ABSTRACT

The study employed the World Bank Enterprise survey 2013 for Uganda and quintile method to determine the relationship between firm location, International Standards Organization (ISO) certification and cash inflows of Small and Medium Enterprises (SMEs) in Uganda. The results show that ISO certification and firm location are positively and significantly related to SMEs’ cash inflows. It was also realized that other factors such as using email, foreign ownership, access to finance and tax administration are not obstacles to firm’s cash inflows. Our findings suggest that creating awareness among entrepreneurs about ISO certification and creating enabling environment for SMEs in Uganda to become ISO certified should be highly considered by Government of Uganda. In addition, the Government of Uganda with Kampala Capital City Authority must develop deliberate policy to enable SMEs get internet connection cheaply and faster. This will ease doing businesses and enable SMEs’ cash inflows to grow.

Key words: Cash inflows, location, International Standards Organization (ISO) certification, Uganda.

Micro, Small and Medium Enterprises (MSMEs) are major contributors to economic growth of developing nations (Calice et al., 2012). Currently, the number of SMEs operating in Uganda’s economy is estimated to exceed 1,100,000, and SMEs contribute approximately 80% to Gross Domestic Product (GDP). In addition, SMEs employ approximately 2.5 million people (National Strategy for Private Sector Development, 2017). To support SMEs, the National Development Plan II (NDP II, 2015) indicates to Government of Uganda the need to establish incubation centers for SMEs to promote and accelerate the use of research, innovation and applied technology. Furthermore, NDP II (2015) provides that Government of Uganda should strengthen standards and processes for SME production. This is for the purpose of enhancing the use of standards and quality infrastructure in industry as an objective of developing Uganda’s industrial sector. Given the stated benefits and measures, it is evident that SMEs are important for Uganda’s economic development. Having discussed the contribution of SMEs to the economy, it is important to consider ISO certification, firm location and cash inflow in the following paragraphs.

Firms hold cash to be able to make regular transactions (transaction cost motive), ability to finance emergencies (precautionary motive) and financing future activities and investments when cash is costly or unavailable (speculative motive) (Oler and Picconi, 2014). In addition, cash holdings can help a firm retire all debt obligations (Bates et al., 2009). Because of the importance of cash to a firm’s operations, the study investigates the factors which influence the cash inflows of the firm. Having discussed the importance of cash holding in a firm, it is imperative to introduce International Organization on Standards (ISO), thus the following paragraph.

The International Organization on Standards (ISO) is a framework where standards on quality assurance in design, production, installation and services are developed. This frame work involves a set of standards, for instance ISO 9000, ISO 9001, ISO 9003, ISO 9004-2, ISO 14000, ISO 22314, ISO 44001, ISO 20700 and ISO 20400 (International Standards Organization, 2017). The entire set of standards aims at ensuring that goods and services are provided on internationally recognized standards framework which is environmentally friendly (Aba and Badar, 2013). It was established that ISO 9000 standards empower customers to assess the quality of products. Eventually products whose quality is conceived to be high, attract more customers, hence increases sales and cash inflows. On the other hand, Beck and Walgenbach (2009) empirically established that in areas known for low quality products such as East Germany, ISO 9000 standards do not lead to high sales per employee. It is further noted that, Gruca and Rego (2005) had established a significant relationship between customer satisfaction and increase in future cash flows of the firm. It can therefore, be argued that complying with international standards of practice by being ISO certified may help in increasing firm cash inflows.

However, for SMEs operating in Uganda, obtaining ISO certificate is ideal but the required quality and quantity by ISO is high, thus limiting SMEs (Ernst and Young, 2011). Moreover, in some market segments such as Ugandan banana products, quality is not a concern for consumers in the local market (Kiiza et al., 2004). If quality is not a concern for consumption in some sectors, one would wonder whether ISO certification can create any influence on firm cash inflows. Having discussed ISO certification, it is important to consider firm location, hence the following paragraph.

It is practical that if firms locate near source of materials, the cost of production reduces hence low prices for goods and services. It can also be argued that firms located in urban centers have access to customers with high purchasing power. However, locating firms in areas known for low quality products cannot lead to increased sales (Beck and Walgenbach, 2009). In addition, an increase in population size within firm location, results in an increase in variety of local goods produced Holmes (1999). This is in anticipation of new customers with quite different tastes and preferences. Furthermore, it is empirically significant that SMEs located in big cities have less liquidity problems compared to those in peripheral (Voulgaris et al., 2003). It is thus indicated that firms located in bigger towns or those in towns with high population size can have cash inflow advantages because of exposure to a large number of customers. However, an investigation was required in Uganda to establish the reality of this position because, though Uganda has many emerging towns, a capital city and rising population, there is increased number of poor people (Uganda Bureau of Statistics, 2017). Therefore, the study had to investigate whether location influences firm’s cash inflows in Uganda.

