ABSTRACT

The study, conducted among maize farmers in the Nanumba North District of the Northern Region of Ghana, examined the willingness of smallholder farmers to participate in the market for drought index crop insurance.A total of 100 farmers participated in the study.The study employed the logistic regression analysis to predict decision to participate in crop insurance. Quantitative and qualitative data collection methods wereemployed to allow for triangulation. These included questionnaires, focus group discussions and key informant interviews.The results demonstrate that access to credit, education and experience of other forms of insurance are the most important determinants of farmers’ willingness to participate in crop insurance.Total damage incurred also increased the probability of decision to participate, whereas return period of disaster event in the past and number of non-nature dependent income sources reduce the probability of decision to participate in crop insurance. The results emphasize the need to integrate crop insurance into micro-finance to enhance buy-in by farmers. Mass education via Radio and television are keys to improving access to information on crop insurance by farmers. However, significant investment in education in rural areas is critical, in the long term, to ensure the adoption of crop insurance.

Keywords:Crop insurance, climate change, participation, weather-indexed insurance, agriculture, climate change, adaptation, maize, farmers.

It is widely predicted that agriculture will be most affected of all sectors by climate change in Africa (Nelson et al., 2009). The resultant higher temperatures, higher incidence of droughts and floods as well as other weather related events pose production risks to farmers. The strong dependence of agriculture on the natural environ-ment, especially rainfall, makes it risk prone rendering large sections of the agricultural population vulnerable to climate change (Kurukulasuriya et al., 2006). Parry et al. (1999) estimate that climate change will put an estimated 55 to 70 million extra peopleat risk of hunger in Africaby 2080. The most affected regions in Africa include Western and Central Africa where agricultural output is expected to reduce by 2 to 4% (Mendelsohn et al., 2000).

The impact of climate change on agriculture in Ghana is expected to be even more severe in the northern Savannah zones where annual droughts are already a problem and affect the livelihoods of the population which

is mostly rural and dependent on agriculture. The area is characterized by a single rainfall season and most dependent on rainfall for agricultural production. It is expected that the mean daily temperature will increase by 3°C while rainfall declines between 9 and 27% by the year 2100.

The rapidly escalating climate change related risk to agriculture has challenged the ability of the natural sys-tem to cope. This has brought new and unprecedented pressure to bear on the natural system as has been observed elsewhere by Ziervogel et al. (2008). In the face of such challenges public intervention in mitigating the effects of climate change has been called for and justified on the grounds that agriculture accounts for a major source of livelihoods. Therefore, such covariate risks as posed by climate change will exacerbate the poverty and food security, especially, in most rural areas. The role of adaptation measures in managing the negative consequences of climate change is undeniable. However, climate change adaptation, just like any other strategy, requires a conducive policy framework to be effective. Khan et al. (2009) affirm the need for multi-sectorial interventions to address food security and poverty. A key challenge in Africa, in this regards, is the fact the region has seen adequate investment in agriculture over a long period of time. This has resulted in poorly developed agricultural and supporting infrastructure as well as poorly developed agricultural markets. One would there-fore, expect that Africa lags behind in climate change related disaster preparedness has a long way to go in putting in place the necessary measures to off-set the effects of climate change to any appreciable extent in the near future.

It is obvious that the most debilitating and obvious effect of climate change on food security, so far, has been increasing incidence of drought and irregular distri-bution of rainfall (Vermeulen et al., 2010). In this regard, irrigation agriculture is expected to play a significant role in the fight against the negative consequence of climate change. This is supported by Valipour (2014a) who indicates that, globally, 46% of all agricultural land is not suitable for agriculture due to climate change. The situation, as would be expected, would be more severe for the global south where irrigation agriculture is poorly developed and a large section of the agricultural popu-lation still depends on smallholder rain-fed agriculture. Valipour (2014b) shows that, globally, irrigated area has expanded by less than 1% since 1975. This is against the background that current estimated potential crop yields are less that 30% for sub-Saharan Africa (Valipour, 2014a). Again, Valipour (2014a) shows that the value of irrigation-equipped area as a percentage of total agri-cultural area is only 5.8% for Africa. This is the case in Ghana where irrigation agriculture accounts for only 1% of agricultural area (Ghana Irrigation Development Authority, 2012). It is important to note that apart from the fact that Africa and Sub-Saharan Africa, in particular, is lagging behind in irrigation development, existing irrigation schemes and infrastructure have suffered the consequences of poor policies and institutions. Valipour (2014b) cites poor macroeconomic policies that render irrigation agriculture unprofitable and the poor performance of many irrigation projects as some of the challenges that have countered the expected poverty reduction effects of irrigation development.

