ABSTRACT

Nowadays there is a general skepticism, uncertainty, and misapprehension regarding China's foreign aid to developing countries, and very few studies have tried to answer the issue of whether China's foreign aid fails to foster economic growth in the recipient countries. Therefore, this study intend to examine the effects of Chinese foreign aid (disaggregated into Project Aid and Development Loan Aid) on gross domestic savings, gross domestic investment, and economic growth rate in African countries from 2000 to 2014 after a 1-year lag. To analyze the effects, multivariate regression analysis with fixed effect, random effect, and pooled OLS regression estimations were conducted. The finding of this study supports the theoretical hypothesis of a positive relationship between foreign aid, saving, investment, and economic growth rate, through documenting project aid and development loan aid categories impact positively on gross domestic saving and gross domestic investment. Development loan aid also predicted the economic growth rate. Therefore, these results predicted that project aid and development loan aid categories pour into African countries accelerated economic growth. This research also proposed that it would be better to identify the forms of aid flows when obtaining aid from the donor countries. Therefore, it attempts to contribute to the scholars and policymakers by identifying the effectiveness of specific aid components that serve as the key aid flow tool for donor countries.

Key words: African countries, Chinese foreign aid, economic growth, investment, saving.

Low capital formation has been described by various economic theories as the fundamental problem hinder the growth of most developing countries, particularly Africa, and therefore aid is allocated to play a vital role in capital formation. The general objectives of foreign aid have been to eradicate extreme world poverty, increase saving and investment, and enhance living standards especially in developing countries (Michael et al., 2016). Meanwhile, in the field of development study, whether foreign aid promotes savings, investment, economic growth, and alleviates poverty in the recipient countries is one of the important issues. Among scholarly scholars and policymakers, the answer to this question remains contentious. In the academic loop, two strings hold opposite views in the literature regarding the issue. The first group of academic researchers documented their views on foreign aid inflows to the recipient countries as if it plays the main role in promoting economic growth through increasing domestic resources and facilitating saving, investment, and enhancing the human capital of the developing countries. The second group stated that foreign aid plays as a catalyst to create corruption, reduce domestic saving, and creates aid dependency this causes a negative effect on the economic growth of the aid recipient countries. Moreover, another group of the studies found a mixed result on effects of foreign aid on economic growth, domestic saving, and investment; such as Sabra and Sartawi (2015), Eltalla (2016) and Basnet (2013).

African Countries have received more foreign Aid from China than other international donors. China's foreign aid system had its origins at the Asian-African Conference in Bandung, Indonesia, in April 1955 with the entry of Chinese Premier Zhou Enlai on the global stage (Ministry of Foreign Affairs, 2014). Chinese aid to developing countries especially in Africa has continued to increase, at February 2017, Forum on China-Africa Cooperation (FOCAC); while hosting more than 40 of the continent’s leaders in Beijing, China’s President Xi Jinping pledged to offer 60 billion US dollars in development finance assistance to African countries, saying that the money came with no expectation of anything in return (Lina and Robertson, 2018). However nowadays, only a few studies have sought to address the issue of whether Chinese foreign aid does not stimulate economic growth in recipient countries. Even the latest interpretation of China's foreign assistance priorities remains hazy. Arguably, the disparity in language, culture, and history also restricts the researcher's further analysis of China's foreign aid, aside from restricted knowledge and evidence released by the Chinese government. It is therefore important to explore the effect of Chinese foreign aid on economic growth in the recipient countries by answering a series of questions focused on this topic. What are the effects of China's foreign aid on African countries' gross domestic savings, gross domestic investment, and GDP growth rates from 2000 to 2014? This set of questions persuaded me to find out more about the effects of Chinese foreign aid.

Some stylized facts on African economic growth and Chinese foreign aid

“Africa is beginning to do well economically. One of the main reasons for such a turnaround in the economic fate of Africa is the emergence of the emerging nations in general and China in particular.” Meles Zenawi, former Prime Minister of Ethiopia, 2012 (FUCHS, 2019).

China has a considerable diplomatic presence in Africa. In reality, Beijing is more commonly portrayed with on-the-ground missions in Africa than in the USA. According to the World Bank report (2017), China surpassed the United States of America as the largest trading partner for Africa. As Albert (2017) documented, Chinese product is a destination for 15 to 16% of exports from sub-Saharan Africa and is the source of 14 to 21% of imports from the region. In addition to lending, China is now investing in the construction of infrastructure and several high-visibility projects that African leaders traditionally favor. The report added that China's soft "non-interference, one-China policy, and no political strings attached" policies have resonated so deeply with African countries who have been so wearied by the stereotypes of democracy, human rights, and good governance proposed by the Western powers.

The Chinese State Council (2015) clarified that between 2000 and 2014, overseas Chinese assistance "captured 4,373 records totaling 354.4 billion dollars. This includes both conventional assistance (approximately 75 billion dollars), and low concessional lending (approximately 275 billion dollars). However, research shows that China's development policy is gradually driven by a desire to gain access to new markets and economic returns as its wealth and power grow. The state added basing the William and Mary research paper (2016) on aid data claims that between 2000 and 2014, China committed 350 billion dollars to foreign aid, parallel to the US $394.6 billion total. The Chinese government, contractors, and banks extended the 143 billion USD in loans to African governments and their state-owned undertakings from 2000 to 2017 (The initiative, 2018). Finance for Chinese loans varies, but Angola is the top receiver of Chinese loans, disbursing 42.8 billion dollars over 17 years. Such government loans qualify as "official assistance for growth."

