ABSTRACT

This study identifies underlying behavioral drivers and impediments of adopting internet banking. Primary data was collected using questionnaire survey from 123 sample clients of three selected branches of Commercial Bank of Ethiopia. Behavioral aspects of clients attributable to the adoption of internet banking were solicited and subjected to binary logistic regression analysis. The findings of the study showed that perceived usefulness, perceived ease of use, trust, attitude, perceived cost and infrastructure factor significantly determine internet banking adoption with the last two determining negatively. Finally, banks are suggested to build up behaviors of clients towards perceiving internet banking as less risky and least costly technology.

Key words: Internet banking, client behavior, perceived usefulness, perceived ease of use, perceived cost, perceived risk, attitude, trust.

Banking has always been a highly sensitive activity that relies heavily on information technology to acquire process, and deliver the information to all relevant users. Information technology is not only critical in processing information, it provides a way for banks to differentiate their products and services (Sara, 2008). Continuous technology development, particularly information technology revolution of the last two decades of the 20th century has forced the banks to embrace Internet banking as a strategy for their sustainable growth in an expanded competitive environment. Internet banking has made financial transactions easier for the participants and introduced a wide range of financial products and services. It has changed the operations of many businesses, and has become a powerful channel for business marketing and communication (Munyoki and Ngigi, 2012). The emerging trend of Internet banking raises important issues in the area of consumers' banking behaviors and choices. For example, technology around the world is changing the ways home buyers and consumers borrow money. In the past, people who wanted to obtain mortgage loans or personal loans have to go to the bank in person. Today, they can get many services from their home.

Internet banking has become profitable distribution channel for banks because it can help them save cost and make their relation with clients easier. Nowadays, many banks especially in the developed countries are benefiting from it. Despite the growth of e-banking worldwide, commercial banks in Ethiopia continue to conduct most of their banking transactions using traditional teller based methods (Zeleke and Yitbarek, 2013). Banking operation is yet under developed due to low level of infrastructural development, lack of suitable legal and regulatory framework, high rates of illiteracy, frequent power interruption and security issues (Gardachew, 2010). The finding indicated that even though electronic banking has been widely used in developed countries and is rapidly expanding in developing countries, in Ethiopia, cash is still the most dominant medium of exchange, and electronic payment systems are at an embryonic stage. He also stressed that in the face of rapid expansion of electronic payment systems throughout the developed and the developing world, Ethiopia’s financial sector cannot remain an exception in expanding the use of the system. Moreover, internet banking is a new technology in Ethiopia which needs a lot of effort and resources to be easily adopted by clients.

Internet banking is expected to lead to cost reductions and improved competitiveness. This service delivery channel is seen as powerful because it can retain web-based clients who continue using banking services from any location. Moreover, internet banking provides opportunities to develop its market by attracting a new client base from existing internet users. Internet technology has the potential to enable banks to enhance their internet offerings with features that will improve client services interactions and allow them with options for increasing control of their internet banking experience. There are limited works investigating behavioral attributes of client intrinsically determining the future of banking industry particularly internet banking. This research is, therefore, designed with the objective of identifying client behavioral attributes underlying clients’ adoption of internet banking.

Sample size and sampling design

The target population was clients who have their own bank account opened at commercial banks of Ethiopia operating at Bahir Dar city. These clients are both users and non-users of internet banking with the later taken within the sample to know their perceptions towards internet banking. According to CBE Bahir Dar district, there are 14 branches operating in Bahir Dar city administration with 447 active internet banking user clients as of August 2016 (CBE, 2016).

Multi-stage sampling was used to reach the required sample respondents and to collect primary data. First, out of 14 branches of CBE, three (Tana, Ghion and Bahir Dar) were selected using purposive sampling technique (Table 1) because of the presence of large proportion of internet banking users relative to other branches and the characteristics of clients in all branches appear to be the same. Secondly, account holders were divided as internet banking user and non-user groups. Finally, although, 130 sample account holders were planned for the study, 7 failed to return the questionnaire, limiting the research to be done with only 123 sample clients selected using probability proportional to size sampling technique and systematic random sampling from each branch.

