ABSTRACT

Family businesses are the main entrepreneurial powers of today in the global economy, but the low survival rate is the main concern all over the world. Family entrepreneurship is the most successful business, where assets, personal involvement, and hired temporary employees help to improve the success of the business. Family businesses contribute about 45-75% to Gross Domestic Product (GDP) and provide job opportunities in many countries. The objective of this study is to examine the factors that influence the success of family businesses and family entrepreneurs’ characteristics. The study was conducted in Faisalabad and Lahore of the Punjab Province. A sample of 150 respondents was selected randomly (75 from each city). A pretested questionnaire was used to collect data from respondents through personal interview. Independent variable (family and business characteristics) was tested to forecast the business success (dependent variable). Regression analysis indicated that some family and business characteristics (age, managerial activities, business size, business problems, personal involvement) were positive and significantly associated with business success; education, work experience, availability of finance were negative and statistically non-significant; gender, and community support were positive and non-significant. This study suggests that appropriate training program should be introduced to improve skill and acknowledge of family entrepreneurs, so that they can operate their business efficiently.

Key words: Family business, business success, regression analysis.

A family firm or business is a company in which one or more family members are involved to manage and control business procedures of the enterprise. The management of family business should be in a way that it is sustained from one business creation to the next generation of the families (Chua et al., 1999). In developing countries, the family firm is considered as a source of value addition and creation of job opportunities to make wealth (Faccio and Lang, 2002; Shanker and Astrachan, 1996). Entrepreneurship is considered generally as an innovative and significant inspiration for the creation of new business avenues (Scott, 1986). Therefore, entrepreneurship is considered as an important element not only for current businesses but also to generate new opportunities for future businesses (Mitra, 2002). The traditional models are used for family businesses and to take action as well do evaluation (Casson, 1982; Shane and Venkaturaman, 2000). The term, causation is used to explain the different traditional approaches used for entrepreneurship. Entrepreneurship has important theories. The entrepreneur to predetermine goals and to select means to achieve these goals uses the causation theory; it is the process through which entrepreneurs plan activities and look for opportunities, as well as evaluate the opportunities (Sarasvathy, 2001).

In effectuation theory, after finding the opportunity, the entrepreneurs use resources to make decision and take action for creating new market in the world; entrepreneurs set new and different goals over time based on their resources. The effectuation theory is used in uncertain situations (Sarasvathy, 2008). In bricolage theory, the entrepreneurs do everything to combine the resources at hand for new opportunity and problems (Baker and Nelson, 2005).

Indeed the family business has three categories: to involve in innovation, risk taking and being proactive. These describe family entrepreneurship major contribution to the development and growth of the world economy (Miller, 1983; Zahra et al., 2004). In this case, some family businesses have strong image in the form of ownership, which is transferred from one successive generation to the next (Fuller, 2003). The characteristics of entrepreneurs are having the ability to take risk, innovative belief, and creating opportunity for other people. Entrepreneurship helps people to control over their physical resources, intellectual resources and belief that will ultimately lead to their advancement. The factors that can lead to an entrepreneur’s success include age, family support, education, personal motivation and access to financial resources. Family entrepreneurship is important in the growth of businesses and for long-term sustenance in the world (Heck and Tarent, 1999). About 90-98% of businesses are owned by families business and these businesses contribute between 45-75% to the Gross Domestic Product (GDP) and provide job opportunities in many countries.

In a family business, one or more members play a vital role in the development and succession of the business structure because of his/ her personal interference and interest in the family businesses to increase profit. The family entrepreneur may be involved in the management team, can be member of the board, a shareholder, or business supporter. Direct interference of a family entrepreneur makes family business different from the non-family business (Moores, 2009). There is personal involvement of the entrepreneur in the business and he uses his best management practices for the growth of business. The best management practices are challenges for the non-family business entrepreneurs and these challenges create an inspiration for the growth of business and succession properly (Ward, 1997).

