ABSTRACT

The need for economic theory to address the problem of unsustainable consumption patterns in a developing economy, Nigeria cannot be overemphasized. The literature suggests that present consumption patterns which use up economic resources beyond the capacity of the environment to replenish may make development unsustainable. This study analyzed consumption behavior vis-à-vis the factors that weakly or strongly influence consumption decisions. The main objective of the study is to determine the consumption patterns among and within individual households in Agyaragu community of Nasarawa and by inference, Nigeria. The study also investigated the extent to which consumption behavior of households supported the predictions of conventional models of consumption. A sample of 500 households was randomly drawn from the community population of 22,750, with a response rate of 97%. The main model employed alongside others, is the Autoregressive Distributed Lagged (ADL) model. The results and findings revealed that individuals do not simply behave according to the baseline models of consumption. Consumption patterns favoured non-durable consumption and necessities. The study recommended the model used in this study as a model of consumption that should incorporate the additional factors revealed by this study. The study further recommended an economic policy and programme that will switch consumption away from non-durables to durables. This would enhance wealth creation, savings, investment and economic growth and development.

Key words: Consumption, consumption pattern, households, logit, autoregressive distributed lag.

Economics does not explain the problem of consumption expenditure patterns that is unsustainable especially in developing economies. By this, we mean, consumption patterns that used up economic assets and jeopardize future increase in wealth and standard of living. Relatively, such patterns generate waste, and promote unsustainable use of the individual’s and economy’s resources (Hyat, 2001; Cohen and Murphy, 2001). Sustainable consumption has to do with the use of services and related products which respond to basic needs and leads to a better quality of life while minimizing the use of available natural and material resources as

well as reducing the emission of waste and pollutants so as not to jeopardize the needs of the future (or future generations) (Cohen and Murphy, 2001). There should be a relationship between income and consumption behavior. There is an interest on how people spend and manage their resources in life. Some of the aspects of household resource management and spending include the patterns of savings and the use of wealth. This reflects choices that individuals make between current consumption and future consumption. There are also choices between leisure and work indicated by labour force participation rates. The last aspect is that of Economics does not explain the problem of consumption expenditure patterns that is unsustainable especially in developing economies. By this, we mean, consumption patterns that used up economic assets and jeopardize future increase in wealth and standard of living. Relatively, such patterns generate waste, and promote unsustainable use of the individual’s and economy’s resources (Hyat, 2001; Cohen and Murphy, 2001). Sustainable consumption has to do with the use of services and related products which respond to basic needs and leads to a better quality of life while minimizing the use of available natural and material resources as well as reducing the emission of waste and pollutants so as not to jeopardize the needs of the future (or future generations) (Cohen and Murphy, 2001). There should be a relationship between income and consumption behavior. There is an interest on how people spend and manage their resources in life. Some of the aspects of household resource management and spending include the patterns of savings and the use of wealth. This reflects choices that individuals make between current consumption and future consumption. There are also choices between leisure and work indicated by labour force participation rates. The last aspect is that of allocation of current consumption expenditure among different categories of goods and services. The allocation of consumption expenditure is the focus of this study vis-a-vis consumption expenditure pattern of households in an emerging economy.

The real issue is not consumption itself but its patterns and effects. There is a link between consumption, poverty, inequality and environmental degradation. There is therefore the need to change consumption from conspicuous display to meeting basic needs and also by shifting from consumer goods to production technologies. This is likely to reduce the problems of consumption and human development. The greatest challenge of Nigerian economy is the consumption patterns of its citizens which does not encourage locally made goods. Households prefer to buy than to make. The culture of buying and buying from outside the economy (abroad) is a great challenge. The present patterns and culture of consumption does not encourage transfer of technologies, but a consumption technology.

The present consumption pattern implies that an economic hypothesis has to be developed in order to change such consumption behaviour. However, this cannot be done unless we understand the variables (factors) influencing the individual’s and society’s decisions on consumption. Consumption decisions are formed and influenced by certain factors. Some of the factors this study investigated include income, past values of consumption and incomes, assets, family size, etc.

The simple theory of intertemporal choice, represented by the simple Life Cycle-Permanent Income (LC-PI) hypothesis says that changes in consumption should be unforecastable. That is, rational and forward-looking economic agents ought to smooth out consumption over their life cycle and to exhaust the stock of assets accumulated during their working career when they retire. Accordingly, consumers estimate their ability to consume in the long-run and then set their consumption to the fraction of that estimate. The fraction may be in the form of wealth or permanent income. Thus, the LC-PI hypothesis is accepted widely as the proper application of dividing consumption between the present and the future. However, most empirical works do not agree with or conform the predictions of the simple theory. One of the theses of this study is that consumption and consumption behavior does not follow the argument of the LC–PI models.

Following the Keynesian revolution, other works emerged to either prove or disprove the ideas contained in Keynes work. Such works included other determinants of consumption, in addition to income. Such other factors included are the level of wealth, expectations, interest rates and distribution of income. A rise in wealth would lead to an increase in consumption and shift the consumption function upwards. Two principal works done in this area are the permanent income hypothesis by Milton Friedman and the life cycle hypothesis by Ardo and Modigliani.

