Full Length Research Paper

ABSTRACT

There has been a monotonic increase in research investigating the performance of commercial banks across the globe. This is a recognition that the banking industry has a significant contribution to the service sector and national output. This paper examined the existence of the structure-conduct performance (SCP) and efficient market hypotheses by employing an autoregressive distributed lag (ARDL) approach for a period between 1990 and 2020. The study revealed the existence of both paradigms due to strongly statistically positive and significant coefficients of bank concentration and the size of the banking sector using the computed composite profitability measure (CPM). The paper suggests various policy implications on internal and external determinants of commercial bank’s performance.

Key words: Malawi, principal component analysis (PCA), total bank deposit, bank concentration ratio, STATA.

INTRODUCTION

This study seeks to determine commercial banks’ performance in Malawi. Commercial banks make up the most significant part of the service sector of any economy. The functions of commercial banks such as facilitating the culture of savings, public lending, government lending, forex trading among others facilitate market activities and in turn contribute to the socioeconomic development of a country. Through commercial banks, people can settle bills, buy goods, save money for future expenses. This helps to build social relationships among people and bring trust on financial issues while facilitating business activities.

A significant larger proportion of the population in Malawi live in rural areas where they are engaged in primary sector activities mostly agriculture and fishing. As an aftermath, existing literature hypes the role of primary economic activities as being crucial to the overall economic performance of Malawi. Realistically, it is the service sector which is a major contributor to the country’s GDP at 55.61% in 2020. This sector also employs 18% of the workforce in the country. The main activities in the tertiary sector are dominated by the financial and banking sector followed by retail services, telecommunications, tourism, and healthcare services (KPMG, 2017). The fact that the significance of the banking sector is under researched in Malawi, signifies how the importance of the sector is under recognized at the expense of the agricultural sector. In order to put the banking sector in limelight, the study seeks to assess the determinants of commercial banks profitability performance in Malawi. The more profitable commercial banks are, the more the contribution to GDP is made.

The study differs from prior studies in Malawi in that it is primarily interested in aggregate outcomes rather than in individual or selective bank performance like Lipunga (2014) and Mkandawire (2016) who focused only on four largest banks. Using aggregate outcomes allows us to focus on the structural changes occurring in the Malawian banking industry. It can also help to generate economic policies that can be validly used to stimulate the banking industry, instead of studying an individual commercial bank or a group of commercial banks.

The determinants of commercial banks profitability performance have been categorized in terms of bank-specific factors, microeconomic factors and industry structure factors. According to Ozili (2018; 2019), a sounding performance of commercial banks is crucial to the financial sector’s stability in the world. As such, the central bank of Malawi, known as the Reserve Bank of Malawi (RBM) as a financial system regulator understands that building trust and confidence in the financial sector can yield a significant improvement in the general economic performance of the economy of Malawi. Consequently, strong regulations and strict supervision of the banking sector has always been the key policy goal of the Reserve Bank of Malawi.

Collusion and efficient market hypotheses

There are generally two highly debated propositions in the market structure-performance theory. These are the structure-conduct performance and the efficient market structure hypotheses.

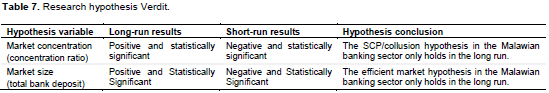

Also known as the collusion hypothesis, the structure-conduct-performance (SCP) hypothesis claims that market structure determines the behavior of firms which eventually affect profitability performance (Chirwa, 2003, Tan, 2016). Key to market structure is the concentration ratio – the number of firms operating in a particular industry. For example, in an industry with limited competition, firms tend to have less constraints with a wider range conducts or behavior such as pricing strategies, investment expansion timings, product differentiation, extent of monopolistic or competition power, and tactility collusion. However, market concentration may not always increase profits because its benefits may be offset by organization slack or x-inefficiency as firms tend to be highly complacent (Gupta and Mahakudi, 2020). The existence of this hypothesis will be validated in Malawian banking sector if market concentration positively influences commercial bank’s performance.

On the other hand, following the criticism of the collusion hypothesis Demsetz (1973) and Peltzman (1977) led to the emergence of the efficient market hypothesis. The later postulates that a firm’s specific efficiency, conduct and behavior lead to changes in sales and profitability (Chirwa, 2003; Edwards et al., 2006). That is, a firm’s higher profitability performance is within reach to firms which are efficient and not because of collusive behaviors. The testing of this hypothesis in relation to the banking sector as per this Malawi-specific study will be measured by the existence a positive relationship between the size of the banking sector (measured by total deposit) and commercial banks’ performance (measured by a composite profitability index). The assumption is that an increase an increase in bank deposits is as a result of its efficient strategies to attract more consumers of banking services.

