ABSTRACT

This study was conducted to assess the impact of Chinese outward foreign direct investment flows on economic growth in sub-Saharan Africa. The design used was a longitudinal study. The analysis used was existing data on 37 sub-Saharan African countries between 2003 and 2011. Two balanced panel regressions were estimated using time and country fixed effects, respectively. The estimations suggested that Chinese foreign direct investment positively affected economic growth in the studied countries. However, the effect, though statistically significant, was weak. Other covariates such as natural resources, employment and trade volume significantly increased economic growth while the opposite effect was observed for inflation rate. Sub-Saharan African countries are still not able to reap the expected benefits from foreign direct investments because most of them still do not have efficient absorptive capacities. It is suggested that African countries implement policies such as the fighting against corruption, the establishment of the rule of law and the setting up of efficient financial infrastructures.

Key words: China, foreign direct investment, economic growth, sub-Saharan Africa, panel regression.

Sub-Saharan African countries, because of the low national incomes and savings, have resorted to foreign direct investment (FDI) as an additional opportunity to seek funding. The inflows of FDI are thus viewed as a channel for the transfer of know-how from foreign countries. China has been one of the key investors in sub-Saharan Africa (SSA). Since 2000, it has become the greatest commercial partner of Africa. It offered opportunities to African countries to decrease their marginalization from the international economy and get resources to boost national economies (Gill and Reilly, 2007; Zafar, 2007). The Chinese FDI stock in Africa has grown from $49 million in 1990 to $2.6 billion in 2006 (Besada et al., 2008)and was evaluated to more than $26 billion against $22 for the United States at the end of 2013 (Chen et al., 2016).

It is therefore important to understand the connection between the Chinese FDI and the economy in Africa in order to identify the conduits through which this FDI boosts economic growth, and subsequently design the corresponding policies to attract and reap the maximum benefits from these investments. However, studies (Adisu et al., 2010; Berthélemy, 2011; Besada et al., 2008; Claassen et al., 2012; Gu, 2009; Kaplinsky and Morris, 2009; Renard, 2011; Shen, 2015) that have been devoted to assessing the impact of Chinese FDI on economies in SSA are mostly descriptive. Three reasons prompted the current study. Firstly, theoretical debates about the presence of China in SSA are controversial. The positive side claims that China increases commercial and investments ties with Africa and provides it with low cost goods (Berthélemy, 2011; Zafar, 2007). The negative side reports an often disloyal competition from Chinese companies with African local companies (Anshan, 2007; Chen et al., 2016). Secondly, investigations about other types of FDI in SSA are still inconclusive (Adams, 2009a, b; Adams and Opoku, 2015; Forte and Moura, 2013; Gui-Diby, 2014; Lamine and Yang, 2010). Finally, to the authors’ knowledge, this is the first paper to econometrically examine the relationship between the Chinese FDI and economic growth within the context of SSA. The analysis concerns a panel of 37 countries between 2003 and 2011.

There is an abundant empirical literature regarding the effects of FDI on economic growth in Africa (Adams, 2009b; Seyoum et al., 2015) for a comprehensive review. However, the current review mainly relates some of them mostly not referenced in these reviews.

Using a panel of 42 SSA countries over 1990 to 2003, Adams (2009b) uncovered that the effect of FDI on economic growth was not proportionate to the increase of FDI inflows. The estimates from ordinary least squares (OLS) and panel fixed effects models showed a significantly positive impact for the OLS regression only. For the fixed effects regression, the author believed that the unexpected finding was due to the weakness of financial markets and the insufficient absorptive capacity of countries to reap the benefits from the investment. The estimates from an OLS regression supported positive effects of FDI on economic growth in Cameroon over the period of 1980 to 2009 (Kang and Mbea, 2011). A similar method indicated that FDI though may be restricted by human capital was beneficial to the national economy in Nigeria (Adegbite and Ayadi, 2011). Gui-Diby (2014) used a generalized method of moments and found negative and positive effects of FDI on economic growth, respectively over the periods 1980 to 1994 and 1995 to 2009 in a panel of 50 African countries. Other studies reported that FDI is beneficial to economic growth only if it is interacted with other elements. Using a panel regression on 32 African countries over the 1997 to 2008 period, Adjasi et al. (2012) found that FDI can positively affect economic growth only when it is interacted with financial market variables. Adams and Opoku (2015) reported diverse interaction elements such as creditmarket and business regulations. The study used a general method of moments and focused on 22 SSA countries over the period of 1980 to 2011.

