The purpose of this paper is to test a temperature-based pricing model of Alaton (2002) in main rice-growing cities of Vietnam. The results of the test are then used for loss hedging analysis and policy implications for Vietnamese farmers, investors and related parties. Data are collected from General Statistics Office (GSO) of Vietnam, 2017 and Vietnam Meteorological and Hydrological Administration, with a reference to acuweather.com, on which the Alaton model is run. We suggest that temperature-based options are great tools for Vietnamese farmers to hedge unfavorable weather risks, and for investors to earn speculative profits. The great geographic diversity among Vietnam cities shows that there is a great potential to expand option contracts nationwide. By far, we acknowledge that findings are constrained by the limited temperature data in Vietnam, and the lack of comparable market prices. Furthermore, the pricing model itself assumes normal distribution, which might not fully capture the evolution of daily and seasonal temperature. Weather derivatives, especially the covered temperature-based options, are potential insurance for farmers and agricultural manufacturers besides existing price subsidiaries. From a policy perspective, the establishment of an active trading market can support the expanded use of weather derivatives within and outside the agriculture sector.

Since temperatures and its indexes like HDDs and CDDs are non-tradable underlying assets, valuation directly from a risk-neutral method and market prices like the Black-Scholes model is difficult. Therefore, a market price of risk is necessary to relate the payoff from the underlying asset with the real payoff in the existing capital and derivatives market. Canbrera (2009) uses Berlin traded futures to calculate the market price of risk. Although finding a market price of risk is mostly difficult, Goncu (2011) suggested that the effect of market price of risk is insignificant for weather derivatives.

Therefore, in this paper, we set the market price of risk at 6.8% accordingly to Vietnam’s 2017 equity risk premium. We also assume that once the market for agricultural derivatives is established, the risk aversion of investors in such market will be as same as the traditional stock market. Furthermore, taking into account that Vietnam is still a frontier market, financial knowledge of market players is limited, and the model is simple to implement, we will also evaluate only call options – since longing a call would likely equal to shorting a put in a bull market. In addition, we assume that farmers/ manufacturers will always be long positions to hedge their risks.

Furthermore, we take the annual temperature range from 2000 to 2015 as a normal range that farmers usually experience. The maximum temperature in this range is 33 degree Celsius, and the minimum temperature in this range is 14 degree Celsius. The call options in this paper are triggered if temperatures rise or drop above or below this range, making them useful against uncertainties. From this point of the paper, for ease of expression, we call this range “the threshold range”. (TRT).

In addition, the call options in this paper depend on the following assumptions:

(i) In cooling harvest, if temperature rise by 2 degrees Celsius from TRT (which will damage the crop), it’s worth exercising the option to act as an insurance mechanism.

(ii) Strike point is a temperature unit.

(iii) In heating harvest, if temperature drop below TRT by 2 degrees Celsius from TRT (which will damage the crop), it’s worth exercising the option to act as insurance mechanism.

(iv) The crops grow accordingly to the temperature of each harvest. In this sense, farmers would only grow, harvest, and sell their products under two main harvest: Winter - Spring harvest and Summer - Fall harvest, which would translate into two 3-month type of call option contracts accordingly.

(v) Insurance coverage (IC) is in term of max loss (%) over the change in crop price per metric ton (mt) for long-positions; therefore, it will be 0 < IC < 1.

Based on the assumptions above, call option prices of Vietnam cities under research scope are summarized in Table 2.

From Tables 1 and 2, the call option prices could be interpreted in several aspects. First, the temperatures, at which a contract in each city is exercised, fit into each city’s seasonal climate. Since an exercise of options depends on anomalies of temperature, which in this case of our paper, the abnormal temperature will be 2 to 3 degrees above maximum or below minimum temperatures that the crops are prone to. The farmers by their experience and using this characteristic can easily monitor the timing their choice of contracts.

