ABSTRACT

This study departs from focusing on the level of tax relief utilization by focusing on the factors contributing to the low trends and how utilization of personal tax relief can influence tax evasion from the premises of the Allingham-Sandmo (A-S) theory. This study considered respondents working within the formal sector of Ghana. Data was collected through the use of questionnaire after the stratified sampling technique was used to select 136,131 respondents across service, industry and agricultural formal sectors in the country. The study identified a low level of awareness of the personal tax reliefs and the factors that contributed to this were ignorance of the existence of personal reliefs; frustration in filling the tax relief/returns forms; the cost of assessing the reliefs which outweighs the benefits and avoidance of contradictory personal information. It was also identified that, utilization of the tax relief can result in the prevention of tax evasion. It is recommended that, a sound education of taxpayers in focal areas of the tax system is needed especially in the various HR units during the initial stages of employing staffs. Also, the reliefs should be simple to claim through the use of computerized systems and finally, there should be an upward review of the reliefs to motivate taxpayers.

Key words: Personal tax relief, Allingham-Sandmo (A-S) theory, tax evasion, Ghana.

Government revenue is generated from so many sources, but a chunk of it is usually from taxation. Lymer and Oats (2009) opined that taxation is a compulsory levy imposed by government or other tax raising body on income, expenditure, or capital assets, for which the taxpayer receives nothing specific in return. Kotlán et al. (2011) similarly stressed that tax is a compulsory contribution to the government, imposed in the common interest of all, for the purpose of defraying the expenses incurred in carrying out the public functions as a government. Kotlán et al. (2011) established that taxation represent a significant factor which influences economic growth and social welfare through its impact on individual growth variable. Reductions in income tax rates affect the behavior of individuals and businesses through both income and substitution effects. The positive effects of

tax rate cuts on the size of the economy arise because lower tax rates raise the after-tax reward to working, saving, and investing. These higher after-tax rewards induce more work effort, saving, and investment through substitution effects.

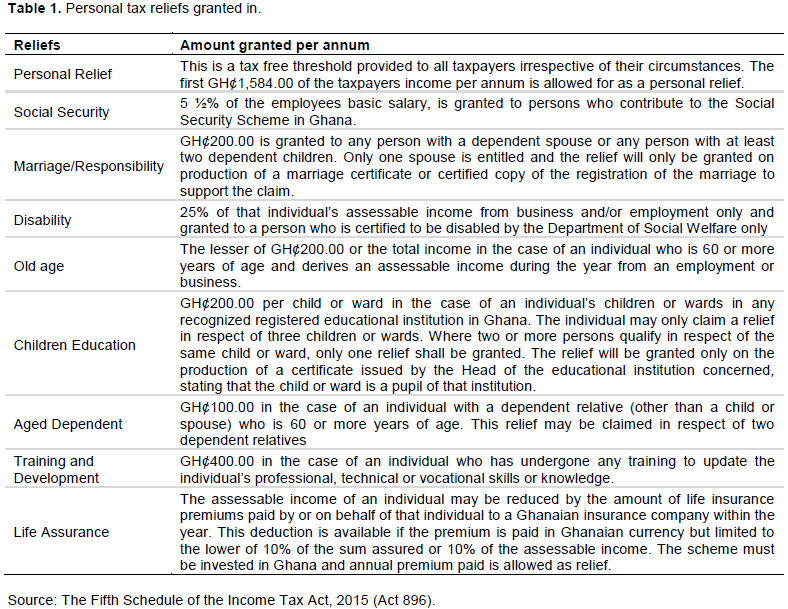

Jacobs (2007) cited that tax reliefs are the most important motivation element for an employer to invest in human capital. Zeva (2012) and Anaman et al. (2017) also stated that personal tax relief was a legitimate and accurate way to pay low income workers. Pobbi and Essel (2017) further opined that tax relief is a legally approved deductible allowance intended to reduce one’s taxable income and thereby lessen the tax burden. To maintain the competitiveness of tax systems and induce taxpayers to correctly declare their income and profits for tax purposes, tax reliefs have become an essential part of most tax systems in the world (Gatsi et al., 2013). In Ghana, the tax law grants reliefs from double taxation, roll over relief and personal tax relief to qualified individuals or entities as a means of achieving both economic and social objectives of the government. The focus of this paper is on personal tax reliefs enjoyed by individuals working under contracts of employment in the country. The Income Tax Act, 2015 (Act 896) has a well-defined personal relief scheme covering most important aspects of government social welfare, economic growth and revenue agendas. The Fifth Schedule of the Ghanaian Income Tax Act, 2015 (Act 896) allows for the following reliefs summarized in Table 1.

