ABSTRACT

Economic sustainability reporting enhances the financial strength of the company by meeting the diverse needs of stakeholders. Whereas, financial performance covers about 25% of the economic sustainability performance indicators as indicated in the GRI-4. To this extent, the study helps to fill this gap by considering the effect of corporate governance on economic sustainability reporting in quoted companies on Nigerian Stock Exchange. This study adopted ex-post facto research design. The population of the study comprised 169 quoted companies on the Nigerian Stock Exchange (NSE) as at December 31, 2019. A sample of 42 quoted companies for the period of 10years (2010-2019) was selected. Data were extracted from published audited annual reports and accounts of the companies. Data were analyzed using descriptive and inferential statistics. The hypotheses were tested at 0.05 significance level. The findings revealed that board size, female director and board ownership have positive and significant effect on economic sustainability reporting of selected quoted companies in Nigeria while CEO duality has negative effect on economic sustainability reporting and independent director has insignificant effect. The study concluded that corporate governance promotes economic sustainability reporting. It was recommended that the shareholders of companies should appoint experienced board members that will enhance sustainability reporting appoint more directors with shareholding interest and include more female on the board, as they boost economic sustainability reporting.

Key words: Board independence, board ownership, board size, CEO duality, economic sustainability reporting, female directors.

Economic sustainability reporting is the disclosure of the impact of the organization on the economic conditions on the both the internal and external stakeholders. According to Global Reporting Initiative (GRI), the economic sustainability indicators include economic performance, market presence, indirect economic impacts and procurement practices. Studies have shown that most companies focus on a part of economic performance proxied by profit and neglect other aspects. Reporting on economic sustainability is very crucial to the attainment of the ultimate objective of enhancing long term value to the shareholders (Ghazali, 2010).

According to Aliyu (2018), the weakness of the traditional financial reporting is that it disseminates information about the use of scarce economic resources to generate profit for the shareholders. However, the traditional definition of economic performance is not only measured by the economic value added (EVA) but also by the impact of the organization on the economic conditions of diverse stakeholders and the economic system at global, national and local economic systems (Sar, 2018). Hence, economic sustainability has a broader perspective than economic performance. Information influencing economic decision making could be financial and/or non-financial in nature. It is germane for organizations to report on economic sustainability as it motivates the providers of capital (Kocmanová et al., 2011; GRI, 2011). The fact that the survival of the organization depends largely on its economic viability makes the focus on economic sustainability reporting critical. Furthermore, it enhances financial health of an entity while preventing its early demise (Gupta and Kumar, 2013).

Corporate governance is a system set up by the shareholders to increase management efficiency so as to deliver maximum value (Ghazali, 2010). Studies from different part of the world such as Canada, United Kingdom, Singapore, South Africa and Nigeria have used board size, board independence, CEO duality, Board ownership, audit committee as proxies for corporate governance (Bakar et al., 2019; Mudiyanselage and Swarnapali, 2018; Mahmood et al., 2018; Adeniyi and Fadipe, 2018; Alotaibi et al., 2019). Sar (2018) also opined that corporate governance helps in balancing the expectations from shareholders and other stakeholders such as customers, suppliers, communities and shareholders. Furthermore, Saltaji (2013) posited that corporate governance is important because of its association with economic sustainability and performance. Also, effective implementation of a carefully crafted corporate governance policy is pivotal to the business success (Buallay and Al-Ajmi, 2019).

Economic sustainability reporting is greatly influenced by the quality of the board and the board quality assist in laying a solid foundation for the strategic performance of organizations (Lawrence et al., 2013; Varshney et al., 2013). From these statements, it can be inferred that economic sustainability and corporate governance are interconnected. Sar (2018) concluded that there is a positive correlation between corporate governance and economic performance. Over the years, academic researchers have attempted to investigate the link between corporate governance and financial performance. Most of the previous studies pointed out a part of economic sustainability indicators such as return on equity (Odiwo et al., 2016; Mateus and Belhaj, 2016; Rahman and Islam, 2018), return on asset (Jouha, 2015; Mateus and Belhaj, 2016; Adesanmi et al., 2018), Tobins Q (Afrifa and Tauringana, 2015; Kyere and Ausloos, 2020) and net profit margin (Azhar and Mehmood, 2018; Olayiwola, 2018). This study used the four indicators of economic sustainability as indicated in the GRI-4 and in the opinion of the researcher, it is a more robust measure than ROE, ROA, TOBINS Q and NPM. The purpose of this study is to investigate the effect of corporate governance on economic sustainability reporting in Nigeria.

According to the Sustainability Reporting Guidelines developed by Global Reporting Initiatives (GRI) in 2011, the economic dimension of sustainability concerns the impact of the organization on the economic conditions of its stakeholders (internal and external) and on economic system at local, national and global levels. According to Kocmanová et al. (2011), economic sustainability can be seen as the necessity to retain capital so as to perform business activities for the purpose of generating profit. Economic sustainability indicators include: direct economic value generated and distributed on accrual basis, risk and opportunities from organization’s activity as a result of climate change, pension fund contribution by the employer and the employee, financial assistance received from government, ratio of entry level wages by gender compared to local minimum wage at significant locations, percentage of senior management that are hired at the location of operation, significant infrastructure and services supported and percentage of local suppliers patronized at locations of operation (GRI-4).

