ABSTRACT

According to the value enhancement and agency cost theory, corporate voluntarily contribution has a positive or negative impact on the overall performance of a firm. In contrast to these theories sometimes corporate giving has no impact on the firm’s performance. This article will provide insight on the impact of corporate giving on Pakistan’s publically traded manufacturing companies. This article also focuses on the impact of ownership structure on corporate giving. This research aims to spot light different type of ownership structure and their voluntarily contribution. The variable of corporate giving is measured by the total value of corporate giving to total sales revenue. Corporate performance will be measured by return on assets; whereas different types of owner structures are measured by number of shares owned by family, mangers and Institution. Empirical results will offer valuable insights for the manufacturing sector

Key words: Corporate social responsibility, firm value, financial performance, ownership structure.

Different researchers have defined CSR in different ways. One researcher Walton (1967) defined corporate social responsibility as the relationship that exists between the corporation and the society; whereas other researchers (Wartick and Cochran, 1985; Wood, 1991) defined the CSR in terms of legal responsibilities, ethnic responsibilities and philanthropic responsibilities of the firm. WBCSD (1998) in their research reported that the CSR is basically defined as the business commitment to the society to behave ethically and contribute in the society wellbeing by improving the quality of life of the employees and their family in the long run. Zenisek(1979) defined the concept of CSR as the strategic plan of maximizing the overall returns of the shareholders.

In broader term CSR is basically the way of doing business that has a positive impact on the society. Wang and Sharkis (2017) stated that the implementation of CSR governance in order to generate CSR outcomes influences the financial performance of the firm. Galant and Cadez (2017) in their study stated that a lot of empirical researches have been conducted to see the impact of CSR and CFP but the relationship between these two variables are equivocal. They further variables is stated that the difference in the findings of these two result of different measurements used for analysis indifferent studies. In another study Kim et al. (2015) stated that the CSR activities increased financial performance of the firm if competitive action of the firm is high and Social irresponsible activities generate high financial revenues if the competitive action of the firm is low.

The practice of corporate social responsibility in Pakistan is still at emerging stage; however reporting guidelines may have been provided to the corporate sector from the government of Pakistan. The requirement for the business responsibility report should be the part of their annual report. The security exchange commission is striving to make CSR performance more regulated in the company. According to the CSR General Order in November 2009 it is mandatory for the companies to make monetary and descriptive disclosures in their Directors Report. According to this law it is the company’s commitment to operate in an economically, socially and sustainable manner. The government of Pakistan has further provided the clarification about the activities that come under the CSR.

Relationship between CSR and ownership structure

The paper aims to fill the gap that exists in literature on the impact of CSR activities of the financial performance of the firm. Galbreath and Shum (2012) stated in their studies that literature review on the corporate social responsibility covered most of the researches conducted by using the sample companies of the developed countries. This shows that fewer studies have been conducted in context of the developing countries like Pakistan. Do companies get reward on their CSR activities for short term only or it help companies to perform financially better in the long run? This research will also focus on the ownership structure of Pakistan and its impact on the CSR decisions. This paper will analyze the trend of CSR in the performance of the companies over the 5 years.

Corporate social responsibility

Margolis and Walsh (2003)in his study on the perspective of corporate social responsibility stated that in last few years the corporate firms have started to engage in many social activities related to health and education once considered as the governmental activities.

Scherer and Smid (2000) in one of their studies stated activities that cover in corporate social responsible activities of the firm. The study explored the activities including social security, human protection, following defined ethical codes, protection of natural environment and firm inclination towards the self-regulations in order to fulfill the gap in defined legal regulations of the firm for environmental health.

