ABSTRACT

The mismanagement of notable government businesses across the nation has led to the abandonment of viable public projects and the attendant indiscriminate lay-off of staff in the public sector have generated the ever-increasing attention in academic, private and public sectors. As a result of the increase in the level of decadence in the government sector, a gamut of dissenting voices have been raised necessitating the need to examine the relationship that exist between forensic accounting and financial crimes in the Nigerian public sector by specifically assessing the measures put in place to ensure a reduction in financial crimes in the Nigerian public sector and evaluating the effect of litigation support service on the reduction of financial crime in the Nigerian public sector. The study adopted survey research design and linear regression technique to analyze the empirical data collected through questionnaire and oral interview and the hypothesis formulated was also tested. The results of the hypothesis tested at 5% level of significance revealed that litigation support service had significant but negative effect (reduction) on financial crimes in the Nigerian public sector. It was recommended that forensic accounting experts be employed to carry out more litigation support services to serve as expert witness that will assist the court to reach a conclusion on issues which the court may not ordinarily have the knowledge to decide, while more forensic accountants be engaged to reduce rate of fraudulent cases in the Nigerian public sector.

Key words: Forensic accounting, litigation support, financial crime, Nigerian public sector.

Financial crimes and fraudulent activities have been one of the most popular challenges to the worldwide economy. Corruption and other fraudulent practices seem to be a global menace that affects severely the economy of any nation and the society where it exists. It has been subject of continuous discussions in literature as the cause of retardation to developing economies like Africa, Latin America, and Asia as seen today. Economic and financial crimes are believed in most intellectual discourse to be one of the fundamental problems of the Nigerian economy that has negatively impacted its economic growth and development as a nation. These crimes are common and rampant in public sectors and it is the bane of slow development to the Nigerian economy as a whole. There is absolutely no aspect or sector of the economy that is not inflicted by this menace ranging from the financial institution to the health and education sectors as well as the public service. Hamilton and Gabriel (2012), opine that the level of fraudulent practices, corruption and other sharp practices in the Nigerian public sector is alarming and seen as norms and way of life.

Financial crimes include oil bunkering, embezzlement, bribery, looting, money laundering, fraud, tax evasion and foreign exchange malpractice (Mukoro, 2013). Ehioghiren and Atu (2016) as well as Onodi et al. (2015) posits that financial crimes comprise subsidy fraud, advance fee fraud, identity fraud, bank fraud, mortgage fraud, cheque fraud, embezzlement, credit card fraud , hedge fund fraud , consumer fraud and occupational fraud. Gottschalk (2010) notes that financial crimes are categorized into four groups which comprise: theft, fraud, manipulation and corruption; these crimes are perpetrated by individuals, organized persons as well as institutions. There is absolutely no aspect or sector of the economy that is not inflicted by this menace, ranging from the financial institution to the health, and education sectors as well as the public service. Dada (2014) posits that fraudulent activities and other sharp practices were uncovered and reported in the area of legislative process, salaries and wages, pensions and in government business. Financial crimes such as embezzlement, bribery, corruption, identity fraud, mortgage fraud, occupational fraud, bankruptcy, security fraud, amongst others are perpetrated by individuals, corporate institutions as well as organized group of people in order to acquire criminal enrichment (Ogutu and Ngahu, 2016; Onodi et al., 2015).

Financial crimes being illegal activities possess the attributes of deception, truce breaking; cover up and they do not rely on the enforcement of physical force or violence. These non-violent crimes are therefore perpetrated by organized persons, individuals and organisations to obtain personal or business advantage (Federal Bureau of Investigation (FBI), 2018) and International Monetary Fund (2017) argue that crimes are aggravated by financial needs caused by lack of self-control, indiscipline, greed, drugs addiction, gambling, debt, peer and family pressure, poor investment decision or living above one’s means. Financial crimes such as fraud in public sectors are perpetrated by the rank and file depending on their capacity, capability and intelligence with its far-reaching consequences such as non-availability of economic resources to prosecute and cater for viable public developmental projects, deteriorated infrastructure, political programs of the nation, payment of staff salaries and emoluments and its attendant adverse effect on the economy (Emeh and Obi, 2013). It has become difficult to curb financial crimes committed in the public sector due to bureaucracy and high level of corruption (Adebisi et al., 2016).

