Full Length Research Paper

ABSTRACT

Making Tax Digital (MTD), an initiative announced in 2015 by MP George Osborne in his autumn statement, brings with it the most impactful change to the UK tax administration for a generation. The Making Tax Digital vision aims to revolutionise the way businesses, landlords, individuals, and tax accountants interact with Her Majesty’s Revenue and Customs (HMRC). Making Tax Digital is intended to aid the government’s tax simplification agenda, which commits to making the UK tax system fully digitalised. Given this background, this research aims to examine the impact of making tax digital. This research has used a combination of primary quantitative and qualitative data that is triangulated across taxpayers, accountants and interdisciplinary practitioners. Questionnaires and semi-structured interviews were employed to collect raw data from a sample of 202 taxpayers, 20 accounting and 4 interdisciplinary practitioners. A particular need identified is for support and clearer guidance on compliance for the 3.5 million sole trader businesses which generate £1.9 trillion of wealth for the United Kingdom. This has to be backed by a strong anti-avoidance business support system for sole proprietary businesses to enable then to adapt to new way of reporting and paying taxes. It is further recommended that HMRC develops a strong communication strategy that encourages and helps sole trader overcome challenges of Making Tax Digital.

Key word: Digital taxation, Making Tax Digital, tax policy.

INTRODUCTION

While tax reforms are essential in the face of extensive economic and digital changes in the world, it is important to evaluate these reforms against other criteria’s as well. This research has developed key hypotheses that test the confidence levels of taxpayers transitioning to Making Tax Digital. This research has used a combination of primary quantitative and qualitative data that is triangulated across taxpayers, accountants and interdisciplinary practitioners. This cross validates findings and discusses the convergence, complementarity and dissonance of results. Furthermore, this research has developed a conceptual framework that aids the analysis and evaluation of the implications of the new Making Tax Digital legislation for the benefit of public policy and future tax environments. This research critically evaluates current literature and reviews the development of taxation legislation leading up to the introduction of MTD. To evaluate the impact of Making Tax Digital, this research has developed hypotheses that are tested with empirical data. The outcome of the research asserts that while short-term transitioning costs and additional complexity may exceed current HMRC expectations, the long-term benefits of managing taxes in real-time and such automation will be instrumental in forging a world class digital tax system for the United Kingdom. HMRC’s Making Tax Digital Framework will bring about drastic change, shifting taxpayers from analogue to digitalisation. The contribution of this research to the existing literature and practice is the provision of evidence of anticipated obstacles and concerns amongst those who would be impacted by these changes, and to address any difficulties and provide further guidance for government policy and HMRC assistance. The study has focused on the most vulnerable taxpayers who are most impacted by the MTD. A need has been identified for support and clearer guidance regarding compliance for the 3.5 million sole trader businesses which generate £1.9 trillion of wealth for the United Kingdom. This must be backed by a strong anti-avoidance business support system for sole proprietary businesses to enable them to adapt to new way of reporting and paying taxes. It is further recommended that HMRC develops a strong communication strategy that encourages and helps sole traders to overcome challenges of the Making Tax Digital initiative.

The overall, primary aim of this study is to analyse and evaluate the impact of ‘Making Tax Digital’ on UK taxpayers. As such this thesis will examine and measure the readiness of the British public to the new HMRC Making Tax Digital Initiative. This paper will identify and evaluate the factors that influence compliant and non-compliant behaviour transitioning to Making Tax Digital by size, business status and sector?

This study adds new research by studying the performance of the proposed Making Tax Digital system in a novel way. More comprehensive analysis and specific novel research encompasses the design of a novel conceptual framework to measure the impact of Making Tax Digital on small businesses.

LITERATURE REVIEW AND HYPOTHESIS DEVELOPMENT

Enhanced digital technology has changed the way individuals and organisations work. Making Tax Digital is an initiative proposed by HMRC to modernise the United Kingdom’s tax system and thus deliver a world class digitalized tax system (Kerschner and Somare, 2017). The underlying principle for this initiative is however not something new. Making Tax Digital is an attempt to bring taxes into real time similar to the Real Time Information (RTI) Pay as you earn system (PAYE) for employers. This enables taxes to be collected quarterly rather than at year end (Seely, 2018). This investigation sought to test the hypothesis ‘whether taxpayers, grouped by turnover, demonstrated any significant impact on the levels of confidence of taxpayers transitioning to Making Tax Digital’. The rationale is to test this attempt to measure the impact on SME’s. The objectives of the Making Tax Digital program are quite simple. Firstly, the system is designed to reduce the amount of late filing penalties (Lane, 2017). This currently stands at approximately 800,000 late returns (2017/18) (Government Statistics, 2018)

Secondly, tax returns would be prompted to be filed quarterly in real time and therefore would negate the need to be filed at the year-end (Hannam, 2017) making the tax system more efficient and effective. It is expected that the MTD will bring about many benefits that will certainly reform the existing tax framework effectively. These benefits essentially include allowing tax payers to be able to observe their revenues, expenses and payable taxes in real time and therefore be able to keep a track of their taxes both paid and due so that they are not shocked by extensive taxes at the end of the year. Furthermore, such automation of taxation services would allow overall improvement in the services of HMRC and will allow greater transparency to persist in the taxation related matters. Automating tax reports will also essentially make it easier for accountants and tax payers; making the whole process easy and smooth; especially at year ends. The MTD system will also facilitate provision of fast and virtual access to tax information through personal accounts. This will allow taxpayers access their information anywhere in the world, while dramatically reducing the need to stock up receipts and records in files on paper and will therefore reduce the need and costs associated with storage (Al-Karaawy, 2018). The proposal to introduce Making Tax Digital has brought with it some apprehension from key stakeholders. The Federation of Small Businesses (FSB) expressed concerns that taxpayers’ workload with regard to filing of taxes would increase if tax filing moved from annual to quarterly basis (Smith, 2017).

