ABSTRACT

This work is an overview of empirical research of the last decades in the field of deferred taxes, focusing on their value relevance when making business, investment and financing decisions. The majority of research is derived from the Anglo-Saxon area, where the USA Accounting Standard SFAS No.109 is implemented. According to the relevant literature, Deferred Tax Assets, in contrast to Deferred Tax Liabilities, are valued positively by capital markets. Deferred Taxes seem to correlate with Earnings Management and contribute positively to the forecast of future cash flows. An aggressive presentation of taxes in the balance sheet and significant Book-Tax Differences (BTDs) have a negative effect on credit rating and are perceived as a red flag for low quality earnings. The question whether the findings of these surveys can be useful for countries with different tax systems and accounting standards does not seem to have been answered adequately.

Key words: IAS 12, deferred taxation, financial markets.

A crucial factor in making an investment decision is comparing the future presumed value (e.g. of a firm) with the amount an investor is required to release for its implementation. So, when making the decision the investor needs to assess (reliably) the value of that undertaking; a process that involves a step-approach (Stickney and Brown, 1999, p.4). Accounting information targets, on the one hand, the realization of a reliable report and, on the other, the release and exchange of financial data between stakeholders. This last feature helps reduce “informational asymmetry” between the authors and potential users of the financial statements and reports with a view to minimizing the "Conflicts of Interest", known in the literature as “principal-agent conflicts” (Fama, 1980; Fama and Jensen, 1983). For external analysts, it is expected that in this way their ability to assess more reliably the value of a firm will be increased. The basic rationale for the use of historical accounting data by participants in the capital markets or in the process of an Over The Counter (OTC) valuation of a firm is the assumption that, based on past profitability and hence the generated cash surpluses, safe conclusions can be drawn regarding future profitability and the expected net cash flows. For this reason, the

assessment of annual financial reports by financial analysts is one of their most important tools for making investment decisions. Despite the fact that the analysis of financial statements is a key pillar of economic analysis, there are sometimes large gaps and discrepancies between information provided and information needs, in certain parts of the periodic or annual financial reports and accounts. Participants in capital markets highlight the importance of the appendix and notes of financial reports, but they raise issues of quality and completeness of the information provided (PWC, 2007, p.8). Also, there are conflicting views on how this information deficit is reflected in valuations of shares.

INVESTMENT DECISIONS AND ACCOUNTING INFORMATION

A crucial factor in making an investment decision is comparing the future presumed value (e.g. of a firm) with the amount an investor is required to release for its implementation. So, when making the decision the investor needs to assess (reliably) the value of that undertaking; a process that involves a step-approach (Stickney and Brown, 1999, p.4): Accounting information targets, on the one hand, the realization of a reliable report and, on the other, the release and exchange of financial data between stakeholders. This last feature helps reduce a view to minimizing the "Conflicts of Interest", known in the literature as “principal-agent conflicts” (Fama, 1980; Fama and Jensen, 1983). For external analysts, it is expected that in this way their ability to assess more reliably the value of a firm will be increased. The basic rationale for the use of historical accounting data by participants in the capital markets or in the process of an Over The Counter (OTC) valuation of a firm is the assumption that, based on past profitability and hence the generated cash surpluses, safe conclusions can be drawn regarding future profitability and the expected net cash flows. For this reason, the assessment of annual financial reports by financial analysts is one of their most important tools for making investment decisions. Despite the fact that the analysis of financial statements is a key pillar of economic analysis, there are sometimes large gaps and discrepancies between information provided and information needs, in certain parts of the periodic or annual financial reports and accounts. Participants in capital markets highlight the importance of the appendix and notes of financial reports, but they raise issues of quality and completeness of the information provided (PWC, 2007, p.8). Also, there are conflicting views on how this information deficit is reflected in valuations of shares. The “Efficient Market” is

Going further, Fama distinguished, based on the information contained each time in the prices of securities, three forms of efficient markets:

(a) Weak-form hypothesis,

(b) Semi strong-form hypothesis,

(c) Strong-form hypothesis.

In weak-form hypothesis, it is assumed that the current stock prices are adapted to all the information of the past, including historical prices, yields, and the volume of purchases and sales.

Because of the assumption that current prices already reflect all past performance and any other information from the past, this efficient market form finds it impossible to attain super profits by using only past information, because the random walk hypothesis comes into effect, which accepts that the changes in securities’ prices occur

in a random way. Semi strong-form hypothesis exists when securities’ prices adjust rapidly to all new information disseminated to the market, which means that the current prices of securities reflect all available public information. Such information includes mainly certified financial reports, data and announcements on the profitability and dividend distribution, financial ratios, as well as information regarding the split of shares, economic and political news, etc… In general, we can say that semi strong-form hypothesis encompasses weak-form hypothesis because all the information of the past is considered to be publicly available. Finally, strong-form hypothesis accepts that securities’ prices fully reflect all information, both publicly available, and unavailable. This simply means that no group of investors may benefit from information not also known by other investors. Therefore, there is no insider information, but all information is disclosed to investors (Fama, 1965, pp. 34-105; Malkiel and Fama,

1970 , pp. 384-389; Fama, 1991).