The family entrepreneurs play a key role in the succession of a firm and this role changes due to the condition of transfer within the system. The young generation of the era wants to supervise or control the firm solely (Handler, 1994). The family business/ entrepreneurship has many types such as sole proprietorship partnership, and limited company. They vary from a small shop to a multinational cooperation (Birley et al., 1999). The family entrepreneurs who create the public family business often hold that greater than essential amount of share control the family business due to the risk and uncertainty (Anderson et al., 2012). The creator of family businesses desires to maintain control of essential differences between families owned businesses and family business to empower ownership (Anderson and Reeb, 2003).

For centuries, family businesses have been the key business in the world (Fuller, 2003; Aldrich and Cliff, 2003). Family business has financial goals than the non-family business with the help of the socio-motional wealth; but socio-motional wealth is possible if the family has overall control and long term sustenance of the business (Zellweger et al., 2012). The business has specific characteristics: (1) It retains long term family board of directors, (2) there is close communication between family entrepreneurs and employees, (3) has high level of diversifications based on gender , (4) the entrepreneurs have more experience and more experienced older managers (Wilson et al., 2013). The entrepreneur’s characteristics affect the entrepreneurial attitude in family business. They considered the process by which creator of own family firm leave the firm because of age, education level, entrepreneurial experience, business experience, and representative characteristics of family firms, organization structure, limiting information policy (Detienne and Cardon, 2012; Hatak and Hyslop 2015). Thus, family businesses are transferred from one generation to another and family business cooperation result in successful strategic planning for the long-term success sustenance of the family business/entrepreneurship. The family business/ entrepreneurship has long term contribution in the growth of economy and it has one of most important stages of business life cycle in which they transfer ownership and leadership qualities from one person to another (Vassiliadis et al., 2015; Hatak and Hyslop 2015). The family entrepreneurship grew from one country to another for long-term succession and the role of each family ownership varies from one family entrepreneur to another (Sciascia et al., 2012). The succession could be seen in the family business with the help of entrepreneurial process, where the coming of the new owner and exit of the old owners describe the creation of the new opportunity (Nordqvist et al., 2013). The determinants of family business/entrepreneurship and how family businesses were going from one place to another and had more specific opportunity for the family members and creating more opportunity in the economy. The family business was created with help of the family loyalty and entrepreneurial orientation and knowledge (Barredy, 2016).

Kellermanns et al. (2008) suggested that entrepreneurial behavior of the chief executive officer examined how this behavior associate with the growth of family businesses and entrepreneurial behavior of CEOs could be influenced by characteristics such as age or tenure and units of family influenced by the family businesses. The family business could be successful in the growth of the business and their flexibility of the business, and there is small change in the family and non-family business concerning economic growth (Chaston, 2012). The family business/entrepreneurship was interaction between the family members and family and non-family businesses (Randerson et al., 2015).

FRAMEWORK AND METHODOLOGY

This study aims at exploring the characteristics of family businesses in perspective of entrepreneurial theories, motivating and demotivating factors of family business managers, characteristics of family business entrepreneurs and family business, business skills and major success factors and challenges faced by the family business entrepreneurs. For this purpose, a questionnaire was designed. The questionnaire includes both close and open ended questions that were used as a result of an initial literature study comprising broad research questions which was further investigated by using a comprehensive and pre-tested questionnaire and in-depth interviews from selected family business entrepreneurs. Family entrepreneurs were asked about questions about their personal, socio-economic characteristics, business facts and major impediments. This study collected data from 150 family business entrepreneurs who were selected randomly from two representative cities: Faisalabad and Lahore of Punjab province (25 respondents each from shop holder/retailer, manufacturing, and trading; making up 75 respondents from each city). Random sampling technique was used to eliminate the biasness in sample selection (Cooper et al., 2006). Collected data was properly checked and edited to ensure that all responses were recorded accurately. Multivariate form of regression analysis was used to show coefficient and significance of family business entrepreneurs and business characteristics, regarding family business success.

Mean attribute score

Mean Attributes Score was calculated using the following formula

MAS = ∑ Xi / N (1)

Where;

MAS = Mean Attributes Score

N = Number of respondents

∑ Xi = Sum of score given by all respondent to specific attributes.

Correlation

Correlation means the movement of two variables in relation to another variables. It ranges from -1 to +1. If two variables move in same direction, they are known as positively correlated and in case they move in opposite direction then the correlation between them is negative.