Braithwaite and Drahos (2000) in his study suggested that on global level, no state and corporate firms can alone provide goods to the public. Study stated that it is a polycentric as well as multilateral process in which government and the corporate sector have to work together by defining rules and regulations

McWilliams and Siegel (2001)worked on the determinants of the firm CSR. The study has analyzed that the value of firm CSR is dependent on the characteristics of the firm that includes business diversity, size of the firm, and income of the consumer, labor and market conditions. Matten and Crane (2005) in their study on corporate social activities reported that the firms nowadays start assuming their role in the society like a state. They further argue that the company starts working for the betterment of human rights and environmental protection that was once considered the responsibility of the government. The study further argued that this condition happens when the government of a particular country failed to work for the basic rights of the citizens, which was originally the sole responsibility of the government. Scherer and Palazzo (2007) in their study stated a lot of researches has been conducted on the role of CSR in the corporate sector but still there is no concise and actual definition of corporate social responsibility.

Corporate social responsibility and financial performance

There are many researches that have been conducted to see the relationship that exists between the corporate social responsibility and financial performance but most of the researches have been conducted in developed countries. Only few researches have been conducted to see the impact. Goss and Roberts (2011) in their study stated that the company’s involvement in CSR activities improves its credit rating results in lower debt cost and improve company’s financial performance.

Mackey (2007) studied the relationship between corporate giving and the financial performance of the firm. They examined that managers should not invest in the social activities of the firm that increase the present value of future cash flow but increase the market value of the company. They also stated that the major purpose of doing business is not just maximizing the profit of the firm but also to invest for the welfare of the society.

Mishra and Suar (2010) studied that the corporate social responsibility influences the performance of financial and non-financial firm of India. The result of the studies shows that the performance of financial and non-financial firms increases with the increase in CSR activities. Stocks listing effect, ownership structure and size of the firm have been used as a control variable of the firm Orlitzky et al. (2003) studied the relationship between corporate giving and corporate financial analysis by doing meta-analysis of 52 companies. The results of the studies show that firm investment in environmental performance pay off and the operationalization between the corporate financial performance and corporate giving results in a positive relationship.

Werther and Chandler (2005) stated that it is beneficial for the firm to invest in the social welfare activities considered important for the stakeholders. They concluded that the firm can lost the support of the stake holders if firms will not take part in the CSR activities that will reduce the value of the firm

H1: There is a positive relationship between CSR activities and financial performance of the firm

Corporate social responsibility and ownership structure

Coffey and Fryxell (1991) conducted a research to see the relationship between the institutional ownership and the corporate giving. The results of their studies show that there is mixed relationship that exists between the institutional ownership structure and the corporate interest towards the social wellbeing.

Rees and Rodionova (2015) explored the impact of family ownership on corporate social responsibility. The study included the data of 3,893 firms from 46 countries of the world. The results show negative association between the family holding equity and their voluntarily contribution in the society. Study reported that family owned companies are closely monitored and do not make considerable contribution in the society.

Yoshikawa et al. (2014) stated that family owned firms usually have a long term vision and they are more concerned about their relationship with the stakeholders in order to ensure the long-term survival of the company. He also stated that family owned firms hesitate to invest in corporate social responsible activities as it does not guarantee the financial returns. He examined that family owned firms are usually wealth maximizers and try to avoid these kinds of expenses.

Coffey and Wang (1998) in his research on the impact of managerial ownership on corporate philanthropy concluded that there is a direct relationship between managerial ownership and corporate giving. He stated that under managerial ownership the corporate contribution in the welfare of the society increases.

Lopatta et al (2016) analyzed the relationship between the bock holder and firms’ corporate social responsibility on the panel data from year 2003-2012. The study concluded that there is a negative relationship between the block holders and corporate social responsibility. Oh et al. (2011) conducted a study on the large Korean firms. The study concluded that there is a negative relationship between the CSR activities and the top management of the firm. Barnea and Rubin (2010) also conducted research on association between the block holder and insider ownership and leverage on corporate social performance. Results of the study show that there is a negative relationship with the corporate social activities. Cespa and Cestone (2007) stated that the investment in corporate social responsibility may entrench the managers to pursue their own interest on the cost of firms’ value that will attract non- financial stakeholders.

