ABSTRACT

The Board of Directors (BoD) as an internal mechanism of corporate governance is considered to be a very important means of control. Indeed, according to several studies, its effectiveness depends on several factors relating to BoD size, the independence of its members, the presence of an audit committee, gender diversity and BoD meetings. To see the influence of independent variables on the dependent variable financial performance (Return on Equity _ROE), we used econometric tests. After the pre-requisite tests, we adopted the random effects model, which was validated through testing. Our empirical validation was conducted on a sample of 30 Senegalese public utility companies over a period of 8 years (2004-2011). The results of the model show that at the 5% threshold, hypotheses H.1, H.2 and H.4 are rejected. On the other hand, H.3 is validated. H.5 was not tested because the audit committee variable was an exception. Our results gave sufficient information to the Senegalese authorities to make good decisions.

Key words: Board of Directors (BoD), financial performance, panel data, modeling.

Since the appearance of the first reports of good practices and due to the bankruptcy of large companies (Enron, 2001; Worldcom, 2002) and the financial crisis of 2008 and its consequences, the last decade has consecrated the notion of corporate governance by placing it at the center of debates. These scandals have certainly affected Northern countries, but also have repercussions in developing countries. These scandals are proof of the inability of governance systems to control the discretionary behavior of leaders.

In Senegal, the management of companies, especially public companies, continued to pose problems. Governance and performance targets were not always met. Some companies were still unable to satisfactorily fulfill their missions. Thus, the issue of governance began to be raised in 2000, which coincided with the first political changeover. The audits that were conducted during this period by the government services showed shortcomings in the management of several public service companies and led to the arrest of their managers. The governance code was drawn up by the Institut Sénégalais des Administrateurs in 2008.

The question of performance and its determinants has always been the subject of debate and controversy in the world of finance, among theorists and practitioners alike. For many financial theorists, including Jensen and Meckling (1976), a firm's underperformance was essentially due to a poor understanding of the conflict of interest between the firm managers and owners. Various control mechanisms are capable of protecting public interest against abuses and managerial discretion in firms. Among these, the BoD occupies a central position (Fama and Jensen, 1983; Charreaux, 1991).

As the central organ of corporate governance, the BoD has a main function relating to the reduction of the discretionary power of managers and subsequently to managing the agency relationship between shareholders and managers as well as the various stakeholders of the company. It oversees the management and quality of the financial information communicated to shareholders. Based on the agency's shareholder theory and considering the explanatory theories of the BoD within the efficiency paradigm, this research focused on the influence of the BoD on the financial performance (Return On Equity=ROE) of Senegalese public service companies. The question raised by such a concern was: could the BoD improve the company's ROE? The general issue guiding our research thus raised the question of the links between the company's BoD and ROE.

General objective

To determine the characteristics of BoDs that could improve the financial performance of Senegalese public utility companies.

Specific objectives

(i) Analyze the BoD of Senegalese public service companies.

(ii) Analyze the ROE of Senegalese public service companies.

(iii) Determine the links between the BoD and the ROE of Senegalese public service companies.

Based on the theoretical and empirical debates on the issue, we have formulated the following hypotheses which we have attempted to test in the Senegalese context following the empirical study.

Hypothesis H1: BoD sizepositively influences ROE.

Assumption H2: There is a positive relationship between the number of independent Directors on the BoD and ROE.

Hypothesis H3: The presence of women in the BoD negatively affects ROE.

Hypothesis H4: There is a positive relationship between the number of BoD meetings and ROE.

Assumption H5: There is a positive link between the audit committee of the BoD and the ROE.

All of these assumptions were tested through an econometric analysis covering eight years (2004 to 2011).

Our study contributes to the field of empirical research on corporate governance mechanisms:

(i) Unlike private firms, empirical work on the governance of public companies is scarce, and our research will help increase their number.

(ii) Given the abundance of empirical studies in Northern countries and the relative scarcity of such studies in Africa, the main contribution of this work is to shed light on the influence of BoDs in improving the financial performance of the Senegalese public service company.

(iii) Finally, this study could help competent authorities to make the right decisions.

Article 11 of the Code des Obligations de l'Administration (COA)[1] states that public service is constituted by "any activity of a legal person governed by public law with a view to satisfying a need in the general interest".

"At the outset, governance is associated with the concern to secure shareholders' investment in large listed companies, to prevent the personal objectives of managers from leading to less shareholder value creation. In the extension of this financial version of governance, the BoD appears to be the main mechanism contributing to the achievement of this objective. "(Charreaux, 2000). In addition, a review of the major studies on the topic of BoD identified that the characteristics and functioning of the BoD influence ROE.

