Full Length Research Paper

ABSTRACT

Cocoa unrelentingly is a valuable crop and key foreign exchange earner in Ghana regarding other agricultural commodity exports. The focal drive of this study was to examine the impact of macroeconomic variables including cocoa price and bank specific characteristics on bank profitability during the period of 2010 to 2020. The study extends the analysis of cointegration, Vector Error Correction Model (VECM) with that of impulse response and provided a vigorous long run and short run dynamic effects on bank profitability. The study confirmed a negative relationship between coca price and bank profitability in the short run. The estimated error correction term shows convergence of banking sector profitability towards long-run equilibrium. The causality test results indicated that there is a unidirectional relationship running from cocoa price to Bank profitability. Thus, cocoa prices have a significant effect on bank profitability. The results raise issues for counter-cyclical policies, such as revenue and stabilization funds during cocoa price boom. Policy makers may thoughtfully consider the significance of cocoa price when framing policy regarding bank profitability among others.

Key words: Cocoa price, bank profitability, Vector Error Correction Model (VECM), impulse response, causality.

INTRODUCTION

Cocoa is a vital crop because it provides food, income, employment, industrial raw material and resources for the Ghanaian economy. The cocoa sector in Ghana is estimated to contribute GH¢2.25 billion, equivalent to $390 million to the Gross Domestic Product (GDP). The crop also leads the agricultural sector and contributes about 30% of the country's export earnings. There are around 800,000 farmers employed directly in cocoa business (GSS, 2019).

Commodity price changes sturdily affect macro-economic performance of commodity-exporting economies. Agarwal et al. (2017) showed that low prices of commodity are due to worse bank health, which results in tightening of bank lending in Low-Income Countries. This worsening association is stronger for commodity-exporting economies. An experimental study on the link between commodity prices and financial sector stability in a sample of emerging and developing nations by Kinda et al. (2016) indicated that, negative commodity price shocks are linked to higher non-performing loans and as such lower bank profitability. In view of this, a price regulation policy, known as the price stabilization mechanisms, has been established by Côte d’Ivoire and Ghana. This allows farmers to be assured about the price to be received to evade side-selling. It protects farmers from world cocoa prices instabilities and lessens price risk.

Cocoa plays a vital role in the economy of Ghana. The impact of the crop is seen in the exports of the nation, it provides job, government revenue, foreign exchange earnings and reduces poverty (Anim-Kwapong and Frimpong, 2004). For instance, Ghana and Cote d’Ivoire accounted for more than 30% of cocoa export earnings over the period 1995-2014 (UNCTAD, 2015). The economy of Ghana depends heavily on commodities that are exported including cocoa, oil and gas and gold, making it susceptible to world economic meltdowns and declines in the prices of commodities.

According to Lartey et al. (2013), “Bank profitability as the capability of banks to produce more revenue than cost relative to their capital base”. Usually, financial institutions mainly provide financial intermediation by gathering resources to fund business and develop projects useful for development of an economy (Nwaeze et al., 2014). Thus, the competence and steadiness of the financial sector are important to economic growth. Most Ghanaian banks benefit from being intermediaries to cocoa farmers through the disbursement of the syndicate loan facility sourced by COCOBOD from international partners. It is noteworthy that, this bank-facilitated loan to COCOBOD targets among other things to boost local farmers’ incomes and their communities and create new and good jobs leading to economic growth. Through this, banks are able to make some turnover hence increasing their profitability. The factors that determine the profitability of banks have been extensively discussed and supported theoretically but less is done on the influence of commodity price (cocoa price) on bank profitability.

The aim of this work is to investigate whether the Cocoa price has an impact on the bank profitability in Ghana a cocoa-exporting country. To test this, the cocoa price is added as an additional macroeconomic factor.

Background of cocoa production and marketing in Ghana

Cocoa has helped greatly in developing the economy of Ghana since its introduction by Tetteh Quarshie in 1879. Cocoa is produced by nearly 800,000 households from six regions in the forest zone of southern Ghana (GLSS, 2014). According to African Business news (2017), cocoa contributed around one-third of the export revenues of the nation, totaling over USD 1.5 billion representing around 25 to 30% of the total export earnings until the discovery and production of oil between 2007 and 2010. The crop generates around 10% of the country’s GDP (Boadu, 2014). In 2020 cocoa season 4.8million metric tonnes of cocoa were produced worldwide, with Ghana being the second highest/biggest producer accounting for 883, 652 metric tonnes after Cote D’Ivoire.

