ABSTRACT

The use of formal financial services has been associated with increased financial wellbeing and overall economic growth. Efforts to increase financial inclusion have emphasized financial literacy provided through formal training and education without due recognition that people’s financial behaviors and practices may be motivated by social interactions. The current study examines the moderating effects of social learning on the relationship between financial literacy and formal financial services usage within a developing country context. Survey data collected from a sample of 351 adults in Kampala, Uganda, was analyzed using Pearson correlation coefficients, hierarchical regression, and ModGraph. Findings reveal significant positive relationships between financial literacy, social learning, and usage of formal financial services. Results indicate that social learning moderates the relationship between financial literacy and financial services usage among people in Kampala. The study finds peers and friends to be critical socializing agents with a significant influence on formal financial services usage. Beyond the promotion of financial literacy, financial inclusion initiatives should recognize the effects of social learning to increase the use of formal financial services in countries such as Uganda. The study integrates aspects of the social learning theory into the financial services domain hitherto dominated by finance and economic models.

Key words: Financial literacy, financial inclusion, Uganda

Formal financial services for savings, loans, insurance, and investment have been associated with increased financial wellbeing and overall economic growth (Demirgüç-Kunt et al., 2017a). In this respect, several low-income countries worldwide work toward broadening the financial sector and increasing populations' financial inclusion. However, the increasing diversification and sophistication of financial services requires correspondingly high levels of the masses' financial literacy to ably understand and use them to improve their wellbeing (Peachey and Roe, 2004). However, most government-instituted strategies for financial education aim to improve the financial literacy of their populations through traditional classroom-based training methods. Quite interestingly, consumer behavior literature suggests the prevalence of alternative learning forms that financial inclusion proponents may not have been sufficiently explored. For instance, Lehesvirta (2004) posits that adult learners learn not only by themselves as individuals but also with others through collaborative interaction. According to the World Bank, globally, close to one-third of adults – 1.7 billion – are still unbanked (Demirgüç-Kunt et al., 2017b); thus necessitating an inquiry into improved formal financial services utilization approaches.

Two important pillars of the national financial inclusion strategy of Uganda are - the deepening and broadening of formal savings, investment and insurance usage; and, the empowerment and protection of individuals through enhanced financial literacy and capability (BOU, 2017). However, the Finscope (2018) survey on access and usage of financial services in the country revealed that formal financial services usage is still shallow, with about 6 out of every ten adult Ugandans relying on informal financial services. The survey findings attributed the high levels of informal financial service utilization in Uganda, to supply-side institutional challenges and demand-side individual challenges coupled with strong social capital characterized by reciprocal trust among Ugandans. In this regard, our crucial research concern is whether financial education delivered in conventional classroom type and or mass media channels can sufficiently propel the utilization of formal financial services to desirable levels. The current study, therefore, first, examines the extent to which financial literacy promotes the use of formal financial services, and secondly, investigates the moderating influence of social learning on the relationship between financial literacy and the use of formal financial services among people living in developing countries.

Hypothesis development

Financial literacy and the use of formal financial services

Financial literacy is a combination of financial awareness, knowledge, skills, attitude, and behaviors necessary to make sound financial decisions and ultimately achieve financial wellbeing (Atkinson and Messy, 2012). Financial literacy surveys worldwide have revealed low levels of financial literacy in developed and developing countries, but policy and academic responses, especially in developing, are low (Refera et al., 2016). The scholars posit that financial literacy can increase the demand and use of financial services such as savings, microcredit, and insurance to improve people's welfare, increase business for financial service providers, and contribute to the development of stable financial systems and sustain economic growth. Lusardi and Mitchell (2013) concluded that financially literate people could process financial information, make informed decisions, accumulate wealth, manage debt and pensions, and be able to cope with the complex products and services in the financial market. Their assertion builds on earlier observations made in Lusardi and Mitchell (2011), where they stated that individuals would suffer a deficiency of knowledge on critical financial products for saving and retirement when deprived of interaction with formal financial institutions.

