Full Length Research Paper

ABSTRACT

The transfer of property tax and billboard fees collection from Local Government Authorities (LGAs) to Tanzania Revenue Authority (TRA) has had drastic consequences for LGAs budgets. This study seeks to examine the effects of shifting the collection of non-tax revenue from LGAs to TRA with reference to Morogoro Municipal Council (MMC). A questionnaire was administered to a sample size of 88 respondents, purposefully selected from Morogoro municipality and TRA. Key staffs were interviewed to complement the survey data. A descriptive analysis of survey data coupled with content analysis of interview data, showed that, non-tax revenue shift from MMC to TRA had various effects that include its inability to fulfil its obligations, loss of jobs to workers who dealt with revenue collection and introduction of other alternative taxes (for instance, waste disposal tax) that added burdens to tax payers. Moreover, MMC level of average annual revenue collection decreased by TZS 239 million from billboard fees and TZS 567 million on property tax respectively, for the three years of 2017 to 2019. Consequently, MMC was not able to fulfill its obligations effectively. It was also found that lack of competent personnel, resulted in poor administrative capacity to broaden the revenue base, tax evasion among municipal dwellers, poor tax enforcement capacity. Other challenges are: corruption from revenue collectors, political interference causing relaxation on revenue collection and overdependence on central government which reduced MMC’s autonomy. It is recommended that MMC needs to enhance its internal revenue collection system in order to be able to fulfil its obligations while encouraging voluntary compliance in payment of revenue. MMC could also adopt the techniques used by TRA in broadening its tax base.

Key words: Non tax revenue, local government authorities, Tanzania revenue authority.

INTRODUCTION

The development and sustainability of any country depends on revenue collection from taxies and levies (Fjeldstad and Moore, 2009). It enables the state to attain assets that are free of indebtedness (Ngotho and Kerongo, 2016). Local government authorities (LGA) in Tanzania had the mandate to raise certain revenues from taxes, levies and fees where the local governments set their own revenue policy within the limits set by central government (Mosha, 2010). LGAs retain all their revenue and use it as part of their own budgets and these revenues do not form part of central government revenue. Local government finance Act cap.290 requires local government to have the right to formulate, approve and execute their budget and plans; exacts bylaws for required rates to be charged on sources of revenue. In 2008, a new decentralized system for property tax (PT) collection was introduced in Dar es Salaam, the country’s largest city (Mosha, 2010). The reform entailed shifting the responsibility for administration and collection of property tax from the municipal councils (MCs) to the national tax administration, the Tanzania Revenue Authority (TRA). The Government expected this measure to increase the revenue collection, but it did not. The reasons for its failure included poor revenue performance and corruption and political interference by local councillors (URT, 2008). According to Fjeldstad et al. (2010) in 2008 to February 2014, the Government announced the return of PT collection to the munici-palities with immediate effect with a centralized collection by TRA. This did not last long. The reasons for its failure include poor revenue collection and problems of coordination and cooperation between MCs and TRA. However, in July 2016, property taxation was again centralised and TRA was assigned full responsibility for administrating the tax in the country (Fjeldstad et al., 2014). Also, in July 2016, the government of Tanzania shifted the responsibility for property tax and billboard/ advertisement fees collection from Local Government Authorities (LGAs) to Tanzania Revenue Authority (TRA) (URT, 2017). Thus, TRA was officially mandated to assess and collect that non-tax revenue mentioned in order to expand its tax base (Fjeldstad et al., 2014).

Non tax revenue refers to government revenue not generated from taxes (Wikipedia Encyclopedia). Examples include: billboard/advertising fees, property tax fees, bond issues and profits from state owned com-panies (Yan, 2010). Moreover, non-tax revenue are all revenues other than tax revenue accruing to Government through the delivery of services by ministries, local governments and other government institution; from their operations, either through the use of Government assets/ facilities and or through the enforcement of regulation. All other funds stipulated by law or regulation to be paid annually or periodically to Government are also non-tax revenue Local Government Act 1982). The transfer of the collection of non-tax revenue from the LGAs to TRA has had drastic consequences for LGAs budgets. It is estimated that non-tax revenues such as billboard fees and property tax earned LGAs approximately 60% of their total revenue while other revenue sources/user charges such as hotel, service, market levies etc. accounted for 40%. Thus, the LGAs revenue base declined by 60% something that made them to incur difficulties in rendering services to people they serve. This effect of transfer of non-tax revenue from LGAs to TRA has not been well investigated.

