ABSTRACT

This empirical study examines the relationship between financing decisions and corporate governance on the one side and firm performance on the other, concerning Italian large and medium private family firms. Tax-aggressive practices are not used to avoid a deprivation of socioemotional wealth, in terms of diminished reputation, caused by a possible tax-related lawsuit. Due to the low risk perception and most likely the profitable use of a larger quantity of cheaper debt, size improves performance. However, more solvent firms exhibit better results only when Return on Assets (ROA) is taken into account. The presence of descendants taking their place in the family business impairs performance. Short- and long-term debts are not related to the agency conflicts between owners and managers and between owners and creditors, therefore debt maturity has no influence on performance. Finally, the negative relationship between leverage and performance tends to reveal pecking order behaviour for the sampled firms.

Key words: Private family firms, performance, financing choices, corporate governance, socioemotional wealth, agency conflicts.

The research on family firms has developed intensively in the last two decades (Carney et al., 2015) and covered several different issues, such as succession, governance, organization theory, small- and medium-sized firms, ownership, and human resources (Benavides-Velasco et al., 2013). In this respect, many articles dealing with the influence of family control on performance stress the importance of several topics, such as the firm’s size, generation of family management, identity of owners and managers, as well as the country-context in which family firms operate (Miralles-Marcelo et al., 2014). This paper further deals with the above-mentioned dimensions, which appear to be of interest empirically.

Specifically, this paper investigates the connection between the double aspect of financing decisions (represented by the choice of the mix of equity and debt for a firm, that is, its capital structure decisions, as well as the selection of the appropriate duration of its liabilities, that is its debt maturity decisions) and corporate governance (used in a very broad meaning, in which the issue of prevention or mitigation of agency conflicts is included, together with the methods for allocating power and responsibilities within a firm) of Italian medium and large private family firms on the one side and their performance (measured by return on equity or return on assets) on the other.

A large body of empirical research has investigated the relationship both between financing decisions and firm performance and between corporate governance facets and firm performance.

Regarding financing decisions and firm performance, Modigliani and Miller (1958) contend that no modification of a firm’s capital structure changes its value or shareholders’ wealth in perfect competition and markets. Specifically, only investment decisions are important in maximising value and improving performance. However, when the assumptions of Modigliani and Miller (1958) are at least partly abandoned, by considering taxation, bankruptcy, asymmetric information, and agency conflicts, one finds that capital structure influences a firm’s performance.

Modigliani and Miller (1963) themselves explain that, as interest payments are deductible from corporate income, firms can increase their proportion of debt to reduce company tax and improve performance. Moreover, the tax burden can be reduced through tax planning activities (Chen et al., 2010). Many studies on the relationship between effective tax rate (that is, the proportion of tax paid on gross profit) and performance highlight an inverse relationship. For example, Noor et al. (2010) contend that profitable companies can achieve lower effective tax rates, thanks to the availability of tax incentives and provisions. Similarly, Derashid and Zhang (2003) find that more efficient firms benefit from tax subsidy in the form of lower effective tax rates, and Gatsi et al. (2013) explain the negative relationship between taxation and profitability in terms of reduction of earnings level. Other studies find that more profitable firms take advantage of tax practices to moderate their tax costs (Minnick and Noga, 2010; Lanis and Richardson, 2012). In terms of tax aggressiveness, which can be defined as downward manipulation of taxable income through tax planning, sometimes implying fraudulent tax evasion (Frank et al., 2009), Desai and Dharmapala (2006) stress the importance of agency theory in explaining its determinants in family firms. On this issue, Chen et al. (2010) find that the tax aggressiveness of listed family businesses is moderate, in order to avoid the non-tax costs of a potential price discount caused by non-controlling shareholders, who fear a family rent-seeking goal, masked by tax avoidance orientation (Desai and Dharmapala, 2006). Nevertheless, it is still unclear how the trade-off between the costs and benefits of being tax aggressive affects privately held family firms.

However, indebtedness generates not only advantages, but also drawbacks. In fact, a high leverage implies greater probability of bankruptcy, which is an important business concern (Graham and Harvey, 2001), together with its related potential costs (Bancel and Mittoo, 2004). Thus, a firm should identify its optimal leverage, which is the result of a compromise between tax benefits and distress costs of debt (Kraus and Litzenberger, 1973). Accordingly, when a firm’s bankruptcy risk is high owing to the sizable amount of debt raised, then the shareholder value will tend to decline, because lenders will demand higher rates of interest on a riskier debt. By contrast, larger firms benefit from higher leverage (Rajan and Zingales, 1995), and this may be interpreted as a low distress-risk perception by lenders. Therefore, larger enterprises can take advantage of lower debt costs and improve their performance.

Moreover, if we look at the issue of corporate governance and its linkage with firm performance, prior studies tend to associate the founder's effect with the superior performance of a family business (Cucculelli and Micucci, 2008). In particular, founder owners are basically focused on growth and financial performance, whereas family owners also pursue socioemotional objectives, generating lower financial returns (Jaskiewicz et al., 2017). Hence, the presence of successors probably has a negative effect on the performance of private family firms. Therefore, weaker performance is expected for older private family firms, in which it is likely that descendants have a growing role as managers and/or owners in the firm, as opposed to younger ones. Furthermore, when we consider the agency conflicts between shareholders and managers and between shareholders and creditors (Jensen and Meckling, 1976), the peculiarities of (private) family firms may have an impact in moderating these agency conflicts in these firms. In other words, the use of debt and its maturity may not be necessary as a means of control over the selfish behaviour of managers, to the detriment of owners, and the same use may not prove to be useful as a method for reducing the opportunistic activities of shareholders to lenders in family-controlled businesses. Coherently, the choice of leverage or debt maturity for these enterprises may not influence their performance.

Although previous analysis acknowledges the effort of academicians in examining the main reasons contributing to business performance, there is virtually no empirical research on the specific issue this paper deals with, that is to say, on the relationship between financing decisions and corporate governance of Italian medium and large private family firms and their performance, as previously described. Specifically, to the best of my knowledge, there is only one recent paper that focuses on the relationship between performance and financing activities from a sample of Portuguese-listed non-financial family and non-family firms (Vieira, 2017). This is quite surprising, as the international importance of family business is widely recognized. For example, over 50% of enterprises in the European Union are family owned; in Latin America, they represent between 65 and 90% of firms, and in the United States, they constitute more than 95% of businesses (PricewaterhouseCoopers, 2007). Family-controlled businesses employ 80% of the United States workforce and 85% of the working population worldwide. A total of 37% of Fortune 500 companies are family ones (Poza, 2007), and overall, family businesses represent approximately 46% of the Standard and Poor’s (S&P) 1500 index firms (Chen et al., 2008). In East Asia, a considerable fraction of firms in the stock markets is controlled by a small number of families (Claessens et al., 2000) and there is also evidence of the domination of family business in Arab and MENA countries (Ayman et al., 2015).

