Full Length Research Paper

ABSTRACT

This paper analyzed the effects of board size and board composition on the performance of Nigerian banks. The financial statements of five banks were used as a sample for the period of nine years and the data collected were analysed using the multivariate regression analysis. The paper found that board size has significant negative impact on the performance of banks in Nigeria. This signifies that an increase in Board size would lead to a decrease in ROE and ROA. On the other hand, board composition has a significant positive effect on the performance of banks in Nigeria. This signifies that an increase in Board composition would lead to a decrease in ROE and ROA. It is recommended that banks should have adequate board size to the scale and complexity of the organisation’s operations and be composed in such a way as to ensure diversity of experience without compromising independence, compatibility, integrity and availability of members to attend meetings. The board size should not be too large and must be made up of qualified professionals who are conversant with oversight function. The Board should comprise of a mix of executive and non-executive directors, headed by a Chairman.

Key words: Board size, board composition, Nigerian banks and financial performance.

INTRODUCTION

The major challenge of world’s economy today is not in the area of manufacturing modern equipments that will help fight governments rebellions or any such crises that may occur in the economy. However, solving the problem of governance can help to completely straitened an economy and improve the living standard of its citizenry. This is evident in the fact that many companies all over the world suffer from the impact of bad governance and which in effect results to costly impact on the performance of organizations in the economy. Wolfgang (2003) observed that good corporate governance results to increased profitability of the firm, higher valuation and sales growth and it has the possibility of reducing capital expenditure. In general, it has been documented that good corporate governance increases confidence of stakeholders and promote goodwill of the organization (Gompers et al., 2003; Klapper and Love, 2004).

Jensen and Meckling (1987) are of the view that the agency theory is mitigated by the existence of a good corporate governance practice; while Shleifer and Vishny (1997) concur with the argument and further proffers that effective corporate governance reduces “control right which shareholders and creditors has on managers thereby increasing the probability of investing in positive net present value projects i.e. investments that yields higher positive net present value or projects that adds value to the firm.

Corporate governance is therefore a tool to ensure the existence of transparency, accountability and fairness in corporate reporting. Mayer concluded that corporate governance is not only about improving corporate efficiency, it also encompasses two major issues that includes; the company’s strategy and life cycle development. It therefore, ensures that operators of the firm or its management pursue those strategies that will safeguard the interest of the shareholders (Ahmadu and Tukur, 2005). Thus, good corporate governance is generally, identified as those governance mechanism that are based on a higher level corporate responsibility that a firm exhibits in relation to accountability, transparency and ethical values. That is why Mulbert, (2010) and Adams and Mehran (2003) concluded that good corporate governance represents a central issue for the operation of modern banking industry in the world today.

It is against this background that this paper seeks to examine the efficacy of corporate governance with a view to determine the impact of board size and board composition on the financial performance of banks in Nigeria.

LITERATURE REVIEW

The review of literature on corporate governance as its affects the firm performance covers two major issues; first, the composition of the Board of directors of the firm and second, the size of the board. Board composition is a debated corporate governance issue as many researchers identified board composition as an issue that could influence deliberations of the board and further determine the capability of the board to control top management decisions and outcomes of deliberations.

Clifford and Evans (1997) defined board composition to be the number of independent non-executive directors on the board relative to the total number of directors. An independent non-executive director is defined as an independent director who has no affiliation with the firm except for their directorship. There is an apparent presumption that boards with significant outside directors will make different and perhaps better decisions than boards dominated by insiders. Although Vance (1978) opined that there is no optimal formula as to the composition of the board, Daily et al.(2003) and Dalton et al. (1998) described the non executive and independent directors as the most important mechanisms for ensuring corporate accountability. Furthermore, Fama and Jensen (1983) concluded that non-executive directors play an important role in the effective resolution of agency problems of a firm and therefore their presence can lead to straightened and more effective decision making in the firm.

Dehaene et al. (2001) find that the percentage of outside directors is positively related to the financial performance of Belgian firms. Connelly and Limpaphayom (2004) find that board composition has a positive relation with profitability and a negative relation with the risk-taking behaviour of life insurance firms in Thailand. Rosenstein and Wyatt (1990) find a positive stock price reaction at the announcement of the appointment of an additional outside director, implying that the proportion of outside directors affects shareholders’ wealth. Bhojraj and Sengupta (2003) and Ashbaugh-Skaife et al. (2006) also find that firms with greater proportion of independent outside directors on the board are assigned higher bond and credit ratings respectively. Furthermore, O’ Sullivan (2000) examines a sample of 402 UK quoted companies and suggests that non-executive directors encourage more intensive audits as a complement to their own monitoring role while the reduction in agency costs is expected.

