Full Length Research Paper

ABSTRACT

IFRS 9 is a global standard whose impact is expected to vary depending on banks’ credit risk approach, size, and country of incorporation. Therefore, it is imperative to study the implementation effects of IFRS 9 in all regions in which IFRS 9 has been implemented. This paper examines the first-time post-adoption effects of IFRS 9 in the Ghanaian banking sector and addresses the gap in empirical academic literature from an African context regarding the implementation effects of IFRS 9. The study found that regulatory capital was adversely affected as a result of an increase in impairment charge at the transition to IFRS 9 on 1st January, 2018. Loan loss provision increased due to timely recognition of expected credit losses. Despite the peculiar context of this study, the results are generally consistent with theoretical and empirical literature from the European region. The findings suggest that a proper regulatory and supervisory framework, as well as consistent application of IFRS 9 will be essential to leverage optimal benefit from the standard.

Key words: IFRS 9, expected credit loss, regulatory capital, impairment charge, banks.

INTRODUCTION

The 2007-2008 financial crisis, due to its severity and transmission mechanism, revealed the intricate and inter-woven connections among financial institutions at the global level. Though a lot of factors were ascribed to the crisis, central to it was the drastic increase in financial innovation and sophisticated financial instruments such as mortgage-backed securities (MBS) without adequate supervision and regulation. As a sequel to this, the attention of supervisory and regulatory bodies was drawn to the need to tighten supervision and regulations in the financial sector. The response of the International Accounting Standards Board (2009) was the introduction of the International Financial Reporting Standard 9 – IFRS 9 (Financial Instruments). The effective date of this standard was 1st January 2018. The objective of this standard is to address the significant adverse effect of untimely recognition of credit loss on the financial positions of banks as revealed by the financial crisis. The standard seeks to create a more stable and formidable financial system since financial instruments account for a significant portion of banks’ financial position. The recognition by regulators that accounting rules can fundamentally impact bank stability is reflected in proposals issued by the Financial Stability Forum (2009) and the US Treasury (2009) strongly recommending that both the Financial Accounting Standard Board (FASB) and IASB re-evaluate fair value accounting, accounting for loan losses, and hedge accounting among other issues.

Academic literature found that some banks exploited accounting discretion during the 2007-2008 financial crisis (Huizinga and Laeven, 2012). Huizinga and Laeven (2012) posited that banks with higher levels of private-label mortgage-backed securities (MBS) on their balance sheets are more likely to overstate the carrying value of their assets by failing to take timely write-downs, delay loan loss provisions and reclassify available-for-sale MBS as held-to-maturity when the fair value of these MBS was less than their amortized cost. Bhat and Ryan (2015) found that banks that rely more on a statistical analysis of loan performance are timelier in recognizing losses in the pre-crisis boom period and late in the financial crisis, but less timely in the financial crisis compared to those that use stress tests. From the above, it is evident the incurred loss model under the International Accounting Standard (IAS) 39 was more reactive and therefore untimely. De Haan and Van Oordt (2018) succinctly stated previous model’s loan losses provisions (LLP) are now considered to be “too little, too late”.

In light of this, International Financial Reporting Standard 9 (IFRS 9), which became effective on 1st January, 2018 introduced new accounting rules for dealing with financial assets, financial liabilities, impairment methodology, fair value options, and hedge accounting. This standard integrates a proactive and forward-looking approach in the estimation and recognition of loan loss provision. IFRS compliant firms are obliged to adopt the Expected Credit Loss (ECL) model under IFRS 9 as a replacement for the Incurred Loan Loss (ILL) model previously used under IAS 39. Based on the robust requirements of this standard, it is very glaring that its impact on enhancing the financial soundness and stability of the banking sector cannot be undermined. The application of the new standard has been obligatory since 1st January 2018 and is expected to have a major impact on the banks’ balance sheets (Bloomberg, 2018).

Though there is diverse literature on IFRS adoption in general, specific literature on IFRS 9 post-adoption effect is very nascent and scarce as the standard became effective barely a few years ago. The few existing literature on the post-adoption effects of IFRS 9 has mostly centered on European Banks. The current strand of literature on this theme is mostly theoretical literature with few empirical studies. Publications by the “big four” audit firms such as PwC, Deloitte, KPMG, and Ernst and Young (EY) all shed light on the expected implications of the standard with less being shed on its actual impact. Ntaikou et al. (2018) focused on the expected impact of IFRS 9 on the Greek banking system. Deloitte in its July 2019 publication shed light on the initial impacts on 6 major UK banks. European Banking Institute (Loew et al., 2019) also shed light on the first-time application effects on European Banks' balance sheets. IFRS 9 is a global standard whose application is not limited to Europe but also in other jurisdictions such as Asia, Africa, etc. Deloitte (2016b) and EY (2018) argued that the impact of IFRS 9 on banks is expected to be influenced by country of incorporation and size. It is therefore imperative to study the implementation effects of IFRS 9 in all regions for which IFRS 9 has been implemented or adopted. In contrast, empirical academic studies on the post-implementation effect of this standard on African banks are very limited or barely available.

The prime contribution of this study is to primarily address the gap in the empirical literature on the post-implementation effects of IFRS 9 from an African context by placing a central focus on the Ghanaian banking sector. To the best of our knowledge, this study is novel to Ghanaian literature on this theme. Based on trend analysis of the published audited financial statements of the banks, it was found that regulatory capital was adversely affected as a result of an increase in impairment charge at the transition to IFRS 9 on 1st January 2018. Loan loss provision increased significantly. In terms of classification and measurement, most financial assets remained in their original classification category under IAS 39 with few changes as amortized cost still accounts for a significant proportion of the entire portfolio of financial assets held by the banks. The result of the study bridges the gap between research and policy as it emphasizes the need for banks to strengthen their risk management and credit methodology to reduce their risk exposure from non-performing loans. Also, due to the high level of managerial discretion involved in the estimation of Expected Credit Losses (ECLs), the regulatory and supervisory body (Bank of Ghana) is admonished to strengthen its surveillance over the risk management practices of the banks to ensure strict adherence to all regulatory directives. This will reduce the buildup of excessive risk in the banking system and also ensure consistent application of the standard.

