The new form of local government organization should be competent and effective in order to provide 21st century services equivalent to the citizens of every country. Its new developmental role can be fulfilled by implementing management techniques that will be conducive to local development. The use of accounting ratios from financial statements is necessary to municipalities as well as to every accounting body to depict the dynamic and static condition of each entity. The aim of the study is to propose a new modeling of an Analytic Hierarchy Process (ΑHP) assessment system for municipalities in Greece based on their public accounting data in the era of austerity, due to the recent Greek economic crisis. Several revenues ratios were analyzed, which were obtained by public accounting data, of a small sample of Greek municipalities with similar population for the years 2011-2015, which is during the period of economic crisis and after the implementation of the “Kallikratis” program in Greece. The analysis of accounting ratios shows useful findings on the efficiency of each one of the examined municipalities. The created assessment model could be applied as a guide in the analysis of financial statements with ratios of all the municipalities in Greece or elsewhere. It could be further used as an evaluation tool by the policy makers and managers in the central state authorities or the municipalities system.

The institution of local government administration in Greece dates back to 1833 according to the law of “Founding of Municipalities” and constitutes fundamental institution for the quality of democracy. Municipalities in Greece have administrative and financial independence. The state ensures the necessary resources in order for municipalities to accomplish their mission while the control exercised on them on behalf of the state is solely restricted to controlling the legitimacy of their actions.

The New Public Management (NPM) reinforced mergers of municipalities worldwide (Reingewertz, 2012; Saarimaa and Tukiainen, 2015; Blesse and Baskaran, 2016; Hirota and Yunoue, 2017). Consequently, in 2010, an important administrative reform occurred in Greece through the “Kallikratis” program (Greek Law 3852/2010). The existing municipalities were united in larger ones so as to achieve improvement of public administration in the local government administration level. From the pre-existing 910 municipalities and 124 communities, 325 new municipalities emerged from this new structure in primary local government administration.

However, the reform took place in a difficult time for Greece due to the economic crisis. In 2010, the Greek economy was in a state of budgetary unbalance, which resulted in voting austerity measures and cuts. All these have an immediate impact on local government administration too since municipalities have to fulfil their new responsibilities with reduced finance from the central government. Therefore, municipalities should apply effective financial accounting techniques and mostly to enforce collection of local public revenue. Analytic Hierarchy Process (ΑHP) (Saaty, 1980) can be proven a powerful tool towards this direction.

The Analytic Hierarchy Process (AHP) is a multiple criteria decision-making method that is used to derive ratio scales from both discrete and continuous paired comparisons (Saaty, 1987). Since its development, it has been used in numerous applications ranging from suppliers selection (Rajesha and Malliga, 2013) and customer satisfaction (Li et al., 2014) to project evaluation (Vidal et al., 2011) and financial performance evaluation (Shaverdia et al., 2014). Yet, the implementation of the AHP for comparison of municipalities based on financial ratios derived from public accounting data has not been reported.

Taking everything into consideration, the present work concentrates on the study of a model of an AHP assessment system for municipalities in Greece during the period of the economic crisis based on their public accounting data. Several revenues ratios are analyzed from a small sample of Greek municipalities with similar population using public accounting data financial statements for the years 2011-2015, in the era of the economic crisis and after implementation of the “Kallikratis” program in Greece. More analytically, the study examines revenue ratios after the study of the financial statements of three neighbouring municipalities: Sintiki, Herakleia and Visaltia of the prefecture of Serres, which all have almost the same population for the years 2011-2015. The analysis of accounting ratios shows useful findings on the efficiency of each examined municipality and the created AHP model could be applied as a guide in the analysis of financial statements with ratios of all the municipalities in Greece. It can also constitute the base of a wider assessment mechanism able to provide authorities with a rating tool for rewarding excellence in financial performance of municipalities. This evaluation tool could be used in Greece or elsewhere from the policy makers and managers in the central state authorities or the municipalities system worldwide.

The structure of this paper is as follows: the next Section presents a bibliographical overview on municipality financial management and accounting issues, the following analyses the examined ratios that will be used for data analysis, the sample of municipalities and the selected methodology. Subsequently, there will be analysis of accounting data with an AHP comparative analysis of the examined municipalities. Finally, the last section refers to the final conclusions of the study.

The analysis of financial statements using indicators to interpret the performance of different municipalities worldwide is one of the most widespread methods (Brusca-Alijarde, 1997; Christiaens, 1999; Cohen, 2008; Godard, 2010). Below is a brief reference to different studies which have been conducted in relation to Local Government Organizations (LGO) in Greece.

