Full Length Research Paper

ABSTRACT

Tax procedures have increased due to the expansion of international trade opportunities, administrative strategies and technology. As a result, tax complexity increases and burdens citizens, enterprises and tax authorities. Traditional causes of complexity are found in political instability, legislation, central and operational planning. The interpretation of legislation greatly affects tax awareness; thus, information systems aimed at tax system modernizations and upgrades, according to international practices. Questionnaires were sent to tax payers and tax authorities investigating their perception of complexity. Through factor analysis, the items generated factors that simplify or complicate a tax system. Some of the traditional factors of complexity such as administration and information systems were expected. However, governmental influence and tax awareness were significantly reduced when dealing with taxation as a system. On the other hand tax reforms simplified the tax system, while tax awareness due to technology has little influence on complexity. This swift of some traditional governmental and citizens’ oriented factors denotes the necessity of simplifying and reforming procedures in favor of demands in technology and tax standardization in a smaller country’s tax system.

Key words: Taxation, tax complexity, tax systems, information systems, systemic complexity, tax simplifications.

INTRODUCTION

Modern studies argue taxes are the monetary, compulsory and unpaid provision of individuals to the state for revenue generation and fulfillment of economic and social policy purposes. An interesting approach from Tran?Nam and Evans (2014) highlighted the elements of complexity in a tax system. In summary, components of complexity are divided into two categories; legal complexity, which includes both the legislative and administrative elements mentioned above; and cost-effectiveness or financial complexity originating from time spent and the cost of tax revenue collection. They argue that breaking down these elements allow the drafting of indicators that measure. Taking this index of indicators as a reference point, tax experts can came up with plans and strategies that reduce complexity levels allowing simplifications without reducing fairness and efficiency. Tax complexity interests state and researchers alike, as a phenomenon having earned the attention of political advisors, tax legislators and economic experts. Most studies argue a positive correlation between high levels of tax systems complexity and non-compliance (Brockmann et al., 2016; Alm et al., 2017).

Furthermore, complexity greatly deters transparency, creates tax illusion and increases public expenditure (Borrego et al., 2018). Voluntary tax compliance is vital for the state in order to cope with budget deficits. Traditional methods for improving tax compliance, such as increasing the number of audits per year, have severe implementation costs (Lois et al., 2019). Complexity rises from increased sophistication in tax laws (Sawyer and Freudenberg, 2019). Tax complexity can take many forms such as computational complexity, forms complexity (Saad, 2014), compliance complexity, rule complexity (Carnes and Cuccia, 1996; Saad, 2014), procedural complexity (Cox and Eger, 2006; Saad, 2014) and the low level of readability (Saad, 2014; Sawyer and Freudenberg, 2019). Despite prior research on the increasing role of tax complexity, there has not been a comprehensive tax complexity measure. Hoppe et al. (2019) argue that the level of tax complexity varies depending on the country. They concluded that tax complexity represents a distinct country’s characteristic and proposed the use of a tax complexity index (TCI) for corporations’ varying exposures to tax complexity in the assessment of country-specific corporate decisions. According to recent research (OECD, 2018; Lois et al., 2019) the complex tax system in Greece does not encourage compliance with tax provisions, reinforces tax evasion and reduces fiscal income. For many years tax compliance in Greece was based on the imposition of fines after audits; however, the task of audits was difficult and the fines often were not collected. This was a result of standing cases, obstructiveness and bureaucracy as demonstrated by data of 2017 (OECD, 2018). The research showed that these fines constituted 35% of the uncollected taxes. Recently, in an effort to simplify and modernize procedures aiming to strengthen confidence in tax administrations, Greece established the “Independent Public Revenue Authority” (IAPR) and introduced integrated tax information systems. This included an increased number of targeted tax audits and a more in depth digitized approach of both the audit and the auditee’s transactions (OECD, 2018).

The aim of this study is initially to present the main causes of tax system complexity in a small country and the key simplifying strategies that can be utilized. The paper uses questionnaires sent to citizens in order to measure strategies with complexity reductive capabilities, such as high tax compliance. Literature Review derived a theoretical framework finalized into a research model through correlation analysis. Greece’s economy, despite being a small country, is strongly correlated with the world’s market due to its connection to the EU. Furthermore the country’s tax system is a representative example of tax complexity. The Greek state recently subjected its tax system to a series of reforms. Thus, problematic issues that increased tax complexity were addressed including matters of bureaucracy and planning. Furthermore, the struggles that originated from the fiscal crisis of 2009 made the work of tax authorities towards increased tax revenues more difficult but at the same time inevitable.