Larger board size can enhance the performance of the firm by reducing management dominance that may promote conflict of interest (Hu and Loh, 2018; Mahmood et al., 2018). Though, there is no globally acceptable number of board members as some organizations adopt smaller board to increase the efficiency in monitoring and decision making. An independent director is a non-executive director who does not have any significant shares or professional link to with the organization. According to Fama and Jensen (1983), a board with higher proportion of independent directors may likely work in the interest of minority shareholders.

The incidence of CEO duality exists when one person performs the role of the CEO and the chairman of the board of directors in the same entity (Mahmood et al., 2018). It leads to strategic corporate decisions being taken by the same personality in CEO and chairman of the board. Though, it makes the work easy but most of the frauds and irregularities are committed due to abuse of power resulting in the combination of the dual roles (Ong and Djajadikerta, 2018). This is further supported by Fama and Jensen (1983) that since CEO duality refers to the absence of separation power between CEO and chairmanship position, the board will be unable to effectively monitor and evaluate the officer occupying the dual roles. By implication, the controlling power of the board can become less effective. The excess power can also weaken the flow of information to other directors on the board (Samaha et al., 2015).

The inclusion of female directors on board enhances the quality of board and leads to the effectiveness of the management. Mahmood et al. (2018) posited that female directors are less economically inclined and more prone to helping mankind than their male counterparts; thereby, making female directors to be less driven by short-term selfish agenda. Since sustainability reporting is a long-term phenomenon, the inclusion of women can positively impact the social sensitivity of an organization.

Board ownership is the concentration of equity ownership by some directors thereby giving the power to influence decision and to control the choices of the organization. According to Nazari et al. (2015) board ownership can be institutional or individual investors’ who have major shareholdings in an organization and are concerned about the risk associated with operational problems business disruptions, meeting regulatory requirements and avoiding reputational damage that can reduce competitive advantage. Furthermore, Institutional ownership and ownership concentration can significantly affect the disclosure from the board on the performance of the company (Chang and Zhang, 2010). Rudyanto (2017) concluded that state ownership positively influences sustainability reporting while family ownership does not have any significant influence on sustainability reporting. This might be due to the fact that the state focuses on public good while the family objective is to maximize shareholders value.

Olayinka (2010) found that there is a strong association between board size, independent directors and corporate financial performance but directors’ shareholding has a negative relationship with financial performance. The proxy for financial performance was Return on Capital Employed (ROCE) and Return on Equity (ROE). Also, Afrifa and Tauringana. (2015) posited that board size, CEO tenure and director’s remuneration are statistically associated with the performance of Small and Medium Scale firms listed on London Stock Exchange. In the same vein, Odiwo et al. (2016) concluded that there is a significant relationship between CEO shareholding and organizational performance while directors’ shareholding has a negative association. Furthermore, Mateus and Belhaj (2016) affirmed that board size has significant influence on the European banks’ performance while board composition and CEO duality have no significant impact. In the same vein, Osundina et al. (2016) opined that board size and audit committee has positive and significant impact on return on asset of manufacturing companies in Nigeria while ownership structure has negative and insignificant impact. Mateus and Belhaj (2016) examined the impact of corporate governance on the performance of banks in Europe and the finding revealed that board size and gender diversity have positive significance on the performance of banks whereas board composition and CEO duality have no significance.

Furthermore, Rahman and Islam (2018) conducted a study on the impact of corporate governance on banks performance in Bangladesh and found that there is a positive and significant relationship between corporate governance attributes such as independent director and CEO duality and performance attributes such as earnings per share (EPS) and return on equity (ROE). In the same vein, Sar (2018) examined the impact of CG on sustainability reporting in Indian FMCG industry and found a positive relationship between board size and economic sustainability reporting. However, Azhar and Mehmood (2018) investigated the effect of CG on firms’ financial performance in textiles firms in Pakistan and found that board size is statistically and insignificantly related to ROA.

Adesanmi et al. (2018) conducted a comparative study on the effect of CG on firm performance between manufacturing and banking sector of the economy. The study revealed a positive and significant relationship between CG (board size and board independence) and ROA. However, Olayiwola (2018) examined the effect of CG of financial performance of listed companies in Nigeria and found that board size has a negative and significant impact on net profit margin (NPM). In the same vein, Koji et al. (2020) conducted a comparative study on the effect of CG on firms’ performance between family owned and non-family-owned firms in Japan. The study found a significant and positive relationship between institutional ownership, foreign ownership and firm performance. However, there is no significant relationship between board size and firm performance for non-family ownership.

Herdjiono and Sari (2017) examined the effect of corporate governance on the performance of companies Indonesia. The study revealed the size of the board of directors has a positive effect on return on asset (ROA) but the size of the audit committee; institutional ownership and managerial ownership have no effect on ROA. In the same vein, Prusty and Kumar (2016) conducted a study on the effect of CG on the financial performance of IT companies in India and found that board composition has positive correlation with ROA & return on capital employed (ROCE).