Following the above discussion, this work contributes to the scarce body of knowledge on the relationship between performance, and financing policy and corporate governance of family firms for the main following reasons. First, it focuses on medium and large private family firms, which differ from both non-family-controlled firms and other kinds of family firms (such as listed or very small ones). Secondly, this work facilitates ample examination of the determinants of performance of medium and large private family firms, including financing choices and corporate governance issues. Thirdly, the paper considers a specific country, Italy, where family firms represent more than 70% of industrial and services businesses (ISTAT Istituto Nazionale di Statistica - Italian Central Statistics Institute, 2013) and which has a bank-based tradition. This study can thus facilitate further comparisons between medium and large private family firms, belonging to countries with similar or different financial-system characteristics. Lastly, by using a wide sample of firms, it tries to overcome the limitation of the small size of the sample Vieira (2017) used in her work to possibly obtain more generalizable results from the private family firms being examined.

The remainder of this paper is organized as follows. Firstly, the peculiarities of private family firms, as opposed to other types of firms, are highlighted. Secondly, pertinent literature and some hypotheses are examined, and this part is followed by a description of the methodology being employed. Then the results of the econometric model are provided and discussed. Lastly, some conclusions are offered.

THE PECULIARITIES OF PRIVATE FAMILY FIRMS

Family firms differ from non-family firms in general, owing to their complex nature, created by the connections between the family members, their beliefs, culture, and values and the specific business. The “familiness” (Habbershon and Williams, 1999) of family enterprises is related to their distinctive financial and governance features as compared to non-family ones. In fact, family owners have concentrated and poorly diversified ownership and they are actively involved in the management, these businesses have long investment horizons and they are characterized by a specific generation leading the firm (Cheng, 2014). From a non-economic perspective, even if all enterprises have several economic as well as non-economic objectives, only family firms should have non-economic goals which represent the unique interests of the controlling family, including its vision, attitudes, and intentions (Chrisman et al., 2012). Moreover, Gomez-Mejia et al. (2007) coined the term socioemotional wealth, which they defined as a group of several facets, including identity, the ability to exercise family influence, and the perpetuation of a family dynasty. The socioemotional orientation implies autonomy and control, family cohesiveness, supportiveness, loyalty, harmony, pride, family name recognition, respect, and status (Zellweger et al., 2011), as well as the need to transfer the family business to future generations and sustain the family’s image and reputation (Naldi et al., 2013).

However, in addition to the difference between family and non-family firms in general, it is also interesting to make a comparison between both private family firms and private non-family firms and between publicly listed family firms and publicly listed non-family firms.

Private firms have equity shares which are not traded in a stock exchange, and they are allowed to release only basic information concerning their financial situation and performance. Nonetheless, privately held family firms benefit from the absence of the capital market discipline which promotes their long-term orientation and socioemotional attitude, even if the lack of these market forces generates excessive altruism, loss aversion, and the pursuit of non-economic goals (Carney et al., 2015).

On the contrary, the power of wealth extraction by controlling shareholders, at the expense of non-controlling ones, in publicly listed firms is subject to capital market forces, and these prove to be effective for both family and non-family firms. Thus, the possibility for family blockholders of engaging in expropriation activities may be as low as that of non-family counterparts (Carney et al., 2015).

The overall differences and similarities between private family firms and other types of businesses are likely to influence the determinants of the performance of the sample enterprises, hence these issues are included in the discussion, which is developed in the following sections.

LITERATURE REVIEW AND HYPOTHESES

Agency conflicts between controlling and non-controlling shareholders and taxation, and financial distress

The agency conflicts between controlling and non- controlling shareholders, the so-called Agency Problem II (Villalonga and Amit, 2006), are likely to be substantial in family firms (Villalonga et al., 2015), especially when compared to the other types of agency conflicts, namely those between managers and shareholders and between shareholders and creditors, as further explained in a subsequent paragraph.

Thanks to the divergence between control rights and cash flow rights (Shyu and Lee, 2009), family controlling owners can expropriate wealth from non-controlling ones through corporate tax activities that, by deceiving non-controlling shareholders, allow them to extract rents (Gaaya et al., 2017). Nonetheless, family controlling shareholders in private family firms have a lower motivation for taking advantage of non-controlling shareholders compared to controlling shareholders in public firms or private non-family firms. On the one hand, one could assert that non-public family firms lack the discipline of the capital market control (Carney et al., 2015), for which they would be punished by a price discount if non-controlling shareholders perceived rent extraction, through misleading tax planning (Chen et al., 2010). On the other hand, though, Steijvers and Niskanen (2014), quoting Gedajlovic and Carney (2010), stress that private family businesses have large family ownership, implying a much longer investment horizon and greater reputation concerns, as opposed to what happens in public firms or private non-family firms. Therefore, it is likely that controlling family shareholders are strongly worried about complying with tax rules, in order not to have reputation damage caused by a tax-related lawsuit (Chen et al., 2010). Such damage in turn leads to the destruction of socioemotional wealth. In particular, this issue has become more important in Italy, since the recent approval of the Legislative Decree on August 5, 2015 n. 128, introducing a new definition of abuse of law and tax avoidance. Hence, for the preceding considerations, Italian medium and large private family firms refrain from engaging in important tax-aggressive practices to decrease their tax burden and enhance their future performance. In this respect, a negative impact of past taxation on profitability is considered possible. Therefore, the first hypothesis is:

H1: Past effective tax rate is negatively associated with performance.

