ABSTRACT

A long history of psychological studies has postulated that good (bad) weather induces a positive (negative) mood. Other studies have concluded that mood can influence humankind decision-making process under risk and uncertainty. Several behavioural finance studies have raised the question of whether sunshine, temperature or other weather variables exert an impact on stock prices by affecting the behaviour of market operators, thus challenging the efficient-market hypothesis. However, very few papers on the weather effect, with contradictory results, have concentrated on the stock markets of emerging countries. We fill this gap by conducting a comprehensive analysis of the effect of four weather variables (temperature, cloud cover, humidity and wind) on the stock markets of nine emerging countries located in three climatic and economically different areas of the world. Differently from the existent literature, we extend the analysis by analyzing stock prices’ behaviour along with that of stock indexes and by inspecting the opening market activity along with the whole-day activity. Based on our results, we strongly reject the weather effect hypothesis.

Key words: Weather effect, market anomalies, efficient market hypothesis, trading behaviour, sunshine effect.

Since the seminal work of Saunders (1993), a considerable number of papers have studied the effect of the weather on stock market prices. Basically, these studies have relied on two hypotheses tested in many psychological studies, namely: a) that individuals making decisions involving risk and uncertainty allow their emotional state to influence their decisions and, b) that some weather conditions have a not negligible effect on human behaviour. Alongside financial studies arguing that external weather conditions, influencing market operators’ mood, have a statistically significant indirect effect on stock market activity, others have contended that there is no convincing relationship between the weather and the stock prices, volumes and volatility. Notably, only a very small number of these studies have concentrated on emerging markets, with conflicting results.

The effect of the weather on human behaviour can vary across different stock markets, thus being an idiosyncratic feature of each specific country (Keef and Roush, 2007; Pizzutilo and Roncone, 2017). Market participants in emerging markets can be differently affected by emotions and moods in their financial

decision under risk than operators in developed stock markets. Indeed, different locations are exposed to very different climatic conditions, and different populations could react differently to the same weather condition, since their experience and their psychological traits can be particularly diverse (Lo and Repin, 2002; Bassi et al., 2013). Finally, different levels of efficiency of national stock markets could experience different impacts of the weather conditions on the market activity.

All of these considerations motivate the need for an in-depth analysis of the weather effect on the stock markets of emerging countries. We conduct our analysis on the stock markets of a set of relatively young and dynamic modern economies that are playing an expanding role in the world economy and politics, have a relatively developed financial stock market and are located in three different fast-growing areas of the world that are strongly differentiated from each other by their climatic, societal and economic features, namely Latin America (Chile, Colombia and Mexico), Eastern Europe (the Czech Republic, Hungary and Poland) and South East Asia (Malaysia, the Philippines and Thailand). Considering the growing importance of these emerging markets in their regional area and in the global economy, an investigation of the weather effects on these stock markets is quite interesting. Moreover, on a practical perspective, studying this stock market anomaly has useful implications for asset managers and private investors interested in this market.

Rather than only analyzing stock market indices (the focus of the large part of the existing literature on the weather effect) we conduct our study at the stock price level too, due to the fact that the weather effect, if any, is ubiquitous and affects stock prices together with the comprehensive market activity. Moreover, differently from most of the existent literature, we do not limit the analysis to a single weather variable but consider the four weather variables (temperature, humidity, cloudiness and wind) that have been found in previous studies to have a statistically significant relationship with stock market activity. Then, supported by the psychological literature that concludes that extreme weather conditions are one of the major reasons for human mood misattributions (see next section for bibliographic details), we employ different specifications for the weather variables analyzed. Finally, we concentrate on the opening-hour market returns along with the daily ones with the belief that the weather effect, if any, is more able to influence the mood of traders and market operators at the beginning of the day than later on; when many other situations could have happened, new information could have been disclosed to the market and modern indoor facilities could have mitigated the outdoor atmospheric conditions.

We strongly reject the weather effect hypothesis for all the variables considered, for the different moments of the trading day examined and for the different time horizons analyzed, arguing that the efficiency of these stock markets is not challenged by the behavioural effect of the weather on the market operator’s mood.

This paper contributes to the existent literature in two ways. First, to the best of our knowledge, this is the first paper to concentrate on an in-depth analysis of the weather effect on these emerging stock markets, thus filling a not negligible gap in financial studies. Second, it contributes to a greater understanding of the relationship between weather-induced mood misattributions and stock market prices by inspecting a comprehensive set of weather variables, analyzing the effect of the weather on the market-opening activity in conjunction with the whole-day trading activity and determining whether there is a statistically significant effect of weather conditions on stock returns along with index returns.

A long history of psychological literature has shown that external weather conditions are able to influence individual mood and behaviour. Around one-third of the human population is estimated to be weather sensitive (Kals, 1982). Wyndham (1969) and Allen and Fischer (1978) postulated that abilities of people to complete tasks are impaired when they are exposed to extreme cold or hot conditions. Extreme hot or cold conditions have also been found to be related to discomfort, hysteria and aggressive behaviour (Scheider et al., 1980; Rotton and Cohn, 2000; Bell et al., 2005; Page et al., 2007). Cunningham (1979) found that the number of hours of sunshine is inversely related to negative moods. At the same time, several studies suggested that low cloud cover is related to good moods, while high cloud cover is related to bad moods, melancholy and depression (McAndrew, 1993; Eagles, 1994; Kent et al., 2009). Another relevant strand of psychological literature postulated that windy weather conditions deteriorate people moods and cause headaches and insomnia (Cooke et al., 2000; Denissen et al., 2008). Sanders and Brizzolara (1982) associated low levels of humidity with good moods while Howarth and Hoffman (1984) observed that positive human performances are negatively correlated with high humidity levels but positively correlated with the number of hours of sunshine. Although people’s well-being does not change daily, Levinson (2012) found a positive effect of temperature on self-reported life satisfaction. At the same time, Kampfer and Mutz (2013) found that respondents surveyed on days with exceptionally sunny weather reported a higher life satisfaction compared to respondents interviewed on days with ordinary weather.

In addition, an extensive literature argued that moods and emotions significantly affect individuals’ financial decision-making process (Damasio, 1994; Loewenstein et al., 2001; Harding and He, 2016). Nevertheless, there is no agreement on the nature of this behavioural relationship. Studies derived from the Mood Maintenance Model of Isen and Patrick (1983) postulate that people in a positive mood wish to maintain their positive state and are more at adverse risk. At the same time, individuals in a negative mood state are tempted to risky behaviours hoping to improve their feelings (Mittal and Ross, 1998; Lin et al., 2006; Yechiam et al., 2016). On the contrary, literature based on the Affect Infusion Model firstly proposed by Forgas (1995) argues that mood substantially influences people’s ability to process information especially in complex, unexpected or new situation. According to those studies, people in a good mood are inclined to take risks since they are predisposed to overweight positive elements and to underestimate the likelihood of negative outcomes. The converse is postulated to be true for people in a sad mood since they have a propensity to pay more attention to negative aspects and underestimate future prospects (Hills et al., 2001; Chou et al., 2007; Otto et al., 2016).

In his pioneering study, Saunders (1993) examined the relation between local New York City weather and daily changes in indexes of listed stocks on Wall Street. His results led to the rejection of the null hypothesis that stock prices from the exchanges in New York City have not systematically been affected by the local weather, supporting the conclusion that the weather conditions in New York City, influencing investor psychology, have a systematic impact on Wall Street security markets.

In the following years, researchers have extended this stream of financial studies, as yet with no conclusive results. Along with analyses confirming Saunders (1993)’ results (Cao and Wei, 2005; Chang et al., 2008; Goetzmann et al., 2015), a copious body of papers has found very little evidence in favour of the so-called weather effect (Loughran and Schultz, 2004; Goetzmann and Zhu, 2005; Frühwirth and Sögner, 2015; Kaustia and Rantapuska, 2016) or strongly criticized the conclusions that stock markets are influenced by weather-induced investor mood changes (Kramer and Runde, 1997; Pardo and Valor, 2003; Jacobsen and Marquering, 2008; Pizzutilo and Roncone, 2017; Kim, 2017).

Compared with the number of studies examining developed economies, very few have focused on the analysis of the weather effect on the stock markets of emerging economies. Moreover, all of them have limited the analysis to the index level; that is, they have not verified whether the behaviour of stock returns can be supposed to be influenced indirectly by weather variables too. No study has paid attention to the opening-hour market activity.

Hirshleifer and Shumway (2003) examined the relationship between sunshine in the city of a country’s leading stock exchange and daily market index returns across 17 developed markets and 9 emerging markets (Argentina, Brazil, Chile, Malaysia, the Philippines, South Africa, Taiwan, Thailand and Turkey) from 1982 to 1997.

For the latter group, they only found little evidence that the returns of the Brazilian index were statistically positively related to sunshine. Nevertheless, they concluded that transaction costs heavily reduce the gains from a weather-based trading strategy. These results as well as those of Saunders (1993) were recently questioned by Kim (2017), who critically evaluated the statistical significance reported in those studies speculating that their findings were highly likely to be spurious and an occurrence of Type I error. He also concluded that the same suspicions concerning spurious statistical significance were likely to be found in many other studies on weather effect.

Shu and Hung (2009) investigated the existence of an underlying relationship between wind and stock market index returns in 18 European countries. The analysis covered 5 emerging financial markets (Russia, Turkey, the Czech Republic, Poland and Hungary) along with continental developed countries for the years 1994 to 2004. Interestingly, the study documented a strong and pervasive negative effect of wind speed on the stock market index performances in many developed countries and no significant effect on the returns of the examined emerging countries’ indexes. On the same line, Dowling and Lucey (2008) conducted a comprehensive analysis of the effect of weather and biorhythm variables on the index returns of 37 markets (Argentina, Chile, China, Indonesia, Korea, Malaysia, Mexico, the Philippines, South Africa, Taiwan and Turkey were the emerging economies considered) for the period 1994 to 2004. They found little support for the assertion that weather variables are significantly related to stock indexes’ prices and volatility.