The cocoa bean sector is controlled by the Ghana Cocoa Board (COCOBOD), which is marketing intermediate between primary producers and processors. It oversees all activities around cocoa trade from the farm gate to the export port. It acts as a legal monopsony setting a pan-territorial and pan- seasonal price at the onset of the main harvest season in early October. Thus, it operates as the sole buyer in the domestic market and as a monopolist for the exports in the world market. The prices of cocoa are given on the international market; this exposes local producers to price instabilities. On the international market, price of cocoa is determined by the interaction of supply and demand of cocoa beans as well as hedging by buyers. To protect farmers’ produce and for them to make a decent and stable income, COCOBOD fixes cocoa price for the farmers based on the international market.

From literature, bank profitability is determined by different factors namely, bank-specific and macroeconomic factors. For bank-specific factors, the followings mainly determine the performance of bank: liquidity, size, efficiency, credit risk and ownership (Molyneux and Thornton, 1992; Miller and Noulas, 1997; Demirguc-Kunt and Huizinga, 1999).

Micco et al. (2007) in a study of banks from 179 countries between 1992 and 2002 found that bank profitability majorly determines the credit risk or liquidity risk a bank would want to take and not just size. Al-Haschimi (2007) using accounting decompositions and panel regression, researched the factors that determine bank net interest rate margins in 10 Sub Saharan African nations concluded that a credit risk has impact on banks’ profitability. Prasanto et al. (2020) investigated the determinants of bank profitability in Indonesia from 2007 to 2017 using Vector Error Correction Model (VECM). They reported a positive relationship between non-performing loans, loan to deposit, economic growth, exchange rates and bank profitability in the long run. Whereas inflation had a negative correlation with bank profitability. Furthermore, there exists no effect on bank profitability by these variables in the short run.

In relation to macroeconomic variables, scholars have discovered connections between inflation, interest rates, and profitability as well as business cycle and the performance of bank (Demirguc-Kunt and Huizinga, 1999; Flamini et al., 2009). Trujillo-Ponce (2012) proposed that there exist a significant association between inflation and bank profitability. On the other hand, Boyd and Champ (2006) showed that the inflation may decrease the loan lending and thus negatively influence the profit. A positive relation has been reported between inflation and bank profitability as well as GDP growth and bank profitability (Hesse and Poghosyan, 2016)

Another evident study conducted by Islam and Nishiyama (2016), remarked that the existence of liquidity and economic growth negatively affects bank profitability.

However, inflation positively affects the profitability of bank. Ullah et al. (2020) also revealed that ROA and NPL ratio and liquidity ratio have significant and negative relationship.

Chidozie and Ayadi (2017) analyzed the impact of Gross domestic product growth, Inflation, Crude oil price and loan to deposit ratio on bank’s profitability in Nigeria using panel regression technique. They reported that, crude oil price are negatively significant in determining bank profitability whereas total assets is positively significant in explaining bank profitability.

Anarfi et al. (2016) investigated some key determinants of bank-specific characteristics and macroeconomic indicators and the degree at which they affect banks’ profitability in Ghana. The study employed a fixed and random effect model with data obtained from annual financial statements of 21 banks from 2007-2014. The study revealed that bank loans and capital positively affect Ghana’s profitability. The results additionally revealed that for the macroeconomic factors, only exchange rate has negative effect on profitability.

Boadi (2015) examined the effect of both internal and external factors on Ghanaian banks’ profitability, using random effects and pooled ordinary least square models and data from 1997 to 2014. The study results found that non-interest income, GDP growth and capital to assets significantly influence bank profitability. Nevertheless, the study revealed liquidity, deposit ratio, overhead, non-performing loans, number of employees; inflation and real interest rate have non- significant effect on the profitability of banks in Ghana.

The empirical results in a study by Keo (2020), reveal that non-performing loan ratio, bank capital ratio, total loan to total asset ratio, and GDP growth for medium banks have a significant impact on return on asset, for Vietnam. The case of Thailand shows bank capital ratio, total deposit to total asset ratio, GDP growth rate for small banks, and inflation show a significant relationship with return on asset.