The paper appreciates the substantial progress that has been made in understanding both the micro and macro-economic determinants of consumption, which has generated more policy instruments for better policy making. Improvement in the welfare of people entails reducing poverty levels in that community (economy). Indicators of welfare and poverty appear to be related and not completely separated. For Nigeria, such human needs as education, health care, environmental, water, sanitation, housing conditions, households’ expenditure patterns, basic infrastructures have been identified as strong indicators of human development and welfare. The sustained improvement on these indicates reduction in poverty (NBS, 2005, 2007). Thus, the testable objectives of the study are as follows:

i) Establishing consumption pattern for the Agyaragu community

ii) Discovering/establishing whether consumers in

Agyaragu behave according to the predictions of the conventional consumption hypothesis.

iii) Identifying the factors that strongly or weakly determine consumption patterns of the individual households in Agyaragu community.

Consumption is the combination of qualities, quantities, actions and tendencies that characterize a community or group of people in the course of using resources for their survival, comfort and enjoyment. Going by the above definition, consumption is very much related to consumer behavior. According to the UNDP (1998), the real issue today is not consumption per se but the patterns of consumption and its effect on the individual and economy. Consumption patterns have a damaging effect on the environment. Besides, it is responsible for the widening inequality and poverty. In the area of inequalities in consumption, 20% of those in the highest income bracket account for 86% of total private consumption expenditure globally, while the poorest account for only 20%. The richest people consume 45% of all meat and fish and the poorest fifth consume only 5%. The rich also consume 58% of total energy against 4% by the poorest fifth. They have 74% of all telephone lines as against 1.5% by the poor: own 87% of the world fleet of vehicles as against 1% by the poorest fifth.

According to Reusswig et al. (2002), lifestyle of people forms part of their consumption patterns. Lifestyle as a concept put consumption processes in the context of socio-economic and cultural regards. Lifestyle means how individuals live and interpret their lives and actions in a social context. To study lifestyle requires an observer and a participant approach because we live our lives among other people who observe us as social and/or economic actors. Also, lifestyle link social structure to attitudes and behavior of people. Thus, we have the American way of life, Indian way of life, Nigerian (African) way of life, etc. The way of life (pattern) influences the consumption decisions and actions of people from a macro-perspective. Three core dimensions have to be combined in order to describe a lifestyle for a group of people. These are (i) Social status of what Marxist called class, (ii) Attitudes and preferences as termed by the marginalists, and (iii) Behaviour. Consumption patterns therefore refer to the aspect of a lifestyle or livelihood that relates to the nature and amount of the different goods and services that household consider adequate for meeting their needs. While lifestyle is the way of living that reflects a household’s values and attitudes, consumption pattern is the relation of goods and services that characterize that lifestyle. Here, emphasis is placed on the consumption of a specific commodity or service by households such as transportation, food, clothes, etc and not on the structure and function of consumption patterns. Consumption patterns are important drivers of development patterns in the developed countries (Crivits, 2008).

Review of theoretical literature

This section provides a review and analysis of economic theories and phenomena on consumption behavior that could have important ramifications for future consumption patterns and decision making. The baseline models of consumption provided a good tool for understanding consumption and these have yielded some useful insights. Thus, some of the main insights were explored and issues were raised on rational-choice models of consumption. The focus is on the potential of applying formal behavioural economic models and theories to theoretical and empirical research on consumption behavior and patterns. Thus, the authors tried to see if future research could go beyond normative considerations to understanding the economic and welfare consequences of consumption behavior and patterns of individual households.

The Keynesian revolution

The Keynesian economic theory otherwise called Keynesian economics or Keynesianism is a macro-economic theory that is based on the ideas of 20th century British economist John Maynard Keynes. The ideas and theories that formed the basis of Keynesian economics and revolution was first presented in Keynes’ work, “The General Theory of Employment, Interest and Money”, which was published in 1936. Keynesian economics opined that the private sector decisions sometimes could lead to inefficient macroeconomic outcomes. He then advocated active policy reactions by the public sector, which should include monetary policy actions by the Central Bank and Fiscal Policy responses by government to stabilize output over the business cycle. Keynesianism recommended a mixed economy with predominate private sector but having a large role played by the government and public sector. This served as the economic model during the latter part of the great depression, World War II and the post war economic expansion of 1945 – 1973 (Dornbusch et al., 2008; Truett and Truett, 1987; Wikipedia, 2010a, b).

Keynes argued that if microeconomic-level actions were taken collectively by a large population of individuals and firms, would lead to inefficient aggregate macroeconomic outcomes/results. This will be the case where the economy operates at below its potential output and growth rate. He contended that a general glut will take place when aggregate demand for goods is insufficient. This will lead to downturn in the economy with unnecessarily high unemployment and losses of potential output. Thus, the central position of the Keynesians was that no strong automatic mechanism could move output and employment to full employment levels.

