Full Length Research Paper

ABSTRACT

The evolution of blockchain technology has drastically altered the provision of banking services. Businesses are currently transitioning to a paperless environment. Robots are taking over labor-intensive jobs, Artificial Intelligence (AI) is assisting in tracking any massive disaster, and biotech is assisting in curing multiple illnesses in a matter of seconds. Blockchain, one of the most important inventions of our time, is poised to assist individuals in reaching new heights of innovation in almost all domains. However, like other technologies, blockchain is confronting unique hurdles that must be overcome before widespread adoption particularly in Ghana and in Africa as a whole. This paper sought to examine the opportunities and challenges of the adoption of blockchain technology in Ghana. A qualitative technique in data gathering was employed for the purpose of this paper. The study used an interview-based technique, aimed to identify and communicate the problems that the banking sector in Ghana experiences in adopting blockchain technology. The interview took place in Ghana's capital, Accra. One representative from the Ghanaian Central Bank and nine from Commercial banks were interviewed. The paper concludes that the implementation of blockchain technology in Ghana's banking sector is being hampered by a lack of international norms or laws, high energy costs, a lack of intermediaries, poverty, corruption, a lack of infrastructure, and a lack of technical support.

Key words: Adoption, banking sector, blockchain technology, financial industry, opportunities, challenges.

INTRODUCTION

Commercial banking operations have been subjected to significant technological and financial innovation for more than 25 years. In terms of financial products, services, and production technology, there has been a significant shift. Many banks are now integrated as part of global financial institutions that engage in a variety of financial operations because of technological innovation (Frame et al, 2014; Anagnostopoulos, 2018; Cucari et al., 2021). Due to technology that did not exist previously, modern business methods and more efficient company strategies have emerged. Nobody expected the internet to make Spotify, Teams, Skype, and Airbnb possible. At this time, blockchain technology is the technology to keep an eye on. The anonymous Satoshi Nakamoto invented blockchain technology (Nakamoto, 2008). Technological improvements, according to Ji and Tia (2021), are giving rise to new issues and opportunities for various organizations. Corporations' failure to adapt to this shift may result in their extinction from the industry. The banking industry is one of the industries that would benefit greatly from Blockchain technology. Blockchain is well known as the technology that underpins the virtual Cryptocurrency Bitcoin, but this article looks into its other applications. What is Blockchain? Blockchain has been defined by Kaur et al. (2018) as “a distributed database or public ledger of all transactions or digital events performed and shared among participating parties”. Zheng et al. (2019), posit that using Blockchain to execute commercial operations is less expensive and faster as it acts as a software distribution mechanism that allows transactions to be completed without the use of a trusted middleman, such as a bank. Blockchain adoption allows all transactions to be inspected and tracked. Blockchain technology was created to track bitcoin transactions, and as a result, it may be used in a variety of industries, including banking, stock exchange, insurance, electoral systems, rental agreements, and state service (Dai and Vasarhelyi, 2017). Bitcoin is the world's first distributed digital currency. Bitcoin, a digital currency, and Blockchain, a related technology, have risen to prominence (Chen, 2018). Blockchain and its use have a bright future because they introduce a new type of financing and provide a significant buffer for investing in modern technology (Mavilia and Pisani, 2019). They believe that Blockchain will be a useful instrument for promoting and improving social development in the Global South, particularly in Ghana. Guo and Liang (2016), state that Blockchain technology will improve and revolutionize the financial sector since it can reform the basic technology of settlement and credit structure. Numerous studies on the impact and issues preventing the adoption of Blockchain in the banking sector have been conducted in various parts of the world, but none in Ghana. However, the use of advanced technology in Ghana's banking sector has been limited, and as a result, there has been little or no research on the subject. Furthermore, this research could be particularly useful in determining the precise application of Blockchain technology in the financial sector. The goal of the study is to determine the possible causes for the slow acceptance of Blockchain technology in the banking sector, as well as to contribute to the current debate about the perceived opportunities and challenges to Blockchain adoption in the banking sector. It seeks to fill the knowledge gap.

LITERATURE REVIEW

Numerous kinds of literature have been suggested to clarify what instigates Blockchain technology in financial institutions. The researcher reviewed the literature on Blockchain in the banking sector in other parts of the world and various business sectors. This is done to draw a conclusion to the research and learn and build from it.

Blockchain in other regions

This work examines the benefit of Blockchain technology in the banking sector, with a case in India, Italy, South Korea, and China. Garg et al. (2020) selected experts who were closely linked with Blockchain-related initiatives in the banking sector across India. These experts were interviewed. They concluded that the benefits of Blockchain technology to the banking systems are the reduction of outgoing cost, transparency, exclusion of intermediaries, and efficient financial transactions. Cucari et al. (2021) write about the impact of Blockchain on banking processes in a case study of the Italian banking sector. Their research follows an abductive theory-building method. They conducted exploratory research and concluded that Blockchain technology can influence and enhance the back-office process. It also shows the system that permits Blockchain technology to enhance the productivity of Banks by Interbank reconciliation. Yoo (2017) researched Blockchain in the banking sector of South Korea. The researcher found that Blockchain technology is majorly used in financial institutions, mainly in payment, Global transfers, stocks, and Smart contracts. With the use of Blockchain technology, there has been an increase in transfers between financial institutions such as Banks without the help of a Reserve Bank. However, Yoo (2017) pointed out that customer needs and technological advancements are changing rapidly, making it very needful for Banks to incorporate Blockchain technology. Liu and Lin (2021) published a paper on the application of Blockchain in China's banking sector. They found out that the utilization of blockchain technology in Banks can assist transform remittance systems, enhance credit risk control, enhance the organization of efficiency of the central and operations office, and improve smart business.

