Full Length Research Paper

ABSTRACT

The inherent financial and reputational risks in companies’ tax avoidance practices should be of great concern to members of the board of directors. However, studies on the relationship between the board’s attributes and corporate tax avoidance have documented mixed findings. Since these studies are predominantly quantitative, the present study uses a qualitative strand in providing explanations to the mixed findings in addition to the quantitative strand. The quantitative data came from the annual reports of the top 100 Malaysian companies based on FTSE tradable index. The panel data were analysed using the system Generalized Methods of Moment (GMM). The findings were used to develop a semi-structured instrument for further qualitative inquiry through personal interview sessions with ten tax auditors of the Inland Revenue Board of Malaysia (IRBM). The quantitative analysis shows board effectiveness to be negatively related to corporate tax avoidance. However, board independence and board members’ financial literacy were not. The analysis of the interview responses shows that the members of the board have little influence on the choice of the company’s tax management strategy. These findings should be understood within the limitations of study focusing on large companies; the timeframe of the three-year financial period and use of the views of the tax auditors instead of the views of the directors. Nevertheless, the findings are relevant for the revision of the guidelines on the appointment and oversight roles of directors in the Malaysian Codes of Corporate Governance (MCCG).

Key words: Board attributes, corporate governance, corporate taxation, corporate tax avoidance, generalized methods of moment, Malaysia.

INTRODUCTION

The various corporate scandals and collapses of Enron, Dynegy, GlaxoSmithKline, WorldCom, and Tyco involving tax aggressiveness through extensive uses of tax shelters have changed the tax profile from traditional obscurity behind the scenes” to the mainstream of corporate concern and an agenda in the Boardroom (Freedman, 2003; KPMG, 2005, p. 2). The board of directors currently view tax issues with more serious concern than in the past given, the financial and reputational risks inherent in tax avoidance practices (ATO, 2005; Rego and Wilson, 2012; Badertscher et al., 2013; Hassan et al., 2014; Guenther et al., 2017). Accordingly, Lanis and Richardson (2011) and Minnick and Noga (2010) argue that the monitoring roles of board of directors on corporate tax avoidance should be investigated.

While the interaction between corporate governance and corporate taxation received belated attentions among accounting and corporate finance researchers, the recent years have witnessed overwhelming investigations into this interaction. Several components of corporate governance have been examined, especially in relation to corporate tax avoidance (Dyreng et al., 2008; Hanlon and Heitzman, 2010; Tang and Firth, 2011; Salihu et al., 2013). Studies such as Desai and Dharmapala (2006), Halioui et al. (2016), Hanlon and Slemrod (2009), Kasipillai and Mahenthiran (2013), Richardson et al. (2013), and Young (2017) have examined the overall influence of corporate governance on corporate tax avoidance. Others, such as Bird and Karolyi (2017), Chen et al. (2010), Khan et al. (2017), Koester et al. (2016), and Richardson et al. (2016) look into the corporate governance mechanisms and investigate the relationships of some of its components with corporate tax avoidance[1].

Since the board of directors has been found to be more responsible in management monitoring than any other corporate governance mechanisms (Ibrahim, Howard and Angelidis, 2003; Uzun et al., 2004; Zahra and Stanton, 1998), some studies have looked into the effects of the attributes of the board of directors on corporate tax avoidance. For instance, Vafeas (2010) investigated the relationships of some characteristics of board of directors and audit committees on two measures of corporate tax avoidance among Fortune 500 companies and documented some significant relationships (both positive and negative) among the variables[2].

Minnick and Noga (2010) looked into the influences of board attributes on tax management strategies of firms on S&P 500 in 2005 and found some of the attributes to be have positive influence on corporate tax avoidance while others have negative influences. Lanis and Richardson (2011) specifically focused on the influence of board composition on corporate tax avoidance among 38 Australian firms and find "that the inclusion of a higher proportion of outside members on the board of directors reduces the likelihood of tax aggressiveness” (Lanis and Richardson, 2011, p. 50).

Furthermore, Mahenthiran and Kasipillai (2012) investigated the relationship between some measures of corporate tax avoidance and board of directors’ attributes among 397 Malaysian firms. Similar to the previously reported studies, the results of this study are also mixed with negative and positive significant relationships documented. Similarly, Paunescu, Vintila and Gherghina measures of corporate tax avoidance) and some attributes of boards of directors among 50 firms listed on NASDAQ for the period of 2000 to 2013. The findings have a mix of positive and negative relationships among the variables.

The persistent mixed results on the relationship between corporate tax avoidance and the attributes of board of directors call for a different approach to investigating this interaction. Thus, the present study adopts a unique approach in examining the influence of the board of directors' attributes on corporate tax avoidance. The study is different from the other studies in two ways specifically.

First, the present study uses an explanatory mixed method of quantitative-to-qualitative approach to provide explanations to the mixed findings documented in quantitative based studies. It is argued that a mixed method approach could be a useful tool in articulating “the complexity of a problem, providing examples of fixes and compelling proof that will contribute to a better [understanding of our] society” (Molina-Azorin and Fetters, 2019). Using this approach could “provide the best opportunity for addressing research questions” (Malina et al., 2011, p. 60). Thus, the quantitative findings, from the analysis of the secondary data from the firms’ annual reports, were subjected to qualitative enquiry through personal interview sessions with tax auditors in the Inland Revenue Board of Malaysia (IRBM). To the best of the authors’ knowledge, this study is the first to adopt this approach in the context of corporate tax non-compliance.

Second, we used four similar but different effective tax rates (ETRs) to capture corporate tax avoidance comprehensively. These are the proportion of income tax expense to the accounting income before tax (denoted as accounting ETR); the ratio of income tax paid to the total accounting income before tax (coded as long-run cash ETR); the ratio of income tax expense to operating cash flows; and ratio of income tax paid to operating cash flows. The first three measures have been extensively used to capture corporate tax avoidance (Hanlon and Heitzman, 2010; Salihu et al., 2013). The fourth measure has been documented to be similar but different to the other three measures (Salihu et al., 2013) and might likely capture the conforming tax avoidance advocated in Hanlon and Heitzman (2010).

We chose Malaysia as the context for this investigation because of the relative stability in the country’s corporate tax rate for the period of the study, which could provide a further insight into the documented mixed results, and the emerging nature of its economy. Furthermore, the issue of commercial tax non-compliance has been identified as a major reason for illicit global fund flow out of the country in the recent past (Global Financial Integrity, 2011; OECD, 2014; Hani, 2011).

The results of the quantitative strand show that board effectiveness (measured as board size and board frequency of meeting) is negatively associated with the four measures of corporate tax avoidance. The predicted negative relationships of board independence (measured as board composition and CEO duality) and board financial literacy are not statistically significant. The analysis of the responses from the interview sessions with the tax auditors reveals that board members have little or no influence on the tax management strategy of the firms. It further shows that the financial interests of these members might be the reason for the lack of such influence as those interests takes precedence over their concern for organizational legitimacy.

[1] The early version of this paper was presented at the symposium of Journal of Contemporary Accounting and Economic, Cinnamon Lakeside, Colombo, 4th - 5th January, 2020.

[2]To mention but a few as the list may be endless.