The first two reliefs in Table 1 are automatically granted upon employment but in order to make claim for the remaining six reliefs in Table 1, taxpayers must submit an application on Income Tax Return Form 21 (Appendix A) to the Commissioner-General of the Ghana Revenue Authority (GRA). Where relief is granted up-front, the company’s accountant completes and countersigns the Tax Deduction Schedule Form (IT Form 51 Supplementary) on behalf of the Taxpayer. In any other case, the taxpayer must personally submit the Tax Deduction Schedule Form (IT Form 51 Supplementary) indicating the amount of taxes incurred each month and other relevant supporting documents to the Commissioner-General.

Filling the form is also beneficial to government because it contains questions which might reveal the other sources of income of the tax payer so government benefits by increasing their revenue if a tax payer has other sources of income. Generally, aside protecting certain defined groups of people in the economy, the relief system attempts to provide the incentives for targeted areas of the economy in a way that promotes increased output so that more revenue in the form of corporate income tax will be generated by the government. Haigbe (2012) posit that despite the institution of the personal relief scheme to provide a legal means of reducing the tax burden of taxpayers, empirical literature (Kotlán et al., 2011; Boakye, 2011; Zeva, 2012; Hiagbe, 2012; Agyei and Gyamerah, 2014) have shown that the goals of these reliefs are increasingly unmet, as the rate of utilization among eligible taxpayers has been very low and government is increasingly faced with public pressure to increase employee remuneration and reduce the high level of taxes in the country; conditions which may have the potential of exacerbating the already poor fiscal environment and further undermine effective economic management.

This situation poses the following important policy questions: Whether taxpayers are aware of the personal tax reliefs provided for under the Act? What are the factors responsible for the low utilization of the relief system? Is it likely awareness and utilization of the personal income tax reduce tax evasion through the declaration of other business income? The paper is aimed at examining the personal tax reliefs available in Ghana and exploring the factors accounting for the utilization of tax reliefs and how it affects tax evasion. The paper is structured as follows: the first part briefly reviews related literature and development of the paper. The next examines the methodology adopted for the study and present a summary of empirical findings and analysis of results from the field study. The study then concludes and provides policy recommendations for achieving the desire level of utilization and suggestions for further research.

LITERATURE REVIEW AND DEVELOPMENT OF STUDY OBJECTIVES

Theoretical framework

The Allingham-Sandmo (A-S) theory formed the basis for discussion for the study. The A-S theory which was formulated by Allingham and Sandmo (1972) postulates that, no account is made of the taxpayer’s “real” decisions and therefore his gross earnings are taken as given, and the same is true of his income from capital. The theory depicts the taxpayer at the moment of filling in his income tax return (which in the case of Ghana forms the basis for granting your tax reliefs): How much of his income should he report and how much should he evade? Allingham and Sandmo (1972) assumes that a taxpayer with an exogenous income of y is subject to a tax rate of (τ) on this income. The decision of the taxpayer is to report an income of x ≤ y, or to hide a proportion of income, α = y − x.

It should be pointed out that one obviously unrealistic simplification in this theory is the assumption that all income is equally unknown to the tax collector. In the case of Ghana only the income from employment is known by the tax authorities because the employer pays it on behalf of the employee but not all income accruing to the tax payer. This make the AS theory relevant for the discussion of utilization of tax reliefs and its possibility of

reducing the level of tax evasion. This is clearly not the case, as in most countries earnings are reported to the tax authorities by the employer, so that this part of his income cannot in fact be underreported by the employee unless he acts in collusion with his employer. On the other hand, the employees other business incomes can be underreported which is the case of developing economies especially Ghana. The analysis should therefore be interpreted as applying to that part of his income which the taxpayer can in fact evade without certainty of detection which is the business income of the employee in the case of Ghana. There is a probability of p that the taxpayer will be audited. Upon audit, the tax authorities learn the true income of the taxpayer, and in that case the taxpayer pays a penalty at the rate of π on the unreported income in addition to the tax due. There are two states that the taxpayer faces:

1. If he is audited and caught, his income (yc) = (1− τ)x − (τ+π)α.

2. If the tax payer is not caught his income is ync = (1− τ)x+α

The taxpayers problem is given by: E(U) = (1 − p)U(ync) + pU(yc) where E(U) denotes the expected utility of the taxpayer, and the utility function is assumed to be concave which implies that the taxpayer is risk averse. From this analysis by the A-S theory, if the taxpayer is risk averse, they may utilize the personal tax reliefs which will compel them to disclose and declare all incomes earned therefore metamorphosing into a higher utilization of personal tax relief schemes and lower level of tax evasion.

Empirical framework and development of study objectives

Boakye (2011) conducted a study to assess the challenges faced by tax collectors in the mobilsation of revenue for the development of the nation. Boakye (2011) asserts that in the government’s quest to increase revenue, governments across the world makes the tax system more efficient through structural changes such as the establishment of the Ghana Revenue Authority to oversee the three revenue agencies and also increasing the base with the introduction of additional taxes like Ghana Education Trust Fund Levy (GETFund), National Health Insurance Levy (NHIL) and Communication Service Tax (CSTax) which have shown a tremendous increase in revenue. After the researcher collected data through the administration of questionnaires, the analysis indicated that most of the tax collectors were in the first degree bracket and considered motivation could be enhanced through regular training and a congenial working environment comparable to the financial institutions. Boakye (2011) again opined that appropriate logistics such as mobile vans are needed for mass education, networked computers to facilitate inter-connectivity for information sharing and a data base for tax payers for effective monitoring.

The finding of his work stated that tax collectors were of the opinion that the amalgamation of the revenue institutions into the Ghana Revenue Authority would enhance efficiency but added that the Tax Identification Numbering system should be pursued vigorously and tax defaulters and tax evaders ought to be punished appropriately to serve as a deterrent for others. From the study by Boakye (2011), it is made abundantly clear that tax payers of all categories do not attend tax seminars and workshops as much as they would and majority see the payment of tax as beneficial to the state. Again, the analysis his study indicated that most of them cannot afford the cost of employing somebody to keep their records for tax purposes and do not pay their taxes willingly due to the high rates. Finally, his study found out that tax payers do not take advantage of tax reliefs and incentives since they do not consider the filing of tax returns as important. The study by Boakye (2011) was right on assessing the challenges faced by tax payers and concluded their unwillingness to file for tax reliefs but did not provide a factors responsible for that hence development of the first objective of the study.

Objective 1: To investigate the level of awareness of the personal tax reliefs under the Income Tax Act, 2015 (Act 896).

Based on the finding by Boakye (2011) and Hiagbe (2012) sought to elaborate much more on the tax reliefs by researching on the assessment of the utilization of tax reliefs by personal income tax payers in Ghana. Hiagbe (2012) study reviewed literature on topics such as the definitions and concepts such as tax, concept of income, equity and the ability to pay theory. The tax reliefs as given by the Internal Revenue Act 2000 as amended. The study found that issues affecting the computation of employee chargeable income were looked at with the aim of laying bare the benefits of tax reliefs. The researcher administered questionnaires personally to the respondents and in some cases the research team was requested to explain further to get the right answers to some of the questions. In total, the researcher interviewed 50 out of a population of 1,294,803 employees for the study. From the size of the data, inference cannot be made from the findings since the sample is way below the number of employees in the country. Primary and secondary sources of data were also used.

Hiagbe (2012) reported his findings with the use of relative frequency. From the survey conducted, he found that a great number of tax payers are not aware of the existence of tax reliefs in Ghana. The results of the survey indicated that 24% of the respondents had never heard of the phrase “tax relief”. Even though 76% of the respondents had heard of tax reliefs, it was found out that only 10% of them have actually applied for tax reliefs. Also, most tax payers do not file returns; only 10% of the respondents had ever filed for tax returns. Hiagbe (2012) also found that improper completion of Tax Return form coupled with the manual procedures causes a long delay on the part of the Ghana Revenue Authority in processing application. However, it can be concluded that, most personal income tax payers do not utilize tax reliefs’ provisions because the frustrations, complexity of procedures and the amount granted is insignificant to some tax payers. According to Hiagbe (2012) study, even majority of those found to be aware of the tax reliefs refused to take advantage of the tax relief provision due to long delays, unwillingness and other frustrations perceived by personal income tax earners in the application. Hiagbe (2012) study indicated factors responsible for a low utilization of tax reliefs but the data collected was not a representation of the population of the study and also the discussion was not done in a theoretical framework which is relevant for discussions of how tax reliefs can resolve the issue of tax evasion. From this backdrop, the second objective is developed.

