ABSTRACT

This paper examines the productivity of revenue from the Ivorian tax system over the period 1984 to 2016. To do this, it estimates the buoyancy and elasticity of tax revenues over this period. It uses the Ordinary Least Squares (OLS) method to estimate the buoyancy and elasticity. The results show a buoyancy and elasticity less than one, reflecting the inelasticity of tax system. Furthermore, they reveal tax reforms undertaken have failed to improve the productivity of the tax system in Cote d’Ivoire.

Key words: Elasticity, buoyancy, tax system, tax reforms, tax revenue, Cote d’Ivoire.

A good tax system is characterized by higher revenue productivity. This revenue productivity depends on the responsiveness of the tax system to changes in economic activity and/or on tax decisions made by the policy makers. The question of the responsiveness of taxes to changes in economic activity or to discretionary changes in tax policy is a subject of interest among economists. Since then, they have been developing models to determine how taxes react to changes in economic activity or to discretionary changes by the authorities. This responsiveness of taxes is commonly assessed through the concepts of elasticity and buoyancy. Elasticity measures the automatic response of revenue to changes in income less discretionary changes in tax policy while buoyancy measures the total response of tax revenue to changes in income and discretionary changes in tax policy.

The Ivorian tax system has been the subject of several tax reforms aimed at improving the productivity of tax revenue and meeting the country's needs for economic and social development. Although a series of tax reforms have been undertaken, the country has failed to generate enough tax revenue to meet financing needs. This inability of the tax system to generate enough revenue has led the government to run large budget deficits. Consequently, bank loans and external financing are requested to finance public expenditure. Since these sources of deficit financing are unsuitable for the medium and long term, efforts must be done to design an efficient tax system capable of supporting public services without resorting to the search for external funds.

Making a tax policy decision without knowing the magnitude of the percentage change in tax revenue at its base can distort the expectations of decision-makers regarding the economy's ability to generate tax revenue and this could lead to a fiscal imbalance. The way taxes are raised and used influences the legitimacy of government and its accountability to taxpayers and encourages good management of public finances. In this regard, the concept of elasticity is a crucial factor in

assessing the effectiveness of the tax system. Elasticity measures, in economics, the variation of a quantity caused by the variation of another quantity. Conversely, inelasticity characterizes the absence of a link or the independence of the variations of the two variables concerned.

However, to measure the productivity of the tax system, a distinction is made between the elasticity of revenue and the buoyancy. Elasticity and buoyancy have the advantage that they can both result in increased tax revenues. However, this growth in tax revenue can come either from an automatic response or from discretionary changes which are the result of action by the authorities. Indeed, the growth in tax revenue resulting when the rules, the tax base, tax rates, etc. (discretionary changes) are held constant is the automatic response. However, the growth in tax revenue resulting from the combined effect of automatic response and discretionary changes is buoyancy.

In general, it is desirable that the growth in revenue from a tax corresponds to that of the Gross Domestic Product (GDP), without frequent discretionary modifications being necessary for its rates and structure. This requires that the tax elasticity coefficient be equal to or greater than one. This property ensures that revenue growth increases with that of income (GDP) without frequent discretionary changes. Also, the study of elasticity and buoyancy is very useful for forecasting revenue.

However, very few studies have focused on studying the buoyancy and elasticity of the Ivorian tax system. Furthermore, the empirical results of these studies are inconclusive. Indeed, the studies of Leuthold and Tchetche (1985), and Keho (2013) show that the Ivorian tax system is not dynamic while that of Den Tuinder (1978) shows that the tax system is dynamic. These contradictory results can be explained by the different methods and the size of the data sample used in each of the studies.

The objective of this paper was to examine the implications of tax reforms on the productivity of tax revenues in Côte d'Ivoire. To do this, the approach of Prest (1962) was used to eliminate discretionary effects on tax revenue series. Then, using the ordinary least squares method, we empirically estimated the buoyancy and elasticities of tax revenues in the Ivorian tax system. The first step was to analyze the productivity of tax revenues and major individual taxes. Then, it was a question of assessing the impact of tax reforms on the productivity of the tax system.

