Full Length Research Paper

ABSTRACT

This research investigates the relationship between financial reporting quality and audit quality within the context of French listed companies. The auditor brand name (Big4) is used as a proxy for audit quality and earnings management is ascertained through real and accruals earnings management estimation. Discretionary accruals are estimated using the Jones Model and the Modified Jones Model while real earnings management is estimated through the use of models proposed by Roychowdhury (2006). The results indicate that clients of Big4 audit firms record higher levels of accruals and real earnings management. This assertion could be attributed to the low level of auditor litigation risk in France. This study contributes to the literature by investigating the case for both discretionary accruals and real earnings management in a French environment that has peculiar auditing characteristics.

Key words: Audit quality, financial reporting quality, earnings management, discretionary accruals, real earnings management.

INTRODUCTION

The quality of financial statements produced by the management of companies is of utmost importance to current and potential investors, as they rely on these statements to make investment decisions. Managers as agents of shareholders are mandated to act in the best interest of shareholders and provide accurate financial information. However, as a result of information asymmetry, the managers of some companies try to manipulate profit figures in cases where these profits fall below the expected benchmarks and thereof influence investor decisions (Thomas, 1989). This act lowers the quality of financial reporting and accounting information (Chi and Pevzner, 2011). It has been observed that managers may take opportunistic advantage of the level of discretion available to them to massage earnings or to draw a wrong picture of the organization’s future (Christie and Zimmerman, 1994). The various ways through which managers achieve this is what is known as earnings management. This study focuses on both accruals earnings management (AEM) and real earnings management (REM) as proxies for measuring earnings management. After the occurrences of major scandals such as Xerox (2000), Enron (2001) and WorldCom (2002), the role played by the quality of external auditing in an attempt to curb these misfortunes has been a major topic of discussion (Sarwoko and Agoes, 2014). The occurrences of such scandals led to the passage of laws such as the Sarbanes Oxley 2002 (SOX). Similarly in the enforcement of the UK Corporate Governance Code (2018) where procedures and systems that can reduce the occurrence of accounting scandals are discussed. In the case of France, there are auditing laws that safeguard the independence of auditors. The joint audit system and the mandatory six-year rotation of auditors ensure that familiarity between auditors and clients, and manager intimidation is reduced to the barest minimum. One aim of this research is to ascertain the relationship that may exist between the quality of financial reporting -using earnings management as a proxy- and Audit quality. As stated by Alzoubi (2018), audit quality can be considered as a control mechanism that would hinder managers from manipulating the earnings of a company. Also stated by Defond and Zhang (2014), high audit quality can be equated to the assurance of high quality of financial reporting.

Various motivating factors urge managers to manipulate earnings. Capital market expectation and valuation, contractual remunerations that are dependent on accounting figures and government regulations may all be considered as part of these motivating factors (Healy and Wahlen, 1999). The tendencies of the occurrence of activities of earnings management are part of the reasons why investors should have a keen interest in the quality of external auditing.

The appointment of external auditors is a result of the classical agency problem in which case the external auditors act as an independent source of assurance that the managers of companies (the agents) provide financial statements that are prepared per the accounting standards (Habib and Bhuiyan, 2011). There are various complexities involved in measuring the quality of audits because of the unobservable nature of the concept. Most studies in the literature have simplified these complexities and have simply adopted the use of brand name (BigX) as a proxy for audit quality (Craswell et al., 1995; Becker et al., 1998; Jordan et al., 2010; Ya?ar, 2013; Miko and Kamardin, 2015). Some scholars have also used audits fees to reflect the quality of audit provided by an external auditor (Hoitash et al., 2007), while others make use of auditor industry specialization as a proxy for audit quality which is a more sophisticated measure (Balsam et al., 2003; Kimberly and Brian, 2004; Ishak et al., 2013; Sarwoko and Agoes, 2014; Yuan et al., 2016).

In this study, the literature on earnings management and audit quality is extended to include the French context. The results of this study could prove interesting because of the special environmental characteristics that pertain to France as compared to other countries in Europe and the Americas. The obligatory joint audit system where firms are required to be audited by two audit companies may affect the use of Big4 as a proxy for audit quality. Also, the low auditor litigation risk in France as compared to other Anglo-Saxon regions may affect the performance of Big4 audit firms and other audit firms in general. Indeed, the relationship between earnings management and audit quality in the French context has been studied by Piot and Janin (2007). However, in their work, the focus was on AEM but in this work, the focus is on both AEM and REM. They concluded that as a result of the low litigation risk, audit quality as proxied by Big4 has no significant effect on the degree of discretionary accruals that occurs. This research finds contradictory results and adds to this by testing the case for REM as well. The results of the study may be of interest to shareholders and regulators to pay more attention to the factors that motivate external auditors to provide good quality audits.