The relationship between the weather variables and the Taiwanese stock exchange index has been investigated by different studies with conflicting results. Chang et al. (2006) explored whether there was a relationship between the Taiwan stock index returns and three weather variables: temperature, humidity and cloud cover. Their study covered the period from July 1997 to October 2003. They argued that the Taiwan stock index returns tend to be lower when the weather is extremely hot or extremely cold. In addition to temperature, they concluded that cloud cover is an important factor affecting stock market returns in Taiwan. According to their results, the Taiwan stock index’s returns tend to be lower when the cloud cover is too heavy. Lee and Wang (2011) investigated the effectiveness of the sunshine effect on the Taiwan Stock Exchange Value Weighted Index (TAIEX) and eight of its sub-indices. By taking into consideration the impact of the U.S. stock market and employing the GED error distribution, they inspected a very large time period (1986 to 2007) and concluded that, for the pre-1997 Asian crisis period, the effect of sunshine on the TAIEX was limited, while it was more effective in the subsequent years. They also found a significant sunshine effect in six out of eight sector indices in the first sub-period and three in the second. Different results were obtained by Wang et al. (2012), who analyzed the behaviour of the TAIEX over the years 2001 to 2007. They found that sunshine and temperature significantly affect TAIEX volatility but not its returns. They also found an insignificant relationship between TAIEX and humidity.

Yoon and Kang (2009) examined whether the daily returns on the Korean Composite Stock Price Index (KOSPI 200) were affected by three weather variables (temperature, humidity and cloudiness) over the years 1990 to 2006. They found that, before the 1997 Asian crisis, extremely low temperatures exerted a positive influence on returns, whereas extremely high humidity and heavy cloudiness exerted a negative effect. They also argued that, after the 1997 financial crisis, the evidence for a weather effect became insignificant. Shim et al. (2015) inspected how historical and implied volatilities move in response to unexpected weather changes in the Korean stock market. They concluded that market volatility tends to increase in cloudy or wet weather, and to decrease in windy weather conditions. They also observed that investors asymmetrically react to extremely high and low weather conditions. According to their results, the Korean stock market seems to become riskier in extremely cloudy, wet, cold and windless conditions as opposed to extremely sunny, dry, hot and windy weather.

Studies have been conducted on the Chinese stock market as well. Kang et al. (2010) inspected the relationship between three weather variables (temperature, humidity and sunshine) and the daily stock returns and volatility of the Shanghai A (domestic board) and B (foreign board) share indexes. They argued that the Shanghai weather affected the A-share index returns and volatility over the whole period inspected and the B-share index returns and volatility after the opening in 2001 of its trading to domestic investors. Lu and Chou (2012) examined the association between weather-related mood factors (cloud cover, temperature, humidity, visibility, pressure and wind speed) and the Shanghai Composite Index (SCI) from 2003 to 2008. Their results indicate that the SCI returns were generally unaffected by the changes in mood introduced by weather variables with the exception of extreme weather conditions. Furthermore, they found that many of these variables were strongly correlated with the market turnover and liquidity.

Recently, Sheikh et al. (2017) studied the impact of weather and biorhythmic variables on index returns and volatility in six stock markets of the Indian region (India, Pakistan, Bangladesh and Sri Lanka). Their analysis covered the period 2000-2012. They found little evidence for the effect of the weather on index returns. Nevertheless, they argued that many weather variables have significant relationship with volatility. Interestingly, their analysis led to the conclusion that rainy days in Indian equity markets are related to positive returns and decreasing volatility.

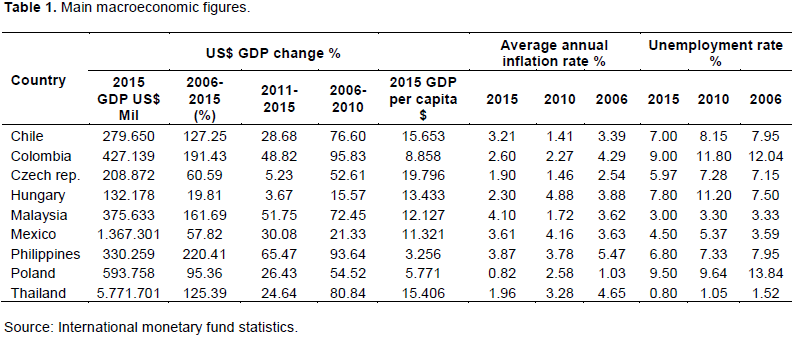

Existing literature (see previous section) has recognized temperature, cloudiness, wind and humidity as weather variables that are able to influence market operators’ mood to such an extent that they have a significant effect on stock market activity. We thus examined the effect of these variables on the stock market returns of a sample of emerging economies. Countries have been selected among those classified by Morgan Stanley Capital Index as Emerging Financial Markets (note 1) and located in three different geographical, political and societal areas of the world, Latin America, East Europe and South East Asia so to permit comparison among different emerging financial regions of the world, too. To ensure a higher level of homogeneity and avoid results being affected by the relative size of their stock markets, BRICs and Asian Tigers have been excluded from eligible countries. Finally, the three countries of each region with the higher market capitalization as of 31 December 2015 have been selected. Table 1 reports major macroeconomic data of the countries that are included in our sample. A remarkable increase in the GDP, associated with inflation and unemployment rates not dissimilar to those of developed countries, distinguished the years covered by our analysis. All of the countries in our sample experienced substantial financial markets reforms in the last 20 years.

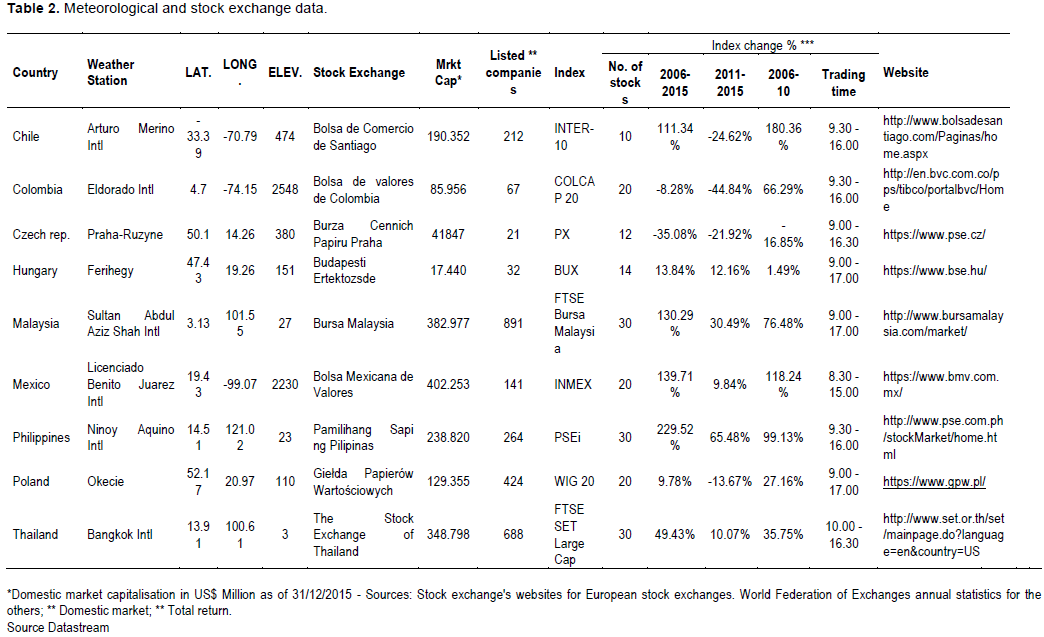

Meteorological data were collected from the archives of the National Centers for Environmental Information (NCEI), the US Federal Centre responsible for hosting and providing access to the world’s largest archives of weather and climate data. The weather data refer to the meteorological observation station nearest to the stock exchange inspected (Table 2). The following definitions apply to the weather variables employed in the analysis. Temperature (TMP) is the air temperature measured in degrees Celsius; humidity (HUM) is the relative humidity measured as a percentage; wind (WND) is the wind speed measured in meters per second; and cloudiness (CLD) denotes the fraction of the celestial dome covered by clouds expressed in oktas ranging from 0 (clear sky) to 8 (overcast) (Note 2).

All the values coded by the NCEI as suspect or erroneous were not taken into consideration. Occasional missing values in weather and price data were not replaced. Given the very small number of missing data, this is not believed to have affected the results to a significant extent. The analysis covers the period from 1 January 2006 to 31 December 2015. To avoid the results being affected by the relatively small number of daily trades, the analysis was conducted on the stocks comprised in the most liquid index of each exchange on 31 December 2015. To avoid the results being affected by the relative small number of observations, shares listed later than 1 January 2014 were excluded from the sample. To avoid redundancies, if preference shares were included in the index along with ordinary shares, only the latter were examined. The behaviour of the main index of each stock exchange was analyzed too. The total return prices adjusted for corporate actions were employed for all the time series under inspection but the Colombia Colcap 20. (Note 3) The returns were calculated as the difference in the natural logarithm between the stock prices. For each trading day, we calculated the daily return (RETD) and the opening return (RETO) as the difference in the natural logarithm between day t and day t-1 closing prices and the difference in the natural logarithm between the day t opening price and the day t-1 closing price, respectively. To reduce the possible bias induced by series of null daily returns, only days in which at least one negotiation of the share occurred were included in the analysis. A total of 186 stocks and 9 indices composed our sample. Table 2 summarizes the data of interest. The market data were collected from Datastream.

First of all, to obtain comparable results with previous studies, we tested the significance of the following regression model, which is similar to the one employed by most existing literature:

Where, RETYit denotes the market response variables inspected (RETD or RETO) of day t for stock i or index i. WYt denotes the explanatory weather variable used (TEMP, HUM, CLD or WND) on day t. The average of the observations for each weather variable during the trading hours of day t (WDt) and the observation at the market opening hour (or the closest one) of day t (WOt) were considered as the weather explanatory variable for the daily and opening analysis, respectively. α is a constant, βi is the regression coefficient and β is the error term.