Trend analyses in banking and financial sector in Malawi

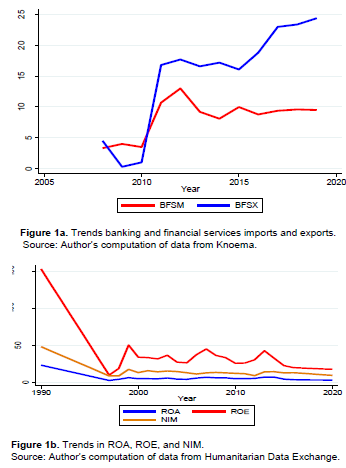

Malawi’s banking and financial services’ % of service imports (BFSM) and exports (BFSX)

In 2019, banking and financial services accounted for 24.4% of services exports and 9.5% of services imports (Figure 1a). Albeit, the banking and financial sector seems to have a positive balance with exports higher than imports after 2012, Malawi is a net importer of total services with a trade deficit of $176 million ($358m minus $182m) in 2019.

Figure 1b clearly shows that in 1990, bank performance was very high at the grasp of all the indicators. During this time, there were only three banks in operational namely: National Bank (1971), Standard Bank (1961) and Nedbank (1976). Commercial bank’s performance then started decreasing as the number of banks started increasing, that is, First Capital Bank (1995), Continental Discount Holdings (1998) up to around 2000s. The commercial bank’s performance started fluctuating with constant ups and downs as the number of commercial banks kept increasing. That is, New Building Society (2004), First Discount Holdings – FDH Financial Holdings (2007) and MyBacks Banking Corporation (2014).

The study uses a composite profitability measure (CPM) which is statistically computed and derived from rate of return on assets (ROA) and equity (ROE) as well as net-interest margin (NIM) in order to measure the performance of commercial banks in Malawi. The explanatory variables include inflation, bank’s concentration ratio, total banks deposits and cost-to-income ratio. In an attempt to examine the performance of commercial banks in Malawi, the study uses a time series analysis of Malawi’s data from 1990 to 2020. The proceeding chapters are organized such that chapter 2 includes a review of existing literature, chapter 3 provides data and estimation methods, chapter 4 gives model estimation results and chapter 5 and 6 provides policy implications and conclusions respectively.

LITERATURE REVIEW

Many studies in the banking and financial sector have been conducted to test the SCP hypothesis. Various papers have investigated the determinants of the structure conduct performance in the banking industry. The findings of this existing literature guided this study in the formulation of its model for data analysis.

In 2003, Chirwa examined the existence of the traditional structure-conduct-performance hypothesis in the Malawian Banking industry. The study used three different models of the profitability of commercial banks measured by return on assets (ROA), return on capital (ROC) and return on equity (ROE). In all specifications, model results showed that concentration was positive and statistically significant at 5% level. Apart from using the three profitability measures in separate linear regressions, his study also employed the two-step Engle-Granger cointegration procedure. This study, on the other hand, differs in the sense that it employs the bounds cointegration procedure and uses a Composite Profitability Measure (CPM) computed using the statistical principal component analysis technique, instead of three different model specifications on each profitability index.

In 2014, Lipunga examined the determining factors of four commercial banks performance in Malawi during the period from 2009 to 2012. The study employed correlation and multivariate regression analysis. He observed that bank-specific factors such as bank size and management efficiency positively influence the profitability of banks which he measured using ROA. This implies that his study validated the existence of both the collusion and efficient market hypotheses in the Malawian banking sector. Mkandawire (2016) equally analyzed the determinants of four commercial banks in Malawi by employing a balanced panel of annual bank-specific and macroeconomic series between 2007 and 2015. The estimated results revealed that banks profitability performance is largely affected by the quality of assets and human resources as well as diversification of income sources.

Kaluwa and Chirwa (2017), investigated the nature of competitiveness among banks in Malawi using monthly data from January 2005 to March 2014. The estimated model was based on non-random sample of 6 out of 11 licensed banks and the Lerner model was estimated as a random effect censored Tobit whereas the spreads model used the feasible generalized least squares (FGLS). Statistical results for both the Spreads and Lerner models revealed the existence of a positive relationship between monopoly power and market share and that market structures negatively influences monopoly power. They argued that dominant firm pricing-leadership collusion phenomenon has been a major driver of limited competitiveness of the banking industry in Malawi.

