ABSTRACT

From previous studies, the effects of expenditure on economic growth appear to provide mixed results. Despite this uncertainty, theory suggests that expenditure induce growth. In Kenya, economic growth has been fluctuating despite the devolved expenditure increasing over time. It is against this background that this study was carried out to investigate empirically the short-run and long-run effect of components of county spending on growth in Kenya using panel data set over the period 2013 to 2017. Employing Harris-Tzavalis test, the study tested for the panel unit root and found that all variables were non-stationary at their level except gross county product (GCP). To check if the variables have long-run relationship, this study applied F bounds test. The result for this test revealed that there exists a long-run relationship among the GCP growth and regressors in the model. Once co-integrating was confirmed using F-bound, the long-run and ECM estimates of the ARDL model were obtained. The ARDL results revealed that spending on recurrent expenditure exerts a positive and significant effect on economic growth both in short-run and long-run hence confirming Keynesian theory in Kenya. However, capital expenditure was insignificant during the study period. From a recommendation standpoint, this study submits that the policymakers need to put in place policies that will improve budget allocation and execution so as to improve expenditure increase to capital infrastructure. This is necessary since counties lack infrastructures that help promote private capital accumulation and consequently county GCP.

Keywords: Gross county product (GCP), counties, expenditure, panel, autoregressive distributed lag model (ARDL), short-run, long-run.

The universal drive towards devolution has been increasingly justified on the basis that greater transfers of resources to sub national governments are expected to deliver greater efficiency in the provision of public commodities and accelerate development (Martinez-Vasquez and McNab, 2005; IMF, 2016). Further, many studies on the linkage between spending and economic expansion have been conducted at the national and international level, for instance, Kakar (2011) and Kimaro et al. (2017). The causes of much of the disparity in

county growth over time are not well understood. In particular, the effect of county expenditure on economic expansion has not been investigated exhaustively. Several studies (Mutie, 2014; Nanjala, 2015; Maingi, 2017) have attempted to investigate the channels through which different fiscal decentralization can affect growth in Kenya. From these studies, the effects of expenditure on growth appear to be inconclusive and other provides mixed pictures.

Devolution is thus projected to make county spending more efficient (ICPAK, 2014), create opportunities for county regimes to mobilize resources around development ambitions (Muriu, 2013) and encourage better coordination between various stakeholders. In addition, devolution is expected to provide each devolved unit the autonomy to pursue a development strategy tailored to its own economic advantage (KIPPRA, 2016), thus contributing to greater county economic growth (IMF, 2016).

Fiscal decentralization may influence county economic expansion are as follows. First, county investment in infrastructure is believed to have a direct effect on economic expansion through increasing the county capital stock. The second channel is the externality effect of spending that alters growth indirectly by raising the marginal productivity of private factors of production through spending on education and health sectors, which add to human capital accumulation. The third channel is intersectoral productivity differentials which makes some sectors to have more potential than others (Age'nor, 2007; Maingi, 2017). The final channel is spending on commodities that increase the aggregate demand (Age'nor, 2007; Kakar, 2011).

Table 1 shows the trend of growth and government size growth in Kenya from 2012 to 2017. From the table, there is evidence that the size of government has been rising, both county and national, in Kenya. However, the growth of government size is that of double digit while GCP is growing at a single digit. Further, the increasing wage bill accounts for the rapid growth in government size over the years (OCOB, 2017). In the review period, the rate of expansion of GCP was cyclical, depicting no clear pattern and responsiveness to changes in both national and county sizes (KIPPRA, 2016; KNBS, 2019). Despite the widespread government strategies to foster economic growth, increase in spending has tended to expand faster than that of county GCP expansion. The trends in this Table 1 reveal a widening gap between government size and GCP growth and therefore a concern that this study is interested in.

Therefore the paper attempts:

1. To determine the long-run and short-run effect of county government recurrent expenditure on county economic growth in Kenya.

2. To investigate the long-run and short-run effect of county government capital expenditure on county economic growth in Kenya.

Solow (1956) model concludes that the addition of physical capital cannot account for either the vast expansion over period in output per worker. The theory forecasted technological progress typically assumed to expand at a constant ‘steady state’- is what determines permanent output expansion in long-run (Romer, 2001).

As pointed, in the neoclassical growth model, if the incentive to save /invest in new capital is influenced by fiscal policy, this alters the equilibrium capital output ratio and therefore the level of output path, but not its slope. The new feature of the public policy endogenous expansion model of Barro and Sala-i (2003) and Madhumita et al. (2019) is that fiscal policy instruments can determine both the level of output path and the steady state growth rate of county.

