ABSTRACT

The research used vector autoregressive (VAR) and the vector error correction mechanism (VECM) technique to see whether disaggregated manufacturing sectors had any effect on Nigeria's economic growth over the last 49 years (1970-2018). The productivity of the oil refining subsector is an effective tool for economic growth, according to empirical findings; the coefficient is positive and meaningful in the short run and insignificant in the long run. A further review of the findings reveals that the other sub-sector identified as M3 in the study plays an important role in Nigeria's long-term economic growth, with variance decomposition results indicating positive fluctuations. The study recommends that the manufacturing sector must be acknowledged not only as a promoter for wealth creation, poverty alleviation, and employment generation but as a major sector for enhancing economic growth

Key words: Manufacturing, oil refining, vector error correction mechanism (VECM), Nigeria.

The mechanism that drives economic growth has been discussed for a long time by economists in the last two decades. According to Libanio and Moro (2009), “a revived interest on this topic arose with the upsurge of ‘new growth’ (or ‘endogenous’ growth) models, after Romer (1986, 1990) and Lucas (1988)”. In comparison to neoclassical growth models, one of the key features of this "new" approach is the importance of increasing returns to scale.

Nigeria's economic growth since 1970 has not been broad-based and also, not delivered significant poverty and unemployment reduction. GDP growth rate reduced from 25% in 1970 to 0.85 in 2017; despite the policies introduced, the unemployment rate moved from 4.8% to 18.8% in the same period (CBN, 2018). By the year 2015 before the economic recession, the unemployment and underemployment rate had reached a peak of 29%. In the same year, life expectancy was 53.1, lower than those of Brazil (74.7) and Ghana (61.5). In addition, 46% of the country's population lived below the poverty line, according to the World Bank's Human Development Indicators (HDI) report (NESG, 2018).

The above development could be attributed to failure to achieve inclusiveness and the pattern and dynamics of economic growth in the past four decades. The pattern can be simply explained by the phrase ‘service led growth’. Data from the CBN (2018) show that, from 1999 to 2018, the services sector contributed 57.3% to real GDP growth. This growth was led by key sub-sectors such as trade, telecoms, real estate, and financial services. The production sector such as manufacturing only accounted for 8.6% of overall growth during the same period. The growing service sector and rising unemployment suggest that value addition in the service sector is low, relative to the production sector.

Manufacturing has the characteristics that make it the engine of growth, according to Kaldor (1966), as stated by Penélope and Thirlwall (2013), for two main reasons. To begin with, manufacturing has rising returns, both static and dynamic, while land-based activities and petty services have declining returns. Second, as the manufacturing sector grows and employs more people.

According to NESG (2018), the Herfindahl-Hirschman Index of 2,646 (HHI) reveals that Nigeria's manufacturing sector is weak, less competitive, and highly concentrated. A market with an HHI of less than 1,500 is regarded as a competitive marketplace; an HHI of 1,500 to 2,500 is a moderately concentrated marketplace, and a market with an HHI of 2,500 or greater to be a highly concentrated marketplace (Hayes, 2021). This development has caused competitive industries to relocate their factories abroad like Dunlop and Michelin. However, a few key industries such as beverages, textiles, cement, and tobacco kept the sector afloat but operated below half their capacity. The manufacturing GDP data from CBN (2018) show that, between 1981 and 2018, only three out of thirteen sub-sectors contributed 78.6% to its overall output. These three sectors include food, beverage and tobacco (56.4%), textile, apparel, and footwear (16%), and cement (6.2%). The remaining 21.39% is shared among wood and wood products; pulp paper and paper products; chemical and pharmaceutical products; non-metallic products, plastic, and rubber products; electrical and electronic, basic metal and iron and steel; motor vehicles and assembly including other manufacturing (NESG, 2018).

It is important to assess the manufacturing sector's output in Nigeria. This will help determine the relative efficiency of the sub-sectors. Knowing the relative efficiency of manufacturing sub-sectors in terms of economic growth could help the government plan its programs and policies, especially in terms of determining which industries should be prioritized.

The remainder of the study is organized as follows: Section two discusses relevant literature and information on the manufacturing sector and economic growth, Section three outlines the methodology, Section four focuses on empirical results, section five discusses the findings, and Section six concludes and offers recommendations.

Chukwuedo and Ifere (2017) used an eclectic model that combined Kaldor's first law of growth and the endogenous growth model to examine the relationship between manufacturing production and economic growth in Nigeria from 1981 to 2013. Real gross domestic product, manufacturing production, contract intensive money, gross fixed capital, and labor force are among the study's variables. The study discovered that the manufacturing sector's output, capital, and technology are the most important determinants of Nigeria's economic growth. The findings also revealed that the labor force and the efficiency of institutions had little impact on economic development. Emmanuel and Saliu (2017) used the ordinary least square (OLS) methodology to examine the effect of the manufacturing sector on economic growth in Nigeria from 1981 to 2015. In the investigation of manufacturing output, government expenditure, investment rate, and money supply, the report used the following variables as the dependent and independent variables: gross domestic product, manufacturing output, government expenditure, investment rate, and money supply.