In a study conducted in Kenya, Shibia and Kieyah (2016) found that financial literacy scores correspond with increasing levels of formality in the usage of financial products suggesting that the more financially literate people were, the more likely they would use formal financial services. Studies from the developed world, such as Mien and Thao (2015), Hogarth and Hilgert (2002), found that financial literacy was associated with responsible financial behaviors. In agreement, Idris et al. (2013) found that financial literacy accounted for variations in individual behavior and financial outcomes associated with credit, investment, and saving behaviors. Literature is also replete with findings on significant relationships established between financial literacy and the broader concept of financial inclusion (Okello et al., 2016; Grohmann et al., 2017). These studies support Wachira and Kihiu (2012) findings, who established a higher probability for people with lower levels of financial literacy to have a higher likelihood of financial exclusion. Individual-level studies such as Cohen and Nelson (2011) found that effective use of formal financial services was partly constrained by inexperience on the part of customers and sophistication on formal financial products. Their findings suggest that increased financial literacy would demystify seemingly complex financial products and grow their utilization at the individual level.

Therefore, the current study hypothesizes that financial literacy is positively associated with formal financial services usage in Kampala, Uganda.

Social learning, financial literacy, and the use of formal financial services

Social learning theory postulates that people can obtain knowledge from their surroundings, especially from their parents (Pinto et al., 2005). Therefore, adult learners do not always learn in their capacity, but they also learn through interaction with others in a process referred to as social learning. In this context, the use of formal financial services is not always informed by financial literacy acquired through traditional lecture-oriented approaches and informal learning sources among peers within their communities.

The current study uses the term social learning to denote the subset of consumer socialization, which relates to financial services usage. The scope of 'financial social learning' encompasses the many dimensions of money management that can be learned socially, such as saving, borrowing, and investment. The social learning theory (Bandura and Walters, 1963) postulates that individuals are social entities who learn from observing others' actions and behaviors. The theory focuses on three major concepts: observational learning, imitation, and modeling (Ormrod, 1999).

Studies have examined social learning processes in work/formal environments and recognized the shift from traditional lecture-oriented to informal learner-centered approaches, especially in the corporate education (Collin, 2009; Lee and Lee, 2018). These studies have found that collaborative learning occurs through interactions among people within informal learning environments and that corporate personnel gain job-related knowledge and skills through social learning. The application of social learning in the financial services domain has been a subject of scientific inquiry. Lee and Lee (2018) established significant relationships between financial, social learning opportunities, and financial behaviors among college students. Their findings collaborates those of Gutter et al. (2010), which found that people acquire or enhance financial skills from their peers, family members, and parents serving as socializing agents within societies. The latter findings build on earlier studies that found that through imitation and modeling, financial knowledge was likely to increase and have a positive effect on financial attitudes (Campbell, 2006; Grable and Joo, 1999).

There is a dearth of studies on the role played by social learning in the financial education and financial services domain in developing countries such as Uganda. The few extant studies have mostly examined individuals rather than the environmental aspects of social learning. For instance, Mindra and Moya (2017) and Mu’izzuddin et al. (2017) investigated the effects of self-efficacy - an individual-level dimension of social learning. Self-efficacy is the level of confidence in one’s ability to deal with financial situations without being overwhelmed (Amatucci and Crawley, 2011). Research attention on the effects of social learning's environmental dimensions, such as interaction and collaborative learning in the financial education and financial services domain, has been insufficient. Studies like Gutter et al. (2010) examined the interactive influences of social learning opportunities of “discussions” and “observations” on consumer decision-making and subsequent practices. They highlight social interactions, including discussions (direct teaching) and observations (modeling) among financial socialization agents such as peers, relatives, and friends. Their findings collaborate with earlier studies that peers can influence consumption-related attitudes and behaviors (Moschis and Churchill, 1978; Moschis and Moore, 1979; Ward, 1974). Other studies have largely dwelt on the direct relationships between social learning, financial literacy, and financial behaviors. For instance, Mahdavi (2012) found that single and educated women who had more social learning opportunities than their married counterparts had lower financial literacy scores. Furthermore, individuals who had educated parents or spouses could learn from their knowledge and experience. Likewise, Lusardi and Mitchell (2011a) found that employed people worldwide had higher financial literacy levels, suggesting that the workplace offers social learning opportunities through which people may acquire financial knowledge, skills, and behaviors from their peers and workmates. The preceding discourse demonstrates that financial services require enhancing financial literacy in terms of financial knowledge, skills, attitudes, and behaviors. However, as further illustrated, the studies have established that learning happens through direct training as well as through social means. This is because, besides the ability to make informed financial decisions, the individuals' decision-making can also be influenced by socializing agents within their environment. The study, therefore, hypothesizes that:

social learning has a moderating effect on the relationship between financial literacy and the use of formal financial services in Kampala, Uganda

Figure 1 illustrates the hypothesized moderating effect of social learning on the relationship between financial literacy and the use of formal financial services. Moderation refers to a situation in which an observed variable strengthens, diminishes, negates, or otherwise alters the association between two other variables. The study sought to test the hypothesis that an individual’s levels of exposure to social learning would affect their use of formal financial services even when they were financially literate. This is because, the highlighted studies suggested that individual financial decision making regarding the use of financial services, is often subject to the observations and discussions with peers and friends, in spite of their levels of financial literacy.

