ABSTRACT

Economic growth is important but not sufficient to generate a sustainable increase in individual welfare. Inclusiveness attributes to growth, the dual virtue of widening the space of economic and social opportunities; while ensuring a better application of distributive equity. In this perspective, Ali and Son suggest that growth is inclusive when combined with high income and equity. This study tries to verify this assertion in Côte d’Ivoire. This study focuses on ARDL Bounds approach for testing cointegration to measure the contribution of institutional factors to inclusive growth in Côte d’Ivoire over the period of 1984 to 2018. The International Country Risk Guide (ICRG) Index is used as institutional factors. The findings of empirical analysis suggest that only government stability as institutional factors have greatly and statically significant effect on inclusive growth in the short and long run.

Key words: Ardl Bounds Test, Côte d’ivoire, inclusive growth, institutional factors.

The objective of strong economic growth and sustainable development in the aftermath of independence in most sub-Saharan Africa countries, particularly in Côte d’Ivoire, is to create the deployment of means and strategies to redirect economic development policy. However, in the 1960s, the economic, financial and institutional situation did not seem to be conducive to motivate economic take-off and improve the social well-being of populations.

In the late of 1980s, a compromise was reached in order to redefine the desirable macroeconomic framework for boosting growth, promoting development and reducing poverty. According to the Washington Consensus (Williamson, 1990), the institutional arrangements put in place should lead without fail to strict budgetary discipline, broadening of the tax base, privatization, deregulation, protection of private property and trade and financial liberalization: this is the conception of the “self-regulating” (Williamson,1990) and efficient market. However, such objective does not tend towards development according to Piketty, but would rather be vulnerable to Kuznets (1955) curse that economic growth feeds inequalities in the first phase of development (Asongu, 2015). Since the seminal publication of Acemoglu et al. (2005) on the crucial role of institutions quality and the economic development nations, a new literature is emerged (Bouzahzah et al., 2015; Asongu, 2015). A large number of economic studies conducted in recent year suggest that institutions are vital for economic development and growth. Indeed, when institutions have not good quality, they are influenced by power groups and act more in their favor. As a result, significant disparities affect the redistribution of the benefits of economic dynamism to disadvantage frailest social groups, including: ethnic minorities, people living in rural areas and women of the disabled (Klasen, 2010). Since the early 1990s, debates on alternatives to the inequality literature have led to a new perception of the concept of pro-poor growth (or inclusive growth). At the same time, the concept of good institutional quality and inclusive growth is on the heart of development policy discussions and conceptions. A large number of studies have examined the role of institutions factors in economic development, poverty reduction and better, in promoting inclusive growth. Indeed, the inclusiveness of growth implies dimensions other than poverty and income distribution such as the good quality of institution factors which, in any case, has an impact on income distribution. Therefore, institutional quality and inclusive growth are important to develop policy agenda, and the question arises, whether institutional factors are conducive to the inclusiveness of Côte d’Ivoire’s economic growth.

This paper attempts to review a theoretical perspective on institutional factors of inclusive growth and estimate an empirical model to measure the contribution of institutional factors of inclusive growth, using Côte d’Ivoire as an example, where the kind research work has rarely been undertaken. The objective of this paper is to measure the contribution of institutional factors to inclusive growth. However, very few studies have considered institutional factors in explaining the inclusiveness of economic growth, especially in Côte d'Ivoire. To the best of the authors knowledge, this issue has not been the subject of any previous research for Africa and especially in Côte d'Ivoire. Even so, institutional variables have been ignored in the explanation of the results of this question. This study makes an empirical contribution for economic research by measuring inclusive growth using the method of Ali and Son (2007b) and the contribution of institutional factors to inclusive growth. Rather than being a study of the determinants of inclusive economic growth, this study contributes to the debate on the link between institutions and inclusive growth. From this point of view, this study differs from existing studies, which focus for the most part on its definition and ways of measuring inclusive growth (Klasen, 2010; Rauniyar and Kanbur, 2010). Only limited studies actually measure it and study the factors that determine it (Anand et al., 2013; Balakrishman et al., 2013; Abbe, 2019). However, these studies focus on Asia, North Africa and West African Economic and Monetary Union (WAEMU).

