This paper investigates the decision usefulness of financial information disclosure to the Nigeria tax authority in discharging its tax assessment and collection responsibility. The paper is built on the notion that the long relationship and influence of taxation on accounting should in particular promote decision usefulness information to the tax authority. Thirteen tax themes were developed whose reflection was checked in the financial reports of firms in the Nigerian banking industry spanning a period of fifteen years (2004-2018). The data generated were analysed using Decision Usefulness Index and descriptive statistics. The computed overall Decision Usefulness Index of 53.85% shows that financial information disclosure in the industry is not significantly decision useful to the tax authority. Further, an analysis of the separate themes reveals that their reflection in the financial reports could not be traced to the relationship and influence of tax on accounting but other factors. The paper concludes that the tax authority requires decision useful financial information in order to fairly conduct tax assessment and collection in the economy. It is therefore recommended that a section in the financial reports of listed firms in Nigerian should be devoted to make disclosure of the themes highlighted in this work. Other countries where disconnect exists between tax and accounting rules are advised to follow in this light.

Taxation has had a strong influence on and relationship with accounting. James (2009) pointed out a number of ways in which taxation has influenced accounting or dependence exists between the two. One area of influence is stated to lie where there is a choice between different accounting policies; the one that is chosen is the one that also has to be used for tax purposes. Secondly, tax rules are often used for commercial accounts where no specific accounting rules apply. With this linkage, the tax authority should undisputedly find decision usefulness

from the information disclosed in financial reports.

Prior to accounting standardization when accounting standards became the primary framework for financial information disclosure, in several countries including Spain, France, Germany, Belgium, Finland, Italy, Austria, among others, tax laws were substantially considered for financial statements preparation. This means that financial reporting practice in these countries was sustaintially aligned with tax laws therefore a strong connect existed between accounting and taxation.

Although in Nigeria, the relationship between accounting and taxation is not well documented, taxation has a history that predates and perhaps contributes to financial reporting in the country. The history of the country’s tax legislation dates back to 1961 when the Income Tax Management Act was promulgated. The Companies Income Tax Act was created from the Income Tax Management Act of 1961 in 1979 with amendment in 1990 and subsequently 2004. In contrast, the Nigeria Accounting Standards Board (NASB) now Financial Reporting Council of Nigeria (FRCN) vested with the responsibility of developing and issuing accounting standards was established in 1982 as a private sector initiative by the Institute of Chartered Accountants of Nigeria (ICAN); it became a government agency in 1992 statutorily empowered to develop and issue accounting standards. However, the legislative backing came in 2003 through the passing into law of the NASB Act of 2003. The tax authority in Nigeria is structured into three tiers namely the Federal Inland Revenue Service (FIRS), State Board of Inland Revenue Service (SBIRS) and the Local Government Revenue Committee (LGRC). These bodies are responsible for tax assessment and collection at the federal, state and local government levels respectively in the country.

Financial reporting may be general purpose or decision usefulness approach focused (Dandago and Hassan, 2013; Ravenscroft and Williams, 2011; Sutton, 2009). General purpose financial reporting, usually guided by accounting standards, is aimed at providing financial information that fairly satisfies the information needs of all the different users of the information. The capacity of general purpose information disclosure to effectively serve the decision purposes of the various users including the tax authority has been questioned for the past four decades (Ravenscroft and Williams, 2011). Though there are studies that had investigated the relationship between accounting and taxation including those by Lamb et al. (1998); Nobes et al. (2004); Dandago and Hassan (2013) and Vokshi (2018), none except Dandago and Hassan (2013) focused on the decision usefulness of financial reporting perspective to the tax authority. Moreover, these previous studies were conducted outside Nigeria and essentially adopted a qualitative than a quantitative approach in investigating the relationship based on financial statement data. This current paper investigates the accounting and tax relationship with a focus on the decision usefulness to the Nigeria tax authority using a quantitative approach whereby tax themes were developed from the Nigeria tax law with reflection checked from the financial reports. That is, using financial statement data. In particular, the paper investigates the accounting and tax relationship in the Nigerian banking industry but with a more superior approach as it utilizes financial reports than drawing conclusion based on opinion research. The paper raised two research questions for investigation. These include: (i) To what extent does financial information disclosure satisfy the decision usefulness needs of the tax authority? (ii) Does the long relationship between tax and accounting promote financial information decision usefulness to the tax authority?