The impact of FDI on economic growth in Africa was also investigated using a dynamic analysis. Abala (2014) found a positive correlation between FDI and economic growth from Kenyan time series data over 1970 to 2010.Belloumi (2014) did not find any Granger causality between FDI and economic growth in Tunisia over the period 1970 to 2008, while Ahmed et al. (2011) revealed such causality in 5 SSA countries. In another set of 5 SSA countries over the period 1970 to 2005, the nature of the causality was found to depend on the extent of the financial market (Adeniyi et al., 2012). The estimates from a Granger causality analysis revealed the weakness of the FDI to boost economic growth in Guinea over the period 1985 to 2008 (Lamine and Yang, 2010). In Nigeria, for the period 1980 to 2009, Imoudu (2012) also reported in a cointegration analysis a very little impact of FDI except in the telecom sector. In a similar analysis on the same country between 1990 and 2009, Inekwe (2013) uncovered that FDI was a catalyst to economic growth in the servicing sector and an impediment for the manufacturing sector. The estimation results showed that economic growth Granger caused FDI in the service sector while there was a mutual causation between them in the manufacturing sector. Seyoum et al. (2015) investigated the Granger causality between FDI and economic growth for 23 African countries over the period of 1970 to 2011. A causal link was reported for the overall sample while unidirectional causality either from FDI to economic growth or in the opposite direction was found for the individual countries.

As it can be seen from the review, the impact of FDI on economic growth in Africa is not straightforward. The results are mixed and depend on some specific conditions of host countries. This concurs with many other studies in Africa and other parts in the world (El-Wassal, 2012).

Data and sample

The study covers a set of 37 SSA countries shown in Appendix Table A1, over the period of 2003 to 2011. The choice of the countries and the variables is purely based on data availability. The dependent variable is economic growth proxied by the Gross Domestic Product (GDP) growth rate. The main regressor of interest is the Chinese annual outward foreign direct investment flows (CHFDI) to SSA countries.

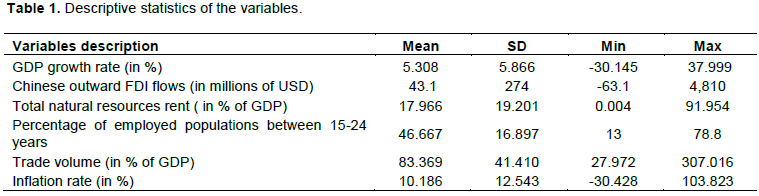

Other explanatory variables that may influence economic growth were also included in the analysis. These variables are the total natural resources rent (NATR), the percentage of employed populations between 15 and 24 years (EMP), trade volume (TV) and inflation rate (INFL).

The CHFDI was obtained from the 2013 Statistical Bulletin of China's Outward Foreign Direct Investment(Ministry of Commerce, 2013), while the remaining variables were retrieved from the World Development Indicators database of the World Bank. The descriptive statistics (Mean, standard deviation, minimum, maximum) of all the variables are shown in Table 1.

The correlation coefficients between the variables did not show any risk of high correlation. The highest correlation coefficient was approximately 0.3. The variance inflator factor (VIF) scores were then computed to assess the risk of multicollinearity between the variables. The usual rule of thumb is that a VIF higher than 10 implies the presence of multicollinearity(Hamilton, 2009). However, the threshold of 5 has been commonly used (Castillo-Manzano et al., 2016). All the VIF scores were less than 5, attesting that there is no risk of multicollinearity between the variables. However, the Breusch-Pagan test provided a statistic of 116.89 with an associated p-value of 0.000. This suggests the presence of heteroskedasticity which needed to be controlled for in the estimation process.

Modeling technique

The modeling technique used in this study is a linear panel model. Panel data are more efficient in that they provide more information, more variability, less collinearity among the covariates and more degree of freedom (Baltagi, 2008; Hsiao, 2014).