Using a 19-year panel data, Gupta and Mahakud (2020), investigated the determining factors of the profitability performance of 64 commercial banks in India. The study used fixed effects estimation model and Generalized Methods of Moments (GMM) with NIM, ROA, ROE and the ratio of pre-provision profits as profitability performance indicators. The study results showed public and private limited banks are more profitable than public sector banks. Measuring efficiency using bank size, the efficient market hypothesis was undoubtedly validated in the Indian Banking industry. Similarly, Osuagwu (2014)examined the profitability performance of commercial banks using a panel of 60% of banks in terms of ownership of assets in Nigeria. With market concentration significant and positive on ROA, ROE and NIM, the study revealed the existence of the SCP hypothesis in the Nigerian banking sector.

Evidence from literature shows that ROA, ROE and NIM are the most commonly used commercial banks profitability performance measures. Some studies used ROA only (Al-Harbi, 2020;Trujillo-Ponce, 2013), others used NIM only (Al-Harbi, 2019; Ho and Saunders, 1981; Saunders et al., 2000). But most studies used all profitability measures in separate models (Gupta and Mahakud, 2020; Chirwa, 2003; Alharthi, 2016;Mkandawire, 206; Seemule et al., 2017; Mbekomize and Mapharing, 2017; Gaber, 2018; Ferrouhi, 2018). Other than using one, two or three different models for each profitability measure, this study employs a composite profitability measure (CPM) which merges ROA, ROE and NIM into one indicator without tampering with the properties of individual variables. The CPM has been computed using the statistical principal component analysis technique.

DATA AND ESTIMATION METHODS

Variable analysis

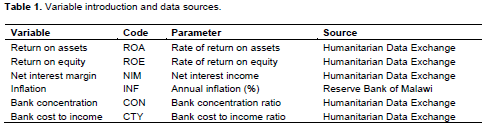

This country specific study employed Malawi’s annual data from 1990 to 2020 in order to establish interactions among the variables. This study computed the Composite Profitability Measure (CPM) which combined ROE, NIM and ROA into a single value each year. The series for these independent variables were obtained from the Humanitarian Data Exchange database. Table 1 summarizes all dependent and independent variables, where;

ROA: this commercial banks’ profitability indicator is a measure of the income generated from banks’ assets. This implies that this indicator is helpful in determining how banks employ their available resources to generate income. It is computed by dividing the company’s net income after tax over its own assets. The higher the ROA number, the better the performance since commercial banks will be earning more money on less investments.

ROE – unlike ROA, this indicator is a measure of profit in form of a proportional gain on shareholder’s equity. That is, ROE financial ratio is used to identify commercial banks’ administrative efficiency in the use of shareholders’ investments. The greater the ROE value, the higher the chances that investors will be attracted to invest as it implies a better profitability performance of the company. Since higher ROE is desirable in attracting investors, managers commonly use monetary controls in order to achieve a higher ROE and gain market competitiveness in the industry (Jumar et al, 2020). The indicator is computed by dividing investors’ equity into company’s profit after tax.

NIM: NIM is another profitability proxy measure. It is an indicator that is used to compare investments’ decisions to debt situation in a bank. Other scholars describe NIM as the net yield on interest earning assets since it is used to track and assess whether investments and lending activities of a bank are profitable or not. Profitability of a bank is determined by a positive NIM whereas a negative NIM signifies investment inefficiencies. The indicator is computed by subtracting interest expenses from interest incomes.

CPM: Composite profitability performance measure has been computed using the principal component analysis (PCA) from ROA, ROE and NIM. The PCA method gives smaller values of a larger dataset without compromising with the meaning and interpretations of the original data series.

INFL: inflation is an important macroeconomic factor which reflects a reduction in the purchasing power of a currency in a country. When there is an increase in inflation, each unit of currency purchases fewer goods and services than before (Jeng et al., 2018). Intuitively, high inflation leads to an increase in demand for money in an economy thereby giving commercial banks the prospect of higher returns due to increased transactions. However, some studies yielded an inverse interaction between banks profitability and inflation (Gupta and Mahakud, 2020; Ayaydin and Karakaya, 2014).