Prior studies such as Besley and Person (2013) studied the impact of intergovernmental transfers on local revenue generation in Sub-Saharan Africa; evidence from Tanzania and found that most subnational governments in Africa, lack institutional capacity to collect local taxes and instead rely heavily on grants from the central government to keep themselves afloat while leaving the effects of transfer of non-tax revenue unattended. Similarly, study done by Fjeldstad et al. (2017) on local government taxation in Sub-Saharan Africa (Tanzania being among them) found that in most African countries, the administrative and institutional capacity of local governments to collect taxes and provide public goods is very limited, particularly in rural areas where geographical vastness, poverty and low population density make it extremely difficult for LGAs to collect taxes. Yet, the effects of transfer of non-tax revenue were left unattended. Moreover, a study by Manwaring (2017) that focused on enhancing revenues for local authorities in Tanzania found that in most LGAs there are continuing problems including poorly managed revenue databases, varied experiences with outsourcing revenue collection and limited voluntary taxpayer compliance something that result into difficulties in increasing their tax base. Other studies include UN-HABITAT (2015) who found decentralising revenue collection created high potential for mismanagement and corruption. Masaki (2018), Tanzi (2000) and Fjeldstad and Semboja (2011) also, reported that, the capacity to collect revenue at local level is extremely limited in Tanzania. The study further stated that there are practical consequences in terms of revenue that are dramatic, including frequent cases of tax evasion, corruption, and even embezzlement of revenues, and constant political tension between local and central governments.

While all prior studies are of paramount importance, none of the studies have examined the effects of non-tax revenue transfer from LGAs to TRA in Tanzania. Most of the studies (Masaki, 2018; Tanzi, 2000) focused on revenue generation, administration and enhancement rather than focusing on the effects incurred after non-tax revenue transfer from LGAs to TRA. Yet, no study has examined the effects of these non-tax revenues shifting from LGAs to TRA with reference to Morogoro municipality. This is the gap to be filled. Therefore, current research study attempts to examine the effects of shifting the collection of non-tax revenue from Local Government Authorities to Tanzania Revenue Authority with reference to Morogoro municipality.

MATERIALS AND METHODS

Description of the study area

The study was carried out in Morogoro Municipality. Morogoro municipality has over 531 km2 and it is divided into 29 wards. The municipality is located on the eastern side of Tanzania Mainland. The municipality lies between latitudes 5?58’ and 10?00’ South of the Equator, and between longitudes 35?25’ and 38?30’ East of Greenwich. It is bordered by seven regions. In the north are Tanga and Manyara while in the eastern side are the Coast Region and Lindi regions. On the western side, there are Dodoma and Iringa regions, while Ruvuma is located in the southern side of the region. The district occupies an area of 260 km2 and population of 227,921 (URT, 2012).

Research approach and design

The study applied mixed approach that utilizes both qualitative and quantitative approaches to obtain the required data. Qualitative approach aims to explore and to discover issues about the problem on hand, because very little is known about the problem (Mwonge and Naho, 2021). There is usually uncertainty about dimensions and characteristics of problem. It uses soft data and gets rich data (Cresswell, 2009). According to Mosha (2010) qualitative approach is designed to help researchers understand people, the social and cultural contexts within which they live. Such studies allow the complexities and differences of worlds-under-study to be explored and represented. With qualitative approach, different knowledge claims, enquiry strategies and data collection methods and analysis were employed (Cresswell, 2009). Also, qualitative data were used in gaining deep understanding of respondent’s attitudes and opinions rather than surface description of the large population in the study area (Mwonge and Naho, 2021). Qualitative data sources include observation and participant observation (fieldwork), interviews and questionnaires, documents and texts, and the researcher’s impressions and reactions. On the other hand, Quantitative approach makes use of questionnaires, surveys and experiments to gather data that is revised and tabulated in numbers, which allows the data to be characterized by the use of statistical analysis. Quantitative researchers measure variables on a sample of subjects and express the relationship between variables using effective statistics such as correlations, relative frequencies or differences between means; their focus is to a large extent on the testing of theory (Kothari, 2004). While quantitative approach presents statistical results represented by numerical or statistical data, qualitative approach presents data as descriptive narration with words and attempts to understand the phenomena in natural settings. The study employed case study design was employed whereby questionnaire and interview guide were used to solicit information from TRA and Morogoro municipality staff regarding revenue collection.