The rest of the paper is structured as follows. Section 2 examines the theory of tax reform and the empirical work on tax elasticities. Section 3 defines buoyancy and elasticity and presents techniques for estimating buoyancy and elasticity. Section 4 is devoted to the presentation of the results while Section 5 concludes the paper.

Theory of tax reform

Tax reforms should be used to stimulate economic growth, including by changing the way the tax burden is distributed between work and consumption and by broadening the tax base rather than increasing tax rates (Remeur, 2015). According to Osoro (1993), a tax reform raises four fundamental questions: why do it? When should it be done? In which direction should it go? how should it be implemented? These questions indicate how tax reform should be examined before it is undertaken in a tax system.

The goal of tax reform is geared towards increasing resources, equity, simplicity and economic efficiency. According to Wilson et al. (2018), the goal of most tax reforms is to make tax revenue levels more progressive and sustainable, to promote independence from tax revenue from natural resources and foreign aid, to elevate the role taxation in building the state and creating a better understanding of its impact on growth and inequality. The need for tax reform stems from the inadequacy of the existing tax system to achieve the objectives set. Tax reforms have therefore moved from the desired task to a necessary task in developing countries. According to Osoro (1993), tax reform is a change from the status quo and has become one of the main concerns of the tax systems of most developing countries. Tax reforms are sometimes difficult to achieve because they create winners and losers but sometimes overcome prejudices about the status quo.

Tax reform is an implicit recognition of the failure of the existing tax system. Reform is now necessary to remedy the faulty, deficient and ineffective system. It is a conceptual fiscal policy strategy designed to improve tax administration. Tax reform measures are mainly aimed at boosting tax revenues, strengthening modern taxes and significantly reducing the complexity and lack of transparency of the tax system (Omondi et al., 2014). According to Wilson et al. (2018), good governance also plays an important role in influencing the level of civic mindedness of citizens through the provision of efficient public services and infrastructure such as schools, health care services and social security programs. Also, for Addison and Osei (2001), investing in democratic institutions is also important for tax reform. Indeed, for these authors, taxpayers will be willing to comply with tax legislation if there are mechanisms guaranteeing them that their money will be used legitimately. Tax reform are therefore a fundamental strategy for fiscal consolidation and governance designed to improve the efficiency of the tax administration. According to Wilson et al. (2018), it is a two-way process that requires changing the way taxes are collected and managed by the government. The fact that tax administration does not work optimally in many countries, distorting the intent of tax laws, is an implicit recognition of the organizational failure of the tax administration systems in these countries. The common thread of tax reform strategies is to improve tax administration by addressing the shortcomings observed in the tax collection system. This involves simplifying the process of collecting and paying taxes, promoting voluntary compliance by taxpayers, and adopting a logical sequence of procedures to effectively identify and manage non-compliance (Pellechio and Tanzi, 1995).

For Pereira et al. (2013), tax reform is the process of reviewing and modifying the administration and collection of taxes by the government in order to boost state revenues on the one hand, and provide more socio-economic benefits important and better, on the other hand. Thus, Silvani and Baer (1997) have listed a number of reasons why tax reforms are justified: a) when there is a need to modernize tax administration as part of a broad tax reform strategy in response to the observed weakness and ineffectiveness of the tax system; (b) in response to the demands of a growing economy, in which an expansion of the tax base is necessary to integrate taxpayers not yet captured, for example, the growing number of actors in the informal sector; and c) when the imperatives of modern information and communication technologies (ICTs) as well as changes in macroeconomic policies and legislation force fiscal reforms, for example, to complement economic, trade and investment policies.

