ABSTRACT

The study examined the effect of corporate governance on firm’s financial performance amongst private business enterprises in Uganda. The study used descriptive and survey design. A mixed method approach which involved both qualitative and quantitative techniques were also used. The study found out that corporate governance significantly influences the financial performance of hotels and manufacturing firms in Lira City and majority of the firms investigated performed on average financially. It was also established that firms whose boards demonstrate high integrity were likely to register positive changes in their financial performance than firms whose boards do not. The study also noted that board independence would propel the firm to grow to greater heights. The study recommends that hotel and manufacturing firm owners should exercise some discipline and leave boards to operate independently. This would allow the board to remain focused on the long-term goals of the firm. The hotel and manufacturing firm owners should be cautious in selecting board members lest they attract many that would increase the firm’s liabilities.

Key words: Corporate governance, board diversity, board integrity, firm performance, financial performance.

The global trends in the management of today’s modern business firms have triggered managers to adopt Corporate Governance Principles. Flowers et al. (2013) reveals that although most business firms in Sub Saharan Africa are adopting corporate governance, its application is still at its infant stage. The practice of adopting Corporate Governance (CG) principles, behaviors and structures guides the firms to develop specific objectives, plans and strategies that help in monitoring its performance. Corporate Governance focuses on the responsibilities and the rights of members of the board, management and different shareholders. CG further shows that the way firms are managed has a direct effect on the market performance. Jizi et al. (2014) opine that CG was developed to protect the interest of the shareholders but turned to gradually gain importance in society and from different stake holders. Mirkovic (2015) posits that the interest of shareholders and investors and the future of their businesses emanates from good CG. Chittithaworn et al. (2011) examine the factors affecting the success of an enterprise which includes the way the business or corporations are run, the services and products offered in the environment at which it is operating, the availability of finances and the strategy. Mahmood and Hanafi (2013) observe that competitive advantage and entrepreneurial innovation are some of the major variables that influence a business performance.

Financial performance measures how effective a business enterprise uses the available assets from its business modes in order to generate more revenue and these performances may be compared with those operating similar businesses. Brealey et al. (2009) posits that financial performance can be measured in terms of profitability, repayment capacity, solvency, liquidity and financial efficiency. Levy (2015) reveals that inadequate financial capacity by a business enterprise hinders the growth of an enterprise. Poor accounting practices have been identified as some of the factors that hinder the ability of a firm to raise finance. Globally, modern firms have gradually applied the principles of corporate governance in their day to day management. Organisations, whether small, medium or large, enjoy almost the same benefit, face similar challenges or influences especially when it comes to the adoption of corporate governance principles or practices (Willan et al., 2016). The wrong mentality of conflict of interest and having too much control or pocketing the shareholders and directors of a firm cause serious problems in a firm and may lead to business failures (Nwidobie, 2016). The board impairment, Auditor independence and Conflicting laws arising from the nature or structure of ownership are other causes of failures in Corporate Governance (Abdulmalik and Ahmad, 2016). The board of directors have also shown lack of commitment in their over sight roles, weaker monitoring system, non-disclosure or transparency in their work and this causes CG failures (Okpara, 2016).

Bates (2013) argues that erroneously, corporate governance has been linked to barriers resulting from red tape and challenges that are left to large companies. Whereas firms have widely adopted the use of corporate governance (CG) as a better principle of corporate performance, Martey et al. (2013) notes that, year of experience, initial capital invested in a business and the cost associated to the business has a significant effect on the performance of an enterprise. The absence of a good CG has been seen as a major course of collapse of most business firms (Michael and Goo, 2015). Similarly, good CG norms are indeed significant in improving the financial performance of business firms (Berger et al., 2016). Most corporate firms are experiencing stagnation in growth and thus registering decline in profits in the last years resulting from harsh and unstable operating business environment (World Bank, 2015).

The study was guided by the following objectives: to assess the effect of board diversity on the firm’s financial performance, to determine the effect of board communication on firm’s financial performance, to establish the effect of board integrity on firm’s financial performance and to determine the relationship between corporate governance and firm’s financial performance. This study would therefore provide empirical evidence on how the practice and the principles of corporate governance affect firms’ financial performance in Lira City.

Hypothesis

1. Board diversity does not affect firm’s financial performance;

2. Board communication does not affect firm’s financial performance;

3. Board integrity affects the firm’s financial performance;

4. Better corporate governance practices leads to better firm’s financial performance.

Theoretical framework

The study built on the stewardship theory, which was advanced by Davis et al. (1997). The theory assumes that when stewards align their interests with those of the principal, there will be no principal-agency problem (Chrisman, 2019). In essence, when the interests of the steward and the principle coincide, both parties achieve their long-term goals without conflicting interests. Given the current study, the managers or executives of the firm are stewards while the stake holders of the firm are the principles. When the managers or executives opt to behave in a manner that drives them towards self- motivation, goal attainment and self-actualization, they will naturally align their ambitions with the organization’s goals (Schillemans and Bjurstom, 2020). Rather than serving their own ill-interests, managers and executives will serve the interests of the organization, which will lead to superior firm performance. Since managers and executives are driven by higher order needs (according to Maslow’s needs theory), they will be motivated by non-financial rewards and mutual relationships, which naturally dissolves their own interests into that of the entire organization. The goal of corporate governance is to create stakeholder value. Therefore, when the managers’ and executives’ espoused values align with the enacted values of the firm, the firm will positively respond to the changing business environment, thus creating stakeholder value (Subramanian, 2018).

Stewardship theory suggests that when the principal and the manager in the business choose to behave as stewards, the two parties will work towards the principal’s interest, which is supported by psychological and situational factors (Madison, 2014). In this article, we argue that when managers and executives constitute the board of directors of business firms, their stewardship behavior is likely to translate into highly performing firms. By examining the diversity of the board of directors, we argue that boards which constitute a majority membership of firm managers and executives are likely to perform better than firms whose boards constitute a greater majority of members outside the firm. The mode of communication in boards where majority of the membership are firm managers and executives will reflect interests internal to the firm, since managers and executives operate on interests that are in line with the firm’s interests, which are the principal’s. Finally, the presence of firm managers and executives on the board is likely to be influential in the integrity of the board. After all, the goals of the managers and executives are self-actualization but in the interest of organizational goals (Grundei, 2008). Our assumption agree with (Subramanian, 2018) who observed that boards that are dominated by insiders (in this case managers and executives) have in-depth, technical and current knowledge and information need for the firm’s success. However, our assumptions do not thwart previous scholars (Chrisman, 2019) who noted the possibility of one individual coming as a steward towards a certain goal and an agent towards another goal. This is possibly due to the multiplicity of goals and conflicts among principals.

Corporate governance

Abor and Biekpe (2007) defines Corporate Governance as a process, structured to manage and guide the affairs of the business firms in order to enhance corporate accountability, prosperity with a goal of realizing value of shareholders. Akinpelu and Ogunbi (2013) opines that corporate governance would provide structures where the business enterprise objectives are set and how they are attained while monitoring its performances as determined. Sharma (2015) posits that CG should ensure that the frameworks that are set in an organization are legitimate and empowers all stake holders to know their rights and freedoms and ought to assume their tasks legitimately.

