ABSTRACT

The main objective of this study was to examine the relationship between risk disclosure and firm characteristics of companies quoted on the Nairobi Securities Market. The study involved all firms that were listed on the NSE between years 2010 and 2016, except the financial institutions. Annual reports were used to determine the variables. A regression analysis was conducted using the random effect model to determine the relationship between the disclosure index and firms’ characteristics. The results show that risk disclosure was positively related to gearing level, company size, profitability, and the industry type. However, it was not found to be related to the liquidity level, ownership and board composition.

Key words: Risk disclosure, firm characteristics, annual reports, Nairobi stock exchange.

In recent years, the concepts of “risk” and “risk management” have received significant attention. This is mainly due to the corporate scandals and corporate failures witnessed worldwide since the 1990s. There has also been debates on how risk information should be communicated to stakeholders. For example, American Accounting Association/Financial Accounting Standards Board (AAA/FASB) (1997) found that risk information provided in the annual reports of US firms was insufficient. The Institute of Chartered Accountants in England and Wales (ICAEW) (2002) encouraged UK companies to disclose more risk information in their reports. According to Beretta and Bozzolan (2004), financial risk disclosure may not be sufficient to inform stakeholders about the financial position of the firm. This is because market and operating risks also affect the performance of the firm and may not be captured in the financial statements. This means that the narrative section of the annual reports is very important in communication risk information (Robb and Zarzeski, 2001). According to Dunne et al. (2003), the narrative section in the annual reports helps stakeholders to understands risks and the risk management strategy of the firm. Risk disclosures help to increase investors confidence due to the increased transparency (Linsley and Lawrence, 2005; Abraham and Cox, 2007). The level of risk can be used in decision making, help to decrease the cost of capital and can be used to determine the market value of the firm more accurately (Beretta and Bozzolan, 2004; Abraham and Cox, 2007). According to Schrand and Elliott (1998), it is not easy to define risk due to the many factors that can affect a business operations, either negatively or positively. Risk emanates from the variabiability in the distribution of future outcomes (Rajab, 2009). Lajili and Zéghal (2005) define risk as the uncertainty that is associated with both a potential loss or gain. Most expert define risk as the variability where probabilities can be assigned and uncertainty as variability where probabilities cannot be assigned (Linsley and Shrives, 2005; Watson and Head, 2016). Risk disclosure has been defined by Beretta and Bozzolan (2004) as the communication of information on factors such which have potential to affect expected returns. Hassan (2009) defines corporate risk disclosure as inclusion in the financial statements of information about managers’ estimates and judgments about operational, economic, political and financial risks. According to Linsley and Shrives (2006), disclosures are regarded as risk disclosures, if the provided information has impacted or will impact on the firm sometimes in future. From these definitions, it is clear that risk discloure is about presenting information about uncertain outcomes, good or bad.

Many of the previous studies on risk disclosures have been in developed countries such as US, Canada, UK and Germany (Beretta and Bozzolan, 2004; Linsley and Shrives, 2006). Linsley and Shrives (2005) examined annual reports of UK companies and found that firms can reduce cost of capital by disclosing more risk information. Dietrich et al. (2001) found that disclosing more forward-looking information in the annual reports leads to improved market efficiency. Kajüter (2001) examined risk disclosures in the annual reports of 82 non-financial German companies, and found that the companies did not adopt a systematic approach to risk reporting and, therefore, the disclosure of risk information was restricted. Woods and Reber (2003) found that German companies disclosed more information due to the the requirements of GAS5. Beretta and Bozzolan (2004) studied 85 companies listed on the Italian Stock Exchange and found that firms disclosed past and present risks but not future risks. Elmy et al. (1998) found that US companies dislose very little risk information. Similar results were obtained by Collins et al. (1993) who found that UK companies disclosed past present and future information about risk but at a limited scale. Amran et al. (2008) studied Malaysian firms and had similar results.