A study by Flamini et al. (2009) examined the annual bank and macroeconomic data for 41 countries from South Saharan Africa for the period 1998 – 2006 to analyze the determinants of banks’ profitability. The study used the Arellano Bonds Two-step General Method of Moments. At the end of the study, it was found that equity and inflation has a positive and significant effect on bank profits.

From the above mentioned, this study then hypothesized that Non-performing loans, credit to deposit ratio, inflation, exchange rate and cocoa price have significant influence on bank profitability.

MATERIALS AND METHODS

Data

The object of the study was to explore the impact of cocoa price on the bank profitability in Ghana using monthly data from January 2010 to October 2020 from the bank of Ghana. This period was used because all the data points were complete and accessible. From the commercial banks records and books, bank specific data on non-performing loans and credit to deposit ratio were sourced. Eviews version 9 was utilized to estimate the model.

Variable

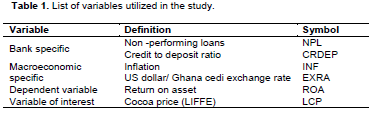

Empirically, the study is to test the correlation between bank profitability and cocoa price. The dependent variable is the Return on Asset (ROA) and it is the alternative used to measure the bank’s profitability as has been used in previous studies (Babalola, 2012; Flamini et al., 2009; Oladele et al., 2012; Arias, 2011; Duho et al., 2019). According to Obamuyi (2013), ROA is a financial ratio utilized to estimate the correlation between earnings and total assets. It is further explained that, ROA evaluates how banks effectively manage their revenues and expenses from operations, and also shows the management’s capability to produce profits with the financial and real assets available. It is believed that a higher return on asset indicates an improved use of banks’ assets to generate profits, while lower ROA shows inefficient use of assets. The independent variables were in two categories: Bank-Specific variables and Macro-economic variables including cocoa price used in determining the bank profitability in Ghana (Table 1). The values of the cocoa prices were converted to natural logarithms.

Non-Performing loans - Empirically, Gyamerah and Amoah (2015) and Miller and Noulas (1997), show that credit risk negatively affects profitability because high-risk loans lead to higher level of unpaid loans. Thakor (1987) and Miller and Noulas (1997) noted that future performance responds greatly to the level of loan loss provisions, that is unpaid loans reduces profitability.

Credit to deposit ratio – this is used as a proxy for banks’ liquidity. Liquidity risk determines bank profitability. The more liquid a bank is the more profitable it becomes in the long run. Nevertheless, studies by Bourke (1989), Molyneux and Thorton (1992) found a negative relationship between liquidity and profitability levels.

Inflation is measured by the percentage increase in consumer price index. Haron and Azmi (2004) and Staikouras and Wood (2003) verified that inflation has positive effect on profitability. Bourke (1989) and Molyneux and Thornton (1992) found inflation and bank performance have positive relationship. Heggestad (1977) shows there are no correlation between inflation and banks’ profitability. The impact of inflation on bank profitability is dependent on whether inflation is expected or not (Perry, 1992).

Exchange rate is the amount of domestic money needed to obtain a unit of the US dollar. It can affect bank performance both directly and indirectly. Prasanto et al. (2020) reported positive correlation between exchange rate and bank profitability. This study is looking at the direct effect on banks’ profitability.

The study employed the linear Granger (1969) causality test in the VECM theme, to examine the short-run and long-run linearity relationship among the variables in bivariate and multivariate mode. To provide accuracy in the estimate of the relationship, it is thus necessary to prior determine the presence of unit root and cointegration between the time series. This helps in implementing VECM scheme which presumes that all variables are endogenous.

Augmented Dickey-Fuller (1981) stationary test

The study applied Augmented Dickey-Fuller (henceforth ADF) test developed by Dickey and Fuller (1981) to examine the unit root in each series with the following hypothesis:

?0: ?=0 that is, the time series is non-stationary and need to be differenced (has a unit root)

??: ?<0 that is, the time series is stationary (has no unit root)

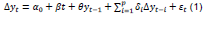

The ADF test is expressed by the following ordinary least square (OLS) correlation:

Where, t is a deterministic trend, α and β are the constants, p is the lag order chosen according to Schwarz Bayesian Criterion (SBC). If the calculated value, in absolute term, is more than the t-statistic value (or the p-value less than 5%), this rejects the null hypothesis (?=0) and conclude that the time series is stationary. If the null hypothesis is rejected at level (without differencing), then the order of the stationary series is designated as I(0) whereas if the null hypothesis rejected at first difference then the order of the stationary series is designated as I(1). Similarly, for second difference the order of the stationary series is designated as I(2).