Fama and Jensen (1983) argue that outside directors have the incentive to act as monitors of management because they want to protect their reputations as effective, independent decision makers. An independent board of directors has fewer conflicts of interest in monitoring managers, even if the presence of outside directors entails additional costs to the firm (fees, travel expenses, etc); moreover, as De Andres and Vallelado (2008) highlight, an excessive proportion of nonexecutive directors could damage the advisory role of boards, since executive directors facilitate the transfer of information between directors and management and give information and knowledge that outside directors would find difficult to gather. After the recent corporate scandals, policymakers and regulators worldwide have called for greater independence of boards of directors from the top management of firms (Aguilera, 2005; Dalton and Dalton, 2005).

He et al. (2009) stated that board independence is the most effective deterrent of fraudulent financial reporting. As a matter of fact, many studies (Dechow et al., 1996; Beasley, 1996; Beasley et al., 2000; Song and Windram, 2004; Uzun et al., 2004; Farber, 2005) showed that firms committing financial reporting fraud are more likely to have a board of directors dominated by insiders. With reference to Italy, Romano and Guerrini (2012) find that the higher the percentage of independent directors on the board, the lower the likelihood of financial fraud, arguing that a higher relative weight of independent directors appears to ensure more effective control.

Many countries have strengthened recommendations on board composition and independence (Aguilera, 2005; Huse, 2005). Even in Italy now both the regulatory framework and market best practices place emphasis on board independence from management (Bank of Italy, 2008). As a matter of fact, a recent study shows that nowadays the independence of non-executive directors is a commonly recommended governance practice (Zattoni and Cuomo, 2010). However, the majority of the existing studies about banks shows a significantly positive relationship between board composition and banks’ profitability or efficiency, highlighting how banks with a higher presence of non-executives or independent members in their boards perform better than the others (Shelash Al-Hawary, 2011; Trabelsi, 2010; De Andres and Vallelado, 2008; Tanna et al., 2008; Bino and Tomar, 2007; Busta, 2007; Pathan et al., 2007; Staikouras et al., 2007; Sierra et al., 2006; Isik and Hassan, 2002). Moreover, Brewer et al. (2000) find that the premiums offered for target banks increase with the proportion of independent outside directors.

However, in banking researches, the results regarding the effectiveness of outside directors are mixed. Some empirical researches in the last decades show no significant relationship between board composition, considered as the proportion of outsiders or of independent board members on the board, and banks performance (Romano et al., 2012; Adams and Mehran, 2008; Love and Rachinsky, 2007; Zulkafli and Samad, 2007; Adams and Mehran, 2005; Simpson and Gleason, 1999; Pi and Timme, 1993).

De Andres and Vallelado (2008), analysing a sample of large commercial banks from six developed countries, find an inverted U-shaped relation between board size and bank performance: the inclusion of more directors in the board improves bank performance but with a limit of 19 directors. Similarly, recently Grove et al. (2011) report a concave relationship between financial performance and board size.

However, there is also a fair amount of studies that tend not to support this positive perspective. Some of them report a negative and statistically significant relationship with Tobin’s Q ( Agrawal and Knoeber, 1996; Yermack, 1996) while others find no significant relationship between accounting performance measures and the proportion of non executive directors ( Vafeas and Theodorou, 1998; Weir et al., 2002; Haniffa and Hudaib, 2006). Furthermore, based on a large survey of firms with non-executive directors in the Netherlands, Hooghiemstra and Van Manen (2004) conclude that stakeholders are not generally satisfied with the way non executives operate. Haniffa et al. (2006) summarize a number of views expressed in the literature which may justify this non positive relationship, such as that high proportion of non-executive directors may engulf the company in excessive monitoring, be harmful to companies as they may stifle strategic actions, lack real independence, and lack the business knowledge to be truly effective (Baysinger and Butler, 1985; Patton and Baker, 1987; Demb and Neubauer, 1992; Goodstein et al., 1994).

Furthermore, the empirical evidences on the best board size in influencing firm performance are inconclusive. Some authors argue that when boards grow, they become less likely to function effectively (Jensen, 1993), may create a diminished sense of individual responsibility and might be more involved in bureaucratic problems: increasing board size might significantly inhibit board processes due to the potential group dynamics problems associated with large groups. Larger boards are more difficult to coordinate and may experience problems with communication, organization, participation, providing worst financial reporting oversight and lowering company performance (Judge and Zeithaml, 1992; Goodstein et al., 1994; Yermack, 1996; Amason and Sapienza, 1997; Eisenberg et al.,1998; Conyon and Peck, 1998; Forbes and Milliken, 1999; Golden and Zajac, 2001; Mak and Kusnadi, 2005); other authors, conversely, argue that larger boards are positively associated with higher corporate performance (Pearce and Zahra, 1992) and that a larger board might be more effective in monitoring financial reporting, because the company might be able to appoint directors with relevant and complementary expertise and skills and, thus, draw from a broader range of knowledge and experiences (Xie et al., 2003; Berghe and Levrau, 2004).