Other studies in Nigeria posited that billions of naira is lost every year as a result of fraudulent activities (Akinbowale, 2018; Amake and Ikathua, 2016; Idolor, 2010). It further argues that such amount of money represents only the amount that is made public. In Nigeria, corruption has negative economic impact as well as on national image (Ribadu, 2006). In all these, individuals, government, institutions, country and society as a whole were the victims. All this has led to very low appalling ratings of the country by Amnesty International (Gbegi and Adebisi, 2014; Sabo, 2003).

Application of computer accompanied by the introduction of electronic businesses though, profits individual and corporate institutions as it increases the performances, efficiency and effectiveness, it also make our job functions easier to execute, however, this change in technology also facilitates easy commitment of crimes which has also contributed greatly to increase in the problem of financial crimes worldwide (Asika, 2012; Efosa and Kingsley, 2016; Jugurnath et al., 2017). Employee theft, fraudulent billing systems, payroll frauds, insurance fraud, management theft, corporate frauds, evasion of tax are various forms of financial crimes and other corrupt practices that are committed in organisations. Crumbley (2009) posit that the effect of increasingly business complexity in today’s world with available information and systems provides great incentives for the perpetrators to engage in theft or fraud resulting in material misstatement of financial statements. It seems relevant statutes and standards have not made adequate provisions for dealing with fraud by statutory auditors (Owojori and Asaolu, 2009).

The size and complexity of accounting services and the inability of the statutory auditors to deal with the problem of financial fraud is further constrained by the related clauses in the company laws and accounting standards. All these remain outside the scope of the statutory auditor to report on except he is placed on inquiry (Emeh and Obi, 2013). The public has been disappointed in relation to the responsibilities of auditors as they failed to contend with the issue of fraud (Gray, 2008; Modugu and Anyaduba, 2013). The growing rate of fraudulent practices and financial crimes in the Nigerian economy has made corporate organisations to devise means to combat these challenges with the use of forensic accounting services (Oseni, 2017). Ojaide (2000) and Izedomin and Mgbame (2001) believe there is need for the services of forensic accounting due to worrying rate of increase in fraudulent cases and activities in Nigeria and such view was supported by recent work (Nwaiwu and Aaron, 2018). Akani and Ogbeide (2017) believed that if the Nigerian public sector and the private sector must be free from corrupt practices, high importance must be accorded forensic accounting. Modugu and Anyaduba (2013) and Enofe et al. (2015) opined that it is envisaged that financial sharp practices may be curtailed by the application of forensic accounting in Nigeria.. According to Emeh and Obi (2013), financial crimes have grave impact on organisations and this has made forensic accounting emerged to curb the increasing rate of financial crimes.

Forensic accounting as a field in accounting is gradually attracting attention due to persistent occurrence of frauds and other related financial crimes in both private and public sectors of the economy. Forensic accounting is a specialised scientific approach, deemed as an efficient and effective institutionalised framework to be readily applied to radically tackle the ugly monster of fraudulent practices in the Nigerian public sector. Ozumba et al. (2016) look at forensic accounting as the utilization of accounting, auditing and investigative skills to assist in legal matter and applies specialised body of knowledge to the evidence of economic transaction and reporting suitable for court proceeding and accountability. Economic crimes and financial scandals such as those of Tyco International Xerox (USA), Tesco of UK, HIH insurance, Waste Management, Sunbeam, Global Crossing, mobility of Saudi Arabia and corporate fraud perpetrated in Nigeria by management of Lever Brothers (now Unilever), Union Dicon Salt, Cadbury (Nigeria) and fourteen distressed banks as exposed by forensic accounting experts, who deployed investigative and analytical skills and techniques due to failure of traditional audit techniques in unraveling financial crimes. The primary aim of forensic accounting is fraud detection and resolving financial issues in a manner that meets standards required by court of law, unlike the traditional auditing that focuses on review of errors, internal control system, identification and prevention.