Determinants of RD and hypothesis development

Various studies have shown that risk disclosures are affected by different firm characteristics. These firm characteristics incude: size, liquidity, industry type, profitability, gearing, ownership, board composition, audit committee size, and role duality. These are referred to as risk disclosure determinats and are discussed below:

Size

A number of studies have shown that the firm’s size affect the level of risk disclosure. Studies such as Hossain et al. (1995), Beattie et al. (2004) and Amran et al. (2008) have found a positive relationship between size and risk dosclosures. Some studies, for example, by Hassan (2009) and by Lajili and Zéghal (2005) found no significant relationship between the two variables. In order to increase investors’ confidence, justify the higher returns and to decrease political sensitivity, larger firms disclose higher level of risk information (Abraham and Cox, 2007; Hassan, 2009). The second reason why larger companies disclose more information is because it is less costly to disclose additional information compared to smaller companies.

Liquidity

In line with the signalling theory, firms will disclose more risk information if their liquidity is high in order to distinguish themselves from low liquidity firms. Research on the infuence of liquidity on the extent of risk disclosures have shown mixed results. Marshall and Weetman (2007) and Elzahar and Hussainey (2012) produced results that support the signalling theory, because they found that there is a significant relationship between liquidity and risk disclosures. Mangena and Pike (2005) found no statistically significant relationship between liquidity and risk disclosure in annual reports. Wallace et al. (1994) found a negative relationship between liquidity and risk disclosures indicating that high liquid companies disclose less information compared with companies with lower liquidity.

Industry type

Due to the fact a firm would want to be appreciated in the market, it is likely to disclose the same level of risk disclosures as other firms in the same industry. Firms in the same indistry are also likely to disclose the same level of risk disclosures because they face the same professional and legal pressures (Touron, 2005; Hassan, 2009). Several studies have found a positive relationship between risk disclosures and industry type (Hassan, 2009). However, there are other studies that have not found any relationship between the two variables (Beretta and Bozzolan, 2004).

Profitability

Agency theory expects that high profitable companies report more information inclusing risk information. This is because managers in such organisation want to justify their performanance to the stakeholders. Studies have provided mixed results on the relationship between profitability and risk disclosures. For example, Al-Shammari (2014) show a significant postive relationship between the two variables. Elzahar and Hussainey (2012) and Mousa and Elamir (2013) find a negative relationship.

Gearing

Based on agency theory, high-geared firms have more agency costs and therefore need to diclose more information (Jensen and Meckling, 1976). In order to send positive signal to stakeholders about the firm’s ability to meet its obligations, managers of high-geared firms are likely to diclose more risk information. Deumes and Knechel (2008) and Taylor et al. (2010) found a positive relationship between gearing and risk disclosures while Abraham and Cox (2007) and Rajab and Handley-Schachler (2009) did not find any relationship.

Ownership

Increasing the number of owners can help solve the problem of monitoring an organization (Schipper, 1981). Disclosures tend to increase with increased number of shareholders. This is because firms, in order to provide information to stakeholders, will provide additional information. Firms with dispersed ownership are likely to have higher agency costs, due to the pressure by the stakeholders to provide more information (Mohobbot, 2005). There are many studies that have found that firms with dispersed ownership provide more information than firms with concentrated ownership. For example, Chen et al. (2008) found that family-owned firms provide less information than non-family owned businesses. Others who have found a positive relationship between risk disclosures and increase in dispersion of ownerships include Mohobbot (2005) and Mangena and Tauringana (2007). Konishi and Ali (2007) found an insignificant relationship between ownership and risk disclosures while Deumes and Knechel (2008) found a negative relationship.

Board composition

Good corporate governance principles require that the board have a mix of executive directors and non-executive directors. Non-executive directors are expected to provide unbiased independent advice to executive directors, due to their lack of association with the firm. Non-executive directors are therefore expected to be more effective in monitoring the firm, and firms with a high-proportion of non-executive directors are expected to be more effective in diclosing information (Fama and Jensen, 1983). Cheng and Courtenay (2006), and Abraham and Cox (2007), have found a positive relationship between the level of risk disclosures and the proportion of non- executive directions. Ho and Wong (2001) and Haniffa and Cooke (2002) found no relationship between the two variables.

