Full Length Research Paper

ABSTRACT

This study examines the effect of savings on investment in East African countries in the face of the recent reduction in trade barriers and other regional integration policies. The findings reveal that among all the regions in Africa, East Africa had the lowest household saving for the period 2000-2016 and only Burundi and Kenya savings and investment rates were co-integrated. The policy implication is that the domestic saving rates significantly drive economic growth via investment in only Burundi and Kenya. In addition, there was weaker impact of savings on investment in the East African Community (EAC) due to flexible capital mobility and harmonized government policies. These findings also corroborate the Solow model that capital accumulation (saving) is not the main driver of economic growth (investment) but rather exogenous technological progress. The study therefore recommends that knowledge, education and skills of the labor force, number of years of schooling, learning by doing, the strength of property rights, the quality of infrastructure, cultural attitudes towards entrepreneurship and work should be improved in the EAC.

Key words: Savings, investment, capital mobility, co-integration, economic growth.

INTRODUCTION

The high economic growth of the newly industrialised countries (NICs) of East Asia has caused heated debate about the impact of domestic savings on investment in Sub-Sahara Africa countries, which despite various economic reforms are trapped in poverty. According to the World Bank’s African Development Indicators, gross domestic savings as a fraction of GDP across Africa is relatively low. It roughly stood at 20, 17 and 21% in the 1980s, 1990s and 2000s, respectively. Comparatively, these figures were 28, 32 and 37% respectively for Asian countries over the same periods. There is increasing beliefs that saving increases investment which in turn leads to sustainable economic growth. Feldstein and Horioka (1980) discover that domestic saving and investment are strongly correlated in 21 industrialised countries since in the real world, there are significant barriers to capital mobility and this may partly be as a result of some government protectionism policies.

Furthermore, Young (1995) uses detailed growth accounting to argue that the higher growth in the NICs is almost entirely due to rising saving- investment, increasing labour force participation, and improving labour quality (in terms of education) and not due to rapid technological progress and other forces affecting the Solow residual. This study thus supports the Solow model of economic growth states that countries will always converge to their balanced growth paths and that poorer countries will catch up with richer ones if all the additional savings are invested locally, since the marginal product of capital in that country is higher than that in other countries and there is no incentive to invest abroad. Like Romer (2012) and Helliwell (1998) find out that the saving-investment correlation is much weaker across regions than across countries. This implies that with removal of restrictions on capital and labour mobility, countries in a regional bloc tend to conditionally convergence at a steady economic growth path than countries in autarky.

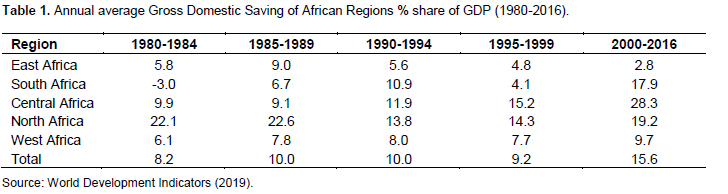

In the past three decades, East African’s national governments have taking steps to prevent large imbalances between aggregate saving and investment, but such imbalances can develop in the absence of government intervention. Among other macroeconomic convergence criteria, the EAC protocol requires partner states prior to joining the East African Monetary Union to have domestic savings as a percent of GDP of least 20%. Although compared to other regions in Africa, East Africa has the lowest saving rates as shown in Table 1; it is far outperforming other regions in terms of investment. Since the strong relationship between saving and investment in the East Asia differs from the predictions of a natural baseline model, there is need to examine whether those associations also exist in The East African Community (EAC) with their widening and deepening social, economic and political co-operation through a Customs Union in 2005, a Common Market in 2010, proposed Monetary Union in 2024 and a Political Federation of the East African States at in a distant future. Hence, there is flexible capital, goods and services, and people movement presently among the Partner States of Burundi, Kenya, Rwanda, Tanzania and Uganda. To this extent, this study investigates whether domestic saving impacts investment in the East African community. The rest of this study is organized as follows. Section 2 provides a brief summary of the literature review. The data and methodology are presented in Section 3.

Section 4 presents the discussion of the research results.

The final section gives conclusions and policy recommendations on improving domestic savings and investment in the EAC.

LITERATURE

The workhouse theory of this study is the Solow-Swan Growth Model (commonly known as Solow Model) which postulates that sustained increase in capital investment rises economic growth only transiently and that in thelong run only differences in technological change cause variation in GDP growth across countries/regions. This is because countries/regions with high marginal rate of return on capital tend to initially attract more investment funds, especially from developed nations that have reached a relatively low return on investment. The model however argues further that as the economies grow, people accumulate wealth through high rates of savings. This, coupled with reduction in investible projects, leads to demand for capital to fall and gradually the region or countries converge to their balanced steady growth paths. Further, Romer (2012) opines that over time developing countries are expected to conditionally converge to developed countries’ growth path as the marginal products of investment across the world convergence due to high savings and low incentives elsewhere.

According to the Solow Model thus, the EAC countries are anticipated to have similar living standards (measured by GDP per capita) and form an economic convergence club as a result of regional economic integration. In the absence of barriers to capital movement, there is no reason to expect countries with high saving rates to also have high investment, labour productivity or GDP growth rates in the long run because they may invest in other countries with higher marginal product of additional capital and cheap labour supply.