Furthermore, Mustafa et al. (2018) in their study on the impact of CG on company performance among medium and large-scale enterprises found that corporate governance tends to influence the performance of larger companies than smaller ones. By implication, the larger the size of the company, the more positive the influence of CG on the performance of the entity. On the contrary, the policies on shareholder protection have a negative influence on financial performance in Istanbul companies (Saygili et al., 2021). Kyere and Ausloos (2020) investigated the impact of corporate governance on financial performance in the United Kingdom and findings indicate that corporate governance mechanism has a positive or a negative relationship, and also sometimes no effect, on financial performance.

Hypothesis development

Extant literature reviewed showed that corporate governance has been measured by ownership concentration, board size, CEO duality, board independence, directors’ shareholdings, institutional ownership, board meetings, board members expertise and audit committee composition (Akbar, 2014; Mudiyanselage and Swarnapali, 2018; Rahman and Islam, 2018; Olayinka, 2019). Corporate governance is the independent variable of this study and it was measured by board size, board independence, CEO duality, female director and board ownership. Previous studies used measure of performance such as ROE, ROA, ROCE, NPM to proxy economic sustainability. However, in the opinion of the researcher, these measures only cover part of the requirement for measuring economic sustainability reporting (ECSR) performance indicators under GRI-4 standard. Therefore, this study used the aggregate of the arithmetic mean of each of the four (4) indicators of economic sustainability reporting (Nazari et al., 2015).

Ho: Corporate governance has no significant effect on economic sustainability reporting in selected quoted companies in Nigeria.

Stakeholder theory

This study is anchored on stakeholder theory because economic sustainability reporting is for the benefit of stakeholders and not for shareholders only. This theory was developed by Freeman (1984). Stakeholder theory views organizations as a system with many interested parties apart from the shareholders. The theory posits that a company can affect a wide range of groups in its domain of operation. The theory also opined that no organization can operate without interfacing with the environment, the interests of other stakeholders such as customers, employees, creditors, regulatory agencies and resident communities should be factored into strategic decision-making process. Stakeholders can be divided into two, based on their characteristics. There are primary stakeholders and secondary stakeholders. The primary stakeholder is a person or group on which the company depends on to survive for the going concern to be in place, for example, shareholders and investors, employees, suppliers and customers, government and community. Secondary stakeholders or group are those people or group who can influence and be influenced by the company’s operations but not have any direct relationship with organization. Chariri and Ghozali (2014) supported this theory by positing that companies must maintain fair relationship with stakeholders to meet their needs most especially the stakeholders that control the resources of the organization such as employees, suppliers, customers and finance providers. The inability of the firm to meet their needs and expectations can lead to the withdrawal of their resources which could be financial or non-financial, thereby threatening the going concern status of the company.

However, Harrison and Freeman (1999) criticized stakeholder theory by positing that categories of stakeholders are not all homogenous and the theory ignored the intra-group heterogeneity. Winn (2001) in advancing the criticism against the theory alluded to the fact that stakeholder groups and subgroups have diverse interests and expectations that are difficult for a firm to satisfy. Therefore, organizations should not only focus on maximizing the return of its shareholders, but also strive to meet the expectations of other stakeholders to a large extent. The stakeholders are interested in the economic sustainability reporting to improve their awareness about the firm`s ability to nurture their interest while taking care of the shareholders. Other common theories used in other studies are agency and legitimacy theories but the researcher considers stakeholder’s theory more relevant for this study because economic sustainability reporting affects both internal and external parties such as employees, communities and government.

Sample selection

The study consists of companies listed on the Nigerian Stock Exchange. 169 firms were listed on the Nigerian Stock Exchange as at 31 December, 2019 out of which 42 firms were selected as the sample for period of 2010 to 2019. The Nigerian Stock Exchange categorized listed firms into 11 sectors of the economy. Stratified and purposive sampling techniques were used in selecting the sample. The rationale for the selection of the 42 companies is based on the following; first, the selected companies must have been listed for about 10 years or more, that is from 2010-2019. Second, the selected listed firms must have up-to date records, that is; they must have been publishing annual financial reports for the period. Third, the company must have been reporting components of economic sustainability reporting in the financial statement or standalone sustainability report for the period. Content analysis was done to extract data from the financial report of the sampled companies.

Model specification and measurement of variables

The model for the study is stated below:

ECSRit = β0 + β1BSit + β2BIit + β3CDit + β4FDit + β5BOit + Uit

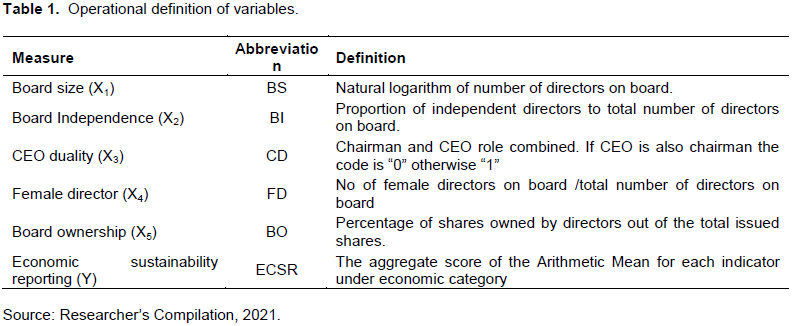

Table 1 shows the operational definition of variables. The parameters of economic sustainability reporting are four (4), the score ranges from 0-1 depending on level of disclosure of Economic sustainability reporting (ECSR). ECSR is measured by the average of the aggregate of the four parameters of economic sustainability reporting in accordance with GRI-4. Disclosure guidelines were developed into a checklist with which the actual disclosures in the annual reports of the sampled firms were compared (Mahmood et al., 2018). The approach used by Nazari et al. (2015) was adopted for this study. This method ensures equality in the weight irrespective of the number of indicators. Board size (BS) was measured by the number of directors on board (Shamil et al., 2014; Aliyu, 2018), Board Independence (BI) was measured by the proportion of independent directors to total number of directors (Mudiyanselage and Swarnapali, 2018), CEO duality (CD) was denoted as “0” if the chairman’s role and Chief Executive Officers’ are performed by one person otherwise “1” (Liao et al., 2015), Female director (FD) is measured by the number of female directors to total number of directors , board ownership (BO) was measured by the percentage of shares owned by directors (Wijethilake et al, 2015).

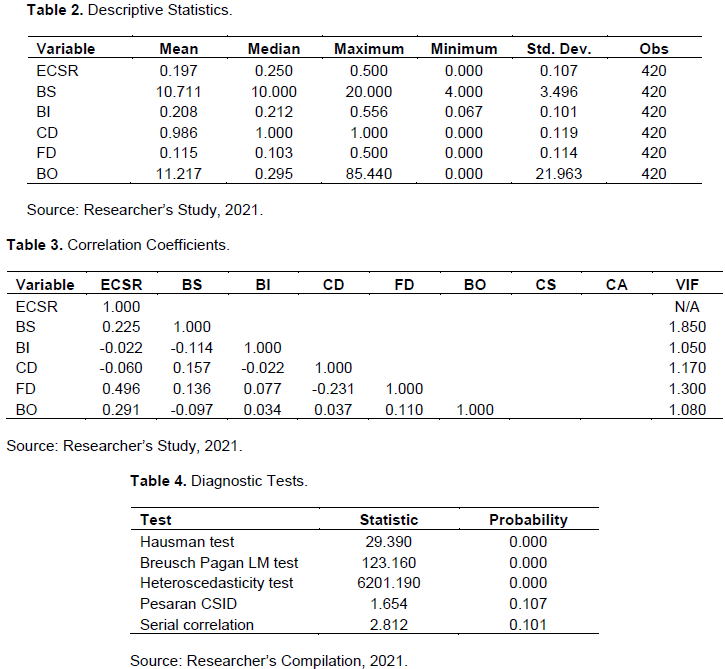

Based on Table 2, the average economic sustainability reporting (ECSR) is 19.7% with the lowest value being 0%. The standard deviation of economic sustainability reporting (ECSR) is 10.7 lower than the mean value and thus it can be said that the deviations in the data are relatively high. Also, the size of the board of directors with lowest number (minimum) is 4.00 or 4 board of directors and a maximum value of 20.00 or 20 boards of directors. From the above data, it can be seen that the size of the board of directors has an average value (mean) of 10.71, meaning that the average board of directors is approximately 11 persons. The standard deviation of the size of the board was 3.50, lower than the mean value and thus it can be said that the deviations of the data are relatively high.

Furthermore, the percentage of independent directors in the study with the lowest value (minimum) is 6.7% and the maximum value is 55.6%. From Table 2, it can be seen that the percentage of independent directors on the board has a mean value of 20.80%, meaning that the average percentage of independent directors is about 2 out of 10-member board. The standard deviation 10.1%, smaller than the mean value, and thus it can be said that the deviations in the data are relatively small.

The chief executive officer duality with the lowest value (minimum) is 0 which means that some of the companies do not have CEO that combined the roles of CEO and chairmanship together, while the maximum value is 1. The mean of 98.6% shows that on the average, the sampled firms do not practice CEO duality. The standard deviation of board ownership was 11.9% lower than the mean value and thus it can be said that the deviations in the data are relatively small.

The percentage of female director on board has a mean value 11.5%. The lowest value is 0 (zero) which implies that some companies do not have female director on board and the highest value is 50% which implies that some companies have half of their board members as female. The standard deviation of 11.4% indicates relatively low variation in the female directors of the sampled companies. The mean value for board ownership is 11.217, and the standard deviation is 21.963. The standard deviation of 2196.3% indicates that there's great variation of board ownership of the sampled companies. The minimum value of 0 (zero) and maximum value of 85.44 shows that some of the sampled firms are not owned by the directors on board while others are owned by the directors on board.

Pearson correlation

Table 3 presents the correlation coefficient. Dependent variable is Economic Sustainability Reporting (ECSR), and independent variables are Board Size (BS), Board Independence (BI), CEO Duality (CD), Female Director (FD), and Board Ownership (BO). The result shows a strong and positive association between female director (0.496) and economic sustainability reporting. Also, there is a weak and positive relationship between board size (0.225) and board ownership (0.291) and economic sustainability reporting (ECSR). However, there is a weak and negative association between board independence (-0.022) and CEO duality (-0.060) and ECSR. The implication of these results is that increase in female directors will lead to a significant increase in economic sustainability reporting while minimal increases in board size and board ownership will lead to an insignificant increase in the quality of ECSR. However, a minimal increase in board independence and CEO duality lead to an insignificant fall in the quality of ECSR.

