Full Length Research Paper

ABSTRACT

This research examines the impact of import substitution policy on the trade balance and exchange rate in Ghana by employing the macroeconomic variables – inflation rate and interest rate. For a robustness check, the policy is analyzed using the augmented trade balance and magnitude of import substitution approaches. The study utilizes quarterly data from 1990Q1 to 2021Q1 and applies the Johansen cointegration test and vector error correction model to estimate the dynamics of the policy impact. The results show that the import substitution policy boosts the capacity of domestic production and improves the trade balance. Also, the study reveals that both the augmented trade balance and magnitude of import substitution and international reserves have a symmetric negative impact on the exchange rate at a statistically significant level of 1%, ceteris paribus. This implies that the implementation of the import substitution policy would ensure the appreciation or stabilization of the domestic currency value in Ghana without depleting the international reserves in the long-run.

Key words: Exchange rate; trade balance; international reserves; inflation rate; interest rate; augmented trade balance; magnitude of import substitution.

INTRODUCTION

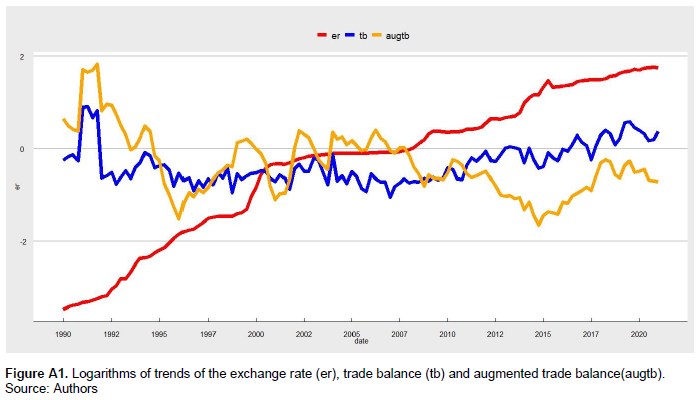

Historically, between 1992 and 2017, Ghana suffered from a trade deficit. The trade balance in Ghana started improving in 2007 when Tullow Oil and Kosmos Energy discovered oil in commercial quantities in the Western region. As of 2017, Ghana has been observing a trade surplus (See Figure A1 in the Appendix for illustration). However, the problem still holds that the exportation has merely been primary commodities while the importation level has been increasing endangering the survival of infant domestic industries (Banson et al., 2015). This has been a major factor in the Ghana Cedis’ depreciation since the importers demand more of the United States dollar (USD) for trading (Bhattarai and Armah, 2013). Hence, the government has to intervene with policies to support the industries. Government intervention ensures measures are adequately enforced to promote the growth and development of localized industries (Steel, 1972; Todaro, 1994; Adelman and Yeldan, 2000; Jackson and Jabbie, 2021).

In a response to difficulties in exchange rates, trade imbalances and economic growth, many developing countries adopted a policy that intends to substitute imported goods with domestically produced goods (Steel, 1972). This policy is termed an import substitution policy. However, it failed after it was regarded by the political leaders as a political weapon and not a coherent economic policy that seeks the development of the industrial sector (Mendes et al., 2014). Earlier researchers have employed tariffs, quotas, embargoes, and import licensing as instruments for import substitution strategies (Yilmazkuday, 2003). These instruments are more for protectionist policies, prone to retaliation from other countries and negatively affect welfare (United States International Trade Commission, 2011). There is still a debate about whether the adoption of an import substitution policy is best for developing countries (Jackson and Jabbie, 2021). However, the least has been said about how import substitution policy through the instruments of macroeconomic variables – inflation and interest rates could be used to stabilize the exchange rate in Sub-Saharan Africa by boosting local industrial production. The authors, therefore, seek to fill the research gap in the macroeconomic concept of the import substitution strategy.

The first objective of this study is to examine the impact of the import substitution policy on the exchange rate and trade balance in Ghana. The second goal is that the authors attempt to propose a policy direction by recommending the appropriate import substitution instrument to ameliorate the devastating impact of imports on the Ghanaian economy.

That is, the research contributes to investigating how the government could intervene in domestic production through the use of macroeconomic variables – inflation and interest rate as policy instruments. The authors employ inflation rate and interest rate due to their significant impacts on production in most African economies including Ghana. Theories suggest a negative relationship between production and inflation level and interest rate (Adebiyi and Babatope-Obasa, 2004). Therefore, the study seeks to ascertain if the government could use them as policy tools to boost producers' capacity in Ghana.

Ghana is chosen as the domestic country for this research because the country practices an inflation-targeting flexible exchange rate regime. Trend analysis shows that Ghana’s exchange rates are explosively higher which implies that the Ghana Cedis have been depreciating (See Figure A1 in the Appendix for illustration). This makes it more suitable to examine the policy implication of import substitution. The study employs the Vector Error Correction (VEC) models as the estimation strategies since they are relevant in analyzing the dynamics among the variables. The study performs a robustness check of the import substitution strategy in two approaches. In the first approach, the impact of the import substitution strategy was analyzed using the trade balance (augmented trade balance) and the second approach applies the magnitude of the import substitution.

The research questions include: How does the import substitution policy impact the exchange rate, trade balance and international reserves in Ghana? What are the dynamics of impact on the import substitution, exchange rate and international reserves? Are interest rates and inflation levels significant instruments in achieving the import substitution policy in Ghana? Our empirical findings suggest that the augmented trade balance and magnitude of import substitution and international reserves have a symmetric negative impact on the exchange rate, ceteris paribus. This implies that the implementation of the import substitution policy would cause the domestic currency in Ghana to appreciate.

THEORETICAL FRAMEWORK AND LITERATURE REVIEW

Exchange rate, trade balance and international reserves

Understanding the link between exchange rate, trade balance and international reserves enhances policy makers in devising international finance and trade policies (Hacker and Hatemi, 2003; Yol and Baharumshah, 2005). The trade balance as represented in Equation (1) stipulates the difference between the monetary value of total export and import. Trade balance responds to the exchange rate shock via either the price or quantity (Hacker and Hatemi, 2003; Krugman and Obstfeld, 2009).

where in log form is the trade balance, and total export and import respectively.

The price and quantity components of the trade balance react differently over time when the exchange rate changes.

Whereas the price of tradable goods responds quickly to exchange rate shock at a higher magnitude in the short-run, the quantity of good dominates in the long-run and causes a reversal of the trade balance. For instance, other things being equal, when a country’s exchange rate increases (depreciation of the local currency) the price of domestic export becomes cheaper for foreigners on the international market and vice versa. On the contrary, the increase in the exchange rate causes the price of importation to be expensive for the domestic country and vice versa. Hence, the price effect in reaction to exchange rate increment in the short-run leads to a positive trade balance.