According to Cohen (2008), the double-entry system has been introduced in many organizations of the Greek public sector since 1998 following in the footsteps of many countries in Europe and around the world. The study examined the financial statements (balance-sheets etc.) of 277 municipalities and they were published during the period, 2002-2004 while five macroeconomic factors, such as municipality population, real estate value, Gross National Product, touristic growth and the fact of the municipality being the capital of prefecture or not, were used to assess the extent of their impact on nine ratios derived from the financial statements. The results showed that financial performance through ratios was influenced by macroeconomic factors.

The budgets of 15 municipalities in the region of Ahaia for the period of 2005-2007 were examined in the study of Bellas et al. (2010). The study analyzes the following ratios: (a) the total certified income as compared to the total budgeted income, (b) the total collected income as compared to the total budgeted income and (c) the total ordered expenses as compared to the budgeted expenses. It was concluded that there is a possibility for improvement both in the increase in income collectability and the decrease of expenses (which have increased by 10 to 15% over the last years).

Kontogeorga et al. (2013) examined the financial statements (balance-sheets etc.) of 16 LGO (municipalities) with more than 5.000 residents in the prefecture of Ahaia which, according to the Presidential Decree 315/1999, are obliged to use the general financial accounting system. The data concerns the financial years, 2005-2007 and the study was conducted with the use of ratios in the first published financial states of the municipalities of Ahaia (that is, after the introduction of general accounting to LGO in Greece) and specifically the figure indicators of Return on Equity (ROE) and gross profit margin. From this study as well, it is evident that there are many opportunities for improvement both in the increase of income collectability and the decrease of expenses.

Smaraidos et al. (2014) analyzed the financial statements of seven LGOs of the prefecture of Aitoloakarnania after the implementation of the “Kallikratis” program. For this reason, during the years, 2011-2012 (the first years of the “Kallikratis” program), seven municipalities were analyzed using 18 ratios. The results revealed that the gross profit margin significantly deteriorated and the ROE and ROA indicators show low levels with low rates. In addition, except for one municipality, all the other municipalities show low percentage of debt financing dependence (from banks etc.) less than 10%, while, in any case, according to Altman’s Z-Score inspection, there is little possibility of bankruptcy of these municipalities. The conclusion is that the LGOs’ administration is not effective and this will probably lead to liquidity problems in the future. There is dependence of municipalities on the state regarding funding and function.

Pazarskis et al. (2013) studied the effect of the “Kallikratis” program on the financial statements of a metropolitan municipality (being the capital of a prefecture), that of Serres. The financial analysis was conducted with the use of the general financial accounting system and the assessment of the performance with the use of several ratios. The analysis of the new merged municipality of Serres based on ratios analysis and as compared to the prior financial statements’ performance (thus, before and after the implementation of the “Kallikratis” program) signalised positive results of the “Kallikratis” impact on financial accounting measures of this municipality.

In another study, Pazarskis et al. (2016) examined the impact of the “Kallikratis” program in a long-term period but this time with public accounting data and human resources information. The analysis of the new municipality examined several ratios for five years before and after the implementation of the program. The results of this study showed that 11 out of 21 ratios (autonomy ratio, functional autonomy ratio, instability ratio, dependence/independence ratios, participation in expenses ratio, coverage of operational expenses ratio, salary payment ratio, etc.) had a statistically significant variation due to the implementation of the “Kallikratis” program. Majority of them has improved.

According to Cohen et al. (2017), the cost behaviour in LGOs (municipalities) was not easily measured regarding the benefits for citizens. In their study, Cohen et al. (2017) analyzed the revenue received by municipalities from various resources: stable subsidies by the state budget, revenue from taxes or provision of services/ goods. According to this study, a significant part of the state subsidy to local government administration has dramatically decreased due to the economic crisis while the measures taken by the Greek government in 2011 to reduce expenses including subsidies, are expected to influence the effectiveness of municipalities.