In recent research Aid Data (2014), estimated that between 2000 and 2014, a research laboratory at William and Mary claimed that China contributed 350 billion dollars to foreign aid. From this Africa takes the lion's share of the aid (around $ 122.27 billion) and the respective African countries used it as a catalyst to improve their economic development. Table 1 reveals there are ten top Chinese foreign aid recipients countries in Africa, from these countries Angola, Ethiopia Sudan, Nigeria, and Zimbabwe were taking the top five Chinese foreign aid recipients (15.3, 14.92, 11.30, 7.24, and 6.09 billion dollars respectively).

From the AidData and the other existing data sources, the top five countries have been selected to show the trends of Chinese foreign aid and Economic growth of countries as an example; therefore, the following five countries information and diagrams on GDP growth rate Vs rate of Chinese foreign aid show the trends of Chinese foreign aid and economic growth in African countries (Appendix A).

Angola

During the first decade of the 21st century, Angola was among the world's fastest-growing economies, with an estimated annual average GDP growth of 11.1 % from 2001 to 2010 (Specter, 2015). From 2000 to 2014, Angola obtained foreign assistance from China amounting to USD 15.3 billion, this takes part in the country's annual GDP growth of 11.1%. The following Figure 1 highlights there is a similar pattern of the link between Chinese foreign aid and GDP growth rate performance in Angola for the year 2000 to 2014.

Ethiopia

Ethiopia has one of the fastest-growing economies in the world and, it is the second-most populous country in Africa next to Nigeria. Since 2004, the economy has undergone sustained real GDP growth of at least 5% (IMF, 2018). From 2000 to 2014 Ethiopia received foreign funding from China amounting to USD 14.92 billion, this also helped to contribute to the country's controversial annual GDP increase. Figure 2 indicates that there is a similar pattern of relationship between Chinese foreign aid and GDP growth rate performance in Ethiopia from the year 2000 to 2014 but the year 2010.

Sudan

Sudan's economy boomed based on oil production increases, high oil prices, and massive foreign direct investment inflows until the second half of 2002. Throughout 2006 and 2007, Economic growth was greater than 10% a year (IMF, 2018). From 2000 to 2014 Sudan received USD 11.30 billion in foreign assistance from China. Figure 3 highlights there is a similar pattern of linkage between Chinese foreign aid and the GDP growth rate performance from 2000 to 2014 in Sudan.

Nigeria

Nigeria's economy is a middle-income, mixed economy and emerging market, with growing sectors of retail, banking, education, media, technology, and entertainment Nigerian Purchasing Power Parity GDP almost tripled from $170 billion in 2000 to $451 billion in 2012, though informal economy value estimates to close the actual figures to $630 billion (Burger, 2018). From 2000 to 2014 Nigeria received USD 7.24 billion in foreign assistance from China. Figure 4 highlights that there is a similar pattern of linkage between Chinese aid and GDP growth rate performance in Nigeria from 2000 to 2014.

Zimbabwe

Zimbabwe's economy is largely made up of tertiary manufacturing, which as of 2017 accounted for up to 60% of overall GDP. Zimbabwe's economy expanded by an average of 12% from 2009 to 2013 rendering it one of the world's fastest-growing economies to grow from negative development from 1998 to 2008, before slowing to 0.7% growth in 2016 (Knoema, 2020). From 2000 to 2014 Zimbabwe received USD 7.24 billion in foreign assistance from China. Figure 5 highlights the inconsistent patterns of linkage between Chinese foreign aid and GDP growth rate performance in Zimbabwe, this may be due to the contraction of business sales or earnings of the country because there was a negative GDP growth rate in the country.

LITERATURE REVIEW: CHINESE FOREIGN AID EFFECTIVENESS DEBATE

The South-South development of aid, in particular Chinese foreign aid to African countries has re-engendered the debate on the efficacy of aid. The point is that, since Chinese assistance does not conform with the specifications of the OECD / DAC, this assistance would then become inadequate and therefore impede the development of Africa. Nevertheless, instead of debating Chinese aid ineffectiveness, time should be focused on exploring how to bring about growth and development in Africa in Chinese aid. Although Western aid in Africa has been unfavorable and unsuccessful, there are not enough reasons to write off aid, especially China's aid. The lessons they can learn from the experience of global aid failure in Africa and what made aid unsuccessful should be what should be essential for countries in Africa and China and other South-South development partners. Rhetorically speaking, the distinction between Western and Chinese assistance to African countries is that Chinese aid is essentially oriented towards growth and self-reliance. Chinese assistance, for example, is given to recipient countries on the basis of national interests, thereby maintaining a win-win, mutual benefit scenario, as well as contributing to the development of the recipient country. As Sun (2017) documented assessing China Africa aid partnerships outline opportunities and impediments, but two factors will depend on whether China's foreign aid to Africa leads to sustainable development. First, it would depend on possibly the essence of the agreements signed between China and recipient countries in Africa and how both sides handle the finances and supervise projects. Second and most significantly, it will also rely on both sides ' commitments.

Besides, the political will and commitment of the donor, as well as the recipient nations is a key aspect that must be taken into account when Chinese aid has to work for the development of Africa. Nonetheless, there is a need for greater political will and commitments on the part of African countries to meet the past obligation and tackle the major development challenges facing their countries cohesively and effectively, most of the promises have come from the ruling elites in African countries. In a 2009 speech in Ethiopia, former Chinese prime minister Wen Jiabao stated that ‘Chinese aid to Africa has not only contributed to Africa's capacity for self-development but has also generated practical results in Africa’. Li Anshan and Wenping (2012) also highlighted the advantages that Africa had gained in its interaction with China. They added that re-engagement has increased the continued demand for African goods, increased the negotiating position for African countries, built infrastructure in the country, and, in effect, contributed to economic growth in Africa.