LITERATURE REVIEW

Audit quality

The most popular proxy for audit quality has been the use of auditor brand, normally referred to as BigX where X represents the number of top tier audit firms within the period under study (Jeong and Rho, 2004). Throughout history, the number of these top tier audit firms has varied, with some audit firms losing their place to others. For example, a while before the period of 2002, there was the Big5, which was made up of Ernst and Young, PWC, KPMG, Deloitte and Arthur Andersen LLP (AA). However, because of the Enron scandal and the role AA played, they had a massive dip in reputation and thereby lost their place as a top tier audit firm. It remains Big4 for the periods under study in this research. Big4 auditing firms are said to produce higher audit quality because they try to isolate themselves from other auditing firms by investing more into their brand. (Craswell et al., 1995; Khurana and Raman, 2004; Krishnan, 2003; Lee and Lee, 2013). These researchers expound more on this by stating that Big4 audit firms spend more resources on staff recruitment and training, audit planning and keeping up to date with the state of the art technology needed for audits.

There are two main pillars upon which the quality of an audit rests; the ability of an auditor to detect material errors and misstatements and also having the independence to acquire the right attitude towards reporting such errors and misstatements (DeAngelo, 1981). The identification of these two pillars is further classified into input-based and output-based approaches. The size of Big4 firms is used as a measure for both competence and independence is an input-based approach. The large sizes of Big4 audit firms afford them the ability to invest more into what it takes to provide good quality audits. This is an input-based approach to ascertaining competence because the stated points are key indicators that disclose that Big4 audit firms are capable of providing audits of good quality (Defond and Zhang, 2014). As stated by Fulop et al. (2018), stakeholders have unreasonable expectations of all auditors. By virtue of the resources available to the Big4, they come closest to meeting these expectations as they provide audits with the best qualities. In the same vein, as a result of their large size and reputation, Big4 audit firms are more motivated to provide good audits (Krishnan, 2003). High litigation risk encourages them to be as independent as possible in the delivery of audit services and they are less likely to be intimidated by big clients (Defond and Zhang, 2014). A recent factor that has been discovered to influence the independence of auditors is the announcement of earnings by companies before the audit procedures are completed. As unearthed by Bronson et al. (2021), there is a higher likelihood of misstatements in the parts of audits that are done in the latter stages when earnings are announced before audit completion. The Big4 audit firms may be in the best place to withstand this threat to their independence. Following this logic, the Big4 proxy for audit quality is an input-based measure that covers both competence and independence.

Earnings management

The role of external auditors is to give an assurance that financial statements published by managers are of reasonable quality (Chen et al., 2011). Despite this, earnings management is a common practice in every company and is only known by external parties in the event of a scandal (Gakhar, 2013).

Managers undertake earnings management in two major forms established in the literature. First, managers may make use of judgment in the preparation of financial statements to decide on accounting estimates and also interpret accounting standards to align with their interests (Ewert and Wagenhofer, 2005). This is known as accrual earnings management (AEM). Secondly, managers can make operational decisions to cause firms to deviate from their regular patterns to have the desired effect on the earnings of the firms at the end of the period (Roychowdhury, 2006). This is termed real earnings management (REM).

There are various models for estimating both AEM and REM, which range from very simple models to highly complex ones. Discretionary accruals have been the most popular proxy used by scholars to estimate levels of earnings management that occur through financial accounting measures (Dechow et al., 1995; Jones, 1991; Kothari et al., 2005). Total accruals are split into two; discretionary accruals which are influenced by the discretion of managers and the non-discretionary accruals, which arise as a result of the nature of the company (Mangala and Isha, 2017). These models are able to make this distinction. On the other hand, REM proxies have been developed and used by Roychowdhury (2006)and Cohen et al. (2008).

This study makes use of the Jones model (1991) and the Modified Jones model (1995) to estimate AEM. To estimate REM, the model proposed by Roychowdhury (2006)is used.

Audit quality and earnings management

Varieties of research works have studied the relationship between audit quality and earnings management. As observed by Jordan et al. (2010), there is a positive relationship between audit quality and quality of financial reporting in the context of US firms. In their work, the results show that Big4 audit firms can restrict the attempts made by managers to manage earnings. They estimated earnings management as the propensity of managers to round up accounting figures to achieve the desired earnings. They observed that these activities are highly reduced through better efforts from auditors with big brands. Similarly, negative results were reported by Reynolds and Francis (2000)also in the context of US firms where audit firms with big brand names mitigate more aggressively the discretionary accruals of companies. This is motivated by the need to protect the brands they have built for themselves.

Despite Graham et al. (2005)finding out that most managers prefer to use REM over AEM, very few have investigated the relationship between audit quality and REM. However, some studies conducted indicate that auditors with big brands are capable of mitigating the levels of REM. Kim and Park (2014)provided evidence to show that auditors with big brands are more likely to drop clients when they observe high levels of REM. Most of these notable works have been conducted in the US with very little conducted in other regions, France to be specific.

Alhadab and Clacher (2018)argue that high-quality audit is not a sufficient factor to reduce all forms of earnings management in the context of IPOs. In their case, high audit quality does indeed reduce discretionary accruals but most of these firms that have high-quality audits switch to REM. This result is consistent with that of Chi and Pevzner (2011)who stipulate that audit quality reduces the occurrence of AEM but firms resort to REM if they have no opportunity to undertake AEM. In the context of Vietnamese firms, Hoang and Vinh (2018)find no significant impact of audit quality on REM. In the peculiar case of French companies, Piot and Janin (2007)find no significant impact of audit quality on discretionary accruals. They concluded that there is no difference between audit firms with big brands and those with small brands when it comes to regulating the discretionary accruals of clients. They attributed their results to the different corporate governance and auditing characteristics present in France. This is consistent with the results provided by the study of Ya?ar (2013).