The Keynesian paradigm treats county spending as an exogenous policy determined variable and economic expansion as endogenous and explained by the expenditure. A key factor in the Keynesian model is that the expansion of aggregate effective demand should accelerate to economic accumulation and pull the county economy out of the recession (Romer, 2001). Keynesian economics is an economic theory of total economy spending and its effects on output and inflation. Keynesian economics is considered a "demand-side" theory that focuses on changes in the economy over the short-run (Romer, 2001; Ntibagirirwa, 2014).

Linking theories: Government expenditure and economic expansion

Wagner’s law of “increasing public and state activities” claims that the role of county expenditure is an endogenous variable in the process of economic expansion. Wagner’s hypothesis asserts that economic expansion leads to increase in income, which results in increased demand for public goods and services. The demand for such public utilities is due to industrialisation and urbanisation, and it increases perpetually; to continue to provide these services, the counties needs to make huge budget allocation. The Keynesian framework holds that county expenditure is an exogenous factor that accelerates county growth, or expenditure can be used as a policy measure to generate employment, and boost economic activity at county level (Nanjala, 2015; Maingi, 2017; Madhumita et al., 2019). From the combination of the above two economic views, this study develops a circular flow as presented in Figure 1.

Empirical research gap

A criticism of previous empirical studies is that if data on the variables is not stationary it may be that, due to the common trends in variables, there can be spurious correlation which imposes upward bias of the estimated coefficients. One way to correct the problem is to run regressions model in the form of first differences. However, such a remedy has its own limitations because it generates only short-run effects, while the relationship is predicted to be long-run. Such analysis can give wrong conclusions. This study used the Error Correction Model (ECM), which distinguishes between short-run and long-run estimates of county fiscal variables on economic expansion and determines the speed of adjustment to the long-run. In addition, a number of the studies, Oguso (2017) and Gebreegziabher (2018) made use of time-series and OLS approach which are prone to many econometrics limitations like multicolliniality. In addition, panel diagnostic tests, stationarity test, and co integration which are very crucial in modeling were glaringly absent. This could put to question reliability of the results so presented.

This study employed historical research design so as to capture the trend of county GCP accumulation and county spending. Historical research design leads to understanding of the past and its relevance to the present and the future. This was carried out in the period 2013 to 2017 using annual series secondary data for 47 counties and panel ARDL technique, resulting in 235 county-year observations. This study was carried out in Kenya. This is because in the study period, there has been a significant transfer of funds to 47 county governments by the national government in order to address disparities in country economic growth. The secondary data was from previous publications which could only be sourced from secondary sources. The study utilized annual panel data from Statistical abstracts, Economic surveys, Gross County Product report and County Budget Implementation Review Reports -Kenya.

Following studies of M’amanja and Morrissey (2005) and Facchini and Melki (2013), logs (ln) of the variables were taken for the estimation of the panel model so as to allow for regression coefficients to be treated as elasticities. An advantage of expressing the variables in natural logarithmic form is to reduce the problem of heteroskedasticity and also achieve stationarity in the lower order of integration (M’amanja and Morrissey, 2005; Greene, 2012). Thus, panel regression to be estimated was:

Panel ARDL specification and co-integration tests

ARDL F-bounds test co integration was used to estimate this study. These tests allow diverse cross-sectional interdependences along with other different individual effects to ascertain the co integration (Pedroni, 2004). Estimation of co integrating relationship requires that all panel data series variables in the model to be integrated order of one. However, panel ARDL model overcomes this problem by introducing F-bounds testing procedure to establish long-run relationship among variables. It does not require, as such, that variables of interest have the same order of integration to model long-run relationship (Pesaran et al., 2001; M’amanja and Morrissey, 2005). The error correction framework of the series can be represented as follows