Audit Committee size

Good corporate governance require that a firm has an Audit Committee that has a number of non-executive directors. It also required that an Audit Committee should be large enough so as to have a large skills set (Mangena and Pike, 2005). One of the main function of the Audit Committee is to review the firm’s internal control systems (Smith Committee, 2003). Nahar et al. (2016) found a positive relationship between risk disclosures and the Audit Committee size. However, Mangena and Pike (2005) found no significant relationship between the two variables.

Role duality

Role duality occurs if the Chairman of the Board of Directors is also the chief executive officer (CEO). Where a person holds both positions, the board’s oversight is impaired due to the concentration of decision-making power (2008). Good corporate governance requires that the two roles are separated. Previous studies have produced mixed results on the role of role duality on risk disclosure. For example, Vandemaele and et al. (2009) found a positive relationship between the two varibales, while Forker (1992) and Haniffa and Cooke (2002) found a negative relationship. Accordingly, the following hypothesis was tested:

H0: there is no significant relationship between risk disclosures and firm characteritics of companies.

This research used the positivist approach. This is in line with most research studies on information disclosures in reports of firms (Amran et al., 2008; Rajab and Handley-Schachler, 2009; Mohobbot, 2005). In this study, the values of variables were determined using analyses of annual reports of the listed companies at Nairobi Securities Exchange (NSE).

Sample and data

The sample consited of final reports of non-financial companies that are listed on the Nairobi Securities Exchange (NSE). The finance institutions were removed from the sample because they are required by regulations to disclose certain risk information. This is inline with several studies such as by Linsley and Lawrence (2005), Abraham and Cox (2007), and Elzahar and Hussainey (2012). Annual reports of companies from 2010 to 2016 were used to collect risk information and other company characteristics.

Risk disclosure index

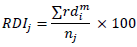

Researchers have used content analysis and disclosure indices to measure extent of disclosures (Wachira, 2017). This study used risk disclosure index. Through a pilot study, risk disclosures items were determined. In the determination of risk disclosure index, an item was given a score of zero if it was not disclosed and a score of one it was disclosed (Madrigal et al., 2015). To calculate the risk disclosure index, the following formula was used.

Where, RDIj is the risk disclosure index for jth firm, rdi is 0 if the item was not disclosed and 1 if the item was disclosed; nj was the maximum number of items that could be disclosed by jth firm. Un-weighted disclosure index was used because there was no way of determining weights to use.

Reliability, validity and transferability

An independent evaluator was used to test the reliability of the disclosure index. Where the results obtained by the study were compared with the results of the independent evaluator. Additionally, accountants from the companies were asked about the accuracy of the index until they agreed that it properly reflected the risk disclosure for their companies.

Data analysis

Panel data, which consisted of longitudinal and cross-sectional data for the period 2010 to 2016 was used. The model below was therefore tested.

Where: RDI: Risk Disclosure index; GR: Gearing ratio; SZ: Size of the company; PR: Profitability; LQ: Liquidity of the company; ID: Industry to which the company belongs; ON: Ownership structure; ND: Proportion of non-executive directors (Board Composition); DL: Leadership structure; AT: Auditor type; AC: Presence of the Audit Committee; and É›: Error term (residual value). Because the research involved panel data, it was not possible to use the ordinary least squares method to estimate the parameters in the regression model (Kohler and Kreuter, 2009) (Table 1). In estimating parameters in panel data, use is made of the fixed-effects or the random-effects model. Statistically, the fixed-effects model is the model for panel data multivariate analysis. However, sometimes the random-effects model produces better estimators. The Hausman test (Hausman, 1978) is used to determine which of the two would produce the best results.

