Full Length Research Paper

ABSTRACT

Research on the effects of internal control systems on organizational performance have been concentrated on large firms with little attention given to Small and Medium Scale Enterprises. To this end, the study examines the effect of internal control systems on the organizational performance of SMEs in Ondo State, Nigeria. The study employs survey primary data which are collected from 323 SMEs that were selected using stratified and random sampling techniques. The data collected were analyzed using descriptive statistics and multiple regression analysis. The results show a significant positive relationship between internal control and all proxies of organizational performance which are business growth, survival and operational efficiency. Furthermore, internal control systems and organizational performance when all the three proxies are aggregated have positive relationship. The findings of this study suggest that internal control systems are necessary, and they should be established in SMEs’ business operations for enhanced productivity, business growth and organizational performance. The study recommends the use of internal control systems by SMEs for their growth, sustainability, operational efficiency and curtailment of wastes. Also, agencies of government that provides financial support and financial advisory services to the SMEs should educate the SMEs operators on the importance of internal control systems in their business operations.

Key words: Internal control systems, business growth, small and medium enterprises, operational efficiency, control environment.

INTRODUCTION

Small and Medium Enterprises (SMEs) are no doubt the engines of growth and catalyst for socio-economic transformation globally (Wang et al., 2019; Vu and Nga, 2022). When they perform at their best, their business survival, operational efficiency and business growth are assured. While the survival of SMEs is assured by the continuous growth of sales, profitability and liquidity, the operational efficiency is evidenced by the ability of the firm to maximize outputs with minimal input through fraud reduction, asset protection, and decrease of misappropriation of funds and reliability in financial information. The optimal performance of SMEs and their ability to generate wealth and create employment is a function of how efficient they are in terms of expense minimization and enthronement of strict internal control measures.

SMEs are therefore expected to put resources, policies and procedure in place to enhance their operational efficiency. The level of success a business achieves in ensuring business survival and operational efficiency determines the chance of business growth.

However, SMEs are often pre-occupied with activities that enhance profitability and liquidity without paying much attention to internal control systems. The SMEs perceived the internal control systems as non-income generating activities without understanding the critical role internal control systems play in curbing wastages, protecting assets and improving organizations performance. Studies have shown that SMEs business performance depends on several internal and external factors. A key external factor related to performance of SMEs is macroeconomic factors (Ipinnaiye et al., 2017; Yang and Li, 2019). Internal factors include business plans, marketing strategy, capitalization level, entrepreneurial ability, human resources, and entrepreneurs' financial knowledge. In addition, competency and internal control systems were also found as determinants of SMEs performance (Heywood et al., 2017). Internal control systems are critical factors in the overall performance of any corporate organization as its sum up passes all management strategies designed to facilitate efficiency, effectiveness, compliance and reliability of business transactions as well as business communication. However, studies on the effect of internal control systems on organizational performance are scarce most especially on SMEs. Research efforts have been concentrated on large firms with little attention given to SMEs in emerging economies. This study attempts to address this gap and contribute to empirical literature.

The study uses survey research design to collect primary data through the use of structured questionnaire from 323 SMEs selected from population of 1,999 SMEs using stratified and random sampling techniques. Descriptive statistics and regression analysis were adopted as data analysis techniques. The results show positive relationship between internal control systems and organizational performance. This suggests that internal control systems are germane to successful operation of SMEs and sustainability.

The study is structured as follows. Section two discusses the literature and hypothesis development while section three gives details of the research design and data analysis methods that were used to accomplish the research objectives. Section four discusses data analysis and discussion of findings while section five summarizes with policy implications.