Johansen-Juselius (1990) cointegration test

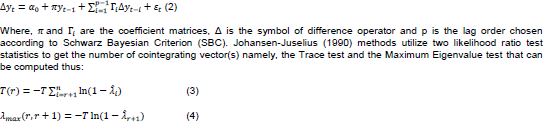

If the time series are non-stationary at level and when the variables are incorporated of same order, the Johansen test of cointegration developed by Johansen and Juselius (1990) can be applied to obtain the number of cointegrating vector(s). Johansen-Juselius (1990) multivariate cointegration model can be written thus:

Where, ??? is the expected eigenvalue of the characteristic roots and T is the sample size. The null hypothesis of the Trace test (equation 3) examines the number of r cointegrating vectors against the alternative of n cointegrating vectors. The null hypothesis of the Maximum Eigenvalue test (equation 4) explores the number of r cointegrating vectors against the alternative of r+1 cointegrating vectors. So, if the variables are cointegrated after doing Johansen-Juselius test then is a long-run equilibrium correlation between the variables. Further, that long-run equilibrium association can be examined by applying VECM scheme.

Vector Error Correction Model (VECM)

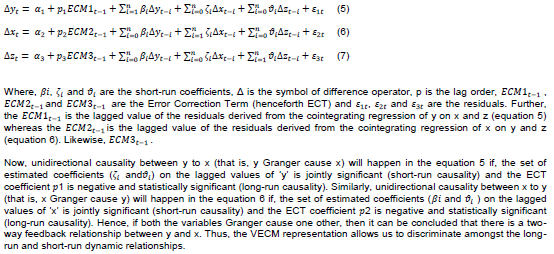

It can be understood that cointegration indicates the presence of causality among two time series but it does not detect the direction of the causal relationship. Engle and Granger (1987) noted that the presence of cointegration among the variables shows unidirectional or bi-directional Granger causality among those variables. Further, they demonstrate that the cointegration variables can be specified by an Error Correction Mechanism (henceforth ECM) that can be estimated by using standard methods and diagnostic tests. The VECM regression equation can be expressed as follows:

The relative importance of the variables in impacting bank profitability fluctuations was also assessed by impulse response analysis. The stability was then tested using CUSUM test.

RESULTS AND DISCUSSION

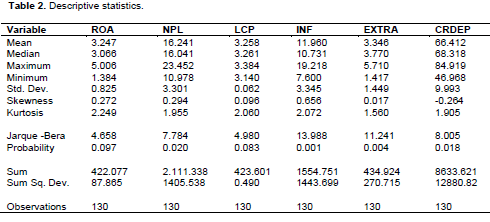

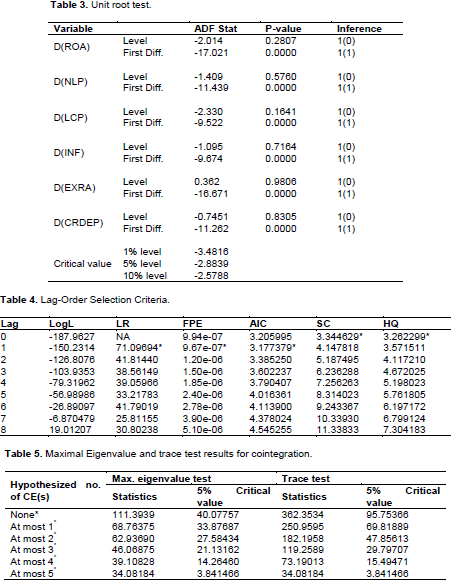

Descriptive statistics display the data set of the study in an enlightening way. The results show that, the return on assets minimum and maximum values range is 1.384 and 5.006. The mean is 3.247 with a standard deviation of 0.825 indicating that it is not widely spread. The mean cocoa price between 2010 and 2017 is 3.258 and the minimum maximum is 3.140 and 3.384 respectively, the standard deviation of 0.062 shows that it is not widely spread (Table 2). Testing data stationarity is very important for time series data, Table 3 shows results of a unit root test for stationarity in levels and in first difference using Augmented Dickey-Fuller (ADF) test. The test results at levels found that the variables were not significant at 1, 5 and 10% level of significance and the null hypothesis of a unit root was not rejected.