To improve the impact of tax reform efforts in developing countries, Rao (2014) recommends a number of points: (1) support local leadership in reform efforts; (2) incorporate political economy analysis into the design and implementation of programs; (3) design tax reform programs to foster broader links between taxation, state-building and governance; (4) pay attention to the complexity of the relationship between foreign aid and tax effort; (5) improve the design of fiscal conditionality and performance indicators; (6) more effectively coordinate donor interventions; and (7) pay more attention to the international political context and its impact on local tax systems.

Successful tax reform involves several steps because it is a major process of fiscal consolidation. First, having recognized that there is a problem with and in the country's tax system, it is important to size the problem. This implies a diagnosis of the problems of the existing budgetary structure. This is followed by an assessment of the role of taxation as a macroeconomic tool (Islam, 2001). The literature on tax reforms has evolved over the past decade, justifying their theoretical and practical importance. However, much of the literature is more descriptive than analytical, and the techniques applied to assess the success or failure of tax reforms are not well documented (Osoro, 1993). However, Osoro (1993) points out that the success of tax reforms in increasing the revenue-raising capacity of the tax system can be assessed by examining the elasticity and buoyancy of the tax system.

The existing budget deficits in many developing countries suggest that the tax systems are not producing enough revenue. Some may ignore this and attribute the cause of the deficits to excessive spending or temporary adverse economic conditions. If budget deficits persist for a long time, it is questionable whether increasing tax revenue should not be the main objective of tax reform. The answer will necessarily depend on the situation in each country. No developing country can afford tax reforms as desirable as they are for other reasons unless these reforms result in substantial tax revenue gains.

Review of empirical studies about buoyancy and elasticity

Several empirical studies have been conducted to assess the performance of tax systems. However, the countries and the methodologies used differ from one study to another. For example, Leuthold and Tchetche (1985) estimated, by logarithmic regression linking tax revenues to GDP, the buoyancy for each of the main Ivorian taxes using annual data from the period 1965 to 1975. They found, unlike Den Tuinder's study (1978), that the Ivorian tax system is less dynamic. In another article, Leuthold and Tchetche (1986) estimated the elasticity and buoyancy of the main taxes of the Ivorian economy over the period 1970-1979. Using alternately the estimation techniques of Prest (1962) and Singer (1968), they conclude that tax revenue in Côte d’Ivoire tends to be slightly inelastic while specific taxes such as value-added tax and the import tax are very elastic.

Keho (2013) was interested in the buoyancy of the UEMOA countries by calculating the buoyancy of individual taxes in each of the member countries of this economic space over the period 1996-2008. The results show that the overall tax system is not dynamic in Côte d’Ivoire. And, the poor performance of indirect taxes negatively affects the overall performance of the tax system. On the other hand, the small fluctuations in trade and indirect taxes are attributable to the low tax elasticities at the base, which indicates that, despite the increase in imports and GDP, import taxes are not collected accordingly.

Akbar and Ahmed (1997) examined the elasticity and buoyancy of various taxes and expenditures of the federal government of Pakistan during the period 1973-1990 using the methodology of Prest (1962). They found that the buoyancy and elasticity of taxes were low due to the low elasticity and buoyancy of tariffs and excise duties. Elasticity and buoyancy were found to be relatively higher for sales tax followed by income taxes. Jeetun (1978) found that Pakistan's direct and indirect taxes were very inelastic over the periods from 1960 to 61 and from 1975 to 1976. Among indirect taxes, tariffs appeared to be more elastic, followed respectively by tariffs import, excise and sales taxes. The main reason for the low elasticity was the low elasticity of the tax relative to the base.

Other studies have estimated short-term and long-term buoyancy of the tax system using time series. Upender (2008) examines the degree of buoyancy in India by fitting a logarithmic regression model with an interaction variable. It considers the period after 1992 as the period of tax reform to examine the forecasts of tax reforms initiated by the government of India. These results show that buoyancy is positively significant and greater than unity during the pre-reform period. However, the coefficient on the interaction variable is significantly negative, showing a downward change in the degree of buoyancy during the post-reform period. The buoyancy estimate, which was just above unity during the pre-reform period, is lower than unity during the post-reform period, which shows that overall taxation is relatively inelastic. Thus, it concludes that the buoyancy during the periods before and after tax reform is not stable.