Simerly and Bass’s (1998) conducted an exploratory study to examine the relationship between the corporate giving and percentage of stock equity owned by mangers, CEOs, and institutions. Their research found negative relationship between the voluntarily contribution and the ownership structures of the firm. Cox et al (2004) studied the effect of institutional ownership on the social responsible activities of the UK based firms. The result reveals that institutional ownership in long term can increase the corporate social performance. Kappes and Schmid (2013) stated that there is a negative relationship between the family ownership and the corporate involvement in social welfare activities. Study claimed that they normally have long term stakes in the firms so the investment in CSR can reduce their own benefits. Gjessing and Syse (2007) studied corporate social responsibility in an Australian company. They reported that investment institutions diversified in many firms can be affected by political and social problems. Study also concluded that in order to compete for the funding institutional investors should keep their good repute by doing CSR.

Zattoni and Cuomo (2008) stated that government ownership has positive relationship with the corporate social activities. They reported that the engagement in the corporate social activities will construct the base for government support. They claimed that winning the government support by involving in social responsibilities will not only help in legitimizing the corporate operations but also increase access to the other benefits like subsidies and tax reductions that ultimately increase the profitability of the firm. Cressy et al. (2012) in their research on government ownership found that the government ownership increases the CSR activities depending on the type and size of the government ownership of the firm.

On the contrary Jia et al. (2009) conducted study in Chinese firms. They provided evidence that the countries with low governance and extensive fraud and corruption result in lower involvement of firms in CSR activities under higher proportion of government ownership. Dam and Scholtens (2012) in their study reported that there is no significant relationship that exists between Institutional ownership and CSR. Whereas another study conducted by Barnea and Rubin (2010) concluded a negative relationship between the CSR and intuitional ownership. This may be because the Institutional owner has the huge stake in corporations to make profit.

H2: There is a negative relationship between family ownership and firms’ participation in corporate social activities

H3: There is a negative relationship between institutional ownership and firms’ participation in corporate social activities

H4: There is a positive relationship between managerial ownership and firm’s participation in corporate social activities

Control variables

Orlitzky and Benjamin (2001),in his study, stated that the size of the firm significantly influences the percentage of profit contributed in social welfare. He concluded that larger firms with more cash flows in hand make considerable social contributions.

Adams and Hardwick (1998) and Brammer et al. (2006) in their studies on the corporate social responsibility concluded that the firms with high percentage of debt in their capital structure have less available financial resources to contribute for the social well-being.

Sample selection

This study includes 54 manufacturing firms listed on Pakistan stock exchange classified into different sectors. These sectors mainly include automobiles assemblers, automobile parts, Gas Exploration and refinery oils, electronics, food and personal care, chemical, fertilizers, cements and textile weaving and spinning sectors. The firms included in the sample cover the criteria that they all remain listed on the Pakistan stock exchange and are involved in the CSR activities over the study period of 2012 to 2016; also submitted their annual reports to the Pakistan stock exchange. The data are extracted from the publically shared annual reports of the firm. The study consists of 270 observations of study for panel regression analysis. Firms were selected on the following criteria:

(i) Firms must be in business for the study period

(ii) The firm that remains listed in Pakistan stock exchange over the period of study

(iii) The firm should not have merged.

(iv) The firm should be involved in CSR activities at least once in 5 years period.

Measures

The variables of study was different and used according to their applicability in the context of Pakistan

CSR activities

The CSR activities were measured by the voluntarily contribution made by the company over the years. It is measured by the amount paid as a donation, gift and kind in the annual reports. In previous study Ali et al. (2010) measured the CSR as the amount paid for some cause based project or to benefit of employees of the company. Van et al. (2005) measured the CSR as the sum of the amount paid for employment welfare and training, social and community expense and environmental and pollution control expense. Voluntary contribution of the firm is measured by,

Corporate Giving = Firms Donations+ Kind+ Gifts/ Sales Revenue*100

Return on assets

ROA is the measure that is widely used by the researchers for measuring the financial performance of the firm. This measure is consistent with the previous researches done on the financial performance of the firm (Orlitzky et al., 2003; Waddock and Graves, 1997).