The MTD vision as captured by IRIS Software Limited (2017) aims to revolutionize the way businesses, landlords, individuals and tax agents interact with Her Majesty’s Revenue and Custom (HMRC). MTD is intended to aid the government’s tax simplification agenda which commits to making the UK tax system fully digitalised by the year 2023. The breakthroughs recorded in the spheres of Information and Communications Technology (ICT) had led to the introduction of an e-tax system. This is credited for an appreciable improvement of the level of tax compliance and at the same time lowering the cost of tax administration (Bojuwon and Obid, 2014). ‘Making Tax Digital’ leverages on the gains of E-tax and E-filing systems and though it is still a work-in-progress with many practicalities needing fine-tuning, it seems to have gained traction. The Digitalisation of the taxation system is varied in forms but is centered on on-line tax assessment and payments and has been adopted in many nations notably Canada, Taiwan, Australia, Malaysia, Singapore, Kenya, and South Africa among others (Mustapha and Sheikh, 2014). Generally, the argument for tax digitalization given by the aforementioned countries as well as the UK, is convenience, time-saving, tax simplification, cost reduction and the closure of tax gap McLure (1990). In the UK, ‘Making Tax Digital’ for all categories of individual and corporate taxpayers is founded on four core concerns it claims to accommodate. These concerns as listed by Stalker (2016) are: (i) it is aimed at making Tax compliance and monitoring much simpler; (ii) it aims to have unhindered access at all times to Information enabling tax liabilities to be more quickly and efficiently determined; (iii) information on both individuals and businesses income-generating activities will be stored in one place such that all taxes are bunched up into a single digital Tax Account; and finally, (iv) it is aimed at making digital communications with HMRC available at all times thus providing taxpayers convenience and greatly reduce the necessity for phone or post contact. In summary, there are three main strands to ‘MTD’ (HMRC March 9, 2018 update): (i) Digital Tax Accounts - profiles created by HMRC for individuals and businesses, pre-populated with the income and tax details they already hold, that can be updated online; (ii) quarterly digital reporting - by 2023 most businesses, self-employed people and landlords will be required to track their tax affairs digitally and update HMRC at least quarterly through their MTD- compliant accounting packages; (iii) options for paying tax - HMRC have started using real-time PAYE data to reduce under and overpayments by changing tax codes in-year. They propose to extend this to personal tax accounts on how/when to pay. Businesses, self-employed people and landlords will be able to adopt ‘pay- as -you- go’ tax payments voluntarily.

It is expected that such a significant and far-reached overhaul of the taxation system will have its own set of challenges, technical glitches and sometimes out-rightly conflicting provisions. HMRC has made efforts to address several of these areas of concerns by outsourcing the review and assessment of the MTD initiative to teams of seasoned experts drawn from the Financial, the Industry, the Academia and the ICT circles. In a published report in August 2016 (updated January 2017) titled “A collection of consultations around specific elements of the ‘Making Tax Digital’ reforms”, the submissions made by the experts and those independently made by pressure groups were analysed in-house and responded to. Setting out this scenario in her online reporting for Accountancy Daily, Pat Sweet (2017) further explains that the result of the foregoing concerted efforts led to a ‘modification of six key elements of the ’Making Tax Digital (MTD)’ vision. According to Sweet (2017), not only has this saved the initiative but also reinforced it; giving it solid and irreversible clout. The six modifications are itemised as follows: (a) bringing business tax into the digital age; (b) tax administration; (c) simplifying tax for unincorporated businesses’ (d) simplified cash basis for unincorporated property businesses; (e) voluntary pay as you go; (f) transforming the tax system through better use of information.

Additionally, two things that stand out of HMRC’s responses and are of utmost importance to various stakeholders including: a staggered implementation plan for MTD to accommodate drivers’ interest and a switch from Annual Tax Return (ATR) to quarterly reporting of Tax updates. For clarity, some literature on the two issues will be reviewed here. HMRC has published a revised plan for the execution of the MTD Initiative which also includes a timetable with specific dates fixed for mandatory compliance of the various categories of taxpayers, including how the various parts of the plan apply to individuals and businesses, and are being communicated by HMRC who also provide advice and support regarding related matters.

The MTD has certain costs associated with it for taxpayers and businesses. The Economic Affairs Committee has undertaken a study and submitted a report in the parliament under the authority of the House of Lords, highlighting that the costs for transitioning to MTD will rise for the businesses for VAT by GBP 109 and the businesses will have to pay a further GBP 43 on average going forward. There will be costs involved for getting the required hardware, software, training and familiarisation for the Making tax Digital operational know how. It is also believed that these costs estimates are rather low and incorrect. It is also mentioned in the report that if the MTD framework fails to deliver the expected tax yield, it will be difficult to mandate its usage going forward in the future for all (Economic Affairs Committee, 2018).

It is evident from the above-mentioned literature review that MTD is not the first introduction of digital technology into UK tax administration. It dates far back to the earliest modernisation efforts which saw the administration move from paper returns to electronic filing, and so digital technology has been employed in the UK tax system since much before. This then puts the construct ‘Making Tax Digital’ in its proper context, meaning a full digitalisation of the existing system rather than the first attempt at digitalisation. In fact, some industry experts would argue that the current UK taxation system is way ahead of many countries in the world as far as tax digitalisation is concerned (ICAEW, 2019).

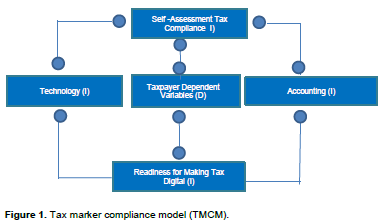

Transitioning from the current self-assessment system to Making Tax Digital and the effective digitalisation of the UK system is a fundamental shift from the present system. The use of information technology creates a climate for a more effective and efficient tax system as seen already in the digitalisation of the Swedish tax system. In order to examine the effective transition of UK taxpayers to Making Tax Digital, it is essential that taxpayer behaviours are evaluated through a set of tax markers. The data then will be able to be used to extrapolate this and used as a basis to ascertain the likelihood of compliance under Making Tax Digital. To measure taxpayer resistance to Making Tax Digital, the author developed a Tax Marker Compliance Model (TMCM) (Figure 1) that encompasses four behaviours namely: (i) current compliance behaviours (ii) technology (iii) accounting (iv) readiness for Making Tax Digital.