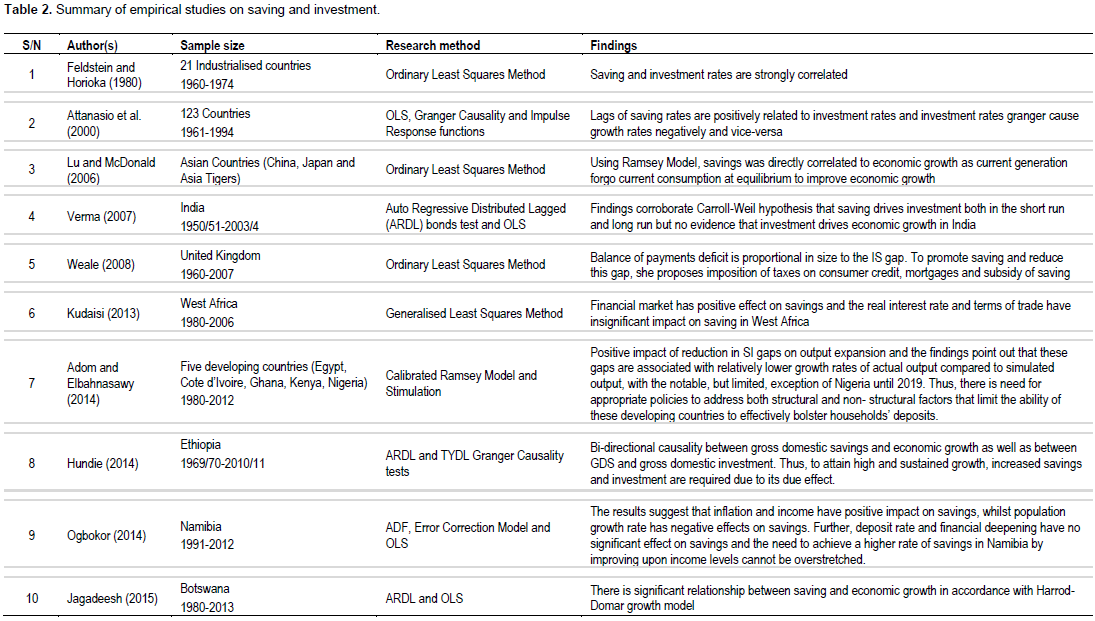

A lot of empirical researches have been done in both developed and developing countries on the nexus be-tween domestic savings rate and investment. However, there still remains a significant knowledge gap due to the growing divergence in saving and investment between and across countries, falling saving rates in major OECD countries (despite huge investment) on one hand and on the other hand, the vital role of investment in the NICs of East Asia. This section presents a summary of empirical works on the nexus between Saving-Investment in and across different regions of the world.

The above empirical evidence shows that since the Solow model postulates that savings does not drive growth (via investment), lots of research have been done in both developed and developing countries. Unfortunately, the evidences are mixed-positive, negative and no association between saving and investment. This study adds to the literature by examining the savings effect on investment in East African countries. It also bridges the gap as to whether savings impacts investment among these countries due to the recent reduction in trade barriers and other regional integration policies (Table 2).

DATA AND METHODOLOGY

This study uses Co-integration and Error Correction Models to test

the causal relationship between domestic saving rates and investment rates in the East African Community member countries. Although these methodologies are often applied to multivariate models, this study applied them to Feldstein and Horioka (1980)’s reduced form bivariate model to examine the long-run relationship between domestic saving and investment (both as percent of GDP). The model takes the following form:

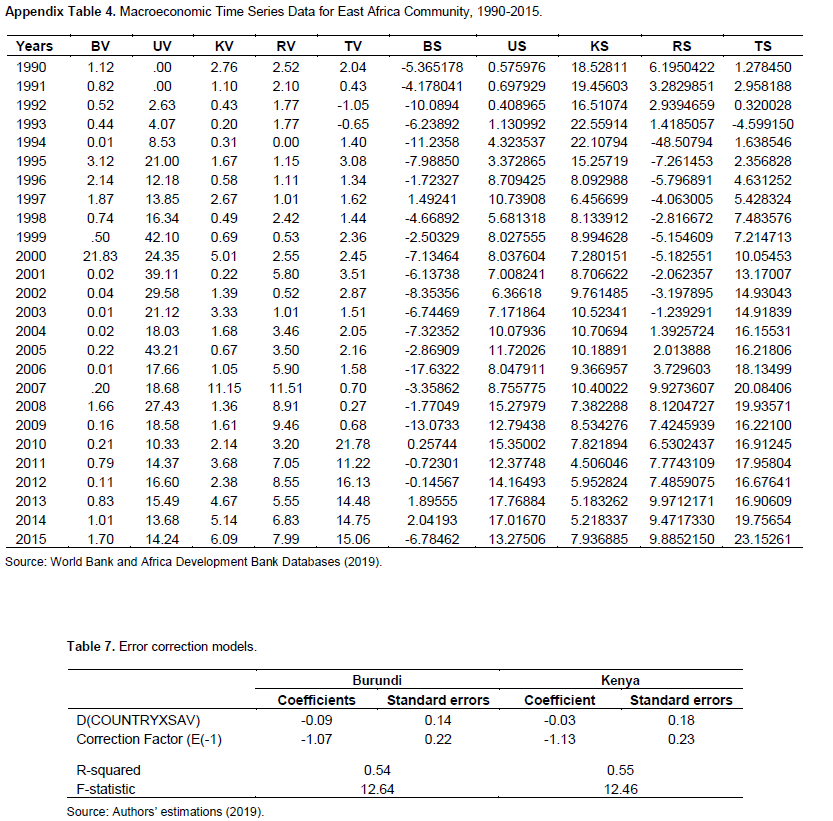

According to Granger (1986), the error-correction models produce better short-run forecasts and provide the short-run dynamics necessary to obtain long-run equilibrium. A cross country correlation analysis is also carried out. Due to unavailability of annual data on investment and domestic saving for Tanzania prior to 1990, the study period covers 1990-2015, compiled from the World Bank and Africa Development Bank databases (Appendix Table 4). The sample of countries consists of Burundi, Kenya, Rwanda, Tanzania and Uganda, all part of the East African Community.