Keynesian economics had four closures which are worthy of mention here (Dos Santos, 2005). These are (i) Household sector: the households receive income in the form of wages, interest on deposit and government bills, distributed profits of banks and firms. They use the income to purchase consumption goods, pay taxes and save. The household sector therefore plays three crucial roles in Keynesian economics. These roles include their consumption expenditures which are crucial part of aggregate demand, their financial decisions which are vital determinants of financial markets’ behavior, and eventually inflation. Households’ wealth accumulation also affects their consumption decisions. (ii) Firms: Firms make four decisions, namely: the mark-up on costs of production, how much to produce, the quantity of capital goods to order and to be added to the existing stock of capital, and how investment will be financed. (iii) Government: Government including monetary authorities decides on how to finance its debt, how to regulate the market and the financial markets and set the minimum required reserve to deposit ratio and the interest rate of Central Bank’s advances and other banks, and (iv) Banks, which play intermediary roles in the economy. The keen interest of this study is in the household sector.

The Keynesian revolution was therefore a fundamental reworking of the mainstream economic theory in the 1930s and 1940s. The reworking replaced the previously dominant school of neo-classical economics with neo-Keynesian economics which is a mixture of neo-classical and Keynesian economics. This mixture is referred to as the neoclassical synthesis. While the neo-Keynesians were regarded as Keynesians in macroeconomics, the neoclassicals were summarized in microeconomics. The Keynesian revolution was set out against the orthodox economic framework of neo-classical economics. In it, the neoclassical meaning of employment was replaced with Keynes’ view that it was demand and not supply that was the principal factor influencing the level of employment. Given the theoretical basis, the Keynesians advocated for government intervention in order to alleviate severe unemployment. The supporting force to Keynes’ claim of a revolution was the economic crisis of the 1930s great depression in the UK and the publication of the General Theory of Employment, Interest and Money in 1936 by Keynes.

Review of empirical literature

The word empirical has to do with what is factual or an event where an experiment was done and the results were observed. It is an attempt where the results of an experiment or observation are fitted to a theory. Empirical research and framework is a way of gaining knowledge by means of direct observation, or experience. It is used to answer empirical questions which are often defined and answerable using data. Thus, empirical framework involves observation vide collection and organization of empirical facts, induction, that is, formulating hypothesis, deduction, testing and evaluation. Empirical literature is important because of the little support theories receive because of the limits of introspection. Thus, result from empirical studies leads to interesting theories.

Simple consumption theories imply that changes in consumption ought to be predictable. Rational and forward looking households and economic agents should be able to smooth consumption over their life cycle. In addition, they should be able to exhaust the stock of assets accumulated during their working life in retirement. Some empirical works appears to be at variance with the predictions of the simple theory of inter-temporal choice.

One of the empirical works is that of Hall (1978) which was a work on time series consumption function. According to him, lagged consumption can be controlled for. Once this is done, under rational expectations, only permanent income affects current consumption. He used distributed lag models and data from the US economy. According to him, consumption is too sensitive to current income for it to conform to the LC-PI principle. He accepted that some measures of wealth have a strong influence on consumption therefore, lagged wealth is recommended as a variable to test. Beyond the next few future periods (t + 1 & t + 2), consumption should be regarded as an exogenous variable. Thus, there is no need to forecast future income and thereafter relate it to income. He reasoned that information about future income is already included in the current permanent income. He assumes infinite horizons and an exogenous stochastic labour income.

The work of Davidson et al. (1978) gave a dynamic model of consumption on the basis of a long-run relationship between consumption and income. Using data from the UK, the theory accepted the restrictions imposed by the error correction models. Some of the most recent works on consumption used micro-data as against aggregate data and some focused on rural economies (Hyat, 2001; Yang, 2006 and Qi Zhu, 2006). Hyat (2001) used data from rural Pakistan to examine consumption mobility among individuals and households. He used four (4) models, viz: the PI hypothesis, the rule of thumb model, liquidity constrained behaviour and perfect risk-sharing model. The empirical evidence rejected the strict version of the permanent income model. Thus, income and income smoothing mechanisms play a vital role in creating the mobility patterns observed in rural Pakistan. One observes that while a great proportion in rural Pakistan moves from one consumption docile to another yearly, showing improvement in the people’s well-being dimensions, this may not be the same experience in Nigeria.

Yang (2006) used micro-data and developed a quantitative, dynamic general equilibrium model of life cycle behaviour. Focusing on housing, evidence showed that there were two patterns of consumption, housing and non-housing goods over the life cycle. Consumption expenditure on non-housing commodities is hump-shaped over the life cycle, that is,, early in life, it is low, rises sharply in middle and therefore fall at old age. But the holding of stock of housing is not hump–shaped. Thus, life time housing stock increases “monotonically” and then becomes rather flat. This finding contradicts the position of the standard life cycle hypothesis. He suggests that the ratio of housing and non-housing consumption should not depend on age. Rather, housing consumption and non-housing consumption should follow the same profile.

Zhu (2006) used a consumption–wealth ratio model to establish the relationship between consumption-wealth ratio and expected returns. Consumption-wealth ratio is the empirical log-linear combination of consumption, asset holdings and labour income. He relied on data on consumer expenditure survey from the US. “Residual based Phillips – Ouliaris cointergration and Johansen’s rank – and trace – based conintegration tests were conducted. Proxy was provided for consumption–wealth ratio. There is empirical evidence showing existence of cointergration among consumption, labour income and assets holding.” However, because consumption–wealth ratio was proxied, the empirical evidence is not sufficient enough to support that consumption–wealth ratio and assets returns have a strong predictive power.