Theoretical framework

Literature on corporate governance mechanisms and firm financial performance has identified the stakeholder theory, the stewardship theory and agency theory, as the three prominent theories of corporate governance which are briefly discussed below.

Stakeholders’ theory

The stakeholders’ theory provides that the firm is a system of stakeholders operating within the larger system of the host society that provides the necessary legal and market infrastructure for the firm's activities. The purpose of the firm is to create wealth or value for its stake holders by converting their stakes into goods and services. This view is supported by Blair (1995) who proposes that the goal of directors and management should be maximizing total wealth creation by the firm. The key to achieving this is to enhance the voice of and provide ownership-like incentives to those participants in the firm who contribute or control critical, specialized inputs (firm specific human capital) and to align the interests of these critical stakeholders with the interests of outside, passive shareholders. Sundaram and Inkpen (2004) also suggest that “stakeholder theory attempts to address the question of which groups of stakeholder deserve and require management’s attention” .

Stewardship Theory

In the stewardship, managers are assumed to be good stewards of the corporations and diligently work to attain high levels of corporate profit and shareholders returns (Donaldson and Davis 1994, hereafter referred to as (D & D). Their arguments support the investment of business schools in the development of management skills and knowledge. It also reinforces the social and professional kudos of being a manager. Whereas agency theorists view executives and directors as self-serving and opportunistic, stewardship theorists, reject agency assumptions, suggesting that directors frequently have interests that are consistent with those of shareholders.

Agency theory

In its simplest form, agency theory explains the agency problems arising from the separation of ownership and control.

It “provides a useful way of explaining relationships where the parties’ interests are at odds and can be brought more into alignment through proper monitoring and a well-planned compensation system” (Davis et al., 1997:24). In her assessment and review of agency theory, Eisenhardt (1989) outlines two streams of agency theory that have developed over time: Principal agent and positivist.

Principal agent research is concerned with a general theory of the principal agent relationship, a theory that can be applied to any agency relationship e.g. employer employee or lawyer client. Eisenhardt describes such research as abstract and mathematical and therefore less accessible to organisational scholars. This stream has greater interest in general theoretical implications than the positivist stream.

On the other side positivist researchers have tended to focus on identifying circumstances in which the principal and agent are likely to have conflicting goals and then describe the governance mechanisms that limit the agent’s self serving behaviour (Eisenhardt, 1989). This stream has focused almost exclusively on the principalagent relationship existing at the level of the firm between shareholders and managers.

For example, Jensen and Meckling (1976), who fall under the positivist stream, propose agency theory to explain, inter alia, how a public corporation can exist given the assumption that managers are self-seeking individuals and a setting where those managers do not bear the full effects of their actions and decisions.

The agency relationship explains the association between providers of corporate finances and those entrusted to manage the affairs of the firm. Jensen and Meckling (1976:308) define the agency relationship in terms of “a contract under which one or more persons (the principal(s) engage another person (the agent) to perform some service on their behalf which involves delegating some decision making authority to the agent”. Agency theory supports the delegation and the concentration of control in the board of directors and use of compensation incentives.

METHODOLOGY

The population of the study comprises the twenty two banks listed at the Nigerian Stock Exchange (NSE) as at March (2015). A non- probability method in the form of judgmental sampling technique was employed in selecting banks into the sample. In nutshell, the sample size is based on the following criteria;

i. Banks with missing values for the variable used were excluded.

ii. The bank was not involved in any merger during the study period.

iii. For the empirical part of this study, the data is limited to bank that is in existence throughout the period of the study.

After applying the above criteria, five banks were selected; Access Bank Plc, Eco Bank, Nigeria Plc, First Bank Nigeria Plc, Guarantee Trust Bank Plc, and Union bank of Nigeria Plc.

The study utilized only the secondary source of data. This is because the estimation of the models in the study requires the use of cross sectional/time series data in the form of financial information which are available through the financial statements of the sample banks. The data were sourced from the annual reports and accounts of the sampled banks for all the relevant years covered by the study. Data was analysed using the multivariate regression analysis. Banks’ performance linked to two explanatory variables (board size, and board composition). Correlation matrix was used to examine the nature and the degree of relationship among variables of consideration.

Empirical model specification

The model employed is an Ordinary Least Squares (OLS) regression to examine the separate and combined effect of board size, and board composition on the performance of banks in Nigeria. The models are in line with the models used in the works of Klapper and Love (2002), Sanda et al. (2004), Musa (2006), Tahir (2008), and Hassan (2011).

The models are stated below.