Barrack and Olukuru (2016) estimated in a comparative study the buoyancy of income tax, value-added tax, import tax, excise tax and total tax revenue in using annual data from 1972 to 2014 for Kenya and South Africa. They applied the error correction model for the short and long-term estimation of buoyancy and the level of convergence between the short-term estimation and the long-term estimation. The results suggest that the tax systems for both countries are dynamic in the long and short term with an average speed of adjustment between the long term and short-term estimates.

Osoro (1993) examined the relationship between tax reforms and the productivity of Tanzania's tax system. These estimates of global and individual tax elasticities show that the tax reforms undertaken in Tanzania have been ineffective in improving the productivity of the tax system. In fact, all taxes, except corporate taxes, had elasticities less than one. He believes that the expected impact of tax reforms seems to have been thwarted by the many exemptions and the efficiency of Tanzania's tax administration. Furthermore, Kusi (1998) assessed the link between tax reforms and the productivity of the tax system using data from Ghana to demonstrate the long-term and medium-term effects of tax policies. His study showed that tax reforms had a significant impact on individual taxes than on the overall tax system. Indeed, he found that all individual taxes except export taxes and excise duties had buoyancy and elasticities greater than unity during the reform period (1983-1993). He concluded that this improvement in tax elasticities and buoyancy can be attributed to the effects of the tax reforms carried out in this country.

Kargbo and Egwaikhide (2012) examined the elasticity of the tax system in Sierra Leone using annual data covering the period 1977-2009. They use the dummy variables method of Singer (1968) to adjust the effect of discretionary tax measures and then compare the measures of buoyancy and elasticity. Their empirical results indicated that the estimates of buoyancy were higher than the estimates of elasticity, and the short-term elasticities were lower than the long-term elasticities. The results of the estimate also showed that discretionary tax measures were effective in raising additional tax revenue and that the tax system was inelastic during the 1977-2009 period.

Mansfield (1972) analyzed the elasticity and buoyancy of the Paraguayan tax system during the period from 1962 to 1970 in which judicious tax reforms were carried out. The results show that the tax system was dynamic with buoyancy greater than elasticity. Thus, for the author, the difference between buoyancy and elasticity indicates that discretionary changes have improved the performance of the Paraguayan tax system by generating additional revenue and increasing the tax burden. All the studies as a whole show that the results obtained largely depend on the estimation techniques or methodologies used, the estimation periods covered by the data, the estimation data itself and the tax reforms were undertaken in the system tax.

ECONOMETRIC METHODOLOGY AND DATA

Definition of buoyancy and elasticity

Buoyancy

The buoyancy of a tax system is measured by the proportional change in total tax revenue relative to the proportional change in national income. The buoyancy is expressed as follows:

Elasticity estimation technique

Elasticity is quite difficult to measure because it requires an estimate of what would have happened if the changes related to the tax structure had not been made. Thus, estimating elasticity involves modifying equation (13) to account for discretionary changes in tax policy. However, various factors can lead to a change in tax revenue: changes in the tax base and tax rates, the efficiency of the tax administration, the introduction of new taxes and collection methods, the abolition of other taxes and fees, etc. In order to estimate elasticity, the time series of tax revenue must be adjusted to eliminate the effects on tax revenue of all factors other than GDP. To eliminate these effects on the tax revenue series, several techniques exist, notably that of Prest (1962) and that of Singer (1968).

However, it is difficult to use the technique of Prest (1962) in the absence of effective monitoring by the tax administration of the estimated amounts of the variations in revenue induced by the tax reform measures. Also, the administrative methods used to estimate the anticipated effects of tax reforms on revenue can be marred by many significant biases. In addition, the method of Prest (1962) is useful when data on the legal tax bases are available and the rate structure is not complex. The technique assumes the existence of statistical data on the legal bases of taxation and tax rates, which is difficult to apply in developing countries because statistics on bases and rates are lacking and the structures of taxation are often very complex.