The review of the relationship between publicized financial reports and the market value of a company is supported by the research carried out by Miller and Modigliani (1966: 333-391). Exploring that correlation from 1993 (Amir et al., 1993, pp.230-264) onwards has been established in the Anglo-American literature as the term "value relevance tests or studies" By means of relevant empirical research, evidence has emerged as a correlation between published financial reports and stock prices. So, one could assume that the Analysis of Financial Statements has its own informative value in the valuation of companies on the stock exchanges. Newer studies (Lev, 1989, p.155) partially support the hypothesis that the evaluation of Annual Financial Reports could lead, to a certain extent, to share outperformance. Inconsistency of EMH theory in this case is explained by the fact that investors react with a certain time delay to specific and often sophisticated accounting information. Based on the aforementioned, it is assumed that the accounting figures (financial statements funds, notes and reports) contain important information for capital market participants, whose decisions therefore they directly affect.

1. In order to make a safer estimate of the value of the business, more than one valuation methods are used at the same time.

2. Here we mean Annual Financial Reports (Financial Statements and accompanying notes).

3. The initial distinction between low and average efficiency was proposed by Harry Roberts in 1959.

4. Such as the price-to-earnings ratio, the dividend-yield ratio, the price-to-book-value.

5. Compare Barth et al., 2001, p. 4.

6. We mean the theoretical chain of accounting information, which is depicted as follows: Accounting Standardization

Annual Financial Report Financial Statement Analysis

Market Valuation.

TAXES AND DEFERRED TAXATION

The information on deferred taxes is among the most objectively specialized (Colley et al., 2009) and costly accounting entries. In many tax regimes, Book income (or loss) differs from tax income. These "BTDs" result from the application of different laws and rules (G.A.A.P) when calculating accounting result from those provided for the calculation of tax income. A classic example is the calculus of depreciation, which according to the USA GAAP and IAS is done according to the useful life of fixed assets, while under the tax legislation it is done by applying rates predefined by the tax authority. These differences may be either temporary or permanent. Permanent differences relate to expenses or income that affect only tax or only book income (e.g. tax penalties and surcharges, various untaxed incomes, such as dividend income), which do not generate recognition of deferred tax liability. Temporary or time differences, instead, affect book and tax income but at a different time (e.g. provisions for employee compensation, despite having shaped the book income, will be tax deductible at the compensation payment time. Temporary differences are divided into: (a) taxable temporary differences, which result in payment of higher taxes in the future and recognition of “Deferred tax liabilities (DTL)” in the present, and (b) Deductible Temporary Differences leading to higher tax paid in the current year and lower in future periods for which a “Deferred Tax Asset (DTA)” is recognized.

The calculation of deferred taxes in accordance with International Accounting Standard IAS 12 and USA Standards of Financial Accounting (SFAS) 109 is based on the Principle of comparison (Differences) of the Value of Balance Sheet accounts, drawn up from GAAP, and that of tax balance sheet “temporary concept”. Deferred Tax Assets (DTA) and Liabilities (DTL) in balance sheets incorporate the estimated future tax effects resulting from Temporary Differences between Book and taxable income. The Total Tax Burden on book income (profit/ loss) for a period is calculated as:

Tax Expense = Current Tax Expense (+/-) Deferred Tax Expense of the period

Questions to be explored in this scientific field are: (a) Is the approach of interperiod tax allocation necessary and what does it contribute? Is it important in decision-making and how does it affect investment decisions and behaviors (value relevance)? (b) Is their designation as costs or revenues sufficient? (c) Are deferred taxes a kind of transitional accounts? or (d) Do they meet the criteria to be recognized as Deferred Liabilities or Assets? And can they, under conditions, be classified as Equity or Deferred Assets (Accounting approach - Interpretation)? (e) What is the appropriate methodology for the measurement of deferred tax positions? (f) To what extent does the information provided through the Annual Financial Information Reports cover the requirements of a thorough analysis of the financial data of a company? And, finally, (g) What is the cost-benefit ratio? For this purpose, the following sections provide an overview of the major theoretical and empirical research trying to answer the above questions.

1. "Generally Accepted Accounting Principles", with US GAAP and International Accounting Standards (I.A.S.) being the most popular.

2. Accounting result is profit or loss for a period as evidenced by the accounting books (G.A.A.P).

3. Taxable income is what is determined according to the rules established by the tax authorities of each country and on which the income taxes are levied.

4. In order to recognize a deferred tax asset, it is a prerequisite that there should be assurance that the enterprise will have future taxable profit or sufficient taxable temporary differences so that it can use the corresponding deductible temporary differences.

Classification of the literature

To review the existing literature, a combined search with relevant keywords was carried out, in free Internet catalogs of academic libraries and electronic literature databases such as EBSCO, JSTOR, etc. Then, the scientific papers found and earlier surveys on the same field were processed and classified. The findings include articles in journals, working papers, dissertations, and other monographs. The research questions, sample, methodology, and major findings of these studies are summarized in the third part of the study. A total of 71 scientific papers were identified (62 articles in scientific journals, 3 monographs, and 6 working papers), which examine issues related to Deferred Tax and its accounting treatment during the preparation of financial statements.