Multivariate analysis

In a panel data analysis, one has to choose whether to use the fixed-effects model or the random effects model. Hausman test (Hausman, 1978) is used to test whether the coefficients estimated by the fixed-effect model and the random effect model are the same. Significant P value shows that coefficients are different and therefore the fixed effect model should be used. In this case the Chi2 (5) had a value of 20.32 and a Prob>Chi2 =0.011. This means that the Chi2 was significant at 5% level of significance and therefore the fixed-effects model was more appropriate to use in the regression analysis. However, after running the fixed-effects regression some of the dummy variables that do not change over time get omitted from the model. A time-invariant variable is omitted from the fixed-effects model because such models are designed to study the causes of changes within the entity being studied (Kohler and Kreuter, 2009). The regression analysis was therefore conducted using the random effect model and the results were obtained. The results obtained indicates that gearing, size, profitability, and the industry in which a company operates were significant at 5% level of significance. Liquidity, ownership, presence of non-executive directors, were not significant at 5% level of significance. Audit type, leadership structure and the presence of an audit committee were not included in the model because the data obtained was the same for all companies studied.

Gearing

According to the findings, gearing does affect the level of risk disclosures. This agrees with studies such as by Tauringana and Chithambo (2016). This does not agree with several studies such as by Elzahar and Hussainey (2012), which found that gearing does not significantly affect the level of risk disclosures. According to this study, a high geared company discloses more risk information. This could be due to the need to assure stakeholders about its viability.

Size

The finding in this study is that the level of risk disclosure is positively affected by the size of the company. This finding is consistent with previous findings such as by Mohobbot (2005), Linsley and Shrives (2005), and Madrigal et al. (2015). This supports the stakeholder theory which posit that larger firms are likely to disclose more information because they have many different stakeholders (Wachira, 2017).

Profitability

Profitability was found to have a positive influence on the level of risk disclosures. This finding agrees with studies by Singhvi (1967) and Abu-Nasar and Rutherford (1994). The findings contradict several studies which have found a negative relationship between profitability and risk disclosures (King and Lenox, 2001). For example, King and Lenox (2001) found that risk disclosures reduce profitability because of the costs it entails. It also contradicts findings by Stanwick and Stanwick (2006) and, Elzahar and Hussainey (2012), who found no correlation between financial performance and risk disclosures. The positive association between profitability and risk disclosures can be explained by legitimacy theory. Very profitable companies may disclose more information in order to justify the level of their reported profits (Haniffa and Cooke, 2005). This positive association can also be explained using the agency theory. According to the agency theory, in order to justify their higher pay, managers in high profitable companies are likely to disclose more information (Wachira and Jankowicz, 2017).

Industry

The relationship between risk disclosures and the industry that the firm belongs to was found to be positive and significant. These findings agree with findings by Elzahar and Hussainey (2012) and Madrigal et al. (2015), but contrast with most of the studies on risk disclosures (Abraham and Cox, 2007). Stakeholder pressure and associated political pressure can explain why an industry in which a company operates influences the level of risk disclosures.

Liquidity

This study finds that there is no significant relationship between risk disclosures and the liquidity of a company. This finding agrees with Al Shammari et al. (2008) and Elzahar and Hussainey (2012) who found no relationship between the two variables.

Ownership

The study found a no significant relationship between ownership and level of risk disclosures. These findings disagree with Deumes and Knechel (2008) who found a negative relationship and with Konishi and Ali (2007) who found positive association between the two variables.

Board composition

The result of this study indicates that the proportion of independent directors did not affect risk disclosures. This study agrees with the findings of Ho and Wong (2001) and Haniffa and Cooke (2002) who found no relationship between the two variables, but disagrees with the findings if Cheng and Courtenay (2006), and Abraham and Cox (2007), who found a positive relationship between the level of risk disclosures and the proportion of non- executive directions.

From the analysis, four factors, namely gearing level, company size, profitability and industry type were found were found to have positive relationship with risk disclosures. No significant relationship was found between risk disclosures and liquidity, ownership and board composition. The fact that the four variables have positive relationship with risk disclosures is an indication that legitimacy, stakeholder and agency theories can be used to explain why listed companies in Kenya disclose risk information.