This is supported by Hanjira et al. (2009) who argue that human capital and access to markets are critical in ensuring that irrigation development achieves the intended poverty alleviation impact. This situation is typical of Ghana and is amply demonstrated in the Tono irrigation scheme in Ghana where Dinye (2013) reveals that Ghanaian traders prefer to purchase tomato from neighbouring Burkina Faso despite the fact that farmers produce large quantities of tomato that go to waste annually. This is the result of poor policies that have rendered irrigation agriculture in Ghana non-competitive. According to the irrigation development Authority of Ghana(2012), a number of factors account for the inadequacies within the irrigation sector including organisational and institutional weaknesses, as well as, lack of clarity of institutional mandate. Thus, irrigation development will continue to be slow unless the right policy and institutional frameworks exist to provide adequate support to the sector.

An agricultural system, like any other system, has a measure of inbuilt adaptation capacity (Ziervogel et al., 2008). However, the current rapid rate of climate change will impose new and potentially overwhelming pressures on existing adaptation capacity. It is has been argued above that the growing climate change risks and the inability of existing agricultural systems in Ghana and elsewhere, as argued above, to cope with its effects has brought forth the need to consider contingency plans against possible widespread food insecurity and famine. One of such interventions is crop insurance. Interest has grown over the years in the introduction of weather-based crop index insurance as one way to address climate related risks to farmers.A notable example, in this case, is China where the agricultural insurance market has grown rapidly over the years. Many countries in Africa have investigated the feasibility of agricultural insurance, and some have implemented pilot programs with support from international donors notably the World Bank. In Ghana, the project “Innovative Insurance Products for the Adaptation to Climate Change” (IIPACC) funded by the German Federal Ministry for the Environment, Nature Conservation and Nuclear Safety implemented a pilot weather-indexed crop insurance (WII) scheme between 2009 and 2013. It was jointly implemented by the National Insurance Commission of Ghana (NIC) and German International Cooperation (GIZ) with support from Swiss Re. The first WII product for drought cover of maize was sold to four institutions in northern Ghana in May 2011 and covered over 3000 smallholder farmers under the Ghana Agricultural Insurance Program (GAIP).

In 2012 the first payouts were made to 136 farmers. Currently crop drought index insurance is offered in six regions, namely: Northern, Upper East, Upper West, Brong Ahafo, Ashanti and Eastern regions. Currently, weather indexed crop insurance is offered by a consortium of private insurers to farmers across Ghana.

While proponents of crop insurance see it as a viable risk coping mechanism that has the potential to help farmers in developing countries to cope with weather related risk others hold the view that crop insurance is unsustainable citing high and unaffordable premiums (Skees et al., 1999). The latter view is also supported by Hazell et al. (1986) and Gurenko and Mahul (2004) who indicate that most crops insurance, globally, fail to earn enough premiums to cover pay-outs and administrative costs because farmers are unwilling to pay the full cost of insurance. This school of thought argue that the case for public subsidy on crop insurance tenable on these grounds. Although the decision to buy insurance is purely an economic one public subsidy on crop insurance is justified on the basis that weather related agricultural constraints such as climate change pose a covariate risk that has a wider implication for sustainable livelihoods and food security for large sections of the people vulnerable to climate change. It has been argued that the absence of a purely private agricultural insurance product is the result of market failures resulting from systemic risk associated with correlated yield losses among.

However, this argument appears to be untenable as others (Wright and Hewitt, 1994; Goodwin and Smith, 2009) argue that systemic risk is much more severe in markets for other types of insurance that are offered by the private sector. The real challenge inducing low uptake of crop insurance by farmers appears to be the fact that premiums are more than what farmers are willing to pay as argued above. Much as it is undeniable that the ability of farmers to pay premiums is important in determining farmers’ decision to participate in crops insurance narrowing the debate to this makes it somehow simplistic. The study rather sought to assess farmers’ willingness to participate in the market for crop insurance. This way, it is possible to examine a wider array of factors, including the ability to pay for crop insurance, regarding uptake of crop insurance.

The Study area

Northern Ghana is situated between 8° and 11° N latitude and 0° to 3° W longitude. Administratively it comprises of the Upper West Region (UWR), Upper East Region (UER) and Northern Region (NR). The area falls within the dry land Savannah zone occupying an estimated 40% of the country. The rainfall pattern is mono-modal. The rainy season permits a growing season of 150 to 160 days in the Upper East Region and 180 to 200 days in the two other regions. Mean total annual rainfall varies from 1,000 mm in the Upper East Region to 1,200 in the south eastern part of the Northern Region. The rainfall shows wide variations from year to year, both as regards the amount and the time when it occurs. Food shortages are a common feature of the dry season. According to the 2010 population and housing census the 3 northern regions together account for 17.3% of the total population of Ghana. Northern region accounts for the largest share (10.2%), followed by Upper East region (4.3%) and the Upper West region (2.8%). The Northern Region, despite being the largest, in terms of land mass, is the least populated among the 3 administrative regions of northern Ghana with a population density of 35 persons per kilometre square. The Upper East region has the highest population density of 118 km2 while the Upper West region has a population density of 38 persons per square kilometre. The study area, Nanumba North District, is located in the eastern corridor of the Northern Region of Ghana between latitude 8.5 N and 9.25 N and longitude 0.57 E and 0.5 W.