CON: Concentration ratio is a measure of the financial structure. The aim of aim of the study is to measure how a 5-bank concentration ratio affects banks performance in Malawi. The hypothesis is such that the greater the concentration ratio, the greater the percentage of total banking assets are owned by few banks and hence the less the competition in the banking sector. High concentration ratio is an evidence that ownership of assets in the banking sector of a country is dominated by few banks leading to monopolistic abnormal profits. On the other hand, a low concentration ratio simply means that the major banks control a low proportion of assets and that minor banks are fairly competitive.

CTY: CTY denotes the ratio of cost-to-income which is a measure of the expenses incurred in running the banks compared to their operating income. It is computed by dividing all operating expenses by the overall generated income. That is, net interest income plus all other incomes. Cost-to-income ratio can be very significant to commercial banks’ profitability performance. The a priori expectation is an inverse relationship, such that the lower the CTY, the higher the profitability.

BDEP: total commercial banks deposit s used as a proxy to the size of the market. It measures total market deposits in the banking sector as a proportion of GDP. The assumption is that entry of new firms is relatively easy in larger markets that smaller markets. There is no definite hypothesis for the direction of causality between bank size and profitability. One may argue that customers in a larger market tend to be highly complicated in their decisions due to a wide range of choices. For instance, Evanoff and Fortier (1988) contended that if the size of the market results in a decrease in the profitability of commercial banks, managers may proportionately offset the scenario if they accommodate riskier portfolios which usually yield higher profits. On the other hand, increase in bank deposits implies the availability of more funds for banks investment diversification in order to increase profitability.

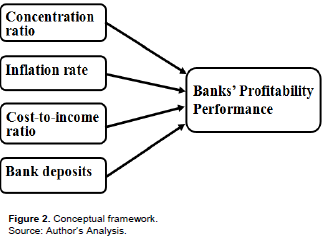

Conceptual framework

The study adopted the framework used by Jeng et al. (2018) with only a difference in the variables used as well as data estimation technique. This is shown in Figure 2, where commercial bank’s performance is measured by a computed composite index of ROA, ROE and NIM.

Research hypotheses

1. The collusion hypothesis does not exist in the Malawian banking industry.

2. The efficient market hypothesis does not exist in Malawi.

Methodology

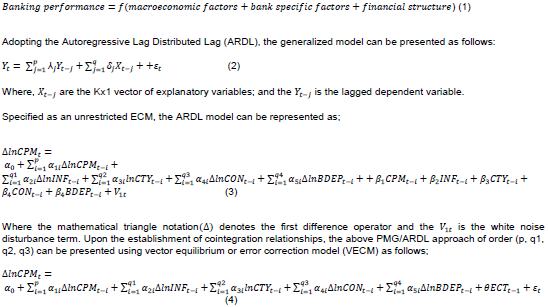

The model specification for this study was adopted from Ozili (2019) as shown in a linear functional form below:

Where ? represents the model’s speed of adjustment parameter while the ECT denotes the error correction term. The sign of the coefficient is expected to be negative and statistically significant as a confirmation of the existence of a cointegration relationship. The ARDL model uses generalized likelihood estimation method whose lag length is obtained from various information criteria such as AIC and SBIC.

EMPIRICAL RESULTS AND DISCUSSION

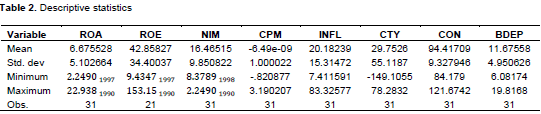

Descriptive statistics

The reported summary result in Table 2 indicates that Malawian banks are fairly profitable, with all banks registering an average increase of 6.7% over the 31 years of study. Earnings from shareholder investments also show fair efficiency with an average value of 16.47%. On the other hand, interest earnings from loans relative to interest paid on deposits show a positive and good value of 20.18%. The cost-to-income ratio shows an average of 29.75 which means commercial banks in Malawi need relatively small operating costs to generate income, but the maximum value was too high at 78.28% in 1997. Inflation in Malawi is very high averaging 20.18%. It also shows that the banking sector’s share of assets is dominated by the largest three banks with an average value of 94.41%, while, total bank deposits averaged 11.67558 for the entire period of the study.

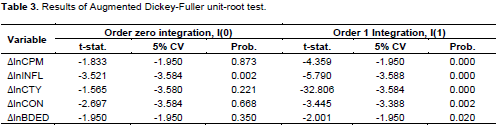

Stationarity tests

One of the most critical requirements of time analyses is that data must be free from unit root. Data with unit roots lead to persistent shocks and spurious regressions such that the forecast of such studies cannot be relied for policy formulations.