Indeed, most recent statistics show that sub-Saharan Africa has experienced high rates of economic growth over the past (Asongu and Le Roux, 2016). In addition, human development indexes have progressed considerably said they. While, there is general support for the notion of inclusive growth, there is no consensus. There are few empirical (or theoretical) studies on the relationship between inclusive growth and its institutional factors. The study’s analysis of the relationship between institutional factors and inclusive growth is based on the existing research and the link between economic growths. The study also gives a theoretical background in the documentation of the relationship between inclusive growth and the international country risk guide as an institutional index.

In the late 1990s, an intense debate over how institutional factors in terms of inclusive growth has been rise to divergent views and conceptions both in economic and within the international community. A large number of empirical frameworks have examined the role of quality of institution in economic development, reducing poverty and promoting inclusive growth. The necessity to improve the quality of institutions has become an imperative of certain governments. Moreover, according to North (1990) and Doumbia (2018), the role of institution is to establish certain stable structure of human relations or interactions. Thus, it follows a complex process of essentially changing rules so that they are dynamic over time. In Africa for example, this dynamic is confronted with traditions and codes of conduct that have remained more or less and closed in themselves. Fight against poverty, inequality and all forms of social exclusion that this concept implies has since given it legitimacy, and its inclusion in international agenda and national development strategies (Nkamleu, 2017). Thus, inclusive growth is essential for restoring public confidence in the capacity of democratic institutions, technological progress and international economic integration to support greater progress to support and well-being for all (Cordemans, 2019).

According to Siyakiya (2017), the poor quality of institutions has a negative impact on the economies of poor countries and some developed countries in terms of transaction costs while increasing the decision to invest, focusing on areas that are likely to be productive by directing economic activity to productive areas and finally, building up trust and cooperation. In fact, institutional economics explains why developing countries remain poor because of their poor or less efficient institutions. In general, developing countries have weak institutions and fail to support productive investments and protect ownership rights. As a result, some poor countries enrich other countries, contributing to increased inequality (Fosu, 2017). In such cases, society will be able to achieve inclusive growth if it reforms the quality of its institutions to make them strong and to achieve poverty reduction. According to the literature, there is a close link between ownership rights and inclusive growth. This is what prompted Acemoglu et al. (2005) to argue that the institutional drivers of inclusive growth that promote better ownership rights, create perfect conditions of competition and impact the decision to invest or not, are conducive to more inclusive growth.

Regarding the role of new middle class in inclusive growth, Wiemann (2015) argues that the greater class struggle in emerging countries, more likely it is to lead to pro-poor growth while diversifying and increasing the demand for consumer goods (which led to a media controversy triggered by the McKinsey-style projection of the market value of Chinese consumer goods and services in India and other developing countries). However, this is not primarily related to good quality institutions, as in the past, societies marked by poverty were working-class in Latin America (...) and nostalgia for order and stability combined with authoritarian government.

Furthermore, the Heritage Foundation (2019) believes that economic freedom based on the rule of law, limited government, effective regulation and open markets are factors in inclusive economic growth. To this effect, there is a literature that explains the close relationship between economic freedom and inclusive growth, as it facilitates the participation of all social strata in economic activity and in benefiting from the spillovers of this economic growth. Economic freedom can be measured by four main categories: rule of law, size of government, regulatory efficiency and open markets (Kouton, 2019). For example, in countries where individuals lack economic freedom, credit and labor market regulation has remained insufficient. At the same time, citizens are not in a position to decide for themselves. As a result, the role of the government in regulating the market through tax exemption and relief will further enable people to participate in productive economic activity. This is undoubtedly the reason why Gwartney et al. (1996) supports societies with strong economic freedom, because they are protected from repression, fraud or theft and aggression and that they are free to bargain as long as their actions do not compromise that of other individuals. For example, Murray and Press (2017) argue that economic freedom is a factor of inclusive growth of African countries. Given recent improvements, human development indicators, and growth rates in sub-Saharan Africa, promoting economic freedom appears to be a means of achieving more inclusive growth. This is the case in Asia, where demographics are large in some countries, serious policy reforms to open up to foreign trade have been implemented since the 1980s and 1990s (Rodrik, 2009).

However, inclusive growth is based on the idea that economic growth is important but not sufficient to generate a sustainable increase in welfare, which implies an equitable sharing of the growth dividend between individuals and social groups. Easterly and Levine (1997) share this view and suggest that despite the traditional determinants of economic growth such as labor supply, physical capital, and human capital, a strong focus on institution is needed in Africa. Therefore, for economic growth to be inclusive, it must be pro-poor, distribute growth equitably, and have strong institutions. Which, in any case, has an impact on income distribution? From this perspective, building effective institutions could be important for inclusive growth. Resnick and Birner (2006) argue that indicators of institutions such as political stability and the rule of law are effective in terms of economic performance, but perform poorly on how to make growth inclusive. In contrast, Doumbia (2018) finds that only institutional indicators such as effective governance and the rule of law promote inclusive growth that compromised that of other individuals.