Limitations of the study

Though an attempt has been made to use a longitudinal study, the time covered is short: only seven years. A study that covers a longer period can help reveal more information of the risk disclosures practise in Kenya. This study, however, covers a longer period than most risk disclosures studies that are cross-sectional. The sample consisted of listed companies only. Because of the monitoring by the Capital Markets Authority (CMA) and listing requirements of the Nairobi Securities Exchange (NSE), listed companies are likely to disclose more information compared to unlisted companies. They are also in the public limelight because they are required to publish some pertinent information. The study, therefore, is limited in the sense that it did not include companies that are small and are not closely monitored by NSE and CMA. In this study, only annual reports were used. Annual reports may not capture all the disclosed information because companies may have used other media, such as websites and stand-alone reports. Use of annual reports, however, is consistent with many risk disclosures studies due to the fact that they are the most important documents. Content analysis was used for this study. Use of content analysis can be criticized for being subjective because people can interpret the same information differently. To minimize errors an independent evaluator was used to analyse the information and the result compared with the findings of the main study. The independent evaluator was an accountant with one of the main auditing firm with good understanding of risk disclosures. This was meant to make the data obtained more reliable.

Further research

Investigation should be done on corporate social responsibility information disclosures in reports other than the annual reports. This is because as risk disclosures develops, more and more reports apart from the annual reports will disclose more social responsibility information. This research only covered companies listed on the stock market. Further research should be conducted into companies that are not listed on the stock market so as to compare the findings of the listed companies and those of others.

The author has not declared any conflict of interests.

REFERENCES

|

Abraham S, Cox P (2007). Analysing the determinants of narrative risk information in UK FTSE 100 annual reports. The British Accounting Review, 39(3):227-248.

Crossref

|

|

|

|

Abu-Nasar M, Rutherford B (1994). Prepare's attitude to financial reporting in less developed countries with moderately sophisticated capital markets: the case of Jordan. The International Journal of Accounting, 30(2):129-138.

|

|

|

|

Al Shammari B, Brown P, Tarca A (2008). An investigation of compliance with International Accounting Standards by listed companies in the Gulf Co-Operation Council member states. The International Journal of Accounting, 43(4):425-447.

Crossref

|

|

|

|

Al-shammari B (2014). Kuwait corporate characteristics and level of risk disclosure: A content analysis. Journal of Contemporary Issues in Business Research, 3(3):128-153.

|

|

|

|

Amran A, Bin A, Hassan B (2008). Risk reporting: An exploratory study on risk management disclosure in Malaysian annual reports. Managerial Auditing Journal, 24(1):39-57.

Crossref

|

|

|

|

Beattie V, McInnes W, Fearnley S (2004). Through the Eyes of Management: Narrative Reporting Across Three Sectors: Final Report., London: Centre for Business Performance.

|

|

|

|

Beretta S, Bozzolan S (2004). A framework for the analysis of firm risk communication. The International Journal of Accounting, 39(3):265-288.

Crossref

|

|

|

|

Cheng E, Courtenay S (2006). Board composition, regulatory regime and voluntary disclosure. The International Journal of Accounting, 41(3):262-289.

Crossref

|

|

|

|

Chen S, Chen X, Cheng Q (2008). Do family firms provide more or less voluntary disclosure?. Journal of Accounting Research, 45:1-38.

Crossref

|

|

|

|

Collins W, Davie E, Weetman P (1993). Management discussion and analysis: an evaluation of practice in UK and US companies. Accounting and Business Research, 23(90):123-137.

Crossref

|

|

|

|

Deumes R, Knechel W (2008). Economic incentives for voluntary reporting on internal risk management and control systems. A Journal of Practice & Theory, 27(1):35-66.

|

|

|

|

Dietrich JR, Kachelmeier SJ, Kleinmuntz DN, Linsmeier TJ (2001). Market efficiency, bounded rationality, and supplemental business reporting disclosures. Journal of Accounting Research, 39(2):243-268.

Crossref

|

|

|

|

Dunne T, Helliar C, Mallin C, Power D (2003). The financial reporting of derivatives and other financial instruments: a study of the implementation and disclosures of FRS 13., London: The Institute of Charteresd Accountants In England & Wales.

|

|

|

|

Elmy F, LeGuyader L, Linsmeier T (1998). A review of initial filings under the SEC's new market risk disclosure rules. Journal of Corporate Accounting & Finance, 9(4):33-45.