THEORETICAL INSIGHT AND HYPOTHESES DEVELOPMENT

One of the means of fulfilling the requirements of the express social contract between a firm and the society where it operates is the payment of taxes by the firm (Christensen and Murphy, 2004; Preuss, 2010; Williams, 2007). The firm will be viewed as socially responsible and accepted in the society where it operates following the fulfilment of this requirement (Deegan, 2006). This ensures the organizational legitimacy of the firm and its continuous survival within the society. It is imperative therefore that, firms should strive to fulfil this civic responsibility to avoid creating a “legitimacy gap” between the value system of the society and that of the firm (Lindblom, 1994, p. 3). Such gap could threaten the very existence of the firms since tax avoidance is often viewed as “a crime against the nation” (Landolf, 2006, p. 6). As such, Salihu et al. (2015) argued for the relevance of legitimacy theory in the study of corporate tax avoidance as tax non-compliance constitutes an act of social irresponsibility (Christensen and Murphy, 2004). It is believed that the members of the board will seek to deter their firms from such criminal act given their concern for organizational legitimacy. Furthermore, studies by Lanis and Richardson (2012) and Huseynov and Klamm (2012) have found firms with high social responsibility disclosure to be less tax avoidant.

Board composition, which means the proportion of independent non-executive directors on board, is a critical factor in determining the effectiveness of the board in management monitoring (Fama, 1980; Fama and Jensen, 1983). This is particularly important as the inside directors may act in a way to maximize their own interests even if it involves fraudulent activities (Uzun et al., 2004; Yermack, 1996). However, this opportunistic behaviour of inside directors could be curtailed with the presence of outside directors on the board (Fama, 1980). It could therefore be inferred that board composition will have negative impacts on corporate tax avoidance given the concern of independent non-executive directors for the firm’s organizational legitimacy.

However, the studies examining the relationship between board composition and corporate tax avoidance have produced mixed results. While some of these studies found significant positive relationships, others documented negative relationships between the two variables. For instance, while Lanis and Richardson (2011) document a negative association between higher proportion of outside directors on Board and corporate tax avoidance, Minnick and Noga (2010) find a positive association between foreign tax avoidance and board composition.

From the perspective of the legitimacy theory, the expected relationship between board composition and corporate tax avoidance should be negative. The independent non-executive directors are expected to seek organizational legitimacy as they are parts of the society and have their reputations to protect.

Thus, given these mixed results and the fact that the presence of independent non-executive directors assists the board to legitimise itself, the present study states the following hypothesis regarding the relationship between board composition and corporate tax avoidance.

Ho1: There is a negative relationship between board composition and corporate tax avoidance

Chief Executive Officer (CEO) duality means the combination of the role of the CEO and chairmanship of a company in the same individual (Rechner and Dalton, 1989). This situation suggests some major issues in leadership and governance of a corporation (Said, Zainuddin and Haron, 2009), as it creates rooms for power concentrate in a personality which could erode the board’s ability in effective control (Fama and Jensen, 1983; Tsui and Gul, 2000). As such, CEO duality affects the level of the independence of the board of directors (Gul and Leung, 2004).

Given this backdrop, there is the need to understand the relationship between CEO duality and corporate tax avoidance (Minnick and Noga, 2010) as tax management decision now rests with the board (KPMG, 2005). However, the studies that examined the relationships between CEO duality and corporate tax avoidance are still limited and inconclusive. The legitimacy theory suggests that CEO duality may deter tax avoidance given the need for reputation on the part of the dominant person. Thus, the present study hypothesizes as follows:

Ho2: There is a negative relationship between CEO duality and corporate tax avoidance

In a group decision-making process, the possibility of the size influencing the outcome of the decision process cannot be overemphasized; hence the size of a board of director might determine its decision outcome and thus affects the quality of corporate governance (Jensen, 1993; Said et al., 2009). However, how large or small a board should be to be effective is an unresolved question among corporate governance researchers (Jenter et al., 2018). While majority of these researchers are of the opinion that larger boards may lead to communication and coordination problems, cost ineffectiveness and poor decision-making process (Jensen, 1993; Lipton and Lorsh, 1992; Raheja, 2003), others have argued that larger boards are needed for cross-fertilization of ideas which may result in better decision outcome (Jenter et al., 2018; Said et al., 2009).

The only study, Minnick and Noga (2010) on corporate tax avoidance that considers the effect of board size documents an inconclusive finding. It finds that “larger boards focus on reducing domestic taxes” (Minnick and Noga, 2010, p. 717) and there is no evidence for such influence on general tax management. Given the propositions in the legitimacy theory, larger board should be more effective in deterring tax avoidance practices because of the concern over organizational legitimacy. Thus, the present study states the following hypothesis:

Ho3: There is a negative relationship between board size and corporate tax avoidance

Board meeting frequency has been identified as “an important dimension of board operations” (Vafeas, 1999, p. 113). Stressing the importance of the board meeting frequency, Conger et al. (1998) opine that the time spent by board members in meeting serve as an important resource for board effectiveness.

While Lipton and Lorsch (1992) have argued that lack of time is the most common problem faced by most directors, partly due to “too many outside directorships” (Vafeas, 1999, p. 114), it is surprising that very few scholars (Brown and Caylor, 2004; Conger et al. 1998; Vafeas, 1999) have investigated the relevance of board meeting frequency in the context of corporate governance. A further understanding of the impact of this variable could add to our knowledge of the proper functioning of a board. Given this argument, frequency of board meeting could be a determining attribute of the board that can impact the relevance of other attributes of board effectiveness.

As such, it is believed that a board that meets more frequently will be effective in tax management of the company. The reason being that tax issues are more frequently discussed under the self-assessment system, most importantly with the current year assessment approach. As a requirement, the company is expected to review (and if necessary revise) its earlier estimated tax liabilities anytime in the assessment period before the ninth month of the year of assessment (Kasipillai, 2010). This is necessary to avoid the likely penalties for any shortfalls. It is therefore, the responsibility of the board to oversee this issue for compliance purposes.

Unfortunately, studies examining the relationship of this attribute and corporate tax avoidance are very few to produce a logical conclusion. Vafeas (2010) provides an insight into the relationship between board frequency of meetings and corporate tax avoidance and finds that board meeting frequency is related to high level of tax avoidance among Fortune 500 firms. This result supports the traditional view of the role of board of directors in tax management of companies but the finding is quite surprising, especially in a disperse ownership setting of the United States of America.

However, this finding contradicts the propositions in legitimacy theory. The theory proposes that board effectiveness as reflected in its frequency of meeting should serve as a deterrent to tax avoidance practice given the concern for organizational legitimacy. Hence the following hypothesis is stated:

Ho4: There is a negative relationship between board meeting frequency and corporate tax avoidance

The need for more financial experts on the boards of directors has been stressed following the various accounting scandals (Nga et al., 2012). This will enhance a better understanding of analysis of financial statements and thus assist the boards in their oversight role. Accordingly, Sarbanes-Oxley Act 2002 (SOX) makes it a requirement for inclusion of financial experts on boards of public listed firms. Also, the Malaysian Code on Corporate Governance (MCCG) requires that all members of audit committees of listed companies to be financially literate and specifically, one member of the committee to be a member of Malaysian Institute of Accountants (MIA).

