ABSTRACT

Within the last decade, the Kingdom of Saudi Arabia (KSA) achieved a high economic rate of growth of about 5.5% per year. Consequently, the number of immigrants grew rapidly reaching 9 million, which resulted in an increase in worker remittances out of the Kingdom. Since then, the KSA has become one of the first countries of the world in terms of remittances outflows and coming third worldwide after the USA and Russia in 2014 as remittances totaled 37 billion dollars, about 5% of the gross domestic product (GDP) and have doubled within 6 years. This research tries to measure the effects of these remittances on the economic growth of Saudi Arabia during the period 1970 to 2014 by using standard growth model augmented by the amount of remittances outflows. The Autoregressive Distributed Lag approach to Error correction modeling (ARDL-ECM) was used in order to estimate a short and long relation between remittances and gross domestic product (GDP) in Saudi Arabia in the studied period. The main result is that, both in the long and the short term, remittances outflows have no significant effect on GDP. This could be attributed to their decreasing share relative to GDP.

Key words: Economic growth, workers' remittances, ARDL model.

The international mobility of labor can be a powerful factor of convergence and growth at an international level. O’Rourke and Williamson (1994) showed that in the 19th century, income convergence between countries was highly favored by international migration. Given the large productivity differential between countries, international migration undoubtedly drove higher welfare gains. Hamilton and Whalley (1984) estimated that free labor movements resulted in the increase of at least about 20% of the world gross domestic product (GDP). However, the heavy dependence on foreign workers could be problematic if some indicators such as remittances outflows or the ratio of foreign workers to the working population reached a certain level, which is the case of the Kingdom of Saudi Arabia

In fact, the continuing changes in the structure of the Saudi economy since the first oil crisis in the 70's are responsible for the exploding remittances outflows reaching 37 Billion dollars in 2014. Saudi Arabia ranked third after USA and Russia in terms of remittances outflows in dollars but ranked first in relation with to the share of remittances in the GDP.

Three main events contributed to this high level of outflows. The first one is the achievement of high rates of economic growth thanks to development plans which increased first, the need for foreign workers and after that with the third sector boom, the reliance on qualified foreign workers increased drastically and so did the stock of wages.

The second reason is related to the fall in transaction fees for sending money (Ratha, 2007) resulting from the extension of new information and communication technologies which encouraged migrants to send more money and more frequently.

The third reason is not an economic one but related to the specificity of the kingdom. Visas restrictions, low labor mobility, limited investments opportunities and difficult access to property compelled foreign workers to remit since their stay in the country is considered as temporary.

For all these structural reasons, the remittance outflows subject has become of major interest. In fact, in the beginning, the increasing amount of remittances outflows was interpreted as a sign of a growing economy but these last years and with the recorded levels of outflows, researchers tried to shed the light on their effects on macroeconomic indicators and this paper fits into this reflection. So, the purpose is to verify if, in the case of Saudi Arabia remittances outflows are harmful for economic growth.

The second section explores the relation between remittances outflows and growth through a literature review and possible transmission mechanisms, then the third section deals with the empirical study where a standard growth model augmented with a remittances outflows variable is estimated with Saudi data from 1970 to 2014 using an autoregressive distributed lag approach to error correction modeling (ARDL-ECM) and results are exposed. A final section will conclude with a synthesis of important results.

Remittances outflows and growth

Extensive studies concerning remittances were devoted to their effects on receiving countries growth since they are becoming an increasingly important part of the financial landscape of many developing countries. In fact, studies are scarce concerning remittances effects on remitting countries since even if the amount of remittances in dollars is important, it is still insignificant relative to their GDP and this point constitutes the specificity of Saudi Arabia where the share of remittances in GDP represents 5% almost the same share of FDI in GDP.

Pioneer studies concerning remittances outflows focused on remittances determinants and studied the causality between remittances outflows and leading macroeconomic indicators but contributions to their effects on economic growth are still limited.

Mahmoud and Abdel-Rahman (2006) found that the economy growth, wages and local instabilities are factors increasing remittances outflows while the return indicators are a decreasing factor in the KSA and Naufal and Termos (2010) proved that oil price and the GDP per capita of the receiving country are significant in determining the amount of remittances from Gulf Cooperation Council (GCC) countries.