Objective 2: To identify the factors responsible for the utilization of the relief system.

Furthermore, to provide an in-depth analysis on the issue of tax reliefs, Agyei and Gyamerah (2014) conducted a study on the awareness of employees’ tax relief in Ghana using self-structured questionnaires from 219 respondents from two regions of Ghana out of the total 10 regions. The study revealed that majority of employees are aware of the tax relief scheme available to tax payers in Ghana, only that just minority (19.2%) have claimed or applied for this scheme before. This revelation according to Agyei and Gyamerah (2014) may be due to the fact that employees may be aware of the tax relief scheme but may not know how it can be claimed. Another reason they provided is that the employers who are supposed to file on behalf of the employees once they qualify for the upfront reliefs are not doing their best. It may also be that the procedure one must go through to claim the relief may be cumbersome. This can lead employees not to apply for the relief. The last reason may be that the amount involved for the employee to enjoy as a tax relief is not motivating enough for one to go through the trouble to claim the relief. From the results, the researchers recommended that a further study be conducted on the reasons why majority of employees have not been accessing the tax relief scheme. The researchers also opined that, further studies should be conducted to cover all regions in Ghana, and also larger sample could be drawn from all regions to aid generalization of findings. The study by Agyei and Gyamerah (2014) provided a better analysis than Hiagbe (2012) but that admitted a limited scope of the study as well as reasons were not provided for the low utilization of the tax reliefs.

Gbadago (2017) conducted a study on the awareness and usage of personal tax relief schemes among Personal Income Taxpayers (PIT) within Kumasi Metropolis of Ghana. The study used a survey research design with sets of structured questionnaires. The results of the study are based on responses from 210 PIT from Kumasi Metropolis of Ghana analyzed using descriptive statistics and binary logistic regression. The results of the study established that though there is fair level of awareness of PTRS, the level of usage, however, is very low among the respondent personal income tax payers suggesting that personal income tax payers in Kumasi Metropolis. Furthermore, the study predicted the respondents’ knowledge of the tax laws, awareness of PTRS usage in mitigating tax burdens, challenges encountered previously when applying for the PTRS, and perception as key factors influencing individual personal income taxpayers’ PTRS usage within Kumasi Metropolis. The analysis of this study provided a better explanation to the issue but had limitations, especially in respect to its inability to cover the whole country as it measures the level of awareness and usage among Ghanaian taxpayers. This may therefore impede the generalization of the inferences made based on the findings.

Objective 3: To assesses how utilization of personal tax reliefs can reduce tax evasion.

From the literature reviewed, the clear gap in literature is the inability of the scholars to link the utilization of tax reliefs and the level of tax evasion through an underlying theory. This study therefore seeks to bridge the gap by analyzing the utilization of tax relief through the A-S theory of tax evasion.