It is generally accepted that the quality of institutions is a major determinant of the level of development (Rodrik, 2000; Collier, 2006). Looking at the quality of institutions through the lens of the six indicators of Kaufmann et al. (2005): participation and accountability, political stability, effectiveness of public power, quality of regulation, rule of law, and control of corruption, it is important to note that the weak performance of poor countries in this area, constrains seriously the inclusiveness of their economic growth. In this regard, Welch and Nuru (2006) point out that democratic governance broadens the range of options for human development. Despite recent improvements, least developed countries are facing the major challenge of creating and strengthening the institutions key of competitive democratic governance that can accommodate the objectives of authority and social inclusion (Gerring et al., 2005). Numerous empirical analyses establish the correlation between political stability and economic growth (Alesina and Perotti, 1996).

This relationship appears to be a bidirectional causal effect: on the one hand, inequality increases social discontent which in turn can lead to violent protest movements (Schock, 1996). And on the other hand, political instability, depending on the degree it has reached, can reduce the spread of the effects of growth inclusiveness by disarticulating the state apparatus and social services (health and education in particular), destroying socio-economic infrastructures, weakening territorial integrity, displacing populations, spreading diseases and reducing the agricultural population (FAO, 2005). In political stability, the large number of underdeveloped countries, particularly in sub-Saharan Africa, is experiencing political and military tensions that reduce the inclusiveness of economic growth as a result of their spillover effects. The effectiveness of public power, including the quality of public spending, especially that allocated to social sectors from which the poor are most likely to be excluded. Corruption affects significantly inclusiveness of economic growth in terms of both wealth creation and equitable redistribution (Gyimah-Brempong, 2001; Dincer and Gunalp, 2005) and multidimensional social welfare (Gupta et al., 2002; Aidt, 2010). Directly, corruption deprives state of important resources to support public action in favor of inclusiveness through the financing of education, health and socio-economic infrastructures or simply reduces the effectiveness of programmed that are supposed to benefit the most vulnerable (Olken, 2005). Corruption also weakens governance and social justice. It also discourages investment (Asiedu and Freeman, 2009) and therefore affects economic dynamism and, even worse; it can at the same time aggravate exclusion of poorest and most vulnerable from the labor market. In terms of corruption, the situation in poor countries is worrying. As mentioned above, there is little work on inclusive growth and its institutional factors, but a few examples can be listed.

Abbe (2019) attempts to explain the role of institutions in the relationship between unemployment and inclusive growth in the ECOWAS zone (Economic Community of West African States), from 2002 to 2016. For this, he uses Kaufman indices as a measure of institutional factors and Ali and Son (2007) method to measure inclusive growth. Applying the Generalized System of Moments Method (system-GMM), he finds that unemployment has a negative but negligible impact on inclusive growth in the Economic Community of West African States. However, the interaction between the quality of all institutions and unemployment is positive on inclusive growth. Studies conducted in the late 1990s on inclusive growth emphasized the importance of economic freedom as a determining factor, particularly in developing countries.

Thus, Kouton (2019) studies the role of institutions in terms of growth inclusiveness in a panel of thirty Sub-Saharan African countries during 1996-2016. To achieve his goal, he used data on economic freedom as an index of institutional factors and GDP per person employed to capture inclusive growth. Using General Moments Methods (GMM) estimation and panel causality testing in a dynamic framework, the results confer a positive and significant effect of economic freedom on inclusive growth. Thus, evidence is provided for the causal relationship between economic freedom and inclusive growth, but not the reverse.

Doumbia (2018) uses the Panel Smooth Transition Regression (PSTR) model to examine the importance of good quality institutions (governance) in terms of pro-poor and inclusive growth for a panel of 112 countries. She uses data from World Government Indicators (WGI) proposed by Kaufmann et al. (2005) and the share of poor people to measure inclusive growth. The results show that all indicators of governance only, government effectiveness and the rule of law are favorable to inclusive growth. In sum, all of these authors studied the link between institutions and inclusive growth, but in a multi-country and short-term perspective. They have therefore not taken into account data from the Political Risk Component by International Country Risk Guide and did it in a short period of time. And only Khan et al. (2016) and Abbe (2019) measured inclusive growth and used this index in econometric framework respectably in time series and panel data.