Regression analysis

Regression analysis was used to check the impact of independent variables on dependent variable. The following regression equation were used during regression analysis.

Model: Impact of family and business characteristics on business success

Family and business characteristics were used to analyze their effect on business success.

Bs = f (FC, BC) (3)

Where

X1 = Age

X2 = Gender

X3 = Education

X 4 = Managerial activities

X5 = Community support

X6 = Work experience

X 7 = Availability of Finance

X8 = Business Size

X9 = Business problems

X10 = Personal involvement

Bs = Business Success

β0 = intercept or constant

β1 = slope of coefficient

Æ = error term

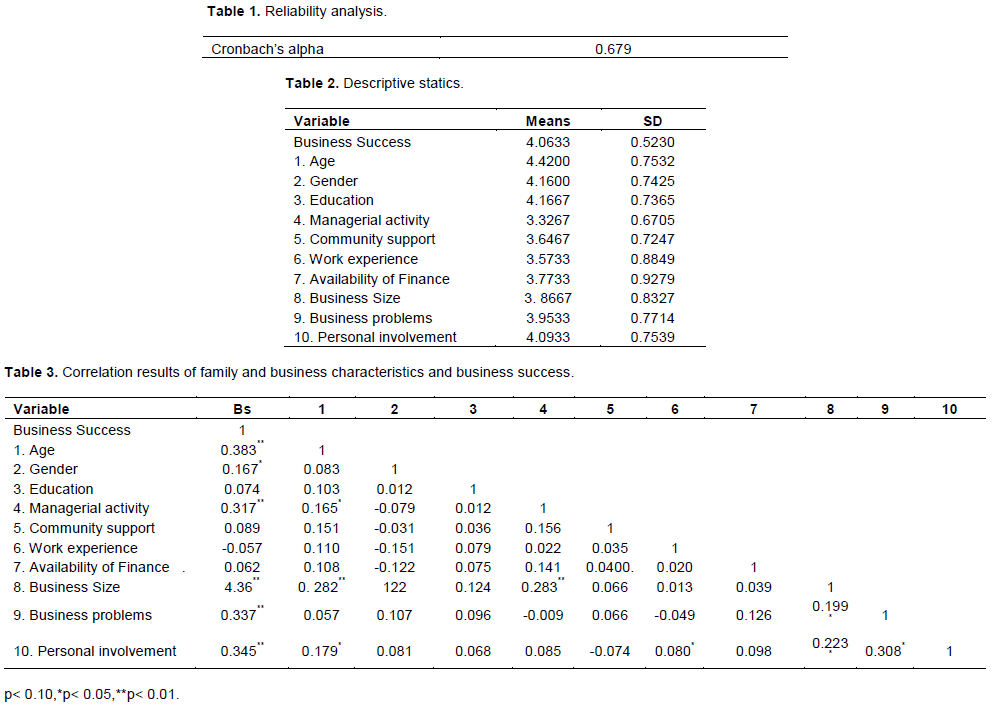

The Cronbach’s alpha value is shown in Table 1, descriptive statistics in Table 2, correlation in Table 3 and regression analysis in Table 4. Table 2 shows that age mean value is 4.4200 which indicate that average number of respondent goes with “strongly agrees” about the statement (Do you think that age affect business success) and having standard deviation of 0.75325 which indicates deviation value from the average point within sample. The education has the impact on the business success, the mean value of 4.1667 average numbers of respondent goes with “strongly agree” and having standard deviation is 0.73655. The gender has effect on the business success. The mean value of 4.16 which indicate that average number of respondent goes with “strongly agree” and having standard deviation 0.74257. The personal involvement has impact on the business success, the mean value of 4.09 which indicate that average number of respondent goes with “strongly agree”; and having standard deviation of 0.75393, which indicate the deviation value from the average point within sample. The business problem has impact on the business success. The business problems mean value of 3.95 which indicate that average number of respondent goes with “Agree” and having standard deviation 0.77144 which indicate the deviation value from the average point within sample.