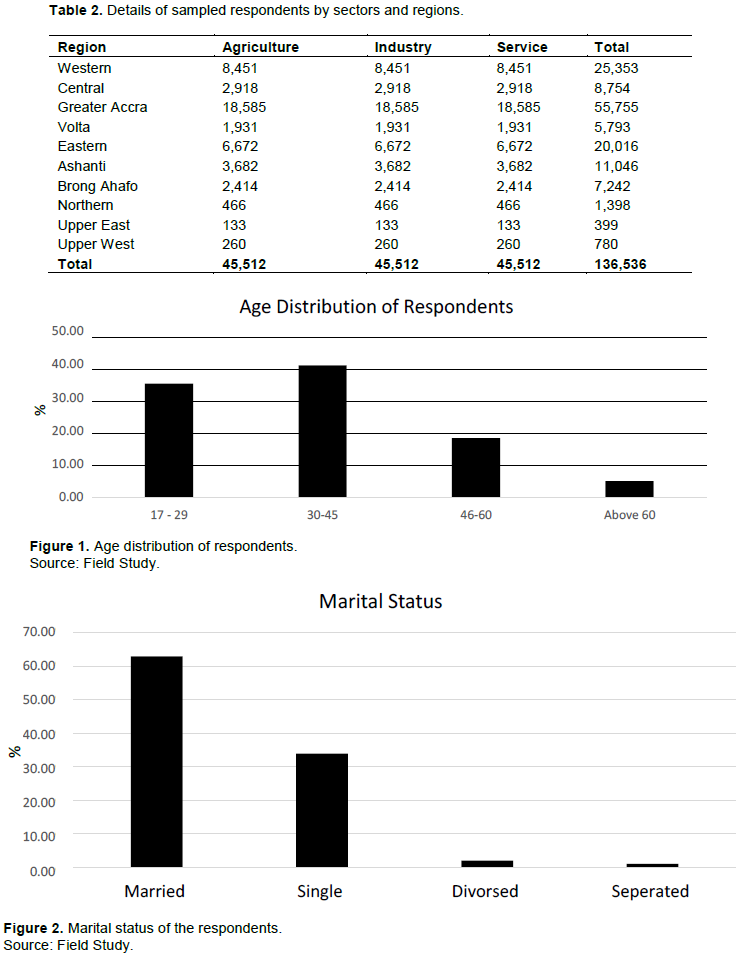

The methodology adopted for the study covers the research design, target population and sampling, data source, data collection techniques and data analysis tools. A descriptive research design was used for this study. The target population of the study comprised 1,355,326 employees (Details in Appendix B) of formal status in Ghana. The formal sector was deemed appropriate because data collected from the formal sector are more reliable than the informal sector mainly due to the level of education of those in the formal sector. We then proceeded to use the stratified sampling technique to sample the respondents by dividing obtaining the employees of formal status in Ghana according to the sector classifications which are the Agricultural, Industrial and Service sectors. This is relevant because a study on the utilization of tax reliefs and how it can affect the level of tax evasion require a representation from all the sectors of the economy for informed decisions to be derived from it. To be fair to all the sectors, we choose the sector with the least employees which is the Agricultural sector with a total of 45,512 as the base for each sector. From this back drop, a sample of 136,536 employees of the formal status was used for the study as depicted in Table 2.

Primary data was collected using self-administered question-naires. The questionnaire included both open and closed ended type of questions which allowed for the collection of both specific and responses bearing the views of the respondents. The researchers employed the services of personnel for the data collection covering a period of 18 months starting from 18th January, 2017 to 20th May, 2018 where all the questionnaires were collected from the respondents. In all, a total of 136,131 questionnaires collected by the researchers represented 99.70% of the sample size. The data generated were analyzed quantitatively through the use of graphs and tables with percentages with the help of Microsoft Excel application.

EMPIRICAL FINDINGS AND DISCUSSION

The results of the study are presented and discussed based on the demographic characteristics and the various objectives of the study which are; the level of awareness of the personal tax reliefs under the Income Tax Act, 2015 (Act 896); factors responsible for the utilization of the relief system; and the effect of utilization of personal tax reliefs on tax evasion.

Demographic characteristics of respondents

The first among the demographic characteristics is the age distribution of the respondents. The age distribution is an important variable which has so many repercussions of the results of the study because age matters for one to be able to assess personal tax relief exhibited in Table 1.

The results in Figure 1 indicates that 35.3% of the age distributions of respondents were between 17–29 years, 41.2% represented the age range of 30-45 years, 18.5% were within the ages of 46–60 years and respondent falling between 60 and above years constituted 5%. This signifies that majority of the active work-force was between the age ranges of 30-45 years and for that matter the responses received from them reveals the real situation because majority of the respondents are within the range of assessing the personal income tax reliefs. This finding according to Hiagbe (2012), reflects reality.