Panel unit root tests

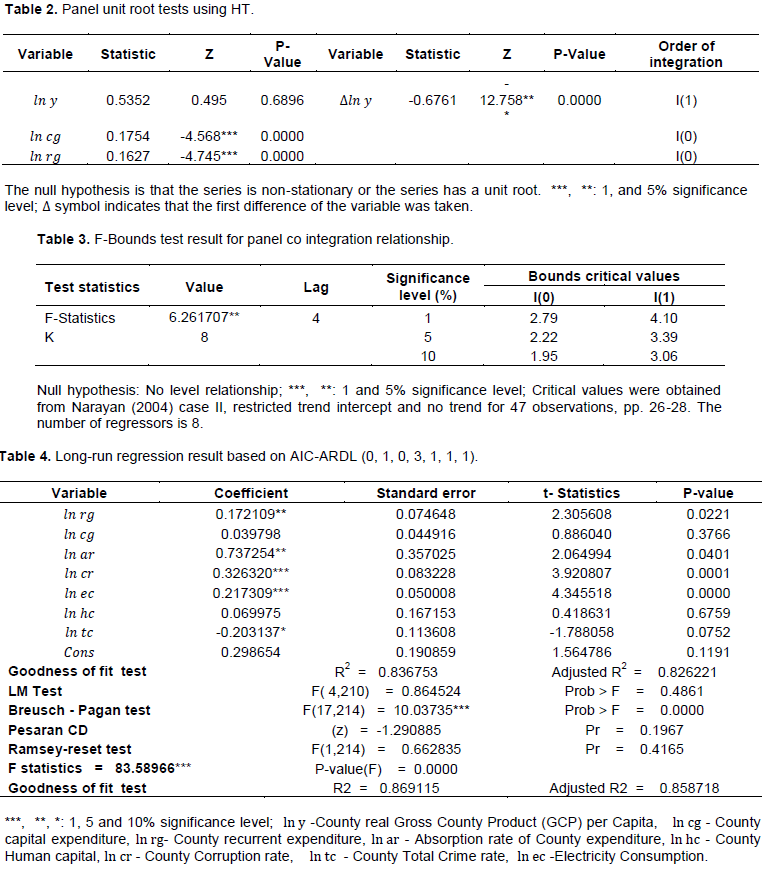

Accordingly, HT (Harris–Tzavalis, 1999), unit root test was applied at level and at first difference and result is presented in Table 4.

The results in Table 2 indicate that all variables were stationary at all level except GCP per capita at 4% level of significance. Thus the null hypothesis of non-stationary for all cannot be rejected and hence the series contains a unit root. However, they become stationary after the first difference implying that the variables are integrated of order one, I (1). However, differencing of a non-stationary series solves the problem of spurious regression results; it leads to a loss of important information about long-run properties of the study variables.

Panel co integration test

This study applied panel autoregressive distributed lag model (ARDL) approach introduced in Pesaran et al. (2001). Given the relatively small sample size in the present study, this study extracted the appropriate critical values from Narayan (2004). In this study, ARDL F-bounds test for panel co integration was applied and the result for co integration analysis between county real GCP per capita and the regressors is shown in Table 3. From the result in the table, the computed F-statistic of the model was 6.26 which is higher than the upper bound critical value (3.39) at 5% level of significance. This implies that there exists a long-run relationship among the real GCP per capita and regressors in the model. To determine the long-term elasticities, this study employed the panel ARDL model technique. The main strength of ARDL test is that it is more robust and performs better for small sample size like in the current study.

Long-run effect of government recurrent expenditure on growth

Table 4 presents the result on effect of county recurrent government expenditure (Rg) on county GCP growth in the long-run.

The individual panel ARDL result revealed that the effect of county recurrent expenditure on economic expansion was positive and statistically significant in the long-run. Thus, one percentage point increase in recurrent spending would cause an increase in real GCP per capita by 0.17%. The result confirmed the fact that most functions of counties are on recurrent spending like health, education and pre-primary service (OCOB, 2019). Also, the significant relationship in counties can be attributed to high recurrent expenditure, for example, the approved budget allocation on recurrent and development spending was 62.0 and 38.0%, respectively, in 2014/15 (OCOB, 2017). Further, Kenya’s private consumption spending recorded the highest growth since 2013, of 7.0% in 2017, accelerating further GCP growth (GoK, 2019; KNBS, 2019). The expansionary expenditure, as explained, can accelerate growth of the output in long-run until resources are fully employed in counties. The result is consistent with other studies (Mudaki and Masaviru, 2012; Gebreegziabher, 2018) on positive effect of recurrent expenditure on economy in long-run. In contrast, Mutie (2014), Oguso (2017) and Maingi (2017), found a negative relationship between recurrent expenditure and growth.