ROA = β + λBS + δBC+ ε………….… (i)

ROE = β + λBS + δBC+ ε ………….… (ii)

Where: ROA = Return on asset; ROE = Return on equity; BS = Board Size; BC = Board Composition; β = Intercept; ε = Error term

Measurement of variables

The dependent variable is banks’ performance. Several variables have been used by previous studies as proxies for banks’ performance. For instance, Chou (2008) uses profitability measured by return on total assets and equity as proxies for performance of banks. Also, the same proxies were used in the studies of Romano and Rigolini (2012), Bino and Tomar (2007), Staikouras et al. (2007) and Dutta and Boss (2006). Because of the popularity of these variables, the performance of banks was measured using return on asset (ROA) and return on equity (ROE).

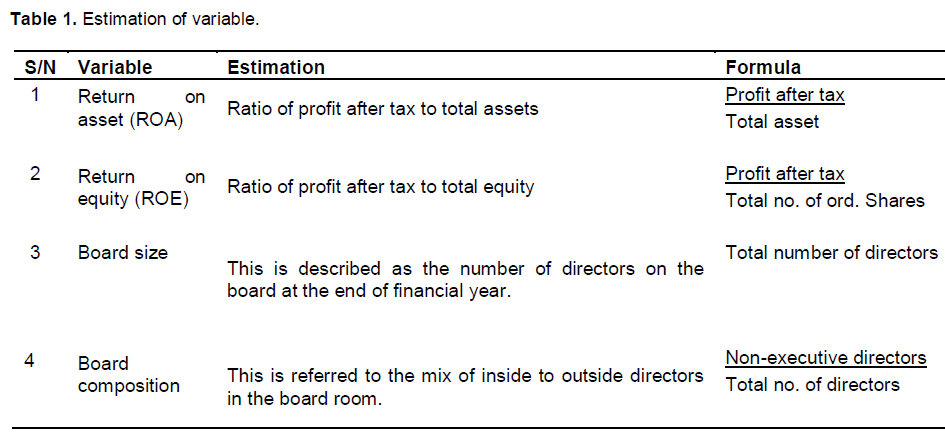

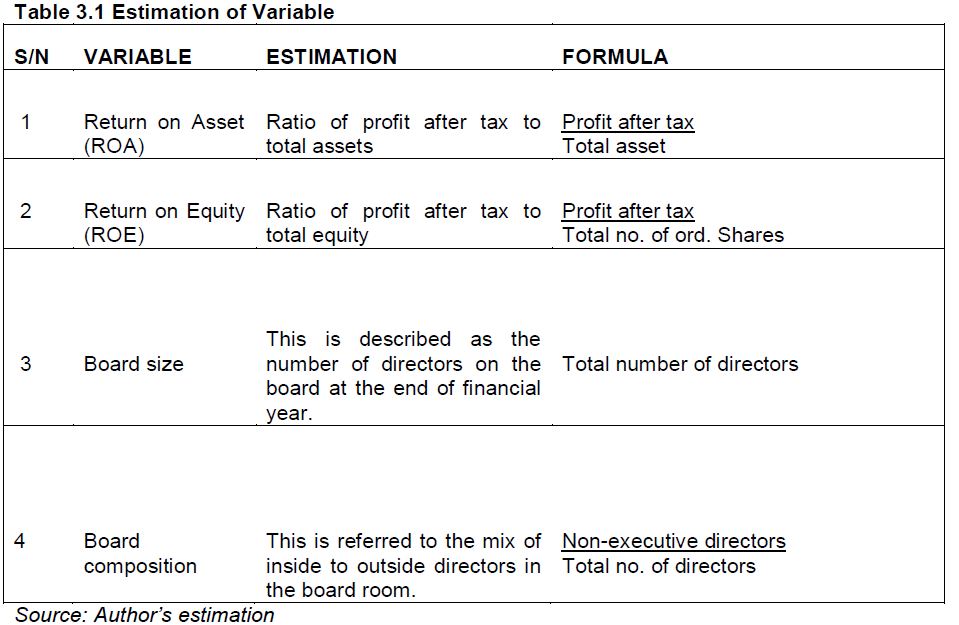

The independent variable is corporate governance. There are several corporate governance attributes. This study only considered two of those attributes; board size, and board composition (Table 1).