Unit root test results indicate that the null hypothesis that the natural logs of all variables are stationary in level is rejected at 5%. But we fail to reject the same after taking first difference. Therefore, we conclude that all variables are stationary of order one, I(1). This makes it appropriate to employ ARDL model as it requires series not integrated of higher order beyond one (Pesaran, et al, 2001).

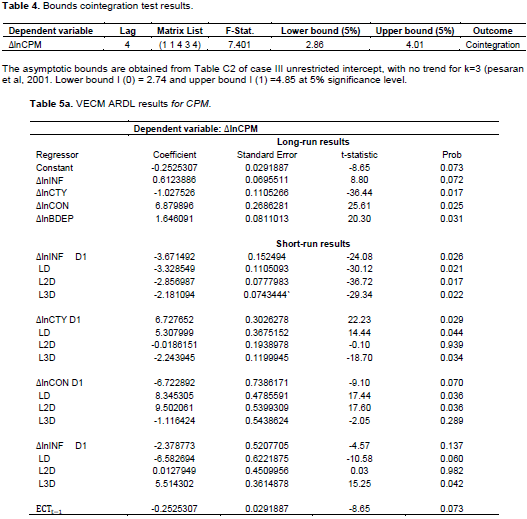

Bounds cointegration tests

In order to defrost the ARDL VECM linear equation, the study employed AIC as a guide with a maximum lag order of 4. Table 3 presents the results of the calculated F-statistics for the dependent variable of the study in the ARDL OLS regression.

When the regression is normalized on Commercial Banks’ Composite Profitability Measure (CPM), the calculated F-statistic neither falls below the lower bound nor between the two bounds. It is desirably above the upper bound critical values. This implies the existence of a long run interaction among all model variables. The optimum lag length of 4 is obtained from the Akaike Information Criteria (AIC).

Error correction model (long-run) estimation results

Following the establishment of a long-run interaction among the variables, the vector error correction model based on equation (4) was estimated with CPM as the dependent variable of the study. The long run absolute values of the t-statistics for all the dependent values are higher than 2. This implies that all the independent variables are statistically significant and influence the composite profitability performance of commercial banks in Malawi. Consistent with Lipunga (2014)’s results in the same study area, inflation is statistically significant and the estimated coefficients of the long run results depict a positive sign. There are many studies that also reveal a positive relationship between inflation and banks performance (Flamini et at., 2009; Trujillo-Ponce, 2013; Batten and Vo, 2019). The reason for inflation’s positive influence on banks performance is not far-fetched; inflation results in an increase in household demand for money due to decrease in the purshing power of a currency. Consequently, banks wil make a greater percentage of profits in relation to their overall resources as transactions with bank services consumers increases.

On the other hand, the long run coefficient of cost-to-income ratio indicates an inverse relationship with banks performance and is highly significant at 5% level. As per a priori expectation, we are 95% confident to conclude that cost-to-income negatively influences commercial bank’s profitbility performance in Malawi, such that a one-unit decrease in the the cost-to-income ratio results in a 4.028-point increase in commercial banks’ profitability performance in Malawi. That is, as long as keeping costs low is not a result of sacrificing innovation and growth of banks through the construction of more branches, planting of more ATMs, adoption of new technology, employing highly skilled managers as well as training workers among others, then an increase commercial banks’ profitability should be the outcome. This is called productive efficiency of a firm.

Commercial banks’ total deposit as a percentage of GDP (BDEP) is positive and statistically significant at 5% level. The coefficient indicates that a one unit increase in the size of existing commercial banks results in a 1.646-point increase in the profitability performance of commercial banks. In line with the a priori hypothesis, an increase in bank deposit (bank size) may provide enough capital for diversification portifolios thereby iincreasing profits (Lipunga, 2014). Though, sometimes an increase in total bank deposits may act as an indicator of profitability thereby attracting new entrants into the industry. In that case, then a negative relationship to profitbility performance may be observed.

Furthermore, the coefficient for concentration ratio is positive and significant at 5% level such that a one unit increase in commercial bank’s concentration results in a 6.88 increase in commercial banks’ profitability performance in Malawi. An increase in concentration ratio, simply means a proportion tilt of ownership of assets towards the largest five banks. The results, therefore, indicate that as the largest banks accumulate more wealth, the profitability performance of all banks increases. Just like Chirwa (2003), this indicates the existence of the structure-conduct-performance hypothesis in Malawi.