From the results on Table 4, the effect of county capital spending on real GCP growth was positive but insignificant at any conventional level of significance in long-run. The result generally revealed that county government capital expenditure did not add significantly to economic expansion in 47 counties during the period under review. This can be justified since most functions of counties are on recurrent expenditure like health and education sectors. Usually, there is always a lag between capital allocation, disbursement and spending. Most often, the actual capital amount disbursed relative to recurrent expenditure is very small and may not have been enough to have a significant effect on economy (OCOB, 2017). The above finding is consistent with the conclusions of other studies like, Nanjala (2015) and Muguro (2017), which point to insignificant relationship in Kenya in the long-run. In contrast, other studies (Oguso, 2017; Gebreegziabher, 2018), concluded that a positive relationship exists in the long-run.

The coefficient of human capital was positive and insignificant at the 5% level in the long-run. The estimated coefficient of human capital of the county economy has a positive sign but not significant at any conventional level. A possible explanation for insignificant result is the low level of county spending in capital expenditure (infrastructure on education), probably because effects from education sector would have very long lags, cost of education and inequity in access, market failure, under-enrollment, school drop-out, low education expenditure absorption rate and corruption

(Adawo, 2011; OCOB, 2017). This result is consistent with several studies (Kweka and Morrissey, 2000; Cardenas, 2007; Adawo, 2011) in that it found human capital to be insignificant. In contrast, Husnain et al. (2011); Gebrehiwot (2015); Kartal et al. (2017); and Mohsin et al. (2017) point a positive relationship.

The estimated coefficient of county expenditure absorption rate is positive and statistically significant in the long-run at 5% level. The significant relationship can be attributed to improved spending rate in counties of over 65% (OCOB, 2017). Further, this demonstrates that economic growth is often tied to public expenditure, that is, failure to spend budgeted money directly affects the rate at which the county economy expands in the long-run. The conclusions are in agreement with Becker et al. (2012) study in Europe but contrast Claudia and Goyeau (2013) study in Europe, and Ionica et al. (2017) study in Romania.

The results of the regression analysis sustain the hypothesis that total crime has a 10% statistical significant negative effect on county growth. The effects of crime on county businesses can be particularly damaging because they can involve both short-period costs and long-term consequences for economic development by diverting resources to crime prevention measures and otherwise discouraging private investment and thus decelerating county economic growth in long-run. A number of studies report that crime decelerates growth in the economy (Cardenas, 2007; McCollister et al., 2010), whereas other holds that the effect is ambiguous or even absent (Chatterjee and Ray, 2009; Goulas and Zervoyianni, 2013).

Corruption was positive and statistically significant at 5% level in counties. The result was against prior expectation that corruption perceptions rate has significance and negative effect when linked to economic growth. However, this result can be attributed to the data on the number of reported cases to EACC which under-estimate considering that not many corruption cases are actually reported in Kenya. Further, numerous studies (Mo, 2001; Pellegrini, 2011) had demonstrated that the negative relationship between corruption and economic growth was likely to fade away when other specific variables are included in the analysis. In addition, Mo (2001) and Pellegrini (2011) argued that the effect of corruption on economic expansion becomes positive after adding human capital and other macroeconomic variables. Other studies support ambiguous results between variables (Mo, 2001; Hanousek and Kocenda, 2011; Pellegrini, 2011).

The effect of electricity consumption on real GCP is positively related and significant at 5% in long-run. Almost all consumption and investment activities in county level use electricity. Empirical results support the findings, for example, Odhiambo (2015), Shaari et al. (2012) and Hammed (2016) but Javid et al. (2013) contrasted the result.