Blockchain in developing countries

Kshetri and Voas (2018) argued that developing countries such as Ghana, Nigeria, South Africa, and Egypt would be affected positively by Blockchain: it can help decrease fraud and extortion and increase legal possessorship titles, bringing about the Global South’s entrepreneurial drive. It can also help financial deals occur more swiftly and ensure that help is distributed with a smaller chance of theft and hoax. Papadaki and Karamitso (2021) examined the application of Blockchain in the MENA. They found out that various standards are implemented in different countries in the MENA region because Blockchain is in its embryonic stages of development. They also found out that there is less education and government support in providing research funds to most countries in MENA. Making accessible research capital and suitable education is principal for improving the experienced workforce and permitting better innovation in the MENA region. Mavilia and Pisani (2019) examined the application of Blockchain and catching up in developing countries. They gathered their data from surveys, interviews and central banks from 53 African countries. They found that the application of Blockchain technology can cause and implement modern types of finance and provide massive opportunities for investment. They also found out that Blockchain technology is still at an embryonic stage in the Global South, specifically Africa, and could be a purposeful instrument for pursuing and executing social development. In addition, Mavilia and Pisani (2019) opine that National governments should consider the advantages they would get from adopting Blockchain and equally come up with laws to make Blockchain work. Senou et al. (2019) published a paper on Blockchain for child labour decrease in cocoa production in West Africa and central Africa. They surveyed existing works connected to child labour and Blockchain. They proposed a smart contract model for their study. They found out that children's condition can be enhanced on the cocoa farm, leading to social welfare. Blockchain is useful because of its transparency and dependability. A smart contract is practiced by decreasing child labour by authorizing farmers to farm upon fulfilling certain circumstances indicated in the smart contract protocol (Senou et al., 2019). Kumar et al. (2019) surveyed in the form of a questionnaire to ascertain the problems faced by industries in adopting Blockchain technology in the global south. The survey was done in Karachi, Pakistan. They used a convenience sampling method to gather their data from various citizens of Karachi. They concluded that the industries in developing countries are not hesitant and have set the least priority on Blockchain technology. They also believe that there is a lack of skilful resources in developing countries (Kumar et al., 2019). Bharti (2019) conducted exploratory research, and the data was gathered from different data sources such as journals and research papers. They took a perspective of India and concluded that the challenges impeding Blockchain adoption are lack of IT infrastructure, lack of regulatory framework, lack of interoperability and Privacy, and Data protection.

Application of blockchain in Ghana

Blockchain is being used for the Cocoa beans supply chain, the Tilapia supply chain, and Land registration in Ghana. One may ask, what is the impact of Blockchain in these sectors? This part of the literature tries to demystify the impact of Blockchain in these areas so that the researcher can draw ideas to help in this research.

Musah et al. (2019) conducted a descriptive-explorative study and concluded that Blockchain has undoubtedly impacted the cocoa supply chain and has helped reduce the problems associated with the supply chain. Rejeb (2018) believes that Blockchain technology can transform Tilapia's supply chain, thereby removing the supply chain challenges. Agbesi and Tahiru (2020), state that Blockchain technology is being used for land registration in Ghana. It has helped resolve the problems of land ownership in Ghana. Now, there is sincerity, immutableness, and clarity in the land administration in Ghana. In addition, Mintah et al. (2020) explored the possibility of Blockchain usage in land purchase and title registration. They conducted a systematic literature review attached to casual discussions with major observers in Ghana. They found out that information on all land deals could be accessible to the public in actual time. They believe this will intensify transparency and potentially settle the issue of infringements and vague land boundaries because investors can specify the rightful landowners before starting deals. Deka et al. (2018) explored the application of Blockchain technology in fund management in Ghana. They gathered data from selected employees of fund management through unstructured interviews. They found out that financiers will have confidence in data protection and effortlessness in doing deals on the web without a third party via Blockchain technology.

Blockchain in the banking sector

This paper reviews the literature on the application of Blockchain technology in the banking sector. Rajnak and Puschmann (2020) researched using a systematic sampling approach with knowledgeable participants from Switzerland. SurveyMonkey was used to gather the data for supporting the research framework. They selected 104 banks using the hypothesis model to analyze their data. Their research aimed to find out the impact of Blockchain on business models in banking. They found that Blockchain technology influences all aspects of banks' business models, although Blockchain technology is still in a primitive phase of advancement. Ji and Tia, (2021) researched to ascertain the effect of Blockchain in the banking sector. They conducted a survey by collecting data from different Banks in Nanjing City, China. They used the PLS to analyze the data. They found out that fraud reduction, the Privacy of Blockchain, security, transparency, and decentralization positively impact all aspects of a Bank's business intelligence. On the contrary, Peter and Moser (2017) did a survey by sending questionnaires to Banks, stock exchanges, credit card providers, Fintech firms, and consulting firms. These firms are located in Austria, Germany, and Switzerland. They found out that the answers given by the Banks are fully extended. None of the banks intend to apply Blockchain technology because of a lack of legal framework, interoperability, lack of standards and governance, and lack of electronic identity management. Garg et al. (2020) selected experts who were closely linked with Blockchain-related initiatives in the banking sector across India. These experts were interviewed. They concluded that the benefits of Blockchain technology to the banking systems are the reduction of outgoing cost, transparency, exclusion of intermediaries, and efficient financial transactions. Cucari et al. (2021) write on the impact of Blockchain on banking processes in a case study of the Italian banking sector. Their research follows an abductive theory-building method. They conducted exploratory research. They performed a semi-structured interview. Cucari et al. (2021) interviewed research managers of the Italian Banking Association (ABI). They concluded that Blockchain technology can influence and enhance the back-office process. It also shows the system that permits Blockchain technology to enhance the productivity of Banks by Interbank reconciliation. Yoo (2017) researched Blockchain in the banking sector of South Korea. The researcher found that Blockchain technology is majorly used in financial institutions, mainly in payment, Global transfers, stocks, and Smart contracts. With the use of Blockchain technology, there has been an increase in transfers between financial institutions such as Banks without the help of a Reserve Bank. However, Yoo (2017) pointed out that customer needs and technological advancements are changing rapidly, making it very needful for Banks to incorporate Blockchain technology. Liu and Lin (2021) published a paper on the application of Blockchain in China's banking sector. They found out that the utilization of blockchain technology in Banks can assist transform remittance systems, enhance credit risk control, enhance the organization of efficiency of the central and operations office, and improve smart business.