There is mixed evidence for Chinese foreign aid's effect on economic growth. Some of the following examples have explored the positive and adverse effects of Chinese foreign aid respectively. Chinese foreign aid flows to recipient countries helps to raise savings, fill foreign exchange shortages, and thereby promote the development of capital and stimulate the expansion of trade that would contribute to economic growth (Ye, 2017). As Cheng (2016) discovered in his work titled ‘has Chinese foreign aid contributed to the economic growth of African countries’, and he found that among the variables he used natural resource rent and governance registered a significantly positive impact on GDP growth. When developing an aid relationship with beneficiaries, China's foreign aid would not enforce political requirements, which would to some degree cope with the 'aid dilemma.' Nour (2011) discovered that while some delays occur within the context of China's assistance to Sudan, China's financing and implementation of projects in Sudan, for example, had a positive impact on the provision of facilities, increased skills, increased production, increased knowledge transfer, increased availability of machinery, equipment, and raw materials, increasing employment opportunities, improving training and capacity-building in these projects and increasing technology transfer, particularly for multi-purpose development work.

Brautigam (2011) explored that the majority of Chinese foreign aid is provided to the recipient countries are in a bilateral way, which might be to fulfill donors' economic interest and consequently inhibit foreign aid effectiveness. As Wang (2014) documented in the working paper entitled "The Western Aid Dilemma and the Chinese Solution," China’s concessional loans are all tied, which is perceived to undermine aid effectiveness in recipient countries. Furthermore, the Chinese approach to non-transparency aid working outside the OECD/DAC scheme is perceived to be a behavior that raises the recipient countries' debt burden (Ye, 2017). He added that Chinese foreign aid is assumed to harm political development by neglecting recipients’ poor authorities’ potential, to assist Chinese agencies to acquire access to extractive resources, to fulfill its economic interests, to improve the resource effectiveness, and to boost the debt burden of recipients, Therefore, Chinese foreign aid can have positive and negative effects on aid recipients' savings, jobs, and economic growth through the same channels as traditional aid dose.

Data type and sources

By merging the current datasets and information, new dataset panels were created with 55 countries, covering the allocation/flow of Chinese assistance to African countries recipients for the period 2000-2014. The reason why I have chosen to concentrate on the period of 2000-2014 was that particularly for two reasons: First, the first Forum of Chinese-African Cooperation (FOCAC) was held in 2000 and marked a new era of cooperation between China and Africa. Second, still, the Chinese foreign aid flow dataset was available for this period only. All the African countries, excluding Somalia, are included in the dataset. The World Bank has not calculated GDP values for Somalia during the majority of the period analyzed due to the difficult conditions in Somalia, while other missing values in the dataset was supplemented with other figures.

The key independent variable is Chinese foreign aid; it is formulated by following AidData through different Chinese foreign aid distribution instruments such as a grant, technical assistance, export credit, scholarship, and strategic supplier credit. For this study, by taking Chinese aid flow from this source and by following OECD (2018) aid flow definitions we composed the Chinese foreign aid flow to the recipient countries into two main variables such as project aid and development loan aid. Project aid is the aggregated amount of Chinese foreign aid that accounts for three major distinct types of aid: grant aid, humanitarian, and export credit aid. Grant aid is assistance committed to projects related to infrastructure, industry, trade, service sector, and agriculture. Humanitarian Aid is the amount of foreign aid committed to projects that provide emergency and disaster relief assistance aid and Export credit aid is assistance committed to projects related to, energy generation and supply, Banking and finance Transport and storage, communication, government, and civil society, forestry, and fishing. Project aid also included financing various programs including health program (vaccine campaign), education program (literacy campaign), civic program (awareness-raising campaign), and included thematic activities such as youth and women empowerment. It is an independent variable for all questions and measured as a percentage.

Development loan aid is comprised of Chinese loans aid that is administered to developing and least developing countries for the exclusive purpose of promoting economic development and social welfare, It accounts for four distinct types of aid: loan, debt rescheduling, debt forgiveness, and strategic supplier credit. Loan aid is assistance committed to projects related to communication, industry, mining, construction, trade, tourism, and other social infrastructures. Debt rescheduling and forgiveness are committed to projects related to transport and storage and action related to debt. Strategic supplier credit is assistance committed to projects related to the energy generation and supply industry, mining, and construction, health. These two main independent variables data were mainly obtained from AidData V3.0 (Dreher et al., 2017). Therefore, my key independent variable was represented by the two main types of Chinese foreign aid flows for the year 2000 to 2014, which may not be homogenous. The sums of these two categories are almost equivalent to the total sum of Chinese foreign aid flow to African countries. The AidData was maintained by the College of William and Mary, Development Gateway, and the Brigham Young University (Aid Data Geocoded Global Chinese Official Finance, Dataset, 2000-2014 Version 1.3). Information on GDP by country was obtained from the Penn World Table PWT 9.0, released in 2016. The outcome variables are gross domestic saving, gross domestic investment, and GDP growth rate.

In addition to the above sources, the following data sources were used to organize the new dataset: Organization for Economic Co-operation and Development (OECD), Development Assistance Committee (DAC) database, the annual panel of African countries between 2000 to 2014, and IMF (World Economic Outlook, 2018). Both disaggregated Chinese foreign aid variables are logged to normalized and logged to distinguish the direction of the effect, this helps to ensure that the country years that are not received foreign aid the variables equal to zero not dropped from the analysis after logging (because the log of zero is undefined), therefore these variables were first amended before logging.

