Accounting practices in different countries influenced by several factors. This study has identified some factors those have a great impact on accounting practices in different countries. This study also explains the accounting practices in a specific country: New Zealand, which is one of the developed counties in the South Pacific Ocean close to Australia and a member of commonwealth countries. However, this study is a desk-based research that analyses the existing knowledge on factors influencing accounting practices from different published academic articles, reports, periodicals and webpages. This study found that accounting policies and standards in New Zealand came from Australia and the United Kingdom, and International Financial Reporting Standards (IFRS) and the External Reporting Board (XRB) are the most influential body of New Zealand for setting up standards for its local demand. Moreover, New Zealand ensures good accounting practices because of having political stability, economic growth, and transparent systems in all public and private sectors. However, this study would be an excellent addition of knowledge on factors affecting accounting practices.

International Accounting Standard Board (IASB) has issued International Financial Reporting Standards (IFRSs) for providing world recognised accounting standards for transparency, accountability and efficiency of financial market. The latest Conceptual Framework for Financial Reporting 2018 has provided a comprehensive guideline for preparing and presenting financial information by the preparers. However, the practices of accounting standards may not be same in every country, and the different aspects of the respective country influence the accounting practices. Surprisingly, IFRS adopted countries have the influence of US GAAP (Lourenco et al., 2018). Therefore, researchers argued for different influencing factors (Iqbal, 2002; Walton et al., 2003; Doupnik and Perara, 2007; Roberts et al., 2008; Nobes and Parker, 2010) those play an influential role in accounting practices. However, there is extremely limited research on influencing factors of accounting practices in a specific country. Therefore, this study is designed to identify factors that influence the accounting practices in New Zealand. This study chooses New Zealand because it is one of the developed countries in Oceania that is culturally and politically close to Australia and was a colonial country of British Emperor. This study would identify the major influencing factors of accounting practices and in a case study of New Zealand how accounting practices are influenced.

The objectives of this study are to find out the factors that influence the accounting practices in different countries and to analyse the influencing factors of accounting practices in New Zealand. Therefore, the research questions of this study would be what are the influencing factors of accounting practices and what factors influence the accounting practices in New Zealand? Therefore, to find out the answer of the above mentioned research questions, this study has been designed as a desk study where available previous literature on influencing factors of accounting practices and existing relevant documents published by different relevant professional bodies in New Zealand and around the world as well as relevant webpages for accounting practices have been analysed. Therefore, this study would be an excellent addition of knowledge in accounting practices and disseminate interesting information to different stakeholders on relevant field.