There are other works which focus particularly on the effects of wealth on consumption (Ahumada and Garegnani, 2003; Baker et al., 2006 and Boone et al., 1998). Ahumada and Garegnani (2003) used an unrestricted autoregressive–distributed lag model for private consumption, disposable income and liquidity assets. They based their model on the general to specific modelling under the Euler approach. Empirical evidence from Argentina showed that only disposable income had a long – run relationship with consumer’s expenditure. Included in their model was a measure of real exchange rate, inflation, sovereign risk and an effect related to peak income. This was done to adjust the empirical definition of wealth. The result still showed disposable income as the only long – run determinant.

Baker et al. (2006) used two data sets to prove that individual investors are likely to consume more from dividend than from capital gains. Their model expresses consumption as a function of a vector of household characteristics, a vector of financial variables (income, lagged wealth and interactions with household characteristics), total Naira (dollar) return on stocks dividend included and total Naira dividend income. Their finding showed that consumption indeed response is much more stronger to returns in the form of dividends than returns in the form of capital gains.

Boone et al. (1998) focused on the effect of stocks market wealth on consumption. They modelled consumption-income ratio (cy) depending on stock market wealth and non–stock market wealth to income ratios (SMWY and NSMWY, respectively). To enrich their model, they added the following variables: real interest rate as a proxy for substitution effects, inflation rate- a proxy for uncertainty and depreciation of non–indexed financial assets and fluctuations in unemployment rate as a proxy for uncertainty regarding future stream of income. The essence is to take care of the weaknesses of the PIH. The result showed that stock market wealth significantly affects consumption on the range of 4 to 7%.

This section deals with the research design, population of study and the method used in data collection for the study. It sets the parameters for the data collected as well as described the mode for data analysis. The blue-print for collecting and analyzing data relates to the problem of investigating consumption pattern in Agyaragu community, Nigeria. Due consideration was given to the models used, population of the study and the type of data (Creswell, 1998, 2003).

The probit model

The cumulative distributive function (CDF) of the probit model is specified as below:

Pi = P(Xi = 1/X) = P(Zi*≤ Zi) = P(Zi = β1+β2Xi) = F(β1+β2Xi ) (1)

In addition to getting estimates for the parameters of β1 and β2, the probit analysis seeks to provide information on the unobservable or unmeasured index Z. This is the propensity to consume in the case of this study. This focuses on which consumption behavior is adopted by individual households in the study. The index is not observable from available survey data. However, it assumed that the individuals may not follow a particular consumption behavior. It is also assumed that this index of strength of consumption behavior is a linear function of income and other explanatory variables (Xi). The model therefore provided a suitable means of estimating the slope and intercept parameters of the relationship between the scale of consumption and the explanatory variables.

The maximum likelihood (ML) or large-sample method was used to estimate the parameters. Thus, the likelihood ratio (LR) statistic is used to test the null hypothesis that the slope coefficients are simultaneously equal to zero. A high value of the LR statistic and low value of the P values means all the explanatory variables have impact on the dependent variable (consumption). When the values of the parameters give high value of log likelihood function, itmeans the sample used in the analysis is correct. High likelihood ratio with low P value shows that the model in question as a whole fit significantly and is good.

Study geographical area

Agyaragu is in Lafia Local Government area of Nasarawa State. It is located on a latitude of 8° 25` 00`` and a longitude of 8° 31` 00``. It has a land mass (area) of 21 sq km. The community shares boundary with Lafia in the North, Doma LGA in the South – West and Obi LGA in the South (Field survey, 2009). The Population of Agyaragu is estimated at 22,750 (NPC, 2008). Different economic activities are found in the community: farmers, traders, artisans, civil servants, among others. Farming activities predominate other economic activities. It is famous for the production of yam, groundnut, maize, guinea corn, millet, cassava, rice, beans, melon, etc.

The choice of Nasarawa State as a population for this study is non-random. The population targeted for this study is therefore Agyaragu community in Nasarawa State, Nigeria. To achieve the objective of this study, the data was grouped into three categories: the demographic characteristics of individuals, the patterns of consumption and the determinants of consumption.

The 2006 population census figure for Lafia Local Government is 330,712 people (NPC, 2008). The population of Agyaragu based on the 2006 population census estimate is 22,750 (NPC, 2008). Agyaragu is the second largest town to Lafia both in terms of population and economic activities.

Based on the above, a sample of 500 individuals (households) was taken. The sample being a part of the entire population was selected using simple random sampling procedure. The sample of 500 individuals was selected by stratified random sampling method. This was to ensure that every member of the community is given equal opportunity of being chosen. With the help of the National Population Commission (2008), Nasarawa State Office, Lafia, the community was stratified into six (6) major sections, “Ekpolu” in Eggon or “Angwan” in Hausa. Households in each section were assigned numbers. Thereafter, these numbers were randomly selected and drawn.