In the long-run, the reduction in the importation such as intermediate goods adversely affects domestic production which makes the quantity of domestic export to fall.

Hence, the long-run adjustment of the quantity impact causes a reversal in the trade balance. The exchange rate and trade balance link get complex when the J-curve effect is considered. The J-curve points out that price elasticities for import and export demand expectedly adjust over time. It is assumed that import and export demand elasticity initially falls and gets higher over time when the exchange rate rises. This leads to a negative trade balance in the initial stage and with time turns to a positive trade balance (Hacker and Hatemi, 2004; Feenstra and Robert, 2014).

One strategy in international trading according to Prebisch (1962) is that when a country lacks the required USD to pay for its pertinent imports, it imports goods that are payable in the currencies received in the export payments.

However, in the case when the export payment is insufficient to offset important imports the central bank uses the international reserves as a provision. Hence, a positive trade balance that results from a reduction in total imports leads to an increase in international reserves.

Existing studies have demonstrated that the excessive imports carried out in developing countries, particularly in Africa pose a threat to the fluctuations in the exchange rate of many countries. For instance, Sekkat and Varoudakis (2000) found significant responsiveness of Sub-Saharan Africa (SSA)-manufactured exports to real exchange rate-induced incentives. Again, they reveal that exchange rate mismanagement in SSA has reduced exporters' incentives to increasingly penetrate the foreign markets. Meniago and Eita (2017) have contributed that there is a positive relationship between imports and exchange rate changes in SSA. However, the degree of responsiveness seems to be extremely low. Exchange rate volatility is also proven to have a significant impact on trade in SSA (Baum and Caglayan, 2006; Senadza and Diaba, 2017).

Igue and Ogunleye (2014) engaged the vector error correction methodology to examine the long-run relationship that exists between trade balance and real exchange rate, Gross Domestic Product (GDP) and world income in Nigeria. The finding lends support to the Marshall-Lerner Condition implying that depreciation of the exchange rate has a positive effect on the trade balance in the long-run. However, Oluyemi and Isaac (2017) revealed contrary results. They found that the exchange rate is not affected by the activities of imports and exports in Nigeria.

In Ghana, Bhattarai and Armah (2013) applied the cointegration analysis to find a stable long-run relationship between imports, exports and the real exchange rate. The elasticity of imports and exports in the short-run turn causes the devaluation of the Ghana Cedi. Okyere and Jilu (2020) used a similar approach to examine the impact of export and import on the economic growth of Ghana using data from 1998 to 2018. The study found that there is no significant relationship between imports in international trade and Ghana’s GDP growth. However, exports have a significant causal relationship with Ghana’s GDP growth. This analysis is supported by Kwame and Omane-Adjepong (2017) who applied the J-Curve to examine the effect of real exchange rate movements on Ghana’s external trade performance. They found that there exists inelastic responses of export and import demand to real exchange rate changes. There exhibited a steady long-run relationship between real exchange rate changes and trade balance. Additionally, the study found an asymmetric impact of real exchange rates on the trade balance.

An investigation of the determinants of Ghana’s trade balance shows a negative relationship with domestic prices. It further suggests that the depreciation of the Ghana Cedi does not improve the trade balance (Akoto and Sakyi, 2019).

This suggests that the bank of Ghana should manage to reduce inflation which would support local producers to increase production (Antwi et al., 2020; Obuobi et al., 2020). Having discussed how the changes in the exchange rate affect trade balance, it is worth revealing that a change in a country’s export and import could also affect its exchange rate.

Import substitution strategy

From the 1950s to the 1970s most development economists incorporated the strategy of substituting imported goods with domestically produced goods which buttresses developing countries to reinforce growth (Edwards, 1993). This is known as the import substitution strategy. According to Bruton (1998), import substitution could support a developing economy that suffers from price distortions, under-utilization capacity, frequent inflation and balance of payment problems to minimize these challenges. Usually, the import substitution strategy is government intervention in domestic production via policy instruments (Yilmazkuday, 2003).

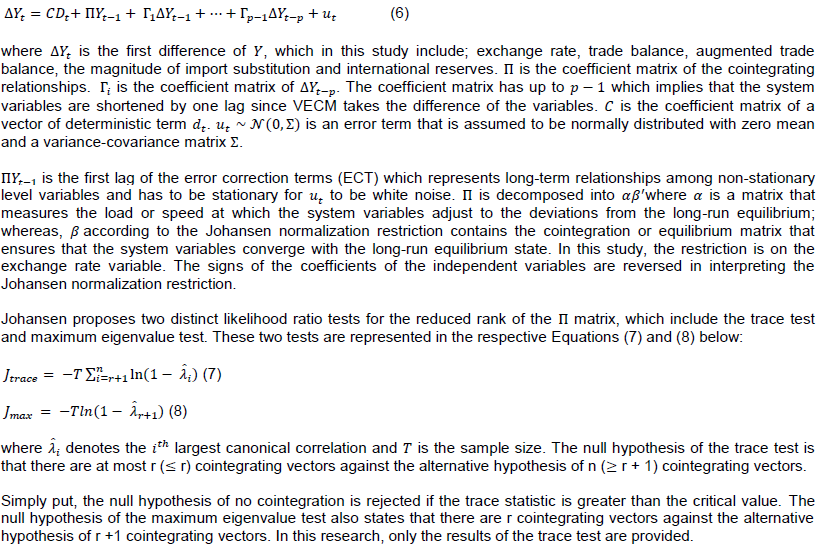

In this research, it was assumed that export is equivalent to domestic production. Export is then formulated as a function of macroeconomic variables – inflation rate and interest rate. That’s, we investigate how the interest rate and inflation level could be used as policy tools to boost the capacity of domestic production. These two macroeconomic variables are regarded as determinants of export (Ahmad, 1976; Yilmazkuday, 2003) in a linear regression below:

The economic impact of the import substitution strategy on developing economies is such that, it enhances domestic production of consumption goods thereby reducing the importation of final goods. The reduction in the level of importation ceteris paribus leads to a trade balance surplus. Moreover, suppose the government controls the importation of intermediate goods used in producing final goods in the local economy. The reduction in the importation of final goods limits pressure on demand for foreign currency such as the USD, and this leads to an appreciation of the value of the domestic currency (a fall in the currency exchange rate).