LITERATURE REVIEW

The American Institute of Certified Public Accountants (AICPA) defines internal control as a strategy and other coordinated means and ways by which businesses protect their assets, verify the accuracy and dependability of their data, improve their effectiveness, and ensure that management policies are in place (Yang and Li, 2019). The Committee of Sponsoring Organizations (COSO) definition, on the other hand, has gained more attraction. An organization's internal control system is defined by COSO as a process that managers and other employees use to provide reasonable assurance that the organization's goals are being met while also adhering to all applicable rules and regulations. This assurance includes accurate financial reporting (Sofyani et al., 2021). This definition provides a holistic view of what internal control is all about as it encompasses the need for organizations’ to abide by their own rules as well as those set by statutory bodies to which they often must answer. It is also reasonable to think of the internal control of an organization as encompassing all the financial and non-financial safeguards that have been put in place by top management to assure adherence to company regulations, protect company assets, and maximize the accuracy and completeness of records (Adekunle et al., 2021).

The processes of quantifying the actions of a company in terms of the goals it has set for itself are what are meant by organizational performance. Performance can be measured in monetary terms as well as in non-monetary terms. Both metrics are utilized by organization’s that are competitive and operate in an environment of dynamic business activities.

Return on assets, sales, equity, organic growth, survivability, and profitability are all examples of financial metrics that can be used to evaluate an organization's success (Souto, 2021). On the other hand, non-financial measures will relate to risk reduction, and curtailment of waste in the context of this study because it is the focus of those measures. This will include the prevention of fraud, the protection of company assets, the lessening of improper use of company cash, and the assurance of the trustworthiness of financial information.

Empirical literature, theoretical framework and hypothesis development

There are many studies on the effect of internal control systems on corporate performance (Nawawi and Salin, 2018; Kabuye et al., 2019; Bure and Tengeh, 2019; Adegboyega et al., 2020; Yangklan, 2022). They however find that the impact of internal controls varies in the five different stages of corporate life cycle of a business organization. The corporate life cycle was divided into introduction, growth, mature, shake-out and decline stages and the impacts of internal controls were found to be more significant at both the maturity and shake-out stages. Also, Yangklan (2022) find that internal controls positively impact firm performance through balanced scored card. Wang et al. (2019) assert that SMEs faces more risks than larger firms because of their lack of access to resources. The study found out that internal controls mitigate turbulent market risks and enhances the sustainability of the SMEs in turbulent times.

Using the Committee of Sponsoring Organizations’ (COSO, 2013) framework Adegboyegun et al. (2020) examine the relationship between internal control systems and operating performance of SMEs in Ondo State. They found significant positive relationship between internal control systems and control environment and control activities in SMEs. Since resources that are at the disposal of SMEs are meagre, there must be efforts to establish control measures that will ensure optimal utilization of scarce resources for maximum productivities of the SMEs in line with Resources-based Theory. The Resource-based theory as propounded by Barney (1991) opined that resources available for optimal performance of business organizations’ are scarce. Hence, long term survival of business enterprises depends on continuous access to these resources that are not readily substituted. Internal control systems are to ensure that available organizational resources are rightly deployed to achieve organizational goals. The internal control systems prevent waste and protect assets of organization from being misused or misappropriated (Attah-Botchwey, 2018). Thus, resource-based theory is relevant to our study because SMEs that strive for competitive advantage would entrench internal control policies that would help in both efficient and effective use of scarce resources (Ahmad et al., 2021).

This study is different from other previous studies as it examines the relationship between internal control systems in COSO framework and organization performances which were measured by three proxies: Business growth, operational efficiency, and business survival. Hence, we hypothesize as follows:

H01: There is no significant effect of internal control system on business growth of SMEs Ondo State

H02: There is no significant effect of internal control system on operational efficiency of SMEs in Ondo State

H03: There is no significant effect of internal control system on business survival of SMEs in Ondo State

H04: There is no significant effect of internal control systems on the organizational performance of SMEs in Ondo State.

MATERIALS AND METHODS

Survey research design was employed to examine the effect of internal control systems and organizational performance of SMEs in Ondo State. The population of the study includes all registered one thousand, nine hundred and ninety-nine managers of SMEs whose list was obtained from Small and Medium Enterprises Development Agency of Nigeria (SMEDAN) in Ondo State. Stratified and random sampling techniques were used to take sample of 323 SMEs from five stratified local government areas of the state. These local government areas are: Akure South, Akoko South-West, Okitipupa, Ondo West, and Akoko North-East. This decision is informed by the dominant numbers of SMEs in the LGAs.