Short-run model estimation results

The estimated coefficients of the short-run results indicate that inflation is statistically significant and negative at all four lags. Minimally, a one unit increase in the average price level in Malawi results into a 2.18 decrease in commercial banks’ profitability performance in the short run. Intuitively, higher average prices can only force people to use their savings in the short-run such that banks’ profitability via net interest margin will not improve due to inflation. Unlike in the long run where households may have run out of their savings, demand for money from banks will increase such that via net interest margin and user charges from increased bank transactions, commercial banks’ profitability performance increases.

The coefficients of the first two lags of cost-to-income ratio depict a positive relationship and are statistically significant at 5% level. For example, the coefficients of the first lag indicate that a one unit increase in cost-to-income ratio results into a 6.7 unit increase in the profitability performance of commercial banks. The short-run objective of commercial banks is to increase sales or market share irrespective of the costs. In fact, the elasticity of demand for banking services is very low in Malawi due to limitedness of commercial banks. Therefore, it is worthwhile of a commercial bank to fork out huge chunks of finance for advertisement, promotions and low interest rate loans in order to attract customers who will be loyal over a long period of time.

Similarly, the second two lags of concentration ratio are positive and statistically significant. It is not surprising that an increase in concentration ratio yields an increase in the profitability of commercial banks because there are a limited number of banks in Malawi and only few have a long history of operations in the country. The fourth lag of total bank deposits is also statistically positive at 5% level. This implies that the growth of the size of commercial banks is hugely dependent on deposits for their capital and operations.

The equilibrium error correction coefficient (ECT) estimate for ROA, ROE and NIM of -0.7739, -0.9530 and -1.218 are significant with the right sign. This indicates a rapid speed of adjustment back to equilibrium after market shocks (supply or demand side). Approximately 77, 95 and 121% of disequilibrias retrun to the long run equilibrium at present time.

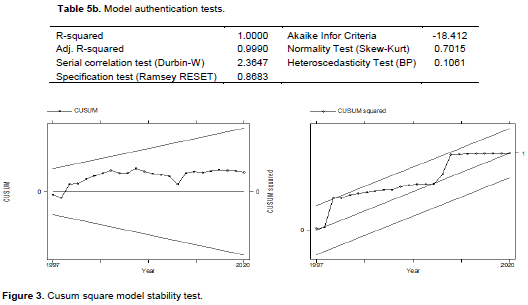

Table 4 presents probabilities for time series properties and other tests. The Durbin-Watson (D-W) test, Skewness Kurtosis (SK) test, Breusch Pagan (B-P) and Ramsey RESET were used to test for autocorrelation, normality, heteroscedasticity and model specification respectively. Since all the probabilities are greater than 0.05, we fail to reject the null hypothesis for each and conclude that the model does not have the problem of heteroscedasticity, no autocorrelation, no misspecification and residuals are multivariate normal. R-squared shows that the model has accommodated a maximum number of variables 100% with respect to the short observations (31 years) of the study. On the other hand, adjusted R-squared shows that 99% of the included variables are explained by the model (Tables 5a and 5b). In addition, the Cusum Square test was used to test for the stability of the model and Figure 3 shows that the model is desirably stable as the series lies inside the 5% bound throughout the study period.

Block Exogeneity Wald tests

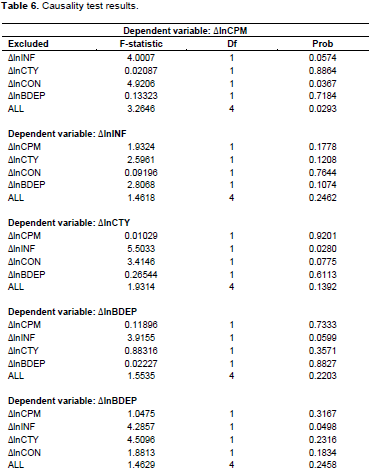

Causality test was conducted among the dependent variables of the study model so as to determine the direction of causality between the various determinants of commercial banks performance. Table 6 presents Block Exogeneity Wald tests results (VEC Granger):

When the model is normalized on the composite performance measure (CPM), only inflation and bank concentration ratio granger cause profitability performance (CPM). However, when all excluded variables are taken together, the probability is found to be statistically significant such that we conclude that inflation, cost-to-income ratio, concentration ratio and total bank deposit granger causes commercial banks’ performance.