Short-run impact of county recurrent expenditure on economic growth

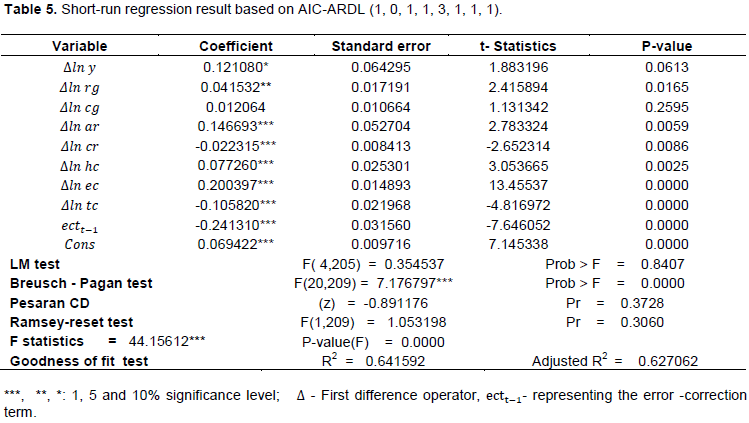

After the long-run co-integrating analysis, the next step is to estimate the short-run dynamic parameters within the panel ARDL framework. Here, the lagged value of all level variables (a linear combination is denoted by CointEq) was retained in the panel ARDL model. Consistent with the long-run findings, the estimated short-run regression results revealed similar results, as presented in Table 5. From the table, in the short-run recurrent expenditure was positive and statistically significant at five percent level of significance. Since this result was contrary to economic theory, the study posits that the result should cautiously be interpreted as a special case for the 47 county’s economy in the short-run, which is not only characterized by poor institutional quality but also weak infrastructural base. This finding can be attributed to a high recurrent allocation being experienced in most counties and hence increasing purchasing power of the population in the short-run (Romer, 2001; OCOB, 2019). Higher recurrent allocation of the county accelerate demand for commodities, which in turn allows suppliers to increase use of their productive capacities by hiring new factor of production thus grow output. This study was consistent with the findings obtained by Age'nor (2007); Mudaki and Masaviru (2012); Claudia and Goyeau (2013) and Gebreegziabher (2018). In contrast, Mutie (2014), Maingi (2017) and Gupta (2018) found a negative relationship.

From the result in Table 5, the impact of county capital spending on real GCP per capita was insignificant in the short-run. Capital allocation is typically seen as spending creating future benefits, as there could be some lags between when it is incurred and when it takes effect on the county. They are more discretionary and are made of new programs that are yet to reach their stage of completion (Age'nor, 2007). Most often, the capital budget relative to recurrent expenditure is very small and may not have been enough to have impact on county growth in short-run (OCOB, 2019). The above findings agree with the results of Muguro (2017) and Oguso (2017) in Kenya; however this finding contrasts other studies (Maingi, 2017; Gebreegziabher, 2018), that shows that positive relationships exist in the short-run.

The coefficient of human capital was positive and significant at the 5% level. This result can be attributed to increase in county and national government education sector budget, thus stimulating productivity for private factors of production and the accumulation of private and public capital, thus economic growth (OCOB, 2019). In addition, the government of Kenya offers secondary education to population at no cost or at subsidised level. The result is similar with the results of Husnain et al. (2011), Gebrehiwot (2015), Kartal et al. (2017) and Gebreegziabher (2018). In contrast, Adawo (2011) found that that the relationship is negative.

From the result in Table 5, county expenditure absorption rate was positive and significant to at 5% level in short-run. This result is consistent with the long-run result. If absorption rate is lower there will be deterioration of the economy. The finding agrees with those of Becker et al. (2012) study on Europe but contrast Claudia and Goyeau (2013) study in Europe, and Ionica et al. (2017) study in Romania on effect of fund utilization on growth.

County Crime rate was negative and significant at 5% level of significance in relation to county economic growth. Crime increase imposes large costs to both government and private sectors which have a negative impact on investment and growth in short-run. Other studies report that crime decelerates county growth (Cardenas, 2007; McCollister et al., 2010), whereas other concludes that the impact is insignificant (Chatterjee and Ray, 2009; Goulas and Zervoyianni, 2013).

Corruption was negative and statistically significant at 5% level in the short-run. Thus, corruption impedes county economic growth by distorting other macro-economic factors at county level in the short-run. County corruption can result in fund misallocation when decisions on how public resources will be invested are made by a corrupt county agency (Rodden, 2004). This result is similar to those of Murphy et al. (1991). Also, other studies find ambiguous effects of corruption (Mo, 2001; Hanousek and Kocenda, 2011; Pellegrini, 2011).

Effect of electricity consumption on real GCP per capita is positively related and statistically significant at 5%. Population access to affordable electricity is a key condition to achieving county economy growth and poverty reduction in Kenya. Empirical results agree with the conclusions of Odhiambo (2015), Shaari et al. (2012) and Hammed (2016), but Javid et al. (2013) contrasted the result.

The estimated coefficient of the error correction term (ECT) has the appropriate negative sign (-0.24) and statistically significant at 1%. However, ECTt-1 is quite low, that of -0.24, implying that equilibrium slowly converge to long-run equilibrium in counties. This implies the speed of adjustment is 0.24% which is relatively low where 24% of disequilibrium is corrected in the first year. The implication is that disequilibrium can persist for a long period of time, hence explaining the significance of the lagged effects on county growth in Kenya.