This paper makes a significant contribution to knowledge by showing the relevance of financial reporting in Nigeria particularly in the banking industry to the tax authority in discharging its tax assessment and collection responsibility and by so doing further reveals whether or not the long-established relationship between accounting and taxation has come to anything with accounting standardization.

Accounting in the context of this paper is synonymous with financial reporting which is the process of preparation of a company’s financial statements to determine the profit or loss and the financial position during a period. Taxation is the imposition of tax by the government on the profits of companies in order to generate revenue and for other socio-economic reasons. Figure 1 show that in an environment of strong relation between accounting and taxation, tax rules dictate financial reporting practices of companies such that the accounting information produced is user-specific purpose information oriented; hence the information disclosed is high decision useful to the tax authority for tax purposes. On the other hand, in an environment of weak relationship or disconnect between accounting and taxation, accounting standards mirror financial reporting practice such that the accounting information produced is general purpose oriented in which case the tax authority will find low decision usefulness from the information disclosed for tax purposes.

From a theoretical perspective as can be seen in Figure 1, the application of tax rules for financial reporting purpose is underpinned by the single-person theory. However, where accounting standards guide financial reporting practice, the information disclosed in financial statements is general purpose oriented; thus the stakeholder theory provides a relevant theoretical framework. In other words, the relevant theories to this paper are the stakeholder and single-person decision usefulness theories. Figure 1 depicts the relationship between accounting and taxation, and how the relationship possibly impacts the decision usefulness that the tax authority finds from accounting information disclosure in financial statements.

The accounting and tax relationship

Dacian (2009) documented substantial literatures on the relationship between accounting and taxation. James (2009) examined the relationship between accounting and taxation and concluded that a relationship exists between the two, stressing that this relationship is evolving with further developments expected. James (2009) pointed out two ways by which taxation influences accounting or dependence exists between the two. One area of influence is stated to lie where there is a choice between different accounting policies; the one that is chosen is the one that also has to be used for tax purposes. Secondly, tax rules are often used for commercial accounts where no specific accounting rules apply.

However, James (2009) noted that the purposes and requirements of commercial accounts rules and those of taxation are not always the same. The differences in tax and financial accounting rules are recognized in the debate documented in the literature pertaining to income manipulation. It is argued that the relationship allows managers to maximize financial accounting income and minimize taxable income. Contrariwise, Abd et al. (2018) pointed out that high tax rate will make corporations to react with sharp tax planning strategies that distort the accuracy and correctness of financial statements. Tijjani and Peter (2020) explain that firms exploit tax planning strategies because tax is a significant expense/liability to firms and their owners with far reaching effects on available profits. Moisescu (2018) found evidence pointing to the fact that Romania firms in doing tax planning either aim to decrease financial result (profit) in order to avoid payment of a bigger tax to the state authority or postpone it. Frank et al. (2009) documented that financial and tax reporting aggressiveness recorded a high between the mid-1990s to the early 2000s. During this period, many companies involved in either fraudulent accounting practices or abusive tax shelter transactions. What is to be pointed out here is that, if there were no differences between financial reporting and tax rules, little or no room would have existed for such practices.

Though financial accounting and income tax rules are very different, as noted by D’Ascenzo and England (2003), financial statements are necessarily the starting point for income tax computations. The promulgated tax laws require certain information such as register of fixed assets for claim of capital allowances to be disclosed for tax computation purposes. The requirements of these tax laws therefore have a direct and significant influence on the way and manner financial statements are prepared.