There are myriad of studies about SMEs operations in Uganda, for example, Tushabomwe-Kazooba (2006) studied the causes of business failure in Uganda: A case of Mbarara town in Western Uganda. Ntayi et al. (2013) focused on moral values in SMEs while applying for licenses or under circumstances of tax payment. Kakeeto-Aelen et al. (2014) studied the impact of trust on customer satisfaction in Ugandan restaurants. Turyakira et al. (2014) discussed extensively about corporate social responsibility (CSR) in Ugandan SMEs. Wangalwa et al. (2016) studied the on-farm milk handling practices in Mbarara (Western Uganda). Kintu (2017) established empirical evidence of the relationship between core values and entrepreneurial performance in SMEs of Uganda’s central region. The study by Namagembe et al. (2018) focused on green practices and firm performances. In addition, the study by Islam et al. (2018) discussed the contribution of mobile money to firm investment. None of the above mentioned considered cash inflows, location and ISO certification in SMEs in Uganda. Although Tushabomwe-Kazooba (2006) discussed location, which is one of the variables in the current study, his study was not specific on which kind of places businesses should locate to have a consistent flow of cash and does not consider ISO certification. Furthermore, Uwonda et al. (2013) considered cash flow management in SMEs in Uganda’s Lango Sub-region, Turyahikayo (2015) focused on challenges of financing SMEs in Uganda, while Mutesigensi et al. (2017) focused on cash flows and survival of SMEs in Uganda’s West Nile region. Whereas, such immediate studies considered many factors for cash flows in Ugandan firms, non-considered location and ISO certification as factors affecting cash inflows in Uganda’s SMEs. It was thus, important to conduct this study to close the knowledge gap.

In order to establish the relationship between cash inflows and ISO certification, and the relationship between cash inflows and firm location among SMEs in Uganda, the following questions were listed:

i) What is the relationship between ISO certification and cash inflows of firms in Uganda?

ii) What is the relationship between location of firms and cash inflows of firms in Uganda?

For the purpose of this study, SMEs were considered as unit of analysis rather than micro enterprises. In addition, cash inflows is measured by percent of total annual sales because entrepreneurs in Uganda can easily understand how firms can generate sales (Kintu, 2017), rather than acquiring credit. ISO certification is measured by ability to possess internationally recognized quality certification, and location is measured by capital city (Kampala) and other towns in Uganda.

Cash is considered to be an important factor while managing firm’s working capital (Abioro, 2013; Enow and Kamala, 2016). In addition, SMEs failure has been linked to inadequate cash flow management (Uwonda et al., 2013). Although the study by is about cash flow management, it was limited on owner’s inefficiencies, poor tax planning and poor working capital management as causes of cash flow mismanagement. ISO certification and firm location was not studied.

ISO certification and cash inflows

The frame work of ISOs involves a set of standards for instance ISO 9000, ISO 9001, ISO 9003, ISO 9004-2 and ISO 14000. The aim of these standards is to ensure that goods and services are provided at an international standard (Aba and Badar, 2013). The ISO certification can be of a competitive advantage to firms. Entrepreneurs, therefore, need to re-affirm their strategies by adopting them. With ISOs being adopted, retail sales can more than double (International Standards Organisation, 2017).

Corbett et al. (2005) empirically established that ISO 9000 certification influences faster growth in firm’s sales. However, the growth does not mean sales increase is relative to asset base. In addition, Beata and Naotaka (2018) using a firm level panel data in Slovenia covering a period 1987 to 2006, established that ISO 9000 certification boosts firms’ sales, exports and employment. Mahelet (2014) established financing from local customers as one of the significant determinants of ISO certification among firms in Ethiopia.

The ISO standards provide a basis upon which international consumers can rely to purchase products. The ISO certification in modern days is a pre-requisite for firms if they are to achieve quality, environmental protection and thus appeal to a large clientele. It is ideal for Ugandan firms, therefore, to become ISO certified in the quest for large market to grow the cash inflows. However, the challenge that exists with Ugandan firms is that most of them do not promote a formal agenda, yet ISO must operate under formal systems.

