ABSTRACT

Using the data of A-share listed companies in Shanghai and Shenzhen stock exchanges from 2008 to 2017, this paper empirically tests the moderating role of ownership structure between financing constraints and inefficient investment. The study found that rational use of the moderating effect of ownership structure is of great significance to improve the investment efficiency of enterprises. When there are financing constraints, managerial ownership is more sensitive to the improvement of inefficient investment. The concentration of equity strengthens the sensitivity of insufficient investment caused by financing constraints, intensifies the degree of insufficient investment of enterprises, and the state-owned holding enterprises are more affected. On this basis, the paper puts forward relevant policy suggestions to improve the inefficient investment of enterprises.

Key words: Financing constraints, inefficient investment, ownership structure, adjustment effect.

As the driving force for the growth and development of enterprises and the source of future cash flow growth, investment is one of the important decisions faced by all enterprises. Under the condition of perfect market, enterprises are easy to realize the optimal investment. However, due to the existence of asymmetric information and principal-agent problems there will be financing constraints and inefficient investment problems in the business process. At present, most studies on the relationship between financing constraints and investment efficiency conclude that financing constraints have a "double-edged sword" effect, which can not only slow down over investment, but also aggravate under investment. So, are there other factors that play a moderating role between financing constraints and investment efficiency? Based on this, this paper uses the data of A-share listed companies in Shanghai and Shenzhen stock exchanges to empirically test the moderating effect of ownership structure on financing constraints and inefficient investment.

RELATED LITERATURE AND CONTRIBUTIONS

Information asymmetry will lead to financing constraints, and financing constraints will have an impact on investment efficiency (Brown et al., 2009). Most studies show that financing constraints can slow down over investment and promote investment efficiency, but at the same time, it will also aggravate the lack of investment and bring about inefficient investment. Enterprises with different property rights make use of their financing advantages and have different effects on investment efficiency. Private enterprises make use of their financing advantages to alleviate the lack of investment, while state-owned enterprises are more likely to make use of their financing advantages for over investment (Liu et al., 2014). Moreover, the introduction of local government industrial policies will also aggravate the degree of financing constraints of Listed Companies in the jurisdiction and reduce the investment efficiency of enterprises (Xinmin et al., 2017).

Ownership structure is the cornerstone of corporate governance, which not only determines the organizational form of the enterprise, but also affects the investment efficiency of the enterprise through a certain mechanism. The concentration of ownership produces the supervision function of managers, reduces the agency cost and improves the efficiency of investment decision-making. However, the absolute ownership concentration of "one share dominating" is more likely to breed the behavior of large shareholders infringing on the interests of small and medium shareholders and external investors, resulting in inefficient investment. Jianhui and Yunyun (2010) found that the increase of the shareholding ratio of the largest shareholder and institutional investors improved the investment efficiency, while the increase of the shareholding ratio of the top five shareholders reduced the investment efficiency (Yang and Zhang, 2017). Equity balance has a positive moderating effect on the relationship between separation of ownership and over investment, and a negative moderating effect on the relationship between pyramid level and under investment (Liang et al., 2021).

Ownership structure affects the efficiency of investment. The problem of over investment is serious in companies that lack equity checks and balances and companies that have inconsistent direct control and actual control rights. Executive shareholding is conducive to reducing over investment (Zhong, 2011). For growing enterprises, managerial ownership and ownership structure significantly aggravate the problem of over investment; for mature enterprises, managerial ownership will aggravate the problem of under investment (Xie and Wang, 2017). The introduction of non-state-owned shareholders in state-owned enterprises can strengthen the supervision of state-owned enterprises and improve the inefficient investment behavior of state-owned enterprises. In the appointment of senior members, non-state-owned shareholders can significantly inhibit the inefficient investment of state-owned enterprises (Sun et al., 2019). Research by Liu (2020) shows that debt financing can restrain the inefficient investment behavior of private enterprises, while the restraining effect on state-owned enterprises is relatively weak, which is more prone to inefficient investment (Liu, 2020).

Through literature review, it is not difficult to find that the existing studies generally use the intermediary variable of financing constraints to test the direct effect of financing constraints on the investment efficiency of enterprises, and on the basis of further subdivision of the nature of property rights, explore the investment efficiency of state-owned and non-state-owned enterprises with financing constraints. Are there other factors that play a moderating role between financing constraints and investment efficiency? Existing studies have shown that different equity structure arrangements will produce different investment efficiency (Yu et al., 2020). Following this research idea, this paper further explores the regulatory role of equity structure on financing constraints and inefficient investment, and provides theoretical basis and practical path for enterprises to improve investment efficiency.