Taghavi (2012) investigated through Granger causality tests and dynamic simultaneous equation system the direction of causality between main macroeconomic indicators and remittances outflows in order to identify if remittances help or hinder economic recovery in GCC countries. Their main findings are that macroeconomic tools are not efficient in reducing remittances outflows since non macroeconomic factors are more powerful. They found that in KSA remittances outflows cause changes in inflation, real effective exchange rate and real interest rate differential in the short term and affect only inflation in the long term.

Al Khathlan (2013) checked the effects of remittances outflows on Saudi growth using an ARDL-ECM, and found that these outflows affect growth negatively in the short run while in the long run, their effect is not significant. Haddad and Choukir (2015) studied the effects of structural shocks of remittances outflows on non-oil GDP, investment and current account balance using TVP-VAR model with stochastic volatility and concluded that high and low volatility regimes of remittances outflows shocks have asymmetric effects ( negative/ positive) on non-oil GDP, investment and current account balance.

Hathroubi and Aloui (2016) using three variants of the wavelet methodology showed that remittances outflows are strongly related to real growth rates employment and government expenditure. Moreover, they found that government expenditure affect positively remittances share to real output and that a positive causality link exists from the active population to the remittances.

Expect Al Khathlan (2013), no one of the reviewed studies did raise the issue of the effect of remittances on economic growth and even Al Khathlan study used a standard growth model where the investment variable is omitted which could result in biased estimations.

Transmission mechanisms

Since papers dealing with such a subject are purely empirical and no link has been settled between remittances outflows and economic growth, this section will try to explore different channels through which these outflows could impact growth in the KSA.

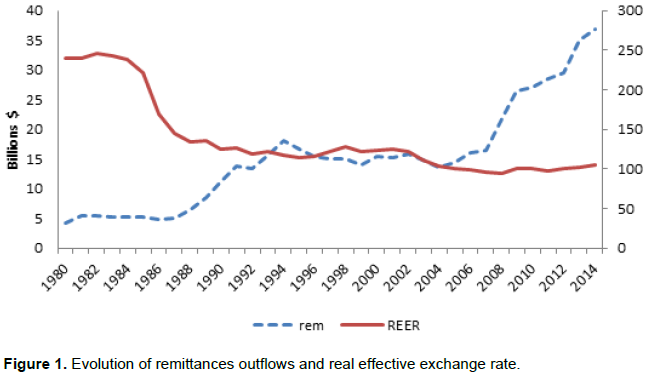

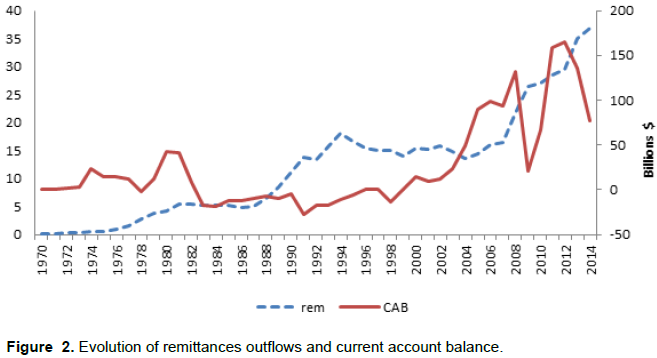

Remittances outflows can have effects on many macroeconomic indicators such as inflation rate, real effective exchange rate (REER), current account balance, reserves and financial resources. Remittances outflows, by lowering the money supply in the economy will result in lower inflation rate which could have either a positive or negative effect on growth according to the growth theory. In the case of KSA which is a commodity exporter country, it suffers from real effective exchange rate appreciation called Dutch disease resulting from high oil revenues and the low rate of inflation helps to depreciate the REER and so mitigates the Dutch disease effect and ameliorates the price competitiveness (Figure 1).

A study conducted by the IMF(2012) in order to explore to what extent foreign workers help to reduce REER appreciation showed that in a panel of oil exporter countries, remittances outflows depreciate significantly the REER. Besides, Espinoza et al. (2013) linked the real exchange to its determinants and added the size of remittance outflows. They found that REM outflows led to real effective exchange rate depreciation on the studied countries.