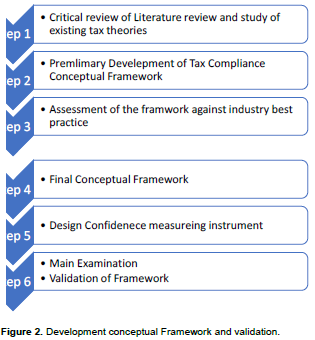

This thesis delineates a conceptual framework that will identify tax behaviours and furthermore measures and captures confidence levels of taxpayers through a set of variables that predict taxpayer compliance. A flow diagram of the process undertaken to develop this framework is illustrated in Figure 2. The steps taken to develop the conceptual framework included firstly critical examination of previous academic studies Secondly, a preliminary conceptual framework was constructed and assessed against tax legislation and best practice across jurisdictions. Thirdly a final refined conceptual framework was constructed and tested with a Likert measuring instrument. The four variables and the rational for their inclusion in the framework are discussed below.

Tax marker 1 - compliance

The definition of tax compliance is defined as the taxpayers’ is the willingness and ability to comply with tax laws, declare the correct income, claim the correct deductions, relief and rebates and pay all taxes on time. Researchers such as Kirchler (2007), suggests that the present compliance regime of filing and paying taxes is deemed as generally acceptable by both taxpayers and tax administrations. The inclusion of this variable in this conceptual framework is based on a tried and test tax system on which the foundation of tax is based.

Tax marker 2 – technology

Information technology is a major component of the rationale of moving to a digital tax system. The rational for inclusion of this variable in the conceptual framework is fundamental to the development of an e-tax system. Technology is a resource that consists of hardware such as computers, mobile devices, modems and networks whose purpose is to collect, store, process and transmit relevant information that supports business or personal operations (Adewoye and Olaoye, 2014). The primary reason why technology has been used as a measure of confidence is to confirm whether information technology improves the tax system. According to Dzidonu (2012), the reported benefits of information technology in public sector tax system have been found to be an improvement in administrative efficiency; effectiveness and productivity; improvement in service delivery; reduction in administration; operational and transactional costs of public and provision of access to information at a reduced cost. In relation to taxation, significance of the use of IT is infinite, some of which are: facilitates a reduction in the overhead cost of managing the agencies of government responsible for tax administration, instant computation of tax liability from the use of online tax calculator, reduced cost of registering tax payers and instant generation of tax identification number, reducing in staff-taxpayers collusion as regards tax liability, reduction in fraudulent activities of tax collectors in the aspect of non-remittance of tax received from taxpayers and boost the revenue of government in terms of reduction in expenses (administrative, overhead and transaction) and corrupt practices.

Ideally, the adoption of IT-facilities in administering taxation can lead to indifference attitude on the payment of taxes, garbage-in-garbage-out, that is imputation of wrong figures that will lead to wrong calculation of tax liability by online tax calculator, poor internet facility, poor electricity to power host server, high cost of maintenance of ICT facilities, lack of technical Know-how by tax administering agencies, high level of illiteracy among lower-income earners that characterized the population, incidence of internet hackers. So also, Oseni (2016), opined that the use of ICT can be catastrophic if carelessly employed by both the taxpayers and the tax administrators as scammers and hackers of the internet facilities can utilize the ignorance or the lax security of the system. The advent of electronic filing was first introduced in the United States where the Inland Revenue Service began offering tax refunds only. Muita (2011) concluded that overall, the group without agents seems to be lagging using technology; whilst those who used an agent seemed more confident. This could be due to confidence levels due to the guidance of agents in promoting the use of technology. It may also suggest that the first group may have the most difficulty in transitioning to Making Tax Digital was the emphasis is on using Technology. This would also suggest that HMRC would need to support this group with technology.

Tax marker 3 - accounting

The Accounting Tax Marker Variable is used to examine the confidence levels of taxpayers keeping statutory accounting records for the purposes of reporting their tax liabilities. One of the essential traits of running a successful business maintains some form of record-keeping (Braithwaite, 2003). Good record-keeping provides feedback to business records profitability, analyse growth and identify new business opportunities and hence is a tool that provides evidence of value. In the UK, the Income and Corporation Taxes Act (ICTA) 2015 requires that taxpayers keep adequate accounting records. Maintaining accounting records allows a business to be able to file tax returns on time (Evans et al., 2005). It was important, therefore, for this study to ascertain the basic level of confidence from which all subsequent tax compliance is derived. Research by McKerchar (1995), found that most taxpayers were not interested in record-keeping due to basic accountancy skills and tax knowledge. Their research also indicates that taxpayers also view record-keeping as time-consuming, burdensome and a general hindrance on the core business (Ashby and Webley, 2008).

Tax marker 4 – readiness for MTD

In order to measure the transition to making tax digital, the inclusion of this variable in the conceptual framework ensures that the levels of confidence transitioning from self-assessment to MTD are captured. This is a fundamental concept that is preceded by the other three variables that provide an effective grounding. Digitalisation has been seen to have a major impact on society and business and this trend is changing how we live and work (Tihinen et al, 2016). In fact, researchers have described digitalisation as the new industrial revolution. The term digitalisation refers to “action or process of digitising the conversion of analogue data into the digital format”. Research indicates that digitalisation or digital transformation is “the changes associated with the application of digital technology in all aspects of human society” (Stolterman and Fors, 2004 pp. 54). An alternative view presented by researchers is digitalization, the “ability to turn existing products or services into digital variants, thus offer advantages over tangible product” (Brennen and Kreiss, 2014).

