Full Length Research Paper

ABSTRACT

After decades of failed developmental efforts, many economies around the world employed the McKinnon-Shaw liberalization thesis to propel the development of their financial systems. Whiles some of these economies had success stories, others had frustrating outcomes. This study examines the financial liberalisation and financial development dynamics considering inflationary effects, in SSA spanning 2000 to 2019. We conducted preliminary tests to ascertain the suitability of the data for the study and then estimated the PVAR model. Impulse response functions and forecast error variance decompositions were obtained from the residuals of the model estimates. The study established a weak, long-run bidirectional relationship between liberalization and financial development, with liberalization accounting for about 0.09% of financial development, while financial development explains about 0.06% of liberalization shocks on average. It takes 3 to 5 years for the impact to manifest after policy implementation. The study further revealed a positive short-run bidirectional relationship between inflation and liberalization, and an inverse short-run bidirectional relationship between inflation and financial development. While inflation explains about 0.87 and 1.79% of liberalization and financial development shocks respectively, liberalization and financial developments respectively explain about 2.62 and 7.41% of inflation shocks on average. It takes 1 to 2 years for the impulse to manifest after policy implementation. We recommend that for financial liberalization policies to succeed, stable inflationary regime and the necessary preconditions for liberalization policies should be in place prior to the implementation of liberalization policies.

Key words: Liberalization, financial development, endogeneity, exogeneity, stochastic trend, impulse response functions (irf), and forecast error variance decomposition (fevd).

INTRODUCTION

Economies around the world continually employ varied ways to improve the efficiency of their financial systems

in order to enhance growth (Abiad et al., 2005). One key tool often employed in this drive is the empowerment of financial institutions. Studies show that many economies have made reforms to empower financial institutions; reducing state control over financial markets and allowing the markets to dictate their own pace. The essence is to create free markets based on fair competition and to liberalize the financial sector in order to create opportunities for foreign capital flows (Shaw, 1973). Despite the inherent benefits of the reforms, some economies have been found to be hard hit by the negative effects of liberalization ranging from banking sector insolvencies, reversal of foreign capital flows, abnormal currency depreciations and difficulties in financing government budget deficits (Kaminsky and Reinhart, 1999). Yet, some economists have expressed skepticisms about the effectiveness of liberalisation (Ghosh, 2005; Karikari, 2010). Karikari (2010) provides evidence that liberalization by itself did not enhance financial development in SSA during the 1996–2002 period; an evidence that corroborates Ghosh (2005) argument that there are many grounds for skepticism regarding the claims made by the votaries of financial liberalization efforts. Similarly, Prasad et al. (2007) admonished the advocates of liberalization to be cautious; warning that liberalization could even pose growth retarding threats; as it could increase the risk of speculative attacks, banking industry instabilities and international capital flight. Misati and Nyamongo (2011) further revealed that the growth retarding effects of financial liberalization dominates its growth supporting effects in Sub-Sahara Africa (SSA). Nevertheless, it appears the positive effects of liberalization dominate the negative effects as economies world-wide continually employ liberalisation efforts to enhance the efficiency of their financial systems (Abiad et al., 2005). Mckinnon (1973) found financial liberalization as a determinant of financial sector development, and Ahmed (2013) confirmed that liberalization has positive effects on financial market development, adding that the effects depend on institutional quality. Furthermore, Chartziantoniou et al. (2013) established that, given the same level of liberalization, SSA countries with better legal environment, on average, outperformed others in terms of financial depth. Moreover, transfer of technological and managerial know-how; as consequence of financial liberalisation, contributes positively to financial sector development by facilitating and making operations more efficient. According to Ayouni et al. (2014), financially liberalised economies seem to attract a disproportionately large share of FDI inflows, which have the potential to generate technology spill-over and serve as a conduit for passing on better management practices and competencies.

Clearly, the empirical evidence of the effects of financial liberalization remains vastly mixed. Nevertheless, there seems to be a consensus that financial sector development could be the consequence of liberalization within the context of small open economies such as SSA countries (Fowowe, 2008; Chartziantoniou et al., 2013). On the other hand, the evidence as to whether developments in the financial market could trigger financial liberalization is not clear and the uncertain empirical results as to what role inflation plays on the nexus between the two magnitudes has not been resolved (Ozturk and Karagoz, 2012). Previous studies have focused on the effects of liberalization on financial development and growth (Odhiambo, 2005; Khalaf and Sanhita, 2011) with little or no emphasis on the reverse relationship. Again, the question of what exactly the nature (negative or positive) of the relationship between the two magnitudes remains unclear. Granted that liberalization is impactful, how long it takes for the liberalization impulse to translate into financial development and the reverse. This study undertakes a cross-country examination of the seeming bi-directional relationship between liberalization and financial development in the presence of inflation. The study thus answers the questions: Is the relationship between liberalization and financial developments bi-directional? What is the nature and magnitude of the relationship between liberalization and financial development? How long does it take for the effects of liberalization to manifest? We therefore hypothesized that liberalization has a positive effect on financial development in the presence of inflation.