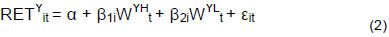

The psychological literature has outlined that the most evident mood misattributions are related to very bad or very good weather conditions (Allen and Fischer, 1978; Bell, 1981; Rotton and Cohn, 2000). Saunders (1993) highlighted that almost all the differences in the returns documented in his study were driven by extreme cloud cover conditions. On the same line, other studies have contended that most of the weather effect is due to extreme weather conditions (Chang et al., 2006; Yoon and Kang, 2009; Goetzmann et al., 2015). To verify whether a relationship exists between extreme weather conditions and the returns of the emerging stock markets analysed, we also tested the significance of the following model:

Where, WYH and WYL are dummy variables that take the value of one if an extremely high (H) or low (L) weather condition is measured on day t (if Y=D) or at the opening hour of day t for the opening analysis (if Y=O) and zero otherwise, and all the rest are as above. To cope with the ambiguity inherent in the definition of an “extreme weather condition”, the strong differences in the climate of the countries analysed (for instance, a temperature of 5 degrees Celsius in a day in January is not an extremely low temperature in Poland, while it is of course in the Philippines) and the variability of the weather during the year (a temperature of 30°C is not an extreme condition if in the previous week the average temperature was 32 but can be considered an extreme condition if the average temperature in the previous 7 days was 18), we specify three different thresholds for extreme weather condition: a) the weather survey is in the first (extreme high weather condition) or the tenth (extreme low weather condition) decile of the distribution (model 2a); b) the weather survey is one standard deviation higher (extreme high weather condition) or lower (extreme low weather condition) than the average of the previous ten days (model 2b); and c) the weather survey is 1.96 standard deviation higher (extreme high weather condition) or lower (extreme low weather condition) than the average of the previous ten days (model 2c).

To gain more insights, all the above analyses were conducted over the whole time period, 2006–2015, and over the two sub- periods of the same extension, 1 January 2006 to 31 December 2010 and 1 January 2011 to 31 December 2015. To identify possible outliers, Cook (1977)’s distance was used. In line with Chatterjee and Hadi (2006), the (1-α) point of the F-distribution with (p+1) and (n-p-1) degrees of freedom was employed as the threshold value with a confidence level of 95%. Excluding from the analysis occasional observations outlined by Cook (1977)’s distance did not significantly change the results; hence, to avoid redundancy, the figures reported hereinafter refer to the whole set of observations only (Note 4). Ordinary least squares (OLS) estimators were employed. The augmented Dickey–Fuller (ADF) and Kwiatkowski, Phillips, Schmidt and Shin (KPSS) tests excluded unit root issues at the usual confidence levels. Since the Durbin and Watson (1950; 1951)’s test and the Breusch and Pagan (1979)’s test raised concerns about serial autocorrelation and heteroskedasticity of the residuals, we employed Newey and West (1994)’s non-parametric bandwidth procedure for heteroskedasticity and autocorrelation consistent covariance estimation to adjust the standard errors and control for unknown forms of heteroskedasticity. The resulting robust standard errors and p-values are shown in the next section and used to discuss the results.