Relatively recent surveys, starting with “Book-Tax Differences – BTDs”, try to draw conclusions as to the viability and generally the quality of earnings and cash flows, and the valuation of BTDs by the stock markets. The Deferred Tax-Expense/Revenue is used in these surveys to approach the taxable income, which in the case of most countries is confidential information - non releasable to the public on the part of businesses and tax authorities. Earnings Management Hypothesis is one of the issues the research community started dealing with quite early. Deferred tax in the income statement and then Valuation Allowance of Deferred Tax Assets were originally added to the variables explored in order to reveal earnings “manipulation” practices. The last variable is of particular concern to the research community because of the growing practice of companies to recognize deferred tax assets from tax losses carried forward in times of crisis, and suspicion of their possible use by management to manage earnings or strengthen regulatory capital (Gee and Mano, 2006; Skinner, 2008). A significant number of studies investigate the informative value of Deferred Tax (value relevance) for participants in financial markets, while a much smaller number uses this information for tax avoidance detection and, more generally, to assess tax management.

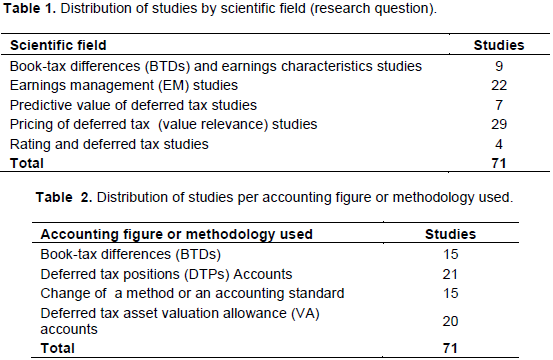

Tables (1 and 2) show a breakdown of studies by scientific field to which answers are sought, and the Accounting Aggregate or Methodology used.

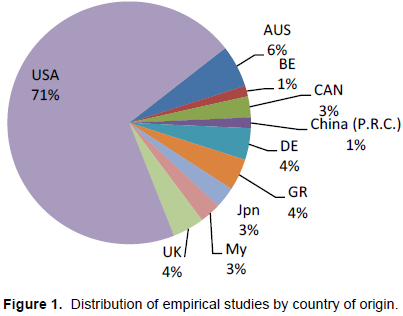

Due to the prehistoryof Accounting Standardization and the research tradition created in the USA, most of the articles (71%) come from there and from countries that apply similar accounting standards to that (US). Studies from Anglo-Saxon countries (USA and UK) occupy the lion's share (76%). This could, in addition to the relatively late implementation of similar accounting standards, be attributed partly to the linguistic disadvantage of the remaining (minority) countries which are under-represented in this research field.

In both Central Europe and Greece several surveys are concerned with the implications of the mandatory application of IAS/IFRS to listed companies after 2005. However, only a small number of surveys focus on the informative value of deferred taxes on Balance Sheets, since applying IAS 12 to the present. Specifically, Gaeremynck and Van de Gucht (2004) in Belgium, Chludek (2011) in Germany, and Samara (2014) and Chytis et al. (2015) in Greece.

The philosophy of IAS 12 is very close to the philosophy of USA-SFAS No. 109 but there is considerable variation in the applied accounting and the tax base applied in the Central European countries (Karampinis and Hevas, 2011; La Porta et al., 1997 ). The question of whether the findings of these surveys can be useful for countries applying different tax and accounting systems does not appear to have been adequately addressed. Figure 1 illustrates the breakdown of studies based on the country of origin.

1. As early as 1944, the Accounting Research Bulletin was applied (US ARB No.23), according to which the Tax is classified as "Expense", recognizing the different times in the accounting of differences (tax) between GAAP and the Tax Balance Sheet and a recommendation to deal with these differences as "Deferred Tax".

2. See for CAN: Chattopadhyay, Arcelus and Srinivasan (1997) and Zeng (2003), UK, Citron (2001), Gordon and Joos (2004), (1997), for AUS: Chang, Herbohn and Tutticci (2009), Herbohn et al. (2010).

2 For a complete review, see Tsalavoutas & Evans, (2009) and Iatridis, (2010).

Surveys focus on the impact of IAS 18, 19, 32, 39. See also Iatridis and Dalla (2011), Karampinis and Hevas (2009, 2011, 2013), Spathis and Georgakopoulou (2007)

The number of studies that have been published since 1967 to date reflects the general trend of increasing research literature dealing with the complex topic "Income Tax Accounting". Key points are time points around which modifications, improvements, abolitions, changes in Accounting Standards, and legislative changes that result in changes in tax rates and depreciation take place. In periods before or after those points, the renewed interest in the issue is reflected in the multitude of scientific researches preceding or following these time points. Thus, the first studies are published after the introduction of Accounting Principles Board (APB) No.11 "Accounting for Income Taxes" in 1967 in the United States. Less attention was given to the issue from the mid-1970s to the mid-1980s. However, with the introduction of Statement of Financial Accounting Standards (SFAS) No.96 in 1987 and SFAS No.109 in 1992, a discussion began on the correct conceptual approach and the appropriate methods for achieving fiscal accrual of uses. The 2004 US Tax Reform and the adoption of International Accounting Standards (IAS / IFRS) in Europe, Asia, and Australia since 2005 have also attracted interest from the research community (Figure 2). This trend is reflected in the relevant publications and has been preserved to date with the incorporation of new interpretive variables, such as BTDs. In the United States, since the beginning of the new millennium there have been mainly questions about the recognition of DTAs and their possible use for purposes related to "earnings management", as well as strengthening of equity and/or capital adequacy. A total of two published studies have been found to be focusing exclusively on the European capital market after the implementation of IAS 12 (IASB, 1996, IASB, 2009) and the impact of deferred taxes on stock valuation.