Board diversity

The diversity in the board is significant in that it enhances effectiveness in corporate governance. Rao and Tilit (2016) reveal that board diversity of its members should be based on various dimensions which are advantageous to a firm, since they come along with different ideas which complement one another. Zhuang et al. (2018) urges that the characteristics in board composition such as nationality, age, independence, gender comes along with many attributes, which supports the firm. Bakar et al. (2019) notes that gender diversity in the composition of the board would enhance a balance in decision making as in a way female think different from men. Female members are very sensitive to many issues such as community response, leadership style, employee’s attitude (Al-shaer and Zaman, 2016). In most business firms, although the board is set as an effective tool in corporate governance, the management of business firms seems to be in theory, it has noted that practically their value is less clear (Akinpelu and Ogunbi, 2013). Corporate governance ought to support the firm’s structures while focusing on the set objectives of the firms and how to monitor the performance that would ensure efficiency and effectiveness in service delivery (Ijeoma and Ezejiofor, 2013). Similarly, Kenga and Nzulwa (2018) opine that the structure and composition of the board should have individuals possessing good reputation and ought to maintain good corporate integrity. It is also important to note that board composition would support the structure of the board to function well. Wasike (2012) posits that the size of the board impacts on the quality of corporate governance taking into consideration that larger boards could be dysfunctional while smaller boards looks to be better because the boards which are large are most likely to plague in to problems of monitoring the firm well. However, Arora and Sharma (2016) reveal that larger boards comes along with vast intellectual knowledge which supports decision making and enhances firms performance. Organizations would want a diverse boards comprising of members with multiplicity of knowledge, experience and skills to support its expansion, however no concrete and substantial evidence has proved that board composition and diversity influences decision making of management (Harjoto et al., 2014). Similarly, Benjamin et al. (2016) reveals that firms having a larger board size is most likely to pay higher dividends at the end of the period while greater independence of the board would promote better quality governance and monitoring of the firm. Saseela (2018) conducted a study on the effect of CG on firm performance of listed companies in Sri Lanka and found out that board sizes and audit committees have a significant impact on return on assets (ROA).

Board communication

The board’s strength is measured on the flow and management of any communication. Effective communication reduces any negative effect on the firm and the success of any board rests squarely on how they communicate to members and all stake holders (Samuel et al., 2019). The method or channel of communications to the board and other stake holders improves on the quality of decision being made and this helps CG structures to perform better (Shivani et al., 2017). The discloser of information in CG through various channels is an effort towards attracting other investors, which enhances the market value of any business firm (Dua and Dua, 2015). CG practices should ensure that the discloser of meaningful financial information is done in a timely manner and transparently such that investors and stake holders would easily acquire all required financial information about the firm for any decision and further action (Wanyama et al., 2013). Transparency is seen in reporting credible corporate information which shows the company’s commitment to the norms of integrity (Cecchetti et al., 2018). CG aims to facilitate an efficient and effective control while monitoring firms whose importance would lie in the transparency and fairness followed in its operations and thus enhances disclosure of sensitive information by protecting all the interest of stake holders (Arora and Bodhanwala, 2018).

Board integrity

Integrity is important in the success of both public and private business. OECD (2017) reveals that integrity would entail accountability, transparency and commitment to the firm and these improves credibility of the firm in terms of reporting. Kakabadse et al. (2010) reveal that the effectiveness of non- executive directors may be determined by access to information, independence, competencies and incentive awarded. Leung et al. (2014) posit that there is a positive relationship between independence of the board and firms’ performance in family businesses and therefore recommendation by directors as regulators on the board is voluntary. Foo and Zain (2010) establish that independence of the board makes it transparent and would be in a position to disseminate the right and useful information which improves in the liquidity of the firm. Board independence helps in mitigating bad corporate image especially when disclosing significant information to shareholders (Zhang, 2012). Lopez-Iturriaga and Morros (2014) reveals that experienced and high profile board members with higher reputations and integrity who sits in various boards can provide ideas, which are worthwhile in increasing the demand for his or her service as an independent director in firms. The board members and directors who sit on related boards usually bring in valuable and useful knowledge to their primary firm and these therefore facilitates the firms’ access to those firms contact (Dass et al., 2014). Some board members who are appointed do not pay enough attention and time on the firm’s governance in their role as directors and also in their managerial roles and function and these greatly affects the functionality of a firm (Liu and Paul, 2015). Mbu-Ogar et al. (2017) reveal that maintain a fairly balanced board ought to be adopted by firms since it supports proper development of strategic decision that may lead to long term maximization of the owner’s value

Firm financial performance

Firm’s performance is a set of both non-financial and financial indicators that may offer any information which determines an accomplished result and objectives which was intended while setting up a firm Lebas and Euske (2002). Performance of any firm can be achieved through items like, evaluation, effectiveness, quality and efficiency (Bartoli and Blatrix, 2015). Samina and Ayub (2013) establish that a firm’s performance is determined by how the assets of the firms are being used to generate more profits and revenue. The firm’s performance and efficiency are measured by its ability in achieving adequate revenues and profits for the institution (Ongore and Kusa, 2013). Financial performance of any business firm is measured by profitability growth, capacity to produce enough, growth in their daily sales, capital utilization and financial resources, end of year financial report and this therefore helps in determining how the business firm performed and a decision would be taken on how to share dividends (Omondi and Muturi, 2013; AKhtar, 2015).

Capital structure of a firm will determine the firm performance. Capital mix, which a firm holds is very important and business firms ought to have appropriate capital mix that propels a firm to generate more profits. Optimum usage of resources whether financial or assets indicates a high financial performance of an organization (Matar and Eneizen, 2018). Inability to use or manage all the resources at the disposal of a company is an indication of low financial performance. Firm size, management, liquidity are some of the factors affecting firm performance and they have a positive effect on financial performance (Almajali et al., 2012). Financial performance of any business firm is determined by the amount of profit it makes and a number of ratios such as (ROA) return on assets, return on equity (ROE) and others calculate profitability. Dasuki (2016) opines that Long term debt have been viewed as having a significant negative effect on (ROA) which may be measured on financial performance of a firm. Subramaniam and Wasiuzzaman (2018) opine that firms should focus on decreasing it’s transactions cost to a reasonable level in doing business while not compromising the quality of its services and products and these would therefore be beneficial to the firm as it improves on its performance and increase dividend payouts. Portfolio yield, return on equity, operating expense and return on assets are being used in measurement of profitability and these ratios are used as guidelines in measuring financial performance of a business enterprise (Rosenberg, 2009).

Corporate governance and firm financial performance

Ansong (2015) posits that the board size and financial performances of a business firm has progressive connections, whereas the board participation level has no relationship with the financial performance. The assumption is always that for aboard to be more effective, it ought to be comprised of a bigger proportion of outsiders in order to achieve a meaningful impact on firm’s performance (Browne, 2013). Liu et al. (2014) posits that in business firms where there are three or more female board directors, there is likelihood that such boards would perform better than those with fewer females as board of directors. The existence of women on the boards in various firms has a big influence of return on assets (ROA) and equity of firms that practice good CG principles and this would therefore affect the financial performance of these firms (Hykaj, 2016). The board diversity in gender has proved to have an effect on Corporate Governance performance measurement on Return on Assets, while the composition of non-executive directors has no significant effect on performance measurement (Imade, 2019). Board gender and management ownership all has a positive effect on the performance of a business firms (Amoateng et al., 2017).