However, further test results revealed that, Return on Assets (ROA), Non-Performing Loans (NPL), cocoa price (LCP), Inflation (INF), Exchange Rate (EXRA) and Credit to Deposit Ratio (CRDEP) are first order difference stationary. That is, all the variables were significant at 1, 5 and 10% level of significance and the null hypothesis of a unit root was rejected. To decrease the fluctuations of the data, first-order difference is made on the six sequences to obtain new series D(ROA), D(NLP), D(LCP), D(INF), D(EXRA) and D(CRDEP) for the study.

With the Johansen test, it is necessary to ascertain optimal lag—order criteria. It removes the serial relationship in the residuals and determines the deterministic trend assumption for VEC model. From Table 4, the lag-order selection by different information criteria shows a lag of 1.

The Johansen cointegration approach is dependent on the trace and maximum eigenvalue which is presented in Table 5. Johansen cointegration test on D(ROA), D(NLP), D(LCP), D(INF), D(EXRA) and D(CRDEP) shows that there are at least 6 cointegrated equations at 5% level of significance. The null hypothesis of no cointegration vectors is not accepted as the trace statistics of 362.3534 is higher than the critical value of 95.7537. Similarly maximum eigenvalue test shows a test statistic of 111.3939 with a critical value of 40.0778 leading to the rejection of no cointegrating vector. These shows are fixed and long-term equilibrium associations among the variables. Based on the existing cointegration relationships, VEC modeling can be done further.

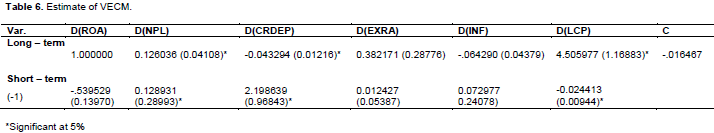

The presence of cointegration indicates that VECM can be utilized. VECM methods help to explore the effect of the estimated long-run equilibrium on the short-run dynamics, the cointegrating vectors. A cointegrated set of time series need to have an error-correlation representation, which shows the short-run adjustment mechanism. There, the parameters of the error-correlation concept inferred by cointegrating vectors for bank profitability are examined for determining if they are rightly signed and important. The long-run impact of cocoa price (LCP), D(NLP) , D(INF) D(EXRA) and D(CRDEP) on bank profitability is presented in Table 6 with the corresponding standard errors. The cointegration vector shows a stationary long run correlation between DROA, the dependent variable, and D(NLP), D(LCP), D(INF), D(EXRA) and D(CRDEP).

From Table 6, it is shown that cocoa price has a positive and significant long run relationship with bank profitability. This implies that a 1% increase in cocoa price would significantly improve bank profitability by 4.51%. This result was expected.

Bank specific factors such as non-performing loans and credit to deposit ratio have positive and negative but significant long-run relationship with bank profitability respectively. That is an increase in NPL would increase bank profitability by 0.126. Similar studies by Prasanto et al (2020) have shown a significant positive association between non-performing loans and bank profitability. The study reported of a negative credit to deposit ratio impact on bank profitability and this is consistent with studies by Bourke (1989), Molyneux and Thorton (1992).

The rest of the variables, exchange rate and inflation have positive and negative relationship with bank profitability respectively, but not significant. A positive relationship between exchange rate and bank profitability was reported by Prasanto et al. (2020), whereas Anarfi (2016) reported a negative impact by exchange rate on bank profitability.

Also this study’s finding of inflation having a negative relationship with bank profitability is consistent with Prasanto et al. (2020) and Boyd and Champ (2006).

The error correction term of -1.539529, suggests that bank profitability responds to its long-run equilibrium path greatly by 153.95% speed of adjusting every year by the contribution of bank specific determinants, macroeconomic variables and cocoa price. Non-performing loans and credit to deposit ratio are significant short term determinants of bank profitability. Likewise, cocoa price exert statistically significant but negative effect on bank profitability in the short-run. The high speed of adjustment by bank profitability can show that the model fits well.

The results also found that, a 1% increase in cocoa price causes bank profitability to increase by 450.60% in the long-run. However, in the short-run a 1% increase in cocoa price leads to 2.44% decrease in bank profitability.