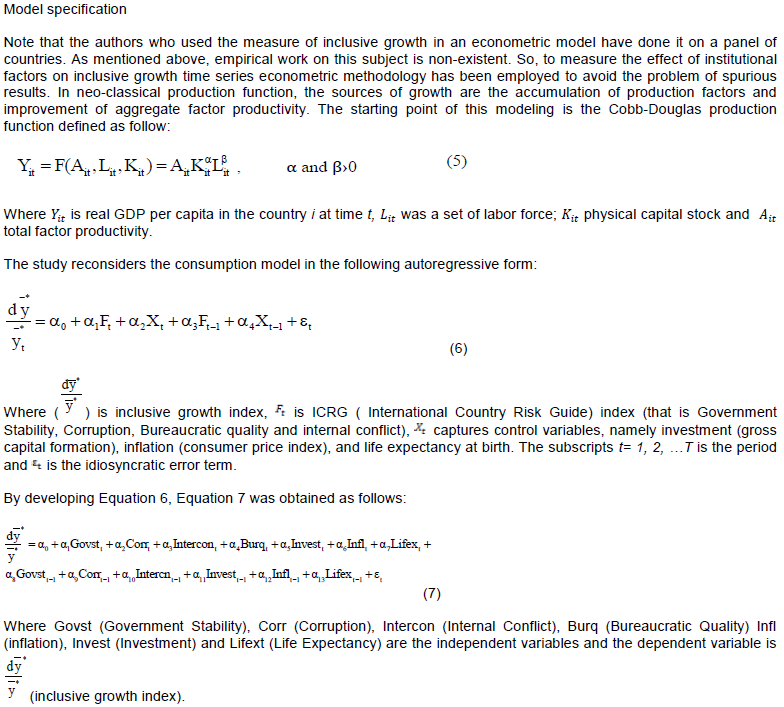

This part of this paper presents data and econometric framework. Institutional quality is used to capture the role of democracy and governance and improve the quality of population life. Indeed, a large literature has accumulated to show that macroeconomic stability is not sufficient to lead to economic growth and inclusiveness (Acemoglu, 2008; Keho, 2012). To be effective, the classical factors of economic growth (labor and capital) must be accompanied by residual factors such as the exercise of democracy and political stability.

Data analysis

The measure of the effect of institutional factors of inclusive growth has been analyzed using the proxies as four parameters of governance in the Political Risk Component by International Country Risk Guide (ICRG) reports respectively between 1984 and 2018 (Iftikhar and Khalid, 2011). Base on the empirical work, four institutional factors and indicators were selected: (i) Government Stability, (ii) Corruption, (iii) Bureaucratic quality, and (iv) internal conflict. Government stability measures the government’s ability to carry out its planned programs and to sustain itself. The corruption indicator measures the extent of corruption and the manner in which public power is exercised for private purposes. The indicator of bureaucracy quality measures the capacity of administration to conduct day-to-day business without major policy changes or disruption to public services. Finally, internal conflict assesses the level of political violence (civil war, coup threat, terrorism, civil unrest) in a country and its actual or potential impact on governance.

These indicators are scored according to the variation in scores and the best institutional quality. They are taken from the International Country Risk Guide database produced by the Political Risk Service Group (PRS Group). Whatever the methodological and statistical reservations about these indicators, they are taken seriously by foreign investors and international organizations. The advantage of these data, unlike other institutional data, is that they extend over a relatively long period from 1984 to 2018 and do not contain missing values. This main advantage gives it a dynamic analysis of the variables and their impact on the economic development and quality of institutions in each country.

In addition, investment is captured by gross fixed capital formation (%GDP), inflation is captured consumer prices (%annual) and life expectancy at birth is the determinants of growth used as control variables in this study. Investment, inflation and life expectancy at birth are taken from the World-Wide Indicators database.

Moreover, exciting results are obtained when the investment equation is introduced into the economic growth equation (Kouton, 2019). Furthermore, according to Hur (2014), in economies where the majority of the population is poor, as is the case in Africa, strategies that promote greater inclusiveness and investment have become more than a necessity. Moreover, the notion of inclusive growth has a favorable echo in the institutions in charge of development and access to socio-economic infrastructure. Sustainable investment policies can directly or indirectly create jobs and ultimately increase economic growth, making it more inclusive. One possible transmission channel for this purpose is the financing of infrastructure projects at the macroeconomic level. These projects can enable states to create additional jobs.