However, existing literatures on corporate tax avoidance have not considered the relationship between financial literacy and corporate tax avoidance despite its relevance for board effectiveness. Although, Vafaes (2010) examines the relationship between presence of a financial expert on the board and corporate tax avoidance and finds a positive relationship, the financial literacy of the whole board members remains unexplored.

A board with high number of members, who are financially literate, could be more effective in its monitoring functions and thus helps in deterring tax avoidance practices given the members’ concern for organizational legitimacy. Thus, this study hypothesizes as follows:

Ho5: There is a negative relationship between board of directors’ financial literacy and corporate tax avoidance.

RESEARCH METHODOLGY

Research design – mixed method approach

The study adopts a dialectical approach (Greene, 2007; Rocco et al., 2003) of combining the pragmatism and transformative philosophical foundations (Morgan, 2007; Tashakkori and Teddlie, 2009) to provide a balanced understanding of the relationship between board attributes and corporate tax avoidance. This approach is considered appropriate as it provides a practical balance between “the two extremes of knowledge generated from the constructivist and positivist reasoning approaches” (Salihu, 2015, p. 140). Since ‘there is no problem in asserting both that there is a single “real world”, and that all individuals have their own unique interpretations of that world’ (Morgan, 2007, p. 73).

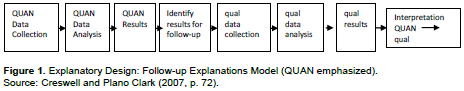

Loo et al. (2010), McKerchar (2008; 2010), and Torgler (2007) have called for the use of mixed method in context of tax compliance. Thus, considering the 13-step model presented in Schoonenboon (2018), the points highlighted in Collins and O’Cathain (2009), and the fact that the previous studies of board attributes and corporate tax avoidance are predominantly quantitative; this study adopts the follow-up explanatory variant of explanatory design (Creswell and Plano Clark, 2007, p. 72; 2011, p. 85). Figure 1 below depicts the flow of the research activities in the study.

Sequent to the adopted follow-up explanatory approach, exhibited in Figure 1, the quantitative strand is given precedence over the qualitative. Thus, the quantitative research design was first implemented and then followed by the qualitative design. The relevant data were hand-collected, from the annual reports of the selected companies, analysed and the results presented. The results were then used to develop a semi-structured interview questions for qualitative data collection. Subsequently, the responses of the interviewed tax auditors were analysed and the findings presented. The conclusion of the study is drawn from findings of both quantitative and qualitative strands with priority given to the qualitative findings.

Empirical methods – quantitative strand

Source of sample data

The sample comprises of the top 100 listed companies on Bursa Malaysia (BM) based on the FTSE Bursa Malaysia Top 100 Index[1]. The annual reports of the companies were downloaded from the website of BM (http://www.bursamalaysia.com/market/listed-companies/company-announcements) for the financial periods of 2009, 2010 and 2011. The reason for the choice of these years is the fact that year 2009 marks the end of the implementation of tax policy for gradual reduction of statutory corporate income tax rate from forty percent (40%) in 1988 to twenty-five percent (25%) in 2009 (Kasipillai, 2010). It is believed that the financial statements of these companies for the financial periods reflect a fixed and steady corporate tax rate which is highly relevant for this type of study in achieving its research objectives. As at the time of this data collection, most of the companies have their annual reports announced up to 2011.

The annual reports of the sampled 100 companies were filtered and the following adjustments were made during data extraction for the empirical investigation:

1. Fifteen (15) companies were excluded due to incomplete financial information for the financial periods (2009; 2010; and 2011) being considered;

2. Five (5) companies with tax refunds or operating loss were also excluded because of the distortion in the measurement of their tax burdens (Zimmerman, 1983);

3. Given the same reason in number two (2) above, sixteen (16) companies with negative operating cash flow for any of the financial periods were also excluded;

4. One (1) company that has one of its tax avoidance measures greater than one was also removed to avert potential model estimation problems (Stickney and McGee, 1982).

A total of sixty-three (63) companies served as the final sample for the present study. Thus, a total of 189 firm-year observations were used for the quantitative empirical analysis based on the three financial periods. This provides a sufficient panel data set that could allow in-depth analyses and thus give room for meaningful inferences from the results.

Specification of empirical model and measurement of variables

The nature of the quantitative data described above necessitates the development of a panel data regression model for the analysis. A critical examination of the focus of the present study suggests the nature of the panel data to be dynamic. As such, the study developed a dynamic panel data model. A set of panel data is considered dynamic when there is an inclusion of unobserved individual-specific effects and/or lagged dependent variables. The present study employs the following model for the dynamic penal data to avert potential effects of endogeneity similar to Minnick and Noga (2010). This model is written as:

[1] FTSE Bursa Malaysia Top 100 Index is one the five tradable indices computed from the market data to reflect the performance of the Bursa Malaysian market. It is the combination of the 30 companies in FTSE Bursa Malaysia KLCI Index and the 70 companies in the FTSE Bursa Malaysia Mid 70 Index.

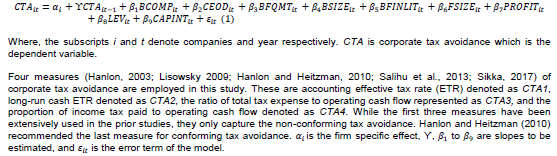

BCOMP, CEOD, BFQMT, BSIZE, and BFINLIT, stand for board composition, CEO duality, board frequency of meeting, board size, and board members’ financial literacy are independent (explanatory) variables for board attributes, respectively.

The board composition is measured as the proportion of independent non-executive directors on board. CEO duality is measured as a dichotomous variable which equals 1 if there is role duality and 0 if otherwise. The board frequency of meeting is measured as the total number of the meetings held during the year. Board size is measured as the total number of directors sitting on board. The board members’ financial literacy is measured as the ratio of the score of financial literacy by members of the board of directors to the maximum possible score that would have been attained by all members of the board[1].

FSIZE, PROFIT, LEV and CAPINT represent firm size, profitability, leverage and capital intensity, respectively are control variables found to impact firms’ tax burden.

The coefficient of lagged dependant variable, ϒ, is expected to be positive. Similar positive signs are expected for to because of the hypothesized negative relationships board attributes and corporate tax avoidance. For the slopes of the control variables, though not hypothesized, positive signs are expected for and and negative signs for to based on the empirical findings in prior studies (Adhikari et al., 2005; Chen et al., 2010; Derashid and Zhang, 2003).

Estimation method

The dynamic nature of the above panel data negates the relevance of the standard pooled regression (OLS) model, fixed or random-effect models given the presence of firm specific effects or any time-invariant firm-specific variable and the lagged dependent variable. The use of generalized method of moment (GMM) estimator has been argued for by Arellano and Bond (1991) in the above situation.

However, the first-difference GMM estimator has been criticized for neglecting the potential information generated, while relating the first differences of levels with the respective levels (Ahn and Schmidt, 1995). As such, Arellano and Bover (1995) recommended the system GMM estimatior of the regressions for the first difference and levels. Blundell and Bond (1998) stressed the relevance of system GMM estimator when the time-period is small and thus the system GMM estimator is adopted in the present study, given the three-year financial periods. It should be noted that the stationary test of the panel data using panel unit root test was not conducted given the short time-series of three years that is considered insufficient for the test (Eviews User’s Guide, 2005).