As family firms are likely to trade off the tax benefits and bankruptcy costs of debt (Kraus and Litzenberger, 1973), a moderate level of leverage is plausible. Lòpez-Gracia and Sànchez-Andùliar (2007), in line with a previous study of Poza et al. (2004), document that family firms reach their optimal leverage more easily, thanks to reduced agency costs. Lòpez-Gracia and Sànchez-Andùliar (2007) also find that family firms are less indebted than non-family ones. The relative low use of debt by family firms (Gallo et al., 2004; McConaughy et al., 2001; Agrawal and Nagarajan, 1990) is probably related to their peculiar features. In fact, first, a significant debt ratio means a high likelihood of losing family control. Secondly, a business failure implies both an economic loss and a loss of the family human capital (Blanco-Mazagatos et al., 2007). Finally, bankruptcy also causes serious damage to family firms that wish to transfer the business to future generations and safeguard their reputation as a family (Berrone et al., 2012). Nevertheless, the financially healthiest family businesses may find it profitable to raise debt capital for new investments, since Italian medium and large private family enterprises rely largely on debt (despite the fact that financial literature documents a lower use of debt in family businesses, as compared to non-family ones, as just described). In fact, on average, debt constitutes 60% of investments for the firms being analysed (Table 2: SOL = 40). Therefore, more solvent and sizeable Italian medium and large private family firms can enjoy moderate rates of interest on their debt, as they are perceived as less risky by creditors. In turn, this may generate better performance, thanks to the profitable employment of a larger amount of cheaper debt capital. Therefore, the next two hypotheses follow:

H2: Solvency is positively related to performance.

H3: Size is positively related to performance.

Age and corporate governance considerations

Age, as a proxy for the generation leading a family firm, is expected to influence the performance of family-controlled businesses. Many empirical studies focus on how a specific generation involved in the family business can affect its performance. However, most of these studies concern companies listed in stock markets, thus rarely is a more varied sample employed (Cucculelli and Micucci, 2008). For example, Villalonga and Amit (2006), examining Fortune-500 firms, find that family ownership creates value, but only when the founder serves as CEO of the family firm or as chairman with a hired CEO. Similarly, Barontini and Caprio (2006), using data from publicly traded corporations in Continental Europe, show that operating performance is significantly higher in founderâ€controlled corporations and in corporations controlled by descendants who sit on the board as nonâ€executive directors, whereas when a descendant is CEO, family firms do not statistically differ from their nonâ€family peers in terms of performance. Within the Standard and Poor’s 500 firms, Peréz and Gonzáles (2006) report that firms run by heirs significantly underperform other firms, especially when a family CEO did not benefit from a selective education, while Cucculelli and Micucci (2008) found that successors cause the firm they run to have a lower performance as compared to founders, in a large sample of Italian manufacturing firms. For the U.S. stock market, Fahlenbrach (2009) gives evidence that founder-CEO firms have better performance. The lower performance, generated by later-generation family businesses, is probably due to their orientation to socioemotional wealth creation. In fact, this orientation causes family firms to accept risks and/or make decisions that possibly decrease performance if those decisions enhance socioemotional wealth creation (Gomez-Mejia et al., 2007; 2011). Actually, family owners, differently from founder owners who are essentially focused on growth and financial performance, also pursue socioemotional wealth objectives, such as dynastic control, family-member employment, and safeguard of reputation, which in turn might imply a sacrifice of financial returns, although compensated by socioemotional wealth creation (Jaskiewicz et al., 2017). Hence, it can be argued that Italian medium and large private family enterprises create lower value, when these businesses involve the descendants, as owners and/or managers. Since the older a family firm is, the higher the probability the successors will have a growing role in the firm itself as well as of an increasing preference to socioemotional goals, it is reasonable to construct the next hypothesis:

H4: Age is negatively associated with performance.

Agency costs between managers and shareholders and between shareholders and creditors

Regarding Agency Problem I (Villalonga and Amit, 2006) in family firms, concerning agency conflicts between (family) shareholders and managers (Berle and Means, 1932; Jensen and Meckling, 1976; Jensen, 1986), many researchers contend that these should be insignificant, owing to corporate governance and altruistic considerations. First, there is little separation between ownership, control, and management in family-controlled businesses, which maximizes stockholder wealth (Hill and Snell, 1989). Furthermore, family shareholders usually have undiversified portfolios and concentrated ownership (Cheng, 2014) and pursue noneconomic goals to preserve their socioemotional wealth (Gomez-Mejia et al., 2007), such as the transmission of the business to future generations and the preservation of the family’s image and reputation (Naldi et al., 2013). Therefore, family controlling owners are encouraged to communicate and cooperate with one another (Van den Berghe and Carchon, 2003) to effectively monitor managers (Shleifer and Vishny, 1986) and stimulate them to create shareholder value as well as to achieve socioemotional goals. Nevertheless, agency conflicts between owner-managers and simply family owners may occur in family firms, especially in later-generation family businesses. In fact, in this kind of family firm, ownership and management become more fragmented, thus generating room for information asymmetries and the opportunistic behaviour of managers (Blanco-Mazagatos et al., 2007). Owner-managers will be focused on the interests of their family unit and make decisions for the benefit of their own nuclear family, rather than that of the family firm as a whole (Blanco-Mazagatos et al., 2016), thus prejudicing family firm performance. Since short-term debt gives lenders the possibility of effectively monitoring managers with minimum effort (Rajan and Winton, 1995), reducing debt maturity also helps minimize the agency conflicts between managers and owners (Stulz, 2000), that is between owner-managers and non-manager owners in family firms, thus improving business performance. The same result can be obtained through increasing leverage, which prevents managers from employing free cash flow to realize personal objectives (Jensen, 1986). Hence, we could expect a positive relationship between the amount of short-term debt and level of debt and firm performance on the one side, and a negative one, between the incidence of long-term debt and firm performance on the other. Nonetheless, adequate governance mechanisms may effectively discipline managers and cause agency conflicts between owner-managers and non-manager owners negligible in the second and later generations (Blanco-Mazagatos et al., 2016). Therefore, Italian medium and large private family firms do not use decreasing debt maturity nor increasing leverage to hinder selfish managerial behaviour, which may impair firm performance, especially when the business is characterized by a more distributed ownership and management (the mean and median values for AGE are, alternatively, 33.8 and 32.0, exhibiting, on average, a certain probability of some kind of ownership and/or managerial fragmentation, due to the greater involvement of the founder’s relatives in the firm). Obviously, at the same time, owner-managers are not allowed to employ long-term debt or decreasing debt to satisfy their selfish interests.