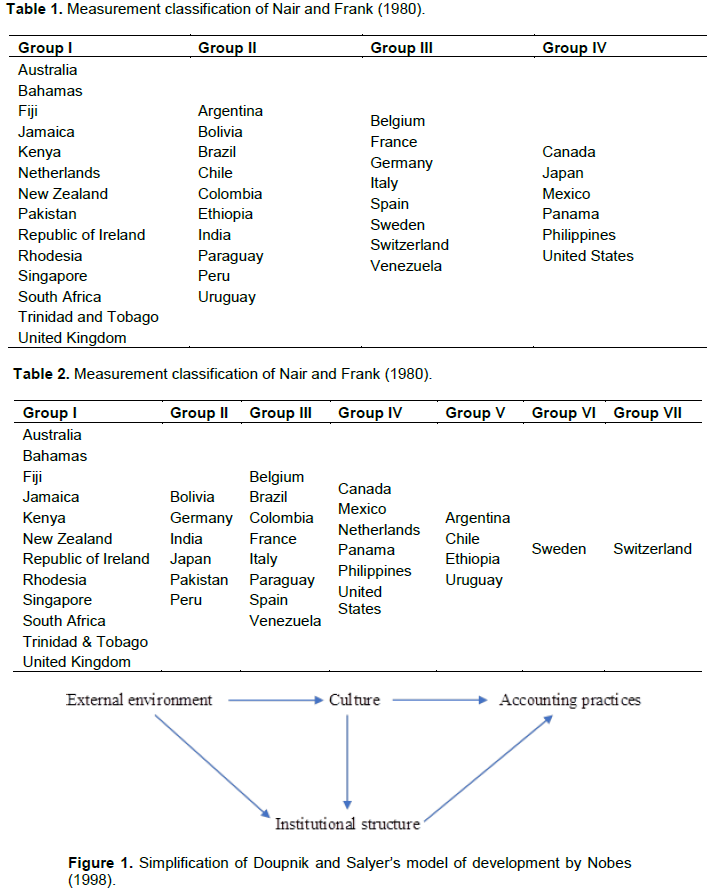

Over the century, different scholars have been trying to classify accounting systems in different groups of countries and they identified reasons behind their classification. In the early of 20th century, Hatfield (1966) took four sample countries’ accounting systems and identified three-group classification. Later, a group of researchers classified accounting systems of different countries (Mueller, 1967, 1968; Seidler, 1967; Previtas, 1975; Buckley and Buckley, 1974; Frank, 1979; Nair and Frank, 1980; Nobes, 1998 and 2011). Nair and Frank (1980) critically analysed the classification of countries of various researchers on measurement and disclosure aspect of accounting practices. In 1973 analysis they summarised four groups (Table 1) of countries after considering 147 measurement practices in 38 countries but after analysing 86 observations on disclosure practices in the same 38 countries for 1973 they finally identified seven country group (Table 2). Nobes (1998) classified accounting systems of fourteen countries in two major classes, but Nobes (2011) first classified accounting systems of same fourteen countries based on practices and in the context of IFRS by using the large number of companies on most recent data. The recent study of Lourenco et al. (2018) analysed accounting practices of 27 countries where IFRS is widely adopted and the result from their cluster analysis identified three group of countries: Australia and New Zealand; USA- influenced countries; and South Africa, Oman and other European countries.

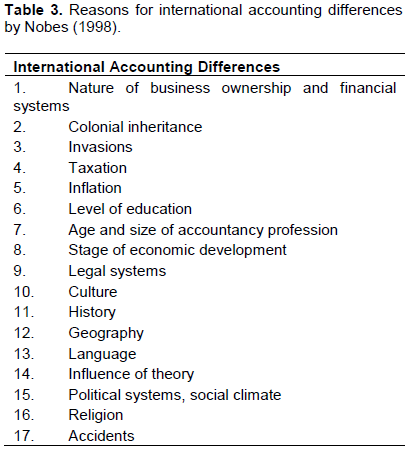

However, Radebaugh et al. (2006), Riahi-Belkaoui (1995), Nobes and Parker (1995) focused on some reasons for differences of accounting practices in different countries but they are failed to develop any theory for those reasons. Gray (1988) and Doupnik and Salter (1995) developed a similar type of theoretical models regarding reasons for accounting differences. Later, Nobes (1998) clearly explained the theory of Doupnik and Salter (1995) that is shown in Figure 1. Nobes (1998) also summarized different reasons for international accounting differences proposed by various scholars (Table 3). However, by analysing the concept of some authors like Iqbal (2002), Walton et al. (2003), Doupnik and Perara (2007), Roberts et al. (2008), Nobes and Parker (2010) the relevant factors to international differences in accounting are Culture, Legal Systems, Taxation, Accounting Profession, Providers of Financing, Political and Economic Systems, Accounting Regulations. However, recent studies also found that management accounting practices of a country is influenced by a group of factors. Wu and Boateng (2010) found that firm size, foreign partnership and intellectual ability of managers and employees influence the Chinese management accounting practices. Similarly, Nair and Nian (2017) argued that firm size, market competition, qualification of preparers and advanced technology have an impact on management accounting practices.

The country

New Zealand is a sovereign island country in the southern Pacific Ocean. It is one of the wealthiest countries and agriculture is the economic mainstay. New Zealand is the top list country on easy of doing business index, political freedom, GDP per capita, human development index, income equality, literacy rate, global peace index, economic freedom and sustainable state. Some important key facts regarding New Zealand is shown in Appendix 1.

History of New Zealand IFRS

Since early 1960s New Zealand has been passing in historical events for standard setting in New Zealand (Cordery and Simpkins, 2016). At first, New Zealand adopted English standards and later Bradbury (1999) suggested changing it in accordance with the local needs. The New Zealand Society of Accountants (NZSA), the first professional body for financial reporting in New Zealand, was established in 1946 (Zijl and Bradbury, 2005) and until the introduction of Financial Reporting Act. 1993 it was the only standards setting body in New Zealand (Cordery and Simpkins, 2016). Despite some having limitations in 1974 NZSA got associate membership of the International Accounting Standards Committee (IASC) (Cordery and Simpkins, 2016) that is now known as International Accounting Standards Board (IASB). In 1974, NZSA first issued Statement of Standards Accounting Practice (SSAP) and later in 1980, Accounting Research and Standards Board (ARSB) were formed by NZSA for developing accounting standards (Nguyen, 2010; Cordery and Simpkins, 2016). Although, few years later this body was split into two separate body namely The Professional Practices Board and the Financial Reporting Standard Board (FRSB) in November 1992 (Nguyen, 2010). In 1996, the NZSA was renamed as the Institute of Chartered Accountants of New Zealand (ICANZ) (Nguyen, 2010) and ARSB was renamed as External Reporting Board (XRB) in 1 July, 2011 (Cordery and Simpkins, 2016).

