ABSTRACT

The study investigated the effect of ownership structure on tax planning of quoted non-financial companies in Nigeria. It aims to find out the ownership structure that improves tax planning thereby reducing tax liability of the firms. Data for the study were extracted from the annual reports and accounts of the companies for ten years (2008 - 2017). The data collected were analysed using descriptive statistics and multiple regressions. The study reveals that managerial and institutional ownerships have no significant positive effect on tax planning, while foreign ownership demonstrates no significant negative effect. Profitability measured using return on assets has a significant positive effect on tax planning of the sampled companies, and leverage shows a no significant negative effect. The findings imply that management-owned companies have fewer incentives to reduce tax, and there is a relationship in the attitude of management and institutional investors towards tax planning of the selected companies. In order to reduce the level of principal-agent conflicts, and to enhance tax planning and monitoring of management activities, the listed non-financial companies in Nigeria should encourage managerial shareholding.

Key words: Tax planning, managerial shareholding, institutional shareholding, foreign shareholding, tax expenses.

Tax is a significant expense/liability to firms and their owners, hence, decreases cash flow available as profit. Shareholders prefer tax planning activities to increase not only profit after tax but also cash available (Khurana and Moser, 2013; Tijjani, 2019). Tax planning is the process of making one’s financial statements with the aim of deferring, reducing or even eliminating the taxes payable to government authorities (Pniowsky, 2010). Tax planning is seen as the best way which does not breach legal guidelines in reducing tax liability. This can be achieved by taking advantage of different tax rates in some places and economic activities, in addition to tax incentives provided under tax regulations (Fallan et al., 1995). Ownership structure refers to the stockholding by shareholders and directors, including shares held by directors/managers, institutional shareholding, shares held by foreigners, concentrated shareholding, government ownership and family ownership. Institutional and foreign ownerships are external corporate governance (CG) mechanisms. Jensen and Meckling (1976) document that ownership structure as a CG variable is viewed as an agency conflict due to the separation of ownership and control. Ownership structure is not only connected with agency costs, in this case debts and equity, but also equity distribution, a crucial factor that refers to votes and capitals, and the identity of equity ownership. Demsetz and Lehn (1985) submit that the general factors that may influence ownership structure are size of the company, control potential, regulating systems and potential comfort from corporate outcomes.

From a policy point of view, company tax regulations can affect ownership structure, consequently, ownership structure may affect company tax planning, and this impacts the decision-making process of tax strategies which involve management and directors. Shareholders of companies would like to minimize corporate tax payments for wealth maximization (Tijjani et al., 2009; Tijjani, 2010). Thus, there is pressure on companies from shareholders to cut costs by taking advantage of gaps in the current tax system. At the same time, the government puts pressure on tax authorities to increase revenue. Consequently, taxation, more than ever before, has become an issue for boards of directors, chief financial officers, tax authorities and researchers in Nigeria.

The relationship between ownership structure and tax planning has been examined in prior studies, but research on the topic is still limited. The current study is appropriate as tax expenses constitute one of the costs of operating businesses. Most of the available studies are from China and examined state ownership and tax planning. Less attention is given to managerial, institutional and foreign shareholdings, which this study examines. In Nigeria, studies on tax planning are generally limited. This study would contribute to tax management in companies in multiple ways. The results will help managers of non-financial companies to see the effects of ownership structure on their tax planning policies. Additionally, it will add to the substantive literature on ownership structure and tax planning.

The American Institute of Certified Public Accountants (2015) identifies two main objectives of tax planning. The first is to minimize the overall income tax liability, whilst the other is to fulfill financial planning with minimal tax results. These goals are achieved through three broad ways. The first is by reducing income tax resulting from an arrangement or a transaction. The second involves shifting the timing of a taxable event, and the third relates to shifting income to another taxpayer in the same category whose jurisdiction has lower tax rate.

Theoretical debates on the study of tax planning as an agency issue was pioneered by Crocker and Slemrod (2005), Slemrod (2004) and Chen and Chu (2005). However, their submissions are not backed with empirical evidence. Thus, other researchers (Desai and Dharmapala, 2007; Abdul-Wahab 2010; Minnick and Noga, 2010; Zemzem and Ftouhi, 2013; Aliani, 2013; Boussaidi and Hamed, 2015; Armstrong et al., 2015) came up with empirical evidence in support of the agency theory.

Adhikari et al. (2006) assert that the effect of ownership structure on tax planning has not been explored as expected, especially in developing countries. This is evidenced by the few studies (Yeung, 2010; Beryl, 2014; Ali and Mohammed, 2014; Annuar et al., 2014; Wiem and Adel, 2015; Aghouei and Moradi, 2015; Boussaidi and Hamed, 2015; Yettyet al., 2016) that exist on the subject. Results from these studies are also mixed, as Ali and Mohammed. (2014), Beryl (2014), Aghouei and Moradi (2015), Resti et al. (2020) found that managerial ownership, institutional ownership and foreign ownership have no significant relationship with tax planning. Annuar et al. (2014) reported an inconclusive finding on the effect of ownership structure on tax planning. However, results from other studies (Andrew and Stephen, 2015; Ana et al., 2015; Jaewoo et al., 2016; Mozaffar et al., 2017; Norman et al., 2019) show that ownership structure has a significant negative effect on tax planning. The mixed nature of the results could be attributed to the fact that developed markets, and emerging markets have different characteristics. In addition, some of the findings of these studies may not be applicable in every country, as each country has different codes of CG, tax laws, institutions, income patterns and attitudes of board members.