Prior to the introduction and adoption of International Financial Reporting Standard (IFRS), studies have suggested a strong influence of tax rules on accounting in the continental European countries particularly France and Germany (Dacian, 2009). Hoogendoorn (1996) showed that there is a strong relationship between the accounting and taxation arrangements in Belgium, Finland, France, Germany, Italy and Sweden in the European region. Cerne (2009) also documented that in countries such as Austria and Germany whose accounting system is based on Roman law, there is virtually a single reporting system for tax purposes and business purposes. Chariri (2011) also reported France and Austria as using tax rules for financial reporting. In the context of Spain, Gonzalo and Gallizo (1992) are quoted by Nobes et al. (2004) to suggest that in the past, tax rules were a main source of bookkeeping and its regulation, with commercial law playing a minimal role in that regard. In fact, in the European Union, Gielen and Hegarty (2007) stated that the degree of relationship between tax and accounting varies significantly along two divides. On the one hand, its member states where financial accounting rules follow tax rules or that tax rules follow financial accounting rules, and on another hand, member states where there are different rules for financial accounting and taxation.

In South Korea, Kim (2001) identified specific areas in which national tax policies influence financial reporting practices. During the 20th century in the Ottoman Empire which metamorphosed into the present Turkey, accounting records and financial statements were equally the basis for tax collection. This important role of accounting as documented by Guvemli and Guvemli (n.d) was the reason behind the passage of regulations regarding matters such as (1) qualifications of accountants, (2) framework for budgets, and (3) audit departments. All these are noted as significantly providing an appropriate environment for the development of accounting thought during the republic period in Turkey. Perhaps, this may be because these regulations that were developed provided a basis that further improved financial accounting practices in that country.

By and large, these assertions could be understood that in some of these countries, tax laws were considered for the purpose of financial statements preparation such that operating profit arrived in forms the basis of income tax assessment without any adjustments required. In other words, the position of the tax law on an item in these countries influenced its treatment and reporting in the financial statements. It is important to note that in Europe, the introduction of the Fourth European Directive has produced major changes in many countries within the region that have resulted in significant independence between accounting and taxation (Dacian, 2009). Specifically, in Spain, Nobes et al. (2004) indicated that the tax dominance in the country prior to the early 1990s has changed dramatically.

The adoption of IFRS in the European region has further changed the narrative. Gielen and Hegarty (2007) explained that IFRS is essentially ‘investor-focused’ with the main concern being the provision of financial information to providers of risk capital to enable them make informed decisions about companies in which they invest the risk capital. Jiraskova and Molin (2015) pointed out clearly that IFRS is directed to capital market and accounting information users needs and not for tax needs. Gielen and Hegarty (2007) explored the association and disassociation between tax accounting and financial accounting in the presence of IFRS in the European Union member states and concluded that the accounting profit determined in conformity with IFRS requires a significant number of adjustments for it to serve a relevant tax base. This is an indication that the decision usefulness of financial accounting information to the tax authority (tax purposes) in the region has reduced in the IFRS reporting regime.

To further buttress the association between accounting and taxation, prior to the introduction of IFRS on Small and Medium Enterpresis (SMEs), it was mandatory for every business to pay income tax; even these categories of businesses that were not statutorily required to produce and publish financial statements engaged in the preparation of at least the basic statements of profit and loss account and balance sheet (income statement and statement of financial position respectively). The foregoing shows tax has a relationship with accounting that should ordinarily enhance decision usefulness to the tax authority as a user of financial information. Empirically, applying an analogue method of analysis, Lamb et al. (1998) investigated the connectivity between taxation and financial reporting with a focus on international variations in the year 1990. They used five types of connection and disconnection classifications to test if there were differences in the connection between taxation and financial reporting between Anglo-Saxon and Continental European countries using fifteen topics. The five connection and disconnection classifications adopted were:

Case I: Disconnection- different tax and financial accounting rules.