In other studies as well, there has been a mix of results. In trying to ascertain the relationship between levels of discretionary accruals and Audit quality, there have been other proxies for measuring audit quality.

Balsam et al. (2003)found a positive association when they made use of the auditor industry specialization as a proxy for audit quality and assessed its impact on the quality of financial reporting. Many other studies have made use of the auditor industry specialization as a proxy to measure audit quality and have found a negative relationship between this proxy and discretionary accrual levels (Krishnan, 2003; Chen et al., 2005; Habbash and Alghamdi, 2016; Yuan et al., 2016).

HYPOTHESES DEVELOPMENT

Studies have argued that audit quality measured by the use of brand name has a negative relationship with levels of discretionary accruals (Reynolds and Francis, 2000; Jordan et al., 2010). This is the case rationally because Big4 audit firms are seen to invest more into all that is needed for quality audit processes. Also in a bid to protect the big brand name they have built for themselves, they are more motivated to provide high- quality audits.

In view of this,

H1: Firms audited by Big4 engage in less discretionary accruals

Even though Big4 audit firms are noted to be capable of reducing discretionary accruals, studies have suggested that firms make use of AEM and REM as substitutes (Alhadab and Clacher, 2018; Chi and Pevzner, 2011; Graham et al., 2005). Cohen and Zarowin (2010)indicate that due to the ability of auditors with big brands to identify and restricts AEM tactics firms are likely to make use of REM to avoid being caught. This is because REM activities are much more difficult to trace. In light of these arguments that suggest that Big4 audit firms control AEM, firms are expected to make the switch to REM and therefore,

H2: In the presence of Big4, firms are likely to have higher levels of REM

METHODOLOGY

Sample

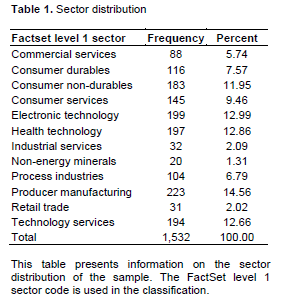

The sample comprises French listed firms and data collected from the Factset Database covering a period of 2009 to 2016 and using the non-probability sampling technique which is slightly biased. Biased in the sense that firms in the finance sector are eliminated due to the special regulations that moderate their activities. Also, companies with 0 or negative sales values are eliminated. After these exclusions, the sample is reduced to 1532 firm-year observations (1204 for REM estimations) (Table 1).

Variable measurement

Audit quality

The Big4 auditing firms have been noted across the literature to produce high levels of quality audits (Reynolds and Francis, 2000; Jordan et al., 2010). For this reason, companies audited by the Big4 are identified as companies with the best audits. Attention is paid to the joint audit system in France which could complicate the coding of this variable. A dummy variable is used where companies

who have at least one of their auditors being a member of the Big4 is denoted by 1 and 0 denotes companies not audited by Big4.

Discretionary accruals earnings management

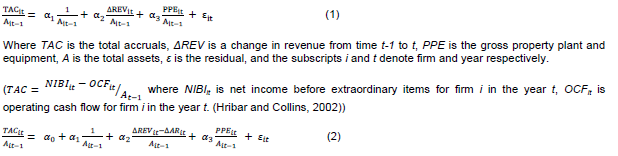

To estimate AEM, two prominent models within the literature are used. AEM reflects the measure of earnings management through accounting choices and accounting standard interpretations. AEM is measured using the Jones model (1991) (Abs_J) and the Modified Jones-Evans model (1995) (Abs_MJ). The models are respectively defined as follows:

Where AR is the change in Accounts Receivable from time t-1 to t for company i at time t. The regression is run cross-sectionally by industry and by year.

The residuals of Eq1 and Eq2 represent the discretionary accruals of companies through the Jones model and the Modified jones model respectively.

Real earnings management

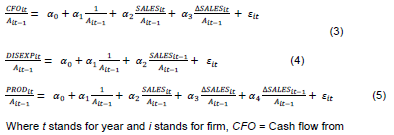

To estimate REM, the model of Roychowdhury (2006)is used. In his work, he suggests that REM can take place through three operational activities and decisions. Sales, discretionary expenditure and production costs are the means through which REM can be undertaken. These are estimated in Eq3, Eq4 and Eq5 respectively. By offering more discounts and lenient credit terms, managers can considerably increase the volume of their credit sales. This affects cash flows by lowering the cash flow from operations for the current year. There could also be a reduction in the discretionary expenditures of a firm. Research and development expenses (R&D), advertising expenses, selling general and administrative expenses make up the discretionary expenditure that managers could manipulate. A reduction in these expenses would affect the earnings reported by firms. Overproduction is also a means of REM. By taking advantage of the concept of economies of scale, managers can manage earnings upwards. Overproduction will decrease the fixed overheads per unit and therefore decrease the cost of goods sold reported in the income statement. The three models are defined in the following equations;

operations, DISEXP = Discretionary expenses estimated as the sum of R&D expenses, advertising, selling, general and administrative expenses.PROD = the production cost estimated as the sum of the cost of goods sold and change in inventories. SALES = Sales; A = Total Assets. ΔSALES = The change in sales from time t-1 to t ε represents the residuals which is an estimation of the abnormal cash flow from operations (Abn_CFO), the abnormal discretionary expense (Abn_DISEXP) and the abnormal cost of production (Abn_PROD)

The regressions are run cross-sectionally for each sector and each year. Absolute values are used, in line with the study conducted by Maurice et al. (2020). The absolute values give an estimation of the degree of earnings management whether income increasing or decreasing.