RESULTS AND DISCUSSION

This section presents and discusses both the descriptive and empirical analysis results of the study. Descriptive statistics were mainly tables and figures while the unit root test, co-integration test and Error Correction Model results were discussed in the empirical subsection.

Descriptive statistics

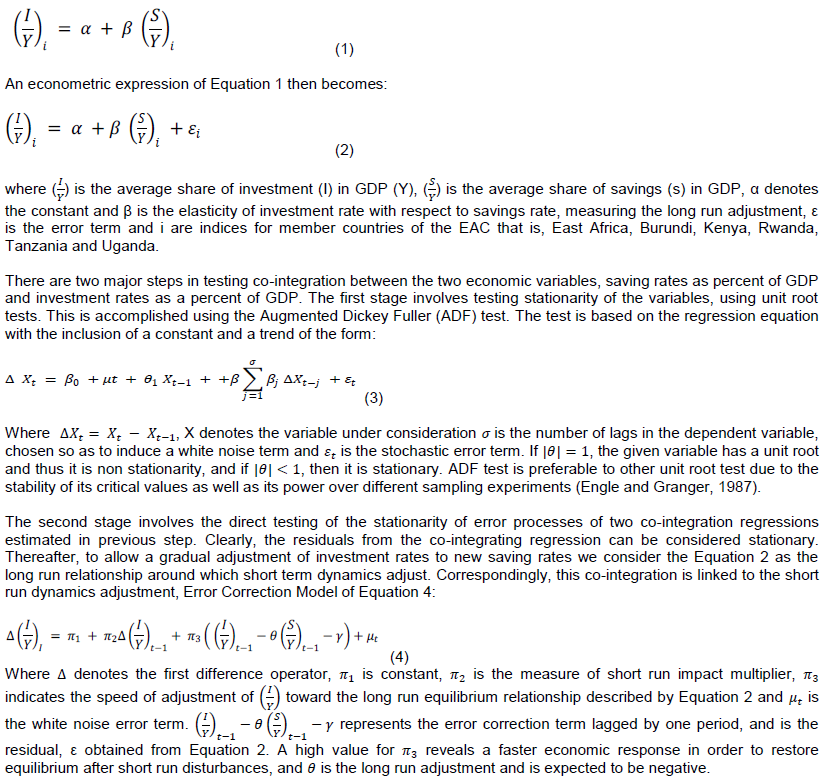

Figure 1 reveals that from 2008 to 2017, the GDP per capita growth in the EAC countries, except Burundi have seem impressive growth. This massive economic deve-lopment in per capita terms was mainly by normalcy in agricultural activities due to favourable weather con-ditions and stable external environment. However, since 2015 Burundi entered economic recession as political instability roam over the country. If peace is restored in Burundi, and weather remains favourable since agriculture is rainfed, the EAC will possibly achieve economic convergence in the not too distant future.

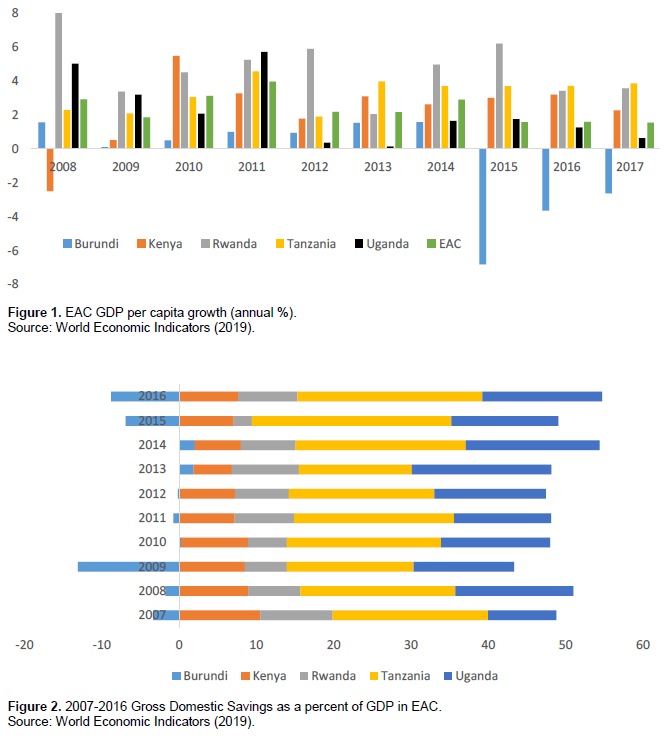

As a result of the tremendous rise in the households’ disposable income in the region recently, the countries have recorded relative improvement in domestic savings. Figure 2 shows that across the EAC, Tanzania and Uganda have the highest domestic savings as a percent of the GDP. In 2016, 23 and 15% of all households’ earnings in Tanzania and Uganda were saved respectively. On the other hand, Burundians were on average in debts as their savings to GDP ratio stood at -8.8%. In addition, Rwanda and Kenyan had very low savings rate. This implies that Burundians, Rwandans and Kenyans are the highest spenders or consumers in the region while Tanzanians and Ugandans are the highest investors (since in classical economic theory savings equals investment). The decreasing growth in the savings in Rwanda and Kenya despite drastic increase in their household incomes could be attributed to higher cost of living and openness relative to other countries.

