Full Length Research Paper

ABSTRACT

The objective of this paper is two-fold. On one hand, it seeks to measure the direct effect of cross-border trade on the dynamism of the economies of countries such as Ghana, Côte d'Ivoire, Morocco and Nigeria from 1971 to 2020. On the other hand, it aims to verify the possibility of establishing a link between the volume of cross-border trade, the dynamics of certain variables (currency, population, income) and the dynamics of growth. The results show that cross-border trade between states in the same zone (ECOWAS) and with different currencies can be beneficial if certain constraints are lifted. Second, the structural variables of income and currency have a positive impact on the ability of cross-border trade to generate more growth, while the population variable has a negative impact on this effect. A series of measures should therefore be adopted in the countries in the sample to enable them to make the most of their participation in international trade.

Key words: Growth, cross-border trade, Sub-Saharan Africa, currency, income, population, ECOWAS.

INTRODUCTION

In an international economic context marked by increasing globalization of socio-political, cultural and economic relations, the most advanced phase of which seems to be globalization, there is an increase in trade as well as capital movements. It can therefore be said that cross-border trade plays a central role in economic and social development, especially for poor countries. In West Africa and other parts of the African continent, the trade sector occupies a large proportion of the population and its contribution to national wealth creation and economic growth is significant.

It should also be noted that in this globalized economic framework, countries have different orientations in their trade policies, depending on their geographical, climatic and natural resource development choices. Economists have long noted that economic exchanges within and between countries differ greatly in intensity. Similarly, economic linkages are much closer within national borders than between countries, especially in the context of countries that are linked by strong historical and political relationships and are more likely to have a common currency (Rose, 2000). It would be incorrect, to say the least, to conclude that national borders and currencies are important barriers to cross-border or bilateral trade that need to be removed (Helliwell and Schembri, 2005).

Furthermore, the economic structure of the empirical models is not rich enough to determine whether national borders and the existence of separate national currencies constitute a barrier to trade or whether, on the contrary, the results obtained reflect the efficient organization of production, consumption and trade within each country on the one hand and between countries on the other (Cooke, 2016). Over the past 25 years, however, empirical work has shown that African countries are much less involved in the global economy than previously thought. Indeed, the methodology used in this area has often been to compare measures of economic exchange between countries with measures of economic exchange within a country.

As the theoretical observation that economic growth is ultimately the result of exports and/or imports, the debate has always been about testing this hypothesis, as the question of the relationship between economic growth and cross-border trade is central to economic theory.

The divergent views on the appreciation of the link between growth and cross-border trade became important for us to conduct a similar study with reference to some key countries in the West African sub-region in order to shed some light on this debate. In the context of this study, the interest of such analysis is therefore focused on Côte d'Ivoire, Ghana, Morocco and Nigeria. As it can be seen, these are three ECOWAS countries (Côte d'Ivoire, Ghana and Nigeria) and one country which is not yet officially part of this community but which has recently expressed the desire to belong to it (Morocco). Moreover, these different countries do not belong to the same monetary zone. In this respect, several recent studies have sought to assess empirically the appropriateness of a single monetary zone for West Africa (Gong et al., 2016).

The overall results highlighted the sub-optimal nature of the ECOWAS monetary union project and the reasons put forward are related to the non-respect of the classic criteria of the theory of optimal monetary zones, namely: the absence of complementarity between economies (i), the low credibility of institutions and development policies (ii) and more particularly in the monetary domain (iii).

The present study differs from previous ones mainly because of the empirical approach adopted. Indeed, it is based on a two-phase estimation. The first phase seeks to conduct an econometric investigation of the effect of non-membership in a monetary union on cross-border trade on one hand and economic performance on the other hand through an augmented standard gravity model. The second phase uses a panel data model to determine the effect of cross-border trade on the economic growth of the countries in the sample. The main question to be answered is: what is the effect of cross-border trade on economic growth dynamics in a situation of countries with different currencies?