Challenges of implementing blockchain

Patki and Sople (2020) researched the challenges of Blockchain technology to the banking sector with a case on India Banks, Fintech Corporations, and banking consultants. They interviewed 25 executives through a structured questionnaire. They found out that Blockchain has a tremendous capacity to change the banking industry. However, its application is loaded with some challenges, which comprise interoperability- there is no general international standard for the blockchain in the world; security- there is no high-rise security for the Blockchain and legal framework; there is no international law on the administration of the Blockchain. Osmani et al. (2020) reviewed relevant academic literature on the Blockchain. They argued that Banks using Blockchain should be ready to face issues such as scalability, where programmers can get access to private information by changing data. Banks cannot reverse any transaction done mistakenly. Lastly, blockchain technology applications are green in the financial sector, making them difficult to regulate. A survey of Blockchain conducted by Gao et al. (2018) identified two specific challenges to applying Blockchain technology, namely security challenges, and performance challenges. Under security challenges, they outlined some issues such as attack and selfish mining, anonymity and privacy, and abuse of Blockchain. They also argued that the availability of a blockchain system is also another possible challenge. Fernandez-Vazquez et al (2019) published a paper on Blockchain in Fintech. They carried out a systematic mapping study. They examined a total of 49 papers. Fernandez-Vazquez et al (2019) found out that Blockchain adoption challenges are electronic risks, latency, laws, and regulatory and technology development. In addition, Liu and Lin (2021) emphasize that the challenges of Blockchain technology in Banks include society's negative attitude towards Blockchain technology, technical issues, high human resource cost, and material cost in establishing the technology, lack of legal establishment, and the mode of policy supervision is not clear.

Benefits of blockchain

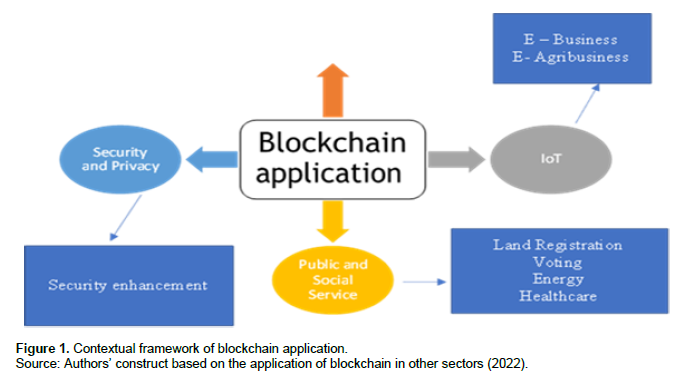

This segment of the paper looks at the benefit derived from the application of Blockchain in the banking sector, according to Hassani et al. (2018), who conducted a complete review of 100 industry-related articles and just a few academic papers. They found out that Blockchain can enhance KYC mechanism, transactions are done faster with less activity, and safety, Blockchain gives banks a lesser overhead cost, smart contract. Clearness is reinforced because the deals are shared across the system, and the ability to increase the volume of deals a Bank may undertake as the essential possibilities. In addition, Patki and Sople (2020) also contributed to the research on the benefit of Blockchain technology. In their research, they found the Low deal cost, high speed of processing remittances and payment deals, no intermediaries or middlemen involved in the Blockchain, transparency of transactions, and lastly, records are noticeable to the parties involved, but none of them can alter the deal process. Osmani et al. (2020) also argued that Blockchain depends on combined administration to provide trust in the money market to guarantee that all engage by accepted rules. The research carried out by Ali et al. (2020) reviewed academic articles on Blockchain technology in the financial sector. They concluded that users could be able to manage their deals and data. Performing transactions would be guaranteed in every respect without an intermediary. They also argued that Blockchain technology could change the system of financial tools. Through theoretical analysis, Gao (2021) also presents the motive for the application of Blockchain technology extensively involved with and used in the banking sector by using the appropriate systems of business principles. Gao (2021) writes that Blockchain promising technology could change the banking sector. He stated that Banks could create a new system of trust technique with customers under a protected and open network that augments infosec and boost business extent. He also writes that the banking business can save costs and improve efficiency via the Blockchain application and believes that Blockchain could become the primary technology of Banks with additional regulations established. On the other hand, Drescher (2017) believes that the absence of any intermediary may limit its adoption in the banking sector. Vovchenko et al. (2017) conducted an analysis of blockchain adoption in Russia and they emphasized that Blockchain brings a sustainable Unique Selling Point (USP) for Banks in financial contracts derived from cost reduction, transparency, and effective management over operational risk. Farah (2018) researched the opportunities embedded in the application of Blockchain in the financial sector. He argued that Blockchain technology has brought about "The Internet of Value exchange," Blockchain has changed a Bank's business model, Blockchain has strengthened market efficiency, and all the processes of Blockchain are saved on a distributed network that helps to protect truthfulness. The authors’ construct of contextual framework of blockchain application based on the application of blockchain in other sectors is shown in Figure 1.