The study discovered that the output of the manufacturing sector, capital, and technology are the key determinants of economic growth in Nigeria. The results also showed that the labour force and quality of institutions do not influence economic growth in the economy. Emmanuel and Saliu (2017) investigated the impact of the manufacturing sector on economic growth in Nigeria for the period 1981-2015 by employing the ordinary least square (OLS) technique. The study utilized the following variables such as gross domestic product as the dependent variable while the independent variables include manufacturing productivity, government expenditure, investment rate, and money supply in the investigation of the impact of the manufacturing sector on the Nigerian economic growth. The findings revealed that manufacturing productivity has a positive impact on Nigeria's economic growth. Chemical, physical, and psychosocial hazards are among the major hazards confronting Nigeria's manufacturing sector, according to the findings.

Szirmai and Verspagen (2015) used manufacturing value added (MVA) as an indicator for manufacturing production to re-examine the role of manufacturing as a growth factor in developed and emerging economies from 1950 to 2005. MVA has a fair positive impact on economic growth, according to their findings. Using Ordinary Least Square (OLS) regression, Obioma et al. (2015) looked at the impact of industrial development on Nigeria's economic growth from 1973 to 2013. GDP, manufacturing production, overall savings, foreign direct investment, and inflation rate were the variables they looked at. The study concluded that the impact of industrial production on economic growth is not statistically important, and it is recommended that the government and its agencies ensure political stability as well as implement strategic policies that will provide a level playing field for foreign investors, thereby improving the establishment of industries, especially manufacturing industries.

From a Kaldorian viewpoint, Rioba (2014) investigated the importance of the manufacturing industry for Kenya's economic growth. The research used time-series data from 1971 to 2013. Manufacturing output growth rate, non-manufacturing output growth rate, and manufacturing employment growth rate were used as dependent variables in the analysis. The data were analyzed using the traditional least square method. According to the study, there is a positive relationship between manufacturing production and economic growth in Kenya, but it is insufficient to spur increased growth.

Adugna (2014) used the Kaldorian method to investigate the effect of the manufacturing sector on Ethiopian economic growth. The research used time series data from 1980 to 2010. The dependent variable was real gross domestic product (RGDP), and the independent variables were manufacturing sector production (MF), manufacturing number of employment (EMP), and manufacturing sector labor productivity (LPDRT). Both descriptive (ratio and percentage) and econometric (double log multiple regression analysis) methods were used to analyze the data. According to the research, a unit shift in the manufacturing sector boosts economic growth by 42 percent. That is, increased manufacturing sector growth can have a variety of effects on the national economy.

Inakwu (2013) investigated the effect of Nigeria's manufacturing sector on economic growth. Time series data from 1980 to 2008 were used in the research. The impact of manufacturing output (MANGDP), investment (INVEST), government expenditure (GOVEXP), and money supply (M2) and the log of real Gross Domestic Product was examined in this report (LRGDP). The data were analyzed using the traditional least square method. The findings suggest that manufacturing and economic growth have a positive and important relationship during the study period.

In Nigeria, Obamuyi et al. (2012) looked into the relationship between bank lending, economic growth, and manufacturing production. The research used time series data spanning the years 1973 to 2009. Manufacturing production (MOT) was used as the dependent variable, with Bank Lending (BLD), Lagged Value of Manufacturing (LVM), Inflation Rate (INFL), Maximum Lending Rate (MLR), Capacity Utilization (CAPU), Financial Deepening (FDP), Exchange Rate (EXR), and GDP as the independent variables. Co-integration and vector error correction model (VECM) techniques were used to analyze the results. The study's findings show that in Nigeria, manufacturing capacity utilization and bank lending rates have a major impact on manufacturing production. The nation, however, was unable to create a link between manufacturing production and economic growth. According to the report, government should make a concerted effort to review manufacturers' and lending institutions' lending and growth policies, as well as provide an effective macroeconomic climate to promote investment-friendly lending and lending by financial institutions.

