ABSTRACT

The study examined the effect of human capital accounting on Earning per Share (EPS) of deposit money banks in Nigeria. Secondary data were collated from annual reports of the sixteen deposit money banks listed on the Nigerian Stock Exchange between 2006 and 2017. The study employed static panel data of fixed and random effect to explore the relationship between human capital accounting and EPS of deposit money banks in Nigeria. Post estimation test (Hausman Test) was also conducted to select the best and most consistent estimator. Random effect was selected to achieve the stated objective. The results of the random effect revealed that the pension and training and development have significant positive relationship with EPS while other salaries and wages have insignificant positive relationship except director’s remuneration (RENMR) that has insignificant negative relationship with EPS. This also implies that training and development, and pension are critical factors that are germane to human capital accounting to boost the earning per share so as to enhance the performance of the banks. The reported adjusted R-Square of value of 0.3876 which is 39% of the systematic variation of the EPS of the firms could be jointly explained by the salaries and wages, training and development, director’s remuneration and pension. Based on these finding, the management of banks should give priority to payment of pension and also engage in continuous training and development of their employees to enjoying better EPS.

Key words: Human capital accounting, Earnings per Share (EPS), banking industry, panel data.

Human capital accounting measures and reports cost and value of employers as organizational assets (Jasrotia, 2004). Human capital accounting is a method of managing the employees so that they contribute significantly to the overall productivity of the organization. In attempt to achieve organizational objectivity, it is important to evaluate the value and efficiency of human capital.

Human capital accounting defines the structure of organization which drives the productivity of such organization, and also develops the effective coordination and communication within the organization. Human capital accounting also gives time to finding the right staff and developing their skills.

Bassey and Tapang (2012) explained that the breakthrough of any organization depends on the ability and competence of human capital within the organization. Human capital effectively and effectively optimizes other resources to achieve the organizational objectives; hence human capital is the most important assets that organization can have. They also explained that human capital is has been as one of the greatest mechanism of gaining competitive advantage by organization in today economy. Human capital accounting was developed to subdue the weakness of traditional accounting system where all investment in human capital were written off as expenses in the year it is measured. Akintoye (2005) pointed out that that essential accumulation of goodwill in an organization can be the function of a well-managed business environment by experience managers who spent enough time to understand organizational policies, politics and ethical values. Human capital accounting is useful in both the business organizations and the society at large. Business organizations are now spending huge sum of money on training, re-training, selection and development of personnel to make them meet the challenges or tasks arising from their day to day running of the business. Human capital accounting creates organization that is more intelligent, flexible and competent than their rivals by applying policies that focus on training and developments of personnel (Adegoroye et al., 2012)

Banking sector is an important industry in Nigeria which contributes towards her economic growth. The issue of human capital accounting in banking industry is all about investing to improving all the skills, innovation and technical ability of the personnel to improve productivity (Adegoroye et al., 2012). Therefore, there is a need for human capital accounting to help management cope with challenges that may confront business organizations.

The sufficient acknowledgement of human capital accounting will enable managers take appropriate decision regarding investment in human capital and provide information regarding benefits assets associated with investment in human capital.

Equity owners own the share of the firms. Equity owners expect capital appreciation on their shares in form of increase in the market value of their shares. Any firm that will achieve capital appreciation must have improved earnings; there is a positive correlation between firms Earnings per Share (EPS) become a yard stick for determining the future prospect of a firm. EPS is that part of firm’s profit allocated to each outstanding ordinary shares. EPS is very important to the would be investors in taking decision on whether to invest or not to invest in a particular firm. EPS has been made mandatory to all companies to be disclosed in their annual financial statements.

Human capital accounting improves the quality of personnel in an organization. The higher the quality of personnel in an organization the higher the finance of the organization.

Therefore, there is a positive link between human capital accounting and financial performance (earnings) of firms.

There are still mixed results on the relationship between human capital accounting and EPS. Ruparelia and Njuguma (2016) reported that there is no relationship between human capital accounting and EPS, while Agbiogwu et al. (2016) reported that there is a positive relationship between human capital accounting and EPS. The effect of human capital accounting on EPS is still controversial.

Based on this backdrop, this study intends to fill this missing link. The study therefore examines the nexus between human capital accounting and EPS of deposit money banks listed on the Nigerian Stock Exchange.