BoD size and ROE

Arguments in favour of large BoDs are derived from resource dependence theory (Pfeffer and Salanick, 1978). Rejecting the idea of contingency theories according to which the environment is an objective reality over which managers have no power, this theory asserts that the firm’s survival is conditioned by its ability to control certain indispensable resources by impacting on its environment. Firms must mobilize these scarce resources at the lowest cost. The BoD then becomes a means of creating links with the external environment by integrating within it the various representatives of these most critical resources. Some authors are in favor of a large turnover. Indeed, in an uncertain environment, the larger the size of the BoD, the more the different knowledge of the Directors can improve ROE and exercise effective control over the manager (Linck et al., 2006). Contrary to the resource dependency theory that argues for larger BoD size, Jensen (1993) theorists have found that the large number of BoD members poses difficulties in terms of organization and coordination in decision making. BoDs with more than seven to eight directors risk being fragmented and having difficulty reaching consensus on important decisions. In addition, the large size of governance bodies encourages the presence of coalitions and internal conflict, which then reinforces the dominance of the leader. Indeed, when the BoD is large, it can present a barrier to controlling the management of the firm because of poor coordination, flexibility and communication. Andrés et al. (2005) have stated that small BoD members create more value than large BoD members. However, Wintoki (2007) found no significant relationship between CA size and firm ROE. Finally, authors such as Guest (2009) found a negative relationship between Tobin's Q (1969) (Q=Firm Market Value/Replacement Value of Fixed Capital) and BoD size.

This divergence of results led to the conclusion that there is no consensus on the influence of BoD size on ROE. Some have argued for greater size. Others, on the contrary, have shown that a smaller number of directors has increased BoD control and subsequently improved corporate ROE.

Independence of BoD members and ROE

This notion has always been the focus of much research. Indeed, previous studies have focused on the distinction between outside and inside directors. According to the theory of the Jensen and Fama (1983), a high proportion of independent directors leads to better monitoring of managerial decisions. Indeed, the presence of independent directors within internal governance bodies contributes to making the latter more independent of the executive. In addition, the presence of independent external members on the BoD guarantees the protection of shareholders' interests, since their only personal interest is to enhance the value of their human capital directly related to their expertise. Triki and Bouaziz (2012) found that the presence of a significant percentage of independent directors on the BoD has positively influenced the ROE of Tunisian companies. Finally, the co-option of independent directors is strongly encouraged by codes of good governance, such as the Code of Corporate Governance of Listed Companies revised in June 2013, which recommends a minimum quota of independent directors equal to half of the BoD for companies with dispersed capital and no controlling shareholders. However, Conyon and Peck (1998) argued that the quality of managerial control activity could be compromised by the weak personal financial interests of independent directors. Furthermore, the Donaldson and Davis (1989) stewardship theory contrasts with the Jensen and Fama (1983) agency theory by valuing the knowledge and experience of inside directors. Finally, Agrawal and Knoeber (1996) found a negative relationship.

BoD diversity and ROE

The main argument that there is a link between the proportion of women directors on BoDs and firm performance is based on resource dependency theory (Pfeffer and Salanick, 1978). Indeed, the presence of women in governance bodies constitutes an additional resource to create links with a complex and uncertain environment in order to reduce their dependence and thus obtain the resources necessary for the firm's activities.

Cabinet McKinsey and Company (2007) confirmed the positive link between the high percentage of women on the BoD and financial performance in terms of return on equity, operating margin and return on invested capital. Proponents of this diversity have said that women bring fresh ideas, have a very high communication capacity compared to men, and address strategic issues at BoD meetings that positively impact the business (Adams and Ferreira, 2009). Kochan et al. (2003) found no positive relationship between gender diversity in decision-making positions and company ROE. Triki and Bouaziz (2012) found in the Tunisian context that BoD diversity negatively and significantly affected performance measured by Return On Asset (ROA). The Copé-Zimmerman law of January 27, 2011 required French listed companies to include at least 20% women in their turnover in 2014 and 40% by 2017.

Frequency of BoD meetings and ROE

Jensen (1993), one of the founding fathers of corporate governance theories, questioned the usefulness of meetings of internal governance bodies. According to him, the time devoted to these meetings by the directors is not sufficiently used to control the management of the company. Indeed, many BoD members waste this time on routine tasks such as management reports and various formalities. A company that optimizes the number of BoD meetings will be considered efficient in that it minimizes the agency costs generated by attendance fees, transportation costs and more generally by the use of managerial time. However, Triki and Bouaziz (2012) found that the frequency of BoD meetings positively affected the company's ROE.