Research design

Financial ratios - accounting measures

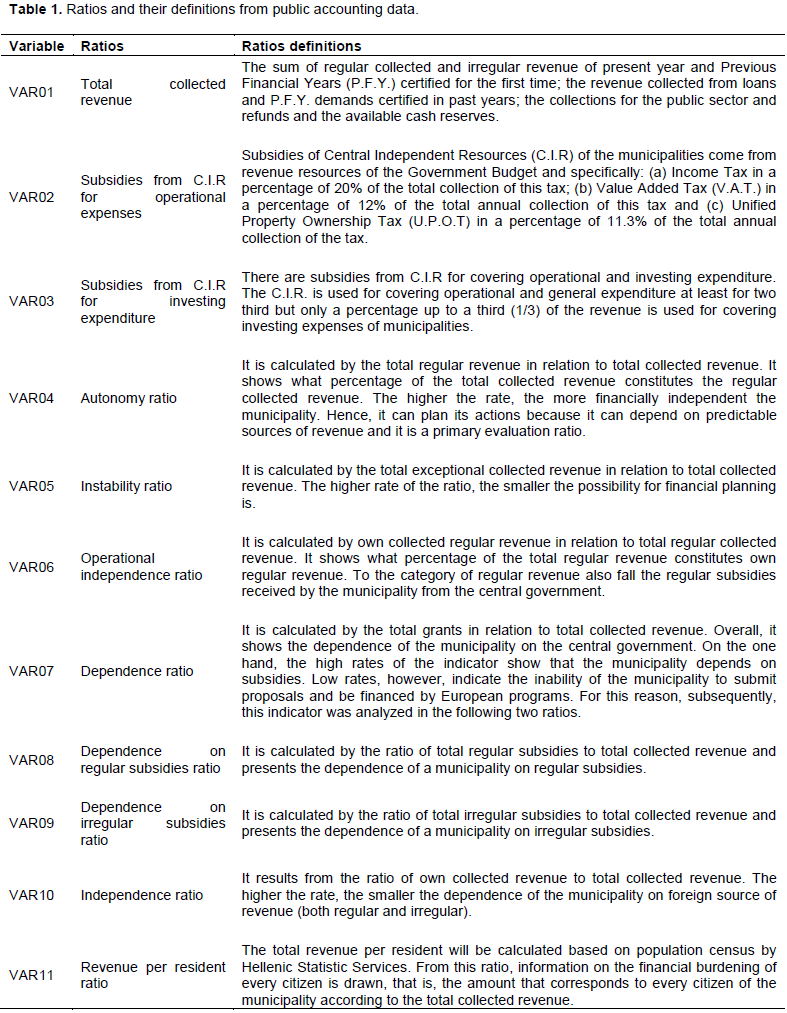

In every institution the use of ratios is conducive to drawing conclusions concerning the effectiveness, efficiency and thriftiness of the financial administration of the institution. They constitute comparative data and contribute to evaluating the financial statements. The analysis of the ratios directly interests the management of the institution, in order for them to check if the pre-set goals have been achieved or to point out any weaknesses and reset their goals, as well as those who are involved in inspecting the institution. The 74712/29.12.2010 decision of the Greek Minister of Internal Affairs, which was issued based on the paragraph 7 of the article 267 of the Law 3852/2010 and 165 article of the Law 3463/2006, defines the evaluation ratios which are necessary to assess the financial statements and public accounting data of municipalities. Through the use of ratios and other general public accounting measures, there will be assessment of the financial statements of several selected municipalities. More specifically, the following financial ratios and accounting measures will be applied as shown in Table 1.

Sample selection

The current project focuses on three equally-populated municipalities of the randomly selected prefecture of Serres which were formed according to the “Kallikratis” program, thus with similar geographical characteristics. The selection of three municipalities with similar population and geographical size within the same geographical area enhances the research comparisons and facilitates the sample examinations by providing the possibility for a sample with identical characteristics. The sample of three municipalities is satisfying, as compared to prior studies conducted in other countries that examined the same number of municipalities (Mizrahi and Ness-Weisman, 2007), as well as the event of analysis of public accounting data than this from questionnaires that derived from the personal opinions and judgments of the executives. In this study, the three examined municipalities are:

Municipality 1: The Municipality of Sintiki (based in Sidirokastro) was composed by the unification of the pre-existing municipalities of Sidirokastro, Kerkini, Petritsi and the communities of Achladochori, Agistro and Promachon. The municipality of Sintiki covers the northern part of the prefecture of Serres and it neighbours with the municipality of Kilkis in the west, with the municipality of Herakleia and Serres in the south and with the municipality of Kato Nevrokopi-Drama in the east. The municipality of Sintiki with 22.195 residents is the second larger municipality in population in the prefecture of Serres.

Municipality 2: The municipality of Herakleia (based in Herakleia) emerged from the unification of three pre-existing Kapodistrian Municipalities of Herakleia, Skotousa and Strymoniko. It is surrounded by the municipalities of Serres and Sintiki and the neighbouring prefectures of Thessaloniki and Kilkis. According to the 2011 population census, the municipality of Herakleia has a permanent population of 21.145 residents, after the new administrative structure of the country.

Municipality 3: The municipality of Visaltia (based in Nigrita) emerged after the unification of the former municipalities of Achinos, Visaltia, Nigrita and Tragilos. The municipality of Visaltia constitutes a geographical unity in the southern-western part of the prefecture of Serres. It is bounded west from the Strymonas River up to the mountains of Kerdylia and south from the middle of the prefecture to the harbour of Amphipolis. The current population, according to the 2011 census, amounts to 20.030 residents.