Human capital accounting

Human capital accounting is defined as the process of acquiring, training, managing, developing, and retraining, of employees for them to contribute efficiently and effectively to the performance of the organization in other word it is the upgrading the existing skills of the employees and extracting best from them. Human capital accounting according to Jeroh (2013), it is the act of identifying and reporting the investment made a human capital of a firm that are currently not accounted for in conventional accounting practice. It includes identification of costs measured by organization to select, recruits, train, hire and develop its employees.

Okpala and Chidi (2010) examined the importance of human capital accounting to stock investment and decision in Nigeria and the findings or the study revealed that corporate success depends on the ability and knowledge of people who can easily adapt to technology changes. They also found out that the function of human capital accounting is to provide information that enables investors to evaluate and understand the true financial position of organization.

Jelil et al. (2014) reported that value of human capital should be included in the statement of financial position.

Earnings per share (EPS)

EPS is the part of a company profit allocated to each outstanding share of common stock. Farah et al. (2016), explained that EPS represent company’s profitability. A company with positive trend of EPS means that the company is generating an improved amount of earnings. A decline trend in EPS is an indication that there is a problem with the company earnings which can lead to reduction in the stock price.

Human capital theory

This theory was proposed by Schultz (1961) and developed by Becker (1964); the theory claimed that training improved the competence and productivity of workers. The theory also suggested that all expenditure incurred on training, education and development of employees should be treated as investment.

Training improves the skill of employees which in turn enhance corporate competitive advantages and performance. Competitive advantage is achievable when an organization has workers that cannot be imitated by its rivals (Barney, 1991). Organization attracts and retails workers when employees are trained and developed. Human capital theory suggests that the level of education and training of employees are positively correlated to their performance (Becker, 1993).

Sweetland (1996) concluded that the theory predicts that investment in people will be beneficial to the individuals and the organization as a whole.

Human capital as a strategic asset, and is the asset that enables organization to increase their performance.

Empirical literature

Moore (2007) suggested that human capital accounting should be considered when making decision about acquisition and disposal of employees. Accounting practice of the company should encourage valuation of human capital companies to acknowledge the contribution of employees but never treat human capital as asset; the way other physical assets were treated in their books of account.

Ting and Lean (2009) carried a study in Malaysia on the relationship between intellectual capital and financial sector for the period 1999 to 2007. Value added intellectual capital (VAIC) was used as proxy for human capital while return on assets was also used as proxy for financial performance. The findings of the study revealed that value added intellectual capital and return on assets are positively related.

Elahi and Shahaei (2010) carried out investigation on the effect of intellectual capital on performance of the branches of Sepal Bank in Tehran. Multiple regression analysis was employed to test the hypothesis. Findings of the study revealed that intellectual capital has a positive effect on the performance of the bank.

Abubakar (2011) examined the relationship between human resources accounting and the quality of financial reporting of quoted service companies in Nigeria.

The data collected were analyzed using Kendall coefficient of concordance (KKC) and Pearson’s Chi-square techniques. KKC was employed to evaluate the concordance of selected experts regarding the nature and characteristics of human capital expenditure and the necessity for their capitalization. Pearson’s Chi-square was used to ascertain the perception of questionnaire respondents on the effect by reporting human capital value as asset could have on the ability of financial statements user to make informed decision. The findings of the study revealed that the nature and characteristics of investments on human capital qualified them to be capitalized like other physical assets rather than expensed.

Bassey and Tapang (2012) examined the effect of human capital costs on corporate productivity of ten selected firms on the Nigeria stock exchange. Structured questionnaire was administered to collect data. Multiple regression analysis was used to test the hypothesis of the study. Finding showed that there is a positive and significant relationship between human capital accounting and financial performance of selected firms.

Sojka (2015) carried out a study on the relationship between human resources management practices and firms finance performance. The research studies the links between human resources management practice and economic performance of a sample of 102 organizations in Slovakia, studying basic management practices such as strategy, organizational structure, corporate culture and operational management. The study reveals a positive correlation between HR practice and economic performance.

Ruparelia and Njuguna (2016) studied the relationship between board remuneration and financial performance of Kenya financial service industry. Secondary data were obtained from audited financial statements of service industry of firms listed on Nairobi securities exchange for eleven years for period between 2003 and 2013. Board remuneration was measured by director annual fees while financial performance was measured by return on assets (ROA), return on equity (ROE), dividend yield (DY), and EPS. Linear regression was used on pooled cross-sectional time series data. The result of the study revealed that there was a significant relationship between board remuneration and ROA while there is no significant EPS.