Control variables

Following the prevalent literature, certain control variables are included. To control for certain firm-specific characteristics that would affect earnings management, the effect of the size of companies is controlled by using the log of total assets. Also included as control variables are the cash flow from operations and the debt to asset ratio (Balsam et al., 2003). Also to control for financial performance, a loss dummy is included. Firms that incur losses are known to have more incentives to manage earnings (Francis et al., 2004). In line with Aubert and Grudnitski (2012), the number of analysts following firms is included as a control variable because this also can influence the earnings management level of firms. The final control variable is the debt to asset ratio. The regressions are all run with a year and sector fixed effect so those can also be considered as a control.

Multivariate model

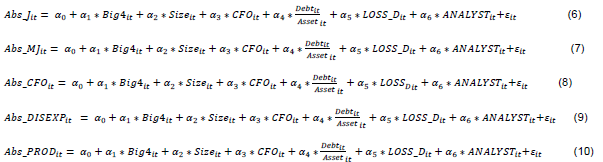

In the multivariate analysis, the absolute values of the AEM and REM estimations are regressed against audit quality proxied by the auditor brand. A fixed-effect panel regression with sector and year fixed effects is run in each case.

Where equations 6 to 10 test the hypotheses. The dependent variables in Equations 6 to 10 are the absolute value of discretionary accrual from the Jones model, the absolute value of discretionary accrual from the Modified Jones model, absolute value of abnormal cash flow from operations, absolute value of abnormal discretionary expense and the absolute value of abnormal production costs respectively. The independent variables are the proxy for audit quality through audit brand (Big4), the log of total assets (Size), cash flow from operations scaled by the lagged total assets (CFO), the debt to asset ratio (Debt/Asset), the loss dummy variable (LOSS_D) and the number of financial analysts following a firm (ANALYST).

RESULTS AND DISCUSSION

Descriptive statistics and correlation matrix

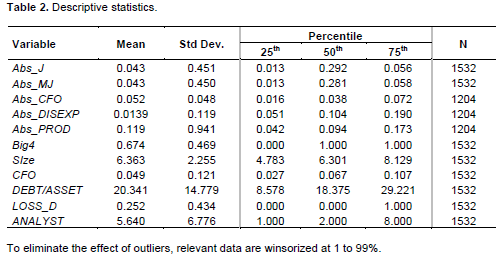

The descriptive statistics of all variables used in the models are reported in Table 2. Due to missing data needed for the estimation of various earnings management proxies, there is a disparity in the firm-year observations for the REM proxies and other variables. For the selected firms in the sample, it is observed that the mean of absolute values of the earnings management proxies is close to zero which is an indication of good estimation. Given that the measure of audit quality is the Big4 against the non-Big4, 67.4% of firms in the sample are audited by the Big4 audit firms.

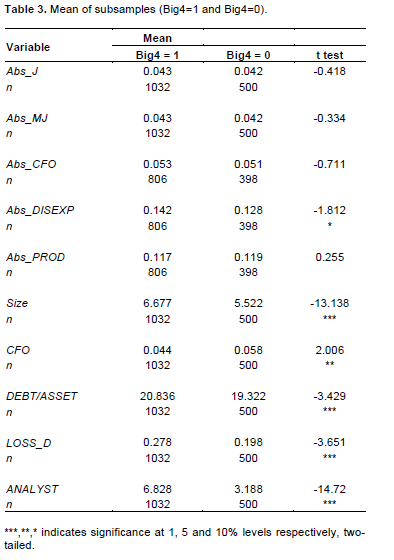

Table 3 essentially breaks down the sample into two subsamples using the measure of audit quality as the base for classification. The first group is made up of firms that are audited by the Big4 and the second group is made up of firms that are audited by the non-Big4. Univariate analysis of these subsamples is conducted by comparing the mean values of each variable.

Looking at both measures of AEM, the mean values for firms audited by the Big4 is higher than that of companies audited by the non-Big4. However, the mean t-test proves insignificant. This is inconsistent with the H1 of the study. The REM proxies mostly produce insignificant results too. Only Abs_DISEXP yields a significant result (p<0.1) where the mean value is higher for firms audited by Big4 audit firms. This is consistent with the H2 of the study.