Facts on Nigeria's manufacturing sector and economic growth

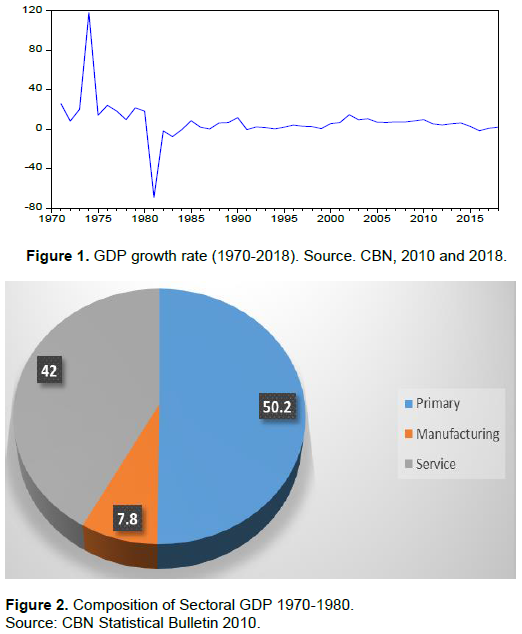

With the exception of 1975 and 1978, the Nigerian economy grew steadily in the second decade of independence (Figure 1). Between 1970 and 1980, real gross domestic product (GDP) grew at a rate of 6.7 percent per year. However, negative growth emerged in the early 1980s, but this was reversed with the introduction of SAP, with real GDP growing at a rate of 4% annually from 1988 to 1997. For much of the three decades following the discovery and extraction of oil, annual growth averaged less than 3% (National Population Commission, 2004). The Nigerian economy has recently experienced a significant acceleration in growth, with real GDP rising by 10.4, 6.9, 7.8, and 7.8%, respectively.

Nigeria's economy expanded by just 2.7% in 2015, a far cry from the 6.3 percent growth it experienced in 2014. Growth has been on a downward trend since the drop in oil prices in mid-2014, and the economy has entered a recession. After experiencing negative growth for the first two quarters of 2016, it continued to deteriorate in 2016 (-0.4 percent and -2.1 percent year-on-year in real terms, respectively). GDP contracted by 2.2 percent in the third quarter, owing to a sharp drop in the country's oil production, as well as electricity, fuel, and foreign exchange shortages. Inflation doubled to 18.8% (projected) at the end of 2016, up from 9.6% at the end of 2015. This was mostly due to rises in fuel and electricity prices, as well as the weakening of the Nigerian naira during the year (NESG, 2018).

According to studies by Onakoya (2017), Oburota and Okoi (2017), and Okon and Osesie (2017), Nigeria's manufacturing industries have performed well in the manufacture of products for the country in the last decade. Products are exported to other countries, and Nigerians are increasingly purchasing goods produced in the country. According to the industrial output index, the manufacturing sector grew from 145.9 in 2006 to 152.2 in 2007. The value of 132.6 rose by 0.69 percent over the first half of 1996, but fell by 0.2 percent in the second half of the same year. The increase in production compared to the same time in 1996 was attributed to the increase in mining and manufacturing production by 1.0 and 0.4% respectively.

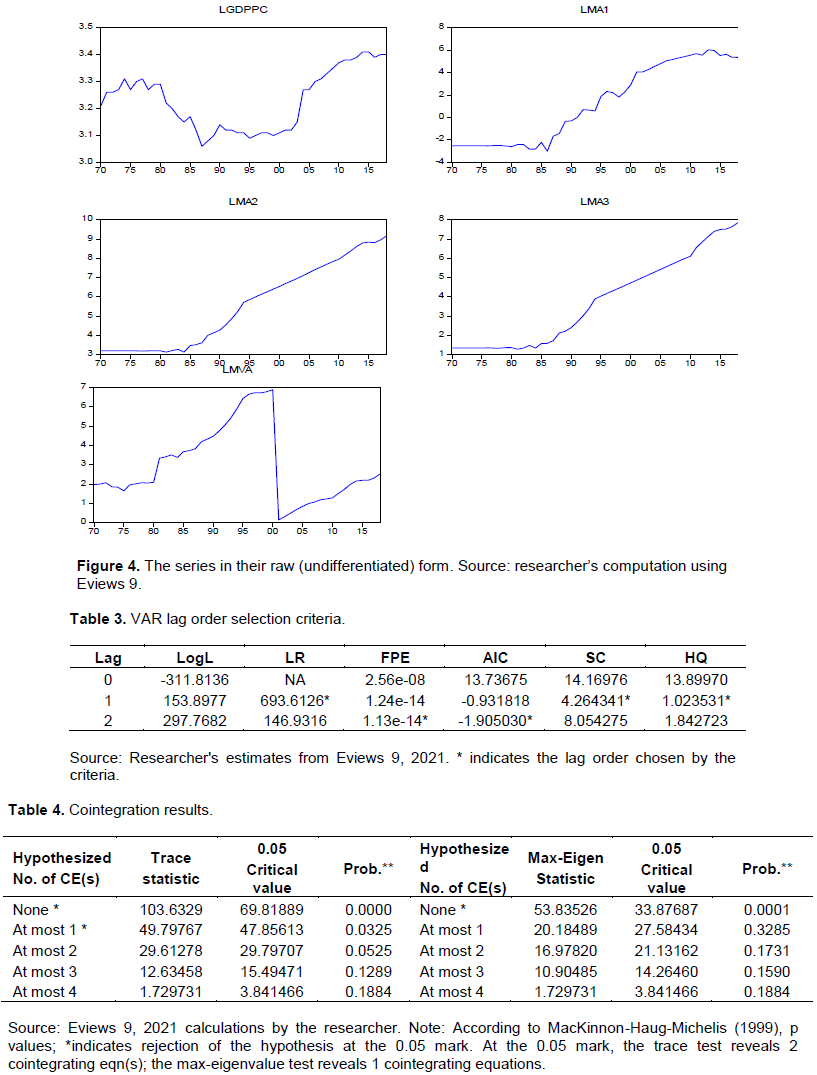

Figure 2 depicts the structure of Nigeria's GDP from 1970 to 1980. It demonstrates the primary sector's supremacy, which includes agriculture, mining, and quarrying (including crude oil and gas). The primary sector contributed roughly 59 percent of GDP in 1970. However, between 1970 and 1980, this share averaged 50.2 percent, reflecting a slow transition from primary to secondary and tertiary operations. The service sector contributed 42%, while manufacturing contributed 7.8% (CBN, 2010).