Furthermore, prior studies (Adegbite, 2015; Ali and Mohammed, 2014; Beryl, 2014; Aghouei and Moradi, 2015; Uchendu et al., 2016; Oyenike et al., 2016; Yetty et al., 2016; Mohammed, 2017; Salawu and Adedeji, 2017) assessed the effect of a few CG mechanisms (such as gender diversity, board size, managerial ownership and institutional ownership) on tax planning. As in other sectors within the Nigerian stock market, there is pressure on non-financial-service companies by shareholders to cut costs by using loopholes in the current tax system. Therefore, the relationship between ownership structure and tax planning needs to be examined. Some previous studies (Yakasai, 2001; Okike, 2007; Adegbite et al., 2012) on CG in Nigeria concentrate on the suitable regulation framework for the introduction of the principles of CG, as little attention is given to empirical evidence on the relationship between CG and tax planning practice.

This study is different from prior research as it includes all three key measures of ownership structure (managerial shareholding, institutional shareholding and foreign shareholding), of which there is a paucity of studies. By including more variables and employing a longer time period (2008 to 2017), the study aimed to obtain more robust results. Moreover, previous studies (Oyenike et al., 2016; Uchendu et al., 2016; Mohammed, 2017; Nengzih, 2018) investigated deposit money bankswhile the current study employed data from non-financial-service firms.

Managerial ownership and tax planning

One CG mechanism that aligns management’s interest with that of shareholders reduces agency problem is managerial ownership. The holding of shares by the company’s executive members can reduce the conflict of interest and reduce the agency problem. Ozkan and Ozkan (2004) opine that as the cost of management’s actions are borne by them, may restrict their willingness to apportion resources to non-value-maximizing activities. In contrast, Badertscher et al. (2013) state that management-owned companies have fewer reasons to manage tax by decreasing it since manager-owners avoid investing in risky activities. Though managerial ownership supports incentives, there is a contrary theory on the effect of managerial ownership on value-adding activities. Fraile and Fradejas (2014) document that having certain level of managerial shareholding, managers have power to act based on their own interests.

Jaewoo et al. (2016) investigate the effects of managerial ownership on tax planning. Their study uses a differential design for 3,321 firm-years in the United States. They found that increased managerial ownership is associated with lower effective tax rate (ETR) which was used to measure tax planning practice. The finding confirms improvement in incentive alignment among managers and shareholders, which leads to tax planning. In addition, Badertscher et al. (2009) examine if private equity ownership companies have impact on tax practices of portfolio firms in the United States from 1975 to 2005. Their study reveals that private equity companies significantly involve in more non-conformity tax planning and lower marginal tax rates than other private firms.

Beryl (2014) examines whether CG mechanisms, specifically ownership structure, shows differences in levels of tax planning in Kenya. The study uses 61 listed firms on the Nairobi securities exchange over the period from 2009 to 2013. Data collected were analysed using descriptive statistics and multiple regressions. The research discloses that foreign ownership and institutional ownership have no significant effect on tax planning. Sartaji and Hassanzadeh (2014) investigate the relationship between CG and ETR using a sample of 85 companies quoted on the Tehran stock exchange. The results show that managerial ownership and institutional ownership have no significant effect on ETR, which contradicts the results of Beryl (2014) in relation to institutional ownership.

Desai and Dharmapala (2006) opine that tax planning is a product of agency conflicts. Hence, self-interested managers engage in tax planning to cover managerial abuse of company resources. Thus, they found a negative association between managerial incentives and tax planning. Mohammed (2017) examines the effect of CG on tax planning of listed deposit money banks (DMBs) in Nigeria from 2006 to 2014. Data were extracted from the annual reports and accounts of 15 sampled DMBs. Data collected were analysed using generalized methods of moments and reveal that board ownership significantly affect tax planning in the DMBs. This means that an acceptable nature of relationship between managerial ownership and tax planning remains mixed. In this regard, the following hypothesis is formulated:

HO1: There is a negative relationship between managerial ownership and tax planning of quoted non-financial companies in Nigeria.

Institutional ownership and tax planning

Institutional ownership refers to the right of institutional investors to own a company. Such institutional investors include insurance companies, pension funds and investment banks, among others. Shleifer and Vishney (1986) document that institutional shareholders play a role in monitoring, and influencing managers. As a result of the supervisory role of institutional shareholders, they help reduce agency problem and make managers to make use of cash flow from tax savings to maximize value of companies (Poorheidari and Sarvestani, 2013). The role played by institutional shareholders in tax management may be influenced by the volume of shareholding.

Ying (2015) contends that when institutional shareholders have higher shareholdings, they hold those shares for a long time which gives them incentive to monitor management’s actions. However, when the shareholding is not high, they have less incentive to monitor managerial actions, as they can easily liquidate or sell off their shares in response to unfavourable performance.