The specialized committees of the BoD and the ROE

In France, the corporate governance code for companies revised in June 2013 recommended that listed companies set up an audit committee and a compensation committee with at least one independent member. Klein (1998) considered that the creation of specialized committees within the BoD could improve its effectiveness, such as those oriented towards the control of executives (audit, compensation and nomination committees, etc.). Klein (1998) showed that the BoD effectiveness depends on its own structure as well as the structure of its committees. Indeed, he argued that the assignment of independent external directors to the audit committee is likely to improve the company's ROE. The audit committee appears to be the most important of these specialized committees. Indeed, audit committees are tools of institutional trust, the establishment of which is one of the fundamental aspects of the corporate governance system.

In summary, the characteristics related to audit committees have been addressed and dealt with in the accounting literature;

(i) Klein (1998) found a positive relationship between the percentage of outside directors on these committees and ROE. However, Brown and Caylor (2004) showed that the independence of audit committees is not positively related to the company's ROE. They also found that audit costs are negatively related to performance measures. Anderson et al. (2004) showed that fully independent audit committees have access to lower cost debt financing.

(ii) The size of the audit committee is positively related to ROE (Anderson et al., 2004).

(iii) The frequency of audit committee meetings is positively related to ROE (Beasley et al., 2000).

This is the hypothetico-deductive approach we followed in our research.

Study area

The study was carried out in the city of Dakar, the capital of Senegal, where the management of all the companies in our sample are located. Dakar is located in the far west of Senegal.

Sample

For the selection of the sample, we took the thirty public utility companies that were in the portfolio of the State of Senegal for the year 2012. The period over which we collected the information was spread over eight years (2004 to 2011).

Variables

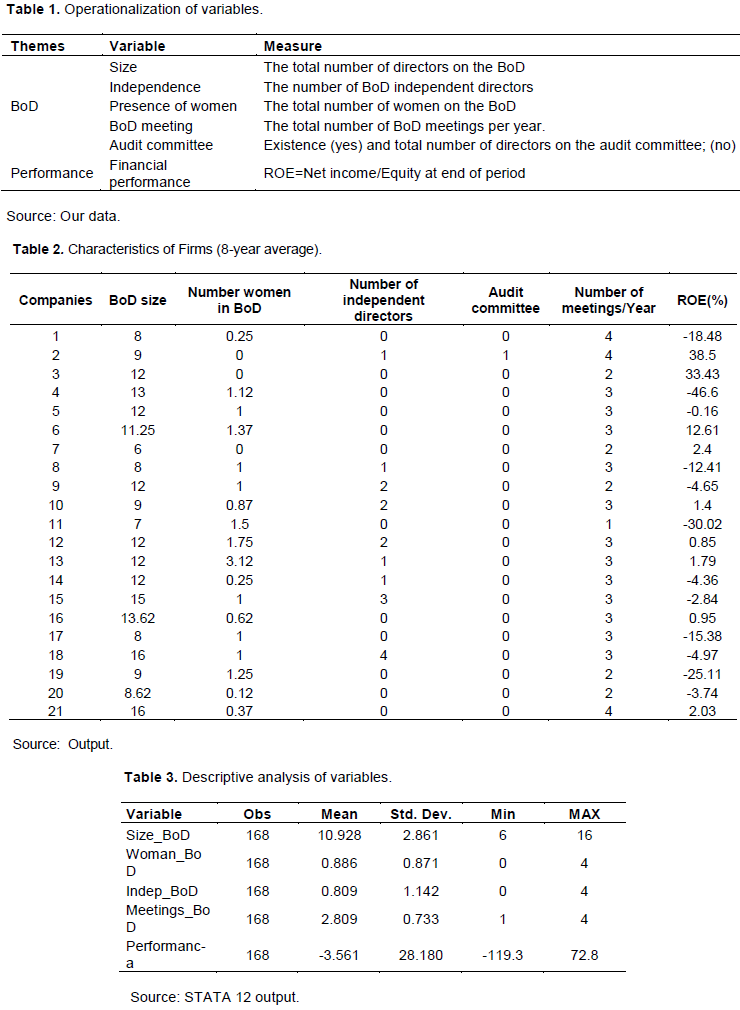

The independent variables were: BoD size, BoD independence, presence of women on the BoD, BoD meetings and the Audit Committee of the BoD. The dependent variable was ROE. The major difficulties related to management research in Senegal are mainly at the level of obtaining data. Our research has not escaped this reality. Initially, we had set out to study performance from several angles, but problems related to the availability of data led us to revise our ambition downwards. So we chose ROE to measure the company's performance. ROE can be defined very simply: Net profit/equity at the end of the financial year. This indicator, despite its limitations, has been used by several authors as a performance measure with a view to creating value for the owners of the company (Brown and Caylor, 2004). In order to be able to collect data in the field, we have operationalized the variables in the following Table 1.