Qualitative strand

The quantitative findings reported herein leave us with lack of consistence among the empirical findings. This, and the calls for the use of mixed methods approach in tax researches by Loo, Evans and McKerchar (2010), McKerchar (2008; 2010), and Torgler (2007), necessitate further investigation through a qualitative inquiry to provide explanations to the inconsistent quantitative findings. As the previous researches in this respect are largely quantitative, precedence is given to the quantitative strand in this investigation. This approach to mixed methods research has been described as an 'explanatory sequential design' by Creswell and Plano (2007, p. 72; 2011, p. 85). Here, the qualitative inquiry is used as a follow-up strategy in explaining the quantitative findings, as discussed later. Hence, the follow-up explanatory variant of the explanatory sequential design (Creswell and Plano, 2007; 2011) was adopted in this study.

In line with the adopted design, we developed a set of questions based on the findings from the quantitative strand. The development of the interview questions followed the procedure suggested in Creswell and Plano (2007). The developed questions were tested through pilot interview sessions with some tax experts including an academia, a tax consultant and some graduate students. The results of the pilot interview sessions were used to improve the structure of the questions and thus guaranteed the validity and internal consistency of the questions.

Ten tax auditors, responsible for the field audit of corporate tax payers, with Inland Revenue Board of Malaysia (IRBM) were interviewed using the improved set of the questions in face-to-face tape-recorded interview sessions. The tax auditors were selected as respondents purposefully (Palinkas et al., 2015) for the interviews for two reasons. First, the tax auditors are directly involved in investigating the tax management of the companies through routine tax audit exercises. Thus, they are perceived to be well acquitted with the tax management strategies of these companies. Furthermore, the findings of the study are expected to help them in the selection process of companies for audit. Second, the sensitive nature of tax avoidance requires third party evidence as seeking such information directly from the companies' directors may not be free from biasness.

The interviews sessions were made possible after obtaining written permission from the directorate of the board in Cyberjaya and taking consents of the tax auditors. All the interview sessions took place in the corporate tax department of the IRBM in block 11, government offices complex, Jalan Duta at different time convenient for the respondents. The average time for the interview session was one and half hour for the first sessions with the help of the semi-structured instrument. There were follow-up visits to some of the respondents after the transcriptions of the tape-recorded responses for further clarifications of their responses.

The transcribed responses were analysed using the procedure suggested in Ary et al. (2006). First, the researchers read the transcribed responses multiple times for familiarization and better organization of the responses. Each researcher took notes of relevant information reflecting general thought during each reading. The general pattern of the information contained in the responses started to emerge during this stage. The notes taken were then used to code and recode the relevant responses to tentative categories. These categories were later sorted into major and minor categories. The coding and recoding, including the sorting, of the categories were done with the help of a computer-aided qualitative data analysis (CAQDA) known as Nvivo 10. Finally, the researchers used the constant comparative method to generate the main ideas from the responses. The thematic analysis was ignored because the inquiry is not meant to create themes. The generated main ideas are presented later on.

[1]These scores are assigned such that 3 points are credited to a director with a membership with any professional accounting body, 2 points to a director with relevant working experience in financial sector and 1 point to a director with finance and/or accounting certificate at tertiary education level.

RESULTS AND DISCUSSION

The quantitative strand

Descriptive statistics

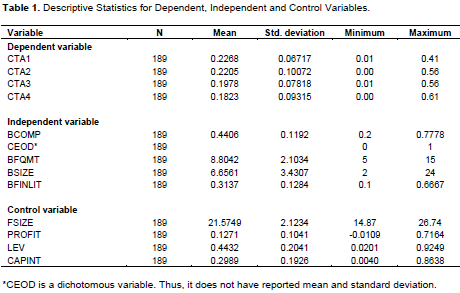

Hejase et al. (2012) contend that informed objective decisions are based on facts and numbers, real, realistic and timely information. Furthermore, according to Hejase and Hejase (2013), descriptive statistics deals with describing a collection of data by condensing the amounts of data into simple representative numerical quantities or plots that can provide a better understanding of the collected data (p. 272). Consequently, the descriptive statistics for the measures of corporate tax avoidance, independent and control variables are presented in Table 1. As for the measures of corporate tax avoidance, the first measure – accounting ETR has the highest mean value of 22.68%. A similar mean value of 22.49% was documented in Noor et al. (2008). Next is the long-run cash ETR with a mean value of 22.05%. While the ratio of income tax paid to operating cash flow has the lowest mean value of 18.23%, the third measure, the ratio of tax expense to operating cash flow, has mean value of 19.78% which makes it next to long-run cash ETR by ranking. Besides the mean values, the variations in the data for the means of each measure are reported as standard deviations. The small values of standard deviation indicate a clustered data set around the means (Lind et al., 2012).

An insight into these statistics shows that the means are generally lower than the statutory company income tax rate of 25%. The highest of the means is 2.32% less than the statutory tax rate. This suggests the prevalence of low tax burdens among large Malaysian companies. While many reasons such as tax incentives could account for this, it also suggests the likelihood of tax avoidance activities among the large companies. This similar inference was drawn from previous ETRs studies such as Noor et al. (2008) and Noor et al. (2010).

As for the independent variables, a mean value of 0.4406 was recorded for the board composition (BCOMP); one of the measures of board independence. It means that 44.06% of the sampled firms’ board members are independent non-executive directors. This is slightly less than the threshold in Malaysian Code of Corporate Governance (MCCG) that recommends 50% of board members to be independent non-executive directors for large companies. Although, the maximum value of 71.87% was recorded, the minimum of 2% showed that most of the large companies are not complying with the Code. Other Malaysian studies have documented similar low percentages. For instance, Haniffa and Cooke (2002) found 45% of board members to be independent non-executive directors. Ghazali and Weetman (2006) documented 35.85%, Wan-Hussin (2009) found 37%, Esa and Ghazali, (2012) reported 42.62% even among the government linked companies (GLCs).

The mean and standard deviation of CEO duality (CEOD), the second measure of board independence, were not reported, given the dichotomous nature of the variable. However, ten (10) out of the sampled firms have the roles of CEO as well as that the chairmanship of the board being vested in a single individual. This shows that most of the large companies are complying with the MCCG requirement of separating the roles of the CEO and chairmanship of the board.

The variable, board frequency of meeting (BFQMT), one of the measures of board effectiveness, has a mean of 8.8042 with minimum and maximum values of 5 and 15 respectively. These statistics suggest that the board members of Malaysian large companies meet more frequently and therefore are effective in the monitoring of the management’s activities.

As for the second measure of board effectiveness, board size (BSIZE), a maximum value of 24 board members with a mean of 6.6561 and minimum of 2 members were recorded. With the average of 7 members on board, the effectiveness of the board could be ensured given the opportunity for cross-fertilization of ideas. While MCCG does not specify the exact number of the board members, it however recognises that size does matter for boards to be effective. The maximum value of 24 board members indicates that Malaysian large companies are having large board members. Although a minimum value of 2 members was recorded, only very few of the sampled companies have less than four members given the standard deviation of 3.4307.