The rest of the study is structured as follows. The next section presents a review of the theoretical and empirical literature on IFRS 9. This is followed by the research design and methodology, discussion of results and conclusion.

LITERATURE REVIEW

The transition from IAS 39 to IFRS 9

Accounting to financial instruments under IAS 39 became a controversial subject in the industry as well as academia as the standard was viewed as too complicated. As a result, reforming financial instruments accounting was determined a high-priority project resulting from the Norwalk Agreement of 2002 (Deloitte, 2019b). The financial crisis of 2008 necessitated the implementation of IFRS 9, as several parties including (G20 and Financial Crisis Advisory Group) expressed concerns about IAS 39’s inherent flaws (IASB, 2014). The “too little, too late” approach in terms of provisions was extensively criticized, sparking the need for a new standard requiring more forward-looking information in the estimation of credit losses (ECB 2017). In response to this, the IASB in 2008, commenced a project to develop a solution. The final version of IFRS 9 Financial Instruments was published in July 2014 (IASB, 2014) and replaced the International Accounting Standards (IAS) 39 effective on the fiscal year commencing 1st January 2018. The key differences between these standards stem from the classification and measurement criteria of the financial instruments, measurement, and recognition of expected credit losses and in hedge accounting. In the context of IFRS 9, changes to financial instruments accounting were introduced in three phases: (1) Classification and measurement, (2) impairment, and (3) hedge accounting (EY 2017).

Theoretical review

Publication by regulatory bodies

European regulators have been at the forefront of research to ascertain the key impacts and challenges associated with the implementation of IFRS 9. Key among these institutions is the European Banking Authority (EBA) which released its initial impact assessment in 2016. A second impact assessment was issued in 2017. EBA (2017) opined that the two assessments showed consistent results. The third impact assessment in 2018 corroborated previous findings despite a small shift in estimated impact severity (EBA 2018).

One of the major findings of the EBA’s studies is the reported negative effect on Common Equity Tier 1 (CET1) ratios. Majority of the fifty European banks surveyed expected a decrease of about 47 basis points (bps) whilst 25% of the surveyed banks expected almost a decrease of 75bps. The EBA posited that the impact seemed to be smaller for firms applying the internal rating-based approach (IRBA) for credit risk as against the standardized approach (SA). EBA (2018) indicated that the impact might have been because, in contrast to SA banks, regulatory expected losses of IRBA banks had already been reflected in CET1. As a way of mitigating the impact of IFRS 9 on regulatory capital, the European authorities introduced the 5-year transitional arrangement to enable banks to absorb the initial impact over this period. Within this transitional arrangement, banks that experience an adverse effect on their common equity following the IFRS 9 introduction can add back the increase in loss allowance to the CET1 ratio. The amount added back is expected to decrease over time until everything is depleted after a maximum of 5 years (European Parliament 2017).

The EBA studies further revealed the inflating impact on provisions of about 13%, with 25% of the banks expecting an increase of 18%. Again, the findings suggested that the effect is less severe for smaller banks using the SA but higher for banks using the IRBA. About 70% of the respondent expected rising volatility in profit and loss with an insignificant impact expected in terms of classification and measurement.

Publication by auditors and consultancies

The “Big 4” audit firms remain a major force to reckon with regarding the interpretation of financial reporting standards. They have published reliable accounting literature on past regulations and accounting standards and can be regarded as a major source for the interpretation of the original guidelines (Bloomberg 2018). The implementation of new systems and processes because of IFRS 9’s new requirements renders the implementation of IFRS 9 an uphill task (PwC, 2017a). Audit firms and Consultancies expect significant impacts on the balance sheets due to different classification and re-measurement of financial instruments and new impairment rules for financial securities (Gruber, Engelbrechtsmüller 2016). The review under this section focuses on the classification and measurement effect, the overall impact on equity, and the impairment effect.

Classification and measurement effect: A greater percentage of assets are expected to remain in their current measurement category (PwC, 2017a; PwC, 2017b). In effect, most assets previously designated as loans and receivables or held-to-maturity, thus measured at amortized cost will still be measured at amortized cost and most assets previously measured through profit or loss will be measured through profit or loss (PwC, 2017a; PwC, 2017b).

Impact on equity: The impact on equity is projected to vary depending on the banks' credit risk approach, country of incorporation, and size (Deloitte 2016, EY 2018). Specifically, SA banks are expected to suffer capital reduction twice as much as IRBA banks (Deloitte 2016). It is expected that the rise in impairment on the transition to IFRS 9 on 1st January 2018 will affect the net profit of the banks. Undistributed profit for the year is immediately reflected in retained earnings. Retained earnings form part of the Common Equity Tier 1 (CET1) capital; the highest core capital item of the banks. Thus, theoretical literature expects a decrease in the CET1 capital following the initial transition to IFRS 9. Also, the effect on equity is expected to differ considerably among the banks. Some banks are projected to witness a positive effect of re-classification which is expected to balance out the increase in impairment provisions. Banks that fall within this category are thus expected to witness a small reduction in equity.