Potential impact of blockchain in the banking sector

Patki and Sople (2020) write on the application of

Blockchain to the banking sector with a case on India Banks, Fintech Corporations, and Banking consultants. They interviewed 25 executives through a structured questionnaire. They found out that Blockchain application is used in different banking processes such as access to funds, processing of Trade Capital deals, including the processing of Letters of Credit (LCs) and account inspection to minimize non-performing assets, facilitating secured loans and lending at a reduced rate of interest, discharging of trade and assets with stored Know Your Customer (KYC) data on a concurrent basis, enhancing transparency and quick settlement, and lastly, enhancing the SCF process with better process security and effectiveness. In addition, Wu and Liang (2017) explored the application of Blockchain in the banking sector in China. They explained that blockchain technology could be applied in the Banking industry in the following areas, namely intellectual property security, asset cataloguing, and securitizing assets. Guo and Liang (2016) published a paper on the application of Blockchain in the banking sector. They found out that Blockchain technology could remodel the payment clearing and credit report process in Banks, improving and metamorphosing them. They believe that Blockchain technology is seen as disruptive technology; it comes with its challenges, such as regulation, efficiency and security issues.

Blockchain in the African region

Niyitunga (2022) posit that correct and well-controlled medical records play a key role in high-quality health care. They are a significant asset that permits hospitals to take care of patients in an efficient way. However, in Ghana, medical records are not given much academic attention. Good record-keeping has been hampered by poor management, as well as a lack of trained personnel who understand how to record and keep these records. Niyitunga (2022) conducted research to explore the application of blockchain technology in enhancing medical records at African hospitals specifically in Ghana and South Africa. The study was qualitative, comprising desktop research of secondary material and its analysis. Niyitunga (2022) found that poor medical reports in sickbays promote the predominance of disease in the Global South such as Africa, which results in resources that could be invested in improvement projects being redirected to health care as an alternative. It also shows that blockchain-based technology could play a major role in the administration of medical records in Africa. Niyitunga (2022) believes it could help organizations acquire and keep more accurate medical records, and ensure their security and longevity. In addition, patients could also gain access to their data, consequently assisting them to assess and control their own health.

METHODOLOGY

This study employed a qualitative technique in data gathering. Commercial banks and the Central bank in Ghana were suitable for this research because access to the pertinent data needed for the research can be sourced from these institutions. The purposive sampling technique was used to select nine commercial banks which consist of a good blend of private and public banks in Ghana. Altogether, 10 sets of one–to one interview were conducted with about sixty minutes per interview. The participants were experts who have in-depth knowledge of Blockchain technology and Fintech operations. The purposive sampling method was adopted to pledge authentic analysis and ensure that the selected have been operating in Ghana for more than ten years. Semi-structured interviews were used to gather the primary data. Given that the research area is intricate, interviews were considered to be a suitable approach for data collection against having a questionnaire. By gathering data in this form, the researchers were provided with explanations and more excellent data. An interview guide was designed aiming to conduct each interview. The research questions were based on the themes of the literature review. The interview questions were fine-tuned separately for every interviewee consistent with individual factors. After the ten interviews, data plethora was attained with recurring topics and assertions expressed. Therefore, further interviews were unnecessary, with the data providing a good foundation for further analysis.

The data gathered through audio recordings were transcribed with a MAXQDA tool. MAXQDA is a software program for the assessment of qualitative data. MAXQDA is capable to evaluate all the information usually gathered in the context of empirical social research. Obviously, the software can also be used for tasks outside of social science study. MAXQDA can support your work throughout every phase of a project. A key element of MAXQDA and software is the possibility of working with codes and allocating codes to particular sections of your data whether they are words or paragraphs of a text, parts of an image, or happenings in a video. The recordings were listened to repetitiously to ensure accuracy. Record memos were used to characterize information about the interview's circumstances and organizational aspects pertinent to the study. Documentation of this information was essential for communicating the findings and examining the quality and dependability of data mining. The next phase was to work on the transcripts. Firstly, lessening the text was done by examining the content and lessening the extent of information by eliminating sentences that do not express meaning and are only used to construct discussion. This lessening of empirical data was done by reading through every text a few times and writing keywords and themes utilizing colour coding and eventually identifying common groupings. The lack of uniformity in this kind of interview can cause dissimilar types of information attained depending on the interviewer and the period it was gathered. To improve reliability and increase the uniformity of the semi-structured interviews and improve validity, an interview guideline was designed to guide the conduct of the interview. Additionally, to increase the authenticity, the respondents were constantly given a context to the research and its purposefulness at the commencement of each interview.

Data analysis

The purpose of the research was to ascertain the likely factors impeding the implementation of Blockchain technology in the banking sector while participating in the present debate on the perceived factors impeding the adoption of Blockchain in the banking sector in other world regions. The paper sought to find answers to the following research questions:

RQ 1: What are the concerns associated with implementing Blockchain technology in Ghana?

RQ 2: Is the banking sector of Ghana well equipped to embrace Blockchain technology?

RQ 3: What are the legal issues regarding the adoption of Blockchain technology in Ghana?