In this study, the local currencies of each country was not consider, namely the CFA Franc (Côte d'Ivoire), the Naira (Nigeria), the Dirham (Morocco) and the Cedi (Ghana), but focus was on the foreign currencies used mainly by these states to settle their debts arising from trade, on the assumption that Ghana and Nigeria have historically used the Dollar as their international currency and Côte d'Ivoire and Morocco have used the Euro currency. There are several reasons for this approach: firstly, the local currencies of the countries in the study sample are not used in bilateral trade to settle debts and are only used within the national borders of the countries, whereas analysis is concerned with the effect of cross-border or external trade on growth and not the effect of internal trade on growth.

For example, it is note that exports and/or imports between Côte d'Ivoire and Nigeria are not settled in CFAF or Naira, just as trade between Morocco and Ghana is not settled in Dhiram or Cedis. Secondly, a modelling of the factors related to cross-border trade allows a better understanding of the dynamics of growth in a situation of different currencies.

Finally, the understanding of the stakes in terms of economic policy, of the process of forecasting growth in a common economic and monetary area under construction; allusion made to the will to set up in ECOWAS of the common currency called Eco. That said,

The rest of the article will be presented as follows: A review of the literature will be the subject of section one. This literature review will be preceded by an econometric analysis of the interactions between cross-border trade and the structural variables that may be complementary to it in its effects on growth. In section two, different models and the estimation methods used were presented. Then, the results obtained on the study sample and the comments will be the subject of section three. Section four will focus on the analysis of the effect of the interaction between cross-border trade and growth through some control variables. Finally, the conclusion and recommendations are presented in the fifth section.

REVIEW OF LITERATURE

In this part of the study, a theoretical and empirical review of the effect of non-membership was presented in the same monetary union of some countries (Côte d'Ivoire, Ghana, Morocco and Nigeria) on cross-border trade and economic performance of these countries.

Theoretical review

If the estimated border effect is partly a consequence of trade barriers, one such barrier could be the use of separate national currencies. Indeed, the use of different currencies creates an additional barrier to trade since cross-border transactions require currency conversion and, in some cases, hedging of exchange rate risk.

The second criticism is that Rose (2000) concludes that the use of a single currency by two countries has increased bilateral flows, when in most cases trade between them was probably already intense because of an economic or political dependency relationship that may have caused the smaller country to adopt the currency of the larger one in order to facilitate extensive trade (e.g., Bahamas and Bermuda, which use the US dollar; Liechtenstein, which uses the Swiss franc). The trade dependency would probably precede the adoption of a common currency, not the other way around.

The third criticism relates to the statistical significance of the dummy variable on the existence of a common currency, which indicates which countries belong to a monetary union at each point in time and not how the situation of a given country changes over time.

Empirical review

McCallum (1995) uses a widely used empirical model of trade, known as the gravity model, which was first used by Tinbergen (1962) in empirical research on trade flows.

Rose (2000) also uses the gravity model to estimate the effect of adopting a common currency on bilateral trade flows, thereby testing the hypothesis that the use of a common currency reduces the cost of cross-border transactions and thus increases trade. To do this, he essentially uses the empirical gravity model of McCallum (1995), with two important differences: a) the model is estimated using a dataset of bilateral flows for 186 countries over a given period; b) the indicator variable in the model takes the value 1 if the two countries have a common currency and 0 otherwise. Rose (2000) finds that the use of a common currency by two countries reduces the cost of cross-border transactions and increases trade. Rose finds that the use of a single currency by two countries increases their trade by more than 300%.

In their study on Factors influencing livestock export in Somali land terminal markets, Musa et al. (2020) show that the Hajj season, the number of livestock exporters, the location of the market and the livestock ban imposed by importing countries are the main factors influencing the monthly volume of livestock traded for export. An investigation of cross-border livestock trade across Ethiopia's dryland borders by Angassa and Negassi (2018), reveals that cross-border livestock trade initially improves people's living conditions.

EMPIRICAL EVALUATION

Data source

The data used in this study are taken from the World Bank (WDI) and The United Nations Conference on Trade and Development (UNCTAD) databases and cover the period from 1960 to 2019. This rather long period (59 years) is explained by the requirements of using fish law (the use of long periods).