The sample size was derived using the Raosoft online sample size calculator. The margin error was 0.05 while the confidence level is 0.95.

Research instrument

Structured questionnaire was the research instrument used to collect primary data on the effect of internal control on organizational performance. The questionnaire is divided into three main sections as follows: Section A is used to obtain demographic information of the respondents. This section of the questionnaire contained information on the background characteristics of the respondents on variables such as name of respondents, sex, age range, name of SME, and year(s) of operation. Section B is used to obtain information on the extent of control measures in the SMEs. The section contains five (5) subsections such as control environment, risk assessment, control activities, information and communication, and monitoring. Each sub-section has minimum of five statements. Each construct will be measured using a four-point Likert Scale with the following options: SA= Strongly Agree; S = Agree; D= Disagree; SD =Strongly Disagree Section C: measures organizational performance metrics. This section deals with the organizational performance indicators in the SMEs. The section has three subsections namely, business growth, performance efficiency and business survival. Each subsection contains statements to be measured using a four-point Likert scale with the following options: SA= Strongly Agree; S = Agree; D= Disagree; SD =Strongly Disagree.

Validity of the research instrument

The research instruments were validated using criterion, content, and construct validity. For criterion and content validity, the instruments were validated by opinion of practitioners who took part in the pilot study and the SMEs researchers. The contributions were used to modify the questionnaire as necessary for the main study taking into consideration how each of the variables were measured in existing literature. Construct validity was ensured using AVE and HTMT criterion to ascertain convergent and divergent validity. The Average Variable Extracted/Explained (AVE) value greater than 0.5 provided proof of convergent validity and the discriminate validity value for the entire construct below one on the Heterotrait-Monotrait (HTMT) criterion provided additional evidence of construct validity for each of the measured variable.

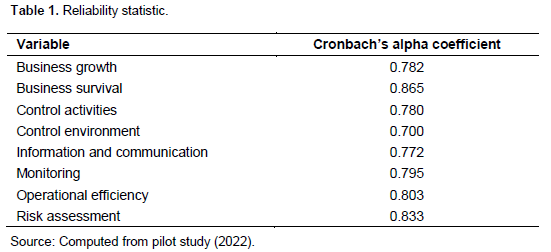

Reliability of the research instrument

The questionnaire was subjected to test reliability. The internal consistency was used to establish the reliability of a measure by evaluating the within-scale consistency of the responses to the items of the measure. Applicable to multiple-item measurement instruments (like that of this study), Cronbach’s alpha coefficient is widely employed for assessing this internal consistency. A Cronbach’s alpha coefficient of > 0.7 but < 1 score for a questionnaire is adjudged to be reliable (Hair et al., 2017). Table 1 depicts the reliability statistic of all the variables in this study. From Table 1, all the measured variables had reliability statistic which is within the acceptable threshold (for Cronbach’s Alpha coefficient) to suggest that the instrument is reliable for its usage in the main study.

Model specification

Y = f(x)

Y = dependent variables which are measures of organizational performance: Business growth, Business survival, and operational efficiency. x = independent variables which are measures of internal control systems: control activities, control environment, information and communication, monitoring, and risk assessment. This was adopted from the study of Ernst and Young (2003) internal control systems evaluation model.

Administration of research instrument, methods of data collection and analysis

The questionnaire administrations were distributed by the authors with the aid of three (3) Graduate Assistants. The questionnaires were retrieved from the offices of the SMEs operators four weeks after the date of their initial distribution. Three hundred and twelve (312) copies were returned. After sorting the questionnaires 301 copies were certified as duly filled and considered usable. The useable questionnaire represented 93.1% response rate. Field data collected were analyzed using inferential and descriptive statistics.