Interpretation of diagnostic test

From Table 4, the diagnostic test reported are the Hausman test, the Breusch and Pagan Lagrangian multiplier test, the heteroskedasticity, the Wooldridge test for autocorrelation and the Pesaran’s test of cross-sectional independence, these tests were carried out so as to determine the appropriateness of the estimation technique for the specified model. First, the Hausman test was used to determine the appropriateness between the fixed effect and the random effect model. The null hypothesis of the Hausman specification test is that there is no correlation between the random effects and fixed effect model, thus the random effect estimates are efficient and consistent, and that the fixed effect estimates are inefficient. The Hausman statistic of 29.39 with a probability value of 0.00 is less than the 5% level of significance hence, the rejection of the null hypothesis. This implies that the random effect model is inefficient and inappropriate. To determine the appropriateness of the fixed effect model, there must not be presence of serial correlation and heteroscedasticity, but the results show evidence of heteroscedasticity, with a statistic of 6201.19 and it is statistically significant at 1 per cent level. The significance of the heteroscedasticity test necessitates the use of Feasible Generalized Least Square (FGLS) which corrects for serial correlation and heteroscedasticity.

To determine the cross-sectional dependence between the selected quoted companies of the study, the Pesaran CSID test was used. The statistic of 1.654 and with a probability value of 0.11 is not statistically significant at 5% level of significance. This implies that the selected listed companies are cross sectional independence. The Breusch-Pagan/Cook-Weisberg test for heteroscedasticity was carried out to determine if the variance of the residual is constant. The null hypothesis of homoscedasticity was rejected and the alternative hypothesis of heteroscedasticity was accepted. This was because the test statistic of 6201.19 is statistically significant at 1 per cent level. In testing for autocorrelation in the panel data, the Wooldridge test was used. The null hypothesis that the successive error terms are not correlated was not rejected because the statistic of 2.812 with a probability value of 0.101 which is greater than the 5% level of significance. Thus, the null hypothesis of no serial correlation was not rejected.

Model

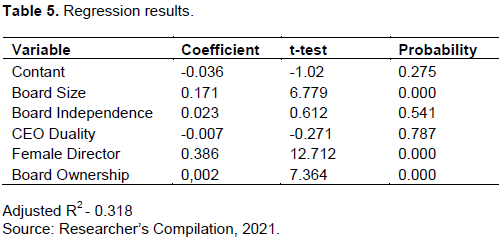

Based on the results of multiple regression analysis in the above table, the regression equation model is obtained as follows:

Y = -0.036+ 0.171X1 + 0.023X2 - 0.007X3+ 0.386X4 + 0.002X5+ U

Interpretation

Table 5 shows the results of regression analysis of the effects of corporate governance on economic sustainability reporting of selected quoted companies in Nigeria. The results show that board size, board independence, female director and board ownership have positive relationship with economic sustainability reporting of selected quoted companies in Nigeria while CEO duality has negative relationship with economic sustainability reporting of selected quoted companies in Nigeria. In addition, there is evidence that board size, female director and board ownership have significant relationship with economic sustainability reporting of selected quoted companies in Nigeria (X1= 0.171, t-test= 6.779, p < 0.05, X4= 0.386, t-test= 12.712, p < 0.05 and X5 =0.002, t-test= 7.364, p < 0.05). This implies that board size, female director and board ownership are significant factors influencing changes in the economic sustainability reporting of selected quoted companies in Nigeria.

Conversely, there is evidence that board independence and CEO duality do not have significant relationship with the economic sustainability reporting of selected quoted companies in Nigeria (X2 = 0.023, t-test= 0.612, p > 0.05 and X3 = -0.007, t-test= -0.271, p > 0.05). This implies that board independence and CEO duality are not significant factors influencing changes in the economic sustainability reporting of selected quoted companies in Nigeria. Concerning the magnitude of the estimated parameters for the coefficients of the regression analysis, a unit increase in board size, board independence, female director and board ownership will lead to 0.171, 0.023, 0.386 and 0.002 increase in the economic sustainability reporting of selected quoted companies in Nigeria respectively, while a unit increase in the CEO duality will lead to 0.007 decrease in the economic sustainability reporting of selected quoted companies in Nigeria. The Adjusted R2 which measured the proportion of changes in the economic sustainability reporting of selected quoted companies in Nigeria as a result of changes in board size, board independence, female director, board ownership and CEO duality explains about 32 per cent changes in the economic sustainability reporting of selected quoted companies in Nigeria, while the remaining 68 per cent were other factors explaining changes in the economic sustainability reporting of selected quoted companies in Nigeria but were not captured in the model. The Wald-Test of 277.52 is statistically significant with p < 0.05 indicating that on the overall, the statistical significance of the model showed that the null hypothesis of corporate governance has no significant effect on economic sustainability reporting in selected quoted companies in Nigeria was rejected. Thus, the alternative hypothesis that corporate governance has significant effect on economic sustainability reporting in selected quoted companies in Nigeria was accepted.