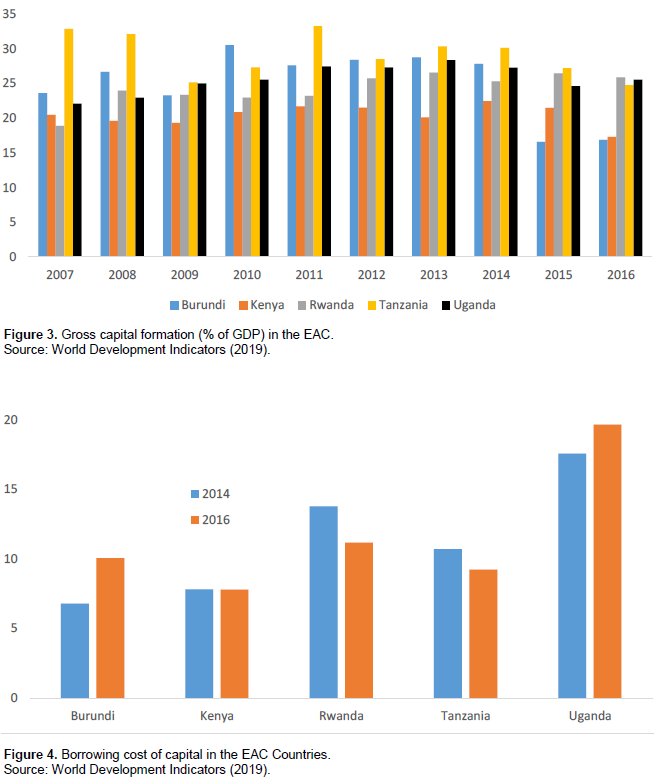

Over the same ten years 2007-2016, EAC relative to other African economic communities recorded an abysmal performance in terms of capital formation mainly as a result of its low domestic savings mobilisation. Expectedly, Figure 3 shows that Tanzania and Uganda, with the highest domestic resources also had the highest gross capital formation on average. However, compared to Kenya, Burundi and Rwanda outperformed despite their lower domestic wealth, implying that foreign grants and aids resources received by these two countries were judiciously employed in fixed capital investment.

However, the community continues to face severe challenges in accessing finance for both public and private sector development investment. These problems range from the small and relatively undeveloped financial system, high transaction and logistic costs to high dependence on the public sector as key driver of economic growth. For instance, despite the region acutely in need of finance to meet its developmental needs, Figure 4 shows that borrowing cost remains very high in member countries. During 2014 and 2016, the real interest rates rose in both Burundi and Uganda, fell slightly in Rwanda and Tanzania but it remains relatively the same in Kenya. However, capital remains still cheaper in Kenya than the rest of the other partner states. In fact, in 2016 alone borrowing cost was on average 20% in Uganda, while it was barely 8% in Kenya. This high cost of borrowing could crowd out investment funds in some countries in favor of others and adversely impact on entrepreneurship and economic transformation in the region. The major source of this high cost is the high demand by the public sector for commercial banks loans to finance their programmes, in face of high risk in the private sector, especially the agricultural sector. The community thus needs to review policies governing financial institutions, public sector’s borrowing strategies, and attempt to de-risk the private sector.