It shares boundary with Yendi District to the north, Nanumba South District to the southeast, East Gonja District to the west and south west and Nanumba South District to the south and the east. The District covers an area of 1,986 km2 with an estimated population of 101,760 people. Annual rainfall averages 1268 mm with most of it falling within six (6) months. Agriculture is the main source of livelihood of the people engaging about 85% of the population. Crops grown include root and tubers, cereals, legumes and tree crops such as teak and cashew nuts. Animal rearing including poultry keeping is an integral part of every household.

Sampling and data collection

The study was conducted among maize farmers. The rational for selecting maize is based on the fact that maize is a major staple, as well as, a cash crop in the study area. Thus, the importance of maize interms of food and cash crops makes it a very important crop. Ten communities were randomly selected for the study. From each of the ten villages selected, 10 farmers were selected to form a sample size of 100 farmers using simple random sampling technique. Quantitative and qualitative approaches are adopted in collecting data for the study to allow for statistically reliable information by way of triangulation.

The questionnaire used for the survey consisted of around 40 questions and divided into different sections. In the first section respondents are asked about their age, occupation, educational background, family size, sources of income, assets, standard of living, type of crop cultivated and so forth. The second section comprises questions related to households’ experience of catastrophic events where respondents are first asked whether or not they suffer from weather disasters (drought). The third section of the questionnaire introduced the respondent to a hypothetical ‘Drought Index Insurance’ that will effectively help to spread the risk of damage caused by drought. Since a Drought Based Index Insurance has been already been introduced in Ghana, a hypothetical market similar to the existing product was explained to the farmer and farmers asked whether they want to buy the hypothetically designed insurance product. After this description of the proposed insurance scheme, respondents were asked whether or not they would be willing to participate in such an insurance scheme in order to reduce the damage risk they are exposed to at that point in time.

Respondents who reply in a positive way are then subsequently asked in a follow-up question, how frequently they would like to pay for the insurance and whom they prefer as the provider of the insurance scheme (Government, micro-credit organizations, insurance companies, and local co-operatives). Respondents who do not agree to participate in the proposed drought insurance scheme were asked for their reasons for not buying insurance in a follow-up question.

Theoretical model

The following theoretical model was constructed for drought index insurance participation:

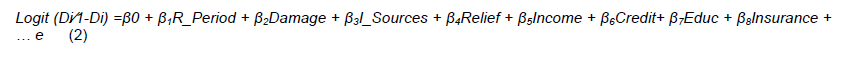

Equation (1) represents the decision of an individual to participate in drought index insurance (Di) which is expected to depend on the level of risk exposure (Ri), the level of damage caused by an event (Li), the ability to pay the insurance premium (Ai), which is determined by the flow of income (Yi) and in part access to and availability of credit (Ci), and relevant socio-economic and demographic characteristics of farmers (Si).

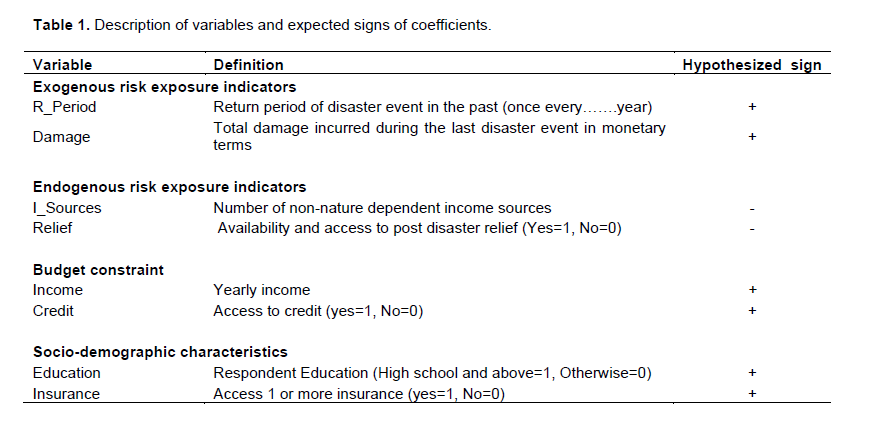

Conventional risk theory disaggregates risk exposure into exogenous and endogenous components (Shogren and Crocker, 1991; Smith, 1992). Following others (Faber and Proops, 1990) and Funtowicz and Ravetz, 1992), exogenous risk exposure may be further disaggregated into: the likelihood of being struck by disaster and the consequence of risk exposure. The probability of being exposed is measured by way of the return period of natural disasters based on experiences in the past considered while consequence of risk exposure is measured through the economic damage to the individual farmer.The more frequent a disaster occurs the more likely a farmer is to invest in insurance and the higher the economic cost of the damage the more likely a farmer is to take insurance cover. Endogenous component of risk include diversification of income sources (Rosenzweig and Stark’s, 1989; Brouwer et al., 2007). Consequently, the ‘number of non-nature dependent income sources’ that a farmer has is expected to have a negative effect on the tendency of a farmer to invest in crop insurance.Following Lewis and Nickerson (1989), the availability and access to disaster mitigating measures such as disaster relief, is used as a proxy for ex-poste exposure to endogenous risk and is expected to have a negative effect on a farmer’s willingness to invest in crop insurance.