Making Tax Digital in the United Kingdom is a step towards digitalisation and follows other countries such as Finish Tax Administration who exemplified the difference between digitalising and digitalisation of taxpayers. If the Finnish tax authorities would have digitalised the process, it would have been to produce a digital tax return and enable the attachment of invoices etc. in an electronic format also. However, the Finnish tax administration overhauled the entire process so that they received tax information directly from source such as employers, banks and other institution from where taxpayers drew down income. The tax authorities’ then send out a more informed tax determination to taxpayers, this prompts no further action from the taxpayer if the proposal is correct. Furthermore, the inclusion of this variable measures cash flow burden on businesses that will have to pay taxes quarterly. Whilst there may be many advantages for a business to plan their tax payments, research indicates that the current global financial and economic crisis presents major challenges to revenue administration in many countries. The overall financial implications of the crisis are described by the International Monetary Fund (IMF, 2009) with crisis-related issues in tax policy set out in a subsequent report (IMF, 2009). Simply summarised, global economic conditions are and will remain in a state of flux, with tax administrations across the nations facing growing tax compliance issues of arrears, avoidance, evasion, and an increase in loss-making businesses. These, with macro-economic factors, impose increasing fiscal pressures upon tax agencies which are unprecedented. Economic pressures may trigger increases in behaviours such as under-reporting tax liabilities, claims of illicit refunds of tax, or underpayment of quarterly taxes due under Making Tax Digital triggering arrears and penalties. Non-compliance also involves tax avoidance schemes through which taxpayers aim to reduce their tax liabilities by means of arrangements that may be legal but usually contradict the intent of the law they purport to follow. This will then undermine one of the major drivers of the Making Tax Digital legislation - that of reducing the tax gap or revenue and expenditure, a priority of tax administration in volatile economic periods (Brondolo et al., 2008). Other issues relating to the impact of quarterly payments of tax under making tax digital are namely: (i) taxpayers who are credit-constrained may withhold taxes as an alternative source of raising cash flow for operating activities; (ii) taxpayers who face extreme financial stress may face a trade-off between bankruptcy and tax evasion, and penalties which may be minimal compared to impending bankruptcy. ‘Cashflow’ is described as ‘the movement of money into and out of your business’, its cyclical reliability of income and outgoings are assessed on bases such as ‘accounts receivable, inventory, accounts payable, and credit terms’ (Noor et al., 2012, p. 234). This section evaluates information based on perceptions according to taxpayer age; a variable potentially indicative of the experience of the payer; and the length of time spent in commercial activity but is not accounted for in the aims and objectives of the research. In terms of confidence in the use of technology, Ramaj et al. (2014, p. 2) points out that financial accounting, whether by the payer or their agent, ‘includes all dimensions of business operations, including the flow of financial data across the organization and beyond’ and cannot be conducted without the use of ICT programmes. Confidence comes with competence and education, arguably more pertinent to accountancy students rather than their future clients. To explore taxpayer confidence levels, it is essential the concept of ‘Confidence’ is defined. ‘Business confidence’ is a broad descriptive term for the management of a diverse range of information evaluations, upon which sole traders, partnerships, and limited companies develop an adaptive business strategy. In the macroeconomic context of national and global politico-economic commerce, the most commonly publicised measure is the Business Confidence Index (BCI). This is described as the statistical evaluation of ‘developments in production, orders and stocks of finished goods in the industry sector [indicators] used to monitor output growth and to anticipate turning points in economic activity’ (OECD, 2019). This predominantly constitutes of external market factors, which businesses must strategically plan for and adapt to maintain commercial viability - an onerous undertaking per se for enterprise managers and owners in the current political environment of Brexit (ICAEW, 2019).

The data gathering methods of this research has principally focused on the more immediate management concerns of legal and financial obligations to its stakeholders and the government. The domestic market is not simply in a state of flux, but the corporate tax accounting legislation imposes new duties and requirements in personal skills and software expense in tax management (House of Lords, November 2018). The Oxford English Dictionary defines ‘confidence’ as ‘the feeling or belief that one can have faith in or rely on someone or something.’ Personal perceptions of businesspeople - user experience - is central to the success of a tax system which the House of Lords asserts shows signs of poor government development and planning, as well as expensive operational and software change (House of Lords, November 2018). This section will, therefore, examine business confidence level data, utilising the classifications outlined above and namely compliance, technology, accounting, and readiness for making tax digital. The analysis will focus on the following categories: (i) the taxpayer in their general perceptions of management of changing administrative obligations in a volatile market environment; (ii) trading status - namely the taxpayer as a sole trader, in partnership or a property landlord; and (iii) trading status categorised by turnover, industry, and the nature of the commercial activity conducted by the business. Further to this, turnover and age are examined and evaluated. This data assessment evaluation is more directly related to the microeconomic perceptions of individual small businesses and their accountancy advisors in their enterprise management.

The Federation of Small Businesses (FSB) (2018:5) asserts: ‘The UK tax system is undeniably complicated. Many small businesses and self-employed entrepreneurs have limited time and resources, which poses a particular challenge when dealing with complex calculation and reporting processes.’ The analysis enables reflection on the confidence felt by traders in their future under the new tax and business regime. It will further differentiate between taxpayers who used an agent - usually an accountant - and those who sought to manage their own affairs with the assistance of software, tax guidance, or HMRC helplines.

There has been a great deal of research undertaken into taxpayer behavior in the degree and willingness of tax law change compliance, although there is no definitive answer to ascertainable success or failure. Brooks (2001) stated that what we have learned from compliance research into tax-payer behaviour is ‘how much we do not know’. It is therefore essential that tax authorities can understand and predict taxpayer behaviour, given that non-compliance is a global phenomenon impacting the integrity of a tax system. The improvement of strategies by tax authorities in gaining taxpayer confidence is therefore essential in the present transition phase of Making Tax Digital. Further examination needs to be undertaken to understand compliance behaviour by tax authorities and other academics, although there is little consensus on appropriate research methods to study compliant behaviour, and those who have tried have acknowledged weaknesses, including access to appropriate data sources and their validity (Jackson and Milliron, 1986). Individuals are complex creatures who behave in ways that are difficult to understand and predict McKerchar, (2001). Nevertheless, tax authorities must develop policy and legislation which encourages positive behaviour that accounts for the diverse relationship between independent and dependent variables of personal interaction with the law to ensure measurable and appropriate outcomes

Investigation of compliance motivation, from a psychological point of view, is beyond the scope of this study, and Jackson and Milliron (1986) suggest that greater confidence can be placed on research-based findings of more limited variables related to a conceptual base, randomised experiments, and observations of real-life behaviour rather than those based on self-reports, simulations, or hypothetical situations.