Second, the pricing process of Alaton model produces higher option prices in cool months (HDDs) and cheaper option prices in hot months (CDDs) as it expects a great concentration to mean temperatures. As a result, farmers can also vary in their choice of period in choosing options to sign. For instance, if farmers in An Giang expect to grow more crops in Summer-Fall harvest season, they can long call options in the period from May to August. Table 2 shows that call options in Summer-Fall are cheaper than those in Winter-Spring harvest, which can hedge farmers at least 52% of their production value. On the other hand, short positions can take chances against long positions. When An Giang farmers buy long positions, investors can create and short call options for Winter-Harvest harvest in the same or different cities where the gain is often the call option price.

Winter-Spring harvest, as shown in Table 1, depicts a much greater volatile nature than Summer-Fall harvest. This is a characteristic for Vietnam northern agricultural areas. Winter often brings highly unexpected coldness or heat, and irrigations fall short because of retreating Hong River. In this sense, given the hedging merits of option contracts in cities like Thái Bình or Ninh Bình, 40-60% of production value could be insured, in the absence of alternative protection means.

HEDGING POWER OF TEMPERATURE-BASED DERIVATIVES

In this section we look at the hedging power of temperature-based derivatives. At first, we examine the probabilities of irregular temperature happening in each city during harvest periods. By combining these probabilities with the option prices presented in Section 5, we present upside and downside cases to illustrate the extent of hedging power of Alaton model (2002) options. We conclude this section with a look at beyond-hedge values of temperature-based options, which provide cash for next-season production.

Predicting the odds of adverse temperature

The study by Schiller et al. (2012) presents four models for weather derivatives, but stops at examining the performances of the models themselves. This approach is shared by Lu (2014) who tests the performance of Alaton model (2002) and CAR model by Benth et al. (2007) in China. However, the research by Kermiche and Vuillermet (2016) includes hedging indicators such as VaR for HDD and CDD contracts in several African cities, and thus it firmly highlights the practical usage of weather derivatives in hedging loss for farmers.

Here, we try to investigate further from the approach taken by Kermiche and Vuillermet (2016) by looking at temperature-based derivatives’ usefulness in loss hedging. First, by using Alaton model (2002), we try to predict the 3-year-ahead likelihood of irregular temperatures from 2017 based on the following assumptions:

(i) Applying the Alaton model (2002) functions to project 3-year-ahead temperatures according to each harvest period

(ii) Using strike temperature 1-2°C above or below TRT. Each city has different strike temperature as shown in Table 2.

(iii) The resulting likelihood is equal to the number of periods at which temperatures meet or exceed the strike temperature divided by the total number of periods.

Table 3 indicates signs of relief for agriculture industries, showing that irregular temperature probabilities are still quite unlikely to take place. Nevertheless, this result does not reduce the insurance significance of call options. For instance, taking the example of Hải DÆ°Æ¡ng in 18 days over 3-year periods, the model indicates temperatures that surpass those of TRT. At such time farmers might expect a week of abnormal temperature each harvest, which increases the odd that a crop’s harvest could be reduced.

Upside and downside cases: how temperature-based options protect farmers

To illustrate the extent of hedging amounts, first we take into account the Vietnam 2017 rice export value. The rice export value is measured in USD per mt (Table 4).

In recent years, from 2013 onward, export rice price has been rising according to the Vietnam Ministry of Agriculture and Rural Development (MARD, 2018) largely due to the improved quality of the planted rice. This improvement is largely distributed to the ongoing efforts of farmers and manufacturers in choosing seeds and growing techniques. However, the quality and the rice export value are still subject to soil and weather factors. For instance, 2015 heavy heat and drought reduced production quantity and decreased quality by large. Therefore, the use of derivatives like call options will aid in reducing in loss value if unfavorable conditions are presented. We illustrate such a use in the upside and downside cases for Thái Bình city options, under the following steps:

(i) Input of export quantity and value per mt for 2017

(ii) Present 3 situations in which rice price per mt drops or rises by 1, 2 and 3 standard deviations from the mean export price per mt of the 2009-2017. Standard deviation(s) from the mean is denoted by k(s).