LITERATURE REVIEW

Following persistently poor economic performance and increases in rural poverty prior to 1970s in SSA, most of the countries adopted the McKinnon-Shaw 1973 financial liberalization thesis. The aim was to increase the role of market forces in determining interest rates, credit allocation and the overall scale of financial intermediation. This brought about major policy reforms and market-friendly incentives that encouraged internationalization and market openness. Thus, creating enabling business environment and enhancing institutional and regulatory mechanisms to stimulate growth.

Literature on the outcomes of financial liberalization reforms vary. Whilst some empirics report that the reforms have been impactful others report otherwise. For instance, Ayouni et al. (2014) report that in the early 1960s, financial systems of Southeast-Asian countries were under immense regulatory measures (interest rates regulation, selective control of credit allocation, taxes on financial institutions, segmentation of capital markets and international capital controls). After implementing liberalization policies, the financial systems became more dynamic with efficient and flexible monetary policies. Pill and Pradhan (1995) reports that financial liberalization impacted financial development in Indonesia, Korea, Malaysia, Philippine, Sri Lanka, and Thailand but did not do so in Gambia, Ghana, Kenya, Madagascar, Malawi, and Zambia. They added that the reforms could not prevent Zambia’s rapid and continuous drop in financial depth in the 1980s. Mosley (1999) examined the impact of liberalization on some African countries and showed that financial depth slightly improved in Madagascar, slightly declined in Malawi and sharply contracted in Tanzania and Uganda during post-liberalization period. Furthermore, Odhiambo (2005) examined the e?ect of financial liberalization on financial deepening in Kenya, South Africa and Tanzania, using Vector Error-Correction Model (VECM) and found that financial liberalization positively impacted financial development. El-Wassal (2005) examined the interactions of stock market growth, economic growth, financial liberalization and foreign portfolio investment in 40 emerging markets from 1980 to 2000 and established that financial liberalization is one of the drivers of stock market growth. Khalaf and Sanhita (2011) tested the Mackinnon-Shaw liberalisation-financial deepening hypothesis in Iraq, with data covering 2005-2010 in an ARDL model and found that financial liberalization stimulates financial depth only in the long-run. Other studies (Habibullah and Eng, 2006; Kabir and Hoque, 2007) found evidence that liberalization impact financial market development. This finding lends credence to Li (1997) explanation that financial market liberalization leads to financial deepening due to increased volume of funds handled by financial institutions and that liberalization enhances the efficiency of capital accumulation through increasing productivity. In spite of the mixed literature of the effects of liberalization on financial development, there seems to be a concensus that liberalization impacts financial development. What is unclear is the extent and nature (negative or positive) of the impact. For instance, what level of financial liberalization will lead to a percentage change in financial development? Whilst some studies report of negative effects of liberalization on financial development, some found positive effects and others found no effect at all (Mosley, 1999; Odhiambo, 2005; Ayouni et al., 2014; Mekki and Samir, 2018; Luuk et al., 2017). So what exactly is the nature of the relationship? Again, how long does it take for liberalization policies to impact financial sector development?

Another aspect of the liberalization-financial development nexus worth considering is whether developments in the financial markets can lead to financial liberalization. Intuitively, unstable or high interest and inflation rates, poor institutional, regulatory and supervisory framework, credit controlling regime and similar tendencies can lead to financial crises; which may require liberalization reforms to fix. To liberalise is to entrust the markets to determine quantities and prices (interest rates) of traded capital (Ayouni et al., 2014). Total financial liberalization entails deregulation of interest rates; removal of credit controls, free entry into the banking sector; autonomy of the Central Bank; private ownership of banks and liberalization of international capital flows. A trigger of any or all of these dimensions is liberalization and often in response to financial market inefficiencies. This argument is in line with the position of Khalaf and Sanhita (2011) that the implementation of the financial liberalization reforms by some industrialized economies and emerging economies in the 70s and 80s respectively was to address financial market inefficiencies. Judging by the paradox; that financial market developments (that is high interest and inflation rates) can lead to financial crises which requires liberalization policies to resolve, against another that liberalization by way of interest rate deregulation can lead to increases in interest rates (financial market developments). It is sufficient to assume a two-way relationship between the two magnitudes. However, this seeming bi-directional nexus between liberalization and financial development has not been empirically examined in literature. Furthermore, the question of whether inflation could influence the nexus between the two magnitudes has not been answered either. Therefore any attempt to empirically examine and validate this nexus considering the influence of inflation in one model, as this study seeks to do is a worthwhile exercise.