Yetty et al. (2016) examine the effect of institutional ownership and leverage on tax planning. The study uses 99 manufacturing firms quoted on the Indonesian stock exchange from 2010 to 2014. Non-parametric statistics were used in data analysis. The results show that institutional ownership has a significant effect on tax planning, and leverage does not show significant effect. Khurana et al. (2013) reveal that U.S. firms with higher institutional ownership engage in tax planning. Companies with high institutional investors with longer-term investment are concerned with long-term consequences of tax planning.

Mozaffar et al. (2017) examine the effect of institutional ownership on tax planning in the United States from 1979 to 2013. The results show that increase in institutional ownership increases in tax planning. Additionally, Andrew and Stephen (2015) investigate the effect of institutional ownership on tax planning using changes in the Russell 1000/2000 index membership over time in the United Statesand find that institutional ownership significantly decreases ETR. Inder and William (2009) determine how institutional ownership affect tax planning of U.S. firms from 1995 to 2008. They document that institutional shareholders influence tax planning with the intention of maximizing firm value in the short term. However, institutional shareholders with a longer investment horizon do not influence tax planning. The authors also point out that institutional shareholders can monitor and discipline managers for maximization of long-term value by discouraging tax planning activities. Also, Nengzih (2018) found that institutional ownership have significant impact on tax planning; therefore, whether institutional ownership has effect on tax planning remains an empirical question. To test this, the following hypothesis is formulated.

HO2: There is a negative relationship between institutional ownership and tax planning of listed non-financial companies in Nigeria.

Foreign shareholding and tax planning

Foreign shareholders have monitoring abilities, but their focus is on liquidity which results in an unwillingness to enter into a long-term relationship with a company and engagement in a process of restructuring in case of poor performance. On this note, foreign shareholding has been found to have positive association with high profitability and efficiency (D’Souza et al., 2001; Smith et al., 1997).

Harry and Gaetan (2006) investigate the relationship between foreign ownership and corporate income taxation in Europe using data from the Amadeus database for European firms in 34 countries. They found that foreign ownership increases corporate income tax rate, which means it discourages tax planning activities. Foreign ownership will generally increase the level of capital income taxation in the absence of international tax policy. Foreign ownership therefore influences whether states can increase their welfare by coordinating their tax policies and, if so, whether coordination requires increases or reductions in overall income tax levels. Huizinga and Nielsen (2002) indicate that a high degree of foreign shareholding may remove the need for increasing source-based capital income taxes via coordination in a world where evasion of residence-based taxes would otherwise justify such coordination. To test the effect of foreign ownership on tax planning, the following hypothesis is formulated.

HO3: There is a negative association between foreign ownership and tax planning of non-financial companies in Nigeria.

This study aligns with agency theory. An agency relationship arises whenever one or more individuals, called principals, hire one or more other individuals, called agents, to perform some services on their behalf. The study uses agency theory because tax literature has not historically differentiated between the corporate and individual aspects of tax planning; prior models of corporate tax planning have been formulated based on individual tax payer compliance. Corporate tax planning in the context of agency theory is more appropriate in the corporate environment because of the principal-agent relationship between shareholders and management. Due to the contributions of agency theory to organizational theory, the testability of the theory as well as the fact that the theory has empirical support; it seems reasonable to adopt it when investigating problems that have a principal-agent structure.

If managers hold a significant proportion of shares, reducing ETR will also benefit them; consequently, they have incentive to make financial decisions that contribute to the reduction of ETRs.

The current study is quantitative, adopting a correlational research design, and covers a period of ten years (2008-2017). The population comprises of 106 non-financial firms quoted on the Nigerian Stock Exchange (NSE) as at 31st December 2017. The non-financial firms have same code of corporate governance which is different from that of financial institutions, and they also have different regulators from financial institutions. The size of the sample is 48 listed non-financial companies in Nigeria. A census sampling technique was used in the selection based on a two-point filter: (i) The companies must be quoted for the period of study, and (ii) They should have data needed to achieve the objectives of the study. Data were extracted from annual reports and accounts of the sampled companies which were analysed using multiple regressions. The analysis was made using STATA version 14 because is most suitable for panel data. The variables of the study consist of dependent and explanatory variables. They are measured following.

Dependent variable

Tax planning: The proxy for tax planning is ETR, measured as total tax expenses to profit before tax, as used by Wilson (2009), Streefland (2016) and Mohammed (2017).

Independent variables

Managerial ownership: Proportion of shares owned by directors/managers to total ordinary shares issued by the company, as employed by Beryl (2014) and Dridi W, Boubaker (2016).

Institutional ownership: Proportion of shares of institutional investors to total ordinary shares, as employed by Inder et al. (2009), Wiem and Adel (2015) and Yetty et al. (2016).

Foreign ownership: Proportion of companies’ shares held by foreign investors to total ordinary shares, as used by Annuar et al. (2014).

Control variable

Two control variables were employed.

Performance (profitability): Proxied using return on assets (ROA). This is measured using profit before tax to total assets, as used by Aliani (2013) and Ana et al. (2015).