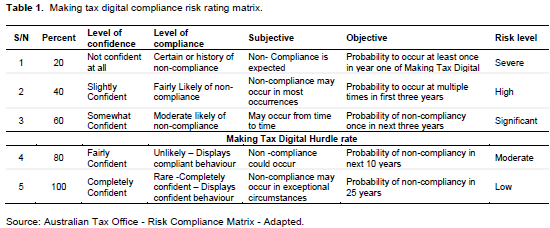

Herein a more narrowly defined examination of behavioural outcomes is utilised to assess taxpayer behaviour prompted by making tax digital legislation and change which results in unintentional non-compliance. This behaviour was reflected in taxpayers who were compliant under self-assessment, but whose behaviour may alter under Making Tax Digital, perhaps - as will be noted - due to the complexity of new obligations, which demand a timely and efficient transition. Baldry and McKinstry (1997) argue that taxpayers who were most likely to be adversely affected by this complexity are those who completed and filed their own tax returns, rather than those who use the services of an agent. This study will analyse data obtained from participants, and which will differentiate between those who used accountants and those who did not to ascertain compliance performance. This reflects confidence levels in understanding obligations and software required to meet new duties, measured by dependent variables which interact with each other to achieve legislative aims. These are divided into four themes: (i) recording accounting information (accounting); (ii) using technology to capture, prepare, and submit a tax return (technology); (iii) reflecting current compliant levels (compliance); and (iv) readiness for making tax digital (readiness). For this study an average confidence rating score of 3 is judged as fairly confident behaviour across all tax markers and thus this could be extrapolated to justify a successful transition to Making Tax Digital ATO (2013) Table 1. A score of 3 or more would also indicate that the probability of transition to making digital is more certain with likelihood of non-compliance occurring once in the next three years. This can be compared to a score of 2 which would indicate that the probability of non-compliance occurring would be multiple times in the next three years. Therefore, a score which is less than 3 would indicate that the transition may be problematic, and the taxpayer may require some form of intervention. It is thought that once Making Tax Digital is rolled out to all – some of the teething problems from its introduction on the 1st April 2021 would have been ironed out by effective risk management strategies illustrated here and therefore, there would be some precedent set to deal with potential issues with Making Tax Digital.

METHODOLOGY

This empirical research employs a pragmatic paradigm. This is in line with the fact that the knowledge and reality of taxation is based on beliefs and habits that are socially constructed. Furthermore, pragmatism is representative of a mixed methods philosophy and therefore is most suitable for this research. Hence, this research is primarily deemed to be explanatory in nature and thus adopts a deductive strategy. Questionnaires and semi-structured interviews were employed to collect raw data from a sample of 202 taxpayers, 20 accounting and 4 interdisciplinary practitioners. The data was analysed statistically through descriptive statistics and inferential analysis using SPSS. In addition, to test the confidence levels of the respondents, a novel, valid and reliable tax instrument namely, Tax Marker Compliance Model was developed to measure the readiness of the UK public for making tax digital. Tax Marker Compliance Model (TMCM) was used to test to test the hypothesis ‘whether taxpayers, grouped by turnover, demonstrated any significant impact on the levels of confidence of taxpayers transitioning to Making Tax Digital’ (Hypothesis 1) in readiness for Making Tax Digital.

RESULTS AND DISCUSSION

Examination of taxpayer confidence by turnover

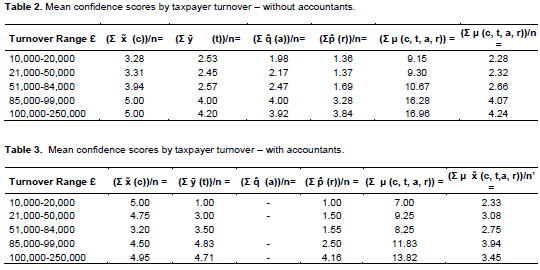

The investigation sought to test the hypothesis ‘whether taxpayers, grouped by turnover, demonstrated any significant impact on the levels of confidence of taxpayers transitioning to Making Tax Digital’. The two groups in this study were namely those taxpayers who used an accountant and those who do not use an accountant to handle their tax affairs. This analysis was based on a series of independent variables: (i) compliance; (ii) technology; (iii) accounting; and (iv) readiness, for making tax digital. This analysis and its findings present significant areas of non-complaint behavior and related implications for HMRC. The mean confidence scores, together with related standard deviations, were recorded per taxpayer. The findings of this investigation were compared against a transition hurdle rate of 3,00. The mean scores recorded (Table 2) were used to test the null hypothesis transitioning to Making Tax Digital. The results suggest the hypothesis is partially supported. The findings suggest that for the taxpayers between the turnover ranges of £10,000 to £85,000, the hypothesis is not valid. However, in the turnover range of £85,000 to £250,000 the hypothesis is accepted. The finding suggested that taxpayers in the turnover range of £10,000 - £20,000 had a mean confidence score of Σ x? (c, t, a, r))/n’ =2.28 and increased to mean confidence score of (Σ x? (c, t, a, r))/n’ =2.66 at turnover between £51,000 and £84,000.

These results suggest that taxpayers in these groups demonstrate a 20% confidence rate compared to a rate of 80% with the £100,000 to £250,000 group. These findings are consistent with research showing that businesses that are liable for VAT (Above £85,000) are reaping the benefits of Phase 1 of Making Tax Digital which went live for VAT on the 1st April 2019. Smith (2019) reports that 51% of respondents reported now having more simplified or more efficient tax processes, with 32% reporting fewer errors on VAT returns. This suggests that businesses in this category are more confident with Making Tax Digital.

Our investigation and analysis of the confidence levels of taxpayers have demonstrated that the management and policy implications for HMRC can be summarised as follows; Our findings show that the readiness for Making Tax Digital compliance statistic in Table 3, £10,000 to £20,000, μ = 1.36, £51,000 - £84,000, μ = 1.69. This suggest that the probability of non- compliancy is likely to occur at least once in year one of making tax digital with a severe consequence on tax revenues (See chapter 3.5 Making Tax Digital Compliance Risk Rating Matrix). The implications are reduced to a probability of non-compliancy once in every three years for turnover ranging from £85,000 - £250,000, with a significant impact on tax revenues. All (except the turnover range of £100,000 - £250,000) respondents demonstrated compliant behaviour ranging between statistical mean confidence score between μ = 5.00 -4.95 (Table 3.19). On the contrary mean confidence scores for readiness for making tax digital range (between μ = 1.00 – 4.16). This suggests that those taxpayers who are presently compliant would be moving to a non- compliance position post implementation of Making Tax Digital. When comparing our results to those of older studies, we conclude that the implications of this for policy makers is that it would have to resort to a deterrence approach (Field et al., 2006), whereby the efficiencies of tax administrations would resort back to HMRC via increases in audit, fines and criminal punishments.