On inflation and financial development, literature shows the two variables as inversely related as Bittencourt (2011) and others proved that inflation is detrimental to financial development. Hami (2017) investigated the effect of inflation on financial development in Iran using data spanning 2000-2015 in a VECM and found that inflation has significant negative effect on financial depth and positive effect on the ratio of total deposits in banking systems to nominal GDP. Salimifar et al. (2012) using Quantile econometric method examined the effect of inflation on financial market performance in Iran during 1973-2007 and showed that inflation has significant negative effect on financial development. Other studies such as Ozturk and Karagoz (2012), Odhiambo (2012), Aboutorabi (2012), Kim et al. (2010) have all found inflation to have negative effects on financial development. Observious, a significant proportion of all the studies analyzed focused on only one side of the two directional relationships (Liberalization on financial development). Again most of the studies analyzed are single country-based and so the results may not reflect the true situation in all countries since each country may have different monetary and financial regulatory frameworks. The empirical examination of the role of inflation on the relationship between liberalization and financial development is also missing in literature. This paper employs a cross-country analysis in a panel VAR framework to examine the bi-directional nexus between liberalization and financial development under the influence of inflation in SSA.

On the transmission mechanism of financial liberalization impulse, Ayouni et al. (2014) explains that financial liberalization can encourage savers to transfer part of their savings to financial investments causing an increase in credit availability in the economy. This view is consistent with Ikhide (1992) position that positive real interest rates encourage financial savings and thus promote financial deepening. Similarly, stock market liberalization increases risk-sharing opportunities between foreign and domestic investors allowing them to diversify. This reduces cost of borrowing and encourages investors to take on more investments to enhance growth (Ozturk and Karagoz, 2012). The transmission mechanisms are generally categorised into direct and indirect channels. On the direct channels: Cross border capital flows allow for increased investments in capital-poor countries while providing a higher return on capital (ROC) than is available in capital-rich countries; thus, reducing cost of borrowing in the capital-poor countries. Again, by increasing capital flows, liberalization could improve the liquidity of the domestic market thereby reducing equity risk premium and lowering cost of capital. On the indirect channels; international financial integration could through its impact on government’s ability to commit to future course of policies, change the dynamics of domestic investments in an economy. This could lead to the reallocation of capital towards more productive activities in response to changes in policies. Again, a country’s willingness to undertake financial integration according to Bartolini and Drazen (1997) could signal its readiness to operate more receptive policies towards foreign investments.

In all, the effectiveness of these transmission mechanisms determines how impactful liberalization effects are on the economy. Many researchers have attributed the mixed results of the impact of the liberalization reforms on the economy as presented in literature, to the ineffectiveness of the transmission mechanisms. But that has not been empirically examined and thus presents a gap for future research. Our study seeks to examine the dynamics of liberalization and financial development nexus under the influence of inflation in a cross-country analysis of sub-Sahara African countries.

METHODOLOGY

The study analyzed annual data from 2000–2019 on financial liberalization and financial development in the presence of inflation. The liberalization index is sourced from Heritage Foundation whilst financial development and the macro data from the International Financial Statistics database of the IMF and World Development Indicators of the World Bank. The data is sourced on Algeria, Botswana, Cameroon, Côte d'Ivoire, Egypt, Ghana, Kenya, Libya, Malawi, Morocco, Mozambique, Namibia, Nigeria, South Africa, Sudan, Tanzania, Tunisia, Uganda and Zambia. The study is limited to these countries due to data availability and because those countries are among the economies that undertook reforms to propel growth. Furthermore, countries from SSA are selected because of their seemingly weaker institutions (controlled Central Banks among others) and the stochastic nature of their inflation which according to existing literature affect financial development.

The annual data used could be the major limitation of this study, as more frequent data could produce better results but are difficult to obtain.

Measurement of variables

Financial liberalization refers to financial reforms seeking to reduce government active participation in financial markets; allowing the markets to determine the quantities and prices of traded capital. It is measured using Heritage Foundation Economic Freedom (HFEF). HFEF measures economic freedom in terms of financial freedom (open markets), monetary freedom (regulatory efficiency), fiscal freedom (government limit) and property right (rule of law). Financial freedom measures banking efficiency and independence from government control and interference in the financial sector. It provides the overall measure of the openness of the banking sector and the extent to which banks are free to operate. Monetary freedom measures both price stability and assessment of price controls. Fiscal freedom measures the tax burden imposed by government on individual and corporate incomes and the overall amount of tax revenue as a percentage of GDP. Property rights measure the degree to which a country’s laws protect private property rights and the degree to which its government enforces those laws. We obtained our financial liberalization index (FLI) by aggregating or taking the composite value of the four indices of economic freedom (financial freedom, monetary freedom, fiscal freedom, and property rights) outlined.