THEORETICAL ANALYSIS AND HYPOTHESES

Under the perfect market conditions, enterprises will always get the investment funds through certain financing channels, that is, there are no financing constraints. In this case, there will be no problem of maximizing the return of investment according to the principal-agent efficiency. However, due to the existence of principal-agent relationship, on the one hand, in order to realize their own interests or avoid risks, managers may give up projects with positive net present value, resulting in underinvestment; on the other hand, managers prefer the construction of personal Empire, and may invest in projects with negative net present value, resulting in over investment. Information asymmetry will lead to financing constraints, increase the difficulty of obtaining funds, and further aggravate inefficient investment. Due to the special institutional background of state-owned holding enterprises, compared with non-state-owned holding enterprises, they have wider financing channels and easier access to investment funds, so they are less affected by financing constraints. Based on the above theories, the study proposes the following hypotheses.

Hypothesis 1

Financing constraints not only aggravate the underinvestment of enterprises, but also alleviate the over investment behavior. Compared with the state-owned holding enterprises, the investment efficiency of non-state-owned holding enterprises is more sensitive to the impact of financing constraints. Management shareholding can reduce agency costs, promote the convergence of management's own interests and shareholders' interests, and then reduce the risk of investment decision-making and financing costs. The higher the proportion of shares held by the management, the more efforts they make in investment decision-making, the higher the scientific level of decision-making and the stronger the ability to avoid risks. Through the positive signals to external investors, it helps to reduce investors' assessment of enterprise risk and uncertainty, reduce the financing constraints faced by enterprises (Gang, 2016), and improve investment efficiency. As the state-owned shares are "dominated by one share", the managers of enterprises are appointed by the competent government departments to manage the business activities of the enterprises on their behalf. Appropriately increasing the proportion of shares can encourage the management to make efforts to improve the investment efficiency. Based on the above analysis, we propose the following hypotheses.

Hypothesis 2

When there are financing constraints, managerial ownership will improve investment efficiency and reduce over investment and under investment. Compared with non-state-owned holding enterprises, state-owned holding enterprises have more influence on inefficient investment. The relatively centralized ownership structure can effectively restrict the management power of the enterprise. With the increase of ownership concentration, the possibility of large shareholders cashing out by selling shares becomes smaller. For the sake of long-term private benefits, the major shareholders will have to supervise the managers more rationally to improve the investment efficiency. Due to the natural financing advantages of state-owned holding enterprises and the "dominance of one share" of state-owned shares, it is not feasible to restrain inefficient investment by increasing the ownership concentration. Based on the above analysis, we propose the following hypotheses.

Hypothesis 3

When there are financing constraints, equity concentration has a certain role in promoting investment efficiency. With the increase of ownership concentration, compared with non-state-owned holding enterprises, state-owned holding enterprises aggravate the degree of insufficient investment.

Variable description

Explained variable

Inefficient investment refers to the behavior that the enterprise's actual investment expenditure is inconsistent with the optimal investment level, mainly in the form of over investment and under investment. That is, when the enterprise has sufficient resources, the managers will invest the company's resources in the projects with negative NPV or abandon the projects with positive NPV. In this paper, we use Richardson residual model to measure the inefficient investment variables, judge the situation of over investment and under investment according to the residual term of the model, and use | ε | to express the degree of over investment and under investment.

Explanatory variables and moderating variables

Relevant studies show that there is a decreasing relationship between the external financing cost and the interest coverage ratio. The higher the interest protection ratio is, the stronger the enterprise's profitability and payment ability are, and the more guaranteed the creditor's repayment of principal and interest is. From the perspective of capital security, investors are more willing to choose such enterprises, so they are subject to lower financing constraints. This paper selects the interest cover ratio as an alternative variable to measure the external financing constraints of enterprises. In order to verify the effect of financing constraints on the ownership structure in the process of non-efficiency, this paper introduces the adjustment variables of ownership structure, and uses the management shareholding ratio and Herfindahl index as the proxy variables of ownership structure.

Control variables

There are many factors that affect the inefficient investment of enterprises. Based on previous studies (Yu et al., 2017), this paper selects asset liability ratio, return on net assets, growth opportunities and enterprise size as control variables. Year and industry are controlled by dummy variables. The symbols and definitions of variables are shown in Table 1.

In order to test hypotheses 1, 2 and 3, we establish a basic model(1) to study the relationship between financing constraints and inefficient investment. On this basis, the cross multiplication terms of financing constraints with management shareholding and ownership concentration are added to investigate the moderating effect of the above factors on financing constraints and inefficient investment, so that, model(2) and (3) are established.