ROA is calculated by the following formula:

ROA= Profit before tax/ total assets *100

Ownership structure

Ownership structure is divided into three types: managerial ownership, public ownership, family ownership. Ownership structure was determined by the number of shares held by the management of the company, family members, and the general public (Zeitun and Tian, 2014). This measure is consistent with other researchers worked on the ownership structure of the firm.

Control variables

Debt ratio

Debt ratio is used as a control variable. Debt ratio is calculated by total debt divided by total assets. According to Wu (2004) and Harvey et al. (2004) debt ratio in the capital structure of the firm determines the amount spent on the CSR activities.

Size

Size of the firm is used as a control variable and calculated by taking the natural log of total assets. Many researchers stated that the size of the firm has a subsequent impact on the corporate giving for social welfare. Researchers have taken natural log of total assets to measure the size of the firm (Huang and Wong, 2002;Harda, 2006;Doukas and Pantzalis, 2003).

Tools of analysis

This study aims to examine the impact of corporate social giving on financial performance of the firm and the relationship between the ownership structure and CSR of the firms in Pakistan by using Panel regression. A panel set of data incorporates both cross sectional and time series. Panel data have the characteristics of capturing the changes that occur with the time. Baltagi et al.(2005) panel regression has the ability to control the individual heterogeneity of the firms in sample and reduce the chances of multicollinearity.

The following panel regression equations were examined to analyze the existing relationship between corporate giving, firm performance and ownership structure. Random effects in Generalized least square (GLS) regression has been used to analyze the relationship between the variables. The use of Ordinary Least Square (OLS) regression does not result in the efficient estimation of the regression coefficients. The decision about using random effect is made on the basis of Hausman test. The significant result of the Hausman tests reveals that the fixed effect is more appropriate whereas insignificant test results show random effect is more appropriate for the panel data (Saleh et al., 2011). The following are the model of the study.

Research models

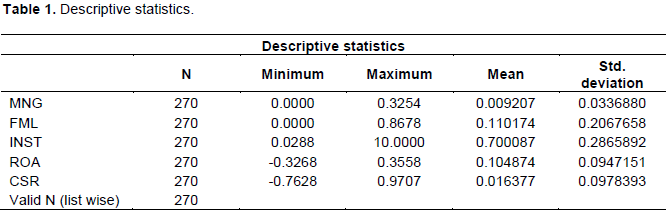

Table 1 provides the descriptive statistics of company ownership structure, corporate social responsibility and profitability ratios. In this study the managerial ownership of the firm is calculated by the total number of shares owned by the insiders divided by total number of shares of the company. The maximum value of the managerial ownership is 0.325 which shows that the average 0.09% of shares in Pakistani manufacturing firms is owned by the managers. The average value of the shares owned by the family member is 11%. Whereas the maximum value in the data of family ownership is 86 percent; which shows that the 86% of company shares are held by the family members. The average value of the institutional ownership is .700, which shows that on average 70% of the manufacturing firms are owned by the institution. The average value of return on assets of the firms is .1048, which shows that on average 10.4% of the return is generated by the assets of the manufacturing companies. The minimum value of the firm return on assets is -0.3268, which shows that there is decrease of 32.6% in the profitability of the firm. CSR is the percentage of income given as a donation, kind and gifts. The average percentage of CSR is 0.016, which shows that on average only 1.6% of the total income is paid out as donations. The minimum value of the CSR is -0.76, which shows that there is a 76% decrease in the firm investment in social responsible activities and the maximum value shows that the 97% of the income is paid out by the firm in social responsible activities.