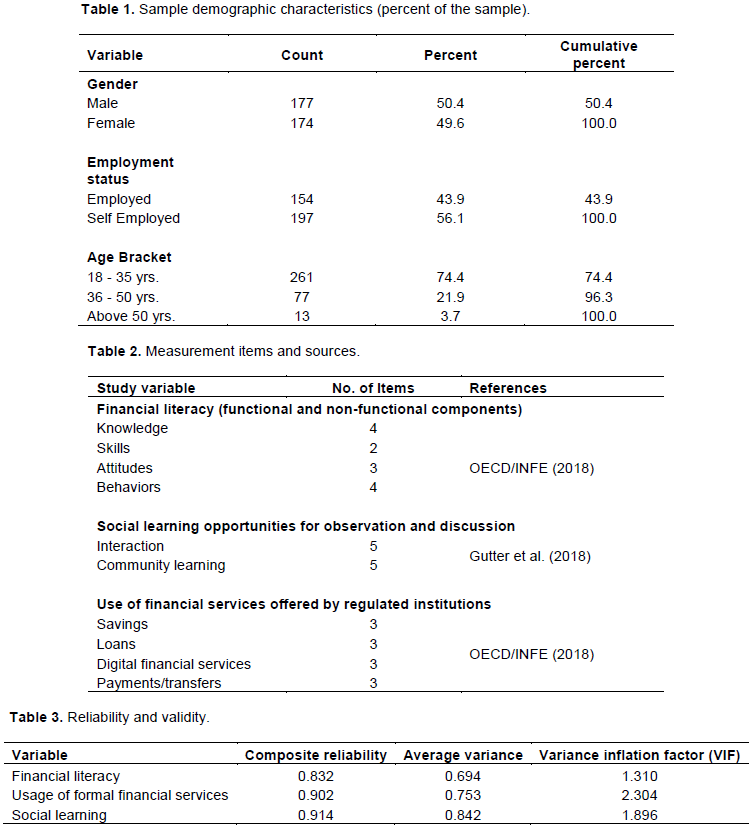

Participants

The target population of this study consisted of economically active users of financial services living in Kampala. This study adopted a proportionate geographical cluster sampling to select study participants. Using the rationale of Krejcie and Morgan (1970), a sample of 384 was randomly sampled from a population of 884,126 adults (aged 18 years and above) living in the five geographical divisions of Kampala, Uganda (UBS, 2014). A survey questionnaire was administered to target all the 384 participants; however, only employed participants were included in the analysis as they were deemed to be the most likely users of financial services. Participation was voluntary, and 351 responses were eligible for analysis representing a response rate of 91%. Out of the valid sample, 177 were male (50.4%) and 174 female (49.6%); 154 employed (43.9%) and 197 self-employed (56.1%). The proportion of participants in each age range was reflective of the national statistics with the greatest number aged between 18 and 35 years (n = 261; 74.4%), followed by 36 to 50 (n = 77; 21.9%), and the rest above 50 (n = 13; 3.7%) (Table 1).

Measurement of variables

A survey questionnaire was used to measure the three variables and their latent constructs: Financial literacy (knowledge, skills, attitudes, and behavior), environmental constructs for social learning (learning community and interaction), and use of financial services (savings, loans, insurance). The social learning measure used focused on participant’s exposure to two social learning opportunities, that is, observations and discussions among peers, friends, and family. The measurement items for financial literacy definition that includes non-functional components of knowledge and skills (Lusardi and Mitchell, 2011) as well as functional components of attitudes and behavior (Holzmann, 2010). And, together with the use of financial services, measurement scale used was adapted from the OECD/INFE (2018) toolkit for measuring financial literacy and financial inclusion. The measure used for social learning was measured used an approach proposed and used by Gutter and Garrison (2008) that is based on individual’s opportunities for observations and discussions among financial socializing agents. The survey instrument therefore measured financial literacy as an individual’s knowledge, skills, attitudes, and behaviors considered as important predictors of use of financial services such as savings, loans, transfers/payments, and digital financial services; as well as to measure social learning based on interaction and community on the relationship between financial literacy and the use of financial services.