Impairment effect: IFRS 9 implementation is invariably expected to have a far-reaching impact on impairment or loan loss provisions. However, the severity of the impact is dependent on whether the bank is using IRBA and SA in their credit assessment. The reason for the expected increase in loan loss provisions for SA banks and the shortfall of the expected loss compared to the IFRS 9 expected loss of IRBA banks is assumed to be mainly caused by the lifetime expected losses for assets allocated to stage 2 as well as "downturn factors in regulatory measures" (Deloitte, 2014).

Academic literature

From academic literature, a decrease in the CET1 ratio is expected due to the change from an incurred to an expected credit loss model (Novotny-Farkas, 2016; Löw and Kluger, 2018). According to Löw and Kluger (2018), a greater effect is expected for SA banks as opposed to IRBA banks due to possible positive effects of the valuation allowance comparison of capital requirement regulation (CRR). In the first year of implementation, the overall first-time implementation effects on European banks are expected to be low to moderate given the 5-year transitional arrangement instituted by the European supervisory authorities (Löw and Kluger, 2018). Besides the reduction of the overstatement of regulatory capital, IFRS 9 is expected to increase its volatility (Novotny-Farkas, 2016).

In terms of classification and measurement effect, Bischof and Daske (2016) argued that IAS 39 loans and receivables, as well as held-to-maturity assets, will mostly satisfy the requirements and continue to be accounted for at amortized cost. The use of the fair value option will remain quite limited (Bischof and Daske, 2016). Similarly, they posited that IAS 39 fair value assets will mainly continue to be accounted for at fair value (Bischof and Daske, 2016).

Thus, it is expected that the implementation of IFRS 9 will only increase the average level of fair value usage modestly and amortized cost will remain the largest category (Bischof and Daske, 2016). In effect, the balance sheet structure in terms of the composition of amortized cost (AC), fair value through profit or loss (FVPL), fair value option (FVO), and fair value through other comprehensive income (FVOCI) is expected to be rather small (Weber, 2018).

According to Krüger et al. (2018), IFRS 9 is envisaged to result in a more adequate and timely recognition of economic values in terms of impairment effects. Some researchers argued that overall earlier and larger loan loss reserves are to be expected due to the forward-looking approach (Novotny-Farkas, 2015).

Empirical review

The current strand of the empirical literature on the first-time implementation impacts of IFRS 9 has mostly been published by regulators and the “big 4” audit firms. The empirical academic literature is scarce on the above subject. The focus of this section is to highlight some empirical findings on IFRS 9 implementation effects mostly from the regulatory bodies and the audit firms. It is structured on overall balance sheet effects, equity effects, classification, and measurement effects as well as impairment effects.

Effects on balance sheet: The European Banking Institute (Loew et al., 2019) identified post-implementation effects on significant balance sheet line items. The findings revealed a significant increase in total commercial loans than consumer loans. However, this was attributable to a change in the overall economic environment rather than an IFRS 9 effect. Other assets increased significantly in relative terms due to the re-classification of financial assets (e.g. contract assets) per IFRS 9. The non-performing loans (NPLs) increased significantly in 2018, having decreased in prior years.

Effects on equity: Empirical studies conducted by the European Banking Institute (Loew et al., 2019) revealed that the majority of European banks experienced a reduction in equity following the implementation of IFRS 9. CET1 capital introduced under BASEL III includes common shares, share surplus, retained earnings, other comprehensive income, and minority interest. It, therefore, stands to reason that, impairment provisions will subsequently affect regulatory capital through the impact on the income statement. Undistributed net profit for the year is transferred to retained earnings which is a key component of CET1 capital. Categorically, they will be immediately reflected in the CET1 ratio (BIS 2018). The findings further suggest that the impact severity is mostly in line with the expectations described in the theoretical literature.

Another study by Deloitte on six major UK banks supported the above empirical findings. Although the banks experienced increased impairment provisions at the transition to IFRS 9 on 1st January 2018, other offsetting factors such as positive classification and measurement effects on accounting reserve and IFRS 9 transitional arrangements among others mitigated the impact (Deloitte, 2019a). Again, it is further observed that the impact of IFRS 9 on regulatory capital is dependent on whether exposures are measured under SA or IRB modeling approach. This further affirms the theoretical literature concerning the impact of the standard on regulatory capital. A similar study conducted by Deloitte (2019b) on five major Nigerian Banks on the post-implementation impact of IFRS 9 also supported the above studies.

Effects on classification and measurement: The actual classification effects are closely in line with the expectations of theoretical literature. The majority of financial assets such as loans and receivables and held-to-maturity remain in their original category as amortized cost, as they do meet the cash flow criterion and are held in a business model “held to collect” contractual cash flows (Loew et al., 2019).

Loans and receivables make up the biggest part of the new carrying value of financial assets at amortized costs. Financial instruments measured at amortized cost account for the largest portion of the bank’s financial asset portfolio.

Portfolios classified as “mixed” (where assets are partly held to collect contractual payments and partly sold but with a significantly lower frequency than in trading), such as promissory note portfolios or asset-backed securities, are reclassified to fair value through other comprehensive income (FVOCI).

The results further indicated that financial assets measured at fair value through profit or loss (FVPL) accounted for about 21% of the overall portfolio. The increase reflects the result of failed SPPI tests reclassified from loans and receivables and available for sale financial assets. Furthermore, financial assets previously designated at FVPL under IAS 39 were reclassified based on their SPPI test and business model designation (Loew et al., 2019). Some loans and advances that were measured at FVPL as trading assets under IAS 39 are measured at AC or FVOCI as a result of the business model designation and the fulfillment of the cash-flow criterion.