Variables description

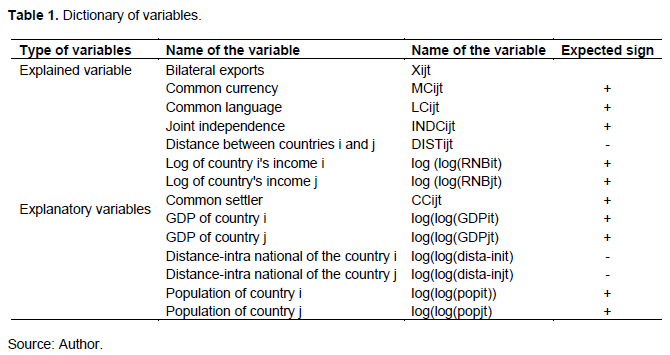

The description of the variables in this study is summarized in the Table 1. Table 1 presents the explanatory variables and the explained variable, which were all mobilized over the study period, by country and by year. These are therefore variables with two dimensions, namely the individual dimension on the one hand and the temporal dimension on the other. In addition, the expected signs were also indicated in Table 1.

Model specification

Specification of gravity model

The econometric investigation of the effect of non-membership in a monetary union of some countries (Côte d'Ivoire, Ghana, Morocco and Nigeria) on cross-border trade and economic performance of these countries is based on an augmented form of the standard gravity model. The gravity model has been widely used in the literature since the work of Tinbergen (1962) despite the lack of theoretical underpinning of this model at the outset. It was not until the mid-1970s that important theoretical developments of the model emerged. Anderson (1979) was the first researcher to derive the expression of gravity from a model that assumes product differentiation.

Subsequently, the contributions of other works have been not only to strengthen the prior theoretical framework but also to propose further extensions (among others, Anderson and Wincoop, 2001; Evenett and Keller, 2002).

Empirically, it has been mobilized to analyse the impact of regional integration on bilateral trade in West Africa (Anyanwu, 2003; Agbodji, 2007; Bangake and Eggoh, 2009; Coulibaly et al., 2015). After presenting the empirical model (increasing gravity model, explained and explanatory variables), the estimation strategies used was outlined in this research as well as the data and their sources.

Theoretical gravity model

RESULTS

This part of the study deal with the presentation of different results and the economic interpretation that follow them. The investigations started with the results and discussion of the econometric pre-tests before ending with the results of the estimation of different econometric models.

Descriptive statistics

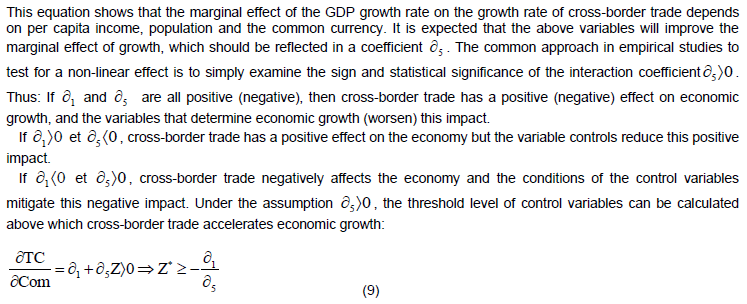

Table 2 shows that the average countries in the study have a growth rate of around 3.8%, and the low standard deviation associated with the growth rate shows that there is no real disparity in growth sample. Moreover, the negative coefficient of the median shows that among the countries studied, the measured value, notably the growth rate, is low.

With regard to exports, it was noted here that the average exports in the sample is around 6.8%. The low standard deviation shows that there are no real major disparities in the export policies implemented by the countries in the sample. The same situation is described in the case of the population and income variables (low mean, low standard deviation and low median).

Unit root tests

The tests used to detect the presence or absence of a unit root are those of IPS, LLC and MW, which are respectively the tests of Im et al. (2003) and Levin et al. (2002). The choice of delays is based on the Schwarz information criterion with a max delay = 4. The values in brackets are the p-values * (**) means rejection of the unit root hypothesis at the 1, 5 (10%) threshold respectively. The results of these tests suggest that the GDP growth rate, exports, population and income are stationary in level. When all variables are considered as first differences, they all appear stationary (Table 3).