Ntim et al. (2017) opines that having a diverse board would help support legitimacy in developing a better linkage with all the stake holders. Similarly, Uwalomwa et al. (2015) reveals that board size, board independence, ownership structure has a significant positive effect on the firm’s profitability. Saibaba and Ansari (2012) argue that having a larger board would result in more benefits to all stake holders, since they would bring good investment proposals which may be visionary consisting of vast knowledge which would ultimately steer the growth of the firm. Gambo et al. (2018) argue that board composition and its communication channels help in monitoring and controlling systems of work and therefore enhance Return on Assets (ROA) of business firm. Palaniappan and Rao (2015) posit that firms’ performance would be boosted when the good principles of CG in disclosure of good information is given to all stake holders. Yang et al. (2012) reveals that a firm that invests a lot in improving CG principles effectively while disclosing all relevant information transparently to all stake holders would eventually help the firms in reduction in cost of equity. However, in effective discloser practices and lack of transparency in corporate governance reduces the effectiveness mechanisms. Similarly, Mostafa and Saadi (2013) reveal that voluntary discloser of information and board size does significantly affect the firm’s performance.

The adoption of the principles of corporate governance by business firms has positive effect on the financial performance (Chinomona, 2013). Business firms that use good CG practices have huge impact on the performance of business firms (Moenga, 2015). A better governed business firms are faced with less management challenges and can handle any business shocks easily. Good CG principles results in to improved firm performances and these eases the modalities of acquiring extra capital for investments (Gupta and Sharma, 2014). Most investors and financial institution would not be willing to invest their money in company’s which does not have well-structured corporate governance (Elshandidy and Neri, 2015).

Olajide et al. (2020) establishes that the agency costs of business firms are high and sounding corporate governance are very responsible for any positive performance of business firms in sub Saharan Africa. Masood et al. (2013) posits that board independency have a positive relationship with firm financial performance. Firms ought to have board members who are independent and open minded this would therefore increase on firm’s efficiency (Dharmadasa et al., 2014). Nwaiwu and Joseph (2018) investigated the relationships between CG and Financial performance in Nigeria and found out that audit committee has a significant effect on profitability of a firm measured using ROA and earnings per share. Panditharathna and Kawshala (2017) establishes that board effectiveness has a significant positive relationship with Return on Equity (ROE) and these would indicate that this new concept is being adopted by many firms in developing nations. The adoption of corporate governance mechanism which is proper would greatly impact on the performances of the firms (Afande, 2015).

Zyad (2014) opines that firms with strong corporate governance are likely to perform better than firms with weaker corporate governance. Proper and accurate disclosure of timely financial reports while adopting proper and good practices of CG helps in the reduction of cost of equity capital (Botosan, 2006). In order to benefit from a fair risk return trade off by investors a business firm ought to adopt a better corporate governance reform which should be acceptable by all (Prasanna, 2013). A business firm that improves its CG principles may have a significant increase in profitability, resulting from increased foreign investment (Patibandla, 2006).

Investors would consider various factors like independence of the board, the size of the board, shareholders and others before they invest in their funds in a business firm (Mallin, 2016). CG has been embraced as crucial in stabilizing financial markets and thus fostering economic growth and development (Bonna, 2012). Cretu (2012) posits that effective CG principles guarantees best performance for shareholders as resulting from their investments therefore contributing to economic growth and development. Adiloglu and Vuran (2012) opine that market value of business firms and enterprises has continued to gain prominence in the stock market as a result of good CG practices. Good CG practices play a significant role in the growth and financial performance of a business firm therefore resulting in economic growth of an economy (Lama, 2012; Rambo, 2013). The conceptual frame work is displayed in Figure 1.

This study was conducted amongst selected hotels and manufacturing firms in Lira City. Descriptive and Survey design was used. The survey design provided causality, reliability and generalization (Bryman, 2001; Cooper and Schindler, 2014). Descriptively, the study brought out the state of corporate governance among hotels and manufacturing firms in Lira City. The study used a mixed research approach, which involved both qualitative and quantitative techniques. Qualitatively, the study gathered qualitative opinions on corporate governance and firm performance from selected key interview informants (Mugenda and Mugenda, 1999; Sarantakos, 2012). The key informants constituted basically board members and purposively selected managers of hotels and manufacturing firm owners. Quantitatively, the study collected numerical information in form of a questionnaire. Bryman and Bell (2015) opine that qualitative research approaches form an important link between the theoretical perspective and this would enhance understanding and knowledge about the case study. A combination of both textual and numerical information analytically supported the study in developing in-depth analysis in determining the firm’s performance. The study based on a sample size of 76 units, who were drawn from a target population of 96 units, constituting 90 managers and employees who double as board members, and 6 board members who come from outside the firms. These study units were selected from the two divisions of Lira City East and Lira City West. The selection in all these categories was purposive to ensure that only employees with extensive knowledge on corporate governance take part in the study. Key informants were purposively selected from Board members and business owners.The sample size to whom questionnaires were administered was determined using Morgan’s sample size determination tables (Krejcie and Morgan, 1970).

Data were collected using structured questionnaires with close-ended questions and structured interviews with open-ended questions. The questionnaire, which was the primary method of data collection, was structured as follows: Section A comprised background characteristics, and had 5 items. Section B comprised items on corporate governance, and comprised 15 items. Section C comprised items seeking to understand financial performance, and comprised 10 items. The items used to measure corporate governance and firm performance was gleaned from literature review. Procedurally, the 15 scale-items on corporate governance returned a coefficient of reliability of 0.829 while the 10 scale-items on financial performance returned a coefficient of reliability of 0.711. Therefore, the items used in this study were highly reliable and internally stable. The study adopted correlation analysis to test the relationship between corporate governance and financial performance, and multiple regressions to measure the influence of each of the predictor variables (board diversity, board communication, board integrity) on financial performance. Firm performance was measured in terms of profitability, capital mix, production or service costs and debt