All measurement items were anchored onto a five-point Likert scale starting from strongly agree (5), agree (4), not sure (3), disagree (2), and strongly disagree (1). In addition to the variable measurement scales, a section to capture demographic characteristics of age, gender, and educational background was included to constitute the survey questionnaire. The initial version of the questionnaire was pilot-tested with 47 users of financial services working in the central division of Kampala, and the final version constructed by deleting or modifying some original survey items based on participant responses in the pilot study (Table 2).

Reliability and validity assessment

The questionnaire's measurement items were tested for reliability and validity to ensure that the results attained would be credible and have followed the protocol for research instrument use. Reliability was tested using the composite reliability, a measure recommended by Hair et al. (2017) as being more advanced and less prone to error than the traditional Cronbach Alpha coefficient. Regarding validity, the instrument was tested for both convergent and discriminant validity. Convergent validity was measured using the Average Variance Extracted (AVE), while the Discriminant validity was tested using the Fornell Larker criterion. The AVE reflects the variance that has been measured by research instrument items for a specific variable relative to the variance that is not measured. AVE values of at least 0.500 indicate that the instrument's Convergent validity is satisfactory, and the items are jointly able to tap more than 50% of the variance of the construct meaning (Henseler et al., 2014; Fornell and Larcker, 1981). The questionnaire items were further tested for collinearity using the Variance Inflation Factor (VIF), a measure of how items could be predicted by others measuring the same variable. If there is a high relationship between these two, then the items could lead to misleading results. VIF values of 5 or higher indicate a problem with the collinearity in the measure used to measure the variable. These they take into account the weaknesses of the traditional approaches to testing reliability and validity measures (Hair et al., 2017). Table 3 presents the results for the Composite Reliability, AVE, and VIF.

Table 3 shows that the reliability measures were all within the acceptable thresholds for the study variables, that is, Composite Reliability (>.07), Average Variance Extracted (AVE >0.05), and the VIF < 5.000, for all the study variables, which means that the reliability, convergent validity, and the collinearity aspects of the tool, were all acceptable. Furthermore, Table 4 presents the Discriminant validity using the Fornell-Larker criterion. Using the Fornell-Larcker criterion, the AVE's square root for each dimension (these appear in the diagonal) should be higher than each of the correlations that the dimension has with the other dimensions. For instance, the AVE's square-root for the 'Attitudes' dimension is 0.844, which is much higher than the correlations it has with the dimensions of 'behavior' (0.526) and 'knowledge' (0.404). Therefore, the 'Attitudes' dimension had a higher shared variance than the measurement items for 'Behavior' and 'Knowledge.'

The 'financial literacy' measure is, therefore, satisfied the condition for discriminant validity using the Fornell-Larcker Criterion. Similarly, Table 5 presents the results of the Fornell-Larcker criterion for social learning dimensions, that is, 'interaction' and 'community learning.' The Square root of the AVE for the ‘interaction’ dimension of social learning was .925. It was higher than the value of the interaction with the ‘learning community’ (.338). The items for this variable indeed also met the conditions for Discriminant Validity. Similarly, as indicated in Table 6, the same approach holds for the variable of 'use of formal financial services.' Furthermore, the Fornell-Larcker Criterion for formal financial services' usage satisfied the condition consistent with Hair et al. (2017). The square root of the AVE for the variable dimension of 'digital services' was .858, which is higher than the correlations this dimension has with the 'loans' (0.163), 'payments' (0.544), and 'savings' (0.712) dimensions.

Hypothesis testing

The study used Pearson (r) correlation coefficient and hierarchical regression analysis (using the enter method) to test the hypotheses. In the first model, financial literacy, social learning in the second model, and a product of financial literacy and social learning in the third model. Beta coefficients from the resultant Table were captured from this regression model and then entered into the Modgraph tool to present the relationship between the variables in the form of a graph.