Empirical evidence

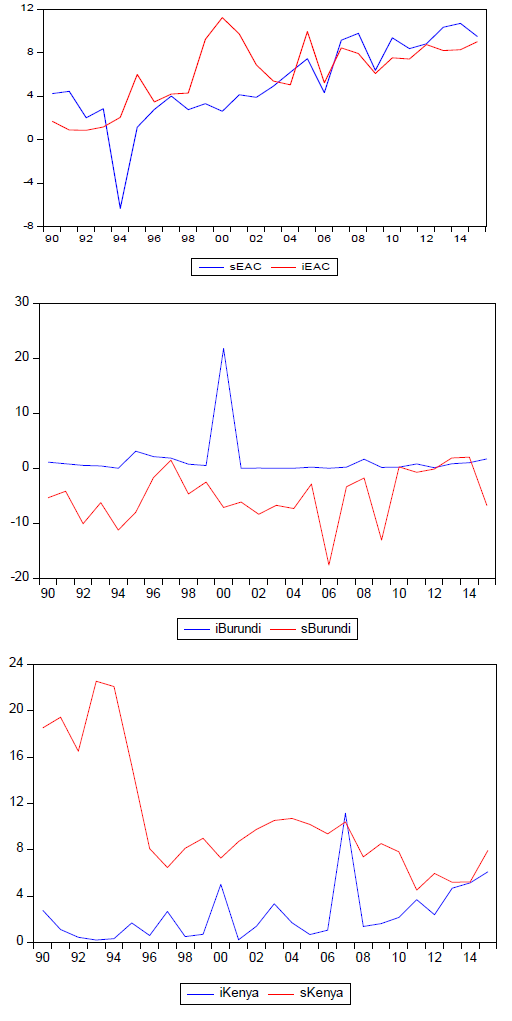

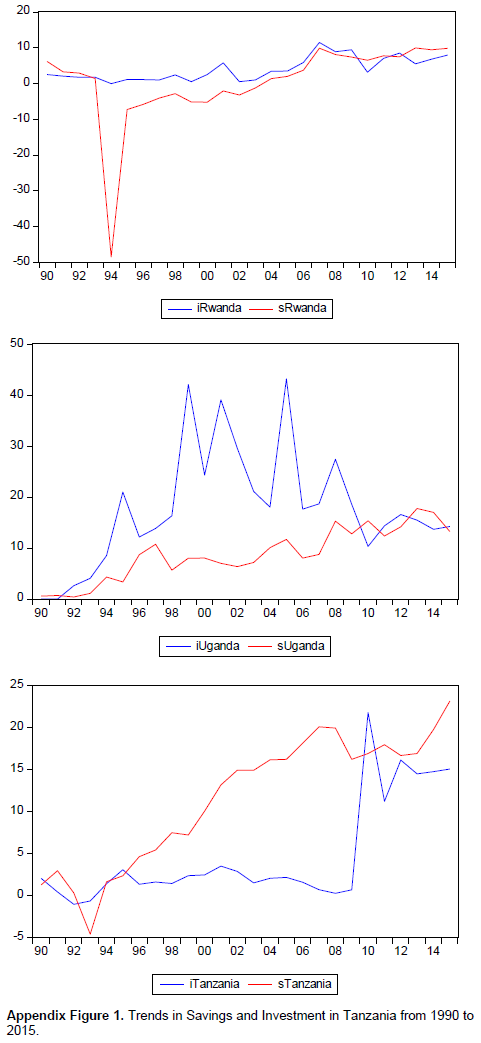

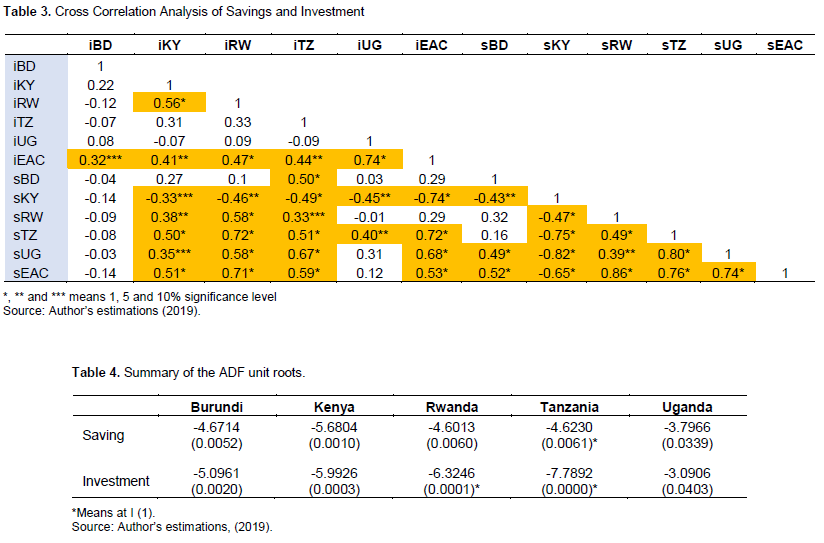

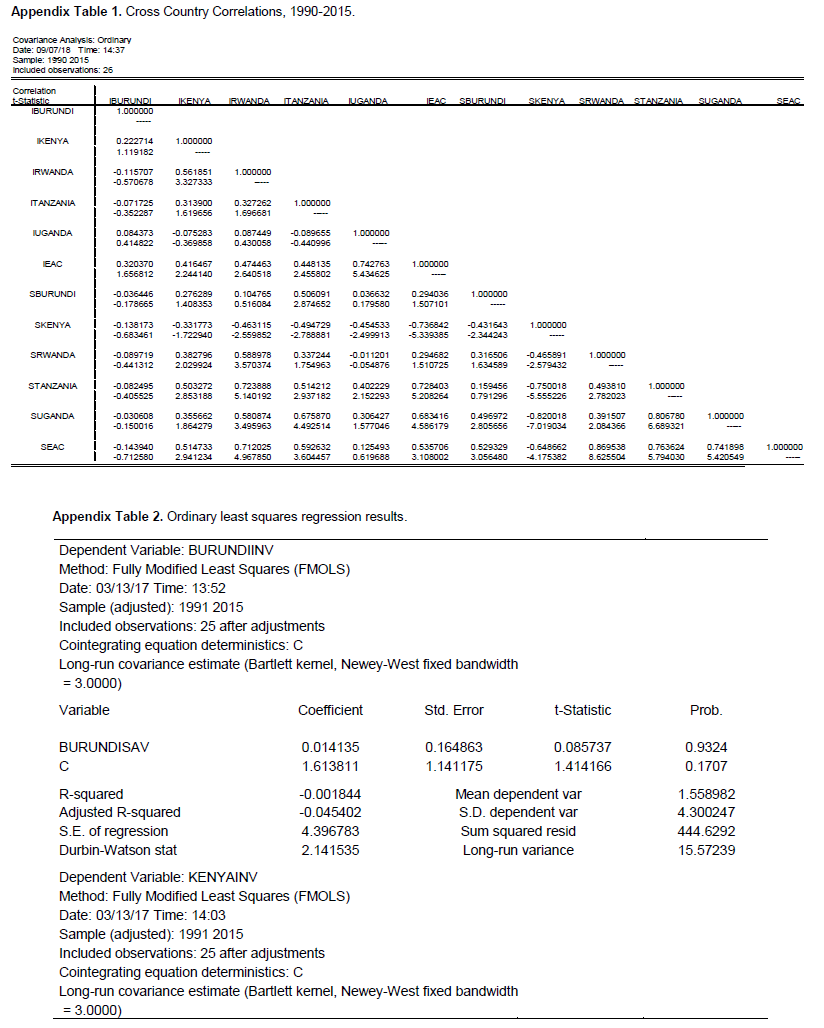

A cross country correlation analysis between savings and investment for the period 1990 to 2015 for the EAC and the individual countries was performed (Appendix Figure 1). Table 3 presents the results of the correlation analysis. The analysis shows that although investment in the EAC is strongly positive and significantly related with investment in the individual countries, it is more correlated with investment in Uganda and weakly related to investment in Burundi. The analysis also reveals that EAC total savings is positively associated with all individual countries’ savings rates, except with Kenya savings rate. At individual countries level, apart from Kenya, all countries’ savings and investment rates are positively correlated. On the other hand, savings rates in Kenya, the largest economy in the EAC, is statistically significant and negatively associated with all other countries’ investment and the overall EAC investment level, implying that most of the domestic savings in Kenya are invested in other EAC member states, instead of in Kenya itself. This is evident in the region as Kenya businesses, especially commercial banks dominate the region’s financial system. However, the results show that Burundi is not benefiting significantly from the savings and investment in other countries, due to its political instability and less openness to trade.

The consequences are that intra EAC trade continues to be pulled by Kenya, Uganda and Tanzania with Rwanda and Burundi continuing to record massive trade deficit. According to the EAC trade statistics, between 2006 and 2015, trade surpluses stood at USD 993.8 million, USD 143.5 million, and USD 60 million for Kenya, Tanzania and Uganda respectively. For the same period however, Rwanda and Burundi recorded massive trade balance deficit of USD 139.2 million and USD 375.6 million respectively. This shows that Kenya investments dominate all countries in the East African Community.