The results in Figure 2 show that 63.9% were married; 36.1% were still single; 2% were divorced and 1% were separated but are not legally divorced. The results demonstrates that majority of the respondents should be utilizing personal tax reliefs especially most of the responsibility reliefs since they were married and have both marriage and children educational responsibilities. In addition, with respect to respondents with wards in recognized registered educational institutions in Ghana, 6% (7,563) of the respondents had no children; 58% (79,410) has between 1 to 3 children; 17% (22,689) has between 4 to 6 children and 19% (26,470) has above 6 children. This implies that most of the respondents are entitled to most of the reliefs presented in Table 3. The results of the sectors where the respondents work is presented show that the study occupied both public and private sector workers. From the results, respondents who work in the public sector were 61% (83,040) while 39% (53,091) of the respondents were from the private sector indicating that the study covered a broad spectrum of the Ghanaian working environment.

Level of awareness of the personal tax reliefs under the Income Tax Act, 2015 (Act 896)

The result for level of awareness of the personal tax reliefs is present with the level of tax compliance. To understand the level of tax compliance, respondents were asked to indicate whether they were taxpaying employees or not. A significant number representing 92.6% responded in the affirmative while only 7.4% represented those who do not pay taxes. Also, to find out how conversant the respondents were with the basis of income tax assessment, it was discovered that 64.4% indicated that they understood the basis of determining their tax liability, while 35.6% had no idea about the mode of assessment. Further assessing if the level of taxes in the country was very high, moderate or low, 55.4% of the respondents indicated that the tax burden was very high, 41.6% were of the view that the tax burden was moderate and just 3% indicated the tax burden as being low. The high compliance level of 92.6% can partly be explained by the fact that, income from employment in Ghana is subjected to withholding taxes and this gives little room for its evasion. Despite the high rate of compliance, majority of the employees were of the view that the burden of income tax was very high.

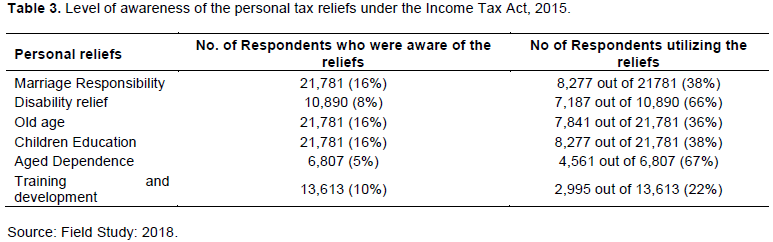

When the respondents were asked whether they were aware of tax reliefs available to employees who pay tax in Ghana, 21,781 of the total respondent of 136,131 representing 16% declared that they were aware of the reliefs, while 114,350 out of the total respondents of 136,131 representing 84% provided that they were not aware of tax reliefs. Out of the employees who were aware of the reliefs 8,277 out of 21781 (38%) were accessing and utilizing the marriage responsibility and children education reliefs while 7,187, 7841, 4,561 and 2,995 out of the 21,781 were utilizing the disability, old age, aged dependence, and training and development reliefs. This result clearly supports previous researches (Boakye, 2011; Hiagbe, 2012; Agyei and Gyamerah, 2014; Gbadago, 2017) conducted on the subject of the study, which had similarly revealed a not so encouraging level of awareness and a woefully low utilization rate of the scheme of reliefs in the country.

In establishing the eligibility of respondents to accessing the reliefs provided for under the Act, the results indicated that, out of the tax paying employees, 35.3% were without children, 15.1% had only a child and 49.6% had two or more children. This implies that majority of the taxpayers qualified for the responsibility and marriage relief under the law. Further analyses of the respondents with children revealed that 35.3% of the children were not attending or are out of school while the remaining 64.8% had children in various educational institutions across the country. 42.9% of the children attending school were at the basic level of education, 35.1% in the senior high school and 22.1% in various tertiary Institutions. This result clearly indicates that 78% of the respondents qualified for the child education relief. In responding to the question of whether having aged dependents, 18.5% responded “No” to the question, while 81.5% of the responded provided a “Yes” answer to the question, indicating that majority of the taxpayers qualified for the aged dependency relief.

Factors responsible for the utilization of the relief system

Analysis of the factors for the level of utilization of tax reliefs system can be well appreciated when the procedure for applying for the reliefs is presented. From this backdrop, as part of the procedures in applying for the relief in Ghana, the taxpayer must file annual returns, hence the respondents were asked to indicate if they had ever filed tax return. The results indicated that only 19.8% had ever filed a return, whereas 80.2% of the taxpayers had never filed a return. Probing further to know the reason for the low level in the filing of returns, majority of the respondents cited low level of tax education, unavailability of tax returns forms, low level of taxpayers guide and support systems, and insignificant amounts of relief granted. Again, about 85% of the respondent opined that frustration in filling the tax relief/returns forms was a reason for not utilizing the relief system. The respondents argue that the tax returns form which is the gateway to assessing the reliefs was too frustrating to complete whether one is educated or not, hence to avoid going through the frustrations, they would not assess the reliefs. The implication of this action is that government may not get all information about their tax payer in other to determine their other sources of income and for that matter increase the tax revenue of government.