1. APB No.11: Comprehensive allocation provided for - Only Deferred Method is allowed - Discrimination of Deferred Taxes on the Balance Sheet in the short and long term - Prohibition of creating a deferred tax asset on Loss carryforwards, https://dart.deloitte.com/USDART/resource/63e82ca9-3f37-11e6-95db-53397939d27

2. SFAS No.96 establishes the "Asset-Liability-Method" and the use of the "Temporary-Concept" while SFAS 109 relaxes the criteria for recognizing Deferred Tax Assets (DTAs), including DTAs of Tax Loss Carryforwards with the simultaneous introduction of the Valuation Allowance method., https://www.fasb.org/pdf/fas109.pdf

3. Surveys of the period (1998-2004) use data after the implementation of SFAS No.109.

4. In 2003, the United States announced a 5 percent reduction in Statutory Tax Rate (from 35% to 30%), first being applied to the 2004 earnings.

OVERVIEW OF THE MOST IMPORTANT SURVEYS

The following section summarizes the research questions and the most important findings of the Deferred Taxation research. An attempt is made to answer the most important questions regarding the accounting status and the informative value of the Deferred Taxes for the users of the financial statements. Finally, the points and directions that need to be further investigated are highlighted.

Past research, particularly, focuses on the evaluation of the information embedded in the Deferred Taxes on the basis of their value relevance. These surveys show that Deferred Tax Assets (DTAs) are positively valued by the markets (Amir et al., 1997; Hanlon et al., 2014, p.30) as opposed to DTLs, which are negatively valued. These findings were also noticed during periods of financial crisis. Research has showed a significant positive association of DTAs with firm market value during the financial crisis of 2007 to 2008 (Badenhorst and Ferreira, 2016). On the other hand, the negative effect of DTLs appears to become more prominent for loss firms during conditions of financial distress (Samara, 2014). The intensity of the correlation differs significantly in the individual surveys, which in part can be attributed to the different structure of the models used. However, the negative valuation of Deferred Tax Liabilities (DTLs) does not appear to be the same as in the case of the other Liabilities (Ohlson and Penman, 1992, p.570). The assumption that the comparatively lower valuation of DTLs is due to their improper presentation at present value (prohibited by the standard), although the market considers that their reversal is placed over time, is probably not rejectable (Givoly and Hayn, 1992, p.406). On the other hand, there are analytical approaches, according to which, in the case of depreciation, this difference (less valuation than the market) is mainly due to the time of reversal of the temporary differences of this type (Guenther and Sansing, 2004, p. 442). The actually recorded overall impact on the market valuation of Deferred Taxes naturally integrates all individual effects, so depending on the structure of the regression model, discrepancies in results and their interpretation by the researchers may arise, as the case may be. Depending on the case under investigation, different findings emerged and, finally, the lack of a generally dominant tendency and interpretation.

With regard to Deferred Tax Assets, due to Tax Loss Carry forwards (DTA_TLC), it was not possible to establish a significant positive contribution to the valuation of the business by the markets. Investors and analysts appear to be more concerned with the negatively evaluated information on loss history rather than the possibility of future tax savings (Amir et al., 1997, p.619; Amir and Sougiannis, 1999, pp. 23-26). This also accounts for the banking sector as well, as recent research has shown a negative association of deferred tax assets with share prices (Hanna and Shaw, 2018).

Newer, mainly, studies extend the empirical exploration of the additional informative value of Deferred Taxes, in addition to value relevance, in the fields of balance sheet and earnings manipulation. However, the results of these investigations are in many cases contradictory. The additional informative value of Deferred Tax is confirmed in some studies (Phillips et al., 2003, p.518; Holland and Jackson, 2004, pp.123; Ettredge et al., 2008, p.24), while others (Miller and Skinner, 1998, p.232) cannot confirm it. Controlling the hypothesis whether Deferred Taxes are used indirectly to improve the results and image of balance sheets (Earnings Management Hypothesis —EM-H) seems to verify the suspicions. The disclosure of these techniques is mainly aided by the fact that on the part of management it is usually attempted to only increase accounting profits. The reason is that a simultaneous increase in taxable profits would lead to higher disbursements for tax payments, which seems to be carefully avoided. As a result, Book and Tax Differences (BTDs) arise, which are accounted for and create Deferred Taxation. Therefore, managers who apply legitimate policies to manipulate earnings or do fraudulent misrepresentation of financial statements usually leave their "traces" in the form of deferred taxes in the balance sheet and earnings (Phillips et al., 2003, p. 518; Ettredge et al., 2008, p. 28). On the other hand, surveys focusing on direct earnings manipulation through Deferred Tax Expense/Income result in different findings. The investigations of Miller and Skinner (1998, p. 232) and Visvanathan (1998, pp. 6-10) cannot verify the above hypothesis (EM-H).