Leverage: Measured as total debts to total assets, as used by Chen et al. (2010).

Since the current study uses more than one sector, sectoral dummies are introduced to see if there is any difference in tax planning across the sectors.

The model of the study is as follows:

ETRit = β0 + β1MOit + β2IOit + β3FOit + c1ROAit + c2LEVit + еit (1)

Where ETR = effective tax rate; MO = managerial ownership; IO = institutional ownership; FO = foreign ownership; ROA = return on assets; LEV = leverage; β0 is the average amount which increases dependent when the independent variable increases by one unit, other independents variables were held constant; β1 – β3 shows the gradient of the independent variables; c1 - c2 indicate control variables and e is the error term.

The model shows that variation in tax planning is explained by managerial ownership, institutional ownership, foreign ownership, profitability and leverage. Thus, β0 explains how dependent variable (tax planning) increases or decreases as a result of a unit change or increase in the explanatory variables.

This part presents the results obtained from data collected. Robustness tests were conducted to ascertain the validity of all statistical assumptions. This serves to assess the impact of distribution problems as well as the problem of outliers before deciding on the appropriate statistical method to adopt. The robustness tests include multicollinearity, heteroskedasticity, normality of dependent variable and the Hausman specification test. This study adopts variance inflation factor (VIF) in checking for the presence of multicollinearity between the explanatory variables in the model. Results from the VIF test are less than 10 for all study variables, which is an indication of absence of multicollinearity. Results of the Breusch-Pagan/Cook-Weisberg test for heteroskedasticity indicate that there was absence of heteroskedasticity in the model with a chi-square probability of 0.0000. Furthermore, the Shapiro-Wilk normality test shows that data are normally distributed, as the p-value of the variables is 0.0000. Finally, results from the Hausman test shows that fixed effect is better than random effect; therefore, interpretation is based on a fixed effect model. Results of the study are presented as follows.

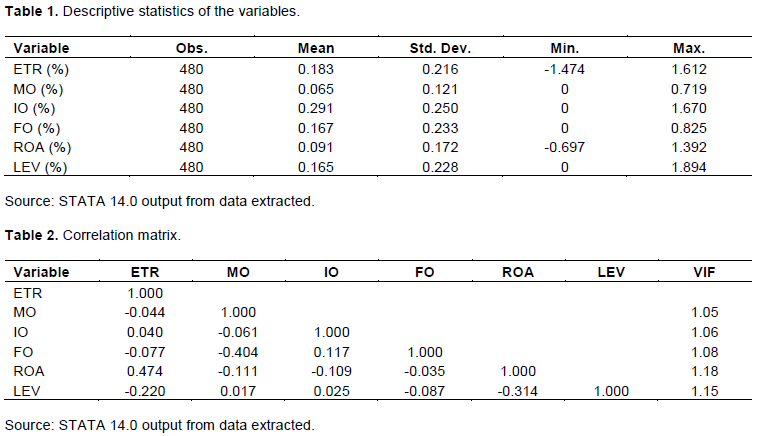

Descriptive statistics

Table 1 details descriptive statistics of the data obtained from the sampled firms. An analysis of Table 1 shows a number of insights. The mean ETR is 18% with a standard deviation of 0.216. The minimum value is -1.474 with a maximum value of 1.612. The mean ETR is below the statutory tax rate of 30%, which is indicative of tax planning practices in the sampled non-financial firms in Nigeria. The standard deviation of 0.216 shows that there is fairly wide deviation in ETR within the sample. The minimum value of -1.474 is an indication of tax computed based on a book loss (loss before tax). The maximum value of 1.612 is a result of tax credit enjoyed by some companies that reported a book loss (negative denominator) but paid taxes (positive numerator). On average, directors hold about 7% of total equity shares of the firms. This shows that 93% of the total equity shares of the companies are owned by shareholders who are not directors. The standard deviation of 0.121 signifies that managerial shareholding of the companies is not diverse, as shown by the minimum managerial shares of 0% and maximum of about18% among the sampled companies for the period of the study. Additionally, the mean institutional shareholding is about 29% of the total equity shares issued by the sampled companies for the period of the study. This implies that the remaining 71% of the total equity shares of the companies was held by individual shareholders of the companies. The minimum institutional shareholding is 0% and maximum is 83%. The standard deviation of 0.250 indicates that institutional shareholding among the sampled non-financial companies is diverse. Similarly, the mean foreign ownership is approximately 17%, indicating that 83% of the shares are owned by citizens and institutions. The minimum foreign shareholding is 0% with a maximum of 76%. The standard deviation of 0.233 shows that foreign shareholding is diverse.

Profitability (measured as profit before tax to total assets) has a mean of 9% with a maximum loss of 69% and maximum profit of 114%. The standard deviation of0.172 indicates no significant dispersion in profitability among the sampled companies. Finally, on average, the sampled companies have a leverage of about 17% with a minimum debt of 0 and maximum of 1.89. The standard deviation of 0.228 implies no significant variation in the leverage of the firms.

Correlation

Correlation shows the strength of relationship between explanatory variables themselves and with the dependent variable. The results for these tests are shown in Table 2.