Effects on impairment: Deloitte’s study on the six major banks in the UK showed that all the banks experienced an increase in impairment provision at the transition to IFRS 9 on 1st January 2018. Total IFRS 9 impairment charge in the 2018 reporting period remained generally in line with or slightly lower than the IAS 39 equivalent in the previous two reporting periods (Deloitte, 2019a). The results of similar studies by Deloitte on 5 major Nigerian banks do not differ significantly from the above studies on the 6 major UK banks. All the banks experienced an increase in impairment charges during the transitional phase of IFRS 9. Subsequently, the banks experienced a general decrease in IFRS 9 impairment charges during the 2018 financial year compared to the IAS 39 equivalent charge for the previous period (Deloitte, 2019a).

Further studies by EBI showed a decrease in the loan loss reserve. The loan loss reserve is a balance sheet line item that represents accumulated loan loss provision over several years. This reserve is increased by additional loan loss provision and decreased by quarterly charge-off each year. Whilst banks and consultancies expected an increase in loan loss reserve, academic researchers projected it to be fairly stable.

From the above literature review, it is evident the impact of IFRS 9 to some extent depends on the credit risk approach of the banks, country of incorporation and size of the banks (Deloitte, 2016; EY, 2018). It is therefore imperative to study the implementation effects of IFRS 9 in all regions for which IFRS 9 has been implemented or adopted. However, empirical academic literature on African banks is rarely available. Therefore, this paper seeks to fill this gap in empirical literature by examining the first-time adoption effects of IFRS 9 from an African perspective by placing a central focus on the Ghanaian banking sector.

RESEARCH DESIGN AND METHODOLOGY

This paper adopts a quantitative and descriptive approach to study the post-adoption effects of IFRS 9 on equity, impairment provisions, non-performing loans (NPLs) and classification and measurement of financial assets. Qualitative disclosures by these banks were taken into consideration to complement the quantitative analysis to have a holistic view of the effects. The study used published audited annual reports of Ghanaian banks from 2016-2018. “Ghanaian banks” herein refer to all licensed commercial banks with operational existence in Ghana and not solely Ghanaian-owned banks.

For each institution, mainly two data sources were used. Firstly, the published audited annual reports as PDF versions were obtained from the corporate websites. They contain both quantitative data as well as qualitative comments.

External auditors are known to give credibility and reliability to financial statements by offering independent audit opinions. Therefore, by using data hand collected from published audited annual reports, the author can guarantee the robustness and reliability of the data for the study. The 2017-2018 banking sector crisis in Ghana led to the revocation of licenses of some commercial banks as well as the consolidation of some banks. Coincidentally, the 2018 fiscal year corresponds with the period for the first time mandatory adoption of IFRS 9 in the Ghanaian banking sector. Thus, the proposed study covered all licensed commercial banks that existed before and after the mandatory adoption of IFRS 9 on 1st January 2018. The study period covered 2015 to 2018 fiscal years. To complement the published audited annual reports, some banks published detailed transition reports as well as further press releases that were considered.

This study adopted a simple random sampling approach as it made equal room for all banks to be selected on grounds of data availability for the pre and post-IFRS 9 eras. The study covered all commercial banks operating in Ghana before and after the implementation of IFRS 9. Before the mandatory adoption of IFRS 9 in 2018, there were 34 commercial banks. However, the banking sector re-capitalization in Ghana which ended on 31st December, 2018 saw some banks exiting the banking space while others were consolidated. After the recapitalization exercise in 2018, the total number of operating commercial banks in Ghana stood at 23. The target population comprised 23 commercial banks as of December 31st, 2018 from which the sample was drawn. To end up with the desired homogeneity, the first filter regarding the sample relates to the elimination of banks that could not meet the recapitalization and were eventually phased out. The second filter was dependent on data availability for the pre and post-IFRS 9 study period. Thus, 4 newly formed consolidated banks were taken out due to the unavailability of data for the pre-IFRS 9 era since these newly consolidated banks were not in operational existence. In effect, the sample size was 19 commercial banks. The final sample however contained 17 banks as data for two of the remaining banks was not readily available. The final list of the sampled banks is shown in Appendix Table 1.

Trend analysis of the published financial statements was used to determine the variations in key balance sheet items as a result of the adoption of IFRS 9. It is worthy of mention that IFRS 9 made room for banks to either apply the full retrospective application or modified retrospective application. The full retrospective application involves the restatement of the financial statement for the earliest comparative period before the implementation of the new standard. Since IFRS 9 implementation was effective on 1st January 2018, the 2017 financial statement which serves as the earliest comparative would have been restated to comply with IFRS 9 if the banks adopted the full retrospective application. The modified retrospective application involves effecting the adjustment of the new standard that would have had on the earliest comparative financial statement as a line item in the retained earnings through the Statement of Changes in Equity. Due to the ease of the modified retrospective application, all banks in Ghana adopted that approach just like the majority of the banks in other jurisdictions. Thus, a direct comparison of the 2018 financial statement with the 2017 comparative financial statement was not feasible. Therefore, in measuring the first-time (short-term) post-adoption effects of IFRS 9 on Ghanaian banks, the author considered the preceding 3 years' average of selected income statement and balance sheet items expected to be impacted following the implementation of IFRS 9 on 1st January 2018. In effect, the average change for 2015, 2016, and 2017 representing the usual volatility in the banks’ financial years was calculated. The average of this usual change was then compared with the change in the 2018 financial year to determine the change as a result of IFRS 9 adoption. The excess of the 2018 change over the average usual change is used to visualize the immediate post-adoption effects of IFRS 9. Also, peculiar developments in the Ghanaian banking sector such as the effects of the 2017-2018 banking crisis and the introduction of the new minimum regulatory capital in the 2018 fiscal year were all taken into account in analyzing and interpreting our results. Descriptive statistics were used to analyze, visualize and interpret the results of this study.