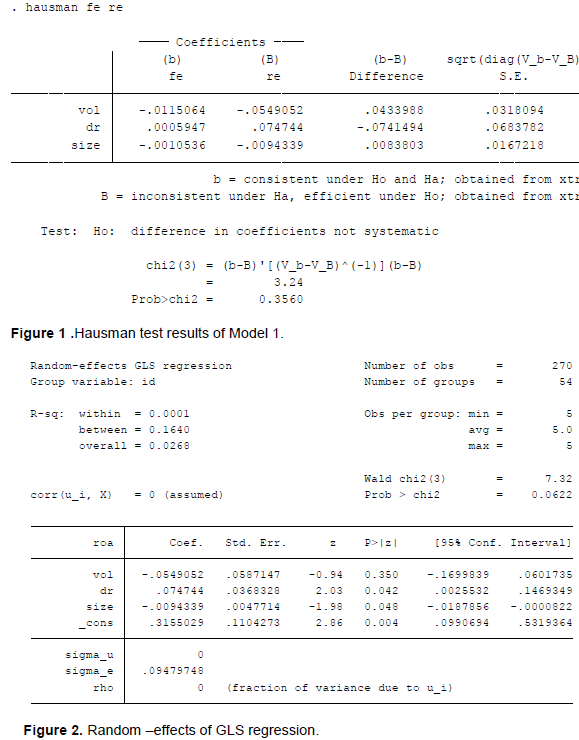

The GLS regression was used to see the relationship between the corporate social responsibility of the firm and the financial performance. Figure 1 provides regression results of model 1. To decide between the fixed and random effect model Hausmen test was conducted. Figure 2 shows the results of the Hausman tests. The insignificant result of the Hasumen test (0.356, P>0.05) shows that the random effect model is appropriate to test the model 1 instead of fixed effect model. The results of the random effect model show that there is an insignificant but negative relationship that exists between the corporate social performance and firm financial performance (-.054, P>0.05). The insignificant but negative sign shows that the profitability of the firm decreases with the increase in the corporate social contribution. Firm’s involvement in the social activities results in corporate expenses that eventually result in damaging the profitability of the firm. Whereas the controlled variables that include size of the firm and debt ratio has a significant relationship with the profitability ratio. The size of the firm is inconsistent with the expected results. The tests found negative significant relationship between size and return on assets (-0.0094, P<0.05). Larger firms have more operating expenses that result in low profitability of the firm. Debt ratio is significantly but positively related to the firm financial performance (0.00059, P<0.05). This shows that increase in the debt ratio increases financial risk of the firm. Managers have to work hard in order to fulfill the financial obligations of the firm. The large percentage of the debt in capital structure increases a firm’s chances of bankruptcy hence managers prefer to invest the available cash in positive NPV projects that result in increase in firms’ profitability (Figure 3).

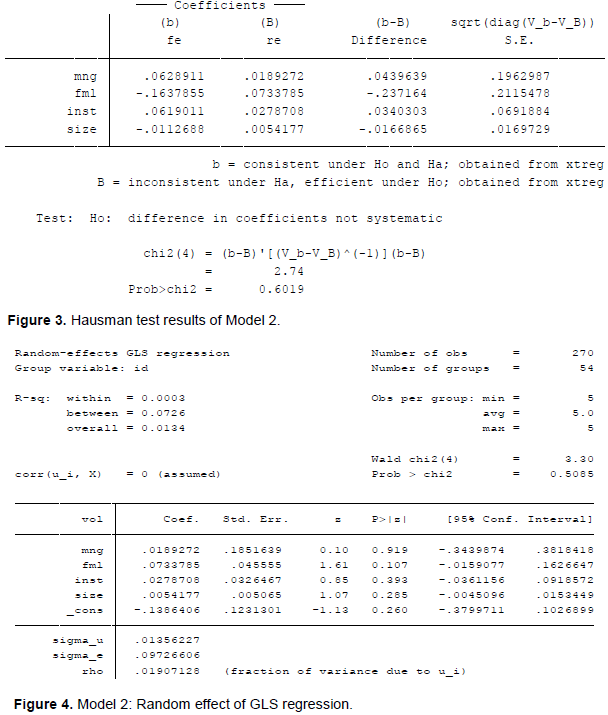

The second joint model was run to see the relationship between the ownership structure and firms financial contribution in social welfare activities. First the Hausman test was conducted to see the appropriate model for effect. The insignificant result of Hausman test shows that random effect model is more appropriate for testing of results.