Budgetary considerations also play an important role in determining the risk behaviour of a farmer. As would be expected farmer’s ability to pay for crop insurance is influenced by the extent of cash liquidity. Consequently, the nature of a farmer’s income as determined flow of a farmers direct income and access to credit, are both expected to affect a farmer’s willingness to pay for crop insurance positively. The highera farmer’s income the more likely it is that they are more able to pay a higher risk premium. Although the nature of the relationship between access to micro-credit and willingness to pay for insurance has been questioned (Adger, 1999) it is still included as a proxy for income since access to credit plays an important role in income generation (Khadaker, 2005). Quite apart from endogenous and exogenous factors, as explained above, social and demographic characteristics of farmers are expected to affect farmers’ decision to invest or not to invest in crop insurance. Key among these is education and access to other forms of insurance. Gine et al. (2008) find that non-insurance purchasers are less likely to invest in insurance because they do not understand the nature of insurance and how it will help them mitigate risk. In the specific case of this study, participation in health insurance is considered as a proxy of farmers’ experience of insurance. Considering the wide spread patronage of the National Health Insurance Scheme, the experience of its benefit or of any other form of insurance is expected to positively influence the demand for crop insurance. Education also enhances respondents’ ability to understand the product even if they have very little or no prior experience with it. Therefore, respondent’s level of education is expected to positively influence insurance participation. The variables and their a priori expectations are as indicated in Table 1.

Preliminary examination of the data showed that 59 respondents were willing to participate in the market for drought indexed crop insurance while 41 were not willing to participate. Consequently, a logit probability model was used to examine factors affecting crop drought index insurance participation due to the disproportionate sample sizes. The logit model is based on the cumulative distribution function. Consequently, it yields results that are not sensitive to the distribution of sample attributes when estimated by maximum likelihood since it only affects that constant term and not the estimated coefficients (Maddala, 1992).

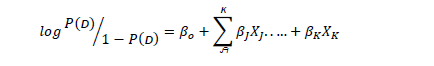

The mathematical form of the model used in this study is:

Where

is the probability of the ith farmer willing to participate and Xk the kth explanatory variable. The dependent variable, log (P (

D)/ (1-P (D)), in Equation (1) is the log-odds ratio in favour of decision to participate in crop insurance market (Gujarati, 1995).

A logit model is specified as:

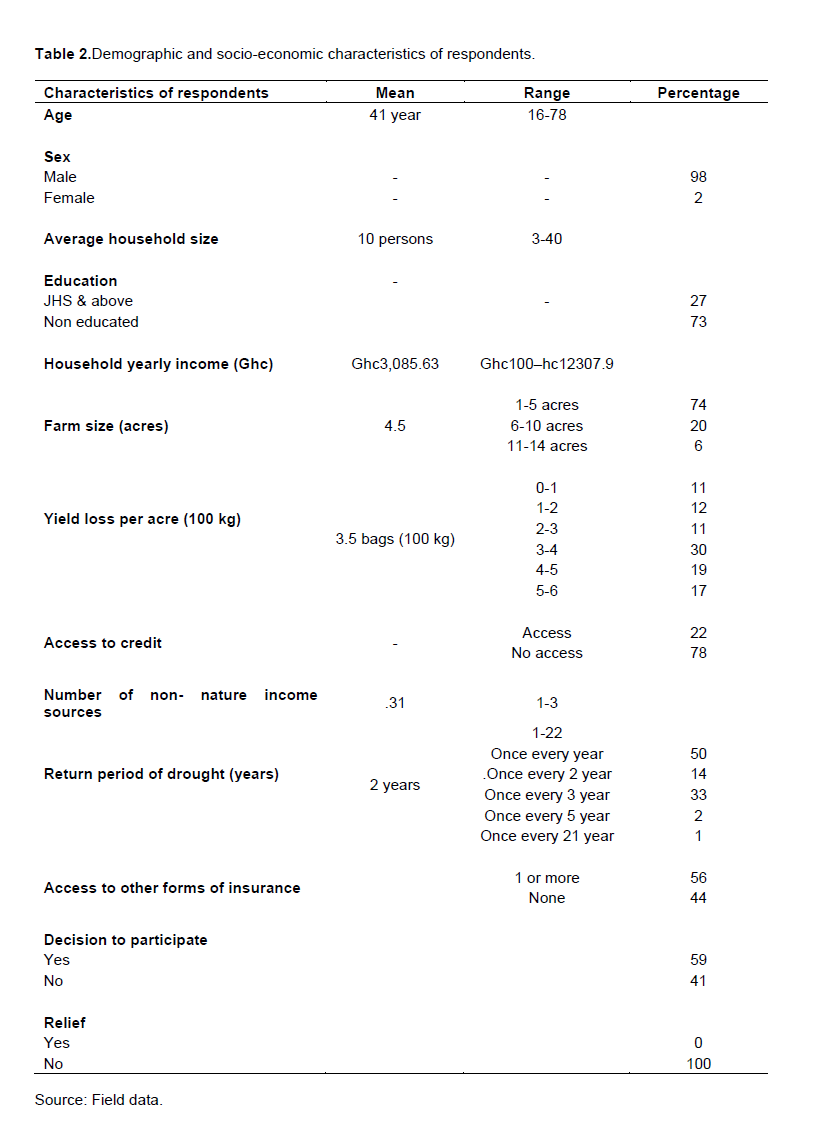

Table 2 summarizes the demographic and socio-economic characteristics of respondents included in the study. The respondents included Ninety-eight were males and two females. This is usual of the study area. Females have limited access to land as men control access traditionally. Moreover, females help their husbands on the family land and have little time to engage in crop cultivation in any significant way. The few exceptions are female household heads.

The average age of the respondents was 41 years and fell within the range of 16 and 78 years. The average age of 41 years means that most of the farmers are within the economically active age. Older farmers were found to be less active on the farmer leaving the management of the farm to their eldest son in most cases. Seventy-three per cent of the respondents had no formal education. This is not unexpected since illiteracy rates in rural areas and among crop farmers in Ghana is generally high (GLSS, 2010).Each household consisted of an average of 10 family members.

Crop farming is the primary occupation of 85% of the sampled farmers. Almost all sampled farmers (94%) owned the farmland where they cultivated their crops. Land, in the study area, is typically owned outright by members of a household. Land is traditionally owned by households and held in trust for the members by the household head. As members come of age they are apportioned sections of the land to cultivate to feed their families and to provide for other needs. The average farm size is 1.6 ha.

This is typical of farms in the study area and reflects the general situation in Ghana as most farmers are subsistence farmers. Average yearly crop income accounted for 80% of yearly household income. Average annual household income was about Ghc 3,085.6 with majority of respondents falling within the range of Ghc 2,000 and Ghc 10,000. Seventy-eight percent of respondents had no access to formal credit. In Ghana most financial service providers have poorly developed network in the rural areas and this has constrained access to credit.

The relatively high risk posed by agriculture has further constrained access to credit by small holder farmers. Fifty-nine percent of respondents are either registered with the National Health Insurance Scheme or a motor insurance scheme. This is expected and is rather low since each district operates a health insurance scheme. Estimated average yield loss per acre as a result of drought is about 350kg per acre translating into about Ghc 350.00. The average return period of drought was 2years with 48% of respondents reporting a return period of 1 year.In all, 41% of respondents declined to participate in the proposed crop insurance scheme either because they do not have sufficient income to pay the premium or simply did not believe that they will actually be paid any claim in case of crop failure.

Empirical results

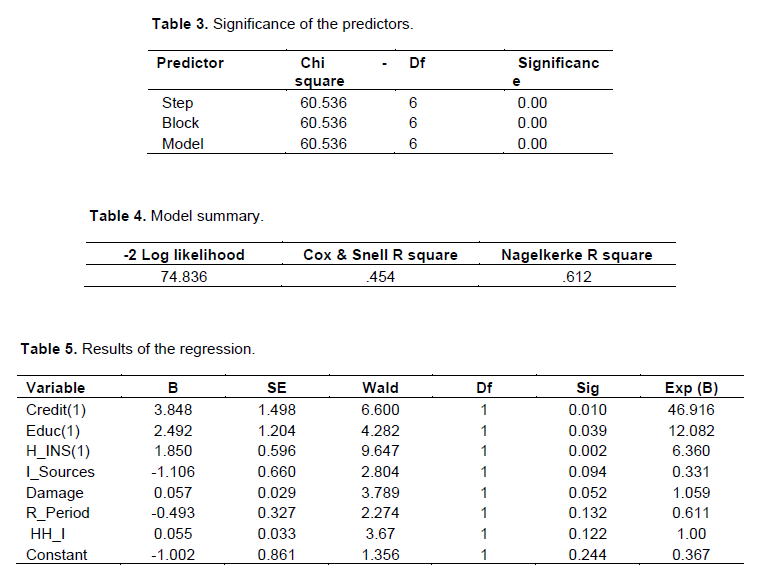

A test of the full model against a constant only model was statistically signiï¬cant, indicating that the predictors as a set reliably distinguished between acceptors and decliners of the offer to participate in crop insurance or not (Table 3).