Data source description

This paper selects A-share listed companies in Shanghai and Shenzhen stock exchanges from 2008 to 2017 as the original samples, and processes the original samples as follows: (1) remove the financial sector enterprises and ST enterprises in the sample period; (2) delete the samples with missing data; (3) winsorize the samples by 1% to reduce the impact of outliers on the regression results. After screening, a total of 6357 valid observations were obtained, and all the data were from the wind database.

Descriptive statistics

Table 2 shows the statistics of the main variables. In the sample period, there are 2225 enterprises with over investment, 4132 enterprises with under investment, and more than 64% of the enterprises have under investment. Compared with the sample of underinvested enterprises, the phenomenon of over investment is more obvious in over invested enterprises. The average value of financing constraints is 2096.77, and the standard deviation is as high as 6740.70, which indicates that financing constraints are widespread, and there are great differences among different sample enterprises, which is suitable for the analysis of the impact of financing constraints on inefficient investment. Other variables are basically consistent with the operation of normal health companies.

ANALYSIS OF EMPIRICAL RESULTS

In order to eliminate the influence of multicollinearity among variables on the estimation results, before regression analysis, the correlation coefficient test of variables is carried out, and it is found that the correlation between variables is small. In addition, we also use the variance expansion factor method to diagnose the collinearity of independent variables. The test results show that the tolerance of each variable is greater than 0.25, and the variance expansion factor VIF is less than 4. The collinearity problem between variables is not serious, which is suitable for regression analysis model.

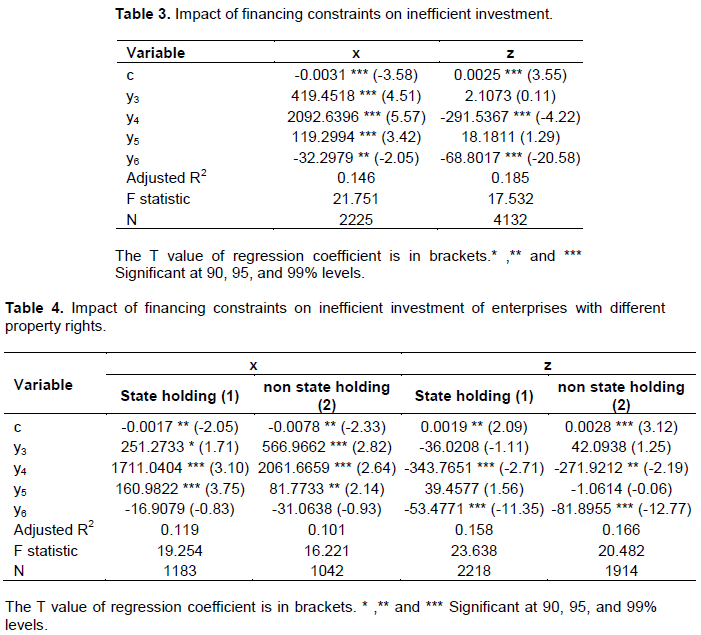

The impact of financing constraints on inefficient investment

Use model (1) to investigate the impact of financing constraints on inefficient investment. The regression results are shown in Table 3. From the regression results, both over investment and under investment samples passed the significance test. At the level of 1%, the coefficient of financing constraint(c) has a significant negative effect on x and a significant positive effect on z, which indicates that financing constraint has a significant inhibitory effect on alleviating over investment, and at the same time, it also intensifies the underinvestment behavior of enterprises, which is consistent with the inference of Hypothesis 1. State owned holding enterprises have always played a special role in China's economic activities, which are different from non-state-owned holding enterprises in terms of resource acquisition, policy support and financing constraints. On the basis of Table 3, according to the nature of property rights, the samples of over investment and under investment are further divided into two categories and four groups for regression. From the results of Table 4, no matter x or z, the sensitivity of non-state-owned holding enterprises to financing constraints is much higher than that of state-owned holding enterprises, which indicates that the financing channels of non-state-owned holding enterprises are single and the security is not strong, and their investment behavior is more strongly affected by financing constraints (consistent with the inference of Hypothesis1). There is a significant positive correlation between asset liability ratio y3 and x, but no significant impact on z. the reason may be that enterprises raise capital holdings through a large amount of debt, which is more prone to over investment. Compared with state- owned holding enterprises, the phenomenon of over investment in non-state-owned holding enterprises is more significant. Under the level of 1%, the return on equity y4 has a significant positive effect on x and a significant negative effect on z. higher return on investment makes the enterprise obtain higher return on capital, and it is easier to stimulate the excessive investment behavior of enterprise managers. Whether state-owned or non-state-owned enterprises, growth opportunity, y5, is significantly positively correlated with x, while enterprise size y6 is significantly negatively correlated with z. With the continuous growth of enterprises, there are more and more over investment, but the expansion of enterprise scale is conducive to the standardization of investment management, making investment decisions more effective.