RESULTS

Demographic data of respondents

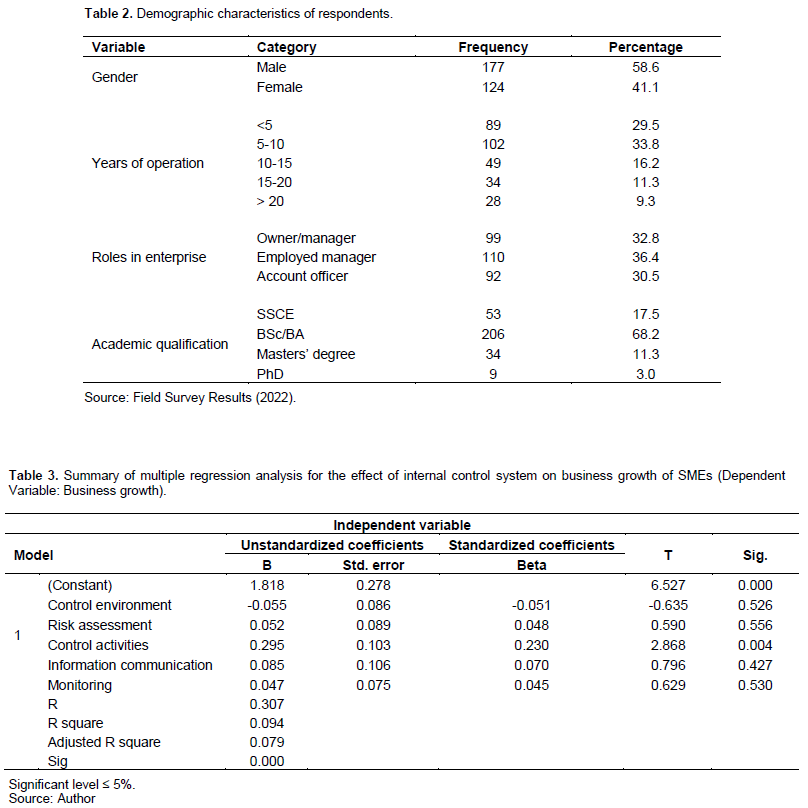

Table 2 presents the demographic information of the respondents of this study. The demographic and personal information of the respondents who participated in this survey is detailed in Table 2. According to the gender profile, 177 of the respondents, which is equivalent to 58.6%, were male whereas 124 of the respondents, which is equivalent to 41.1%, were female. This suggests that most of the respondents were male.

Demographic and personal profile of respondents as shown in Table 2 by years of operation revealed that 89 respondents representing 29.5% had less than 5 years, 102 respondents representing 33.8% had 5-10 years, 49 respondents representing 16.2% had 10-15 years, 34 respondents representing 11.3% had 15-20 years, and 28 respondents representing 9.3% had over 20 years, indicating that most of the respondents had 5-10 years. Also, 99 respondents representing 32.8% were owner/manager, 110 respondents representing 36.4% were employed manager, and 92 respondents representing 30.5% were account officers. Furthermore, 53 respondents representing 17.5% had SSCE, 206 respondents representing 68.2% had BSc/BA etc., 34 respondents representing 11.3% had Masters’ Degree, and 9 respondents representing 3.0% had PhD.

Internal control systems and business growth

The values of the internal control system sub-measures were regressed on the values of business growth. The data for internal control system (independent variable) was produced by adding responses to each of the variables used to measure it (Control Environment, Risk Assessment, Control Activities, Information Communication, and Monitoring), whereas the data for business growth of SMEs in Ondo State (dependent variable) was produced by adding responses to each of the variables used to measure it. The regression test results are presented in Table 3.