Study population

According to Kothari (2004) the population denotes to the populace where an investigator needs to take a broad view emanating from the results of a study. The population touches the resolutions researchers make about resources and sampling essential for the research (Kothari, 2004). The study population involved TRA and Morogoro municipality staff totalling 750 responsible for revenue collection.

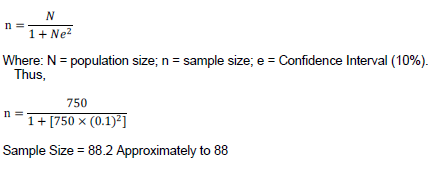

Sampling technique and sample size

Purposive sampling technique was used in this study. Purposive sampling is a non-probability sampling, which refers to sampling procedures where the sample for the study is deliberately selected by the researcher (Kothari, 2004). In this respect, elements of the population have no equal and known chance of being selected into the sample (Saunders et al., 2007). Respondents were selected based on knowledge of tax collection. A minimum sample size of 88 respondents was purposefully selected from which 25 involved TRA staff and 63 Morogoro municipal staff. This sample size was drawn using a model proposed by Yamane (1987) which shows the following relationship.

Data collection

Questionnaires and interview guide were used in the study data collection. Structured and semi-structured questionnaires were administered to tax/revenue collectors to get information. Copies of questionnaires were organized based on the essentials of a good questionnaire, that is short and simple, and organized in a logical progression moving from relatively simple to more difficult issues (Yin, 2003). Questionnaire is a list of questions given to respondent and fills them themselves. The main reasons for the use of questionnaires in this study arose from the fact that they were relatively economical and can be used to cover a wide geographical area with minimal cost in terms of both time and money, they have standardized questions, can ensure anonymity; and questions were written for the specific purposes. Questionnaires also increased the chances of response; they made it possible for the researcher to measure what a person knows or information, what a person likes and dislikes. Additionally, questionnaires are good for measuring what a person values and preferences and what a person thinks attitudes and beliefs. In this study questionnaires were used for formal education in the study area (Kelly, 1996). The schedule-structured interview was considered appropriate for this study as it enabled one to obtain elaborate answers to open ended questions from the respondents. It also helped to obtain responses from property owners who had modest school education. Besides, the personal interview enabled the study to avoid the pitfalls of mail questionnaire and telephone interviews, which are the other types of data gathering instruments in the survey method. On the other hand, the researcher used face to face interview to the management for TRA [manager and heads of revenue department] and Morogoro Municipality [director and heads of revenue and trade department] in order to solicit information concerning the matter.

Data analysis

Both quantitative and qualitative data were collected. The collected data were edited and coded. Descriptive statistics was applied for quantitative data where frequencies and percentages were computed. Statistical Package for Social Science (SPSS) facilitated the analysis and reliability of data. Moreover, for qualitative data content analysis was used.

RESULTS AND DISCUSSION

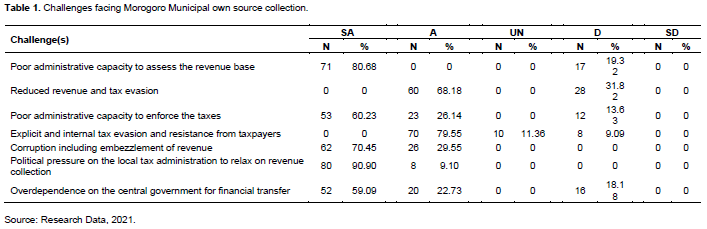

To examine the effects on tax collection following the shifting of billboard and property tax to TRA, respondents were asked to provide their opinions on six variables; poor administrative capacity to assess the revenue base; reduced revenue and tax evasion; poor administrative capacity to enforce the taxes; explicit and internal tax evasion and resistance from taxpayers; corruption including embezzlement of revenue; political pressure on the local tax administration to relax on revenue collection; and overdependence on the central government for financial transfer. The respondents were required to identify the challenges by indicating whether they strongly agree (SA), Agree (A), Uncertain (UN), Disagree (D) and Strongly Disagree (SD). Table 1 presents the study results.