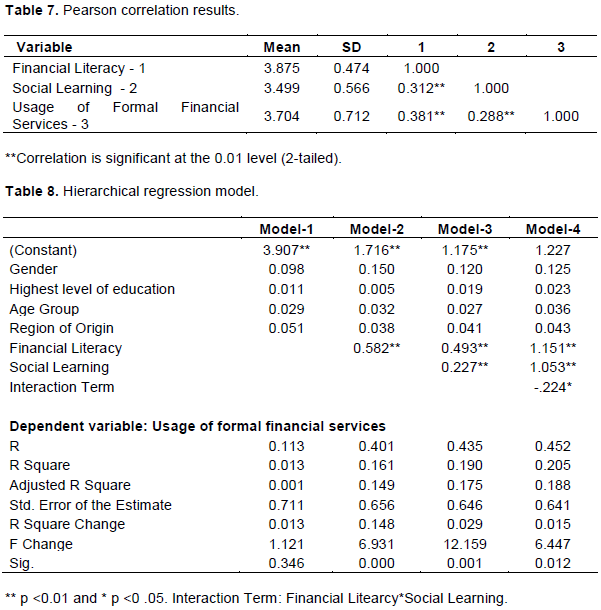

Pearson correlation results

The Pearson correlation coefficient was used to test for the relationships between the study’s variables. The results are presented in Table 7. The correlation results presented in Table 5 indicate a significant and positive relationship between financial literacy and usage of formal financial services in Kampala (r = 0.381, p<0.01). This finding implies that the higher the levels of financial literacy, the higher the likelihood that an individual would use formal financial services. Similarly, the findings show that social learning was significantly positively associated with the use of formal financial services (r = 0.288, p<0.01). Therefore, the results imply that individuals who demonstrate higher levels of social learning through observations and discussions with their peers and friends were more likely to have a higher incidence of using formal financial services. Nonetheless, the relationship between financial literacy and formal services usage is stronger than the relationship between social learning and formal financial services usage.

Regression

Table 8 presents a hierarchical regression to test for the moderating effect. First, the control variables are input into Model-1, and after that, study constructs added into the subsequent regression models until the final model where the interaction term, that is, a product of the financial literacy and social learning.

In both Models 2 and 3, the addition of financial literacy and social learning, it was noted that both variables are significant predictors of the use of formal financial services in Uganda (p <0.01). The Adjusted R Square value for financial literacy increases from .149 (p < 0.05) in model 2 to .175 in model 3 with the introduction of social learning into the equation. It was noted that the variance explained increases by a magnitude of 2.9%. The Adjusted R square was preferred in this study since it allows the researcher to generalize the broader population's findings. It was also noted that when the interaction term in Model 4 was included, a significant change in the value of formal financial services usage was gotten. The findings suggest that social learning plays a moderating role in the relationship between financial literacy and formal financial services usage. Furthermore, to explore the moderating effect, a graphical illustration is generated using the following section's mod-graph tool.

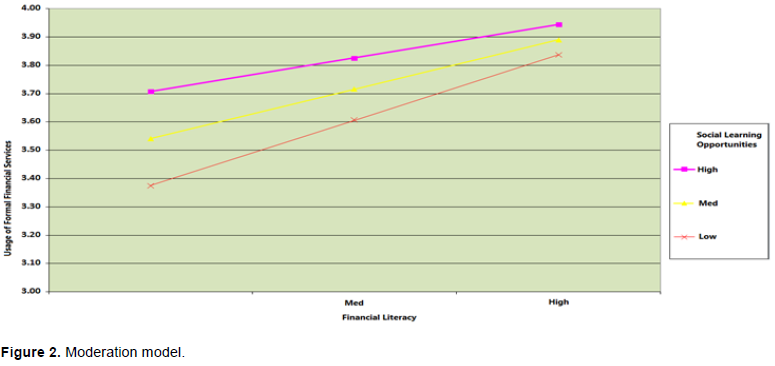

Moderation

Further analysis to test for the moderating effects of social learning on the relationship between financial literacy and formal financial services usage is presented in Figure 2. The results in Figure 2 show that the weakest association between financial literacy and usage of formal financial services occurs when individuals have the highest incidence of social learning through interactions with peers and friends. Therefore, the study finds support for Hypothesis 2 that “Social learning has a moderating effect on the relationship between financial literacy and the use of formal financial services in Kampala, Uganda.” The implication of this is that financially literate individuals are less likely to use formal financial services when their social interactions provide an alternative social, financial learning. It is highly likely that individuals adopt particular perspectives that do not typically encourage the use of formal financial services through observations and discussions. On the contrary, individuals with higher financial literacy levels are very likely to use formal financial services when they exhibit minimum social, financial learning.