An analysis of the table reveals that all the variables (dependent and explanatory) have a perfect positive linear relationship with themselves, as indicated by 1.000 on the diagonal. Managerial ownership, foreign ownership and leverage have a weak negative relationship with tax planning measured using ETR, while institutional ownership and profitability (ROA) have a weak positive relationship with tax planning. All the explanatory variables except leverage have a weak negative relationship with managerial ownership. In addition, foreign ownership and leverage have a weak positive relationship with institutional shareholding, as profitability has a weak negative relationship with institutional shareholding. Profitability and leverage have a weak negative relationship with foreign shareholding. Finally, leverage has a weak negative relationship with profitability.

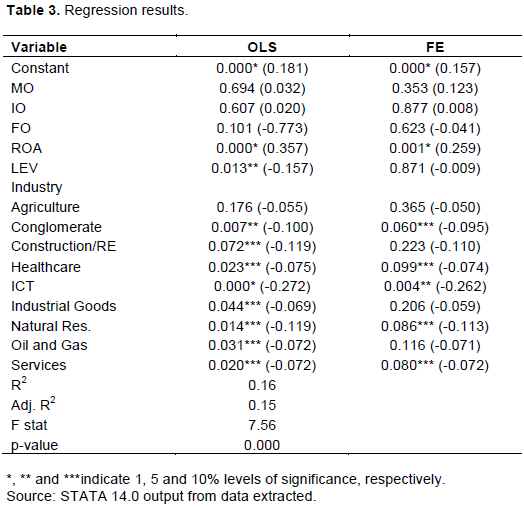

Regression

Table 3 depicts regression results, interpretations are based on fixed effect (FE) regression. Table 3 indicates that the R2 of 0.16 (16%) is the percentage of total variation in the dependent variable explained by the linear model. The F-statistics testing the overall hypothesis of the slope coefficient display a very significant relationship based on the probability output of 17.6 at a probability level of 0.000, which is less than the critical value of 0.05 (0.00 < 0.05). Therefore, the study rejects the null hypothesis; thus, ownership structure has a significant effect on tax planning of listed non-financial companies in Nigeria. This indicates that the model is fit and statistically significant in influencing the extent of tax planning of listed non-financial companies in Nigeria.

In respect to the sectoral dummies, the positive and significant intercept of ETR in the model means that the base sector (consumer goods sector) has a positive ETR. This implies that tax planning in consumer goods industry is not glaring. However, other non-financial sectors (such as agriculture, conglomerate, construction/real estate, healthcare, ICT, industrial goods, natural resources, oil and gas, and services sectors) have a negative effect on ETR. This implies that companies belonging to these sectors practice tax planning.

Results on ownership structure show that managerial shareholding has an insignificant positive effect on tax planning of the sampled non-financial companies in Nigeria. This implies that a unit increase in managerial shareholdings, all other factors remaining constant, has a percentage increase in ETR of the companies and is statistically insignificant. The result indicates that managerial ownership does not encourage tax planning. This finding is not surprising in view of the fact that shares owned by board members in the sampled companies are relatively few. Most of the board members do not own shares, which is why the proportion of shares held by directors is small. This means that there is no goal congruence between board members/managers and shareholders, which is in agreement with agency theory. The finding contradicts Mahenthiran and Kasipillai. (2012), Ana et al. (2015), Boussaidi and Hamed (2015), Jaewoo et al. (2016) and Mohammed (2017), who find a negative and significant relationship between managerial ownership and tax planning, therefore agrees with Li (2014.), Yeung (2010), Zhou (2011), Chen (2013), Sartaji and Hassanzadeh (2014), Desai and Dharmapala(2006), and Resti et al. (2020).

Furthermore, institutional shareholding has an insignificant positive relationship with tax planning, which implies that the more institutions own shares the lower the tax planning in the sampled companies. Thus, institutional shareholders are not among the major determinants of tax planning of the sampled companies. This is in line with the findings of Sartaji and Hassanzadeh (2014), Beryl (2014), Mozaffar et al. (2017) and Jamei (2017), who found an insignificant positive relationship between institutional ownership and tax planning, and is inconsistent with Andrew and Stephen (2015) and Yetty et al. (2016), Nengzih (2018), and Resti et al. (2020) who found a significant negative relationship between institutional ownership and tax planning.

Foreign shareholding is also reported to have an insignificant negative effect on tax planning of the sampled companies. Thus, it means that as foreign shareholding increases, ETR decreases, which implies increased tax planning. This result is not expected because the proportion of shares held by foreign investors in the sampled companies is relatively few, thus, number of shares does not matter. However, the small proportion of shares held by investors increases tax planning. The finding contradicts the findings from Rawiwan (2013), Annuar et al. (2014), Beryl (2014) and Yetty et al. (2016), and Resti et al. (2020) who found an insignificant positive relationship between foreign ownership and tax planning. Return on assets is seen to have a positive and significant effect on tax planning. This implies that profitability is not a major determinant of tax planning, as more profitable companies do not engage in tax planning. Finally, leverage has a negative and insignificant effect on tax planning. This means that a highly leveraged company engages more in tax planning activities. The finding supports Derashid and Zhang (2003) and Ogbeide (2017), and contradicts Jamei (2017). The result supports the argument as posited by Gupta and Newberry (1997) that firms who have higher debt-equity ratios are more efficient at decreasing ETR. Therefore, debt tax shield associated with the choice of debt financing contributes towards tax planning.