Data collection

The study period was spread over eight years between 2004 and 2011. Visits were made to the companies selected for the research. Secondary data was collected using structured sheets and interviews. Data was collected from twenty-one out of thirty public service enterprises.

The econometric model

The econometric model allows us to establish the variables in regression form and to highlight the weight and influence of each independent variable on the dependent variable, which is the ROE. An eight-year panel, between 2004 and 2011, allowed us to examine the evolution of the relationship between CA and ROE. Each variable has an index (t) and (i). Index "(i)" represents individuals (firm) and index "(t)" represents the time variable. Thus the model can be written as follows:

Financial performance it = αi + β1i(Size)it + β2i(Attendance women)it+ β3i(Attendance independent)it + β4i(Frequency of meetings)it+ β5i(Committee)it + ε i t

The coefficients βi (i= 1, ...5) constitute the elasticity of each of the exogenous variables and also make it possible to determine the direction of the relationship between these variables and the endogenous variable. The coefficient α can be a specific constancy or the same for all firms. The term "(ε)" measures the residual, i.e. the unexplained part of the explained (dependent) variable.

In our research, we have a sample of panel data so the first thing to do is to specify the homogeneity and heterogeneity of the data generating process (Khalfaoui, 2005). The specification or homogeneity test allowed us to see and understand the nature of the model we have. Is it a totally homogeneous model (no effect)? Is it an individual or specific model or is it possible to use a panel? Hausman (1978) noted that: "For panels of reduced time size, there may be large differences between the parameter estimation realizations of random effects and fixed effects models," and we used Hausman's test to determine the nature of the effects. We used the Hausman test to determine the nature of the effects. The Hausman test is particularly used in individual models in order to make a choice between a fixed-effects and a random-effects model.

In a fixed-effects model, the ai parameters are constants and specific for each individual. On the other hand, in a random effects model, the ai parameters are no longer deterministic constants. They contain hazards. The residual or error has three factors: unobserved individual effects, unobserved temporal effects, and unexplained effects. Before specifying the model, we performed a few pre-requisite tests (stationarity test on individual data by the LLC method (Levin and Lin, 1992) and stationarity test on individual data by the IPS method (Im et al. 1997)) for a better robustness and reliability of the estimation. Finally, in order to validate our model, we performed the tests of serial correlation (Pesaran), heteroskedasticity (Breusch-Pagan), significance of random effects (Brusch-Pagan) and significance of fixed effects (Fisher test).

Presentation and discussion of results

We presented successively descriptive analyses, modeling and discussion.

Descriptive analyses

The results obtained in Tables 2 and 3 gave a general view of the study variables analyzed on a cylindrical panel of twenty-one companies whose data are used over eight consecutive years (2004 to 2011).

Uni-variate descriptive analysis

(i) ROE reached an average level of -3.56% with a strong standard deviation indicating a high dispersion.

(ii)The average BoD size was 11 directors and is within the optimal range (8 and 11) proposed by Leblanc and Gillies (2004). Compared to the texts in force, OHADA (1997) and Senegalese Law 90-07 of 26 June 1990, the BoD must have a size between 3 and 12 members.

(iii) The presence of women on the BoD was almost nil. However, all companies have complied with OHADA and Senegalese laws, particularly Law 90-07 of 26 June 1990 and the law on parity, which do not take this issue into account.

(iv) The presence of independent directors on the BoD has been almost non-existent.

The standard deviation of 1.14 indicates a strong dispersion. The companies were in conformity with the texts in force (OHADA (1997) and the law 90-07 of June 26, 1990).

(v) The number of BoD meetings per year averaged 3, with six companies not meeting the minimum (3 meetings/year) required by law.

(vi) The audit committee: there was only one company that had an audit committee and had the best ROE. This exception risked distorting the econometric analysis, which is why we removed this variable.

Bi-variate descriptive analysis

Through the bi-variate analysis, we try to apprehend the relationships between the variables two by two but especially the relationships between the explanatory variables and the explained variable (Table 4).

Performance and BoD size

Our correlation coefficient between turnover size and ROE is 0.07. At the 5% threshold, the correlation is positive but not significant. Our results are close to those of Godard (1998), Wintoki (2007) and Triki and Bouaziz (2012).