Accounting standard setter and professional bodies in New Zealand

New Zealand adopted International Financial Reporting Standards (IFRS) as New Zealand equivalent and it is relatively similar to IFRS standards issued by IASB with three additional New Zealand specific standards (IFRS, 2016). The External Reporting Board (XRB) is the independent Crown Entity that issues and monitors accounting and auditing and assurance standards in New Zealand and it was established under section 22 of the Financial Reporting Act 1993 and started its operation under section 12 of the Financial Reporting Act 2004 (The External Reporting Board, 2021). This organization consists of three important boards: The XRB Board itself (XRB Board), The New Zealand Accounting Standards Board (NZASB) and The New Zealand Auditing and Assurance Standards Board (NZAuASB). The accounting professional body in New Zealand is the Institute of Chartered Accountants Australia and New Zealand (ICANZ, 2019) that is affiliated with renowned accounting alliances and member bodies such as, Global Accounting Alliance (GAA), Chartered Accountants Worldwide, Association of Chartered Certified Accountants(ACCA), International Federation of Accountants (IFAC), International Accounting Standard Board (IASB), Australian Accounting Standards Board (AUASB), Accounting and Finance Association of Australia and New Zealand (AFAANZ), International Public Sector Accounting Standards Setting Board (IPSASB), etc.

New Zealand’s political and regulatory system

Political interference (such as colonial inheritance) has a great impact on financial reporting (Nobes, 1998) and the impact of this factor goes to the political history and the accounting system of colonised country (Cerne, 2009). This not only influences on politics and accounting systems but also influences in legal systems and cultural factors (Parker, 1989). New Zealand has constitutional monarchy and parliamentary democracy headed by Queen Elizabeth II as the Governor-General of the country (The Commonwealth, 2019). So, the legal and accounting environment is largely influenced by history and culture of United Kingdom (UK). For analysing and evaluating the performance of public sector organization, such as government, budgetary transparency is highly acceptable tool (Cimpoeru and Cimpoeru, 2015). Fiscal transparency of government that linked with political polarization and government debt and deficit is also important and increased transparency index shows lower level of government debt (Alt and Lassen, 2006).

However, New Zealand ensures a transparent regulatory system among the entire department of the government and other institutions. It focuses on the improvement of the overall policy guidelines by improving and maintaining the capability needed for enforcement of the regulations and by overseeing and managing the whole system. It includes all three organs of the government- the Executive, Parliament and the Judiciary that is shown in the Figure 2 (New Zealand Productivity Commission, 2014). New Zealand continuously ensure transparency on budget and in 2017 New Zealand’s open budget index score was 89 out of 100 (International Budget Partnership, 2019).

Cultural factors in New Zealand

Hofstede (1980) defines culture as “the collective programming of the mind which distinguishes the members of one group or category of people from another”. Nobes (1998) developed a simplified model of cultural influence on accounting based on Doupnik and Salter’s model that explains how culture influence on accounting practices. The influence of culture on accounting practices can also be identified from the research work of a large number of authors (such as, Da Costa et al. (1978), Frank (1979), Nair and Frank (1980), MacArthur (1996), Nobes (1998), Perera et al. (2012), Drnevich and Stuebs (2013). New Zealand has a close cultural relation with Australia (Gray, 1988). CPA Australia and Institute of Chartered Accounts in Australia and New Zealand, two prominent accounting professional bodies, operate their activities both in Australia and New Zealand. Both countries are in Anglo-American group and they are closely influenced by factors developed by Hofstede’s analysis (Fechner and Kilgore, 1994). From the analysis of Nair and Frank, 1980 of different countries it is found that Australia and New Zealand was in same country group. However, the accounting standards in New Zealand are highly influenced by the standards issued by International Financial Reporting Board (IFRS, 2016).

New Zealand financial reporting framework

In the past, the UK and Australian standards were responsible for setting up the standards for New Zealand and some legislations were fully adopted by those of that countries (Keenan, 2000); and the controlling authority of those countries rather than the professional bodies of New Zealand dominated in standard setting (Cordery and Simpkins, 2016). However, at present, financial reporting systems in New Zealand is influenced by IFRS and XRB. All the companies in New Zealand use NZ IFRS for preparing their financial statements and it has been mandatory from 1 January 2007 (IFRS, 2016). On the other hand, public sector organisations report their financial statements in accordance with International Public Sector Accounting Standards (IPSAS) (Cordery and Simpkins, 2016). However, financial reporting framework in New Zealand is divided into four important tiers such as Tiers 1, 2, 3 and 4 and the criteria for these tiers are defined by the XRB and this framework normally influenced by two important parts, such as the statutory financial reporting framework and the accounting standards framework (KPMG, 2014).