In contrast, other investigations (Burgstahler et al., 2002, p. 21; Schrand and Wong, 2003, pp.607-608; Dhaliwal et al., 2004, p.451; Phillips et al., 2004, p.64; Frank and Rego, 2006, p. 63; Kasipillai and Mahenthiran, 2013, p.15; Warsono, 2017, p. 211) argue that they find evidence that the deferred taxes are handled as part of their earnings management practices. Most recent research (Bauman and Bowler, 2018) has shown that taking into account the impact of analyst forecasts, firms that managed their earnings used discretionary Deferred Tax Asset Allowances changes. Regarding the usefulness of Deferred Taxes when forecasting future cash flows, Cheung et al. (1997, pp.1-15) and Legoria and Sellers (2005, p.158) found that incorporating Deferred Taxes into the related models (Lorek and Willinger, 1996, pp. 81-101) enhances the accuracy of the cash flow forecasting function. Foster and Ward (2007, p. 47), on the other hand, argue that neither the Deferred Tax Expense (DT Expense) nor the change in Deferred Tax Positions (DTPs) have a consistent statistically significant correlation with the Cash Flows of the following financial year. The analysis of Chludek (2011), taking into account the different deferred tax components, shows that investors generally do not consider deferred taxes to convey relevant information for assessing firm value, with the exception of large net deferred tax assets.

Most recent survey by Laux (2013) shows that deferred taxes provide additional information on future tax payments, but the magnitude of this information is questionable. Finally, Dreher et al. (2017) document that accounting information on tax loss carry forwards and deferred taxes not only does not improve the accuracy of performance forecasts but may even worsen them.

The usefulness of deferred tax information in bonds rating is not confirmed by the research by Huss and Zhao (1991, p.64) and Chattopadhyay et al. (1997, p.556). However, Crabtree and Maher (2009, pp.75-99) argue that both an aggressive and a conservative presentation policy in the tax balance sheet have a negative impact on the assessment of bankruptcy risk by rating agencies. Similarly, the results of the research by Ayers et al. (2010, pp.359-402) indicate that significant (positive or negative) changes to DT_Expense or BTDs have a significant impact on credit rating.

Relatively recent surveys analyzing BTDs are trying to draw conclusions about the quality of earnings and cash flows. The results of the Lev and Nissim (2004, pp.1039-1074) survey show that the TI/BI ratio satisfactorily forecasts earnings growth five years before and after US SFAS 109, and its forecasting capacity increases over time. Hanlon and Shevlin (2005, p. 137) concludes that companies with large BTDs show less stable earnings. Raedy et al. (2011b, pp.55-63) prove that a reappraisal of existing significant deferred tax positions due to a change in tax rate can have a significant impact on the profitability and capital structure of enterprises. Raedy et al. (2011a) find correlations between BTDs and stability and future development of profits. They argue, however, that investors do not assess the informative value of BTDs, in tax notes, because they will probably find it difficult to understand due to its complexity. Tang and Firth (2011) conclude in their research that BTDs are suitable for the detection of Earnings and Tax management. Chen et al. (2012, pp. 93-116) demonstrate that the cohesion of the Book-Tax Differences, as a measure of shared influence in the management of profits and tax planning, is associated with stability and book and tax income. Finally, Hanlon et al. (2012) further argue that large BTDs are an observable proxy for earnings management, incorporate information used by auditors when assessing the risk of a business, and are associated withhigher audit fees.

The present work was aimed at the exploration of the informative value of Deferred Taxes when making business, investment, and financing decisions. The geographic classification of the relevant surveys shows that the majority of them come from the Anglo-Saxon area, having as a reference the US accounting standard US SFAS No. 109. The question whether the findings of these surveys can be useful for countries with different tax systems and accounting standards (e.g. IAS 12) does not appear to have been adequately addressed (Chludek, 2011).

The review of the relevant literature shows that Deferred Asset Taxes (DTAs) are positively valued by markets, as opposed to DTLs.

Regarding in particular Deferred Assets from Tax Loss Carryforwards (DTA_TLC), it was not possible to establish a significant positive contribution to the valuation of the enterprise. The control of the hypothesis whether Deferred Taxes are used to improve the results and the image of the balance sheets (Earnings Management Hypothesis) seems to verify the relevant suspicions. Regarding the usefulness of Deferred Taxes when forecasting future cash flows, the results of the investigations are often contradictory. An aggressive or conservative presentation policy in the tax balance sheet has a negative impact on the assessment of bankruptcy risk by rating agencies. Significant (positive or negative) DT_Expense /Income or BTDs have a negative impact on Credit Rating, refer to less qualitative earnings, and are best suited for identifying profit and tax manipulation practices. In Europe, very little research has focused on the informative value of Deferred Taxes since the application of IAS 12, and this appears to require further investigation.