Heteroscedasticity and autocorrelation tests results

Analysis of Table 4 show that the rejection of the null hypothesis of no heteroscedasticity and the rejection of the null hypothesis of no autocorrelation results in errors at the 1% level for the equation. In other words, the data in the study do not have constant variance errors. Indeed, over the entire study period, the error term corresponding to one period is correlated with the error term of another period.

The correlation matrix between the different variables

The matrix of linear correlation coefficients between different variables indicates that the different estimated values are less than 40% (Table 5). It can therefore be said that collinearity problems are less likely.

The estimation of PPML with dependent variable bilateral exports (Xijt)

The results presented in this study confirm that the Poisson pseudo maximum likelihood estimator generally performs well, even when the conditional variance is far from proportional to the conditional mean. Moreover, as expected, the fact that the dependent variable has a high proportion of zeros does not affect the performance of the estimator (Table 6). On the contrary, the presence of zeros is an additional reason to use the pseudo Poisson maximum likelihood because, in this case, all estimators based on the log-linearization of the gravity equation have to use unreasonable solutions to handle these observations. Therefore, as before, it can be concluded that the pseudo Poisson maximum likelihood estimator is a promising tool for estimating constant elasticity models such as the gravity equations (Silva and Tenreyro, 2010).

DISCUSSION

In many empirical studies, the common currency has always had a positive sign coefficient in addition to being significant at varying thresholds relative to the optimal currency area theory. But in the study, it was found that this variable has a negative sign coefficient contrary to expectations, although it is significant at the 1% level. As pointed out above, the common currency variable is captured here by the currencies of the colonizing countries, used in international transactions for the extinction of the international debts of the countries in our analysis sample, that is, the dollar for Nigeria and Ghana, then the euro for Côte d'Ivoire and Morocco.

The negative sign of the coefficient of this variable can be explained in several ways. For countries such as Côte d'Ivoire and Nigeria, which do not have the same international currency according to the study, the volume of international flows of goods and services will not be dynamic because of the transaction costs linked to the exchange rate between the different currencies involved (the Dollar and the Euro). These are often very high transaction costs that discourage economic operators in the respective countries from exchanging goods and services.

Moreover, for countries sharing the same international currency, such as Morocco and Côte d'Ivoire for example, the absence of an interest rate differential will not favor a real gain in trade, especially since the absence of an interest rate differential does not appear to be very attractive for economic operators that engage in trade. In other words, one Euro or one Dollar will only bring in one Euro or one Dollar and nothing will be added in terms of substantial gains from the exchange. In short, the fact of having a common currency or not does not, according to the study, favor the dynamism of international trade in goods and services, thus justifying the negative sign of our common currency variable, even though it is significant at the 1% level.

The common independence variable is characterized here by a positive sign in line with the one predicted beforehand and shows a significance at the 1% level. In other words, this variable has a positive influence on the volume of trade or cross-border trade between states that share a common independence or that obtained their independence at the same date. Indeed, among the factors that increasingly bring nations together around the world are sociological and historical factors, among which the acquisition of independence at the same date is in pole position.

Once the rapprochement has been achieved thanks to the sharing of certain historical facts, the divisions and other constraints or obstacles to cross-border trade fall away and thus give free rein to the various economic operators of the countries in question to exchange their goods and services appropriately, thus making trade or cross-border trade between groups of countries dynamic.

Author, such as Bennafla (2002), has demonstrated in her work that cross-border trade constitutes a threat to African countries, because according to her, these are fake and unviable states inherited from colonization.

Although Karine Bennafla's reflection is correct, it is still subject to discussion because, as the results of her work show, cross-border trade is not dangerous for the countries of sub-Saharan Africa as long as they share major sociological and historical facts such as political independence. It is therefore appropriate to put into perspective the words of Bennafla (2002).

The variable distance between countries has a negative sign, in line with expectations, and also has a significance level of 1%. Empirically, when two countries are very distant from each other, the volume of trade between them is very low, and this seems to be the result of estimation. Indeed, when the result of econometric estimation shows, two countries are quite far apart, the economic operators between these two countries bear too many costs linked to trade.

These costs are very regularly linked to road congestion, attacks by armed groups who loot at the borders and the poor quality of communication infrastructures. Moreover, in the sample countries, the land road network, which remains the only means of facilitating the exchange of goods and services, is not dense and is defective in some places.