The result proves that the larger the board size, the higher the tendency for companies to report on economic sustainability. This is consistent with the results of the research conducted by Mateus and Belhaj (2016), Herdjiono and Sari (2017), Sar, (2018) and Al-Homaidi et al. (2019). The depth of economic sustainability reporting depends on the ability of the board of directors to leverage on their number and wealth of experience in supervising managers to act ethically and in the best interest of the organization. However, Olayiwola, (2018) disagrees with the outcome of this study by establishing that the larger the board size, the lower the tendency of the board to report on economic sustainability. This is further corroborated by the finding of Azhar and Mehmood (2018) that confirmed that board size does not significantly impact return on asset. This might be due to the problem of coordination, difficulty in taking decisions as a result of size, personal interest of board members and the cost incurred on the large board. The finding of this study also proves that the higher the number of independent directors the lower the content of economic sustainability reporting. This might be due to the fact independent directors do not have any substantial interest in the shares of the company and as such can effectively supervise the management without bias. Therefore, independent directors might not be interested in economic sustainability reporting because of lack of personal interest. This result might also due to the lack of requisite experience by the independent directors to influence management decision on the disclosure of economic sustainability. However, the finding of this study does not align with previous studies conducted by Adesanmi et al. (2018) and Mudiyanselage and Swarnapali (2018). Also, Michelon and Parbonetti (2012) in their study did not find any significant correlation between the proportion of independent directors and sustainability reporting.

The outcome of this study reveals an inverse relationship between the incidence of CEO duality and economic sustainability reporting. The more there is a combination of the roles of the chief executive officer (CEO), and that of managing director (MD) in a single individual, the more the tendency of the person to influence the decisions of board members negatively on economic sustainability reporting. This is due to the fact the absence of separation of management weakens the ability of the board in effective monitoring and evaluation of the CEO. Ong and Djajadikerta (2018), supported the finding of this study because CEO duality can promote unreported fraud because of the excessive power conferred on one person performing dual roles of chairman and CEO. Shamil et al. (2014) also aligned with the result of this study that CEO duality tends to compromise board independence and the capacity to discharge duty with creativity. Though, Villier et al. (2011) posited that CEO duality has no significant impact on sustainability reporting.

Furthermore, this study reveals that the more the female included on the board the higher the tendency to report on economic sustainability. Arayssi et al. (2016) align with this study by positing that adequate women representation on the board enhances quality deliberations and ultimately influences the quality and integrity of sustainability reporting. Furthermore, Garcia- Sanchez et al. (2018) supports the outcome of this study in that the board with greater female representation have tendency to report sustainability issues without technically suppressing facts or give misleading information intended to attract the attention of various stakeholders. Adeniyi and Fadipe (2018) disagreed with the result of this study as evidence shows that there is no significant relationship between female representation on the board and sustainability reporting. By implication, the inclusion or non-inclusion of women on board has no significant impact on sustainability reporting.

Finally, the outcome of this study proves that the higher the percentage of shares owned by directors the higher the tendency of the board to report on economic sustainability. This might be due to the fact that the owners of bulk shares are concerned about mitigating risk that can lead to operational problems, minimizing the disruptions of activities, complying with regulatory requirements and minimizing issues that affect public perception. Shareholders on board also want to avoid management policies that can lead to reputational damage and ultimately reducing competitive advantage. Chang and Zhang (2010) and Rudyanto (2017) align with the outcome of this study. However, part of the outcome of the study of Rudyanto, (2017) disagreed with this study by confirming that family ownership does not have any significant influence on sustainability reporting. This is typical of an organization where family has major shareholding as the board does not bother about other people’s interest.

CONCLUSION AND RECOMMENDATIONS

Based on the analysis and discussion, the board size affects economic sustainability reporting in selected quoted companies in Nigeria in 2010-2019 period; the board independence does not affect economic sustainability reporting in selected quoted companies in Nigeria in 2010-2019 period; the CEO duality has a negative effect on economic sustainability reporting in selected quoted companies in Nigeria in 2010-2019 period; the female director inclusion affects economic sustainability reporting in selected quoted companies in Nigeria in 2010-2019 period and the board ownership affects economic sustainability reporting in selected quoted companies in Nigeria in 2010-2019 period.

As a result of the findings of this study, the following recommendations are put forward. Shareholders of companies should appoint board members with diverse background that will enhance economic sustainability reporting. The shareholders should appoint more directors with shareholding interest and include more female on the board, as they boost economic sustainability reporting. Incidence of combination of the roles of managing director and chairman of the board in the same person should be avoided as it negatively impacts economic sustainability reporting. Shareholders are also encouraged to appoint well experienced independent directors so as to influence the robustness of economic sustainability reporting.

LIMITATION OF STUDY AND FUTURE RESEARCH

More studies should be done using data from other countries to measure economic sustainability reporting because most companies used as sample are just beginning to embrace sustainability reporting. Data from more advanced countries may be more desirable. More independent variables other than corporate governance such as public perception, company reputation, and company position in the industry can also be used in future research.

The author has not declared any conflict of interest.

REFERENCES

|

Bakar ABSA, Ghazali NABM, Ahmad MB (2019). Sustainability reporting and board diversity in Malaysia. International Journal of Academic Research in Business and Social Sciences 9(3):91-99.