The results also show that inflation granger causes cost-to-income ratio, concentration and total bank deposits. This is concurrent to the common hypothesis that inflation leads to an increase in the cost of operation for firms, such that even banks will face an increase in cost relative to income during an inflationary period. Inflation granger causes banks’ concentration ratio in the sense that a persistence rise in prices may prevent new entrants into the industry. This is because besides creating a situation full of uncertainties, the planned investment budget for potential investors in the industry will keep on changing. It is not unfathomable that inflation also granger causes bank deposits as higher inflation leads to an increase in demand for money in an economy. Many people lose their jobs as some companies fail to cope up, people start withdrawing their savings thereby decreasing bank deposits. Apart from these, there exists no any other granger causality among the variables.

Policy implications

The banking sector in Malawi is determined by macroeconomic, bank-specific and financial structure factors such as inflation, cost-to-income ratio, bank concentration ratio and total bank deposits. The Block exogeneity test results revealed a unidirectional causality relationship of all determinants of commercial banks towards its profitability performance. Inflation, cost-to-income and total bank deposits indicate a positive influence on profitability. Therefore, the reserve bank should lower the cash reserve ratio to allow banks have more cash to meet the surge in demand for money during an inflationary period. This is consistent with the findings of Mkandawire (2016) who observed that commercial banks thrive well during periods of high inflationary pressures. This could presumably be due to high interest rates as the central bank tightens monetary policy in an effort to combat inflation. Other studies have also found a positive long run relationship between inflation and commercial bank’s performance (Bourke, 1989; Moulyneux and Thornton, 1992; Demirgüç-Kunt and Huizinga, 1998).

Since an decrease in cost to income ratio results in an increase in commercial banks’ performance, it implies the need for banks to efficiently reduce their expenditure but without sacrificing education and trainings, opening of more branches, research and development, acquisition of more ATMs and other tools, equipment and advanced technology that directly benefits consumers in the long run. On the other hand, the estimated results indicate that the size of banks is highly dependent on deposits. Therefore, banks need to initiate superfluously attractive saving schemes to induce the savings culture in a developing country like Malawi where most people live from hand to mouth. Furthermore, the long run results indicate that bank concentration is positive and statistically significant. This implies that it is worthwhile to increase concentration whether through subsidies or privatization.

CONCLUSION

This paper analysed the determinants of commercial bank’s performance in the category of macroeconomic factors, bank-specific factors and financial structure factors. The study used an autoregressive distributed lag (ARDL) approach for a period between 1990 to 2020. The results reveal that inflation has a positive influence on commercial banks’ performance in the long run but a negative relationship in the short-run. On the other hand, cost-to-income ratio, concentration ratio and total bank deposits have a positive influence on commercial banks’ performance. Tables 6 and 7 provides a summary verdit on the two research hypothesis.

To this end, the study suggests that the Reserve Bank as the main regulatory authority of the financial sector in Malawi is responsible for enhancing the performance of commercial banks. For example, during an inflationary period, they may lower the cash reserve ratio. This implies that commercial banks will have more cash to meet the sudden increase in demand for money. Furthermore, the papers suggests that commercial banks should not focus on keeping costs low in an economy that is far from full productive potential with many potential areas of improvement. Rather they should focus on effective projects like innovation and growth. Further, it has been shown that each bank is responsible for its deposits and incentive can be put in place to induce the savings culture among its customers.

CONFLICT OF INTERESTS

The author has not declared any conflict of interests.

REFERENCES

|

Al-Harbi A (2019). The determinants of convectional banks profitability in developing and underdeveloped OIC countries. Journal of Economics, Finance and Administrative Science 24(47):4-28. |

|

|

Al-Harbi A (2020). The Determinants of the Rate of Return on Deposits in Islamic Banks. Journal of Finance and Islamic Banking 2(2):4-28. |

|

|

Alharthi M (2016). Determinants of profit ability in banking: an international comparative study of islamic, conventional and socially responsible banks. Corporate Ownership and Control 13(4):627-639. |

|

|

Ayaydin H, Karakaya A (2014). The Effect of Bank Capital on Profitability and Risk in Turkish Banking. International Journal of Business and Social Science 5(1):252-271. |

|

|

Batten J, Vo XV (2019). Determinants of Bank Profitability-Evidence from Vietnam. Emerging Markets Finance and Trade 55(6):1417-1428. |

|

|

Bourke P (1989). Concentration and Other Determinants of Bank Profitability in Europe, North America and Australia. Journal of Banking and Finance 13(1):65-79. |