Financial development refers to improvement in the quality, quantity and efficiency of financial intermediation services in an economy and the tendency for all individuals to benefit from the improved comprehensive service thereon (Choong and Chan, 2011). We measure financial development using a combination of stock market capitalization and credit to private sector in the economy. Whilst the ratio of stock market capitalization to GDP measures contribution from the capital market; that of credit to private sector to GDP measures the banking sector contribution to the financial sector development. We aggregated these two ratios (stock market capitalisation and credit to private sector, to GDP) to obtain our financial development index (FDI).

Inflation is the disproportionate increase in the general level of prices and the irregular increasing trend of prices in an economy. Inflation has been a concern for researchers as it creates economic uncertainty, destroys macroeconomic stability, and hurts low-income individuals thereby adversely affecting growth (Hanif and Batool, 2006). Literature shows that inflation affects the relationship between the financial sector and growth; a reason the interrelation between inflation and financial development is an important issue in less developed countries (Ozturk and Karagoz, 2012). Higher inflation makes the banking system non-competitive, in that prices of financial products and services such as interest rates become less informative. We take annual inflation rates (InfR) as the measure of inflation for this study.

In conclusion and by a priori expectation, financial liberalization affects financial development which passes on liberalization effects to the economy. The influence of inflation on the nexus is crucial as high inflation creates economic uncertainty and destroys macroeconomic stability which may nullify the benefit of liberalization.

Model specification

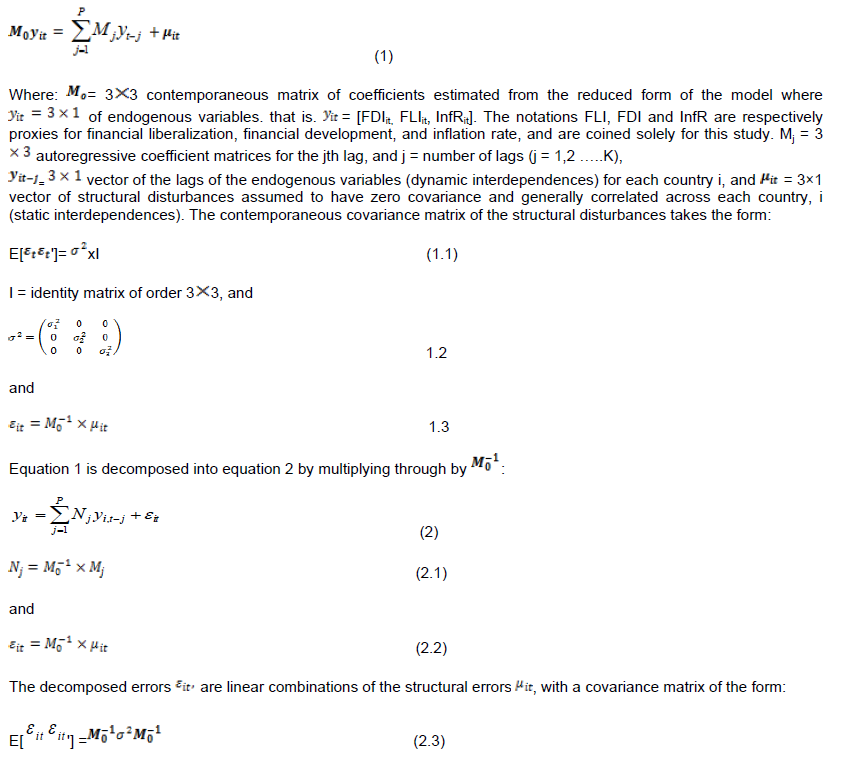

The study adopts a panel VAR framework in analyzing the dynamic link between financial liberalization (FLI) and financial development (FDI), under the influence of inflation (InfR). The structural representation of the model is:

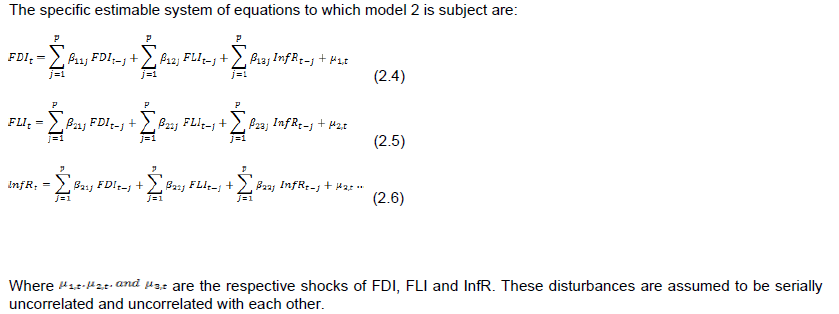

In line with existing literature, we identified and estimated the shocks of the model variables in their respective equations.

Model justification

The use of the VAR(p) model is necessary to examine the complex dynamics of the variables involved and to deal with the problem of endogeniety among the variables.