Data ratio analysis per municipality

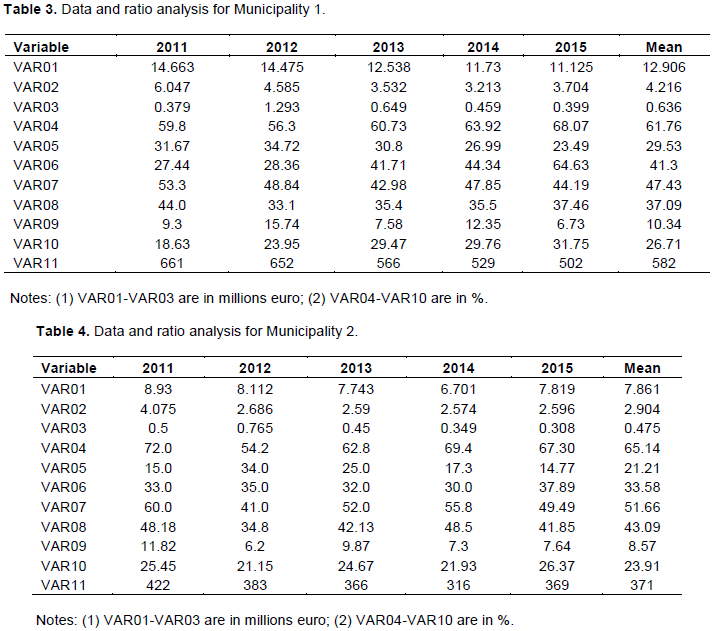

The data were drawn and further calculated from the account charts of the years from 2011 to 2015 which were received on demand from the municipalities. Subsequently, they are presented in Tables 3, 4 and 5 and there is an analytical financial presentation of data of every municipality with their comparative analysis.

Municipality 1

Regarding the variables VAR01 to VAR03, there is a significant decrease in the total collected revenue for the years 2011-2015. State subsidies to cover operating and investment costs show a significant reduction from 2011 to 2015, which means that the municipality should arrange for the establishment and collection of its own revenue, as well as for the development and creation of infrastructure projects and to turn to other forms of funding.

For the variables VAR04 to VAR06, from the participation of each revenue group (regularly-extraordinary) to the total revenue collected, the autonomy ratio and the instability ratio were calculated. After processing the data, the following results were obtained: from the range of values ​​moving from the autonomy ratio, from 56.3 to 68.07%, it can be inferred that the Municipality 1 relies more on the regular revenues, which are foreseeable sources of revenue, which allows it to plan its action. The municipality can be considered autonomous because it is more than 50% and has a constant trend of growth. The constant decline in the instability ratio means that the municipality is not based on uncontrolled sources of revenue, that is, extraordinary income, which is also confirmed by the values of the previous ratio. The municipality does not have difficulties in planning its action because it is more reliant on its regular revenue.

Analysis of the variables VAR07-VAR10 reveals that the municipality, with a significant increase in its own revenue tactics, is increasingly operating autonomously. It is based on its own regular revenues, not the subsidies it receives from the state to meet its operational needs. Because the value of the dependence ratio is of twofold importance, high prices mean dependence on external sources of finance, but also low prices mean that the municipality is unable to absorb European funds, so the ratio of regular subsidy dependence and the ratio of dependence on extraordinary subsidies will be calculated. Reducing the price of the dependence on regular subsidies ratio means that the Municipality’s self-reliance is constantly increasing. It is based more on its own revenues, which is also confirmed by the functional independence ratio. On the other hand, the rates of the dependence on irregular subsidies are low. This means that the Municipality 1 should use the co-funded European programs to provide resources for the development of the region. The values of the independence ratio are constantly increasing, which means that the municipality is becoming more and more independent.

Based on the revenue per resident ratio (VAR11), it is understood that the amount of each citizen’s total income is constantly decreasing. Each year, the municipality has an ever smaller per capita income for the implementation of its strategic objectives. The burden ratio, which reflects the amount of each resident’s own income tax revenue, is increasing while the per capita fee burden index is decreasing.