The Agency Problem III (Villalonga et al., 2015), that is the agency conflicts occurring between owners and creditors, is supposed to be irrelevant in family-controlled businesses, as argued by Croci et al. (2011) and Dìaz-Dìaz et al. (2016). In fact, family owners tend to behave fairly with lenders, because they wish to preserve the socioemotional wealth reflected in the family firms they run and want to safeguard their concentrated and scarcely diversified investments, in the firms themselves. Consequently, creditors do not need to compensate for the strong possibility of selfish behaviours of shareholders by paying less for a firm’s debt, demanding higher interest rates, developing monitoring activities, and requiring bonding activities (Jensen and Meckling, 1976). All of these circumstances would normally increase financial and managerial costs and worsen firm performance. Coherently, short-term debt is not required in family-owned businesses to lessen the agency problems of underinvestment or overinvestment (Myers, 1977; Barnea et al., 1980; Childs, et al., 2005; Dang and Phan, 2016). Neither higher debt nor longer debt maturity are seen by creditors as a means for expropriating considerable lenders’ wealth. More precisely, debt maturity and leverage are not connected with the performance of Italian medium and large private family firms, because creditors do not require costly activities or higher interest rates in the absence of suitable financing policies. Similarly, specific financing typologies cannot improve a firm’s performance. Thus, the next hypotheses are proposed as applicable in both the contexts of Agency Problems I and III, discussed in this paragraph:

H5: There is no statistically significant relationship between short-term debt and performance.

H6: There is no statistically significant relationship between long-term debt and performance.

H7: There is no statistically significant relationship between leverage and performance.

Sample selection and model characteristics

The sampled firms are composed of Italian medium and large private family firms, belonging to all sectors except for the financial one. The choice of only non-financial businesses allows this research to avoid the effect of financial sector regulations and specific firms’ financing policy (Gottardo and Moisello, 2014). Furthermore, following previous studies (Anderson and Reeb, 2003, Anderson et al., 2003; Barth et al., 2005; Amore et al., 2011; Croci et al., 2011; Dìaz-Dìaz et al., 2016), ownership is considered for identifying family firms. Specifically, depending on data availability, private family firms are referred to herein as those unlisted firms with one or more named individuals or families, jointly owning at least 50% of the equity. The choice of the percentage of 50% for ownership lies in the fact that privately owned firms have concentrated ownership structures, therefore an ownership of 50% is needed to achieve actual control (Amore et al., 2011). As far as the issue of firm size in the sample is concerned, this work refers to the EU approach (Commission Recommendation of 6 May 2003, concerning the definition of micro-, small-, and medium-sized enterprises). In particular, medium and large businesses in this research are those with revenues from sales and services (annual turnover) of at least EUR 10 million and at least 50 employees.

The sample data were gathered from the AIDA (Analisi Informatizzata Delle Aziende) database for the period of 2008-2016. AIDA is the Italian provider of the Bureau Van Dijk European Databases, containing comprehensive financial and accounting information on Italian companies in all sectors of activity. The initial sample includes all active non-financial Italian medium and large private family firms of the database, which are represented by 1,760 units. Enterprises with missing observations and/or negative values for effective tax rates and/or short-term debt, long-term debt, and leverage are excluded in order to avoid misleading results. Hence, the final sample is made of 983 family firms, as defined above. All of the variables used in the empirical model concern book values and are described in detail in Table 1.

The following empirical models are employed to test the proposed hypotheses:

Where, PERA or B i,t = performanceA or B for firm i at time t; β0 = constant; ETRi,t-1= effective tax rate for firm i at time t-1 (where the initial/final t-1 periodtable is between 2007 and 2015); SOLi,t = solvency for firm i at time t; SIZEi,t = size for firm i at time t; AGEi,t = age for firm i at time t; STDi,t = short-term debt for firm i at time t; LTDi,t = long-term debt for firm i at time t; DEi,t = leverage for firm i at time t; εi,t = error term and εi,t = εi + vi,t, where εi is the firm-specific effects and vi,t is a random term.

The study exploits a static panel data approach. In general, Hsiao (2007) asserts that panel data methodology has several advantages over either cross-sectional or time-series data. Specifically, Terra (2011) emphasizes three main advantages of panel data estimation, quoting Hsiao (1986). First, it creates larger datasets which have higher variability and less collinearity among independent variables. Furthermore, it allows for the examination of topics that cannot be adequately addressed by cross-section or time series models. Lastly, it offers an instrument for reducing the missing variable problem. A fixed effects or random effects model can be used when it comes to a static panel data approach. As suggested by Abor (2007), the choice of the former or latter method depends on the underlying assumptions, and an Hausman test is conducted, which generates a probability of less than 0.05, thus indicating that the fixed effects model is preferable to the random effects one.

Descriptive statistics

Table 2 shows the descriptive statistics for all variables used in the regressions. Some main comparisons highlight that SOL, AGE, and PERA are characterized by the highest variability, as their standard deviations are greater than 10. By contrast, SIZE, STD, and LTD display the lowest variability, as the values of their standard deviations are less than 1. In greater detail, the mean values for PERA and PERB account for 9.88 and 6.62%, respectively. That tends to document an overall ability of the firms considered to generate value, although the period of the investigation (2008 to 2016) substantially refers to the international financial crisis one. Notoriously, it starts with the subprime mortgage financial crisis in 2007 in the USA and then propagates to Europe, including Italy, as a major credit crunch and lack of investment opportunities for businesses. Subsequently, after 2010, firms from a few European countries (the so-called PIIGS), such as Italian medium and large private family firms, are also hit by the effects of the sovereign debt crisis of the Eurozone, in terms of further credit restrictions and worsening of economic perspectives. As expected, the mean value for PERA is coherently greater than that for PERB, as the former includes, of course, the equity risk premium, demanded by shareholders on their riskier investment, and the latter is a gross weighted average rate of returns for shareholders and lenders. On average, the ETR is 0.55, implying quite a heavy tax burden for the surveyed firms. Despite a relatively low use of debt in family firms, which is recognized by the preceding researches, as previously written, SOL shows the importance of debt, as the percentage of equity on average employed by the firms analysed is only 40%, and DE exhibits a mean value of almost 1. Whereas the low SIZE variability reveals that the dimensions of the firms observed are similar, the significant mean AGE, that is to say 33.8, shows that they were generally founded many years ago, with the oldest firm being 107 years old. As for STD and LTD, their average values (0.85 and 0.15, respectively) could suggest the low use of long-term debt by Italian medium and large private family firms. Nonetheless, it is important to stress that the sampled firms may tend to rely on the rolling over of short-term debt, thus becoming de facto long-term debt and increasing the actual amount of debt repaid in the long run.