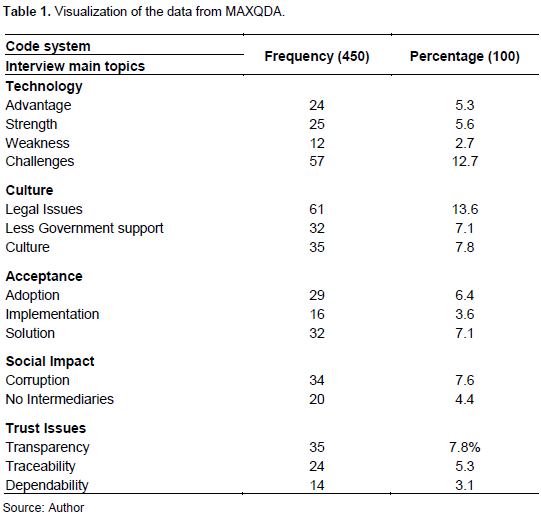

The primary data acquired, on the application of blockchain technology and other significant information were analyzed and summarized using MAXQDA Software. This part is divided into two subgroups that result from the TAM 2 model. The TAM 2 model assesses the intermediating function of perceived easiness of use and perceived benefit in their connection between structural characteristics and the likelihood of system application. Cognitive Instrumental Processes that emphasized the expediency, the superiority and the results of blockchain technology applications are observed. The social influence Method unveiled the findings that pertained to social methods and cultural aspects. The quotations in this part have the name of respondent banks and dates when the interview took place to assist the reader know which quotes the interviewee makes. The coding of the subject was then accomplished separately by color-coding the transcripts. Table 1 shows the color codes used.

Technology

Answers connected with technological advantages and challenges were color-coded. These were generally discovered in the middle of the interviews. The interviewees usually expressed their responses in the following ways: advantages are [….]; strength is [….]; weakness is [….]; challenges are [….].

Culture

Answers connected with social factors were color-coded. The answers were mostly discovered in the middle and end of the interviews. The participants commonly involved the following words in their answers: legal issues; less government supports; and culture.

Acceptance

Answers connected with technology acceptance were color-coded. The answers were mostly discovered toward the end of the interviews. The participants commonly involved the following words in their answers: adoption; implementation and solution.

Trust

Answers connected with decentralized trust were color-coded. The answers were mostly discovered in all parts of the interviews. The participants mostly involved words like: transparency; trust and traceability.

Social Impact

Answers connected with Banking were color-coded. The answers were in parts of the interviews. The participants mostly involved the following words in their answers: corruption; and no intermediaries.

Eventually, the coding of the transcript was switched, and another reading of the transcript was done in order to categorize the findings.

RESULTS AND DISCUSSION

In this part, the conclusions from the research were evaluated jointly with the findings from the literature review. This part is divided into two subgroups which are resulting from the TAM 2 model. The first part, cognitive instrumental process, emphasized how the expediency, the superiority, and the results of blockchain technology are observed. The second part, social influence method, unveiled the findings that pertained to social methods and cultural aspects. The quotations in this part were numbered to assist the reader know which quotes are made by the same interviewees. The numbers are nevertheless not connected to the list of interviewees presented earlier.

Cognitive instrumental process

Three main findings linked to the perceived advantages of blockchain technology are presented in this study. These findings have similarities to the interviews and are supported by the literature review. A similarity in the preponderance of the interviews was that blockchain was perceived to have ferocity of job significance as described in the TAM 2 framework. Additionally, a preponderance of the institutional interviews proposed that blockchain technology is significant and perceived as valuable in the banking industry. The key features of the technology that were used as inspirations were its ability to decrease costs by reducing the number of arbitrators, computerizing processes by exploiting smart contracts, trackability, building trust, and speedy settlements. Moreover, the implementation of blockchain was perceived to generate substantial outcomes as it could impressively reduce costs by eliminating arbitrators and computerizing processes. Nonetheless, blockchain was only perceived to be beneficial in certain precise circumstances in academic interviews. It was affirmed that if the establishment of trust is the only justification for a blockchain application, it is oftentimes needless. The reason is that blockchain technology will have a minimal comparative advantage over modern technologies as trust can occasionally be generated easier and in more useful ways. This was also affirmed by one of the interviewees about the cost of implementing the technology. New technologies turn out to be very expensive in their implementation. Conversely, sometimes, where trust cannot be generated differently, it can be advantageous to apply blockchain provided its cheaper such as in multilateral environments. In one of the academic interviews, the following was aforementioned about the comparative advantage of blockchain when queried if blockchain is particularly advantageous:

“In a system where it consists of numerous small stakeholders deprived of an ordinary central stakeholder. It may not continually be excellent for all the members, but it is good for the system unfortunately the cost of implementing a blockchain is very expensive” – Interviewee A.

Besides, the technical interview condemned the present-day output level of blockchain as they perceived the Blockchain technology is not mature enough for application. The absence of standard and legislation descriptions and steady protocols were particularly emphasized as challenges to the technology. The following was mentioned about blockchain and its maturity:

“A virgin and versatile technology. The code must be steady, and the procedure should be well-defined. There are no standard descriptions and individuals are still developing the latest concepts in the blockchain which they apply in their own style. Currently, that is how organizations work because you must follow an established procedure” – Interviewee B.