The import substitution policy has been recommended in several studies. Nurhaliq and Masih (2016) and Babatunde et al. (2019) have discussed import substitution as a strategy the government could adopt in achieving economic growth in developing countries. Adewale (2017) examines the relationship between import substitution industrialization (ISI) and economic growth in the group of BRICS (Brazil, Russia, India, China and South Africa). The study revealed that ISI policy catalyzes the industrialization process in the short-run. Specifically, the cointegration tests show evidence of a long-run relationship between real growth and indicators of import substitution.

With the import substitution and exchange rate movement, Moreira et al. (2017) conducted research on Latin America and the Caribbean and found a significant relationship between domestic currency depreciation and a reduction in import penetration. This suggests that the import substitution strategy is recommended when the local currency keeps depreciating. This study extends the literature and explores policy directions that incorporate macroeconomic variables for import substitution through the research hypotheses below.

Hypothesis 1 (H1): Interest rate and inflation rate are significant instruments for import substitution strategy

From hypothesis 1, the inflation level and interest rate are estimated to have a negative relationship with domestic production (export) (Adebiyi and Babatope-Obasa, 2004). Therefore, if the Government intervene or the central bank manage the inflation level and interest rate to an appropriate level it would increase local production to meet the internal demand for goods. This is expected to reduce the level of importation of consumer goods which ensures an improvement in the country’s trade balance and drives an import substitution strategy.

Hypothesis 2 (H2): Import substitution policy has a significant negative impact on the exchange rate

In this Hypothesis 2, an increase in the country’s total supply was expected to result from an upsurge in domestic production (export) which is improved by the macroeconomic variables – inflation level and interest rate. This domestic production improvement reduces the level of importation and demand for foreign currencies for international trading. Hence, this hypothesis test that an increase in the augmented trade balance and the magnitude of import substitution lead to a fall in the country’s exchange rates.

Hypothesis 3 (H3): Import substitution boosts the central bank’s international reserves

Having explained that advancement of the import substitution leads to a reduction in the level of importation in a country. It implies that the central banks would not be compelled to use the international reserves as a provision to pay for imported goods (Prebisch, 1962). In this vein, the hypothesis test that the import substitution policy amplifies the central bank’s international reserves.

Empirical framework

Data description

Quarterly data which span from the period 1990Q1 to 2021Q1 in Ghana were used. This gives a total observation of 125. The variable data used in this study include the exchange rate (Ghana Cedis (GHS) per the United States dollar (USD); exports and imports quoted in USD; international reserves which represent the central bank’s International Reserves and Liquidity, Reserves, Official Reserve Assets, Special Drawing Rights (SDRs) and USD. For the availability of data, the 3-months Treasury bill rate is used as Ghana’s interest rate. The inflation level is computed from the Consumer Price Index (CPI) as the 4-quarter difference of the CPI thus ln(CPIt) – ln(CPIt-4). All the variable data are extracted from the Thomson Reuters DataStream except the international reserves which are sourced from the IMF’s International Financial Statistics (IFS).

METHODOLOGY

Vector Error Correction Model (VECM)

The Vector Error Correction Model (VECM) is employed in this study. The VECM is a multivariate dynamic model that entrenches a cointegrating equation. It is important when the variables used to conduct the research are integrated in order 1 (I (1)) thus if the variables are stationary at the first difference and exhibit a linearly independent cointegrating relationship. The cointegration test is such that if the residuals of the linear regression of the system variables are stationary (I (0)) then the variables are cointegrated. The cointegration term of VECM is economically imperative in investigating the long-run relationship between the exchange rate, trade balance, import substitution and international reserves. Since the research uses three system variables, identifying the rank of cointegration for the VECM is important, hence Johansen (1988) and Johansen and Juselius (1992) cointegration and VECM approaches are applied.

Their methodology makes it flexible to determine the cointegration rank for the VECM. The Vector Error Correction Model is represented in Equation (6) below:

Simply put, the null hypothesis of no cointegration is rejected if the trace statistic is greater than the critical value. The null hypothesis of the maximum eigenvalue test also states that there are r cointegrating vectors against the alternative hypothesis of r +1 cointegrating vectors. In this research, only the results of the trace test are provided.