Key findings that emerged are: sole traders had the lowest mean confidence level was of 2.14 (20.14% without accountants), and the highest 5.00 (100%, with accountants). For partnerships lowest mean confidence level was 3.71 (60.71%) and the highest 4.63 (80.63%). For landlords the lowest confidence level was 2.57 (40.57%) and the highest 4.57 (80.57%). These results suggest that low turnover businesses will be less motivated to transition to Making Tax Digital. However, these results can be compared with taxpayers’ perceptions of transition to making tax digital. In a report, HMRC (HMRC Research Report, 2021) confirms that transitioning costs were outweighed by longer term benefits. However, it is acknowledged that there are considerable discussions among researchers as to what is an acceptable criterion for transitioning to a new tax structure and therefore one single measure cannot assure a successful transition. It is therefore necessary to use an array of criterion to assess the effect on taxpayers such as the criterion laid down by the Inland Revenue - practical criterion to evaluate a change to a tax structure.

The 1986 Public Expenditure White Paper HM Treasury (1986 vol 2 p 314) describes these as: (i) the cost or yield to the exchequer and the distribution of gainers and losers among different categories of the taxpayer; (ii) the economic effects of the proposals and any behavioral changes they would likely induce; (iii) the consistency of the proposals with the general thrust of the government's tax policy, and it's broader economic, financial and social policies; (iv) the implications for other parts of the tax system, and the social security system, or for other proposals which ministers may be considering; (v) the likely effect on the perceived fairness and general acceptability of the tax system; (vi) the effect of the proposals in increasing or reducing the complexity of the tax system; (vii)the administrative implications, including effects on public expenditure and the use of public service manpower; (viii) the compliance burden on employers, businesses and other taxpayers; (ix) any views bearing on the proposals expressed in parliament, or by representative bodies or by individual taxpayers; (x) any relevant international obligations arising from, for example, double taxation agreements or European Community obligations.

Sandford (1994) argued that taxpayers preferred public administrative costs over compliance costs, because administrative costs are paid out of tax revenues which, aligns with the government's concept of equity. It can be stated further that it may be led to resentment by the taxpayer and reluctance to conform to any new system that would have otherwise been if the burden was on the government. Additionally, compliance costs may not be more obvious for the taxpayers than administrative costs, so there may be a higher burden on the taxpayer than first generally realized.

The results presented suggest that taxpayers who had a statutory requirement to be registered for Value Added Tax were already on the journey to Making Tax Digital. This was due to the phased introduction of Making Tax Digital for Value Added Tax on the 1st April 2019. Therefore additionally, at this stage of understanding, we can conclude that the support provided by accountants in transition to Making Tax Digital seems an important aspect of the Making Tax Digital process, likely due to recommendations, prompts and guidance toward Making Tax Digital. However, when comparing these results to those of prior studies, it must be pointed out that changes in tax system would not only affect taxpayers but their accountants also. Sheedy (2018) has listed 8 issues facing Accounting practice today; postulating that constant changes in the tax regime mean the need for public practice Accountants to stay up to date is greater than ever. This will require training and re-training and investing in the purchase of relevant up-to-date Software and updating or else outright acquisition of suitable hardware. It is claimed that by a far greater percentage, most of those who own electronic devices and potentially can access the internet are practically unable to use them to confidently carry out any demanding work except for simple business tasks.

A report presented in the UK parliament highlighted some major concern for individuals and businesses in the country who are intended users of the Making Tax Digital system. It was argued that there is lack of existence of a long-term plan for the Making Tax Digital itself and digital data collection and this has been causing a lot of uncertainty among businesses especially smaller businesses who are concerned about having to find and install alternate tax software in case it does not work out in the long term. This is also an issue if the businesses are using one MTD software for VAT and then they need to get software for business or corporate tax (Economic Affairs Committee, 2018). The approach utilized here suffers from the limitation that was indicated by Brooks (2001). Brooks found that these factors not only of economic factors such as tax rates and income levels in a country but psychological factors such as culture, morals and attitudes. These issues are beyond the scope of this study. They further found that demographics such as ethnicity, culture, age and gender also play an important part.

Based on the findings of this experiment presented the results suggest that that taxpayers who used agent and were in the higher turnover range (£100,000 - £250,000) were able to transition to Making Tax Digital, a positive indication of compliant behaviour. However, when comparing these results to those of other studies namely Sandford (1994) it must be noted that there exists some evidence that tax reforms can be successful if it occurs in small packages of proposals as opposed through an incremental process. But even then, the probability of success falls somewhat short of expectations. One issue is that the political process does not clarify what the aims are nor are they clear. (Robinson and Sandford, 1983, p221) concluded that political parties considering tax policy in the United Kingdom ‘showed only limited capacity for rational consideration of their chosen objectives. They did not examine then in enough detail, nor did they fully explore the consequences of their chosen policies. To assist the taxpayer to discharge their reporting obligations, HMRC may want to provide additional support and guidance. A similar conclusion was reached by James and Wallschutzky (1993). Wallschutzky states that most of the research undertaken in this area is around why some taxpayers do not comply rather than why others do so. It can be said that many taxpayers may be faithfully willing to comply, however, they do not understand or not aware of their full obligations. While it can also be stated that even if the taxpayer was fully aware of his/her duties there might be exist other reasons. In cases such as this, it may be advantageous to devolve resources by educating them and thus release additional tax revenues that exceed any costs expended on additional resources.

The transition to Making Tax Digital will need to be monitored by taxpayers to assess whether they will exceed the threshold. This then represents a further compliance issue, one which may require careful monitoring by tax administrations in order to ensure compliance. A successful compliance system must be more than simply the rewards and punishment model and therefore must encompass a wider range of motivations. There are some reservations of readiness for Making Tax Digital and overall, the results do not indicate compliant behaviour. It is important to highlight the fact that the transition to a new tax system may encompass some complexity with taxpayer behaviours. Previous researchers such as Bird and Oldman (1990, p3) suggest ‘The best approach to reforming taxes,” should consider taxation theory, empirical evidence, and political and administrative realities and will further combine them all with a good dose of local knowledge and a sound appraisal of the current macroeconomic and international situation to produce a feasible set of proposals sufficiently attractive to be implemented and sufficiently robust to withstand changing time.” Within these limits however, tax administrations need to assess compliance costs and tax attitudes to best ease the transition to Making Tax Digital.