Case II: Identity- tax and financial rules are the same.

Case III: Accounting Leads- financial accounting rules are followed for both accounting and tax purposes.

Case IV: Tax Leads- tax rules are followed for both purposes.

Case V: Tax Dominates- financial accounting rules are overridden.

The conclusion reached was that, from a contemporary operational sense, the sampled countries could be distinguished in terms of relatively low and relatively high tax influence on financial reporting. Though the relationship between or influence of tax on financial reporting was shown to be on a declining trend, the results of the study did show that in some countries the tax authorities substantially found decision usefulness from financial information disclosure.

Nobes et al. (2004), adopting a similar methodology with Lamb et al. but using sixteen rather than fifteen topics covering the periods 1980, 1994 and 2003 in Spain, refute the proposition suggesting that the relationship between taxation and financial reporting has substantially reduced. The sixteen topics used included: fixed asset measurement; lease classification; depreciation (normal and excess); contingencies, provisions; grants and subsidies; research and development costs; inventory valuation (flow assumptions and other areas); long term contracts; interest expense (capitalization and others); foreign currency transactions; non-consolidation purchased goodwill; pensions; policy changes and fundamental errors; scope of the group; fines, charitable donations, entertaining expenses; and financial assets. Nobes et al. (2004) however noted in their conclusion that the adoption of IFRS which was proposed in their study area by 2005 might lead to amendments in tax law that may create a further disconnect between financial reporting and tax rules. Studies after the IFRS adoption by Gielen and Hegarty (2007) concluded that the accounting profit determined in conformity with IFRS requires a significant number of adjustments for it to be relevant for tax purposes. Gavana et al. (2013) also showed that while Italian GAAP reporting is closely related to tax rules, a high degree of disconnection exists between IFRS and tax reporting in the country. These are clear indications that financial accounting information has become less decision useful to the tax authorities during the IFRS adoption in the European region.

Radciffe (1993) cited in Dacian (2009) focused on establishing whether a distinction exists between tax compliance and financial compliance. Tax compliance was defined on the assumption that “taxable income is calculated under Generally Accepted Accounting Principles” and financial compliance as “a financial reporting practice involving substantial dependence on the choice of a specific accounting practice in preparing financial statements, to be conclusive for tax purpose”. The results showed the existence of compliance which the author interpreted to reflect that there is a close relationship between accounting and taxation and that both of them have the power to influence each other. Also cited in Dacian (2009), Boross et al. (1995) who examined the influence of tax on financial reporting based on some new accounting system introduced in Hungary since 1992 found that tax rules have priority in preparing financial statements.

In a more recent and novel study, Vokshi (2018) examined the connection between taxation and accounting with a focus on the degree of knowledge and application of accounting and tax rules by professionals (accountants and auditors) in the preparation of financial statements. The study used questionnaire which was administered to professionals across 264 business organisations in Kosovo. Two dominant research questions were explored by the study: (1) “When preparing the financial statements, are you led by fiscal rules and then you make adjustments for your accounting needs?” and (2) “When preparing the financial statements, are you led by accounting rules and then you make adjustments for your fiscal needs?” The first question essentially sought to understand if financial statement preparation is influenced by tax rules while the second by accounting rules. The study’s independent varaiables included the characteristics of respondents such as level of education, familiarity with legal regulations, work experience and continuous professional training. Descriptive statistics and cross-tabs were used to analyse the data. The results indicated that 16.7% of the respondents fully agree with another 15.5% partially agreeing on question one. About 49.2% totally disagree on the issue while the remaining 14.4% were neutral. The cross-tab based on the respondents’ characteristics revealed that the higher the level of education, the more the professionals deny the fact that financial statements are prepared in accordance with tax rules, then, adjusted for accounting needs. The same finding was the case for professional experience, professional training, and knowledge of legal framework. This result led to the rejection of the hypothesis that in preparing the financial statements, business organisations are governed by fiscal (tax) rules. The results with respect to the second research question and corresponding hypothesis revealed that 53.0% of the respondents fully agree, 15.5% moderately agree, another 15.5% were neutral and 16.0% disagree with the assertion. The cross-tab indicated that educational level, professional experience, professional traning, and knowledge of legal framework all influenced professionals’ agreement with the fact that financial statements are compiled under accounting rules and then adjusted for tax purposes. Based on the evidence, the study accepted the hypothesis that in preparing financial statements, business organisations are guided by accounting rules, then, adjust for tax purposes. By and large, the study showed that a disconnect exists between accounting and tax rules with accounting rules dominating over tax rules in the preparation of financial statements. In other words, Vokshi (2018) showed that Kosovo falls within the third category (Case III-Accounting Leads) of Lamb et al. (1998) connection and disconnection taxanomy. These studies provide mixed evidence to believe that financial information disclosure is decision useful to the tax authorities.