For these different reasons, we adopt the technique of dummy variables developed by Singer (1968). This approach allows the introduction of a dummy variable into the model of equation (13) presented above in order to capture changes in discretionary fiscal policy. Thus, to isolate the effects of discretionary fiscal policy on tax k and estimate the elasticity of this tax, equation (13) was estimated by increasing it by the indicator variable considering the years of application of the discretionary tax policy reforms affecting the tax series. The revised model takes the following form:

Data

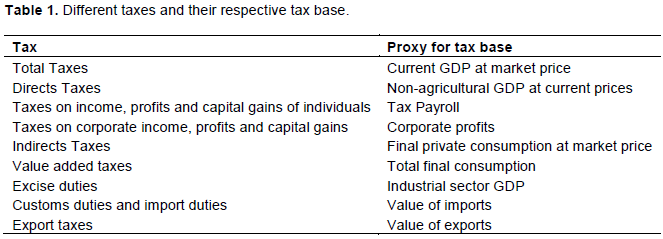

The study uses annual time series covering the period 1984-2016. The data come from the databases of the Central Bank of West African States (CBWAS) and the database of the Organization for Economic Cooperation and Development (OECD). Data on nominal GDP, non-agricultural GDP, wage bill, industrial GDP, current GDP at market price, value of imports and exports, total final consumption and final private consumption come from the CBWAS data while total tax revenue, direct and indirect taxes, corporate profits come from the OECD database. The variables are transformed in logarithmic form in order to attenuate the fluctuations of the series. Also, the logarithmic transformation will allow us to interpret the estimates of the coefficients in terms of elasticities and growth rates. The data on tax reforms come from our compilations, based on various sources including official reports of tax administrations, versions of the General Tax Code and the Customs Code, versions of the book of tax procedures and IMF country reports. For the estimation of the decomposition of the elasticity, the bases of the different taxes and charges summarized in Table 1 will be used.

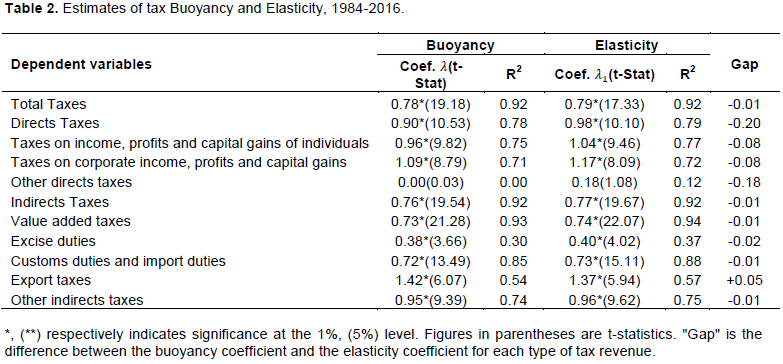

The results of the estimates are summarized in Table 2. It was noted that the Ivorian tax system is less dynamic. Indeed, the buoyancy estimate shows that tax revenue is inelastic, which translates into low productivity in the tax system. The buoyancy coefficient of 0.78 is less than the unit. This indicates that a 1% change in GDP results in a less than proportional change of 0.78% in tax revenue. These results are consistent with those obtained by Leuthold and Tchetche (1985) and by Keho (2013) for the Cote d’Ivoire. These authors found that the Ivorian tax system was less dynamic with coefficients of buoyancy lower than unity, unlike Den Tuinder (1978) who found that the tax system was dynamic with a coefficient of buoyancy greater than unity.

Like the buoyancy results, the elasticity estimation results show that the tax system is inelastic with an elasticity coefficient of 0.79. In short, this low elasticity does not allow enough tax revenue to be mobilized to finance public spending. By taking tax revenue by major categories, we make the same observation. Indeed, we realize that direct taxes and indirect taxes are inelastic with a respective buoyancy of 0.90 and 0.76 on the one hand and an elasticity of 0.98 and 0.77 respectively on the other.