Data presentation and analysis

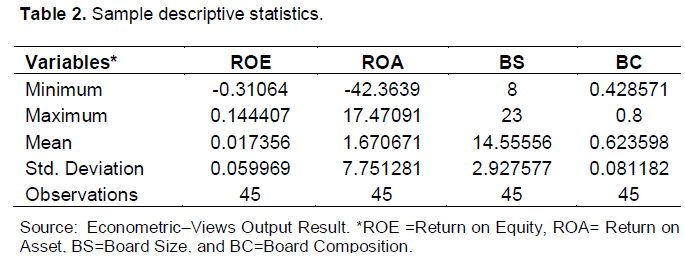

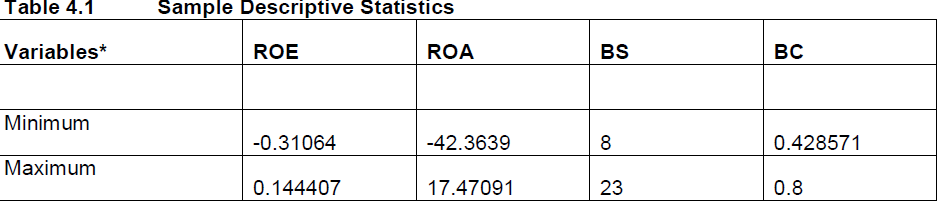

Table 2 shows the minimum, maximum, mean, and standard deviation values of the variables used in the study.

The table indicates that, on average, returns on equity and asset have mean values of about 1.7 and 167% respectively which are proxies for bank performance. Board size, board composition, the range of the variables were given by the minimum and the maximum values. The variable with the highest standard deviation among the explanatory variables is board size with a value of about 2.928. The variable with the least standard deviation among the two measurement of bank performance employed in the study is return on equity with a value of about 6%. This suggests that return on equity is a more appropriate measure of bank performance over return on asset. The study used a total of 45 observations for each metric variable considered.

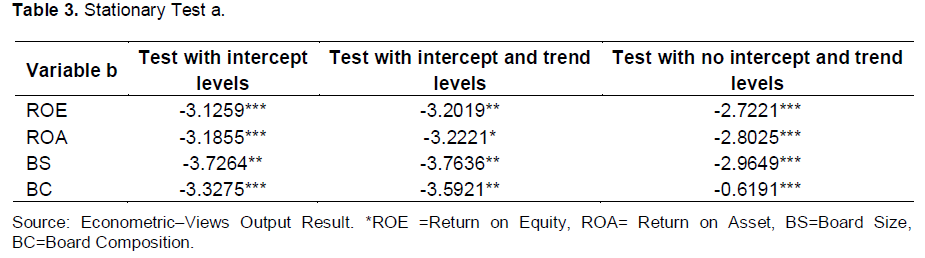

Augmented Dickey fuller (ADF) Stationarity Test

The Augmented Dickey Fuller (ADF) has been employed to test the unit roots of the concerned time series metric variables. Table 3 displays the estimates of the Augmented Dickey fuller (ADF) test in levels of the data with an intercept only, with an intercept and trend and with no intercept and trend. The test has been performed using the McKinnon Critical Values.

The ADF test with an intercept implies that all variables are stationary at levels at 1% level of significance except board size which is stationary at 5% level. Similarly, the test with intercept and trend also shows that the variables are stationary within acceptable level of significance in levels. The variables are also stationary for ADF test with no intercept and trend. Collectively, all test results imply that all variables are stationary at levels and hence variables are integrated at levels. The economic implications of these results indicate that the time series metric variables employed in this study are suitable for econometric analysis.

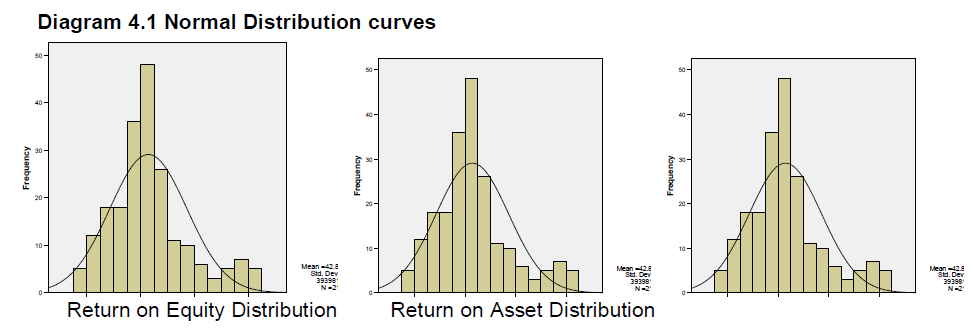

Normality distribution test

Figure 1 shows the normal distribution of the univariate time series employed. The curves of all the diagrams indicate that the metric variables are normally distributed. The implication of this is that the univariate time series data employed are suitable for mutivariate regression analysis.

Correlation Matrix

Table 4 shows the correlation matrix for the time series metric variables employed in the study. Precisely, the matrix did not only show the relationship between the variables but also indicates the direction of the relationship.

The above table indicates that there is a positive relationship

Source: Econometric Views Output Result. aROE =Return on Equity, ROA= Return on Asset, BS=Board Size, BC=Board Composition.between board size, and board composition and the dependent variable. It further indicates that most cross-correlation terms for the independent variables are fairly small, thus, giving little cause for concern about the problem of multicollinearity among the independent variables.