Tax Digital and this may be indicative of involuntary non-compliant behaviour. The task of evaluating a tax system and the development of coherent recommendation is no easy feat as was evidenced as somewhat difficult as with the initial formation of the Meade Committee back in 1978. The timescales of transition to Making Tax Digital is fundamental to its successful implementation. It is interesting to note that previous tax systems overhauls underestimate the timeframes of change. It takes longer for change to embed than Parliament allows for. Sabine (1966, p254) has argued that the optimal process of “direct taxation has been its extraordinary sensitivity to criticism and its extreme flexibility and adaptability to accommodating such criticism.” Making Tax Digital (making tax digital) evidently lacks such flexibility and it is asserted that further targeted support and guidance will be required.

This gives rise to consideration of the tax review opinions of The Meade Committee (1978) and The Mirrlees Review (2011). Any new tax system overhaul needs first to clarify its aims and objectives and by what criteria it will scrutinise the present tax system. The Committee formed the following six desirable qualities of a new tax system namely: (i) incentives and economic efficiency; (ii) simplicity and cost of administration and compliance; (iii) flexibility and stability; (iv)transitional problems; (v) consider the system as a whole; (vi) seek neutrality; (vii) achieve progressivity as efficiently as possible. It is now generally accepted that technology in the 21st century is essential for a tax system to move to a fully digitalised process, dependent on shifting the attitudes of the present taxpayers.

This is arguably indicative of a lack of attention to payer needs in developing Making Tax Digital. Pagan (1993) suggests forward ‘ten commandments’ for any new tax legislation. An Extract of the relevant part of the Ten Commandment for any new taxation legislation namely: (i) do only what is necessary; (ii) do it timely; (iii) respect the basic principles of the existing system; (iv) control and define any consultation process. From this standpoint, it is generally accepted that the transition to Making Tax Digital would be best approached using a change management approach as is best described by Lewin (1951) forcefield analysis. The changes in the environment trigger opportunities for change and hence forces against this position avail to protect the status quo. The optimum position may be ascertained with a close examination of the reasons for the resistance. The pressure for change eventually pushes through, yet the resistance is strong enough to know the desired optimal position and this result consequently to an unsatisfactory compromise.

LIMITATIONS

Making Tax Digital legislation is presently a proposal but has not been implicated yet and so HMRC has not instigated these changes. This study investigates the impact of the Making Tax Digital initiative however, because there are no valid statistics available as of yet which can guide us regarding the actual effects of this initiative, this study is based entirely on predictions only for now. The lack of tested and well researched data published in academic papers in this area, has also been a major limitation. Price and Murnan (2004) assert that academic studies should acknowledge characteristics that impacted or influenced the findings of research. This limitation, however, has provided an opportunity to critically appraise the research problem, evaluate the available literature and develop valid methods of studying the impact of Making Tax Digital. Furthermore, this paper also provides grounds for further academic research. Tax legislation in the United Kingdom is based on the principal of income generation and therefore is based on a standardised approach. However, this becomes problematic when faced with human nature and the differences between demographics, social norms, culture, ethics and ethnicity. Therefore, a major limitation of this study is shadowed by a general limitation, namely an oversimplification of social reality. It is also important to note that although the survey questions devised in this study are correctly formulated; they may not be relevant based on culture and social norms. The research in this study is based on a small sample of taxpayers and is therefore important to state that the findings presented in this thesis may or may not be reflective of the entire taxpayers in the United Kingdom. Consequently, further study could be enhanced by using a larger sample to confirm the findings of this study. This needs to be undertaken by government studies and professional research as the MTD program progresses with its inevitable introduction and any related problems that occur. Moreover, since the MTD system has been initiated very recently, it’s difficult to learn from its mistakes at time and recommend solutions to deal with any issues occurring with its usage or implementation. Hence, this is also a limiting factor for this paper and can only be resolved in the future after some time has elapsed after the full introduction of Making Tax Digital (Al-Karaawy, 2018).

CONCLUSION AND RECOMMENDATION

The traders who use the services of an accountant are completely confident with Making Tax Digital. On the other hand, traders without accountants showed lower level of confidence. The data suggests that there is a significance difference between confidence levels of taxpayers with and without accountants. This would seem logical under normal circumstances; however, this study is interested in the readiness of the taxpayers to face challenges of making tax digital. The costs and benefits of this will have an impact and may not be a viable option to some taxpayers especially for those with low turnovers. Further analysis suggests sole traders (without accountants) demonstrated overall mean frequencies levels of confidence between 1.37 (20.37%) and the highest 2.21 (40.21%). For partnerships, this ranged between 2.05 (40.05%) and 4.00 (80%). Additionally, for landlords, the confidence level was 3.26 (60.26%) and the highest 3.32 (60.32%). This provides further evidence that sole traders are mostly at risk when they fail to comply with making tax digital. The lower confidence levels of the non-agent firms may lead to inefficiencies because the low confidence means that they’re more likely to make mistakes and could face penalties. This examination found support for the assertion that confidence levels for transition to Making Tax Digital are lower with taxpayers who do not use the services of accountants. However, the extent to which it is possible to predict the instability of the whole Making Tax Digital system is due to these observations being subjective to the taxpayers. The lower confidence may be due to the transitional period and the period of uncertainty as firms may be quick to adapt to change. It is only possible to get actual statistics after MTD has been fully instigated.

It is recommended that the Tax Marker Compliance Model (TMCM), developed in this paper, should be used to assess the confidence levels of taxpayers on the phase three of making tax digital legislation and corporation taxes. In addition, The Standard Cost Model (SCM), which is a method for determining the administrative burdens for businesses, should be imposed by regulation. Making Tax Digital legislation will impose administrative burden on businesses and individuals. This model should be used to measure excessive compliance costs Nijsen and Vellinga (2002). Furthermore, studies combining SCM and TMCM will provide dual impact on businesses and will provide information regarding financial costs and levels of confidence with making tax digital legislation.

CONFLICT OF INTERESTS

The author has not declared any conflict of interest.