Consistent with this study's objectives, three findings emerged: First, the study established a significant positive relationship between financial literacy and usage of formal financial services in Kampala, Uganda. The implication is that the higher the level of financial literacy, measured as being more knowledgeable and better skilled in financial matters, the greater their likelihood of using especially savings, credit, and transfer/payment services offered by regulated institutions. This finding is consistent with mainstream thinking shaped by previous studies that have justified the application of financial literacy as a tool for improved uptake and use of financial services in many countries. In Uganda, for instance, the national strategy for financial literacy has been designed to deliver financial education programs targeting people at all levels: the youth in schools, the employed at the workplaces, community outreach programs (BOU, 2017).

Secondly, the study established a significant positive relationship between social learning and formal financial services usage in Kampala, Uganda. The implication is that people with a higher level of social interactions involving observation and discussions among their friends and peers were more likely to use regulated institutions' financial services. In other words, friends and peers play an important role as financial socialization agents among users of formal financial services in Kampala. This finding is consistent with Gutter et al. (2010), who found a significant relationship between social learning opportunities and financial behaviors. Their study found higher financial behaviors of saving and budgeting among students who had a higher level of exposure to social learning opportunities of observation and discussion among peers.

The two findings have important implications for policymakers, financial educators, and financial institutions. First, financial literacy is a vital tool to equip users and potential users of financial services, with knowledge, skills, and attitudes necessary to utilize formal financial services. Second, peers and friends are essential financial socialization agents through which individuals, through interaction and discussion, become aware and may develop favorable perspectives towards the use of certain financial services. Therefore, financial inclusion and education efforts would be more effective if they targeted individual users as social entities whose financial decisions are subject to social influences.

This study's third finding was that social learning was a significant moderator in the relationship between financial literacy and usage of formal financial services. Notably, the study found that higher levels of social learning weakened the relationship between financial literacy and formal financial services usage. In comparison, lower levels of social learning strengthened the relationship. In other words, financially literate respondents in Kampala Uganda reported a lower incidence of formal financial services usage in instances where they had higher exposure to financial, social learning. On the contrary, respondents with lower social interaction levels were more likely to have higher usage of formal financial services. Therefore social interactions (observations and discussions) were found to discourage formal financial services usage even among financially literate people in Kampala, Uganda. Policymakers, service providers, and financial educators ought to take cognizance of social influences to promote financial inclusion in countries like Uganda. This recommendation supports Okello et al. (2016), who found that financial literacy alone had no significant impact on financial inclusion but rather that social capital's introduction fully mediated the relationship between financial literacy and financial inclusion in rural Uganda. Bandura (1986) postulates that learning also occurs when people, through interactions, observe others, imitate them, and seek to model specific behaviors, our results highlight the importance of social interactions in synthesizing knowledge on formal financial products, before actual product uptake. In support of this presumption, the study recommends further empirical investigations into the comparative efficiency of using person-to-person delivery channels for financial education generally and financial products specifically through peer networks that are critical financial socialization agents within specific communities.

This study examined the extent to which social learning may moderate the relationship between an individual’s level of financial literacy and their use of formal financial services. By focusing on the user perspective, the study established the prevalence of financial social learning opportunities through discussion and observations among peers had a significant influence on consumers' financial services usage. This finding is consistent with Ramsden and Moses (1992), who found that individuals acquired financial knowledge and skills, attitudes, and behaviors to handle their financial problems. The study’s contribution to knowledge is embedded in developing a theoretical model that explains FI in Uganda from a demand-side perspective. The study also contributes to the body of knowledge through the moderating role of social learning in the relationship between financial literacy and the use of financial services in Kampala, Uganda. This study contributes to the behavioral finance discourse by adopting behavioral theory, that is, the social learning theory, to compliment the economic models of demand and supply that are often used. This provides a better theoretical and empirical understanding of financial services usage in the population's urban segment in the Ugandan context.

Specifically, the study findings suggest that the design of national strategies for financial literacy should consider the different economic and social conditions and the varying levels of financial market development. However, a caveat to the findings' applicability is that the current study adopted a cross-sectional design, which captures the status-quo in terms of social learning exposure and the ongoing use of financial services. Therefore, a fundamental limitation is that the analysis is unable to provide observations over a long time. Future research could use longitudinal approaches. Furthermore, the sample size is limited to Kampala, Uganda. Therefore, to allow for generalizations of findings, future studies should utilize larger samples in other social-economic contexts.

The authors have not declared any conflict of interests.