LITERATURE REVIEW

A tax system’s complexity is a multifaceted issue. This study separates complexity depending on its different stages of the tax system. Tran?Nam and Evans (2014) defined four types of complexity. They argued that one type of complexity is related to political issues. Political complexity consists of political expediency, since tax policy makers deliberately use it for political and other purposes, deviating from the usual purpose of the tax system. On the other hand, legislative complexity arises from the tax legislation and its possible interpretations. The third type, administrative complexity, is encountered in the manner of tax legislation’s enforcement and the guidelines followed during its implementation, by the tax administration and the various agencies. Finally, complexity of compliance concerns taxpayers and refers to their tax calculations, provisions and compliance to the law and covers their various tax obligations (Almunia and Lopez-Rodriguez, 2018; Vincent, 2021). Tax complexity is globally and strongly affected by transfer pricing regulations in the tax code and complexity of tax audits. While countries experience complexity in both their tax code and tax framework, rankings of complexity differ significantly. Furthermore, some cases demonstrated high tax code complexity and a low tax framework complexity or vice versa (Hoppe et al., 2019).

Tran-Nam and Evans (2014) further analyzed the sources of complexity, focusing on actions of the state. They argue the fundamentals of complexity ultimately regard governmental policies. However there are elements partially or virtually out of the government’s control. This demands public agencies approach of complexity issues and the various possible coping mechanisms from an appropriate approach. The state controls elements that complicate or stabilize a tax system (such as securing government revenue, political expediency, tax return systems, and separation from citizens and tax consultants). Moreover, state related complexity is affected from the legislative framework’s frequency of changes, the interpretation of the legislation but also from the necessary actions for securing tax revenue.

When analyzing the associations between tax complexity and other country characteristics, we identify different correlation patterns. For example, we find that tax (framework) complexity is negatively associated with countries' governance, suggesting that strongly governed countries tend to have less complex tax frameworks (Hoppe et al., 2019). Tax culture and the general economy also influence the complexity of a country’s system as a whole and partially within the state’s jurisdiction. The state has little influence regarding taxpayers’ compliance and tax professional’s dependability and work ethic (Hallsworth et al., 2017). The above tax complexity’s separation in different systematic stages highlights the primary factors that affect it (Tran-Nam and Evans, 2014).

Based on the above an indicator for measuring a tax system’s complexity should utilize both quantitative and qualitative components. The quantitative part usually consists of data derived from tax revenues, number or type of taxes. The amounts spent on administrative costs may be the most important element but at the same time is one of the most difficult to calculate. The qualitative component can be found from provisions’ volume, amount of text lines or pages in the physical file of the audit, and also an auditor’s ability to understand each case. The number of problematic audit reports successfully can play the latter role (Lois et al., 2019). Moreover, the number and extent of which taxpayers receive advice from accountants or tax experts combined with the number of appeals for disputes with tax authorities would greatly enhance an indicator’s strength for measuring complexity. Finally, the index should cover the overall assessment of complexity in a country's system, separately for citizens and organizations. At the same time, the empirical data used for constructing factors of complexity are the basis of the whole index for ensuring the reliability of the results (Tran?Nam and Evans, 2014).

Lack of political stability and constant legislative changes perpetually complicate tax systems. Freudenberg et al. (2012) conducted a survey using small businesses from the USA, Australia and New Zealand. Each sample country strived with different types of tax complexity. However, frequent changes in legislation regarding tax provision calculations were found in all three countries as one of most important factor of tax complexity for small businesses in all three countries. Bureaucracy, according to Papaconstantinou et al. (2013), always remains a constant factor of complexity. Thus, based on the above the following hypothesis was formed:

H1: Current tax framework increases tax complexity.