The business size has impact on the business success. The business size mean value of 3.8667 which indicate that average number of respondent goes with “Agree” and having standard deviation 0.83277 which indicate the deviation value from the average point within sample. The availability of finance has impact on the business success. The availability of finance of mean value 3.7733 indicate that average number of respondent goes with “Agree” and having standard deviation 0.92792 which indicate the deviation value from the average point within sample. The community support has effect on the business success. The community support of mean value 3.6467 which indicate that average number of respondent goes with “Agree” and having standard deviation 0 .72479 indicate the deviation value from the average point within sample. The work experience has effect on the business success. The work experience of mean value 3.5733 indicate that average number of respondent goes with “Agree” and having standard deviation 0 .88497 indicate the deviation value from the average point within sample. The managerial activities have effect on the business success. The managerial activities of mean value 3.3267 indicate that the average number of respondent goes with “Agree” and standard deviation 0 .67054 indicate the deviation value from the average point within sample.

Table 3 shows significance and non-significant relationship between independent and dependent variables. Correlation between age and Business success is 0.383** which shows a high correlation between them. Correlation between gender and Business success is 0.167* and Correlation between age and gender is 0.083. Correlation between education and business success is 0.0174; correlation between age and education is 0 .103; and correlation between education and gender is .012. It shows that there is no correlation between them. Correlation between managerial activity and business success is 0.317** which shows they are highly correlated, correlation between managerial activity and age is 0.165* which shows correlation between them. The correlation between managerial activity and gender is -0.079, which shows they are negatively correlated and correlation between managerial activity and education is 0.012, which shows there is no correlation between them. Correlation between community support and business success is .089; correlation between community support and age is 0.151; correlation between community support and gender is -0.031; correlation between community support and education is 0.036; and correlation between community support and managerial activity is 0.156. Correlation between work experience and business success is -0.057, it shows they are negatively correlated. Correlation between work experience and age is 0.110; Correlation between work experience and gender is -0.0151; Correlation between work experience and education is 0.079; Correlation between work experience and managerial activity is 0.022; and Correlation between work experience and community support is 0.035; showing there is no correlation between them. Correlation between availability of finance and business success is 0.062; correlation between availability of finance and age is 0.108; correlation between availability of finance and gender is 122; correlation between availability of finance and education is 0.075; correlation between availability of finance and managerial activity is 0.141; correlation between availability of finance and community support is 0.040; and the correlation between availability of finance and work experience is 0.020. Correlation between business size and business success is 4.36**, correlation between business size and age is 0.282**; it shows the high correlation between them. Correlation between business size and gender is 0.122, correlation between business size and education is 0.124, correlation between business size and managerial activity is 0.283**, correlation between business size and community support is 0.066, correlation between business size and work experience is 0.013, and correlation between business size and availability of finance is 0.039. Correlation between business problems and business success is 0.337** it shows that highly correlated between them, correlation between business problems and age is 0.057; correlation between business problems and gender is 0.107; and correlation between business problems and education is 0.096. In addition, correlation between business problems and managerial activity is -0.009; correlation between business problems and community support is 0.066; correlation between business problems and work experience is -0.049; correlation between business problems and availability of finance is 0.126; and correlation between business problems and business size is 0.199*. Correlation between personal involvement and business success is 0.345**, it shows high correlation between them. Correlation between personal involvement and age is 0.179*, correlation between personal involvement and gender is 0.081, and correlation between personal involvement and education is 0.068. Correlation between personal involvement and managerial activities is 0.085, correlation between personal involvement and community support is -0.074, correlation between personal involvement and work experience is 0.080, correlation between personal involvement and availability of finance is 0.098, correlation between personal involvement and business is 0.223** and correlation between personal involvement and business problems is 0.308*.

Therefore, the result shows that all the independent variables are positively or negatively correlated with dependent variables.