The quote above shows how the absence of standardization or legislation is a feature adversely affecting the perceived serviceability as described in the TAM 2 model. It is also supported by a contemporary study where it was discovered that there is a need for standardization at the code level (Patki and Sople, 2020). In the energy sector, comparable results from research have also been made about blockchain technology (Song et al., 2018). An additional significant feature that was considered in the academic interview was that although transparency can contribute to certain systems, it can be regarded as a concern in others. Consequently, the output level of blockchain varies dependent on the interests of the members. The key problem that transparency could generate is that certain corporations can be unenthusiastic to distribute their information as it could endanger their position of competitive advantage. The reason is that increased effectiveness is not usually in every stakeholder’s interest as effectiveness can also denote that revenue could reduce because you are the ineffective participant. In one of the interviews, the following statement was made about stakeholders’ unwillingness to distribute their information: “It is about conquering, not being authentic” – Interviewee A.

This is consistent with the aforementioned study, where it has been discovered that blockchain will not just produce victors but also failures (Novak and De Silva, 2019) and highlights blockchains’ capability to modify the movement of money in a fashion that can be problematic to predict. In the interviews, it was discovered that this adversely affected the perceived usefulness of applicants feeling endangered by the technology. The other principal discovery that evolved from the academic interview was that blockchain technology has the possibility to increase banking transactions. This information was inspired by numerous factors. The most typical was its technological features which could accelerate the incorporation of documentation solutions to reduce the obstacles of entry to the system. Additionally, the identification obstacle does not occur for the distributed blockchain cryptocurrencies which are accessible nowadays, the only requisite to partake in these systems for anybody is an internet and a gadget. Nevertheless, it is significant to discover how these kinds of solutions deprived of prerequisites for documentation can be created to conform to fundamental principles such as KYC. In Ghana, most homes do not have access to the internet thereby making it impossible to utilize blockchain technology. This is in agreement with earlier research, where it has been said that it is imperative for blockchain to succeed if individuals who participate in this application have an internet connection (Kumar and et al., 2019).

Moreover, another significant characteristic that was discovered in a greater part of the interviews was the case that blockchain is distributed, permissionless, and computerized, which makes a resilient instance for utilizing this technology to increase banking transactions as the technology does not differentiate, it permits everybody to join because it knows no risk. Likewise, in some of the interviews, it was emphasized that the technology’s capability to permit deals at nigh zero charges could make it useable in settlement and when making small transactions. The significance of these features for increasing blockchain application in the banking sector is supported by discoveries in a study published by the ICRIER (Indian council for research on international economic relations). It was discovered that high-priced, lack of documentation, lack of technological know-how, and lack of trust are significant causes describing why Blockchain technology is not applied in the banking sector (Sharma et al., 2019).

Social influence process

Discoveries connected to perceived usefulness involving social influences procedure are discussed in this study. Moreover, as in the preceding part discoveries are examined consistent with the distribution of innovations theory. Primarily, most interviews proposed that the usage of blockchain solutions is perceived to upsurge individuals’ social impression and significance, attributes described in the academic structure of TAM2, by stimulating more effective banking services. This is reinforced by the numerous issues discussed in the interviews. Blockchain applications that can assist to increase banking services and thus their social impression and significance are credit scoring, worldwide settlement, credit history, and enhancing electoral processes such as voting. One key discovery from the interviews concerning blockchain in Ghana is that the technology may be needless and not seen to be advantageous if the unique aim of applying it is to build trust. This is because trust can be created easier and more efficiently through informal ways in our Ghanaian communities, thereby giving blockchain technology a low comparative benefit. Hence, If the only aim of applying blockchain is to build trust, it is very significant to contemplate every individual case aiming to arrive at assumptions on blockchains' comparative benefit. There is less trust in government and corporations in Sub Sahara which can be an issue according to Interviewee A. Some nations in Global South have been plagued with non-transparency and bribery. One typical corruption in Africa is land fraud. This is where individuals form alliances and conspire with government officials to produce land titles they want to obtain. In the last issue, blockchain can be used to create secure computerized land records. The subsequent assertion was made about blockchain technology by a Central bank official in Ghana about how the technology can be exploited to lessen bribery, and thus upsurge banking services but its cost of implementation is very enormous: “Blockchain is distributed, blockchain technology does not differentiate. Everybody can partake because it does not matter if you are rich or poor” – Interviewee C. This comment by interviewee C, emphasizes the significance of the technology’s capacity to not be manipulated by unethical third parties, which is a problem in Africa. However, research has found that the level of corruption can be a barrier to innovation. Bribes weaken the possibility of new technologies being introduced. Additionally, a major part of the interviews recommended that a good end-user experience will be of big significance if blockchain solutions are going to be implemented. Interviewee D said this about the significance of the command-line interface when asked what is important to make people in Ghana perceive Blockchain as advantageous:

“Most Ghanaians that use unofficial saving systems do it in physical cash. You cannot have one or two buttons on an app if you want to create an informal saving system on a blockchain app. You should have very little information. For a technology to be accepted, it is very significant to keep it simple” – Interviewee D

Principles regarding blockchain technology will depend on the personal experience of usage consistent with TAM2. Improved system involvement may decrease the effects of personal norms according to TAM 2 model. To build a progressive peculiar experience, frequent practice, and system involvement of blockchain solutions, the strategy of the end-user experience must be streamlined, easy, and customized to the population in most individuals in the Ghanaian population are underprivileged and illiterate. Generally, what can be concluded is that while the impaired organized circumstance of Ghanaians produces big hypothetical for numerous blockchain use cases, it can likewise be a big impediment to its implementation and distribution.