According to the findings in Table 3, internal control system and the expansion of small and medium-sized enterprises in Ondo State, Nigeria, have a positive but marginally significant association (R = 0.307, p0.05). The internal control system dimensions explain 7.9% of the variations in the business growth of SMEs in Ondo State, Nigeria, according to the coefficient of determination (Adj. R2) of 0.079, whereas the remaining 92.1% of the variation in the business growth of SMEs in Ondo State is explained by other variables not examined in this study. The ANOVA (overall model significance) of the regression test findings are shown in Table 3. It was shown that internal control system dimensions significantly affect the business growth of SMEs in Ondo State, Nigeria. The F-value (6.158) and low p-value (0.000), which is statistically significant at a 95% confidence range. Hence, the result posited that internal control system dimensions significantly influenced the business growth of SMEs in Ondo State, Nigeria.

Additionally, Table 3 regression coefficient results showed that, with a 95% degree of certainty, a change in Control Activities would result in a 0.295 rise in the business growth of SMEs in Ondo State, Nigeria, if all other variables remained the same. Only control activities out of all the internal control system sub-variables investigated had a substantial relative impact on company growth for SMEs in Ondo State, Nigeria. This study rejects null hypothesis one (H01), which claims that there is no significant impact of internal control system on business growth of SMEs in Ondo State, Nigeria, based on this finding (Adj. R2 = 0.079, F(5.296) = 6.158; p=0.000).

Internal control systems and operational efficiency

The values of the internal control system sub-measures were regressed on the operational efficiency values in the study. The operational efficiency of SMEs in Ondo State (dependent variable) was generated by adding responses to all items used to measure the variable, whereas the data for internal control system (independent variable) was generated by summing responses of all variable items (Control Environment, Risk Assessment, Control Activities, Information Communication, and Monitoring). The regression test results are shown in Table 4.

From the results in Table 4, internal control system has a positive but weak significant relationship with the operational efficiency of SMEs in Ondo State, Nigeria (R = 0.465, p<0.05).

The coefficient of determination (Adj. R2) of 0.203 shows that internal control system dimensions explain 20.3% of the changes in operational efficiency of SMEs in Ondo State, Nigeria, while the remaining 79.7% variation in operational efficiency of SMEs in Ondo State is detailed by external variables not appearing in this study regression model. The results of the regression test using the ANOVA (overall model significance) method are shown in Table 4. It was shown that the internal control system dimensions significantly affect the operational effectiveness of SMEs in Ondo State, Nigeria. This is explained by the low p-value (0.000), which is statistically significant at a 95% confidence range, and the F-value (16.299). Hence, the result posited that internal control system dimensions significantly influenced the operational efficiency of SMEs in Ondo State, Nigeria.

In addition, the results of regression coefficients in Table 4 revealed that at 95% confidence level, a unit change in Risk Assessment will lead to a 0.290 increase in the operational efficiency of SMEs in Ondo State, Nigeria, given that all other factors are held constant. In addition, the results also revealed that at 95% confidence level, a unit change in monitoring will lead to a 0.179 increase in the operational efficiency of SMEs in Ondo State, Nigeria, given that all other factors are held constant. Out of the internal control system sub-variables examined, Risk Assessment and monitoring have a significantly relative effect on operational efficiency of SMEs in Ondo State, Nigeria while Control Activities, Control Environment, Information communication, presents insignificant relative effect. More so, it is important to stress that Risk Assessment has the highest relative effect with a beta of 0.290 and t value of 3.679 followed by monitoring with beta of 0.179 and t value of 2.663. It is on the strength of this result (Adj. R2 = 0.203, F(5.296)= 16.299, p= 0.000), this study rejects the null hypothesis two (H02) which states that there is no significant effect of internal control system on operational efficiency of SMEs in Ondo State, Nigeria.

Internal control and business survival

The data for internal control system (independent variable) was generated by summing responses of all variable items (Control Environment, Risk Assessment, Control Activities, Information communication, and Monitoring) respectively while that of business survival of SMEs in Ondo State (dependent) was generated by adding responses of all items used to measure the variable. The regression test results are presented in Table 5.

From the results in Table 5, internal control system has a positive but weak significant relationship with the business survival of SMEs in Ondo State, Nigeria (R = 0.288, p<0.05).