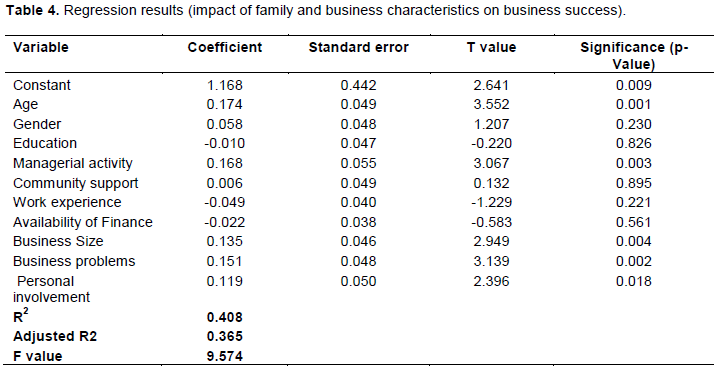

The variation in the dependent variable explained by the independent variables was given by the coefficient of determination that is R2. The value of R2 closer to 1.0 show the model is good fit, but it normally lies from 0 and 1 (Gujarati, 2003). The value of R-Square in the analysis was 0.408, which indicates that independent variable explained 40.8% change in dependent variable business success. Adjusted R2 means adjusted for degree of freedom. It was used for cross sectional data. In this analysis, the value of Adjusted R2 was 0.365 which is significant. The value of Adjusted R2 represents all the independent variable explained by 36.5% variation in the dependent variable, keeping all other factors constant. F-ratio implies that all the independent variables tend to be significant or insignificant factors; which was used variation in the dependent variable. The F-value in the analysis is 9.574 (p<0.01) which is highly significant and explains the overall appropriateness of model.

Table 4, given the value of the coefficient of the gender 0.058 (p>0.1), shows the positive sign but was insignificant. These results were lined with the previous study perceived business success (Wallace, 2010). The coefficient of variable explained that one unit increase in response category of gender there might be an increase of 0.058 units in the response category business success, keeping all other factor constant.

The coefficient of the age 0.174 (p<0.01) shows the positive sign and was significant. The coefficient of variable explained that one unit increase in response category of Age might be an increase of 0.174 units in the response category Business success, keeping all other factor constant. The coefficient of the managerial activities 0.168 (p<0.05) shows the positive sign and was significant. These results were lined with the previous study perceived family business success (Wallace, 2010). The coefficient of variable explained that one unit increase response category of managerial activities might be an increase by 0.168 units in the response category business success, keeping all other factor constant. The results indicate that managerial activities increased degree as family business entrepreneurs perceive their family business to be successful. The coefficient of the business size 0.135 (p<0.01) shows the positive sign. The coefficient of variable explained that one unit increase response category of in business size might be an increase of 0.135 units in the response category business success, keeping all other factor constant. The results indicated that business size had increased degree, which family business entrepreneurs perceive as their family business is succeed.

The coefficient of the business problems 0.151 (p<0.01) shows a positive sign but is significant. These results were lined with the previous study perceived family business success (Wallace, 2010). The coefficient of variable explained that one unit increase in response category of business problems might decrease by 0.151 units in the response category perceived business success, keeping all other factor constant. The results indicate that business problems increased the degree of how family business entrepreneurs perceived their family business as unsuccessful. The coefficient of the personal involvement 0.119 (p<0.01) shows the positive sign. These results are in line with previous study on perceived family business success (Winter et al., 2004). The coefficient of variable explained that one unit increase response category of in personal involvement might be an increase of 0.119 units in the response category perceived business success, keeping all other factor constant. The results indicate that personal involvement have increased degree of which family business entrepreneurs perceive their family business as a success. The coefficient of the Education -0.10 (p>0.1) shows the negative sign but was insignificant. The more years of education of family business entrepreneurs positively affect the perceived success of family business and these results are in line with the previous study (Wallace, 2010). The coefficient of variable explained that one unit increase in response category of education might lead to decrease of 0.15 units in the response category of business success, keeping all other factor constant.

The coefficient of the community support 0.006 (p>0.1) shows the positive sign but was insignificant. The family business entrepreneurs have higher level of satisfaction with the community support and the perceived success of family business. These results are in line with the previous study perceived business success (Wallace, 2010). The coefficient of variable explained that one unit increase in response category of community support there might be increase of 0.006 units in the response category of perceived business success, keeping all other factor constant. The coefficient of the work experience -0.049 (p>0.1) shows the negative sign but was insignificant. The more work experience of family business entrepreneurs perceived, the more successful the family business will be. The coefficient of variable explained that one unit increase in response category of work experience might be decrease -0.049 units in the response category perceived business success, keeping all other factor constant.