In Nigeria, the secondary sector, which includes manufacturing and its thirteen sub-sectors, contributes the least to GDP. Figure 2 depicts Nigeria's primary sector's intense dominance in GDP and the manufacturing sector's marginal contribution between 1970 and 1980.

The primary sector contributed 34.2 percent of GDP on average between 1981 and 2018. Despite the fact that the primary sector's contribution to GDP has decreased, it still accounts for more than a third of Nigeria's production. The service sector contributed 57%, while manufacturing contributed 8.8% (CBN, 2018). Due to its relative size and linkage impact, the manufacturing sector is correlated with a higher growth contribution than conventional sectors. As famously stated in Kaldor's (1966) first growth rule, a country's GDP growth is positively linked to the growth of its manufacturing sector.

Data from the CBN (2018) show that a negative growth of the manufacturing sector is associated with a negative growth of the economy. The oil boom era started in 1973 as a result of the embargo placed by the USA on Arab oil, the economy became heavily dependent on oil and the industrial sector also depended on imported inputs, machinery, and raw materials. By this time, oil revenue represented almost 90% of foreign exchange earnings and about 85% of total exports. While the boom afforded the government much-needed revenue, it also created serious structural problems in the economy (NESG, 2018). The exchange rate regime encouraged imports with the economy heavily dependent on imports; almost everything was imported, from toothpicks to toothpaste dispensers. There was no serious attempt to invest the windfall from oil in viable projects. Except for the huge expenditures on education and construction of dual carriage highways in some parts of the country, Nigeria would have had nothing to show from the oil boom era (NESG, 2018). The manufacturing sector's growth increased from 24% in 1973 to 150% in 1974. There markable increase appears misleading and must be interpreted with caution if industrialization is seen to imply the process of developing the capacity of the country to master and locate, within its borders, the industrial production process. The whole industrial production process is the production of raw materials; production of intermediate products for other industries; fabrication of the machines and tools required for the manufacture of the desired products and of other machines and tools; skills to manage factories and to organize production processes (Okon and Osesie 2017).

Declining oil revenues, disequilibrium in the balance of payments, growing unemployment, increasing rate of inflation, and political instability, all confirmed that demand-induced policies were no longer effective. By 1978, a country that had thought that foreign exchange was not a constraint on development went borrowing on the Euro-dollar market. Despite the oil boom, the private sector remained weak. The existing macroeconomic policies continued to encourage consumption rather than production. The economy was consuming what she was not producing. The austerity measures introduced by the military administration under General Olusegun Obasanjo in 1977 were short-lived because structural problems were not addressed.

A sharp fall of 150% growth rate of the manufacturing sector in 1974 to 0.4% in 1975 is believed to contribute to the negative economic growth of 5.2% in 1975. Years that the manufacturing sector experienced negative growth in Nigeria were associated with negative growth of the economy or growth rates that were not more than 3%. The manufacturing sector experienced negative growth rate in 1981 (55.3%), 1983 (33.8%), 1984 (12.8%), 1986 (3.0%), 1992-1995 (3.4%), 1998 (12.3%) and 2016 (9.4%). In all these years, the economy had a negative growth rate (Figure 2).

The study employed the use of secondary data that were mainly sourced from the Central Bank of Nigeria (CBN) Statistical Bulletin of 2010; 2018 and the World Bank. The scope of the study covers the period between 1970 and 2018. All data will be converted into a log-log equation for time series processing. Thus, the coefficient can be interpreted as an elasticity. The variables and their sources are presented in Table 1.

Model specification

To test for the manufacturing sub-sector that mostly drive economic growth in Nigeria, the following equation is specified:

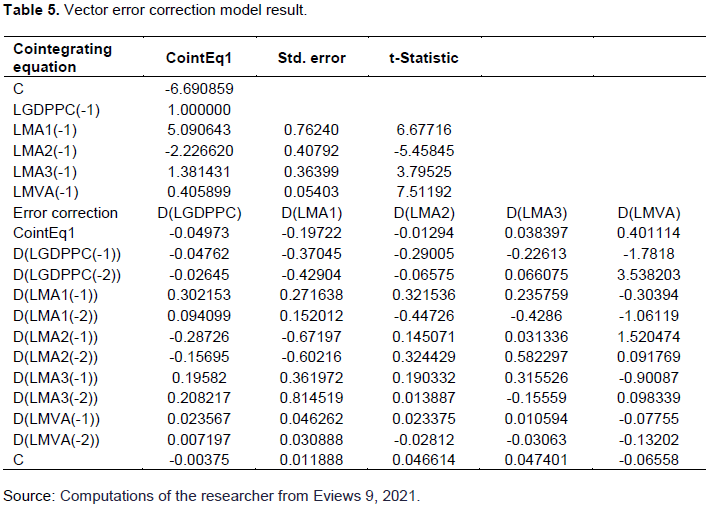

Data in time series also shows rising or declining patterns, as well as fluctuations. As a result, trend analysis is needed before unit root testing in order to determine if the series has a unit root. Trend analysis can be used to see if a sequence is stationary around a constant or if it has a trend that can be used in unit testing. The series exhibit a random walk with drift and pattern, according to the results of the graphic shown in Figure 3. The series are non-stationary since they represent a trend with a pattern of significant fluctuations. This gives the impression that the data series is non-stationary in levels, and that any regressions involving such variables would lead to serious errors in inferences, that is, spurious regression (Greene, 2003).

Stationarity test

We test unit root by first checking the series at level, including a constant, then constant and trend, taking into account the properties of our series. We do, however, have none in order to investigate our series further. We then put the sequence to the test at the first difference. The analysis will use the Augmented Dickey-Fuller (ADF) method to perform unit root tests, which will be validated by the PP test (Ihugba, 2020).

When measured at a level with a constant, constant and trend, or zero, all variables are non-stationary, as indicated by the asterisk. It is concluded that the series are non-stationary at a level since they are not stationary when measured at constant and trend. All variables, however, are stationary at first difference, as shown by the asterisk. As a result, the Phillips–Perron (PP) test validates the ADF test results.

The unit root test of Phillips–Perron

The PP test has an advantage over the ADF test in that it corrects for heteroscedasticity and serial correlation in error terms Ut. PP tests are often based on a serially correlated regression error term and do not entail lag selection. Table 2 shows that the series are non-stationary at level but stationary at first difference, based on the results of the PP test. The variables are depicted in their differenced form in Figure 4. The use of the VAR model for estimation is justified as a result of this result.

Since the trace statistic value is greater than the critical value (103.6329>69.81889) and the likelihood value is less than 5% (P-value = 0.000), the null hypothesis is rejected by trace test statistics (MacKinnon et al., 1999). This result indicates that at least one cointegrating vector exists. The null hypothesis that there are no cointegrating equations is also dismissed based on the Max-Eigen results. Since the Max-Eigen Statistic is greater than the critical value (53.83526> 33.87687), and the likelihood value is less than 5% (P-value = 0.000), this is the case. After we've established that the vectors have a long-term relationship, we'll look at how that relationship came to be.

Estimation of vector error correction model (VECM)

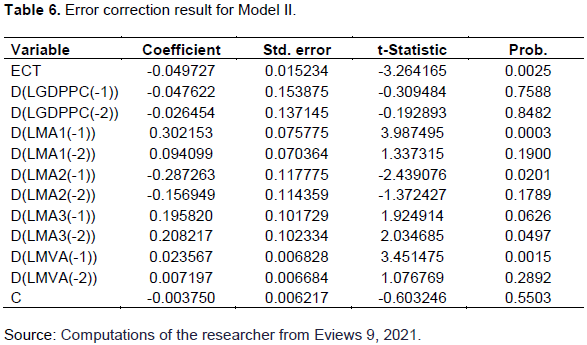

Two Vector Auto-regression Models (VAR and VEC) have been developed using the same variables in an attempt to determine the appropriate model on the empirical relationship between economic growth, disaggregated three sub-components of the manufacturing sector, and manufacturing value-added in Nigeria. The error correction term in the VECM systems method is used to estimate a causal association between endogenous variables. The short-run test results are presented in Table 5.

The error correction term of the target variable is negative (-0.049) and that of LMA1 (-0.197), LMA2 (-0.012), and LMA3 (0.0384). The result of the LGDPPC equation reveals a negative relationship between LGDPPC and its first and second lagged values. A positive relationship is revealed between LGDPPC and the first lagged value of LMA1 including the first lagged values of LMA3 and LMVA. The first and second lag values LMA2 are negatively related to economic growth. This implies that the growth of LMA2 is inimical to the long-run economic growth of Nigeria. The result of the LMA1 equation reveals a positive relationship with its first lagged value and LMA3 and LMVA. This implies that the growth of LMA3 and LMVA is good for the growth of LMA1 (oil refining). LGDPPC and LMA2 are unfavorable to the growth of LMA1 in the long run.

LMA2 which comprises output in cement; food, beverages, tobacco, and textile is positively related with its first and second lag values, LMA1 (-1) and the first and second lag values of LMA3. LMA3 comprises output in apparel and footwear, wood and wood products, pulp paper and paper products, chemical and pharmaceutical products, non-metallic products, plastic and rubber products, electrical and electronic, basic metal and iron and steel; motor vehicles and assembly also show a positive relationship with its first lagged value and the error correction term is positive (0.038) indicating no long-run relationship (Table 5).