|

|

Chirwa EW (2003). Determinants of commercial bank's profitability in Malawi: a cointegration approach. Applied Financial Economics 13(8):565-571. |

|

|

Demirgüç-Kunt A, Huizinga (1998). Determinants of Commercial Bank Interest Margins and Profitability: Some International Evidence. World Bank Economic Review 13(2):379-408. |

|

|

Demsetz H (1973). Industry Structure, Market Rivalry, and Public Policy." The Journal of Law and Economics [University of Chicago Press, Booth School of Business, University of Chicago, University of Chicago Law School] 16(1):1-9. |

|

|

Edwards S, Allan AJ, Shaik S (2006). Market Structure Conduct performance (SCP) hypothesis revisted using Stochastic Frontier Efficiency Analysis. Presented at the American Agricultural Economics Association Annual Meeting. Long Beach, California, July 23-26, 2006. |

|

|

Ferrouhi EM (2018). Determinants of banks' profitability and performance: an overview. Munich Personal RePEc Archive (MPRA). MPRA Paper No. 89470. |

|

|

Flamini V, Schumacher ML, McDonald MCA (2009). The determinants of commercial bank profitability in Sub-Saharan Africa 2009(015). IMF Working paper WP/09/15. |

|

|

Gaber A (2018). Munich Personal RePEc Archive Determinants of Banking Sector Profitability: Empirical Evidence from Palestine. International Journal of Economics and Finance 8(2):117-128. |

|

|

Gupta N, Mahakud J (2020). Ownership, bank size, capitalization and bank performance: Evidence from India. Cogent Economics and Finance 8(1):1-39. |

|

|

Ho TSY, Saunders A (1981). The Determinants of Bank Interest Margins: Theory and Empirical Evidence. The Journal of Financial and Quantitative Analysis 16(4):581-600. |

|

|

Jeng LW, Ramasamy S, Rasiah D, Yen PYY, Pillay SD (2018). Determinants of local commercial bank's performance in Malaysia. International Journal of Engineering and Technology 7(3):457-463. |

|

|

Kaluwa B, Chirwa GC (2017). Competition, regulation and banking industry pricing conduct in Malawi. African Review of Economics and Finance 9(2):3-17. |

|

|

KPMG (2017). Malawi Economic Snapshot H2, 2017: Trade and investment SWOT. Swiss, KPMG International Cooperative. |

|

|

Lipunga AM (2014). Determinants of profitability of listed commercial banks in Developing Countries: Evidence from Malawi. Research Journal of Finance and Accounting 5(6):41-49. |

|

|

Mbekomize CJ, Mapharing M (2017). Analysis of Determinants of Profitability of Commercial Banks in Botswana. International Journal of Academic Research in Accounting, Finance and Management Sciences 7(2):131-144. |

|

|

Mkandawire PM (2016). An analysis of the determinants of bank performance in Malawi: A case of listed commercial banks. MPRA Paper No. 92392. |

|

|

Moulyneux P, Thornton J (1992). Determinants of European Bank Profitability: A Note. Journal of Banking and Finance 16(6):1173-1178. |

|

|

Osuagwu ES (2014). Determinants of Bank Profitability in Nigeria. International Journal of Economics and Finance 6(12):46-63. |

|

|

Ozili PK (2018). Banking stability determinants in Africa. International Journal of Managerial Finance 14(4):462-483. |

|

|

Ozili PK (2019). Determinants of Banking Stability in Nigeria. MPRA Paper No. 94092. |

|

|

Pesaran MH, Shin Y, Smith RJ (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics 16(3):289-326. |

|

|

Peltzman S (1977). The Gains and Losses from Industrial Concentration (1977). NBER Working Paper No. w0163. |

|

|

Saunders A, Schumacher L, Schiff JM (2000). The determinants of bank interest rate margins: An international study. Journal of International Money and Finance 19(6):813-832. |

|

|

Seemule M, Sinha N, Ndlovu T (2017). Determinants of Commercial Banks' Profitability in Botswana: An Empirical Analysis. IUP Journal of Bank Management 16(2):7-28. |

|

|

Tan Y (2016). Efficiency and Competition in Chinese Banking, Efficiency and Competition in Chinese Banking. Elsevier Inc. doi: 10.1016/C2014-0-00976-8. |

|

|

Trujillo-Ponce A (2013). What determines the profitability of banks? Evidence from Spain. Accounting and Finance 53(2):561-586. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0