Performance and number of women in the BoD

Our correlation coefficient between the number of women in the BoD and performance is -0.17. At the 5% threshold, the correlation is negative and significant. So we can say that the relationship between these two variables exists but it is negative. Our results contradict those of gender diversity advocates such as Singh et al. (2008). We find that the negative sign of the coefficient on the variable presence of women in CA was consistent with the expected sign. This result was corroborated by Triki and Bouaziz (2012).

Performance and number of independent directors

The correlation coefficient between the number of independent directors and ROE is 0.07. At the 5% threshold, the correlation is positive but not significant. Our results are close to authors such as Yermack (1996) who highlighted the absence of significant correlation between the two parameters mentioned.

Performance and number of BoD meetings per year

Our correlation coefficient between the number of BoD meetings per year and performance is 0.1518. At the 5% threshold, the correlation is positive and significant. Our results have been confirmed by Triki and Bouaziz (2012).

In conclusion, the analysis of the correlation matrix showed a low level of correlation between companies' ROE. However, on the direction of variation between the variables we noted a similar evolution between ROE and the size of the BoD, the independence of the latter, the number of meetings. On the other hand, the presence of women on the BoD has evolved in the opposite direction of the ROE of the company, which is quite surprising in view of the parity which is more and more a topical issue.

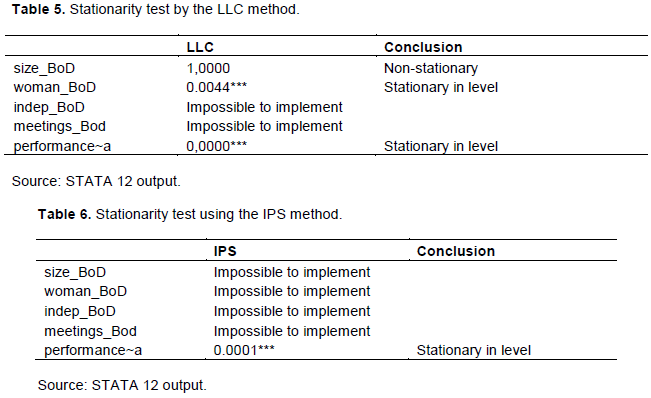

Pre-requisite test results

Stationarity test on the data taken individually

Stationarity test by the LLC method: These results showed that only the size series of the company's turnover is not stationary (Table 5). However, the series for the number of women in the firm's BoD and ROE are stationary. Furthermore, given the nature of the data, which were qualitative variables transformed into quantitative variables, it was impossible to apply the stationarity tests to them.

Stationarity test using the IPS method

The results showed that only the variable ROE could be implemented under stata and the hypothesis H0 which states that all components of the variable (ROE) are stationary, against the hypothesis H1 where some components are stationary. The conclusion show only the CA size series was non-stationary, so it is not useful to do a cointegration test because the variables are not integrated in the same order (Table 6).

The specification of the model

The real challenge in the study of panel data lies in modeling individual heterogeneity (country, individual, in our case companies), without neglecting the temporal dimension. Indeed, the greater the individual heterogeneity, the greater the variability of the observations, which increases the precision of the estimators. To do this, we studied fixed-effect models and compound error models.

Criterion for choosing between the fixed-effects model and the random-effects model: The Hausman test

The assumptions of the Hausman test are as follows:

H0: Presence of random effects

H1: Presence of fixed effects

The test statistic (Pro. ≥ chi2=0.793) is higher than the 10% threshold and the H0 hypothesis cannot be rejected. We must therefore favor the adoption of a random effects model. For our study we have chosen the random effects model. The random effects model was chosen (Table 7).

The selected model: the random effects model

The results of the estimation by the random effects model showed that the variable number of women in the turnover has a significant relationship with the ROE of the firms. The number of women on the BoD is negatively related to ROE. Moreover, the specification appears to be good (Prob. ≥ Chi2=0.01). The elasticities found for each explanatory variable could be framed by confidence intervals. The 95% confidence interval (CI) is an interval of values that has a 95% chance of containing the true value of the estimated parameter. In order to validate our model, we carried out tests (Table 8).

Results of model validation tests

In fact, the major problems with panel data are serial correlations and heteroskedacity.

Serial correlation test (Pesaran)

The results showed that the H0 hypothesis, which states that there is a serial correlation between the data, was rejected. This is not a good thing for our model. It should be noted that the tests for serial correlation are not appropriate for the data we have available. Indeed, these tests are intended for data over long periods of time ranging from 20 to 30 years.

H0: There is a serial correlation between the data.

H1: there is no serial correlation between the data.