Nagelkerke’s R2 of 0.612 indicates a moderately strong relationship between prediction and grouping (Table 4). Prediction success was 75.5% for decline and 83.1% for acceptance with an overall prediction success of 80%.

Access to credit, education and participation in other forms of insurance contributed significantly to willingness to pay for crop insurance at 5% significance level (p =0 .010, 0.039 and 0 .002 respectively).Number of non-nature income sources and damage made significant contribution to willingness to pay for crop insurance at 10% significance level (p=0.094 and 0.052, respectively). Frequency of return period of drought was not a significant predictor and income had no influence on participation. Access to relief was excluded because of collinearity and farm size was also excluded because of its strong correlation with damage.Number of non-nature income sources and frequency of return period of drought were negatively related to participation (Table 5).The log odds ratio(EXP (B)) is 46.9 times as large for respondents who had access to credit than those who did not. Therefore farmers who have access to credit are 46.9 more likely to participate in crop insurance than those who do not have access to credit.

This is as pre-dicted given the existence of evidence to the effect that micro-credit plays an important role in promoting income generation activities among beneficiaries (Khadaker, 2005). Consequently, farmers’ access to credit increases their disposal income making them more likely to buy insurance cover. The odds ratio of those who have education is 12.1 times as large. Therefore, farmers with some level of formal education are 12 times more likely to participate in a crop insurance marketthan those who do not have formal education. This met the priori expectation that a respondent’s level of formal education affects demand for insurance positively and significantly sinceeducation enhances the respondents’ ability to understand the product offered even if they have very little or no prior experience of it.

The odds ratio of those who participate inone or more forms of insurance is 6.4 times as large indicating that they are 6 times more likely to participate in crop insurance than those who do not participate in any other form of insurance. Experience of from one or more forms of insurance was predicted to have a significant positive effect on a respondent’s decision to participate in the market for crop insurance. The effect of income on willingness to participate in the crop insurance market did not meet the a priori expectation that the higher the household income the more willing a farmer will be to participate in crop insurance. The odd ratio of 1.00 means that a unit increase in income will have no effect on willingness to participate. The log odd ratio for number of non-nature dependent income sources is 0 .331. This implies that a unit (an additional source of income) increase in number of non-nature dependent income sources decreases the willingness of respondent to participate in crop insurance by 0.331 times. This outcome, although marginal,is as predicted.

The higher the number of ‘non-nature dependent income sources’ the lower a respondent is exposed to endogenous risk. This is expected to influence the decision to participate in crop insurance negatively. The log odd ration for the return period of drought is 0.611. This implies that when the return period of drought increases by one year farmers are 0.611 times lesslikely to participate in crop insurance. This is expected as it was hypothesized that increase in the return period of drought influences insurance participation decision negatively. When damage increase by one unit (100kg) the odds ratio is 1.059 times as large and therefore farmers are 1.059 more times likely to participate in crop insurance. This meets the a prioriexpectation that, the higher the loss caused by catastrophic eventsthe more willing farmers are willing to participate in the market for crop insurance.

It is revealing to note that as many as 41% of respondents were not willing to participate in the market for crop insurance. These farmers viewed insurance as unnecessary and additional burden. This is not surprising since knowledge and access to insurance among the rural populace in Ghana is generally poor. This appears to be supported by the fact that 44% of respondents are not insured. The only form of insurance that appears to be working in the rural areas is the national health insurance which is subsidized and does not reflect reality of as far as premiums are concerned. Culture and, to some extent, religion appears to influence the decision to participate in insurance generally. This is because it is not considered normal to anticipate disaster as it would mean wishing disaster for oneself. This belief is quite strong among the more traditional societies.

This phenomenon is common not only in rural areas but is experienced in the cities as well. The results showthat access to credit, education and experience of other forms of insurance are the most important determinants of farmers’ willingness to participate in crop insurance.The indeterminate effect of a farmer’s direct income on the willingness to participate in the market for crop insurance is surprising viewed against the significant and positive contribution of credit to willingness to participate in crop insurance. Perhaps, this may be attributed to the fact that farmers consider it too risky to mortgage their household income for future and unknown benefit. Generally, direct household from crop farming which is the major source of livelihood in the area is low. Under such circumstances it is natural that people are more likely to protect their meagre incomes than gamble it against future benefits. However, access to credit is perceived as a major incentive to obtain extra income through income generating activity and hence, improves a farmer’s disposable income. The positive relationship between farmers’ access to credit and insurance participation extending and strengthening credit facilities in rural areas can play an important role in increasing the up-take of crop insurance schemes. Unfortunately, experience in the study area shows that access to credit by farmers is limited and, when it is available, farmers are not willing to access it due to high interest rates. Currently, the average interest rate charged by micro-finance institutions is about 40%. Access to banks is even more limited and micro-finance institutions are unwilling to operate in remote rural areas due to higher cost of administering credit and risk. One potential strategy to encourage financial institutions to extend credit to poor farmers in such remote rural areas is to incorporate crop insurance into credit products by insuring against potential risk. This reduces lender risk and encourages insurance up-take in rural areas although it will increase the cost of credit to farmers who are already not happy with the current regime of high cost of credit.