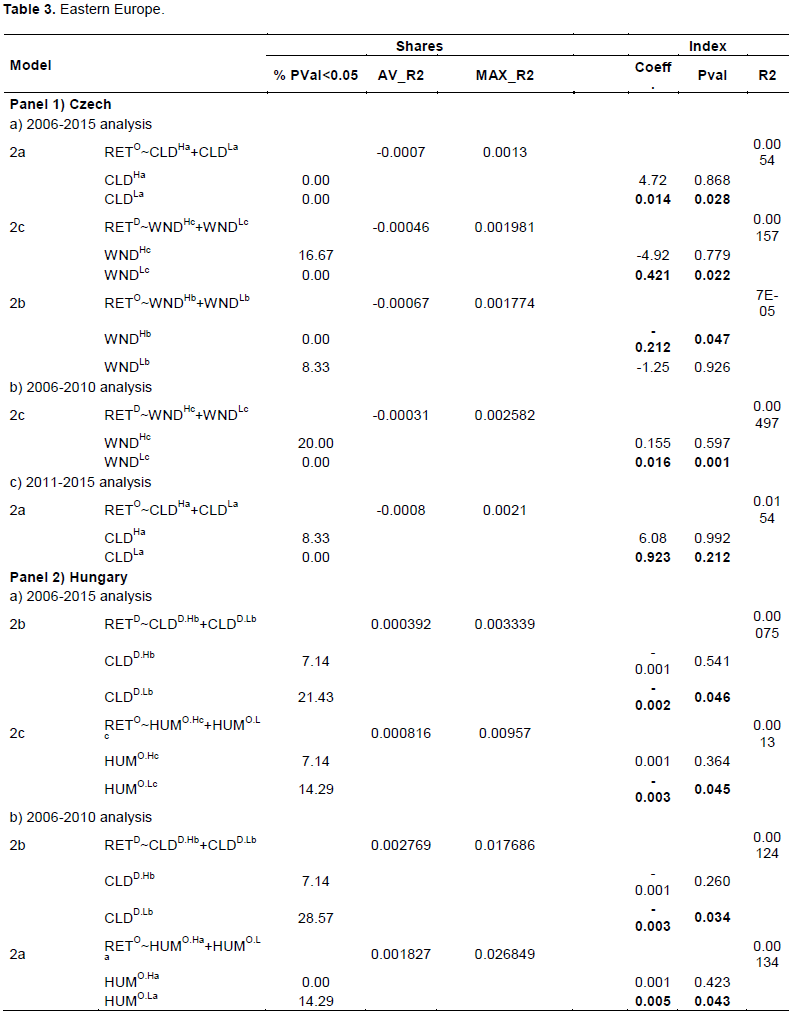

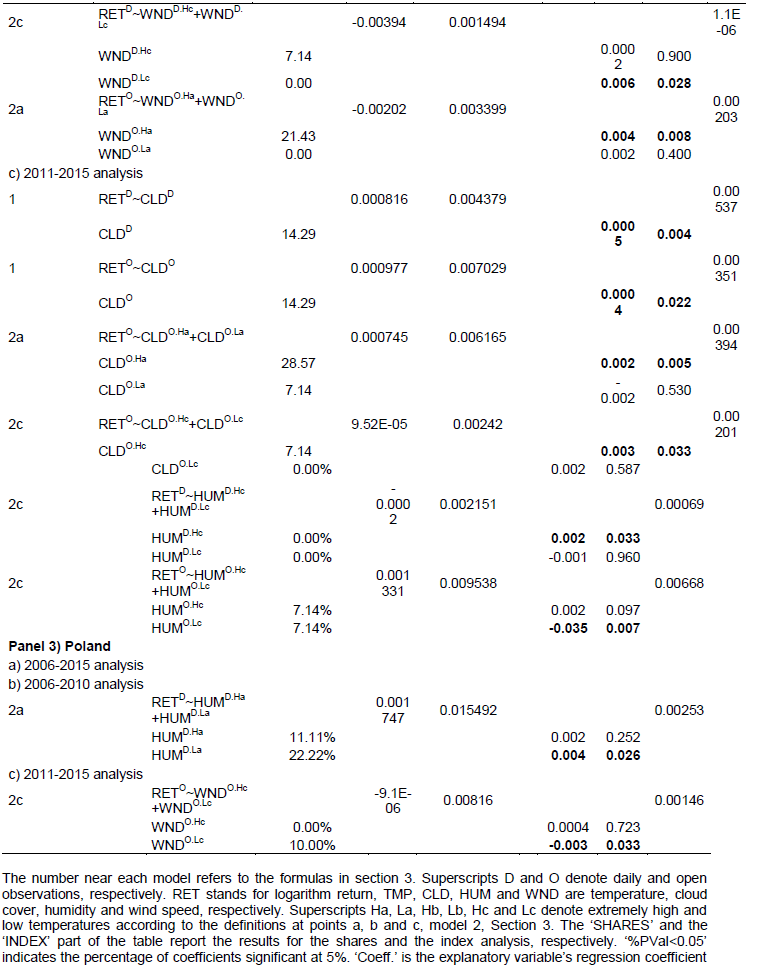

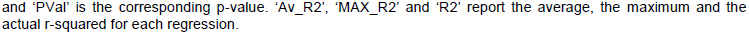

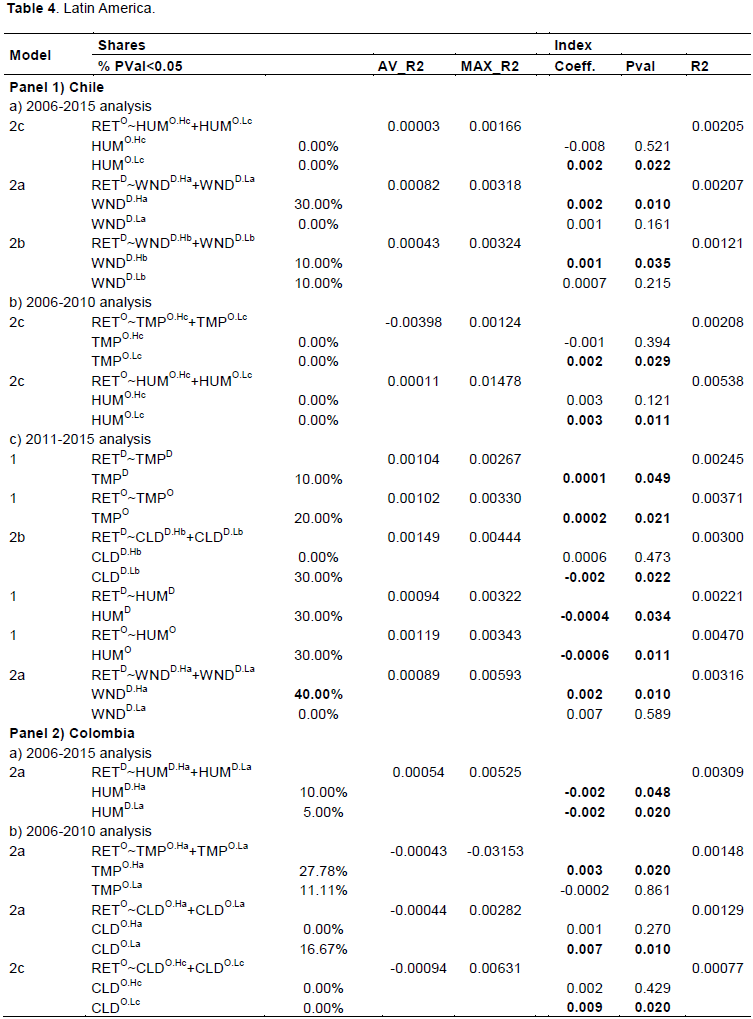

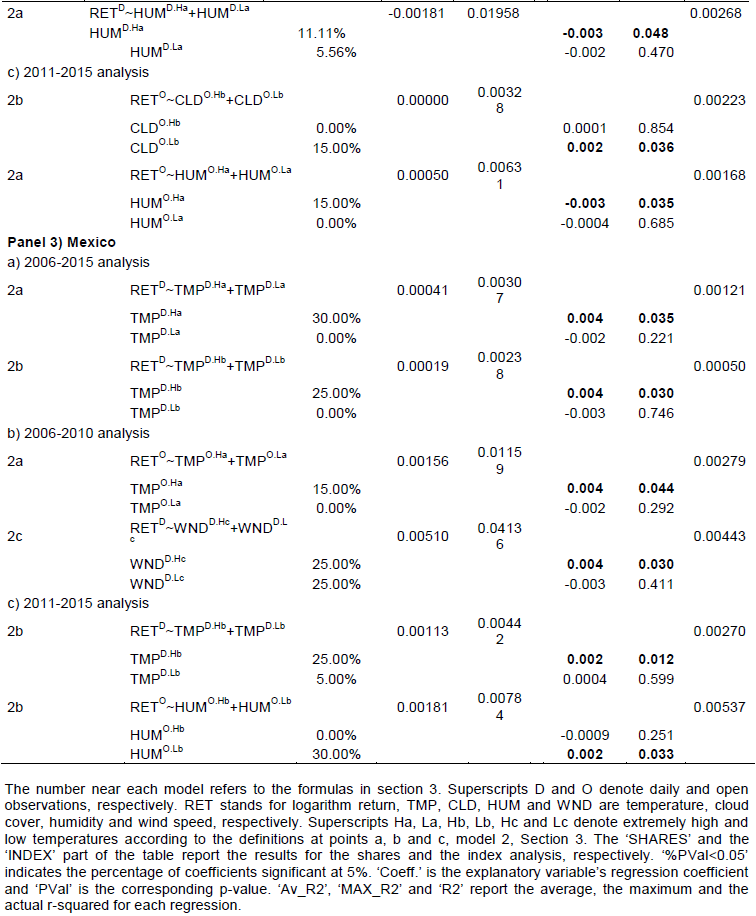

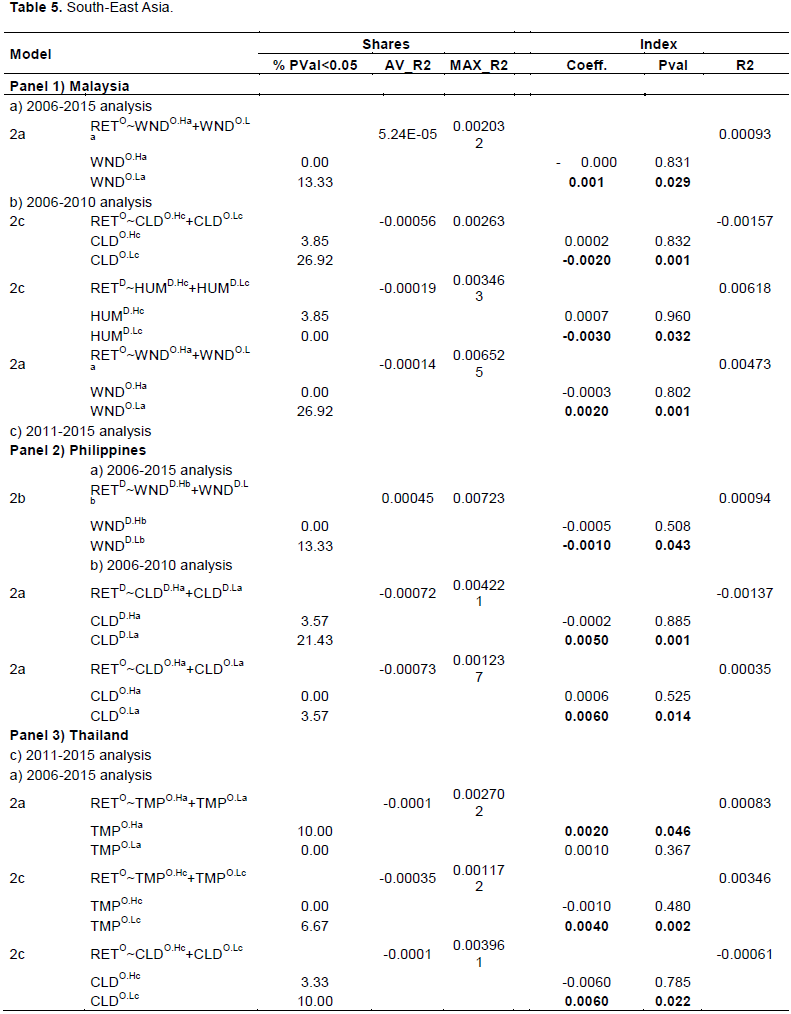

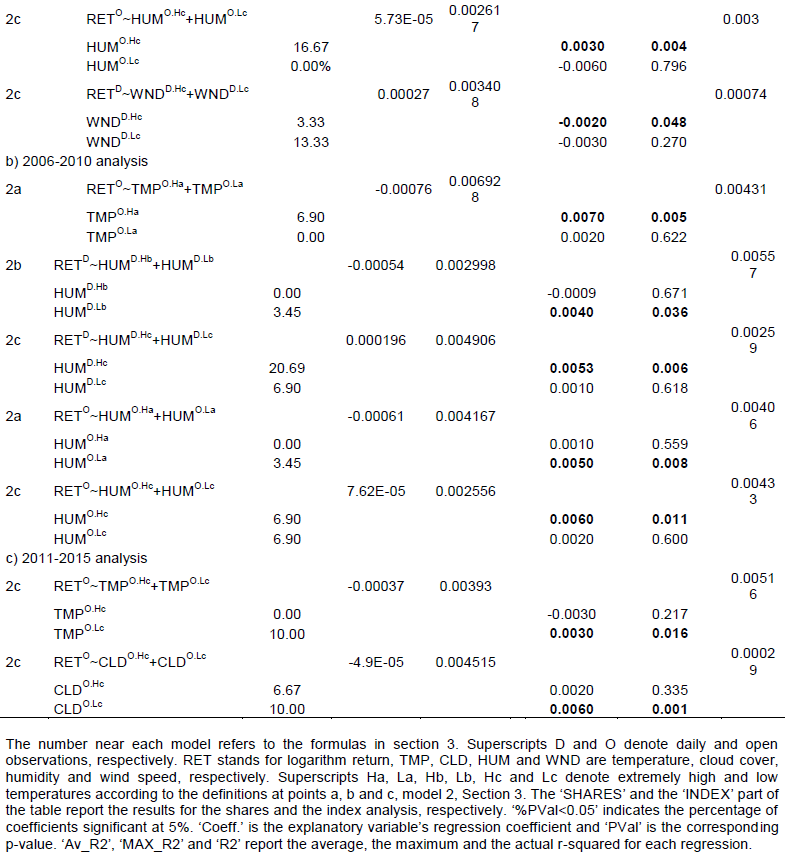

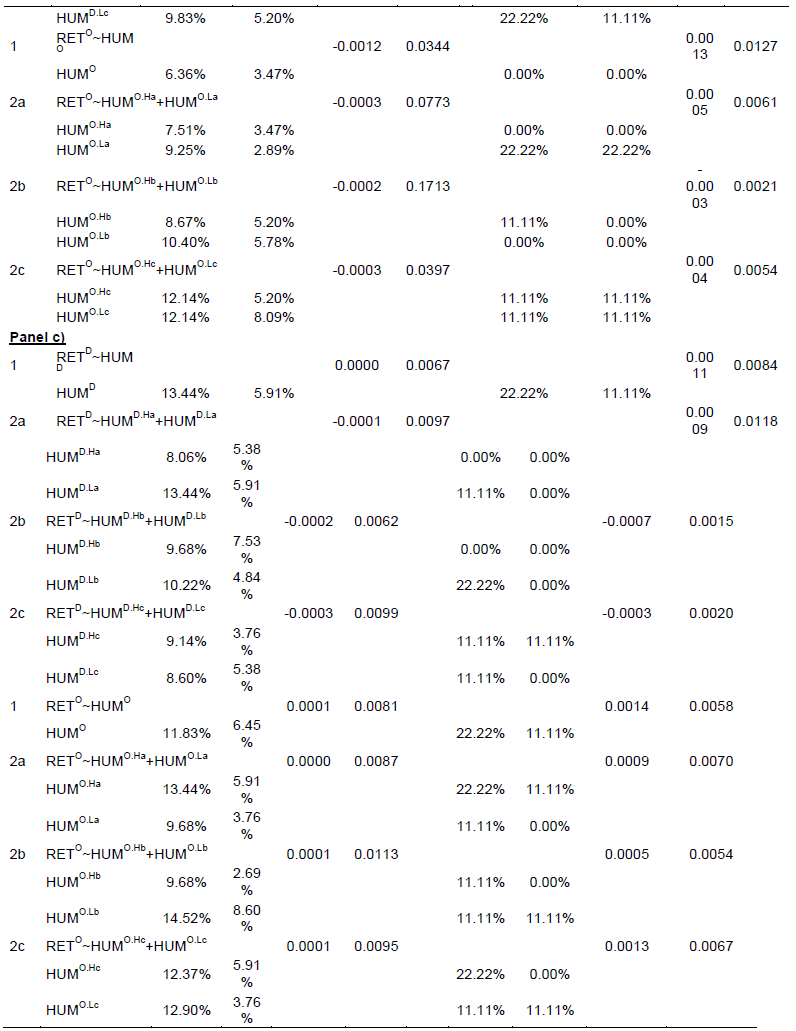

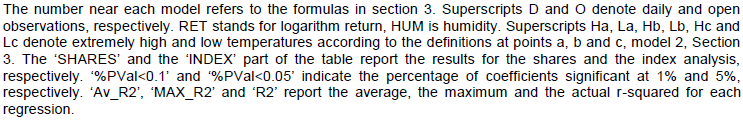

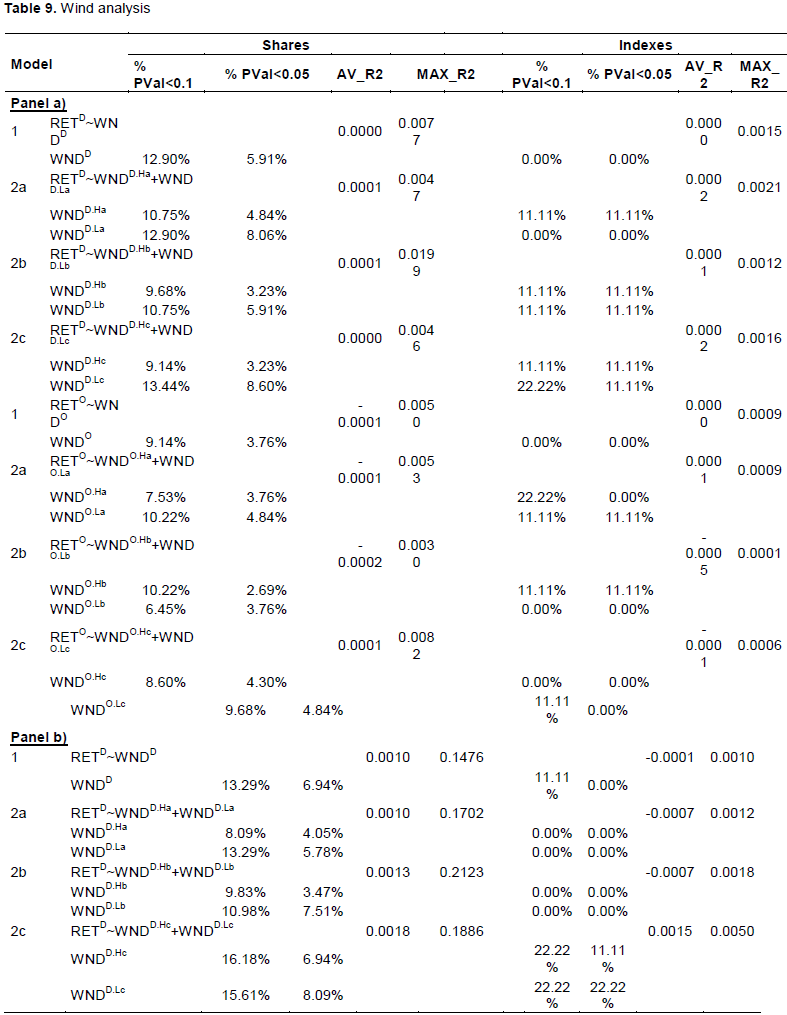

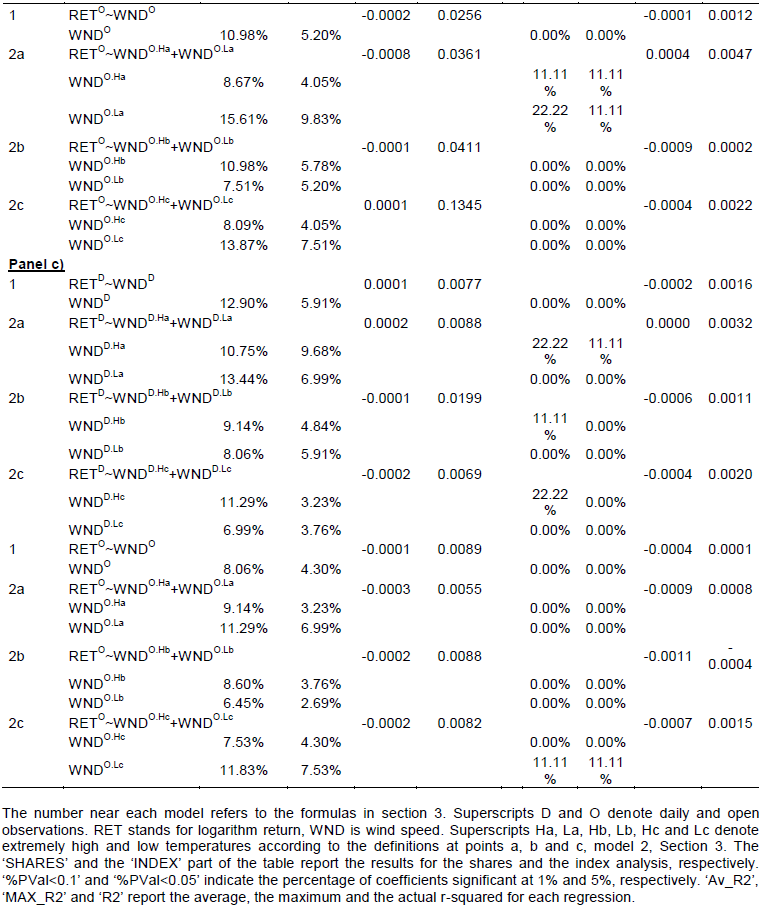

Tables 3, 4 and 5 report the regressions for which significance at the 95% confidence level was found for at least one explanatory variable in the index analysis or, for the stock analysis, significance at the 95% confidence level was found for at least one explanatory variable for a minimum of 40% of the shares of a country. The results are grouped into regional clusters to provide insights into the three geographical areas inspected. To save space, we avoid reporting index regression figures for which any significance at the usual confidence level was found and stock regression figures for which significance was found for fewer than 40% of the shares analysed for each country. Complete data are obviously available to whoever is interested on request.

If the analysis is confined to the index level, as in all the previous research on the weather effect in emerging countries, a strong effect of the weather on these stock markets can be argued. For instance, it can be advocated that extremely high (beta -0.002; Pval 0.048) and extremely low (beta -0.002; Pval 0.048) humidity have a negative effect on Colombian stock markets, that a clear sky in Prague (beta 0.0142; Pval 0.028) exerts such a positive effect on the mood of Czech stock market traders that it is positively reflected in the returns of the PX index or that a very high temperature in Bangkok early in the morning (beta 0.002; Pval 0.046) leads to positive opening prices and so on for the other significant coefficients. Nevertheless, no similar patterns are observable by comparing countries belonging to the same geographical area.