Moreover, since the exchange rate is pegged to the dollar, remittances outflows could have two opposite effects. On the one hand, remittances outflows will increase the Riyal offer and in order to defend the parity with the dollar, the monetary authority will tap into reserves; the depletion of reserves could exert bad signaling effect that could affect economic growth. On the other hand, remittances outflows will play the role of a tacit monetary policy since it is constrained by the defense of the parity in a context where the US and Saudi policies are not always aligned and remittances could temper the effect of American interest rate variations on the Saudi economy. Termos et al. (2015) explained that ''given the lack of an operational governmental bond market in this regional economy in addition to a less autonomous monetary policy, the staggering amount of remittances fleeing the GCC economies during economic upturns seems to play a stabilizing role as a tacit monetary policy tool".

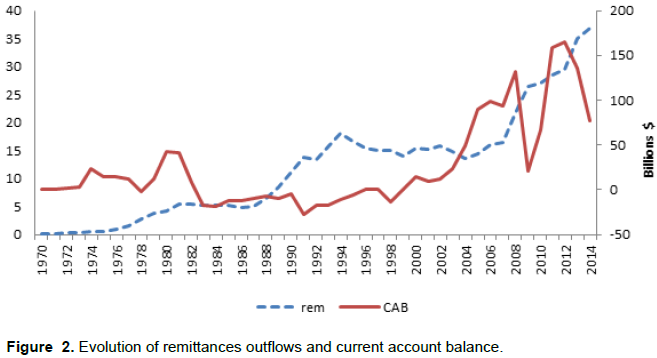

Concerning the current account balance (CAB) effect on growth, by construction an increase in remittances outflows will have the same effect as an increase in imports and will deteriorate the current account balance (CAB). However, the effect of CAB deficit on growth will depend on the origin of the deficit. It will be unsustainable if it is due to a low saving rate or an excess of imports over exports but it will have a favorable effect on growth if it is due to high investment relative to saving. In the case of KSA, and through data examination, no remarkable impact of remittances was recorded on the CAB. In fact, in the last ten years, periods of remittances increase aren't coupled with CAB deterioration (Figure 2).

Besides, remittances outflows reduce the propensity to consume since workers prefer to save a large share of their income, so the government spending multiplier will decrease diminishing the efficiency of government spending in boosting the economic activity and this could result in lower growth rates.

Finally, remittances outflows are a sort of resource flight, a loss of profit since the workers savings instead of being invested locally are fleeing the country, and thus lowering the investment potential.

Empirical study

Model and data description

Growth theories have identified various factors that influence a country growth. These factors include

investment, human capital, innovation, economic policies, governmental factors, trade openness, institutional framework, foreign direct investment, political and socio-cultural factors, demography and many others.

In order to examine the empirical evidence of the effects of remittances outflows on economic growth, the study takes traditional determinants of growth and adds the remittances outflows variable. The model to be considered is:

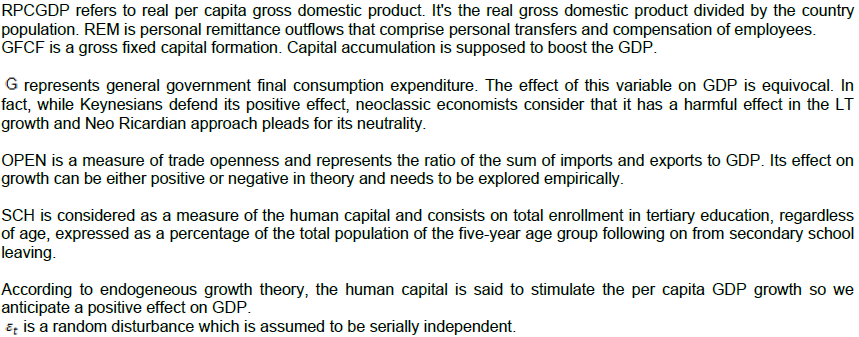

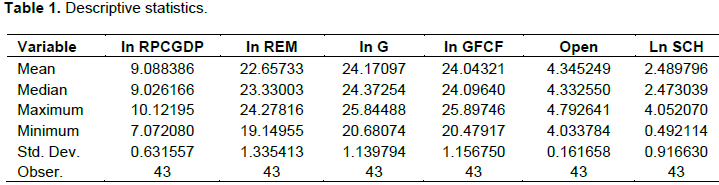

All the data is derived from the World Development Indicators data base, and Table 1 recapitulates the descriptive statistics of the variables used in the study.