Crossref

|

|

|

|

Elzahar H, Hussainey K (2012). Determinants of narrative risk disclosures in UK interim reports. Journal of Risk Finance, 13(2):133-147.

Crossref

|

|

|

|

Fama E, Jensen M (1983). Separation of ownership and control. Journal of Law and Economics, 26(4):9-15.

Crossref

|

|

|

|

Forker J (1992). Corporate governance and disclosure quality. Accounting and Business Research, 22(86):111-124.

Crossref

|

|

|

|

Haniffa R, Cooke T (2002). Culture, corporate governance and disclosure in Malaysian corporations. ABACUS, 38(3):317-349.

Crossref

|

|

|

|

Haniffa R, Cooke T (2005). The impact of culture and governance on corporate social reporting. Journal of Accounting and Public Policy, 24:391-430.

Crossref

|

|

|

|

Hassan M (2009). UAE corporations-specific characteristics and level of risk disclosure. Managerial Auditing Journal, 24(7):668-687.

Crossref

|

|

|

|

Hausman J (1978). Specification tests in econometrics. Econometrika, 46:1273-1291.

Crossref

|

|

|

|

Hossain M, Perera M, Rahman A (1995). Voluntary disclosure in the annual reports of New Zealand companies. Journal of International Financial Management and Accounting, 6(1):69-87.

Crossref

|

|

|

|

Ho S, Wong K (2001). A study of the relationship between corporate governance structures and the extent of voluntary disclosure. Journal of International Accounting, Auditing and Taxation, 10(1):139-156.

Crossref

|

|

|

|

Jensen M, Meckling W (1976). Theory of the firm: managerial behaviour, agency costs and ownership structure. Journal of Financial Economics, 3:305-360.

Crossref

|

|

|

|

Kajüter P (2001). Risikoberichterstattung: Empirische Befunde und der Entwurf des DRS 5. Der Betrieb, 54(3):105-111.

|

|

|

|

King A, Lenox M (2001). Does it really pay to be green? Accounting for strategy selection in relationship between environmental and finance performance. Journal of Industrial Ecology, 5(1):105-116.

Crossref

|

|

|

|

Kohler U, Kreuter F (2009). Data Analysis Using Stata. 2 ed. College Station, Texas: Stata Press.

|

|

|

|

Konishi N, Ali M (2007). Risk reporting of Japanese companies and its association with corporate characteristics. International Journal of Accounting Auditing and Performance Evaluation, 4(3):263-285.

Crossref

|

|

|

|

Lajili K, Zéghal D (2005). A content analysis of risk management disclosures in Canadian annual reports. Canadian Journal of Administrative Sciences, 22(2):125-142.

Crossref

|

|

|

|

Li J, Pike R, Haniffa R (2008). Intellectual capital disclosure and corporate governance structure in UK firms. Accounting and Business Research, 38(2):137-159.

Crossref

|

|

|

|

Linsley P, Lawrence M (2005). Risk reporting by the largest UK companies: readability and lack of obfuscation. Accounting, Auditing and Accountability Journal, 20(4):620-627.

Crossref

|

|

|

|

Linsley P, Shrives P (2005). Examining risk reporting in UK public companies. The Journal of Risk Finance, 6(4):292-305.

Crossref

|

|

|

|

Linsley P, Shrives P (2006). Risk reporting: A study of risk disclosures in the annual reports of UK companies. Risk reporting: A studyThe British Accounting Review, 38(4):387-404.

Crossref

|

|

|

|

Madrigal M, Guzmán B, Guzmán C (2015). Determinants of corporate risk disclosure in large Spanish companies: a snapshot. Contaduría y Administración, 60(4):757-775.

Crossref

|

|

|

|

Mangena M, Pike R (2005). The effect of audit committee shareholding, financial expertise and size on interim financial disclosures. Accounting and Business Research, 35(4):327-349.

Crossref

|

|

|

|

Mangena M, Tauringana V (2007). Disclosure, corporate governance and foreign share ownership on the Zimbabwe stock exchange. Journal of International Financial Management and Accounting, 18(2):53-85.