Crossref

|

|

|

|

Adeniyi SI, Fadipe AO (2018). Effect of board diversity on sustainability reporting in Nigeria: A study of beverage manufacturing firms. Indonesian Journal of Corporate Social Responsibility and Environmental Management 1(1):43-50.

|

|

|

|

|

Adesanmi AD, Sanyaolu OA, Ogunleye OO, Ngene TW (2018). Corporate governance and firm's performance: A comparative study of manufacturing companies and banks in Nigeria. International Journal of Contemporary Research and Review 9(7):20940-20950.

|

|

|

|

|

Afrifa GA, Tauringana V (2015). Corporate governance and performance of UK listed small and medium enterprises. Corporate Governance 15(5):719-733.

Crossref

|

|

|

|

|

Al-Homaidi EA, Almaqtari FA, Ahmad A, Tabash MI (2019). Impact of corporate governance mechanisms on financial performance of hotel companies: Empirical evidence from India. African Journal of Hospitality, Tourism and Leisure 8(2):1-21.

|

|

|

|

|

Aliyu US (2018). Board characteristics and corporate environmental reporting in Nigeria. Asian Journal of Accounting Research 30:1-17.

Crossref

|

|

|

|

|

Alotaibi MZM, Aburuman NM, Hussein LFM (2019). The Impact of Board Characteristics on the Level of Sustainability Practices Disclosure in Jordanian Commercial Banks Listed on the ASE. European Journal of Scientific Research 153(4):353-363.

|

|

|

|

|

Akbar A (2014). Corporate governance and firm performance: Evidence from textile sector of Pakistan. Journal of Asian Business Strategy 4(12):200-207.

|

|

|

|

|

Arayssi M, Dah M, Jizi M (2016). Women on boards, sustainability reporting and firms performance. Sustainability Accounting, Management and Policy Journal 7(3):376-401.

Crossref

|

|

|

|

|

Azhar KA, Mehmood W (2018). Does corporate governance affect performance? Evidence from the textile sector of Pakistan. Journal of Southeast Asian Research 10(1):1-14.

Crossref

|

|

|

|

|

Mateus C, Belhaj S (2016). Corporate governance impact on bank performance: Evidence from Europe. Corporate Ownership and Control 13(4):583-597.

Crossref

|

|

|

|

|

Buallay A, Al-Ajmi J (2019). The role of audit committee attributes in corporate sustainability reporting: Evidence from banks in the Gulf Cooperation Council. Journal of Applied Accounting Research 21(2):249-264.

Crossref

|

|

|

|

|

Chang K, Zhang L (2010).The Effects of corporate ownership structure on environmental information disclosure: Empirical Evidence from unbalanced panel data in heavy-pollution industries in China. Wseastransactions on Systems and Controls 10:405-414.

|

|

|

|

|

Chariri A, Ghozali I (2014). Teori akuntansi: International Financial Reporting System (IFRS). Edisi Keempat. Semarang: Badan Penerbit UNDIP.

|

|

|

|

|

Fama EF, Jensen MC (1983). Separation of ownership and control. The Journal of Law and Economics 26(2):301-325.

Crossref

|

|

|

|

|

Freeman RE (1984). Strategic Management: A Stakeholder Approach. In: Clarke T, Clegg S (eds.), Changing Paradigms: The Transformation of Management Knowledge for the 21st Century. London, Harper Collins.

|

|

|

|

|

Garcia-Sanchez I, Suarez-Fernandez O, Martinez-Ferrero J (2018). Female director and impression management in sustainability reporting. International Business Review 28(2):359-374.

Crossref

|

|

|

|

|

Ghazali NAM (2010). Ownership structure, corporate governance and corporate performance in Malaysia. International Journal of Commerce and Management 20(2):109-119.

Crossref

|

|

|

|

|

Global Reporting Initiative (GRI) (2011). A new phase: the growth of sustainability reporting. GRI's Year in Review.

|

|

|

|

|

Gupta S, Kumar V (2013). Sustainability as corporate culture of a brand for superior performance. Journal of World Business 48(3):311-320.

Crossref

|

|

|

|

|

Harrison J, Freeman E (1999). Stakeholders, social responsibility, and performance: Empirical evidence and theoretical perspectives. Academy of Management Journal 42(5):479-485.

Crossref

|

|

|

|

|

Herdjiono I, Sari IM (2017). The effect of corporate governance on the performance of a company. Some empirical findings from Indonesia. Central European Management Journal 25(1):33-52.

Crossref

|

|

|

|

|

Hu M, Loh L (2018). Board governance and sustainability disclosure: A cross sectional study of Singapore-listed companies. Journal of Sustainability 2578:1-14.

Crossref

|

|

|

|

|

Jouha F (2015). Effect of Corporate governance on corporate financial and market performance with sustainability reporting as intervening variable. South East Asia Journal of Contemporary Business, Economics and Law 6(1):1-6.

|

|

|

|

|

Koji K, Adhikary BK, Tram L (2020). Corporate governance and firm performance: A comparative analysis between listed family firms and non-family firms in Japan. Journal of Risk and Financial Management 13(215):1-20.

Crossref

|

|

|

|

|

Kocmanová A, Hrebicek J, Docekalova M (2011). Corporate Governance and sustainability reporting. Economics and Management 16:543-550.

|

|

|

|

|

Kyere M, Ausloos M (2020). Corporate governance and firms financial performance in the United Kingdom. International Journal of Finance and Economics 26(2):1871-1885.