To examine the effects of Chinese foreign aid on gross domestic savings in Africa countries, multiple regression models were employed. The foreign aid-domestic saving model of the study was based on the neoclassical assumption that interconnects national savings and national income. The study model explored the effectiveness of Chinese foreign aid in promoting gross domestic savings in African countries is similar to several other prior research approaches (Balde 2011; Chowdhury and Garonne, 2009). Also in light of the scholarly literature, the foreign aid-savings relationship was tested by econometric models, hypothesizing that domestic savings as a proportion depend on per-capita GDP, inflation rate, interest rate, and aid as a percentage of GDP (Rana and Dowling, 1998; Nushiwat, 2007). Most of these empirical studies of the foreign aid and domestic savings relationship used all or some of these explanatory variables in their models. This study also followed the same path to investigate the role of disaggregated Chinese foreign aid in promoting gross domestic savings in African countries.

In this research, domestic savings are represented as a function of per-capita GDP, interest rate, and inflation rates and Chinese foreign aid as a percentage of the GDP. In mathematical terms, the domestic savings function is expressed as follows:

St=f (CAIDdisag, GDP/POP, INT, INF)it (1)

Since the Chinese foreign aid amount is disaggregated into two components Project aid and, Development loan aid, the structural form of the foreign aid-savings relationship model will be:

S/GDPit = (Pro_Aid) it-1 + (Loan_ Aid) it-1 + (GDP/POP) it + (INT) it + (INF) it + Error term (2)

The gross domestic savings function in equation 1&2 is then rewritten as:

Where:

S represents the gross domestic savings as a percentage of GDP,

represents a constant, (

Pro_Aid) represents project aid, (Loan _Aid) represents development loan aid,(

GDP/POP) represents GDP or aggregate income per capita represents,

POP represents the total annual population,

INF represents the inflation rate, it-1 represents a previous period,

t represents the period time, i represents the country i, and alphas are parameters to be estimated by the regression tests.

The second research question examining the effects of Chinese foreign aid and gross domestic investment tuned with the neoclassical investment theory and following different research works and consider the same, which means domestic investment as a share of GDP is a function of the following explanatory variables savings as the ratio of GDP, interest rate, inflation rate, per capita GDP, and the share of domestic savings to GDP (Chowdhury and Garonne, 2009; Grimm and Herzer, 2011). Therefore, to examine the effects of Chinese foreign aid on gross domestic investment in African countries over the years 2000-2014 in one-year time lag employed by following the same footstep:

INV/GDP=f (CAID, GDP/POP, INT, S/GDP, INF) (4)

Structurally, the Chinese foreign aid-investment equation is in the form of:

INV/GDP = GDP/POP + CAIDdisag+ INT + INF + S/GDP (5)

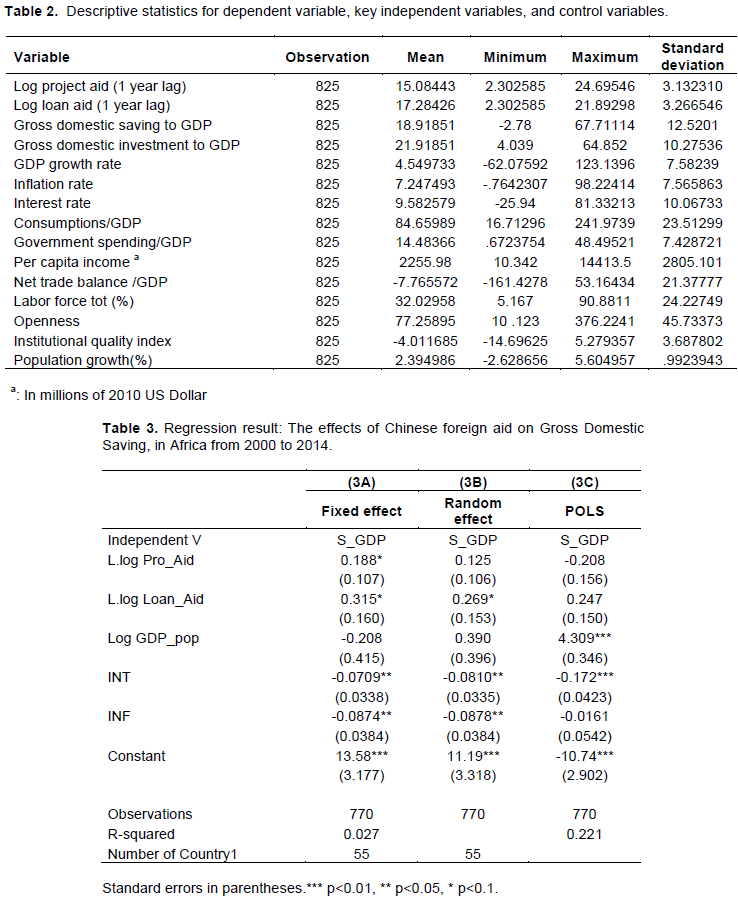

Descriptive analysis

The descriptive statistics of the ratio variable are listed in Table 2 to examine what the maximum and minimum ratings are, what the parameters are, and how well they represent data or what is indicated by the standard deviation.