The SPSS, Eview and Stata Computer packages were employed in this study to routinely calculate the slope and intercept parameters and others estimates such as the F-statistic, t-statistic, z-statistic values along with the usual regression output. The usual regression output includes the estimated coefficients, their standard errors, p values or actual level of significance, coefficient of determination (R2), Durbin Watson (d) statistic and the maximum likelihood functions for the probit and logit models

DATA ANALYSIS AND DISCUSSION OF FINDINGS

Demographic characteristics of respondents

Gender statistics

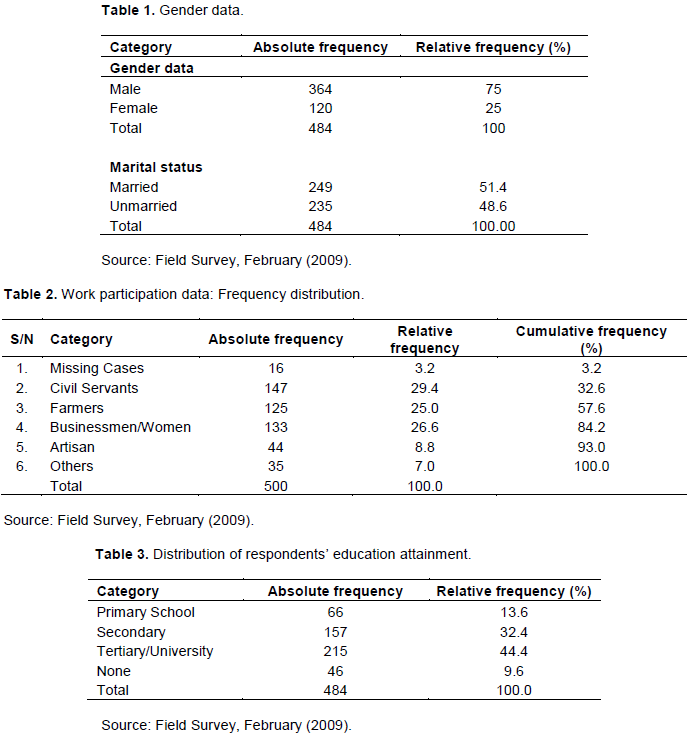

From the 484 households that responded, 75% were males while 25% were females. Similarly, 51.4% were married while 48.6% were unmarried. No widow, widower or divorced responded.

Work participation data

The response rate from the sampled units of 500 people was 97% while the non-response rate stood at 3%. From the sample survey, 25% are farmers, while 28.2% are businessmen/women and 9% are artisans. Thus, 60.4% of the people are self-employed while 29.4% are engaged in paid jobs.

From the survey, 44.4% of the households in the community are either polytechnics, college of education or university graduates, 32.4% have attained secondary education, while 9.6% have not attained any schooling.

Whether or not individuals spent so much on family upkeep, the survey revealed the following: Yes = 305 (63.0%); No (Other needs) = 133 (27.5%); Nil = 46 (9.5%); Total = 484 (100%).

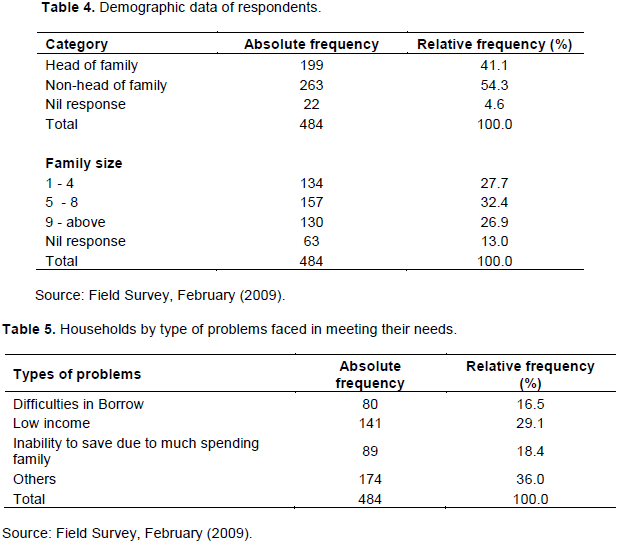

Family heads constitute 41.1% of the households covered in the survey, while non-family heads are 54.3%. In terms of family size, 27.7% of the households in the community has a family size of 1 to 4 persons, while 32.4% has a size of 5 to 8 persons. Those with family of above nine persons constitute 26.9%. The implication is that family size influence consumption positively that add little to wealth for the future. From the survey, 63% households affirmed that they spend so much on consumption expenditure. This is supported by the evidence in Tables 1 to 3; and further by Tables 4 and 5, where 18.4% of the households are unable to save because of high expenses of family upkeep.