Data collection method

To address the research objective, primary data were gathered from active clients. The questionnaire is composed of behavior-related variables influencing adoption decision of internet banking (trust, attitude, perceived usefulness, perceived cost, perceived ease of use and perceived risk). These behavioral variables are adapted from vast literature of previous studies (Zhao et al, 2008; Santoso and Murtini, 2014; Kesharwani and Bisht, 2012; Alalwan et al., 2014; Martins et al., 2014; Safeena et al., 2014; Rakesh and Ramya, 2014). The behavioral statement questions are then framed in a five point Likert scale ranging from 1 for “strongly disagree”, 2 for “disagree”, 3 for “no opinion”, 4 for “agree”, to 5 for “strongly agree”. Socio-economic variables (sex, age, occupation, income and education level) were also included for hint around banking policymakers for prioritized targeting.

Data analysis method

Data from the structured-self-administered questionnaire was properly organized through data coding, cleaning and entering. The data is subjected to analysis using binary logistic regression model. Binary logistic regression model is appropriate and preferred probability model used from mathematical viewpoint and is flexible for interpreting binary response dependent variables (Feder et al., 1985). Hence, binary logit model is used to analyze behavioral variables of clients attributable for adoption of internet banking.

The econometric model is specified as:

Socio-economic description of clients

As shown in Table 2, there is a significant mean age difference of adopter clients and non-adopter clients and it is negatively correlated with adoption of internet banking. There is also a significant mean monthly income difference between adopters and non-adopters. Only education level of clients shows significant difference between adopters and non-adopters implying that education factor is positively associated with adoption of internet banking services (Table 3).

All internet banking related independent variables are found to have statistically significant mean difference between adopter and non-adopters of internet banking services (Table 4). All statistically significant variables have positive relationship with adoption, whereas perceived risk and perceived cost have negative correlation with adoption of internet banking, implying that the riskier the banking service, the higher the likelihood of not adopting it by clients.

Behavioral attributes of clients determining adoption of internet banking

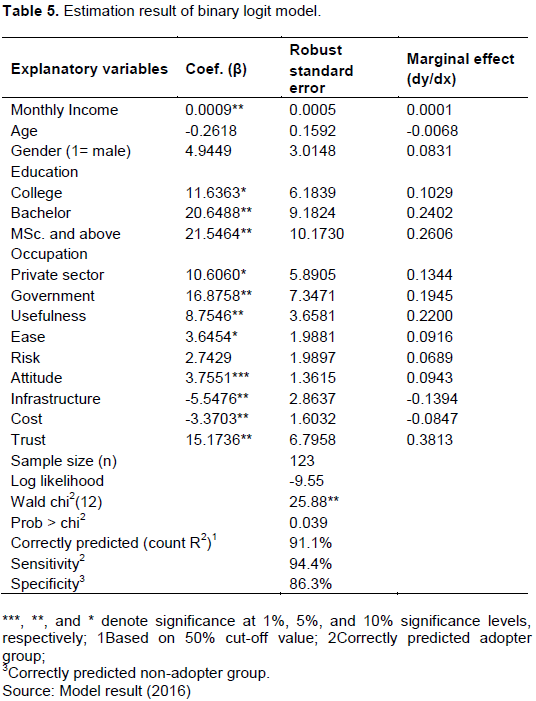

Variables supposedly influencing internet banking adoption are individual socio-economic variables, behavioral variables and technological attributes of internet banking. These independent variables are supposed to determine whether a client either adopts or not; 12 were selected based on theoretical literature and empirical studies done before. A total of 9 independent variables significantly determine internet banking adoption (Table 5). Perception on usefulness of internet banking, infrastructure factor and trustworthiness to internet banking services was found to be positively and significantly related to adoption of internet banking at 5% probability level, except developing positive attitude which did at 1% probability level and perceived ease of use at 10% significant level. Perceived cost showed negative and significant relationship with adoption of internet banking (5%).