In addition, Ugandan SMEs find the criteria for being ISO certified difficult to cope with (Ernst and Young, 2011) and at the same time, some Ugandan consumers in specific markets such as the banana products market do not care about quality to consume (Kiiza et. al., 2004). It is thus interesting to establish whether ISO certification can influence firm cash inflows in situations where most firms do not want to be formal or find it hard to be ISO certified and having a section of customers not minding quality to consume. The following hypothesis can thus be stated:

H1: There is a positive significant relationship between ISO certification and cash inflows in Ugandan firms.

H0: There is no positive significant relationship between ISO certification and cash inflows in Ugandan firms.

Firm location and cash inflows

It is projected that by 2025, the ratio of urban to rural dwellers will be 3:2 (Satterthwaite et al., 2010). The growth in population may be associated with increase in demand for products and product variety. Holmes (1999) contended that firms located in places of high population have an opportunity to produce a variety of goods for the market. Furthermore, firms locate where they expect market opportunities (Lucia et al., 2012). In addition, because they have less access to information and high operating costs, rural firms are less liquid compared to urban firms (Tim and Paul, 2005).

The studies which relate firm location to liquidity/or firm sales/or cash inflows are from developed world such as the United States of America. Thus, there are limited study findings about the subject in under-developed economies such as Uganda.

Although firms are free to establish anywhere in Uganda, firms which locate in urban centers have an advantage of serving the community with higher purchasing power and incur lower transaction costs. However, Uganda is unique in a way; as population rises, the number of poor people also increases (Uganda Bureau of Statistics, 2017). Therefore, it may not be a surprise that firms that locate in urban areas have stagnating sales which affect their cash inflows/or liquidity. It is important then to establish the effect of location to firm’s cash inflows. From the above discussion the following hypotheses arise:

H2: There is a significant positive relationship between firm location and firm cash inflows.

H0: There is no significant positive relationship between firm location and firm cash inflows.

In order to provide insight on the effect of firm location and possession of an ISO on cash inflow, this study employs both descriptive and quantitative statistical techniques. Descriptive statistical analysis entails the use of cross-tabulations where we generated the average percentages of firms and by key background characteristics in order to draw insights on the interactions between different characteristics. On the other hand, quantitative statistical techniques entail the estimation of an empirical model with a view of answering the set study questions.

Empirical model

The empirical model employed in this section draws from Beck and Walgenbach (2009), but with modifications in the outcome variable and also the explanatory variables considered in the overall model. It is assumed that within each firm

The quintile regression is deemed appropriate because unlike the OLS, it permits assessing the effect of different explanatory variables at various quintiles in the distribution of the dependent variable. The quintile regression estimation is also more robust in case of presence of any outliers and also when the dependent variable is not normally distributed. Results from the OLS estimation are reported and compared with those from the quintile regression (Table 1).

Data source and scope

The study uses the World Bank Enterprise Survey (WBES, 2013) data for Uganda. This is a cross-sectional data set covering a period of 2013. The WBES data covers information on various aspects with topics ranging from sales and supplies performance, finance, firm and entrepreneurial characteristics, and the general investment climate. This information is provided by a representative sample of top managers and firm owners engaged in non-agricultural formal sector. A total sample of 762 firms belonging to both the manufacturing and service sector from all regions of the country, that is; Kampala, Central, Western, Eastern and Northern were considered.

Descriptive statistics

Table 2 provides summary statistics for the study variables. Firms’ cash inflow is measured by annual sales in the fiscal year prior to the survey and summary statistics for difference between location and ISO certification is shown in Table 3. Firms located in Kampala have more average sales than firms located in other towns of Uganda. Likewise, ISO certification for firms located in Kampala has more impact on sales than ISO certification for firms located in other towns of Uganda.