As seen in Table 2, the first two dependent variables values of this study, gross domestic savings and gross domestic investment for the specified period (2000 to 2014) vary from -2.78 to 67.71 and 4.03 to 64.85 among 55 countries respectively, and there is a minor variation in values. It verified by the standard deviation equivalent to 12.52 and 10.27smaller than the mean value equivalent to 18.91 and 21.91 respectively, and the third main dependent variable GDP growth rate often ranges from -62.07 to 123.13, which does not have a large variation in values, but rather minor variations. It is verified by the standard deviation of 7.58 that is greater than the mean of 4.54. The key independent variable Project aid and development loan aid ranges from 2.30 to 24.69 and 2.30 to 21.89 respectively. There is a small variation that does not make a big difference in developing countries that have received foreign aid from China. The very small standard deviation equal to 3.13 and 3.26, which is higher than the mean equal to 2.3, further supports this small difference in observation. Development loan aid and project aid from China to African countries from 2000 to 2014 have increased. Project aid showed no comparable increase to just like the increase in development loan aid, although both irregular spikes were included in the trend. Appendix B of Figures 1 and 2 shows changes over the study period in Chinese foreign aid disaggregated as Project aid money and development loan aid money.

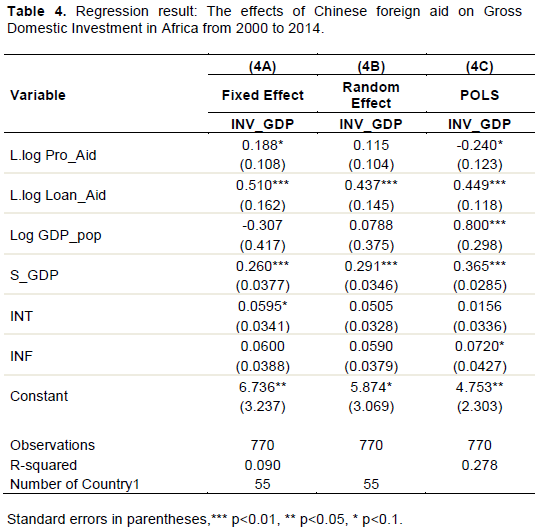

Effects of Chinese foreign aid on gross domestic saving

The pooled OLS, Fixed Effect, and Radom Effect test results are presented in Table 3. Saving is the dependent variable and project aid, development loan aid interest rate inflation rate and GDP per capita are the independent and control variables. At first, the study did different regression tests (FE, RE, and POLS); however, the result shows that the significance level is very different between the dependent and independent variables. To specify one specific approach between random and fixed effects, we did the Hausman test. The Hausman test result shows that the p-value for chi-square is 0.0001, which is significant. The outcome represents that there are fixed effects rather than random effects based on the hypothesis test. The comparative analysis of rho values also reflects that individual-specific fixed effects are higher than random effects. But, the study also needs to check between OLS and random effects. The Breusch Pagan LM test for random effects is the best method to decide between OLS and random effects. The Breusch Pagan test result shows that OLS regression is not the best approach to explain the relationship between the dependent and independent variables for this specific case. Therefore, after the Hausman and Breusch Pagan tests, the study decides that the fixed effects regression estimation approach is the best approach to explain data for African countries on the effect of dis-aggregated Chinese foreign aid on gross domestic saving.

As seen in Table 3A, the correlation between project aid and development loan aid on savings is poisitve and significant. This assumes the theoretical presumption is valid that the higher the financial inflow, the higher the domestic saving is anticipated. Where the impacts of other independent variables are taken into consideration, it is important to verify whether this finding holds. The study took column 3A as our base results based on the tests above. According to the point estimate, a 10% increase in project aid and development loan aid raises the probability of saving by 10.7 and 16% points respectively or when saving increase by 1% project aid and development loan aid will increase by 18.8 and 31.5%. This pointed out that there is a positive and significant relationship between project aid and development loan aid on saving. This coincides with the study finding documented by Phijaisanit (2010) Foreign aid is designed to compensate for the lack of investible funds required for development projects and to fill the gap in savings and foreign currency necessary for investing and importing capital inputs for local development, and Ye (2017) added that the amounts of Chinese foreign aid flow to the aid recipient countries help to boost the domestic savings, fill the shortage of foreign exchange, and hence facilitate the formation of capital and stimulate trade expansion, that would contribute to economic growth. Developing countries that have received more foreign aid from China would achieve better savings based on this outcome.

GDP per capita is expected to contribute to gross domestic savings in African countries. As seen in Table 3A the regression result is -0.208 (negative and insignificant) which is not aligned with assumptions based on previous research. This would suggest that a negative saving would be created by the low per capita GDP. Therefore, in this analysis, GDP per capita can not be defined as a factor that will exert a certain impact on saving. Basing the interest rate and inflation rate their coefficients are negative and significant at 5% levels, this means that interest rate and inflation rate are negatively and significantly associated with saving. As long as other independent variables are held constant, when the interest rate and inflation rate declines by 1 unit, the saving will decline at 7 and 8.7% respectively. The finding of saving and interest rate relationships have coincided with the finding of Loayza et al. (2000) documented a negative effect on the research paper titled ‘Saving in Developing Countries’. The aid recipient government should therefore place a strong focus on savings, to impact economic growth in African countries.