The handling of deferred tax assets positions in times of financial crisis and recession is of high priority under the agenda of the European Securities and Markets Authority, while attention is drawn to the recoverability of deferred tax assets from losses carried forward and emphasis is placed on the need to improve the information provided (ESMA, 2019). It is therefore understood that questions pertaining to: The causes and the accounting treatment of DTAs_TLC, as well as the possible effect of factors related to the internal and external business environment, seem not to have been answered satisfactorily so far and deserve special attention in periods of economic downturn.

The authors have not declared any conflict of interests.

REFERENCES

|

Accounting Principles Board (APB) Opinion No. 11, Accounting for Income Taxes, Norwalk Connecticut 1967. Available at:

View

|

|

|

|

Amir E, Sougiannis T (1999). Analysts' interpretation and investors' valuation of tax carryforwards. Contemporary Accounting Research 16(1):1-33.

Crossref

|

|

|

|

|

Amir E, Harris TS, Venuti EK (1993). A comparison of the value-relevance of US versus non-US GAAP accounting measures using form 20-F reconciliations. Journal of Accounting Research 3:230-264.

Crossref

|

|

|

|

|

Amir E, Kirschenheiter M, Willard K (1997). The valuation of deferred taxes. Contemporary Accounting Research 14(4):597-622.

Crossref

|

|

|

|

|

Ayers BC, Laplante SK, McGuire ST (2010). Credit ratings and taxes: The effect of book-tax differences on ratings changes. Contemporary Accounting Research 27(2):359-402.

Crossref

|

|

|

|

|

Badenhorst WM, Ferreira PH (2016). The financial crisis and the value relevance of recognised deferred tax assets. Australian Accounting Review 26(3):291-300.

Crossref

|

|

|

|

|

Barth ME, Beaver WH, Landsman WR (2001). The relevance of the value relevance literature for financial accounting standard setting: another view. Journal of Accounting and Economics 31(1-3):77-104.

Crossref

|

|

|

|

|

Bauman MP, Bowler CR (2018). FIN48 and income tax based earnings management: Evidence from the deferred tax asset allowance. Advances in Taxation 25:29-50.

Crossref

|

|

|

|

|

Burgstahler D, Elliott WB, Hanlon M (2002). How firms avoid losses: Evidence of use of the net deferred tax asset account. University of Washington Working Paper. Available at SSRN:

View

Crossref

|

|

|

|

|

Chang C, Herbohn K, Tutticci I (2009). Market's perception of deferred tax accruals. Accounting and Finance 49(4):645-673.

Crossref

|

|

|

|

|

Chattopadhyay S, Arcelus FJ, Srinivasan G (1997). Deferred taxes and bond ratings: A Canadian case. Journal of Business Finance and Accounting 24(3):541-557.

Crossref

|

|

|

|

|

Chen LH, Dhaliwal DS, Trombley MA (2012). Consistency of book-tax differences and the information content of earnings. Journal of the American Taxation Association 34(2):93-116.

Crossref

|

|

|

|

|

Cheung J.K, Krishnan GV, Chung-ki M (1997). Does interperiod income tax allocation enhance prediction of cash flows? Accounting Horizons 11(4):1-15.

|

|

|

|

|

Chludek AK (2011). Perceived versus actual cash flow implications of deferred taxes-An analysis of value relevance and reversal under IFRS. Journal of International Accounting Research 10(1):1-25.

Crossref

|

|

|

|

|

Chytis E, Koumanakos E, Gumas S (2015). Deferred Tax Positions under the prism of financial crisis and the effects of a corporate tax reform. International Journal of Corporate Finance and Accounting 2(2):21-58.

Crossref

|

|

|

|

|

Citron DB (2001). The valuation of deferred taxation: Evidence from the UK partial provision approach. Journal of Business Finance and Accounting 28(7â€8):821-852.

Crossref

|

|

|

|

|

Colley R, Rue J, Volkan A (2009). Continuing Case Against Inter-Period Tax Allocation. Journal of Business and Economics Research 7(6):13-23.

Crossref

|

|

|

|

|

Crabtree A, Maher JJ (2009). The influence of differences in taxable income and book income on the bond credit market. Journal of the American Taxation Association 31(1):75-99.

Crossref

|

|

|

|

|

Dhaliwal DS, Gleason CA, Mills LF (2004). Lastâ€chance earnings management: Using the tax expense to meet analysts' forecasts. Contemporary Accounting Research 21(2):431-459.

Crossref

|

|

|

|

|

Dreher S, Eichfelder S, Noth F (2017). Predicting earnings and cash flows: The information content of losses and tax loss carryforwards. Argus Discussion Paper, No 224, Arbeitskreis Quantitative Steuerlehre (argus), Berlin. Available at:

View

|

|

|

|

|

ESMA (2019). PUBLIC STATEMENT Considerations on recognition of deferred tax assets arising from the carryforward of unused tax losses. Available at:

View

|

|

|

|

|

Ettredge ML, Sun L, Lee P, Anandarajan AA (2008). Is earnings fraud associated with high deferred tax and/or book minus tax levels? Auditing: A Journal of Practice and Theory 27(1):1-33.