Regression results

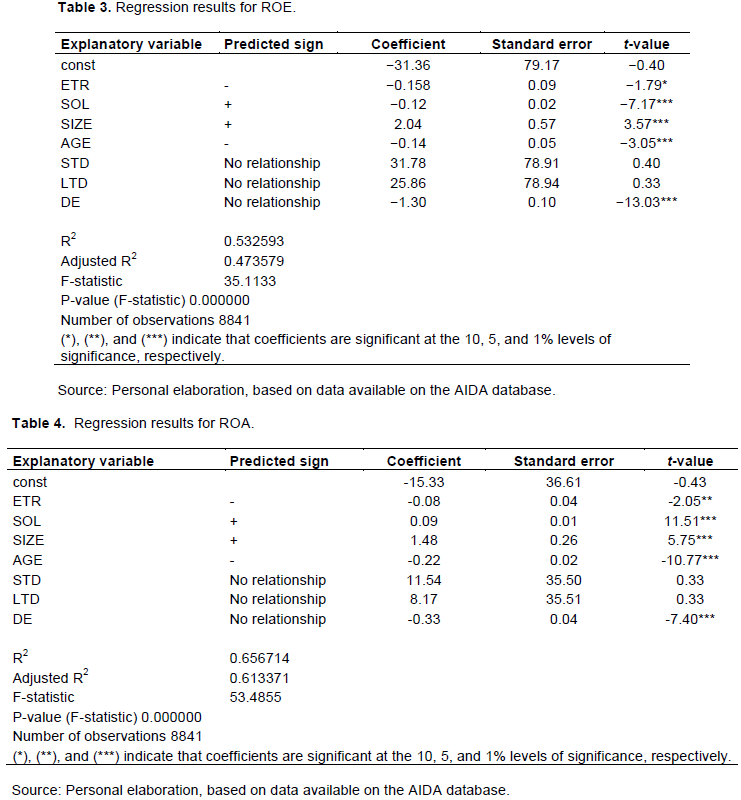

Tables 3 and 4 present the regression results, by considering ROE or ROA as the dependent variables, respectively, and employing a fixed-effects approach for the above-mentioned reason. The findings regarding the signs of the coefficients are generally the same in both cases, thus only the relationships concerning ROE and its explanatory variables are commented on, unless differences arise for the dependent variable of ROA.

The sign of the relationship between performance and ETR is negative, as hypothesized, albeit only significant at the 10% level. The significance, though, reaches the 5% level if ROA is taken into account. Therefore, it is fairly clear that, owing to socioemotional concern for a possible tax-related lawsuit (Chen et al., 2010), Italian medium and large private family firms avoid engaging themselves in strong tax-aggressive practices. As a result, past tax burden does not cause these firms to abuse or even use tax-avoidance instruments, and this is reflected on the decreasing profitability.

Regarding the issue of the financial distress relative to performance, firstly the positive impact of SOL on performance was supposed, as more solid Italian medium and large private family firms, from a financial point of view, should be able to moderate their interest expenses and increase performance. However, an opposite result is found. One possible explanation may concern the use of SOL as a solvency variable and ROE as a performance measure. In other words, the most solvent firms being examined are those which obviously employ a considerable amount of equity, that is shareholder’s funds. Therefore, one may conclude that, despite a lower cost of debt, which certainly decreases the interest payments, the profit those enterprises produce, by using a greater quantity of less costly debt, may not be sufficient to generate an adequate ROE. This statement could be supported by the positive relationship between SOL and ROA, which could tend to show a positive effect of decreasing default risk and interest rates on the ability of the surveyed firms to improve their value, obviously for both shareholders and creditors. Nonetheless, the positive direction of the relationship involving SIZE is as it was supposed to be, thus sizeable Italian medium and large private family firms can benefit from a larger amount of cheaper debt and reach better performance.

Furthermore, the negative linkage between AGE (as a proxy for the likelihood of the presence of later-generation family firms and the growing involvement of descendants and their preferences) and performance confirms the correctness of the specific hypothesis. This is based on the fact that descendants in Italian medium and large private family firms impair the performance of the businesses they manage once founders have left the enterprise or are less involved in their ownership and/or management. In fact, family owners, unlike founder owners, also purse socioemotional wealth objectives, that is, non-economic ones such as dynastic control, family-member employment, and safeguard of reputation, which in turn causes the sacrifice of financial returns in exchange for socioemotional wealth creation (Jaskiewicz et al., 2017).

Lastly, the reasoning for the linkage between financing choices and performance is only partly proven to be true. In fact, on the one hand and as believed, there is no statistically significant relationship between performance and either STD or LTD, implying no benefit or disadvantage of debt maturity in curbing agency conflicts arising between owner-managers and non-manager owners or between owners and lenders in Italian medium and large private family firms. First, that means that suitable instruments of governance tend to adequately monitor owner-managers, making agency conflicts between them and non-managers owners insignificant, mostly in later-generation family enterprises. Thus, no specific use of debt maturity is necessary from the principals’ point of view (non-managers) or allowed for self-serving agents (owner-managers). Furthermore, that also implies that, because of the socioemotional orientation of family owners, together with their need to protect their concentrated and undiversified investments in the firm, lenders neither fear to be expropriated by selfish shareholders by using long-term debt, nor is short-term debt employed to moderate the self-interested behaviour of owners. On the other hand, a negative and statistically significant linkage between DE and performance is found, and that contrasts with what it was supposed to be; that is, no relationship. However, this unexpected result may be explored in the context of the pecking order theory (Myers, 1984; Myers and Majluf, 1984), that is by considering a hierarchy in the choice of the source of financing, for Italian medium and large private family firms: internal funds, debt, hybrid forms of debt and equity, and equity as a last resort. Specifically, more profitable firms can invest considerable quantities of earnings, whose costs, related to asymmetric information, are nil, whereas they are positive for the other items in the pecking order, including debt. Actually, the issue of asymmetric information is likely to be particularly justified for the businesses being considered. In fact, their shares are not traded in stock exchanges, and these firms are allowed to release only little information concerning their financial situation and performance (Carney et al., 2015), as previously mentioned. Thus, a negative relationship between performance and debt is reasonable. Moreover, this result is in line with the assertion of Vieira (2017), even if this author, especially considering ROA, finds a negative association not only between performance and total debt, but also between performance and both short- and long-term debt.