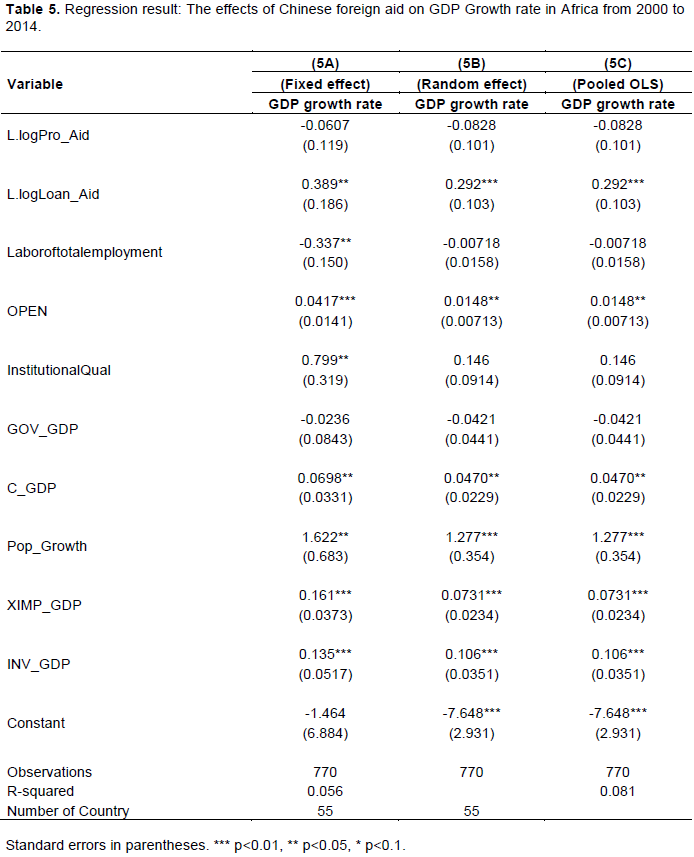

Effects of Chinese foreign aid on gross domestic investment

As indicated in Table 4A, the project aid and development loan aid coefficients are (0.188) and (0.510), which are significant at 10 and 1% level respectively. It indicates a positive and significant relationship between project aid, development loan aid, and investment. In other terms, developing countries receiving more foreign aid from China would achieve higher levels of investment, which would improve economic growth.

As indicated, the coefficient of saving, is positive and significant at the one % level; the coefficient is (0.260). This implies that: a) saving is positive and significantly correlated to the investment, and the probability of this significant relationship existing by chance is less than 1%; b) As long as other independent variables are kept constant when savings increase as a share of GDP by 1 unit, the investment would increase accordingly by 0.260 units. Moreover, the effect is consistent with the assumption that higher investment can be done with more savings. The recipient’s government should then put a heavy emphasis on savings. Concerning GDP per capita, its coefficient is negative and insignificant. The negative relationship is not in line with assumptions based on previous research. Therefore, it is not possible to identify GDP / POP as a factor that would have a favorable effect on investment.

The correlation between investment and interest rate is significant.This confirms the theoretical assumption that higher interest rates are expected to result in higher investment through higher savings. It is important to verify if this finding holds when the effects of other independent variables are taken into account. As indicated in Table 4, the interest rate coefficient is equal to 0.059, which is significant at the level of 10%. This indicates that the relationship between investments and interest rates is positive and significant. Lastly, it is expected that the inflation rate would also impact investment. The regression coefficient of the inflation, as indicated in Table 4A, is 0.0600 and positive but not significant, which is not compatible with expectations in earlier studies. Therefore, it is not possible to identify the inflation rate as a factor that would have a definite effect on investment.

Effects of Chinese foreign Aid on GDP growth rate

As can be seen in Table 5, the correlation between development loan aid and the GDP growth rate is significant. This confirms the theoretical assumptions that higher loan aid is likely to yield higher economic growth. Also, it is important to verify if this finding holds when the effects of other independent variables are taken into account. Then the result of the development loan aid coefficient is 0.389, which is significant at the 5% level. This reveals the positive and significant relationship between development loan aid and GDP growth rate. Based on this outcome, African countries that have obtained more foreign aid, especially development loans from China would achieve a higher GDP growth rate. These findings align with previous work on the effectiveness of foreign aid in supporting economic development, which has been found a positive correlation between foreign aid and GDP growth (Bhattarai, 2009; Feeny and Ouattara, 2006). Also backed by the finding of Lauren Tait and Chatterj (2016) in their study on foreign aid and economic growth in sub-Saharan African countries, they have documented that foreign aid has a positive and significant effect on economic growth.

Based on the project aid, the coefficient is negative and insignificant. The negative relationship is not compatible with prior research and assumptions. Concerning this insignificant relationship, project aid is the data for this independent variable, which can partially justify this outcome. Furthermore, since the outcome is not significant and the probability of occurrence by chance is too low, project aid is therefore not defined as a factor that affects economic growth in Africa based on the timeframe specified. This result coincides with the findings of (Mosley 1980; Rajan and Subramanian, 2008) in their result they documented that foreign aid was not associated with GDP growth rates in recipient nations. Also, this is inconsistent with the debate from Niyonkuru (2016) he is stated the ineffectiveness of aid is due to the mismanagement of ODA by the recipient countries, Rajan and Subramanian (2008) in their research on the analysis of data for the least developing nations, they documented no significant relationship existed between GDP growth and foreign aid over the study period. Doucouliagos and Paldam (2006) concluded that foreign aid should be reformed to become more effective.

Trade openness, net export, and investment, all are positive and significant at the 0.01 level. The coefficients are 0.041, 0.161, and 0.135 respectively. This suggests that (a) trade openness, net exports, and investment have a positive and significant relationship with economic growth; (b) as long as other control variables are held constant, the increase in trade openness, net exports, and investment with 1 unit, economic growth will increase at 0.041, 0.161and 0.135 units respectively. This means trade openness, net export, and investment have a positive effect on the GDP growth rate. Regarding the population growth rate, the empirical results found that with a 1% increase in the population growth the economic growth will increase by 162.2%. This suggests that population growth has a great effect on the economic growth in developing countries. These results are supported by the findings of Mallik's (2008) co- integration study, which assessed the impact of foreign aid on GDP growth rates in the six poorest African countries from 1960 to 1990, he documented a positive correlation between foreign aid at the proportion of GDP and the real long-term investment.