Probit analysis results

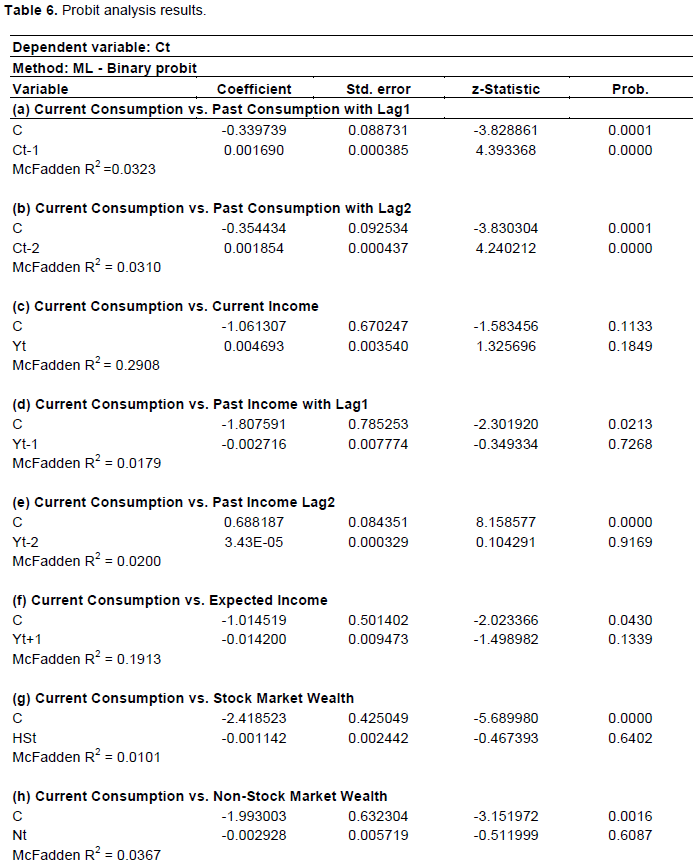

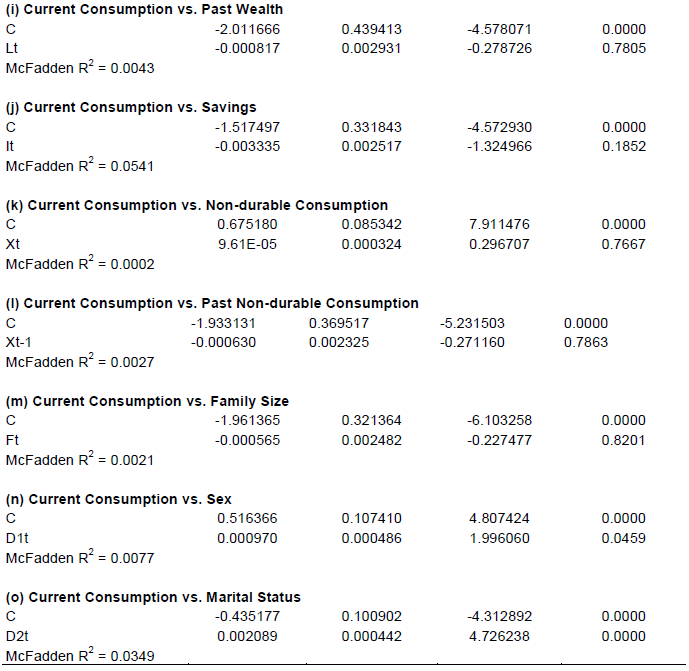

Findings from the estimates of the coefficients show that past consumptions, current income, past income lagged by two periods, non-durable consumption and marital status have positive relationship with current consumption- the dependent variable. Saving too has the correct sign as expected. On the other hand, past income lagged one period, expected income, stock market wealth, non-stock market wealth, past wealth and past non-durable consumption have negative relationship with the dependent variable, contrary to the a priori expectation (Table 6).

Thus, in terms of their impact on consumption, non-durable consumption, past income and current income has the greatest influence on consumption behavior and expenditure of the households. An increase of N1.00 (or one unit) in non-durable consumption increased current consumption by N9.61; while an increase in past income by N1.00 increased consumption by N3.43. Although, savings, past consumption, marital status and sex of the households also effect consumption, these play but a very marginal role in influencing consumption. Their parameter estimates are almost close to zero. In terms of statistical significance, only past consumption, sex and marital status are statistically significance at 5% level of significance. Current income and savings are statistically significant at about 20% while expected income is significant at more than 10% levels. The rest of the variables are statistically insignificant.

However, going by the likelihood ratio, the LR statistic, only six explanatory variables were adjudged to have impact on consumption. These are marital status, past consumption (lags 1 and 2), expected income, sex, current income and savings in this order. This is further revealed by the low MacFaden R-squared. The log likelihood function represents the Zi index. The values of the log likelihood for the sample used are high with an average log likelihood of -124.7265. This means that consumption decisions took place in the community and consumption expenditures were incurred by the individuals on all the consumption items covered in the study-food, housing, clothing, health, recharge cards and non-durable consumption. The second implication of the high value of the log likelihood function is that the sample used in the analysis and in the study is correct. In addition, the models used as a whole fit significantly and is good.

Thus, the findings by this analysis and study showed that non-durable consumption is the most important in influencing consumption, suggesting that consumption patterns in the community favoured non-durable goods and necessities (Table 6).

Patterns of consumption in Agyaragu Community

The analyses by the models revealed that consumption of non-durable items and necessities topped the consumption of individuals in the community. This showed that the consumption patterns of this community and by inference, of Nasarawa state were highly skewed in favour of necessities and non-durable consumption. Already, both the distributed lag model and the linear model have rejected assets because it is statistically insignificant in predicting consumption. What this implies is that assets being part of durable consumption is not significant in the consumption decisions and patterns of the community. Thus, the consumption patterns of the community had not favoured durable consumption and other durables, which would have enhanced wealth creation. Thus, the patterns though quite unique, were not too different from known patterns of consumption, which is usually between durable and non-durable consumption. The inference drawn from the above findings is that consumption patterns in the Agyaragu community which is agrarian, is different from the consumption patterns established by the baseline models and other empirical works sighted from industrialized economies. The patterns established by these works based on evidences from the more developed economies, favoured durables more than necessities and non-durable consumption.