Homoscedasticity test (Brusch-Pagan)

Homoscedasticity qualifies a constant variance of the data residuals composing the sample. Conversely, heteroscedasticity is said to exist when the variance of the model residuals is not constant. Table 9 showed us that the random effects are significant (Prob. ≥ chibar2 =0.000). This means that there is the presence of heteroskedasticity that would inevitably have to be corrected by the WHITE method. We have corrected the heteroskedasticity with White's method specified with the areg command on Stata.

Random effects significance test (Brusch-Pagan)

Before regressing the random effects model, the Brusch Pagan test for the significance of the random effects should be run. H0: Absence of random effects; H1: Presence of random effects. The principle remains the same as what is done for the homoscedasticity test.

Test of significance of fixed effects (Fisher's test)

Finally, with respect to the Fisher test, the main objective is to ensure the presence of fixed effects or not because the hypotheses are: H0: Absence of fixed effects, H1: Presence of fixed effects. However, the Brusch-Pagan test has shown that the random error model is better suited, so it was no longer useful to do this test since the

Fisher test only applies to the fixed effects model. After the validation tests, the estimated general model and the results associated with the estimation are as follows:

PERFORMANCE i t = - 70.67 + 0.84 Size CA i t - 5.64 Women* CA i t + 1.92 Indep. CA i t + 1.67 Meeting CA i t (the star indicates the significant variable at the 5% threshold).

The selected model: PERFORMANCE it = - 70.67 - 5.64 woman.

Rejected hypotheses

H1: BoD size positively influences ROE: rejected

The size of the turnover has no significant relationship with the ROE of the companies. Contrary to the resource dependency theory that argues for larger BoD size, agency theorists (Jensen, 1993) consider that large BoD size poses difficulties in terms of organization and coordination in decision making. Our result was confirmed by Wintoki (2007) Triki and Bouaziz (2012) who found no significant relationship between the size of the BoD and the firm's ROE.

H2: There is a positive link between the number of independent directors on the BoD and ROE: rejected

BoD independence has no significant effect on corporate performance. In parallel with the work that seeks to identify the link between the independence of the BoD and the achievement of performance for a firm, there is a hybrid current in the financial literature between advances in agency and stewardship theories. This trend leads to the conclusion that the BoD independence has no effect on the firm’s performance. Our result was close to the hybrid current. It was corroborated by Kaymak and Bektas (2008); Klein (1998) who found no significant relationship between the two parameters mentioned.

H4: There is a positive link between the number of BoD meetings and ROE: rejected

The number of annual BoD meetings has no significant relationship to the company's ROE. Omri and Mehri (2003) found the same result in the Tunisian context.

Validated hypothesis

H3: The presence of women in the BoD negatively affects the ROE: validated

Our results indicated that the coefficient on the variable presence of women in CA is negative and statistically significant at the 5% threshold (coef. = -5.64; P> IzI = 0.040). We found that the negative sign of the coefficient on the presence of women in the BoD was consistent with the expected sign. Indeed, this result was corroborated by Farrell and Hersch (2005) who found a negative impact of BoD diversity on ROE due to the reduced number of women in the BoD. Similarly, Triki and Bouaziz (2012) found in the Tunisian context that BoD diversity negatively and significantly affected the performance measured by ROA. In addition, our results on the significant negative relationship between the presence of women and ROE could be explained by the low percentage of female representation on the BoD. Indeed, Kanter's theory (1977) indicates that within social groups, there are two types of categories; the dominant and the dominated (i.e. tokens). Kanter postulated that the number of dominants models the perception of the members of the group, in this case the BoD. Thus, the dominated (tokens), who are less important in number, behave in a similar way than the dominants, in order to be better integrated. According to this theory, minorities should ideally reach a representation percentage of 35% of the total workforce within a group before they hope to exert a significant influence on the group. However, our results indicated that the threshold of 35% of the workforce was not reached (the average of women on the BoD was 0.88) and that as a result, these women directors were not able to play an effective role on the BoD. Finally, these differences in results could be explained by several factors. Differences in the countries where the analyses were carried out in terms of culture, legislation and involvement in the professional situation of women may be the cause. The diversity of the methods and indicators used could also be an explanation for this heterogeneity of results. Indeed, Triki and Bouaziz (2012) found in the Tunisian context that the diversity of the turnover has negatively and significantly affected the performance measured by the ROA. On the other hand, when performance was measured by Tobin's Q or by ROE, these authors found a non-significant relationship between performance and BoD diversity.