The results show insignificant relationship with all types of ownership structure (Figure 4). The results show that the managerial ownership has a positive but insignificant relationship with the firm voluntarily contribution (0.0189, P >0.05). The positive results show that managers prefer to invest funds in corporate social responsible activities in order to earn the good will that result in customers’ loyalty. The family ownership (0.0733, P>0.05) and institutional ownership (0.0278, P>0.05) also showed positive but insignificant results. The results of the study show that there is no significant effect of ownership structure on their contribution in social responsible activities. The insignificant result may be the impact of firms’ lack of interest in the disclosure of their corporate social responsible contribution in annual reports. In developing country there is subsequent benefit that a company gets in disclosing their contributions for the welfare of the society. The limitation of the study is that the study only included data from the annual reports. In developing countries like Pakistan firms are not so regularized for disclosing their contributions in annual reports. The study has used only one source for gathering information about the firm investments in social responsible activities.

Corporate social responsibility is an emerging trend in developing countries like Pakistan. A wide research has been conducted to see the Impact of CSR on financial performance of the firm and the impact of ownership structure on voluntarily contribution in developed country. The regulations have been developed in order to encourage firms to declare information regarding their investments in social wellbeing. In our study on the manufacturing sector of Pakistan we found negative but insignificant relationship between firm’s involvement in the social responsible activities and the firm financial performance. The results also show that there is no impact of ownership structure on the corporate social responsible activities of the firm in context to Pakistan.

LIMITATIONS AND FUTURE IMPLICATION OF RESEARCH

The research has some limitations. The first limitation is that this research only focuses on 2012-2016. Due to political instability and other economic condition that has influenced the business, years after 2016 till 2018 were not included in the research. Secondly this research also focused on 54 non-financial firms listed on Pakistan Stock Exchange from 2012 to 2016. Further research can be conducted by including industry wise analysis on relationship between the CSR and firms’ financial performance. Thirdly multiple measures for financial performance of the firms can be used to analyze the relationship between the CSR and financial performance.

The authors have not declared any conflict of interests.

REFERENCES

|

Adams M, Hardwick P (1998). An analysis of corporate donations: United Kingdom evidence. Journal of Management Studies35(5):641-654.

Crossref

|

|

|

|

Ali I, Rehman KU, Ali SI, Yousaf J, Zia M (2010). Corporate social responsibility influences, employee commitment and organizational performance. African Journal of Business Management 4(13):2796-2801.

|

|

|

|

|

Baltagi BH, Bratberg E, Holmås TH (2005). A panel data study of physicians' labor supply: the case of Norway. Health Economics 14(10):1035-1045.

Crossref

|

|

|

|

|

Barnea A, Rubin A (2010). Corporate social responsibility as a conflict between shareholders. Journal of Business Ethics 97(1):71-86.

Crossref

|

|

|

|

|

Braithwaite J, Drahos P (2000). Global business regulation.Cambridge University Press.

|

|

|

|

|

Brammer S, Brooks C, Pavelin S (2006). Corporate social performance and stock returns: UK evidence from disaggregate measures. Financial Management 35(3):97-116.

Crossref

|

|

|

|

|

Cespa G, Cestone G (2007). Corporate social responsibility and managerial entrenchment. Journal of Economics and Management Strategy 16(3):741-771.

Crossref

|

|

|

|

|

Coffey BS, Fryxell GE (1991). Institutional ownership of stock and dimensions of corporate social performance: An empirical examination. Journal of Business Ethics 10(6):437-444.