Specifically, from a decision usefulness approach to financial reporting perspective, Dandago and Hassan (2013) examined whether or not financial reporting of companies in Malaysia provides useful information to the Inland Revenue Board for income tax determination. The study collected data through questionnaire and the analysis using descriptive statistics revealed that financial reporting of companies is not tailored towards decision usefulness to the Inland Revenue Board’s function of tax assessment and income tax determination. A major short coming of this study is that it was but entirely an opinion research. The current study explores the subject matter utilizing financial statements which are anchored by accounting standards which might increase disconnect between tax and accounting.

Consequences of the tax and accounting relationship

The tax influence or relationship with accounting is not without consequences. The influence of tax on accounting is so much that it had been stated at some quarters that the development of good accounting which lies in financial reports showing “true and fair view” is hindered by tax concerns (D’ Ascenzo and England, 2003). According to D’ Ascenzo and England, the tax authorities are interested in consistent, well-specified and easy to verify rules than the true and fair view rule which is the key objective of financial statement preparation in accounting. In practical terms, Balakrishnan et al. (2011) showed that the requirement that companies pay taxes makes them to indulge in aggressive tax planning so as to reduce their tax liability; the effect of which is less transparent financial reporting. James (2009) argued that accounts are sometimes subject to modification for the purposes of taxation, ending in a serious effect on the most profitable way the business is operated. James (2009) further posited that though there may be alternative methods of preparing accounts that conform to accounting standards; the choice might be influenced by the taxation implications in an inappropriate way. Kim (2001) also postulated that in countries where tax influence on accounting is very strong, conservative financial reporting practices are likely to be adopted by companies in order to minimize tax liabilities. Empirically, Asgari and Behpouri (2014) investigated the effect of tax cost on accounting conservatism using 61 firms listed on the Tehran stock exchange for the period 2004 to 2009. It was found that the relationship between conservatism accounting and corporate tax burden is positive and significant. In furtherance, the results showed that firms with high book-tax conformity had higher motivation to use conservative accounting to reduce their tax payments.

It is evident that taxation impacts financial reporting directly and indirectly. Directly, the conformity with tax requirements influences financial reporting and indirectly, tax avoidance strategies by companies also influence financial reporting. Suzuki (2005) documented critics who maintained that the connection between financial reporting and taxation distorts useful financial information disclosure. The Organisation for Economic Cooperation and Development (OECD, 1987) as cited in Macdonald (2002) also stated that tax influences pose an obstacle to the achievement of comparability and harmonization in financial reporting. This assertion was recently reaffirmed by Abd et al. (2018) in their study on impact of international taxation systems varaiations on the application of financial accounting principles. Dacian (2009) and Nobes et al. (2004) arguing in the same direction pointed out that international harmonization of accounting practice will prove difficult where the relationship between financial reporting and taxation is strong especially as tax rules are based on national economic considerations. On the strength of these evidences; Cannon (1973) concluded that the influence of tax on accounting exceeds that of accounting on tax. Notwithstanding, Jiraskova and Molin (2015) indicated that proponents for the strengthening of the relationship between accounting and taxation believe that a one-book system will decrease opportunistic behaviour by corporate managements thereby allowing tax authorities greater control of corporations reported earnings. It suffices to conclude here that tax exerts significant influence on financial reporting particularly in the area of business income tax determination. Recent efforts world over in the standardization of accounting practice in IFRS seems to create a significant disconnect between tax and accounting therefore reducing to the minimal some of these consequences.