The above results are used to test the three null hypotheses presented in the literature review as follows:

HO1: The study fails to accept the hypothesis; hence, there is a positive relationship between managerial ownership and tax planning of listed non-financial firms in Nigeria.

HO2: The study fails to accept the hypothesis; therefore, institutional shareholding and tax planning of listed non-financial companies are positively related.

HO3: The study fails to reject the hypothesis; hence, there is a negative association between foreign ownership and tax planning of non-financial companies in Nigeria.

CONCLUSION AND RECOMMENDATIONS

Based on the results presented, the different industries used as control variables have different effective tax rates, and there appears to some extent negative relationship between foreign ownership and effective tax rate.In addition, managerial and institutional ownerships have a positive and insignificant effect on tax planning of sampled non-financial firms in Nigeria. The findings imply that management-owned companies have less incentive to manage tax in decreasing it, and there is a relationship in the attitude of management and institutional investors towards tax planning of the selected companies. In line with the findings, the study recommends that; to reduce the level of principal–agent conflict, and to enhance tax planning and monitoring of management activities, Nigerian non-financial companies should encourage managerial shareholding to enhance tax planning and to reduce owner-manager conflict. This will contribute towards reducing tax liabilities of the companies. Also, since institutional ownership does not encourage tax planning, companies should encourage institutions to own more shares to better inform management practices.Finally, shareholders in Nigeria should be encouraged to own substantial shares since foreign shareholding contributes insignificantly in tax planning. This can be done by increasing dividend payouts and bonus issues.

LIMITATIONS AND FURTHER RECOMMENDED RESEARCH

The study used only non-financial companies; thus, future studies should use all listed companies. In addition, the study has not captured all ownership structure variables; this gives room for future studies to include more variables such as ownership concentration, and family ownership to see the impact on tax planning. Finally, upcoming studies can extend the time frame.

The authors have not declared any conflict of interests.

REFERENCES

|

Abdul-Wahab NS (2010). Tax planning and corporate governance: effects on shareholders' valuation (Doctoral dissertation, University of Southampton).

|

|

|

|

Adegbite SA (2015). Good corporate governance in Nigeria: Antecedents, propositions and peculiarities. International Business Review 24(2):319-330.

Crossref

|

|

|

|

|

Adegbite E, Amaeshi K, Amao O (2012). The politics of shareholder activism in Nigeria. Journal of Business Ethics 105(3):389-402.

Crossref

|

|

|

|

|

Adhikari A, Derashid C, Zhang H (2006). Public policy, political connections, and effective tax rates: Longitudinal evidence from Malaysia. Journal of Accounting and Public Policy 25(5):574-595.

Crossref

|

|

|

|

|

Aghouei MV, Moradi M (2015). A Study of the Relationship of Firm Characteristics and Corporate Governance with the Difference between Declared and Final Taxes in Iran. Mediterranean Journal of Social Sciences 6(4):488-498.

Crossref

|

|

|

|

|

Aliani K (2013). Does corporate governance affect tax planning? Evidence from American companies. International Journal of Advanced Research 1(10):864-879.

|

|

|

|

|

Armstrong CS, Blouin JL, Jagolinzer AD, Larcker DF (2015). Corporate governance, incentives, and tax avoidance. Journal of Accounting and Economics 60(1):1-17.

Crossref

|

|

|

|

|

Ana R, Antonio C, Elisico B (2015). The Determinants of Effective Tax Rates: Firms' Characteristics and Corporate Governance: FEP Working Papers, School of Economics and Management, University of Porto. Available at:

View

|

|

|

|

|

Andrew B, Stephen AK (2015). Governance and Taxes: Evidence from Regression Discontinuity. Tepper School of Business, Carnegie Mellon University, USA.

Crossref

|

|

|

|

|

Annuar HA, Salihu IA, Sheikh Obid SN (2014). Corporate ownership, governance and tax avoidance: An interactive effects. Procedia-Social and Behavioral Sciences 164:150-160.

Crossref

|

|

|

|

|

Badertscher B, Katz SP, Rego SO (2009). The impact of private equity ownership on portfolio firms' corporate tax planning. Harvard Business School.

|

|

|

|

|

Badertscher BA, Katz SP, Rego SO (2013). The separation of ownership and control and corporate tax avoidance. Journal of Accounting and Economics 56(2-3):228-250.

Crossref

|

|

|

|

|

Beryl AO (2014). The Relationship between Ownership Structure and Tax Avoidance of Companies Listed at the Nairobi Securities Exchange, (Unpublished MBA Project), University of Nairobi, Kenya.

|

|

|

|

|

Boussaidi A, Hamed MS (2015). The impact of governance mechanisms on tax aggressiveness: empirical evidence from Tunisian context. Journal of Asian Business Strategy 5(1):1-12.

|

|

|

|

|

Chen KP, Chu CYC (2005). Internal Control vs. External Manipulation: A model of corporate income tax evasion. RAND Journal of Economics 36(4):151-164.

|

|

|

|

|

Chen S, Chen X, Cheng Q, Shevlin T (2010). Are family firms more tax aggressive than non-family firms?. Journal of Financial Economics 95(1):41-61.