The coefficient of the availability of finance is -0.022 (p>0.1), which shows the negative sign but was insignificant. The availability of finance of family business entrepreneurs perceived more successful family business. The coefficient of variable explained that one unit increase in response category of availability of finance might decrease -0.039 units in the response for business success, keeping all other factor constant. This study contribute to knowledge in terms of impact of family and business characteristics for perceived long-term business success. The implications of this study has direct effect of family entrepreneurs and business characteristics on the business success. According to the results, there is negative impact of education, work experience and availability of finance on business success. It is important in the family business to adopt the latest techniques and get the latest knowledge on modern practices to improve business success. So this should be addressed in a suitable way. This study suggests that personal involvement of the family business entrepreneurs in the family business to improve the business success and long term lead to success in business. This study suggests that appropriate training program should be introduced to improve skill, knowledge and awareness of family entrepreneurs, so that they can operate their business in a more efficient way.

In conclusion, family business is an enterprise or company whereby one or more family member is involved to manage and control all business procedures. The family businesses are contributing around 45-75% to GDP; providing new creation of job opportunity in many countries, transferring it from one generation to another. The characteristic of entrepreneurs are risk taking capability, innovative belief, and creating opportunity for other people. An important factor of entrepreneur’s success include family support, education, personal motivation and access to financial resources.

Managerial activities, business size, personal involvement and more aged persons have major impact on the success of a business. In this study, many entrepreneurs were satisfied with the performance of their family businesses, and they adopt family members for business expansion. The more educated and skilled people involved in the business occupy better position to ensure long success of family business. The major characteristics of family business entrepreneurs and business affect the success of family business. These variables were generated after reviewing the studies that affect the business success.

Finally, it is suggests that family and business characteristics have positive and negative impact on a business success. The family and business characteristics have significant (age, managerial activities, business size, business problems, and personal involvement) and non-significant (gender, education, community support, work experience, availability of finance) impact on the success of a business.

The authors have not declared any conflict of interests.

REFERENCES

|

Aldrich HE, Cliff JE (2003). The pervasive effects of family on entrepreneurship: toward a family embeddedness perspective. Journal of Business Venturing 18:573-596.

Crossref

|

|

|

|

Anderson RC, Reeb DM (2003). Foundingâ€family ownership and firm performance: evidence from the S&P 500. The Journal of Finance 58(3):1301-1328.

Crossref

|

|

|

|

|

Anderson RC, Reeb DM, Zhao W (2012). Familyâ€controlled firms and informed trading: evidence from short sales. The Journal of Finance 67(1):351-385.

Crossref

|

|

|

|

|

Baker T, Nelson RE (2005). Creating something from nothing: Resource construction through entrepreneurial bricolage. Administrative Science Quarterly 50(3):329-366.

Crossref

|

|

|

|

|

Barredy C (2016). In search of future alternatives for family business: Family law contributions through Civil and Common Law comparison. Futures 75:44-53.

Crossref

|

|

|

|

|

Birley S, Ng D, Godfrey A (1999). The family and the business. Long Range Planning 32(6):598-608.

Crossref

|

|

|

|

|

Casson MC (1982). The entrepreneur: An economic theory. Oxford: Martin Robertson.

|

|

|

|

|

Chaston I (2012). Recession and family firm performance: an assessment of small UK family-owned hotels. Journal of CENTRUM Cathedra: The Business and Economics Research 5(1):60-69.

Crossref

|

|

|

|

|

Chua JH, Chrisman JJ, Sharma P (1999). Defining the family business by behavior. Entrepreneurship Theory and Practice 23:19-40.

Crossref

|

|

|

|

|

Cooper DR, Schindler PS, Sun J (2006). Business research methods (Vol. 9). New York: McGraw-Hill Irwin.

|

|

|

|

|

DeTienne DR, Cardon MS (2012). Impact of founder experience on exit intentions. Small Business Economics 38(4):351-374.

Crossref

|

|

|

|

|

Faccio M, Lang LH (2002). The ultimate ownership of Western European corporations. Journal of Financial Economics 65(3):365-395.

Crossref

|

|

|

|

|

Fuller T (2003). If you wanted to know the future of small business what questions would you ask? Futures 35:305-321.