Forensic accountants have been described as experienced auditors, accountants and investigators that are hired to look into legal and financial documents to detect fraud and prevent a recurrence of sharp practices (Zysman, 2004). These professionals also provide services in areas such as criminal investigation, shareholders’ and partnership disputes, business economic loss, mediation and arbitration, professional negligence, personal Injury claim/motor vehicle accident, accounting, damages, analysis, evaluation, and general consulting (Oluyombo and Okunola, 2018). Forensic accountants, law enforcement personnel and lawyers work together during investigations and often appear as expert witnessing during trials (Oyedokun, 2015; Rabiu and Noorhayati, 2015; Suleiman et al., 2018). Forensic Accounting is an amalgam of forensic science and accounting and can be described as the use and application of accounting, auditing, investigative and analytical skills for the purpose of resolving financial issues in a manner that meets standards required by court of law (Crumbley, 2006). The integration of accounting, auditing and investigative skills results in the special field known as forensic accounting. It was stated that forensic accounting involves the application of accounting concepts and techniques to legal problem (Coenen, 2005). It demands reporting, where the accountability of the fraud is established and the report is considered as evidence in the court or in the administrative proceeding. It provides an accounting analysis that is suitable to the court, which will form the basis of discussion, debate and ultimately dispute resolution (Zysman, 2004). This analysis was also explained in the SCOPE model of fraud (Vousinas, 2019). This means that forensic accounting is a field of specialization that has to do with information that is being used as evidence especially for legal purposes. Forensic accounting encompasses both litigation support and investigative accounting. Litigation support provides assistance of all nature in a matter involving existing or pending litigation. It deals primarily with issues related with the quantification of economic damages, while investigative accounting is associated to the investigation of criminal matters (Economic and Financial Crimes Commission, 2017).

To combat the menace of financial crimes and fraudulent activities, various anti-corruption agencies set up to counter economic and financial crime in Nigeria has not shown much significant improvement in public sector in Nigeria today. Economic and Financial Crimes Commission (2004) posits that financial crimes have become a talking point on every national discourse and is assuming a position of preeminence in the scale of governmental preference for urgent attention. Okoye and Gbegi (2013) observe that three elements are required to establish that fraud has been committed under common law, a material false statement made with intent to deceive, a victim’s reliance on the statement and damages. Dada (2014) posits that several anti-corruption agencies such as the tribunals, probe panels has been set up to reduce the growing rate of corruption and financial crimes, but it appears they do not have the skills to carry out investigations that can lead to a successful prosecution of persons accused of corruption. Enofe et al. (2013) opine that forensic accounting arises as result of causes and effects of fraud and technical errors made by human. According to the Nigerian institute of Advanced Legal studies (2010), the public sector should be involved in the forensic investigation initiative for in view of the fact that it is the biggest spender in the Nigerian economy and it is the victim of most of the corrupt practices and therefore need forensic and investigative accounting support than other stakeholders. There is a need to adopt effective forensic accounting technique that will assist the anti-corruption institutions to successfully reduce corruption. Against this backdrop, this study examined forensic accounting and financial crimes in Nigerian public sector. The objective of the study is to examine the effect of litigation support service in the process of reducing financial crimes in Lagos State public sector.

Forensic accounting refers to the application of analytical and investigative skills for the purpose of resolving financial issues in a manner that meets standards required by court of law. Forensic accounting is also defined as the application of accounting concepts and techniques to legal problems (Abdulrahman, 2019). This suggests however, that the term ‘forensic’ may cut across several areas of life for which evidences may be sought for litigation (Eliezer and Emmanuel, 2015). Accounting, on the other hand, according to Oluyombo (2016), is the process of collecting, recording, analysing, presenting and interpreting financial information for the users of financial statements. This involves accurate book-keeping, records, measuring and interpreting the financial results of the business by the preparation of accounting ratios and communicating these results to management and other interested parties or users. Merging these two terminologies will paint the picture of what forensic accounting entails. Forensic accounting according to Apostolou et al. (2000) and Kolawole et al. (2018) is the use of accounting, auditing and investigative abilities to provide expert support in legal matters. Jugurnath et al. (2017) describe forensic accounting as a field of accounting that takes care of present, existing or projected disputes hence it is therefore suitable for legal assessment and ensures a successful reduction of financial malpractices. From the point of view of the prosecutor, forensic accounting is concerned with collecting, understanding, compacting and displaying intricate financial matters in a clear, precise, and accurate way. Onodi et al. (2015) perceive forensic accounting as the utilisation of the concepts of accounting and its definitions in dealing with legal issues. Manning (2010) defined forensic accounting as the art of assembling and exhibiting financial data in a form that will be acknowledged by a court of jurisprudence against culprits of monetary violations.