Inflation is the loss of the purchasing power of money that allows for macroeconomic recovery. Indeed, according to the UNDP definition, the redistribution of the benefits of inclusive growth is not obvious and disappears in an environment of macroeconomic instability. In other words, a stable macroeconomic environment is a favorable condition for inclusive growth. It is along the same lines that Kumah and Sandy (2013) found that countries that maintain a stable macroeconomic environment and have a life expectancy that is not too high have initiated inclusive growth thanks to the political and structural reforms that have been implemented (James et al., 2017). Life expectancy at birth shows how long, on average, a newborn can live, if current death rates do not change. In fact, life expectancy at birth has risen steadily in most 1970 OECD (Organization for Economic Co-operation and Development) countries and increasing by over ten years, on average 1970 (James et al., 2017).

Inclusive growth measurement

To be sustainable and effective, economic growth must be inclusive. In other words, it must require an income growth and equity, equality of opportunity and protection of markets and labor transitions. In absence of consensus on measurement, inclusiveness of growth can be seen in Ali and Son (2007), Anand et al. (2015) and ABBE (2019) who applied in an econometric model. Ali and Son (2007) started from a utilitarian social function integrating both dimensions of growth and equity in a unified framework to measure inclusiveness of growth. This function based on a generalized concentration curve, the social mobility curve, such as follows:

Measuring the effect of institutional factors on inclusive growth is dynamic that is evolves over time. Indeed, this dynamism can be assessed in the long and short term, and the ARDL (Autoregressive Distributed Lage) bound testing model of Pesaran and Shin (1999) and Pesaran et al. (2001) is the most appropriate for differentiating the measurement of its effects in such situations in the estimation of Equation 7. The ARDL model is the model par excellence for explaining small-sample models as it combines series of different orders of cointegration.

The study justifies the choice of the estimation of Equation 7, which is a dynamic autoregressive equation using the ARDL (Autoregressive Distributed Lag), for reasons justified in the empirical macroeconomic growth literature. First, this model, which is in the family of dynamic models, allows the estimation of short- and long-term effects even for series of different order of integration, as seen with the limit test approach of Pesaran et al. (2001). Finally, the latter have the particularity of integrating temporal dynamics (adjustment delay and expectations) into the explanation of a variable (time series), thus improving forecasts and the effectiveness of policies (decisions and actions), unlike the simple (non-dynamic) model, whose instantaneous explanation (immediate effect or effect not spread over time) only restores part of the variation of the variable to be explained. Another advantage of this approach is that it does not take into account the order of integration of the regressors, unknown or mixed (I(0) or I(1)), which is not possible with conventional cointegration tests (Pesaran and Shin, 1999; Sam et al., 2019). However, it is possible to fall into the degenerate cases of non-cointegration from the ARDL limit test. This possibility has often been ignored in empirical application.

This technique of ARDL bounds testing has been used in several works to solve economic problems in both micro and macroeconomics and more frequently in problems of public spending and taxation (Afonso and Rault, 2009). This Bound test technique provides a perfect explanation of how the variables tested are cointegrated and the order of their integration. Thus, if the case of the lagged independent variable case is met, the ARDL equation is summarized to Dickey-Fuller unit roots and the independent variable is shown as I(0); otherwise, it is I(1). If the test suggests degenerate dependence or non-cointegration, it indicates that the dependent variable is not included in the cointegration equation embedded in this ARDL equation. The motion of the dependent variable does not respond to the motion of the independent variables, again indicating non-cointegration.

The descriptive statistics results

Descriptive statistics can be used to better decide on the reliability of the data. Two important measures are used to check the reliability of the data. One is the measure of trend and the other is the measure of dispersion. Usually, the mean, median and mode are used as a measure of central tendency and the standard deviation, quartile, range and mean deviation are used as a measure of dispersion (Khan et al., 2016). The results show that the mean and median are almost identical, that there is no evidence of skewness, and that almost all variables have small standard deviation, indicating low variation and low consistency in the data (Table 1).