Regarding the institutional quality and consumption, the positive and significant correlations between institutional quality and consumption are found, as indicated in Table 5A. This depicts that economic growth is positive and strongly correlated with institutional quality and consumption, and the probability of this significant relationship is at 5%. This positive relationship between institutional quality and economic growth is consistent with previous studies but consumption. The higher the institutional quality the higher subsequent GDP growth rate is expected. Whereas, in terms of the labor of total employment, a negative and significant relationship has registered. The negative relationship is not in line with assumptions based on previous findings. With regard to this significant relationship, the significant result and the likelihood of the occurrence is low, so the labor of total employment can be identified as a factor that would have a negative effect on GDP growth rate, this may be due to the real demand elasticity of employment in the manufacturing sector is very low.

The Regression output for government expenditure is negative and insignificant. Based on the previous studies, this is not consistent with theoretical expectations. This mean that the higher government expenditure is projected to result in lower economic growth. The potential reason for this insignificant and negative coefficient is that it requires time to witness the conductive influence of improvement in government expenditure on GDP growth rate. However, since the result is not significant, the probability of this relationship happening by chance is not strong. Therefore, the effects of government expenditure should not be defined as a cause that can have a negative effect on GDP growth rate.

To understand the effects of Chinese foreign aid on gross domestic saving, investment, and GDP growth rate in African Countries, this study used a sample of 55 countries over 15 years from 2000 to 2014. The result revealed that Chinese foreign aid has a significant and positive effect on gross domestic saving, gross domestic investment, and GDP growth rate during the study period in African countries. At the same time, we have controlled for Labor of total employment, Trade openness, Institutional quality, Government expenditure, Total consumption, Population growth, net trade, and Investment.

In general, the result of this study was interesting and may mote light on current debates relating to Chinese foreign aid effectiveness in developing countries especially in African Countries. The findings of this study showed the need to formulate new aid flow methods for developing nations, especially to African countries. As an aid-recipient country, policymakers must focus on the project aid and development loan aid categories/ flow with the efficient uses of Chinese foreign aid or other forms of aid while providing aid to developing countries to gear toward achieving sustainable economic growth. Finally, the African country's government needs to be held accountable for its governance and for the creation of an environment in which the rule of law prevails. Without a democratic environment in the rule of law takes precedence over corrupt politics, Chinese foreign aid inflows will not have a positive effect on reducing the level of poverty in Africa through sustainable economic development.

This study suggests for further study to find out the appropriate way by which the benefits of growth can be distributed equally among every individual of the economy from the Chinese foreign aid, a study also needed regarding the relationship between Chinese foreign aid and government investment in African countries, and future research also should be conducted into the effects of multilateral foreign aid on private savings, rather than on total savings. The effects of foreign aid inflows on private savings may be different from the effects on total savings.

The author has not declared any conflict of interests.

REFERENCES

|

Albert E (2017). China in Africa. Review of Council on Foreign Relations. Available at:

View (Accessed February 13, 2020).

|

|

|

|

Balde Y ( 2011) The impact of remittances and foreign aid on Sub-Saharan Africa's investment. African Development Review 23(2):247-262.

Crossref

|

|

|

|

|

Basnet HC (2013). Aid, Savings, and Economic Growth in South Asia. International Business and Economics Research Journal 12(11):1389-1391.

Crossref

|

|

|

|

|

Bhattarai BP (2009). Foreign aid and economic growth in Nepal: An empirical analysis. Journal of Development Areas 42(2):283-302.

Crossref

|

|

|

|

|

Brautigam D (2011). Characteristics of Chinese Foreign Aid: The Chinese Foreign Aid and Development Finance Meet OECD-DAC Aid Regime. Journal of International Development 23(5): 752-758.

Crossref

|

|

|

|

|

Burger J (2018). One Africa: Africa Singapore Business Forum 2018 Edition. NBY-SBF Center for African Studies 13(1):10-15.

|

|

|

|

|

Cheng M (2016). Does Chinese Foreign Aid have a contribution to Economic growth to African Countries? Unpublished manuscript last modified January 10. PDF file. Georgetown University.

|

|

|

|

|

Chowdhury A, Garonne P (2009). Effective foreign aid, economic integration, and subsidiarity: The Lessons from Europe.

|

|

|

|

|

Doucouliagos H, Paldam M (2009). Aid effectiveness on accumulation: A meta-study. Kylos 59:227-254.

Crossref

|

|

|

|

|

Dreher A, Fuchs A, Parks B, Strange AM, Tierney MJ (2017). Chinese, Aid, and Growth. The Evidence from a New Global Development Finance Dataset. AidData Working Paper #46.

Crossref

|

|

|

|

|

Eltalla AH ( 2016). Foreign Aid, Savings, and Economic Growth on the Selected MENA Countries. Business and Economic Research 61(1):354-360.

|

|

|

|

|

Feeny S, Ouattara B (2009). The type of economic growth that aid support. The Applied Economics Letter, pp. 720-725.

|

|

|

|

|

Fuchs A (2019). Chinese Foreign Aid to Africa and Its Consequences. The Past, Present, and Future of African-Asian Relations International conference. University of Neuchâtel April 25-27. Hamburg.

|

|

|

|

|

Grimm M, Herzer D (2011). Does Foreign aid increases private investment? The Evidence of panel cointegration test. Applied Economics 44(20):2537-2550.