EMPIRICAL RESULTS

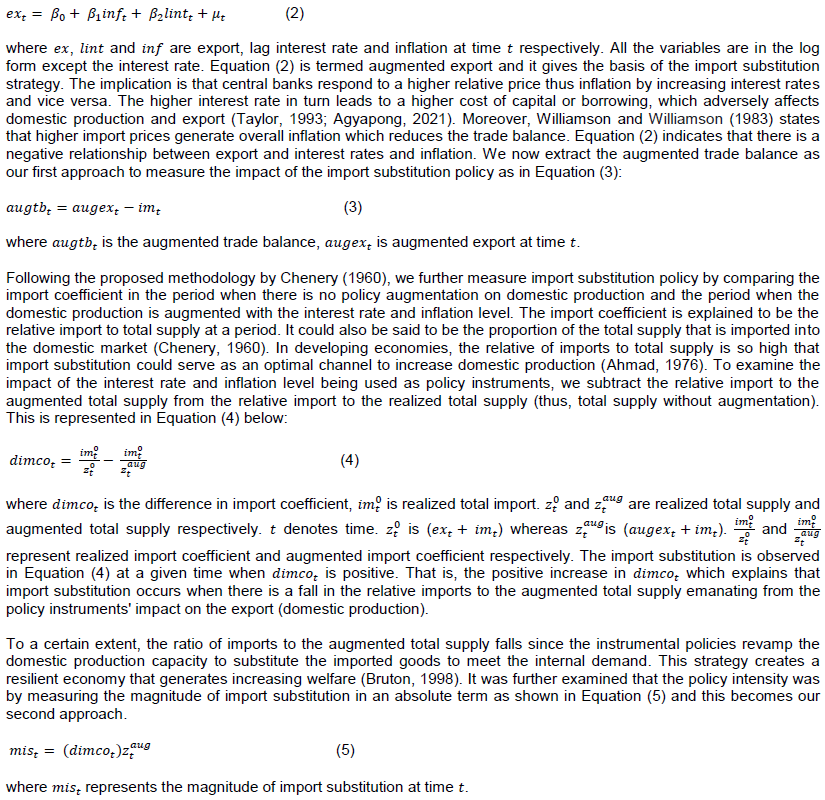

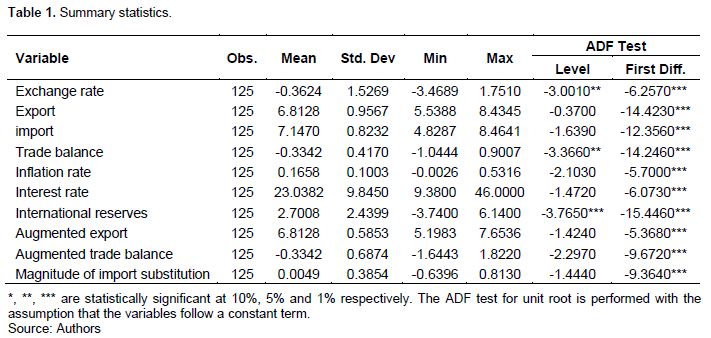

Summary statistics

Table 1 reports the mean, standard deviation, minimum, maximum and unit root test for all the variables in the study. The interest rate has the highest mean of 23.0382 whereas the exchange rate has the lowest mean of -0.3624. The most dispersed variable is the interest rate (9.8450) and the least dispersed variable is the inflation rate (0.1003). Moreover, the variable with the highest maximum value is the interest rate of 46.0000 and the variable with the least value is the inflation rate of 0.5316. Finally, the variable with the highest minimum value is the interest rate of 9.3800 and the variable with the lowest minimum value is international reserves of -3.7400.

The Augmented Dickey-Fuller (ADF) test for unit root with a specification of a constant term shows that only the exchange rate, trade balance and international reserves are stationary at the level. It is observed that all the variables are stationary at the first difference.

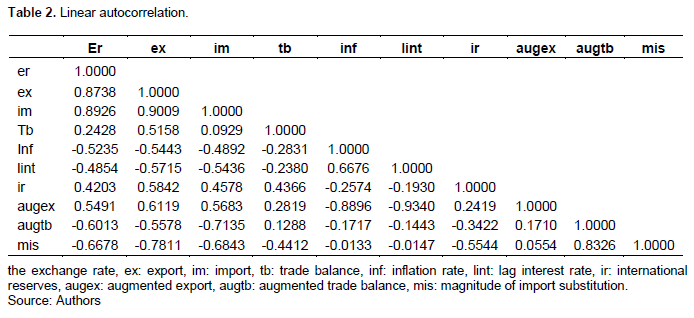

The linear correlation results presented in Table 2 show that the inflation rate (-0.5443) and interest rate (-0.5715) negatively correlate with export. More so, the inflation rate and interest have a negative effect with augment trade balance, the magnitude of import substitution and international reserve. We also observe the augmented trade balance (-0.6013) and magnitude of import substitution (-0.6678) negatively correlate with the exchange rate.

Exchange rate, trade balance and international reserves

Optimal lag for exchange rate, trade balance and international reserves

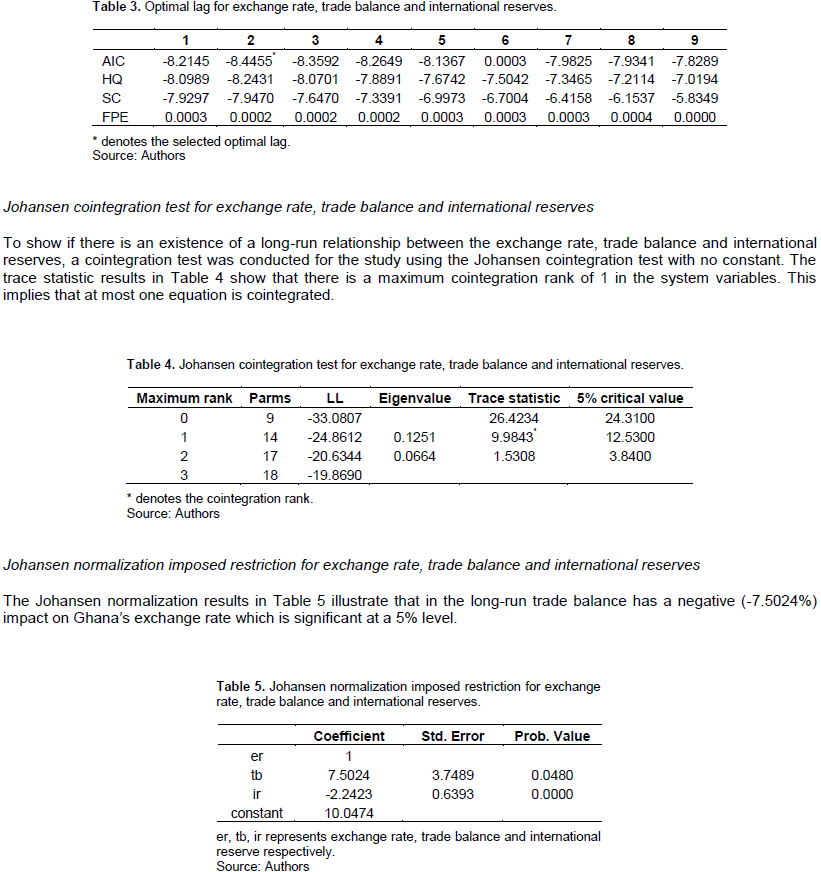

The information criteria used in selecting the lag order include Akaike Information Criterion (AIC(n)), Hannan-Quinn Information Criterion (HQ(n)), Schwarz Information Criterion (SC(n)) which is the same as Bayesian Information Criterion (BIC(n)) and Final Prediction Error (FPE(n)). From Table 3, all the information criteria provide the same optimal lag length of 2 for estimating the model.

That is, a trade surplus would cause the Ghana Cedis to appreciate (a fall in the exchange rate) in the long-run. Whereas international reserves have a positive (2.2423%) impact on Ghana’s exchange rate and it is 1% significant. This means that trade balance and international reserves are statistically significant in estimating the long-run dynamics in the exchange rate.

All things being equal, the two variables have proven to have an asymmetric impact on Ghana’s exchange rate.