Crossref

|

|

|

|

|

Fama EF (1965). The behavior of stock-market prices. The Journal of Business 38(1):34-105.

Crossref

|

|

|

|

|

Fama EF (1980). Agency problems and the theory of the firm. Journal of Political Economy 88(2):288-307.

Crossref

|

|

|

|

|

Fama EF (1991). Efficient capital markets: II. The Journal of Finance 46(5):1575-1617.

Crossref

|

|

|

|

|

Fama EF, Jensen MC (1983). Separation of ownership and control. The Journal of Law and Economics 26(2):301-325.

Crossref

|

|

|

|

|

Foster BP, Ward TJ (2007). The Incremental Usefulness Of Income Tax Allocations In Predicting One-Year-Ahead Future Cash Flows. Journal of Applied Business Research 23(4):37-48.

Crossref

|

|

|

|

|

Frank MM, Rego SO (2006). Do managers use the valuation allowance account to manage earnings around certain earnings targets?. Journal of the American Taxation Association 28(1):43-65.

Crossref

|

|

|

|

|

Gaeremynck A, Van De Gucht L (2004). The Recognition and Timing of Deferred Tax Liabilities. Journal of Business Finance and Accounting 31(7â€8):985-1014.

Crossref

|

|

|

|

|

Gee MA, Mano T (2006). Accounting for deferred tax in Japanese Banks and the consequences for their international operations. Abacus 42(1):1-21.

Crossref

|

|

|

|

|

Givoly D, Hayn C (1992). The valuation of the deferred tax liability: Evidence from the stock market. Accounting Review 67(2):394-410.

|

|

|

|

|

Gordon EA, Joos PR (2004). Unrecognized deferred taxes: evidence from the UK. The Accounting Review 79(1):97-124.

Crossref

|

|

|

|

|

Guenther DA, Sansing RC (2004). The valuation relevance of reversing deferred tax liabilities. The Accounting Review 79(2):437-451.

Crossref

|

|

|

|

|

Hanlon D, Navissi F, Soepriyanto G (2014). The Value Relevance of Deferred Tax Attributed to Asset Revaluations. Journal of Contemporary Accounting and Economics 14(2):1-42.

Crossref

|

|

|

|

|

Hanlon M, Shevlin T (2005). Book-tax conformity for corporate income: An introduction to the issues. Tax Policy and the Economy 19:101-134.

Crossref

|

|

|

|

|

Hanlon M, Krishnan GV, Mills LF (2012). Audit Fees and Book-Tax Differences. The Journal of the American Taxation Association 34(1):55-86.

Crossref

|

|

|

|

|

Hanna J, Shaw ZW (2018). Banks' deferred tax assets during financial crisis. Review of Quantitative Finance and Accounting 53(2):527-550.

Crossref

|

|

|

|

|

Herbohn K, Tutticci I, Khor PS (2010). Changes in Unrecognised Deferred Tax Accruals from Carryâ€Forward Losses: Earnings Management or Signalling? Journal of Business Finance and Accounting 37(7â€8):763-791.

Crossref

|

|

|

|

|

Holland K, Jackson RH (2004). Earnings management and deferred tax. Accounting and Business Research 34(2):101-123.

Crossref

|

|

|

|

|

Huss HF, Zhao J (1991). An investigation of alternative treatments of deferred taxes in bond raters' judgments. Journal of Accounting, Auditing and Finance 6(1):53-68.

Crossref

|

|

|

|

|

Iatridis G (2010). International Financial Reporting Standards and the quality of financial statement information. International review of financial analysis 19(3): 193-204.

Crossref

|

|

|

|

|

Iatridis G, Dalla K (2011). The impact of IFRS implementation on Greek listed companies: An industrial sector and stock market index analysis. International Journal of Managerial Finance 7(3):284-303.

Crossref

|

|

|

|

|

IAS (1996). IAS 12 Income Taxes. Available at:

View

|

|

|

|

|

IASB (2009). Exposure Draft ED/2009/2: Income tax. Available at:

View

|

|

|

|

|

Statement of Financial Accounting Standards (SFAS) No.96, (1987). Accounting for Income Taxes, Norwalk Connecticut 1987. Available at:

View

|

|

|

|

|

Statement of Financial Accounting Standards (SFAS) No.109 (1992). Accounting for Income Taxes, Norwalk Connecticut 1992. Available at: View

|

|

|

|

|

Karampinis N, Hevas D (2009). The Effect of the Mandatory Application of IFRS on the Value Relevance of Accounting Data: Some Evidence from Greece. European Research Studies 12(1):73-100.

|

|

|

|

|

Karampinis NI, Hevas DL (2011). Mandating IFRS in an unfavorable environment: The Greek experience. The International Journal of Accounting 46(3):304-332.

Crossref

|

|

|

|

|

Karampinis NI, Hevas DL (2013). Effects of IFRS adoption on tax-induced incentives for financial earnings management: evidence from Greece. The International Journal of Accounting 48(2):218-247.