However, an innovative credit product that ensures high returns on investment in spite of the relatively higher interest rates and the benefit of insurance is likely to motivate farmers to take up credit. For instance, a combination of pre-financing farmers’ cash needs during critical periods such as the period immediately preceding harvest when prices are lower and providing insurance cover for farmers’ harvest against price fluctuation later will ensure that farmers benefit from higher prices for their products subsequently. However, the poor presence of micro-finance institutions in rural areas is a major limitation in this regard. Access to education and experience of other encourages insurance uptake since it enables easier comprehension of such a novel concept as crop insurance. Given the high illiteracy rate in the area and the substantial numbers of farmers who have not experienced other forms of insurance in rural areas it is expected that the introduction in rural areas will be slow and extra effort is required to promote insurance up-take.

Therefore, there is the need that the promotion of crop insurance be preceded by extensive education and awareness creation drive in the short-term. In the longer term, it is expected that improved access to education, as a key poverty alleviation strategy by the government, will simultaneously improve insurance up-take. In this regards, public support in promoting crop insurance is critical.

The positive relationship between farmers’ access to credit and insurance participation suggests that micro credit and micro-insurance are complementary products. Therefore, extending and strengthening credit facilities in rural areas can play an important role in increasing the take-up of crop insurance schemes. This will address the fear of loan default among farmers which, hitherto, had rendered them reluctant to access loans. A major challenge in this regard is that most financial service providers in Ghana have poorly developed network in the rural areas resulting in limited access to the majority of smallholder farmers. Similarly, high interest rates, ave-raging, 48% per annum has deterred most smallholder farmers from accessing loans. On the other hand financial service providers consider extending credit to smallholder farmers more risky and expensive due to distance and the scattered nature of smallholder farmers. To address the challenges on both sides and ensure increased uptake of crop insurance therefore, financial service providers must insure their loan portfolios. This way, farmers are relieved from the burden of bearing the cost in the case of widespread losses while financial service providers are able to recover their losses. Given the high illiteracy rate in the area, reducing illiteracy and improving education levels in the long term will ensure substantial uptake of crop insurance. Therefore, government’s drive to improve education in rural areas, as expected, has important implication for rural poverty reduction, in general, and crop insurance uptake, in particular, as it would result in increased access to information and improved understanding of the crop insurance concept and the need to seek protection.

The authors have not declared any conflict of interest.

REFERENCES

|

Adger WN (1999). Social vulnerability to climate change and extremes in coastal Vietnam. World Dev. 27(2):249-69.

Crossref

|

|

|

|

Brouwer R, Akter S, Brander L (2007). Socio-economic vulnerability and adaptation to environmental risk: A case study of climate change and flooding in Bangladesh. Risk Anal. 27(2):313-326.

Crossref

|

|

|

|

|

Dinye RD (2013). Irrigated Agriculture and Poverty Reduction in Kassena Nankana District of in the Upper East Region, Ghana. J. Sci. Technol. 33(2):59-72.

Crossref

|

|

|

|

|

Faber M, Proops JLR (1990). Evolution, time, production and the environment. Springer, Berlin.

Crossref

|

|

|

|

|

Funtowicz SO, Ravetz JR (1992).Three types of risk assessment and the emergence of post-normal science. In: Krimsky S, Golding D (Eds.), Social Theories of Risk, Praeger, Westport, CT. pp. 251-273.

|

|

|

|

|

Ghana Living Standards Survey (2010). Ministry of Food and Agriculture. Ghana.

|

|

|

|

|

Gine X, Townsend R, Vickery J (2008).Statistical analysis of rainfall in-surance payouts in Southern India, Am. J. Agric. Econ. Forthcoming

|

|

|

|

|

Ghana Irrigation Development Authority (2012).Ghana Agricultural Water Management and Investment Framework. Available at:

View Accessed 1st September 2015

|

|

|

|

|

Goodwin BK, Smith VH (2009). Private and Public Roles in Providing Agricultural Insurance in the United States in Jeffrey Brown, editor, Public and Private Roles in Insurance, AEI Press, Washington, D.C. Forthcoming.

|

|

|

|

|

Gujarati DN (1995). Basic Econometrics, 3rd Edition. New York: McGraw-Hill, 1995. ISBN 0-07-025214-9.

|

|

|

|

|

Gurenko E, Oliver M (2004). Enabling productive but asset poor farmers to succeed: a risk financial framework. World Bank Policy Research paper 3278.

Crossref

|

|

|

|

|

Hanjra MA, Ferede T, Gutta DG (2009). Pathways to breaking the poverty trap in Ethiopia: investments in agricultural water, education, and markets. Agric. Water Manage. 96(11):1596-1604.

