|

|

|

|

Anderson RE, Srinivasan SS (2003). Eâ€satisfaction and eâ€loyalty: A contingency framework. Psychology and Marketing 20(2):123-138.

Crossref

|

|

|

|

|

Barnes SJ, Mattsson J (2017). Understanding collaborative consumption: Test of a theoretical model. Technological Forecasting and Social Change 118:281-292.

Crossref

|

|

|

|

|

Becker L, Pousttchi K (2012). Social networks: the role of users' privacy concerns. Paper presented at the Proceedings of the 14th International Conference on Information Integration and Web-based Applications & Services.

Crossref

|

|

|

|

|

Chae M, Kim J (2004). Do size and structure matter to mobile users? An empirical study of the effects of screen size, information structure, and task complexity on user activities with standard web phones. Behaviour and Information Technology 23(3):165-181.

Crossref

|

|

|

|

|

Chandra S, Srivastava SC, Theng YL (2010). Evaluating the role of trust in consumer adoption of mobile payment systems: An empirical analysis. Communications of the Association for Information Systems 27(1):29.

Crossref

|

|

|

|

|

Chau PY (2001). Influence of computer attitude and self-efficacy on I.T. usage behavior. Journal of Organizational and End User Computing 13(1):26-33.

Crossref

|

|

|

|

|

China Ministry of Education (2019). 2018å¹´æ¥åŽç•™å¦ç»Ÿè®¡. (Statistical report on international students in China for 2018) By Xing Yi In Shanghai. Available at: View

|

|

|

|

|

Chiou S, Chang T (2009). The effect of management leadership style on marketing of information, single quality, and finial results: a cross-cultural.

Crossref

|

|

|

|

|

Dahlberg T, Mallat N, Öörni A (2003). Trust enhanced technology acceptance model consumer acceptance of mobile payment solutions: Tentative evidence. Stockholm Mobility Roundtable. Available at:

View

|

|

|

|

|

Davis FD (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly 13(3):319-340.

Crossref

|

|

|

|

|

Delafrooz N, Paim LH, Haron SA, Sidin SM, Khatibi A (2009). Factors affecting students attitude toward online shopping. African Journal of Business Management 3(5):200-209.

|

|

|

|

|

Dong W, Asmi F, Zhou R, Keren F, Anwar MA (2017). Impact of Trust and Perceived Privacy in B2C Mobile Apps among Foreigners: A Case of People's Republic of China. Paper presented at the 2017 IEEE 14th International Conference on e-Business Engineering (ICEBE).

Crossref

|

|

|

|

|

Fassnacht M, Köse I (2007). Consequences of Webâ€based service quality: Uncovering a multiâ€faceted chain of effects. Journal of Interactive Marketing 21(3):35-54.

Crossref

|

|

|

|

|

Fishbein M, Ajzen I (1975). Belief, attitude, intention and behavior: An introduction to theory and research. Available at:

View

|

|

|

|

|

Fornell C, Larcker DF (1981). Structural equation models with unobservable variables and measurement error: Algebra and statistics. Journal of Marketing Research, pp. 382-388.

Crossref

|

|

|

|

|

Fungacova Z, Weill L (2014). Understanding financial inclusion in China. BOFIT Discussion Papers.

Crossref

|

|

|

|

|

Gefen D, Karahanna E, Straub DW (2003). Trust and TAM in online shopping: An integrated model. MIS Quarterly 27(1):51-90.

Crossref

|

|

|

|

|

Ghose A, Goldfarb A, Han SP (2013). How is the mobile Internet different? Search costs and local activities. Information Systems Research 24(3):613-631.

Crossref

|

|

|

|

|

Grandison T, Sloman M (2000). A survey of trust in internet applications. IEEE Communications Surveys and Tutorials 3(4):2-16.

Crossref

|

|

|

|

|

Hair JF, Black WC, Babin BJ, Anderson RE, Tatham RL (1998). Multivariate data analysis (Vol. 5): Prentice hall Upper Saddle River, NJ.

|

|

|

|

|

Hair JF, Risher JJ, Sarstedt M, Ringle CM (2019). When to use and how to report the results of PLS-SEM. European Business Review 31(1):2-24.

Crossref

|

|

|

|

|

Hampton-Sosa W, Koufaris M (2005). The effect of web site perceptions on initial trust in the owner company. International Journal of Electronic Commerce 10(1):55-81.

Crossref

|

|

|

|

|

Hannig A, Jansen S (2010). Financial inclusion and financial stability: Current policy issues.

Crossref

|

|

|

|

|

Hong W, Thong JY, Wong WM, Tam KY (2002). Determinants of user acceptance of digital libraries: an empirical examination of individual differences and system characteristics. Journal of Management Information Systems 18(3):97-124.

Crossref

|

|

|

|

|

Hsu CL, Lu HP (2004). Why do people play online games? An extended TAM with social influences and flow experience. Information and Management 41(7):853-868.