As for the last independent variable board members’ financial literacy (BFINLIT), a mean value of 0.3137 was documented with minimum and maximum values of 0.1 and 0.6667 respectively. This shows that members of Malaysian large companies are averagely literate financially considering a percentage of 31.37%. This percentage is higher than that of Nga et al. (2012) of 27.84%. Although, Nga et al. (2012) sampled number of companies more than that of the present study, the present study used a wider scope for the measurement of financial literacy.

For the control variables, a mean value of 21.574 was documented for the variable firm size and growth (FSIZE). This value is higher than 13.122 found in Derashid and Zhang (2003); 13.02, reported in Adhikari, Derashid and Zhang (2006); and 5.63, recorded in Noor et al. (2008). The focus of the present study on large Malaysian firms could account for such high firm value. ROA, a measure for the companies’ profitability, has a mean of 0.1271. While a high profitability of 71.64% was recorded in some companies, few of the companies reported negative profits for either one or two of financial periods under consideration. The recorded average profitability of 12.71% seems higher than the percentages of 8.1, 8 and 8.1% reported in Derashid and Zhang (2003), Adhikari et al. (2006), and Noor et al. (2008) respectively. The higher mean value for the profitability is expected because of the focus on the large firms. Leverage, another control variable, has a mean of 0.4432. This value shows that 44.32% of the total assets are financed by the debts. The value is higher than 13.12% documented in Derashid and Zhang (2003); 13.02% in Adhikari et al. (2006) and 5.63% found in Noor et al. (2008). The high value is also expected, given the opportunities to debt financing for the large firms. The last control variable which is capital intensity (CAPINT) has a mean of 0.2989. It means 29.89% of the total assets comprises of property as well as plant and machinery. This is also higher than the values of 9.3, 23.56, and 14% reported in Derashid and Zhang (2003), Adhikari et al. (2006), and Noor et al. (2008) respectively. The same reason large companies could account for this.

The general low values of standard deviation observed across all the independent and control variables show that the data’s distributions are clustered around the means. Thus, the means are good representations of the centre of the data.

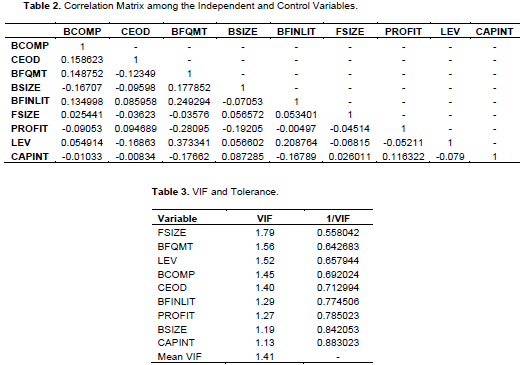

Correlations among independent and control variables

Table 2 presents the correlation matrix among the independent and control variables in the empirical model. While the correlations among these variables are expected, high correlation coefficients will amount to the problem of multicollinearity. The degree of correlation that could be counted as multicollinearity problem has been set by various authors. For instance, Gujarati and Porter (2009) suggest that the magnitude of correlation coefficient exceeding 0.8 or 0.9 could amount to collinearity. A more stringent cut-off of 0.7 was suggested by Tabachnick and Fidell (2008) and Kennedy (2008). The perusal of the correlation matrix reported in Table 2 shows none of the coefficient to be above 0.4. This suggests the non-severity or non-existence of multicollinearity among the independent and control variables (Kennedy, 2008).

Further tests of multicollinearity, using Variance Inflation Factors (VIF) and its inverse tolerance, were carried out. The results of these tests are presented in Table 3. All the values of the VIF are less than 2 and that of tolerance are higher than 0.5. These further suggest the lack of multicollinearity problem as these values are far less than the threshold of 10 for VIF and higher than 0.10 for tolerance (Gujarati and Porter 2009; Hair et al., 2009; Chehimi et al., 2019).

Taking a second look at Table 2, a positive correlation coefficient (0.1586) between board composition (BCOMP) and CEO duality (CEOD) indicate that the two variables could jointly measure board independence.

Similarly, board frequency of meeting (BFQMT) also positively correlated with board size (BSIZE) with a coefficient of 0.1779. This also indicates the likely joint measurement of both variables of board effectiveness.

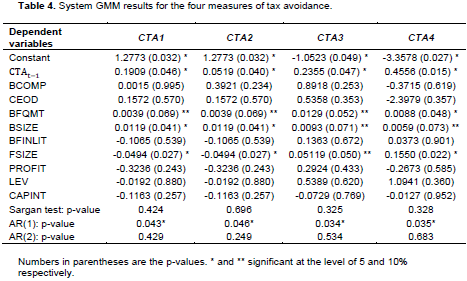

GMM estimation

The results of the system GMM estimation of the model are presented in Table 4. The results show board frequency of meeting and board size to have positive significant relationships with the four variants of ETRs. The two variables therefore impact these measures of corporate tax avoidance negatively. This is consistent with the findings in Halioui et al. (2016) and Paunescu et al. (2016). Board composition, CEO duality and board of directors' financial literacy are not statistically related to the four measures of corporate tax avoidance. This is contrary to the findings of Lanis and Richardson (2011), Richardson et al. (2013), Halioui et al. (2016), and Paunescu et al. (2016). Thus, board effectiveness seems to impact corporate tax avoidance strategy negatively and therefore help the firms in achieving their organizational legitimacy in Malaysian context. This result is in contrast to the findings in Vafeas (2010) where board size and its frequency of meeting were found to be insignificantly related to the measures of corporate tax avoidance. The difference in the findings of the two studies might be due to the different context of the studies or the statistical method of analysis employed. While Vafeas (2010)’s study was carried out in a market-based capitalism, the present study focuses on a relationship-based economy. Furthermore, the present study also considered the issue of endogeneity which accounts for the use of system GMM estimator which Vafeas (2010) did not consider sure issue.

For the assumption of the exogeneity of the explanatory variables, the test for over-identification of the instrumental variables using Sargan tests for each of the models run was done. The results, also presented in Table 4, showed no problem of over-identification restriction. Furthermore, we checked for serial correlation problem and found that the second-order autocorrelation [AR (2)] failed to reject null hypothesis of no serial correlation. The reported p-values for the first-order auto correlation [AR (1)] are however not unexpected, given the likely serial correlation in the first order difference. Thus, the required specification tests for the estimated models showed the estimations are consistent and unbiased.

The significant coefficients documented for lagged dependent variable and the constant for the four estimated models further strengthen the consistence of the estimation. As for the control variables, only firm size is found to be significantly related to the four variants of ETRs. Thus, consistent with political cost theory and findings in Adhikari et al. (2005; 2006), firm size could impact corporate tax avoidance. The other control variables are not significantly related to the measures of corporate tax avoidance. The overall results on the control variables are consistent with findings in Salihu et al. (2014) and Salihu et al. (2015).

Findings from qualitative data analysis

The generated main ideas from the analysis of the responses described above revealed that the members of the board have little or no influence on the choice of tax management strategy adopted by the firms.