The variable relating to the income of the importing country shows a positive sign of its coefficient in addition to being significant, and in line with the predicted sign. When several countries are engaged in trade relations, the dynamism of trade between them is quite often based on the level of income of the countries among them that are importing countries. Indeed, importing countries are those that buy from their trading partners the goods and services they need not only to satisfy the well-being of their respective populations but also to invest in activities that create wealth and employment. On this basis, when imports are strong and exporting countries respond appropriately to the demands made of them, the volume of trade can only be dynamic. This is certainly reflected in the result related to the income variable of the importing country.

The variable relating to the populations of the cross-border trade partner countries shows a positive sign in line with the predicted sign and is significant at the 1% threshold. In economic theory, population plays an important role in the dynamism of trade relations between countries. When the population is small in terms of numbers, the demand for products from other partner countries is also small, which does not favor exports and imports of goods and services produced in the different partner countries. But when the population is large in volume, the mutual demand and supply of goods and services that the partner countries trade with each other is large and therefore has a positive impact on cross-border trade. Nigeria alone has a population of over 200 million and when this population is joined by Côte d'Ivoire, Ghana and Morocco, the demand and supply of products to be satisfied increases accordingly, thus making trade between these different states dynamic.

The variable relating to the intra-national distances of the trade partner countries, which is the subject of analysis, has the following form: negative coefficients, significance at the 1% threshold, in line with the predictions. Intra-national distances have a fairly negative effect on the volume of trade between the countries that are supposed to be trade partners. Indeed, when the distances separating the capitals of the nations studied are quite high, this discourages trade. Moreover, when cities within a country are too far apart, the thorny issue of the flow of goods and services from the production sites to the local demand markets arises. This constraint may also be the reason for the drop in exports, since the poor state of the roads will not allow the goods and services requested by the partner countries to be delivered in time to meet the needs of the populations. Such a state of affairs will implicitly reduce the volume of trade and therefore the dynamism of cross-border trade.

Analysis of the interaction effect

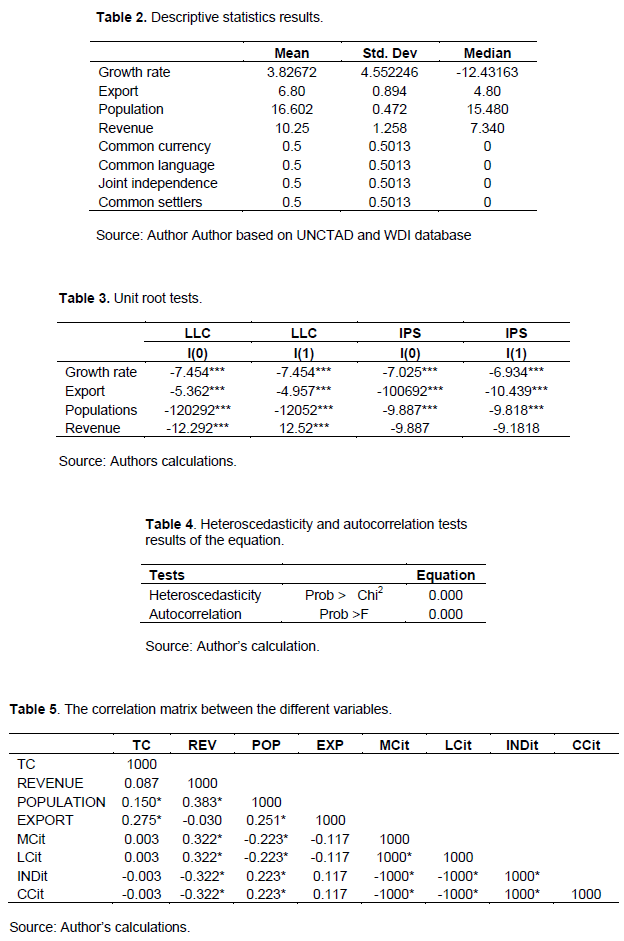

In this part of the study, the effect of the interaction between the interactive variables that allow us to understand the conditions that cross-border trade to have an influence on economic growth and to try explain the direction of the nature of the observed influence. As shown in the Table 7, the researcher focused on three interactive variables: Y1=export*income; Y2=export*population and Y3=export*Mcit (Annexes Figures).