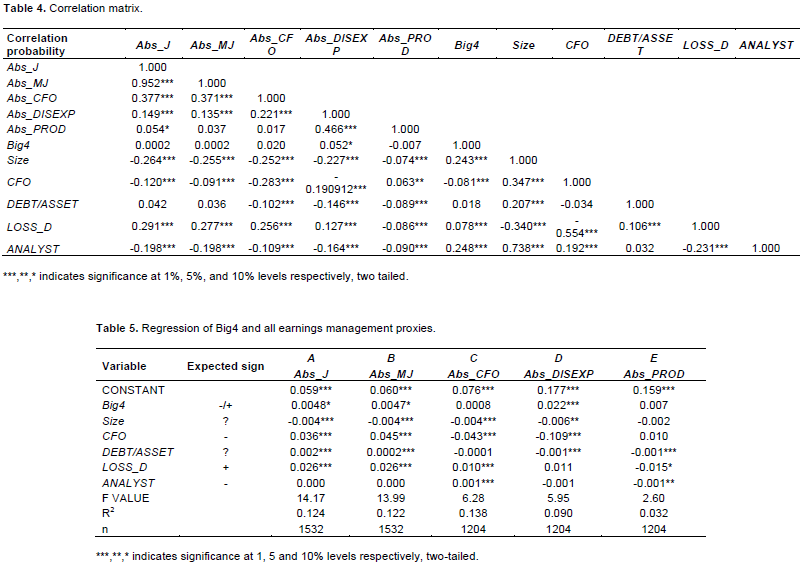

Table 4 presents the correlation between the variables. A positive and insignificant correlation coefficient is observed between the absolute values of AEM and audit quality which is inconsistent with the H1. Also with regards to REM, Abs_CFO and Abs_PROD both produce insignificant correlation coefficients with audit quality. Abs_DISEXP on the other hand records a positive coefficient with audit quality and is significant at p<0.1. This is in line with the H2 of the study. The variance inflation factors (VIF) amongst variables in present in the same model are estimated. The highest VIF recorded is 2.88 which is a good indication that multicollinearity is not likely to be an issue.

Multivariate analyses

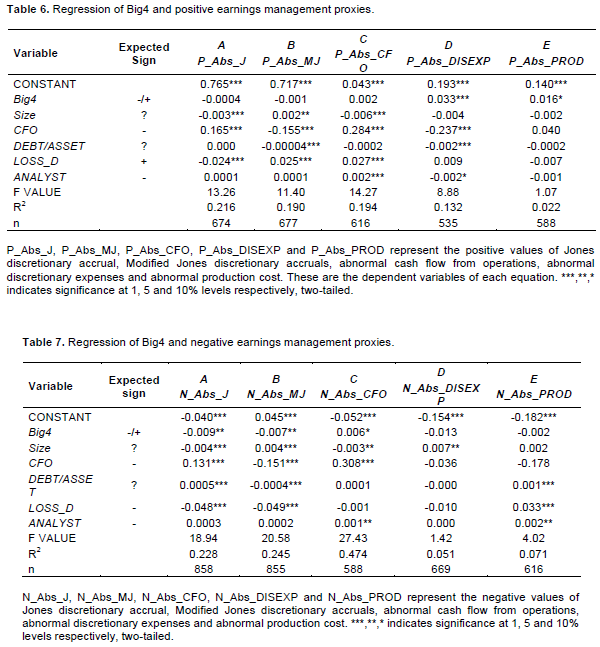

Table 5 reports the multivariate results after regressing the various measures of earnings management as dependent variables against audit quality which is the independent variable. Columns A and B record the results of the regression dealing with AEM estimations. Abs_J and Abs_MJ produce positive coefficients of 0.0048 and 0.0047 respectively, with both being significant at p<0.1. This indicates that there is a positive relationship between the Big4 measure of audit quality and earnings management. This is contrary to the H1 and also the result obtained by Piot and Janin (2007)who found no significant relationship between audit quality and discretionary accruals amongst French companies. The results of this indicate that clients of the Big4 audit firms record higher levels of discretionary accruals. This might be due to the low auditor litigation risk in France as mentioned in the work of Piot and Janinot (2007). The H1 of this study that states that firms audited by Big4 engage in less discretionary accruals is therefore rejected. This result contradicts the US studies of Jordan et al. (2010) and that of Reynolds and Francis (2000). This can also be attributable to the difference in auditor litigation risk in the countries.

Columns C to E of Table 5 report the case of REM proxies and audit quality. Both Abs_CFO and Abs_PROD yield insignificant results with audit quality, indicating that audit quality has no significant impact on managers’ REM activities through the channels of abnormal cash flow manipulation and overproduction. However, a positive coefficient of 0.022 for audit quality in the case of Abs_DISEXP which is significant at p<0.01 is attained. This is an indication that firms that are audited by Big4 manage earnings more by manipulating their discretionary expenditures. Even though the other two proxies generate insignificant results, the H2 of the study which states that in the face of Big4 firms utilize REM is validated. This is because the result suggests that they do so through the usage of abnormal discretionary expenses. This result is in line with those obtained by Alhadab and Clacher (2018) and Chi and Pevzner (2011). The reason for this is explained by Cohen and Zarowin (2010)where they state that firms make use of REM because they are more difficult to trace by regulators. This indicates that even in high litigation risk environments, firms will make use of REM because of the higher likelihood of getting away with it.