Crossref

|

|

|

|

|

Handler WC (1994). Succession in family business: A review of the research. Family Business Review 7(2):133-157.

Crossref

|

|

|

|

|

Hatak I, Hyslop K (2015). Cooperation between family businesses of different size: A case study. Journal of Co-operative Organization and Management 3(2):52-59.

Crossref

|

|

|

|

|

Heck RK, Trent ES (1999). The prevalence of family business from a household sample. Family Business Review 12(3):209-219.

Crossref

|

|

|

|

|

Kellermanns FW, Eddleston KA, Barnett T, Pearson A (2008). An exploratory study of family member characteristics and involvement: Effects on entrepreneurial behavior in the family firm. Family Business Review 21(1):1-14.

Crossref

|

|

|

|

|

Miller D (1983). The correlates of entrepreneurship in three types of firms. Management Science 29:770-791.

Crossref

|

|

|

|

|

Mitra R (2002). The growth pattern of women-run enterprises: An empirical study in India. Journal of Developmental Entrepreneurship 7(2):217-229.

|

|

|

|

|

Moores K (2009). Paradigms and theory building in the domain of business families. Family Business Review 22(2):167-180.

Crossref

|

|

|

|

|

Nordqvist M, Wennberg K, Hellerstedt K (2013). An entrepreneurial process perspective on succession in family firms. Small Business Economics 40(4):1087-1122.

Crossref

|

|

|

|

|

Randerson K, Bettinelli C, Fayolle A, Anderson A (2015). Family entrepreneurship as a field of research: Exploring its contours and contents. Journal of Family Business Strategy 6(3):143-154.

Crossref

|

|

|

|

|

Sarasvathy SD (2001). Causation and effectuation: Towards a theoretical shift from economic inevitability to entrepreneurial contingency. Academy of Management Review 26(2):243-288.

Crossref

|

|

|

|

|

Sarasvathy SD (2008). Effectuation: Elements of entrepreneurial expertise. New horizons in entrepreneurship research. Cheltenham, U.K.: Edward Elgar Publishing.

Crossref

|

|

|

|

|

Sciascia S, Mazzola P, Astrachan JH, Pieper TM (2012). The role of family ownership in international entrepreneurship: Exploring nonlinear effects. Small Business Economics 38(1):15-31.

Crossref

|

|

|

|

|

Scott CE (1986). Why more women are becoming entrepreneurs. Journal of Small Business Management 24:37.

|

|

|

|

|

Shane S, Venkataraman S (2000). The promise of entrepreneurship as a field of research. Academy of Management Review 25(1):217-226.

Crossref

|

|

|

|

|

Shanker MC, Astrachan JH (1996). Myths and realities: family businesses' contribution to the US economy. A framework for assessing family business statistics. Family Business Review 9:107-123.

Crossref

|

|

|

|

|

Vassiliadis S, Siakas K, Vassiliadis A (2015). Passing the Baton to the Next Generation of the Greek Family Businesses. Procedia Economics and Finance 33:528-534.

Crossref

|

|

|

|

|

Wallace JS (2010). Family-owned businesses: Determinants of business success and profitability. All Graduate Theses and Dissertations 594 p.

|

|

|

|

|

Ward JL (1997). Growing the family business: Special challenges and best practices. Family Business Review 10(4):323-337.

Crossref

|

|

|

|

|

Wilson N, Wright M, Scholes L (2013). Family business survival and the role of boards. Entrepreneurship Theory and Practice 37(6):1369-1389.

Crossref

|

|

|

|

|

Winter M, Danes SM, Koh SK, Fredericks K, Paul JJ (2004). Tracking family businesses and their owners over time: panel attrition, manager departure and business demise. Journal of Business Venturing 19(4):535-559.

Crossref

|

|

|

|

|

Zahra SA, Hayton JC, Salvato C (2004). Entrepreneurship in family vs. non-family firms: A resource based analysis of the effect of organizational culture. Entrepreneurship Theory and Practice 28(4):363-381.

Crossref

|

|

|

|

|

Zellweger TM, Kellermanns FW, Chrisman JJ, Chua JH (2012). Family control and family firm valuation by family CEOs: The importance of intentions for transgenrational control. Organization Science 23(3):851-868.

Crossref

|

|