The variables used in the model are time-series and any unit roots and/or cointegration associated with the data have to be taking into account. Applying the ARDL bounds testing methodology of Pesaran and Shin (1999) and Pesaran et al. (2001) can provide some advantages relatively to conventional cointegration testing like using a mixture of I(0) and I(1) data, estimating a simple single-equation set-up which combines the long run equilibrating and the short run dynamics of the relationships between the variables and this method gives more robust result in the use of small or finite samples.

The ARDL regression model needs to follow this step by step approach:

1. To make sure that data is I(0) or/and I(1) and none of variables are I(2)by using ADF and PP unit root tests.

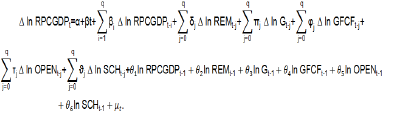

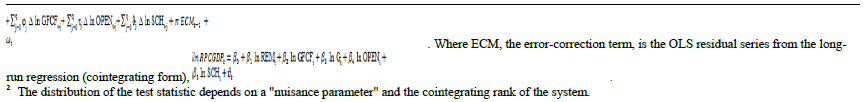

2. The second step consists in formulating an "unrestricted" error-correction model (ECM) that will be a particular type of an ARDL model:

criterion is made automatically by the software program Eview's. It chooses the model which contains the maximum of lags but it has the smaller value of the information criterion.

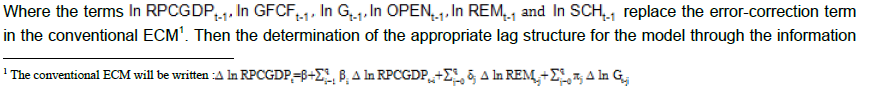

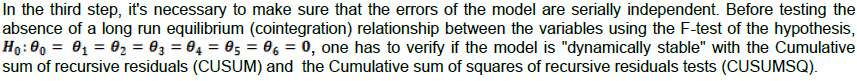

Finally, if the F-statistic falls between the bounds, the test is not conclusive. When the bounds test is conclusive, it's possible to extract the long run effects from the unrestricted ECM and to measure separately the short run dynamic effects and the long run equilibrating relationship between the variables.

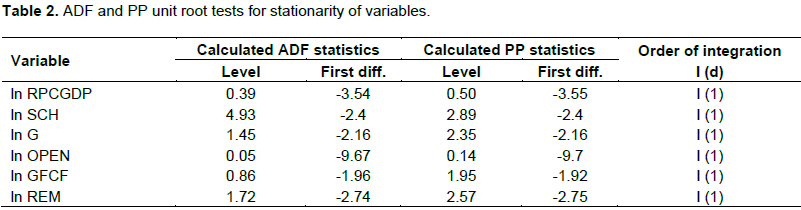

Before using the ARDL method, it's necessary to verify that all variables are I(0) or I(1) or both.

The results of the ADF and the PP unit root tests reported in table2 confirm the possibility to estimate the model with the ARDL method. Then, the F-statistic of the bounds test (4.3047) exceeds the corresponding upper critical bound values at 5% of significance level (3.79). So, we can reject the null hypothesis of the no cointegration, and we conclude the long-run relationship between the dependant variable and the regressors exists. The AIC criterion method selects an ARDL (1, 0, 1, 0, 2, 0) (Table 2).

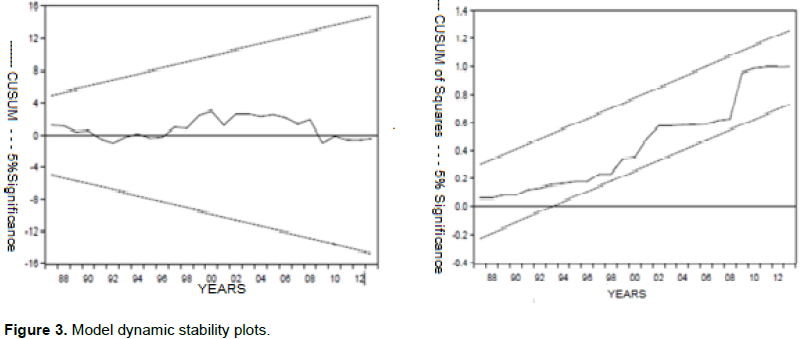

Then, using the Breusch-Godfrey serial correlation LM test, the null hypothesis of the absence of a serial correlation for the errors is not rejected because the F-statistic (0.5175) < the F-theoric (3.442). Moreover, the plots of CUSUM and the CUSUMSQ tests (Figure 3) indicate the dynamic stability of the model within the 5% significance.