However, taken individually, it can be seen at the level of buoyancy that the taxes on income, profits and capital gains of companies as well as export taxes are elastic with an elasticity of 1.09 and 1.42 respectively. However, at the elasticity level, the taxes that have proven to be the most dynamic in the tax system are personal income taxes, profits and capital gains (1.04), income taxes, corporate profits and capital gains (1.17) and export taxes (1.37). This means that a 1% increase in GDP causes a more than proportional increase in these individual taxes. Moreover, the other individual headings indicate an inelasticity of these taxes. This reflects a less than proportional increase in these taxes relative to GDP.

The difference between buoyancy and elasticity shows the importance of discretionary changes. To estimate the importance of the tax reforms undertaken by the Ivorian government on the yield of tax revenues, the buoyancies of the same revenue categories were compared to those of the elasticities. As noted, the tax system has a buoyancy of 0.78 versus an elasticity of 0.79; a difference of -0.01. It is safe to say, therefore, that the impact of discretionary changes has been negligible on the mobilization of tax revenue from the tax system. This result is consistent with that of Osoro (1993) for Tanzania but contrary to that of Kusi (1998) for Ghana. It is the same observation that is made for all taxes taken individually, except for the tax on export taxes.

Indeed, the gap between the buoyancy and the elasticity of income tax, profits and capital gains of individuals, income tax, profits and capital gains of companies, of other direct taxes, value-added tax, excise duties, customs and import duties, other indirect taxes is negative and varies between -0.01 and -0.20. This implies that the tax reforms had rather negative effects on these different revenue categories. This is understandable if one considers the reductions or abolition of VAT and the economic liberalization policies that led to the UEMOA Common External Tariff. However, the estimate shows that export taxes have been increased following discretionary changes. Indeed, the difference between buoyancy and the elasticity of export tax revenue is 0.05. The main cause of the growth in export taxes can be the discretionary changes, in particular the gradual reduction of the single exit duty (DUS) on coffee and cocoa in order to promote exports and of import substitution operated in 1995.

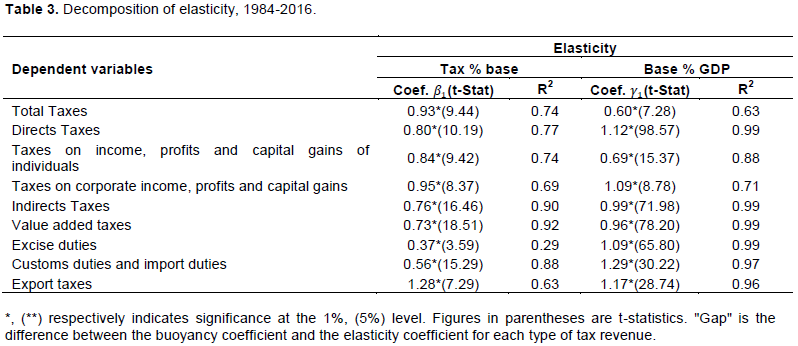

In addition, Table 3 shows the results of decomposing the tax elasticity to the base and the elasticity of the base to GDP. As noted above, the elasticity of the Ivorian tax system is low (0.78). This can be explained by the upward rigidity of revenues in relation to tax bases (0.93) and tax bases in relation to GDP (0.60). For direct taxes, their overall elasticity is only 0.90. This relative inelasticity is explained by the combined effects of the inelasticity of indirect taxes which evolve more slowly than the change in their base (0.80) and the slight elasticity of the base in relation to changes in GDP (1.12). As for indirect taxes, with an overall elasticity of (0.76), they also proved to be inelastic due to their rigidity to variations in their base (0.76) even if the base proved to be insensitive to changes in the GDP (0.99).