The stationary tests results

To begin, all the variables mentioned in this document were submitted to the tests of Augmented Dickey-Fuller and Philip Perron for their stationarity. Despite the fact that inflation is integrated of order zero, life expectancy, corruption, inclusive growth and internal conflicts are integrated of order (1). In contrast to the last variables, investment, bureaucratic quality and government stability are integrated of order zero and order one respectively. This confirms the hypothesis of Pesaran et al. (2001), which states that the variables should have an order of integration of either I(0) or I(1) to use the Bound test. However, the ARDL Bound test is more preferable to the ARDL because it is applied when the series are stationarily integrated in the same order and are cointegrated, or with an appropriate difference in integration. Also, the Bound test can be used when the series have a mixed order of integration (some being stationary, others non-stationary) but provided that none of the series is beyond I(1) (Pesaran and Shin, 1999; Pesaran et al., 2001). In the end, the limit test is in fact a test of co-integration between integrated series of different orders below I(2). Then, the ARDL test procedures were applied to estimate the long-term

relationship (Table 2).

The bounds tests results

Table 3 shows the results of the bounds test. Indeed, the ARDL bounds test is a new technique developed by Pesaran et al. (2001) in order to test the presence of long-term relationships (cointegration) between variables using the Wald test. Since the value of the F-statistic is above the limit, then the null hypothesis of the non-existence of cointegration is rejected. Therefore, there is a long-term relationship between inclusive growth and institutional factors. The next step will be to assess the effects of institutional factors on inclusive growth in Côte d'Ivoire in the long and short term. These results are shown in Tables 4 and 5.

Short and long run contemporaneous estimates

Table 4 shows all the long run estimates in explaining the dependent variable. While government stability is significant at 10% level of significance, the investment is significant at 1% level of significance and the inflation is significant at 5% level of significance. Table 5 shows all the short run estimates in explaining the dependent variable. While government stability is significant at 10% level of significance, the investment and inflation are significant at 1% level of significance. The error cointegration term is negative and significant which means that any exogenous shock in one of the variables will lead to convergence towards the equilibrium. An exogenous shock in the inclusive growth will lead movement towards the original equilibrium every year, thus equilibrium is stable.

The diagnostic test of the ARDL result

Table 6 highlights the results of the tests of error autocorrelation, heteroskedasticity and error normality. The Breusch and Godfrey test allows testing an autocorrelation of order greater than 1 and remains valid in the presence of the lagged endogenous variable among the explanatory variables. Heteroskedasticity qualifies data that do not have a constant variance. Error heteroskedasticity does not prejudice the estimation of the coefficients, but rather the statistical tests since the estimated standard errors of the coefficients are not adequate. The normality test verifies whether the data follow a normal distribution. All three tests show statistically significant results at the 1% threshold, so these values lead us to reject the null hypothesis of the absence of autocorrelation, heteroskedasticity and error normality.

An investigation into the measure of institutional factors using International Country Risk Guide on inclusive growth in Côte d’Ivoire is the focus of this study. The study employed a data span of 34 years using the Autoregressive Distributed Lage Model bounds tests and Ali and Son (2007b) method to measure inclusive growth.

The study revealed that only government stability as institutional factor affects inclusive growth significantly and negatively in short run but affects positively in long run. Though, this result shows that there is a relationship between government stability and inclusive growth. Inflation and investment affect significantly inclusive growth in short and long run. In view of the above, this study appeals to competent authorities that they should first reform their institutional system before fully embarking on the path of inclusive growth. Clearly, government would gain to set up a government unit, a strong legislation and assistance in the effective population for more inclusive economic growth. The establishment of such institutions is a long and even delicate process.

The author has not declared any conflict of interests.

REFERENCES

|

Abbe H (2019). Qualités institutionnelles, chômage et croissance inclusive dans l'UEMOA. Revue Internationale de Gestion et d''Economie 7(1):125-148.

|

|

|

|

Acemoglu D (2008). Interactions between Governance and Growth: What World Bank Economists Need to Know. In Governance, Growth and Development Decision Making by the World Bank, pp. 1-8.

|

|

|

|

|

Acemoglu D, Johnson S, Robinson JA (2005). Institutions as a fundamental cause of long-run growth. Handbook of Economic Growth 1:385-472.