Far more than the type and number of significant variables, model goodness-of-fit is the prior issue to discuss regression model results. The equivalence of F-test statistic used in linear regression as a measure of model goodness-of-fit is Likelihood test statistic for non-linear regression (logit). As per the result, the Likelihood test statistic of the model (Wald Chi2 = 25.88) exceeded Chi-square critical value (Prob > Chi2 = 0.039) at 12 degree of freedom, justifying the model’s goodness-of-fit or the fitted logistic regression model fitting the data well. The result is consistent with most previous studies (Abushanab and Pearson, 2007; Mohammad and Ebrahim, 2010; Candra, 2013; Daniel and Jonathan, 2010; Effah and Agbeko, 2015).

Monthly income

Monthly income of clients was found to be positively and significantly related with adoption of internet banking at 5% probability level. It is justifiable that as their income increases, their inclination to expose themselves to advanced/new technologies will be increased and so does their likelihood of adopting internet banking. A marginal effect of 0.0001 implies that as clients earn more income, their probability of adopting IB service will be increased, on average, by 0.01%. The results of the study are partially consistent with prior studies (Alfred, 2016) in Ghana.

Education level

Educational level of clients is positively and significantly related with adoption of internet banking at 5% probability level. Almost all levels of education are positively related with adoption of internet banking, justifying that the more educated the clients, the greater their inclination to expose themselves to advanced/new technologies and so does their likelihood of adopting internet banking. A marginal effect implies that as clients are more educated, their probability of adopting IB service will be increased, on average, by 20%. It is consistent with Alfred (2016) and Al-Ajam and Nor (2013).

Occupation

Occupation of clients was found to be positively and significantly related with adoption of internet banking at 5% probability level. All occupation levels are positively associated with adoption of internet banking implying that those employed are better off than unemployed ones. This shows that the more they are government employed clients, the greater their inclination to expose themselves to advanced/new technologies and so does their likelihood of adopting internet banking. A marginal effect of implies that as clients are government employed, their probability of adopting internet banking service will be increased by 15.5%.

Usefulness

Perception of usefulness of internet banking is positively and significantly related with adoption of internet banking at 5% significance level. It is evident that whenever a new technology is perceived useful for someone, the tendency of an individual going to use/adopt it will increase. Hence, if clients perceive more usefulness of internet banking, they will opt to adopt it. This is shown by the marginal effect of the variable which stood at 22% justifying the average increase in the probability of clients to adopt internet banking given that they increasingly perceive internet banking is useful. It is consistent with studies of Bisrat (2015).

Perceived ease of use of IB

As expected, perceived ease of use was found to be positively and significantly related with adoption of internet banking at 10% significance level. It is evident that whenever a new technology is perceived easy to use by someone else, the tendency to use/adopt it will increase. Hence, if clients perceive more easiness of internet banking, they will opt to adopt it. This is shown by the marginal effect of the variable which stood at 9.16% justifying the average increase in the probability of clients to adopt internet banking given that they increasingly perceive internet banking should be used.

Attitude

Attitude of clients was hypothesized to be positively correlated with adoption of internet banking. As expected, it was found to be positively and significantly related with adoption of internet banking at 1% significance level. When every new technology is promoted to individuals supposed to use it, the compatibility of the technology with individuals need, psychological, economic situations is paramount for acceptance of the new technology. With the same analogy, adoption of internet banking will have to be determined by client’s psychological makeup (their attitude after being acquainted) with internet banking. As per the result, the more the clients develop positive attitude towards internet banking, the more likelihood they will adopt it and the probability of adopting it will increase on average by 9.43%.

Infrastructural factor

This variable is negatively related to adoption of internet banking and significant at 5% significance level. This shows no one will be certain to use new technology if there is perception that the infrastructural facility is not stable. Similarly, if clients perceive there is an interruption of light and network using internet banking which is not stable situation, then their likelihood of not adopting it will be imminent. On average, when clients develop perception that using internet banking is risky, their probability of adoption will decline by 13.94%.

Cost (perceived costliness of using internet banking)

Cost is found to be negatively and significantly related to adoption of internet banking at 5% significance level. In all our daily life, individuals will never be determined to undergo or have costly events. If clients perceive that using internet banking will entail incurring more cost, the probability of adopting the technology will decline and this is indicated by a marginal reduction of 8.47%.