REFERENCES

|

Amatucci FM, Crawley DC (2011). Financial self-efficacy among women entrepreneurs. International Journal of Gender and Entrepreneurship, 3:23-37.

Crossref

|

|

|

|

Atkinson A, Messy FA (2012). Measuring Financial Literacy: Results of the OECD / International Network on Financial Education (INFE) Pilot Study. OECD Working Papers on Finance, Insurance and Private Pensions, No. 15, OECD Publishing.

Crossref

|

|

|

|

|

Bandura A (1986). Social foundations of thought and action: A social cognitive theory Englewood Cliffs, NJ: Prentice- Hall, Incorporated.

|

|

|

|

|

Bandura A, Walters RH (1963). Social learning and personality development. New York: Holt, Rinehart and Winston, [Stanford University, Stanford, CA, and Univ. Waterloo, Ontario, Canada] 329 p.

|

|

|

|

|

BOU (2017). National financial inclusion strategy. Bank of Uganda [Online] Available at:

View

|

|

|

|

|

Campbell JY (2006). Household Finance. NBER Working Paper No. w12149. Available at SSRN:

View

Crossref

|

|

|

|

|

Grable JE, Joo S (1999). Factors Related to Risk Tolerance: A Further Examination. Consumer Interests Annual 45(1): 53-58.

|

|

|

|

|

Cohen M, Nelson C (2011). Financial Literacy: A Step for Clients Towards Financial Inclusion. Valladolid: Global Microcredit Summit 2011

|

|

|

|

|

Collin K (2009). Work-related identity in individual and social learning at work, Journal of Workplace Learning 21(1):23-35.

Crossref

|

|

|

|

|

Demirgüç-Kunt A, Klapper L, Singer D (2017a). Financial Inclusion and Inclusive Growth: A Review of Recent Empirical Evidence. Policy Research Working Paper 8040. World Bank Group.

Crossref

|

|

|

|

|

Demirgüç-Kunt A, Klapper L, Singer D, Ansar S, Hess J (2017b). The Global Findex Database. Measuring Financial Inclusion and the Fintech Revolution. The World Bank Group. [Online] Available at:

View

|

|

|

|

|

Finscope (2018). Finscope Uganda Topline findings Report. [Online] Available at:

View

|

|

|

|

|

Fornell C, Larcker DF (1981). Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. Journal of Marketing Research 18(1):39-50.

Crossref

|

|

|

|

|

Grohmann A, Klühs T, Menkhoff, L (2017). Does Financial Literacy Improve Financial Inclusion? Cross Country Evidence. Deutsches Institut für Wirtschaftsforschung.

Crossref

|

|

|

|

|

Gutter MS, Garrison S, Copur Z (2010). Social Learning Opportunities and the Financial Behaviors of College Students - Family & Consumer Sciences Research Journal. 38(4):387-404.

Crossref

|

|

|

|

|

Gutter MS, Garrison S (2008). Perceived norms, financial education, and college student credit card behavior. Journal of Consumer Education 24:73-88.

|

|

|

|

|

Hair JF, Sarstedt M, Ringle CM, Gudergan SP (2017). Advanced issues in partial least squares structural equation modeling (PLS-SEM). Thousand Oaks, CA: Sage Publications.

Crossref

|

|

|

|

|

Henseler J, Ringle CM, Sarstedt M (2014). A new criterion for assessing discriminant validity in variance-based structural equation modeling. Journal of the Academy of Marketing Science 43(1):115-135.

Crossref

|

|

|

|

|

Hogarth JM, Hilgert MA (2002). Financial knowledge, experience, and learning preferences: Preliminary results from a new survey on financial literacy. Consumer Interest Annual (48),

View

|

|

|

|

|

Holzmann R (2010). Bringing financial literacy and education to low and middle income countries: the need to review, adjust, and extend current wisdom. World Bank, IZA and CES, Washington DC.

Crossref

|

|

|

|

|

Idris FH, Krishnan KSD, Azmi N (2013). Relationship between financial literacy and financial distress among youths in Malaysia: An empirical study, Malaysian Journal of Society and Space 9(4):106-117.

|

|

|

|

|

Krejcie RV, Morgan DW (1970). Determining Sample Size for Research Activities.' Educational and Psychological Measurement. 30:607-610.

Crossref

|

|

|

|

|

Lee H, Lee M (2018). Social learning constructs and employee learning performance in informal Web-based learning environments, Journal of Workplace Learning.