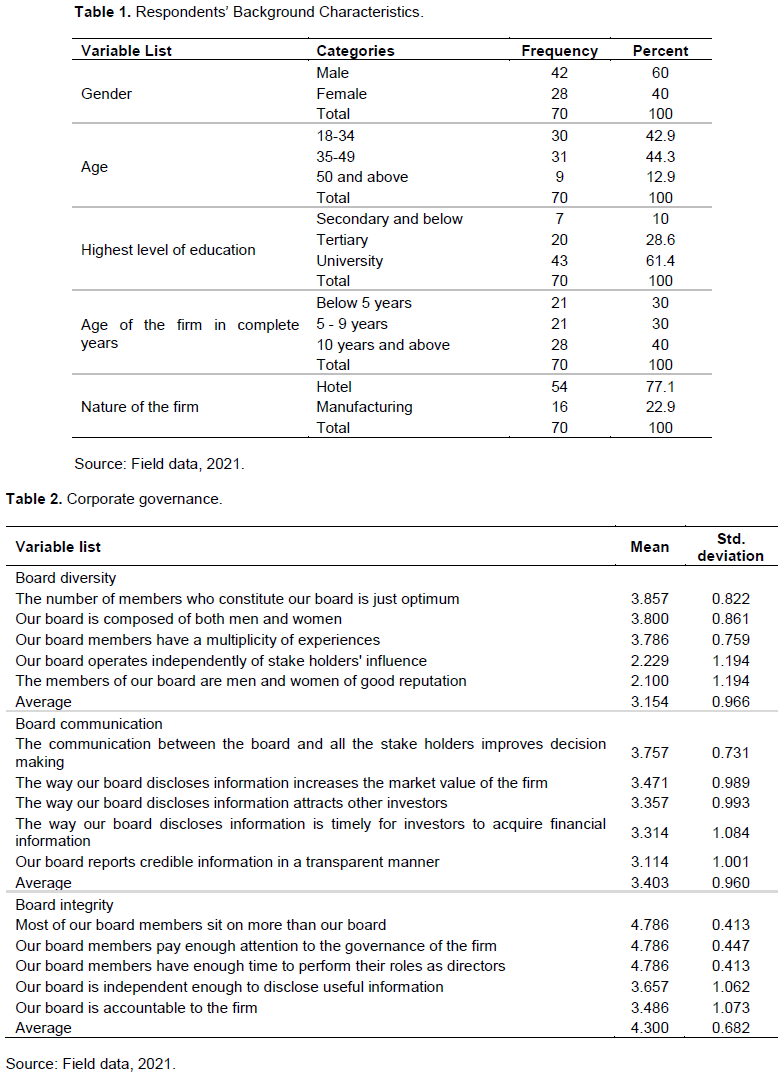

Table 1 summarizes the Bio data of respondents, who constituted managers, employees serving on boards, and board members. The variation in the gender of participants indicates that 60% were male while 40% were female. With regard to the age of the participants, 44.3% fell in the 35 - 49 years’ age bracket; 42.9%, 18 - 34 years; 7%, 50 years and above. In terms of education, 61.4% were university degree holders, 28.6% had tertiary diplomas, while 10% had secondary education and below. About 60% of the firms have been in operation for over 10 years while only 40% have been in operation for less than 10 years. About 77.1% of the participants were form hotels, while only 22.9% were from manufacturing firms. The study adopted descriptive statistical measures to understand corporate governance in Lira City. Accordingly (mean < 2.500) were interpreted as “weak” (2.500 < mean < 3.500) were interpreted as “average” while (mean > 3.500) were interpreted as (strong).

The study shows that corporate governance among hotels and manufacturing firms in Lira City is generally moderate in terms of board diversity (mean = 3.154; std =.966), moderate in terms of board communication (mean = 3.403; std. =.960), and strong in terms of board integrity (mean = 4.300; std. =.682). The statistics generally imply that most of the hotels and manufacturing firms in Lira City have boards that demonstrate integrity. This is good for businesses in that the board would check and monitor the performance of the managers. The standard deviations, all of which tend towards zero demonstrate consistent opinions on corporate governance. Specific indicators to the moderate level of board diversity point to board size (mean = 3.857), gender composition (mean = 3.800), and multi-experience of members (mean = 3.786). The statistics suggest that the firms investigated enjoy the benefits that accrue from board diversity. The board with a wealth of various experience and sex comes along with various knowledge and these would build the enterprise. However, these boards seem to be lacking in terms of independence from stake holders’ influence and members’ reputation. This may not be good if the owners have too much influence in the board, this affects their work. The greatest benefit of board communication is the promotion of free interaction among stake holders that improves decision making (mean = 3.757). In terms of board integrity, it was revealed that most of the board members sit on more than one board, pay attention to the governance of the firm and render enough time to perform their roles as directors (mean = 4.786) (Table 2).

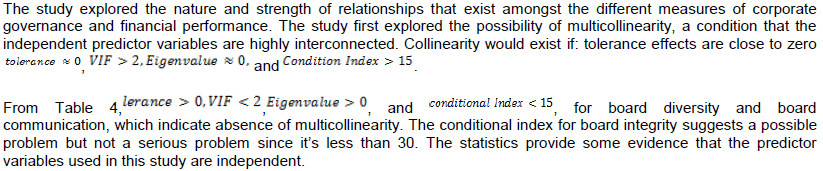

The study adopted descriptive statistical measures to understand financial performance of the selected hotels and manufacturing firms in Lira City. Accordingly (mean < 2.500) were interpreted as “low” (2.500 < mean < 3.500) were interpreted as “average” while (mean > 3.500) were interpreted as (high). The financial performance among the selected firms (mean = 4.09; std. =.792) was high, and participants were very consistent in attesting to this view. The statistics imply that majority of the firms investigated are performing above average financially. The high level of financial performance observed among selected hotels and manufacturing firms characterizes growth in daily sales (mean = 4.81; std. = 0.392), growth in capital accumulation (mean = 4.79; std. = 0.413), optimal use of financial resources (mean = 4.78), and high profit generation (mean = 4.74; std. = .530). The researcher observes that these firms were performing very highly in terms of profits, and capital accumulation. On the lower side, the selected firms appeared to exhibit low financial performance in terms of the level of goods and or services produced (mean 2.90; std. =.1.157), and debt management (mean = 2.10; std. = 1.241) (Table 3).

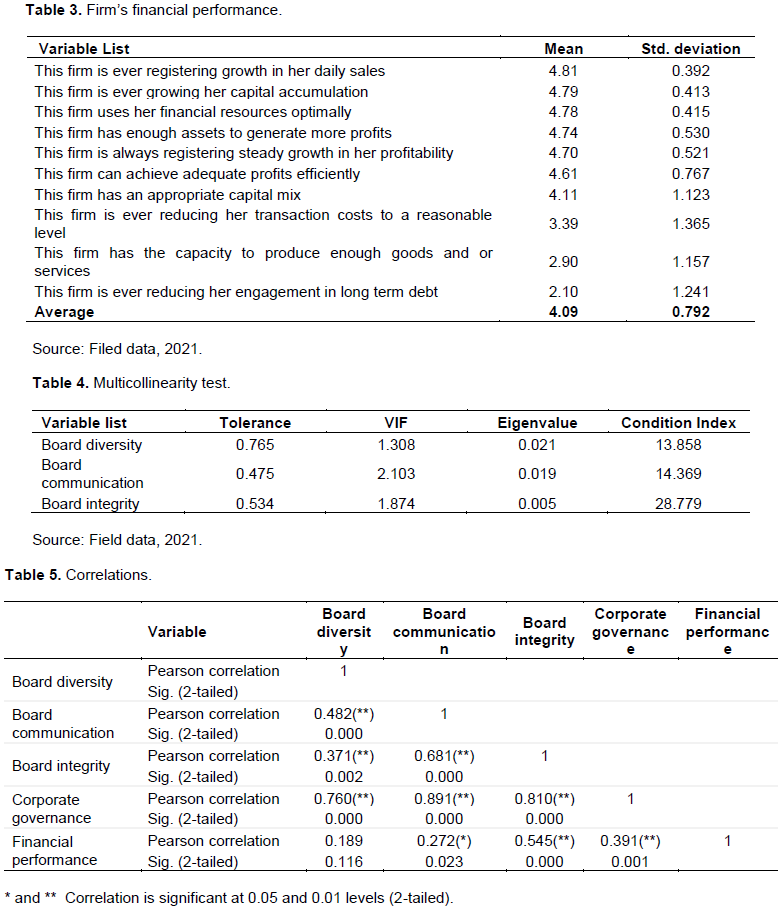

The study used Pearson’s correlation coefficient to test for the relationship between corporate governance and financial performance. Correlation coefficients closer to zero, indicate a weak relationship while those closer to 1, indicate a strong relationship. Table 5 reports the relationships. The relationship between corporate governance and financial performance (r = .391) is weak though it is significant. This suggests that a variation in the corporate governance practices is associated to a weak variation on the financial performance of hotels and manufacturing firms in Lira City. The implication is that much as hotels and manufacturing firms may endeavor to consciously select their board members, financial performance would change but in weak levels. The study further observed a positive and significant relationships exists between board communication and financial performance (r = .272; p-value <.05), and board integrity and financial performance (r = .545; p-value <.05). These statistics indicate that variations in board communication and board integrity are associated with positive variations in financial performance. However, the study showed a weak and insignificant association between board diversity and financial performance (r = .189; p-value >.05). Implicitly, a variation in board diversity may not realize significant changes in financial performance of hotels and manufacturing firms in Lira City. While correlation is good for establishing the nature of the relationship between sets of variables, it does not predict the influence of one variable onto the other. Therefore, the study adopted the regression model to understand the influence of corporate governance onto financial performance among hotels and manufacturing firms in Lira City.