Complexity derived from accumulating amount of cases, modern managerial options available to tax payers as well as technological swifts calls for the involvement of risk management implementations accompanied by sufficient resources. Digitalization of the public administration provides many benefits in terms of fulfilling these processes (Sadiq, 2021), but another important resource for the public administration is its human resources (Lazos et al., 2019; Lois et al., 2019b). The main tax revenue authority in Greece, the “Independent Public Revenue Authority” (IPRA) was established in 2017 and plays an important role in the smooth operation of the tax system. IPRA is charged to provide and support electronic services, facilitate transactions, reduce bureaucracy, simplify procedures and reach tax revenue goals (Katharakis and Tsakas, 2010). IPRA integrated information systems with the tax system in Greece and introduced e-government. The effectiveness of tax services in Greece was found dependent not only on the central administration, but also on various characteristics found in different geographical regions. More specifically internal procedures and policies were found to differ regardless by region despite the state’s guidelines. Digitization still needs vision and methodology implementations. Geographical Information Systems (GIS) identified the need for clear e-government policies and objectives, and reoriented information management strategies for high quality services (Stamoulis et al., 2001).

At the same time, public sector employees were more concerned with the quality of services and information than with the quality of the system. In order to improve information systems, higher quality, simplification and standardization of tax procedures is vital for improved decision-making processes (Floropoulos et al., 2010). Thus, based on the above the following hypotheses were formed:

H2: Informational Systems decrease tax complexity.

H3: Informational Systems increase tax awareness

Another component of tax complexity emanates from administrative causes, that is, the way tax law is implemented by the tax administration and the various authorities (Tran-Nam and Evans, 2014). Although complexity is unavoidable to a certain degree, it is described as a “structural pathogenesis” when derived from sources in an administrative level. This burdens the system with expenses that are ultimately transferred to taxpayers. Administrative tax complexity is considered of grave importance in Greece, especially regarding tax authorities and officials. State administration should aim for an efficient and easy way for tax payers to interact with the system of services. However, administrative and by extension tax authorities complexity is considered the most hard type of complexity in matters of measurement and evaluation. This is especially true in Greece, regarding characteristics and high corruption rates in public administration (Lois et al., 2019).

Tax administrations face the problem of managing complex procedures beyond their job description (OECD, 2019). Tax administrations are charged with the responsibility of registering taxpayers in the tax services, processing tax revenues and payments, while simultaneously supporting taxpayers in fulfilling the latter’s’ obligations. Greece’s public sector, due to covid-19 and the accumulative debt issues with E.U., underwent a serious series of reforms towards digitization and modernization. However, research demonstrates low administrative capacity, which remains a key challenge for providing high quality public services, and attracting investments. These issues relate mostly to low levels of trust in the state and on the evaluation of the public sector’s performance. Overall, various causes of complexity regarding the state’s tax and administrative system are concentrated on policies and approaches of public administration. Perhaps, one of the most troubling issues is the high level of corruption found in the Greek tax system. The latter not only strengthens individuals towards tax avoidance but also the tax system’s complexity in general (Lazos et al., 2019; Lois et al., 2019b).

Corruption causes complexity and complexity enhances corruption. In 2006, Katsios investigated the dimension of corruption and highlighted three major causes; the first being a high taxation rate and the second complexity and volume of tax legislation regarding provisions. These inevitably lead to corruption and cases of shadow economy. The third was inadequacy in the public sector. Furthermore, frequent cases of unregistered informal economy activities in Greece, greatly diminish tax originated revenues. This income reduction consequently also diminishes the quality of services in the public sector. These issues point out the importance in reforming the tax system in order to face complexity and consequently corruption issues as well as unregistered activities. Meeting these tax reforms incurs significant expenses, since many cases of legislative interpretations are difficult. Thus, based on the above the following hypotheses were formed:

H4: Tax administration increases tax complexity.

H5: Reforms in the tax system decrease tax complexity.

Tax compliance with tax rules and legislation includes completing and submitting financial data and paying tax. States should cultivate citizens’ tax compliance. From its ethical point of view non-tax compliance has a significant social impact, since it reduces the state’s corporate originated tax revenue and defies corporate social responsibility tactics (Awang and Amran, 2014; Hertiningtyas and Yustina, 2021; Almunia and Lopez-Rodriguez, 2018). Regarding Greek economy, Vousinas (2017) attempted to highlight some major issues favored by the current tax system; tax evasion, corruption and unregistered informal economy. Greece demonstrates high levels of corruption, complexity and an inefficient tax system’s structure. Citizens’ educational level and tax knowledge decreases corruption and tax evasion incidents. High education levels correlate with high levels of tax compliance and perceived tax fairness (Saad, 2014). Tax knowledge of procedures is a key factor for tax compliance, since it explains the reasons for tax compliance (Bornman and Ramutumbu, 2019). To acquire such tax knowledge employees and taxpayers need education and training regarding the tax system (Yong et al., 2019) and its reforms. Thus, based on the above the following hypothesis was formed:

H6: Tax awareness decreases tax complexity

METHODOLOGY

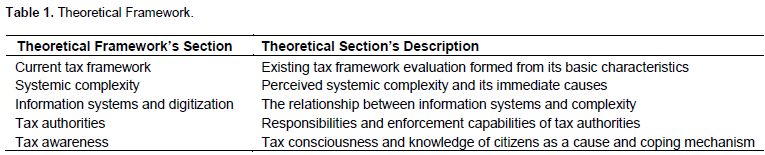

This research investigates the perceived tax system’s complexity. A Likert scale questionnaire was drafted based on literature to highlight the factors of tax complexity. The sample consisted of 105 taxpayers and tax officials. Stratified sampling divided the population into subgroups based on the education and employment. The questionnaire included thirty eight (38) items used to investigate the main reasons for tax system’s complexity, causes and coping mechanisms. The items formed a theoretical framework, separated into five sections as shown in Table 1: one section was on demographics profiles of the respondents (gender, age, education, employment). The first section evaluates tax framework and its particular characteristics, which according to literature, cause complexity. The second section measures participants’ perception about complexity and its immediate causes and effects in the tax system. In the third section, the questionnaire measures digitization and the use of information systems. The fourth section examines tax authorities' influence on increased complexity. Finally, in the fifth section, tax consciousness of citizens is evaluated as a cause and coping mechanism of complexity. This research aims to demonstrate the factors influencing tax complexity and how they are formed. Furthermore, due to little previous research on tax complexity in a small country during a simultaneous series of tax reforms, a Principal Component Analysis was used in order to reveal structure in data and relationships between variables.

RESULTS AND ANALYSIS

Descriptive statistics

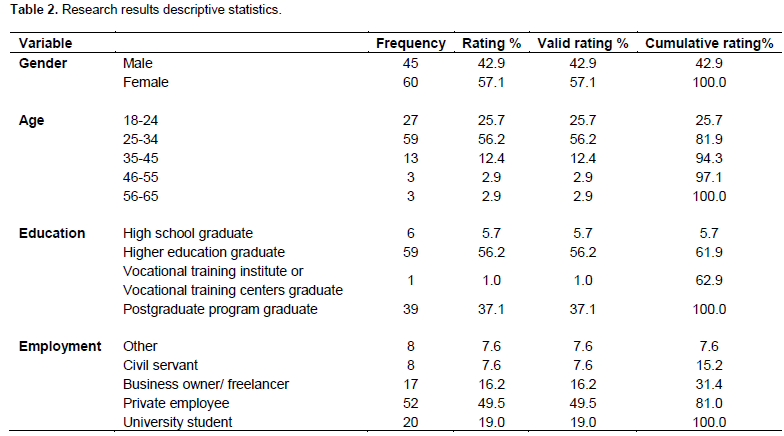

Table 2 describes the demographic data of the sample. The sample comprised 42.9% men and 57.1% women. The second item concerned the age of the participants. It is worth noting that people of all ages participated in the study. The third item concerned the education of the participants, and the educational background of the respondents is shown in the same table. As can be seen, majority are graduates of a higher education institution (56.2%), while 37.1% are postgraduates. Overall, the educational background is quite high. Then, in the fourth item regarding the employment of the respondents the sample consists of private employees (49.5%), freelancers, students and private employees. Overall, the main characteristics were the ages of the respondents (25 to 34 years), educational level (higher education institutions) and working sector (private sector).