A year trend was added to the models to control for time-related unobserved factors that may affect economic growth. In order to test the robustness of the results, a year fixed effects in Model 1 and a country fixed effects in Model 2 were estimated. All the models were estimated with robust standard errors to control for the presence of heteroskedasticity. The estimations were performed using a balanced panel of the 37 countries over 9 years giving a total number of 333 observations. Table 2gives the estimation results. All the estimations were performed using Stata 14 (StataCorp, 2015).

The two models are globally statistically significant as shown by the p-values of their F-statistics which are less than 5%. The R-squared in all models suggest that the variables explain more than 80% of economic growth rate. All the variables have the expected signs and these signs are statistically significant and consistent across the two models.

The coefficient of CHFDI is positive suggesting that Chinese investment boosts economic growth in SSA countries. However, the magnitude of the impact is reasonably minimal as shown by the coefficient of CHFDI which is in the order of the millionth. Some studies reported similar findings on the impact of the global FDI. In a comprehensive literature review, the effect of FDI on economic growth was found to be negligible in African countries (Adams, 2009). The relationships between FDI and poverty were insignificant and ambiguous, respectively in Northern and Southern Africa, and West Africa for the 1990 to 2007 period (Gohou and Soumaré, 2012). El-Wassal (2012) reported a null or very limited impact of FDI inflows on economic growth in 16 Arab countries between 1970 and 2008. These unexpected findings are due to the fact that the impact of FDI depends on the local conditions of host countries (Adams and Opoku, 2015). A country reaps greater benefits from FDI in the presence of many conditions such as a well-functioning domestic market (Adjasi et al., 2012; Ali, 2014; Drogendijk and Blomkvist, 2013; Morrissey, 2012), skilled manpower (Ali, 2014; Morrissey, 2012), political and economic stability (Bartels et al., 2009), technological know-how (Morrissey, 2012)and appropriate infrastructures to support the development. However, few African countries have developed effective plans to capture the opportunities created by their collaboration with China (Shen, 2015).

Natural resources, employment rate and trade volume are, as expected, related to a high economic growth while inflation is found to hamper it. In fact, employment is the source of more economic activities which drive up economic growth. This result is supportive of Agrawal and Khan (2011). As far as trade is concerned, it promotes economic growth by generating more foreign currency as found by Sakyi et al. (2012), Abala (2014), Omri and kahouli (2014), Adams and Opoku (2015) and Sakyi et al. (2015). Inflation augments the cost of buying goods and undermines the value of savings which results in decreasing investment and definitely in a low economic growth. This result is consistent with those of Anyanwu (2012), Omri and kahouli (2014), Feeny et al. (2014) and Adams and Opoku (2015).

CONCLUSIONS AND POLICY IMPLICATIONS

This study investigates the relationship between Chinese outward foreign direct investment flows and economic growth in SSA. A panel regression model estimated with country and year fixed effects supports a positive effect of this investment on the continent economic growth. However, similar to other studies on other types of foreign direct investment, the impact is found to be weak. This implies the need for African countries to build a conducive environment that welcomes any foreign investment. The policies to design should be directed towards the fight against corruption, the rule of law, a sustainable openness, the promotion of competition, the offer of efficient financial infrastructures and the training of skilled labor. These elements will increase the continent absorptive capacity in terms of foreign investment. When more data become available a further investigation as well as a causality analysis is suggested.

Nevertheless, the results of this study should be cautiously interpreted. The findings may suffer from external validity because of the data limitation which did not permit the inclusion of all the sub-Saharan African countries. Also, the analysis uses aggregate data which, though incorporating the impact of broader policies, overlook countries heterogeneities effects on economic growth.

Despite these limitations, the findings of the study can still offer a benchmark for decision-makers in designing appropriate policies to welcome foreign direct investment.

The authors have not declared any conflict of interests.

The authors gratefully acknowledge full financial support from the People’s Republic of China through its scholarship granted by the China Scholarship Council.

REFERENCES

|

Abala DO (2014). Foreign direct investment and economic growth: an empirical analysis of Kenyan data. DBA Africa Management Review 4(1):62-83.

|

|

|

|

Adams S (2009a). Can foreign direct investment (FDI) help to promote growth in Africa? African Journal of Business Management 3(5):178-183.

|

|

|

|

|

Adams S (2009b). Foreign direct investment, domestic investment, and economic growth in Sub-Saharan Africa. Journal of Policy Modeling 31(6):939-949.