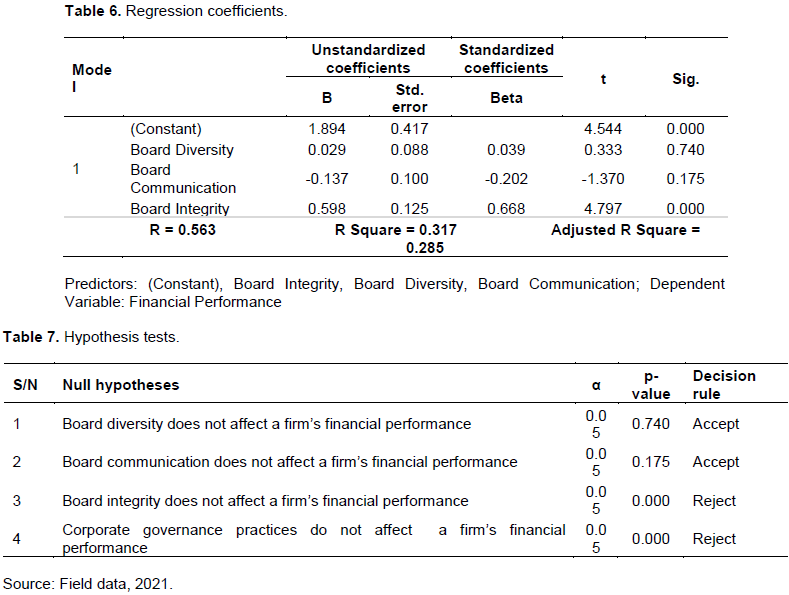

The study established that corporate governance accounts for only 31.7% (R Square = .317) of the variations in financial performance in hotels and manufacturing firms in Lira City. This percentage is not substantial enough, which suggests the existence of other factors that account for the variation in financial performance. Individually, board diversity (β = .039; p-value >.05), and board communication (β = -.202; p-value >.05) do not have any significant influence on financial performance of hotels and manufacturing firms in Lira. Actually, board communication seems to reduce the performance of financial performance. The study established that board integrity (β = .668; p-value <.05) significantly accounts for about 66.8% of the variations in the financial performance of hotels and manufacturing in Lira City. The implication is that hotels and manufacturing firms whose boards observe ethical integrity while executing their roles are likely to register improvement in the financial performance than firms with loose boards. The suggested model for the relationship between corporate governance and financial performance is: Financial performance = 1.894 + 0.668*board integrity + 0.039*board diversity – 0.202*communication + ε, where ε is the possible error in the model.

The (constant = 1.894) suggests that even hotels and manufacturing firms that do not have boards are capable of performing financially, although their performance is likely to be below the average financial performance of firms that have corporate boards (Table 6).

Hypothesis testing

This study tested hypotheses using the p-values approach. The p-value approach compares the test statistic with the type 1 error to be as small as 0.01, 0.05 or 0.10. In this study, the type 1 error was set to be as low as 0.05. In this approach, the null hypothesis is assumed to be true. If the p-value is less than the test statistic (α = .05), reject the null hypothesis else accept the alternative hypothesis. Similarly, if the p-value is greater than the test statistic (α =.05), accept the null hypothesis and reject the alternative hypothesis. The study accepted the null hypothesis that board diversity does not affect a firm’s financial performance (Table 7). The study accepted the null hypothesis that board communication does not affect a firm’s financial performance. The study rejected the null hypothesis and accepted the alterative hypothesis that board integrity affects a firm’s financial performance. Similarly, the study rejected the null hypothesis and accepted the alternative hypothesis that corporate governance practices affect a firm’s financial performance. Assuming that the sample taken for this study was representative enough, over 95% of the sample units are likely to accept that board diversity and board communication do not affect financial performance in hotels and manufacturing firms in Lira City. On the other hand, over 95% of the same samples are unlikely to accept that board integrity nor corporate governance practices do not affect financial performance among hotels and manufacturing firms in Lira City.

The study examined the Influence of Corporate Governance on the performance of firms. It was established that Corporate Governance has a significant effect on firm performance though the amount of influence suggested some factors beyond corporate governance. The findings agree with Chinomona (2013), Moenga (2015), and Gupta and Sharma (2014) who revealed a positive effect of Corporate Governance on firms’ financial performance. Normally, corporate boards discuss strategic positioning of the firms to remain competitive businesswise. In effect, the firms’ financial performances improve in terms of increased profits, reduced costs of production and or services, etc. The finds also support the stewardship theory, which suggests that when the principle and the managers in the business choose to act as stewards, they would work towards the principle’s interests. The significant influence of corporate governance on the firm’s financial performance observed Lira City is highly a collaboration of principles and the firm managers. In JKL (Not real name the manufacturing firm), for example, some five members of the employees sit on the board. This kind of team work helps the principles and the managers to align their goals.

Actually, one of the key informants reiterates:

“…this is my second term of representing workers on the board. I have always found it a challenge to bargain for the rights of workers, especially on their rewards. And while it has always been a battle front, my presence has always brought workers’ interests to the attention of the board.

This is credible…as he laughs…” In this excerpt, this study observed that boards that might constitute only members outside the firm are likely to misalign the interests of the principles and the managers, who also constitute the employees.

The study established that board diversity and board communication had no significant influence on the firm’s financial performance of hotels or manufacturing firms in Lira City. The findings seem to support Akinpelu and Ogunbi (2013) who observed that in most businesses, the board does not effectively control the management of the firms, leaving their presence to be in theory. In Lira City, the contention on board diversity rested on board independence of stake holders’ influence. According to one key informant, who was a member on another board:

“…I find my role usurped when I have got to debate board business in the favor of the proprietors even when the circumstances are irrational in business sense…then why did they appoint me on the their board?… ”

This excerpt resonate participants’ views on the independence of the board in its deliberations. Practice shows that board independence is very important in propelling of the business to greater heights and a focus on vision. The non-significant effect of board diversity on the financial performance of firm supports that larger boards tend to be dysfunctional to the business as they plague into the problems of monitoring the firm very well (Wasike, 2012; Harjoto et al., 2014). Among the firms investigated for example, the board of PH (pseudo name) was found with a board composition of 23 members. It was further discovered that it was a family business trailing on family problems. Notwithstanding the interests of different families in the business, the fact remains that the larger the board size the more dysfunctional it’s likely to be since bigger and larger boards bring in a lot of conflict of interest. The findings however disagree with (Ansong, 2015) when he posits that boards that comprise a big proportion of outside members are likely to impact on firm financial performance than their counterparts that have majority of the members coming from within the firm. Ideally, boards with small board size miss out on the experiences and knowledge brought by members from other boards and firms.