Interaction between exports and income

In view of the sign of the coefficient associated with the variable Y1 (positive sign and significance at 1%), exports have a favorable effect on the level of economic growth of the countries in the study sample and the income of the countries amplifies this effect. Indeed, the level of growth of the states is strong when these countries are rich because they have a high income that allows them to import more products from the co-trading countries. The fact is that when countries are rich, they produce a lot, thus creating a large supply of goods and services for the benefit of the population, which thus has a wide range of differentiated products. This high level of production will certainly have a solvent demand due to the high level of income. Cross-border trade will thus have a strong dynamic since the high supply will have a strong demand in front of it.

Interaction between exports and population

The negative sign of the coefficient associated with the Y2 variable and its non-significance at all thresholds show that exports certainly have a positive effect on growth, but the population has a negative impact on this effect, reducing it considerably. In fact, a population is not always a source of growth and well-being. When the population is high in number, it often undermines all the social security mechanisms defined and implemented in the States. Moreover, a high population has a negative impact on state resources. In addition, it is a source of evils such as theft, delinquency and other anti-social practices, not to mention the destruction of nature and especially the reduction of environmental assets.

Interaction between exports and money

Cross-border trade has a positive effect on the economic growth of the countries in the sample and currency has a positive impact on this effect. This is reflected in the positive sign associated with the variable Y3. In general, when several countries or groups of countries use the same currency, this eliminates or considerably reduces the transaction or conversion costs resulting from their main bilateral or multilateral trade. The use of the same unit of account, the same instrument of exchange, encourages the socioeconomic and political rapprochement of states. Once this rapprochement has been achieved, monetary barriers disappear between these states and they naturally become more willing to trade more. When these bilateral exports, which are assimilated here to cross-border trade, increase in volume, this promotes economic growth.

On analysis, the results are similar to those of Mignamissi (2018), even if in some respects there are notable differences. Indeed, Mignamissi (2018) multilateral and bilateral resistance and then intra-national distance have mixed effects on bilateral trade; the researcher work shows that these variables have a fundamentally negative effect on economic growth via cross-border trade. However, like Mignamissi (2018), the results show that the single currency acts positively on the dynamism of cross-border trade.

It is also worth noting that the results of the present study are similar to those of Musa et al. (2020) as population, intra and inter-regional distance and multilateral resistances are the main factors that influence the dynamism of cross-border trade. Angassa and Negassi (2018) are in line with the present study when they argue that cross-border trade has a positive impact on the level of growth.

CONCLUSION

The purpose of this study is to analyse the transmission channels through which cross-border trade impacts on economic growth in selected sub-Saharan African countries such as Nigeria, Ghana, Côte d'Ivoire and Morocco between 1971 and 2020, although these states do not use the same local and international currency to facilitate their trade. This led to the presentation of the literature review through which we were able to have an overview of the existing literature on this topic. From there, the homogeneity, heteroscedasticity and stationarity tests were applied, which prerequisites for the validation of estimates.

In this same dynamic, an econometric approach was preceded using a standard augmented gravity model in a first step; then a panel data model was implemented in a second step in order to reach the confirmation or denial of objectives. The results of these different models show that cross-border trade combined with income and currency positively influence the level of economic growth of the countries in the study sample, unlike population, which acts as an inhibiting factor to the positive influence of cross-border trade on the willingness of states to go for a high economic growth rate. This first observation requires that the countries concerned by this study should work in their preferred zone, which is ECOWAS, to accelerate the implementation of the future single currency called ECO.

In addition, they would also benefit from monitoring the quality of their respective populations. Indeed, almost all the countries of sub-Saharan Africa are subject to a major problem of quality of human capital which does not allow foreign investors to employ them and stimulate economic growth as in Asian countries. Thus, faced with this obstacle of the quality of the local workforce, foreign companies operating in this area very often rely on expatriate engineers and managers, and the local workforce is very regularly employed in labor tasks.