Theoretical framework

This paper is underpinned by the single person decision usefulness theory. Dandago and Hassan (2013) documented that the single-person decision usefulness theory is promoted by the works of Demski (1972), Ijiri (1983), Raiffa (1968), Scott (2009) and Staubus (1999). The theory was developed in response to the criticism of general purpose financial statements. Accounting has different users including investors, creditors, tax authorities, customers, managers, employees, financial analysts, legislators and community, each with varying decision information needs. With the different users and their varying information needs, general purpose financial statements are considered inadequate in effectively satisfying these information needs. The single-person decision usefulness theory is premised on an individual user of financial reports who has to make decision under condition of uncertainty. It emphasizes preparers of financial reports identification of who the users of the reports are and an understanding of their decision problems and information needs (Dandago and Hassan, 2013). Though, the theory emphasizes usefulness of financial reporting to the primary users (investors and creditors), Dandago and Hassan (2013) argued that other users such as the Inland Revenue Board (tax authority) should be provided with accounting information which is useful to their decision needs. Put differently, this theory advocates for each user decision specific information disclosure than the general purpose financial reporting that is currently obtained. This theory has valid argument because the preparation of general purpose financial statements sometimes does not capture key items of relevance to a particular user or requires search strategies (or adjustment) to obtain such information. The single-person decision usefulness theory directly or indirectly seeks to promote relevance and reliability of financial reporting to each of the stakeholders which in the context of this paper is the tax authority.

This paper adopts an objectivist research paradigm. Thus, a quantitative approach is followed. The question of whether or not the long relationship between tax and accounting has come to nothing in terms of decision usefulness of financial information disclosure to the tax authority is explored in this paper by examining the financial reports of quoted Nigerian banks during the period 2004 to 2018. The sentence should read “The choice of 2004 as base year was informed by amendment to the companies’ income tax Act in Nigeria from where the tax themes were developed for this paper. The paper using a filter whereby a bank must be quoted on the Nigerian Stock Exchange, be a Nigerian based bank and have complete data, sampled 15 banks out of the 21 quoted banks as at 31 December 2018. A total of 2,925 observations were made. The banking industry was selected because it is one of the most highly regulated and investor patronized (Tijjani, 2010; Umoren, 2009) and is reported to post profits higher than firms in the real sector of the Nigerian economy such as the manufacturing industry (Bello, 2009). The paper adopts the tax approach to accounting thought to examine the issue. The tax approach to accounting thought is an accounting reasoning whereby tax rules are applied for the purposes of financial reporting (Dandago and Ormin, 2011; Hamid, 2009). Using a similar but more empirical approach to Lamb et al. (1998) and Nobes et al. (2004) as postulated by the authors but consistent with Tijjani and Ormin (2016), 13 themes were developed from the Nigerian tax law (Appendix Table 1) and their reflection in financial statements checked. Also, following the technique characteristics of compliance or application of accounting standards studies, the reflection of any theme in the financial reports was scored 1 otherwise 0. The modified criteria of Kantudu (2005) and Abdullahi and Maishanu (2014) for judging level of compliance or application of accounting standards in financial reports was adopted for deciding on decision usefulness of financial information disclosure to the tax authority. An overall mean score of 0-19% denotes “decision not useful”, 20-39% “very weakly decision useful, 40-49% “weakly decision useful”, 50-69% “decision useful” and 70-100% “significantly decision useful”. In order words, decision usefulness index and descriptive statistics (mean, minimum, maximum and standard deviation) were utilized to analyse the data.