In Table 5, VAR has defined and estimated a simultaneous equation using the VECM method. The simultaneous equation calculated under VAR using the VECM method, on the other hand, only provides coefficients, standard deviations, and t-statistics, but no likelihood values. As a result, the simultaneous equation must be estimated as a basis for calculating the effect of manufacturing sub-sectors and manufacturing value-added on Nigerian economic growth. The analysis uses OLS to estimate the simultaneous equation to determine the effect of the explanatory variables on Nigeria's economic growth.

Since the error correction term (ECT) is significant and negative, the results for the error correction term coefficient in Table 6 theoretically indicate a long-run relationship between the dependent variable (economic growth) and the explanatory variables (disaggregated three sub-components of the manufacturing sector and manufacturing sector value-added) for Nigeria in the period 1970-2018. The ECT signifies the frequency at which the long-run and short-run estimates are adjusted for disequilibrium (Engle and Granger, 1987). According to the VECM figures, 0.05 percent of the disequilibrium between long-run and short-run estimates is corrected and brought back to equilibrium on an annual basis. With a p-value of 0.00 at a 1% confidence level and a corresponding standard error of 0.015234, this value is significant.

In line with the Apriori expectation, the log of MA1 (oil refining output) has a positive and important relationship with economic growth. Findings also show that, a 1% rise in LMA1 would result in a 30% increase in LGDPPC. A 1% increase in the second lag of LMA2 (output in cement; fruit, beverages, tobacco, and textile) would reduce economic growth by 29%, and it is significantly linked to economic growth. Economic growth and LMA3 have a positive significant relationship. A 1% rise in LMVA would increase economic growth by 0.02 percent in the long run, according to the first lag of LMVA.

Diagnostic tests

Autocorrelation residual LM test

The Godfrey LM test will support the null hypothesis of no serial autocorrelation for two lags because their p-values are greater than the significance values of 0.05, whereas the null hypothesis of serial autocorrelation will be rejected for one lag because its p-values are less than the significance values of 0.05. As a result, we can assume that there is no serial autocorrelation since the null hypothesis is accepted by the majority of the lags (Table 7).

Stability test

CUSUM and CUSUM – SQ test for stability

Since the CUSUM, CUSUMSQ test statistic, and recursive coefficients are all verified to be within the 5% critical bounds of parameter stability, Figures 5 to 7 shows that there is no instability. This implies we support the null hypothesis and assume that our parameters are stable and, as a result, do not have any misspecification.

We conclude that our equation is true based on these checks.

Residual normality test

The Jarque-Bera statistic of 10.64 with a likelihood of 0.005 shows the null hypothesis is rejected at a 5% significance stage, based on the findings from Figure 9. This demonstrates that residuals are not usually distributed, which is unfavorable. Non-normality in the residuals, according to Harris (1995), is not a concern (Figure 8).

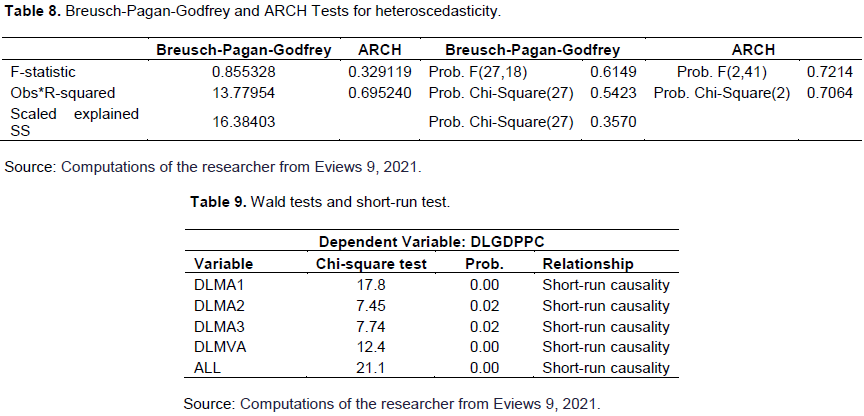

The tests for heteroscedasticity show that the variance is constant. At the 5% critical point, the observed R- square likelihood values for the Breusch-Pagan-Godfrey Test and the ARCH test are not important. As a result, the LGDPPC systems equation is stationary and homoscedastic, making it suitable for economic analysis (Table 8).

Simultaneous equation short-run simulation and Analysis

Table 9 shows the outcomes of the short-run test. The Chi-square joint statistics probability values show that there is a short-run relationship between the explanatory variables and the independent variable. The null hypotheses (H0): β5=0 would be dismissed because the p-value of the chi-square test for the log of MA1 (oil refining output) is equal to 0.00, which is less than 0.05. Thus, LMA1 induces LGDPPC in the short run. The Chi-Square test p-value for LMA2 is 0.02, which is less than 0.05, indicating that the null hypotheses (H0: β2=0) will be dismissed, implying that LMA2 triggers LGDPPC in the short term. As a result, we can deduce that production in cement, food, beverages, tobacco, and textiles has a negative effect on economic growth in the short term.