At this point, we now conduct unit root tests on savings and investment variables for all countries in the EAC before carrying out the cointegration and Error Correction Models tests. Table 4 shows the results of unit root tests obtained using the Augmented Dickey Fuller Test (ADF). The results show that all the data series were stationary at levels (that is at I (0)) except Tanzania investment and savings series and Rwanda investment rates. For these series, they were stationary at first differences (that is at I (1)). In other words, all the ADF tests rejected the null hypothesis of unit root in favor of the alternative in the level with trend and intercept apart from Tanzania variables and Rwanda’s investment rates, in which the latter variables are stationary at first differences.

Next, we test cointegration between savings rates and investment rates in member states of the EAC using the Engle- Granger Causality test. The essence of the co-integration analysis is to determine if there is a long-run relationship between the two variables, and if so, the number of co-integrating vectors. In general, economic variables (often non-stationary variables) are said to be co-integrated if a linear combination of these variables is stationary (that is, X and Y variables are I?1(0)).

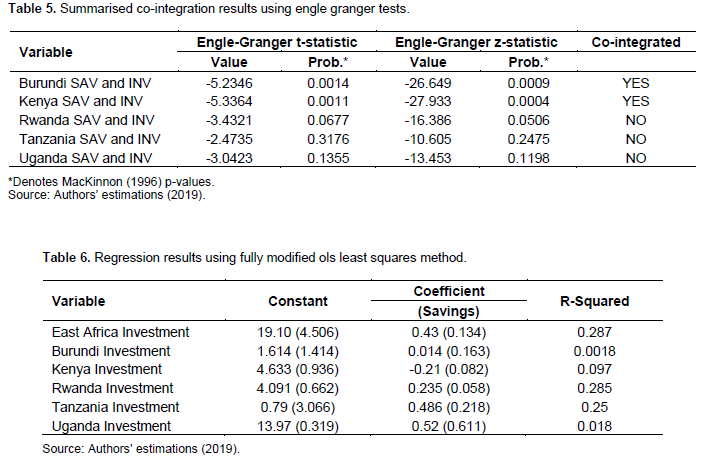

The Engle granger co-integration test between the saving rates and investment rates results is presented in Table 5. The results show that only saving rates and investment rates of Burundi and Kenya are co-integrated. All the other countries in the EAC have non co-integrated saving and investment rates because their p- values are greater than 0.05 (5% significance level). Therefore, there is no long run relationship between saving rates and investment rates in all countries in the EAC, except Burundi and Kenya. This has an adverse implication on the policy of encouraging domestic savings in hope of encouraging investment in these countries.