The determination coefficient (Adj. R2) of 0.067 shows that internal control system variation predict 6.7% of the changes in business survival of SMEs in Ondo State, Nigeria, while the remaining 93.3% changes in business survival of SMEs in Ondo State is explained by external variables not included in this study regression model. The ANOVA (overall model significance) of regression test findings are shown in Table 5. They show that internal control system dimensions significantly affect the ability of SMEs in Ondo State, Nigeria, to remain in operation. This may be explained by the F-value (5.338), which is statistically significant at a 95 percent confidence range, and the low p-value (0.000).

Hence, the result posited that internal control system dimensions significantly influenced the business survival of SMEs in Ondo State, Nigeria.

Additionally, Table 5 regression coefficient results showed that, if all other variables are held constant, a unit change in monitoring will result in a 0.132 increase in the business survival of SMEs in Ondo State, Nigeria, at a 95% confidence level. The monitoring sub-variable of the internal control system that was evaluated had a large relative impact on the survival of SMEs in Ondo State, Nigeria, but risk assessment, control environment, control activities, and information communication have negligible relative impacts. It is on the strength of this result (Adj. R2 = 0.067, F(5.296)= 5.338, p= 0.000), this null hypothesis one (H03) is rejected in this study which stipulated that there is no very significant effect of internal control system on business survival of SMEs in Ondo State, Nigeria.

Internal control and organizational performance

In the analysis, the values of organizational performance were regressed on the values of internal control system. The data for internal control system (independent variable) was generated by summing responses of all variable items (Control Environment, Risk Assessment, Control Activities, Information communication, and Monitoring) respectively while that of organizational performance of SMEs in Ondo State (dependent) was generated by adding responses of all items (business survival, business growth and operational efficiency) used to measure the variable. The regression test results are presented in Table 6.

According to the results in Table 6, internal control system and organizational performance of SMEs in Ondo State, Nigeria, have a positive but marginally significant association (R = 0.413, p0.05). The internal control system predicts 17% of the variation in organizational performance of SMEs in Ondo State, Nigeria, according to the coefficient of determination (R2) of 0.170, while the remaining 83% of variation in organizational performance of SMEs in Ondo State is explained by extraneous variables not considered in this study. The ANOVA (overall model significance) of the regression test findings are shown in Table 6. They show that internal control system has a substantial impact on organizational performance of SMEs in Ondo State, Nigeria. The F-value (61.653) and low p-value (0.000), which is statistically significant at a 95% confidence range, provide an explanation for this. As a consequence, the findings suggested that internal control system dimensions had a substantial impact on how well SMEs performed as an organization in Ondo State, Nigeria.

A unit change in the internal control system will, with a 95% degree of confidence, result in a 0.458 rise in the organizational performance of SMEs in Ondo State, Nigeria. This study rejects null hypothesis four (H04), which claims that internal control systems have no effect on the organizational performance of SMEs in Ondo State, Nigeria (R2 = 0.170, F(1.300)= 61.653, p=0.000).

DISCUSSION

The relationship between internal control systems and business growth was found to be positive. This implies that internal control systems had a substantial impact on the expansion of SMEs. SMEs’ sales and profitability growth are enhanced when internal control systems are deployed to monitor sales and profitability performances, and report variances from management targets for immediate remedial actions that will ensure that growth targets are reasonably met. This agrees with the studies of Wang et al. (2019); Adegboyegun et al. (2020), Vu and Nga (2022) and others in China and South Africa (D’Mello et al., 2017; Dubihlela and Nqala, 2017)) respectively. However, only control activities had a substantial relative impact on the business growth of SMEs, out of the internal control systems sub-variables evaluated. Similarly, the effect of internal control systems on operational efficiency of SMEs was positive. This suggests that internal control systems curtails losses and entrenches the use of organizational resources to achieve optimum returns in accordance with the resource-based theory. The breakdown of the analysis also reveals that the effect of Control Environment, Information Communication and Control Activities on the operational effectiveness of SMEs is not significant while risk assessment and monitoring have the highest effect on operational efficiency at 5% significance.