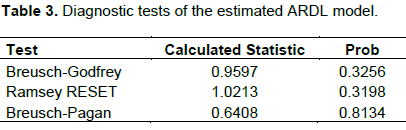

Finally, as presented in Table 3, results of Ramsey RESET and Breusch-Pagan tests suggest that the model is correctly specified and that there is no heteroscedasticity problem. As a result of this statistic analysis, it's possible to conclude that the used ARDL model is the best specified and is also free from error problems.

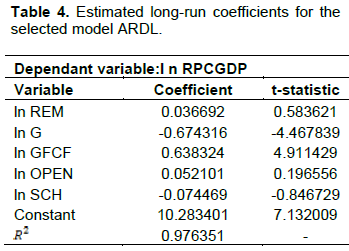

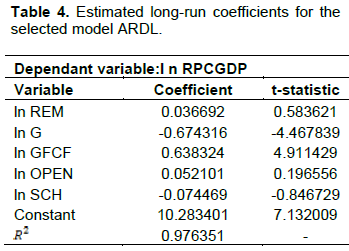

The long term relation results (Table 4) show that general government final consumption has a negative and significant effect on RPCGDP comforting the neo classical theory. As expected, physical capital have a positive and significant effect on RPCGDP. However, openness and human capital variables turn to be insignificant. Concerning the interest variable, the result is the same as Al Khathlan (2013). Indeed, the effect of remittances on growth in the LT is not significant.

This result can be explained by the both sides' effects of remittances on macroeconomic indicators. In fact, on the one hand they serve to alleviate the Dutch disease that characterizes commodity exporting countries by lowering inflation and so reducing the real effective exchange rate. They also offer another tool to the monetary policy to temper the effect of American interest rate variations on the Saudi economy. On the other hand, these outflows are considered as resources fleeing the country instead of being invested locally, and so have a negative effect on investment. Moreover, these outflows need to be compensated for by reserves in order to maintain the parity with the dollar so they result in reserve depletion.

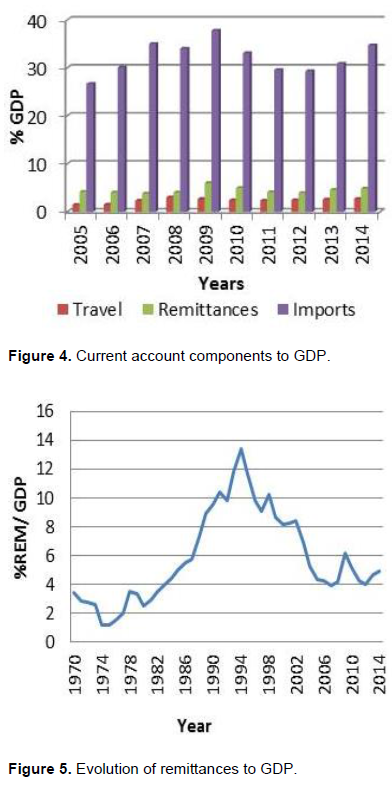

An alternative explanation could be derived from the current account. In fact, remittances share to GDP is comparable to the share of goods and services that Saudi residents acquire in other economies (Debit of the travel account) relative to GDP as shown in the Graph 4.

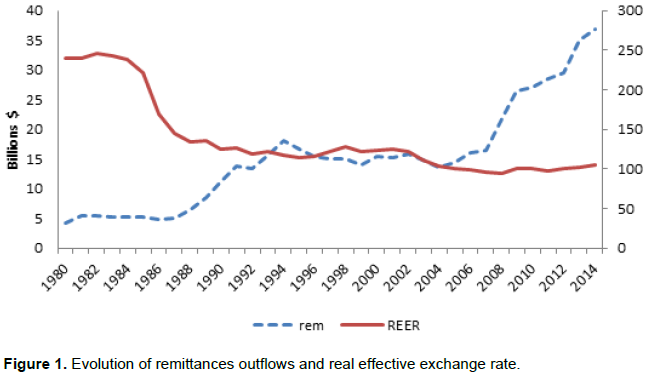

In addition, the share of remittances to GDP represents only the sixth of the share of imports to GDP. Furthermore, as exposed in Graph 5, remittances outflows share relative to GDP has been decreasing since the mid 90's. All these reasons plead for the non- significant effect of remittances on GDP (Figures 4 and 5).