In the category of direct taxes, we can see that the overall elasticity of income, profits and capital gains tax for individual’s amounts to 0.96 and it results from the product between this inelastic tax variation in the base (0.84) and its base even less sensitive to variations in GDP (0.69). The low sensitivity of this tax to changes in its base undoubtedly means that job creation has taken place in sectors that are not very profitable from a tax point of view. As for the low reactivity of the base to changes in GDP, it reflects the fact that the country's economic growth has not translated into equivalent creation of jobs whose income is taxable. For corporate income, profit and capital gains taxes, an overall elasticity of 1.09 can be observed. This elasticity results from the combination of the inelasticity of this tax to changes in the base (0.95) and the elasticity of its base to changes in GDP (1.09). Consequently, if it had not been for the sensitivity of the base relative to income (1.09), the overall elasticity of the recipe, which amounted to 1.09, would be much less. The elasticity of the base of this tax to changes in GDP is no doubt explained by the transformation of the economy, which results in the creation of formal businesses and productive salaried employment. In the category of indirect taxes, one could justify the quasi-elasticity (0.99) noted by the elasticity of the base with respect to GDP of excise duties (1.09), import duties and taxes (1.29) and export taxes (1.17). However, except for export taxes, which are a 1.28 elasticity of tax relative to the base, the elasticities of the revenue bases, of duties and taxes on imports and exports are inelastic in relation to the base by the inelastic nature of their respective base.

Analysis of the components of the income elasticities revealed that the modesty of the elasticity of the tax system results, first of all, from the inelasticity of the tax bases, in particular the tax bases of indirect taxes, namely the Tax on value-added, excise duties and customs and import duties. To improve the yield on indirect taxes, structural actions going beyond fiscal policy are necessary and should be combined with reforms aimed at improving the efficiency of collection procedures or adjusting the rates of certain indirect taxes. Second, the inelasticity of the tax system results from the inelasticity of the bases in relation to the GDP of direct tax items. Indeed, the elasticity coefficients of the base relative to the GDP of these tax items have been shown to be low. In order to improve the return on this type of tax, measures to broaden the base can range from facilitation to setting up large companies to detecting new tax loopholes.

This paper examined the productivity of revenue from the Ivorian tax system. The results show that the most elastic taxes are export taxes, followed by taxes on income, profits and corporate capital gains. This results in buoyancies greater than the unity of these tax headings. However, the least elastic taxes are value added tax, customs and import duties followed by excise duties. This results in buoyancies below the unit of these taxes. We have seen the low productivity of the tax system because the buoyancy is less than the unit, reflecting the inelasticity of the tax system.

In addition, estimates of the buoyancy and elasticity of total tax revenue and individual tax revenue show that tax reforms have failed to increase revenue productivity. Indeed, all the different tax headings (including the total tax system), except for the export tax, have a coefficient of buoyancy lower than that of elasticity, which shows that discretionary modifications have not been significant in increasing tax revenues.

Analysis of the components of the income elasticities revealed that the modesty of the elasticity of the tax system results, first of all, from the inelasticity of the tax bases, in particular the tax bases of indirect taxes, namely the Tax on value-added, excise duties and customs and import duties. Second, the inelasticity of the tax system results from the inelasticity of the bases in relation to the GDP of direct tax items. Indeed, the elasticity coefficients of the base relative to the GDP of these tax items have been shown to be low. To improve the return on indirect taxes, reforms to improve the efficiency of collection procedures or adjust the rates of certain indirect taxes are needed. As for direct taxes, measures to broaden the base and detect new tax loopholes will be necessary.

The author has not declared any conflict of interests.

REFERENCES

|

Addison T, Osei D (2001). Taxation and fiscal reform in Ghana. UNU World Institute for Development Economics Research. Discussion Paper No. 2001/97.

|

|

|

|

Akbar M, Ahmed QM (1997). Elasticity and buoyancy of revenues and expenditure of federal government. Pakistan Economic and Social Review 35(1):43-56.

|

|

|

|

|

Barrack M, Olukuru J (2016). Tax buoyancy: A comparative study between Kenya and South Africa. School of Finance and Applied Economics. Strathmore University, Nairobi, Kenya.