The study found a significant influence of board integrity on the firm’s financial performance of hotels and manufacturing firms in Lira City. The findings seem to agree with Leung et al. (2014) who also relates board integrity with board independence. The authors show a positive relationship between board independence and financial performance, especially in family businesses. However, the findings disagree with Liu and Paul (2015) who observes that some board members do not pay enough attention to the governance of the firm, thereby affecting its functionality. This observation agrees with one key informant, a board member of board RS (pseudo name), who posits that

“…apart from coming for their sitting allowance, what else have they contributed to the business? ...and the Director does not seem to see this! They are actually milking the business…” The experience of this board shows a practical negative turn of board members that are least mindful of the core goals of the business. Rather than adding to the firms’ survival, they do more harm to it than good.

CONCLUSION AND PRACTICAL IMPLICATION

In today’s business world, successful businesses will not do without corporate boards. In this study, corporate governance was found to significantly influence the financial performance of hotels and manufacturing firms in Lira City. Firms whose boards demonstrate integrity are likely to register positive changes in their financial performance than firms whose boards do not. This study demonstrates that board integrity promotes independence of the board, which is a key factor in aligning both the principals’ and managers’ goals. Whereas previous studies indicate the importance of board diversity and board communication in firm performance, evidence among hotels and manufacturing firms in Lira City indicates the contrary. As firms struggle to diversify board membership, they are likely to attract men and women with low reputation, leave alone those who might stifle the independence of the board in executing its roles. This study extends the application of the stake holders’ theory to understanding the significance of board integrity on firms’ financial performance. Additionally, the study has generated a testable relationship between corporate governance and firms’ financial performance, which is important for business practice. Therefore, hotel and manufacturing firm owners should be cautious in selecting board members lest they attract many that would increase the firm’s liabilities. Secondly, hotel and manufacturing firm owners should exercise some discipline and leave boards to operate independently. This would allow the board to remain focused on the long-term goals of the firm.

The authors have not declared any conflict of interest.

REFERENCES

|

Abdulmalik SO, Ahmad AC (2016). Corporate Governance and Financial Regulatory Framework in Nigeria: Issues and Challenges. Journal of Advanced Research in Business and management Studies 2:50-63.

|

|

|

|

Abor J, Biekpe N (2007). Corporate governance, Ownership structure and performance of SMEs in Ghana: Implication for financing operations. Corporate Governance 7(3):288-300.

Crossref

|

|

|

|

|

Adiloglu B, Vuran B (2012). The relationship between the financial ratios and transparency levels of financial information disclosures within the scope of corporate governance: Evidence from Turkey. Journal of Applied Business Research 28:543-554.

Crossref

|

|

|

|

|

Afande FO (2015). Adoption of corporate governance practices and financial performance of small and medium enterprises in Kenya. Research Journal of Finance and Accounting 6(5):36-73.

|

|

|

|

|

Akhtar S (2015). Dividend pay-out determinants for Australian multinational and Domestic Corporation. Accounting and Finance 55(1):1-27.

Crossref

|

|

|

|

|

Akinpelu YA, Ogunbi OJ (2013). Corporate Social Responsibility Activities Disclosure by Commercial Banks in Nigeria. European Journal of Business and Management 5(7):173-185.

|

|

|

|

|

Almajali AY, Alamro SA, Al-Soub YZ (2012). Factors affecting the financial performance of Jordanian Insurance Companies Listed at Amman Stock Exchange. Journal of Management Research 4(2):266-289.

Crossref

|

|

|

|

|

Al-Shaer H, Zaman M (2016). Board gender diversity and Sustainability reporting quality. Journal of Contemporary Accounting and Economics 12(3):210-222.

Crossref

|

|

|

|

|

Amoateng AK, Osei KT, Ofori A, Gyabaa EN (2017). Empirical study on the impact of corporate governance practices on performance: Evidence from SMEs in an emerging economy. European Journal of Accounting, Auditing and Finance Research 5(8):50-61.

|

|

|

|

|

Ansong A (2015). Board size, intensity of board activity and financial performance of SMEs: Examining the mediating roles of access to capital and firm reputation. Journal of Entrepreneurship and Business 3(2):26-41.

Crossref

|

|

|

|

|

Arora A, Sharma C (2016). Corporate governance and firm performance in developing countries: Evidence from India. Corporate Governance 16(2):420-436.

Crossref

|

|

|

|

|

Arora A, Bodhanwala S (2018). Relationship between corporate governance index and firm performance: Indian evidence. Global Business Review 19(3):675-689.

Crossref

|

|

|

|

|

Bakar ABSA, Ghazali NABM, Ahmad MB (2019). Sustainability reporting and board diversity in Malaysia. International Journal of Academic Research in Business and Social Sciences 9(3):91-99.

Crossref

|

|

|

|

|

Bartoli A, Blatrix C (2015). Management dans les organizations publiques-4eme edition. Dunod, Paris, France.

|

|

|

|

|

Bates C (2013). Governance in SMEs: Moving beyond red tape.

|

|

|

|

|

Benjamin SJ, Wasiuzzaman S, Mokhtarinia H, Rezaie NN (2016). Family ownership and dividend pay-out in Malaysia. International Journal of Managerial Finance 12(3):314-334.

Crossref

|

|

|

|

|

Berger AN, Imbierowicz B, Rauch C (2016). The roles of corporate governance in banks failures during the recent financial crisis. Journal of Money, Credit and Banking 48(4):729-770.

Crossref

|

|

|

|

|

Bonna AK (2012). The impact of corporate governance on corporate financial performance (Doctoral dissertation, Walden University).

|

|

|

|

|

Botosan CA (2006). Disclosure and the cost of capital: what do we know? Accounting and Business Research 36(sup1):31-40.

Crossref

|

|

|

|

|

Brealey RA, Myers SC, Marcus AJ (2009). Fundamentals of Corporate Finance. 6thed. McGraw-Hill.

|

|

|

|

|

Browne D (2013). Investor protection and corporate governance: Evidence from Worldwide CEO turnover. Journal of Accounting Research 42(2):269-312.

Crossref

|

|

|

|

|

Bryman A (2001). Social Research Method. Oxford University Press.

|

|

|

|

|

Bryman A, Bell E (2015). Business Research Methods. New York, United States of America. Oxford University Press, 4th Ed.

|

|

|

|

|

Cecchetti I, Allegrini V, Monteduro F (2018). The role of boards of directors in transparency and integrity in state-owned enterprises. In Hybridity in the Governance and Delivery of Public Services. Emerald Publishing Limited.

Crossref

|

|

|

|

|

Chinomona R (2013). Dealers legitimate power and relationship quality in Gaunxi distribution channel: A Social rule system theory perspective. International Journal of Marketing Studies 5(1):25-74.

Crossref

|

|

|

|

|

Chittithaworn C, Islam MA, Keawchana T, Yusuf DHM (2011). Factors affecting business success of small and medium enterprises (SMEs) in Thailand. Asian Social Science 7(5):180.