Crossref

|

|

|

|

|

Afonso A, Rault C (2009). Spend and Tax: A Panel Data Investigation for the EU. CESIFO Working Paper (2705).

|

|

|

|

|

Aidt TS (2010). Corruption and Sustainable Development. CWPE 1061.

|

|

|

|

|

Alesina A, Perotti R (1996). Income distribution, political instability and investment. European Economic Review 81(5):1170-1189.

|

|

|

|

|

Ali I, Son H (2007). Measuring Inclusive Growth. Asian Development Review 24(1):11-31.

|

|

|

|

|

Ali I, Son H (2007b). Defining and measuring inclusive growth: Application to the Philippines. (E. W. Paper, Éd.) Asian Development (No. 98).

|

|

|

|

|

Anand R, Saurabh M, Shanaka JP (2013). Inclusive Growth Revisited: Measurement and Determinants. The World Bank Economic Premice 122:7.

|

|

|

|

|

Anand R, Mishra S, Peiris S (2015). Inclusive Growth revisited: Measurement and evolution.

View

|

|

|

|

|

Asiedu E, Freeman J (2009). The Effect of Corruption on Investment Growth: Evidence from Firms in Latin America, Subâ€Saharan Africa, and Transition Countries. Review of Development Economics 13(2):2000-2014.

Crossref

|

|

|

|

|

Asongu SA, Le Roux S (2016). Enhancing ICT for Inclusive Human Development in Sub-Saharan Africa. Yaoundé: African Governance and Development Institute AGDI Working Paper.

|

|

|

|

|

Asongu SA (2015). The impact of mobile phone penetration on African inequality. International Journal of Social Economics 42(8):706-716.

Crossref

|

|

|

|

|

Balakrishman R, Steinber C, Buslamante JA (2013). The elusive quest for inclusive growth: growth, poverty, and inequality in Asia. Fonds monétaire internationa, IMF Working Paper 13/152, Washington.

Crossref

|

|

|

|

|

Bouzahzah M, Asongu SA, Jellala M (2015). Institutional Governance, Education and Growth. African Governance and Development Institute.

|

|

|

|

|

Collier P (2006). African Growth - Why a Big Push? Journal of African Economies 15(2):188-221.

Crossref

|

|

|

|

|

Cordemans N (2019). Inclusive growth: a new societal paradigm? Economic Review pp.29-50.

|

|

|

|

|

Dincer OC, Gunalp B (2005). Corruption, Income Inequality, and Growth: Evidence from U.S. States. SSRN Electronic Journal.

Crossref

|

|

|

|

|

Doumbia D (2018). The quest for pro-poor and inclusive growth: The role of governance. Applied Economics 51(16):1762-1783.

Crossref

|

|

|

|

|

Easterly W, Levine R (1997). Africa's growth tragedy: policies and ethnic division. The Quarterly Journal of Economics 112:1203-1250.

Crossref

|

|

|

|

|

FAO (2005). Conflits et développement: Un défi pour la réalisation des Objectifs du Millénaire. Document d'information 11 p.

|

|

|

|

|

Fosu AK (2017). Growth, inequality, and poverty reduction in developing countries: Recent global evidence. Research in Economics 72(2):306-336.

Crossref

|

|

|

|

|

Gerring J, Thacker S, Moreno C (2005). Centripetal Democratic Governance: A Theory and Global Inquiry. American Political Science Review 99:4.

Crossref

|

|

|

|

|

Gupta S, Davoodi H, Alonso-Terme R (2002). Does Corruption Affect Income Inequality and Poverty? IMF working paper, Fiscal Affairs department, WP/98/76: pp.1-41.

Crossref

|

|

|

|

|

Gwartney J, Lawson R, Block W (1996). Economic freedom of the world: 1975-1995. The Fraser Institute.

|

|

|

|

|

Gyimah-Brempong K (2001). Corruption, Economic Growth, and Income Inequality in Africa. University of South Florida, Economics of Governance 3(2002):183-209.

Crossref

|

|

|

|

|

Foundation H (2019). Building an America where freedom, opportunity, prosperity, and civil society flourish. Washington: the U.S. State Department's Mandela Washington Fellowship.

|

|

|

|

|

Hur SK (2014). Government spending and inclusive growth in developing Asia. ADB Economics Working Paper Series (415), 39 p.

Crossref

|

|

|

|

|

Hussein K, Mukungu A, Awel Y (2017). Les moteurs de la croissance inclusive en Afrique. Projet deSection de la prévision, Division des politiques macroéconomiques. Nations Unies.

|

|

|

|

|

Iftikhar M, Khalid S (2011, march). Institutions, Governance and Development in Pakistan. The Empirical Economics Letters 10(3):215-225.

|

|

|

|

|

James C, Devaux M, Sassi F (2017). Inclusive growth and health. OECD Health Working Papers (103).