Adjusted R2 and p-values for both models showed that the overall goodness of fit of the models was satisfactory. The F-statistics measuring the joint significance of all regressors was significant at 1% for the model. Further, the regression model passed all diagnostic tests except heteroscedasticity, which was corrected by the use of panel robust standard error.

The individual panel ARDL finding showed the effect of county recurrent spending on county economic growth was significant and positive in counties. This was true on both long-run and short-run regression findings. As a result, county spending augments the aggregate demand, which stimulates an increased output depending on county spending multipliers. The county governments stimulate spending through increasing purchasing power of the population through demand for raw materials, which ultimately creates new jobs. The significant relationship in counties can be attributed to high recurrent expenditure budget allocation over the years. Furthermore, most functions of counties are on recurrent spending like health, education and pre-primary service.

The panel ARDL regression model results revealed that capital expenditure was positive but insignificant both in the long-run and short-run. Implying, the positive effect of higher public investment is offset by the negative results of higher taxes. In addition, most functions of counties are on recurrent expenditure like health and education. Further, it could be due to a failure of government spending; that is lack of prioritization of government projects, weak budget preparation, crowding out effect, ineffective monitoring and evaluation units to check the quality of capital expenditure, and inefficient financial planning processing. Also, it could be that these public investments need a longer period to flourish.

The findings on control variables used in this study confirm the importance of absorption rate of expenditure, human capital and electricity consumption as key accelerators of economic expansion in counties. However, corruption and crime rate in counties were identified as factors that impede GCP growth in Kenya.

The estimated coefficient of the error correction term in short-run panel ARDL regressions models was low, implying that the adjustment process towards equilibrium was fairly low, hence explaining the significance of lagged terms. This means that disequilibrium can exist for a long period in Kenyan counties.

From a recommendation standpoint, this study submits that for a robust economic growth, recurrent expenditure is necessary as it stimulates output depending on county expenditure multipliers. However from past results, government recurrent spending, despite its significant role in welfare advancements has been detrimental to economic growth; for it to enhance growth there is the need for policy makers in counties to examine its composition. Even though recurrent spending currently consumes on average over 63% of county budget, by this study results, it should be noted that its positive contribution to county economy is very negligible. It is likely that the multiplier effect of capital allocation could outweigh that of recurrent in the long-run.

The results also showed that capital public expenditure has positive but insignificant effect on economic growth in Kenya. This suggests that there is need for the county authorities to reduce government recurrent expenditure so as to free resources which can be used for development purposes. The county government needs to increase its investments and introduce such policies that would protect and enhance private investments. There is also the need for policies that will help control those investments that compete with private investments. Also, enhance budgetary control to ensure that exchequer issues are utilized for the approved purpose.

Since the county allocation and economic expansion co-move towards long-run equilibrium, the county authority should constitute strong monitoring and evaluation mechanisms to evaluate county public financed projects in to get value for budget on those county projects.

AREAS OF FURTHER RESEARCH

The empirical work in this study was done on the macroeconomic level, while the analysis of mechanisms through which county spending become more effective should involve mostly microeconomic investigation. Also, macroeconomic analysis should be extended to include the source of funds (tax revenue and budget deficit) used to finance county public expenditure, need to be identified and taken into account in the regression analysis.

The authors have not declared any conflict of interests.

REFERENCES

|

Adawo M (2011). Has education (human capital) contributed to the economic growth of Nigeria? Journal of Economics and International Finance 3:46-58.

|

|

|

|

Age'nor P (2007). Economic Adjustment and Growth. New Delhi: Viva books Private Limited.

|

|

|

|

|

Barro R, Sala-i MX (2003). Economic Growth. Cambridge, MIT press.

|

|

|

|

|

Becker SO, Egger PH, Von Ehrlich M (2012). Too Much of a Good Thing? On the Growth Effects of the EU's Regional Policy. European Economic Review 56(4):648-668.

Crossref

|

|

|

|

|

Cardenas M (2007). Economic growth in Colombia: a reversal of fortune? Documentos de Trabajo (Working Papers). pp. 1-36. Available at:

View

|

|

|

|

|

Claudia A, Goyeau D (2013). EU Funds Absorption Rate and the Economic Growth. Timisoara Journal of Economics and Business 6(20):153-170.

|

|

|

|

|

Ethics and Anti- Corruption Commission ( EACC) (2017). National Ethics and Corruption Survey 2017. Available at:

View

|

|

|

|

|

Facchini F, Melki M (2013). Efficient Government Size in France. European Journal of Political Economy 31:1-14.