An opposite picture is drawn by the correspondent stock-level analysis. A very small number of stocks can be supposed to have their price behaviour indirectly influenced by the same weather condition that can be statistically argued to have a significant effect on the index price. In all the cases for which a 95% confidence level of significance was found in the index analysis, the percentage of stocks included in the index for which similar significance is measured is very small. For the majority of the cases, this percentage is below 15%, while the maximum percentage is 30%. For the 2006 to 2015 examination, in 4 of a total of 19 significant coefficients in the index analysis none of the stocks included in the index reported a similar statistically significant relationship. None of the regressions, whether or not they were significant in the index analysis, recorded a 95% confidence level for the majority of the stocks included in the same index. In general the stock analysis strongly rejects the existence of any kind of weather effect in the countries under inspection, consistently with Kramer and Runde (1997), Pardo and Valor (2003), Jacobsen and Marquering (2008), Pizzutilo and Roncone (2017) and Kim (2017).

Apart from the very low figures for the stock analysis, other evidence leads us to conclude that a weather effect is not to be postulated for these markets. The sub-period analysis for instance does not describe the same picture as the whole-period analysis. Of a total of 19 significant coefficients for the 2006–2015 index analysis, only 10 have the same significance in 1 of the 2 sub-periods (1 coefficient is significant but with the opposite sign). No coefficients are significant in both of the sub-periods. On the other hand, 32 regressions show significance in 1 of the sub-periods analysed but not in the 2006 to 2015 analysis. None of the models employed show significance in both sub-periods. Hence, the weather effect, if any exists in these countries, can be considered to be highly time dependent; that is, it is manifested over some periods but not others, which, from a practical perspective, means that the weather effect, if any, cannot easily be exploited through a trading strategy. Neither the recent financial crises (that hit the final years of sub-period 1) nor the subsequent years of recovery, austerity and financial reforms (which happened in sub-period 2) seem to have had any influence on this seemingly data driven pattern.