This article analyses a sample of 983 Italian large and medium private family firms and relates their corporate governance facets and financing decisions to their performance.

By employing a static panel data model (a fixed effects approach), the research documents that most of the relevant explanatory variables considered have the same signs regarding performance as those hypothesized. ROE and ROA are used as dependent variables for performance. The results concerning ROE are preferably examined. Nonetheless, ROA is also taken into account, when empirical evidence shows differences with ROE.

The inverse linkage between ROE and past ETR reveals no use of tax-aggressive practices to avoid the deprivation of socioemotional wealth in terms of diminished reputation caused by a possible tax-related lawsuit (Chen et al., 2010).

The sign for SOL is the opposite of what it was supposed to be, that is negative instead of positive, as it was conjectured that more trustworthy enterprises should benefit from lower financial expenses on their debt, whose cheaper and greater employment enhanced their performance. However, this result can be caused by the fact that the most solvent firms are those which can certainly raise a considerable amount of equity. Therefore, these businesses could not generate sufficient value to improve their ROE, although the amount of debt interest they pay is moderate. On the contrary, the positive relationship between SOL and ROA is as forecasted, and the positive relationship between SIZE and ROE confirms that sizeable Italian medium and large private family firms can improve their performance, thanks to the profitable use of a possibly less costly debt.

The inverse relationship between AGE and ROE is to be interpreted as the negative effect on performance of the presence of successors, having an increasing role as shareholders and/or managers in older Italian medium and large private family firms, once founders have left the enterprise or are less directly involved, as owners and/or managers. In fact, unlike founder owners, family owners also try and achieve socioemotional goals, which cause them to accept a sacrifice of financial returns, counterbalanced by an increase in socioemotional wealth (Jaskiewicz et al., 2017).

STD and LTD are not related to ROE. Specifically, debt maturity is not employed by Italian medium and large private family firms to both limit agency conflicts arising between owner-managers and non-manager owners and between owners and lenders. Debt maturity is also not used by selfish agents (owner-managers or owners, respectively) to expropriate their principals’ wealth (non-manager owners, or lenders, alternatively). In fact, on the one hand, adequate mechanisms of governance tend to satisfactorily monitor owner-managers, making agency conflicts between them and non-managers owners insignificant, mostly when later-generation family businesses are considered. On the other hand, the socioemotional wealth orientation of family owners and their concentrated and scarcely diversified investments cause creditors to believe that family owners are reliable. Therefore, lenders do not fear to be expropriated by selfish shareholders, nor the latter are willing to do so.

Lastly, contrary to the expectation, a negative relationship between DE and ROE is empirically found, which may thus reveal a pecking order behaviour among the sampled firms. In other words, more profitable Italian medium and large private family enterprises rely less on external sources, including debt. Interestingly, this finding is in line with that of Vieira (2017), even if the author, especially considering ROA, finds a negative association not only between performance and total debt, but also between performance and both short- and long-term debt.

A limitation of this study may concern the use of an indirect measure for the presence of later-generation family firms and descendant involvement that is AGE, owing to the data availability concerning ownership. Nonetheless, this exploration may stimulate further investigations on the performance of family firms and their corporate governance and financing decision issues, by comparing different kinds of family firms (e.g., founder-run versus descendant-run family businesses) and/or their different legal and financial settings (that is, civil-law relative to common-low countries and/or bank-centred as opposed to market-centred countries). Furthermore, an examination of possible differences and similarities between family and non-family enterprises could shed more light on this field of research.

The authors declare that they have no conflict of interest.

REFERENCES

|

Abor J (2007). Debt policy and performance of SMEs: evidence from Ghanaian and South African firms. Journal of Risk Finance 8(4):364-379.

|

|

|

|

Agrawal A, Nagarajan NJ (1990). Corporate capital structure, agency costs, and ownership control: The case of all-equity firms. Journal of Finance 45(4):1325-1331.

|

|

|

|

|

Amore MD, Minichilli A, Corbetta G (2011). How do managerial successions shape corporate financial policies in family firms? Journal of Corporate Finance 17(4):1016-1027.

|

|

|

|

|

Anderson RC, Mansib SA, Reeb DM (2003). Founding family ownership and the agency cost of debt. Journal of Financial Economics 68(2):263-285.

|

|

|

|

|

Anderson RC, Reeb DM (2003). Founding-Family Ownership and Firm Performance: Evidence from the S&P 500. Journal of Finance 58(3):1301-1328.

|

|

|

|

|

Ayman E, Shattarat W, Abu-Ghazaleh N, Nobanee H (2015). The Impact of Ownership Structure and Family Board Domination on Voluntary Disclosure for Jordanian Listed Companies. Eurasian Business Review 5(2):203-234.

|

|

|

|

|

Bancel F, Mittoo UR (2004). Why do European firms issue convertible debt? European Financial Management 10(2):339-374.

|

|

|

|

|

Barnea A, Haugen RA, Senbet LW (1980). A rationale for debt maturity structure and call provisions in the agency theory framework. Journal of Finance 35(5):1223-1234.

|

|

|

|

|

Barontini R, Caprio L (2006). The Effect of Family Control on Firm Value and Performance: Evidence from Continental Europe. European Financial Management 12(5):689-723.

|

|

|

|

|

Barth E, Gulbrandsen T, Schøne P (2005). Family ownership and productivity: the role of owner-management. Journal of Corporate Finance 11(1):107-127.

|

|

|

|

|

Benavides-Velasco CA, Quintana-García C, Guzmán-Parra VF (2013). Trends in family business research. Small Business Economics 40(1):41-57.

|

|

|

|

|

Berle A, Means G (1932). The Modern Corporation and Private Property. Mcmillan. New York.

|

|

|

|

|

Berrone P, Cruz C, Gomez-Mejia LR (2012). Socioemotional Wealth in Family Firms: Theoretical Dimensions, Assessment Approaches, and Agenda for Future Research. Family Business Review 25(3):258-279

Crossref

|

|

|

|

|

Blanco-Mazagatos V, de Quevedo-Puente E, Castrillo LA (2007). The trade-off between financial resources and agency costs in the family business: An exploratory sudy. Family Business Review 20(3):199-213.