Agbiogwu et al. (2016) studied the effect of human resources costs on profitability of banks in Nigeria, from 2010 to 2014. First Bank of Nigeria Plc. and Zenith Bank of Nigeria Plc. were selected for the study. Content method analysis and linear regression model were used to test the hypotheses. Results showed significant effect on EPS, net profit margin, and return in capital employed by the banks (Appendix).

Asika et al. (2017) carried out study on the appraisal of human resources accounting on the profitability of corporate organizations in Nigeria.

The study used increase in staff salary, increase in staff and staff retirement as the proxies for human resources accounting. Ten commercial banks were selected for the study. Secondary data were collected from the selected banks. T-test statutory tools with aid of SPSS version 20.0 version was used to test the hypothesis. The findings revealed that increase in salary and retirement benefits have positive effects in organizational profitability.

This study adopts the model of Abdul et al. (2014) in their exploratory study of impact of compensation on employees’ performance in the banking sector of Pakistan. Their model specified that performance is a function of salaries, welfare and number of employees’. The linear representation of their model is presented as:

Hucapit = B0 + B1salariesit + B2welfareit + B3employeeit + Uit+

The modified model is presented in functional and linear forms as:

Y = F (PC, TC, DR, SW, GR)

Linear representation of the modified model is as:

where Yit = profitability of deposit money banks proxied by Earnings per Share (EPS), Hucap = Human Capital, PC = Pension costs for the banks in year t, TC = Training cost for the banks in year t, DR = Directors’ remuneration for the banks in year t, SW = Salaries and wages for the banks in year t, Uit= Stochastic error terms, t = time period, and i = cross sectional units.

The dependent variables in this study include profitability index (EPS). EPS is fundamental to the bank’s performance; it is calculated as net profit after taxes divided by number of share outstanding. The independent variables used in his study are: pension cost (PC), training cost (TC), director remuneration (DR) and salaries and wage (SW).

Pension cost

This is the amount that an organization charges to expense in relation to its liabilities for pension payable to employees.

Training cost

This is the cost measured by organization in educating its employees on how they will improve on their jobs.

Director’s remuneration

This is the process by which directors of a company are compensated, either through fees, salary or the use of company’s property with approval from the shareholders and board of directors.

Salaries and wages

These are the remunerations paid to employees for work performed on behalf of an employee or services provided. The estimating technique used in this study is the panel data analysis.

Panel data involves fixed effect model and random effect model.

The post estimation test (Hausman test) was conducted to select the best estimator for the study. The diagnostics test such as first order Autocorrelation test was conducted. The application of these techniques on data estimation gathered for this study is to ensure efficient and unbiased estimates having avoided loss of a degree of freedom. The estimation technique is subjective to whether the data is a short panel or long panel.

The data for the study were collected from Secondary sources. The data were collected from annual reports of the sixteen deposit money bank listed on the Nigerian stock exchange. In addition, data was also sourced from scholarly articles from academic journals and some relevant textbooks in the field of the research.