The results in Table 1 indicated that there have been various challenges that face MMC own source collection after shifting of non-tax revenue to TRA. The results show that 71(80.68%) of respondents stated that there has been poor administrative capacity to assess the revenue base. It was found that failure to assess the revenue base resulted into little collection of revenue and reliance of funds from the central government. One of the key respondents was of the following view:

We admit that, MMC lacks administrative capacity to assess the revenue base from the fact that our personnel are not more equipped on the matter. Our request to be provided with competent personnel has not yet been fulfilled as the implementation of plans put are awaiting for the approval from the central government. The personnel available have helped the MMC to get some of revenue after the shift (Municipal treasurer).

On the other hand, 17(19.32%) of respondents disagree that there is no poor administrative capacity to assess the revenue base from the fact that personnel responsible for assessing revenue base have either been demoralized or are engaging in corruption. Such challenges have resulted in little revenue base and some of the revenue collected is mismanaged. One of the key respondents was of the following view:

We have some revenues sources such as service levy and hotel levy not collected to the required amount. What happens is that some of personnel do not do well their jobs and end up into corrupt practices although they have adequate expertise to enable the MMC to attain its targeted goals (Informant from trade and revenue department).

Furthermore, the results in Table 1 indicate that 60 (68.18%) of respondents agreed that the other challenge is the reduced revenue and tax evasion while 28 (31.82%) disagreed. This implies that after shifting non-tax revenue to TRA, there has been a reduction of revenue. It is argued that, revenue reduction, together with tax evasion, is the reason the MMC entered into revenue crisis. Moreover, there has been little tax education that hindered smooth revenue payment. One of the key respondents was of the following view:

Reduced revenue was due to inability to tap other sources while being unable to provide services to the dwellers in the MMC. Such hindrances resulted into drop in revenue collection and evasion (Informant from revenue unit).

The study result is consistent with the findings of Mosha (2010) who asserted that many LGAs lack personnel to assess the tax base and those available are immersed into corruption something that renders many LGAs to deliver poor services to its dwellers. It is argued that there are some LGAs that are able to collect and utilize well their revenue. Revenues such as service and hotel levies have not been well collected from the fact that some LGAs officials do the businesses of the same and become reluctant to fully collect revenue.

Similarly, the results in Table 1 indicates that 53 (60.23%) respondents accounted to 60.23% of respondents strongly agreed that there is poor administrative capacity to enforce the taxes while 23 (26.14%) of respondents disagreed. The study result implies that some personnel do not have the capacity to fulfil their obligations well resulting into little revenue enforcement. Moreover, 12 (13.63%) of the respondents accounted to 13.63% disagreed with the statement that poor administrative capacity to enforce the taxes has not been a challenge from the fact that although some revenue sources have been transferred, alternative sources have come into existence. One of the key respondents stated as follows:

After shifting non-tax revenue to TRA, new sources of revenue to MMC were introduced such as sales of plots, adjustment of business license provision to legible tax payers and enhancement of waste disposal to boost revenue collection (Informant from trade and revenue department).

The statements above concur with Yan (2010) who stressed on diversification of tax base to enable government entities to add alternative revenue sources that do not harm peoples’ income.

Regarding explicit and internal tax evasion and resistance from tax payers, it was found that 70(79.55%) of respondents agreed, while 10 (11.36%) of respondents were neutral and 8(9.09%) of respondents disagreed. Despite the general inclination to resist taxes, it was found that people were able to pay revenue as assessed, so long as the revenue collection follows procedures and is administered equitably. One of the key respondents was of the following view.

Our tax payers have been non-resistance when revenue introduced is for the benefit of the whole dwellers in MMC. Also, people are non-resistant when revenue proposed passes through proper channels for decision and implementation. Therefore, when these procedures are followed people are able and ready for implementation (Informant from revenue unit).

Additionally, the results in Table 1 indicate that 62(70.45%) of respondents strongly agreed that there is corruption that includes embezzlement of revenue to some revenue collectors and those who practice corruption are dealt with in accordance to the law. 26(29.55%) of respondents agreed that there is corruption that includes embezzlement of revenue, while none of the respondents were uncertain or disagreed:

One of the key respondents stated as follows: Although some corrupt practices cannot end completely, personnel who get identified are dealt with. In this MMC corrupt including embezzlement has been minimal and steps are taken to eliminate such practices (Informant from legal department).