RESULTS

Balance sheet effects

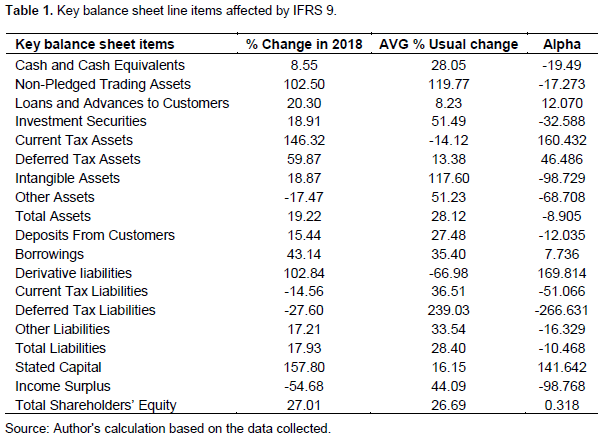

Key balance sheet line items were selected and analyzed to examine the first-time adoption effects of IFRS 9 on the balance sheets of Ghanaian banks (Table 1). The percentage change for the 2018 financial year was calculated. The 2018 financial year represents the year for the first time implementation of IFRS 9. Also, the average percentage change for the years 2015, 2016, and 2017 was calculated. The change from 2015 to the 2017 fiscal year represents the usual change in the balance sheet items as a result of the normal volatility in the operating environment of the studied banks.

This enabled us to visualize the abnormal change which was not due to the normal operating conditions. Alpha denotes the difference between the percentage changes in 2018 compared to the average percentage usual changes.

Thus, Alpha represents the excess of the normal balance sheet volatility and provides a useful measure of the volatility triggered by IFRS 9. The calculated data is aggregated across the whole sample, dependent on data availability.

The high decrease in Alpha for cash and cash equivalent is mainly attributable to the banking crisis and consolidation of some banks in 2018 which caused panic withdrawal by some customers. This effect is therefore not a major IFRS 9 shift. Non-pledged trading securities decreased significantly following the implementation of IFRS 9 partly as a result of changes in the classification and measurement of financial assets. According to theoretical literature, the overall amount of outstanding loans is expected to decrease following IFRS 9 implementation as the rise in impairment charges at the transition to IFRS 9 is expected to reduce outstanding loan balances. In contrast, our study found an increase in the overall amount of outstanding loans and advances. This effect is partly explained by the injection of fresh capital by the under-capitalized banks in their bid to meet the Bank of Ghana’s new minimum capital requirement. Under-capitalized banks, therefore, introduced additional capital which increased their ability to lend more loans to the public. Thus, the high Alpha for loans and advances is not a major IFRS 9 shift. The change in other assets is partly due to changes in the classification and measurement of financial assets as a result of IFRS 9. Deposits from customers decreased significantly not because of IFRS 9 introduction but mainly due to the uncertainty brought about by the banking crisis. Even though most liabilities such as derivative liabilities, current, and deferred tax liabilities saw significant changes, this effect is not attributable to IFRS 9, as the treatment of financial liabilities remained largely unchanged. Stated capital increased drastically as a result of the injection of additional capital. This change is therefore not an IFRS 9 change.

Income surplus decreased significantly as a result of the IFRS 9 impact. The impact on equity will be explained further under the equity effect.

Equity effects

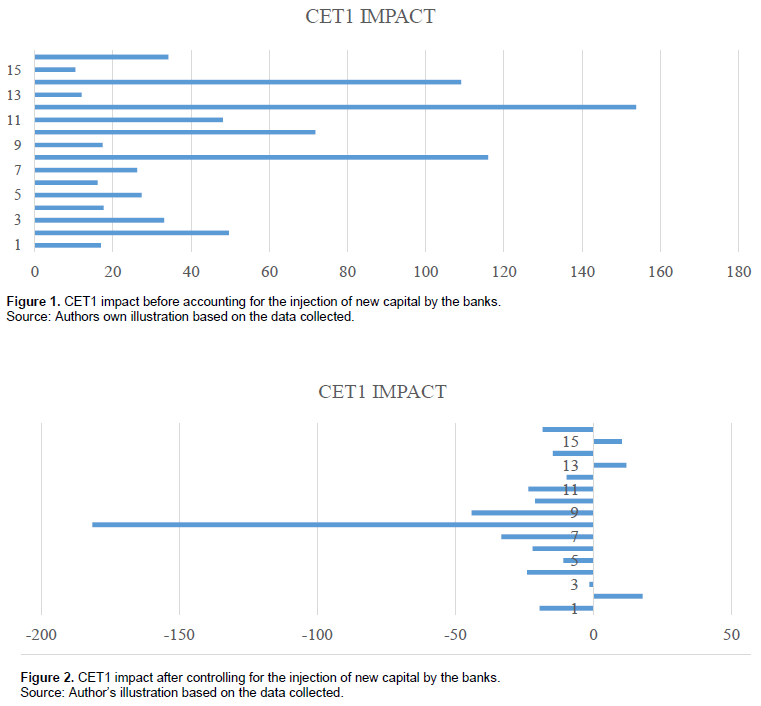

One of the major impacts of IFRS 9 according to the literature review is its impact on Common Equity Tier1 (CET1) ratio.

CET1 capital represents the highest quality or core capital items. The ratio was introduced by Basel III and measures capital in terms of the percentage of an institution’s risk-weighted assets. The CET1 capital includes common shares or stated capital, share surplus, retained earnings or income surplus, other comprehensive income (OCI), and minority interest. Impairment provisions net of tax arising under IFRS 9 will therefore directly affect regulatory capital through the profit and loss statement as undistributed profit or loss for the period is transferred to retained earnings or income surplus. Conclusively, they will be immediately reflected in the CET1 ratio (BIS 2018).