Preliminary tests and study statistic

To determine the suitability of the data for the study, a series of panel unit root (stationarity) tests and Pedroni residual panel cointegration tests are performed. If the results of the stationarity test suggest the existence of a possible long-run relationship (that is unit root) among the variables, co-integration test is conducted for confirmation. If the result of the cointegration test proves the presence of cointegration, a panel VECM is estimated, otherwise estimate PVAR model. The study then performed the lag length selection test to determine the optimum lag length for the model, estimate the model and then generate the impulse response functions (irf) and forecast error variance decompositions (fevd) from the residuals generated. The irf and fevd statistic are employed in the analysis as they are more informative than the regression coefficients due to the complicated dynamics of the PVAR model.

Model stability test

To check the robustness of the results, we performed the Eigen Value Stability Condition test to determine if the model is stable. If the results show that all the eigen values lie within the unit circle, then the VAR stability condition is satisfied, hence the PVAR model estimated is stable and robust.

RESULTS

This section presents and discusses the preliminary test results, the estimated model, the impulse response function graphs and the forecasts error variance decompositions. Following are the various tests results.

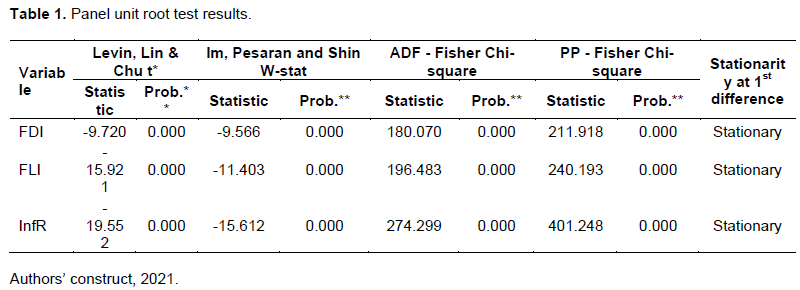

Unit root test

Estimations with time series data require that the data is stationary, as non-stationary data estimation can give spurious results. To avoid spurious results, various panel unit root tests are conducted on the data under the hypothesis: panels have unit roots. Table 1 presents the results. Table 1 shows that all but one of the panel variables are stationary, thus the null hypothesis of non-stationarity in panels cannot be rejected; hence, the existence of a long-run stochastic trend within and across the panels is possible.

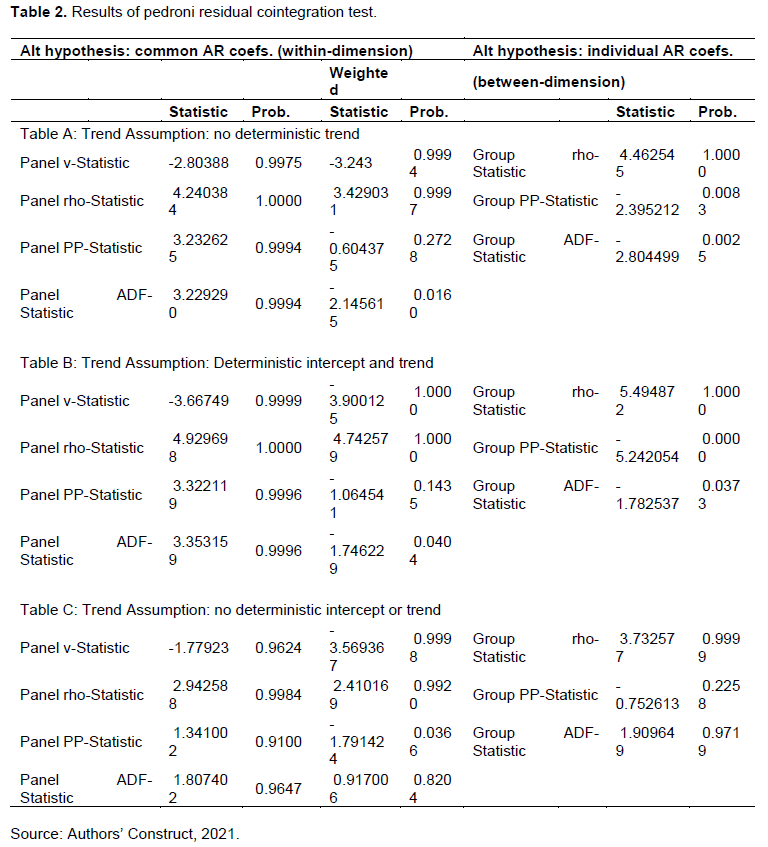

Panel cointegration test

To ascertain the presence of long-run relationship within and across the panels as envisaged, we performed the Pedroni residual cointegration test with three trend assumptions. Table 2 presents the results. The Pedroni residual test results reveal that most of the test statistics have probability values greater than the 5% significance level in all the three trend assumptions. Thus, there is no basis to reject the null hypothesis of no cointegration.