The findings above are in line with Besley and Persson (2013) who reported that corruption has been a hindrance in many LGAs where provision of services has been minimal. Such practices have rendered people to resist in paying revenue in some instances as what is paid for does not meet the development expectations of LGA dwellers. The results in Table 1 shows that 80(90.90%) of respondents strongly agreed that the availability of political pressure on local tax administration to relax on revenue collection followed by 8 (9.10%) of respondents who agreed to some extent that there is political pressure on local tax administration to relax on revenue collection. It was found that Morogoro municipality council is challenged by politicians who always like to see their voters un-harassed in paying taxes. Although, taxes are insisted for payment, some politicians go further and interrupt the implementation process unnecessarily. One of the key informants stated as follows:

It has been a challenge to some politicians to persuade people not to pay what pertains revenue something that results into little revenue collection. Although such issues have been happening, orientations have been done in each tenure of service to educate politicians on their role to significantly be part and parcel of tax enforcement (Municipal treasurer).

Finally, the results in Table 1 indicate that 52(59.09%) of respondents strongly agree that in the period of shifting non-tax revenue, there has been an overdependence of central government for financial transfer followed by 20(22.73%) of respondents who agreed to some extent that there has been overdependence from central government. Also, the study found that 16 (18.18%) of the respondents disagreed that overdependence on the central government for financial transfer was a challenge. The study result implies that the availability of overdependence of central government were in opinion that Morogoro municipality council was obliged to seek for funds from the central government to fulfil its obligations. Such funds include; salary and emoluments, infrastructure development, free education funds, health services etc. One of the key respondents was of the following view:

We are obliged to seek for funds from the central government to finance issues such as free basic education; health related financing, infrastructure development, salary and others. Such financing rendered the MMC to be dependent on central government subsidies to carry out its developmental projects (Municipal treasurer).

It was observed that various challenges have been encountered by Morogoro municipality council (MMC) such as poor administrative capacity to assess and broaden the revenue base due to lack of competent personnel, reduced revenue and tax evasion among dwellers, poor administrative capacity to enforce taxes introduced, corruption from revenue collectors, political interference causing relaxation on revenue collection and overdependence on central government for financing the MMC. Moreover, in order to mitigate the challenges competent personnel employment and fighting for corrupt revenue collectors have been emphasized and implemented.

CONCLUSION

The shifting of non-tax revenue (billboard fee and property tax) from Morogoro municipality council (MMC) to TRA had fiscal consequences to MMC from the fact that it was unable to fulfil its obligations such as planning and completing its projects in time, loss of jobs to workers who dealt with revenue collection, resulting into tax burden among taxpayers due to introduction of other alternative taxes (that is, waste disposal tax). Also, there was inadequate education services provision after the transfer of non-tax revenue from the fact that, what was utilized by MMC from non-tax revenue could not be replaced, thus hindering the planned projects that would enable citizens get rid of some challenges that befall them. On the TRA side, it utilized well its personnel to manage and collect more revenue than that collected by MMC previously. Moreover, the non-tax revenue collected had no special measure for property and billboard fees that would enable owners pay the required amount as result, they ended up paying flat rates. Additionally, the reduction of revenue to MMC was indicated by an average annual decrease of TZS 239 million from billboard fees and an average decrease of TZS 567 million on property tax shift for the three years of 2017 to 2019. This shift rendered the MMC to fulfil its obligations with difficulties while some initiated projects became had to be stopped. Moreover, such shift had spill over positive effect at national level as there has been a positive improvement and implementation of services in the country. Therefore the perception of stakeholders on such shift gave credit to the central government on health and education related services but with little credit on municipal infrastructure development such as roads maintenance. Finally, MMC was found to have poor administrative capacity to assess and broaden the revenue base due to lack of competent personnel, reduced revenue and tax evasion among dwellers, poor administrative capacity to enforce taxes introduced, corruption from revenue collectors, political interference causing relaxation on revenue collection and over-dependence on central government among the challenges. Moreover, in order to mitigate the challenges encountered, MMC need to have competent personnel in line of revenue assessment and administration; and fight corrupt revenue collectors as mitigating strategies.

RECOMMENDATIONS

Based on the conclusion, the subsequent recommendations are put forward:

1. It is recommended that the system TRA adopted needs to be adapted for MMC revenue collection enhancements generally, and if non-tax revenue collection is returned to its mandate.

2. It is recommended that MMC needs to enhance its internal revenue collection in order to be able to fulfil its obligations while facilitating voluntary compliance in payment of revenue.