Crossref

|

|

|

|

|

Kaufmann D, Kraay A, Mastruzzi M (2005). Governance matters IV: Governance indicators for 1996-2004. Washington, D.C.: World Bank.

Crossref

|

|

|

|

|

Keho Y (2012). Le role des facteurs institutionnels dans le developpement financier et economique des pays de l'uemoa. revue economique et monetaire 12:9-43.

|

|

|

|

|

Klasen S (2010). Measuring and Monitoring Inclusive Growth: Multiple Definitions, Open Questions, and Some Constructive Proposals. ADB Sustainable Development Working Paper Series (No.12).

|

|

|

|

|

Khan A, Khan G, Safdar S, Munir S, Andleeb Z (2016). Measurement and Determinants of Inclusive Growth: A Case Study of Pakistan (1990-2012). The Pakistan Development Review 55(4):455-466.

Crossref

|

|

|

|

|

Kouton J (2019). Relationship between Economic Freedom and Inclusive Growth: A Dynamic Panel Analysis for Sub-Saharan African Countries. Journal of Social and Economic Development 21(1):143-165.

Crossref

|

|

|

|

|

Kumah FY, Sandy M (2013). In Search of Inclusive Growth: The Role of Economic Institutions and Policy. Modern Economy 4:758-775.

Crossref

|

|

|

|

|

Kuznets S (1955). Croissance économique et inégalité des revenus. American Economic Review 45(1):1-28.

|

|

|

|

|

Murray I, Press D (2017). Economic freedom is key to African development. OnPOINT (227).

|

|

|

|

|

Nkamleu GB (2017). Croissance Inclusive: La performance du Djibouty. Banque africaine de développement. Abidjan; Côte d'Ivoire: Groupe de Banque Africaine de Developpement.

|

|

|

|

|

North DC (1990). Institutions, Institutional Change, and Economic Performance. Cambridge: University Press.

Crossref

|

|

|

|

|

Pesaran H, Shin Y (1999). An Autoregressive Distributed Lag Modelling Approach to Cointegration. Econometrics and Economic Theory in the 20th Century: The Ragnar Frisch Centennial Symposium.

|

|

|

|

|

Olken B (2005). Corruption and the Costs of Redistribution: Micro Evidence from Indonesia. National Bureau of Economic Research, pp. 1-27.

|

|

|

|

|

Pesaran H, Shin Y, Smit R (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics 16(3):289-326.

Crossref

|

|

|

|

|

Rauniyar G, Kanbur R (2010). Inclusive Growth and Inclusive Development: A Review and Synthesis of Asian Development Bank Literature. Journal of the Asia Pacific Economy 15(4):455-469.

Crossref

|

|

|

|

|

Resnick D, Birner R (2006). Does good governance contribute to pro-poor growth? A review of the evidence from cross-country studies (No. 580-2016-39349).

|

|

|

|

|

Rodrik D (2000). Institutions for high quality growth: What they are and how to acquire them. NBER Working paper 7540, 46 p.

Crossref

|

|

|

|

|

Rodrik D (2009). Growth after the Crisis. CEPR Discussion paper (DP7480).

|

|

|

|

|

Sam CY, Mcnown R, Goh S (2019). An augmented Autoregressive Distributed Lag bounds test for cointegration. Economic Modelling. 80:130-141.

Crossref

|

|

|

|

|

Schock K (1996). A conjonctural model of political conflict - The impact of political opportunities on the relationship between economic inequality and violent political conflict. Journal of Conflict Resolution 40(1):98-133.

Crossref

|

|

|

|

|

Siyakiya P (2017). The Impact of Institutional Quality on Economic Performance: An Empirical Study of European Union 28 and Prospective Member Countries. World Journal of Applied Economics 3(2):3-24.

Crossref

|

|

|

|

|

Welch G, Nuru Z (2006). OECD Governance for the Future: Democracy and Development in the Least Developed Countries 2006. UNDP Administrator and The Under-Secretary General and The High Representative Of The UN-OHRLLS.

|

|

|

|

|

Wiemann J (2015). The new middle classes: Advocates for good governance, inclusive growth and sustainable development? European Journal of Development Research 27:195-201.

Crossref

|

|

|

|

|

Williamson J (1990). The Washington Consensus as Policy Prescription for Development. Washington: Institute for International Economics.

|

|