The implication of the finding is that the establishment of control mechanisms to anticipate and mitigate risks, and periodic evaluation of control systems to determine their capacities to prevent business risks will enhance operational efficiency of the SMEs.

Furthermore, internal control systems have a substantial impact on small business survival according to the findings of the study. However, a thorough analysis of the internal control systems’ components revealed that only monitoring; as opposed to other sub-variables (risk assessment, control environment, control activities, information, and communication) has a significant relative impact on the survival of SMEs. According to some empirical findings, 95% of the SMEs failed within the first five years of their operations because of frauds perpetuated by both the employees and clients or customers to the SMEs. The employees either carried out the fraud independently of the clients or in connivance with them. These empirical studies recommend among others the establishment of internal control systems in the SMEs. Hence, internal control systems reduce the risk of fraud, error, and loss (Zainal et al., 2022).

Finally, the effect of internal control systems on the overall performance of small and medium scale enterprise was examined. The study found that internal control system significantly contributes to overall organizational performance of SMEs in Ondo State, Nigeria. The organizational performance as proxied by business growth in sales and profitability, business survival and operational efficiency The findings agree with the findings of Khakhonova (2021) and Bure and Tengeh (2019). It should however be noted that the control environment and control activities sub-variables have the most significant effect on the organizational performance of the SMEs. This implies that SMEs entrepreneurs should exhibit high ethical standards in formulation of control policies and executing them in management of SMEs business activities. This will enhance the performance of the organization and optimal utilization of scare organization’s scarce resources in accordance with the resource-based theory.

CONCLUSION

The study investigated the effect of internal control system on the performance of SMEs in Ondo state, Nigeria, based on the Committee of Sponsoring Organizations of the Treadway Commission's (COSO) internal control integrated framework. Internal control systems have been implemented by various organizations’ to support best business practices and it has helped them achieved improved accountability, profitability, and survival. This is also found to be true for the SMEs examined in this study. The findings of this study have highlighted the importance of effective internal control system to the survival, growth and operational efficiency of small-scale enterprises in Ondo state. It is obvious that SMEs in the state have taken steps to avoid the common pitfalls of many SMEs that operate with poor internal control systems. Development finance institutions in Nigeria, Bank of Industry and Bank of Agriculture for example, which provide financial supports to the SMEs and government regulatory agencies that perform financial advisory services to the SMEs, for instance Small and Medium Scale Enterprises Agency of Nigeria (SMEDAN), should make financial education of the SMEs operators on the use of effective internal controls a mandatory part of their financial support and advisory service.

The study has focused on SMEs in Ondo State. However, due to time and logistical constraints, the study did not cover the whole of the state but selected some local governments. Small sample from the study cannot be used to make generalization. However, further studies could cover the thirty-six states of the country.

CONFLICT OF INTERESTS

The authors have not declared any conflicts of Interests.

REFERENCES

|

Adegboyegun AE, Ben-Caleb E, Ademola AO, Oladutire EO, Sodeinde GM (2020). Internal control systems and operating performance: Evidence from small and medium enterprises (SMEs) in Ondo state. Asian Economic and Financial Review 10(4):469-479. |

|

|

|

|

|

Adekunle OA, Ola TO, Ogunrinade R, Odebunmi AT (2021). The role of cooperative societies in advancing small and medium scale enterprises in Osun State, Nigeria. Journal of International Business and Management 4(6):1-13. |

|

|

|

|

|

Ahmad N, Mahmood A, Han H, Ariza-Montes A, Vega-Muñoz A, Iqbal Khan G, Ullah Z (2021). Sustainability as a "new normal" for modern businesses: Are SMES of Pakistan ready to adopt it?. Sustainability 13(4):1944. |