CONCEPT OF LITIGATION SUPPORT SERVICE

Litigation is a term encompassing the use of court processes to resolve a dispute, in line with the rules in place in that jurisdiction. According to Harwood (2016), stages in litigation involves before litigation starts, preparing a case and finally, trial and enforcement. Before litigation begins various forms of preliminary investigations takes place also, various forms of alternative dispute resolution (ADR) are encouraged to be examined. It is encouraged that parties consider alternative means of resolving the disputes first. The more conventional alternative dispute resolution (ADR) options include: Arbitration a confidential form of dispute resolution where one or more arbitrators decide a case rather than a court appointed judge. Mediation is a facilitated negotiation assisted by an independent third-party mediator appointed by the parties. An independent expert is appointed to resolve the matter by producing a legally binding decision (Harwood, 2016). In preparing cases for litigation claim forms and particulars of claims for both parties are drafted and served accordingly, this is usually followed by defence and counter claims and replies by the parties involved. Allocations and directions for future conducts of the case are done, presentation of documents, statements by witnessing, expert reports and meetings with experts all form part of the preparation of cases for litigations. This stage is now followed by the trial and enforcement stage as well as appeals by the parties involved. The concept of litigation and business advisory adopted in this study is how the fear and possible avoidance of a court process as well as yielding to expert’s objective and independent advice as a forensic accounting technique can serve as an instrument for mitigating as well as possible curbing of financial crimes in the public sector organizations by the perpetrators of these crimes (Harwood, 2016).

Financial crimes

Financial crimes according to Eiya and Otalor (2013) may involve fraud or any other crime against property. It may be in respect of falsification of the ownership of property belonging to another as one's own personal use and benefit. Financial crimes may be carried out by individuals, corporations, or by organised crimes against individuals, corporate bodies and governments. Financial crimes involve corruptions, bribery, political donation, nepotism, kickbacks, artificial pricing and frauds of all kinds. The EFCC Act (2004) attempts to capture the variety of economic and financial crimes found either within or outside the organisation. The salient issues in the definition include violent, criminal and illicit activities committed with the objective of acquiring wealth illegally in a manner that violates existing legislation and these include any form of fraud, embezzlement, money laundering, bribery, narcotic drug, trafficking, tax evasion, theft of intellectual property and piracy, foreign exchange malpractice including counterfeiting, open market abuse, dumping of toxic waste and prohibited goods, illegal oil bunkering and illegal mining, looting and any form of corrupt malpractices and child labour.

In the opinion of Okafor (2004), fraud can be said to be a non-violent crime and illicit activity committed with the aim of acquiring illegal wealth either individually, as a group or an organised manner which violates existing legislation governing the economic activities of government and its administration. Fraud, according to Ramamoorti (2008), involves deceit, purposeful intention, risk of being cut, rationalisation, strong desire and violating trust. Fraud is a planned tricky process or device usually undertaken by a person or group of persons with the full intention of cheating another person or organisation to gain ill-gotten benefits (Onodi et al., 2015).

Ngai et al. (2010) observe in their study that financial fraud is becoming an increasingly serious problem and effectively detecting an accounting fraud has always been an important but complex task for financial experts. It was observed that about 80% of public sector officials are involved in fraudulent activities and other economic misdeed which have hindered national growth and development. Forensic accountants are therefore expected to be proactive and possess professional and expert skills not found in traditional auditor in identifying and preventing fraud.

This study was driven by the fact that although there exist a substantial amount of research works carried out on forensic accounting there is however a dearth of empirical studies that critically examines the influence of litigation support service on financial crime in the Nigerian public sector (Augustine and Uagbale-Ekatah, 2014; Amahalu et al., 2017; Dada et al., 2013; Enofe et al., 2015; Kalubanga and Kakwezi, 2013; Nwaiwu and Aaron, 2018).

One of the gaps noticed by the current study is that previous researchers did not take time to decompose the concept of financial accounting tools into proxies and concepts that can be easily analyzed for the proper understanding of the study. For instance, Anuolam et al. (2017) studied the relative impact of forensic accounting on financial crisis in Nigeria with no special focus on decomposed measures of forensic accounting or financial crime variables but they used the concept of forensic accounting as it were. The study filled the gaps in literature in that it provided empirical evidence on the effect of forensic accounting on financial crimes in the Nigerian public sector unlike prior studies that focused on knowledge and skills of task performance fraud risk assessment. All the studies listed above failed to look into the effect of litigation support services on the financial crimes the public sector in Nigeria focussed on these gaps in the literature.

This study adopted survey research design and data used for the study is the primary data and hence, such design was considered appropriate for this study since it involves the use of quantitative method of data collection, analysis and the evaluation of opinions of respondents with regards to the focus on the study. Additionally, similar studies carried out by some researchers (Dada et al., 2013; Modugu and Anyaduba, 2013; Okoye and Gbegi, 2013; Popoola et al., 2015; Amahalu et al., 2017) adopted survey research design method. The research objective investigates the effect of forensic accounting on reduction of financial crimes in Lagos State public sector.