Interpretation and discussion of findings

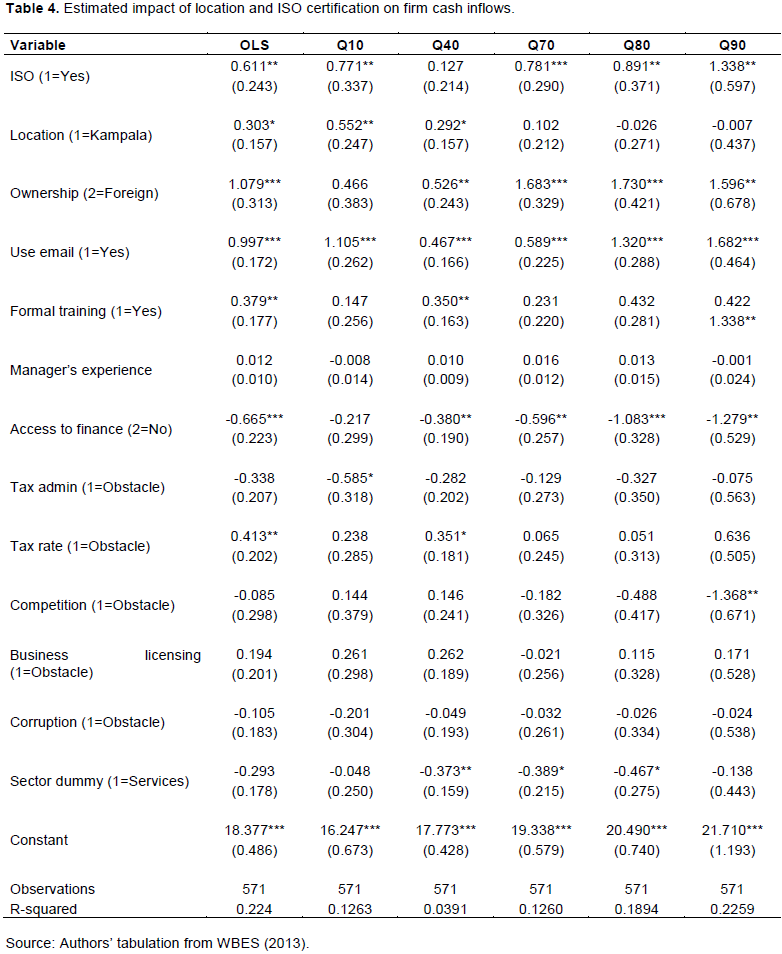

Table 4 indicates a significant positive relationship between ISO certification and cash inflows. Using the quintile method, the relationship between ISO certification and cash inflows is significant and positive except at Q40. It is further indicated that the level of influence of ISO certification to cash inflows increases as quintiles increase. At Q10, the influence is significant at 0.771, it increases at each level of significant quintile, and at Q90 the cash inflow is 1.338. The performance indicated in Table 4 implies that a firm which is ISO certified has more sales compared to firms which are not ISO certified. Also, ISO certification has more influence to firms with high level of sales than those with low sales level as indicated from Q10 to Q90. This kind of performance concurs with International Standards Organization (2017) that adopting ISO standards influences faster growth in firm sales. The performance also concurs with Beata and Naotaka (2018) who used a firm level panel data in Slovenia covering a period 1987 to 2006 and established that ISO certification influences firm growth. Given the above discussion, the first hypothesis and research question H1: There is a positive significant relationship between ISO certification and cash inflows in Ugandan firms is confirmed.

Table 4 indicates that locating firms in Kampala is significant and positively related to firm cash inflows at Q10 and Q40. This implies that firms with low sales level that locate in Kampala can make more turnovers compared to similar firms located in other towns. Findings concur with Tim and Paul (2005) who established that firms that locate in urban areas are more liquid compared to those located in rural areas. Findings also concur with Voulgaris et al. (2003) who established that firms located in bigger cities have less liquidity problems. However, firms with larger level of sales from Q70 to Q90 have an insignificant positive relationship between location in Kampala and cash inflows. This implies that locating in Kampala (capital city) does not matter for firms with relatively high level of sales in generating cash inflows. The findings in Table 3 concur with Lucia et al. (2012) who assert that firms locate where they expect market opportunities.

Given the above discussion, the second hypothesis H2: There is a significant positive relationship between firm location and firm cash inflows is confirmed. The relationship between ISO certification and firm cash inflows using OLS analysis is significant and positive at 0.611. The performance at OLS is similar to that of quintiles except for Q40. On the other hand, locating firms in Kampala is positive and significantly related to cash inflows using the OLS approach. The OLS results are similar to results obtained using quintile approach at only Q10 and Q40. It was also discovered that the use of emails, access to finance, foreign ownership and tax administration are not obstacles to firms’ cash inflows.

The article was set to establish the impact of firm location and ISO certification on SMEs’ cash inflows using data drawn from World Bank Enterprise Survey for Uganda (2013). The analysis employs both descriptive and estimation of OLS and quintile regression model at Q10, Q40, Q70, Q80 and Q90. The results show that ISO certification is significantly related to cash inflows at OLS and Q10, Q70, Q80 and Q90. Firms with ISO certification can raise more cash inflows than firms which are not ISO certified. Also, locating firms in Kampala (Uganda’s capital city) is significantly related to firms’ cash inflows at OLS, Q10 and Q40. This implies that location impacts more on firms with low levels of sales than firms with high levels of sales.