EMPIRICAL RESULTS

This section presents and interprets the regression results in respect of the banks’ performance and corporate governance equations formulated. The study used two models for the purpose of examining the effects of corporate governance on the performance of banks in Nigeria. Table 5 presents the regression result in line with the first model using return on asset as measurement of bank performance while Table 6 presents the regression result in line with the second model using return on equity as the performance measure. The study hypothesized a relationship between board size, board composition on one hand and bank performance on the other hand.

Table 5 shows the regression results on the relation-ship between board size, and board composition on one hand and bank performance on the other hand. The estimated regression relationship for the model is ROA = 0.967-0.101(BS) +0.0271 (BC). The parameters of all the variables under consideration are statistically significant at 1% level.

Furthermore, the results also show the coefficient of determination for the model. This coefficient measures the proportion of the total variation in the performance of banks that is explained by the considered variables. Precisely, the adjusted R-squared for the model is approximately 45% which offers an explanation of the variations in ROA explained by variation in the independent variables. Also, the value of the F-statistics is 74.297 with a p-value of 0.001, indicates fitness of the model.

Table 6 also shows the regression results on the relationship between board size, board composition, audit composition, bank risk, and gender diversity on one hand and bank performance on the other hand using return on asset as the proxy for bank performance. The estimated regression relationship for the model is ROA = 0.568-0.131(BS) +0.050 (BC).

The parameters of all the variables under consideration are statistically significant at 1% level.

The results also show the coefficient of determination for the model. This coefficient as mentioned earlier measures the proportion of the total variation in the performance of banks that is explained by the considered variables. The adjusted coefficient of determination (R2) of approximately 71% offers a better explanation of the variations in ROE occasioned by variation in the independent variables. Also, the value of the F statistics is 74. 297 with a p-value of 0.001, indicates fitness of the model.

The following five sub sections present the discussion of findings on the effect of corporate governance characteristics and the performance of banks in Nigeria.

Relationship between board size and the performance of banks in Nigeria

The regression results indicate that board size has coefficients of –0.101 and -0.131 for the two models which are both statistically significant at 1%. These results provide evidence for the rejection of the first hypothesis which states that there is no significant relationship between board size and performance of banks in Nigeria. The implications of these results are in two fold. First, board size significantly engenders bank performance in Nigeria negatively. These results signify an inverse relationship between board size and bank performance. This finding suggests that a smaller board size can enhance banks’ performance as the smaller size can take quick and adequate decision for the performance of the banks as large boardrooms tend to be slow in making decisions, and hence can be an obstacle to change. Second, the results also signify that both return on equity and asset are appropriate for the measurement of bank performance. This is an indication of absence of measurement error.

This result confirms the findings of Judge and Zeithaml (1992); Yermack (1996); Amason and Sapienza (1997); Mak and Kusnadi (2005). However, the results of other authors, conversely, argue that larger boards are positively associated with higher corporate performance (Pearce and Zahra, 1992) And that a larger board might be more effective in monitoring financial reporting, because the company might be able to appoint directors with relevant and complementary expertise and skills and, thus, draw from a broader range of knowledge and experiences (Xie et al., 2003; Berghe and Levrau, 2004).

Effect of board composition on the performance of banks in Nigeria

The regression results indicate that board composition has coefficients of 0.0271 and 0.050 for the two models which are both statistically significant at 1%. These results provide evidence for the rejection of the second hypothesis which states that there is no significant relationship between board composition and performance of banks in Nigeria. The results show that board composition significantly affects bank performance in Nigeria positively. These signify a direct relationship between board composition and banks’ performance. This finding suggests that banks with higher presence of non executives or independent members in their boards perform better than the others. This is correct because outside directors have the incentive to act as monitors of management because they want to protect their reputations as effective, independent decision makers.

This result is in line with the empirical findings of Shelash Al-Hawary (2011); Trabelsi (2010); De Andres and Vallelado (2008); Tanna et al. (2008); Bino and Tomar (2007); Busta (2007); Pathan et al. (2007); Staikouras et al. (2007); Sierra et al. (2006); Isik and Hassan (2002). However, the results of Romano et al. (2012); Adams and Mehran (2008); Love and Rachinsky (2007); Zulkafli and Samad (2007); Adams and Mehran (2005); Simpson and Gleason (1999) and Pi and Timme (1993) revealed otherwise. Their empirical results revealed that there is no significant relationship between board composition, considered as the proportion of outsiders or of independent board members on the board, and banks performance.