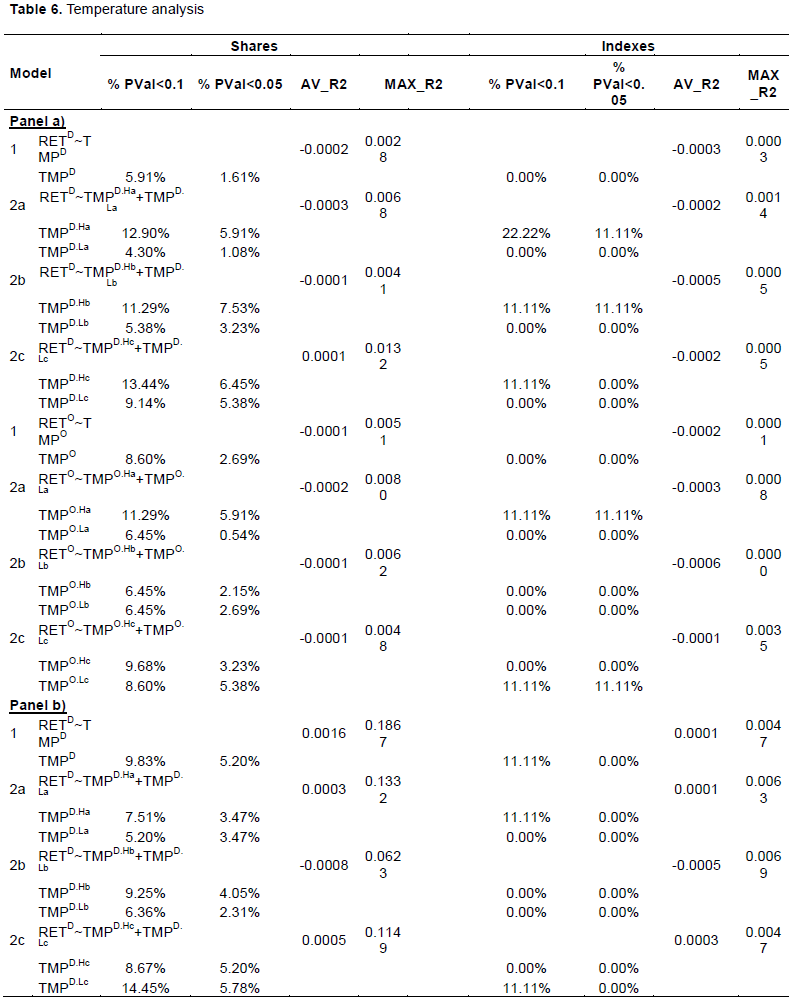

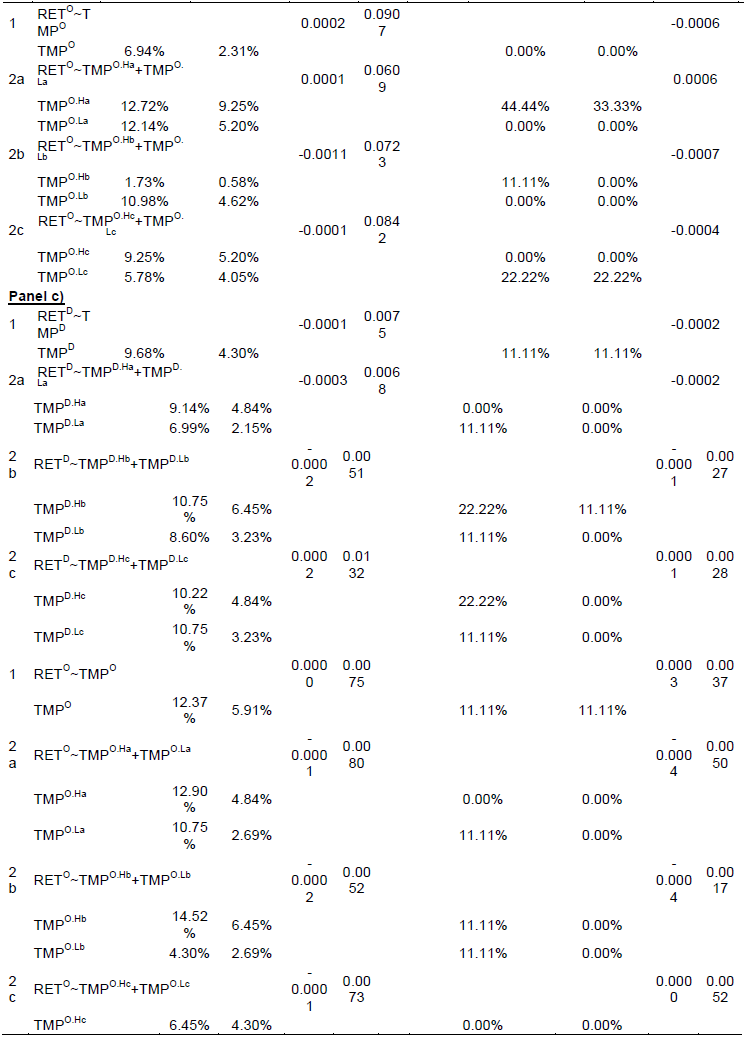

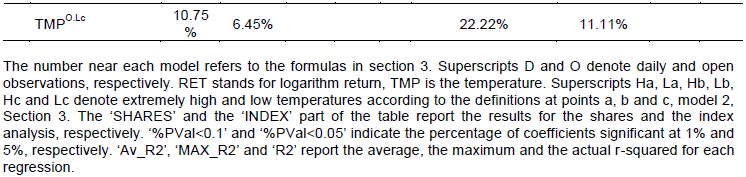

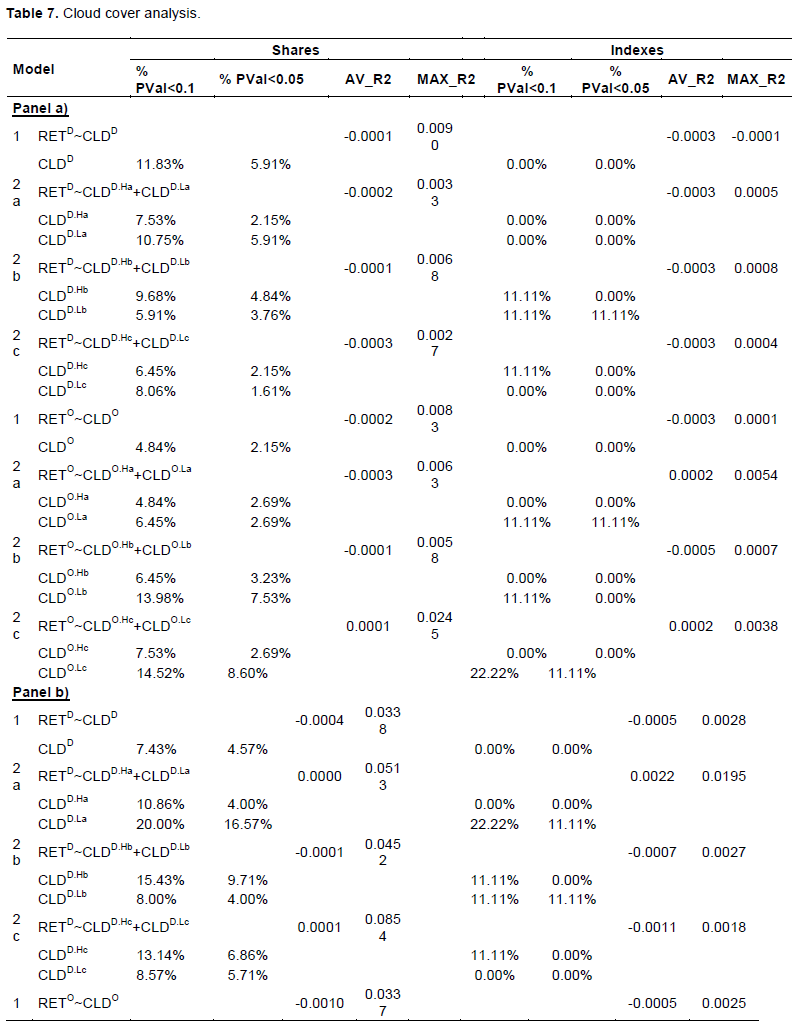

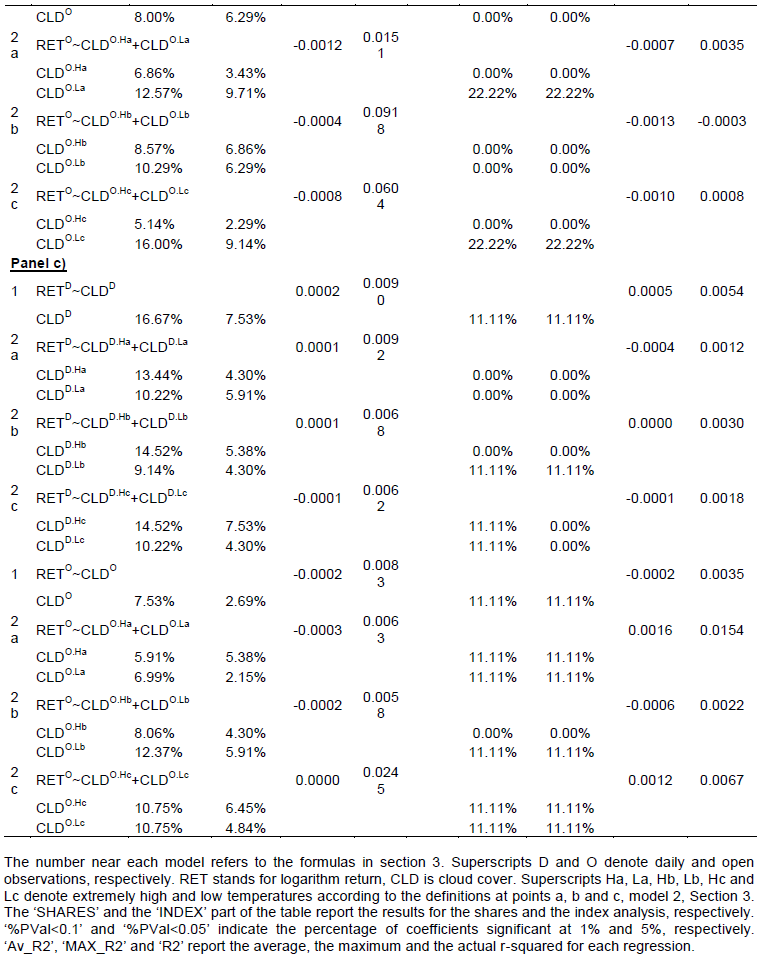

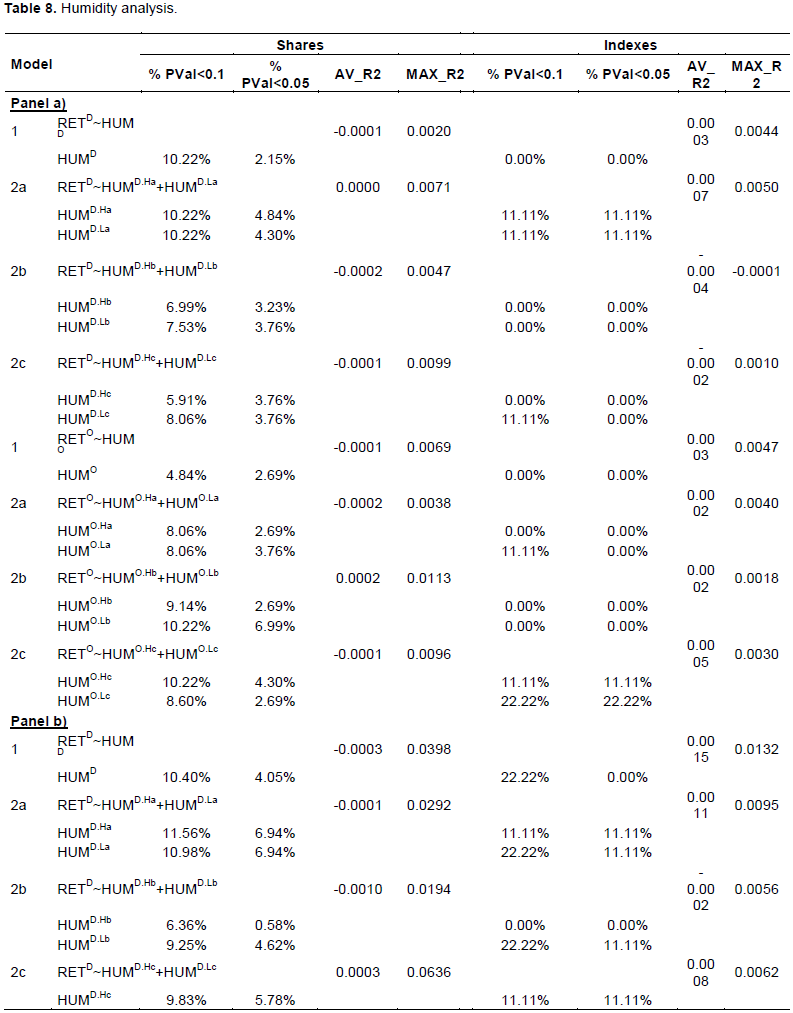

Moreover, consider Tables 6, 7, 8 and 9, which report, for each of the weather variables inspected and for each model employed the comprehensive percentage of significant coefficients. The percentages of significant coefficients are strongly below the 50% even at the 90% confidence level, for the stock (maximum percentage 20%, only 7 coefficients over 336 are significant for more than the 15% of the shares analysed) as well as for the index analysis (maximum percentage 44%, only 28 coefficients over 336 are significant for more than the 15% of the indexes analysed), leading us to conclude in favour of the rejection of the weather effect hypothesis. Moreover, the very low levels of adjusted r-squared (0.21 the highest adjusted r-squared, only 9 regressions over 192 show an adjusted r-squared higher than 0.1) reinforce the conclusion of any kind of weather effect in these countries. A low r-squared is a common feature of all the studies on the weather effect, independently they inspected developed or emerging financial markets, independently they accepted or rejected the weather effect hypothesis and independently of the model employed, raising concerns on the effective nature of the significances eventually found and on the predictive ability (in sample and especially out of sample) of any asset pricing model that controls the weather variables.

Adopting the same approach as that followed in the existing literature, we tried to model the indirect effect (the weather that influences the emotional state and the mood of market operators to such an extent that their financial decisions are affected and this is reflected in the stock market prices) in a direct econometric model (how a weather time series explains financial returns). Such an approach, which is the only viable one given the variables involved, in our opinion requires great caution in the discussion of the results and the necessity of finding robust results to confirm the hypothesis. Contrary to a large part of the existing literature on the subject, we do not think that the significance of a model on its own is definite proof of the existence of the weather effect.

Following the conviction that misleading and incorrect conclusions can be drawn by selecting and disclosing only part of the examinations carried out, we follow the American Statistical Association Ethical Guidelines and disclose and discuss the full extent of the tests and results. In our opinion, our results suggest that, without any further evidence, the relationship between weather- related variables and stock returns in the emerging markets analysed is spurious and that the significance recorded for some of the indexes is data driven and cannot be used as evidence of any kind of weather effect, consistently with Kim (2017). We strongly believe that, if a weather effect were present, the same influence of the weather should have been measured for a large portion of the stocks included in the index and should be evident

from analysing sub-periods as well. This indeed is not the case.

Our results are not in contrast with psychological literature claiming that mood misattributions induced by external events like weather conditions can influence individual behaviour and decision making under risk. They only postulate that these possible individual misattributions, if any, are arbitraged in a very short period of time by the market and cannot significantly influence stocks’ price behaviour. We are thus confident in asserting that the efficient-market hypothesis is not challenged by the indirect effect of the weather on the mood of the stock market operators for the nine emerging countries examined. An important implication of our results is that they do not advocate the inclusion of behavioural weather-related variables in the asset-pricing models to be employed for these countries. Our results also call for a robust and widespread examination that takes into account stocks’ price behaviour as well in the assessment of the weather effect for developed and emerging countries.