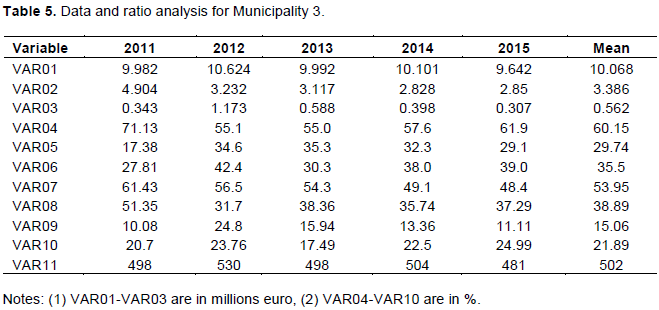

Municipality 2

For the variables VAR01 to VAR03, there is a continuous decrease in total collected revenue from 2011 to 2014, while in 2015 as compared to 2014, there is an increase. From the analysis of the variables VAR04 to VAR06, state subsidies that cover operating and investment costs show a significant decrease, which means that the municipality should arrange for the establishment and collection of its own revenues as well as for the development and creation of infrastructure projects to turn to other forms financing. From the participation of each revenue group (regularly-extraordinary) to the total revenue collected, the autonomy ratio and the instability ratio were calculated. After the data were processed, the following occurred: From the value range that moves the autonomy ratio, from 54.2 to 72.0%, it appears that the Municipality 2 is more reliant on regular revenues, which are predictable sources of revenue. This allows the municipality to plan its action. The municipality can be considered autonomous because the ratio values are more than 50%. The instability ratio values are low, suggesting that the municipality is not relying on extraordinary revenue, but only on predictable revenue sources that give it the possibility of programming.

Regarding the variables VAR07-VAR10 From the rates of the dependence ratio, it appears that most of the regular revenue of the municipality is the subsidies received from the state. The same revenue regularly collected is below 50%, showing a significant improvement in 2015. The Municipality 2 cannot therefore be considered to be functionally autonomous and to rely on its own potential. Since the value of the dependence ratio is twofold, high values mean reliance on external sources of finance, but also low values mean that the municipality is unable to absorb European funds, so the ratio of dependence on regular subsidies ratio and the dependence on irregular subsidies ratio are needed so as to have a clear picture. The bulk of the subsidies are the regular subsidies received from the state to meet operational needs. Exceptional subsidies are low. This means that the Municipality 2 should use the co-funded European programs to provide resources for the development of the region. The values of the independence ratio come are low. The municipality cannot rely on its own revenue, which makes it harder for its financial planning.

Based on the revenue per resident ratio (VAR11), we understand that the amount of each citizen’s total income is constantly decreasing. Each year, the municipality has an ever smaller per capita income for the implementation of its strategic objectives.

Municipality 3

Regarding the variables VAR01 to VAR03, the total collected revenue values, received over the past five years as shown in Table 5, are roughly the same.

For the variables VAR04 to VAR06, from the price range that moves the autonomy ratio, from 55 to 71.13%, it appears that the Municipality 3 is more reliant on regular revenues, which are predictable sources of revenue. This allows the municipality to plan its action. The municipality can be considered generally autonomous because the ratio values are more than 50%. The values of the instability ratio are low, suggesting that the Municipality 3 is not based on extraordinary revenue but only on predictable sources of revenue, which also gives it the possibility of programming. From the values of the operational independence ratio, it appears that most of the municipal revenue is the subsidies received from the state.

From the analysis of the variables VAR07-VAR10, there is the same regularly received revenues range of below 50%. The municipality cannot therefore be considered to be functionally independent and to rely on its own revenue-making potential. Since the value of the dependency ratio is twofold, high values mean reliance on external sources of finance but also low values mean that the municipality is unable to absorb European funds, so the dependence on regular subsidies ratio and the dependence on irregular subsidies ratio will be calculated in order to have a clear picture. The majority of subsidies are the subsidies received from the state to meet operational needs. Grants for investment, as well as subsidies from European programs, represent a small percentage. This means that the Municipality 3 should use the co-funded European programs to provide resources for the development of the region. The values of the independence ratio make it difficult to plan financially, but the fact that the ratio values are constantly rising is encouraging.

From the revenue per resident ratio (VAR11), it is understood that the amount of each citizen’s total income is constantly fluctuating. The revenue per resident ratio of the same income collected and the fees payable increases.

Ratio analysis

Regarding the average of the total collected revenue for the years 2011-2015, Municipality 1 displayed the highest collected revenue followed by Municipalities 2 and 3.

Then, regarding the average of the rates of every indicator (VAR04-VAR06) during the last five years, the rate of the autonomy ratio is higher for Municipality 2. As compared to other municipalities, Municipality 2 has a greater capability of programming its actions based on predictable revenue sources which are its total regular revenue. Taking the average of the five-year period into account, the rate of the instability ratio is higher for the municipality of Municipality 3. The total irregular revenue in relation to the total collected revenues is higher as compared to the other municipalities. The regular revenue, is not considered a predictable source. This causes problems on programming. Taking the average of the five-year period into consideration, the rate of the operational independence ratio (VAR06) is higher for Municipality 1 in relation to the others. This municipality raised its regular revenue achieving operational autonomy and limited its dependence on government granting.