Crossref

|

|

|

|

|

Chen C (2013). Discussion of Government Ownership, Corporate Governance and Tax Aggressiveness: Evidence from China. Accounting and Finance 53(4):1053-1059.

Crossref

|

|

|

|

|

Crocker KJ, Slemrod J (2005). Corporate tax evasion with agency costs. Journal of Public Economics 89(9-10):1593-1610.

Crossref

|

|

|

|

|

D'souza J, Megginson W, Nash R (2001). Determinants of performance improvements in privatized firms: the role of restructuring and corporate governance.

Crossref

|

|

|

|

|

Demsetz H, Lehn K (1985). The Structure of Corporate Ownership: Causes and Consequences. Journal of Political Economy 93(6):1155-1177.

Crossref

|

|

|

|

|

Derashid C, Zhang H (2003). Effective Tax Rates and the Industrial Policy Hypothesis: Evidence from Malaysia. Journal of International Accounting, Auditing, and Taxation 12(1):45-62.

Crossref

|

|

|

|

|

Desai MA, Dharmapala D (2006). Corporate tax avoidance and high-powered incentives. Journal of Financial Economics 79:145-179.

Crossref

|

|

|

|

|

Dridi W, Boubaker A (2016). Corporate governance and book-tax differences: Tunisian evidence. International Journal of Economics and Finance 8(1):171-186.

Crossref

|

|

|

|

|

Fallan L, Hammervold R, Gronhaug K (1995). Adoption of Tax Planning Instruments in Business Organizations: A Structural Equation Modelling Approach. Scandinavian Journal of Management 11(2):177-190.

Crossref

|

|

|

|

|

Fraile IA, Fradejas NA (2014). Ownership structure and board composition in a high ownership concentration context. European Management Journal 32:646-657.

Crossref

|

|

|

|

|

Gupta S, Newberry K (1997). Determinants of the Variability in Corporate Effective Tax Rates: Evidence from Longitudinal Data. Journal of Accounting and Public Policy 16(1):1-34.

Crossref

|

|

|

|

|

Harry H, Gaetan N (2006). Foreign ownership and corporate income taxation: An empirical evaluation. European Economic Review 50(5):1223-1244.

Crossref

|

|

|

|

|

Huizinga H, Nielsen SB (2002). Capital Income and Profit Taxation with Foreign Ownership of Firms. Journal of International Economics 42:149-165.

Crossref

|

|

|

|

|

Inder KK, William JM (2009). Institutional ownership and tax aggressiveness. University of Missouri, Trulaske College of Business, 432 Cornell Hall, Columbia, MO 65211.

|

|

|

|

|

Jaewoo K, Philip Q, Ryan W (2016). Managerial Ownership and Tax Planning: Evidence from Stock Ownership Plans. Workshop at the University of Arkansas. Available at:

View

|

|

|

|

|

Jamei R (2017). Tax avoidance and corporate governance mechanisms: Evidence from Tehran stock exchange. International Journal of Economics and Financial Issues 7(4):638-644.

|

|

|

|

|

Jensen MC, Meckling W (1976). Theory of the Firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics 3(4):305-360.

Crossref

|

|

|

|

|

Khurana I, Moser WJ (2013). Institutional shareholders' investment horizons and tax avoidance. Journal of the American Taxation Association 35:111-134.

Crossref

|

|

|

|

|

Li Y (2014). The Relationship between equity ownership structure and tax aggressiveness of listed companies. In Eastern Academic Forum.

|

|

|

|

|

Mahenthiran S, Kasipillai J (2012). Influence of ownership structure and corporate governance on effective tax rates and tax planning: Malaysian evidence. Australian Tax Fund 27:941.

Crossref

|

|

|

|

|

Minnick K, Noga T (2010). Do corporate governance characteristics influence tax management?. Journal of Corporate Finance 16(5):703-718.

Crossref

|

|

|

|

|

Mohammed AN (2017). Effect of corporate governance mechanisms on tax avoidance in deposit money banks in Nigeria. (Unpublished PhD Thesis) Ahmadu Bello University, Zaria - Nigeria.

|

|

|

|

|

Mozaffar K, Srinivasan S, Tan L (2017). Institutional ownership and corporate tax avoidance: New evidence. The Accounting Review 92(2):101-122.

Crossref

|

|

|

|

|

Nengzih (2018). Determinants of Corporate Tax Avoidance: Survey on Indonesia's Public Listed Company. International Journal of Economics, Business and Management Research 2(2):133-145.

|

|

|

|

|

Norman DM, Grahita C, Sunardi (2019). Ultimate Ownership Structure, CSR and Tax Avoidance: Evidence from Publicly Listed Manufacturing Firms in Indonesia. IOSR Journal of Business and Management 21(4):47-53.

|

|

|

|

|

Okike ENM (2007). Corporate governance in Nigeria: The status quo. Corporate Governance: An International Review 15(2):173-193.