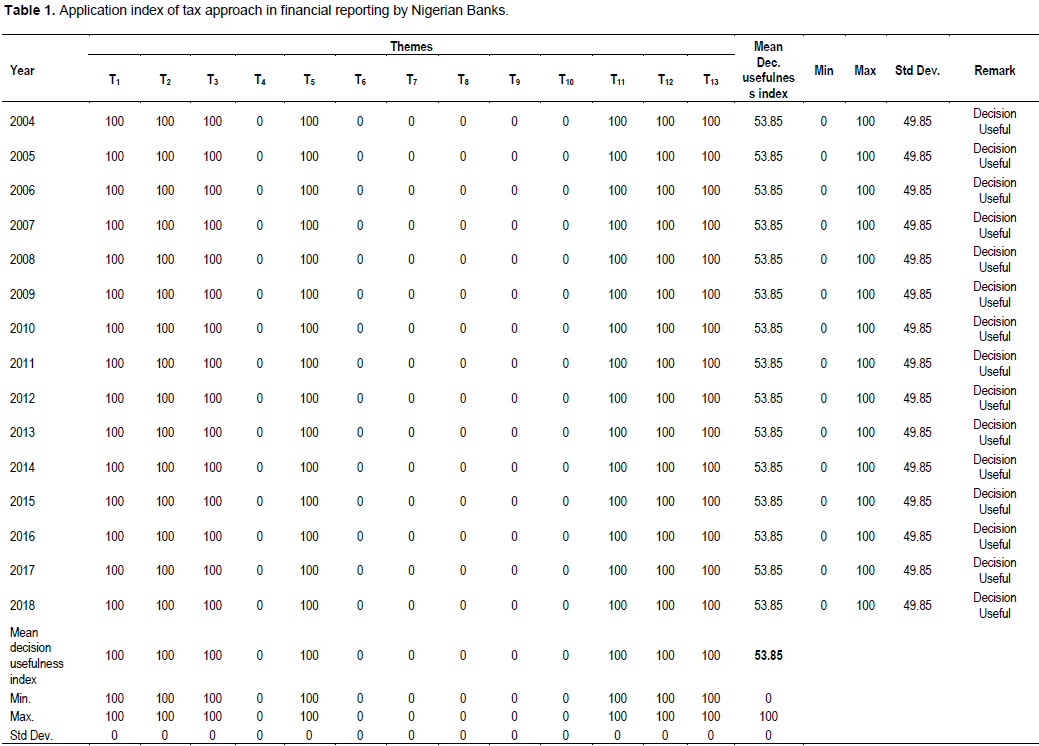

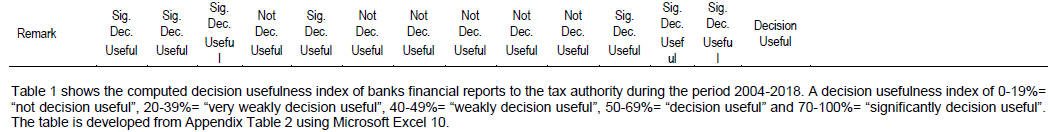

This section presents and discusses the results of the study. Appendix Table 2 shows the decision usefulness score sheet for the 13 themes by the sampled firms during the period 2004 to 2018. Table 1 presents the summary statistical results from Appendix Table 2 using Microsoft Excel 10. Table 1 shows that of the 13 themes developed to estimate the decision usefulness of financial information disclosure to the tax authority and by extension if the relationship between tax and accounting has come to nothing, 7 of the themes as indicated by the computed mean decision usefulness index of 100% were fully reflected in the sampled financial reports during the study period. These themes include disclosure of operating and other incomes (T1), donations/charitable gifts (T2), corporation tax (T3), fixed assets measurement (T5), pension (T11), financial assets (T12) and withholding tax (T13). Based on the developed criteria for judging decision usefulness, the financial information disclosure on these themes is significantly decision useful to the tax authority. The minimum and maximum reflection of these themes is both 100% and since the reflection level is consistently 100 percent, the standard deviation around the mean value is zero.