Impulse response function for exchange rate, trade balance and international reserves

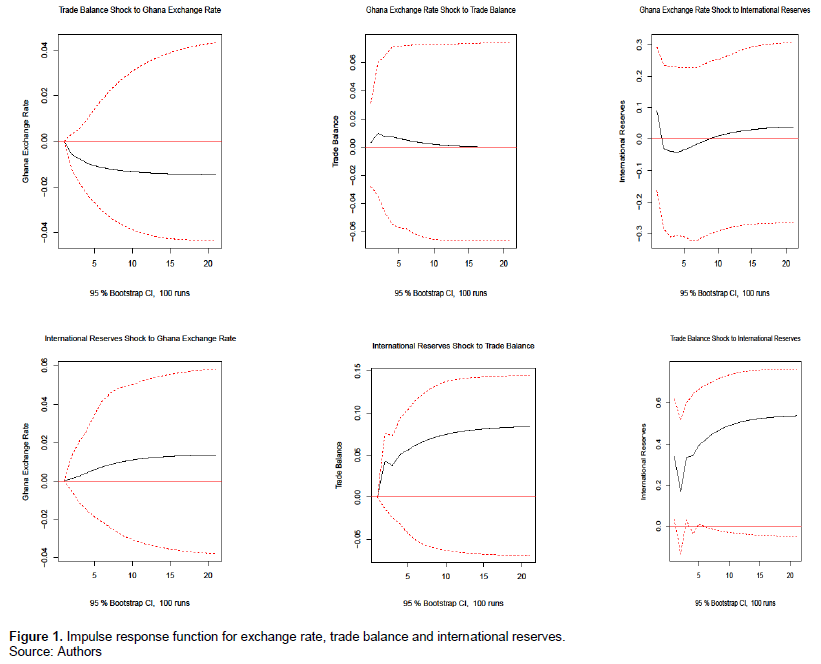

In macroeconomics, it is imperative to illustrate the dynamic response of variables to shocks from other variables. This is relevant for policy implications.

From Figure 1, the exchange rate negatively responds to a change in the trade balance and observes a persistent fall over time. Contrary to the trade balance shock, an exchange rate shock causes Ghana’s trade balance to initially jump and then persistently fall in the second quarter to equilibrium. This result is consistent with the price and quantity effect explained under the theoretical framework (Hacker and Hatemi, 2003; Krugman and Obstfeld, 2009). The international reserves respond to the exchange rate shock in Ghana by falling temporarily and then spiking after the second quarter. There is a persistent rise in Ghana’s exchange rate when a shock sets into the international reserves.

Examining the international reserves shock to trade balance, there is an increase in trade surplus and it quickly falls between the second and third quarter within the positive margin then persistently rise above the equilibrium. Moreover, the international reserves respond to the trade balance impulse by initially falling until the second quarter and then gradually rising in the long-run.

Exchange rate, augmented trade balance and international reserves

This presents the results of the first approach in examining the impact of the import substitution policy.

Augmented export

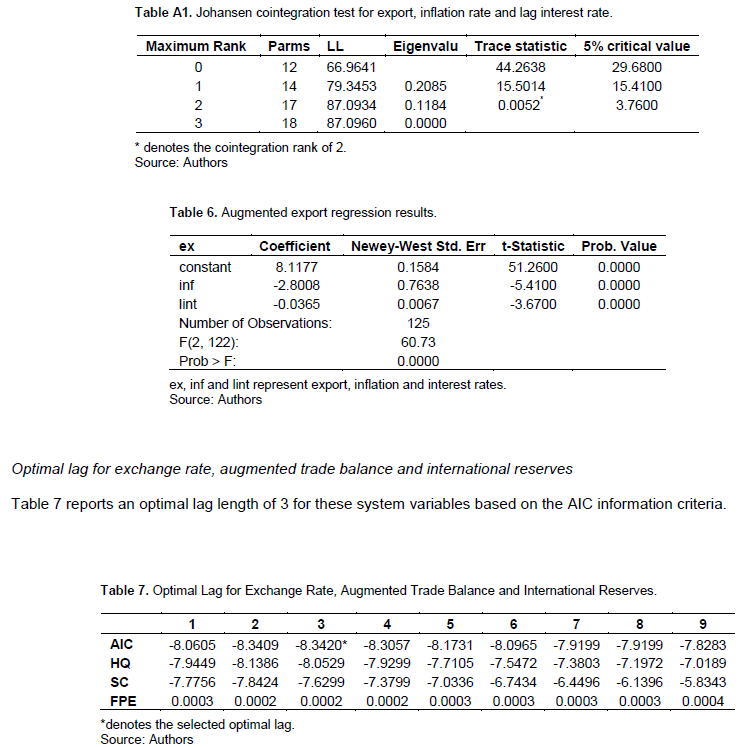

The realized export level was regressed on the import substitution policy drivers which are inflation and interest rates.

The estimated (augmented) export provides a basis for examining how the import substitution strategy could be achieved via the macroeconomic variables. In ensuring that the regression provides robust results, the Newey-West Standard Errors is applied. Although the variables used in the regression are integrated order one (I (1)), it could still run a valid regression because they are cointegrated (Appendix Table A1). The existence of cointegration between the variables ensures that the nonstationarity is explained and the residuals become stationary. The results in Table 6 show that both interest rate (-0.0365%) and inflation (-2.8008%) have a significant negative impact on export at a 1% significance level. This implies that a fall in inflation and interest rates would cause the export to increase and vice versa. These results support that inflation and interest rates are good instruments for import substitution.

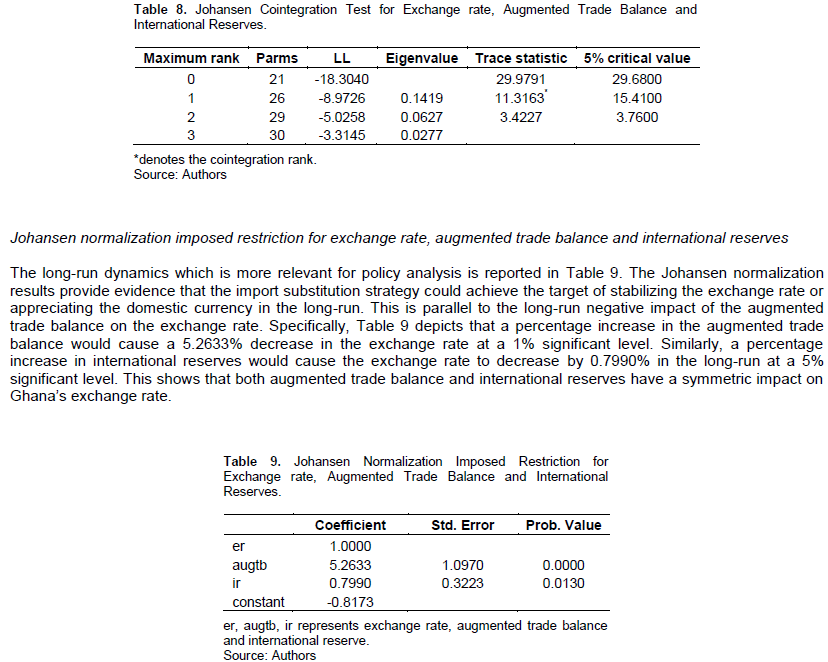

Johansen cointegration test for exchange rate, augmented trade balance and international reserves

The Johansen cointegration test with trace statistics under a constant trend is carried out for the exchange rate; augmented trade balance and international reserves and the results are presented in Table 8. The results display that there exists a maximum cointegration rank of 1.