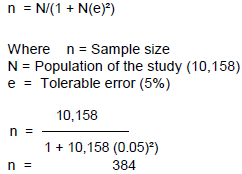

For the purpose of this study, staff in finance function with knowledge of forensic accounting in Lagos State Ministries, Departments and Agencies (MDAs) constitutes the population of the study. Lagos State was chosen because it’s approved budgets for 10 years reviewed constitutes almost 32% of all other states of federation budgets. Secondly, this particular population was used due to the peculiarity of the study and the fact that the federal government parastatals are more difficult to access during the period of the study. Also, considerations were made for the knowledge of the respondents on forensic Accounting and financial crimes. A total of 10,158 staff in finance functions with knowledge of forensic accounting in Lagos State Ministries, Departments and Agencies (MDAs) in Lagos State as elements of the population. Employing the formula developed by Taro (1964), the sample size of 384 was derived as specified in the workings below:

To assess the effect of litigation support service on financial crimes in the Nigerian public sector, linear regression analysis using Statistical Package for Social Sciences (SPSS) was employed to establish the relationship that exists between the response variable (financial crimes) and the explanatory variables (Litigation support service).

Model specification

Y = f (X)

Where: Y = dependent variable (Financial Crimes (FC))

X =independent variable (Litigation Support services (LSS)

Financial crime (FC) = f (Litigation support service (LSS)

That is FC = f (LSS)

X= Litigation support service (LSS)

FC= f (LSS)

FC = α1 + β1 LSS + μ1

Where:

α1 is intercept ; β1 is the coefficients of the explanatory variables

µ1 is the stochastic variables of the model (Table 1).

Model

FC = β0 + β1 LSS + µ

FC = -3.69 - 1.171 LSS

(0.330) (0.017)

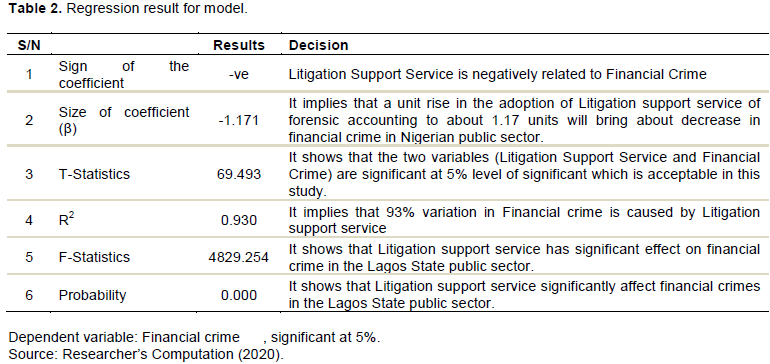

The simple regression result of model tested the relationship that exists between forensic accounting and financial crimes. The result revealed that forensic accounting measured by Litigation Support Service had a negative effect on financial crimes. This is indicated by the negative sign of the coefficient, that is β1= -1.171; which is < 0 (Table 2).

The magnitude of the result of the coefficient -1.171 implies that a unit rise in the adoption of Litigation support service in forensic accounting to about 1.17 units will bring about decrease in financial crime in the Nigerian public sector. This result agrees with the a priori expectation that the forensic accounting would have a negative effect on financial crime. This therefore implies that the Litigation process is very paramount to forensic accounting as anybody in the public sector knows that in a proper judiciary settings with a good litigation process of forensic accounting, those involved in crimes will be prosecuted and if found guilty, they will be served the appropriate jail terms. This is expected to serve as a deterrent, thereby, trigger a reduction in the propensity for financial crimes among other public officials in the government settings. Also, looking at the individual probability of t-statistic, it showed that the two variables are significant at 5% level of significance, which is acceptable in this study. This is because the probability value of the t-statistics (69.493) of LSS is 0.000. The R-square of 0.93 showed that about 93% variations in financial crime can be attributed to Litigation Support Service of forensic accounting while the remaining 7% variations are due to other factors external to the model. Hence the coefficient of determination shows that the main model has a good explanatory power of the model.

The F-statistics is 4829.25 with a probability value of 0.0000 shows that Litigation Support service has significant effect on financial crime in the Lagos State public sector. Therefore, this study rejected the null hypothesis and accepted that alternative which means that there is significant relationship between the litigation support service of forensic accounting and reducing of financial crimes in Lagos State public sector. It is therefore theoretically proven that Litigation support service has a negative relationship with financial crime and it therefore corroborates the theory of fraud triangle which explains the motivation behind an individual's decision to commit fraud and it outlines three components (opportunity, pressure and rationalization) that contribute to increasing the risk of fraud. Hence, when there is something that acts as a barricade to financial crime, it is being curbed invariably.