Crossref

|

|

|

|

|

Oyenike O, Olayinka E, Emeni F (2016). Female directors and tax aggressiveness of listed banks in Nigeria. Available at:

View

|

|

|

|

|

Ozkan A, Ozkan N (2004). Corporate Cash Holdings: An Empirical Investigation of UK Companies. Journal of Banking and Financing 28(9):2103-2134.

Crossref

|

|

|

|

|

Pniowsky J (2010). Aggressive tax planning-How aggressive is too aggressive. Thompson Dorfman Sweatman LLP. pp. 1-3.

|

|

|

|

|

Poorheidari O, Sarvestani A (2013). Identifying and Explaining the Factors Affecting Tax. Accounting Knowledge 4(12):89-110.

|

|

|

|

|

Rawiwan K (2013). Tax Aggressiveness, Corporate Governance, and Firm Value: An Empirical Evidence from Thailand. (Unpublished M.Sc Finance Dissertation), Thammasat University, Bangkok, Thailand.

|

|

|

|

|

Resti YM, Arie FM, Andison, Popi F (2020). Ownership structure, political connection and tax avoidance. International Journal of Innovation, Creativity and Change 11(12):497-512.

|

|

|

|

|

Sakthi M, Kasipillai J (2012). Influence of Ownership Structure and Corporate Governance on Effective Tax Rates and Tax Planning: Malaysian Evidence.

|

|

|

|

|

Salawu RO, Adedeji ZA (2017). Corporate Governance and Tax Planning Among Non-Financial Quoted Companies in Nigeria. African Research Review 11(3):42-59.

Crossref

|

|

|

|

|

Sartaji A, Hassanzadeh M (2014). Investigation the relationship between corporate governance and tax violations in Tehran stock exchange. International Journal of Accounting Research 42(1835):1-9.

|

|

|

|

|

Shleifer, A., &Vishney, R. (1986).Large Shareholders and Corporate Control. Journal of Political Economy 94:461-488.

Crossref

|

|

|

|

|

Slemrod J (2004). The Economics of Corporate Tax Selfishness. National Tax Journal 57(4):877-899.

Crossref

|

|

|

|

|

Smith S, Cin B, Vodopivve M (1997). Privatization Incidence, Ownership Forms and Firm Performance: Evidence from Slovenia. Journal of Comparative Economics 25:158-179.

Crossref

|

|

|

|

|

Streefland IM (2016). Gender Board Diversity and Corporate Tax Avoidance. (Unpublished M.Sc Economics & Business Economics Dissertation) Erasmus Universiteit Rotterdam.

|

|

|

|

|

Ogbeide SO (2017). Firm Characteristics and Tax Aggressiveness of Listed Firms in Nigeria: Empirical Evidence. International Journal of Academic Research in Public Policy and Governance 4(1):556-569.

|

|

|

|

|

Tijjani B (2010). Share Valuation and Stock Market Analysis in Emerging Markets: The Case of Nigeria, Adamu Joji Publishers, Kano - Nigeria.

|

|

|

|

|

Tijjani B (2019). A Survey of Investors' Share Evaluation Methods in Nigeria. Journal Global Business Advancement 12 (5):670-692.

Crossref

|

|

|

|

|

Tijjani B, Fifield SG, Power DM (2009). The Appraisal of Equity Investments by Nigerian Investors. Qualitative Research in Financial Markets 1(1):6-26.

Crossref

|

|

|

|

|

Uchendu O, Ironkwe D, Nwaiwu D (2016). Corporate governance mechanism and tax planning in Nigeria. International Journal of Advanced Academic Research 2(9):45-59.

|

|

|

|

|

Wiem D, Adel B (2015). Corporate Governance and Book-Tax Differences: Tunisian Evidence. International Journal of Economics and Finance 8(1):171-186.

Crossref

|

|

|

|

|

Wilson R (2009). An Examination of Corporate Tax Shelter Participants.The Accounting Review 84(3):969-999.

Crossref

|

|

|

|

|

Yakasai AG (2001). Corporate governance in a third world country with particular reference to Nigeria. Corporate Governance: An International Review 9(3):238-253.

Crossref

|

|

|

|

|

Yetty M, Eka S, Eneng S (2016). The Role of Institutional Ownerships, Board of Independent Commissioner and Leverage: Corporate Tax Avoidance in Indonesia. Journal of Business and Management 18(11):79-85.

|

|

|

|

|

Ying T (2015). Corporate Governance and Tax Strategies in Chinese Listed Firms.(Unpublished PhD Thesis), University of Nottingham.

|

|

|

|

|

Yeung CTK (2010). Effects of Corporate Governance on Tax Aggressiveness. (Unpublished Honours Degree Project), Hong Kong Baptist University. Available at:

View

|

|

|

|

|

Zemzem A, Ftouhi F (2013). The Effects of Board of Directors Characteristics on Tax Aggressiveness. Research Journal of Finance and Accounting 4(4):140-147.

|

|

|

|

|

Zhou Y (2011). Ownership Structure, Board Characteristics, and Tax Aggressiveness. Lingnan University, Hong Kong. Available at:

View

|

|