Taxation systems in New Zealand

Accounting systems in some countries can be highly influenced by taxation and some countries are not (Nobes 1998). In some countries tax accounting and financial accounting are different (Doupnik and Salter (1995). With having some exception, tax regulations set by the government dominate the accounting and the taxable profit of the corporations that is important for the government (Lamb et al., 1995). Alley and James (2005) suggest that rules and regulations regarding the tax should be reviewed and updated with the needs of business activities and the principles in tax systems itself. In New Zealand, the adoption of IFRS have a tax consequence and government’s recommendation is normally included in discussion documents for standards setters and New Zealand tax legislators also adopt relevant financial reporting standards (Alley and James, 2005). Inland Revenue Department (IRD) is the sole controlling authority for collecting and maintaining tax related activities in New Zealand as a department of Government of New Zealand. Among the developed countries New Zealand was ranked second for overall tax system and first for its personal taxes by the US-based Tax Foundation (New Zealand Immigration, 2019). IRD impose tax on personal and business income, and on the supply of goods and services. But there is no inheritance tax, general capital gains tax (with some exception), local or state tax, payroll tax, social security tax (with some exception) and healthcare tax (New Zealand Immigration, 2019). New Zealand has flat transparent tax rate (Table 4) on company’s income that attracts new business and the revenue from taxes are more efficiently collected by New Zealand compared with other OECD countries by imposing broad base low rate (Inland Revenue, 2017) and the collection of crown tax revenue is increasing year by year (The Treasury, 2017) that is shown in Figures 3 and 4.

Auditing and assurance standards framework in New Zealand

Assurance practitioners in New Zealand must comply with the specific standards developed and issued by New Zealand Auditing and Assurance Standard Board (NZAuASB) which is performed by the section 12(b) of the Financial Reporting Act 2013. NZAuASB also provide guidance statements, practice statements, consultation documents and exploratory documents for interpretation and application of auditing and assurance standards (XRB). XRB Au1: Application of Auditing and Assurance Standards has developed five important suites of standards and provide guidelines regarding which suit of standards will be applicable in what type of assurance engagement. This is summarized in Table 5.

One the other hand, public entities are audited by Auditor-General with relevant professional accounting and auditing standards or the Auditor-General’s own specific standards. Moreover, Auditor-general has to publish Auditing Standards, by the way of a report to the House of Representative, at least once in every three years (Controller and Auditor-General, 2019).

Financing systems

Financial system plays a dominant role in financial reporting of a country. Zysman (1983) identified three types of financing systems such as: capital market based; credit based systems: government; credit based systems: financial institutions. Nobes (1998) showed two dominant groups of financial systems: insiders dominant and outsiders dominant. In New Zealand firms largely depend on debt finance instead of equity finance and the banks are the single largest providers of debt (Reserve Bank of New Zealand, 2021).

Accidents of history

In New Zealand there is a considerable impact of financial accidents from its own making and from international market. Chiang and Prescott (2010) identified 50 finance companies as at May 2010 those were failed and the main reason for that failure was poor corporate governance. Reserve Bank of New Zealand (2009) was documented some banks for financial crisis because of the significant erosion of the banking system capital and for the credit-driven asset price boom. Consequently, all the evidence influenced accounting systems in New Zealand.

The overall environment of accounting systems and policies are greatly influenced by a group of factors over different countries, even the same accounting standards are followed. This study is contributing to identify those factors and how accounting practices of an individual country is influenced by those factors. Therefore, this study has found the influencing factors of accounting and made a linkage up of these factors to New Zealand. New Zealand is one of the developed countries with small area and ensure transparent and accountability in its accounting practices. But some key facts affect the overall environment of accounting systems. Though it was a British colonised country and politically and is regionally close to Australia, most of the accounting policies and standards came from these two countries. However, IFRS and XRB are the most influential body of New Zealand for setting up standards for its local demand. Therefore, having been political stability, economic growth and transparent systems in all public and private sectors New Zealand ensure good accounting practices.

However, this study has some limitations. The study has been conducted by analysing secondary data only, thus the practical situation of accounting practices in New Zealand would not be present. Therefore, the analysis of practical phenomena by developing some hypothesis based on literature and a set of interviews with key accounting professional bodies in New Zealand or other major stakeholders would provide more interesting data. However, this study would provide a clear understanding of the factors those influence the accounting practices. Moreover, this study would provide an overview of accounting practices of New Zealand and how it is influenced by different factors.