The study findings show that Ugandan firms have to become ISO certified if they are to grow their cash inflows. Government and all trade related bodies should ensure that they encourage firms and put in place necessary infrastructure such as easy and cheap access to internet to enable firms obtain ISO certificates. However, this can be achieved through a deliberate policy of firm monitoring, quality supervision and guidance.

Having established that the relationship between locating firms in Uganda’s capital city and cash inflows is significant for firms with low level of sales (Q10 and Q40), Kampala Capital City Authority (KCCA) must have a deliberate policy to make these firms flourish rather than perish. Infrastructure development enabling cheap and quicker access to internet should be prioritized.

Finally, Ugandan firms with larger sales volume do not collect much cash inflows in the capital city. This implies that the rise in poor population in capital city does not affect their cash inflows. The results may also imply that firms with higher sales are focusing on brand acceptance over the economy than being centered only in the capital city.

Study contribution

Beata and Naotaka (2018) used a firm level panel data in Slovenia covering a period 1987 to 2006 to establish that ISO certification influences firm growth. However, this study used World Bank Enterprise survey data (2013) to establish that ISO certification and location are significant factors in determining firms’ cash inflows in Uganda.

Whereas studies such as Uwonda et al. (2013) and Mutesigensi et al. (2017) used percentages and descriptive statistics to determine the relationship between cash flow management and SMEs’ performance.

This study employed both descriptive and quintile method of regression analysis to determine whether firm location and ISO certification influence firms’ cash inflows in Uganda. From the literature perspective, the study has established that ISO certification for firms located in Kampala has more impact on sales than ISO certification for firms located in other towns of Uganda. Also, the relationship between ISO certification and cash inflows for firm at low levels of sales is insignificant among SMEs in Uganda. It was further established that the relationship between locating firms in Uganda’s capital city (Kampala) and cash inflows is significant only with firms that have low sales levels.

The authors have not declared any conflict of interests.

The authors appreciate the comments made by colleagues from the School of Business and the School of Economics, Makerere University. Appreciation also goes to the management of College of Business and Management Sciences for providing necessary financial support for assembling the manuscript.

REFERENCES

|

Aba EK, Badar AM (2013). A review of the impact of ISO 9000and ISO 14000 certifications. The Journal of Technology Studies 39(1/2):42-50.

Crossref

|

|

|

|

Abioro M (2013). The impact of cash management on the performance of manufacturing companies in Nigeria. Uncertain Supply Chain Management 1(3):177-192.

|

|

|

|

|

Bates TW, Kahle KM, Stulz MR (2009). Why do US firms hold so much more cash than they used to? The Journal of Finance 64(5):1985-2021.

Crossref

|

|

|

|

|

Beata J, Naotaka S (2018). The ISO 9000 certification: Little pain, big gain? European Economic Review 105:103-114.

Crossref

|

|

|

|

|

Beck N, Walgenbach P (2009). The economic consequence of ISO 9000 certification in East and West Germany firms in the mechanical engineering industry. Journal of East European Management Studies 14(2):166-185.

Crossref

|

|

|

|

|

Calice P, Chando MV, Sekioua S (2012). Bank financing to small and medium enterprises in East Africa: findings of a survey in Kenya, Uganda, Tanzania and Zambia African. Development Bank Working paper. Series No 146 Available at

View

|

|

|

|

|

Corbett JC, Montes-Sancho JM, Kirsch AD (2005). The financial impact of ISO 9000 certification in the United States: An empirical analysis. Journal of Management Science 51(7):1046-1059.

Crossref

|

|

|

|

|

Enow ST, Kamala P (2016). Cash management practices of Small, Medium, and Micro enterprises in the Cape Metropolis, South Africa. Investment Management and Financial Innovations 13(1):230-236.

Crossref

|

|

|

|

|

Ernst and Young (2011). 2010 Baseline Survey of Small and Medium Enterprises in Uganda.

|

|

|

|

|

Gruca ST, Rego LL (2005). Customer satisfaction, cash flow, and shareholder value. Journal of Marketing 69(3):115-130.

Crossref

|

|

|

|

|

Holmes JT (1999). Scale of local production and city size. The American Economic Review 89(2):317-320.

Crossref

|

|

|

|

|

International Standards Organization (2017). Building for better future. Available at:

View

|

|

|

|

|

Islam A, Muzi S, Meza JLR (2018). Does mobile money use increase firms' investment? Evidence from enterprise surveys in Kenya, Tanzania and Uganda. Small Business Economics 51(3):687-708.