Crossref

|

|

|

|

|

Den Tuinder BA (1978). Ivory Coast: The Challenge of Success. Report of a Mission Sent to the Ivory Coast by the World Bank. Baltimore: Johns Hopkins University Press.

|

|

|

|

|

Islam A (2001). Issues in tax reforms. Asia-Pacific Development Journal 8(1):1-12.

|

|

|

|

|

Jeetun A (1978). Buoyancy and Elasticity of Taxes in Pakistan. Applied Economics Research Centre (AERC) Karachi. (Research Report No. 27.).

|

|

|

|

|

Kargbo BI, Egwaikhide FO (2012). Tax Elasticity in Sierra Leone: A Time Series Approach. International Journal of Economics and Financial Issues 2(4):432-447.

|

|

|

|

|

Keho Y (2013). Determinants of Tax Yield in UEMOA Countries: The Effects of Institutions and Economic Structure. ENSEA, Abidjan, Côte d'Ivoire, Paper to be presented at the International Centre for Tax and Development's 2013 Annual Meeting, Lomé.

|

|

|

|

|

Kusi NK (1998). Tax reform and revenue productivity in Ghana. AERC research paper 74, Nairobi: African Economic Research Consortium.

|

|

|

|

|

Leuthold JH, Tchetche N (1985). The Buoyancy of Ivory Coast Taxes. Bureau of Economic and Business Research. University of Illinois, Urbana-Champaign, Faculty Working Paper No 1182.

|

|

|

|

|

Leuthold JH, Tchetche N (1986). Tax Buoyancy vs Elasticity in a Developing Economy. Bureau of Economic and Business Research. University of Illinois, Urbana-Champaign, Faculty Working Paper No 1272.

|

|

|

|

|

Mansfield CY (1972). Elasticity and buoyancy of a tax system: A method applied to Paraguay. International Monetary Fund Staff Papers 19(2):425-446.

Crossref

|

|

|

|

|

Omondi OV, Wawire NHW, Manyasa EO, Kiguru TG (2014). Effects of Tax Reforms on Buoyancy and Elasticity of the Tax System in Kenya: 1963-2010. International Journal of Economics and Finance, Canadian Center of Science and Education 6:10.

Crossref

|

|

|

|

|

Osoro NE (1993). Revenue Productivity Implications of Tax Reform in Tanzania. AERC Research Paper No. 20.

|

|

|

|

|

Pellechio AJ, Tanzi V (1995). The reform of tax administration. International Monetary Fund, Working Paper.

Crossref

|

|

|

|

|

Pereira FG, Hoekstra WO, Queijo J (2013). Unlocking tax-revenue collection in rapidly growing markets. Public Sector.

|

|

|

|

|

Prest AR (1962). The sensitivity of the yield of personal income tax in the United Kingdom. The Economic Journal 72:576-596.

Crossref

|

|

|

|

|

Rao S (2014). "Tax reform: Topic guide", Birmingham, UK: GSDRC, University of Birmingham.

|

|

|

|

|

Remeur C (2015). Politique fiscale de l'Union Européenne : Enjeux et défis. EPRS - Service de recherche du Parlement européen, Service de recherche pour les députés.

|

|

|

|

|

Silvani C, Baer K (1997). Designing a tax administration reform strategy Experiences and guidelines. International Monetary Fund, Working Paper.

|

|

|

|

|

Singer NM (1968). The Use of Dummy Variables in Estimating the Income Elasticity of State Income Tax Revenues. National Tax Journal 21(2):200-204.

|

|

|

|

|

Upender M (2008). Degree of tax buoyancy in India: an empirical study. International Journal of Applied Econometrics and Quantitative Studies 5:2.

|

|

|

|

|

Wilson EH, Innocent AN, Caritas CN (2018). Tax Reforms and Nigeria's Economic Stability. International Journal of Applied Economics, Finance and Accounting 3(2):74-87.

Crossref

|

|