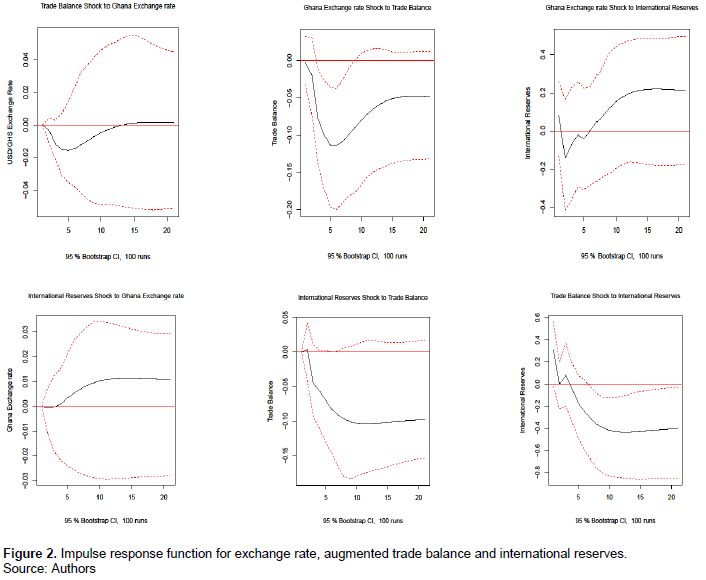

Impulse response function for exchange rate, augmented trade balance and international reserves

From Figure 2 a shock in augmented trade balance causes negative changes in the exchange rate but rises in the tenth quarter and then stabilizes from the thirteenth quarter. Contrary to the augmented trade balance shock, an exchange rate shock causes Ghana’s augmented trade balance to initially fall then rise from the sixth quarter and remain negative. The early fall of the augmented trade balance corresponds to the initial stage of the J-curve effect (Hacker and Hatemi, 2004; Feenstra and Robert, 2014). However, it remains negative in the long-run. The international reserves respond to exchange rate shock by falling temporarily and then spiking after the second quarter. There is initial stability in Ghana’s exchange rate and then rises from the fourth quarter and stayed persistently stable from the tenth quarter when a shock sets into the international reserves. Examining the international reserves shock to the augmented trade balance, the augmented trade balance responds negatively and falls throughout. Moreover, international reserves respond to the trade balance shocks by initially falling until the second quarter then gradually rising and then falling through in the long-run.

Exchange rate, magnitude of import substitution and international reserves

This part provides results on the second approach of examining the impact of the import substitution policy.

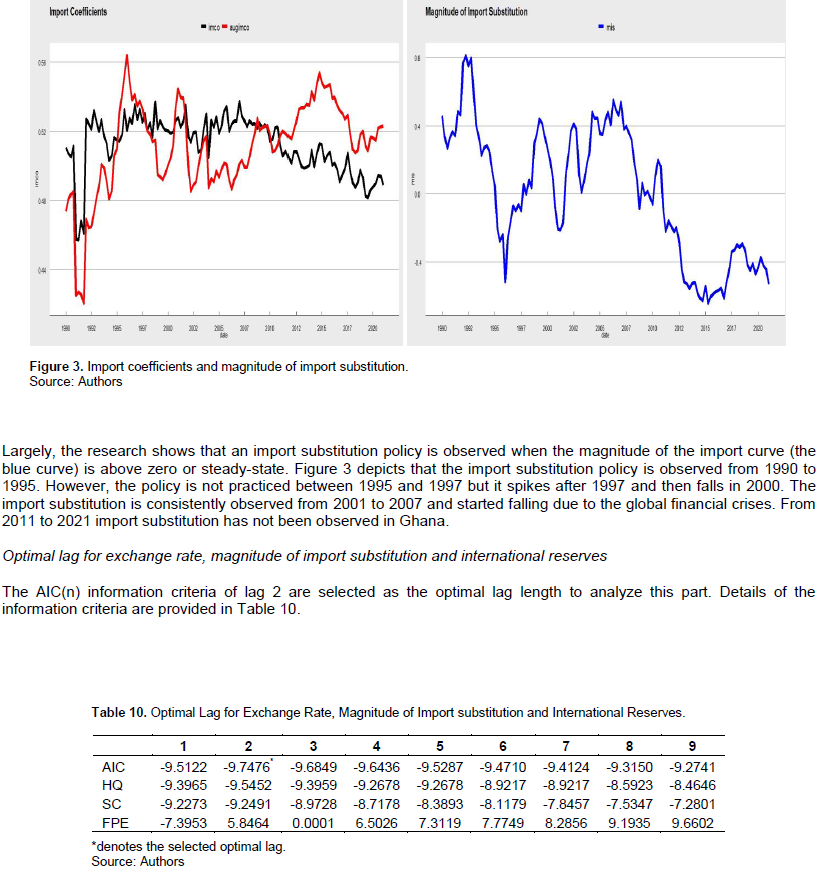

Import coefficients

The import coefficients as illustrated in Equation (4) are demonstrated in Figure 3 to give a clear picture or trend of the import substitution strategy. From Figure 3, the import substitution strategy is observed when the realized import coefficient curve (the black curve) outweighs the augmented import coefficient curve (the red curve) and vice versa. This demonstrates the impact of the interest rate and inflation level being used as policy instruments. Here, the trend of the import substitution policy that results from the interest rate and inflation is well captured by the magnitude of import substitution (Equation (5)).

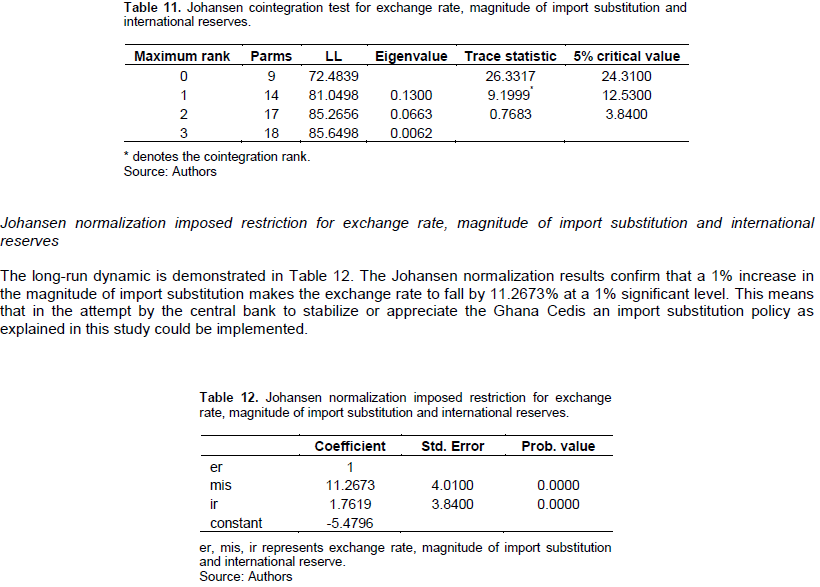

Johansen cointegration test for exchange rate, magnitude of import substitution and international reserves

The trace statistics of the Johansen cointegration test with no constant reported in Table 11 show that a maximum cointegration rank of 1 exists among the exchange rate, the magnitude of import substitution and international reserve. This means that at most one equation shows the existence of a long-run relationship among the variables.