The ambition of our research was to determine the influence of the BoD on the ROE of public service companies in the Senegalese context. We have adopted the hypothetical-deductive approach, making assumptions based on previous work. Verification or refutation of the hypotheses is done through the use of statistical and econometric tools. Initially we had five independent variables (BoD size, BoD independence, presence of women on the BoD, BoD meetings and the Audit Committee of the BoD) and the dependent variable is the ROE. The variable (audit committee) has been removed because it is an exception in our field data.

Introducing this variable into the model risked biasing the results. At the end of the tests, assumptions H1; H2 and H4 were rejected. On the other hand, hypothesis H3 was validated. We did not find a significant relationship between governance and ROE. Our conclusion was confirmed by Bauer et al. (2004), who, based on a sample of 300 FTSE companies, found no significant relationship between governance and performance, whether in terms of stock market or accounting performance. Louizi (2011), based on a sample of 132 French listed companies over the period 2002-2008 with 14 variables concerning the functioning of the BoD, shows that there is no significant influence of the BoD on performance. Indeed, out of the 14 variables, only the independence of the BoD has a positive and significant link on the company's performance. Kiel and Nicholson (2003) even state that attempts to identify direct links between corporate performance and governance practices are "naïve" and that there are no adequate recommendations for all firms. At the end of this research, other studies could be envisaged:

(i) The influence of the BoD on performance using other measurement criteria. For this, it is necessary to involve the Government of Senegal for access to the financial and accounting information of companies.

(ii) The influence of the characteristics of the BoD on overall performance. Thus, the notion of performance would no longer be limited to ROE, but would integrate environmental and social performance within it.

(iii) Other variables such as the profile of the executives, their seniority and remuneration, the profile of the Chairman of the BoD, etc. could be included in a future empirical study.

The authors have not declared any conflict of interests.

REFERENCES

|

Adams RB, Ferreira D (2009). Women in the boardroom and their impact on Governance and performance. Journal of Financial Economics 94:291-309.

Crossref

|

|

|

|

Agrawal A, Knoeber CR (1996). Firm Performance and Mechanisms to Control Agency Problems between Managers and Shareholders, Journal of Financial and Quantitative Analysis 31:377-397.

Crossref

|

|

|

|

|

Anderson RC, Mansi SA, Reeb DM (2004). Board characteristics, accounting report integrity and the cost of debt. Journal of Accounting and Economics 37:315-342.

Crossref

|

|

|

|

|

Andrés P, Azofra V, López FJ (2005). Corporate Boards in some OECD countries: Size composition, functioning and effectiveness. Corporate Governance: An International Review 13(2):197-210.

Crossref

|

|

|

|

|

Bauer R, Nadja G, Roger O (2004). Empirical Evidence on Corporate Governance in Europe: The Effect on Stock Returns, Firm Value and Performance». Journal of Asset Management 5:91-104.

Crossref

|

|

|

|

|

Beasley MS, Carcello JV, Hermanson DR, Lapides PD (2000). Fraudulent Financial Reporting: Consideration of Industry Traits and Corporate Governance Mechanisms. Accounting Horizons 14(4):441-454.

Crossref

|

|

|

|

|

Brown L, Caylor M (2004). Corporate governance and firm performance. Working paper.

Crossref

|

|

|

|

|

Cabinet McKinsey and Company (2007). Rapport 2007.

View

|

|

|

|

|

Charreaux G (1991). Structure de propriété, relation d'agence et performance financière. Revue Économique, pp.521-552.

Crossref

|

|

|

|

|

Charreaux G (2000). Le conseil d'administration dans les théories de la gouvernance, Centre de Recherche en Finance, Architecture et Gouvernance des Organisations, Université de Bourgogne.

|

|

|

|

|

Conyon M, Peck SI (1998). Recent Developments in UK Corporate Governance'. in T Buxton, P Chapman and P Temple (eds), Britain's Economic Performance. 2nd edition, Routledge, London, pp. 253-277.

|

|

|

|

|

Donaldson L, Davis JH (1989). CEO governance and shareholder returns: Agency theory and stewardship theory, Paper presented at the annual meeting of the Academy of Management, Washington DC.

|

|

|

|

|

Enron (2001). Stories: Enron ou l'histoire d'une faillite retentissante.

View

|

|

|

|

|

Fama EF, Jensen MC (1983). Agency problems and residual claims. Journal of Law and Economics 26(2):327-349.

Crossref

|

|

|

|

|

Farrell KA, Hersch PL (2005). Additions to Corporate Boards: The effect of Gender. Journal of Corporate Finance 11(1-2):85-106.

Crossref

|

|

|

|

|

Godard (1998). Les déterminants du choix entre un conseil d'administration et un conseil de surveillance. Finance Contrôle Stratégie, -

View

|

|

|

|

|

Guest PM (2009). The impact of the board size on firm performance: evidence from the U.K, European Journal of Finance 15:385-404.