In addition, the cost of assessing the reliefs which outweighs the benefits was one of the prevalent reasons provided for not utilizing the tax reliefs. 70% of the respondents stated that the tax office is far from their location and to complete the entire process where one is required to get the form from the tax authorities and endorsed by the immediate employer before the relief is granted involves huge transaction cost which does not inure to the overall benefit of being granted the relief. In support of this same point, other respondents stated that getting the reliefs was an expense delayed out of proportion. Also, about 65% of the respondents indicated that to avoid providing contradictory personal information, they would rather prefer not to access the relief than fill a form that would eventually expose their true source of income. This is because of the unintegrated nature of information collation in Ghana. For example, some employees reduce their age when they are being employed and by filling the tax returns form it might expose the employee; so to avoid providing contradictory information which has a penalty of a jail term, the tax payer would prefer not to utilize the reliefs than utilize it and get exposed for a probable jail term.

Finally, in analyzing the ease of access to the reliefs, respondents who had applied for the relief were asked to indicate whether the particular relief applied for was granted or not. 72% indicated they were granted the reliefs and 38% said they were not granted. The high of 72% results signifies that once the taxpayer satisfies the legal conditions, the relief applied for is granted. As a follow-up to knowing why 38% of the respondents were not granted the reliefs, majority of them indicated that they could not provide the supporting documentations to facilitate the process and also because of undue delays, they had to abandon the process.

How utilization of personal tax reliefs can reduce tax evasion

8,277 out of 21781 respondents who utilized the reliefs indicated that, the reliefs aided in reducing their annual tax burden by 30%. Implying that indeed accessing and utilizing the personal tax reliefs is beneficial to the well-being of the tax payer. From this backdrop, this findings contradicts the AS theory which lays emphasis on the taxpayer’s decision to report their annual income and that the tax payer either has the option to disclose all their earnings or not. This study has proven that the tax payer actually has three options which are to disclose all income; understate their income or not to disclose at all but because the reliefs improve the tax payers’ well-being, the tax payer would prefer to utilize the relief system. In view of tax evasion, we deduce that, if the tax payers’ well-being will be improved by the relief system, then regarding the AS theory which assumes the tax payer is rational, all tax payers will utilize the relief system with proper education and control mechanism and this will eventually reduce the rate of tax evasion in Ghana. This outcome is consistent with the argument by Anaman et al. (2017) whose study on fiscal aggregates and economic growth also emphasized on an effective tax relief system in other to reduce the rate of tax evasion for an ultimate economic growth in the economy.

PRACTICAL IMPLICATION OF THE RESULTS

The major implication which comes out of this study is that a huge chunk of people are not interested in accessing the reliefs because of the mindset that taking advantage of them would predispose them to be declaring all their income sources thereby reducing their disposal incomes and also the frustrations one would have to go through before utilizing the reliefs. From the results, policy makers should make the relief forms available with all registered tax institutions and make it easy for filling by reducing the requirement on the form. Finally, the results indicates that if tax education is fully embarked on, most of the citizens will take advantage of the reliefs which will lead to a win-win situation for the government since government will increase tax income while the taxpayers tax burden is reduced.

It is therefore revealed that the institution of the relief scheme has not been efficient in realizing the policy objective of transferring income from government to the targeted population and promoting voluntary compliance with the tax law. This is as a result of the low level of awareness and not so encouraging utilization rate of the reliefs in the country. The study further identified that the lack of awareness and low utilization rate may partly be explained by the low level of taxpayer education programs and the inadequate taxpayer support services in the country. Again, conditional on being eligible is the filing of tax returns, which many taxpayers feel would result in an additional tax burden and thus deter many from accessing the relief. The undue difficulties and lengthy administrative procedures that taxpayers have to go through to access the relief, also serve as a major disincentive to many. Additionally, the paltry amounts granted as reliefs are not motivating enough for the taxpayer to go through all the stress and processes of claiming the relief. Finally, if taxpayers were effectively utilizing the personal tax reliefs, it would result in the declaration of their true income and tax liability, reduce the level of tax evasion and possibly lead to an increase in government revenue.