Since the rate of the dependence indicator (VAR07) has a dual meaning, as previously mentioned, we will calculate the dependence on regular subsidies ratio (VAR08) and the dependence on irregular subsidies ratio (VAR09) so as to have a clear picture. The municipality with the highest indicator of dependence on regular subsidies ratio and the lowest dependence on irregular subsidies ratio is Municipality 2. Besides, it was the municipality with the lowest rate of the operational independence ratio confirming the rate of this specific ratio. The irregular subsidies are less than those of the other municipalities, thus, it should submit proposals to European programs to raise funds. The municipality with the highest independence indicator (VAR10) is Municipality 1. As compared to the others, it mostly relies on its own revenue which renders it more independent.

For Municipality 1, the total revenue corresponding to each resident (VAR11) is more in comparison with the others. Therefore, Municipality 1 holds a larger sum per resident for the implementation of its strategic goals.

AHP assessment system results

It is generally accepted that financial ratios of an entity can be compared without any model mainly because they are absolute values and can be interpreted by any expert. The problem arises when someone wants to compare entities according to more than few financial ratios. It is easy to conclude which entity is better or best according to one financial ratio, but it is slightly more difficult to determine which is better or best in certain performance segment or in general. The problem is considerably more complex when someone needs to compare several entities according to their performance during several years and also express his demands and preferences. For such complex problems, a model has to be developed.

In this paper, an assessment system for municipalities in Greece was proposed based on the Analytic Hierarchy Process (AHP). Besides tangible, the AHP enables comparisons of intangible criteria. This attribute is used to enable users to express their judgments on their performance. The model developed in this paper is based on the accounting ratios presented in the third section and further analyzed in the fourth section. The model was developed in R programming language (R Core Team, 2016) using the AHP package (Glur, 2018).

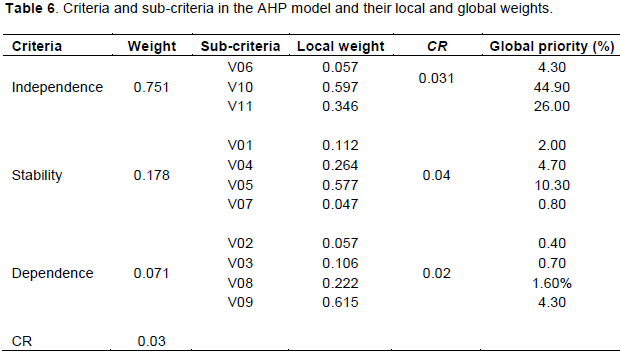

The first step towards the development of such an assessment tool was to decompose the decision problem into a hierarchy map which, in terms of our study, means to create groups of ratios that have common characteristics and give information on specific segment of municipalities’ performance. For the purposes of the study, these ratios were separated into three groups. The separation of the ratios, as well as their evaluation, was identified as a result of literature reviewing and interviewing with leading experts. These groups constitute the criteria of the model while the ratios, the sub-criteria (Table 6). In other words, it is concluded that the financial performance of a municipality can be assessed by a group of financial ratios (V06, V10 and V11) measuring its independence, a group of financial ratios (V04, V05, V07 and V01) measuring its stability and a group of financial ratios (V02, V03, V08 and V09) measuring its dependence.

The second step involves the pair-wise comparison among the three groups. More precisely, the directors of the department of accounting of the two municipalities as well as members of the faculty of the Technological Educational Institute of Central Macedonia were interviewed in order to express their professional opinion about the importance of the accounting ratios in public accounting under consideration in assessing the performance of a municipality based on a nine point weighting scale (Table 2). Consequently, a comparison matrix A (Equation 1) is constructed.

The third step is dealing with the estimation of the importance (weights) for the criteria using Equation 2 and 3. The consistency of judgments was then checked, that is, a review of the judgments was done in order to ensure a reasonable level of consistency in terms of proportionality and transitivity (Equations 4 to 5). It is concluded from Table 6 that the most important criterion is Independence (0.751) followed by Stability (0.178) and Dependence (0.071), respectively. The consistency result (CR=0.03) was acceptable indicating that judgments were consistent.

The fourth step, a similar procedure followed in steps 2 and 3 was executed in order to derive the local weights for each sub-criterion in each criterion, which indicate the preferred ratio with respect to each group. When it comes to the independence criterion, the most important sub-criterion is independence ratio followed by the revenue per resident ratio. The sub-criteria with the highest weight among sub-criteria of the stability ratios are the instability ratio and the dependence ratio. The most important sub-criteria of the dependence ratios are the dependence on regular subsidies ratio and the dependence on irregular subsidies ratio.