At first glance from Figure 1, all the studied banks recorded a significant increase in CET1 capital contrary to the expectation in the literature. However, this unusual expectation is not one of the major impacts of IFRS 9. The increase in the CET1 capital was a result of the introduction of the additional capital by the under-capitalized banks to meet the new minimum capital requirement introduced by the Bank of Ghana in 2018. According to PwC Ghana Banking Sector Survey, over GHS1.5 billion was injected as fresh capital into the banking sector in 2018. It is therefore not surprising that all the banks recorded a significant rise in CET1. The capital adequacy ratio increased to 23.42% in 2018 compared to 19.45% and 17.28% in 2017 and 2016 respectively. However, this effect is not a major IFRS 9 shift but basically, a result of the increase in minimum capital. Thus, a further level of analysis was essential to better visualize IFRS 9’s impact on the CET1 capital. Figure 2 shows the actual impact of IFRS 9 on the CET1 capital after controlling for the additional capital introduced.

The variation in stated capital between the 2018 and 2017 financial years shows the additional capital introduced by the banks in 2018. After this effect is taken into account, it is observed that 80% of the studied banks recorded a negative reduction in CET1 capital which corroborates the expectation of the literature. The negative effect on CET1 capital was a result of the increase in impairment charge at the transition to IFRS 9 on 1st January 2018. This impacted the net profit for the period which in turn affected the retained earnings or income surplus as seen under the overall balance sheet effects. Since retained earnings or income surplus forms part of the CET1 capital, a decrease in the retained earnings ultimately affected the CET1 capital negatively. Only 20% of the sampled banks recorded an increase in CET1 capital after the introduction of IFRS 9.

Impairment effects

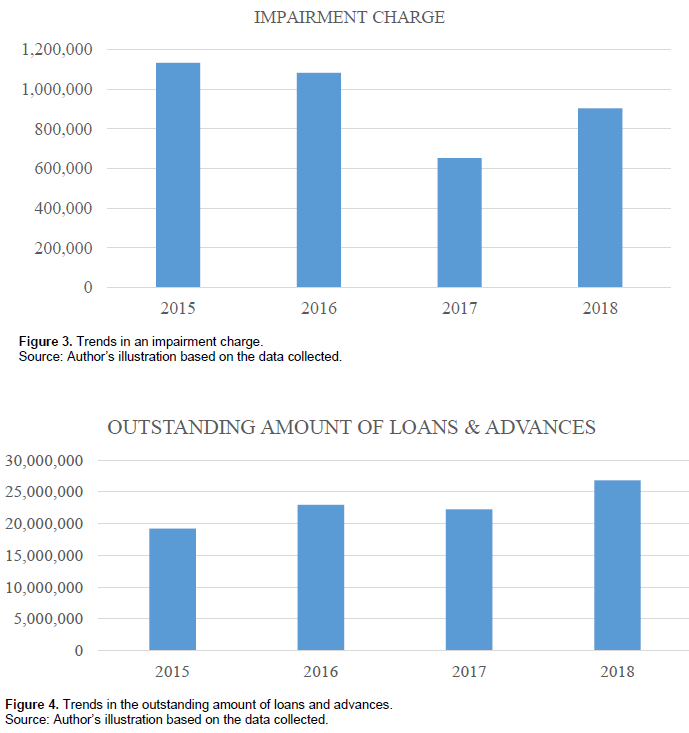

As seen from the literature review, it is obvious that one of the significant changes that the introduction of IFRS 9 brings is the expected credit loss model. This model is projected to result in earlier and timely recognition of credit loss right from the origination of loans and advances. The expected credit loss model is projected to increase impairment charges which will reduce the overall amount of outstanding loans and advances. Figure 3 shows the development in an impairment charge in Ghana Cedi (GHS) among the studied banks from the period 2015 to 2018.

It can be observed from Figure 3 that, the yearly impairment charge by the sampled banks decreased consistently till 2017. However, when IFRS 9 was implemented in 2018, the impairment charge increased. This supports the expectation in the literature that the implementation of IFRS 9 is expected to increase impairment provisions. The increase in an impairment charge for the 2018 financial year was mainly a result of an increase in impairment provision at the transition to IFRS 9 on 1st January 2018. As explained under the equity effect, the increase in an impairment charge for the year affected the net profit, thereby hurting regulatory capital through its impact on retained earnings. The three years average non-performing loan ratio for the studied banks was 18.78% compared to 19.55% in 2018.

In terms of IFRS 9 impact on the overall outstanding amount of loans and advances, our result is different from the expectation in the literature. Though the majority of the banks experienced a significant increase in impairment charges after the adoption of IFRS 9 in 2018, other offsetting factors such as the injection of additional capital by the under-capitalized banks increased the number of loans and advances granted in 2018. The increase in loans and advances during the year was enough to mitigate the impact of high impairment provisions on the overall amount of outstanding loans and advances at the end of the 2018 fiscal year. Figure 4 shows trends in the outstanding amounts of loans and advances.

The outstanding amount of loans and advances increased in the 2018 financial year contrary to the expectation of literature and prior studies. This is a result of other factors such as the new minimum capital requirement directive by the Bank of Ghana which enabled the banks to grant more loans in 2018 and not necessarily the IFRS 9 effect.