Crossref

|

|

|

|

|

Kasipillai J, Mahenthiran S (2013). Deferred taxes, earnings management, and corporate governance: Malaysian evidence. Journal of Contemporary Accounting and Economics 9(1):1-18.

Crossref

|

|

|

|

|

La Porta R, Lopez-de-Silanes F, Shleifer A, Vishny R (1997). Legal determinants of external finance. Journal of Finance 52:1131-1150.

Crossref

|

|

|

|

|

Laux RC (2013). The association between deferred tax assets and liabilities and future tax payments. The Accounting Review 88(4):1357-1383.

Crossref

|

|

|

|

|

Legoria J, Sellers KF (2005). The analysis of SFAS No. 109's usefulness in predicting future cash flows from a conceptual framework perspective. Research in Accounting Regulation 18:143-161.

Crossref

|

|

|

|

|

Lev B (1989). On the usefulness of earnings and earnings research: Lessons and directions from two decades of empirical research. Journal of Accounting Research 27:153-192.

Crossref

|

|

|

|

|

Lev B, Nissim D (2004). Taxable income, future earnings, and equity values. The Accounting Review 79(4):1039-1074.

Crossref

|

|

|

|

|

Lorek KS, Willinger GL (1996). A multivariate time-series prediction model for cash-flow data. Accounting Review: 71(1):81-102.

|

|

|

|

|

Malkiel BG, Fama EF (1970). Efficient capital markets: A review of theory and empirical work. The Journal of Finance 25(2):383-417.

Crossref

|

|

|

|

|

Miller GS, Skinner DJ (1998). Determinants of the Valuation Allowance for Deferred Tax Assets under SFAS No. 109. Accounting Review 73(2):213-233.

|

|

|

|

|

Miller MH, Modigliani F (1966). Some estimates of the cost of capital to the electric utility industry, 1954-57. The American Economic Review 56(3):333-391.

|

|

|

|

|

Ohlson JA, Penman SH (1992). Disaggregated accounting data as explanatory variables for returns. Journal of Accounting, Auditing and Finance 7(4):553-573.

Crossref

|

|

|

|

|

Phillips JD, Pincus M, Rego SO, Wan H (2004). Decomposing changes in deferred tax assets and liabilities to isolate earnings management activities. Journal of the American Taxation Association 26(s-1):43-66.

Crossref

|

|

|

|

|

Phillips J, Pincus M, Rego SO (2003). Earnings management: New evidence based on deferred tax expense. The Accounting Review 78(2):491-521.

Crossref

|

|

|

|

|

PwC (2007). 16th annual global CEO survey dealing with disruption. Focus on tax. Tax strategy and corporate reputation: a tax issue, a business issue. Available at:

View

|

|

|

|

|

Raedy JS, Seidman JK, Shackelford DA (2011a). Corporate Tax Reform, Deferred Taxes, and the Immediate Effect on Book Profits. Available at: View

Crossref

|

|

|

|

|

Raedy JS, Seidman, JK, Shackelford DA (2011b). Is there information content in the tax footnote? Available at:

View

Crossref

|

|

|

|

|

Roberts HV (1959). Stock-market" patterns" and financial analysis: methodological suggestions. The Journal of Finance 14(1):1-10.

Crossref

|

|

|

|

|

Samara AD (2014). Assessing the relevance of deferred tax items: Evidence from loss firms during the financial crisis. The Journal of Economic Asymmetries 11:138-145.

Crossref

|

|

|

|

|

Schrand CM, Wong MF (2003). Earnings management using the valuation allowance for deferred tax assets under SFAS No. 109. Contemporary Accounting Research 20(3):579-611.

Crossref

|

|

|

|

|

Skinner DJ (2008). The rise of deferred tax assets in Japan: The role of deferred tax accounting in the Japanese banking crisis. Journal of Accounting and Economics 46(2-3):218-239.

Crossref

|

|

|

|

|

Spathis C, Georgakopoulou E (2007). The adoption of IFRS in South Eastern Europe: the case of Greece. International Journal of Financial Services Management 2(1):50-63.

Crossref

|

|

|

|

|

Stickney CP, Brown PR (1999). Financial Reporting and Statement Analysis, 4. Auflage, USA.

|

|

|

|

|

Tang T, Firth M (2011). Can book-tax differences capture earnings management and tax management? Empirical evidence from China. The International Journal of Accounting 46(2):175-204.

Crossref

|

|

|

|

|

Tsalavoutas I, André P, Evans L (2009). Transition to IFRS and value relevance in a small but developed market: A look at Greek evidence. In La place de la dimension européenne dans la Comptabilité Contrôle Audit (pp. CD-ROM). Available at:

View

|

|

|

|

|

Visvanathan G (1998). Deferred tax valuation allowances and earnings management. Journal of Financial Statement Analysis 3:6-15.

|

|

|

|

|

Warsono (2017). Deferred tax assets and deferred tax expense against tax planning profit management. Shirkah Journal of Economics and Finance 2(2):199-214.

Crossref

|

|

|

|

|

Zeng T (2003). The valuation of loss carryforwards. Canadian Journal of Administrative Sciences/Revue Canadienne des Sciences de l'Administration 20(2):166-176.

Crossref

|

|