Crossref

|

|

|

|

|

Igbaria M, Iivari J (1995). The effects of self-efficacy on computer usage. Omega 23(6):587-605.

Crossref

|

|

|

|

|

Jarvenpaa SL, Tractinsky N, Vitale M (2000). Consumer trust in an Internet store. Information Technology and Management 1(1-2):45-71.

Crossref

|

|

|

|

|

Tampuri Jnr MY, Kong Y, Asare I (2019). Financial inclusion in China: Deepening high-level financial inclusion for foreigners in China. North America Academic Research 2:121-147.

|

|

|

|

|

Kelly L, Kerr G, Drennan J (2010). Avoidance of advertising in social networking sites: The teenage perspective. Journal of Interactive Advertising 10(2):16-27.

Crossref

|

|

|

|

|

Koufaris M (2002). Applying the technology acceptance model and flow theory to online consumer behavior. Information Systems Research 13(2):205-223.

Crossref

|

|

|

|

|

Kreyer N, Pousttchi K, Turowski K (2003). Mobile payment procedures: scope and characteristics. E-Service 2(3):7-22.

Crossref

|

|

|

|

|

Linck K, Pousttchi K, Wiedemann DG (2006). Security issues in mobile payment from the customer viewpoint. Available at:

View

|

|

|

|

|

Mayer RC, Davis J H, Schoorman FD (1995). An integrative model of organizational trust. Academy of Management Review 20(3):709-734.

Crossref

|

|

|

|

|

Moon JW, Kim YG (2001). Extending the TAM for a World-Wide-Web context. Information and Management 38(4):217-230.

Crossref

|

|

|

|

|

Moore GC, Benbasat I (1991). Development of an instrument to measure the perceptions of adopting an information technology innovation. Information Systems Research 2(3):192-222.

Crossref

|

|

|

|

|

Pousttchi K (2003). Conditions for acceptance and usage of mobile payment procedures. Available at:

View

|

|

|

|

|

Pousttchi K, Dehnert M (2018). Exploring the digitalization impact on consumer decision-making in retail banking. Electronic Markets 28(3):265-286.

Crossref

|

|

|

|

|

Pousttchi K, Wiedemann DG (2007). What influences consumers' intention to use mobile payments. L.A. Global Mobility Round table pp. 1-16.

|

|

|

|

|

Rammile N, Nel J (2012). Understanding resistance to cell phone banking adoption through the application of the technology acceptance model (TAM). African Journal of Business Management 6(1):86.

Crossref

|

|

|

|

|

Ranaweera C, Bansal H, McDougall G (2008). Web site satisfaction and purchase intentions: impact of personality characteristics during initial web site visit. Managing Service Quality: An International Journal 18(4):329-348.

Crossref

|

|

|

|

|

Rogers RW (1985). Attitude change and information integration in fear appeals. Psychological Reports 56(1):179-182.

Crossref

|

|

|

|

|

Runnemark E, Hedman J, Xiao X (2015). Do consumers pay more using debit cards than cash? Electronic Commerce Research and Applications 14(5):285-291.

Crossref

|

|

|

|

|

Schneider B, White SS, Paul MC (1998). Linking service climate and customer perceptions of service quality: Tests of a causal model. Journal of Applied Psychology 83(2):150.

Crossref

|

|

|

|

|

Shih HP (2004). An empirical study on predicting user acceptance of e-shopping on the Web. Information and Management 41(3):351-368.

Crossref

|

|

|

|

|

Statista (2019). Statista - The Statistics Portal.

|

|

|

|

|

Taylor S, Todd PA (1995). Understanding information technology usage: A test of competing models. Information Systems Research 6(2):144-176.

Crossref

|

|

|

|

|

Teo TS, Lim VK, Lai RY (1999). Intrinsic and extrinsic motivation in Internet usage. Omega 27(1):25-37.

Crossref

|

|

|

|

|

Teo TS, Srivastava SC, Jiang L (2008). Trust and electronic government success: An empirical study. Journal of Management Information Systems 25(3):99-132.

Crossref

|

|

|

|

|

UNESCO (2018). Inbound internationally mobile students by continent of origin. Institute for Statistics.

|

|

|

|

|

Venkatesh V, Davis FD (2000). A theoretical extension of the technology acceptance model: Four longitudinal field studies. Management Science 46(2):186-204.

Crossref

|

|

|

|

|

Venkatesh V, Morris MG, Davis GB, Davis FD (2003). User acceptance of information technology: Toward a unified view. MIS Quarterly 27(3):425-478.

Crossref

|

|

|

|

|

Xu J (2017). China's Internet Finance: A Critical Review. China & World Economy 25(4):78-92.

Crossref

|

|

|

|

|

Xu Y, Ghose A, Xiao B (2019). Mobile Payment Adoption: An Empirical Investigation on Alipay.

|

|