The study recommends that a sound education of taxpayers in focal areas of the tax system is needed. Taxpayers need to understand the importance of contributing to the tax system. Further, they need to develop a deeper understanding of the procedures for filing returns and claiming reliefs. Increasing public education would call for adequately funding and resourcing the country’s revenue agency to carry its mandate. Employing qualified, well trained and adequately compensate tax officials and the government as well as providing the necessary premises to support the work of GRA would significantly improve taxpayer awareness in the country. The reliefs should be simple to claim and adequate supply of explanatory, information and guides, income tax return forms. Policy makers should think creatively of reducing the filing burden and increasing participation through the use of computerized systems. The use of the internet for transmission of information and access to tax forms by taxpayers, and also interactive telephone methods for taxpayers to file their tax returns and resolve queries and tax-account problems can be implemented to help reduce the long delays, frustrations and the complex procedure of manually processing returns. Finally, an adequate penalty structure for non-complying taxpayers is needed to ensure that taxpayers file regularly their tax returns and perform other obligations under law.

This study provided a viewpoint of only employees and tax authorities. There are other notable actors, such as academicians and taxable entities that have not been captured. Attention is however drawn to the fact that this study is not to generalize through a robust statistical methodology but rather to produce an analytical context-specific generalization. Finally, the study did not provide statistical proof of interactions among the variables. It is recommended that future studies will establish statistical proof of the interactions among the variables.

The authors have not declared any conflict of interests.

REFERENCES

|

Agyei A, Gyamerah S (2014). The Awareness of Employees on Tax Relief Scheme in Ghana. International Journal of Business and Management 9(1):79-83.

|

|

|

|

Allingham MG, Sandmo A (1972). Income tax evasion: A Theoretical Analysis. Journal of Public Economics 1:323-338.

Crossref

|

|

|

|

|

Anaman EA, Gadzo SG, Gatsi JG, Pobbi M (2017). Fiscal aggregates, government borrowing and economic growth in Ghana: an error correction approach. Advances in Management and Applied Economics 7(2):83-104.

|

|

|

|

|

Boakye EK (2011). Assessing the challenges of tax revenue mobilisation in Ghana: A case of Sunyani municipality. PhD Dissertation, Institute Of Distance Learning, Kwame Nkrumah University of Science and Technology. Available at:

View

|

|

|

|

|

Gatsi JG, Gadzo SG, Kportorgbi HK (2013). The effect of corporate income tax on financial performance of listed manufacturing firms in Ghana. Research Journal of Finance and Accounting 4(15):118-124.

|

|

|

|

|

Gbadago FY (2017). Personal Tax Relief Schemes: Awareness and Usage among Personal Income Taxpayers within Kumasi Metropolis of Ghana. Asian Journal of Economics, Business and Accounting 3(1):1-16.

Crossref

|

|

|

|

|

Hiagbe B (2012). An Assessment of the Utilization of Tax Reliefs on the Personal Income Tax Payers in Ghana: Institute of Professional Studies. Unpublished Thesis, Institute of Professional Studies

|

|

|

|

|

Jacobs B (2007). Optimal Tax and Education Policies and Investments in Human Capital. Theory and Evidence. Cambridge: Cambridge University Press.

|

|

|

|

|

Kotlán I, Machová, Z, JaníÄková L (2011). Vliv zdanÄ›ní na dlouhodobý ekonomický růst. Politická Ekonomie 59(5):638-658.

Crossref

|

|

|

|

|

Lymer A, Oats L (2009). Taxation: Policy and Practice (16th ed). Birmingham: Fiscal Publications.

|

|

|

|

|

Pobbi M, Essel YP (2017). Principles and Practice of Taxation. Accra Ghana, BigMic Publishers.

|

|

|

|

|

The Ghanaian Income Tax Act, 2015 (Act 896).

View

|

|

|

|

|

Zeva MP (2012). Personal Tax Reliefs. Recruiter, 30. Unpublished.

|

|