The fifth step is devoted to what is called, Model Synthesis. In this fifth step, there is need to calculate the global priority for each sub criterion; that is, priorities that take into account not only our priorities of sub criterion for each criterion but also the fact that each criterion has a different importance. Given that we are using all the values provided in the model, this step is called model synthesis.

In order to validate the results, performance ranking of the three municipalities for the period of 2011-2015 years were obtained using the accounting ratios presented in the fourth section. According to the weights of criteria and sub-criteria and the local importance of every alternative, the application generates the overall priority list of municipalities (Figure 1).

The results of the validation show that Municipality 1 has the highest overall priority for all years but 2011. The main reason for such a result is the highest local priority of the independence ratio (VAR10), which was recognized as the most important criterion from the view point of the experts.

Managerial implications and discussion

The New Public Management (NPM) served from the beginning of the 1990s as the theoretical framework for the implementation of mergers in every public sector or even worldwide and consequently at municipalities (Reingewertz, 2012; Saarimaa and Tukiainen, 2015; Blesse and Baskaran, 2016; Hirota and Yunoue, 2017). In Greece, after the outbreak of the U.S’s crisis in mid-2007 and as a partial side effect of this, there was a severe debt crisis in Greece at the end of 2009. In 2009, the Greek government resorted to the ‘support mechanism’ (known as ‘troika’), a mechanism which was set up by the International Monetary Fund, the European Union and the European Central Bank (Pazarskis et al., 2016). During the following period, the Greek government was forced to take several actions, one of which was the reduction of provided resources for municipalities.

In 2010, the “Kallikratis” program, an important administrative reform, occurred in Greece and the existing municipalities were united in larger ones so as to achieve improvement of public administration in the local government administration level. The new 325 municipalities emerging from this new structure in primary local government administration have to deal with new extended responsibilities, but also to operate with a reduced funding, as referred above due to the debt crisis and the obligatory reductions from ‘troika’. In this austerity environment in Greece due to the economic crisis, local government administration (municipalities) should apply effective financial accounting techniques and mostly to enforce collection of local public revenue.

Obviously, in austerity periods and with a reduced funding from central government the most important issue for a public organization is its ability to collect revenues. This paper aims to provide essential knowledge on this field by selecting a set of revenues ratios from public accounting, which were selected not only as a result of relevant literature reviewing, but also after interviewing ten leading experts in this field and similarly to other past studies (Mizrahi and Ness-Weisman, 2007). Besides, in Greece, the case on restricted borrowing does not exist (as in other states worldwide, for example in U.S.), but the Greek state guarantees for the municipal debt and requires and checks for enhanced collection of revenues. Thus, the ability of a municipality to collect revenues gains on this paper intentionally extended research attention as it is the most important issue for a public organization over an austerity period.

Furthermore, from the beginning of the debt crisis and with a reduced funding from Central Independent Resources (C.I.R.) for municipalities, there is a large discussion between the central government and local administrations during the last years about the way C.I.R. should be shared among the 325 municipalities. Till now, there is a model that takes into account the level of unemployment for every municipality, the local development, the geographical position (near borders, on an island) etc. Within this model, there is no parameter of a supreme success in resource administration. For example, if a municipality cares for the environment, it receives an environmental grant or prize in a European or national level. But there is no provision or practise for the case of excellent public administration of local funding. Also, if that is the case in some municipalities (thus, their citizens are enforced to pay more local taxes than in other municipalities) this should be recognised from many aspects. Not only from a grant in a local administration level, but also from an extra funding for this municipality, for example 3% of C.I.R., as the citizens that are enforced to pay more local taxes than others, and thus, they should receive an extended funding from C.I.R for investing expenditure.

From this aspect, the aim of the study is to propose an assessment tool for evaluating the financial efficiency of municipalities in Greece based on several revenue ratios drawn from their public accounting data than any other examined approach (Agostino and Arnaboldi, 2018; Arnaboldi et al., 2015; Siverbo, 2014). Consequently, the development of such a tool should be based on multi-criteria analysis since it involves the assessment of several criteria/revenue ratios of the municipality under evaluation. Indeed, there are plenty of multi-criteria methods that have been used in financial analysis in both the private and the public sector (Zopounidis and Doumpos, 2002). The AHP is a well-known multi-criteria technique that is still widely used in performance evaluation of the public sector and municipalities as well (Mizrahi, 2017; Mizrahi and Ness-Weisman, 2007). As a decision method, AHP not only dissects a complex multi-criteria group decision problem into a hierarchy of more easily comprehended sub-problems, but it is also a measurement theory that prioritizes the hierarchy and consistency of judgmental data provided by a group of decision makers. Therefore, the authors believe that it can definitively become and can be recommended as tool for financial analysis on municipal level.