Crossref

|

|

|

|

|

Jensen MC, Fama EF (1983). Separation of ownership and control. The journal of law and Economics, -

View

|

|

|

|

|

Hausman JA (1978). Specification tests in econometrics. Econometrica: Journal of the econometric society. pp.1251-1271.

Crossref

|

|

|

|

|

Jensen MC, Meckling WH (1976). Theory of the firm: Managerial Behavior, Agency Costs and Ownership Structure. Journal of Financial Economics 3(4):305-360.

Crossref

|

|

|

|

|

Jensen MC (1993). The modern industrial revolution, exit the failure of internal control systems. Journal of Finance 48:831-880.

Crossref

|

|

|

|

|

Kanter RM (1977). Some effects of proportions on group life: Skewed Sex Ratio and Responses to Token women. American Journal of Sociology, pp. 965-990.

Crossref

|

|

|

|

|

Kaymak T, Bektas E (2008). L'impact de l'indépendance et de la dualité du conseil d'administration.

View

|

|

|

|

|

Khalfaoui H (2005). Libération financière: impacts et conditions de réussite, un essai d'application pour les pays du Maghreb.

|

|

|

|

|

Kiel GC, Nicholson GJ (2003). Board Composition and Corporate Performance: how the Australian experience informs contrasting theories of corporate governance. Corporate Governance: An International Review 11:189-205.

Crossref

|

|

|

|

|

Klein A (1998). Firm Performance and Board Committee Structure, Journal of Law and Economics 41:275-303.

Crossref

|

|

|

|

|

Kochan T, Bezrukova K, Ely R, Jackson S, Joshi A, Jehn K, ... Thomas D (2003). The effects of diversity on business performance: Report of the diversity research Network, Human's Resource Management, Spring 2003, 42(1):3-21.

Crossref

|

|

|

|

|

Leblanc R, Gillies J (2004). Improving Board Decision-Making: An Inside View Alternatives Beyond Imagination, Company Directors Conference, Port Douglas, Queensland, AICD.

|

|

|

|

|

Levin A, Lin CF (1992). Unit Root Test in Panel Data: Asymptotic and Finite Sample Properties», University of California at San Diego, Discussion Paper No. 92-93.

|

|

|

|

|

Levin A, Lin CF (1992). Unit Root Test in Panel Data: Asymptotic and Finite Sample Properties, University of California at San Diego, Discussion Paper No. 92-93.

|

|

|

|

|

Linck J, Netter J, Yang T (2006). A large sample study on board changes and determinants of board structure. Working Paper, University of Georgia.

Crossref

|

|

|

|

|

Louizi A (2011). Les déterminants d'une. Bonne Gouvernance et la performance des entreprises Françaises: Études empiriques, Thèse de doctorat en Sciences de gestion, Université Jean Moulin Lyon 3.

|

|

|

|

|

Im KS, Pesaran MH, Shin Y (1997). Testing for Unit Roots in Heterogenous Panels, DAE, Working Paper 9526, University of Cambridge.

|

|

|

|

|

Im KS, Pesaran MH, Shin Y (1997). Testing for Unit Roots in Heterogenous Panels», DAE, Working Paper 9526, University of Cambridge.

|

|

|

|

|

OHADA (1997). Acte Uniforme relatif au Droit des Sociétés Commerciales et du Groupement d'Intérêt Economique, Ed. Comptables et Juridiques, Dakar.

|

|

|

|

|

Omri A, Mehri B (2003). Performance des Entreprises Tunisiennes.

View

|

|

|

|

|

Pfeffer J, Salanick GR (1978). A social information processing approach to job attitudes, Administrative science quarterly, JSTOR.

Crossref

|

|

|

|

|

Singh V, Terjesen S, Vinnicombe S (2008). Newly appointed directors in the boardroom: How do women and men differ? European Management Journal 26:48-58.

Crossref

|

|

|

|

|

Tobin J (1969). Une approche d'équilibre général de la théorie monétaire, Journal of Money, Credit and Banking, JSTOR.

|

|

|

|

|

Triki M, Bouaziz Z (2012). L'impact de la présence des comités d'audit sur la performance financière des entreprises tunisiennes.

|

|

|

|

|

Wintoki MB (2007). Endogeneity and the Dynamics of Corporate Governance. Working paper.

|

|

|

|

|

Worldcom (2002). Worldcom scandal.

View

|

|

|

|

|

Yermack D (1996). Higher market valuation of companies with small board of directors, Journal of Financial Economics 40:185-211.

Crossref

|

|