By implication, there are some studies that lend credence to the current findings. For instance, Nwaiwu and Aaron (2018) in investigating the relevance of forensic accounting (through litigation support service) and fraud detection process and financial performance in Nigeria, failed to properly decompose the forensic accounting variable such that it was only evaluated from the litigation support angle, which is however too shallow when forensic accounting is analysed. Also, from the argument by Amake and Ikhatua (2016) on how forensic accounting especially litigation can help in fraud detection in the Nigerian public sector, it was discovered that the use of forensic accounting to detect fraud in Nigerian public sector is not very effective.

This study has provided insight into the effect of forensic accounting, proxied by litigation support service, on financial crimes on Lagos State MDAs. It also provides an affirmation of the extent to which the variations in the response variable are caused by the explanatory variables as depicted by the R-square. Thus, the study concluded that litigation support service (as proxy of forensic accounting) indeed an anti-financial crime strategy which will help bring financial prudency and sanity to the ministries, departments and agencies of the government in the Nigerian public sector.

(i) Based on litigation support services, forensic experts from professional accounting firms must be involved in order to provide professional and technical supports to the court in reaching reasonable conclusions on issues that the court may ordinarily not have the knowledge to decide.

(ii) There is the need to review the strategic plans and strategies by organizations and public sector ministries, departments and agencies in order to capture forensic accounting in a digitalized environment taking into consideration forensic software as an aid to speed up the investigation of fraudulent cases and other criminal offences.

(iii) More awareness on forensic accounting should be created in order to have more forensic accountants to engage them in handling fraudulent cases thereby reducing financial crimes in Nigeria.

(iv) The public sector organizations should ensure improvement of their internal control measures to check fraudulent practices by the perpetrators.

The authors have not declared any conflict of interests.

REFERENCES

|

Abdulrahman S (2019). Forensic accounting and fraud prevention in Nigerian public sector: A conceptual paper. Igbinedion University Journal of Accounting 2(7):215-238.

|

|

|

|

Adebisi JF, Matthew OB, Emmanuel YV (2016). The impact of forensic accounting in fraud detection and prevention: evidence from Nigerian public sector. International Journal of Business Marketing and Management 1(5):34-41.

|

|

|

|

|

Akani FN, Ogbeide SO (2017). Forensic accounting and fraudulent practices in Nigerian public sector. An International Journal of Arts and Humanities 6(2):171-181.

Crossref

|

|

|

|

|

Akinbowale A (2018). Economic and financial crime in the Nigerian economy: Forensic accounting as antidote. Journal of Arts and Social Sciences 6(1):47-63.

|

|

|

|

|

Amake CC, Ikathua OJ (2016). Forensic accounting and fraud detection in Nigerian public sector. Igbinedion University Journal of Accounting 2(1):148-172.

|

|

|

|

|

Amahalu N, Ezechukwu B, Obi J (2017). Effect of forensic accounting application on financial crime detection in deposit money banks in Nigeria. International Journal of Advanced Engineering and Management Research 2(6):2350-2379.

|

|

|

|

|

Asika A (2012). Money Laundering: The role of a forensic accountant as an expert witnessing. A paper presented at the ICAN conference held at the International Conference Center in Abuja, October 13-17.

|

|

|

|

|

Anuolam OM, Onyema TE, Ekeke U (2017). Forensic accounting and financial crisis in Nigeria. West African Journal of Industrial and Academic Research 17(1):120-125.

|

|

|

|

|

Apostolou B, Hassell JM, Webber SA (2000). Forensic expert classification of management fraud risk factors. Journal of Forensic Accounting 1:181-192.

|

|

|

|

|

Augustine EA, Uagbale-Ekatah RE (2014). The growing relevance of forensic accounting as a tool for combating fraud and corruption: Nigeria experience. Research Journal of Finance and Accounting 5(2):71-77.

|

|

|

|

|

Coenen TL (2005). Fraud in Government. Wiscons in Law Journal.

|

|

|

|

|

Crumbley DL (2009). So what is forensic accounting? The ABO Reporter, 9. Available at:

View

|

|

|

|

|

Crumbley DL (2006). Forensic accountants appearing in the literature. Available at:

View

|

|

|

|

|

Dada SO (2014). Forensic accounting technique: A means of successful eradication of corruption through fraud prevention, bribery prevention and embezzlement prevention in Nigeria. Kuwait Chapter of Arabian Journal of Business and Management Review 4(1):176-186.