Crossref

|

|

|

|

|

Adams S, Opoku EEO (2015). Foreign direct investment, regulations and growth in sub-Saharan Africa. Economic Analysis and Policy 47:48-56.

Crossref

|

|

|

|

|

Adegbite EO, Ayadi FS (2011). The role of foreign direct investment in economic development: A study of Nigeria. World Journal of Entrepreneurship, Management and Sustainable Development 6(1/2):133-147.

Crossref

|

|

|

|

|

Adeniyi O, Omisakin O, Egwaikhide FO, Oyinlola A (2012). Foreign direct investment, economic growth and financial sector development in small open developing economies. Economic Analysis and Policy 42(1):105-127.

Crossref

|

|

|

|

|

Adisu K, Sharkey T, Okoroafo SC (2010). The impact of Chinese investment in Africa. International Journal of Business and Management 5(9):3-9.

Crossref

|

|

|

|

|

Adjasi C, Abor J, Osei KA, Nyavorâ€Foli EE (2012). FDI and economic activity in Africa: The role of local financial markets. Thunderbird International Business Review 54(4):429-439.

Crossref

|

|

|

|

|

Agrawal G, Khan MA (2011). Impact of FDI on GDP: A comparative study of China and India. International Journal of Business and Management 6(10):71.

Crossref

|

|

|

|

|

Ahmed AD, Cheng E, Messinis G (2011). The role of exports, FDI and imports in development: evidence from Sub-Saharan African countries. Applied Economics, 43(26):3719-3731.

Crossref

|

|

|

|

|

Ali S (2014). Foreign capital flows and economic growth in Pakistan: An empirical analysis. World Applied Sciences Journal 29(2):193-201.

|

|

|

|

|

Anshan L (2007). China and Africa: policy and challenges. China Security 3(3):69-93.

|

|

|

|

|

Anyanwu JC (2012). Why does foreign direct investment go where it goes?: new evidence from African countries. Annals of Economics and Finance 13(2):425-462.

|

|

|

|

|

Baltagi B (2008). Econometric analysis of panel data: John Wiley and Sons.

|

|

|

|

|

Bartels FL, Alladina SN, Lederer S (2009). Foreign direct investment in Sub-Saharan Africa: Motivating factors and policy issues. Journal of African Business 10(2):141-162.

Crossref

|

|

|

|

|

Belloumi M (2014). The relationship between trade, FDI and economic growth in Tunisia: An application of the autoregressive distributed lag model. Economic Systems 38(2):269-287.

Crossref

|

|

|

|

|

Berthélemy JC (2011). China's engagement and aid effectiveness in Africa. China and Africa: An Emerging Partnership for Development. pp. 1-34. Available at:

View

|

|

|

|

|

Besada H, Wang Y, Whalley J (2008). China's growing economic activity in Africa. In China's Integration into the World Economy. pp. 221-254.

Crossref

|

|

|

|

|

Castillo-Manzano JI, Castro-Nu-o M, Fageda X (2016). Exploring the relationship between truck load capacity and traffic accidents in the European Union. Transportation Research part E: Logistics and Transportation Review 88:94-109.

Crossref

|

|

|

|

|

Chen W, Dollar D, Tang H (2016). Why is China investing in Africa? Evidence from the firm level. The World Bank Economic Review lhw049. Available at:

View

Crossref

|

|

|

|

|

Claassen C, Loots E, Bezuidenhout H (2012). Chinese Foreign Direct Investment in Africa. African Journal of Business Management 6(47):11583-11597.

Crossref

|

|

|

|

|

Drogendijk R, Blomkvist K (2013). Drivers and motives for Chinese outward foreign direct investments in Africa. Journal of African Business 14(2):75-84.

Crossref

|

|

|

|

|

El-Wassal KA (2012). Foreign direct investment and economic growth in Arab countries (1970-2008): An inquiry into determinants of growth benefits. Journal of Economic Development 37(4):79.

|

|

|

|

|

Feeny S, Iamsiraroj S, McGillivray M (2014). Growth and foreign direct investment in the Pacific Island countries. Economic Modelling 37:332-339.

Crossref

|

|

|

|

|

Forte R, Moura R (2013). The effects of foreign direct investment on the host country's economic growth: theory and empirical evidence. The Singapore Economic Review 58(03):1350017.