3. The availability of poor administrative capacity to assess and broaden the revenue base due to lack of competent personnel, reduced revenue and tax evasion among dwellers, poor administrative capacity to enforce taxes introduced, corruption from revenue collectors, political interference causing relaxation on revenue collection and overdependence on central government among the challenges need to be solved by having competent personnel in line of revenue assessment and administration and fight corrupt revenue collectors as mitigating strategies.

CONFLICT OF INTERESTS

The authors have not declared any conflict of interest.

REFERENCES

|

Besley T, Persson T (2013). Taxation and development. In: Auerbach AJ, Chetty R, Feldstein M, Saez E (eds), Handbook of Public Economics (Volume 5), Elsevier, Amsterdam. |

|

|

Cresswell P (2009). Research Methodology Methods and Techniques, Second Edition, New Delhi: New Age International publisher. |

|

|

Fjeldstad OH, Ali M, Katera L (2017). Taxing the urban boom in Tanzania: Central versus local government property tax collection. CMI Insight. |

|

|

Fjeldstad OH, Chambas G, Brun JF (2014). Local government taxation in Sub-Saharan Africa: A review and an agenda for research. CMI Working Paper. |

|

|

Fjeldstad OH, Fjeldstad OH, Katera L, Ngalewa E (2010). Local government finances and financial management in Tanzania: empirical evidence of trends 2000-2007. REPOA Special Paper no. 10-2010. Dar es Salaam: Mkuki na Nyota Publishers. |

|

|

Fjeldstad OH, Moore M (2009). Revenue authorities and public authority in sub-Saharan Africa. The Journal of Modern African Studies 47(1):1-18. |

|

|

Fjeldstad OH, Semboja J (2011). Dilemmas of fiscal decentralization: a study of local government taxation in Tanzania. Forum for Development Studies 27(1):205-214. |

|

|

Kelly R (1996). The Evolution of a Property Tax Information Management System in Indonesia: In Information Technology and Innovation in Tax Administration, edited by G. Jenkins. Cambridge, MA: Kluwer pp. 115-135. |

|

|

Kothari CR (2004). Research Methodology Methods and Techniques, 2nd Ed. New Delhi: New Age Int. (P) Limited. |

|

|

Manwaring P (2017). Enhancing Revenue for Local Authorities in Tanzania, International Growth Centre, IPS. Available at: |

|

|

Masaki T (2018). The impact of intergovernmental transfers on local revenue generation in Sub-Saharan Africa: Evidence from Tanzania. World Development 106:173-186. |

|

|

Mosha A (2010). Challenges of Municipal Finance in Africa. Nairobi: United Nations Human Settlements Programme (UN-HABITAT). |

|

|

Mwonge LA, Naho A (2021). Determinants of credit demand by smallholder farmers in Morogoro, Tanzania. African Journal of Agricultural Research 17(8):1068-1080. |

|

|

Ngotho J, Kerongo F (2016). Determinants of Revenue Collection in Developing Countries: Kenya's Tax collection Perspective. Journal of Management and Business Administration 1(1):1-9. |

|

|

Saunders M, Lewis P, Thornhill A (2007). Research Methods for Business Students, 4th Edition, Pearson Education Limited, London. |

|

|

Tanzi V (2000). Policies, institutions and the dark side of economics. Books. |

|

|

UN-HABITAT (2015). The challenges of local government financing in developing countries', United Nations Human Settlements Programme, Nairobi, Kenya. |

|

|

United Republic of Tanzania (URT) (2008). Report of the sub-committee on matters required to be accomplished to enable Tanzania Revenue Authority to collect property rate on behalf of local government authorities in mainland Tanzania (July). Dar es Salaam: Prime Minister's Office Regional Administration and Local Governments and Tanzania Revenue Authority. |

|

|

United Republic of Tanzania (URT) (2012). Population and Housing Census: Population Distribution by Administrative Areas. |

|

|

United Republic of Tanzania (URT) (2017). Speech by the Minister for Finance and Planning, Hon. Dr Philip I. Mpango (MP), presenting to the National Assembly, the estimates of government revenue and expenditure for 2017/18, Dodoma (8 June). |

|

|

Yamane T (1967). Statistics: An Introductory Analysis, 2nd Edition, New York: Harper and Row. |

|

|

Yan S (2010). Competitive Strategy and Business Environment: The Case of Small Enterprises in China. Asian Social Science 6(11):64-71. |

|

|

Yin RK (2003). Case Study Research: Design and Method: Applied Social Research Methods, Vol.5: Sage Publications Limited. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0