|

|

|

|

|

Attah-Botchwey E (2018). Internal control as a tool for efficient management of revenue mobilization at the Metropolitan, Municipal and District Assemblies in Ghana: a case study of Accra metropolitan assembly. American International Journal of Contemporary Research 8(1):29-36. |

|

|

|

|

|

Barney J (1991). Firm resources and sustained competitive advantage: Journal of Management 17(1):99-120. |

|

|

|

|

|

Bure M, Tengeh RK (2019). Implementation of internal controls and the sustainability of SMEs in Harare in Zimbabwe. Entrepreneurship and Sustainability Issues 7(1):201-215. |

|

|

|

|

|

COSO (2013). Internal control - Integrated framework. Executive summary. Available at: |

|

|

|

|

|

D'Mello R, Gao X, Jia Y (2017). Internal control and internal capital allocation: evidence from internal capital markets of multi-segment firms. Review of Accounting Studies 22(1):251-287. |

|

|

|

|

|

Dubihlela J, Nqala L (2017). Internal controls systems and the risk performance characterizing small and medium manufacturing firms in the Cape Metropole. International Journal of Business and Management Studies 9(2):87-103. |

|

|

|

|

|

Ernst and Young (2003). An evaluation of internal control: Considerations for evaluating internal control at the entity level. Available at: |

|

|

|

|

|

Hair JF, Hult GT, Ringle CM, Sarstedt M (2017). A primer on partial least squares structural equation modeling (PLS-SEM), 2nd edition. Thousand Oaks, CA: Sage. |

|

|

|

|

|

Heywood JS, Jirjahn U, Struewing C (2017). Locus of control and performance appraisal. Journal of Economic Behavior and Organization 14(2):205-225. |

|

|

|

|

|

Ipinnaiye O, Dineen D, Lenihan H (2017). Drivers of SME performance: a holistic and multivariate approach. Small Business Economics 48(4):883-911. |

|

|

|

|

|

Kabuye F, Kato J, Akugizibwe I, Bugambiro N (2019). Internal control systems, working capital management and financial performance of supermarkets. Cogent Business and Management 6(1):1573524. |

|

|

|

|

|

Khakhonova N (2021). Internal control as an effective tool of the small business management system: The Scientific Heritage 60(3):41-42. |

|

|

|

|

|

Nawawi A, Salin AS (2018). Internal control and employees' occupational fraud on expenditure claims. Journal of Financial Crime 25(3):891-906. |

|

|

|

|

|

Sofyani H, Hasan HA, Saleh Z (2021). Internal control implementation in higher education institutions: determinants, obstacles and contributions toward governance practices and fraud mitigation. Journal of Financial Crime 29(1):141-158. |

|

|

|

|

|

Souto JE (2021). Organizational creativity and sustainability-oriented innovation as drivers of sustainable development: overcoming firms' economic, environmental and social sustainability challenges. Journal of Manufacturing Technology Management 33(4):805-826. |

|

|

|

|

|

Vu Q, Nga NTT (2022). Does the implementation of internal controls promote firm profitability? Evidence from Vietnamese small-and-medium-sized enterprises (SMEs). Finance Research Letters 45:102178. |

|

|

|

|

|

Wang L, Dai Y, Ding Y (2019). Internal control and SMEs' sustainable growth: the moderating role of multiple large shareholders. Journal of risk and financial Management 12:182-196. |

|

|

|

|

|

Yang X, Li B (2019). Research on the influence of internal control quality on the Growth of SMEs. In 2019 3rd International Conference on Education, Economics and Management Research (ICEEMR 2019), Atlantis Press. pp. 689-693. |

|

|

|

|

|

Yangklan P (2022). The internal control affects the evaluation of the balance scorecard organization of small and medium-size businesses in Thailand. Journal of Positive School Psychology 6(5):960-966. |

|

|

|

|

|

Zainal SF, Hashim HA, Ariff AM, Salleh Z (2022). Research on fraud: an overview from small medium enterprises (SMEs). Journal of Financial Crime 29(4):1283-1296. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0