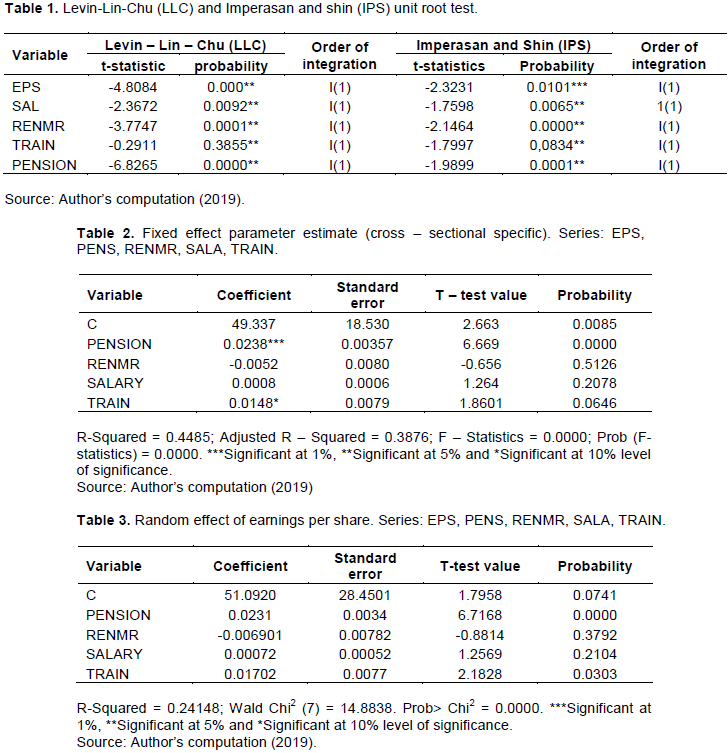

Result of panel unit root tests

The results of the stationary tests conducted on all the data by means of homogenous panel unit root test (Levin-Lin-Chu (LLC)) and heterogeneous panel unit root test (Im peresan and Shin (IPS)) are presented in Table 1. A time series is stated as non-stationary if the mean and variance of the time series are dependent over time. On the other hand, a time series is stationary if the mean and variance is constant over time.

In Table 1, the result reveals that all the series are integrated of different orders. Majority of the variables such as EPS, salary of staff (SALARY), and director’s remuneration (RENMR) are stationary at first difference except training of the staff (TRAIN). In view of the aforementioned result, condition for panel cointegration is not met. Therefore, there is need to proceed to fixed effect and random effect panel model.

Panel data analysis

To analyze the relationship between human capital accounting and the profitability of money deposit in the banks, the study employs static panel data analysis of a single equation model of EPS as a proxy for the financial performance to determine the profitability of banking firms. EPS serves as a dependent variable while SALARY, DIRECTOR RENUMERATION, TRAINING and PENSION are the explanatory variables that determine the quality of human resources accounting. In a bid to arrive at the most consistent and efficient estimates, the study conducts unrestricted panel data analyses which include fixed effect and random effect panel estimates, followed by post estimation test such as Hausman test. Hence, result for the estimation is presented in separate tables for unique analysis, before drawing conclusion on the most consistent and efficient estimator.

Objective: Nexus between human resources accounting and EPS

From the Table 2, almost all variables like SALARY, TRAIN and PENSION have positive relationship with EPS but only PENSION and TRAIN are significant. This implies that TRAINING and PENSION are critical factors that are germane to human resources to boost the EPS as a means to enhance the profitability of the banks. The reported R-Square of value of 0.4485 which is almost 45% of the systematic variation of the EPS of the firms can be jointly explained by the independent variables. The R-Square value is below average indicating that the explanatory variables are fairly fit measures for EPS.

The result in Table 3 is nearly the same with the fixed effect. The finding shows that PENSION and TRAIN have significant positive relationship with EPS while other variables have insignificant positive relationship except director remuneration (RENMR) that has insignificant negative relationship with EPS. This also implies that TRAINING and PENSION are critical factors that are germane to human resources to boost the EPS so as to enhance the performance of the banks. The reported R-Square of value of 0.24148 which is 24% of the systematic variation of the EPS of the firms can be jointly explained by the independent variables. The R-Square value is low indicating that the explanatory variables are not good fit measures for EPS.

Post-estimation

Since the probability value of the Hausman test is more than 0.05 or 5% level of significance, the null hypothesis is not rejected. Therefore, the random effect is the most appropriate model to assess the relationship between human capital accounting and EPS (Table 4).

Diagnostic test

In order to examine the robustness of the model, diagnostic test is implemented using first order autocorrection test in the model. The result of the serial correlation test revealed that at 5% level, we reject the null hypothesis that there is no autocorrelation in the residuals for any of the orders tested, thus this test finds no evidence of model misspecification. The result is presented in Table 5.

CONCLUSION AND RECOMMENDATIONS

The study examined the relationship between human capital accounting and EPS of deposit money banks in Nigerian stock of exchange. The finding shows that pension and train have significant positive relationship with EPS while other variables have insignificant positive relationship except director remuneration (RENMR) that has insignificant negative relationship with EPS. This also implies that train and pension are critical factors that are pertinent to human resources to boost the EPS so as to enhance the performance of the banks. The finding of the study agreed with finding of Agbiogwu et al. (2016), Therefore, the study concludes that training and development of the staff and pension are good measures of human capital assets that are capable of improving the EPS of money deposit banks. It is also concluded that remuneration of directors is not veritable variable of human capital and not significant to promote EPS of Nigerian banks. Based on these finding, the management of banks should give priority to payment of pension and also engage in continuous training and development of their employees to enjoying better EPS.