Crossref

|

|

|

|

|

Gebreegziabher S (2018). Effects of tax and government expenditure on economic growth in Ethiopia. In Economic Growth and Development in Ethiopia. Springer, Singapore pp. 87-104.

Crossref

|

|

|

|

|

Gebrehiwot GK (2015). The Impact of Human Capital Development on Economic Growth in Ethiopia: Evidence from ARDL Approach to Co integration. Journal of Economics and Sustainable Development 6(13):155-168.

|

|

|

|

|

Government of Kenya (GOK) (2018). Economic surveys. Nairobi, KNBS. Available at:

View

|

|

|

|

|

Granger CW (1988). Causality, Cointegration and Control. Journal of Economic Dynamics and Control 12:551-559.

Crossref

|

|

|

|

|

Granger CW (1988). Causality, cointegration, and control. Journal of Economic Dynamics and Control 12(2-3):551-559.

Crossref

|

|

|

|

|

Greene WH (2012). Econometric Analysis. England, Pearson Education Limited.

|

|

|

|

|

Goulas E, Zervoyianni A (2013). Economic growth and crime: does uncertainty matter?. Applied Economics Letters 20(5):420-427.

Crossref

|

|

|

|

|

Gupta R (2018). The impact of government expenditure on economic growth in Nepal. Quest International College, Pokhara University, Nepal. Available at: View

Crossref

|

|

|

|

|

Hammed A (2016). Economic Growth Effects of Public Capital Expenditures: Evidence from South Africa's Municipalities. Financial Fiscal Commission report. pp. 38-58.

|

|

|

|

|

Hanousek J, KoÄenda E (2011). Public investment and fiscal performance in the new EU member states. Fiscal Studies 32(1):43-71.

Crossref

|

|

|

|

|

Harris RD, Tzavalis E (1999). Inference for unit roots in dynamic panels where the time dimension is fixed. Journal of Econometrics 91(2):201-226.

Crossref

|

|

|

|

|

Husnain MI, Khan M, Akram N, Haider A (2011). Public Spending, FDI and Economic Growth: A Time Series Analysis for Pakistan (1975-2008). International Research Journal of Finance and Economics 61(1):21-27.

|

|

|

|

|

ICPAK (2014). Position Paper on Impact of Decentralized Funds in Kenya. Available at:

View

|

|

|

|

|

International Monetary Fund (IMF) (2016). Regional economic outlook, Sub-Saharan Africa. Washington, D.C. Available at:

View

|

|

|

|

|

Ionica O, Andreea M, Gabriela P, Raluca B (2017). The Effects of the Structural Funds on the Romanian Economic Growth. Economica 13(2):91-101.

|

|

|

|

|

Javid AY, Javid M, Awan ZA (2013). Electricity consumption and economic growth: evidence from Pakistan. Economics and Business Letters 2(1):21-32.

Crossref

|

|

|

|

|

Kakar K (2011). Impact of Fiscal Variables on Economic Development of Pakistan. Romanian Journal of Fiscal Policy 2:1-10.

|

|

|

|

|

Kartal Z, Zhumasheva A, Acaroglu H (2017). The Effect of Human Capital on Economic Growth: A Time Series Analysis for Turkey. In: Bilgin M, Danis H, Demir E, Can U (eds,). Regional Studies on Economic Growth, Financial Economics and Management. Eurasian Studies in Business and Economics 7(19):175-191.

Crossref

|

|

|

|

|

Kenya National Bureau of Statistics (KNBS) (2019). Gross County Product Report, Nairobi, Kenya.

|

|

|

|

|

Kimaro EL, Chee CK, Lin LS (2017). Government Expenditure, Efficiency and Economic Growth: A Panel Analysis. African Journal of Economic Review 5(2):34-54.

|

|

|

|

|

KIPPRA (2016). Kenya Economic Report: Fiscal Decentralization in Support of Devolution. KIPPRA publication, Nairobi. Available at

View

|

|

|

|

|

Madhumita R, Minaketan S, Sibanjan M (2019). Public Expenditure and Economic Development Regional Analysis of India. Journal of Economic and Political Weekly 54(10):50-56. Available at:

View

|

|

|

|

|

Maingi JN (2017). The Impact of Government Expenditure on Economic Growth in Kenya: 1963-2008. Advances in Economics and Business 5(12):635-662.