Factor analysis

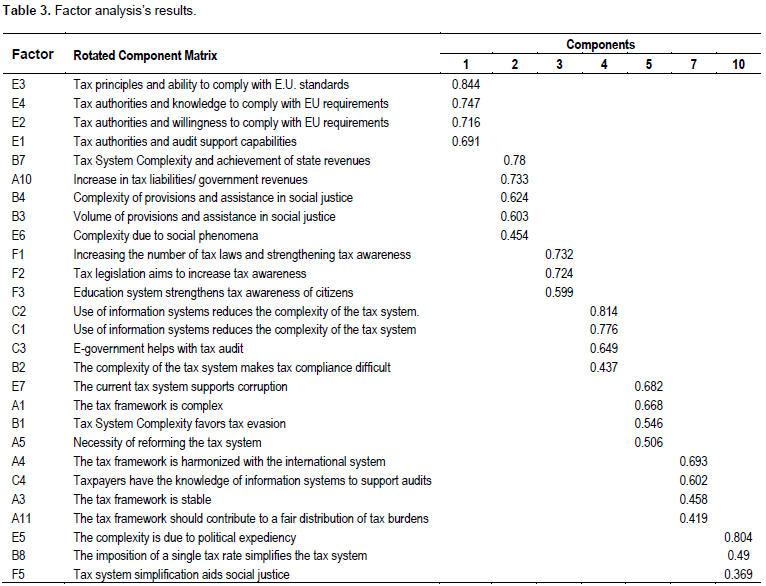

Factor analysis correlates variables to groups (factors) and help draw conclusions. Analysis calculates variability for each item. Communalities show relations between variables and factors. Specifically, the values above 0.5 explain 61.8% of the sample. The "Initial Eigenvalues" were greater than 1.0. Following the main components analysis a Rotated Component Matrix resulted in seven (7) factors with loads greater than 0.3 (Table 3). The first factor was named “Administrative Tax Complexity” (ATC) which refers to the ability and knowhow of tax authorities and represents the administrative causes of complexity. The second factor (Systemic Tax Complexity- STC) emphasizes complexity of the tax system and the latter’s ability to reach tax revenues goals. The third factor’s items focused on tax consciousness of citizens as a cause of complexity; it is named “Citizens Tax Awareness and their influence on tax system complexity is named “Digitized Assisted Taxation” (DAT). The fifth factor “Tax System Reforms” (TSR) refers to taxation system’s reforms as mean of addressing complexity. The sixth factor emphasized the characteristics of the current tax framework and was named Current Tax Framework (CTF). Finally, the last factor Governmental Tax Complexity (GTC) emphasized governmental influences on a tax system’s complexity. The emerged factors are near the questionnaire’s thematic analysis and are supported from the literature review. However, factors include items from different thematic sections.