Many psychological studies have argued that good or bad weather conditions induce shifts in individuals’ mood that can influence their decision-making process under risk and uncertainty. Based on these conclusions, some behavioural finance studies have raised the question of whether sunshine, temperature or other weather variables have an impact on stock prices by affecting the behaviour of market operators, thus challenging the efficient-market hypothesis. However, these studies have not obtained conclusive results. Moreover, very few papers on the weather effect have concentrated on the stock markets of emerging countries, with contradictory results. We conducted a comprehensive analysis of the effect of four weather variables (temperature, cloud cover, humidity and wind) on the stock markets of nine emerging countries located in three climatic, socially, politically and economically different areas of the world, thus filling a not negligible gap in the financial literature. Our analysis covered the years 2006 to 2015. To gain more conclusive results, differently from the existing literature, we extended the analysis by analysing stock prices’ behaviour along with that of stock indexes and by inspecting the opening market activity along with the whole-day activity following the belief that: a) the weather effect, if any, affects the prices of the stocks in the same way than the prices of the market indexes given a not lower level of efficiency that is to be recognized in the latter and b) that external weather conditions exert a greater effect on human mood at the beginning of the day rather than later on, when indoor facilities could have mitigated the possible effect of the weather and other news or circumstances may have influenced the market operators’ mood. Moreover, supported by the psychological literature that concludes that extreme weather conditions are the major reason for human mood misattributions, we employed different specifications for the weather variables analysed.

We argued that there is no weather effect in the nine emerging markets analysed (Chile, Colombia, the Czech Republic, Hungary, Malaysia, Mexico, the Philippines, Poland and Thailand). Thus, our findings do not contest the notion of efficient markets for these countries or advocate the inclusion of behavioural weather-based variables in asset-pricing models.

The authors have not declared any conflict of interests.

We are grateful to Prof. Maurizio Fanni, Prof. Ageliki Anagnostou, Prof. Stefano Mainardi, Prof. Ali Shahid, Prof. Caterina Marini, Dr. Alessandra Caragnano, Dr. Marianna Zito and two anonymous referees, for their constructive comments and suggestions.

Note 1. Since we are analyzing financial markets, MSCI classification has been preferred to the International Monetary Fund’s one.

Note 2. Okta is the unit of measurement for total sky coverage. It refers to the number of eighths of the sky covered by clouds.

Note 3. The total return prices for the Colombia Colcap 20 are not distributed. Prices only adjusted for corporate actions were analyzed for this index.

Note 4. Those interested in the other set of results are welcome to contact the authors.

REFERENCES

|

Allen MA, Fischer GJ (1978). Ambient Temperature Effects on Paired Associate Learning. Ergonomics 21(2):95-101.

Crossref

|

|

|

|

Bassi A, Colacito R, Fulghieri P (2013). 'O sole mio: an experimental analysis of weather and risk attitudes in financial decisions. The Review of Financial Studies 26(7):1824-1852.

Crossref

|

|

|

|

|

Bell PA, Greene TC, Fisher JD, Baum A (2003). Environmental Psychology. Publisher Belmont, Wadsworth. Available at:

View

|

|

|

|

|

Bell PA (1981). Physiological Comfort, Performance and Social Effects of Heat Stress. Journal of Social Issues 37(1):71-94.

Crossref

|

|

|

|

|

Breusch TS, Pagan AR (1979). Simple Test for Heteroscedasticity and Random Coefficient Variation. Econometrica 47(5):1287-1294.

Crossref

|

|

|

|

|

Cao M, Wei J (2005). Stock Market Returns: A Note on Temperature Anomaly. Journal of Banking and Finance 29(6):1559-1573.

Crossref

|

|

|

|

|

Chang SC, Chen SS, Chou RK, Lin YH (2008). Weather and Intraday Patterns in Stock Returns and Trading Activity. Journal of Banking and Finance 32(9):1754-1766.

Crossref

|

|

|

|

|

Chang T, Chien-Chung N, Ming Jing Y, Tse-Yu Y (2006). Are Stock Market Returns Related to the Weather Effects? Empirical Evidence from Taiwan. Physica A 364:343-354.

Crossref

|

|

|

|

|

Chatterjee S, Hadi AS (2006). Regression analysis by example, 4th ed. New York: John Wiley & Sons, Inc.