Crossref

|

|

|

|

|

Kakeeto-Aelen TN, Dalen JC, Herik JD, Walle B (2014). Building customer loyalty among SMEs in Uganda: the role of customer satisfaction, trust and commitment. Maastricht School of Management, Working Paper No. 2014/06.

|

|

|

|

|

Kiiza B, Abele S, Kalyebara R (2004). Market opportunities for Ugandan banana products: National, regional and global perspectives. Uganda Journal of Agricultural Sciences 9:743-749.

|

|

|

|

|

Kintu I (2017). The relationship between core values and entrepreneurial performance: A study of SMEs in the informal economy of Uganda's central region. PHD Thesis, University of Witwatersrand, Johannesburg, South Africa.

Crossref

|

|

|

|

|

Lucia MD, Antonio P, Manuel JV (2012). Transport infrastructure impacts on firm location: the effect of a new metro line in the suburbs of Madrid. Journal of Transport Geography 22(15):236-250.

Crossref

|

|

|

|

|

Mahelet FG (2014). Firm level determinants of international certification: Evidence from Ethiopia. Journal of World of Development 64(10):286-297.

Crossref

|

|

|

|

|

Mutesigensi D, Eton M, Ebong CD, Mwosi F (2017). Cash flow and survival of SMEs in Arua District, West Nile region of Uganda. International Journal of Small Business and Entrepreneurship Research 5(5):9-18.

|

|

|

|

|

Namagembe S, Ryan S, Sridharan R (2018). Green supply chain practice adoption and firm performance: manufacturing SMEs in Uganda. Management of Environmental Quality: An International Journal 30(1):5-35.

Crossref

|

|

|

|

|

National Development Plan II (2015). Available at: View

|

|

|

|

|

National Strategy for Private Sector Development (2017). Available at: View

|

|

|

|

|

Ntayi JM, Mutebi H, Kamanyi S, Byangwa K (2013). Institutional framing for entrepreneurship in Sub-Saharan Africa: Case of Uganda. World Journal of Entrepreneurship, Management and Sustainable Development 9(2/3):133-154.

Crossref

|

|

|

|

|

Oler D, Picconi MP (2014). Implications of insufficient and excess cash for future performance. Contemporary Accounting Research 31(1):253-283.

Crossref

|

|

|

|

|

Satterthwaite D, McGranahan G, Tacoli C (2010). Urbanisation and its implications for food and farming. Philosophical Transactions of the Royal Society 365(2010):2809-2820.

Crossref

|

|

|

|

|

Tim L, Paul S (2005). Liquidity: Urban versus rural firms. Journal of Financial Economics 78(2):341-374.

Crossref

|

|

|

|

|

Turyahikayo E (2015). Challenges faced by Small and Medium Enterprises in raising finances in Uganda. International Journal of Public Administration and Management Research 3(2):21-33.

|

|

|

|

|

Turyakira P, Venter E, Smith E (2014). The impact of Corporate Social Responsibility factors on the competitiveness of small and medium -sized enterprises. Southern African Journal of Economic and Management Sciences 17(2):157-172.

Crossref

|

|

|

|

|

Tushabomwe-Kazooba C (2006). Causes of Small Business Failure in Uganda; A case study from Bushenyi and Mbarara Towns. African Studies Quarterly 8(4):135-136.

|

|

|

|

|

Uganda Bureau of Statistics (2017). The Uganda National Household Survey 2016/2017. Available at:

View

|

|

|

|

|

Uwonda G, Okello N, Okello GN (2013). Cash flow management utilization by Small and Medium Enterprises (SMEs) in Northern Uganda. Merit Research Journal of Accounting. Auditing, Economics and Finance 1(5):067-080.

|

|

|

|

|

Voulgaris F, Asreiou D, Agiomirgianakis G (2003). The determinants of small firm growth in the Greek manufacturing sector. Journal of

Crossref

|

|

|

|

|

Economic Integration 18(4):817-836.

|

|

|

|

|

Wangalwa R, Tolo CU, Kagoro GR, Matofari JW (2016). Assessment of on- farm milk handling practices in Mbarara district south Western

|

|

|

|

|

Uganda. African Journal of Dairy Farming and Milk Production 3(2):141-148.

|

|

|

|

|

World Bank Enterprise Survey (WBES) (2013). Uganda-Enterprise Survey 2013. Available at:

View

|

|