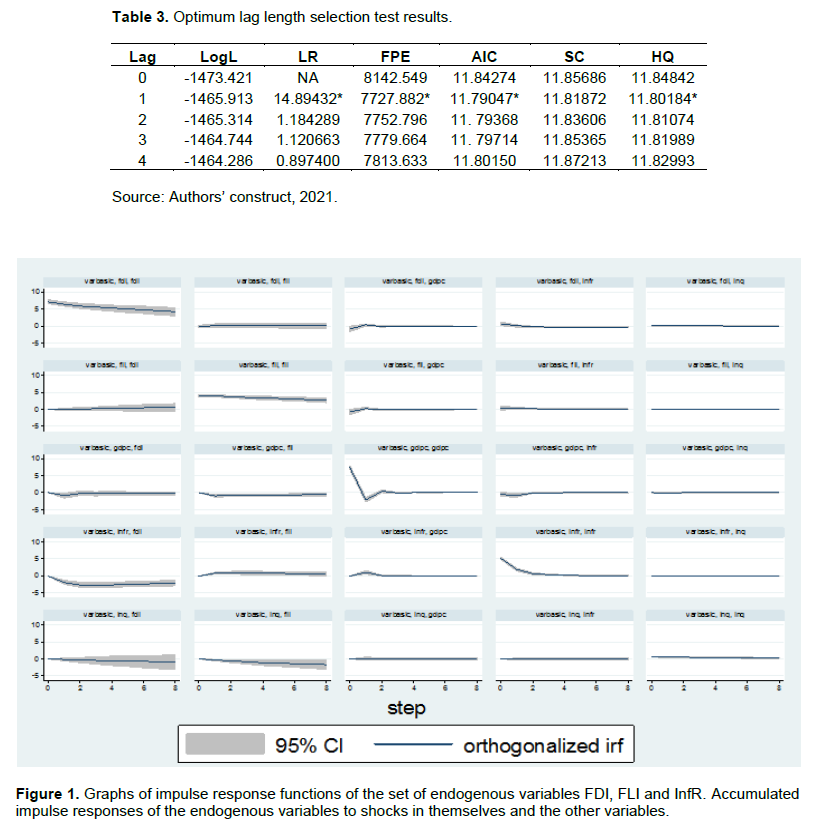

Lag-order selection test

In time series analysis, the use of lags is essential as most economic variables do not impact one another instantaneously but do so within a time-span (lag). Hence using the appropriate lag length is important in deciding the explanatory power of regression variables. Table 3 reports the lag length selection results.

Table 3 shows that the optimum lag length for the estimation of the PVAR model is 1 at 5% significance level. With this satisfactory preliminary test results, we proceed to estimate the decomposed model through the system of equations 2.4 to 2.6.

Heteroscedasticity and model stability test

We performed autocorrelation Lagarangian Multiplier (LM) test on the residuals generated from the model estimation under the hypothesis (H0): no autocorrelation at lag order. We found evidence to support the rejection of the null hypothesis and thus conclude that there is significant correlation of all series within and across panels. Therefore the findings of this study holds for all sampled countries.

Model stability test

Our eigen value stability condition test results show that all the eigen values lie within the unit circle. This satisfies the VAR stability condition; hence our PVAR model estimated is stable and robust.

DISCUSSION

The result is however not only consistent with Khalaf and Sanhita (2011) finding that liberalization impacts financial depth only in the long-run, but also corroborates their assertion that some economies implemented liberalization reforms in response to financial market dysfunctioning. It is also consistent with Ahmed (2013) finding that financial liberalization has positive effects on financial market development. Furthermore, the finding that financial development positively affects financial liberalization is in line with apriori expectation as negative developments in financial markets may require liberalization policies to fix.

Again, inflation responded positively to financial development shocks only in the short-run whilst financial development responds negatively to shocks in inflation both in the short and long-runs. This finding supports Hami (2017) finding that inflation has negative significant effect on financial depth and positive significant effect on the ratio of total deposits in banking system to nominal GDP in Iran. The finding is also consistent with Salimifar et al. (2012) finding that inflation has significant negative effect on financial development. Furthermore, the finding of an inverse bi-directional relationship between financial development and inflation is in line with economic theory and intuition as high inflationary pressure reduces general consumption and economic activity by lowering aggregate demand. This will in turn dampen financial market activity and consequently the general financial developments. Similarly, the results corroborate Suhaibu and Abdulai (2017) finding of an inverse relationship between stock market development and inflation. Intuitively, the negative impulse of inflation on financial development is channelled through its tendency to lower productivity and disposable incomes. Thus; leading to lower financial market activities and hence lower financial market development.

Inflation and financial liberalization positively affect each other in the short-run. This finding supports McKinnon-Shaw 1973 proposition that liberalizing financial systems will lower inflation and demolish financial repression. It also reinforces the thinking of the neo-structuralists that liberalization attracts foreign capital. The finding is however contrary to Gupta (2005) positive inflation-financial repression nexus for small open economies.