For instance, on the impact of board composition on corporate tax avoidance practices, one of the respondents said:

..yah, what I see is that if there are external directors on board, especially very well-known figures, the chances of tax avoidance is lesser. Because they are very particular in the proper running of the company and also they are quiet answerable to the public. Therefore, with the external directors who are not linked in any way, tax planning and tax avoidance are lesser…

Other respondents argued to the contrary saying:

…if you ask me strictly, I do not think so because they (directors) are all appointed. Therefore, I don’t think the appointed external directors could have serious impacts on the companies’ tax avoidance activities. Because if I appoint you and you do not listen to me, then you are gone…

…I do not think the outside directors could have effects on the tax avoidance practices of the company. This is because the directors are being paid by the company. Since they are paid directors, I do not think they have such power…

On the impact of CEO duality, all the respondents agreed that this lead to more tax avoidance practices. These are some of their statements:

…of course yes. let’s say the person has got a full say in the running of the company then you have to be careful because that may signal something. This normally shows us areas we need to focus more…

…that will lead to more tax avoidance. Because there will be lots of direct interferences in management decision process. I have one particular case I feel there is an element of interference…

On the relevance of board effectiveness (board size and board frequency of meeting) to corporate tax avoidance practices, the responses showed that the characteristics of the individual directors are more important than their number and frequency of meeting. For instance, one of the respondents said:

…I would say it all depends on the directors, if they are representing different shareholders and there are so many shareholders in that company, then yes, because if anything comes up they can voice out because they represent their shareholders and everyone wants the company to be good. But if there is somebody controlling and that person wants to avoid tax, then the other got no choice, based on my experience…

On the impact of directors' financial literacy on tax avoidance, the tax auditors agreed that being financial literate should help in mitigating tax avoidance practice, but it all depend on whether they want to compile with tax laws or not. Here is one of the responses:

…I think it all depends on whether they want to do it or not, but of course financial literate directors are good for tax compliance…

Summary of findings from qualitative data analysis

As a summary of the findings from the analysis of responses from the tax auditors, the characteristics and dispositions of individual director to tax compliance, especially the chairman of board, could influence the tax management strategy of a firm. However, the fact that these directors are appointed and being paid by the companies could overshadow their concern for organizational legitimacy. Moreover, the directors in most cases sit on more than one board and have little concern for the legal issues as compared to the financial matters. Thus, the directors might take little cognizance of the tax status of the companies where they sit. The choice of tax management strategy is therefore left in the hands of the management.

CONCLUSION

The present study has provided a new dimension in the study of the relationships between the attributes of the board of directors and corporate tax avoidance. With the use of four similar but different variants of effective tax rates (ETRs), the study tried to capture the tax avoidance comprehensively. Also, the mixed quantitative findings on the impacts of the board on corporate tax avoidance were subjected to qualitative investigation through face-to-face interview sessions with tax auditors responsible for the audit of the corporate taxpayers. The findings from the qualitative strand showed that attributes of the board might have little or no impact on the corporate tax avoidance practices, as the directors are not responsible for a firm tax management strategy. Given priority to the qualitative findings, it could therefore be concluded that while the directors are perceived to have influence on choice of tax management strategy of the firms, due to their general oversight roles and concern for organizational legitimacy, the financial benefits accruing from the firms and the fact that these directors are appointed by firms preclude their sense of judgement.

This conclusion is relevant for the revision of the guideline on appointment of directors in Malaysian Codes of Corporate Governance (MCCG). The oversight roles of the directors, especially the independent non-executive directors, should be expended to include liability for directors in cases of apparent negligence in matters related to tax law non-compliance. The review should consider shorter tenure of a director sitting on the board of a firm and issues of multiple directorship need review.

This conclusion should be understood within some limitations. First, this study focuses on large companies, given their propensity for tax management. Second, the timeframe of the three-year financial period could limit the generalization of its quantitative findings. Finally, although the views of the tax auditors provide unbiased inquiry to the roles of the directors in firms’ tax management, the views of directors themselves might give more insights into this.

Thus, an investigation into the point of views of the directors on board might provide a better insight to understanding their roles in firms' tax management strategy. We suggest further qualitative investigation using the retired directors or dismissed directors as respondents for better understanding of the happenings in the board room in relation to tax management strategy.

CONFLICT OF INTERESTS

The authors have not declared any conflict of interest.

REFERENCES

|

Adhikari A, Derashid C, Zhang H (2005), Earnings management to influence tax policy: evidence from Malaysian firms. Journal of International Financial Management and Accounting 16(2):142-163. |

|

|

Adhikari A, Derashid C, Zhang H (2006). Public policy, political connections, and effective tax rates: longitudinal evidence from Malaysia. Journal of Accounting and Public Policy 25(5):54-595. |

|

|

Ahn S, Schmidt P (1995). Efficient estimation of models with dynamic panel data. Journal of Econometrics 68(1):5-28. |

|

|

Arellano M, Bond S (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Review of Economics Studies 58(2):277-297. |

|

|

Arellano M, Bover O (1995). Another look at the instrumental variables estimation of error-components models. Journal of Econometrics 68(1):29-51. |

|

|

Ary D, Jacobs LC, Razavieh A, Sorensen C (2006). Introduction to Research in Education, 7th ed., Thomson/Wadsworth, Singapore. |

|

|

Australian Taxation Office (ATO) (2005). Updated compliance program 2005-06, Australian Tax Office, Canberra, ACT. |

|

|

Badertscher B, Katz S, Rego S (2013). The separation of ownership and control and its impact on corporate tax avoidance. Journal of Accounting and Economics 56(2-3):228-250. |

|

|

Bird A, Karolyi SA (2017). Governance and taxes: evidence from regression discontinuity. The Accounting Review 92(1):29-50. |

|

|

Blundell R, Bond S (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics 87(1):115-143. |

|

|

Brown LD, Caylor ML (2004). Corporate governance and firm performance, Working paper, Georgia State University, Atlanta, GA. |

|

|

Chehimi GM, Hejase AJ, Hejase NH (2019). An Assessment of Lebanese Companies' Motivators to Adopt CSR Strategies. Open Journal of Business and Management 7:1891-1925. |

|

|

Chen S, Chen X, Cheng Q, Shevlin T (2010). Are family firms more tax aggressive than non-family firms?. Journal of Financial Economics 95(1):41-61. |

|

|

Christensen J, Murphy R (2004). The social irresponsibility of corporate tax avoidance: taking CSR to the bottom line. Development 47(3):37-44. |

|

|

Collins KM, O'Cathain A (2009). Ten points about mixed research to be considered by the novice researcher. Mixed methods for novice researchers. International Journal of Multiple Research Approaches 3(1):2-7. |

|

|

Conger JA, Finegold D, Lawler III EE (1998). Appraising boardroom performance. Harvard Business Review 76:136-148. |

|

|

Creswell JW, Plano Clark VL (2007). Designing and Conducting Mixed Methods Research (1st ed.), Sage Publications Inc., London. |

|

|

Creswell JW, Plano Clark VL (2011). Designing and Conducting Mixed Methods Research (2nd eds.), Sage Publications Inc., London. |

|

|

Deegan DC (2006). Legitimacy theory. In Hoque Z (eds.), Methodological issues in accounting research: theories, methods and issues, Spiramus Press Ltd., London, UK. pp. 161-181. |