REFERENCES

|

Adewoye JO, Olaoye CO (2014). Usage of information technology to enhance professional Productivity among accountants in Ekiti State. International Journal of Accounting and Financial Management Research 4(2):7-18. |

|

|

Al-Karaawy NAA (2018). The impact of making tax digital application on the accounting costs. Academy of Accounting and Financial Studies Journal 22(3):1-13. |

|

|

Ashby JS, Webley P (2008). But everyone else is doing it': a closer look at the occupational taxpaying culture of one business sector. Journal of Community and Applied Social Psychology 18(3):194-210. |

|

|

Baldry J, Mckinstry K (1997). Explaining the growth in usage of tax agents by Australian personal income taxpayers. Australian Tax Forum 13(1):135-153. |

|

|

Bird RM, Oldman O (1990). Taxation in developing countries. Baltimore, Md.: Johns Hopkins University Press. |

|

|

Bojuwon M, Obid SNBS (2014). The influence of technology characteristics towards an online tax system usage: the case of Nigerian self-employed taxpayer. International Journal of Computer Applications 105(14):30-36. |

|

|

Braithwaite V (2003). A new approach to tax compliance. In: Braithwaite V (ed.), Taxing Democracy: Understanding Tax Avoidance and Evasion. Aldershot: Ashgate Publishing Limited. |

|

|

Brennen S, Kreiss D (2014). Digitalization and digitization. |

|

|

Brondolo J, Borgne L, Bosch F, Silvani E (2008). Tax Administration Reform and Fiscal Adjustment: The Case of Indonesia (2001-7). [IMF Working Paper 08/129]. Washington: Washington International Monetary Fund. |

|

|

Brooks N (2001). Key issues in Income Tax: Challenges of Tax Administration and Compliance. |

|

|

Dzidonu CK (2012). Using information and communication technology (ICT) in managing national resources. 7th Internal Audit Forum, Accra. |

|

|

Economic Affairs Committee (EAC) (2018). Making Tax Digital for VAT: Treating Small Businesses Fairly. (2018). HOUSE OF LORDS. |

|

|

Evans C, Carlon S, Massey D (2005). Record keeping practices and tax compliance of SMEs. eJTR 3:288. |

|

|

Government Statistics (2018). Over 93% of taxpayers file tax returns by the deadline. |

|

|

Hannam J (2017). What everyone needs to know about tax: An introduction to the UK tax system. New York: John Wiley & Sons. |

|

|

HMRC (2021). Research Report 605. |

|

|

ICAEW (2019). Audit and Beyond April 2019. |

|

|

IMF Report (2009). Annual Report of the Executive Board for the Financial Year Ended April 30, 2009. |

|

|

Jackson B, Milliron VC (1986). Tax compliance research: Findings, problems, and prospects. Journal of Accounting Literature 5:125-165. |

|

|

James S, Wallschutzky I (1993). Returns to the future: The case for electronically submitted tax returns. British Tax Review 5(38):401-405. |

|

|

Kerschner I, Somare M (2017). Taxation in a Global Economy: Series on International Law. Germany: Linde Verlag GmbH. |

|

|

Kirchler E (2007). The economic psychology of tax behaviour. Cambridge University Press. |

|

|

Lane J (2017). Making tax digital for business: The new roadmap. |

|

|

Lewin K (1951). Field theory in social science. Washington DC: Harper. |

|

|

McKerchar M (1995). Understanding small business taxpayers: Their sources of information and level of knowledge of taxation. Australian Tax Forum 12(1):25-41. |

|

|

McKerchar M (2001). The study of income tax complexity and unintentional non-compliance: research method and preliminary findings. |

|

|

McLure C (1990). The Theory of Taxation for Developing Countries. David Newbery, Nicholas Stern. Economic Development and Cultural Change 38(2):426-431. |

|

|

Muita EW (2011). Factors that influence adoption and use of e-filing system of Kenya revenue authority among the large taxpayers. [Unpublished] MBA Project submitted to the JKUAT Nairobi Central Business District Campus. |

|

|

Mustapha B, Sheikh SNB (2014). The influence of technology characteristics towards an online tax system usage: the case of Nigerian self-employed taxpayer. International Journal of Computer Applications 105(14):30-36. |

|

|

Nijsen A, Vellinga N (2002). A model to measure the administrative burden of businesses. Zoetermeer, EIM. |

|

|

Noor MI, Nour A, Musa S, Zorqan S (2012). The role of cash flow in explaining the change in company liquidity. Journal of Advanced Social Research 2(4):231-243. |

|

|

OECD (2019). Business confidence index (BCI). |

|

|

Oseni M (2016). Sustenance of tax administration by information and communications technology in Nigeria. Archives of Business Research 4(1):47-54. |

|

|

Pagan JC (1993). Increasing length and complexity of tax legislation avoidable - or inevitable? Fiscal Studies 14(4):90-105. |

|

|

Price JH, Murnan J (2004). Research limitations and the necessity of reporting them. American Journal of Health Education 35(2):66-67. |

|

|

Ramaj BZ, Begolli T, Ujkani M (2014). Impact of Information Technology in the accounting profession. In 5th International Conference "Information Systems and Technology Innovations: projecting trends to a New Economy". |

|

|

Robinson A, Sandford C (1983). Tax policy-making in the United Kingdom: A study of rationality, ideology and politics. London: Heinemann. |

|

|

Sabine B (1966). A history of income tax. London: George Allen & Unwin. |

|

|

Sandford C (1994). Self-Assessment for Income Tax - Another View. British Tax Review 6(2):206-208. |

|

|

Seely A (2018). Making tax digital. UK: House of Commons Library. |

|

|

Sheedy C (2018). The top 8 issues facing accounting practices today. |

|

|

Smith E (2017). Do all VAT-registered businesses start at once? |

|

|

Smith E (2019). Guide to making tax digital for businesses: What is required under making tax digital initiative and how will the regime affect businesses? |

|

|

Stalker L (2016). IS for Profit: Making Tax Digital Explained. |

|

|

Stolterman E, Fors AC (2004). Information technology and the good life. In Information systems research. Springer, Boston, MA. pp. 687-692. |

|

|

Sweet P (2017). Croner - i Accountancy Daily: Why Nando's uses Croner-i. |

|

|

Tihinen M, Kääriäinen J, Ailisto H, Komi M, Parviainen P, Tanner H, Tuikka T, Valtanen K (2016). The Industrial Internet in Finland: on route to success?. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0