Unlike the long-run effect of the international reserves explained in the case when the original trade balance is applied, the occurrence of the import substitution policy affects the international reserves to negatively impact Ghana’s exchange rate in the long-run.

The results indicate that a 1% rise in international reserves causes the exchange rate to fall by 1.7619% at a 1% significant level. This shows that import substitution policy and international reserves in Ghana have a symmetric impact (negative impact) on the value of the Ghana Cedis, ceteris paribus.

Impulse response function for exchange rate, magnitude of import substitution and international reserves

From Figure 4, a shock (increase) in the magnitude of import substitution slightly jumps the exchange rate above the steady-state and falls back over time. The policy ensures a long-run stabilization of the exchange rate. The magnitude of import substitution negatively responds to the exchange rate shock. It temporarily declines and begins rising in the fifth quarter beneath the steady-state. The international reserves respond to exchange rate shock by falling temporarily to negative and then spiking after the second quarter above the steady-state. There is a persistent rise in the exchange rate below the steady-state when a shock sets into the international reserves. Also, the magnitude of import substitution persistently falls below the steady-state at a larger margin in response to impulse from international reserves. The function displays a similar effect on the international reserves when there is a shock in the magnitude of import substitution.

DISCUSSIONS AND POLICY IMPLICATIONS

The study explores the impact of import substitution policy on the trade balance, exchange rate and international reserves by applying the macroeconomics variables – inflation rate and interest rates as policy instruments. The relevance of the macroeconomic variables as policy drivers are demonstrated in the study as the two variables have a significantly negative impact on export (domestic production). This corresponds to the research by Adebiyi and Babatope-Obasa (2004). The idea of the study is to examine how the policy could boost domestic production of consumption goods to meet internal demand thereby reducing the importation of final goods. For robustness check, the performance of the import substitution policy is analyzed through the augmentation of trade balance and magnitude of import substitution.

The performance of the trade balance in stabilizing the exchange rate improves when the central bank applies the inflation rate and interest rate as instruments in supporting the local industries. The augmented trade balance stabilizes the performance of the domestic currency in the long-run significantly better than without the implementation of the import substitution. Extensively, the policy changes the long-run impact of the international reserves on the exchange rate from positive in the case of trade balance without the policy instruments to negative when the trade balance is augmented with the policy instruments.

This implies that the macroeconomic variables – inflation rate and interest rates employed in this research to stimulate import substitution in Ghana would work to stabilize the value of the Ghana Cedi or appreciate it. To a larger extent, the policy could revive the economy and set a platform for boosting production, expanding exports and eventually stabilizing the exchange rate. This would, moreover, help reduce the persistent call for external management of the economy such as IMF due to the devastating impact on the economy caused by the turbulence in the exchange rate.

The study reveals long-run dynamics that support that the magnitude of import substitution and international reserves in Ghana have a symmetric negative impact on the Ghanaian exchange rate, ceteris paribus. Furthermore, the study suggests that import substitution responds to the wave of currency devaluation in Ghana by stabilizing the value of the domestic currency in the long-run without depleting the Central Bank’s international reserves.

From the empirical results and what have discussed so far, it is established that inflation and interest rates have a negative correlation with the import substitution policy. The policy implication is that during inflationary periods, banks respond by increasing their lending (interest) rates to offset their cost. Higher interest rates imply higher capital costs which discourage domestic producers from taking loans from the banks to expand production (Abor and Biekpe, 2007).

Also, the inflationary periods make input costs more expensive for the firm. Hence, for the government to achieve a stabilized exchange rate economic growth measures should be considered to ensure that the inflation rate goes down or does not exceed the target. Moreover, we recommend that the Central Bank reduce interest rates to encourage producers to take loan capital to boost domestic production. In a more specific approach, we suggest the Central Bank encourages commercial banks to charge preferential interest rates on all loans that intend to support domestic producers (Adebiyi and Babatope-Obasa, 2004).

In appendage to the interest rates reduction, as indicated by Adelman and Yeldan (2000), who suggest that the government expand the domestic supply of funds to producers through the promotion of the establishment of more development banks, the creation of financial intermediaries that would ensure the transfer of finance to the industries.

CONCLUSION AND RECOMMENDATION

This study examined the impact of import substitution policy on the trade balance, exchange rate and international reserves. The macroeconomic variables – inflation and interest rates were employed as the import substitution instruments (Ahmad, 1976; Yilmazkuday, 2003). This study contributes to the discussion on the persistent search for a suitable remedy for the worrying fluctuations of the country’s currency value. Thus, the study does not only fill the gap in literature but also provides sound empirical evidence to inform policy actions and recommendations. The effect of the import substitution policy has been demonstrated clearly through the augmentation of the trade balance and the magnitude of import substitution.

The study revealed that the augmented trade balance and magnitude of import substitution and the international reserves have a symmetric negative impact on the exchange rate in the long-run. That is, an improvement in the import substitution would cause a fall in the exchange rate. Specifically, while the policy contributes to improving the domestic currency value, the central bank's international reserves (import cover) also recover.

By and large, the import substitution policy makes the domestic producers capacitated to expand domestically produced goods which helps the country to achieve a stabilized exchange rate and reinforce growth (Ahmad, 1976; Edwards, 1993; Jackson and Jabbie, 2021). Hence, it was recommend that for the government to stabilize the exchange rate or appreciate the domestic currency value, more attention should be directed to instituting policies that would help boost domestic production in the import substitution industries. Although the study has given enough evidence of the impact of the import substitution policy, getting data on Ghana’s industrial production index was a challenge. A better analysis of the policy would be embedded in knowing the industrial production index. Hence, we suggest this should be considered in future research on the topic.

ACKNOWLEDGMENT

The authors express their gratitude to Joscha Beckmann for his helpful comments and support for this paper.

CONFLICT OF INTERESTS

The authors have not declared any conflict of interests.