Additional tests and robustness check

Additional tests are conducted to further examine the relationship between earnings management and audit quality in France. Singed values of the various proxies of earnings management estimated are used. The signed values represent the direction of earnings management and this could be income increasing or income decreasing (Balsam et al., 2003; Maurice et al., 2020). For AEM, positive values indicate income increasing discretionary accruals while negative values indicate income decreasing discretionary accruals. This is not as straightforward for the proxies REM. According to Roychowdhury (2006), more negative values for abnormal cash flow from operations and abnormal discretionary expenses indicate that firms have tried to increase earnings through these two channels and positive values for abnormal production costs indicate that firms have tried to increase earnings through overproduction.

Tables 6 and Table 7 report the results of regressions that make use of the signed values of earnings management as the dependent variables. In Table 6 of the positive values of each earnings management proxy are used while in Table 7 the negative values of each earnings management proxy are used. All the regressions are run with sector and year fixed effects.

As Columns A and B indicate in Table 6 insignificant results are obtained to explain the relationship between audit quality and income increasing accruals. This is to mean that Big4 audit firms do not have any significant impact on the level of income increasing discretionary accruals of their clients. However, Columns A and B of Table 7 report negative and significant (p<0.05) Big4 coefficients for income decreasing discretionary accruals. This implies that the more audit quality increases the more firms engage in income decreasing discretionary accruals.

By virtue of the negative values of discretionary accruals, increasing its occurrence would mean a further reduction in negative values. In the face of Big4, firms make use of more income decreasing AEM and this accounts for the positive and significant results attained in the main model.

Columns C to E of Tables 6 and 7 report the results of regression using the positive and negative values of REM proxies as dependent variables respectively. The positive values of abnormal cash flow from operations yield insignificant results while negative values yield a positive coefficient (significant at a p<0.1).

This implies that in the presence of Big4 audit firms, managers make use of irregular sales operations to decrease earnings. However, this relationship is not strong enough to outmatch the insignificant results obtained for the case of positive values. This gives reason for the insignificant result obtained in the main analyses.

For the case of the relationship between abnormal discretionary expense and audit quality, a positive coefficient (significant p<0.01) is reported for positive values and a negative coefficient (significant at p<0.05) for negative values. This translates as firms audited by Big4 making use of abnormal discretionary expenditure as a means to both increase or decrease earnings.

With regard to the impact of audit quality on the abnormal cost of production, a positive and significant coefficient for the positive values (p<0.1) is obtained and an insignificant coefficient for negative values. This indicates that firms audited by Big4 do make use of overproduction to increase earnings but this is overshadowed by the insignificant results obtained for the negative abnormal production cost, hence the results of the main model.

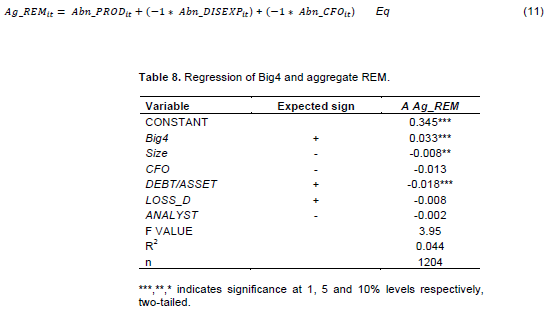

Aggregation of REM proxies

To perform further tests on the REM an aggregation of the various proxies as done in some studies is used (Alhadab and Clacher, 2018; Bozzolan et al., 2015; Tulcanaza-Prieto et al., 2020; Zang, 2012). To estimate the aggregate of REM the following equation is used;

Where Ag_REM represents the aggregate of REM proxies. Other variables are already defined.

Table 8 reports the results of the regression making use of the absolute value of Ag_REM as the dependent variable. The positive and significant coefficient (p<0.01) obtained for the Big4 variable indicates that firms audited by the Big4 make use of more activities of REM and is consistent with the H2. The abnormal discretionary expenditure may be the sole reason for this result obtained as it is the only measure of REM that yields a significant result independently.

CONCLUSION

This study is dependent on the fundamental agency problem that occurs between managers and shareholders. The presence of information asymmetry allows managers to manipulate earnings to meet short term earnings targets. The services of external auditors are engaged as an agency cost to reduce the information asymmetry. This study investigates the possibility of audit quality improving the quality of financial reporting. The study makes use of the auditor brand as a tool to measure the quality of the audit provided. The quality of financial reporting is also measured through the use of accruals earnings management and real earnings management. This research is conducted in the context of French listed companies where there is peculiar auditing and litigation risk environment.

The results provide evidence that shows that Big4 auditors do not limit the levels of AEM that their clients engage in. This is an indication that within the context of France, clients of the Big4 auditors are more likely to have higher levels of AEM in which case the H1 of the study is rejected. This result is contradictory to those obtained in other regions. A reason for this may be as a result of the low audit litigation risk in France as compared to other regions like the USA (Piot and Janin, 2007). The tests provide a mix of results concerning REM. Ultimately, it can be concluded that clients of Big4 engage in more activities of REM which validates the H2 of the study. However, some insignificant results are obtained for the individual proxies of REM. The results indicate that clients of Big4 mainly make use of abnormal discretionary expenses as their means of managing earnings through REM.