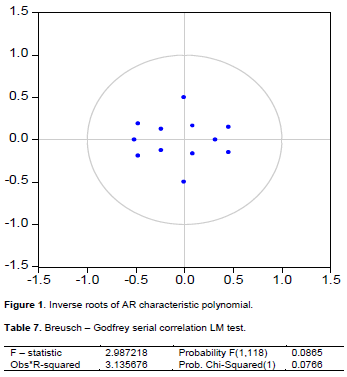

Diagnostics checks

Diagnostic checks are very important in this analysis since a problem in the residuals from the estimation of the model indicates that the model is inefficient and that parameter estimates from such a model can be biased. The VEC model was subjected to arduous diagnostic test using AR Roots and serial correlation tests (Figure 1). The estimated VEC is stable since all the roots lie inside the unit circle, making impulse response standard errors valid.

The model was subjected to thorough diagnostic test to certify the parameter valuation of the results obtained by the model. From Table 7, the test for serial correlation generated an F –statistic of 2.9872 with a probability of 0.0865 indicating the acceptance of the null hypothesis that there is no serial relationship. Thus, the variables are independent of one another.

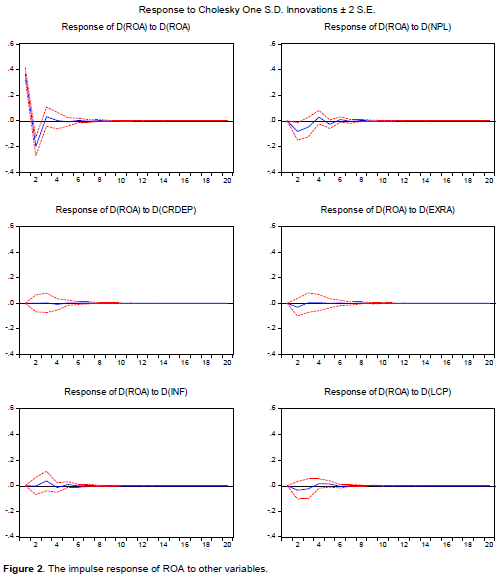

Impulse response function (IRF)

Impulse response function of a dynamic system is its output when presented with a brief input signal called an impulse. The general impulse response functions trace the responsiveness of the dependent variable in the VECM to shock each of the variables. For each equation, a unit shock is employed on the error and the impacts on the VECM system over the given time were evaluated. Nevertheless, the prime aim of the study is to examine the influence of cocoa price on bank profitability, therefore only the responsiveness of the dependent variable, ROA, is traced. The aim of this analysis is to look at the response of long-term dynamics of each variable when there is some shock of one standard deviation in each equation. From the VEC model, there are six (6) variables and there is possible response between these variables. The response function is displayed in Figure 2. These impulse functions reveal the dynamic response of ROA to a one-period standard deviation shock to the innovations of the system showing the anticipated pattern and verify the results from the short run correlation analysis. Shocks of all the variables including cocoa prices (LCP), are significant, although not obstinate. The response of ROA to a one-period shock to cocoa prices is a transitory depreciation. This result implies that increase in cocoa prices depreciates the bank profitability in the short run.

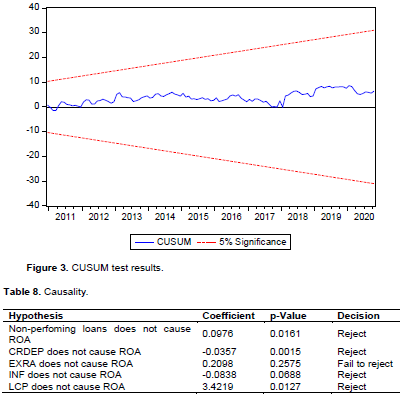

Stability of bank profitability test (CUSUM)

This part of the study deals with the empirical analysis of the stability of the parameters of bank profitability. For stability of short-run dynamics and the long run parameters of bank profitability, it is important that the CUSUM statistics stay within the 5% critical bound, represented by two straight lines. As can be seen in Figure 3, the CUSUM plots do not cross the 5% critical boundary, hence powerful to detect changes in the conditional model parameters. It can therefore be concluded that the estimated parameters for the short run and long run dynamics of bank profitability are stable over the period. Table 8 reports on the causalities and it revealed a causality that runs from cocoa price, non-performing loan and credit to deposit ratio to ROA at 5% significance level. Thus, any change in cocoa price leads to a change in bank profitability. It was also found out that inflation cause ROA at 10% significance level.