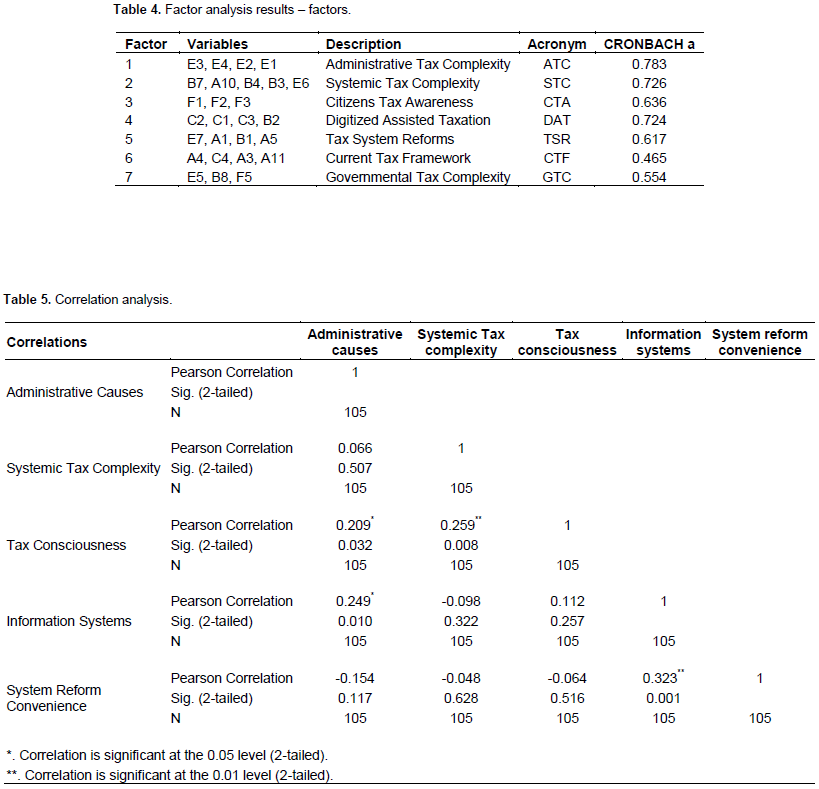

Research continues with the reliability analysis of the 7 factors. The Cronbach alpha index was used and showed that only 5 factors could be considered reliable (near or above 0.7). Specifically the factors that best describe and influence systematic tax complexity were found to be administrative causes (ATC), tax awareness (CTA), information systems (DAT) and tax reforms (TSR). Regarding the last factor and its low Cronbach score, its proximity to 0.7 and its relation to literature urged retaining it. More specifically, the indicators are summarized in Table 4. In order to better explain the results and as the main issue of this research, the second factor (Systemic Tax Complexity) was considered as the dependent variable. The remaining factor as the independent variables will explain how complexity is affected. Table 5 explains the correlations between the five remaining factors. The second hypothesis measured Informational Systems and their ability to deal with complexity. The two factors, Digitized Assisted Taxation- DAT and Systemic Tax Complexity- STC correlated and supported the second hypothesis. The third hypothesis was the ability of information system reforms to increase tax awareness. The second correlation concerned information systems and their influence on tax awareness. More specifically the factor Digitized Assisted Taxation positively influenced the factor regarding Citizens Tax Awareness. Thus, the third hypothesis was supported.

The fourth hypothesis referred to tax authorities and tax administration related complexity and its increase of systemic complexity issues. This hypothesis is supported since Administrative Tax Complexity correlates and influences the Systematic Tax complexity. The next hypothesis regarded reforms in the tax system and how the latter decrease systemic complexity. The fourth correlation was expected, and kept mainly because it was strongly supported by literature since the reliability of the Tax System Reforms factor was low. The final hypothesis concerned tax awareness and its negative correlation with tax system complexity, where the hypothesis is significantly supported. It was found that the factor “Systemic Tax Complexity” decreases by higher level of the Citizens Tax Awareness’s factor.

Out of the six hypotheses, four were supported. The reliability of the last two factors “Current Tax Framework” and “Governmental Tax Complexity” was not strong enough to include it in this current research. The first hypothesis concerned the current tax framework and how it influences complexity. Since the seventh factor (CTF) measuring the current tax framework was not reliable, the hypothesis was not supported. The hypotheses and the correlations found are further explained and analyzed in the Discussion section.

DISCUSSION

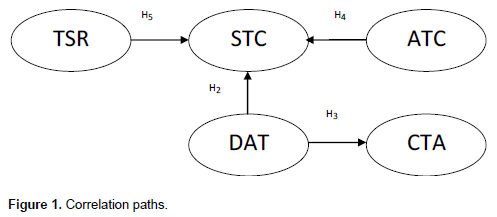

This study provides data on complexity found in a small country’s tax system with turbulent issues regarding tax awareness and tax undergoing tax reforms. It identifies the main correlations between the factors influencing systematic complexity. Determinants that emerged include administrative function’s related complexity of tax authorities, citizens’ tax awareness, digitalization and tax system’s reforms. The correlations of the factors through the research’s hypotheses are shown schematically in Figure 1. Initially, it is understood that the current tax system does not affect systemic complexity. This result can be explained by the fact that the study respondents and questionnaires focused mainly on issues that reduce or increase complexity and do not measure its current levels. Furthermore, the small reliability of the latest factor showed that the factors related to action plans and solutions were found more significant. Information systems and the digitization of the tax system were expected to influence and simplify tax systems (Sadiq, 2021). The impact of information systems also seems to affect the relationship of taxpayers with the tax system. In particular, changes and developments in information systems seem to explain to citizens issues of taxation which they could not understand (Lois et al., 2019b). This was also related to whether the education and training of citizens and tax officials on these systems is sufficient to simplify the procedures. The information available to citizens and tax officials through technology helps them to understand the tax system and its requirements (Lazos et al., 2019). In this way, information systems seem to increase tax awareness (Alm et al., 2017; Lois et al., 2019). However, the tax conscience itself does not directly affect systemic complexity. The latter can be explained by the absoluteness of the system and the possibility of following orders irrelevant to conscience but to necessity.