Crossref

|

|

|

|

|

Chrisman JJ (2019). Stewardship theory: Realism, relevance, and family firm governance.

Crossref

|

|

|

|

|

Cooper DR, Schindler PS (2014). Business Research Methods.© The McGraw−Hill Companies. New York.

|

|

|

|

|

Cretu RF (2012). Corporate governance and corporate diversification strategies. Revista de Management Comparat International 13:621-633.

|

|

|

|

|

Dass N, Kini O, Nanda V, Onal B, Wang J (2014). Board expertise: Dodirectors from related industries help bridge the information gap? The Review of Financial Studies 27(5):1533-1592.

Crossref

|

|

|

|

|

Dasuki AI (2016). The effect of capital structure on financial performance. DOKBAT Conference Proceedings pp. 95-104.

Crossref

|

|

|

|

|

Davis JH, Schoorman FD, Donaldson L (1997). Davis, Schoorman, and Donaldson reply: The distinctiveness of agency theory and stewardship theory. Academy of Management. the Academy of Management Review 22(3):611-613.

Crossref

|

|

|

|

|

Dharmadasa P, Gamage P, Herath SK (2014). Corporate governance, Board characteristics and firm performance: Evidence from Sri Lanka.

|

|

|

|

|

Dua P, Dua S (2015). A review article on corporate governance reforms in India. International Journal of Research 2(2):806-835.

|

|

|

|

|

Elshandidy T, Neri L (2015). Corporate governance, risk disclosure practices, and market liquidity: Comparative evidence from the UK and Italy. Corporate Governance: An International Review 23(4):331-356.

Crossref

|

|

|

|

|

Flowers D, Parker H, Arenz J, Gaffley J, Greighton L, Fredricks L (2013). An exploratory study on corporate governance for practices in small and micro fast moving consumer goods enterprises in cape Metropole, Western Cape, South African. African Journal of Business Management 7(22):2119-2125.

|

|

|

|

|

Foo YB, Zain MM (2010). Board independence, board diligence and liquidity in Malaysia. Journal of Contemporary Accounting and Economics 6(2010):92-100.

Crossref

|

|

|

|

|

Gambo EMJ, Bello BA, Rimamshung SA (2018). Effect of board size, board composition and board meetings on financial performance of listed consumer goods in Nigeria. International Business Research 11(6):1-10.

Crossref

|

|

|

|

|

Grundei J (2008). Are managers agents or stewards of their principals?. Journal für Betriebswirtschaft 58(3):141-166.

Crossref

|

|

|

|

|

Gupta P, Sharma AM (2014). A Study of the impact of corporate governance practices on firm performance in Indian and South Korean companies. Procedia-Social and Behavioral Sciences 133:4-11.

Crossref

|

|

|

|

|

Harjoto M, Laksmana I, Lee R (2015). Board diversity and corporate social responsibility. Journal of Business Ethics 132(4):641-660.

Crossref

|

|

|

|

|

Hykaj K (2016). Corporate governance, institutional ownership and their effects on financial performance. European Scientific Journal 12(25):46-69.

Crossref

|

|

|

|

|

Ijeoma N, Ezejiofor AR (2013). An Appraisal of corporate governance issues in enhancing transparency and accountability in small and medium enterprises (SME). International Journal of Academic Research in Business and Social Sciences 3(8):162-176.

Crossref

|

|

|

|

|

Imade OG (2019). Board gender diversity, non-executive director's composition and corporate performance: evidence from listed firms in Nigeria. African Journal of Business Management 13(9):283-290.

Crossref

|

|

|

|

|

Jizi MI, Salama A, Dixion R, Stratling R (2014). Corporate governance and Corporate Social responsibility disclosure: Evidence from the US banking Sector. Journal of Business Ethics 125(4):601-615.

Crossref

|

|

|

|

|

Kakabadse NK, Yang H, Sanders R (2010). The effectiveness of non-executive directors in Chinese state owned enterprises. Management Decision 48(7):1063-1079.

Crossref

|

|

|

|

|

Kenga ST, Nzulwa J (2018). The role of corporate governance practices on firm performance of medium sized firms. The Strategic Journal of Business and Change Management 5(2):639-661.

|

|

|

|

|

Krejcie RV, Morgan DW (1970). Determining sample size for research activities. Educational and Psychological Measurement 30(3):607-610.

Crossref

|

|

|

|

|

Lama TB (2012). Empirical evidence on the link between compliance with governance of best practice and firms' operating results. Australasian Accounting Business and Finance Journal 6(5):63-80.

|

|

|

|

|

Lebas M, Euske K (2002). A conceptual and operational delineation of performance. Business performance measurement: Theory and practice pp. 65-79.

Crossref

|

|

|

|

|

Leung S, Richardson G, Jaggi B (2014). Corporate board and board committee independence, firm performance and family ownership concentration: An analysis based on Hong Kong firms. Journal of Contemporary Accounting and Economics 10:16-31.

Crossref

|

|

|

|

|

Levy B (2015). Obstacles to Developing Indigenous Small and Medium Enterprises: An Empirical Assessment. The World Economic Review 7(1):65-83.

Crossref

|

|

|

|

|

Liu C, Paul DL (2015). A new perspective on directors busyness. Journal of Financial Research 38(2):193-218.

Crossref

|

|

|

|

|

Liu Y, Wei Z, Xie F (2014). Do women directors improve firm performance in China? Journal of Corporate Finance 28:169-184.

Crossref

|

|

|

|

|

Lopez-Iturriaga FJ, Morros I (2014). Boards of directors and firm performance: The effect of multiple directorships. Spanish Journal of Finance and Accounting 43:177-192

Crossref

|

|

|

|

|

Madison KJ (2014). Agency theory and stewardship theory integrated, expanded, and bounded by context: an empirical investigation of structure, behavior, and performance within family firms.

|

|

|

|

|

Mahmood R, Hanafi N (2013). Entrepreneurial Orientation and Business performance of Women Owned Small and Medium Enterprises in Malaysia: Competitive Advantage as a Mediator. International Journal of Business and Social Science 4(1):82-90.

|

|

|

|

|

Mallin CA (2016). Corporate governance (5thed.) Oxford, England: Oxford University Press.

|

|

|

|

|

Martey E, Annin K, Attoah C, Wiredu AN, Etwire PM, Al-Hassan RM (2013). Performance and Constraints of Small Scale Enterprises in the Accra Metropolitan Area of Ghana. European Journal of Business Management 5(4):83-93.

|

|

|

|

|

Masood F, Zaleha A, Norman MS (2013). The effect of corporate governance and divergence between cash flow and control on firm performance: Evidence from Malaysia. International Journal of Disclosure and Governance 11(4):326-340.

Crossref

|

|

|

|

|

Matar A, Eneizen BM (2018). Determinants of financial performance in industrial firms: Evidence from Jordan (D.O. Philippos I. Karipidis, Ed.) Asian Journal of Agricultural Extension, Economics and Sociology 22(1):1-10.

Crossref

|

|

|

|

|

Mbu-Ogar GB, Effiong SA, Abang JO (2017). Corporate Governance and Organizational Performance: Evidence from the Nigerian Manufacturing Industry. IOSR Journal of Business and Management (IOSR-JBM) 19(6):46-51.

|

|

|

|

|

Michael B, Goo SH (2015). Corporate governance and its reform in Hong Kong: a study in comparative corporate governance. Corporate Governance 15(4):444-475.