Crossref

|

|

|

|

|

Coffey BS, Wang J (1998).Board diversity and managerial control as predictors of corporate social performance. Journal of Business Ethics 17(14):1595-1603.

Crossref

|

|

|

|

|

Cox A (2004). The art of the possible: relationship management in power regimes and supply chains. Supply Chain Management: An International Journal 9(5):346-356.

Crossref

|

|

|

|

|

Cressy R, Cumming D, Mallin C (2012).Entrepreneurship, governance and ethics.In Entrepreneurship, Governance and Ethics 95:117-120.

Crossref

|

|

|

|

|

Dam L, Scholtens B (2012). Does ownership type matter for corporate social responsibility? Corporate Governance: An International Review 20(3):233-252.

Crossref

|

|

|

|

|

Doukas JA, Pantzalis C (2003). Geographic diversification and agency costs of debt of multinational firms. Journal of Corporate Finance 9(1):59-92.

Crossref

|

|

|

|

|

Galant A, Cadez S (2017). Corporate social responsibility and financial performance relationship: a review of measurement approaches. Economic research-Ekonomskaistraživanja 30(1):676-693.

Crossref

|

|

|

|

|

Galbreath J, Shum P (2012). Do customer satisfaction and reputation mediate the CSR-FP link? Evidence from Australia. Australian Journal of Management 37(2):211-229.

Crossref

|

|

|

|

|

Gjessing OPK, Syse H (2007). Norwegian petroleum wealth and universal ownership. Corporate Governance: An International Review 15(3):427-437.

Crossref

|

|

|

|

|

Goss A, Roberts GS (2011).The impact of corporate social responsibility on the cost of bank loans. Journal of Banking and Finance 35(7):1794-1810.

Crossref

|

|

|

|

|

Harda SI (2006). Policies on Roma's social inclusion in Europe: towards succeeding in social intervention-ROMAin: a quantitative analysis of 85 projects.

|

|

|

|

|

Harvey CR, Graham JR (2001). The Theory and Practice of Corporate Finance: Evidence from the field. Journal of Financial Economics 60(60):187-243.

Crossref

|

|

|

|

|

Jia C, Ding S, Li Y, Wu Z (2009). Fraud, enforcement action, and the role of corporate governance: Evidence from China. Journal of Business Ethics 90(4):561-576.

Crossref

|

|

|

|

|

Kappes I, Schmid T (2013).The effect of family governance on corporate time horizons. Corporate Governance: An International Review 21(6):547-566.

Crossref

|

|

|

|

|

Kim KH, Kim M, Qian C (2018). Effects of corporate social responsibility on corporate financial performance: A competitive-action perspective. Journal of Management 44(3):1097-1118.

Crossref

|

|

|

|

|

Lopatta K, Buchholz F, Kaspereit T (2016). Asymmetric information and corporate social responsibility. Business and Society 55(3):458-488.

Crossref

|

|

|

|

|

Mackey A (2007). Conversational interaction in second language acquisition: A series of empirical studies. Oxford University Press.

|

|

|

|

|

Margolis JD, Walsh JP (2003). Misery loves companies: Rethinking social initiatives by business. Administrative Science Quarterly 48(2):268-305.

Crossref

|

|

|

|

|

Matten D, Crane A (2005). Corporate citizenship: Toward an extended theoretical conceptualization. Academy of Management Review 30(1):166-179.

Crossref

|

|

|

|

|

McWilliams A, Siegel D (2001). Profit maximizing corporate social responsibility. Academy of Management Review 26(4):504-505.

Crossref

|

|

|

|

|

Mishra S, Suar D (2010). Does corporate social responsibility influence firm performance of Indian companies? Journal of Business Ethics 95(4):571-601.

Crossref

|

|

|

|

|

Oh WY, Chang YK, Martynov A (2011). The effect of ownership structure on corporate social responsibility: Empirical evidence from Korea. Journal of Business Ethics 104(2):283-297.