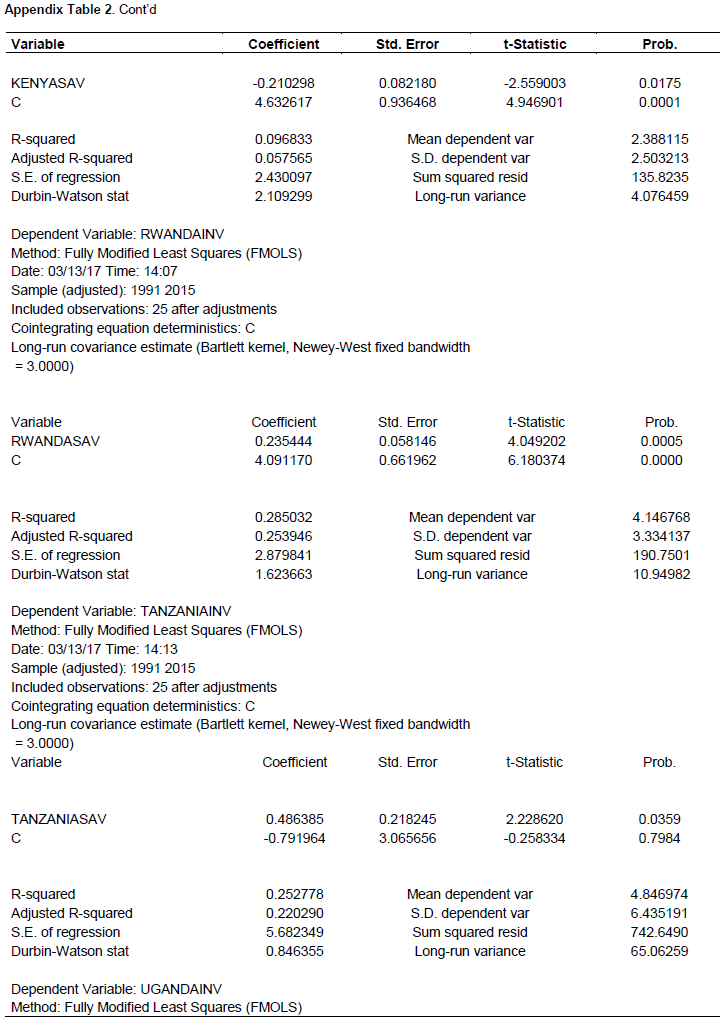

Furthermore, a co-integrating regression was estimated in order to examine the long run impact of savings rates on investment levels in the EAC. Table 6 presents the regression results, with standard errors in parentheses. The results reveal that with the exception of Kenya, all the other countries have positive long term impact of savings on investment. These results are supported by the findings from the cross country correlations, where savings and investment were positively correlated in all member countries, apart from Kenya (Appendix Table 1). However, the sole impact of savings on investment levels is very weak. For instance, in the EAC the R-squared of 0.287 implies that only 28.7% of changes in investment are attributable to changes in saving rates and it points to the possibility of high capital mobility from the region to other regions. Thus, the bulk of the changes are caused by other factors such as foreign direct investment, infrastructure and political stability etc (Appendix Table 2).

In consonance with the correlation analysis, the results further reveal that across individual countries, Uganda has the higher saving-investment impact while Burundi has the lowest impact in the region. In Rwanda, saving contributes only 24% of changes in investment. However, there was significant positive relationship between them and the R2 almost like that of the entire region. This may be partly due to political stability, peace, security of lives and property, conducive economic environment including government investment policies and its high portfolio and foreign direct investment. The result thus corroborates the findings of Helliwell (1998) of weaker saving-investment correlation across regions than across countries due to capital mobility but contradicts the findings of Feldstein and Horioka (1980) who found a one to one relation between savings and investment.

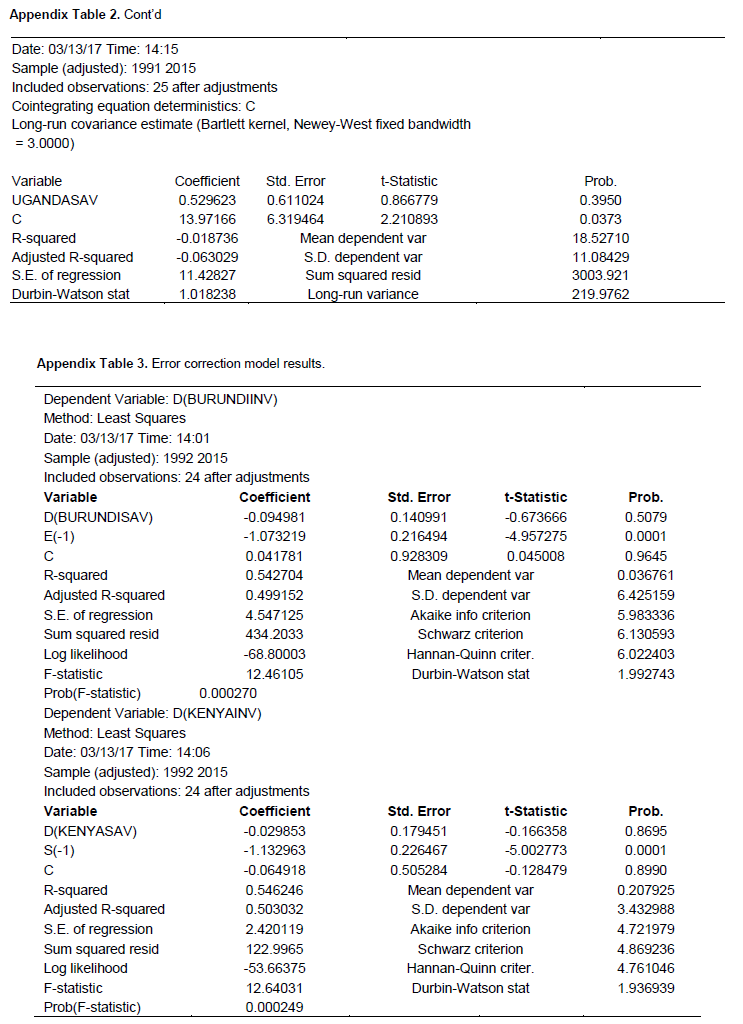

Finally, an Error Correction Model Estimations was done for those countries whose savings and investment are co-integrated (Appendix Table 3). If savings and investment are not co-integrated (that is not moving together in the long run), it is very unlikely that they would move in the same direction together in the short run either. As such, the empirical results of the estimated error correction model presented in Table 7 report only for Burundi and Kenya. The high F-statistics for both countries show the models are well specified and this could be justified further by their high short term predictive power since the R-squared of the models reveals that 54 and 55% of changes in investment is accounted by changes in domestic savings alone in these countries. The policy implication is that the domestic saving rates significantly drive economic growth via investment in both Burundi and Kenya.