Crossref

|

|

|

|

|

M'amanja D, Morrissey O (2005). Fiscal Policy and Economic Growth in Kenya. Credit Research papers No. 05/06. United Kingdom.

|

|

|

|

|

Martinez-Vazquez J, McNab R (2005). Fiscal Decentralization, Macro - stability and Growth. International Studies Working Paper No. 0506, Georgia State University.

|

|

|

|

|

McCollister KE, French MT, Fang H (2010). The cost of crime to society: New crime-specific estimates for policy and program evaluation. Drug and Alcohol Dependence 108(1-2):98-109.

Crossref

|

|

|

|

|

Mo P (2001). Corruption and Economic growth. Journal of Comparative Economics 29: 66-79.

Crossref

|

|

|

|

|

Mudaki J, Masaviru W (2012). Does the composition of public expenditure matter to economic growth for Kenya? Journal of Economics and Sustainable Development 3(3):60-70.

|

|

|

|

|

Muguro WJ (2017). Effect Of Public Expenditure On Economic Growth In Kenya: 1963-2015 (Doctoral dissertation, KCA University).

|

|

|

|

|

Murphy K, Shleifer A, Vishny R (1991). The Allocation of Talent: Implications for Growth. Quarterly Journal of Economics 106:503-530.

Crossref

|

|

|

|

|

Mutie N (2014). Effects of Devolved Funds on Economic Growth in Kenya: Empirical Investigation (1993-2012). Master's thesis, University of Nairobi, Nairobi.

|

|

|

|

|

Nanjala CS (2015). Explaining the Relationship between Public Expenditure and Economic Growth in Kenya using Vector Error Correction Model (VECM). International Journal of Economic Sciences 4(3):19-38.

Crossref

|

|

|

|

|

Narayan PK (2004). Reformulating critical values for the bounds F-statistics approach to cointegration: an application to the tourism demand model for Fiji, Department of Economics Discussion Papers

|

|

|

|

|

No. 02/04, Monash University, Melbourne, Australia.

|

|

|

|

|

Ntibagirirwa S (2014). Philosophical Premises for African Economic Development Sen's Capability Approach. Globethics net Theses 7, Geneva.

|

|

|

|

|

OCOB (2017). Annual County Governments Budget Implementation Review Report. Nairobi, Kenya. Available at:

View

|

|

|

|

|

Office of the Controller of Budget (OCOB) (2019). Annual County Governments Budget Implementation Review Report. Nairobi, Government Printer.

|

|

|

|

|

Odhiambo NM (2015). Government expenditure and economic growth in South Africa: An empirical investigation. Atlantic Economic Journal, 43(3):393-406.

Crossref

|

|

|

|

|

Oguso A (2017). Growth Effects of Public Recurrent Expenditure in Kenya. Journal of Economics, Management and Trade 19(2):1-20.

Crossref

|

|

|

|

|

Pedroni P (2004). Panel co integration; Asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econometric Theory 20:597-625.

Crossref

|

|

|

|

|

Pellegrini L (2011). The effect of corruption on growth and its transmission channels: Corruption, Development and the Environment. Kyklos 57(3):429-456.

Crossref

|

|

|

|

|

Pesaran MH (2004). General diagnostic tests for cross section dependence in panels. Cambridge Working Papers in Economics No. 0435.

|

|

|

|

|

Pesaran MH, Shin Y, Smith RP (2001). Bounds Testing Approaches to the Analysis of Level Relationships. Journal of Applied Econometric 16(3):289-326.

Crossref

|

|

|

|

|

Chatterjee I, Ray R (2009). Crime, corruption and institutions. Monash University, Department of Economics Discussion Paper. Available at:

View

|

|

|

|

|

Rodden J (2004). Comparative federalism and decentralization: On meaning and measurement. Comparative politics, 481-500.

Crossref

|

|

|

|

|

Romer DH (2001). Advanced Macroeconomics. Berkeley, the McGraw-Hill Co. Inc.

|

|

|

|

|

Shaari M, Hussain N, Ismail M (2012). Relationship between Energy Consumption and Economic growth: Empirical Evidence for Malaysia. Business Systems Review 2(1):17-28.

|

|

|

|

|

Solow RM (1956). A contribution to the theory of Economic Growth. The Quarterly Journal of Economics 70(1):65-94.

Crossref

|

|