CONCLUSION

An efficient financial system is a significant factor for effective financial intermediation which leads to sustainable private sector investment and the promotion of entrepreneurship (Yaron et al., 1998). As such, an understanding of the determinants of the profitability of financial institutions such as the banks is essential and crucial to the stability of the economy. The study investigated the long-run equilibrium relationship between bank profitability and Non-Performing Loans (NPL), cocoa price (LCP), Inflation (INF), Exchange Rate (EXRA) and Credit to Deposit Ratio (CRDEP) during the period 2010 to 2020. The existence of the long-run equilibrium relationship between bank profitability and cocoa price changes have been confirmed in a Vector Error Correction Model. Impulse response was found to be compatible with bank profitability and CUSUM test also confirmed the stability of Ghana’s bank profitability function. However, an increase in cocoa prices depreciates the bank profitability in the short run. The estimated error correction term shows convergence of banking sector profitability towards long-run equilibrium. There are unidirectional causalities that run from cocoa price, credit to deposit ratio, inflation and non-performing loans to ROA, bank profitability. Accordingly, any change in cocoa price will lead to a direct change in banks’ profitability. The results raise issues for policy in Ghana, which includes the vulnerability of the financial sector to external shocks of the cocoa market. Hence a set of counter-cyclical policies, such as revenue and stabilization funds, are required during periods of a cocoa price boom. The pricing of cocoa policy by the government, COCOBOD, to provide farmers with a stable income and plan their businesses should be complied for a better banking performance. Once more in the long run the economic divergence agenda should be accelerated with the end result of broadening the collection of economic activities that reduces the vulnerability of export revenues to cocoa. Some practical tools that may be adopted to help the divergence agenda involve further processing of the raw primary commodity for local use and export.

There are some limitations in the studies, different bank react to cocoa price at different speed. For instance, some banks are more sensitive to cocoa price changes and move at the same time, while some lag. Also cocoa price may have different impact on large banks and small banks.

CONFLICT OF INTERESTS

The authors have not declared any conflicts of interests.

REFERENCES

|

Agarwal I, Duttagupta R, Presbitero AF (2017). Commodity prices and bank lending in low-income countries. International Monetary Fund, Working Paper WP/17/279 |

|

|

Al-Haschimi A (2007). Determinants of bank spreads in Sub-Saharan Africa, draft. |

|

|

Anarfi D, Abakah EJA, Boateng E (2016). Determinants of Bank Profitability in Ghana: New Evidence. Asian Journal of Finance and Accounting 8(2). |

|

|

Anim-Kwapong GJ, Frimpong EB (2004). Vulnerability and adaptation assessment under the Netherlands climate change studies assistance programme phase 2 (NCCSAP 2). |

|

|

Arias JC (2011). Banking profitability determinants. Semiannual Publication 4(2):209. |

|

|

Babalola YA (2012). The determinants of bank's profitability in Nigeria. Journal of Money, Investment and Banking 24:6-16. |

|

|

Boadi I (2015). Profitability Determinants of the Ghanaian Banking Sector in Ongoing Wave of Consolidation. International Journal of Business and Management 10(12):1833-8119. |

|

|

Boadu MO (2014). Assessment of pesticides residue levels in cocoa beans from the Sefwi Wiawso Dstrict of the Western Region of Ghana (Doctoral dissertation). |

|

|

Bourke P (1989). Concentration and other determinants of bank profitability in Europe, North America and Australia. Journal of Banking and Finance 13(1):65-79. |

|

|

Boyd JH, Champ B (2006). Inflation, Banking and Economic Growth, Federal Reserve Bank of Cleveland, Cleveland, OH 01/94. |

|

|

Chidozie UE, Ayadi FS (2017). Macroeconomy and Banks' Profitability in Nigeria. African Research Review 11(2):121-137. |

|

|

Demirgüç-Kunt A, Harry H (1999). Determinants of commercial bank interest margins and profitability: some international evidence. World Bank Economic Review 13(2):379-408. |

|

|

Duho KCT, Onumah JM, Owodo RA (2019). "Bank diversification and performance in an emerging market". International Journal of Managerial Finance 16(1):120-138. |