The null hypothesis (H0): β5=0 will also be rejected for LMA3 because its chi-square test p-value is equal to 0.02 which is less than 0.05. As a result, output in apparel and footwear, wood and wood products, pulp paper and paper products, chemical and pharmaceutical products, non-metallic products, plastic and rubber products, electrical and electronic, basic metal and iron and steel, motor vehicles and assembly will cause economic growth in the short run. Ex-ante forecasting using impulse response and variance decomposition tests is the next step.

Impulse response

As indicated by LGDPPC shocks, the impulse response forecast indicates that Nigeria's future economic growth as a result of oil refining production is optimistic. A one standard deviation positive own shock causes LGDPPC to increase by 0.033 in the short run, but by 0.032 in the long run. LGDPPC will decrease in the short term but increase in the long term as a result of LMA2 innovations.

According to the findings, a one positive standard deviation shock to LMA2 causes LGDPPC to decrease by -0.003, while LGDPPC increases by 0.008 in the long run. Further evidence demonstrates that adjustments to LMA3 would boost LGDPPC in the short and long term. LGDPPC would increase by 0.003 in the short run and by 0.0001 in the long run as a result of a positive standard deviation shock to LMA3 (Table 10).

Variance decomposition

Impulses, innovations, and shocks to economic growth account for 99.5 percent of economic growth variations in the short run. In the long run, however, the economic growth own shock fluctuations fall to 95.5 percent. Meanwhile, in the short-run, shocks to LMA1 account for 0.1 percent of economic growth fluctuations. Economic growth variations due to LMA1 advances rise to 0.2 percent in the long run. Shocks to LMA2 account for 0.2 percent in the short term, and shocks to LMA3 account for 0.2 percent. Shocks to LMA2 account for 0.7 percent in the long run, while shocks to LMA3 account for 1.2 percent (Table 11).

The error correction term coefficient implies a long-run relationship between the dependent and independent variables in theory. According to CBN (2018), oil refining contributed just 4.1 percent to manufacturing output, which may explain why the coefficient of oil refining output (LMA1) is positive and important in the first lag but negligible in the second lag, despite being positive. The sub-sectors' contribution to the manufacturing sector's overall output (4%) indicates that the sub-sector is less sustainable. One of the ten sub-sectors is oil refining.

After accounting for nearly 80% of the manufacturing sector's total output, output in cement, food, beverages, tobacco, and textiles (LMA2) has a negative and negligible relationship with economic growth in its second lag. This demonstrates that LMA2 has been working in extremely unfavorable conditions, including inadequate power (infrastructure), poor transportation, political uncertainty, poverty, lack of financial resources, and corruption. As a result, many textile businesses have failed in the last 20 years. Owing to high energy costs, smuggling of textile products, and limited access to finance, they faced increasing operating costs and weak sales. Several of them have had to lay off employees.

The majority of the factories have ceased production today. According to official report from NESG (2018), the textile industry in Nigeria is currently operating at less than 20% of its production capacity, with a workforce of less than 20,000 people. Furthermore, the cotton-growing industry has ceased to exist, depriving thousands of smallholder farmers of a source of income. Furthermore, we import a substantial portion of our clothing products from China and European countries. This trend indicates that cement, food, beverages, and tobacco account for the bulk of the manufacturing sector's 80 percent contribution.

The manufacturing sector, for example, expanded at an annual rate of 12% on average between 2005 and 2014, owing largely to rising market demand. The key point here is that major changes in LMA1 and LMA3 are yet to be reported. This justifies the need for policy realignment that could aid in the development of the country's indigenous manufacturing technological capability.

Furthermore, the LMA3 coefficient has a negative and important association with economic growth, which contradicts our Apriori expectations. In the short run, the past value of LMA3 does not cause economic growth.

CONCLUSIONS AND RECOMMENDATIONS

Manufacturing sub-sectors have the potential to expand the economy, but policymakers and other stakeholders must recognize the numerous and long-term benefits that the sub-sectors will bring. As a result, the government must close loopholes that have hampered the manufacturing sector's success over the last 49 years, and the Nigerian spirit of entrepreneurship must be reignited. It must upgrade our deteriorating physical infrastructure (electricity, roads, rail, and seaports and airports) and build a business-friendly climate. Through investing in skills and technology development, the government will assist in the development of locally based knowledge and technology, freeing the country from the stranglehold of importation.

Without rapid structural transformation of our manufacturing sector, achieving Sustainable Development Goal 8--"higher levels of productivity of economies through diversification, technical upgrading, and innovation, particularly through an emphasis on high value-added and labor-intensive sectors"—will be a mirage. However, there is hope for a better future for this country if our policymakers learn from the experiences of Brazil of South America, China, Singapore, and other fast-developing Asian countries. This hope must be based on the government's ability to develop the will, commitment, and capacity to implement policies and programs that will turn around the Nigerian manufacturing sector's fortunes, allowing it to resume its position as a unique engine of growth (wealth creation, employment generation, and poverty alleviation). The study recommends that our manufacturing sector should be recognized as a major sector for enhancing national growth and development as well as a catalyst for creating wealth, generating jobs, and alleviating poverty. As a result, it must be given due consideration and priority in the overall scheme of things.