Trust (perception that using internet banking is trustworthy)

Moreover, perception on trustworthiness of internet banking is positively related to adoption and significant at 5% probability level. It is obvious that beyond usefulness of internet banking, its trustworthiness is more important for clients to adopt it. Whenever clients perceive internet banking is trustworthy, their probability of adoption will increase, on average, by 38.13%. This is also consistent with studies by Abushanab et al. (2010), Al-Qeisi (2009) and Goudarzi et al. (2013).

CONCLUSION AND RECOMMENDATIONS

This research aimed to identify factors affecting adoption branches at Bahir Dar City administration. The study examined the relationship of demographic characteristics (age, gender, occupation status, education level and monthly income) of clients with adoption status, and attested the relationship of technology specific variables with adoption of internet banking from primary data obtained from 123 account holder clients.

Descriptive statistical results have shown statistically significant mean difference between adopters and non-adopters for a range of explanatory variables; attitude is the only variable significant at 1% probability level. Like educational level, occupation, monthly income, perceived trust, perceived cost, perceived ease of use, perceived usefulness and infrastructural factors are all significant at 5% probability level, except perceived ease of use which is significant at 10%; three variables: age, gender and perceived risk were not statistically significant. Besides, most established study hypotheses are supported (accepted) at 5% probability level.

Binary logit analytical result (fitted using binary logistic regression model) was significant to best fit the observed data as shown by Likelihood ratio statistic and summary of classification table statistic. Based on both goodness-of-fit test statistics, the fitted logit model fit the data well. And out of 12 independent variables of the model, 9 had statistically significant relationship with adoption of internet banking. Only perceived cost and infrastructural factor are negatively related, while perceived usefulness, perceived ease of use, perceived trust, monthly income, educational level, occupation and attitude are positively related with adoption of internet banking among clients.

Policy suggestions

To advance towards modernized and widespread expansion of the banking industry of the region and Ethiopia in general, the following policy recommendations are suggested for future intervention specific to internet banking.

As long as educational level and occupation of clients are positively related with adoption of internet banking, a breakthrough intervention should continue for increase and further user of the internet banking technology at larger stages in the near future. This is accompanied by those who have more monthly income, implying that still continued intervention is needed both for mutual benefit of clients and efficient banking industry.

Perceived usefulness of internet banking relationship hypothesis was supported as it is positively and significantly related with adoption of internet banking. As a policy intervention here, attributes of usefulness pertaining to internet banking have to be increasingly promoted to clients of CBE. This is because, the more useful attributes and more perception towards usefulness, the more likely many clients will join using internet banking sooner.

Concerning attitude and perceived trust, they are variables which positively determine adoption of internet banking. Banking policy interventions targeting promotion of how trustworthy and useful internet banking technology is for clients should be continued to pull most clients of CBE to internet banking. Another more important way to influence clients towards using internet banking is attitudinal change with those who are showing negative attitude towards the technology either via social learning (peer adopter client) or large level promotion, clarifying how easy, useful and cost efficient internet banking technology is.

Since infrastructural factors and perceived cost show negative relationship with adoption of internet banking, interventions tailored at reducing risky and costly environment associated with using internet banking should be promoted at large to trigger more clients’ inclination to adopt internet banking. Besides, promoting low cost and no risk use of internet banking should also be carried out by clients to influence users’ perception of internet banking being less risky and least costly.

Moreover, advancement in internet banking technology will be possible provided that those not included and discussed in this paper are taken into account to increase mutual benefit between clients and CBE from internet banking technology. One thing that still needs attention is that peer learning and established infrastructural issues like electric power cut and internet connection should also be given due attention to make the technology pull many clients and last long.

The authors have not declared any conflict of interests.

REFERENCES

|

Abushanab E, Pearson J (2007). Internet banking in Jordan: The unified theory of acceptance and use of technology (UTAUT) perspective. Journal of Systems and Information Technology, 9(1):78-97.

Crossref

|

|

|

|

AbuShanab E, Pearson JM, Setterstrom AJ (2010). Internet banking and customers' acceptance in Jordan: The unified model's perspective. Communications of the Association for Information Systems. 1:26(1):23.