CONCLUSION AND RECOMMENDATIONS

Concerns associated with the implementation of Blockchain technology in Ghana

It was discovered from the discussion that technology could increase banking services by permitting accessibility, openness, and affordability. One of the purposes is its capability to decrease costs for sustaining a bank account. Blockchain technologies can reduce transaction fees and quick payment time for worldwide settlement. Conversely, there are challenges that need to be overcome for its full implementation in Ghana. Evolving a blockchain-permitted system is a matter of high cost, and if the banking sector is to benefit from the technology, then it should be homogeneous throughout banks in the world. A further concern is the cost of energy required to power the blockchain systems, which affects the profit of most banks in Ghana. Blockchain eliminates the presence of an intermediary such as banks. It was also discovered that the absence of intermediaries like banks and other financial institutions could also bring about a loss of revenue. Another area of concern is the high rate of the underprivileged and the high rate of illiteracy in Ghana. The conclusion is that for any technology to reach an acceptance and implementation level, it must be kept simple and easier for the underprivileged and illiterate to be able to make use of it.

The banking sector of Ghana being equipped to embrace blockchain technology

The findings of the research depict that inadequate access to funds, absence of infrastructure and tech support in Ghana, and lack of research and advancement support for utilizing such technologies comprise the largest obstacle to a vast extent of Blockchain technology adoption in the banking sector of Ghana. These obstacles may be strenuous to overcome by the government and the banking sector of Ghana. Alternatively, corporation-oriented strategy tools like fostering intermediary capital are more presumably to encourage blockchain investments. Action is required at the national level to eliminate the possible constraints of a technology shift. This action consists of the removal of technological and administrative barriers, building a steady macro-economic environment, and transparency.

Legal issues regarding the adoption of blockchain technology in Ghana

Another finding was that blockchain technology is perceived as advantageous but that the technology is not seen as prepared for implementation yet. Blockchain technology was uncovered as advantageous because of its capability to upsurge productivity using its technological features. In Ghana, the absence of standards or legislation for blockchain technology, it is perceived as the main challenge to the implementation of blockchain in the banking sector. Blockchain is perceived as a technology that is in its infant stage, therefore there is a detachment between dissimilar standards or legislation applied by all countries in the world. Therefore, there is need for a uniform regulated structure that will permit the system to develop. The study does nevertheless illustrate that even if the technical issues are resolved, there are issues of how the services should be legalized in an attempt to reach technology acceptance and implementation in Ghana.

Recommendations and suggestions for future research

There are numerous areas that are of importance to study in the future. This research is entirely qualitative with no quantitative components. Nevertheless, the structure of TAM deployed in this research is mostly carried out by quantitative analysis. Moving forward, this research can be carried out with quantitative modus, to try to authenticate the findings in this study. Regulations should be formulated as soon as possible to enhance the rapid adoption of Blockchain technology in the banking sector. There turns to chaos in any society without regulations. Therefore, for Blockchain to be successful in the coming years, a formidable regulation governing its application in the financial sector should be made without delay. The additional principal viewpoint that this study lacks is financial inclusion. In future, it would be exciting if financial inclusion is researched and attempt should be made to ascertain what requirements blockchain solutions need to fulfil to include the banked and unbanked. The limitation of this research is the dependence on self-disclosed data. Another drawback of carrying out this kind of qualitative research is the challenge of trying to unconventionally authenticate the data and duplicate the outcomes (Robins et al., 2007). Hence, the same outcome may not be achieved anytime the research is duplicated.

CONFLICT OF INTERESTS

The authors have not declared any conflict of interest.

REFERENCES

|

Agbesi S, Tahiru F (2020). Application of Blockchain Technology in Land Administration in Ghana. DOI:10.4018/978-1-7998-3632-2.ch006. |

|

|

Ali O, Ally M, Clutterbuck, Dwivedi Y (2020). The state of play of blockchain technology in the financial services sector: A systematic literature review. International Journal of Information Management 54:102-199. |

|

|

Anagnostopoulos I (2018). Fintech and regtech: Impact on regulators and banks. Journal of Economics and Business 100:7-25. |

|

|

Bharti AK (2019). A study of emerging areas in adoption of blockchain technology and it's prospective challenges in India. In 2019 Women Institute of Technology Conference on Electrical and Computer Engineering pp. 146-153. |

|

|

Chen Y (2018). Blockchain tokens and the potential democratization of entrepreneurship and innovation. Business Horizons 61(4):567-575. |

|

|

Cucari N, Lagasio V, Lia G, Torriero C (2021). The impact of blockchain in banking processes: the Interbank Spunta case study. Technology Analysis and Strategic Management 2021:1-13. |

|

|

Dai J, Vasarhelyi MA (2017). Toward Blockchain-Based Accounting and Assurance. Journal of Information Systems 31(3):5-21. |

|

|

Deka GC, Kaiwartya O, Vashisth P, Rathee P (2018). Communications in Computer and Information Science. Applications of Computing and Communication Technologies Volume 899 (First International Conference, ICACCT 2018, Delhi, India, March 9, 2018, Revised Selected Papers) Blockchain Technology in Fund Management pp. 310-319. |

|

|

Drescher D (2017). Blockchain basics: a non-technical introduction in 25 steps, Apress, viewed November 23rd 2018, ISBN-10:1484226038. |

|

|

Farah NAA (2018). Blockchain technology: Classification, opportunities, and challenges. International Research Journal of Engineering and Technology 5(5):3423-3426. |

|

|

Fernandez-Vazquez S, Rosillo R, De La Fuente D, Priore P (2019). Blockchain in FinTech: A Mapping Study. Sustainability 11(22):6366. |

|

|

Frame W, Scott W, Lawrence J (2014). Technological change, financial innovation, and diffusion in banking. SSRN pp. 1-5. |

|

|

Gao W, Hatcher WG, Yu W (2018). A Survey of Blockchain: Techniques, Applications, and Challenges," 2018 27th International Conference on Computer Communication and Networks pp. 1-11. |