Crossref

|

|

|

|

|

Gill B, Reilly J (2007). The tenuous hold of China Inc. in Africa. Washington Quarterly 30(3):37-52.

Crossref

|

|

|

|

|

Gohou G, Soumaré I (2012). Does foreign direct investment reduce poverty in Africa and are there regional differences? World Development 40(1):75-95.

Crossref

|

|

|

|

|

Gu J (2009). China's private enterprises in Africa and the implications for African development. The European Journal of Development Research 21(4):570-587.

Crossref

|

|

|

|

|

Gui-Diby SL (2014). Impact of foreign direct investments on economic growth in Africa: Evidence from three decades of panel data analyses. Research in Economics 68(3):248-256.

Crossref

|

|

|

|

|

Hamilton LC (2009). Statistics with STATA, updated for version 10. 10 Davis Drive. Belmont, CA, USA.

|

|

|

|

|

Hsiao C (2014). Analysis of panel data: Cambridge university press.

Crossref

|

|

|

|

|

Imoudu EC (2012). The impact of foreign direct investment on Nigeria's economic growth; 1980-2009: Evidence from the Johansen's cointegration approach. International Journal of Business and Social Science 3(6):122-134.

|

|

|

|

|

Inekwe JN (2013). FDI, employment and economic growth in Nigeria. African Development Review 25(4):421-433.

Crossref

|

|

|

|

|

Kang Z, Mbea B (2011). Foreign direct investment and economic growth in Cameroon. Paper presented at the Artificial Intelligence, Management Science and Electronic Commerce (AIMSEC), 2011 2nd International Conference on.

Crossref

|

|

|

|

|

Kaplinsky R, Morris M (2009). Chinese FDI in Sub-Saharan Africa: engaging with large dragons. The European Journal of Development Research 21(4):551-569.

Crossref

|

|

|

|

|

Lamine KM, Yang D (2010). Foreign direct investment effect on economic growth: Evidence from Guinea Republic in West Africa. International Journal of Financial Research 1(1):49.

|

|

|

|

|

Ministry of Commerce (2013). 2012 Statistical Bulletin of China's Outward Foreign Direct Investment: MOFCOM Beijing.

|

|

|

|

|

Morrissey O (2012). FDI in Sub-Saharan Africa: Few linkages, fewer spillovers. The European Journal of Development Research 24(1):26.

Crossref

|

|

|

|

|

Omri A, Kahouli B (2014). The nexus among foreign investment, domestic capital and economic growth: Empirical evidence from the MENA region. Research in Economics 68(3):257-263.

Crossref

|

|

|

|

|

Ouédraogo NB (2012). Foreign direct investment in Sub-Saharan Africa. African Journal of Economic and Sustainable Development 1(1):49-66.

Crossref

|

|

|

|

|

Renard MF (2011). China's Trade and FDI in Africa. Series N° 126. African Development Bank. Tunis, Tunisia. Available at: http://core.ac.uk/download/pdf/6429060.pdf

|

|

|

|

|

Sakyi D, Villaverde J, Maza A (2015). Trade openness, income levels, and economic growth: The case of developing countries, 1970–2009. The Journal of International Trade & Economic Development 24(6):860-882.

Crossref

|

|

|

|

|

Sakyi D, Villaverde J, Maza A, Reddy Chittedi K (2012). Trade openness, growth and development: evidence from heterogeneous panel cointegration analysis for middle-income countries. Cuadernos de Economía 31(SPE57):21-40.

|

|

|

|

|

Seyoum M, Wu R, Lin J (2015). Foreign Direct Investment and Economic Growth: The Case of Developing African Economies. Social Indicators Research 122(1):45-64.

Crossref

|

|

|

|

|

Shen X (2015). Private Chinese investment in Africa: Myths and realities. Development Policy Review 33(1):83-106.

Crossref

|

|

|

|

|

StataCorp (2015). Stata: Release 14. Statistical Software. College Station, TX: StataCorp LP.

|

|

|

|

|

Zafar A (2007). The growing relationship between China and Sub-Saharan Africa: Macroeconomic, trade, investment, and aid links. The World Bank Research Observer 22(1):103-130.

Crossref

|

|