Crossref

|

|

|

|

|

Chou KL, Lee TMC, Ho AHY (2007). Does mood state change risk taking tendency in older adults? Psychology and Aging 22(2):310-318.

Crossref

|

|

|

|

|

Cook RD (1977). Detection of Influential Observations in Linear Regression. Technometrics 19(1):15-18.

|

|

|

|

|

Cooke L, Rose M, Becker W (2000). Chinook winds and migraine headache. Neurology 54:302-307.

Crossref

|

|

|

|

|

Cunningham MR (1979). Weather, Mood and Helping Behavior: Quasi-Experiments with the Sunshine Samaritan. Journal of Personality and Social Psychology 37(11):1947-1956.

Crossref

|

|

|

|

|

Damasio A (1994). Descartes' Error: Emotion, Reason, and the Human Brain. Putnam, New York. Available at:

View

|

|

|

|

|

Denissen JJA, Butalid L, Penke L, van Aken MAG (2008). The effects of weather on daily mood: A multilevel approach. Emotion 8(5):662–667.

Crossref

|

|

|

|

|

Dowling M, Lucey BM (2008). Robust global mood influences in equity pricing. Journal of Multinational Financial Management 18(2):145-164.

Crossref

|

|

|

|

|

Durbin J, Watson GS (1950). Testing for Serial Correlation in Least Squares Regression, I. Biometrika 37(3-4):409-428.

Crossref

|

|

|

|

|

Durbin J, Watson GS (1951). Testing for Serial Correlation in Least Squares Regression, II. Biometrika 38(1-2):159-179.

Crossref

|

|

|

|

|

Eagles J (1994). The relationship between mood and daily hours of sunlight in rapid cycling bipolar illness. Biological Psychiatry 36(6):422-424.

Crossref

|

|

|

|

|

Forgas JP (1995). Mood and Judgment: The Affect Infusion Model (AIM). Psychological Bulletin 117(1):39-66.

Crossref

|

|

|

|

|

Frühwirth M, Sögner L (2015). Weather and SAD related mood effects on the financial market. The Quarterly Review of Economics and Finance 57:11-31.

Crossref

|

|

|

|

|

Goetzmann WN, Zhu N (2005). Rain or Shine where Is the Weather Effect?. European Financial Management 11(5):559-578.

Crossref

|

|

|

|

|

Goetzmann WN, Dasol K, Kumar A, Wang Q (2015). Weather-Induced Mood, Institutional Investors, and Stock Returns. Review of Financial Studies 28(1):73-111.

Crossref

|

|

|

|

|

Harding N, He W (2016). Investor mood and the determinants of stock prices: an Experimental analysis. Accounting and Finance 56:445-478.

Crossref

|

|

|

|

|

Hills AM, Hill S, Mamone N, Dickerson M (2001). Induced mood and persistence at gaming. Addiction 96(11):1629-1638.

Crossref

|

|

|

|

|

Hirshleifer D, Shumway T (2003). Good Day Sunshine: Stock Returns and the Weather. The Journal of Finance 58(3):1009-1032.

Crossref

|

|

|

|

|

Howarth E, Hoffman MS (1984). A Multidimensional Approach to the Relationship Between Mood and Weather. British Journal of Psychology 75(1):15-23.

Crossref

|

|

|

|

|

Isen A, Patrick R (1983). The effect of positive feelings on risk taking: When the chips are down. Organizational Behavior and Human Decision Processes 31(2):194-202.

Crossref

|

|

|

|

|

Jacobsen B, Marquering W (2008). Is It the Weather?. Journal of Banking and Finance 32(4):526-540.

Crossref

|

|

|

|

|

Kals WS (1982). Your Health, your Moods and the Weather. Doubleday, New York, NY.

|

|

|

|

|

Kampfer S, Mutz M (2013). On the Sunny Side of Life: Sunshine Effects on Life Satisfaction. Social Indicators Research 110:579-595.

Crossref

|

|

|

|

|

Kang SH, Jiang Z, Lee Y, Yoon SM (2010). Weather Effects on the Returns and Volatility of the Shanghai Stock Market. Physica A 389:91-99.

Crossref

|

|

|

|

|

Kaustia M, Rantapuska E (2016). Does mood affect trading behavior?. Journal of Financial Markets 29:1-26.

Crossref

|

|

|

|

|

Keef SP, Roush ML (2007). Daily weather effects on the returns of Australian stock indices. Applied Financial Economics 17(3):173-184.

Crossref

|

|

|

|

|

Kent ST, McClure LA, Crosson WL, Arnett DK, Wadleu WG, Sathiakumar N (2009). Effect of Sunlight on Cognitive Function among Depressed and non-Depressed Partecipants: a REGARDS Cross-sectional Study. Environmental Health 8(34):1-14.

|

|

|

|

|

Kim JH (2017). Stock returns and investors' mood: Good day sunshine or spurious correlation?. International Review of Financial Analysis 52:94-103.

Crossref

|

|

|

|

|

Kramer W, Runde R (1997). Stocks and the Weather: An Exercise in Data Mining or Yet Another Capital Market Anomaly?. Empirical Economics 22(4):637-641.

Crossref

|

|

|

|

|

Lee YM, Wang KM (2011). The effectiveness of the sunshine effect in Taiwan's stock market before and after the 1997 financial crisis. Economic Modelling 28(1-2):710-727.

Crossref

|

|

|

|

|

Levinson A (2012). Valuing public goods using happiness data: the case of air quality. Journal of Public Economy 96:869-880.

Crossref

|

|

|

|

|

Lin CH, Yen HR, Chuang SC (2006). The effects of emotion and need for cognition on consumer choice involving risk. Marketing Letters 17(1):47-60.

Crossref

|

|

|

|

|

Lo AW, Repin VD (2002). The Psychophysiology of Real-Time Financial. Journal of Cognitive Neuroscience 14(3):323-339.

Crossref

|

|

|

|

|

Loewenstein GF, Hsee CK, Weber EU, Welch N (2001). Risk as Feelings. Psychological Bulletin 127(2):267-286.

Crossref

|

|

|

|

|

Loughran T, Schultz P (2004). Weather, Stock Returns, and the Impact of Localized Trading Behavior. The Journal of Financial and Quantitative Analysis 39(2):343-364.

Crossref

|

|

|

|

|

Lu J, Chou RK (2012). Does the Weather Have Impacts on Returns and Trading Activities in Order-driven Stock Markets? Evidence from China. Journal of Empirical Finance 19(1):79-93.

Crossref

|

|

|

|

|

McAndrew FT (2003). Environmental Psychology. International Thompson Publishing Inc, Brooks/Cole.

|

|

|

|

|

Mittal V, Ross WT (1998). The impact of positive and negative affect and issue framing on issue interpretation and risk taking. Organisational Behaviour and Human Decision Process 76(3):298-324.

Crossref

|

|

|

|

|

Newey WK, West KD (1994). Automatic Lag Selection in Covariance Matrix Estimation. Review of Economic Studies 61(4):631-653.

Crossref

|

|

|

|

|

Otto AR, Fleming SM, Glimcher PW (2016). Unexpected but incidental positive outcomes predict real-world gambling. Psychological Science 27(3):299-311.

Crossref

|

|

|

|

|

Page L, Hajat S, Kovats R. (2007). Relationship Between Daily Suicide Counts and Temperature in England and Wales. British Journal of Psychiatry 191(2):106-112.

Crossref

|

|

|

|

|

Pardo A, Valor E (2003). Spanish Stock Returns: Where is the Weather Effect?. European Financial Management 9(11):117-126.

Crossref

|

|

|

|

|

Pizzutilo F, Roncone V (2017). Red sky at night or in the morning, to the equity market neither a delight nor a warning: the weather effect re-examined using intraday stock data. European Journal of Finance 23(14):1280-1310.

Crossref

|

|

|

|

|

Rotton J, Cohn EG (2000). Violence is a Curvilinear Function of Temperature in Dallas: a Replication. Journal of Personality and Social Psychology 78(6):1074-1081.

Crossref

|

|

|

|

|

Sanders JL, Brizzolara MS (1982). Relationships between mood and weather. Journal of General Psychology 10(1):155-156.

Crossref

|

|

|

|

|

Saunders EM Jr. (1993). Stock Prices and Wall Street Weather. The American Economic Review 83(5):1337-1345.

|

|

|

|

|

Scheider FW, Lesko WA, Garrett WA (1980). Helping behavior in hot, comfortable and cold temperatures: a field study. Environment and Behavior 12(2):231-240.

Crossref

|

|

|

|

|

Sheikh MF, Shah SZA, Mahmood S, (2017). Weather Effects on Stock Returns and Volatility in South Asian Markets. Asia-Pacific Financial Markets 24(2):75-107.

Crossref

|

|

|

|

|

Shim H, Kim H, Kim J, Ryu D, (2015). Weather and stock market volatility: the case of a leading emerging market. Applied Economics Letters 22(12):987-992.

Crossref

|

|

|

|

|

Shu H, Hung M (2009). Effect of Wind on Stock Market Returns: Evidence from European Markets. Applied Financial Economics 19(11):893-904.

Crossref

|

|

|

|

|

Wang Y, Lin C, Lin JD (2012). Does weather impact the stock market? Empirical evidence in Taiwan. Quality and Quantity 46(2):695-703.

Crossref

|

|

|

|

|

Wyndham HC (1969). Adaptation to Heat and Cold. Environmental Research 2(5-6):442-469.

Crossref

|

|

|

|

|

Yechiam E, Telpaz A, Krupenia S, Rafaeli A (2016). Unhappiness intensifies the avoidance of frequent losses while happiness overcomes it. Frontiers in Psychology 7(1703).

Crossref

|

|

|

|

|

Yoon SM, Kang SH (2009). Weather Effects on Returns: Evidence from the Korean Stock Market. Physica A 388:682-690.

Crossref

|

|