|

|

Flamini V, Calvin M, Liliana S (2009). The determinants of commercial bank profitability in sub-Saharan Africa. International Monetary Fund. |

|

|

GSS, Ghana Statistical Service (2019). Rebased 2013-2018 Annual Gross Domestic Product: April 2019 Edition. Ghana. |

|

|

Gyamerah IA, Amoah B (2015). Determinants of Bank Profitability in Ghana. International Journal of Accounting and Financial Reporting. 5(1). |

|

|

Haron S, Azmi WNW (2004). Profitability Determinants of Islamic Banks: A Cointegration Approach. Islamic Banking Conference. Union Arab Bank, Beirut, Lebanon. |

|

|

Heggestad A (1977). Market structure, risk and profitability in commercial banking. The Journal of Finance 32(4):1207-1216. |

|

|

Hesse H, Poghosyan T (2016). Oil prices and bank profitability: Evidence from major oil-exporting countries in the Middle East and North Africa. In Chapter 12A. |

|

|

Islam MS, Nishiyama S (2016). The Determinants of Bank Profitability: Dynamic Panel Evidence from South Asian Countries. Journal of Applied Finance and Banking 6(3):77-97. |

|

|

Johansen S, Juselius K (1990). Maximum likelihood estimation and inference on cointegration-with applications to the demand for money. Oxford Bulletin of Economics and statistics 52(2):169-210. |

|

|

Keo V (2020). Impact of Bank-Specific and Macroeconomic Determinants on Financial Performance in Commercial Banks -Case Study in Thailand and Vietnam. International Journal of Social Sciences 6(2):514-534. |

|

|

Kinda MT, Mlachila MM, Ouedraogo R (2016). Commodity Price Shocks and Financial Sector Fragility. IMF Working Paper 16/12, International Monetary Fund, Washington DC. |

|

|

Lartey VC, Antwi S, Boadi EK (2013). The relationship between liquidity and profitability of listed banks in Ghana. International Journal of Business and Social Science 4(3). |

|

|

Micco A, Panizza U, Yañez M (2007). Bank ownership and performance. Does politics matter? Journal of Banking and Finance 31(1):219-241. |

|

|

Miller SM, Noulas AG (1997). Portfolio Mix and Large-bank Profitability in the USA. Applied Economics 29(4):505-512. |

|

|

Molyneux P, John T (1992). Determinants of European bank profitability. Journal of Banking and Finance 16(6):1173-1178. |

|

|

Nwaeze C, Michael O, Nwabekee CE (2014). Financial Intermediation and Economic Growth in Nigeria (1992-2011). The Macro theme Review 3(6):124-142. |

|

|

Obamuyi TM (2013). Determinants of Banks' Profitability in a Developing Economy: Evidence from Nigeria. Organizations and Markets in Emerging Economies 4(8):97-111. |

|

|

Oladele PO, Sulaimon AA, Akeke NI (2012). Determinants of bank performance in Nigeria. International Journal of Business and Management Tomorrow 2(2):1-4. |

|

|

Perry P (1992). Do banks gain or lose from inflation. Journal of Retail Banking 14(2):25-40. |

|

|

Prasanto O, Wulandari D, Narmaditya BS, Kamaludin M (2020). Determinants of Bank Profitability: A New Evidence from State-Owned Banks in Indonesia, Trikonomika 19(1):29-35. |

|

|

Staikouras C, Wood G (2003). The determinants of bank profitability in Europe. Paper presented at the European Applied Business Research Conference, Venice. |

|

|

Thakor A (1987). Asset writedowns: managerial incentives and security returns: discussion. The Journal of Finance 42(3):661-663. |

|

|

Trujillo-Ponce A (2012). What Determines the Profitability of Banks? Evidence from Spain. Journal of Accounting and Finance 53(2):561-586. |

|

|

Ullah MA, Nath SD, Biswas MR (2020). "Impact of bank-specific internal factors on the profitability of state-owned commercial banks in Bangladesh. Indian Journal of Commerce and Management Studies 11(2):24-32. |

|

|

UNCTAD (2015). Integrating Small Farmers into the Global Value Chain. UNCTAD/SUC/2015/4, New York and Geneva. |

|

|

Yaron J, Benjamin M, Charitonenko S (1998). Promoting efficient rural financial intermediation. The World Bank Research Observer 13(2):147-170. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0