Crossref

|

|

|

|

|

Lehesvirta, T. (2004), "Learning processes in a work organization: from individual to collective and/or vice versa?", Journal of Workplace Learning, 16(1/2):92-100.

Crossref

|

|

|

|

|

Lusardi A, Mitchell OS (2011). Financial literacy and retirement planning in the United States, Journal of Pension Economics and Finance, Cambridge University Press 10(04):509-525.

Crossref

|

|

|

|

|

Lusardi A, Mitchell OS (2011a). Financial Literacy and Planning: Implications for Retirement Well-Being. In Financial Literacy: Implications for Retirement Security and the Financial Marketplace, edited by Olivia S. Mitchell and Annamaria Lusardi, Oxford and New York: Oxford University Press. Mahdavi pp.17-39.

Crossref

|

|

|

|

|

Lusardi M, Mitchell O (2013). The Economic Importance of Financial Literacy Theory and Evidence. From

View (Retrieved on 18 March 2014).

Crossref

|

|

|

|

|

Mien NT, Thao TP (2015). Factors affecting personal financial management behaviors: evidence from Vietnam. Proceedings of the Second Asia-Pacific Conference on Global Business, Economics, Finance, and Social Sciences [Online] Available at:

View

|

|

|

|

|

Mindra R, Moya M (2017). Financial self-efficacy: a mediator in advancing financial inclusion, Equality, Diversity and Inclusion. 36(2):128-149.

Crossref

|

|

|

|

|

Moschis GP, Churchill GA Jr (1978). Consumer Socialization: A Theoretical and Empirical Analysis. Journal of Marketing Research 15(4):599-609.

Crossref

|

|

|

|

|

Moschis GP, Moore RL (1979). Family Communication and Consumer Socialization, in NA - Advances in Consumer Research Volume 06, eds. William L. Wilkie, Ann Abor, MI: Association for Consumer Research, pp. 359-363.

|

|

|

|

|

Mu'izzuddin T, Ghasarma R, Putri L, Adam M (2017). Financial Literacy; Strategies and Concepts in Understanding the Financial Planning With Self-Efficacy Theory and Goal-Setting Theory of Motivation Approach. International Journal of Economics and Financial Issues. 7(4):182-188.

|

|

|

|

|

OECD (2018), OECD/INFE Toolkit for Measuring Financial Literacy and Financial Inclusion. Paris: Organisation for Economic Co-operation and Development.

View

|

|

|

|

|

Okello CBG, Ntayi JM, Munene JC, Nabeta, JN (2016). Social capital: mediator of financial literacy and financial inclusion in rural Uganda. Review of International Business and Strategy 26(2):291-312.

Crossref

|

|

|

|

|

Ormrod JE (1999). Human Learning (3rd Edition). Upper Sadle River, NJ: Merrill Prentice Hall.

|

|

|

|

|

Peachey S, Roe A (2004). Access to finance (Unpublished Study). Washington, D.C.: World Savings Banks Institute and the World Bank.

|

|

|

|

|

Pinto MB, Parente DH, Mansfield PM (2005). Information learned from Socialization Agents: Its Relationship to Credit Card Use Family and Consumer Sciences Research Journal 33(4):357-367.

Crossref

|

|

|

|

|

Ramsden P, Moses I (1992). Associations between research and teaching in Australian higher education. Higher Education 23(3):273-295.

Crossref

|

|

|

|

|

Refera MK, Dhaliwal NK, Kaur J (2016). Financial literacy for developing countries in Africa: A review of concept, significance and research opportunities. Journal of African Studies and Development 8(1):1-12.

Crossref

|

|

|

|

|

Shibia AG, Kieyah J (2016). Effects of Financial Literacy on Individual Choices Among Financial Access Strands in Kenya. International Journal of Business and Economics Research. 5(1):10-18.

Crossref

|

|

|

|

|

Uganda Bureau of Statistics (UBS) (2014). The National Population and Housing Census 2014 - Main Report. Kampala, Uganda [Online]. Available at:

View

|

|

|

|

|

Wachira MI, Kihiu E (2012). Impact of Financial Literacy on Access to Financial Services in Kenya. International Journal of Business and Social Science 3(19):42-50. [Online] Available at:

View

|

|

|

|

|

Ward S (1974). Consumer Socialization. Journal of Consumer Research 1(2):1-14. Retrieved February 14, 2020, from

View

Crossref

|

|