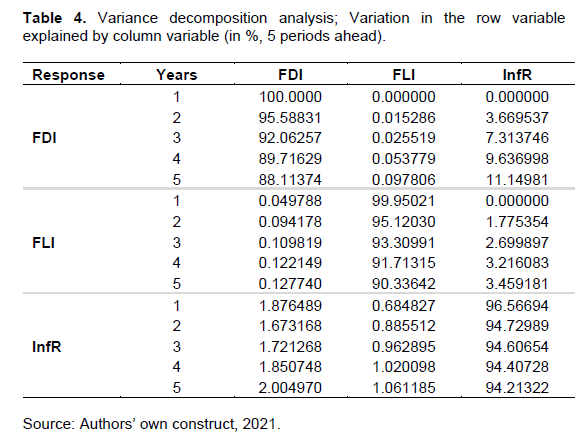

Forecast error variance decomposition (FEVD) analysis

To determine the extent to which how changes in one variable explain changes in other variables, we performed FEVD analysis. Table 4 reports the results. The result indicates that generally, as the forecast horizon moves from 1 to 5 forecast periods ahead, the predictive power of one variable over another improves. All the model variables are strongly endogenous; with financial development, financial liberalization and inflation explaining 100 to 88.11%, 99.25 to 90.34% and 96.57 to 94.21% respectively of their past shocks. The rest of the variables are highly exogenous. As the forecast horizon moves from 1 to 5 forecast periods ahead, financial development explains about 0.02% to 0.10%, and 3.67% to 11.15% of the shocks in financial liberalization and inflation respectively. In the same vein, financial liberalization explains about 0.05 to 0.13% and 1.78 to 3.46% of shocks in financial development and inflation respectively. Again, inflation accounts for 0.68 to 1.06% and 0.87 to 2.71% of the shocks in financial liberalization and financial development respectively. The novelty of this study is three-fold; the quantification of the explanatory power of one variable over the other, the length of time it takes for the impact to manifest, and the bi-directionality of the link between liberalization and financial development under the influence of inflation. Ayouni et al. (2014), Khalaf and Sanhita (2011) and others found that liberalization impacted financial development, yet, could not establish the magnitude of the explanatory power of liberalization on financial development. Neither did they consider the bi-directionality of the link between the variables, nor report on how long it takes for the impact to manifest, considering the inflation effect.

CONCLUSIONS AND RECOMMENDATIONS

This study examined and validated the dynamic bi-directional nexus between financial liberalization and financial development in the presence of inflation in 19 SSA countries over the period 2000-2019 using a panel VAR framework. The study established a weak long-run bi-directional relationship between financial development and financial liberalization, with liberalization accounting for about 0.09% of financial development shocks whilst financial development explains about 0.06% of liberalization shocks on average. It takes 3 to 5 years for the impact to manifest after policy implementation. The study further revealed a positive short-run bi-directional relationship between inflation and liberalization, and an inverse short-run bi-directional relationship between inflation and financial development. Whilst inflation explains about 0.87 and 1.79% of liberalization and financial development shocks respectively, liberalization and financial developments respectively explain about 2.62 and 7.41% of inflation shocks on average. It takes 1 to 2 years for the impulse to manifest after policy implementation. We recommend that for financial liberalization policies to succeed, stable inflationary regime and the necessary preconditions (stable macroeconomic climate, institutional and financially developed systems) for liberalization policies should be in place prior to the implementation of the policies. For future research, we recommend the use of more frequent and recent data for better estimates than the annual data employed in this study.

CONFLICT OF INTERESTS

The authors have not declared any conflict of interest.

REFERENCES

|

Abiad A, Mody A (2005). Financial reform: What shakes it? What shapes it? American Economic Review 95(1):66-88. |

|

|

Aboutorabi MA (2012). The Effect of Inflation on Financial Development: The Case of Iran. Journal of Basic and Applied Scientific Research 2(8):8394-8400. |

|

|

Ahmed AD (2013). Effects of financial liberalization on financial market development and economic performance of the SSA region: An empirical assessment. Economic Modelling 30:261-273. |

|

|

Ayouni SE, Issaoui F, Brahim S (2014). Financial Liberalization, Foreign Direct Investment and Eco. Growth: A Dynamic Panel Data Validation. International Journal of Economics and Financial Issues 4(3):677-697. |

|

|

Bartolini L, Draze A (1997). Capital-Account Liberalization as a Signal. American Economic Review 87(1):138-54. |

|

|

Bittencourt M (2011). Inflation and Financial Development: Evidence from Brazil. Economic modeling 28(1):91-99. |

|

|

Chartziantoniou I, Duffy D, Filis G (2013). Stock market response to monetary and fiscal policy shocks: Multi-country evidence. Economic Modelling 30:754-769. |