Crossref

|

|

|

|

Marshall A, Weetman P (2007). Modelling transparency in disclosure: the case of foreign exchange risk management. Journal of Business Finance and Accounting, 34(5-6):705-739.

Crossref

|

|

|

|

Mohobbot A (2005). Corporate risk reporting practices in annual reports of Japanese companies. Japanese Journal of Accounting, 16(1):113-133.

|

|

|

|

Mousa G, Elamir E (2013). Content analysis of corporate risk disclosures: The Case of Bahraini Capital Market. Global Review of Accounting and Finance, 4(1):27-54.

|

|

|

|

Nahar S, Azim M, Jubb C (2016). The determinants of risk disclosure by banking institutions: Evidence from Bangladesh. Asian Review of Accounting, 24(4):426-444.

Crossref

|

|

|

|

Rajab B (2009). Corporate Risk Disclosure, Edinburgh,UK: Edinburgh Napier University.

|

|

|

|

Rajab B, Handley-Schachler M (2009). Corporate risk disclosure by UK firms: trends and determinants. World Review of Entrepreneurship, Management and Sustainable Development, 5(3):224-243.

Crossref

|

|

|

|

Robb S, Zarzeski L (2001). Nonfinancial disclosures across Anglo-American countries. Journal of International Accounting, Auditing and Taxation, 10(1):71-83.

Crossref

|

|

|

|

Schipper K (1981). Discussion of voluntary corporate disclosure: The case of interim reporting. Journal of Accounting Research, 19:85-88.

Crossref

|

|

|

|

Schrand C, Elliott J (1998). Risk and financial reporting: A summary of the discussion at the 1997 AAA/FASB conference. Accounting Horizons, 12(3):271-282.

|

|

|

|

Singhvi S (1967). Corporate disclosure through annual reports in the USA and India, New York: Doctoral Dissertation, Columbia University.

|

|

|

|

Smith Committee (2003). Audit Committee Combined Code Guidance. London: Financial Reporting Council.

|

|

|

|

Stanwick P, Stanwick S (2006). Corporate environemtal disclosure: a longitudinal study of Japanese firms. Journal of American Academy of Business, 9(1):1-7.

|

|

|

|

Tauringana V, Chithambo L (2016). Determinants of risk disclosure compliance in Malawi: a mixed-method approach. Journal of Accounting in Emerging Economies, 6(2):111-113.

Crossref

|

|

|

|

Taylor G, Tower G, Neilson J (2010). Corporate communication of financial risk. Accounting and Finance, 50:417-446.

Crossref

|

|

|

|

Touron P (2005). The adoption of US GAAP by French firms before the creation of the International Accounting Standard Committee: an institutional explanation. Critical Perspectives on Accounting, 16(6):851-873.

Crossref

|

|

|

|

Vandemaele S, Vergauwen P, Michels A (2009). Management Risk Reporting Practices and their Determinants: A Study of Belgian Listed Firms, Hasselt, Belgium: Working Paper, Hasselt University..

|

|

|

|

Wachira M (2017). Determinants of Corporate Social Disclosures in Kenya: A Longitudinal Study of Firms Listed on the Nairobi Securities Exchange. European Scientific Journal, 13(11):112-132.

Crossref

|

|

|

|

Wachira M, Jankowicz D (2017). How Accountants Perceive and Construe the Intention to Disclose Social Responsibility Information: A Study of Kenyan Companies. European Journal of Business and Management, 9(9):93-108.

|

|

|

|

Wallace R, Naser K, Mora A (1994). The relationship between comprehensiveness of corporate annual reports and firm characteristics in Spain. Accounting and Business Research, 25(97):41-53.

Crossref

|

|

|

|

Watson D, Head A (2016). Corporate finance: principles & practice. 7 ed. Edinburgh: Pearson Education.

|

|

|

|

Woods M, Reber B (2003). A comparison of UK and German reporting practice in respect of risk disclosures post GAS 5, Seville, Spain.: EAA 2003 Congress, Seville, Spain.

|