The implication of the above finding for policy is that such patterns that dwell heavily on necessities and non-durables would hamper economic growth and development. This is because if a community is actually experiencing economic development, consumption patterns should be seen to be moving away from necessities and non-durables consumption to (consumer) durables. This would enhance wealth creation, and eventually economic development. The patterns discovered by this study do not encourage wealth creation. This has the negative effect of slowing down economic development and the pace of economic growth. Necessary policy framework required towards addressing these issues of heavy consumption of necessities and non-durables in favour of durable consumption. Such policy actions should be targeted at increased incomes of households, wealth generation, savings and investment.

CONCLUSION AND RECOMMENDATIONS

The cross-sectional data series were used to establish the long run relationships between current consumption and disposable income, lagged incomes and other variables that were regarded as useful for modeling their effects on consumption behaviours. Thus, not only current incomes determined consumption, other variables also influenced consumption. Not only the first lagged value of consumption but both the first and second lagged values of consumption predicted consumption significantly. In fact, lagged consumption was also established and had a greater predictive influence on consumption decisions than lagged incomes. That is, consumers did not depend much on past incomes. This demonstrates that individuals always try to maintain and sustain habits formed in the past.

Conspicuous consumption habits and behaviours in Agyaragu community were high. In addition, consumption patterns in the community favoured non-durable goods and necessities. Policy actions tailored towards increasing the output and incomes of the residents of the community on the one hand, and those aimed at changing their consumption patterns are imperatives.

Policy makers had not focused enough attention on the issues of consumer behaviour. If properly formulated and implemented, such policy actions required should include looking at consumer behaviours and patterns that hindered sustainable development. Henceforth, policies should focus both on economic instruments and behavior related social policies.

The empirical results from this study confirmed our a priori expectation for the model which included lagged consumption, lagged incomes, conspicuous consumption and marital status. The regression results demonstrated a strong predictive power for changes in consumption.

The study worked on the assumption that the consumers maximized their expected utility and that they were able to borrow freely to sustain consumption. The Agyaragu community consumers did not behave completely or strictly as the Lifecycle – Permanent Income models predicted. Besides, various tests conducted showed that the variables cointegrate. Hence, there exists a long-run relationship between consumption and the selected variables. Furthermore, our model is stable and reliable.

On this basis, the autoregressive distributed lag model is recommended as model of consumption for our economy. The model as modified, with the additional variables included, is adequate. It reflects my contribution to knowledge. Both the probit and logit analyses confirmed the results and findings of the ADL model. Both the linear and log linear approximations can be applied to the model. Similarly, cross-sectional, panel and time series data can be applied to the model appropriately.

The findings are important for policy making in developing policies and programmes for consumption of durable and invariably for wealth creation and poverty reduction that anticipate changes in quality of life and development of opportunities for developing economies and the rural people. Conspicuous consumption and consumption of non-durables in the community is higher than savings. For example, while the coefficient of savings was 0.628, that of conspicuous consumption was 1.3. The implication was that savings were considerably lower than conspicuous consumption. This finding lends support for policy interventions needed to discourage and reduce conspicuous consumption and non-durable consumption. Some of the policy interventions recommended include the following:

1. Production or supply-based policy interventions: Since the community is agrarian, policy interventions to increase production and domestic supply are imperative. These should comprise of measures to increase agricultural inputs supply. Improved seeds and inputs should be supplied to those involved in agricultural activities. The improved seed/inputs have the capacity of increasing yields and output at short periods. Such increase in output will raise the incomes of the producers given good market prices. Allied to this measure is the need to promote agricultural extension and training; irrigation, and increase access to agricultural credits. The agricultural credits are required for finance investments in areas that need technical improvements. In addition to increasing yields, this measure would help in dealing with those technological problems that had been limiting the volume of agricultural production.

There are also artisans and other self-employed producers in the community and other rural economies. There are infrastructural and institutional constraints, as well as insufficient production incentives. To reduce these constraints, part of the policy measures should include improvement in rural infrastructures of roads, road maintenance and water supply. There should be deliberate investment in rural infrastructures. Improvement in and reform of rural institutions is also vital. In addition, reduction in costs of production through consistent marketing and pricing policy is recommended, among others.

2. Interventions that will help to change consumption patterns: As demonstrated by the findings of this study, consumption patterns are influenced by many factors other than income. From the data gathered, households in the community lacked access to capital, tools and certain vital services. In addition, they faced liquidity constraints. The majority of the households depended on firewood as source of energy. The firewood was collected from public or common land in ways that contributed to deforestation, erosion and domestic air pollution. Besides, the households lacked access to good sanitation, safe drinking water and other public services. This indicates that there is some level of property inherent in the community. Apart from being influenced by the factors identified in this study, consumption patterns in turn have effect on several issues. These include the quality and availability of natural and economic resources; health or quality of life of the households and environmental problems.