Administrating tax system and the issues that arise from it were expected to affect systemic complexity as confirmed by literature (Hoppe et al., 2019). Administrations could nurture elements of complexity; thus, administrative causes are directly related to complexity tax officials who are ultimately responsible for implementing tax legislation and guidelines. Government complexity did not seem to affect systemic complexity at this stage. This can be explained by the fact that decisions regarding changes and the need for simplification have already been taken at the governmental level. At the same time, technology and digitization have defined more closely tax processes. Furthermore, copying and applying international tax administration practices and strategies leaves few options for external influences. This is similar to the requirements and directives of International Economic Associations (EU, OECD (Lois et al., 2019)).

Tax reforms in the tax system have been found to affect systemic complexity. Public administration and the need to modernize education and training of employees were expected factors and supported by the literature (Lazos et al., 2019; Lois et al., 2019b). Similarly, the relationship between tax awareness and systemic tax complexity demonstrated negative correlations. Tax complexity is affected by a number of factors. Nevertheless, it seems that in a period of tax reforms, more importance is given to systemic tax complexity. Reform factors of the system regard regulations, tax practices and information systems. These changes affect both citizens and tax officials. On the contrary, the only factor that seems to complicate the tax system was administrative complexity and the way the tax legislation’s enforcement and guidelines are followed during its implementation.

CONCLUSION

Reforms in technology, information systems and tax legislation were found to simplify tax systems. During these changes, some of the traditional tax complexities such as governmental complexity were lessened compared to other types. Administrative complexity in-fluenced and increased complexity through tax legislation implementations. These implementations are performed by tax administrations that further support the results on complexity. The significant role of information systems and technology also simplify the way the taxation system is followed and viewed. Tax reforms were regarded as necessary elements towards simplification. Tax aware-ness was found irrelevant to systemic complexity. However, digitization and information systems were positively correlated with citizens’ tax awareness due to availability of information and clarity of guidelines and procedures.

RESEARCH IMPLICATIONS

Through this research proposal, solutions could be sought to face tax system’s complexity. The latter directly affects citizens and enterprises. Simplification factors increase entrepreneurship levels, since an inflexible and complex tax system deters the private and public sectors’ development. Moreover, the small influence of governmental tax complexity on the general phenomena demonstrates a decentralization of responsibility regarding both complexity and enforcement of tax regulations from the state to tax authorities. Corruption levels, according to the literature, significantly affect simplifications on tax systems (Cabello et al., 2019). However, results indicate that practices of corruption might have moved from their traditional channels.

FUTURE RESEARCH AND RESEARCH LIMITATIONS

The sample was questioned on issues of complexity and not on assessment of the current tax system. Although complexity of the tax system is an issue that greatly concerns literature the case of Greece could cover more specific data on corruption, entrepreneurship and risk management due to fiscal and sanitary crises. Furthermore, research on informal channels that enable black economy could highlight a swift from traditional to modern practices of corruption related and influenced by technology and legislation. The results are obtained from the sample’s perception of tax complexity factors. The findings are supported by literature but more research could include comparative analysis with respective countries from economic groups to which they jointly belong (Freudenberg et al., 2012).

CONFLICT OF INTERESTS

The authors have not declared any conflict of interests.

REFERENCES

|

Alm J, Bloomquist KM, McKee M (2017). When you know your neighbour pays taxes: Information, peer effects and tax compliance. Fiscal Studies 38(4):587-613. |

|

|

Almunia M, Lopez-Rodriguez D (2018). Under the radar: The effects of monitoring firms on tax compliance. American Economic Journal: Economic Policy 10(1):1-38. |

|

|

Awang N, Amran A (2014). Ethics and Tax Compliance. Ethics, Governance and Corporate Crime: Challenges and Consequences. Developments in Corporate Governance and Responsibility 6:105-113. |

|

|

Borrego AC, Lopes CM, Ferreira CM (2018). The perception of tax complexity within local authorities' VAT framework: Evidence from Portugal. In Handbook of Research on Modernization and Accountability in Public Sector Management. pp. 384-405. |

|

|

Bornman M, Ramutumbu P (2019). A conceptual framework of tax knowledge. Meditari Accountancy Research 27(6):823-839. |

|

|

Brockmann H, Genschel P, Seelkopf L (2016). Happy taxation: increasing tax compliance through positive rewards?. Journal of Public Policy 36(3):381-406. |

|

|

Cabello OG, Gaio LE, Watrin C (2019). Tax avoidance in management-owned firms: evidence from Brazil. International Journal of Managerial Finance 15(4):580-592. |