Crossref

|

|

|

|

|

Orlitzky M, Benjamin JD (2001). Corporate social performance and firm risk: A meta-analytic review. Business and Society 40(4):369-396.

Crossref

|

|

|

|

|

Orlitzky M, Schmidt FL, Rynes SL (2003). Corporate social and financial performance: A meta-analysis. Organization Studies 24(3):403-441.

Crossref

|

|

|

|

|

Rees W, Rodionova T (2015). The influence of family ownership on corporate social responsibility: An international analysis of publicly listed companies. Corporate Governance: An International Review 23(3):184-202.

Crossref

|

|

|

|

|

Saleh M, Zulkifli N, Muhamad R (2011). Looking for evidence of the relationship between corporate social responsibility and corporate financial performance in an emerging market. Asia-Pacific Journal of Business Administration 3(2):165-190.

Crossref

|

|

|

|

|

Scherer AG, Palazzo G (2007). Toward a political conception of corporate responsibility: Business and society seen from a Habermasian perspective. Academy of Management Review 32(4):1096-1120.

Crossref

|

|

|

|

|

Scherer AG, Smid M (2000). The downward spiral and the US model business principles-Why MNEs should take responsibility for the improvement of world-wide social and environmental conditions. Management International Review 40(4):351-371.

|

|

|

|

|

Simerly RL, Bass KE (1998). The impact of equity position on corporate social performance. International Journal of Management 15:130-135.

|

|

|

|

|

Van Dyck C, Frese M, Baer M, Sonnentag S (2005). Organizational error management culture and its impact on performance: a two-study replication. Journal of Applied Psychology 90(6):1228.

Crossref

|

|

|

|

|

Vomberg A, Homburg C, Bornemann T (2015). Talented people and strong brands: The contribution of human capital and brand equity to firm value. Strategic Management Journal 36(13):2122-2131.

Crossref

|

|

|

|

|

Waddock SA, Graves SB (1997).The corporate social performance-financial performance link. Strategic Management Journal 18(4):303-319.

Crossref

|

|

|

|

|

Walton CC (1967). Corporate social responsibilities. Wadsworth Publishing Company.

|

|

|

|

|

Wang Z, Sarkis J (2017). Corporate social responsibility governance, outcomes, and financial performance. Journal of Cleaner Production 162:1607-1616.

Crossref

|

|

|

|

|

Wartick SL, Cochran PL (1985).The evolution of the corporate social performance model. Academy of Management Review 10(4):758-769.

Crossref

|

|

|

|

|

Werther Jr WB, Chandler D (2005).Strategic corporate social responsibility as global brand insurance. Business Horizons 48(4):317-324.

Crossref

|

|

|

|

|

Wood B (1991). KoobiFora research project: Hominid cranial remains (Vol. 4). Oxford University Press, USA.

|

|

|

|

|

Wu L (2004). The impact of ownership structure on debt financing of Japanese firms with the agency cost of free cash flow. In EFMA 2004 Basel Meetings Paper.

Crossref

|

|

|

|

|

Yoshikawa T, Zhu H, Wang P (2014). National governance system, corporate ownership, and roles of outside directors: A corporate governance bundle perspective. Corporate Governance: An International Review 22(3):252-265.

Crossref

|

|

|

|

|

Zattoni A, Cuomo F (2008). Why adopt codes of good governance? A comparison of institutional and efficiency perspectives. Corporate Governance: An International Review 16(1):1-15.

Crossref

|

|

|

|

|

Zeitun R, Tian GG (2014). Capital structure and corporate performance: evidence from Jordan. Australasian Accounting Business and Finance Journal, Forthcoming 2014:1-36.

Crossref

|

|

|

|

|

Zenisek TJ (1979). Corporate social responsibility: A conceptualization based on organizational literature. Academy of Management Review 4(3):359-368.

Crossref

|

|