(iii) Identify the currency value of the amount hedged by the call options presented in section 5.

(iv) Present upside and downside cases of export rice

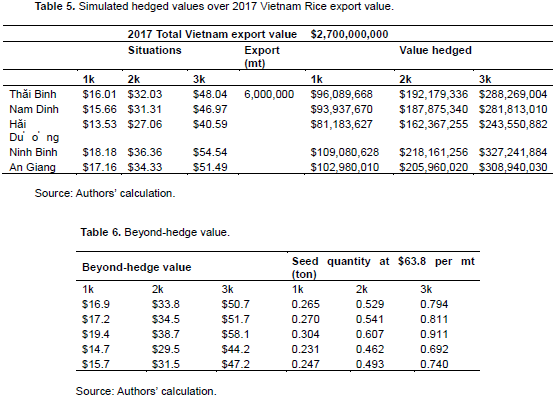

Since a long position for dropping price is similar to a short position for rising price, we are taking a long position stand (Table 5). Long positions are farmers and rice manufacturers, who will face a possible drop in price, which is 1, 2 and 3 k, accordingly. These changes in price are assumed and thus can be different in reality. The rise or drop in price, under the scope of this paper, is mainly due to irregular temperature patterns. Taking the case of Thái Bình city, a farmer who longs a 3-month call option before export will experience these two cases.

Upside case

Export price per mt drops 1, 2, and 3 k. The farmer is entitled to maximum losses of $16.01, $32.03 and $48.04 per mt, respectively. These translate into max losses of $96mn, $192mn and $288mn, respectively. Because 2017 total rice export value (MARD, 2018) was nearly $3bn, call options could have hedged losses for nearly 10% of total export value. On the other hand, the short positions can earn respectively the hedged losses valued. In other words, if long and short positions are parties of the same country, we can expect a net cash outflow from the country owing to negligible change in price.

Downside case

In reverse of upside case, when export price increase greatly (and in reality, they did from 2014-2017), the farmers can choose not to exercise the call options and only earn money from the rice. Otherwise, they can choose to exercise the contracts and earn the spread. The spread here is the difference between a favorable temperature and the call option’s strike temperature (Table 2) multiplied by the option price per mt. We will also discuss the social economic implications of this high gain case in 6.3.

Beyond-hedge gains for farmers and investors

Table 6 presents one of many uses besides hedging of temperature-based call options. Schiller et al (2012) stated: “Since weather variables are mostly uncorrelated with the classical financial market, weather derivatives form the only possibility on the financial market of insuring against unfavorable weather. The development of the weather derivatives market assumes that an increasing number of corporations take advantage of these new opportunities”.

In addition to hedging mechanisms, the value once hedged provides good back up cash for next-season or future production. This back up cash is what we call “beyond-hedge” value of temperature-based options. Taking the second line of Table 6, a Thái Bình city, for example, when the export price drops 1k, the remaining value after the losses is $16.9 per mt. This money can be effectively used to buy 0.265 mt of high-quality type seeds, and stored for use in the future. For this concern, we argue that since there is not a trading market for agricultural derivatives in Vietnam at the moment, their many uses are often overlooked. Table 6 shows that a call option not only helps farmers avoid taking the full-size losses but also frees up cash from such losses in price, providing backup capital for use, like buying seeds for the next harvest. In favorable temperature and price conditions, farmers as long positions also gain what could be called a non-operational profit, which comes from upside price gains rather than from crop production value.

POLICY IMPLICATIONS

Kermiche and Vuillermet (2016) conclude that weather derivatives can be included in a long-term sustainable plan to hedge temperature risk in African countries. Investigating the argument, we have shown the hedging capabilities of weather derivatives in Vietnam in Section 5 and Section 6. Farmers can both protect their production value and gain profits with Alaton model (2002) temperature-based options, provided that a real market exists. Such a market will allow capital flows from the financial market to a commodity-based market. It will provide not only indirect profit opportunities for non-agricultural investors, but also choices for farmers to hedge temperature risks.