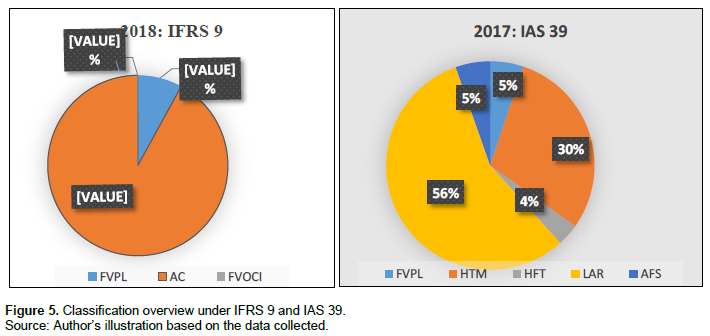

Classification and measurement effects

The effects on classification and measurement are broadly in line with the expectations discussed in the literature. The findings show that most financial assets remained in the initial classification and measurement category under IAS 39. Figure 5 provides an overview of the classification category under both IFRS 9 and IAS 39.

Following the adoption of IFRS 9, the majority of financial assets such as loans and advances, receivables, and held-to-maturity are still classified as amortized costs as they passed the sole payments of principal and interest (SPPI) test.

Thus, they still met the cash flow criterion and are held in a business model “held to collect” contractual cash flows. Loans and advances, as well as receivables, formed a significant portion of financial assets classified as an amortized cost under IFRS 9. Under IAS 39, loans and advances and held to maturity financial assets jointly accounted for 86% of the entire portfolio of financial assets. Amortized cost financial assets formed 91.99% of the overall portfolio of financial assets under the new standard. This compared with the 86% under IAS 39 indicated that there was no significant change in financial assets held in a business model for their contractual cash flows.

Under IAS 39, financial assets at fair value through profit or loss (FVPL) and held for trading financial assets (HTM) jointly accounted for 10% of the overall portfolio of financial assets, whilst under IFRS 9, fair value through profit or loss (FVPL) financial assets accounted for 7.99% of the gross portfolio of financial assets. Financial assets that did not meet the amortized cost and fair value through profit or loss criterion were subsequently reclassified as fair value through other comprehensive income (FVOCI). These included financial assets that were previously designated as available for sale (AFS) under IAS 39. Available for sale financial assets are mixed portfolios assets partly held to collect contractual payments and partly sold but with a significantly lower frequency than in trading. Available for sale financial assets that no longer met the contractual cash flow characteristics were reclassified as fair value through profit or loss. Therefore, financial assets carried at fair value through other comprehensive income (FVOCI) accounted for a negligible 0.02% of the total portfolio of financial assets under IFRS 9 while available for sale (AFS) financial assets measured at fair value through other comprehensive income (FVOCI) accounted for 5% of the portfolio under IAS 39. The classification and measurement of financial liabilities nevertheless largely remained unchanged under both IFRS 9 and IAS 39.

CONCLUSION

The adoption of IFRS 9 (Financial Instruments) is expected to significantly impact financial institutions as financial instruments account for a significant portion of their balance sheets. Theoretical literature argues that the impact of IFRS 9 is projected to vary depending on the banks' credit risk approach, country of incorporation, and size (Deloitte, 2016; EY, 2018). It is therefore imperative to study the implementation effects of IFRS 9 in all regions for which IFRS 9 has been implemented or adopted. In contrast, empirical academic studies on the post-implementation effect of this standard on African banks are very limited or barely available. Thus, this paper was necessitated by the gap in empirical knowledge on the post-implementation effects of IFRS 9 from an African context. This study investigated the first-time implementation impacts of IFRS 9 on Ghanaian banks by sampling 17 out of the 23 operating commercial banks due to data availability. The study period covered 2015 to 2018 financial years using financial data hand collected from the published audited annual reports of the sampled banks as well as useful press releases and commentaries on the transitional impacts of IFRS 9.

Trend analysis of the financial statement was employed to study the post-adoption effects of IFRS 9 on regulatory capital (CET1 capital), impairment provisions and non-performing loans (NPLs). Qualitative disclosures by these banks were taken into consideration to complement the quantitative analysis to have a holistic view of the effects. The author accounted for the usual volatility in the banks’ financials due to the changes in the economic and operating environment over the three years before the implementation of IFRS 9. This usual change represents the yearly change that is not caused by IFRS 9. The average of this usual change is then compared with the change in the 2018 financial year to determine the change as a result of IFRS 9.

The results of the study were broadly in line with the expectation of the literature. The findings of the study indicated that the overall balance sheet effects are broadly aligned with literature with few exceptions. Balance sheet line items such as non-pledge trading assets and other assets recorded significant changes as a result of changes in classification and measurement. On the other hand, outstanding loans and advances increased, contrary to the expectation of literature as a result of the new minimum capital requirement which increased the banks’ lending abilities. Therefore, this is not IFRS 9 shift. Retained earnings were adversely affected due to the rise in impairment provisions. Treatment of financial liabilities largely remained the same.

The study also revealed that in terms of the impact of IFRS 9 on regulatory capital, it appeared that regulatory capital in the form of common equity tier 1 capital increased. This increase was basically due to the increase in minimum capital requirement by the Bank of Ghana which saw the injection of fresh capital by the majority of the banks. A further analysis controlling for the effect of the additional capital revealed that 80% of the studied banks recorded a decrease in their CET1 capital mainly as a result of an increase in impairment charge for the 2018 financial year which reduced the net profit and thus affected the regulatory capital negatively.

The impact of IFRS 9 on impairment supported the results of prior studies as the majority of the banks recorded an increase in impairment provision at the transition to IFRS 9 on 1st January 2018. The high impairment charge negatively affected regulatory capital. In terms of the impact of a high impairment charge on the outstanding amount of loans and advances, the findings showed that despite the rise in impairment provision, the outstanding amount of loans and advances increased on grounds of the additional capital injection which made room for the banks to advance more credit in the 2018 fiscal year.

On the classification and measurement of financial assets, the study showed that amortized costs accounted for a significant portion of the overall portfolio of financial assets held by these banks. There was no significant change in terms of classification and measurement of financial liabilities.