The authors have not declared any conflict of interests.

REFERENCES

|

Abdul H, Muhammad R, Hafiz MKZ, Ghazanfar A, Muhammad A (2014). Impact of compensation on employee performance: Empirical Evidence from Banking Sector of Pakistan. International Journal of Business and Social Sciences 5(2):302-309.

|

|

|

|

Abubakar S (2011). Human resource accounting and the quality of financial reporting of quoted service companies in Nigeria. Unpublished Ph.D. Dissertation, Ahmadu Bello University, Zaria, Nigeria.

|

|

|

|

|

Adegoroye AA, Oladejo M, Moruf A (2012). Strategic human resources management practices in the post consolidated Nigerian commercial banks. European Journal of Business and Management 35(2):147-165.

|

|

|

|

|

Agbiogwu AA, Ihendinitiu JU, Azubike JUB (2016). Effect of human resourcess cost on profitability of banks in Nigeria. Expert Journal of Finance 4(2):10-18.

|

|

|

|

|

Akintoye CR (2005). Human resources accounting in service organization: A review and suggested application of model. International Journal of Business Management and Economic Research 3(4):566-575.

|

|

|

|

|

Asika ER, Chitom JAR, Chelichi IF (2017). Appraisal of human resource accounting on profitability of corporate organization. Economics 6(1):1-10.

Crossref

|

|

|

|

|

Barney JB (1991). Firm resources and sustained competitive advantage. Journal of Management 17(1):99-120.

Crossref

|

|

|

|

|

Bassey BE, Tapang AT (2012). Expensed human resources cost and its influence on corporate productivity: A study of selected companies in Nigeria. Global Journal of Management and Business Research 12(5):3-8.

Crossref

|

|

|

|

|

Becker GS (1964). Human capital: A theoretical and empirical analysis, with special reference to education, New York; National Bureau of Economic Research distributed by Colombia University Press.

|

|

|

|

|

Becker GS (1993). Human capital: A theoretical and Empirical Analysis with special Reference to Education (3rd Ed.). Chicago: University of Chicago Press.

Crossref

|

|

|

|

|

Elahi AK, Shahaei B (2010). Examines the impact of intellectual capital on the performance of bank Sepah in Tehran. Journal of Governance and Management 3(5):73-90.

|

|

|

|

|

Farah N, Farrukk I, Faizaan N (2016). Financial performance of firms. Evidence from Pakistan cement industry. Journal of Teaching and Education 5(1):81-94.

|

|

|

|

|

Jasrotia P (2004). The need for human resource accounting. Retrieved April, 23, 2013.

|

|

|

|

|

Jelil AA, Olotu AE, Omojola SO (2014). Optimizing the effectiveness of financial reporting through human resources accounting. International Journal of Accounting Research 42(1836):1-13.

|

|

|

|

|

Jeroh E (2013), Human capital accounting and the comparability of financial statement in Nigeria. Journal of Accounting Management 3(2):53-63.

|

|

|

|

|

Moore R (2007). Measuring how 'human capital'appreciates in value over time. Plant Engineering 61(4):29.

|

|

|

|

|

Okpala PO, Chidi OC (2010). Human Capital accounting and its relevance to stock investment decisions in Nigeria. European Journal of Economics, Finance and Administrative Sciences 4(21):13-18.

|

|

|

|

|

Ruparelia R, Njuguna A (2016). Relationship between board renumeration and financial performance in the Kenya financial service industry. International Journal of Financial Research 7(2):247-255.

Crossref

|

|

|

|

|

Schultz TW (1961). Investment in human capital. American Economic Review 51:1-17.

|

|

|

|

|

Sojka L (2015). Investigation of the relationship between human resource management practices and firm's finance performance. European Scientific Journal 11(34):87-115.

|

|

|

|

|

Sweetland SR (1996). Human capital theory: Foundations of a field of inquiry. Review of Educational Research 6(3):341-359.

Crossref

|

|

|

|

|

Ting IWK, Lean HH (2009). Intellectual capital performance of financial institution in Malaysia. Journal of Intellectual Capital 10(4):588-599.

Crossref

|

|