Crossref

|

|

|

|

|

Mirkovic R (2015). Governance for all including SMEs.

|

|

|

|

|

Moenga GO (2015). The effect of corporate governance on the financial performance of micro finance institutions in Kenya (Doctoral dissertation, University of Nairobi).

|

|

|

|

|

Mostafa KH, Saadi SH (2013). Corporate governance, economic turbulence and financial performance of UAE listed firms. Studies in Economics and Finance 30(2):118-138.

Crossref

|

|

|

|

|

Mugenda OM, Mugenda AG (1999). Research methods: Quantitative and qualitative approaches. Acts press.

|

|

|

|

|

Ntim CG, Soobaraoyen T, Broad MJ (2017). Governance Structures, Voluntary disclosures and public accountability: The case of UK higher education institutions. Accounting, Auditing and Accountability Journal 30(1):65-118.

Crossref

|

|

|

|

|

Nwaiwu JN, Joseph B (2018). Core corporate governance structure and financial performance of manufacturing companies in Nigeria. International Journal of innovative Development and Policy Studies 6(2):35-49.

|

|

|

|

|

Nwidobie BM (2016). Corporate governance practices and dividend policies of quoted firms in Nigeria. International Journal of Asian Social Sciences 6(3):212-223.

Crossref

|

|

|

|

|

OECD (2017). Corporate governance and business integrity in Kazakhstan. OECD publishing.

|

|

|

|

|

Okpara GC (2016). Banking Sector performance and corporate governance in Nigeria. International Journal of Economics, Finance and Management Science 4(2):39-45.

|

|

|

|

|

Olajide OS, Funmi SR, Kehinde OA (2020). Corporate Governance Relationship: Empirical Evidence from African Countries. A Principal Components Analysis. European Journal of Business and Management 12(17):64-74.

|

|

|

|

|

Omondi MM, Muturi W (2013). Factors affecting the financial performance of listed companies at the Nairobi securities exchange in Kenya. Research Journal of Finance and Accounting 4(15):99-105.

|

|

|

|

|

Ongore VO, Kusa GB (2013). Determinants of financial performance of commercial banks in Kenya. International Journal of Economics and Financial Issues 3:237-252.

|

|

|

|

|

Palaniappan G, Rao S (2015). Relationship between corporate governance practices and firm performance of Indian context. International Research Journal of Engineering and Technology 3(3):1-5.

|

|

|

|

|

Panditharathna K, Kawshala H (2017). The Relationship between Corporate Governance and Firm Performance. Management and

|

|

|

|

|

Administrative Sciences Review 6(2):73-84.

|

|

|

|

|

Patibandla M (2006). Equity pattern, corporate governance and performance: A study of India's corporate sector. Journal of Economic Behavior and Organization 59(1):29-44.

Crossref

|

|

|

|

|

Prasanna PK (2013). Impact of Corporate governance regulations on Indian stock market volatility and efficiency. International Journal of Disclosure and Governance 10(1):1-12.

Crossref

|

|

|

|

|

Rambo CM (2013). Influence of the capital markets authority's corporate governance guidelines on financial performance of commercial banks in Kenya. The International Journal of Business and Finance Research 7(3):77-92.

|

|

|

|

|

Rao K, Tilit C (2016). Board composition and corporate social responsibility: The role of diversity, gender, strategy and decision making. Journal of Business Ethics 138(2):327-347.

Crossref

|

|

|

|

|

Rosenberg R (2009). Measuring Results of Microfinance Institutions, Minimum investors that donors and investors should Track. A technical Guide. Consultative Group to Assist the Poor (CGAP)/ The World Bank.

|

|

|

|

|

Saibaba MD, Ansari VA (2012). Impact of board size: an empirical study of companies listed in BSE 100 Index. Indian Journal of Corporate Governance 5(2):108-119.

Crossref

|

|

|

|

|

Samina R, Ayub M (2013). The impact of bank specific and macroeconomic indicators on the profitability of commercial banks. The Romanian Economic Journal 16:22-36.

|

|

|

|

|

Samuel C, Kit FSY, Srinidhi B (2019). The value of boardroom communication: Ethics directors' out-of-board community affiliation with other board members and the quality of accruals (Paper presentation). AFAANZ 2019 conference, Brisbane, Australia. pp. 1-62.

|

|

|

|

|

Sarantakos S (2012). Social research. Macmillan International Higher Education.

|

|

|

|

|

Saseela B (2018). Corporate Governance and firm Performance: Empirical Evidence from Emerging Market. Asian Economic and Financial Review 8(12):1415-1421.

Crossref

|

|

|

|

|

Schillemans T, Bjurstrøm KH (2020). Trust and verification: Balancing agency and stewardship theory in the governance of agencies. International Public Management Journal 23(5):650-676.

Crossref

|

|

|

|

|

Sharma PK (2015). Codes and Standards of Corporate Governance. In Corporate Governance Practices in India. Palgrave Macmillan, London, pp. 28-42.

Crossref

|

|

|

|

|

Shivani MV, Jain PK, Yadav SS (2017). Governance structure and Accounting returns: Study of NFTY500 corporate. Business Analyst 37(2):179-194.

|

|

|

|

|

Subramaniam V, Wasiuzzaman S (2018). Corporate diversification and dividend policy: Empirical evidence from Malaysia. Journal of Management and Governance 23:735-758.

Crossref

|

|

|

|

|

Subramanian S (2018). Stewardship theory of corporate governance and value system: The case of a family-owned business group in India. Indian Journal of Corporate Governance 11(1):88-102.

Crossref

|

|

|

|

|

Uwalomwa U, Olamide O, Francis I (2015). The effects of corporate governance mechanisms on firms dividend payout policy in Nigeria. Journal of Accounting and Auditing 2015:1-11.

Crossref

|

|

|

|

|

Wanyama S, Burton B, Helliar C (2013). Stakeholders, accountability and the theory?practice gap in developing nations' corporate governance systems: Evidence from Uganda. Corporate Governance 13(1):18-38.

Crossref

|

|

|

|

|

Wasike JT (2012). Corporate governance practices and performance at Elimu Sacco in Kenya (Doctoral dissertation, University of Nairobi).

|

|

|

|

|

Willan CL, Couchman PK, Sohal A, Zutshi A (2016). Exploring differences between smaller and larger organizations corporate governance of information technology. International Journal of Accounting Information System 22:6-25.

Crossref

|

|

|

|

|

World Bank (2015). Doing Business 2015. Going Beyond efficiency. World Bank Group.

|

|

|

|

|

Yang IH, Yan LIY, Yang H (2012). Disclosure and cost of equity capital: An analysis at the market level. 1-54. Research Collection School of Accountancy.

|

|

|

|

|

Zhang L (2012). Board demographic diversity, independence and corporate social performance. Corporate Governance 12(5):689-700.

Crossref

|

|

|

|

|

Zhuang Y, Chang X, Lee Y (2018). Board composition and corporate social responsibility performance: Evidence from Chinese public firms. Sustainability (Switzerland) 10(8):1-12.

Crossref

|

|

|

|

|

Zyad M (2014). The effect of corporate governance on firm performance in Jordan (Doctoral dissertation, University of Central Lancashire).

|

|