Moderating effect of ownership structure on financing constraints and inefficient investment

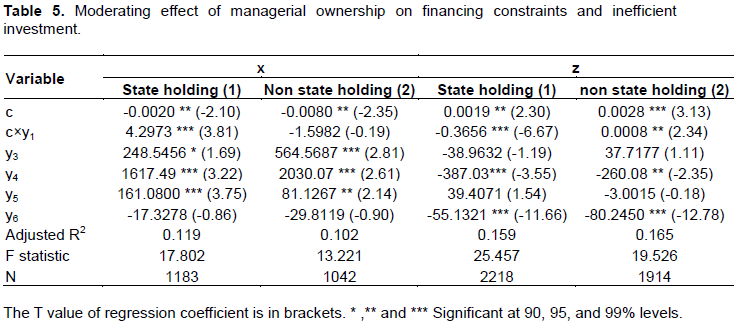

Moderating role of managerial ownership

In order to test the moderating effect of ownership structure between financing constraints and inefficient investment, we add the cross product term of financing constraints and management Shareholding on the basis of model (1). According to the regression results in Table 5, the moderating effect of managerial ownership on financing constraints and inefficient investment is quite different between state-owned and non-state-owned enterprises. For the sample of state-owned holding enterprises, the financing constraints c and x are significantly negative at the 5% level, while the interaction coefficient (c×y1) is positive and highly significant at the 1% level. This shows that when there are financing constraints, the management shareholding strengthens the sensitivity of financing constraints to restrain over investment, and promotes the state-owned holding enterprises to further reduce over investment. In the sample of non-state-owned enterprises, the moderating effect of managerial ownership is not significant. On the contrary, for the sample of non-state-owned holding enterprises, the financing constraint c is significantly positive at the level of 1%, the coefficients of z and c×y1 are also significantly positive at the level of 5%, which indicates that the management shareholding of non-state-owned holding enterprises strengthens the sensitivity of financing constraint leading to under-investment and aggravates the underinvestment of non-state-owned holding enterprises. The reason is that management shareholding can reduce agency costs, promote the convergence of private benefits of management and shareholders' interests, and reduce inefficient investment. However, in the face of severe external financing constraints and personal performance appraisal, the management of non-state-owned holding enterprises may reduce investment expenditure, aggravating the degree of underinvestment. However, the managers of state-owned holding enterprises are mainly appointed by government departments, and almost do not hold the shares of the enterprises. Increasing their shareholding ratio can encourage the managers to improve the investment efficiency and slow down the degree of over investment and under investment. So far, the inference of Hypothesis 2 has been verified.

Moderating effect of ownership concentration

We use model (3) to examine the moderating effect of equity concentration on financing constraints and inefficient investment. From the regression results in Table 6, the ownership concentration only shows a significant positive correlation in the case of z, and does not have a moderating effect on x, which is not completely consistent with Hypothesis 3. Although the relative concentration of equity can have a supervisory and restrictive effect on managers, the excessive concentration of equity will also lead to the interest encroachment of major shareholders. When the capital is short and the investment is insufficient, as the direct stakeholders of the enterprise, the large shareholders will not significantly reduce the over investment to improve the investment efficiency, but further reduce the investment scale and aggravate the degree of underinvestment.

On the basis of further dividing the samples of state-owned and non-state-owned enterprises, we find that the moderating effect of equity concentration on financing constraints and inefficient investment has not changed (Table 7). Whether state-owned or non-state-owned enterprises, ownership concentration have no moderating effect on x, but have a significant positive moderating effect on z. In the case of underinvestment, the cross product coefficient (c×y2) is significantly positive at the level of 1%. This shows that when there are financing constraints, the concentration of equity strengthens the sensitivity of insufficient investment caused by financing constraints, and intensifies the degree of insufficient investment. Compared with non-state-owned holding enterprises, state-owned holding enterprises are more affected. So far, the inference of Hypothesis 3 has been partially verified.

Robustness checks

In order to enhance the reliability of research conclusions and avoid the impact of single index measurement, in this paper, KZ index method was used to reconstruct the financing constraint variables. The regression equation is established by using the net cash flow, Tobin Q value, asset liability ratio, cash holdings and dividend payment rate of sample enterprises, and the calculated financing constraint variables are substituted into the original model(1)(2)(3) for robustness test. The above research conclusions remain unchanged.