Crossref

|

|

|

|

|

International Monetary Fund (IMF) (2018). International Monetary Fund. Retrieved from World Economic Outlook Reports. Available at:

View (Accessed October 15, 2020).

|

|

|

|

|

Knoema (2020). Zimbabwe - Gross domestic product in constant price's growth rate. Retrieved from Knoem. Available at:

View (Accessed July 13, 2020).

|

|

|

|

|

Lauren AS, Chatterji I (2016). Foreign Aid and Economic Growth in Sub-Saharan African Countries. Economics Discussion/Working Papers 15-35. Western Australia University Department of Economics.

|

|

|

|

|

LI Anshan LH, Wenping H (2012). Twelve Years Later FOCAC: Challenges, and Achievements, Way Forward. Discussion Paper 74. School of International Studies in cooperation with Nordiska Afrika institute Peking University Uppsala.

|

|

|

|

|

Lina B, Robertson W (2018). Xi Jinping pledged $60 billion for Africa. Where will the money go? Retrieved from The Washington Post. Available at: View (Accessed May 2, 2020).

|

|

|

|

|

Loayza N, Schmidt-Hebbel K, Servén L (2000). Saving in Developing Countries: An Overview of Economic Review. The World Bank Economic Review 14(3):393-414.

Crossref

|

|

|

|

|

Mallik G ( 2008). Foreign aid and economic growth: An Overview of the cointegration analysis of the six poorest African countries. Economic Analysis and Policy 38(2):251-260.

Crossref

|

|

|

|

|

Mankiw NG (2008). Macroeconomics (Volume 9). (J. E. Tufts, Ed.) New York, 41 Madison Avenue: Worth Publishers.

|

|

|

|

|

Michael E, Omoruyi M, Zhibin S (2016). Foreign Aid and Economic Growth: Does It Play Any Significant Role in the Sub-Saharan African Countries? Journal of International African and Asian Studies 23:24-26.

|

|

|

|

|

Ministry of Foreign Affairs (2014). The Asian-African Conference. Retrieved from Ministry of Foreign Affairs, the People's Republic of China. Available at View (Accessed December 21, 2019).

|

|

|

|

|

Mosley P (1980). Savings, Aid, and growth revisited. Economics and Statistics the Oxford Bulletin. pp. 75-90.

Crossref

|

|

|

|

|

Niyonkuru F (2016). Failure of aid in developing countries: A quest for the alternatives. Journal of Business and Economics 7:231.

Crossref

|

|

|

|

|

Nour S (2011). Assessment of Effectiveness of Chinese Aid in Financing Development in the Sudanese. SSRN Electronic Journal. 10.2139/ssrn.1949150.

Crossref

|

|

|

|

|

Nushiwat M (2007). Foreign aid to the developing countries: Does it crowd-out the countries' domestic savings? Journal of Finance and Economics 12(11):94-102.

|

|

|

|

|

OECD (2018). DAC Glossary of Key Terms and Concepts. Retrieved from OECD. Available at:

View (Accessed May 23, 2020).

|

|

|

|

|

Phijaisanit E (2010) The time series analysis of the endogenous fiscal response to development aid in Thailand. Journal of International Studies 15:12-26.

|

|

|

|

|

Rajan R, Subramanian R (2008). Aid and growth: What does the evidence the cross-country really show? Review of Economics and Statistics 90:643-665.

Crossref

|

|

|

|

|

Rana P, Dowling J (1998). The Impact of Foreign Capital on Growth. Evidence from Asian Developing Countries. Developing Economies 26:3-11.

Crossref

|

|

|

|

|

Sabra MM, Sartawi S (2015). The Development Impacts of Foreign Aid on Economic Growth, Domestic Savings, and the Dutch Disease Presence in Palestine. Journal of International Economics and Empirical Research 3(11):532-541.

|

|

|

|

|

Specter M (2015). The severe inequality of the Angolan oil boom. Retrieved from The New Yorker. Available at:

View (Accessed June 25, 2020).

|

|

|

|

|

State Council (2015). The Policy Briefing on Accelerating Implementation of Innovation-Driven Development Strategy through Strengthening Institutional Reforms, Beijing: The People's Republic of China. Available at:

View

|

|

|

|

|

Sun Y (2017). China-US Focus. Retrieved from china US, focus Web site. Available at:

View (Accessed August 7, 2019).

|

|

|

|

|

The initiative HA (2018). China Africa Research Initiative. Retrieved from Johns Hopkins University's School of Advanced International Studies. Available at:

View (Accessed August 15, 2019).

|

|

|

|

|

Wang X (2014). The West's Aid Dilemma and the Chinese Solution? Ozanne A (eds.), Manchester: The University of Manchester Economics School of Social Sciences and Centre for Chinese Studies.

Crossref

|

|

|

|

|

Ye Q (2017). China's Foreign Aid and Economic Growth: What is the effect of China's foreign aid on economic growth in developing countries.Rotterdam University.

|

|

|

|

|

World Bank Report (2017). World Report on Development: The State in a Changing World. New York, NY: Oxford University Press.

|

|

represents a constant, (Pro_Aid) represents project aid, (Loan _Aid) represents development loan aid,(GDP/POP) represents GDP or aggregate income per capita represents, POP represents the total annual population, INF represents the inflation rate, it-1 represents a previous period, t represents the period time, i represents the country i, and alphas are parameters to be estimated by the regression tests.

represents a constant, (Pro_Aid) represents project aid, (Loan _Aid) represents development loan aid,(GDP/POP) represents GDP or aggregate income per capita represents, POP represents the total annual population, INF represents the inflation rate, it-1 represents a previous period, t represents the period time, i represents the country i, and alphas are parameters to be estimated by the regression tests.