|

|

|

|

|

Blanco-Mazagatos V, de Quevedo-Puente E, Delgado-García JB (2016). How agency conflict between family managers and family owners affects performance in wholly family-owned firms: A generational perspective. Journal of Family Business Strategy 7:167-177.

|

|

|

|

|

Carney M, Van Essen M, Gedajlovic ER, Heugens PPMAR (2015). What Do We Know About Private Family Firms? A Meta–Analytical

|

|

|

|

|

Review. Entrepreneurship Theory and Practice 39(3):513-544.

|

|

|

|

|

Chen S, Chen X, Cheng Q (2008). Do Family Firms Provide More or Less Voluntary Disclosure? Journal of Accounting Research 46(3):499-536.

|

|

|

|

|

Chen S, Chen X, Cheng Q, Shevlin T (2010). Are family firms more tax aggressive than non-family firms? Journal of Financial Economics

|

|

|

|

|

95(1):41-61.

|

|

|

|

|

Cheng Q (2014). Family firm research – A review. China Journal of Accounting Research 7(3):149-163.

|

|

|

|

|

Childs PD, Mauerb DC, Steven H (2005). Interactions of corporate financing and investment decisions: The effects of agency conflicts. Journal of Financial Economics 76(3):667-690.

|

|

|

|

|

Chrisman JJ, Chua JH, Pearson AW, Barnett T (2012). Family involvement, family influence, and familyâ€centered nonâ€economic goals in small firms. Entrepreneurship Theory and Practice 36(2):267-293.

|

|

|

|

|

Claessens S, Djankov S, Lang LHP (2000). The separation of ownership and control in East Asian Corporations. Journal of Financial Economics 58:81-112.

Crossref

|

|

|

|

|

Commission Recommendation of 6 May 2003. Available at:

View

|

|

|

|

|

Croci E, Doukas JA, Gonenc H (2011). Family Control and Financing Decisions. European Financial Management 17(5):860-897.

|

|

|

|

|

Cucculelli M, Micucci G (2008). Family succession and firm performance: Evidence from Italian family firms. Journal of Corporate Finance 14:17-31.

|

|

|

|

|

Dang VA, Phan HV (2016). CEO inside debt and corporate debt maturity structure. Journal of Banking and Finance 70:38-54.

|

|

|

|

|

Derashid C, Zhang H (2003). Effective tax rates and the "industrial policy" hypothesis: Evidence from Malaysia. Journal of International Accounting, Auditing and Taxation 12(1):45-62.

|

|

|

|

|

Desai M, Dharmapala D (2006). Corporate tax avoidance and high-powered incentives. Journal of Financial Economics 79(1):145-179.

|

|

|

|

|

Dìaz-Dìaz NL, García-Teruel PJ, Martínez-Solano P (2016). Debt maturity structure in private firms: Does the family control matter? Journal of Corporate Finance 37:393-411.

|

|

|

|

|

Fahlenbrach R (2009). Founder-CEOs, Investment Decisions, and Stock Market Performance. Journal of Financial and Quantitative Analysis 44(2):439-466.

|

|

|

|

|

Frank MM, Lynch LJ, Rego SO (2009). Tax Reporting Aggressiveness and Its Relation to Aggressive Financial Reporting. The Accounting Review 84(2):467-496.

|

|

|

|

|

Gaaya S, Lakhal N, Lakhal F (2017). Does family ownership reduce corporate tax avoidance? The moderating effect of audit quality. Managerial Auditing Journal 32(7):731-744.

|

|

|

|

|

Gallo MA, Tàpies J, Cappuyns K (2004). Comparison of family and nonfamily business: Financial logic and personal preferences. Family Business Review 17(4):303-318.

|

|

|

|

|

Gatsi JG, Gadzo SG, Kportorgbi HK (2013). The Effect of Corporate Income Tax on Financial Performance of Listed Manufacturing Firms in Ghana. Research Journal of Finance and Accounting 4(15):118-124.

|

|

|

|

|

Gedajlovic E, Carney M (2010). Markets, hierarchies, and families: Toward a transaction cost theory of the family firm. Entrepreneurship Theory and Practice 34(6):1145-1172.

|

|

|

|

|

Gomez-Mejia LR, Cruz C, Berrone P, De Castro J (2011). The Bind that Ties: Socioemotional Wealth Preservation in Family Firms. Academy of Management Annals 5(1):653-707.

|

|

|

|

|

Gomez-Mejia LR, Takacs-Haynes K, Nu-ez-Nickel M, Jacobson KJL, Moyano-Fuentes J (2007). Socioemotional wealth and business risks in family-controlled firms: Evidence from Spanish olive oil mills. Administrative Science Quarterly 52(1):106-137.

|

|

|

|

|

Gottardo P, Moisello AM (2014). The capital structure choices of family firms: evidence from Italian medium-large unlisted firms. Managerial Finance 40(3):254-275.

|

|

|

|

|

Graham JR, Harvey CR (2001). The theory and practice of corporate finance: Evidence from the field. Journal of Financial Economics 60:187-243.

|

|

|

|

|

Habbershon TG, Williams ML (1999). A Resource-Based Framework for Assessing the Strategic Advantages of Family Firms. Family Business Review 12(1):1-25.

|

|

|

|

|

Hill CWL, Snell SA (1989). Effects of Ownership Structure and Control on Corporate Productivity. The Academy of Management Journal 32(1):25-46.

|

|

|

|

|

Hsiao C (1986). Analysis of Panel Data, Cambridge University Press, Cambridge.

|

|

|

|

|

Hsiao C (2007). Panel data analysis – advantages and challenges.

|

|

|

|

|

Sociedad de Estadística e Investigación Operativa 16:1-22.

|

|

|

|

|

ISTAT – Istituto Nazionale di Statistica (Italian Central Statistics Institute) (2013) – Chapter 2 - Il sistema delle imprese italiane: competitività e potenziale di crescita. Available at:

View

|

|

|

|

|

Jaskiewicz P, Block JH, Combs JG, Miller D (2017). The effects of founder and family ownership on hired CEOs' incentives and firm performance. Entrepreneurship Theory and Practice 41(1):73-103.

|

|

|

|

|

Jensen MC (1986). Agency Costs of Free Cash Flow, Corporate Finance, and Take-overs. American Economic Review 76(2):323-329.