|

|

Carnes GA, Cuccia AD (1996). An analysis of the effect of tax complexity and its perceived justification on equity judgments. Journal of the American Taxation Association 18(2):40-56. |

|

|

Cox SP, Eger III RJ (2006). Procedural complexity of tax administration: The road fund case. Journal of Public Budgeting, Accounting and Financial Management 18(3):259-283. |

|

|

Freudenberg B, Tran-Nam B, Karlinsky S, Gupta R (2012). A comparative analysis of tax advisers' perception of small business tax law complexity: United States, Australia and New Zealand. In Australian Tax Forum 27(4):677-718. |

|

|

Floropoulos J, Halvatzis D, Spathis C, Tsipouridou M (2010). Measuring the success of the Greek Taxation Information System. International Journal of Information Management 30(1):47-56. |

|

|

Stamoulis D, Gouscos D, Georgiadis P, Martakos D (2001). Revisiting public information management for effective e?government services. Information Management and Computer Security 9(4):146-153. |

|

|

Hallsworth M, List JA, Metcalfe RD, Vlaev I (2017). The behavioralist as tax collector: Using natural field experiments to enhance tax compliance. Journal of Public Economics 148(1):14-31. |

|

|

Hertiningtyas I, Yustina AI (2021). Taxation Ethical Issues: Perspectives of Tax Professionals in Indonesia. The Indonesian Journal of Accounting Research 24(1):21-50. |

|

|

Hoppe T, Schanz D, Sturm S, Sureth C (2019). Measuring tax complexity across countries: A survey study on MNCs. Arqus Discussion Paper 245:1-79. |

|

|

Lazos G, Pazarskis M, Karagiorgos A (2019). Business Taxation in the Digital Economy: Existing Problems and Perspectives. Actual Problems of Economics 10:86-92. |

|

|

Lois P, Drogalas G, Karagiorgos A, Chlorou A (2019). Tax compliance during fiscal depression periods: the case of Greece. EuroMed Journal of Business 14(3):274-291. |

|

|

Lois P, Drogalas G, Karagiorgos A, Tsikalakis K (2019b). The Contribution of Internal audit in the Digital era, Opportunities, Risks and Challenges. EuroMed Journal of Business 21(4):645-662. |

|

|

Katharaki M, Tsakas M (2010). Assessing the efficiency and managing the performance of Greek tax offices. Journal of Advances in Management Research 7(1):58-75. |

|

|

Katsios S (2006). The shadow economy and corruption in Greece, South-Eastern Europe Journal of Economics 1:61-80. |

|

|

Organisation for Economic Cooperation and Development (OECD) (2018). OECD Economic Surveys: Greece 2018. Available at: |

|

|

Organisation for Economic Co-operation and Development (OECD) (2019). Tax Administration 2019: Comparative Information on OECD and other Advanced and Emerging Economies. Available at: |

|

|

Papaconstantinou P, Siriopoulos C, Tsagkanos GA (2013). How bureaucracy and corruption affect economic growth and convergence in the European Union The case of Greece. Managerial Finance 39(9):837-847. |

|

|

Saad N (2014). Tax Knowledge, Tax Complexity and Tax Compliance: Taxpayers' view. Procedia - Social and Behavioral Sciences 109(2014):1069-1075. |

|

|

Sadiq M (2021). Impact of making tax digital on small businesses. Journal of Accounting and Taxation 13(4):304-316. |

|

|

Sawyer AJ, Freudenberg B, Yong S, Lo K (2019). Tax Compliance in the New Millennium. UC Business School Conference Contributions pp. 1-45. |

|

|

Tran?Nam B, Evans C (2014). Towards the development of a tax system complexity index. Fiscal Studies 35(3):341-370. |

|

|

Vincent O (2021). The development of a scale to measure SMEs tax compliance in Nigeria: An adaptation of Fischers model. Journal of Accounting and Taxation 13(3):132-143. |

|

|

Vousinas LG (2017). Shadow economy and tax evasion. The Achilles heel of Greek economy. Determinants, effects and policy proposals. Journal of Money Laundering Control 20(4):386-404. |

|

|

Yong S, Lo K, Freudenberg B, Sawyer A (2019). Tax compliance in the new millennium: Understanding the variables. In Australian Tax Forum 34(4):766-808. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0