Therefore, this section considers policy implications for non-agricultural players, such as investors and regulators on an exchange market. We would like to demonstrate the necessary factors for a viable option trading market in Vietnam and other emerging markets: the market price of risk, clearing houses, investment banks, insurance companies, and structured derivatives. Moreover, based on our experience about Vietnam and reports from SSC (2018) and GSO (2018), we look at some barriers that might undermine the creation of temperature-based derivatives market in Vietnam. Once these barriers are overcome in the near future, Vietnamese farmers may be able to use temperature-based derivatives to deal with changing climate.

Market price of risk and implications for non-agricultural players

The market price of risk, or the extra return an investor wants usually reflects the hope for beating non-systematic factors such as inflation (described by inflation premium in the CAPM model), or business risks. In a similar aspect, a temperature-based option offers a premium above irregularities in temperature. While farmers are expected to be effectively hedged against losses using temperature-based derivatives, other non-agricultural earnings can be various.

Given that there is an actively traded market for temperature-based derivatives and a derivative contract is in its effective period, one initial option contract can change hand multiple times, through which secondary sellers and buyers bet their luck and gain profits. For instance, with Nam Äịnh options priced at VND4758 per mt, the primary short-position can bid and sell the contract in a secondary market at par. Under the Alaton model price, Nam Äịnh option is priced at VND4758 at an interest rate of 6.5%, and VND7425 at an interest rate of 6%. A speculative secondary investor, having expected this 0.5% drop in interest rate, can ask for the contract at VND5000. The investor can later sell it at VND6000 to make a non-exercise profit at VND1000. When this process continues with or without the initial contractors exercising it, profit can grow gradually.

Furthermore, temperature-based contracts can be included in investment portfolios. Singal (2017) wrote “commodity futures provide the diversification benefit in combination with equity and bond in the portfolio” and “they can be used as excellent hedging tools against inflation”. In the portfolio context, temperature-based options provide more freedom than futures, since exercising the option is optional, bringing somewhat a “temperature related risk premium” in the traditional portfolio of equity and bonds. Although there is a need for a real market to certify this attribute of Alaton model temperature-based derivatives, we believe that the results should be similar to existing price-underlying or interest-underlying futures or options.

Policy implications for market regulator

The main limit of temperature-based derivatives in Vietnam is the lack of a real market. The lack of an official trading platform poses an obstacle for potential market players to determine the suitable price ranges. Moreover, as discussed earlier, the benefits of temperature-based to farmers and non-agricultural players are explicit: the derivatives are not only easy to understand, use and monitor, but also suitable to act as a bridge connecting farmers with capital and insurance market. Therefore, we propose that the Vietnam government, especially the SSC, create a market for agricultural temperature-based derivatives through these following steps:

Step 1: Strengthen the emerging market

We acknowledge that the Vietnam equity market is still in the process of development. By 2017, Morgan Stanley Capital International (2017), still categorized Vietnam as a frontier market. This is mainly due to the restricted foreign investment into listed Vietnam companies, and also the lack of complex financial products, such as commercial back securities or derivatives. However, since 2016, both the Ho Chi Minh stock exchange (HOSE) and Hanoi stock exchange (HNX) – the two stock exchanges in the country, have taken efforts to launch futures and warrants. These derivatives, though quite new to the market and stock-underlying, received huge investment. According to the SSC (2018), by July 2018, there are 35,725 active transaction accounts whose values are up to VND4.7 trillion (+50%YoY). Among these accounts, domestic investors account for over 98%, signifying the curiosity of domestic investors towards more complex investment tools.