|

|

Choong C, Chan S (2011). Financial Development and Economic Growth, A Review. African Journal of Business Management 5(6):2017-2027. |

|

|

El-Wassal AK (2005). Understanding the Growth in Emerging Stock Markets. Journal of Emerging Market Finance 4(3):227-261. |

|

|

Fowowe B (2008). Financial liberalization policies and economic growth: panel data evidence from sub-Saharan. African Development Review 20(3):549-574. |

|

|

Ghosh J (2005). The economic and social effects of financial liberalization: A primer for developing countries. Economic and Social Affairs 4:1-18. |

|

|

Gupta R (2005). Financial Liberalization and inflationary dynamics: An Open economy analysis. Economics working papers, 200532. |

|

|

Habibullah MS, Eng YK (2006). Does Financial Development Cause Economic Growth? A Panel Data Dynamic Analysis for the Asian Developing Countries. Journal of the Asian Pacific Economy 11(4):377-393. |

|

|

Hami M (2017). The effects of inflation on financial development indicators in Iran (2000-2015). Studies in Business and Economics 12:2. |

|

|

Hanif MN, Batool I (2006). Openness and Inflation: A Case Study of Pakistan. MPRA Paper 10214:1-8. |

|

|

Ikhide S (1992). Financial Deepening, Credit Availability and the Efficiency of Investment: Evidence of Selected African Countries. Development Research Paper Series, Research Paper 2. |

|

|

Kabir SH, Hoque HA (2007). Financial Liberalization, Financial Development and Economic Growth: Evidence from Bangladesh. Journal of Savings and Development 31(4):431-448. |

|

|

Kaminsky GL, Reinhart CM (1999). The Twin Crises: The Causes of Banking and Balance of Payments Problems. American Economic Review 89(3):473-500. |

|

|

Karikari JA (2010). Governance, Financial Liberalization, and Financial Development in Sub-Saharan Africa. Paper presented at the African Development Bank's African Economic Conference, Tunisia. Pp. 27-29. |

|

|

Khalaf A, Sanhita A (2011). Financial liberalization and ?nancial development in Iraq. The Review of Finance and Banking 3(2):67-78. |

|

|

Kim D, Lin S, Suen Y (2010). Dynamic Relationship between Inflation and Financial Development. Macroeconomic Dynamics 14(3):343-364. |

|

|

Li Kui-Wai (1997). Money and monetization in China's economic reform. Applied Economics 29(9):1139-1145. |

|

|

Luuk E, Niels H, Jan J, Aljar M (2017). Financial development, Financial liberalization and Social capital. Applied Economics 50(11):1268-1288. |

|

|

McKinnon RI (1973). Money and Capital in Economic Development. Washington, D.C.: Brookings Institution. |

|

|

Mekki H, Samir M (2018). Overall effect of financial liberalization: Financial Crisis versus Economic growth. International Review of Applied Economics 33(4):568-595. |

|

|

Misati RN, Nyamongo EM (2011). Financial liberalization, financial fragility and economic growth in Sub-Saharan Africa. Journal of Financial Stability 7(1):26-37 |

|

|

. |

|

|

Mosley P ( 1999). Micro Macro Linkages in Financial Markets: The impact of Financial Liberalization on Access to Rural Credit in Four African Countries. Finance and Development Research program, Development Initiative. Working Paper 4. |

|

|

Odhiambo NM (2005). Financial liberalization and financial deepening: Evidence from Three Sub-Saharan African (SSA) Countries. Journal of African Review of Money, Finance and Banking pp. 5-23. |

|

|

Odhiambo NM (2012). The Impact of Inflation on Financial Sector Development: Experience from Zambia. Journal of Applied Business Research 28(6):1497-1508. |

|

|

Ozturk N, Karagoz K (2012). Relationship between Inflation and Financial Development: Evidence from Turkey. Journal of Alanya Faculty of Business/Alanya Isletme Fakültesi Dergisi 4(2):81-87. |

|

|

Prasad E, Rogoff K, Wei S, Kose M (2007). Financial globalization, growth and volatility in developing countries. NBER Chapters, in: Globalization and Poverty. National Bureau of Economic Research, Incorporation pp. 457-516. |

|

|

Pill H, Pradhan M (1995). Financial Indicators and Financial Change in Africa and Asia. International Monetary Fund, Research Department, Working Paper 123/95, i-31. |

|

|

Salimifar M, Mojtahedi S, Hadad MM, Zendehdel SH (2012). The Impact of Inflation on Financial Sector Performance in Iran. Quarterly Journal of Applied Economics Studies in Iran 1(2):177-215. |

|

|

Shaw ES (1973). Financial Deepening in Economic Development. New York: Oxford University Press. |

|

|

Suhaibu I, Abdulai A (2017). Economic growth and stock market developments; evidence from Africa. UDS International Journal of Development 4(2):2026-5336. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0