REFERENCES

|

Abor J, Biekpe N (2007). Small business reliance on bank financing in Ghana. Emerging Markets Finance and Trade 43(4):93-102. |

|

|

Adebiyi MA, Babatope-Obasa B (2004). Institutional framework, interest rate policy and the financing of the Nigerian manufacturing sub-sector. In Forum on African Development and Poverty Reduction: The macro-micro linkage, held at Lord Charles Hotel, Somerset West, South Africa, from (Volume 13). |

|

|

Adelman I, Yeldan E (2000). Is this the end of economic development?. Structural Change and Economic Dynamics 11(1-2):95-109. |

|

|

Adewale AR (2017). Import substitution industrialisation and economic growth-Evidence from the group of BRICS countries. Future Business Journal 3(2):138-158. |

|

|

Agyapong J (2021). Application of Taylor rule fundamentals in forecasting exchange rates. Economies 9(2):93. |

|

|

Ahmad J (1976). Import Substitution and the Growth of Exports An Econometric Test. Revue économique pp. 286-296. |

|

|

Akoto L, Sakyi D (2019). Empirical analysis of the determinants of trade balance in post-liberalization Ghana. Foreign Trade Review 54(3):177-205. |

|

|

Antwi S, Issah M, Patience A, Antwi S (2020). The effect of macroeconomic variables on exchange rate: Evidence from Ghana. Cogent Economics & Finance 8(1):1821483. |

|

|

Babatunde OA, Bashir AO, Ganiyu YO (2019). Exchange rate, trade balance and growth in nigeria: an asymmetric cointegration analysis. The Journal of Developing Areas 53(4). |

|

|

Banson K, Muthusamy G, Kondo E (2015). The import substituted poultry industry; evidence from Ghana. |

|

|

Baum CF, Caglayan M (2006). Effects of exchange rate volatility on the volume and volatility of bilateral exports. Boston College, Department of Economics. |

|

|

Bhattarai KR, Armah M (2013). The effects of exchange rate on the trade balance in Ghana: Evidence from co-integration analysis. African Journal of Business Management 7(14):1126-1143. |

|

|

Bruton HJ (1998). A reconsideration of import substitution. Journal of economic literature 36(2):903-936. |

|

|

Chenery HB. (1960). Patterns of industrial growth. The American economic review 50(4):624-654. |

|

|

Edwards S (1993). Openness, trade liberalization, and growth in developing countries. Journal of economic Literature 31(3):1358-1393. |

|

|

Feenstra T, Robert A (2014). International Macroeconomics. New York, NY: Worth Publishers ISBN 978-1-4292-7843-0. pp. 261-264. |

|

|

Hacker RS, Hatemi JA (2003). Is the J-curve effect observable for small North European economies?. Open economies review 14(2):119-134. |

|

|

Hacker RS, Hatemi JA (2004). The effect of exchange rate changes on trade balances in the short and long run: Evidence from German trade with transitional Central European economies. Economics of transition 12(4):777-799. |

|

|

Igue NN, Ogunleye TS (2014). Impact of real exchange rate on trade balance in Nigeria. African Development Review 26(2):347-358. |

|

|

Jackson EA, Jabbie MN (2021). Import Substitution Industrialization (ISI): An approach to global economic sustainability. In Industry, Innovation and Infrastructure. Cham: Springer International Publishing pp. 506-518. |

|

|

Johansen S (1988). Statistical analysis of cointegration vectors. Journal of economic dynamics and control 12(2-3):231-254. |

|

|

Johansen S, Juselius K (1992). Testing structural hypotheses in a multivariate cointegration analysis of the PPP and the UIP for UK. Journal of econometrics 53(1-3):211-244. |

|

|

Krugman PR, Obstfeld M (2009). International economics: Theory and policy. Pearson Education. |

|

|

Kwame Akosah N, Omane-Adjepong M (2017). Exchange rate and external trade flows: empirical evidence of J-curve effect in Ghana. |

|

|

Mendes APF, Bertella MA, Teixeira RF (2014). Industrialization in Sub-Saharan Africa and import substitution policy. Brazilian Journal of Political Economy 34(1):120-138. |

|

|

Meniago C, Eita JH (2017). Does Exchange Rate Volatility Deter Trade in Sub-Saharan Africa?. International Journal of Economics and Financial Issues 7(4):62-69. |

|

|

Moreira MM, Pierola MD, Sánchez-Navarro D (2017). Exchange rate devaluation and import substitution in Latin America and the Caribbean. Nota técnica del BID (1275). |

|

|

Nurhaliq P, Masih M (2016). Export orientation vs import substitution: which strategy should the government adopt? Evidence from Malaysia. |

|

|

Obuobi B, Nketiah E, Awuah F, Agyeman FO, Ofosu D, Adu-Gyamfi G, Amadi AG (2020). Impact of currency redenomination on an economy: An evidence of Ghana. International Business Research 13(2):62-73. |

|

|

Okyere I, Jilu L (2020). The impact of export and import to economic growth of Ghana. European Journal of Business and Management 12:130. |

|

|

Oluyemi O, Isaac ED (2017). The effect of exchange rate on imports and exports in Nigeria from January 1996 to June 2015. International journal of economics and business management 3(2):66-77. |

|

|

Prebisch R (1962). The economic development of Latin America and its principal problems. Economic Bulletin for Latin America. |

|

|

Sekkat K, Varoudakis A (2000). Exchange rate management and manufactured exports in Sub-Saharan Africa. Journal of Development Economics 61(1):237-253. |

|

|

Senadza B, Diaba DD (2017). Effect of exchange rate volatility on trade in Sub-Saharan Africa. Journal of African Trade 4(1-2):20-36. |

|

|

Steel WF (1972). Import substitution and excess capacity in Ghana. Oxford Economic Papers 24(2):212-240. |

|

|

Taylor JB (1993). Discretion versus policy rules in practice. In Carnegie-Rochester conference series on public policy-39. North-Holland pp. 195-214. |

|

|

Todaro MP (1994). Economic Development (5th Edition). New York and London: Longman. |

|

|

United States International Trade Commission (2011). The Economic Effects of Significant U.S. Import Restraints, Washington, DC, Government Printing Office. 4253:332-325. |

|

|

Williamson J, Williamson RC (1983). Open Economy & World Economy. New York: Basic Books. |

|

|

Yilmazkuday H (2003). Export promotion vs. import substitution. Import Substitution. papers.ssrn.com |

|

|

Yol MA, Baharumshah AZ (2005). The effect of exchange rate changes on trade balances in North Africa: Evidence. In International Trade and Finance Association Conference Papers. bepress pp. 46. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0