|

|

Derashid C, Zhang H (2003). Effective tax rates and "industrial policy" hypothesis: evidence from Malaysia. Journal of International Accounting and Taxation 12(1):45-62. |

|

|

Desai MA, Dharmapala D (2006). Corporate tax avoidance and high-powered incentives. Journal of Financial Economics 79(1):145-179. |

|

|

Dyreng SD, Hanlon M, Maydew EL (2008). Long?run corporate tax avoidance. The Accounting Review 83(1):61-82. |

|

|

Esa E, Ghazali MNA (2012). Corporate social responsibility and corporate governance in Malaysian government-linked-companies. Corporate Governance 12(3):292-305. |

|

|

Eviews 5.1 User's Guide (2005). Quantitative Micro Software. |

|

|

Fama EF (1980). Agency problems and the theory of the firm. Journal of Political Economy 88(2):288-307. |

|

|

Fama EF, Jensen MC (1983). Separation of ownership and control. Journal of Law and Economics 26(2):301-325. |

|

|

Freedman J (2003). Tax and corporate responsibility. Tax Journal 695(2):1-4. |

|

|

FTSE (2013). FTSE Bursa Malaysia Index Series, FTSE Monthly Report, January, 2013. |

|

|

Global financial Integrity (2011). Illicit financial flows from developing countries: 2000-2009. Update with a focus on Asia. Washington, D. C.: Global Financial Integrity. |

|

|

OECD (2014). Illicit financial flows from developing countries: Measuring OECD responses. |

|

|

Greene JC (2007). Mixing Methods in Social Inquiry, Jossey-Bass, San Francisco. |

|

|

Guenther DA, Matsunage SR, Williams BM (2017). Is tax avoidance related to firm risk?. The Accounting Review 92(1):115-136. |

|

|

Gujarati N, Porter DC (2009). Basic Econometrics. McGraw-Hill/Irwin, New York. |

|

|

Gul FA, Leung S (2004). Board leadership, outside directors expertise and voluntary corporate disclosures. Journal of Accounting and Public Policy 23(5):351-379. |

|

|

Hair JF, Black WC, Babin BJ, Anderson RE (2009). Multivariate Data Analysis 7th ed., Pearson, New Jersey. |

|

|

Halioui K, Neifar S, Abdelaziz FB (2016). Corporate governance, CEO compensation and tax aggressiveness: Evidence from American firms listed on the NASDAQ 100. Review of Accounting and Finance 15(4):445-462. |

|

|

Hani (2011). Tax evasion or corruption? |

|

|

Haniffa RM, Cooke TE (2002). Culture, corporate governance and disclosure in Malaysian corporations. ABACUS 38(3):317-349. |

|

|

Hanlon M, Heitzman S (2010). A review of tax research. Journal of Accounting and Economics 50(2-3):127-178. |

|

|

Hanlon M, Slemrod J (2009). What does tax aggressiveness signal? Evidence from stock price reactions to news about tax shelter involvement. Journal of Public Economics 93(1-2):126-141. |

|

|

Hanlon M (2003). What can we infer about a firm's taxable income from its financial statements?. National Tax Journal 2003:831-863. |

|

|

Hassan I, Hoi CK, Wu Q, Zhang H (2014). Beauty is in the hand of beholder: the effect of corporate tax avoidance on the cost of bank loans. Journal of Financial Economics 113(1):109-130. |

|

|

Hejase HJ, Hejase AJ, Hejase HANJ (2012). Quantitative Methods for Decision Makers: Management Approach. Dar Sader Publishers, Beirut, Lebanon. |

|

|

Hejase AJ, Hejase HJ (2013). Research Methods: A Practical Approach for Business Students, 2nd ed., Masadir Incorporated, Philadelphia, PA, USA. |

|

|

Huseynov F, Klamm BK (2012). Tax avoidance, tax management and corporate social responsibility. Journal of Corporate Finance 18(4):804-827. |

|

|

Ibrahim N, Howard D, Angelidis J (2003). Board members in the service industry: an empirical examination of the relationship between corporate social responsibility orientation and directors type. Journal of Business Ethics 47(3):393-401. |

|

|

Jensen MC (1993). The modern individual revolution, exit and the failure of internal control systems. The Journal of Finance 48(3):831-880. |

|

|

Jenter D, Schmid T, Urban D (2018). Does board size matter?", Working paper presented at AFA 2019, 2018 SFS Cavalcade North America, 2018 CEPR Symposium. |

|

|

Kasipillai J (2010). A Guide to Malaysian Taxation. McGraw-Hill Education, Kuala Lumpur. |

|

|

Kasipillai J, Mahenthiran S (2013). Deferred taxes, earnings management, and corporate governance: Malaysian evidence. Journal of Contemporary Accounting and Economics 9(1):1-18. |

|

|

Kennedy P (2008). A Guide to Econometrics, 6th ed., Wiley-Blackwell, New Jersey. |

|

|

Khan M, Srinivasan S, Tan L (2017). Institutional ownership and corporate tax avoidance: new evidence. The Accounting Review 92(2):101-122. |

|

|

Koester A, Shevlin T, Wangrin D (2016). The role of managerial ability in corporate tax avoidance. Management Science 63(10):1-27. |

|

|

KPMG (2005). Tax in the Boardroom. A discussion paper no. 211-321, KPMG, London, UK. |

|

|

Landolf U (2006). Tax and corporate responsibility. International Tax Review 29:6-9. |

|

|

Lanis R, Richardson G (2011). The effect of board of director composition on corporate tax aggressiveness. Journal of Accounting and Public Policy 30(1):50-70. |

|

|

Lanis R, Richardson G (2012). Corporate social responsibility and tax aggressiveness: an empirical analysis. Journal of Accounting and Public Policy 31(1):86-108. |

|

|

Lind DA, Marchal WG, Wathen SA (2012). Statistical Techniques in Business & Economics, 15th ed., McGraw-Hill, New York. |

|

|

Lindblom CK (1994). The implications of organizational legitimacy for corporate social performance and disclosure. A paper presented at Critical Perspective on Accounting Conference, New York, NY. |

|

|

Lipton M, Lorsch J (1992). A model proposal for improved corporate governance. Business Lawyer 48(1):59-77. |

|

|

Lisowsky P (2009). Inferring U. S. tax liability from financial statement information. The Journal of the American Taxation Association 31(1):29-63. |

|

|

Loo EC, Evans C, McKerchar M (2010). Challenges in understanding compliance behaviour of taxpayers in Malaysia. Asian Journal of Business and Accounting 3(2):145-161. |

|

|

Mahenthiran S, Kasipillai J (2012). Influence of ownership structure and corporate governance on effective tax rates and tax planning: Malaysian evidence. Australian Tax Forum 27(4):941-969. |

|

|

Malina MA, Nørreklit HSO, Selto FH (2011). Lessons learned: advantages and disadvantages of mixed method research. Qualitative Research in Accounting and Management 8(1):59-71. |

|

|

McKerchar M (2008). Philosophical paradigms, inquiry strategies and knowledge claims: applying the principles of research design and conduct to taxation. eJournal of Tax Research 61(1):5-22. |