This paper develops a model as a decision-making tool for performance management systems that maximizes the importance of public accounting revenues, encourages the use of real performance information (as public accounting data), and promotes an organizational culture in local development level on municipalities that favours excellence in revenues’ performance management. The examined framework applies the analytic hierarchy process methodology, which is usually used for grading multi-criteria alternatives where a subjective (expert) comparison between alternatives is required (Mizrahi, 2017). The created AHP model proposes a general model and an example from three Greek municipalities could be applied as a guide in the analysis of financial statements with ratios of all the municipalities in Greece, providing a municipalities’ rating tool of good or not performance. This evaluation tool could be used in Greece or elsewhere from the policy makers and managers in the central state authorities or the municipalities system worldwide to deliver a possible “bonus” for the good ones from the state revenue resources of the Government Budget.

The institution of local government in Greece dates back to 1833. Municipalities (Local Government Organizations) belong to the administration of local affairs. Municipalities have administrative and financial autonomy. The state is taking care of securing resources to fulfil their mission by subsidies. In 2010, with the “Kallikratis” program, the existing Greek municipalities were divided into 325 new municipalities. However, the reform took place in a difficult time for Greece and municipalities have to fulfil their new responsibilities under a reduced-rate regime by the central government. It is therefore essential that they be managed efficiently and, in particular, local public revenue is collected.

The purpose of this paper is to analyze revenue by using ratios in three municipalities with the same characteristics from one randomly selected Greek Prefecture, in order to allow for comparative analysis. The Prefecture of Serres with the municipalities of Sintiki, Herakleia and Visaltia were selected and based on their public accounting data from 2011 to 2015 were evaluated for their performance in this period that is after the implementation of the “Kallikratis” program. As with every economic unit, municipalities also need to use ratios that show the dynamic and static image of the organization in an embossed way so that the success of this program can be evaluated.

After analysing the ratios, it is concluded that in the municipalities in question state subsidies represent the largest proportion of their revenues. They are therefore heavily dependent on the ability of the central government to reimburse them for subsidies, thus limiting their autonomous action. Also, since the revenue from the central administration for the execution of projects can only cover their maintenance needs of existing infrastructure, they should make use of all the possibilities offered to them to submit proposals for funded projects.

Furthermore, it was observed that the unproven own revenues are constantly increasing. That is why they should move all their revenue collection processes and make the most efficient use of their immovable and movable property in order to ensure their operational autonomy. Moreover, the economic “weakness” of the citizens on the one hand, and also the new responsibilities of the municipalities, as well as their developmental role, on the other, make utilizing and collecting their own revenues necessary in order to avoid liquidity problems in the future.

As a conclusive remark, it can be said that municipalities with new increased competencies in the post-Kallikrati period and with reduced state subsidy cannot be strong growth and efficient local public service providers unless they manage a high level of financial management so that they can meet the needs of their citizens and the requirements of the time (thus achieving the objectives of the “Kallikratis” program).

Thus, in order to compare several entities, as the municipalities of the study, according to their performance during several years, a model has to be developed. More specifically, an assessment system for municipalities in Greece has been proposed based on the Analytic Hierarchy Process (AHP). The model developed is based on ratios from public accounting data and primarily based on public revenues. For the purpose of the study, these ratios were separated into three groups. These groups constitute the criteria of the model while the , the sub-criteria. The model was developed in R programming language using the AHP package. The results of the study show that the highest overall priority for every year but the first examined year has one of the three municipalities.

The created AHP model could be applied as a guide in the analysis of financial statements with ratios of all the municipalities in Greece, providing useful findings on the efficiency of each one of the examined municipalities. Also, it can be used as a municipalities’ rating tool of good or not performance, with a possible “bonus” for the good ones from the state revenue resources of the Government Budget. This evaluation tool could be used in Greece or elsewhere from the policy makers and managers in the central state authorities or the municipalities system worldwide.

In terms of future research, the following investigations are recommended.

Firstly, the comparison of the municipalities could cover either a different control period, either before or after the economic crisis in Greece. This comparative investigation could help in raising awareness of the impact of the economic crisis on Greece.

Secondly, a comparison with other European companies can be carried out in the manner currently investigated. This would result in a better understanding and perspective on the extent of the economic crisis on Greek municipalities as compared to municipalities in other countries.

Thirdly, a study on an extended sample using a different approach method (neural networks) could provide a different approach in the same examined problem. Such future research could be of additional usefulness to interested parties (policy makers and official authorities, business executives and managers in the LGOs, and consultants in the public sector).