In effect, this study concludes that audit quality has a negative impact on the quality of financial reporting in France. This study recommends that there should be the enforcements of some government policies to give external auditors the extra motivation to mitigate the occurrence of both AEM and REM. The low auditor litigation risk in France may imply that auditors can be relaxed about their duties without the fear of lawsuits in case of negligence. Also, the use of abnormal discretionary expenses to manipulate earnings should be a caution to shareholders to empower audit committees to keep an eye on such activities. REM activities are detrimental to shareholder value in the long run. Theoretically, some studies have concluded that audit quality limits managers ability to manipulate earnings through discretionary accrual and specifically in France it has been observed that audit quality has no relationship with discretionary accruals. However, it is found in this study that audit quality has a negative impact on AEM. Very few studies have been conducted to study the relationship between audit quality and REM. This is investigated and it can be concluded that in the context of French companies, audit quality also has a negative impact on REM, especially through the use of abnormal discretionary expenses.

Similar to other studies, the results of this study should be interpreted with some thoughtfulness. The findings and conclusions of this study are derived from auditor brand and earnings management which are academic proxies for audit quality and quality of financial reporting. These two concepts are not directly observable and hence the reliance on proxies which may not be accurate in reality.

There are some limitations to the study that must be noted. The usage of only one proxy as a measure for audit quality and as noted by Rajgopal et al. (2021), the Big4 proxy lack nuance because it is not an engagement specific measure. Future studies can incorporate multiple proxies like audit fees and auditor industry specialization to examine the joint effect of these proxies. Also in the context of France where there is the mandatory joint audit rule, there could be a study to investigate the case where both auditors of a company are part of the Big4.

CONFLICT OF INTERESTS

The author has not declared any conflict of interests.

REFERENCES

|

Alhadab M, Clacher I (2018). The impact of audit quality on real and accrual earnings management around IPOs. British Accounting Review 50(4):442-461. |

|

|

Alzoubi ESS (2018). Audit quality, debt financing, and earnings management: Evidence from Jordan. Journal of International Accounting, Auditing and Taxation 30:69-84. |

|

|

Aubert F, Grudnitski G (2012). Analysts' estimates; What they could be telling us about the impact of IFRS on earnings manipulation in Europe. Review of Accounting and Finance 11(1):53-72. |

|

|

Balsam S, Krishnan, Yang J (2003). Auditor Industry Specialisation And Earnings Quality. Auditing: A Journal of Practice and Theory 22(2):71-97. |

|

|

Becker CL, Defond M, Jiambalvo J, Subramanyam KR (1998). The effect of audit quality on earnings management. Contemporary Accounting Research 15(1):1-24. |

|

|

Bozzolan S, Fabrizi M, Mallin CA, Michelon G (2015). Corporate Social Responsibility and Earnings Quality: International Evidence. International Journal of Accounting 50(4):361-396. |

|

|

Bronson SN, Masli A, Schroeder JH (2021). Releasing earnings when the audit is less complete: Implications for audit quality and the auditor/client relationship. Accounting Horizons 35(2):27-55. |

|

|

Chen HW, Chen JZ, Lobo GJ, Wang YY (2011). Effects of Audit Quality on Earnings Management and Cost of Equity Capital: Evidence from China. Contemporary Accounting Research 28(3):892-925. |

|

|

Chen KY, Lin KL, Zhou J, Chen KY, Lin K (2005). Audit quality and earnings management for Taiwan IPO firms. Managerial Auditing Journal 20(1):86-104. |

|

|

Chi W, Pevzner M (2011). Is Enhanced Audit Quality Associated with Greater Real Earnings Management? Accounting Horizons 25(2):315-335. |

|

|

Christie A, Zimmerman JL (1994). Efficient and Opportunistic Choices of Accounting Procedures: Corporate Control Contests. Accounting Review 69(4):539-566. |

|

|

Cohen DA, Dey A, Lys TZ (2008). Real and Accrual-Based Earnings Management in the Pre- and Post-Sarbanes-Oxley Periods. The Accounting Review 83(3):757-787. |

|

|

Cohen D, Zarowin P (2010). Accrual-based and real earnings management activities around seasoned equity offerings. Journal of accounting and Economics 50(1):2-19. |

|

|

Craswell AT, Francis JR, Taylor S L (1995). Auditor brand name reputations and industry specializations. Journal of Accounting and Economics 20(3):297-322. |

|

|

DeAngelo LE (1981). Auditor size and audit quality. Journal of Accounting and Economics 3(3):183-199. |

|

|

Dechow PM, Sloan RG, Sweeney AP (1995). Detecting Earnings Management. The Accounting Review 70(2):193-225. |

|

|

Defond M, Zhang J (2014). A review of archival auditing research. Journal of Accounting and Economics 58:275-326. |

|

|

Ewert R, Wagenhofer A (2005). Economic effects of tightening accounting standards to restrict earnings management. The Accounting Review 80(4):1101-1124. |

|

|

Francis J, Lafond R, Olsson PM, Schipper K, Lafond R, Schipper K (2004). Costs of Equity and Earnings Attributes. The Accounting Review 79(4):967-1010. |

|

|

Fulop MT, Tiron-Tudor A, Cordos GS (2018). Audit education role in decreasing the expectation gap. Journal of Education for Business 94(5):306-313. |

|

|

Gakhar DV (2013). Earnings management practices in India: A study of auditor's perception. Journal of Financial Crime 21(1):100-110. |