The results of the short term presented in Table 5 show first of all that the estimated coefficient of ECM is negative and significant confirming the existence of co-integrating relationship between RPCGDP and studied determinants (stable long term equilibrating) and that a deviation from the long run equilibrium following a short run sock is corrected within one year by about 38.19%. Besides, physical capital effect is still positive and significant while the estimated effects of other variables are not significant even the remittances outflows variable.

Remittances outflows seem to be a loss of profit and a capital fleeing the country instead of being invested locally. But, this study based on Saudi economy data from 1970-2014, estimated a standard growth model augmented by remittances outflows variable using ARDL-ECM technique found that these outflows have a non- significant effect on Saudi RPCGDP on the short and the long run.

This neutral effect on economic growth could be attributed to the decreasing share of remittances outflows on GDP and also to the sum of two opposite effects on growth. Indeed, remittances outflows on the one hand reduce inflation and the REER but on the other hand they are a lost opportunity for the investment and reduce reserves.

However, more advantage could be taken from migrants if their savings could be invested locally. In fact, allowing them to have a long legal stay, removing visas restrictions and giving them the right to property are policies that help to reduce remittances outflows.

The authors have not declared any conflict of interests.

REFERENCES

|

Abdel-Mahmoud M, Abdel-Rahman M (2006). "The Determinants of Foreign Worker Remittances in the Kingdom of Saudi Arabia". J. King Saud Univ. 18(2):93-121.

|

|

|

|

Alkhathlan K (2013). "The nexus between remittance outflows and growth: A study of Saudi Arabia". Econ. Model. 33:695-700.

Crossref

|

|

|

|

Haddad H, Choukir J (2015). The Time-varying Reponses of Saudi Arabia Economy to Workers Remittance Outflows Shocks. Arab. J. Bus. Manage. pp. 5-6.

|

|

|

|

Hamilton B, Whalley J (1984). Efficiency and distributional implications of global restrictions on labour mobility. J. Dev. Econ. 14:61-75.

Crossref

|

|

|

|

Hathroubi S, Aloui C (2016). On interactions between remittance outflows and Saudi Arabian macroeconomy: New evidence from wavelets". Econ. Model. 59:32-45.

Crossref

|

|

|

|

International Monetary Fund (2012). Saudi Arabia: Selected Issues. IMF Country Report No. 12/272.

|

|

|

|

Naufal GS, Termos A (2010). Remittances from GCC Countries: A Brief Outlook. Middle East Institute, Migration and the Gulf, Washington, DC. pp. 37-41.

|

|

|

|

O'Rourke KH, Williamson JG (1994). Late 19th Century Anglo-American Factor Price Convergence: Were Heckscher and Ohlin Right? J. Econ. Hist. 54:892-916.

Crossref

|

|

|

|

Espinoza R, Fayad G, Prasad A (2013). The Macroeconomics of the Arab Countries of the Gulf. Oxford University Press and the International Monetary Fund.

|

|

|

|

Pesaran M, Hashem SY (1999). Generalized impulse-response analysis in linear multivariate models. Econ. Lett. 58(1):17-29.

Crossref

|

|

|

|

Pesaran MH, Shin Y, Smith RJ (2001). Bounds testing approaches to the analysis of level relationships. J. Appl. Econ. 16(3):289-326.

Crossref

|

|

|

|

Ratha D (2007). Leveraging Remittances for Development. MPI Policy Brief (June),

|

|

|

|

Taghavi M (2012). The Impact of workers' remittance on macro indicators: The case of the Gulf Cooperation Council. Topics in Middle Eastern and African Economies. 14:49-73.

|

|

|

|

Termos A, Genc I, Naufal G (2015). A Tacit Monetary Policy of the Gulf Countries: Is There a Remittances Channel?. IZA DP No. 8810.

|