Crossref

|

|

|

|

|

Lawrence S, Collins E, Roper J (2013). Expanding responsibilities of corporate governance: The incorporation of CSR and sustainability. Indian Journal of Corporate Governance 6(1):49-63.

Crossref

|

|

|

|

|

Liao L, Luo L, Tang Q (2015). Gender diversity, board independence, environmental committee and greenhouse gas disclosure. The British Accounting Review 47(4):409-424.

Crossref

|

|

|

|

|

Mahmood Z, Kouser R, Ali W, Ahmad Z, Salman T (2018). Does corporate governance affect sustainability disclosure? A mixed methods study. Sustainability 10(1):1-20.

Crossref

|

|

|

|

|

Michelon G, Parbonetti A (2012). The effect of corporate governance on sustainability disclosure. Journal of Management and Governance 16(3):1-33.

Crossref

|

|

|

|

|

Mudiyanselage R, Swarnapali NC (2018). Board involvement in corporate sustainability reporting: Evidence from Sri Lanka. Corporate Governance: International Journal of Business in Society 18(6):1042-1056.

Crossref

|

|

|

|

|

Mustafa S, Berisha H, Llaci S (2018). The impact of corporate governance on company performance: a study among medium and large enterprises in Kosovo. Mediterranean Journal of Social Sciences 9(6):207-212.

Crossref

|

|

|

|

|

Nazari JA, Herremans IM, Warsame HA (2015). Sustainability reporting: external motivators and internal facilitators. Corporate Governance 15(3):375-390.

Crossref

|

|

|

|

|

Odiwo WO, Chukwuma CS, Kifordu AA (2016). The impact of corporate governance on the performance of manufacturing firms in Nigeria. International Journal of Science and Research 5(9):924-933.

|

|

|

|

|

Olayinka OM (2019). Audit committee and firms' performance in Nigeria: Case study of selected Nigerian banks. International Journal of Scientific and Research Publications 9(9):315-323.

Crossref

|

|

|

|

|

Olayinka MU (2010). The impact of board structure on corporate financial performance. International Journal of Business and Management 5(10):155-166.

Crossref

|

|

|

|

|

Olayiwola KT (2018). Effect of corporate governance on financial performance of listed companies in Nigeria. European Journal of Accounting Financial Research 6(9):85-98.

|

|

|

|

|

Ong T, Djajadikerta HG (2018). Corporate governance and sustainability reporting in the Australian resources industry: An empirical analysis. Social Responsibility Journal 2018:1-13.

Crossref

|

|

|

|

|

Osundina JA, Olayinka IM, Chukwuma JU (2016). Corporate governance and financial performance of selected manufacturing companies in Nigeria. International Journal of Advanced Academic Research 2(10):29-43.

|

|

|

|

|

Prusty T, Kumar S (2016). Effectively of corporate governance on financial performance of IT companies in India with special reference to corporate board. Amity Journal of Corporate Governance 1(1):15-33.

|

|

|

|

|

Rudyanto A (2017). State ownership, family ownership and sustainability report quality: The moderating role of board effectiveness. Accounting and Finance Review 2(2):15-25.

Crossref

|

|

|

|

|

Rahman MA, Islam J (2018). The Impact of Corporate Governance on Bank Performance: Empirical Evidence from Bangladesh. Global Journal of Management and Business Research 18(8):1-8.

|

|

|

|

|

Saltaji IM (2013). Corporate governance relation with corporate sustainability. Internal Auditing and Risk Management 8(2):137-147.

|

|

|

|

|

Samaha K, Khlif H, Hussainey K (2015). The impact of board and audit committee characteristics on voluntary disclosure: A meta-analysis. Journal of International Accounting, Audit and Tax 24:13-28.

Crossref

|

|

|

|

|

Sar AK (2018). Impact of corporate governance on sustainability: A study of the Indian FMCG industry. Academy of Strategic Management Journal 17(1):1-10.

|

|

|

|

|

Saygili AT, Saygili E, Taran A (2021). The effects of corporate governance practices on firm-level financial performance: evidence from Borsa Istanbul Xkury companies. Journal of Business Economics and Management 22(4):884-904.

Crossref

|

|

|

|

|

Shamil MM, Shaikh JM, Ho P, Krishnan A (2014). The influence of board characteristics on sustainability reporting. Asian Review of Accounting 22(2):78-97.

Crossref

|

|

|

|

|

Villiers C, Naiker V, Van Staden CJ (2011). The effect of board characteristics on firm environmental performance. Journal of Management 37(6):1636-1663.

Crossref

|

|

|

|

|

Varshney P, Kaul VK, Vasal VK (2013). Corporate governance mechanisms and firm performance: A study of select Indian firms. Afro-Asian Journal of Finance and Accounting 3(4):341-395.

Crossref

|

|

|

|

|

Winn M (2001). Building stakeholders theory with a decision modelling methodology. Business and Society 40(2):133-166.

Crossref

|

|

|

|

|

Wijethilake C, Ekanayake A, Perera S (2015). Board involvement in corporate performance: evidence from a developing country. Journal of Accounting in Emerging Economies 5(3):250-268.

Crossref

|

|