|

|

Graham JR, Harvey CR, Rajgopal S (2005). The economic implications of corporate financial reporting. Journal of Accounting and Economics 40(1-3):3-73. |

|

|

Habbash M, Alghamdi S (2016). Audit quality and earnings management in less developed economies: the case of Saudi Arabia. Journal of Management and Governance 21(2):351-373. |

|

|

Habib A, Bhuiyan MBU (2011). Audit firm industry specialization and the audit report lag. Journal of International Accounting, Auditing and Taxation 20(1):32-44. |

|

|

Healy PM, Wahlen JM (1999). A Review of the Earnings Management Literature and Its Implications for Standard Setting. Accounting Horizons 13(4):365-383. |

|

|

Hoang K, Vinh KN (2018). Audit Quality, Firm Characteristics and Real Earnings Management: The Case of Listed Vietnamese Firms. International Journal of Economics and Financial Issues 8(4):243-249. |

|

|

Hoitash R, Markelevich A, Barragato CA (2007). Auditor fees and audit quality. Managerial Auditing Journal 22(8):761-786. |

|

|

Hribar P, Collins DW (2002). Errors in Estimating Accruals: Implications for Empirical Research. Journal of Accounting Research 40(1):105-134. |

|

|

Ishak AM, Mansor N, Maruhun ENS (2013). Audit Market Concentration and Auditor's Industry Specialization. Procedia - Social and Behavioral Sciences 91:48-56. |

|

|

Jeong SW, Rho J (2004). Big Six auditors and audit quality: The Korean evidence. The International Journal of Accounting 39:175-196. |

|

|

Jones JJ (1991). Earnings Management During Import Relief Investigation. Journal of Accounting Research 29(2):193-228. |

|

|

Jones?Evans D (1995). A typology of technology?based entrepreneurs: A model based on previous occupational background. International Journal of Entrepreneurial Behavior and Research 1(1):26-47. |

|

|

Jordan CE, Clark SJ, Hames CC (2010). The impact of audit quality on earnings management to achieve user reference point in EPS. The Journal of Applied Business Research 26(1):19-30. |

|

|

Khurana IK, Raman KK (2004). Litigation Risk and the Financial Reporting Credibility of Big 4. The Accounting Review 79(2):473-495. |

|

|

Kim Y, Park MS (2014). Real activities manipulation and auditors' client-retention decisions. The Accounting Review 89(1):367-401. |

|

|

Kimberly AD, Brian WM (2004). Audit Firm Industry Specialization and Client Disclosure Quality. Review of Accounting Studies 9(1):35-58. |

|

|

Kothari SP, Leone AJ, Wasley CE (2005). Performance matched discretionary accrual measures. Journal of Accounting and Economics 39(1):163-197. |

|

|

Krishnan GV (2003). Does big 6 auditor industry expertise constrain earnings management? Accounting Horizons 17:1-16. |

|

|

Lee H, Lee H (2013). Do Big 4 audit firms improve the value relevance of earnings and equity? Managerial Auditing Journal 28(7):628-646. |

|

|

Mangala D (2017). A brief mapping of earnings management's drivers and restraints. Journal of Commerce and Accounting Research 6(3):19-28. |

|

|

Maurice Y, Mard Y, Severin É (2020). The Effect of Earnings Management on Debt Maturity: an International Study. Accounting Control Audit 26:125-156. |

|

|

Miko NU, Kamardin H (2015). Impact of audit committee and audit quality on preventing earnings management in the pre-and post-Nigerian corporate governance code 2011. Procedia-Social and Behavioral Sciences 172:651-657. |

|

|

Piot C, Janin R (2007). External Auditors, Audit Committees and Earnings Management in France. European Accounting Review 16(2):37-41. |

|

|

Rajgopal S, Srinivasan S, Zheng X (2021). Measuring audit quality. Review of Accounting Studies 26(2):559-619. |

|

|

Reynolds JK, Francis JR (2000). Does size matter? The influence of large clients on office-level auditor reporting decisions. Journal of Accounting and Economics 30(3):375-400. |

|

|

Roychowdhury S (2006). Earnings management through real activities manipulation. Journal of Accounting and Economics 42(3):335-370. |

|

|

Sarwoko I, Agoes S (2014). An Empirical Analysis of Auditor's Industry Specialization, Auditor's Independence and Audit Procedures on Audit Quality: Evidence from Indonesia. Procedia - Social and Behavioral Sciences 164:271-281. |

|

|

Thomas JK (1989). Unusual Patterns in Reported Earnings. The Accounting Review 64(4):773-787. |

|

|

Tulcanaza-Prieto AB, Lee Y, Koo JH (2020). Effect of leverage on real earnings management: Evidence from Korea. Sustainability 12(6):2232. |

|

|

Ya?ar A (2013). Big four auditors' audit quality and earnings management: Evidence from Turkish stock market. International Journal of Business and Social Science 4(17):154-163. |

|

|

Yuan R, Cheng Y, Ye K (2016). Auditor Industry Specialization and Discretionary Accruals: The Role of Client Strategy. International Journal of Accounting 51(2):217-239. |

|

|

Zang AY (2012). Evidence on the trade-off between real activities manipulation and accrual-based earnings management. The Accounting Review 87(2):675-703. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0