The study contributes to the existing body of literature on the post-implementation effects of IFRS 9 on firms. Most importantly, it contributes significantly to the non-existing empirical academic literature on IFRS 9 in Africa by drawing insight into the first-time adoption effects of IFRS 9 on Ghanaian banks. It serves as the prima reference point for assessing the actual impacts of IFRS 9 on African banks and provides a baseline for future evaluation of the long-term impact of IFRS 9 on other sectors in Ghana and Africa at large. The implementation effects of IFRS 9 are projected to differ across jurisdictions due to the country of incorporation and firm size. The results of this study are thus very useful for global standards setters such as the International Accounting Standards Board (IASB) who need feedback from all regions for which IFRS 9 has been implemented to form a basis for future revision and or modification to this standard. The findings suggest that a proper regulatory and supervisory framework, as well as consistent application of IFRS 9, will be essential to leverage optimal utility from the standard.

One of the main limitations of this research is the short study horizon as it focused on the immediate post-adoption effects of IFRS 9, that is, the first-year implementation effect using trend analysis. With the availability of data, future research should focus on investigating the long-term impact of IFRS 9 in the Ghanaian banking sector as some of the effects are not immediately visible. More so, future studies can be extended to Sub-Saharan Africa as empirical literature on IFRS 9 adoption is very scarce from this region.

CONFLICT OF INTERESTS

The author has not declared any conflict of interests.

REFERENCES

|

Bhat G, Ryan SG (2015). The impact of risk modeling on the market perception of banks' estimated fair value gains and losses for financial instruments. Accounting, Organizations and Society 46:81-95. |

|

|

Bank for International Settlements (BIS) (2018). Accounting provisions and capital requirements-Executive Summary. Available at: |

|

|

Bischof J, Daske H (2016). Interpreting the European Union's IFRS endorsement criteria: The case of IFRS 9. Accounting in Europe 13(2):129-168. |

|

|

Bloomberg (2018). IFRS 9 SPPI streamlines the classification and measurement of financial securities, 208661 DIG 0618, FactSheet available via Bloomberg Terminal. |

|

|

Board FS (2009). Report of the Financial Stability Forum on addressing procyclicality in the financial system. Basel. April. |

|

|

De Haan L, Van Oordt MR (2018). Timing of banks' loan loss provisioning during the crisis. Journal of Banking and Finance 87:293-303. |

|

|

Deloitte (2014). Fourth Global IFRS Banking Survey. Available at: |

|

|

Deloitte (2016). A Drain on Resources? The Impact of IFRS 9 on Banking Sector Regulatory Capital. |

|

|

Deloitte (2019a). International GAAP Bank Limited Illustrative disclosures under IFRS 7 as amended by IFRS 9, 219314 5, Rzeszów. |

|

|

Deloitte (2019b). After the First Year of IFRS 9: Analysis of the initial impact on the large UK banks. Available at: |

|

|

European Banking Authority (EBA) (2016). Report on results from the EBA impact assessment of IFRS 9. |

|

|

European Banking Authority (EBA) (2017). EBA Report on results from the second EBA impact assessment of IFRS 9. |

|

|

European Banking Authority (EBA) (2018): First Observations on the Impact and Implementation of IFRS 9 by EU Institutions. |

|

|

European Central Bank (ECB) (2017). SSM thematic review on IFRS 9 Assessment of institutions' preparedness for the implementation of IFRS 9. |

|

|

European Parliament (2017). Regulation (EU) 2017/2395 of the European Parliament and of the Council, official Journal of the European Union L345/27. |

|

|

EY (2017). Financial Instruments. A summary of IFRS 9 and its effects March 2017-EY. Available at: |

|

|

EY (2018). IFRS 9 expected credit loss: Making sense of the transition impact. Available at: |

|

|

Huizinga H, Laeven L (2012). Bank valuation and accounting discretion during a financial crisis. Journal of Financial Economics 106(3):614-634. |

|

|

International Accounting Standards Board (IASB) (2014). IFRS 9 Financial Instruments - Project Summary. |

|

|

Krüger S, Rösch D, Scheule H (2018). The impact of loan loss provisioning on bank capital requirements. Journal of Financial Stability 36:114-129. |

|

|

Loew E, Schmidt LE, Thiel LF (2019). Accounting for Financial Instruments under IFRS 9-First-Time Application Effects on European Banks' Balance Sheets. European Banking Institute Working Paper Series 2019 - no. 48. |

|

|

Löw E, Kluger C (2018). Auswirkungen der Ablösung von IAS 39 durch IFRS 9 auf die aufsichtsrechtlichen Eigenmittel europäischer Banken. Recht der Finanzinstrumente 3:215-222. |

|

|

Novotny-Farkas Z (2016). The interaction of the IFRS 9 expected loss approach with supervisory rules and implications for financial stability. Accounting in Europe 13(2):197-227. |

|

|

Ntaikou D, Vousinas G, Kenourgios D (2018). The expected impact of IFRS 9 on the Greek banking system's financial performance: some theoretical considerations and insights. In Proceedings of the 9th National Conference of the Financial Engineering and Banking Society pp. 21-22. |

|

|

PwC (2017a). IFRS 9 Financial Instruments - Understanding the basics. |

|

|

PwC (2017b). IFRS 9 for banks - Illustrative disclosure, February 2017, 170203-120218-CB-OS. |

|

|

US Treasury (2009). Financial Regulatory Reform: A New Foundation; Rebuilding Financial Supervision and Regulation. US White Paper on Financial Regulatory Reform. |

|

|

Weber C (2018). Heterogene Umsetzung von IFRS 9 in Banken, Schmalenbach-Gesellschaft: Arbeitskreis, Strategieentwicklung und Controlling in Banken, April 2018, Frankfurt. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0