The authors have not declared any conflict of interests.

REFERENCES

|

Adugna T (2014). Impact of the manufacturing sector on economic growth in Ethiopia: A Kaldorian approach. Journal of Business Economics and Management Science 1(1):1-8.

|

|

|

|

CBN Statistical Bulletin (2010). Annual report and statement of accounts.

|

|

|

|

|

CBN Statistical Bulletin (2012). Annual report and statement of accounts.

|

|

|

|

|

CBN Statistical Bulletin (2018). Annual report and statement of accounts.

|

|

|

|

|

Chukwuedo SO, Ifere EO (2017). Manufacturing subsector and economic growth in Nigeria. British Journal of Economics, Management and Trade 17(3):1-9.

Crossref

|

|

|

|

|

Emmanuel OO, Saliu WO (2017). Hazards of the manufacturing sector and economic growth in Nigeria. International Journal of Social Sciences, Humanities, and Education 1(1):1-16.

|

|

|

|

|

Engle RF, Granger WJ (1987). Cointegration and Error correction: Representation, Estimation, and Testing, Econometrica 55:251-76.

Crossref

|

|

|

|

|

Greene WH (2003). Econometric analysis. 5th Edition, Prentice Hall, New York.

|

|

|

|

|

Harris RJ (1995). Using cointegration analysis in econometric modeling. Harvester Wheatsheaf: Prentice-Hall.

|

|

|

|

|

Hayes A (2021). Herfindahl-Hirschman index (HHI).

|

|

|

|

|

Ihugba OA (2020). Population growth in Nigeria: implications for primary school enrolment, Journal of School of Arts and Social Sciences. 8(1):229-250.

|

|

|

|

|

Inakwu UA (2013). An assessment of the impact of the manufacturing sector on economic growth in Nigeria: A research project. Caritas University, Amorji-Nike, Enugu, Nigeria.

|

|

|

|

|

Johansen S (1988). Statistical analysis of cointegration vectors. Journal of Economic Dynamics and Control 12:231-254.

Crossref

|

|

|

|

|

Kaldor N (1966). Causes of the slow economic growth of the United Kingdom, Cambridge University Press, Cambridge.

|

|

|

|

|

Libanio G, Moro S (2009). Manufacturing industry and economic growth in Latin America: A Kaldorian approach. Mimeo, Federal University of Minas Gerais, Brazil.

|

|

|

|

|

Lucas RE (1988). On the mechanics of economic development. Journal of Monetary Economics 22:4-42.

Crossref

|

|

|

|

|

MacKinnon JG, Haug AA, Michelis L (1999). Numerical distribution functions of likelihood ratio tests for cointegration, Journal of Applied Econometrics 14(5):563-577.

Crossref

|

|

|

|

|

Nigeria Economic Summit Group (NESG) (2018). The manufacturing sector and Nigeria's economic growth pattern: redesigning policy intervention for inclusive growth.

|

|

|

|

|

Obamuyi TM, Edun AT, Kayode OF (2012). Bank lending, economic growth, and the performance of the manufacturing sector in Nigeria. European Scientific Journal February edition, 18:3. ISSN: 1857-7881(print). E-ISSN: 1857-7451.

|

|

|

|

|

Obioma BK, Anyanwu UN, Kalu AU (2015). The effect of industrial development on economic growth (An empirical evidence in Nigeria 1973-2013). European Journal of Business and Social Sciences 7(13):160-170.

|

|

|

|

|

Oburota CS, Okoi IE (2017). Manufacturing subsector and economic growth in Nigeria. British Journal of Economics, Management and Trade 17(3):1-9.

Crossref

|

|

|

|

|

Okon EO, Osesie SW (2017). Hazards of the manufacturing sector and economic growth in Nigeria. International Journal of Social Sciences, Humanities, and Education 1:1.

|

|

|

|

|

Onakoya AB (2017). Does manufacturing matter for economic growth in the Nigerian case? A confirmatory test of Kaldorian first growth law. Babcock Journal of Economics, Banking, and Finance 4:253-274.

|

|

|

|

|

Penélope P, Thirlwall AP (2013). A New interpretation of Kaldor's first growth law for open developing economies.

|

|

|

|

|

Rioba ME (2014). Manufacturing industry and economic growth in Kenya: A Kaldorian approach. A research project. University of Nairobi, Kenya.

Crossref

|

|

|

|

|

Romer P (1986). Increasing returns and long-run growth. Journal of Political Economy 94(5):1002-1037.

Crossref

|

|

|

|

|

Romer P (1990). Endogenous technical change. Journal of Political Economy 98(5, Part 2):S71-S102.

Crossref

|

|

|

|

|

Szirmai A, Verspagen B (2015). Manufacturing and economic growth in developing countries, 1950-2005. Structural Change and Economic Dynamics 34:46-59.

Crossref

|

|