Crossref

|

|

|

|

|

Dada SO, Owolabi SA, Okwu AT (2013). Forensic accounting a panacea to alleviation of fraudulent practices in Nigeria. International Journal of Business, Management and Economics Research 4(5):787-792.

|

|

|

|

|

Economic and Financial Crimes Commission (EFCC Act) (2004). A bill for an act to repeal the financial crimes commission (Establishment) Act, 2002 and enact the financial crimes commission (establishment) Act, 2003; and for matter connected therewith.

|

|

|

|

|

Economic and Financial Crimes Commission (2017). A review on the influence of forensic accounting on financial crime in Nigeria. International Journal of financial management 5(1):21-44.

|

|

|

|

|

Efosa EE, Kingsley AO (2016). Forensic accounting and fraud management: Evidence from Nigeria. Igbinedion University Journal of Accounting 2(8):245-308.

|

|

|

|

|

Ehioghiren EE, Atu OK (2016). Forensic accounting and fraud management: Evidence from Nigeria. Igbinedion University Journal of Accounting 2:248-308.

|

|

|

|

|

Eiya O, Otalor I (2013). Nigeria's corruption and related economic behaviour in their global context: Centre for Human Rights Research and Development Research Review.

|

|

|

|

|

Eliezer O, Emmanuel B (2015). The relevance of forensic accounting in the detection and prevention of fraud in Nigeria. Historical Research Letter 23:17-20.

|

|

|

|

|

Emeh Y, Obi J (2013). An empirical analysis of forensic accounting and financial fraud in Nigeria. African Journal of Social Sciences 3(4):112-121.

|

|

|

|

|

Enofe A, Izvbigie D, Usifo E (2015). Impact of confidential privilege or forensic accountant in litigation support services. West African

|

|

|

|

|

Journal of Business and Management Science 4(2):119-126.

|

|

|

|

|

Enofe AO, Okpako PO, Atube EN (2013). The impact of forensic accounting on fraud detection. European Journal of Business and Management 5(26):61-72.

|

|

|

|

|

Federal Bureau of Investigation (FBI) (2018). Forensic accounting and financial crime: A survey of academicians and practitioners. Journal of forensic Accounting 12(4):58-76.

|

|

|

|

|

Gbegi DO, Adebisi J (2014). Forensic accounting skills and fraud investigation in the Nigerian public sector. Mediterranean Journal of Social Sciences 5(3):243-252.

Crossref

|

|

|

|

|

Gottschalk P (2010). Prevention of white collar crime: The role of accounting. Journal of Forensic and Investigative Accounting 3(1):23-48.

|

|

|

|

|

Hamilton DI, Gabriel MO (2012). Dimension of fraud in Nigeria quoted firms. American Journal of Social and Management Sciences 3(3):112-120.

Crossref

|

|

|

|

|

Harwood A (2016). An examination of the impact of obedience pressure on perceptions of fraudulent acts and the likelihood of committing occupational fraud. Journal of Forensic Studies Accounting Business, Winter 1(1).

|

|

|

|

|

Idolor S (2010). Corruption and development: A Nigerian perspective paper presented at the 2008 annual conference of Institute of Chartered Accountants of Nigeria in Abuja.

|

|

|

|

|

International Monetary Fund (2017). Financial crime rate in African economies. A focus on sub-Saharan African economies.

|

|

|

|

|

Izedomin F, Mgbame C (2001). Curbing financial frauds in Nigeria, a case for forensic accounting. African Journal of Humanities and Society 1(12):52-56.

|

|

|

|

|

Jugurnath D, Bissessur I, Ramjattan A, Soondrum N, Seedoyal M (2017). Forensic accounting education: A survey of academicians and practitioners, advances in accounting education. Available at:

View

|

|

|

|

|

Kalubanga M, Kakwezi P (2013). Value for money auditing and audit evidence from a procurement perspective-A conceptual paper. International Journal of Advances in Management and Economics 2(5):115-124.

|

|

|

|

|

Kolawole KD, Salman RT, Durodola SE, Babatunde D, Igbekoyi EO (2018). Determinants of forensic accounting and its effects on alleviation of fraud practices in Nigerian Deposit Money Banks. Journal of Sustainable Development in Africa 20(1):331-342.

|

|

|

|

|

Gray D (2008). Forensic Accounting and Auditing: Compared and Contrasted to Traditional Accounting and Auditing. American Journal of Business Education 1(2):115-126.