View

|

|

|

|

|

Al-Ajam AS, Nor KM (2013). Influencing factors on behavioral intention to adopt Internet banking service. World Applied Sciences Journal, 22(11):1652-1656.

|

|

|

|

|

Al-Qeisi KI (2009). Analyzing the use of UTAUT model in explaining an online behavior: Internet banking adoption. Brunel University Brunel Business School PhD Theses.

|

|

|

|

|

Alalwan A, Dwivedi Y, Williams M (2014). Examining Factors Affecting Client Intention and Adoption of Internet Banking in Jordan.

|

|

|

|

|

Alfred SM (2016). Exploring The Factors That Influence the Adoption of Internet Banking in Ghana. Journal of Internet Banking and Commerce, 21(2).

|

|

|

|

|

Bisrat A (2015). Factors Affecting the Adoption of Internet Banking Services by Customers in Addis Ababa. Unpublished MBA thesis). Addis Ababa University, Addis Ababa.

|

|

|

|

|

Candra S (2013). Revisit Technology Acceptance Model for Internet Banking: Case Study in Public Banking in Indonesia.

|

|

|

|

|

Commercial Bank of Ethiopia (CBE) (2016). Bahir Dar district; August 30, 2016 report.

|

|

|

|

|

Daniel P, Jonathan A (2013). Factors affecting the Adoption of Online Banking in Ghana: Implications for Bank Managers. International Journal of Business and Social Research, 3(6):94-108.

|

|

|

|

|

Effah J, Agbeko M (2015). Internet banking deployment in a sub-Saharan African country: a socio-technical perspective. International Journal of Electronic Finance, 8(2-4):239-257.

Crossref

|

|

|

|

|

Feder G, Just RE, Zilberman D (1985). Adoption of agricultural innovations in developing countries: A survey. Economic Development and Cultural Change, 1;33(2):255-98.

|

|

|

|

|

Gardachew (2010). Electronic-Banking in Ethiopia- practices, opportunities and Challenges. Journal of Internet Banking and Commerce, 15 (2).

|

|

|

|

|

Goudarzi S, Ahmad MN, Soleymani SA, Mohammad HN (2013). Impact of Trust on Internet Banking Adoption: A Literature Review. Australian Journal of Basic and Applied Sciences, 7(7).

|

|

|

|

|

Kesharwani A, Bisht SS (2012). The impact of trust and perceived risk on Internet banking adoption in India: An extension of technology acceptance model. International Journal of Bank Marketing, 30(4):303-322.

Crossref

|

|

|

|

|

Martins C, Oliveira T, PopoviÄ A (2014). Understanding the Internet banking adoption: A unified theory of acceptance and use of technology and perceived risk application. International Journal of Information Management, 34(1):1-13.

Crossref

|

|

|

|

|

Mohammad Y, Ebrahim B (2010). Factors Affecting the adoption of online banking. International Journal of Business and Management, 5(9).

Crossref

|

|

|

|

|

Munyoki JM, Ngigi EN (2012). Challenges of e-banking adoption among the commercial banks in Kenya. Doctirial Dissertation, University of Nairobi.

|

|

|

|

|

Rakesh M, Ramya J (2014). A study on factors influencing consumer adoption of internet banking in India. International Journal of Business and General Management, 3(1).

|

|

|

|

|

Sara N (2008). Factors affecting the adoption of internet banking in Iran. Lulea university of Technology.

|

|

|

|

|

Safeena R, Date H, Kammani A (2014). Assessment of Internet Banking Adoption: An Empirical Analysis. Arabian Journal for Science and Engineering, 39:837.

Crossref

|

|

|

|

|

Santoso S, Murtini U (2014). Usage and risk perception of Internet banking: case study in Yogyakarta special region, Indonesia. European Scientific Journal, 10(34).

|

|

|

|

|

Zeleke S, Yitbarek T (2013). Analysis of factors influencing client intention to the adoption of E-banking service channel in Bahir Dar city. European Scientific Journal, 9(13).

|

|

|

|

|

Zhao A, Zhao AL, Hanmer-Lloyd S, Ward P, Goode MM (2008). Perceived risk and Chinese consumers Internet banking services adoption. International Journal of Bank Marketing, 26(7):505-525.

Crossref

|

|