Crossref

|

|

|

|

|

Hazell P, Carlos P, Alberto V (1986). Crop Insurance for Agricultural Development: Issues and Experience. Johns Hopkins University Press, Baltimore.

|

|

|

|

|

Khadaker SR (2005). Microfinance and Poverty: Evidence Using Panel Data from Bangladesh. World Bank Econ. Rev. 19(2):263-286.

Crossref

|

|

|

|

|

Khan S, Hanjra MA, Mu J (2009) Water management and crop production for food security in China: a review. Agric. Water Manage. 96(3):349-360.

Crossref

|

|

|

|

|

Kurukulasuriya P, Mendelsohn R, Hassan R, Benhin J, Diop M, Eid H M, Fosu KY, Gbetibouo G, Jain S, Mahamadou A, El-Marsafawy S, Ouda S, Ouedraogo M, Sène I, Maddision D, Seo N, Dinar A (2006). Will African agriculture survive climate change? World Bank Econ. Rev. 20:367-388.

Crossref

|

|

|

|

|

Lewis T, Nickerson D (1989). Self-Insurance against natural disasters. J. Environ. Econ. Manage. 16:209-223.

Crossref

|

|

|

|

|

Maddala GS (1992). Introduction to Econometrics. Prentice-Hall International, 1992.

|

|

|

|

|

Mendelsohn R, Dinar A, Dalfelt A (2000). Climate change impacts on African agriculture. Preliminary analysis prepared for the World Bank, Washington, D.C.

|

|

|

|

|

Nelson GC, Rosegrant MW, Koo J, Robertson R, Sulser T, Zhu T, Ringler C, Msangi S, Palazzo A, Batka M, Magalhaes M, Valmonte-Santos R, Ewing M, Lee D (2009). Climate change: Impact on agriculture and costs of adaptation. Food Policy Report. Washington, D.C.: International Food Policy Research Institute.

Crossref

|

|

|

|

|

Parry ML, Rosenzweig C, Iglesias A, Livermore M, Fischer G (1999). Effects of climate change on global food production under SRES emissions and socio-economic scenarios P. 64.

|

|

|

|

|

Rosenzweig M, Stark O (1989). Consumption smoothing, migration and marriage: evidence form rural India.' J. Polit. Econ. 97(4).

Crossref

|

|

|

|

|

Shogren J, Crocker T (1991). Risk, Self-Protection, and Ex Ante Valuation. J. Environ. Econ. Manage. 20:1-15.

Crossref

|

|

|

|

|

Skees J, Hazell P, Miranda M (1999). New approaches to crop insurance in developing countries. Environment and Production Technology Division, International Food Policy Research Institute Discussion Paper No. 55, Washington, D.C. U.S.A.

|

|

|

|

|

Smith VK (1992). Environmental risk perception and valuation: Conventional versus prospective reference theory. In: Bromley DW and Segerson K (Eds.), The Social Response to Environmental Risk: Boston: Kluwer.

Crossref

|

|

|

|

|

Valipour M (2014a). Land use policy and agricultural water management of the previous half of century in Africa. Appl. Water Sci. 5(4):367-395.

Crossref

|

|

|

|

|

Valipour M (2014b). Variations of irrigated agriculture indicators in different continents from 1962 to 2011. Adv. Water Sci. Technol. 01:01-14.

|

|

|

|

|

Vermeulen SJ, Aggarwal PK, Ainslie A, Angelone C, Campbell BM, Challinor AJ, Hansen J, Ingram JSI, Jarvis A, Kristjanson P, Lau C, Thornton PK, Wollenberg E (2010). Agriculture, Food Security and Climate Change: Outlook for Knowledge, Tools and Action. CCAFS Report 3. Copenhagen, Denmark: CGIAR-ESSP Program on Climate Change, Agriculture and Food Security.

|

|

|

|

|

Wright BD, Julie AH (1994). All Risk Crop Insurance: Lessons from Theory and Experience. In Darell L. Hueth and William H. Furtan, Economics of Agricultural Crop Insurance: Theory and Evidence; pp. 73-109, Kluwer Academic Publishers, Boston.

Crossref

|

|

|

|

|

Ziervogel G, Cartwright A, Tas A, Adejuwon J, Zermoglio F, Shale M, Smith B (2008). Climate change and adaptation in African agriculture. Stockholm: Stockholm.

|

|

is the probability of the ith farmer willing to participate and Xk the kth explanatory variable. The dependent variable, log (P (D)/ (1-P (D)), in Equation (1) is the log-odds ratio in favour of decision to participate in crop insurance market (Gujarati, 1995).

is the probability of the ith farmer willing to participate and Xk the kth explanatory variable. The dependent variable, log (P (D)/ (1-P (D)), in Equation (1) is the log-odds ratio in favour of decision to participate in crop insurance market (Gujarati, 1995).