|

|

Gao Y (2021). A promising application prospect of Blockchain in the Banking Industry from the Perspective of Stakeholder Theory. Proceedings of the 1st International Symposium on Innovative Management and Economics pp. 161-165. |

|

|

Garg P, Gupta B, Chauhan A, Kumar S, Uthayasankar G, Shivam MS (2020). Measuring the perceived benefits of implementing blockchain technology in the banking sector. Technological Forecasting and Social Change 163:120407. |

|

|

Guo Y, Liang C (2016). Blockchain application and outlook in the banking industry. Financial Innovation 2(1):24-30. |

|

|

Hassani H, Huang X, Silva E (2018). Banking with blockchain-ed big data. Journal of Management Analytics 5(4):256-275. |

|

|

Ji F, Tia A (2021). The effect of blockchain on business intelligence efficiency of banks, Kybernetes pp. 1-10. |

|

|

Kaur H, Alam MA, Jameel, R, Mourya AK, Chang V (2018). A proposed solution and future direction for blockchain-based heterogeneous medicare data in cloud environment. Journal of Medical Systems 42:1-11. |

|

|

Kshetri N, Voas J (2018). Blockchain in developing countries. IT Professional 20(2):11-14. |

|

|

Kumar R, Tahir MF, Kumar S, Zia A, Memon H, Mahmood W (2019). Challenges in Adoption of Blockchain in Developing Countries. 2019 4th International Conference on Emerging Trends in Engineering, Sciences and Technology. |

|

|

Liu T, Lin D (2021). Application and Prospect of Blockchain Technology in China's Commercial Banks. Advances in Economics, Business, and Management Research, volume 166. Proceedings of the 6th International Conference on Financial Innovation and Economic Development pp. 449-453. |

|

|

Mavilia R, Pisani R (2019). Blockchain and catching-up in developing countries: The case of financial inclusion in Africa. African Journal of Science, Technology, Innovation and Development 12(2):151-163. |

|

|

Mintah K, Baako KT, Kavaarpuo Godwin O, Gideon K (2020). Skin lands in Ghana and application of blockchain technology for acquisition and title registration. Journal of Property, Planning and Environmental Law 12(2):147-169. |

|

|

Musah S, Medeni TD, Soylu D (2019). Assessment of the Role of Innovative Technology through Blockchain Technology in Ghana's Cocoa Beans Food Supply Chains. 2019 3rd International Symposium on Multidisciplinary Studies and Innovative Technologies pp. 1-10. |

|

|

Nakamoto S (2008). Bitcoin: A peer-to-peer electronic cash system. Available at: |

|

|

Niyitunga EB (2022). current and potential role of blockchain-based technology in managing medical records in Africa. Digital Policy Studies. |

|

|

Novak M, De Silva A (2019). Economics of Blockchain Technology. Economic Papers. A Journal of Applied Economics and Policy 38(2):73-73. |

|

|

Osmani M, El-Haddadeh R, Hindi N, Janssen M, Weerakkody V (2020). Blockchain for next-generation services in banking and finance: cost, benefit, risk, and opportunity analysis. Journal of Enterprise Information Management (In press). |

|

|

Papadaki M, Karamitsos I (2021). Blockchain technology in the Middle East and North Africa region. Information Technology for Development 27(3):617-634. |

|

|

Patki A, Sople V (2020). Indian banking sector: Blockchain implementation, challenges and way forward. Journal of Banking and Financial Technology 4(1):65-73. |

|

|

Peter H, Moser A (2017). Blockchain-Applications in Banking and Payment Transactions: Results of a Survey. European Financial Systems 2017. Proceedings of the 14th International Scientific Conference, Brno: Masaryk University, 2017, part 2, pp. 141-149. |

|

|

Rajnak V, Puschmann T (2020). The impact of blockchain on business models in banking. Information Systems and e-Business Management 19:809-861. |

|

|

Rejeb A (2018). Blockchain Potential in Tilapia Supply Chain in Ghana. Acta Technica Jaurinensis 11(2):104-118. |

|

|

Robins RW, Fraley RC, Krueger RF (2007). Handbook of research methods in personality psychology. The Guilford Press. |

|

|

Senou RB, Dégila J, Adjobo EC, Djossou APM (2019). Blockchain for Child Labour Decrease in Cocoa Production in West and Central Africa. IFAC-Papers Online 52(13):2710-2715. |

|

|

Sharma S, Arnab B, Himanshu S, Rohit P (2019). Strategy for Financial Inclusion of Informal Economy Workers. Indian Council for Research on International Economic Relations. Available at: |

|

|

Song W, Li Y, Yang D (2018). Research on the Application of Blockchain in the Energy Power Industry in China. |

|

|

Vovchenko NG, Andreeva AV, Orobinskiy AS, Filippov YM (2017). Competitive Advantages of Financial Transactions on the Basis of the Blockchain Technology in the Digital Economy. European Research Studies Journal 20:193-212. |

|

|

Wu T, Liang X (2017). IEEE 2017 12th International Conference on Computer Science and Education (ICCSE) - Houston, TX, USA (2017.8.22-2017.8.25)] 2017 12th International Conference on Computer Science and Education - Exploration and practice of inter-bank application based on block chain pp. 219-224. |

|

|

Yoo S (2017). Blockchain-based financial case analysis and its implications. Asia Pacific Journal of Innovation and Entrepreneurship 11(3):312-321. |

|

|

Zheng K, Zhang J, Chen Y, Wu Ji (2019). Blockchain adoption for information sharing: risk decision-making in spacecraft supply chain. Enterprise Information Systems 15(6):1-22. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0