Policy recommendations

It is clear that the countries in the study sample would benefit from diversifying their economies to cross the transformation threshold while working towards greater monetarization. The share of international trade remains relatively low in sub-Saharan Africa, where most countries are not industrial countries. It is therefore important for the African continent to implement a set of measures, including improving the business climate, strengthening the quality of institutions and adopting a common currency, in order to develop.

CONFLICT OF INTERESTS

The author has not declared any conflict of interests.

REFERENCES

|

Agbodji AE (2007). Integration et echanges commerciaux intra-sous regionaux: cas de l'UEMOA. Revue africaine de l'integration 1(1):161-188. |

|

|

Anderson JE (1979). A Theoretical Foundation for the Gravity Equation. American Economic Review 69:106-116. |

|

|

Anderson JE, Wincoop E (2001). Gravity with Gravitas: A Solution to the Border Puzzle. National Bureau for Economic Research, Working Paper, 8079. |

|

|

Angassa T, Negassi A (2018). A Review on Cross-Border Livestock Trade Across Dry Land Borders of Ethiopia: The Trends and Implications. Journal of Scientific and Innovative Research 7(2):36-42. |

|

|

Anyanwu J (2003). Estimating the Macroeconomic Effects of Monetary Unions: The Case of Trade and Output. Africa Development Review 15(2-3):126-145. |

|

|

Balassa B (1965). Trade Liberalisation and "Revealed" Comparative Advantage. The Manchester School 33:99-123. |

|

|

Bangake C, Eggoh J (2009). The Impact of Currency Unions on Trade: Lessons from CFA Franc Zone and Implication for Proposed African Monetary Union. Saving and Development (478). |

|

|

Bennafla K (2002). Le commerce frontalier en Afrique centrale. Paris: Karthala, 368 p. |

|

|

Cooke D (2016). Optimal Monetary Policy with Endogenous Export Participation. Review of Economic Dynamics 21:72-88. |

|

|

Coulibaly AD, Traore M, Diarra S (2015). UEMOA versus CEDEAO:Analyse par le modèle de gravité des flux de commerce intra-communautaire. Commission de l'UEMOA, Document de reflexion, DR 2015.1. |

|

|

Evenett SJ, Keller W (2002). On Theories Explaining the Success of the Gravity Equation, Journal of Political Economy 110:281-316. |

|

|

Gong L, Wang C, Zou H-F (2016). Optimal Monetary Policy with International Trade in Intermediate Inputs. Journal of International Money and Finance 65:140-165. |

|

|

Helliwell JF, Schembri L (2005). Frontières, monnaies communes, commerce et bien-être :que pouvons-nous déduire de l'observation des faits? REVUE DE LA BANQUE DU CANADA • PRINTEMPS 2005. |

|

|

Im KS, Pesaran MH, Shin Y (2003). Testing for Unit Roots in Heterogeneous Panels. Journal of Econometrics 115(1):53-74. |

|

|

Levin A, Lin CF, Chu J (2002). Unit root tests in panel data: Asymptotic and Þnite sample properties. Journal of Econometrics 108:1-24. |

|

|

Mignamissi D (2018). Monnaie unique et intégration par le marché en Afrique: le cas de la CEEAC et de la CEDEAO. African Development Review, African Development Bank 30(1):71-85. |

|

|

McCallum J (1995). National borders matter: Canada-US regional trade patterns. American Economic Review 85:615-623. |

|

|

Musa AM, Wasonga OV, Mtimet N (2020). Factors influencing livestock export in Somaliland's terminal markets. Pastoralism 10:1. |

|

|

Rose AK (2000). 'One Money, One Market, Estimating the Effect of Common Currencies on Trade', Economic Policy 30:9-45. |

|

|

Sachs JD, Warner AM (1995). Natural Resource Abundance and Economic Growth. National Bureau of Economic Research, Cambridge, MA, NBER Working Paper No. w5398. |

|

|

Silva JS, Tenreyro S (2010). On the existence of the maximum likelihood estimates in Poisson regression. Economics Letters 107(2):310-312. |

|

|

Tinbergen J (1962). Shaping the World Economy: Suggestions for an International Economic Policy. New York: Twentieth Century Fund. |

|

|

WDI data (2020). World Development Indicators. The World Bank Group. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0