DISCUSSION AND CONCLUSION

Based on the data of A-share listed companies in Shanghai and Shenzhen stock exchanges from 2008 to 2017, this paper empirically tests the moderating role of ownership structure between financing constraints and inefficient investment. The results show that: financing constraints have a "double-edged sword" effect, which can not only restrain the over investment behavior of enterprises, but also bring about the underinvestment of enterprises. Moreover, financing constraints are more sensitive to the impact of inefficient investment of non-state-owned holding enterprises; when there are financing constraints, managerial ownership is more sensitive to the improvement of inefficient investment. On the contrary, the concentration of equity strengthens the sensitivity of insufficient investment caused by financing constraints, and intensifies the degree of insufficient investment. Compared with non-state-owned holding enterprises, state-owned holding enterprises are more affected.

The Enlightenment of this study is that it is of great significance to improve the investment efficiency of enterprises to make rational use of the regulatory role of ownership structure. No matter what kind of property rights enterprises, moderate decentralization of equity is beneficial to reduce inefficient investment behavior and improve the efficiency and effect of enterprise investment decision-making. For the state-owned holding enterprises, we should encourage the implementation of equity incentive plan and increase the proportion of shares held by the management, so as to stimulate the managers to strive to improve the efficiency of enterprise investment. For non-state-owned holding enterprises, it is more conducive to reduce inefficient investment behavior to appropriately reduce the proportion of management shareholding.

The author has not declared any conflict of interest.

The author is grateful for the supports given by the National Natural Science Foundation of China (NO.71362017), Soft Science Research Funding Project of Hubei Technological Innovation Project (NO.2016ADC033), Research Center for Mining and Metallurgy Culture and Socio-economic Development in the Middle Reaches of Yangtze River Foundation (NO. 2014kyb06).

REFERENCES

|

Brown JR, Fazzari SM, Petersen BC (2009). Financing innovation and growth: Cash flow, external equity, and the 1990s R&D boom. The Journal of Finance 64(1):151-185.

Crossref

|

|

|

|

Gang WE (2016). Managerial Ownership, R&D Investment and Cost of Equity Capital. Available at:

View

|

|

|

|

|

Jianhui J, Yunyun L (2010). Ownership structure and investment efficiency. In 2010 International Conference on Future Information Technology and Management Engineering 2:88-91.

|

|

|

|

|

Liang S, Qi X, Xin F, Zhan J (2021). Pyramidal ownership structure and firms' audit fees. Emerging Markets Finance and Trade 57(9):2447-2477.

Crossref

|

|

|

|

|

Liu R (2020). An empirical test of the relationship between the nature of equity, inefficient investment and debt financing constraint behavior: Statistics and Decision 36(1):154-157.

|

|

|

|

|

Liu X, Liu L, Dou W (2014). Financing constraints, agency conflict and inefficient investment behavior of Chinese Listed Companies. Journal of Management Engineering 28(3):64-73.

|

|

|

|

|

Sun S, Qian PS, Jiang W (2019). Research on the Impact of Non-state Shareholders on Inefficient Investment of State-owned Enterprises.-Empirical Data of State-owned Listed Enterprises. East China Economic Management 33(11):134-141.

|

|

|

|

|

Xie P, Wang C (2017). Managerial Power, Corporation Life Cycle and Investment Efficiency: Empirical Research Based on Chinese Manufacturing Listed Companies. Nan Kai Business Review 20(1):57-66.

|

|

|

|

|

Xinmin Z, Zhang T, Chen D (2017). Industrial Policy, Financial Constraints and Investment Efficiency. Accounting Research (4):12-18.

|

|

|

|

|

Yang J, Zhang Y (2017). Financial Development, Ownership Structure and Investment Efficiency. Corporate Governance Theory and Application Research (Chinese): Available at:

View

|

|

|

|

|

Yu X, Jiang B, Li Y (2017). The relationship between cash dividend, free cash flow and investment efficiency: an analysis based on the sample data of China's A-share Manufacturing Listed Companies. Contemporary Economic Research 1:80-88.

|

|

|

|

|

Yu X, Wang Y, Wang S (2020). The relationship between financing constraints and inefficient investment: Based on the moderating effect of ownership structure. Contemporary Economic Research 5:5-11.

|

|

|

|

|

Zhong Y (2011). Investment efficiency and ownership structure: Based on the perspective of equity refinancing of listed companies (In Chinese). Industrial Technology Economy 10:143-149. Available at:

View

|

|