|

|

McKerchar M (2010). Design and Conduct of Research in Tax, Law and Accounting. Lawbook Co., New South wales. |

|

|

Minnick K, Noga T (2010). Do corporate governance characteristics influence tax management?" Journal of Corporate Finance 16(5):703-718. |

|

|

Ghazali NAM, Weetman P (2006). Perpetuating traditional influences: Voluntary disclosure in Malaysia following the economic crisis. Journal of International Accounting, Auditing and Taxation 15(2):226-248. |

|

|

Molina-Azorin JF, Fetters MD (2019). Building a better World through mixed methods research. Journal of Mixed Method Research 13(3):275-281. |

|

|

Morgan D (2007). Paradigms lost and paradigms regained: methodological implications of combining qualitative and quantitative methods. Journal of Mixed Methods Research 1(1):48-76. |

|

|

Nga E, Iskandar TM, Yatim P (2012). Corporate ownership and corporate governance. Paper presented at the 2nd Accounting Research & Education Conference (AREC), UiTM Shah Alam, Malaysia. |

|

|

Noor RM, Fadzillah NS, Mastuki NA (2010). Corporate tax planning: a study on corporate effective tax rates of Malaysian listed companies. International Journal of Trade, Economics and Finance 1(2):189-193. |

|

|

Noor RM, Mastuki NA, Bardai B (2008). Corporate effective tax rates: a study on Malaysian public listed companies. Malaysian Accounting Review 7(1):1-20. |

|

|

Palinkas LA, Horwitz SM, Green CA, Wisdom JP, Duan N, Hoagwood K (2015). Purposeful Sampling for Qualitative Data Collection and Analysis in Mixed Method Implementation Research. Administration Policy Mental Health 42(5):533-544. |

|

|

Paunescu RA, Vintila G, Gherghina SC (2016). Exploring the link between corporate governance characteristics and effective corporate tax rate: A panel data approach on U.S. listed companies. Journal of Financial Studies and Research 2016:857506. |

|

|

Preuss L (2010). Tax avoidance and corporate social responsibility: you can't do or can you?. Corporate Governance 10(4):365-385. |

|

|

Raheja C (2003). The interaction of insiders and outsiders in monitoring: a theory of corporate boards", working paper, Vanderbilt University, Nashville, TN. |

|

|

Rechner PL, Dalton DR (1989). The impact of CEO as board chairman on corporate performance: evidence versus rhetoric. Academy of Management Executive 3(2):109-123. |

|

|

Rego S, Wilson R (2012). Equity risk incentives and corporate tax aggressiveness. Journal of Accounting Research 50(3):775-809. |

|

|

Richardson G, Taylor G, Lanis R (2013). The impact of board of director oversight characteristics on corporate tax aggressiveness: An empirical analysis. Journal of Accounting and Public Policy 32(3):68-88. |

|

|

Richardson G, Wang B, Zhang X (2016). Ownership structure and corporate tax avoidance: evidence from public listed private firms in China. Journal of Contemporary Accounting and Economics 12(2):141-158. |

|

|

Rocco TS, Bliss LA, Gallagher S, Perez-Prado A, Alacaci C, Dwyer ES, Fine JC, Pappamihiel NE (2003). The pragmatic and dialectical lenses: Two views of mixed methods use in education. In Tashakkori A, Teddlie C. (eds.), Handbook of mixed methods in social and behavioural research. Thousand Oaks, CA: Sage pp. 595-615. |

|

|

Said R, Zainuddin YH, Haron H (2009). The relationship between corporate social responsibility disclosure and characteristics in Malaysian public listed companies. Social Responsibility Journal 5(2):212-226. |

|

|

Salihu AI (2015). Determinants of Corporate Tax Avoidance among Malaysian Public Listed Companies" unpublished manuscript, doctoral dissertation, International Islamic University Malaysia, Malaysia. |

|

|

Salihu IA, Annuar HA, Shiekh Obid SN (2015). Foreign investors' interests and corporate tax avoidance: Evidence from an emerging economy. Journal of Contemporary Accounting and Economics 11(2):138-147. |

|

|

Salihu IA, Sheikh Obid SN, Annuar HA (2013). Measures of corporate tax avoidance: empirical evidence from an emerging economy. International Journal of Business and Society 14(3):412-427. |

|

|

Salihu IA, Sheikh Obid SN, Annuar HA (2014). Government ownership and corporate tax avoidance: Empirical evidence from Malaysia, Handbook on the Emerging Trends in Scientific Research. ISBN: 978-969-9347-16-0. pp. 673-689. |

|

|

Schoonenboon J (2018). Designing mixed methods research by mixing and merging methodologies: A 13-step model. American Behavioural Scientist 62(7):998-11015. |

|

|

Sikka P (2017). Accounting and Taxation: Conjoined twins or separate siblings? Accounting Forum 41(4):390-405. |

|

|

Stickney C, McGee V (1982). Effective corporate tax rates: the effect of size, capital intensity, leverage and other factors. Journal of Accounting and Public Policy 1(1):125-152. |

|

|

Tabachnick BG, Fidell LS (2008). Using Multivariate Statistics, 6th ed., Pearson/Allyn and Bacon, Boston, MA. |

|

|

Tang T, Firth M (2011). Can book-tax differences capture earnings management and tax management? Empirical evidence from China. The International Journal of Accounting 46(2):175-204. |

|

|

Tashakkori A, Teddlie C (2009). Foundations of Mixed Methods Research: Integrating Quantitative and Qualitative Approaches in the Social and Behavioural Sciences. Sage Publications Inc., Thousand Oaks, CA. |

|

|

Torgler B (2007). Tax compliance and tax morale: A theoretical and empirical analysis. Edward Elgar Publishing. |

|

|

Tsui J, Gul FA (2000). Corporate governance and financial transparencies in Hong Kong special administrative region of the people's Republic of China. Paper presented at the 2nd Asian Roundtable on Corporate Governance, Hong Kong. |

|

|

Uzun H, Szewczyk SH, Varma R (2004). Board composition and corporate fraud. Financial Analysts Journal 60(3):33-43. |

|

|

Vafeas N (1999). Board meeting frequency and firm performance. Journal of Financial Economics 53(1):113-142. |

|

|

Vafeas N (2010). How do boards of directors and audit committee relate to corporate tax avoidance? Advances in Quantitative Analysis of Finance and Accounting 8:85-100. |

|

|

Wan-Hussin WN (2009). The impact of family-firm structure and board composition on corporate transparency: evidence based on segment disclosures in Malaysia. The International Journal of Accounting 44(4):313-333. |

|

|

Williams DF (2007). Developing the Concept of Tax Governance. KPMG, London. |

|

|

Yermack D (1996). Higher market valuation of companies with a small board of directors. Journal of Financial Economics 40(2):185-211. |

|

|

Young A (2017). How does governance affect tax avoidance? Evidence from shareholder proposals. Applied Economics Letters 24(17):1208-1213. |

|

|

Zahra S, Stanton W (1998). The implications of board of directors' composition for corporate strategy and performance. International Journal of Management 5(2):229-236. |

|

|

Zimmerman J (1983). Taxes and firm size. Journal of Accounting and Economics 5:119-149. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0