CONCLUSIONS AND RECOMMENDATIONS

Board size has significant negative impact on the performance of banks in Nigeria. This signifies that an increase in Board size would lead to a decrease in ROE and ROA. On the other hand, board composition has a significant positive effect on the performance of banks in Nigeria. This signifies that an increase in Board size would lead to a decrease in ROE and ROA. The overall conclusion of the study is that corporate governance has significant effect on the performance of banks in Nigeria. However, while some corporate governance charac-teristics such as board composition positively influenced the performance of banks in Nigeria, other characteristics such as board size negatively affect the performance of banks in Nigeria.

The recommendations of this study are directed at different parties that are involved in monitoring the institutionalization of an effective system of corporate governance in Nigeria. These parties include, share holders, board of directors, and government/regulatory bodies. Shareholders of banks should seek to positively influence the standard of corporate governance in the bank in which they invest by making sure there is strict compliance with the code of corporate governance. Further, it is the responsibility of the shareholders to ensure that the committee is constituted in the manner stipulated and is able to effectively discharge its statutory duties and responsibilities.

The paper indicated that corporate governance characteristics affect the performance of banks in Nigeria. On the basis of this revelation, the following recommendations are being made to banks’ boards of directors. Banks should have adequate board size to the scale and complexity of the company’s operations and be composed in such a way as to ensure diversity of experience without compromising independence, compatibility, integrity and availability of members to attend meetings. The board size should not be too large and must be made up of qualified professional who are conversant with oversight function. The Board should comprise a mix of executive and non-executive directors, headed by a Chairman. The majority of Board members should be non-executive directors whom should be independent directors. A bank should have a risk management function (including a chief risk officer (CRO) or equivalent, a compliance function and an internal audit function, each with sufficient authority, stature, independence, resources and access to the board; An internal controls system which is effective in design and operation should be in place; The sophistication of a bank’s risk management, compliance and internal control infrastructures should keep pace with any changes to its risk profile (including its growth) and to the external risk landscape; and Effective risk management requires frank and timely internal communication within the bank about risk, both across the organization and through reporting to the board and senior management.

CONFLICT OF INTERESTS

The author has not declared any conflict of interest.

REFERENCES

| Adams RB, Mehran H (2008). Corporate performance, Board structure and its determinants in the Banking industry. Working Paper Presented at the EFA Moscow Meetings. | ||||

| Ahmad SA, Tukur G (2005). Corporate governance mechanism and firms' financial performance in Nigeria. Research paper 149. African Economic Consortium. Nairobi Kenya. | ||||

| Bank of Italy (2008). Supervisory Provisions Concerning Banks. Organization and Corporate Governance, March. | ||||

| Beasley M S(1996). An Empirical Analysis of the Relation between the Board of Director Composition and Financial Statement Fraud. Account. Rev. 71:443-465. | ||||

| Beasley M, Carcello J, Hermanson D, Lapides P (2000). Fraudulent financial reporting: Consideration of industry traits and corporate governance mechanisms. Account. Horizons14(4):441-454. | ||||

| Berghe LA, Levrau A (2004). Evaluating boards of directors: What constitutes a good corporate board? Blackwell-synergy. Retrieved from http://www.blackwell-synergy.com/doi/abs/10.1111/j.1467-8683.2004.00387.x. | ||||

| Bino A,Tomar S(2007). Corporate governance and bank performance: Evidence from Jordanian Banking Industry, Paper presented at Conference on Regulation and Competition Policy for development. Challenges and practice, 27-28 January, University of Jordan. | ||||

| Brewer E, Jackson WE, Jagtiani JA (2000). Impact of independent directors and the regulatory environment on bank merger prices: Evidence from takeover activity in the 1990s, Unpublished working paper. Federal Reserve Bank of Chicago, IL. | ||||

| Busta I(2007). Board effectiveness and the impact of the legal family in the European banking industry. FMA European Conference, Barcelona–Spain. | ||||

|

Conyon M, Peck S (1998). Board size and corporate performance: Evidence from European ountries. Academy of Management Journal, 41(2). 112- 123. Crossref |

||||

| Clifford P, Evan R (1997). Non Executive Directors: A Question of Independence, Corporate Governance. Int. Rev. pp.224-231 | ||||

| Daily CM, Dalton DR, Canella AA (2003). Corporate govrnance: Decades of dialogue and data. Acad. Manag. Rev. 28(3):371-382. | ||||

|

Dalton DR, Daily CM, Ellstrand AE, Johnson JL (1998). Meta-analytic reviews of board composition, leadership structure and financial performance. Strat. Manag. J. 19:269–290. Crossref |

||||

|

Dalton CM, Dalton DR (2005). Boards of directors: Utilizing empirical evidence in developing practical prescriptions. Br. J. Manag. 16:91-97. Crossref |

||||

| Davis J, Schoorman D, Donaldson L (1997). Toward a stewardship theory of management. Acad. Manag. Rev. 22(1). | ||||