|

|

|

|

|

Jensen MC, Meckling WH (1976), Theory of the firm: managerial behaviour, agency costs and ownership structure. Journal of Financial Management 3(4):305-360.

|

|

|

|

|

Kraus A, Litzenberger RH (1973). A State-preference Model of Optimal Financial Leverage. Journal of Finance 28(4):911-922.

|

|

|

|

|

Lanis R, Richardson G (2012). Corporate social responsibility and tax aggressiveness: an empirical analysis. Journal of Accounting and Public Policy 31(1):86-108.

|

|

|

|

|

Legislative Decree 5 August 2015 n. 128 (Decreto legislativo 5 agosto 2015, n. 128). Available at:

View

|

|

|

|

|

Lòpez-Gracia J, Sànchez-Andùliar S (2007). Financial Structure of the Family Business: Evidence from a Group of Small Spanish Firms. Family Business Review 20(1):269-287.

|

|

|

|

|

McConaughy DL, Matthews CH, Fialko AS (2001). Founding family controlled firms: Performance, risk and value. Journal of Small Business Management 39(1):31-49.

|

|

|

|

|

Minnick K, Noga T (2010). Do corporate governance characteristics influence tax management? Journal of Corporate Finance 16(5):703-718.

|

|

|

|

|

Miralles-Marcelo JL, Miralles-Quirós MDM, Lisboa I (2014). The impact of family control on firm performance: Evidence from Portugal and Spain. Journal of Family Business Strategy 5:156-168.

|

|

|

|

|

Modigliani F, Miller MH (1958). The Cost of Capital, Corporation Finance and the Theory of Investment. American Economic Review 48(3):261-297.

|

|

|

|

|

Modigliani F, Miller MH (1963). Corporate Income Taxes and the Cost of Capital: a Correction. American Economic Review 53(3):443-453.

|

|

|

|

|

Muhammad H, Shah B, Islam ZU (2014). The impact of capital structure on firm performance: evidence from Pakistan. Journal of Industrial Distribution & Business 5(2):13-20.

|

|

|

|

|

Myers SC (1977). Determinants of Corporate Borrowing. Journal of Financial Economics 5(2):147-175.

|

|

|

|

|

Myers SC (1984) The Capital Structure Puzzle. Journal of Finance 39(3):575-592.

Crossref

|

|

|

|

|

Myers SC, Majluf NS (1984). Corporate Financing and Investment Decisions When Firms Have Information That Investors Do Not Have. Journal of Financial Economics 13(2):187-221.

|

|

|

|

|

Naldi L, Cennamo C, Corbetta G, Gomez-Mejia L (2013). Preserving Socioemotional Wealth in Family Firms: Asset or Liability? The Moderating Role of Business Context. Entrepreneurship Theory and Practice 37(6):1341-1360.

|

|

|

|

|

Noor RMD, Fadzillah NSM, Mastuki NA (2010). Corporate Tax Planning: A Study on corporate effective tax rates of Malaysian listed companies. International Journal of Trade, Economics and Finance 1(2):189-193.

|

|

|

|

|

Peréz-González F (2006). Inherited control and firm performance. American Economic Review 96(5):1559-1588.

|

|

|

|

|

Poza E, Hanlon S, Kishida R (2004). Does the family business interaction factor represent a resource or a cost? Family Business Review 17(2):99-118.

|

|

|

|

|

Poza E (2007). Family Business, 2/e. Mason (OH): Thomson South-Western.

|

|

|

|

|

PricewaterhouseCoopers (2007). The Price water house Coopers Family Business Survey 2007/08. Available at:

View

|

|

|

|

|

Rajan R, Winton A (1995). Covenants and Collateral as Incentives to Monitor. Journal of Finance 50(4):1113-1146.

|

|

|

|

|

Rajan RG, Zingales L (1995). What Do We Know about Capital Structure? Some Evidence from International Data. Journal of Finance 50(5):1421-1460.

|

|

|

|

|

Ramadan IZ (2013). Debt-performance relation: evidence from Jordan. International Journal of Academic Research in Accounting, Finance and Management Sciences 3(1):323-331.

|

|

|

|

|

Sadeghian NS, Latifi MM, Soroush S, Aghabagher ZT (2012). Debt policy and corporate performance: empirical evidence from Tehran Stock Exchange companies. International Journal of Economics and Finance 4(11):217-224.

|

|

|

|

|

Salim M, Yadav R (2012). Capital structure and firm performance: evidence from Malaysian listed companies. Procedia – Social and Behavioral Sciences 65:156-166.

|

|

|

|

|

Sheik NA, Wang Z (2011). Determinants of capital structure: an empirical study of firms in manufacturing industry of Pakistan. Managerial Finance 37(2):117-133.

|

|

|

|

|

Shleifer A, Vishny RW (1986). Large Shareholders and Corporate Control. Journal of Political Economy 94(3):461-488.

|

|

|

|

|

Shyu YW, Lee CI (2009). Excess Control Rights and Debt Maturity Structure in Family-Controlled Firms. Corporate Governance: An International Review 17(5):611-628.

|

|

|

|

|

Steijvers T, Niskanen M (2014). Tax aggressiveness in private family firms: An agency perspective. Journal of Family Business Strategy 5(4):347-357.

|

|

|

|

|

Stulz MR (2000). Does financial structure matter for economic growth? A corporate finance perspective. Working paper.

|

|

|

|

|

Terra PRS (2011). Determinants of corporate debt maturity in Latin America. European Business Review 23(1):45-70.

|

|

|

|

|

Van den Berghe LAA, Carchon S (2003). Agency Relations within the Family Business System: an exploratory approach. Corporate Governance. An International Review 11(3):171-179.

|

|

|

|

|

Vieira ES (2017). Debt policy and firm performance of family firms: the impact of economic adversity. International Journal of Managerial Finance 13(3):267-286.

|

|

|

|

|

Villalonga B, Amit R (2006). How do family ownership, control and management affect firm value? Journal of Financial Economics 80(2):385-417.

|

|

|

|

|

Villalonga B, Amit R, Trujillo MA, Guzmán A (2015). Governance of Family Firms. Annual Review of Financial Economics 7:635-654.

|

|

|

|

|

Zellweger TM, Nason RS, Nordqvist M, Brush CG (2011). Why Do Family Firms Strive for Nonfinancial Goals? An Organizational Identity Perspective. Entrepreneurship Theory and Practice 37(2):229-248.

|

|