In this sense, given a still agricultural-based economy, we believe that the market acceptance of temperature-based options will be promising. As for any financial product to be introduced, we suggest the SSC work closely with the Ministry of Agriculture and Rural Development and the Ministry of Finance to collaborate in the collection of harvest timing data, temperature data, rice and related main crops data, export value data, and insurance policies. We expect such cooperation will result in a concrete and real-time database for temperature-based derivatives (in our case, the Alaton model options).

Step 2: Create a market of options, and involve players

Once chosen an acceptable pricing model, e.g., Alaton temperature-based model, Agribank one of the four largest banks in the country can support the creation of the clearing house and investment banking of the temperature-based derivatives market. Since Agribank is a state-owned commercial bank, created by the Vietnam government to infuse credit for agriculture production, it will be capable of providing the capital needed to facilitate the underwriting of new options, asking and biding, also provisions for long-short party gains and losses.

Next, we recommend Agribank work closely with securities and brokerage firms to market the option contracts to farmers and non-agricultural investors. The marketing process can involve workshops, simulated trading platforms and discounts for first-time users. According to GSO, in Quarter 1, 2018, labor in agriculture is 20.9 million, accounted for nearly 39% of total 15-year-and-older labor force. It would be unrealistic to have all agriculture workforces buying the contracts, but we expect at least 100,000 accounts joining the market (approximately 0.5% of agriculture labor force) once the market is established. This will be about three times the number of accounts currently joining stock-underlying futures.

Step 3: Extend and evaluate

Our proposed temperature-based option contract can be extended in several ways. Instead of using temperature as the underlying asset, Agribank and brokerage firms can create other options whose underlying assets are humidity, average sunlight hour, and so on. Similar to temperature, those are climate elements encompassed in the agricultural production and can be easily monitored by farmers. Farmers, having a diverse base of underlying, will have more freedom in choosing the right hedging tool specifically for their crops.

On the other hand, options, just like stocks or mortgage, can be pooled together as collaterals for commercial-back securities (CBS). We expect the introduction of CBS will elevate the complexity of Vietnam market and make it more attractive to foreign investors. As a result, by virtue of temperature-based derivatives, Vietnam might be able to see its market rank elevated to emerging market, or even a developed one. In short, we see agricultural temperature-based options as a great bridge that links the agriculture sector more closely with the financial sector, a relationship that fuels Vietnam economy to a more horizontal growth across sectors.

Barriers to temperature-based derivatives market in Vietnam

Although we try to put forth a step-wise action framework for market regulators in 7.2, we recognize that there are several existing barriers which hinder the creation of an attractive temperature-based derivatives market in Vietnam. The first barrier is the limited financial knowledge of potential market players, e.g., farmers. According to GSO (2018), among the 15-year-old-and-older labor force, only around 20% are trained workers from industrial schools and colleges. Educating and convincing farmers in this 20% to join financial markets are already challenging and time-consuming tasks.

The second barrier is the currently strong foreign influence on Vietnam stock market. According to SSC (2018), foreign investors account for around 60.7% total stock market transaction value. This means that the Vietnam stock market is extremely sensitive to foreign investment. We observed that from March to July, 2018, when foreign investors withdrew from Vietnam and other emerging markets in fear of imminent Trump-provoked trade war, VN-Index (Vietnam general market index) dipped from 1201 basis points to 898 basis points, but it recovered in September, 2018 to 1024 basis points when foreign capital flooded back in. Broadly speaking, the acceptance of a temperature-based derivatives market depends greatly on foreign investors’ decision, whereas we are not able to recognize that SSC can convince them to invest.

The last barrier is the perceptions of Vietnamese farmers, which are probably the hardest to tackle. To our best knowledge, most Vietnamese farmers think and produce crops according to annual harvest, which is short-term. They tend not to have backup plans to hedge against unexpected events. Therefore, a risk-hedging product like temperature-based options might not be attractive to farmers. Without our target users, a temperature-based derivatives market simply cannot exist. In short, despite the promising benefits of temperature-based options, we need to have continuous efforts to create it.