The empirical results further depict that in the short run any shocks on investment levels as a result of changes in domestic savings will be restored to equilibrium within the next fiscal year only, since the correction factors are -1.07 and -1.13 in Burundi and Kenya respectively (approximately 100%). The adjustment factor should be negative and significant or else the economic shocks will not be dissipated but rather keep compounding year in year out in both countries. The results further imply that in Burundi and Kenya if there is a fluctuation in domestic saving rates among citizens it will take just a year to normalize the investment rates. Despite this faster adjustment rates, these countries are among the countries with the lowest domestic savings rates in the EAC. In particular Burundi continues to face increasing threats to its plans to improve domestic savings and investment as one third of its economy has shrunk since 2015 due to heightened political tensions.

CONCLUSION AND RECOMMENDATIONS

The empirical evidence on the nexus of saving-investment analysis is mixed. In addition, while there is a wide range of research in other parts of the world on this important topic, such research is few in Sub-Sahara Africa. In fact, to the author’s best knowledge this is the first research conducted on the nexus of savings and investment using Co-integration and Error Correction Models in the EAC. These methods are superior and preferable to the traditional Ordinary Least Regression in that they are less prone to its restrictive assumptions. Some research confirms the Solow model that the rich and poorer economies can always converge to balanced growth paths because (rational) investors could choose to invest in poor countries with often higher return on capital in the absence of barriers to trade. With respect to this, one of the measures taken by various governments around the world is regional economic integration, whereby higher savings in other countries within the same region or bloc could be invested in needy countries with higher marginal return on capital, without fear of capital mobility restrictions and other trade barriers often imposed by sovereign states. With the EAC pursuing a monetary unification by 2024, and already implemented two regional integration road marks such as the custom union and the common market area, this study is apt and timely in investigating the relationship between savings and investment in the EAC partner states.

The findings revealed that amongst all the regions in Africa, East Africa has the lowest saving rates. The cross country correlation analysis shows that savings and investment are statistically positively correlated with investment levels in all the member states, except in Kenya. The negative association of Kenyan domestic savings with the rest of the other countries is evident in the presence of high Kenyan investment across the region, especially in wholesale and commercial banks. Further, although all the variables were stationary, only Burundi and Kenya domestic saving rates, and investment rates were co-integrated. The Error correction models show the level of domestic savings impact greatly on investment in the short run and that it takes only one fiscal year for the savings and investment to stabilize at equilibrium in the face of external shocks. Nonetheless, the co-integrating regression results show there is weaker impact of savings on investment in the EAC due to flexible capital mobility and harmonized government policies.

To sum up, these results conform to the traditional Solow economic growth theory, in which that capital accumulation (through saving) is not the main driver of long run economic growth (investment) but rather some exogenous technological progress factors. The study supports the EAC partner states’ regional economic integration, especially its monetary unification prospects, in removing significant barriers to capital mobility, exorbitant and multiple taxes on rate of returns and capital income, lower discount rates to encourage higher savings, strong workers’ unions, increased labour productivity so as to encourage households’ savings and investment. But for EAC to have strong and sustainable economic growth in the long run, this study recommends that the community focuses on impressively improving the Solow residuals (1-R2 ) of abstract knowledge (basic and applied research), education and skills of the labor force, number of years of schooling, learning by doing (thereby improving innovation), the strength of property rights (collateral reduces risk and makes finance accessible), the quality of infrastructure (to reduce transaction costs), and cultural attitudes towards entrepreneurship and work.

CONFLICT OF INTERESTS

The author has not declared any conflict of interests.

REFERENCES

|

Adom AD, Elbahnasawy NG (2014). Saving-investment Gap and economic growth in developing countries: Simulated evidence from selected countries in Africa. British Journal of Economics, Management and Trade 4(10):1585-1598. |

|

|

Attanasio OP, Picci L, Scorcu AE (2000). Saving, growth, and investment: a macroeconomic analysis using a panel of countries. Review of Economics and Statistics 82(2):182-211. |

|

|

Engle RF, Granger CW (1987). Co-integration and error correction: representation, estimation, and testing. Econometrica: Journal of the Econometric Society 55(2):251-276. |

|

|

Feldstein M, Horioka C (1980). Domestic Saving and International Capital Flows. Economic Journal 90(3):314-329. |

|

|

Granger CJ (1986). Developments in the study of cointegrated economic variables. Oxford Bulletin of Economics and Statistics 48(3):213-228. |

|

|

Helliwell JF (1998). How much do National Borders Matter? Washington, DC: Brookings Institution. Mimeo, August. |

|

|

Hundie SK (2014). Savings, investment and economic growth in Ethiopia: Evidence from ARDL approach to co-integration and TYDL Granger-causality tests. Journal of Economics and International Finance 6(10):232-248. |

|

|

Jagadeesh D (2015). The impact of savings in economic growth: an empirical study based on Botswana. Available at: |

|

|

Kudaisi BS (2013). Savings and its Determinants in West Africa Countries. Available at: |

|

|

Lu L, McDonald IM (2006). Does China save too much?". The Singapore Economic Review 51(3):283-301. |

|

|

Ogbokor CA (2014). A Time Series Analysis of the Determinants of Savings in Namibia. Available at: . |

|

|

Romer D (2012). Advanced Macroeconomics (4th ed.)", New York: McGraw-Hill. |

|

|

Verma R (2007). Savings, Investment and Growth in India: An Application of the ARDL Bounds Testing Approach. South Asian Economic Journal 8(1):87-98. |

|

|

Weale M (2008). Commentary: The Balance of Payments and the Savings Gap. National Institute Economic Review 11(2):203-218. |

|

|

Young A (1995). The Tyranny of Numbers: Confronting the Statistical Reality of the East Asian Growth Experience. Quarterly Journal of Economics 110(3):641-680. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0