Crossref

|

|

|

|

|

Manning GA (2010). Financial investigation and forensic accounting. CRC Press.

|

|

|

|

|

Modugu K, Anyaduba J (2013). Forensic accounting and financial fraud in Nigeria: An empirical approach. International Journal of Business and Social Science 4(7):16-34.

|

|

|

|

|

Mukoro D (2013). The role of forensic accountants in fraud detection and national security in Nigeria. Manager 17:90-106.

|

|

|

|

|

Ngai B, Hu C, Wong H, Chen C, Sun W (2010). Non-audit services and auditor independence: empirical findings from Bahrain, International Journal of Accounting, Auditing and Performance Evaluation 4(1):57-89.

Crossref

|

|

|

|

|

Nwaiwu J, Aaron F (2018). Forensic accounting relevance and fraud detection process and financial performance in Nigeria. International Journal of Advanced Academic Research 4(2):16-35.

|

|

|

|

|

Ogutu GO, Ngahu S (2016). Application of forensic auditing skills in fraud mitigation: a survey of accounting firms in the county government of Nakuru, Kenya. IOSR Journal of Business and Management 18(4):73-79.

|

|

|

|

|

Ojaide F (2000). Frauds detection and prevention: The case of pension accounts. ICAN NEWS January/March P 8.

|

|

|

|

|

Okafor S (2004). Economic and financial crime and forensic accounting: An antidote. West African Journal of Business and Management Services 5(1):27-40.

|

|

|

|

|

Okoye EI, Gbegi DO (2013). Forensic accounting: A tool for fraud detection and prevention in the public service. (A study of selected ministries in Kogi State). International Journal of Academic Research in Business and Social Sciences 3(3):1-19.

|

|

|

|

|

Oluyombo O (2016). Forensic accountants and the litigation support engagement. Nigeria Accountant 40(2):49-52.

|

|

|

|

|

Oluyombo OO, Okunola AO (2018). Audit expectation gap in the public sector: Conceptual analysis. LAPAI International Journal of Administration 1(2):205-215.

|

|

|

|

|

Onodi BE, Okafor TG, Onyali CI (2015). The impact of forensic investigative methods on corporate fraud deterrence in banks in Nigeria. European Journal of Accounting, Auditing and Finance 3(4):69-85.

|

|

|

|

|

Oseni A (2017). Forensic accounting and financial fraud in Nigeria: Problems and prospects. Journal of Accounting and Financial Management 3(1):23-33.

|

|

|

|

|

Owojori AA, Asaolu TO (2009). The role of forensic accounting in solving the vexed problem of corporate world. European Journal of Scientific Research 29(2):183-187.

|

|

|

|

|

Oyedokun G (2015). Forensic investigation and forensic audit methodology in a computerized work environment. Journal of Business Ethics 1(5):1-20.

Crossref

|

|

|

|

|

Ozumba CN, Ofor TN, Okoye PV (2016). Forensic accounting and fraud in the public sector. A case of Edo State ministry of finance. Research Journal of Management Sciences 5(12):1-6.

|

|

|

|

|

Popoola O, Che-ahmad A, Samsudin R (2015). Forensic accountant and auditor knowledge and skills requirements for task performance fraud risk assessment in the Nigerian public sector. Accounting Research Journal 2(8):78-97.

|

|

|

|

|

Rabiu N, Noorhayati K (2015). The role of forensic accounting in fraud investigation and litigation support. The Nigerian Academic Forum 17(1):34-45.

|

|

|

|

|

Ramamoorti S (2008). The psychology and sociology of fraud; integrating the behavioural sciences component into fraud and forensic accounting curricula. Issues in Accounting Education 23(4):521-533.

Crossref

|

|

|

|

|

Ribadu N (2006). Nigeria's struggle with corruption: Being a paper presented to the US Congressional House Committee on International Development, Washington DC.

|

|

|

|

|

Sabo O (2003). The emerging role of forensic accounting. The Nigerian Accountant April/June pp. 43-44.

|

|

|

|

|

Suleiman N, Dalhat BS, Sule S (2018). Socially constructing the meaning of public sector corruption (PSC) to depict the Nigerian situation. Asian Journal of Multidisciplinary Studies 6(8):27-38.

|

|

|

|

|

Vousinas GL (2019). Advancing theory of fraud: The S.C.O.R.E. model. Journal of Financial Crime 26(1):372-381.

Crossref

|

|

|

|

|

Zysman A (2004). Forensic accounting demystified: World investigators network standard practice for investigative and forensic accounting engagements. Canadian Institute of Chartered Accountants (June 2018).

|

|