To develop policies that are effective in changing consumption patterns, policy makers need to know why and how consumers make choices and decisions. So far, policy makers have been more interested in the motivations behind consumer behavior, like saving time, saving money, fashion or consumption trends. These motivations are good but may be difficult to measure. Rather, interventions should look at issues from the cluster point of view. The cluster approach should consider issues such as consumer goods and services, building and housekeeping (or maintenance), food, recreation and mobility (transportation), etc.

Consumers have different ways to satisfy their needs. They want goods and services for eating, cleaning, dressing, home decoration, leisure activities and for several other purposes. Goods purchased by consumers included tools and appliances, clothing, footwear, toiletries, cosmetics, books, furniture, etc. For instance, they can shift from product to services. One could decide to use the services of launderer rather than buying and owning a washing machine. Again, in the area of transportation, we could take a ride in public vehicles as against owning a personal car. For this policy action to be effective, issues causing market failure have to be addressed. Also, the transport sector should be developed.

The consumption clusters reflect current consumption patterns, their main effects on resources use, and on the environment. It is the recommendation of this study that sustainable consumption patterns be achieved by shifting to communal activities or by purchasing services rather than products. Example is the use of public transportation instead of private cars, using a laundry service instead of buying a washing machine. The overall impact of this intervention approach is to increase consumers understating of the motivations and the reasons for trends in the consumption of certain items and services.

This would help in understanding the underlying motivations behind the individual’s choices. It will also shift consumption towards more resource-efficient items and minimize waste resulting from conspicuous consumption.

The authors have not declared any conflict of interests.

REFERENCES

|

Ahumada HA, Garegnani ML (2003). Wealth Effects in the Consumption Function of Argentina: 1980-2000. UTDT & UNKP – BCRA, Central Bank of Argentina.

|

|

|

|

Baker M, Nagel S, Wurgler J (2006). The Effects of Dividends on Consumption. Division of Research, Harvard Business School.

Crossref

|

|

|

|

|

Boone L, Gierno C, Richardson P (1998). Stock Market Fluctuations and Consumption Behaviour: Some Recent Evidence. Economics Department Working Papers. No. 208, OECD, Paris.

|

|

|

|

|

Cohen M, Murphy J (2001). Exploring Sustainable Consumption: Environmental Policy and the Social Sciences. New York: Pergamon

|

|

|

|

|

Creswell J (1998). Qualitative Inquiry and Research Design: Choosing Among Five Traditions. California: Sage Publications. Sage Publications Series. ISBN: 0761901434, 9780761901433

|

|

|

|

|

Creswell J (2003). Research Design: Qualitative, Quantitative and Mixed Methods Approaches. California: Sage Publications. ISBN: 9780761924418

|

|

|

|

|

Crivits M (2008). Analysing Consumption and Lifestyles. Consentus Project. WP1 Paris. Brussels: Belgian Science Policy.

|

|

|

|

|

Davidson JEH, Hendry DF, Srba F, Yeo S (1978). Econometric Modelling of the Aggregate Time-Series Relationship Between Consumers' Expenditure and Income in the U.K. Economic Journal 88(352):661-692.

Crossref

|

|

|

|

|

Dornbusch R, Fischer S, Startz R (2008). Macroeconomics, 10th edition. New York: McGraw Hill

|

|

|

|

|

Hall RE (1978). "Stochastic Implications of the Life-Cycle – Permanent Income Hypothesis: Theory and Evidence." Journal of Political Economy 86(6):971-987.

Crossref

|

|

|

|

|

Hyat T (2001). Intertemporal Choice, Consumption Dynamics and the Poor. University of Oxford.

|

|

|

|

|

Keynes JM (1936). The General Theory of Employment, Interest and Money. London: Macmillan. United Kingdom: Palgrave Macmillan. ISBN: 978-0-230-00476-0

|

|

|

|

|

National Bureau of Statistics (2005). Poverty Profile for Nigeria. Federal Republic of Nigeria. Abuja,Nigeria: National Bureau of Statistics.

View

|

|

|

|

|

National Bureau of Statistics (2007). General Household Survey Reports 1995 2005. March, Nigeria. Abuja,Nigeria: National Bureau of Statistics.

View

|

|

|

|

|

National Population Commission (2008). Details of the Breakdown of Nasarawa State Provisional 2006 Census Result by Local Government Areas. July. Abuja, Nigeria: National Population Commission.

|

|

|

|

|

Qi Zhu (2006). Cointegration of Consumption, Wealth and Income, Evidence from Micro-Data. Emory University.

|

|

|

|

|

Reusswig F, Lotze-Campen H, Grelinger K (2002). Changing Global Lifestyle and Consumption Patterns: The Case of Energy and Food. Columbia: Potsdam Institute for Climate and Impact Research (PIK)Truett LT, Truett DB (1987). Economics Toronto: Times Mirror/Mosby College Publishing.

|

|

|

|

|

Wikipedia (2010a). Keynesian Economics. Retrieved from

View, on 19th December, 2010.

|

|

|

|

|

Wikipedia (2010b). Taste. Retrieved from

View, on 19th December.

|

|

|

|

|

Yang F (2006). Consumption over the Life Cycle: How Different is Housing? Working Paper 635, Federal Reserve Bank of Minneopolis, Research Department, August.

|

|