|

Dechow PM, Sloan RG, Sweeney AP (1996). Causes and consequences of earnings manipulation: An analysis of firms subject to enforcement actions by the SEC. Contemp. Account. Res. 13(1):1-36. Crossref |

||||

| Donaldson T, Preston LE (1994). The stakeholder theory of the corporation: Concepts, evidence, and implications. Acad. Manag. Rev. 20(1):65-91. | ||||

| Eisenhardt KM (1989). Agency theory: An assessment and review. Int. J. Manag. 5:341-353. | ||||

|

Grove H, Patelli L, Victoravich L, Xu P (2011). Corporate governance and performance in the wake of the financial crisis: Evidence from US commercial banks, corporate governance. Int. Rev. 19(5):418-436. Crossref |

||||

| Hassan SU (2012). Corparate Governance, Earnings Management and Financial Performance: A Case of Nigerian Manufacturing Firm. Am. Int. J. Contemp. Res. 2(7). | ||||

|

Jensen MC, Meckling WH (1976). A theory of the firm: Governance, residual claims, and organizational forms. J. Financ. Econ. 3(4):305-360. Crossref |

||||

|

Jensen MC (1993). The modern industrial revolution, exit, and the failure of internal control systems. J. Financ. 48:831-880. Crossref |

||||

|

Klapper LF, Love I (2002). Corporate Governance, Investor protection and Performance in Emerging Markets, World Bank Policy Research working Paper No. 2818. Available at http://dx.doi.org/10.2139/ssrn.303979 retrieved on 19 july,2015. Crossref |

||||

| Love I, Rachinsky A (2007). Corporate governance, ownership and bank performance in emerging markets: Evidence from Russia and Ukraine, Working paper. | ||||

|

Mak Y, Kusnadi Y (2005). Size Really Matters: Further Evidence on the Negative Relationship Between Board Size and Firm Value. Pacific Basin Finance J. Vol. 13. Crossref |

||||

|

Mulbert PO (2010). Corporate governance of banks after the financial crisis - Theory, evidence, reforms. ECGI – Law Working Paper No 130/2009 . Crossref |

||||

| Musa FJ (2006). The impact of Corporate Governance on the performance and value of banks in Nigeria: An Agency Approach, Nigerian J. Account. Res. 1(4). | ||||

|

Pathan S, Skully M, Wickramanayake J (2007). Board size, independence and performance: An analysis of Thai banks. Asia-Pacific Financial Markets 14 (2):211-227. Crossref |

||||

|

Pearce JA, Zahra SA (1992): Board Composition from a Strategic Contingency Perspect. J. Manag. Stud. 29(4):414-438. Crossref |

||||

|

Romano G, Guerrini A (2012). Corporate governance and accounting enforcement actions in Italy. Manag. Audit. J. 27(7):622-638. Crossref |

||||

| Sanda A, Minkailu AS, Garba T (2005). Corporate governance mechanisms and firm financial performance in Nigeria. AERC Research paper 149 Nairobi:http://www.aercafrica.org/documents/R p.149. | ||||

|

Shleifer A, Vishny RW (1997). A survey of corporate governance. J. Financ. 52:737-783. Crossref |

||||

| Shelash ASI (2011). The Effect of banks governance on banking performance of the Jordanian commercial banks: Tobin's Q Model "An Applied Study". Int. Res. J. Financ. Econ. 71:34-47. | ||||

|

Sierra G, Talmor E, Wallace J (2006). An examination of multiple governance forces within Bank holding companies. J. Financ. Services Res. 29:105–1. Crossref |

||||

|

Simpson WG, Gleason AE (1999). Board Structure, Ownership, and Financial Distress in Banking Firms, Int. Rev. Econ. Financ. 3:281-292. Crossref |

||||

|

Song J, Windram B (2004). Benchmarking audit committee effectiveness in financial reporting. Int. J.Audit.8:195-205. Crossref |

||||

|

Staikouras P, Staikouras C, Agoraki ME (2007). The effect of board size and composition on European bank performance. Euro. J. Law Econ. 23(1):1-27. Crossref |

||||

| Tanna S, Pasiouras F, Nnadi M (2008). The effect of board size and composition on the efficiency of UK banks. Coventry University, Economics, Finance and Accounting Applied Research Working Paper, No. 2008-05. | ||||

|

Vance SC (1978). Corporate governance: Assessing corporate performance by boardroom attributes, J. Bus. Res. 6(3):203–220. Crossref |

||||

|

Xie B, Davidson WN, DaDalt PJ (2003). Earnings management and corporate governance: The role of the board and the audit committee. J. Corporate Financ. 9:295-316. Crossref |

||||

|

Zattoni A, Cuomo F (2010). How independent, competent and incentized should non – executive directors be? An empirical investigation of good governance codes, Br. J. Manag. 21:63-79. Crossref |

||||

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0