On the contrary, 6 of the 13 themes including depreciation (T4), operating lease (T6), finance lease (T7), provisions/contingencies (T8), research and development costs (T9) and interest expenses (T10) were completely not reflected in the sampled financial reports of the 15 firms as indicated by the computed zero mean decision usefulness index. Therefore, the financial information disclosure on these themes lacks decision usefulness to the tax authority.

The annual statistics in Table 1 which is more pertinent in reaching conclusion indicates mean decision usefulness indexes of 53.85% for each of the years. The minimum and maximum reflection of the themes for each of the years (2004 to 2018) is 0 and 100% respectively. The standard deviation around the mean decision usefulness index of 53.85% of 49.85 is the same for the years and shows existence of wide dispersion in the reflection of the 13 themes for the years. The overall mean decision usefulness index as shown in Table 1 is 53.85% which falls under the decision useful region. On this premise, therefore, it is concluded that financial information disclosure is not significantly decision useful to the needs of the tax authority. This position concurs with Dandago and Hassan (2013)’s finding that the financial reporting of companies is not tailored towards decision usefulness of the Inland Revenue Board in a country like Malaysia.

A close consideration of the 7 themes fully reflected in the financial reports to determine whether this stems from the long relationship between tax and accounting does not suggest the obvious. In particular, the disclosure of operating and other incomes (T1), corporation tax (T3), fixed assets measurement (T5), pension (T11) and financial assets (T12) might stem from the requirements of the statutes of Companies and Allied Matters Act (CAMA) and Banks and Other Financial Institutions’ Act (BOFIA) which mandates disclosure on these items than any influence of tax. Similarly, the theme of donation/charity and gifts (T2) could be as a result of the firm’s fulfilment of corporate social responsibility. These arguments corroborate the non-reflection of themes such as depreciation (T4), operating lease (T6), provision/contingencies (T8), research and development costs (T9) and interest expenses (T10) which are purely tax matters.

Infact, only 2 themes namely corporate tax (T3) and withholding tax (T13) could in the real sense be said to be underpinned by the tax and accounting relationship. Invariably, the long relationship between tax and accounting or the influence of tax on accounting as documented by Boross et al. (1995) in Dacian (2009), Lamb et al. (1998), Nobes et al. (2004) and Vokshi (2018) has faded away with the standardization of accounting practice whereby accounting standards mirrors financial reporting. Simply put, the long relationship between tax and accounting has not promoted financial information decision usefulness to the tax authority. This does not only confirm Lamb et al.’s assertion of a declining trend in the tax and accounting relationship, but also reinforces D’ Ascenzo and England (2003) by showing that developments in accounting have created differences between tax and financial reporting rules. In particular, there is evidence pointing to the fact that IFRS implementation around the world will further widen the tax and accounting relationship (Gavana et al., 2013; Gielen and Hegarty, 2007; Jiraskova and Molin, 2015). This position was not obvious from the current study since the reflection of the tax themes in financial statements remained unchanged after IFRS adoption by banks in 2012 in Nigeria.

By and large, the result shows a disconnect between tax and accounting in the Nigerian environment. The implication is that financial statements produced have little decision usefulness to the tax authority in Nigeria. This further means that a lot of efforts will still be exerted by the tax authorties in adjusting financial statements prepared to conform with the requirements of the tax law. This in turn has far reaching effect on the timeliness of tax payment and collection as well as overall cost of tax administration in the country.